- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-07-2014

Crude oil fell for a sixth day in a row as Libya prepared to increase exports from two ports closed for a year. Libya is ready to export from the Es Sider and Ras Lanuf terminals after ending force majeure, the country's Oil Ministry said today.

Futures also dropped as the Islamist insurgency in Iraq hasn't spread to the south, the source of most of the country's output. Fighting remains concentrated in the north.

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $103.38 a barrel (-0.38%) on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture fell to $110.26 a barrel (-0.27%) on the London exchange ICE Futures Europe.

Most stock indices declined after the weaker-than-expected German economic data. German industrial production dropped 1.8% in May, missing expectations for a 0.3%, after a 0.3% decline in April. April's figure was revised down from a 0.2% increase.

Sentix investor confidence index for the Eurozone increased to 10.1 in July from 8.5 in June, beating expectations for a drop to 7.5.

PostNL NV shares surged 18% after increasing its profit forecast.

Deutsche Boerse AG shares declined 3% after fter Credit Suisse Group AG downgraded the company's shares.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,823.51 -42.54 -0.62%

DAX 9,906.07 -103.01 -1.03%

CAC 40 4,405.76 -63.22 -1.41%

The U.S. dollar traded lower against the most major currencies. The U.S. currency remained supported by Thursday's strong U.S. labour market data. U.S. companies added 288,000 jobs in June.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

The euro traded higher against the U.S. dollar after mixed economic data from the Eurozone. German industrial production dropped 1.8% in May, missing expectations for a 0.3%, after a 0.3% decline in April. April's figure was revised down from a 0.2% increase.

Sentix investor confidence index for the Eurozone increased to 10.1 in July from 8.5 in June, beating expectations for a drop to 7.5.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports in the U.K.

The Swiss franc traded higher against the U.S. dollar after the economic data from Switzerland. Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in June, in line with expectations.

The Swiss National Bank's foreign exchange reserves increased to 449.553 billion Swiss francs in June, from 444.351 billion Swiss francs in May. May's figure was revised down from 444.354 billion Swiss francs.

The Canadian dollar traded lower against the U.S. dollar after mixed Canadian economic data. Building permits in Canada increased 13.8% in May, exceeding expectations for a 3.1% rise, after a 2.2% gain in April. . That was the fastest pace in 10 months.

April's figure was revised up from a 1.1% increase.

Ivey purchasing managers' index for Canada dropped to 46.9 in June from 48.2 in May, missing expectations for a rise to 51.3.

The New Zealand dollar increased against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar climbed against the U.S. dollar after the economic data from Australia. The AI Group/HIA released its housing construction index for June. The index increased to 51.8 in June from 46.7 in May.

The ANZ job advertisements rose 4.3% in June from a decline of 5.7% in May. May's figure was revised down from a drop of 5.6%.

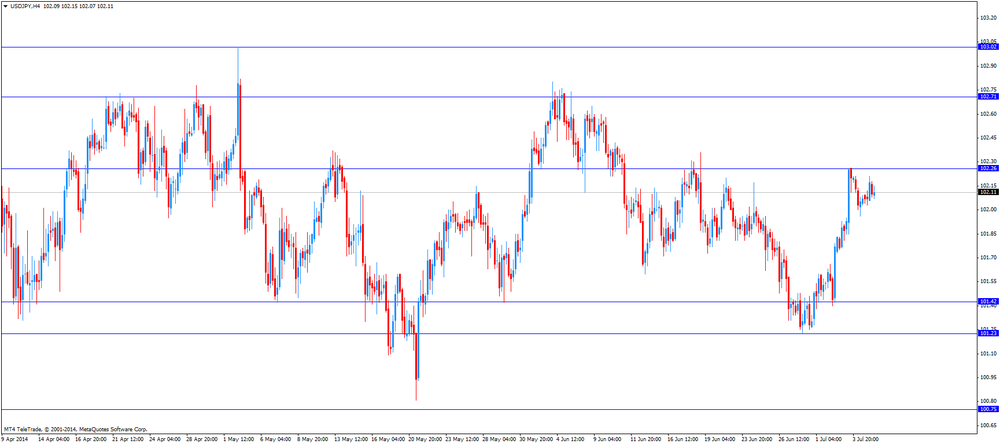

The Japanese yen traded higher against the U.S. dollar. Japan's leading economic index declined to 105.7 in May from 106.5 in April, missing expectations for a decrease to 106.0. April's figure was revised down from 106.6.

