- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-04-2022

- EUR/USD is eyeing more downside as DXY strengths on discussions of restoration to neutral rates.

- The shared currency has failed to capitalize on hawkish ECB minutes and decent Retail Sales.

- Members of the UN Human Rights Council voted in favor of ceasing Russia as an associate.

The EUR/USD pair has displayed a six-day losing streak and is likely to extend losses on Friday amid expectations of escalation in the Ukraine crisis after Russia ceases to be a member of the United Nations (UN) Human Rights Council. The members of the UN Human Rights Council voted in favor of stripping Russia from the members' list after the Russian rebels committed war crimes in Bucha, Ukraine. As world nations are isolating Russia from major communities, Russian leader Vladimir Putin could de-escalate progress talks with Ukraine, and the Ukraine crisis may continue to elevate further.

Meanwhile, the hawkish European Central Bank (ECB) minutes of March’s monetary policy meeting have failed to cushion the shared currency. Most of the ECB policymakers have favored immediate action through monetary policy to corner the galloping inflation. Apart from that, the ECB should halt the Asset Purchase Programme (APP) as the stated objective behind its launch has been achieved.

Along with the hawkish ECB minutes, the shared currency has also failed to capitalize upon the outperformance of the Euro Retail Sales. The Eurostat reported Retail Sales at 5%, higher than the preliminary estimate of 4.8% but significantly lower than the previous print of 8.4%.

On the dollar front, the US dollar index (DXY) is eyeing a trigger, which will drive the asset towards the much-awaited resistance of the 100.00 figure. Federal Reserve (Fed) policymakers have started favoring the restoration of policy rates to neutral amid rising inflation and an objective of self-dependent economy.

- The AUD/JPY edges higher in the Asian session, up some 0.19%.

- Market participants disregard Russia-Ukraine woes, as shown by Asian equity futures rising.

- AUD/JPY Price Forecast: Despite a negative divergence in the daily chart, the pair might consolidate as the RSI’s slope turns horizontal.

The AUD/JPY recovers some ground after falling for two consecutive days as the Asian Pacific session begins. The AUD/JPY is trading at 92.81 amidst an upbeat market mood, portrayed by Asian equity futures trading in the green.

US equities ended the session in a mixed mood, contrary to the Asian market futures, which point to a higher open. So far, market players have put aside Russia-Ukraine woes, despite Russian Foreign Minister Lavrov complaining that Ukraine’s new draft agreement presented to Russia does not fulfill Russia’s demands on Crimea and Donbas. Also, late reports stated that Russia is regrouping troops as they prepare to launch another offensive aiming to seize the Eastern regions of Ukraine, Donetsk, and Luhansk.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY is upward biased, but failure at 94.00 exposed the pair to selling pressure. Additionally, momentum indicators like the Relative Strength Index (RSI) at 70.745 made a successive series of lower highs, contrarily to AUD/JPY price action, with subsequent series of “quasi” same highs, forming a “double-top” chart pattern. Moreover, a negative divergence between price action and RSI would send the pair lower.

Even though the Relative Strength Index (RSI) at 70.76 remains in overbought levels, it portrays a horizontal slope, meaning that the AUD/JPY might consolidate as traders assess the direction of the pair

That said, the AUD/JPY first resistance would be 93.00. A breach of the latter would expose the R2 daily pivot at 93.60, followed by the 94.00 mark. On the flip side, the AUD/JPY first support would be 92.26. A decisive break would expose the 91.00 mark, followed by the “double-top” neckline at 90.76.

Technical levels to watch

- A pullback likely near ascending triangle formation will contact sellers to take the charge.

- The 20- and 200-period EMAs have displayed a bear cross, which adds to the downside filters.

- The RSI (14) needs to tumble below 40.00 for validating a bearish setup.

The USD/CAD pair has witnessed a firmer upside move in the last three trading sessions, which has driven the asset near 1.2600 after hitting a low of 1.2403 on Tuesday. The asset has managed to close above the 20-period Exponential Moving Average (EMA) on Thursday, which is trading at 1.2570 and is near to the mighty 200-EMA.

On the daily scale, a pullback attempt by the greenback bulls has sent the asset near to the lower boundary of the ascending triangle formation whose horizontal resistance is placed from 20 August 2021 high at 1.2950 while the ascending trendline is plotted from June 2021 low at 1.2007.

A bear cross of 20- and 200-period EMAs adds to the downside filters. However, the Relative Strength Index (RSI) (14) has climbed above 40.00-60.00 area, which advocates consolidation.

Should the asset test the lower boundary of ascending triangle formation at 1.2630, pullback sellers may attack the asset and will send it towards the psychological support at 1.2500, followed by Tuesday’s low at 1.2403.

On the flip side, greenback bulls may regain strength if the asset overstep March 17 high at 1.2699, which will push the pair towards the March 16 high at 1.2778. Breach of the latter will drive the asset towards the March 14 high at 1.2827.

USD/CAD daily chart

-637849685695259836.png)

- The USD/JPY is advancing in the week by some 1.26%.

- A positive market mood lifts the greenback as investors shrug off geopolitical jitters.

- USD/JPY Price Forecast: Upward biased as bulls, eye the YTD high at 125.10.

USD/JPY records further gains in the week on broad US dollar strength as the Asian Pacific session begins. At 124.15, the USD/JPY remains buoyant, despite been trading in a narrow 55-pip range in the last three days, as the Eastern Europe conflict between Russia-Ukraine, extends for the sixth consecutive day.

Asian market futures trade with gains, shrugging off the Russia-Ukraine conflict woes

US equities ended the session in a mixed mood, contrarily to the upbeat tone of Asian market futures, which point to a higher open. On Thursday, investors shrugged off Russia-Ukraine chatters, despite Russian Foreign Minister Lavrov complaining that Ukraine’s new draft agreement presented to Russia does not fulfill Russia’s demands on Crimea and Donbas. Meanwhile, late reports said that Russia is regrouping troops as they prepare another offensive aiming to reclaim the Eastern regions of Ukraine, Donetsk, and Luhansk.

Thursday’s North American session witnessed Fed speaking, led by St. Louis Fed President James Bullard, who said that the Fed remains behind the curve trying to tame inflation. Bullard added that he would like to see the Federal Funds Rate (FFR) at 3.5% by the second half of the year.

Later on the day, Chicago’s Fed President Charles Evans stated that we [Fed] will going to get to neutral setting by the end of this year or early next.

The Japanese docket would feature the Current Account for February, and Consumer Confidence for March, as the highlights of economic data being reported. On the US front, Wholesale Inventories for February on a monthly basis will be unveiled.

USD/JPY Price Forecast: Technical outlook

The USD/JPY remains upward biased, but in the last three days, the Average Daily Range (ADR) has been 55-pips. The daily moving averages (DMAs) residing below the spot price further confirm the uptrend, and it’s worth noting that the 100-DMA at 109.48 is about to cross over the 200-DMA at 109.60.

That said, the USD/JPY first resistance would be 124.00. A breach of the latter would expose March’s 29 daily high at 124.30, followed by the YTD high at 125.10.

- USD/CHF remains stuck around 0.9350 as the US Treasury yields rebound sharply.

- The DXY is aiming at 100.00 on raising bets on an aggressive interest rate hike.

- Russia ceases to be a member of the UN Human Rights Council.

The USD/CHF pair is oscillating in a narrow range of 0.9318-0.9348 since Thursday as the Federal Reserve (Fed) policymakers have started dictating a reversion to neutral rates from the ultra-loose stances on the monetary policy.

After commenting on the extent of an interest rate hike by the Fed in coming monetary policies, Fed’s Monetary Policy Committee (MPC) members have shifted to advocating a move back to the neutral policy. The ultra-loose monetary policy and helicopter money to spurt the growth rate after the Covid-19 pandemic has done its job now and it would be better to resort to a situation of normal rates and a self-dependent economy. Atlanta Fed President Raphael Bostic on Thursday cited that it is fully appropriate that the Fed move policy closer to a neutral position, it should do so in a cautious way, reported Reuters.

On the Russia-Ukraine front, Russia ceases to be a member of the United Nations (UN) Human Rights Council as the members have voted against the Kremlin after its war crimes in Bucha, Ukraine. Also, US lawmakers have voted to ban oil, gas, and coal imports from Moscow. Adding to that, the former has also decided to strip its tag of ‘most Favored nations’ trade status, which will result in higher tariffs for Moscow.

Meanwhile, the US dollar index is aiming to tap the magical figure of 100.00 on expectations of higher US Consumer Price Index (CPI) numbers next week. The 10-year US Treasury yields have reclaimed a three-year high at 2.66% as rate hike fears renew.

