- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-03-2024

- GBP/USD attracts some buyers to a fresh 2024 high above 1.2800 on the weaker USD.

- Fed Chair Powell said interest rate cuts may not be too far off if inflation signals cooperate.

- Investors expect the BoE to lower interest rates after the Fed, which boost the Pound Sterling.

- The US February labor market report will be a closely watched event.

The GBP/USD pair holds ground above the 1.2800 psychological barrier during the early Asian trading hours on Friday. The selling pressure in the US Dollar (USD) provides some support to the major pair. The highlight on Friday will be the US labor market data for February. GBP/USD currently trades around 1.2810, up 0.01% on the day.

The Federal Reserve (Fed) Chairman Jerome Powell presents the Monetary Policy Report and responds to questions before the Senate Banking Committee on Thursday. Powell said that interest rate cuts may not be too far off if inflation signals cooperate. Fed Chair didn’t provide a precise timetable for rate cuts but noted that the day could be coming soon. Investors expect the first cut to come in June, with four reductions totaling a full percentage point by the end of 2024.

On the other hand, the financial markets anticipate that the Bank of England (BoE) to lower interest rates after the Fed. This, in turn, boosts the Pound Sterling (GBP) and acts as a tailwind for the GBP/USD pair. Investors expect the BoE to start easing in the August meeting. Nonetheless, BoE policymakers will see more evidence of inflation before making a decision.

Moving on, traders will keep an eye on the US February Nonfarm-Payrolls, Unemployment Rate, and Average Hourly Earning, due on Friday. These events could trigger volatility in the market. Market players will take cues from the data and find trading opportunities around the GBP/USD pair.

- NZD/USD gains ground near 0.6175 in Friday’s early Asian session.

- US weekly Initial Jobless Claims last week came in at 217K, worse than expected.

- RBNZ’s Conway said it might cut interest rates sooner than expected if the Fed begins easing later this year.

- The US February Nonfarm Payrolls (NFP) will be in the spotlight on Friday.

The NZD/USD pair gains momentum above the mid-0.6100s during the early Asian session on Friday. The uptick of the pair is supported by the sell-off of the US Dollar Index (DXY) below the 103.00 mark for the first time since early February. Investors will closely monitor the highly-anticipated US Nonfarm Payrolls (NFP) due on Friday. This event could trigger volatility in the market. At press time, NZD/USD is trading at 0.6175, up 0.01% on the day.

On Thursday, the US weekly Initial Jobless Claims for the week ended March 2 held at a seasonally adjusted 217,000, worse than the market expectation of 215,000 in the previous week. Meanwhile, Continuing Claims rose by 8,000 to 1.906M in the week ended February 24 from 1.899M prior.

The strong labor market and hot inflation data since the beginning of the year have lowered the likelihood that the Federal Reserve (Fed) will lower interest rates in May. Fed Chair Jerome Powell said to the Senate Banking Committee on Wednesday that he thought the interest rate in the US had reached its peak and would be cut later this year.

The Reserve Bank of New Zealand (RBNZ) kept interest rates unchanged at 5.5% at its February meeting and stated that it will keep monetary conditions tight in the near term to further bring down inflation. RBNZ Chief Economist Conway said on Wednesday that the Fed rate cuts could drive up the New Zealand Dollar (NZD) and reduce inflationary pressure. Conway added that the RBNZ might cut interest rates sooner than expected if the Fed begins easing later this year.

Looking ahead, the US February labor market report will be due on Friday, including Nonfarm-Payrolls, Unemployment Rate, and Average Hourly Earnings. The NFP figure is estimated to see 200,000 jobs added to the US economy, while the unemployment rate is expected to hold steady at 3.7%.

- EUR/JPY bounces from three-week low to 161.96, forming a 'hammer' pattern suggesting potential upside.

- Mixed technical indicators prompt caution, with the RSI nearing a bearish shift as the pair eyes the 162.04 Tenkan-Sen.

- Bears and bulls vie for control, with critical supports and resistances set around key psychological and technical marks.

On Thursday, the EUR/JPY registered a volatile session that saw the pair dive to a three-week low of 160.55. However, the losses were short-lived amidst the ECB’s hawkish hold, and the session finished with losses of 0.43%. As the Friday Asian session begins, the cross trades at 161.96, down 0.10%.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY formed a 230 pip ‘hammer,’ which indicates the pair is edged to the upside. However, mixed signals between price action and the Relative Strength Index (RSI) are closing to the 50-midline about to shift bearish, suggesting caution is warranted.

On the upside, the pair is capped by the Tenkan-Sen at 162.04, which, once cleared, could open the door to testing the March 7 high at 162.81, followed by the psychological 163.00 mark. Nevertheless, should bears keep the EUR/JPY from climbing above 162.00, the pair could extend its losses.

The first support would be the Senkou Span A at 161.67, followed by the Kijun-Sen at 161.31. Once surpassed, the 160.55 March 7 low emerges as the demand area, followed by 160.00.

EUR/JPY Price Action – Daily Chart

- Decreasing RSI on the daily chart, along with rising MACD red bars, signal an increase in selling pressure.

- On the hourly chart, there are signs of a steady positive momentum.

On Thursday, the GBP/JPY pair declined to 189.58, recording a 0.27% loss. It's noted a somewhat subdued bullish drive, with bears starting to gain ground. The negative tone is more clear on the daily chart while on the hourly chart buyers remain resilient.