Japan's coincident index remained unchanged at 111.1 in May, beating expectations for a decline to 111.0.

The Bank of Japan Governor Haruhiko Kuroda said on Monday the BoJ will maintain its stimulus programme for as long as necessary to achieve its 2% inflation target. He added that "the BOJ will examine upside and downside risks to the economy and prices, and adjust monetary policy as needed".

The Bank of Canada released its business outlook survey for the second quarter on Monday:

- There are "some encouraging signs for the economic outlook, although lingering uncertainty amid intense competition still hinders the pace of growth";

- 64 % of executives expect the inflation to be at 1% to 2% over the next two years;

- Canadian companies saw a "more modest improvement" in sales over the past 12 months, "expectations for future sales growth remain positive, and there are indications that business sentiment regarding exports is gradually firming";

- Competitive conditions remain challenging;

- Canadian companies operating on the domestic market hope that sales growth will improve;

- Canadian companies operating on the international markets saw an improvement compared with a year ago due to a strengthening of the U.S. economy and the depreciation of the Canadian dollar.

EUR/USD $1.3500, $1.3525, $1.3545, $1.3600, $1.3610, $1.3615, $1.3650-55

USD/JPY Y101.00, Y101.50, Y102.00, Y102.20, Y102.50-55

EUR/JPY Y138.50, Y139.75

USD/CHF Chf0.9000

AUD/USD $0.9360, $0.9495

NZD/USD $0.8800

USD/CAD C$1.0700, C$1.0725, C$1.0735

U.S. stock-index futures fell as investors weighed valuations and speculated the Federal Reserve may raise interest rates sooner than expected.

Global markets:

Nikkei 15,379.44 -57.69 -0.37%

Hang Seng 23,540.92 -5.44 -0.02%

Shanghai Composite 2,059.93 +0.55 +0.03%

FTSE 6,830.66 -35.39 -0.52%

CAC 4,424.09 -44.89 -1.00%

DAX 9,954.08 -55.00 -0.55%

Crude oil $104.00 (-0.46%)

Gold $1316.70 (-0.47%)

(company / ticker / price / change, % / volume)

| The Coca-Cola Co | KO | 42.30 | +0.02% | 0.6K |

| Cisco Systems Inc | CSCO | 25.май | +0.08% | 10.9K |

| Caterpillar Inc | CAT | 109.66 | +0.09% | 0.8K |

| Verizon Communications Inc | VZ | 49.71 | +0.10% | 13.0K |

| United Technologies Corp | UTX | 115.30 | +0.14% | 0.2K |

| Home Depot Inc | HD | 82.11 | +0.16% | 1.2K |

| AT&T Inc | T | 35.73 | +0.17% | 22.8K |

| Merck & Co Inc | MRK | 59.19 | +0.24% | 0.4K |

| Procter & Gamble Co | PG | 79.77 | +0.26% | 3.0K |

| Chevron Corp | CVX | 130.59 | +0.28% | 0.4K |

| JPMorgan Chase and Co | JPM | 57.13 | +0.28% | 1.7K |

| Walt Disney Co | DIS | 86.69 | +0.29% | 1.4K |

| Pfizer Inc | PFE | 30.48 | +0.36% | 2.1K |

| Johnson & Johnson | JNJ | 106.25 | +0.37% | 0.6K |

| General Electric Co | GE | 26.72 | +0.41% | 24.1K |

| Intel Corp | INTC | 31.11 | +0.42% | 6.7K |

| Wal-Mart Stores Inc | WMT | 75.62 | 0.00% | 0.1K |

| Exxon Mobil Corp | XOM | 101.50 | -0.07% | 1.8K |

| Microsoft Corp | MSFT | 41.80 | -0.24% | 0.2K |

| International Business Machines Co... | IBM | 187.84 | -0.29% | 0.7K |

Upgrades:

Downgrades:

Other:

JPMorgan Chase (JPM) target raised to $72 from $68 at Oppenheimer

Citigroup (C) target raised to $67 from $66 at Oppenheimer

Bank of America (BAC) target raised to $20 from $19 at Oppenheimer

Apple (AAPL) target raised to $100 from $93 at Pacific Crest

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia AiG Performance of Construction Index June 46.7 51.8

03:30 Australia ANZ Job Advertisements (MoM) June -5.7% Revised From -5.6% +4.3%

07:00 Japan Leading Economic Index May 106.5 106.0 105.7

07:00 Japan Coincident Index May 111.1 111.0 111.1

07:45 Switzerland Unemployment Rate June 3.2% 3.2% 3.2%

08:00 Germany Industrial Production s.a. (MoM) May -0.3% Revised From +0.2% +0.3% -1.8%