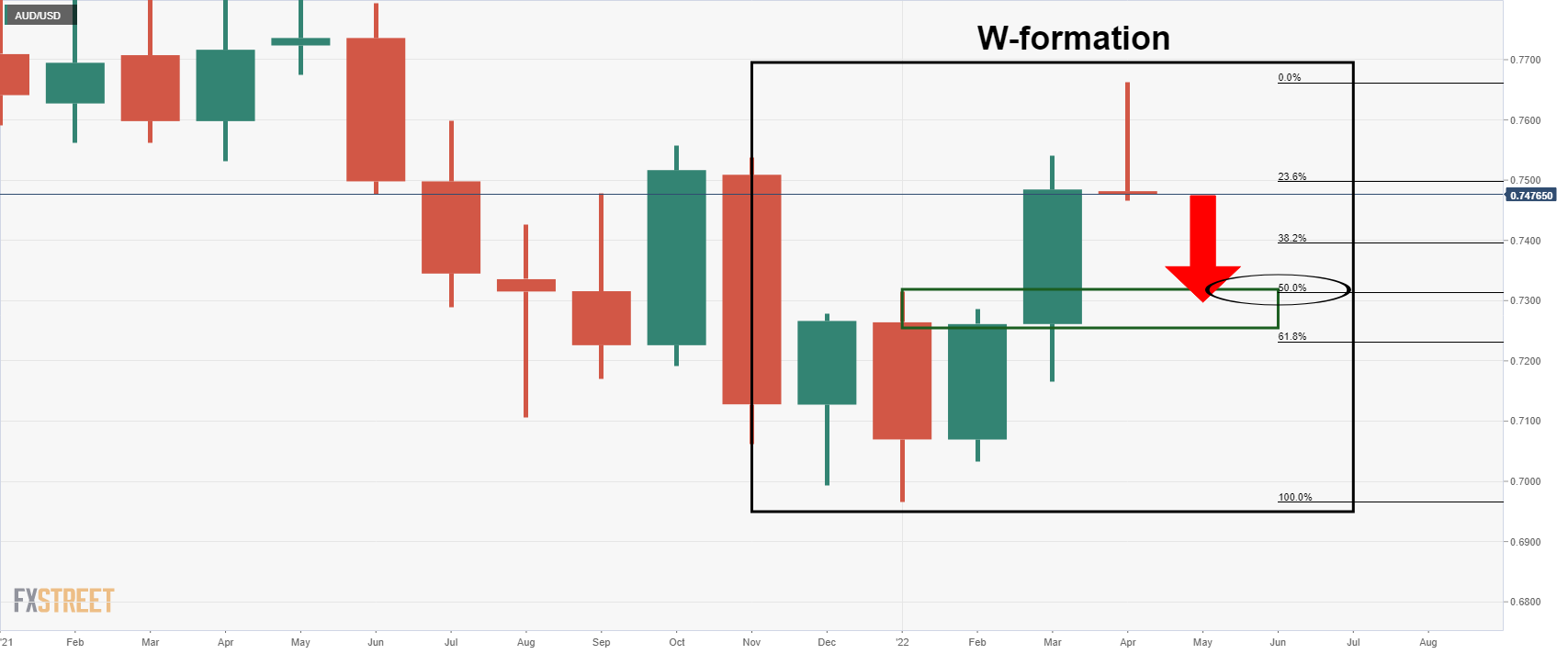

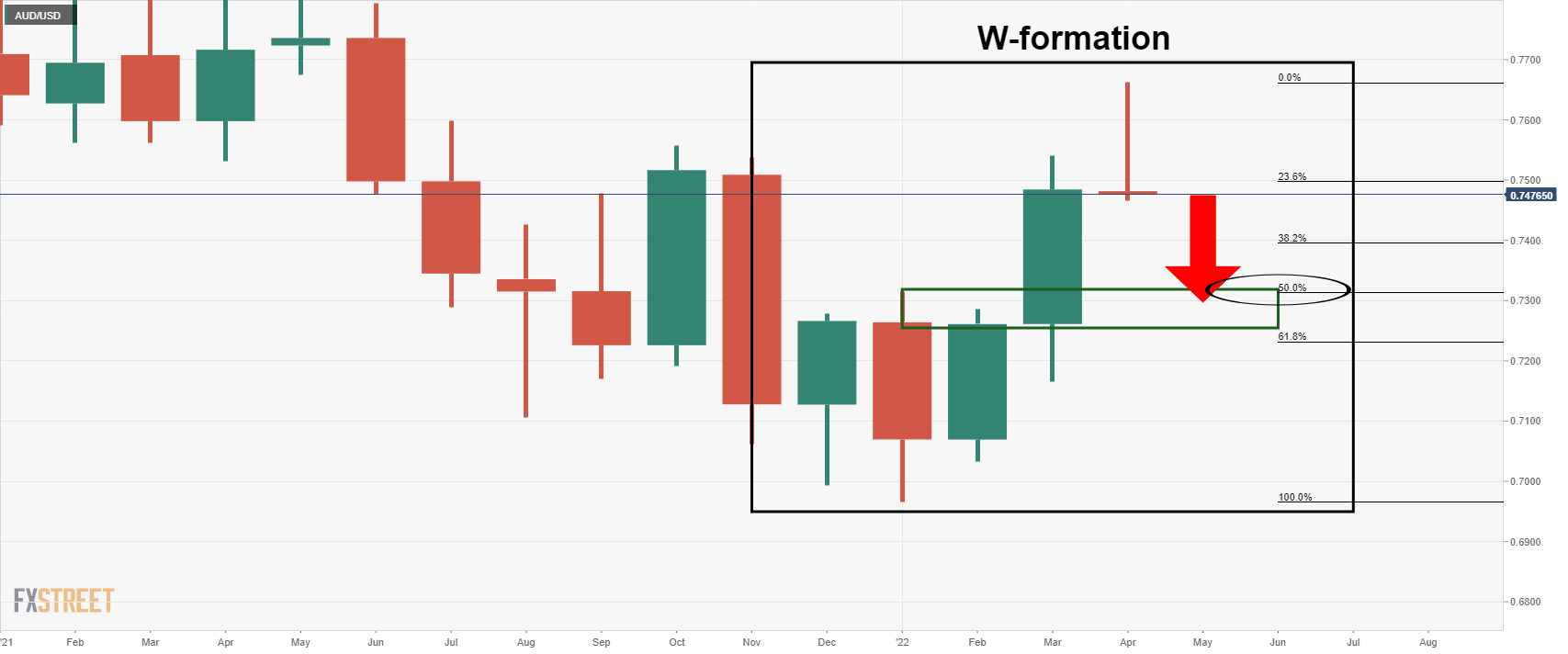

- AUD/USD has failed to break and hold territory to the upside and is under pressure.

- AUD/USD bears are seeking a break from daily support.

AUD/USD suffered another down day on Thursday and is set to break to fresh lows below the 0.7450s. As per the prior longer-term analysis, AUD/USD Price Analysis: Bulls coming up for their last breath?, while the October highs were broken, they have not been ''well and truly cleared''.

AUD/USD monthly chart

Therefore, the Monthly W-formation, a reversion pattern, remains in the picture.

This analysis is based on the need for the mitigation of the imbalance of price since the bullish impulse over the past couple of months. The neckline of the 'W' has a confluence with the 50% mean reversion level near 0.7315.

AUD/USD daily chart

From a daily perspective, the price is heavy following the start of the week's strong rejection from the daily highs, followed by a bearish engulfing candle and subsequent follow-through on Thursday:

- The EUR/JPY is barely advancing some 0.03% as the Asian Pacific session begins.

- Risk sentiment fluctuated as US equities finished mixed on Thursday’s session.

- EUR/JPY Price Forecast: Range-bound, but about to break upwards.

The EUR/JPY cross-currency pair remains subdued in choppy trading, as low-yielder currencies, the euro and the Japanese yen, lack the catalyst to stir the exchange rate beyond the narrow trading range. At the time of writing, the EUR/JPY is trading at 134.89.

US equities ended the session mixed, reflecting the market mood. Investors shrugged off Russia-Ukraine chatters, despite Russian Foreign Minister Lavrov complaining that Ukraine’s new draft agreement presented to Russia does not fulfill Russia’s condition on Crimea and Donbas. Meanwhile, late reports said that Russia is regrouping troops as they aim to seize the Eastern regions of Ukraine, Donetsk, and Luhansk.

Aside from this, the EUR/JPY stood within the 134.40-135.50 range in overnight trading, seesawing in the latter for the last three days. It is worth noting that the Relative Strenght Index (RSI) remains in bullish territory as its reading at 62.35 portrays. However, its slope is almost horizontal, depicting the neutral bias of the EUR/JPY.

EUR/JPY Price Forecast: Technical outlook

The 1-hour chart depicts that the EUR/JPY sustained for the last three days, successive series of higher highs and higher lows. However, the 50, 100, and 200-hour simple moving averages (SMAs) above the spot price exert downward pressure on the pair, as EUR/JPY sellers lean on those when opening fresh short bets on the pair.

To the upside, the EUR/JPY’s first resistance would be the confluence of the 50 and 100-SMAs, lying within the 134.95-135.00 area. A breach of the latter would open the door towards the convergence of the 200-SMA and the R1 daily pivot around the 135.34-42 range. Once cleared, it would open the door towards the R2 daily pivot at 136.00, followed by March 30 daily high at 136.84.

On the downside, the EUR/JPY’s first support would be an upslope trendline that passes near 134.50. A break would expose the confluence of the S1 daily pivot and April’s five daily low at 134.30, followed by the 134.00 mark, and then the S2 daily pivot at 133.82.

Technical levels to watch

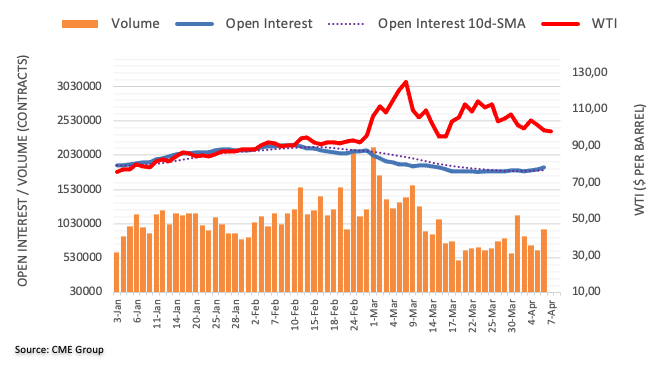

- US oil under pressure below $100bbls spot.

- The supply of oil is kicking in and weighing the price into fresh lows for the week.

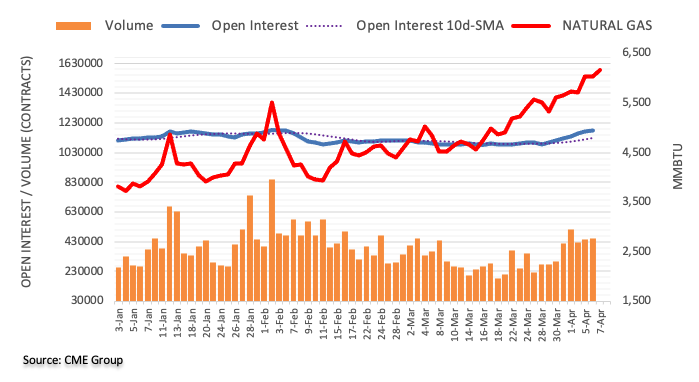

West Texas Intermediate (WTI) crude oil has been pressured this week and it carved out a fresh low on Thursday for the same period at $93.84c after falling from a high of $98.80c. The price of crude oil has fallen for a second straight day on Thursday.