On the daily chart, the GBP/JPY's Relative Strength Index (RSI) has been hovering in the positive terrain, with a decline in the latest reading, suggesting a moderation in buying pressure. Moreover, the Moving Average Convergence Divergence (MACD) also indicates a dampened bullish sentiment, as the red bars are on the rise.

GBP/JPY daily chart

Turning to the hourly chart, the RSI similarly operates within the positive zone, trending flat in its last readings. The MACD histogram, however, reflects decreasing positive momentum, as it prints declining green bars.

GBP/JPY hourly chart

Altogether, the chart seems to be pointing to weakening bullish traction and a resurgence of the bears. However, given that the pair is above the 20,100 and 200-day Simple Moving Averages (SMAs) the overall trend remains bullish.

- EUR/USD rallies on renewed Euro strength.

- Fed holds the line, says rates will come down eventually.

- Friday’s US NFP to be the key data print this week.

EUR/USD rallied into 1.0950 on Thursday, bolstered by prospects of movement from the European Central Bank (ECB) and an easing US Dollar (USD) on the back of a steady showing from Federal Reserve (Fed) Chairman Jerome Powell who reiterated most of his statements from Wednesday’s Semi-Annual Monetary Policy Report to the US Congressional House Financial Services Committee.

Thursday’s Fed outing before the Senate Banking Committee found little new material for markets as Fed Chair Powell stuck closely to familiar narrative elements. The Fed sees rate cuts coming, possibly later this year, as long as inflation continues to recede.

Daily digest market movers: EUR/USD climbs as lack of Fed news drops the Greenback

- ECB held rates as markets broadly expected.

- European inflation continues to ease, ECB President Christine Lagarde teases June rate cut.

- ECB Press Conference: Lagarde speaks on policy outlook

- ECB to reveal new framework for monetary policy implementation, possibly as soon as next week.

- Fed Chair Powell revealed little new on Thursday.

- Jerome Powell Speech: Fed Chair says removing restrictive stance of policy could begin this year

- Friday’s US Nonfarm Payrolls (NFP) expected to come in at 200K versus the previous month’s 353K, its highest print since January of 2022.

- NFP Preview: Forecasts from 10 major banks

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the .

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.43% | -0.57% | -0.40% | -0.81% | -0.84% | -0.76% | -0.52% | |

| EUR | 0.42% | -0.14% | 0.03% | -0.38% | -0.41% | -0.35% | -0.09% | |

| GBP | 0.55% | 0.14% | 0.16% | -0.24% | -0.28% | -0.20% | 0.06% | |

| CAD | 0.40% | -0.01% | -0.18% | -0.41% | -0.44% | -0.37% | -0.12% | |

| AUD | 0.80% | 0.38% | 0.23% | 0.41% | -0.03% | 0.03% | 0.30% | |

| JPY | 0.84% | 0.39% | 0.27% | 0.42% | 0.02% | 0.06% | 0.32% | |

| NZD | 0.75% | 0.34% | 0.20% | 0.37% | -0.04% | -0.06% | 0.25% | |

| CHF | 0.50% | 0.09% | -0.06% | 0.12% | -0.29% | -0.32% | -0.25% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: EUR/USD extends into bullish territory, but obstacles remain

EUR/USD rallied into 1.0950 on Thursday, and the pair is set for a fifth consecutive bullish close. The pair is up overt 2.3% from the last swing low into 1.0700, and EUR/USD has closed in the green for all but three of the last 17 trading days.

The last notable high set late in December at 1.1140 remains a far-off technical ceiling, but the pair is stretching away from the 200-day Simple Moving Average (SMA) at 1.0832. A pullback could see another bullish leg form up off a rising trendline.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- AUD/USD climbs above 0.6600, rallying 0.82% after Powell hints at upcoming Fed rate adjustments.

- ECB's resistance to early easing contrasts with Powell's openness to rate cuts based on inflation trends.

- US labor market shows resilience with steady unemployment claims; trade deficit widens more than expected.

The Australian Dollar rallied against the US Dollar in late trading on Thursday after Fed Chair Jerome Powell's second day of testimony before the US Congress. The AUD/USD trades above the 0.6600 figure, posting gains of 0.82% as investors look for the Fed’s first rate cut.

AUD/USD strengthens amid Fed’s rate cut speculations

The financial markets' narrative revolves around when the major central banks will cut rates. On Thursday, the European Central Bank (ECB) pushed back against easing in April, sticking to its data dependence and noted that it would have more data to assess the appropriate restrictiveness of monetary policy in June.

Meanwhile, Fed Chair Jerome Powell reiterated the US central bank stance, suggesting they would begin to cut borrowing costs at some point in the year. Nevertheless, he added that it would depend on the inflation path, moving sustainably towards the Fed’s 2% goal.

Regarding the labor market, which, according to Powell, remains robust, the number of Americans filling for unemployment claims rose by 217,000, unchanged from the previous week, an exceeded estimate of 215,000.

Other data showed that the US trade deficit widened from $-64.2 billion to $-67.4 billion, exceeding forecasts, according to the US Department of Commerce.

What to watch?

The Australian economic docket is empty. In the US, February’s Nonfarm Payrolls are expected to drop from 353K to 200K, in tune with the ongoing economic slowdown. The Unemployment Rate is expected to remain unchanged at 3.7%.