08:00 Germany Industrial Production (YoY) May +1.8% +1.3%

09:00 Switzerland Foreign Currency Reserves June 444.4 449.6

10:30 Eurozone Sentix Investor Confidence July 8.5 7.5 10.1

11:00 Eurozone Eurogroup Meetings

11:00 Eurozone ECB President Mario Draghi Speaks

The U.S. dollar traded lower against the most major currencies. The U.S. currency remained supported by Thursday's strong U.S. labour market data. U.S. companies added 288,000 jobs in June.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

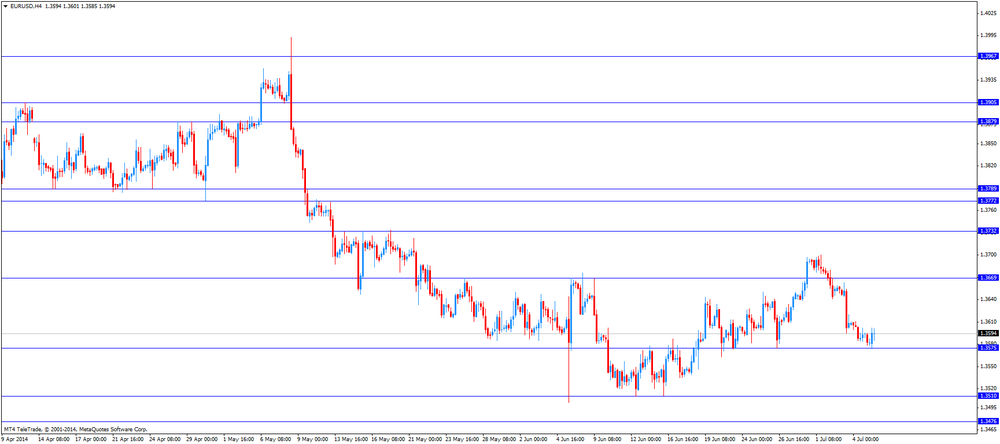

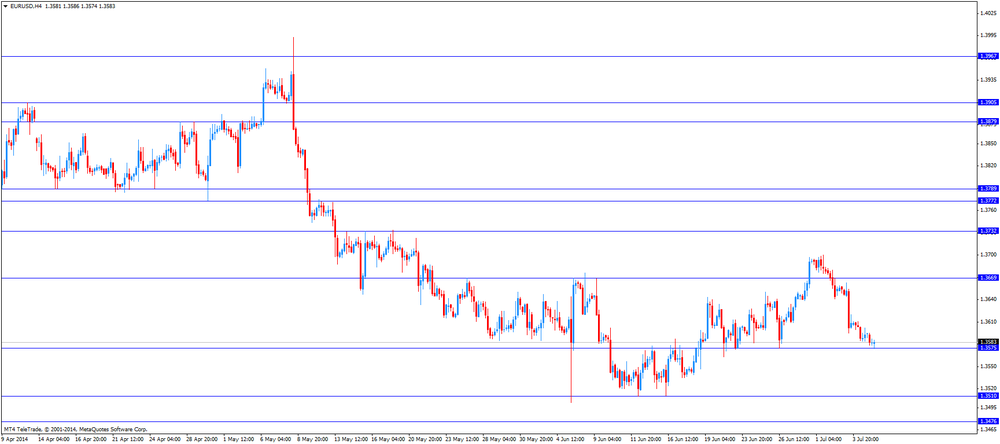

The euro traded higher against the U.S. dollar after mixed economic data from the Eurozone. German industrial production dropped 1.8% in May, missing expectations for a 0.3%, after a 0.3% decline in April. April's figure was revised down from a 0.2% increase.

Sentix investor confidence index for the Eurozone increased to 10.1 in July from 8.5 in June, beating expectations for a drop to 7.5.