Supply is back with yesterday's announcement of the release of 60-million barrels of strategic reserves from members of the International Energy Agency. Also, a drop in Chinese demand as it quarantines the commercial centre of Shanghai to check the spread of a Covid-19 outbreak is weighing on prices. When coupled with higher US oil inventories, it has made for a bearish recipe.

Meanwhile, analysts at TD Securities explained that the physical oil markets are showing signs of softening amid dual blows from significant Chinese lockdowns and a massive SPR release, but energy supply risks will likely remain elevated nonetheless.

''After all, while our tracking of Chinese mobility had indicated a 10% slump in road traffic, we now see a sign of stabilization in Chinese mobility according to a weighted average of congestion indicators for the 15 largest cities by vehicle registrations.''

''However,'' the analysts added, ''changes in Chinese demand pale in comparison to the persistent underproduction from OPEC+, with spare capacity split between a few 'Haves' and a larger contingent of 'Have-Nots'.''

Ukraine crisis risks

Sanctioning has been a theme in the markets this week as the EU and US announced the proposed plans that include a ban on imports of Russian coal by the EU while the US plans to ban all new investment in Russia. European Council President Charles Michel told the European Parliament Wednesday that “measures on oil and even gas will also be needed sooner or later,” as he condemned reports of atrocities by Russian forces in Ukraine.

''Further, self-sanctioning continues to have a significant impact on Russian oil exports as highlighted by their flagship Urals crude trading at a record discount. And yet, the right tail remains fat in energy markets as the European Commission continues to debate on how to tackle Russian oil,'' analysts at TD Securities explained.

''The war in Ukraine is further driving up the cost of trading energy products across the world, creating additional frictions for commodity traders and thereby providing an additional channel for energy supply risks to rise.''

- US equities rose on Thursday, as dip-buying helped shield the major indices from negative geopolitical newsflow and further Fed hawkishness.

- The S&P 500 rose 0.4% to close at the 4500 level amid big gains in some large US healthcare names.

- Focus is already turning to next week’s US inflation data and the unofficial start to the Q1 2022 earnings season.

US equities gained across the board on Thursday, with the S&P 500 rebounding from weekly lows in the 4450 area to close bang on the 4500 mark, a gain of 0.4% on the session. The index was propped up by big gains in some of the largest US healthcare names and managed to close back to the north of its 200-Day Moving Average, with traders largely ignoring downbeat news on the geopolitics front.

The US Senate voted to strip Russia of its “most favoured nation” trading status and the UN general assembly voted to kick Russia out of the human rights council, a day after the US, UK and EU toughened sanctions on Russia’s economy. Meanwhile, the Russian Foreign Minister was pessimistic about the state of Russo-Ukrainian peace talks.

Elsewhere, with equities having already seen a substantial dip since the start of the week, dip-buying helped shield the market from further downside as a result of more hawkish Fed chatter. Specifically, Fed’s James Bullard called for rates to hit 3.5% by the year’s end. While the equity market didn’t react to these comments, US yields, particularly at the long end, continues to press higher.

This capped the rebound in the growth/tech stock heavy Nasdaq 100 index, which mustered a more modest 0.2% rebound back above the 14,500 level. The Dow Jones Industrial Average, meanwhile, also rose about 0.2% to back above 34,500. The CBOE S&P 500 Volatility Index or VIX remained not too far above 20.00, its long-run average.

A record strong US weekly initial jobless claims figure of 166K was shrugged off by equities, but does underpin the idea that the US labour market is red hot, which should bolster Fed confidence that the economy can handle aggressive monetary tightening. US inflation data (Consumer and Producer Price Indices) out next week should further bolster the idea that aggressive Fed tightening is very much needed, with MoM inflation rates expected to surge thanks to the outbreak of the Russo-Ukraine war. Another key risk for investors to watch next week will the unofficial start to the Q1 2022 earnings season, which kicks of as the big US banks start reporting.

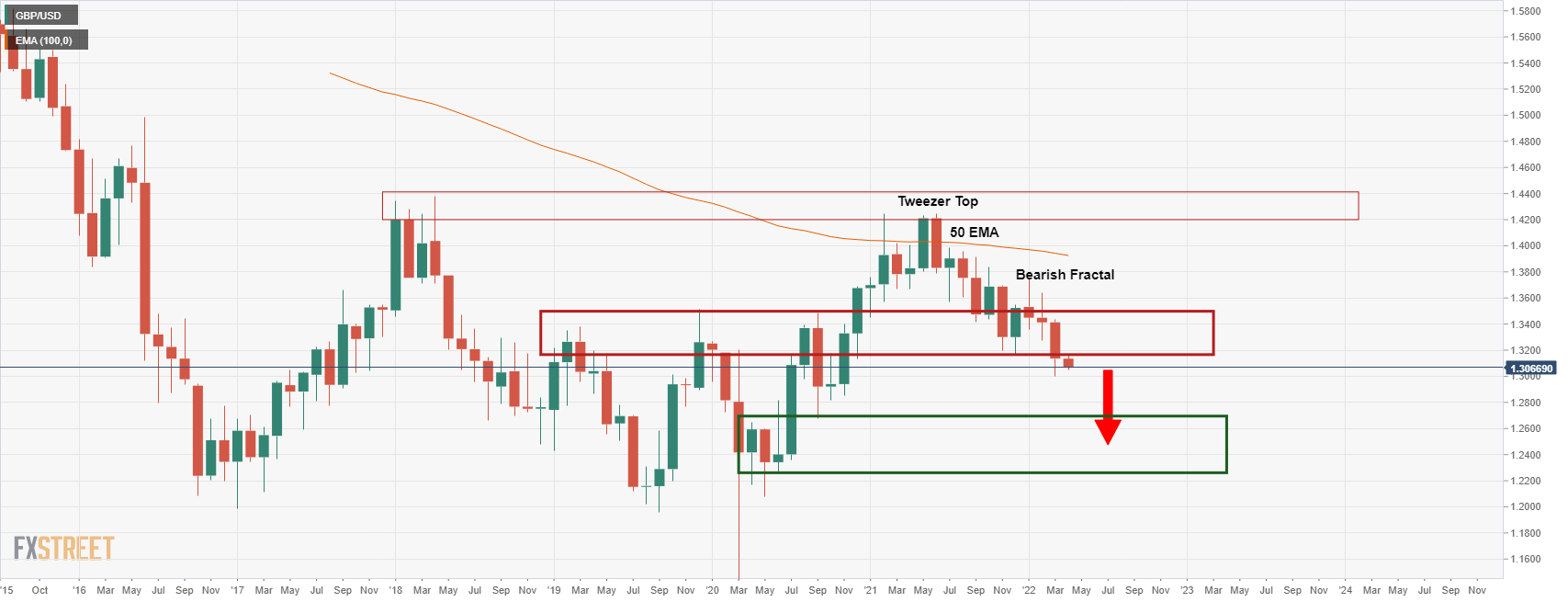

- GBP/USD bears are in control, for now, and aim for a monthly support area.

- The daily chart's M-formation's neckline is important.

GBP/USD is performing on the bid on Thursday afternoon US session, trying to resurface from the recent lows around 1.3050 following a strong move in the greenback. Meanwhile, however, the pair remains vulnerable to further losses from a longer-term perspective and the following illustrates the market structures across the monthly, weekly and potentially, from a daily point of view also.

GBP/USD monthly chart

The monthly chart is highly bearish following a restest into the 50 EMA, followed by the Tweezer Top and a bearish Fractal. The pair has subsequently continued south and broken support that now would be expected to act as resistance on a subsequent retest of the structure.

GBP/USD weekly chart

Meanwhile, the weekly chart's M-formation, a reversion pattern, has seen the price revert towards the neckline in a 38.2% Fibonacci retracement. This is potentially far enough to lure in the bears at a discount and thus see prices extend lower in the coming weeks towards the monthly support area.

GBP/USD daily chart

From a daily point of view, however, there could still be some upside to come as the price is drawn to the M-formation's neckline. This will need to hold on a retest and bears will need to protect this area if the downside is going to play out in the foreseeable future. If the price breaks the neckline, then the bulls could well take back control in the meantime.

What you need to take care of on Friday, April 8:

The market’s mood remained sour as the focus remained on central banks’ hawkishness and tensions between Russia and the western world. The US has widened its actions against Moscow, hitting Russian Sberbank and Alfa Bank and prohibiting investment in the country by American companies. The EU, in the meantime, backed a Russian coal embargo, although without officially confirming it. The dollar remained strong.

On Thursday, Ukraine has presented a new agreement proposal, although it includes discussing the situation of Crimea and Donbass, something that Russia considers unacceptable.

The European Central Bank released the Accounts of its latest meeting. The document showed that policymakers believe the bond-buying program has now fulfilled its objective, and by ending it in the summer, it would clear the way for a 3Q rate hike.

Asian and European equities closed in the red, but Wall Street managed to recover some ground after two days of sharp losses. At the same time, government bond yields held at the upper end of the range, with the 10-year US Treasury note yielding 2.65% by the end of the day.

The EUR/USD pair trades around 1.0870, while GBP/USD stands at 1.3070. The dollar appreciated against its safe-haven rivals, with USD/CHF trading at 0.8340 and USD/JPY near 124.00.

Commodity-linked shed some ground, with AUD/USD down to 0.7470 and USD/CAD up to 1.2585.

Cardano price ready to breakout with the arrival of bonds on the Ethereum-killer’s blockchain

Like this article? Help us with some feedback by answering this survey:

- NZD/USD fell under 0.6900 on Thursday as the US dollar gained ground across the board amid surging US yields.

- Bond markets are reacting to recent Fed hawkishness, while the kiwi has been hurt by lower equity and commodity prices.

- But the longer-term technicals remain positive for the kiwi, with an uptrend from late January still in play.

NZD/USD fell for a second straight session on Thursday and dipped below its 200 and 21-Day Moving Averages, both of which reside just to the north of the 0.6900 level, as well as dipping below the big figure. The selling pressure has eased in recent hours, with NZD/USD bottoming out in the 0.6880s, with some buying ahead of late March lows in the 0.6875 area offering some support.

Kiwi underperformance versus the US dollar on Thursday was roughly in line with that of its risk appetite/commodity-sensitive G10 peers the Aussie and the loonie, all of which have suffered amid declining equity/commodity prices in recent days. But NZD/USD dip back under 0.6900 isn’t just a kiwi story. With US yields (particularly at the long-end) continuing to surge higher as traders react to hawkish rhetoric from the Fed this week, the US dollar is on the front foot across the board.

