- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-04-2011

The major equity averages continue to plod along with modest losses, but Netflix (NFLX 232.80, -7.08) is grappling with some rather stiff selling pressure. Its weakness comes after analysts on CNBC's Fast Money segment issued cautious commentary.

Global phone and handset maker Nokia (NOK 8.94, -0.08) is also under considerable pressure after the stock had set a new one-month high yesterday. Its retreat comes after analysts at Moody's downgraded its rating on the company.

Deutsche Bank has changed its ECB call and is now forecasting a 25bps ECB rate hike in July, adding that it could come in June if there is a significant deterioration in inflation expectations. DB previously expected the ECB to sit on its hands through the summer after the April hike. DB also expect follow up hikes in September and December. "We are thus raising our year-end Refi rate target to 2.00% from 1.75%".

Stocks are on the backslide as they continue to seek direction. Oil prices seem to only be going higher, however. As such, crude oil futures prices have pushed above the $110 per barrel mark. Prices for the energy component recently set a new two-year high of $110.16 per barrel.

The euro remain near its highest level in more than a year after European Central Bank President Jean- Claude Trichet said today’s interest-rate increase wasn’t necessarily the “first of a series.”

The ECB raised its key rate by 25 basis points to 1.25 percent.

“We did not decide that it was the first of a series of interest-rate increases,” Trichet said during a press conference in Frankfurt. “We will continue to do in the future” what is appropriate “to ensure price stability,” he said.

“Trichet is leaving the door open for flexibility in case he needs it and that’s why the euro sold off a little bit,” said Carl Forcheski, a director on the corporate currency sales desk at Societe Generale SA in New York. “The rate hike was very well telegraphed.”

The euro eased a bit versus its major peers after Portugal’s Prime Minister, Jose Socrates, said yesterday the nation was seeking financial assistance from the European Union.

Portugal plans to make a formal written request to the European Commission for financial aid, government minister Pedro Silva Pereira said in Lisbon. A rescue package for Portugal may be worth as much as 75 billion euros ($107 billion), two European officials with knowledge of the situation said.

“Portugal’s decision to trigger the rescue mechanism was expected,” said Lutz Karpowitz, a currency strategist at Commerzbank AG in Frankfurt. “Portugal is not a problem as long as there no contagion to Spain. People are not convinced the mechanism is large enough for that.”

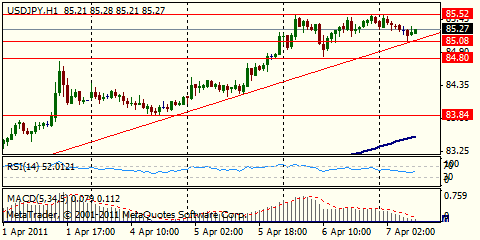

The yen strengthened against the dollar after reports of a 7.4 magnitude earthquake off Japan’s coast and tsunami warnings.

- UPSIDE INFLATION RISKS HIGHER THAN 6 MONTHS AGO

May crude oil has been chopping around in recent trade slightly above the unchanged line. In current activity, crude at $108.97/barrel, up $0.14.

Precious metals are higher this morning with June gold showing gains of 0.4% at $1464.20/oz. while May silver is up 0.5% at $39.59/oz.

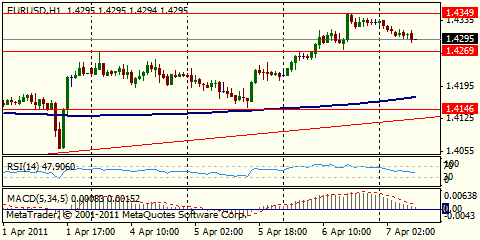

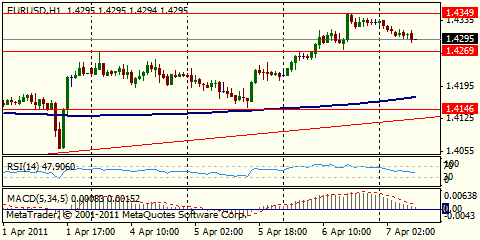

EUR/USD holds below $1.4300. Earlier rate printed session highs on $1.4326, but failed to set above the figure. Some traders believe Trichet has left the market with the impression that a June rate hike is possible, but not necessarily

probable. Meanwhile the market begins to price in a June hike. Resistance remains at $1.4330.