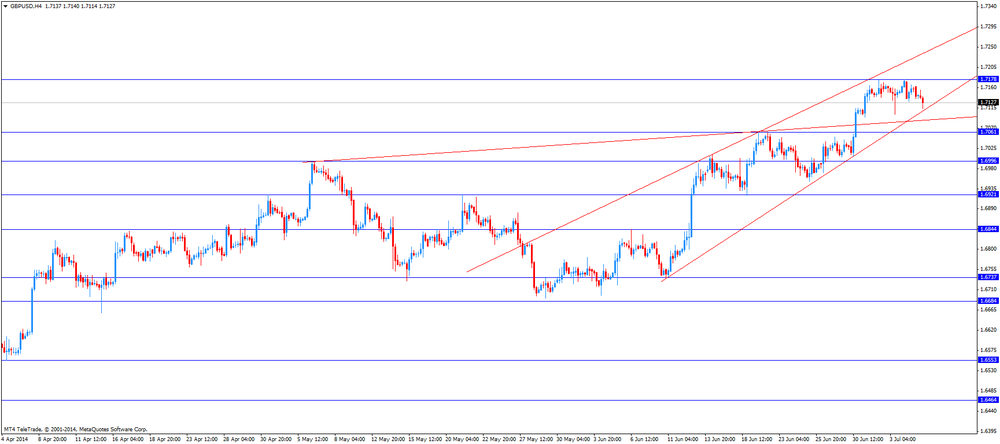

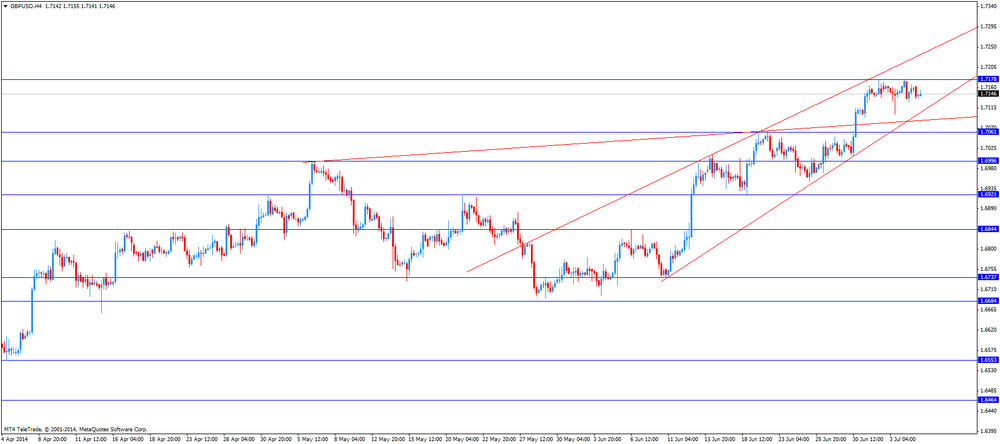

The British pound fell against the U.S. dollar in the absence of any major economic reports in the U.K.

The Swiss franc traded higher against the U.S. dollar after the economic data from Switzerland. Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in June, in line with expectations.

The Swiss National Bank's foreign exchange reserves increased to 449.553 billion Swiss francs in June, from 444.351 billion Swiss francs in May. May's figure was revised down from 444.354 billion Swiss francs.

The Canadian dollar rose against the U.S. dollar ahead of the Canadian economic data. Building permits in Canada should increase 3.1% in May, after a 1.1% gain in April.

Ivey purchasing managers' index for Canada should climb to 51.3 in June from 48.2 in May.

EUR/USD: the currency pair climbed to $1.3601

GBP/USD: the currency pair decreased to $1.7114

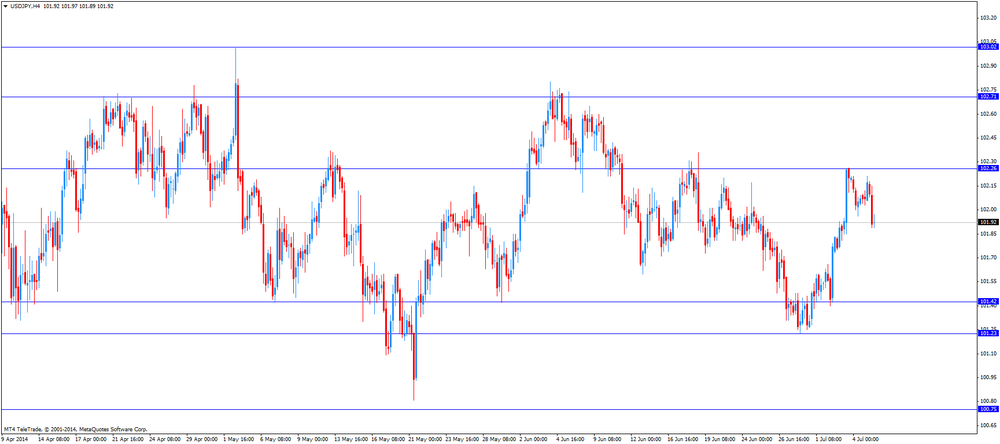

USD/JPY: the currency pair declined to Y101.89

The most important news that are expected (GMT0):