From a technical perspective, things are far from catastrophic for NZD/USD. The pair remains in an uptrend that has been in play since the late January lows under 0.6600, and would have to fall all the way to the mid-0.6800s to test this uptrend. And before getting that far, the pair would have to break below a key balance area in the 0.6875 region.

If sentiment in commodity and equity markets stabilises next week, that would be a plus for the kiwi, which might also get a lift if the RBNZ comes out firing with a 50 bps rate hike and hawkish rate guidance at its upcoming meeting. But NZD/USD traders should also be on notice for US Consumer and Producer Price inflation figures which, if ugly (as many expect), will exert further pressure on the Fed to tighten monetary policy rapidly.

Atlanta Fed President Raphael Bostic said on Thursday that while it is fully appropriate that the Fed move policy closer to a neutral position, it should do so in a cautious way, reported Reuters. It's going to take longer than initially thought for supply chain issues to resolve, he added, noting that the Fed's goal is to try to have sustained growth that extends for as long as possible.

Market Reaction

Bostic is on the dovish end of the Fed spectrum nowadays, as demonstrated by his emphasis on getting rates "closer" to neutral in a "cautious" way (rather than other Fed members who want to actually get to neutral or above it in a more rapid way). Markets did not react to his comments.

Chicago Fed President and FOMC member Charles Evans on Thursday said that the Fed will probably get rates to neutral by the end of this year or early next, reported Reuters. I'm optimistic that the Fed can get to neutral, look around and think there's not much more going on, he added.

- The USD/CAD grinds higher in the North American session, up some 0.38%.

- The Russian-Ukraine war weighs significantly on sentiment, as NATO/US officials warned that the conflict could extend for years.

- USD/CAD Price Forecast: The pair remains downward biased, but a daily close above 1.2600 would add upward pressure on the USD/CAD.

The USD/CAD is recovering some ground and aims to break above the 200-DMA, but retreated late in the North American session, amidst a risk-off market sentiment that dragged the pair below the 1.2600 mark. At the time of writing, the USD/CAD is trading at 1.2589.

Easter Europe geopolitical issues, particularly the Ukraine-Russo war, keep weighing on the mood. Nevertheless, risk appetite increased, with US equities fluctuating, as the US Senate unanimously backed a legislation banning oil imports from Russia.

Meanwhile, NATO and US officials warned that the war in Ukraine might last for weeks or even years, while Kyiv’s Foreign Minister pleaded for urgent military assistance so that Ukraine could make a difference in its fight with Russia.

Reports from the Kremlin reported that Russian President Putin discussed peace talks with the Russian security council and the military operation in Ukraine, as reported by RIA.

An absent Canadian economic docket keeps USD/CAD traders adrift to US Data. However, Canadian employment figures would grab the headlines on Friday, with the Employment Change for March expected at 80K. The Unemployment Rate for the same period is likely to drop toward 5.3%.

On the US front, the economic docket revealed Initial Jobless Claims for the week ending on April 2, which came at 166K less than the 200K expected.

USD/CAD Price Forecast: Technical outlook

The USD/CAD entered the Thursday session as neutral-downward biased, but after the Fed minutes, it reacted upwards. During the session, the USD/CAD briefly tested the 200-day moving average (DMA) at 1.2617, retreating afterward back below the 1.2600 figure. On its way south, USD/CAD bears reclaimed the March 3 daily low-turned-resistance at 1.2587, and it’s worth noting that the Relative Strength Index (RSI) at 49.43 remains below the 50-midline, despite the steeper 131-pip USD/CAD rally.

The USD/CAD first support level would be 1.2532. A breach of the latter would expose the 1.2500 mark, followed by March 25 daily low at 1.2465.

Upwards, the USD/CAD first resistance would be 1.2600. Once cleared, the next resistance would be the 200-DMA at 1.2617, followed by the February 10 daily low turned resistance at 1.2636, followed by the confluence of the 50 and 100-DMAs at 1.2667 and 1.2687, respectively.

- AUD/USD bears stepping in as the bulls throw in the towel.

- Bears eye the 50% monthly mean reversion level in the W-formation.

AUD/USD remains pressured into the closing session so the week as a firm US dollar persists surrounding the hawkish US central bank narrative. After sliding from a high of 0.7518, at 0.7478, during the time of writing, AUD/USD is losing some 0.37% and is in close proximity to the day's lows at 0.7466.

AUD/USD has been driven back by the bears this week following a brief spell up at 0.7661. These were the highest levels seen since June 2021 and were reached on the back of a hawkish twist at the Reserve Bank of Australia. ''Just as the Aussie lost some of its commodity price support, the RBA discarded its 'patient' outlook, stoking a fresh wave of yield support for the currency,'' analysts at Westpac explained. ''Yet 10-month highs were soon reversed as hawkish Fed rhetoric ratcheted up even further.''

We have a series of Fed hawkish themes this week that started with a speech from Lael Brainard who said Tuesday that the central bank could start reducing its balance sheet as soon as May and would be doing so at “a rapid pace.”

She also indicated that interest rate hikes could come at a more aggressive pace than the typical increments of 0.25 percentage points. The central bank has already increased rates in a 0.25% hike at the March meeting, the first in more than three years and likely one of many to occur this year.

Then along came the Fed minutes on Wednesday. In these, it was noted by the markets that the Fed officials reached consensus at their March meeting that they would begin reducing the central bank balance sheet by $95 billion a month, likely beginning in May. The minutes also underpinned a notion that 50 basis point interest rate increases are ahead.

On Thursday, St. Louis Fed president James Bullard added to the hawkishness by saying that the Fed remains behind the curve despite increases in mortgage rates and government bond yields. As a consequence, the US dollar is rallying and has reached fresh two-year highs as measured by the DXY index.

At the time of writing, DXY is trading at 99.780, a touch below the highs of 99.821 from the lows of 99.399. The 25 May 2020 weekly highs are located at 99.975. Next week's US inflation data seems likely to keep the US dollar on the boil as well.

AUD/USD monthly chart

As per the prior longer-term analysis, AUD/USD Price Analysis: Bulls coming up for their last breath?, while the October highs were broken, they have not been ''well and truly cleared''. Therefore, the Monthly W-formation, a reversion pattern, remains in the picture:

- GBP/JPY is set for a fifth straight session of gains, though continues to struggle to push above 162.00.

- The yen remains out of favour due to the ongoing rise in global yields following this week’s Fed/ECB hawkishness.

- But doubts are creeping in that the BoE will live up to tightening expectations, capping GBP/JPY upside for now.

GBP/JPY’s steady upside grind that has been in motion for the whole week so far has continued on Thursday, with the pair now on course to post a fifth successive daily gain. Global yields continue to move higher, with notable breaks higher seen in US yields on Thursday against the backdrop of hawkish commentary from Fed policymakers all week, plus recent Fed and ECB minutes releases, both of which were hawkish.

This is not a good environment for the highly rate differential sensitive Japanese yen, which is at present suffering from the fact that the BoJ looks intent on maintaining its Yield Curve Control policy (keeping 10-year yields within 25 bps of zero). As global yields rise, this makes holding the yen less attractive.

But GBP/JPY’s on the week gains aren’t that impressive at just 0.8% at the time of writing. The pair continues to struggle to push to the north of the 162.00 level, which looks like it might be in the early stages of forming a double top (on the four-hour candlesticks).

The pullback in global equity markets isn’t helping the risk-sensitive pair, and neither is the comparatively modest moves higher recently in UK yields (versus US yields, for comparison). The tone of the BoE has shifted as of late to be more concerned about an expected growth slowdown from Q2 onwards, rather than being worried about inflation.

As a result, doubts about the bank’s conviction for further rate hikes are creeping in and denting pound sterling’s appeal. Many analysts are of the view that, especially in light of stagflationary events in Ukraine, the BoE will not live up to currently priced rate hike expectations for 2022. If this is the case, UK yields may not have much further to run to the upside.

While it is probably too early to bet on a GBP/JPY reversal lower given the yen remains very much out of favour, it's hard to see the pair progressing much higher. Late March highs above 164.00 will likely act as a ceiling in the next few weeks and a pullback to test support in the form of 2021 and early 2022 highs in the 158.00 area in the coming months seems a decent bet, assuming the BoE doesn’t live up to the hawkish hype.