AUD/USD Price Analysis: Technical outlook

the AUD/USD has risen more than 1.50% during the last two days, clearing key resistance levels on its way up. For a bullish continuation, buyers need to reclaim the January 5 low-turned resistance at 0.6640, ahead of challenging 0.6650. Further upside is seen at 0.6747, the January 5 high. On the other hand, if sellers push prices below 0.6600, look for a correction towards the confluence of the 100 and 200-day moving averages (DMAs) at 0.6560/65.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

- Dow Jones gains, but thinly in easy Thursday trading.

- Fed’s Powell repeat appearance delivers little of note to investors.

- Market focus pivots to Friday’s US NFP jobs report.

The Dow Jones Industrial Average (DJIA) is up a little over a quarter of a percent on Thursday as investors take the opportunity to bid up equities and readjust their exposure after Federal Reserve (Fed) Chairman Jerome Powell’s second appearance before US government oversight committees produced little of note. Markets are now gearing up for Friday’s US Nonfarm Payrolls (NFP) jobs report.

Fed Chair Powell reiterated most of his statement from Wednesday’s appearance before the US Congressional House Financial Services Committee. Thursday’s Q&A with the Senate Banking Committee largely echoes information the market has already heard. Equities are paring away recent losses, and the DJIA seeks to reclaim the 39,000.00 handle.

Technology stocks are leading the market rebound, with the Technology Sector climbing over 2% on Thursday. The Real Estate and Financials Sectors are the market’s soft spots on the day, shedding around a third and a tenth of a percent, respectively.

Dow Jones News: Investors thankful for no Fed surprises turn to focus on US NFP

The DJIA is on the higher side for Thursday but still lagging behind the Standard & Poor’s 500 and NASDAQ Composite indexes, which are up around 1.7% and 1.10%, respectively. Fed Chair Powell’s repeat appearance gave investors little new to chew on, with the Fed head sticking to the “eventually, but not right now” stance on when the Fed might begin cutting interest rates.

Read more: Fed Chair says removing restrictive stance of policy could begin this year

Markets are gearing up for another US NFP print on Friday, and investors expect the February jobs additions to be 200K, down from January’s 11-month peak of 353K new payroll positions.

NFP Preview: Forecasts from 10 major banks, employment continues to rise strongly

Intel Corp. (INTC) is leading the Tech Sector charge on the Dow Jones on Thursday, climbing nearly 4% to trade above $46.00 per share. On the downside, the day’s weakest performer on the Dow 30 is Amgen Inc. (AMGN), falling around 1.75% to trade below $272.00 per share after the biotech company’s board revealed a $2.25 per share dividend. The dividend is slated to be paid out on June 7. AMGN’s stock sees further discounting as Amgen currently holds a Forward P/E ratio of 14.39 compared to the industry average of 22.45 by similar companies in the same sector.

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

DJIA technical outlook

The Dow Jones Industrial Average (DJIA) is struggling to chalk in further ground above 38,800.00 as the index sees intraday technical rejection from a resistance zone priced in from 38,800.00 to 38,950.00. The major equity index is up for Thursday, but gains are looking capped as markets flows pull into the midrange ahead of Friday.

The DJIA is set to etch in a second day in the green after falling for two consecutive sessions, but the index is still down around 1.4% from February’s peak near 39,250.00.

DJIA 5-minute chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- The daily chart of the NZD/JPY suggests a growing selling momentum.

- In contrast, indicators at the hourly chart show a mild recovery, with an improving RSI.

- Whilst the pair have been subject to short-term selling pressure, the dominant bullish trend still prevails.

The NZD/JPY pair was trading at 91.36 in Thursday's session, experiencing a decline of 0.18%. From a technical perspective, bearish signals are evident on the daily chart, whereas the hourly chart shows potential improvement.

On the daily chart, the Relative Strength Index (RSI) has been residing in negative territory for the past few sessions. The most recent RSI value stands at 45, indicating a slightly bearish bias daily. This bearish stance is further reinforced by the MACD, which shows rising red bars, indicating negative momentum in the pair.

NZD/JPY daily chart

However, when in the hourly chart, the RSI has been showing signs of improvement with the latest RSI level of 55 sitting in the positive territory. Despite this, the MACD is presenting green bars, indicating a steady positive momentum.

NZD/JPY hourly chart

Regarding broader technical aspects, the NZD/JPY sits below its 20-day Simple Moving Average (SMA). However, it remains above its longer-term 100 and 200-day SMAs. This suggests that the longer-term bullish trend could still remain intact despite the recent short-term selling pressure. Thus, the divergence between the daily and hourly readings may imply that the underlying bullish bias could resurface, especially if the hourly indicators continue to improve.

The continuation of the solid sentiment surrounding the risk-associated universe kept the US Dollar under extra pressure. On the central banks’ front, the ECB left its policy rates intact, while President Lagarde delivered an apathetic press conference. Next on tap comes the key US Non-farm Payrolls amidst rising bets for a Fed’s rate cut in June.

Here is what you need to know on Friday, March 8:

The greenback intensified its decline and prompted the USD Index (DXY) to break below the 103.00 support for the first time since early February. On March 8, the release of Non-farm Payrolls will take centre stage, seconded by the Unemployment Rate. In addition, the Fed’s J. Williams is due to speak.