- Cbanks not taking same decisions,not in same situation

- But cbanks have unity of purpose in anchoring expect

- If needed we can decide extraordinarily rapidly

- Today's decision thus helps all countries of eurozone

- Int rates are low

- We do what we have to do even when not pleasing to all

- Cbanks not taking same decisions,not in same situation

- But cbanks have unity of purpose in anchoring expect

- If needed we can decide extraordinarily rapidly

- Today's decision thus helps all countries of eurozone

- Int rates are low

- We do what we have to do even when not pleasing to all

- interest rates very accomodative;

- hike warranted;

- our decision will help keep inflation expectations anchored;

- to continue to monitor all upside price risks very closely;

- to wartch all developments very closely;

- potential risks from disasters in Japan;

- banks have expanded lending further to private sector;

- banks must contine to expand credit to private sector;

- rate hike is warranted due upside price stab risks;

- rate hike to help keep inflation expect firmly anchored;

- interest rates across spectrum low;

- monpol remains accomm;

- to watch all developments with respect to price stability risks;

- strengthening confidence in public finances is key;

- today's decision was unanimous;

- did not decide today that this was forst of series;

- to continue to take appropriate decisions in future;

- I confirm we will do all neded to ensure price stab;

- were unanimous today, all colleagues there, also Weber.

EUR/USD $1.4300, $1.4250, $1.4200, $1.4175, $1.4150, $1.4500

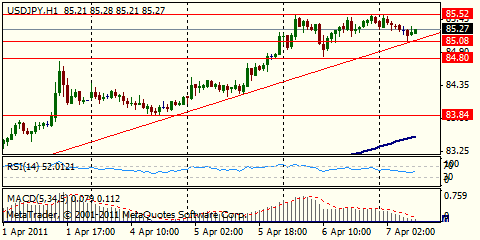

USD/JPY Y86.00, Y85.50, Y85.00(lge), Y84.70, Y84.60, Y84.50, Y84.20

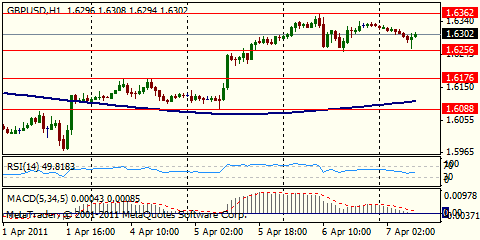

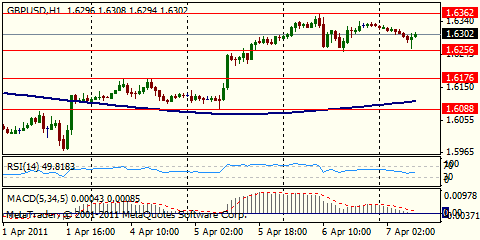

GBP/USD $1.6270

USD/CHF Chf0.9275

AUD/USD $1.0400, $1.0340, $1.0320, $1.0300, $1.0250

EUR/AUD A$1.3830

USD/CAD C$0.9660

U.S. stocks were set to edge higher Thursday, after the European Central Bank raised its key interest rates by a quarter point and initial claims for unemployment showed improvement.

The ECB's increase to 1.25% was in line with expectations. Separately, the Bank of England, in its meeting Thursday, made no change in its key rate.

"Us not raising rates doesn't mean rates won't rise," said Joe Clark, market analyst with Financial Enhancement Group.

Economy: The Labor Department reported the number of people filing for first time unemployment fell by 10,000 to 382,000 in the latest week. The reading was better than expected.