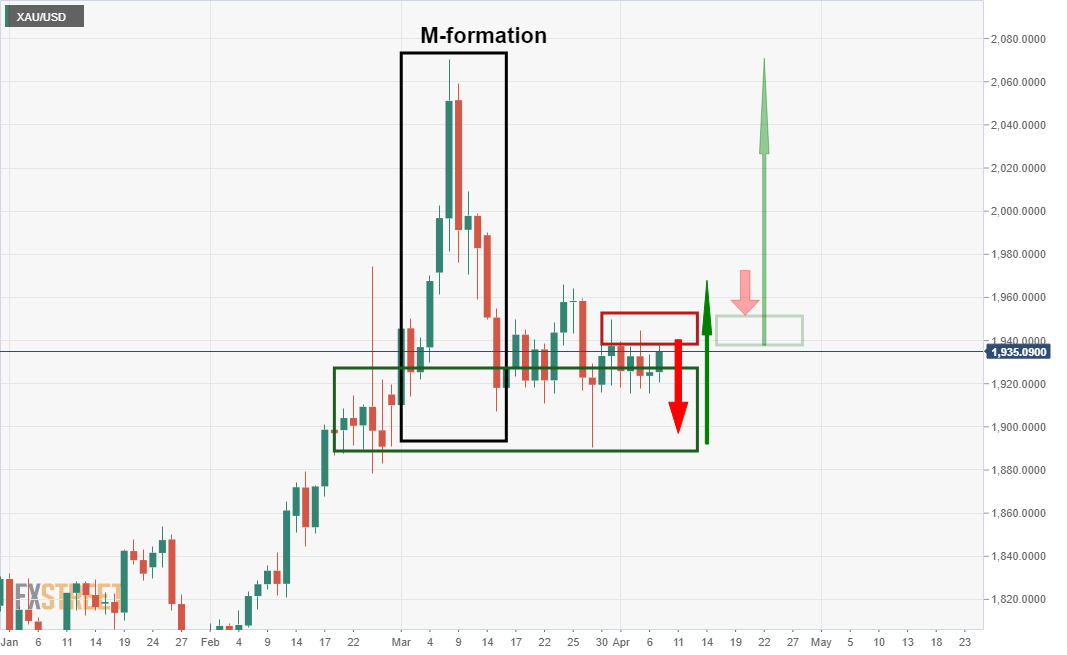

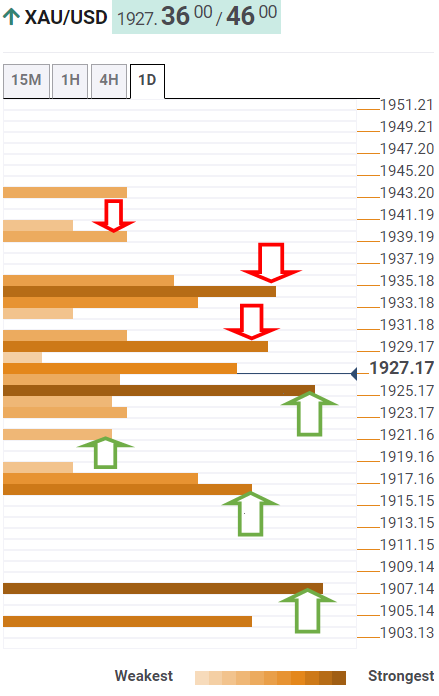

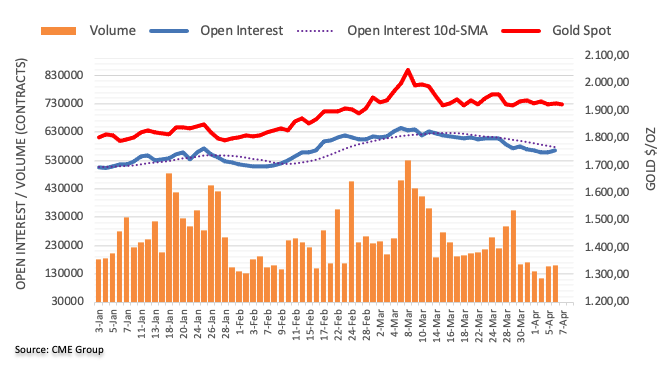

- The gold price is stuck between familiar ranges and awaits a catalyst one way or the other.

- The fundamental bias remains to the downside in the absence of escalation over the Ukraine crisis.

The gold price is stuck in familiar ranges, bouncing around between a daily resistance and support channel. However, like a coil, the build-up of energy and maintained force could be about to set off an almighty breakout, one way or the other. At the time of writing, XAU/USD is trading at $1,934.09, higher by some 0.43% and has travelled between a range of $1,920.62 and $1,937.85.

The gold price has been extremely resilient to the most hawkish Federal Reserve in a generation. Instead, the gold price is elevated due to protection against the fog of war and could also be associated with the inflationary and/or recession narratives playing out in markets.

It is worth taking note of positioning in the futures markets. ''Money managers cut their gold long exposure and increased short positioning, as rates along the yield curve continued to move higher. Specs also reacted to the hope that the Russia-Ukraine tensions may ease, lower crude oil prices and moderate inflation expectations,'' analysts at TD Securities explained.

''The combination of somewhat less geopolitical risk and the general view that the Fed is behind the curve, prompted speculation that the US central bank has the runway to aggressively tighten policy, an impression which was supported by statements from Fed officials. Given that March payrolls were strong, the belief that there may be several 50 bps Fed Funds increases in the cards drove crude lower on Friday, which suggests that investors may continue to reduce long exposure in the yellow metal,'' the analysts concluded.

This would indicate that the bias is to the downside in absence of an escalation in the Ukraine crisis. As the analysts at TD Securities warn, due to the lack of shorts in the market, leaves gold vulnerable to de-escalation in the war ''or a change in the market's focus as the fear of trade subsidies, given that there are no shorts in sight.''

Meanwhile, in today's markets, US equities have dropped while the benchmark US Treasury yields remain bid on due to the narrative surrounding the US central bank. The minutes released yesterday from the Fed's March meeting underpin the worries of higher prices and reinforce the prospect that the US central bank's balance sheet reduction is imminent.

St. Louis Fed president James Bullard amplified these risks by saying the Fed remains behind the curve despite increases in mortgage rates and government bond yields. As a consequence, the US dollar is back on the bid and reaching fresh two-year highs as measured by the DXY index. At the time of writing, DXY is trading at 99.770, a touch below the highs of 99.821 from the lows of 99.399. The 25 May 2020 weekly highs are located at 99.975.

Gold technical analysis

The outlook, from a technical picture, is consolidation until either a clean break of $1,960 or $1,915 with firm daily closes above or below respectively. If the price is unable to break below $1,900, given the longer-term bullish trajectory, a run into the $2,000s is the more likely outcome of the build-up in this phase of consolidation.

- The EUR/USD slides during the North American session, some 0.09%.

- ECB minutes lifted the EUR/USD above 1.0900, but a risk-off sentiment and Fed’s minutes dragged the pair under the former.

- EUR/USD Price Forecast: The break of a rising wedge opened the door towards 1.0700.

The shared currency is almost flat in the North American session after reaching a daily high at 1.0938, courtesy of hawkish than expected European Central Bank (ECB) March meeting minutes, despite broad risk aversion in the market. Nevertheless, of late, the EUR/USD dipped below the 1.0900 mark and is trading at 1.0879 at the time of writing.

ECB minutes perceived as hawkish

On Thursday, the ECB unveiled its March 10 minutes. The Governing Council (GC) said that it could afford to be patient, with measures of long-term inflation expectations at around 2%. Regarding the Ukraine-Russia War, the GC added that the initial effects of the war on the EU economy would be upwards on inflation and downwards on economic growth and noted that it could have inflationary/disinflationary impacts in the longer term.

Concerning inflation, a large number of ECB members noted that inflation is high and persistent, so-called for immediate further steps toward monetary policy normalization.

The EUR/USD reacted upwards on the release. However, a dismal market sentiment courtesy of the continuation of the Russia-Ukraine war, and Wednesday’s hawkish Federal Reserve minutes, exerted downward pressure on the common currency, dragging the pair back under the 1.0900 mark.

- Breaking: FOMC minutes say participants judged it appropriate to move policy towards neutral expeditiously

The EU economic docket revealed Retail Sales for February. The monthly reading expanded by 0.3%, at a slower pace than the 0.6% estimated. But, the year-over-year figure rose by 5%, higher than the 4.8% foreseen though trailed by January’s 8.4% increase.

The US docket revealed Initial Jobless Claims for the week ending on April 2, which came at 166K less than the 200K expected.

EUR/USD Price Forecast: Technical outlook

The EUR/USD bias remains downwards and further cemented it when on April 4, the EUR/USD broke the upslope trendline of a rising wedge, which opened the door towards 1.0700, but first would need to overcome some hurdles on its way down.

The EUR/USD first support would be 1.0848. A breach of the latter would expose the 2022 YTD low at 1.0806, followed by April 2020 swing lows around 1.0727, and then the abovementioned 1.0700 mark.

- Silver prices are broadly flat on Thursday near their 50DMA at $24.40, thus remaining sandwiched between major support/resistance at $24.00/$25.00.

- Despite rising US yields amid hawkish Fed rhetoric, silver remains underpinned, perhaps amid ongoing demand for inflation protection.

Spot silver (XAG/USD) prices have flatlined near their 50-Day Moving Average at $24.40 on Thursday, as the ongoing focus on the Russo-Ukraine war and related developments takes the spotlight and distracts from the ongoing shift higher in US yields. The 50DMA has been acting like a magnet for the past two sessions, with XAG/USD traders seemingly happy to keep the precious metal trading in the mid-$24.00s per troy ounce, rather than pushing it towards the 21DMA at $25.00 or the 200DMA just below $24.00. Both of these levels have in recent weeks offered support and resistance.

Silver’s resilience in the face of the ongoing push higher in yields across the US treasury curve, which continues to be spurred by hawkish Fed rhetoric (and Wednesday’s hawkish minutes), has surprised some. Fed uber hawk James Bullard even went as far as calling for rates to hit 3.5% by the end of 2022. Normally moves higher in bond yields and the idea of higher rates weighs on precious metals given the increased “opportunity cost” of holding non-yielding precious metals.

Some market commentators have suggested that demand for inflation protection ahead of the release of US Consumer Price Inflation figures for March next week could be at play. The preliminary estimate of Eurozone inflation in March showed a big jump to even higher levels beyond the ECB’s target and expectations are for next week’s US inflation figures to show the same. While silver certainly remains vulnerable to higher interest rates, given elevated inflation, real rates remain deeply negative.

Given the war in Ukraine putting downwards pressure on already highly negative near-term real rates, it perhaps shouldn’t come as a surprise to see XAG/USD remain resilient in the $24.00s. For now, as markets await further major macro updates, it would make sense to see silver continue ranging within $24.00 to $25.00 parameters.

Despite more hawkish central banks around the world, analysts at Wells Fargo still see the “aggressive tightening from the Federal Reserve” as supportive of the US dollar over the medium to longer term. They expect the Fed to remain at the forefront of major central bank tightening, and they see two 50 bps hikes and a more pronounced tightening cycle compared to last month.

Key Quotes:

“Despite more hawkish foreign central banks, we maintain our view that aggressive tightening from the Federal Reserve should support the U.S. dollar over the medium to longer term. We expect the Fed to remain at the forefront of major central bank tightening, and now expect two 50 bps hikes from the Fed and a more pronounced tightening cycle compared to last month.”

“In our view, the Fed will likely be one of the more hawkish central banks in the world, which could boost the U.S. dollar. While the greenback should remain strong, we nonetheless believe the extent of U.S. dollar strength and foreign currency weakness may be mitigated to some extent by foreign central banks also raising policy rates faster and by more than previously expected.”

- The USD/CHF falls in the North American session, down 0.05%.

- USD/CHF Price Forecast: Range-bound, but if the 0.9349 is broken, a move towards 0.9400 is on the cards.