EUR/USD rose further and printed new multi-week tops near 1.0950 after the ECB left its monetary conditions unchanged. Another revision of the GDP Growth Rate in the broader Euroland is expected at the end of the week.

GBP/USD clinched fresh 2024 highs in levels just above 1.2800 the figure amidst extra selling pressure in the Greenback. The next event of note across the Channel will be the publication of the labour market report on March 12.

USD/JPY tumbled to fresh five-week lows well south of the 148.00 support on the back of lower US yields and further speculation of the BoJ’s potential lift-off as soon as at its March meeting. A busy docket on March 8 will see Household Spending, Bank Lending, preliminary prints of the Coincident Index and the Leading Economic Index and finally the release of the Eco Watchers Survey.

AUD/USD added to Wednesday’s strong rebound and finally left behind the key 0.6600 hurdle in response to the sour sentiment around the US Dollar. The RBA’s S. Hunter is due to speak on March 11.

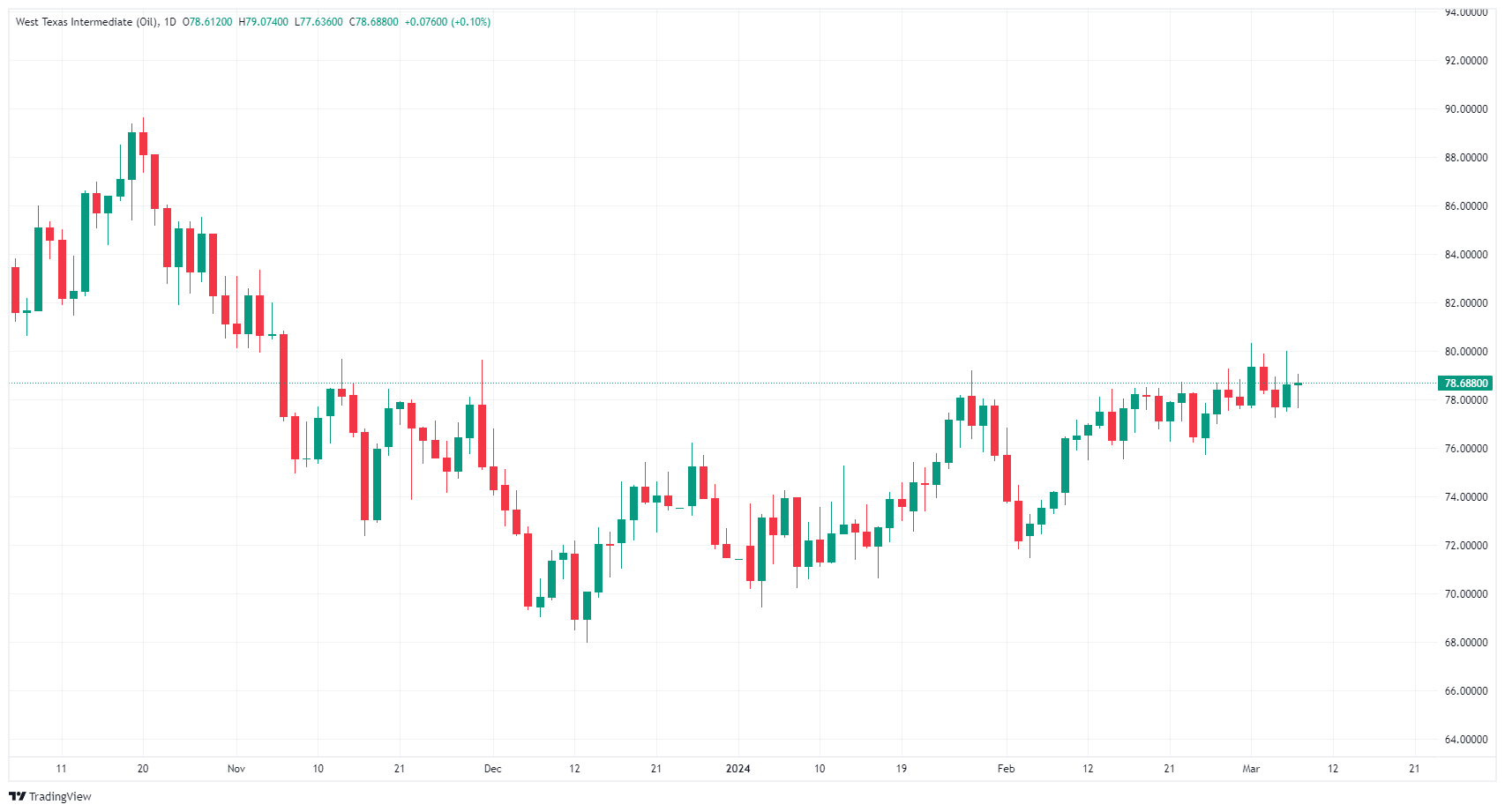

Prices of WTI extended their consolidative mood near the $80.00 region per barrel amidst expectations of a Fed’s rate cut and larger crude oil imports in China during January and February.

Gold prices rose further and clinched an all-time high past the $2,160 mark per troy ounce. Its cousin Silver followed suit and flirted with the $24.50 zone per ounce, or three-month highs.

- Gold's rally propels it to an unprecedented $2,164.78, buoyed by expectations of easing policies from ECB and Fed.