Companies:Pier 1 Imports (PIR) reported earnings of 48 cents per share, beating analyst estimates by a penny.

Another prominent home retailer, Bed Bath & Beyond (BBBY, Fortune 500), said it earned $1.12 per share in its fiscal fourth quarter, far outdoing the 97-cent per share profit analysts had predicted. Shares rose 10.3% in pre-market trading.

Also Thursday, many large retail chains are scheduled to report their same-store sales for the latest month.

- Today's decision was unanimous

- Did not decide today that this was forst of series

- To continue to take appropriate decisions in future

- Interest rates across spectrum low;

- monpol remains accomm;

- to watch all developments with respect to price stability risks;

- Strengthening confidence in public finances is key.

- Banks have expanded lending further to private sector;

- Banks must contine to expand credit to private sector;

- Rate hike is warranted due upside price stab risks

- interest rates very accomodative;

- hike warranted;

- our decision will help keep inflation expectations anchored;

- to continue to monitor all upside price risks very closely;

- to wartch all developments very closely.

Data released:

10:00 Germany Industrial production (February) seasonally adjusted 1.6% 0.6% 2.0 (1.8)%

10:00 Germany Industrial production (February) not seasonally adjusted, workday adjusted Y/Y 14.8% 11.2% 12.7 (12.5)%

11:00 UK BoE meeting announcement 0.50% 0.50% 0.50%

11:45 EU(17) ECB meeting announcement 1.25% 1.25% 1.00%

As expected the ECB hiked its main rate by 25 basis points to 1.25 percent today.

Earlier the EU currency fell after Prime Minister Jose Socrates said late yesterday that Portugal was seeking assistance from the European Union. A rescue package for Portugal may be worth as much as 75 billion euros ($107 billion), two European officials with knowledge of the situation said.

Europe’s currency has gained 6.8% versus the dollar this year as surging economic growth in Germany and accelerating inflation spurred investors to raise bets that rates would be increased to curb consumer prices, which reached a two-year high of 2.6% in March.

“We definitely see further upside potential in the euro,” said Chris Scicluna at Daiwa Capital Markets Europe in London.

The pound slipped versus the dollar as the Bank of England held rates steady at 0.5%.

Japan’s yen rose for the first time in 11 days versus the dollar. The currency was lifted on bets Japanese exporters took advantage of the slide to purchase yen.

“The yen looks oversold and exporters are apparently buying the currency to capitalize on its rapid weakness,” said Lee Wai Tuck, a foreign-exchange strategist at Forecast Pte. “The near-term bias for the yen is likely to be positive.”

Australia’s dollar rose for a second day versus the greenback after statistics showed the unemployment rate fell to 4.9% in March from 5% the previous month. Employers added 37,800 workers in March from the previous month, the statistics bureau said.

“The jobs number was very strong,” said Sean Callow, a senior currency strategist at Westpac Banking Corp.. “This will only encourage the Aussie bulls. If you’re bearish the U.S. dollar and looking for an alternative, then the Aussie remains very attractive.”

EUR/USD slowly weakened from $1.4330 to $1.4260 before ECB rate decision, After the announcement euro recovered to $1.4293.

GBP/USD fell after BOE left rate unchanged. Pound matched lows around $1.6397 before it was back to $1.6310.

USD/JPY fell to the lows around Y84.89. Later rate recovered to Y85.22.

Now the focus is on Trichet' press-conference.

US data starts at 12:30 GMT with the initial jobless claims. Market expects clains to fall 3,000 to 385,000 in the April 2 week after falling 6,000 in the previous week.

GBP/USD remains under $1.6300 with EUR/GBP extends its recovery ahead of ECB rate decision. The pound is under pressure following the decision by the BOE MPC to keep rates on hold. Support seen to $1.6290 with stops below, a break to open a deeper move toward $1.6260/40. Resistance remains at $1.6340/50 ahead of $1.6364.