14:30 Canada Building Permits (MoM) May +1.1% +3.1%

16:00 Canada Ivey Purchasing Managers Index June 48.2 51.3

16:30 Canada Bank of Canada Business Outlook Survey Quarter II

EUR/USD

Offers $1.3700-20, $1.3680/85, $1.3660, $1.3635

Bids $1.3565, $1.3550/40, $1.3500

GBP/USD

Offers $1.7300, $1.7250, $1.7230, $1.7200

Bids $1.7095/90, $1.7065, $1.7035/30, $1.7010

AUD/USD

Offers $0.9505, $0.9480, $0.9465/70, $0.9420, $0.9400

Bids $0.9330, $0.9320, $0.9300

EUR/JPY

Offers Y140.50, Y140.00, Y139.50, Y139.30, Y139.00

Bids Y138.50, Y138.20, Y138.00

USD/JPY

Offers Y102.80, Y102.65, Y102.50, Y102.30

Bids Y101.70, Y101.40/30, Y101.20, Y101.10/00, Y100.80

EUR/GBP

Offers stg0.8030, stg0.8000, stg0.7970, stg0.7950

Bids stg0.7905-890, stg0.7800

Most stock indices traded lower after the weaker-than-expected German economic data. German industrial production dropped 1.8% in May, missing expectations for a 0.3%, after a 0.3% decline in April. April's figure was revised down from a 0.2% increase.

Sentix investor confidence index for the Eurozone increased to 10.1 in July from 8.5 in June, beating expectations for a drop to 7.5.

Current figures:

Name Price Change Change %

FTSE 100 6,852.74 -13.31 -0.19%

DAX 9,989.85 -19.23 -0.19%

CAC 40 4,450.45 -18.53 -0.41%

The Bank of Japan Governor Haruhiko Kuroda said at BoJ's quarterly meeting of regional branch managers (32 domestic branches and general managers based in the U.S. and Europe):

- The BoJ's stimulus programme is producing the intended effects;

- The BoJ will maintain its stimulus programme for as long as necessary to achieve its 2% inflation target;

- "The BOJ will examine upside and downside risks to the economy and prices, and adjust monetary policy as needed";

- Japan's has continued to recover moderately, despite a domestic sales tax hike in April;

- Japan's financial system has remained stable.

Most Asian stock indices traded lower in a subdued trading session. Investors are awaiting the release of the Chinese consumer price index and producer price index and the Federal Reserve's last policy meeting on Wednesday.

The Bank of Japan Governor Haruhiko Kuroda said on Monday the BoJ will maintain its stimulus programme for as long as necessary to achieve its 2% inflation target. He added that "the BOJ will examine upside and downside risks to the economy and prices, and adjust monetary policy as needed".

Japan's leading economic index declined to 105.7 in May from 106.5 in April, missing expectations for a decrease to 106.0. April's figure was revised down from 106.6.

Japan's coincident index remained unchanged at 111.1 in May, beating expectations for a decline to 111.0.

Indexes on the close:

Nikkei 225 15,379.44 -57.69 -0.37%

Hang Seng 23,540.92 -5.44 -0.02%

Shanghai Composite 2,059.93 +0.55 +0.03%

EUR/USD $1.3500, $1.3525, $1.3545, $1.3600, $1.3610, $1.3615, $1.3650-55

USD/JPY Y101.00, Y101.50, Y102.00, Y102.20, Y102.50-55

EUR/JPY Y138.50, Y139.75

USD/CHF Chf0.9000

AUD/USD $0.9360, $0.9495

NZD/USD $0.8800

USD/CAD C$1.0700, C$1.0725, C$1.0735

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia AiG Performance of Construction Index June 46.7 51.8

03:30 Australia ANZ Job Advertisements (MoM) June -5.7% Revised From -5.6% +4.3%

07:00 Japan Leading Economic Index May 106.5 106.0 105.7

07:00 Japan Coincident Index May 111.1 111.0 111.1

07:45 Switzerland Unemployment Rate June 3.2% 3.2% 3.2%

08:00 Germany Industrial Production s.a. (MoM) May -0.3% Revised From +0.2% +0.3% -1.8%

08:00 Germany Industrial Production (YoY) May +1.8% +1.3%

09:00 Switzerland Foreign Currency Reserves June 444.4 449.6

10:30 Eurozone Sentix Investor Confidence July 8.5 7.5 10.1

11:00 Eurozone Eurogroup Meetings

11:00 Eurozone ECB President Mario Draghi Speaks

The U.S. dollar traded higher against the most major currencies. The U.S. currency was still supported by Thursday's better-than-expected U.S. labour market data. U.S. companies added 288,000 jobs in June.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

Market participants speculate the Fed may hike its interest rate sooner than expected.