- Despite ECB's hawkish hold, Lagarde's openness to June adjustments contrasts with rising US Treasury yields.

- Powell hints at easing, increasing June rate cut odds amid cooling US labor market signs.

Gold witnessed an extension of the incumbent rally, hitting an all-time high of $2,164.78 and remaining on the path toward $2,200. The US Dollar tumbled across the board as major central banks like the European Central Bank (ECB) and the Federal Reserve (Fed) prepare to ease policy.

On Thursday, the ECB decided to hold rates unchanged and delivered hawkish remarks led by the ECB President Christine Lagarde. Even though she prepared a possible policy adjustment, she disregarded a possible cut by the April meeting, though June looks possible. Consequently, US Treasury yields rose, sparking a pullback in yellow metal prices.

Across the pond, Fed Chair Jerome Powell appeared at the US Congress and reiterated yesterday’s speech. He said they would adjust borrowing costs and added the Fed was “not far” from being able to ease policy. Although he pushed back against a cut in March, the window is open for June’s meeting. Odds for a quarter of a percent rate cut in that meeting increased.

Yields on US Treasuries tumbled throughout the week with the 10-year benchmark note rate at 4.116%, down six basis points. Besides that, soft US economic data suggests the economy isn’t faring as solidly as expected. Americans filing for unemployment claims rose as expected by 217K, though this suggests the labor market is cooling, a consequence of tighter policies.

Daily digest market movers: Gold price skyrockets as the Greenback tumbles

- The US Dollar Index tumbled 0.48% and is at 102.85, its lowest level since January 24. This is a tailwind for the non-yielding metal.

- The CME FedWatch Tool shows odds for a 25-basis-point rate cut in June are at 73%.

- On Wednesday, Minnesota Fed President Neel Kashkari said that he expects only one rate cut if it’s appropriate as economic data remains robust. He put into the table the chance of keeping rates unchanged through 2024.

- The Initial Jobless Claims for the week ending March 2 were 217K, surpassing estimates and the previous reading of 215K.

- The US Balance of Trade was $-67.4 billion, exceeding estimates of $-63.5 billion and higher than December’s $-64.2 billion.

- US economic data previously released during the week:

- Private companies hired less than forecast but exceeded January’s reading at 111K as they added 140K jobs to the workforce, below estimates of 150K, according to ADP Employment Change report.

- The US Job Openings and Labor Turnover Survey (JOLTS) for January showed that there were 8.863 million job openings, a figure that fell short of expectations and was marginally lower than the previous month's report of 8.9 million and 8.889 million, respectively.

- The S&P Global Services PMI experienced a slight decrease to 52.3, falling from January's 52.5, while the Composite PMI, which includes both manufacturing and service sectors, registered at 53.8. This figure did not meet expectations and was lower than the previous reading of 54.2.

- Additionally, the ISM Services PMI reported a decline to 52.6 from 53.4, coming in below the anticipated consensus of 53. This resulted in a negative impact on the US Dollar.

- Factory Orders in January fell more than expected, from 0.2% to -3.6% MoM.

- On Monday, Atlanta Fed Bank President Raphael Bostic said a strong labor market and decent economic growth have bought time for the Federal Open Market Committee (FOMC) to decide on when rate cuts will be optimal. Bostic added that the Fed is having a “rebounding success” as inflation slowly returns to the desired target without hurting labor demand.

Technical analysis: Gold surges to all-time highs amid Powell’s comments

The Gold rally is extending past the psychological $2,150 mark and hit an ATH at $2,164.78. Even though the Relative Strength Index (RSI) suggests the uptrend is overextended, it makes it difficult for sellers to step in and push prices lower. On the other hand, buyers could step in, though they need a pullback toward the $2,150 area or the $2,100 mark, before targeting the $2,200 figure.

In another scenario, if XAU/USD drops below March’s 6 low of $2,123.80, that would pave the way for a correction toward $2,100. If that level is surpassed, the next support would be the December 28 high at $2,088.48 and the February 1 high at $2,065.60.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

- US Crude Oil stocks rose less than expected this week.

- China saw an uptick in Crude Oil demand.

- Market shrugs off more productive US Crude Oil well efficiency.