Most likely the ECB will hike rate today at 1145GMT by 25 points. But the key focus is clearly on the press conference at 1230GMT, to analyse Trichet's language, where mkts expect Trichet to to continue to describe ECB interest rates as "accommodative" or even "very accommodative," thus signaling that rates are likely to normalize in the months ahead.

The euro slipped from an 11-month high against the yen and 14-month peak versus the dollar as investors focused on how much room the European Central Bank has for raising interest rates beyond a widely expected tightening later in the day.

The Bank of Japan met market expectations that it would keep monetary policy steady and signal its readiness to ease policy further.

The ECB is set to raise its benchmark rate by 25 basis points for the first time since July 2008. Portugal's request for a European bailout has not changed the view the ECB would follow up with more interest rate hikes, but many believe the euro has risen too fast too far and is overdue a correction.

Analysts also say ECB President Jean-Claude Trichet must sound hawkish enough to keep alive expectations for around 100 basis points in rate hikes by November and for the euro to achieve fresh gains.

"The euro has rallied considerably on the ECB rate hike view but it may be the case of buy the rumour sell on the fact," said Koji Fukaya, chief FX strategist at Credit Suisse. "The euro zone debt crisis has not stopped the ECB from making hawkish comments. That means Portugal's story is not going to stop a rate hike. The market is pricing in 100 bps of rate hikes, but it may be difficult for us to really see that."

The Australian dollar scaled a fresh 29-year peak against the greenback of $1.0481 and rose to 89.45 yen , its highest since September 2008, after data showed the economy added a higher-than-expected 37,800 jobs in March.

The Bank of England is widely expected to leave its key Bank rate unchanged at 0.50% and also the size of the Asset Purchase Programme unchanged at Stg200 billion. Meanwhile, the median probability analysts attached to a May Bank Rate hike is 45%.

EUR/USD draggs lower after triggering bids on $1.4280. A break lower exposes stops. Further demand placed down to $1.4270. Currently rate holds around $1.4275. Next suppoprt seen into $1.4250. More stops noted below.

Longer-term inflation expectations unchanged

EUR/USD $1.4300, $1.4250, $1.4200, $1.4175, $1.4150, $1.4500

USD/JPY Y86.00, Y85.50, Y85.00(lge), Y84.70, Y84.60, Y84.50, Y84.20

GBP/USD $1.6270

USD/CHF Chf0.9275

AUD/USD $1.0400, $1.0340, $1.0320, $1.0300, $1.0250

EUR/AUD A$1.3830

USD/CAD C$0.9660

previous week.

The euro rallied to its highest level against the dollar in more than 14 months on speculation the European Central Bank will increase borrowing costs further after raising its target lending rate tomorrow.

ECB President Jean-Claude Trichet signaled on March 3 that policy makers may raise the benchmark rate at their next meeting to curb inflation, which reached a two-year high of 2.6 percent last month.

The ECB will raise its main rate by 25 basis points from a record low 1 percent tomorrow, according to economists.

Europe’s currency has gained 6.9 percent against the dollar this year as stronger economic growth in Germany and accelerating inflation boosted expectations that policy makers in the 17-member bloc will need to raise interest rates even as nations including Ireland and Portugal struggle to contain debt.

The yen tumbled against all of its major counterparts on bets the Bank of Japan will keep interest rates low as the nation recovers from the earthquake and tsunami while borrowing costs in other developed nations rise. The dollar slid against most of its peers while advancing to a six-month high versus the yen on the view that the Federal Reserve will trail other central banks in ending economic stimulus except the BOJ.

The Swiss franc gained versus most of its major counterparts, rising 0.8 percent to 91.77 centimes versus the dollar, as inflation unexpectedly accelerated in March.

Consumer prices increased 1 percent from a year earlier, the Federal Statistics Office reported. The median forecast of economists was for a 0.5 percent annual pace, the same as in the previous month.

German industrial output data is due at 10:00 GMT. This is followed at 1145GMT by the policy decision from the European Central Bank with the usual press conference led by ECB President Trichet starting from 1230GMT.

previous week.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.