The USD/CHF remains subdued amid a choppy trading session, as the pair seesaws around the 0.9300-47 range, unable of breaking above Wednesday’s high at 0.9349, meaning that consolidation might lie ahead. At the time of writing, the USD/CHF is trading at 0.9332.

Investors’ sentiment is negative, as shown by European and US equities falling. Factors like the Russo-Ukraine war, the global central bank’s tightening monetary conditions in the middle of an elevated inflation scenario, and China’s March PMIs contracting below 50 paint an ugly outlook for Q2 2022.

Nevertheless, the greenback holds to gains, boosted by its safe-haven status on Thursday. The US Dollar Index, a gauge of the buck’s value against its peers, edges up 0.07% and sits at 99.692. The 10-year US Treasury yield rises three basis points, up to 2.633%.

Overnight, the USD/CHF clung to the daily pivot point around 0.9323 and hovered up/down that level, though trendless as USD/CHF traders assessed the pair’s direction.

USD/CHF Price Forecast: Technical outlook

The USD/CHF uptrend remains intact. The daily moving averages (DMAs) reside well below the spot price, though almost horizontally, but sitting beneath the 0.9263 50-DMA.

The 4-hour chart shows that a bullish flag, drawn since March 14 highs around 0.9460, was broken, opening the door for further upside on the USD/CHF pair but consolidated within the central daily pivot at press time the R1 resistance level.

That said, the USD/CHF first resistance would be 0.9349. A clear break would expose March 27 and 29 highs area around the 0.9370-80 region, which, once broken, might send the pairs towards March 16 daily high at 0.9460, but first would need to reclaim the 0.9400 mark once broken.

Technical levels to watch

In the wake of recent developments, analysts at Wells Fargo now expect earlier and more rapid monetary tightening (and specifically Deposit Rate increases) from the European Central Bank (ECB) than previously. Their outlook for the ECB to end its quantitative easing program by July remains unchanged.

Key Quotes:

“The Eurozone economy has had an unsettled start to 2022, as a temporary surge in COVID cases and Ukraine-related uncertainties have weighed on activity. From a longer-term perspective there also appears to be some softening in consumer fundamentals, and we have lowered our Eurozone GDP growth forecast for 2022 slightly to 3.1%.”

“In contrast, Eurozone headline CPI inflation has moved sharply higher, and core inflation has also firmed, though to a much lesser extent. Still, even if price gains do not become broad-based, persistently elevated energy prices and headline CPI inflation could still prompt a response from the European Central Bank (ECB).”

“We now expect earlier and more rapid monetary tightening from the ECB than previously. We forecast an initial 25 bps increase in the Deposit Rate at the September 2022 meeting (compared to December previously). Beyond that, we expect a steady series of 25 bps increases at the December 2022, March 2023 and June 2023 meetings, which would lift the Deposit Rate to +0.50% by the middle of next year.

Key Canadian data will be released on Friday with the March employment report. Analysts at TD Securities expect jobs to grow by 35.000. They consider the number will have little impact on the near term path of the Bank of Canada (BoC).

Key Quotes:

“The March Labour Force Survey will provide the last major data point ahead of next week's Bank of Canada meeting. TD looks for job growth to slow to 35k, below the market consensus for +80k, following an exceptionally strong performance in February. A 35k print should help nudge the unemployment rate lower to 5.4%, while wage growth should push higher towards 3.8% y/y.”

“USDCAD is mostly trading where it should, with high-frequency fair value sitting near 1.25. We would look to fade rallies ahead of 1.27 but think more of the action for CAD lies on the crosses.”

“With 50bps hikes well in play, this print should have little impact on the near-term BoC path, we need to see a string of deterioration to do so.”

The United General Assembly has voted to suspend Russia from its Human Rights Council following accusations that the country's military have committed widespread atrocities against Ukrainian civilians in occupied parts of the country.

- US dollar remains firm as US yields continue to rise.

- GBP/USD unable to recover, challenges the 1.3050 area.

- Risk aversion also weighs on GBP/USD, Dow Jones falls by 0.72%.

The GBP/USD reversed after hitting 1.3106, and during the American session printed a fresh daily low at 1.3051. It is testing the critical support of 1.3050, moving with a bearish bias amid a stronger US dollar across the board.

Greenback up, Treasuries down

More comments from Fed official, plus the recent FOMC minutes, point to a more aggressive policy. James Bullard, St. Louis Fed President, called on Thursday for more rapid rate hikes to curb inflation. Data released on Thursday, showed US initial jobless claims dropped more than expected to 166K, the lowest since 1968.

The DXY bounced and is back in positive ground for the day supported by higher US yields. The 10-year stands at 2.63% and the 30-year at 2.68%. Both reached new multi-year highs on Thursday. At the same time, the Dow Jones drops by 0.62% and the S&P 500 falls 0.47%.

Short-term outlook

Risks remain tilted to the downside for GBP/USD after begin unable to hold above 1.3100. The crucial area around 1.3050 is being challenged since Wednesday. A recovery above 1.3100 could alleviate the pressure and above 1.3180 the pound should gain momentum.

“Sterling remains heavy just below $1.31 after having an outside down day earlier this week. We still look for an eventual test of last month’s cycle low near $1.30. After that is the November 2020 low near $1.2855 and then the September 2020 low near $1.2675. Between the likely return of risk-off impulses and the even more hawkish Fed outlook for tightening, we believe the dollar uptrend remains intact”, wrote analysts at BBH.

Technical levels

- The Russian ruble keeps strengthening vs. the greenback, as the USD/RUB falls 4.17%.

- Risk-aversion, and the further duration of the Ukraine-Russia war, weigh on the market mood.

- USD/RUB Price Forecast: Upward biased, but downside risks remain as it is probing the 200-DMA.

The Russian ruble keeps rallying vs. the greenback and is pushing through the 200-DMA as portrayed by the USD/RUB pair, which is falling 4.20% during the North American session amidst a dismal market mood. At the time of writing, the USD/RUB is trading at 78.6855.

In the North American session, the sentiment turned sour. The Ukraine/Russia war continues to weigh on sentiment, as Ukraine’s President Zelenskiy will meet EU Commission President von der Leyen, on Friday in Kyiv. Meanwhile, Moscow said that the US sending weapons to Ukraine does not contribute to peace talks and added that it would retaliate against current sanctions.

Elsewhere on Wednesday, the Federal Reserve revealed its March minutes. The central bank said that most participants were eager to hike rates 50 bps if not for Ukraine. The Fed agreed to cap its balance sheet by an amount of $95 billion, $60 billion on US Treasuries, and $35 billion on mortgage-backed securities (MBS).

The FOMC added that participants expect the Quantitative Tightening to begin by May, following the May 4 meeting, where market participants, as shown by STIRS, are pricing in an 80% chance of a 50 bps hike.

Meanwhile, the US Dollar Index, a gauge of the greenback’s measure against a basket of its rivals, retreats from YTD highs, down 0.04%, sitting at 99.586. Contrarily, the US Treasury yields are rising, as depicted by the 10-year benchmark note sitting at 2.652%, gaining five basis points, reflecting the aggressive tightening of the Fed.

USD/RUB Price Forecast: Technical outlook

The USD/RUB upward bias is being tested, as the price is probing the 200-day moving average (DMA) at 78.2696. On Wednesday, I noted that “a daily close under the 80.3254 level would further extend losses, and the USD/RUB could aim toward the 200-day moving average (DMA).” On Thursday, that is happening, and a break could pave the way towards February 11 swing low at 74.2631.

That said, the USD/RUB first support would be 78.0000. A breach of the latter would expose March 31, a daily low at 75.5500, followed by the February 11 swing low at 74.2631.

Upwards, the USD/RUB first resistance would be 82.7882. Breach of the latter would expose essential resistance levels. The next supply zone would be 85.00, followed by the 50-DMA at 88.7789.

- AUD/USD has continued to pull lower despite the recent hawkish shift in RBA tightening expectations and is now around 0.7475.

- That’s a near 200 pip reversal from Tuesday’s highs in the 0.7660s.

- AUD/USD has been weighed by falling commodity and equity prices plus hawkish Fed vibes (policymaker comments plus Wednesday’s minutes).

A significant hawkish shift in the market’s expectations for RBA policy since Tuesday’s policy announcement where the reference to “patience” regarding rate hikes was dropped has not been able to prevent AUD/USD from continuing its reversal back from multi-month highs. Having been as high as the 0.7660s earlier in the week in the immediate hawkish RBA aftermath, the pair has now reversed nearly 200 pips lower and at current levels in the 0.7475 area, trading with losses of about 0.4% on the day. That means the pair now trades lower by about 0.3% on the week.

The reversal in AUD/USD fortunes comes as a pullback in broader commodity prices and global equities weigh on the commodity and risk-sensitive Australian dollar, whilst hawkish rhetoric from Fed policymakers/in the recently released minutes spurs a buoyant US dollar. Traders will now be eyeing the next key support zone in the 0.7440-50s area. So long as the recent pullback in commodities/equities doesn’t worsen, some might be inclined to buy the dip.

Indeed, the RBA now seems to be only two months away from implementing its first-rate hike, if the calls from the four largest Australian banks are anything to go by. But analysts don’t expect the RBA to hike interest rates anything like as aggressively as the Fed (Westpac forecast 125 bps of tightening in 2022). This may be a key reason why Tuesday’s post-RBA gains didn’t last and could continue to weigh on AUD/USD in the months ahead.

St Louis Fed President James Bullard on Thursday said that he would like to see the Federal Funds rate hit 3.5% in the second half of 2022, reported Reuters. Bullard said he would "lean into" a 50 bps rate hike at the May meeting, though he is watching the data. Most of the balance sheet decisions are already priced in, he added, noting that there is no reason for that to influence the pace of interest rate increases.

Bullard commented that sales of mortgage-backed securities are "not imminent", with the Fed wanting to get the passive runoff started before later assessing things. The geopolitical schism from the Ukraine war is likely to last, he noted, and this would realign global markets.

Increases in the Federal funds rate to neutral should be relatively cost-free in terms of any hit to the economy, or increase in recession risk, he said, adding that, as it stands, he does not think the Ukraine war should be a reason to avoid action in the US on inflation.