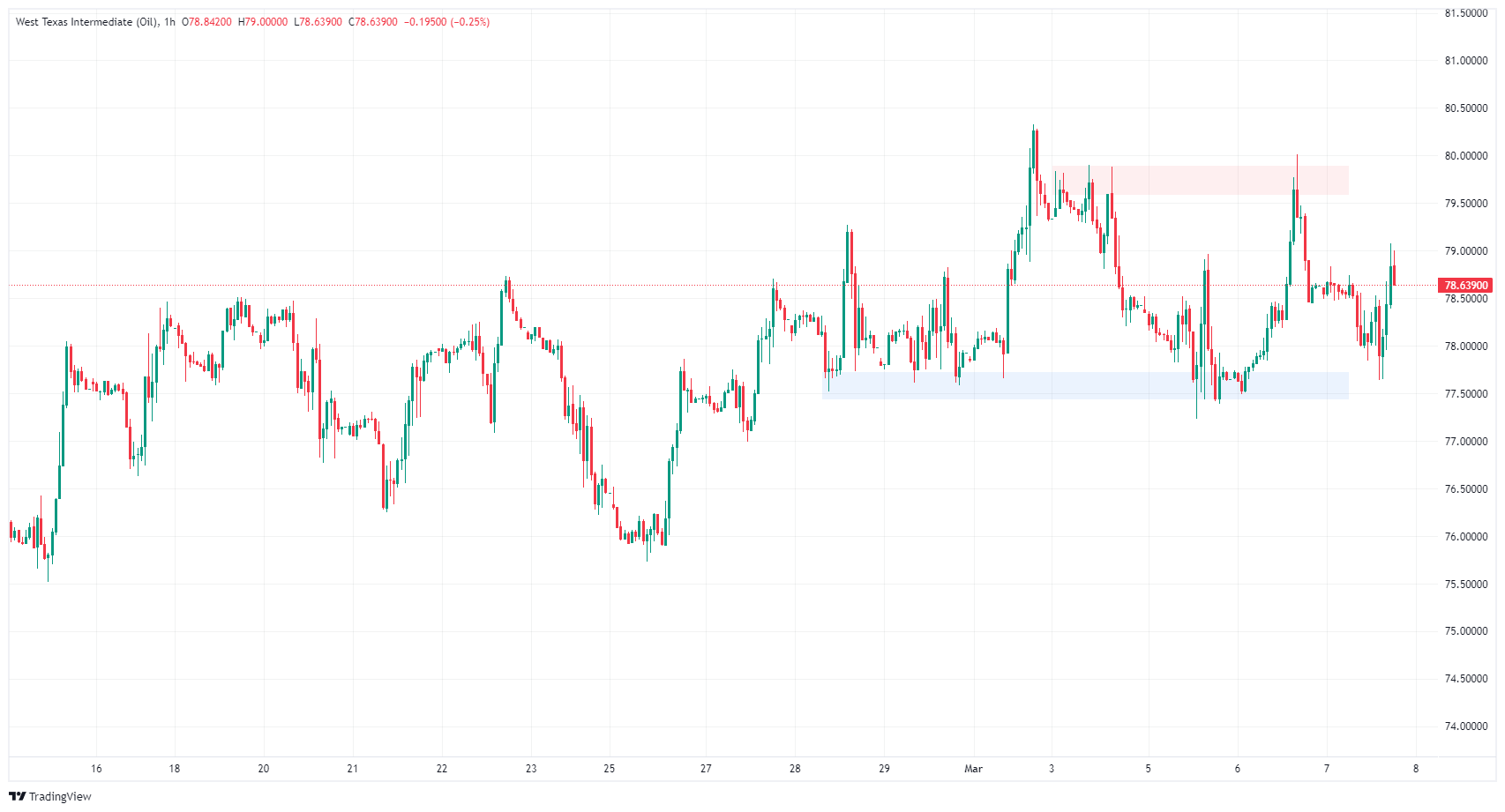

West Texas Intermediate (WTI) fell towards $77.60 per barrel early Thursday before a firm rally in the US trading session dragged US Crude Oil back into the high end for the day. US Crude Oil supplies rose less than expected this week, and a drawdown in US gasoline reserves is propping up hopes of demand outrunning supply.

China’s Crude Oil imports rose over 5% in January and February according to Chinese government data published on Thursday. The Lunar New Year holiday saw Chinese demand for fuel surge as holiday travel bolstered consumption.

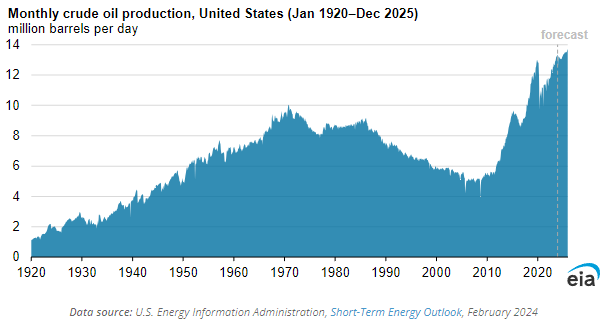

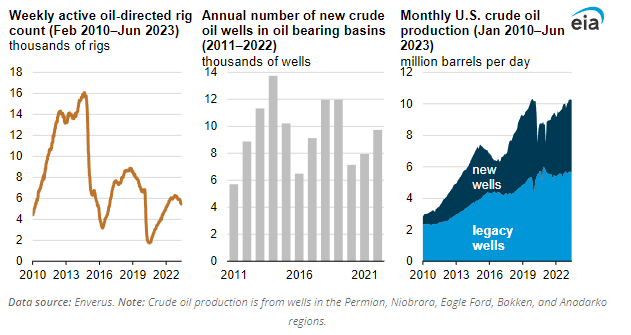

US Crude Oil production continues to rise into record levels, and according to the Energy Information Administration (EIA), that trend is set to continue. As noted by the EIA, increasing efficiency in already-existing US Crude OIl production facilities is driving the total output volume into higher numbers despite a bearish outlook on the total number of production facilities. Counts on US oil rigs are steadily decreasing and the number of new wells being produced has been easing for over a decade.

However, previously built or “legacy” wells continue to produce higher amounts of Crude Oil as the US energy market becomes increasingly efficient.

WTI technical outlook

WTI’s near-term churn keeps US Crude Oil bids trapped in a rough range with the $80.00 handle acting as a technical ceiling, and Thursday’s rebound has WTI struggling to etch in chart paper above $79.00.