The New Zealand dollar decreased against the U.S dollar in the absence of any major economic reports in New Zealand. The U.S. dollar was still supported by Thursday's U.S. jobs report.

The Australian dollar traded slightly higher against the U.S. dollar after the economic data from Australia. The AI Group/HIA released its housing construction index for June. The index increased to 51.8 in June from 46.7 in May.

The ANZ job advertisements rose 4.3% in June from a decline of 5.7% in May. May's figure was revised down from a drop of 5.6%.

The Japanese yen traded higher against the U.S. dollar. Japan's leading economic index declined to 105.7 in May from 106.5 in April, missing expectations for a decrease to 106.0. April's figure was revised down from 106.6.

Japan's coincident index remained unchanged at 111.1 in May, beating expectations for a decline to 111.0.

The Bank of Japan Governor Haruhiko Kuroda said on Monday the BoJ will maintain its stimulus programme for as long as necessary to achieve its 2% inflation target. He added that "the BOJ will examine upside and downside risks to the economy and prices, and adjust monetary policy as needed".

EUR/USD: the currency pair declined to $1.3580

GBP/USD: the currency pair decreased to $1.7135

USD/JPY: the currency pair declined to Y102.09

The most important news that are expected (GMT0):

14:30 Canada Building Permits (MoM) May +1.1% +3.1%

16:00 Canada Ivey Purchasing Managers Index June 48.2 51.3

16:30 Canada Bank of Canada Business Outlook Survey Quarter II

EUR / USD

Resistance levels (open interest**, contracts)

$1.3705 (2149)

$1.3679 (1595)

$1.3644 (275)

Price at time of writing this review: $ 1.3583

Support levels (open interest**, contracts):

$1.3570 (311)

$1.3551 (1747)

$1.3527 (1594)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 19043 contracts, with the maximum number of contracts with strike price $1,3800 (3163);

- Overall open interest on the PUT options with the expiration date August, 8 is 26370 contracts, with the maximum number of contracts with strike price $1,3500 (6253);

- The ratio of PUT/CALL was 1.38 versus 1.29 from the previous trading day according to data from July, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.7402 (975)

$1.7304 (1371)

$1.7207 (1360)

Price at time of writing this review: $1.7138

Support levels (open interest**, contracts):

$1.7092 (700)

$1.6996 (1288)

$1.6898 (1539)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 13361 contracts, with the maximum number of contracts with strike price $1,7100 (1584);

- Overall open interest on the PUT options with the expiration date August, 8 is 16701 contracts, with the maximum number of contracts with strike price $1,6900 (1539);

- The ratio of PUT/CALL was 1.25 versus 0.94 from the previous trading day according to data from Jule, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(time / country / index / period / previous value / forecast)

23:30 Australia AiG Performance of Construction Index June 46.7

01:30 Australia ANZ Job Advertisements (MoM) June -5.6%

05:00 Japan Leading Economic Index May 106.5 106.0

05:00 Japan Coincident Index May 111.1 111.0

05:45 Switzerland Unemployment Rate June 3.2% 3.2%

06:00 Germany Industrial Production s.a. (MoM) May +0.2% +0.3%

06:00 Germany Industrial Production (YoY) May +1.8%

07:00 United Kingdom Halifax house price index June +3.9% -0.3%

07:00 United Kingdom Halifax house price index June +8.7%

07:00 Switzerland Foreign Currency Reserves June 444.4

08:30 Eurozone Sentix Investor Confidence July 8.5 7.5

12:30 Canada Building Permits (MoM) May +1.1% +3.1%

14:00 Canada Ivey Purchasing Managers Index June 48.2 51.3

14:30 Canada Bank of Canada Business Outlook Survey Quarter II

22:00 New Zealand NZIER Business Confidence Quarter II 52

23:50 Japan Current Account (adjusted), bln May 130.5 170.0

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.