- Oil prices fell on Thursday, hitting fresh multi-week lows in the mid-$95.00s, as bears eye a run lower towards $90.

- First prices must break below March’s lows in the $93.00s.

- Massive oil reserve release announcements from the IEA plus technical selling seem to be weighing on sentiment for the moment.

Oil prices pushed lower on Thursday, with front-month WTI futures failing an attempt earlier in the session to push back higher towards $100 again and with prices subsequently sliding to fresh lows since 17 March under $95.50. At current levels in the $96.00s, WTI trades with on-the-day losses of slightly more than $1.50, with bears eyeing a test of March lows in the mid-$93.00s.

Non-US IEA nations on Wednesday announced that they would release a further 60M barrels of crude oil, which comes on top of the 180M barrel reserve release announcement made by US authorities last week. 15M of those barrels will come from Japan, the Foreign Minister there revealed on Thursday. The prospect of all these added barrels in the near-term is clearly weighing on crude oil, as it reduces the acute threat of a near-term supply shortage as Russian output falls due to sanctions.

Technicians noted that WTI made bearish moves on Thursday, confirming a break below a key long-term pennant that had been squeezing the price action over the last few weeks. Technical selling could carry WTI all the way lower to the next key support area around $90 per barrel. But analysts have noted that while the announced reserve releases from the IEA (the largest in history) are significant, they are unlikely to make up for the more than 2M barrels per day in output expected to be lost from Russia.

A push even lower than $90 thus might be a great difficulty. Indeed, should concerns about global supply continue (which seems very likely), a dip back to these levels is likely to be viewed as a buying opportunity. Some analysts pointed out that recent reserve release announcements have put upward pressure on crude oil futures scheduled for delivery further than six months out, given expectations that, following massive reserve releases in the coming months, nations will need to restock.

This diminishes the prospect of a pullback in oil prices later in the year. Meanwhile, other analysts said that recent reserve release announcements make OPEC+ less likely to open the taps, despite increased calls from major oil consumers for more output. All the while, indirect US/Iran talks to rekindle the 2015 nuclear deal and remove sanctions capping the latte’s crude oil exports remain at an impasse, with political decisions reportedly needed in Washington and Tehran to move things forward.

Aside from massive oil reserve releases, the only other factor that could ease the global supply squeeze is the state of lockdowns in China. As the lockdown in Shanghai enters its eleventh day, high-frequency flight data showed traffic at its lowest since early 2020. With the highly virulent Omicron Covid-19 variant proving difficult to contain, if lockdowns further spread, that presents a major threat to Chinese oil demand. China is the world’s largest consumer of more than 14M barrels of crude oil per day.

- USD/JPY climbed back closer to the one-week high, though struggled to conquer the 124.00 mark.

- The formation of an ascending channel favours bulls and supports prospects for additional gains.

- Sustained break below the trend-channel support is needed to negate the constructive outlook.

The USD/JPY pair attracted some dip-buying near the 123.45 region on Thursday and climbed to a fresh daily high during the early North American session. Bulls, however, struggled to capitalize on the move and now seem to wait for sustained strength beyond the 124.00 round-figure mark.

The FOMC meeting minutes released on Wednesday reinforced market bets for a 50 bps rate hike at the upcoming meetings. Investors also seem concerned that surging commodity prices would put upward pressure on the already high inflation. This, along with more hawkish comments from St. Louis Fed president James Bullard, remained supportive of elevated US Treasury bond yields.

Conversely, Bank of Japan board member Asahi Noguchi said that the central bank should maintain its ultra-easy monetary policy despite rising inflationary pressures. This points to a major divergence in the central bank policy outlooks, which, in turn, acted as a tailwind for the USD/JPY pair. That said, the risk-off impulse drove some haven flows towards the JPY and capped the upside.

From a technical perspective, the USD/JPY pair has been trending along an upward sloping channel over the past one week or so. This points to a well-established short-term bullish trend and supports prospects for a further appreciating move. Hence, a subsequent move towards testing the trend-channel resistance, currently around the 124.30 region, remains a distinct possibility.

Some follow-through buying will mark a fresh bullish breakout and set the stage for a move back towards reclaiming the 125.00 psychological mark, or the multi-year high touched in March. The momentum could further get extended towards the 125.25-30 region (August 2015 peak), above which the USD/JPY pair could climb to challenge the 2015 yearly swing high, around the 125.85 zone.

On the flip side, the 123.45 region seems to have emerged as immediate strong support and should protect the immediate downside ahead of the 123.30-123.25 region. The latter marks confluence support comprising of 100-hour SMA and the lower end of the aforementioned channel, which should act as a pivotal point for traders.

A convincing break below would negate the near-term positive outlook and prompt aggressive long-unwinding trade around the USD/JPY pair. The corrective pullback could then drag spot prices to the 123.00 round figure. This is followed by the 122.80-122.75 region and the next relevant support near the 122.35-30 zone and the 122.00 mark.

USD/JPY 1-hour chart

-637849355158293155.png)

Key levels to watch

- USD/TRY extends the weekly rebound to the 14.75 area.

- The lira depreciates despite the weaker dollar.

- Turkey Treasury Cash Balance comes up next in the docket.

The lira loses further ground and lifts USD/TRY to the area of weekly highs in the 14.70/75 band on Thursday.

USD/TRY remains broadly side-lined

USD/TRY fades Wednesday’s small pullback and resumes the weekly upside in spite of the offered stance in the greenback and the better mood in the risk-linked galaxy.

The weekly retracement in the Turkish currency appears to be underpinned by the sour sentiment among investors after inflation figures in the country saw the CPI rise to 20-year highs above 61% in March. On this, finmin N.Nebati said on Wednesday that “if the exchange rate has come stable and interest rate are off the agenda, we will bring down inflation together sooner or later”.

It is worth recalling that Nebati pledged to bring down inflation to single digits during 2023. Good luck with that…

Later in the session, Turkey’s Treasury Cash Balance figures are due ahead of Friday’s End Year CPI Forecast.

What to look for around TRY

The lira keeps the range bound theme unchanged vs. the greenback, always in the area below the 15.00 neighbourhood for the time being. So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine. Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: End Year CPI Forecast (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is gaining 0.24% at 14.7387 and faces the next hurdle at 14.9889 (2022 high March 11) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a drop below 14.6150 (monthly low April 1) would expose 14.5136 (weekly low March 29) and finally 14.0920 (55-day SMA).

USD/JPY is creeping up again. Economists at ING expect the pair to climb towards the 130 levels by end-2022.

The biggest risk is that the Bank of Japan becomes less dovish

“We think a front-loaded Fed tightening cycle, a dovish BoJ and a deteriorating Japanese balance of payments position on the back of the fossil fuel spike will keep USD/JPY bid for most of the year – and it should be nearing 130 by year-end.”

“The biggest risk is that the BoJ becomes less dovish – as evidenced by it allowing 10-year JGB yields to trade above 0.25%. That is not what we forecast.”

Sterling’s multiple failures to break firmly through 1.31 during yesterday’s session have left the cable trading in a narrow channel over the past two sessions. Economists at Scotiabank believe that GBP/USD could test the 1.30 level on a dip below the mid-1.30s.

Resistance past 1.3100/10 aligns at 1.1350

“A drop below the mid-1.30s leaves the GBP at clear risk of testing the 1.30 low of mid-March after which point only the next figure level stands as psychological support.”

“Resistance past 1.3100/10 is the 1.3150 area and ~1.3165.”

The S&P 500 Index has come under pressure over the past couple of sessions, however key support at 4455/50 is still holding for now. Only a break below here would turn the short-term risks back lower in the range, according to analysts at Credit Suisse.

S&P 500 set to test resistance at 4663/68 whilst above key support at 4455/50

“S&P 500 is holding around its key 63 and 200-day moving averages at 4490/50 and short-term MACD momentum stays outright positive, even if is starting to roll over. We, therefore, stay directly biased higher whilst above 4455/50 and look for a test of the 78.6% retracement of the 2022 fall and price resistance at 4663/68.”

“Above 4663/68 would open the door to a move to 4707/12 next, then what we look to be tougher resistance, starting at 4744/49. We expect a cap around this zone, in line with our broader medium-term view that the market is set to stay trapped in a broader mean-reverting phase.”

“Key support is seen at the 63-day average, price lows and 38.2% retracement of the recovery from the March low, which all coincide at 4455/50. Only a break below here would turn the short-term risks back lower within the range, with next supports then seen at 4376, then 4252.”

Ukrainian Negotiator Mykhailo Podolyak on Thursday dismissed comments made by Russian Foreign Minister Sergey Lavrov earlier in the day that Ukraine's recent draft peace deal proposal to Russia contained "unacceptable" elements, reported Reuters.

Podolyak told Reuters that Lavrov is not directly involved in the negotiations process and therefore his statements are "of purely propagandistic significance". Lavrov's comments should be seen in the light of Russian attempts to divert global attention from recent events in Bucha, he added.

The Russian military stands accused of committing widespread war crimes against civilians in Bucha, Ukraine and many other parts of the country.

The US Dollar Index (DXY) is up for the sixth straight day and made a new cycle high near 99.821. Economists at BBH expect DXY to test the the March 2020 high near 103 after breaking the 100 level.

The dollar uptrend remains intact

“After the psychological 100 level, the March 2020 high near 103 is the next big target.”

“Between the likely return of risk-off impulses and the even more hawkish Fed outlook for tightening, we believe the dollar uptrend remains intact.”

Tensions are mounting in France’s presidential election race. A Le Pen victory could drag the EUR/USD down to the 1.05 level, economists at ING report.

Add French politics to the euro’s other challenges

“While Frexit is less of a risk today than it was back in 2017, concerns of a Le Pen victory and what it would mean for the unity of EU policy response are just adding another bearish layer for EUR/USD.”

“A strong performance from Le Pen in the first round and a surprise win in the second would see EUR/USD trade 1.05 sooner rather than later.”

In prepared remarks at the University of Missouri, St Louis Fed President and FOMC member James Bullard said on Thursday that even with financial market tightening, the Fed remains behind the curve in its fight against inflation. Even a "generous" reading of monetary policy rules shows that the Federal Funds rate of around 3.5% is needed to fight high inflation, he continued, much higher than the current 0.25-0.5%. Bullard added that it's important that the Fed now "ratifies" the guidance it has given with interest rates at upcoming meetings.