Daily candlesticks are stuck in a close pattern with the 200-day Simple Moving Average (SMA) near $77.90. US Crude Oil has risen around 10% from early February’s swing low into $71.50, but further topside moment has drained out of WTI.

WTI hourly chart

WTI daily chart

- A neutral outlook is seen on the daily chart.

- The hourly chart for AUD/JPY paints a different picture, showcasing mounting buying pressure.

The AUD/JPY pair is currently trading at 97.99, showcasing slight losses. The currency pair is experiencing a delicate dynamic between short-term buyers, who are starting to become more active, while on the daily chart, the outlook is mixed. However, the overall trend remains bullish as the pair hovers above key Simple Moving Averages (SMAs) of 20,100 and 200 days.

On the daily chart, the AUD/JPY pair is displaying a neutral momentum, underpinned by the Relative Strength Index (RSI) falling to negative territory this week. However, a slight increase was observed in the latest reading, suggesting a balanced market. Moreover, the fading red bars of the Moving Average Convergence Divergence (MACD) histogram indicate softening bearish momentum, casting doubt on the durability of the latest bearish move.

AUD/JPY daily chart

Taking a look at the AUD/JPY hourly chart, an interesting contrast comes into the picture. The recent positivity in the hourly Relative Strength Index (RSI), now within positive territory, underscores the mounting buying pressure at a granular level. Additionally, the rising green bars on the MACD histogram reveal escalating bullish momentum in this shorter timeframe, dispelling the cloud of bearishness cast by the daily chart.

AUD/JPY hourly chart

When combining daily and hourly views, it appears that the AUD/JPY is about to experience a period of consolidation after hitting multi-year highs in late February.

- Silver's nearly 1% gain drives it to around $24.40, as market bets on a June Federal Reserve rate cut.

- Technical indicators bullish as silver surpasses 50, 100, and 200-day DMAs, eyeing December highs.

- Despite bullish trend, potential pullback risks exist if silver dips below $24.50, with supports at $24.00 and $23.57.

Silver price advances during Thursday’s session, gains almost 1% and stays above the $24.00 figure as investors expect a rate cut by the Federal Reserve in June. Therefore, XAG/USD exchanges hands at $24.40.

XAG/USD Price Analysis: Technical outlook

After bottoming at around $22.50, the grey metal extended its gains due to fundamental news. That opened the door to clear key resistance levels seen at the 50, 100, and 200-day moving averages (DMAs). If buyers push prices above the December 28 high of $24.48, look for a leg-up toward the December 22 peak at $24.60, ahead of the $25.00 psychological figure.

On a bearish scenario, the less likely as Relative Strength Index (RSI) studies show bullish momentum, XAG/USD’s daily close below $24.50, could sponsor a pullback. The first support would be the $24.00, followed by the March 6 low of $23.57,

XAG/USD Price Action – Daily Chart

- Mexican Peso gains as February's lower-than-expected inflation fuels speculation of an upcoming Banxico rate cut.

- Mixed signals from Mexico's CPI data leave markets anticipating key Banxico decision on March 21.

- Cooling US job market and widening trade deficit add complexity to Fed's policy outlook as Powell reiterates cautious stance.

The Mexican Peso posted minuscule gains against the US Dollar after Mexico’s National Statistics Agency (INEGI) revealed that inflation cooled in February. Therefore, speculation for the Bank of Mexico's (Banxico) first rate cut looms large. This should weigh on the emerging market currency and underpin the USD/MXN pair. Hence, the exotic pair exchanges hands at 16.88, down 0.13%.

Mexico’s Consumer Price Index (CPI) for February was lower than expected on monthly and annual figures. Nevertheless, underlying CPI came as expected in MoM data, a tick higher compared to January’s reading, but inflation dipped in the annual readings. It remains to be seen whether the conditions are met for Banxico’s first rate cut at the March 21 meeting, and there’s a tranche of data to be released ahead of that date.

In the United States, the job market is cooling. Americans filing for unemployment claims rose above estimates, aligned with the previous week’s data, suggesting the labor market is getting more balanced. At the same time, the US trade deficit widened in January as imports grew more than in December.

At the time of this writing, US Fed Chair Jerome Powell is testifying before the US Senate Banking Committee on Capitol Hill. He is echoing some of Wednesday’s comments, saying that if the economy evolves as expected, the Fed will carefully remove its restrictive policy stance.

Daily digest market movers: Mexican Peso boosted by broad US Dollar weakness

- Mexico’s inflation was 4.40% YoY, below estimates of 4.42% and January’s 4.88%. On a monthly basis, CPI was down from 0.11% to 0.09%.

- Excluding volatile items, the so-called Core CPI rose by 4.64% above forecasts but lower than the previous reading of 4.76%, while monthly figures were aligned with estimates of 0.49%, up from 0.40%.

- Mexican data released previously:

- On Wednesday, Mexico’s consumer confidence index was 47.0 in February when adjusted for seasonal factors. The unadjusted index was 47.1.

- On Monday, Mexico’s economic docket revealed that Gross Fixed Investment in December remained flat MoM. Nevertheless, on an annual basis, it dipped from 19.2% to 13.4%.