USD/CAD gains have extended to the upper 1.25s. Economists at Scotiabank expect the key resistance at 1.2590 to cap the pair.

USD/CAD to correct lower towards 1.2485/75 on a dip below 1.2540

“We had anticipated gains through the upper 1.25s – which might include a retest of key resistance (former support) at 1.2590. That may still happen but we expect strong resistance there and note that intraday price action is suggesting a minor top/reversal may be developing.

“Intraday losses below 1.2540 should see USD gains over the past couple of sessions correct a little more (back to 1.2475/85).”

- EUR/USD manages to finally reverse the downtrend.

- Further downside could see the 2022 low retested.

EUR/USD posts a moderate rebound after bottoming out in fresh lows near the 1.0860 region on Thursday.

That said, immediately to the upside comes the temporary resistance at the 55-day SMA, today at 1.1156 ahead of the 1.1230 region, where the 100-day SMA and the 8-month line coincide. Beyond this area, the selling bias is expected to subside and allow for extra gains in the short-term horizon.

The ongoing recovery is seen as temporary, leaving the prospects for further downwide well in place for the time being. Against that, there is still the probability that the pair could drop further and test the 2022 low at 1.0805 (March 7) in the not-so-distant future.

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1465

EUR/USD daily chart

- Gold has remained within recent ranges in the $1920-$1935 area despite recent hawkish ECB and Fed minutes.

- Geopolitics remains in focus and supportive, but rising global yields could send XAU/USD lower towards $1900.

Spot gold (XAU/USD) prices continue to chop within recent ranges and, thus far on Thursday have largely stuck within $1920-$1935ish bounds, having largely ignored the recent release of surprisingly hawkish ECB meeting minutes and mixed US weekly jobless claims figures. Upside potential, for now, remains capped by the presence of weekly highs and the 21-Day Moving Average in the $1940 area, while recent lows in the mid-$1910s continue to offer support ahead of the 50DMA just below at $1906.

The hawkish ECB minutes, which showed policymakers becoming increasingly uneasy with the bank’s current ultra-easy stance in the face of high inflation, come on the back of Wednesday’s even more hawkish Fed minutes. These showed that a large number of the bank’s members were chomping at the bit for a 50 bps rate hike at the most recent meeting, only to be deterred by Russia’s invasion of Ukraine.

As a result, it's not too surprising to see that bond yields in both the US and Europe are moving higher again this Thursday and this could weigh on gold prices and push it back towards weekly lows in the mid-$1910s. Higher yields raise the “opportunity cost” of holding non-yielding assets. Of course, geopolitics remains in focus and stagflation risks are rising as the US and EU further toughen sanctions, though the EU isn’t yet banning Russian oil and gas imports.

But in the absence of fresh alarming geopolitical developments and against the backdrop of hawkish central bank-driven upside in global bonds, a bearish break in XAU/USD seems more likely than an upside push. Gold bears continue to eye recent lows under $1900 as a potential target.

The Swedish krona has been propelled to the top of the G10 performance table on a one-day. That said, it continues to languish second to last, after the JPY, in the year to date. Economists at Rabobank have revised lower their three-month EUR/SEK forecast from 10.30 to 10.20.

Sweden’s non-NATO position could still result in increased volatility

“Despite the inflationary risks, wage rises in Sweden are still modest. This gives policy-makers breathing room. Another factor that Riksbank policymakers are likely to consider is the relatively high level of household debt. This suggests the potential for a heightened degree of sensitivity to higher interest rates. This factor on top of the uncertainties generated by the war in Ukraine argue for an increment pace of tightening from the Riksbank and a relatively low peak compared with previous economic cycles.”

“A more hawkish stance from the central bank coupled with Sweden’s low dependency on Russia oil imports is supportive for the SEK vs. the EUR. However, Sweden’s non-NATO position could still result in increased volatility.”

“We have moved our three-month EUR/SEK forecast lower from 10.30 to 10.20.”

- USD/CAD gained positive traction for the third straight day and shot to a near two-week high.

- Oil prices languished near the multi-week low and undermined the commodity-linked loonie.

- The Fed’s hawkish outlook continued acting as a tailwind for the USD and remained supportive.

The USD/CAD pair maintained its bid tone during the early North American session and was seen hovering near the top end of its daily trading range, around the 1.2570 region.

The pair build on the previous day's breakout momentum through the 1.2500 psychological mark and gained traction for the third successive day on Thursday. With the latest leg up, the USD/CAD pair has now recovered over 150 pips from the YTD low, around the 1.2400 mark touched on Tuesday. Crude oil prices languished near the three-week low touched on Wednesday, which, in turn, undermined the commodity-linked loonie and acted as a tailwind for the major.

On the other hand, a softer tone around the US Treasury bond yields capped the recent US dollar rally to a near two-year high and did little to provide any additional lift to the USD/CAD pair. That said, the Fed's hawkish outlook favours the USD bulls and supports prospects for a further near-term appreciating move for the major. Hence, a subsequent move towards testing last week's swing high, around the 1.2590-1.2595 region, remains a distinct possibility.

On the economic data front, the US Weekly Initial Jobless Claims dropped to over a five-decade low level of 166K in mid-April. Adding to this, the previous week's reading was also revised down to 171K, pointing to strong higher and the lowest layoffs on record. This adds credence to the near-term constructive outlook and pushed the USD/CAD pair to a near two-week high. Meanwhile, any meaningful pullback should now be seen as a buying opportunity and remain limited.

Technical levels to watch

UOB Group’s Head of Research Suan Teck Kin, CFA, and Senior Economist Alvin Liew comment on the recent inversion of the US yield curve and the likeliness of a recession in the US economy.

Key Takeaways

“The recent flattening of sections of the US Treasury yield curve and “inversion” in a key part of the yield curve has flagged concern given the track record of yield curve inversion foreshadowing US economic recessions.”

“While the yield curve has a reliable track record of preceding US recessions, it had given false signals before and the length of time before the occurrence of a US recession varied significantly from months to years, thus there is a need to treat this with caution.”

“Based on the factors we examined, we think that recession risks remain low in the next 6-12 month horizon. As such, we are maintaining our US growth projections at 3.3% in 2022 and 2.3% in 2023 and we expect the US Fed to continue with its rate hikes in the remaining 6 meetings in 2022.”

There were 166,000 Initial Jobless Claims in the US in the week ending on 2 April, the latest release from the US Department of Labour on Thursday showed, a record low. That was well below the median economist forecast for a reading of 200,000 and a steep drop from the prior week's 202,000. That meant the four-week average fell to 170,000 from 178,000 the week before.

Continued Claims, meanwhile, rose to 1.523M in the week ending on 26 March, well above the consensus forecast for 1.311M and a small jump from the prior week's 1.506M reading, which had been revised significantly higher from 1.307M. That meant the insured unemployment rate came in at 1.1%, unchanged versus the prior week (though this was revised higher from 0.9%).

Market Reaction

FX markets did not seem to react to the latest mixed US jobless claims figures, which showed initial claims dropping to a fresh record low, but saw continued claims coming in a massive 2M higher than expected.

Bank of England Chief Economist Huw Pill said on Thursday that it cannot be taken for granted that monetary policy tools like QE are the right too to address market dysfunction, reported Reuters.

- Silver gained some traction on Thursday and is now looking to build on the overnight recovery.

- Repeated failures near the $25.00 mark and the 200-hour SMA resistance favours bearish traders.

- Sustained break below the $24.00 round figure will set the stage for additional near-term losses.

Silver attracted some dip-buying near the $24.25 region on Thursday and climbed to a fresh daily high during the mid-European session. The white metal was last seen trading around mid-$24.00s and is now looking to build on the previous day's bounce from over a one-week low.

From a technical perspective, the recent repeated failures near the $25.00 psychological mark and the emergence of fresh selling around the 200-hour SMA favours bearish traders. The latter, currently around the $24.65-$24.70 region, should continue to act as an immediate barrier.

Given that technical indicators on hourly charts have recovered from the negative territory, some follow-through buying might prompt some short-covering move. The XAG/USD might then aim to surpass the $25.00 mark and accelerate the momentum towards the $25.35-$25.40 resistance zone. Bulls might eventually aim to test the next relevant hurdle around the $25.75-$25.80 area and push the XAG/USD further towards the $26.00 round-figure mark.

On the flip side, the $24.25-$24.20 region now seems to protect the immediate downside ahead of the $24.00 level. The said handle coincides with the very important 200-day SMA, which if broken decisively will set the stage for a further near-term depreciating move. The XAG/USD would then turn vulnerable to accelerate the fall towards the next relevant support near the $23.60 region and slide further to the $23.20-$23.15 support zone.

Silver 1-hour chart

-637849307139926002.png)

Key levels to watch

- EUR/USD jumped in wake of the latest hakwish ECB minutes and is back above 1.0900.

- However, the even more hawkish Fed minutes on Wednesday means the pair failed to sustain a lasting rally.

- As the Fed/ECB policy divergence widens, traders may view a retest of the 1.0950 area as a sell zone.

Following the release of a resoundingly hawkish set of ECB minutes on Thursday, the euro is trading on the front foot. EUR/USD has jumped about 20 pips from around 1.0890 to around 1.0910 in wake of the release, which said a large number of governing council members viewed the high level and persistence of inflation as warranting immediate steps towards policy normalisation. The minutes revealed that members also argued that the central bank’s three criteria for rate hikes had been met.

The net result is that Eurozone yields are moving higher again as traders up their bets that the ECB starts hiking interest rates in the latter half of the year, a short-term positive for the euro. However, the pair has not been able to rest earlier session highs in the 1.0930 area, nor mount a meaningful challenge of Wednesday’s highs just above it in the mid-1.0930s.

Fed hawkishness, both in the form of recent public remarks from policymakers and in the form of Wednesday’s release of FOMC meeting minutes, is likely making EUR/USD traders reluctant to pile into further longs. Rallies back towards resistance in the 1.0950s area (late March lows) likely remain a sell in the eyes of most traders. Even if the ECB is pivoting hawkishly in moving towards rate hikes, it remains well behind the Fed.