- A Reuters poll sees the Mexican Peso depreciating 7% to 18.24 in 12 months from 16.96 on Monday, according to the median of 20 FX strategists polled between March 1-4. The forecast ranged from 15.50 to 19.00.

- A Reuters poll shows 15 analysts estimate that inflation will slow down in February, corroborating bets that the Bank of Mexico (Banxico) could cut rates as soon as the March 21 meeting.

- Mexico’s General Election campaign started on March 1. Polls suggest the ruling party’s nominee, Claudia Sheinbaum, maintains her lead over Xochitl Galvez. Parametria’s poll shows Sheinbaum's support at 49%, while Galvez, the opposition candidate, stands at 29%.

- Banxico’s private analytics poll projections for February were revealed. They expect inflation at 4.10%, core CPI at 4.06%, and the economy to grow 2.40%, unchanged from January. Regarding monetary policy, they see Banxico lowering rates to 9.50% and the USD/MXN exchange rate at 18.31, down from 18.50.

- During Banxico’s quarterly report, policymakers acknowledged the progress on inflation and urged caution against premature interest rate cuts. Governor Victoria Rodriguez Ceja said adjustments would be gradual, while Deputy Governors Galia Borja and Jonathan Heath called for prudence. The latter specifically warned against the risks of an early rate cut.

- Banxico updated its economic growth projections for 2024 from 3.0% to 2.8% YoY and maintained 1.5% for 2025. The slowdown is blamed on higher interest rates at 11.25%, which sparked a shift in three of the five governors of the Mexican Central Bank, who are eyeing the first rate cut at the March 21 meeting.

- Economic trade issues between Mexico and the US could depreciate the Mexican currency if the Mexican government fails to resolve its steel and aluminum dispute with the United States. US Trade Representative Katherine Tai warned the US could reimpose tariffs on the commodities.

- US economic data hurt the prospects for a higher USD/MXN, with buyers failing to keep the exchange rate above 17.00.

- The political race is almost defined in the United States after Super Tuesday. Former President Donald Trump leads the Republicans with 995 delegates, shy of the 1,215 needed. On the Democratic side, US President Joe Biden leads with 1,497 delegates, short of the 1,968 needed.

- The Initial Jobless Claims for the week ending March 2 were 217K, surpassing estimates and the previous reading of 215 K.

- The US Balance of Trade was $-67.4 billion, exceeding estimates of $-63.5 billion and higher than December’s $-64.2 billion.

- As Fed Chair Jerome Powell testifies, the CME FedWatch Tool shows traders increased their bets for a 25-basis-point rate cut in June from 52.7% a week ago to 71.9%.

Technical analysis: Mexican Peso advance continues as USD/MXN holds firm below 16.90

The USD/MXN downtrend remains intact, with sellers keeping the exchange rate below 16.90. If they push the pair below the year-to-date (YTD) low of 16.78, look for a deeper correction past last year’s 16.62 low. Initial targets are October 2015’s low of 16.32 and the 16.00 mark.

On the other hand, if buyers reclaim the 17.00 figure, that could open the door to testing the 50-day Simple Moving Average (SMA) at 17.05, followed by the 200-day SMA at 17.24 and the 100-SMA at 17.38.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

- Canadian Dollar mixed on the day but climbs over US Dollar.

- Canada brings its own labor figures to US NFP Friday.

- USD/CAD breaks down below 1.3500 on weaker Greenback flows.

The Canadian Dollar (CAD) found some room on the high end above the US Dollar (USD) on Thursday. The USD/CAD pair slipped below the 1.3500 handle as markets buckle down for the wait to Friday’s US Nonfarm Payrolls (NFP) jobs report.

Canada answers the US NFP print with labor figures of its own on Friday. American markets will be switching to Daylight Savings Time this weekend, while Canada will be largely absent from the economic calendar with strictly low-tier data on offer next week. However, plenty of US data will arrive to drive the markets, with February’s US Consumer Price Index (CPI) inflation slated for next Tuesday.

Daily digest market movers: Markets pull away from Greenback as investors await key data

- Canada’s MoM Building Permits jumped to a seven-month high of 13.5% in January, well above the 5.5% forecast and recovering from the previous month’s -11.5% decline (which was revised upward from -14.0%).

- US Initial Jobless Claims for the week ended March 1 printed slightly above expectations, coming in at 217K versus the forecast 215K, while the previous week saw a revision to 217K from 215K.

- Initial Jobless Claims came in above the four-week average of 212.25K.

- US Nonfarm Productivity in the fourth quarter held steady at 3.2% compared to the forecast of a tick lower to 3.1%.

- US Q4 Unit Labor Costs ticked down to 0.4% from the previous 0.5%, missing the forecasted uptick to 0.6%.

- Federal Reserve (Fed) Chairman Jerome Powell testifies before the US Senate Banking Committee in the second of a two-day Q&A about the Fed’s Semi-Annual Monetary Policy Report.

- Canada’s Unemployment Rate is expected to tick higher from 5.7% to 5.8% on Friday.

- Canadian Net Change in Employment in February is forecast to print at 20K versus the previous month’s 37.3K.

- Friday’s US NFP print is expected to come in at 200K for February, down from January’s 11-month peak of 353K.

- NFP Preview: Forecasts from 10 major banks, employment continues to rise strongly.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.35% | -0.45% | -0.33% | -0.77% | -0.77% | -0.70% | -0.46% | |

| EUR | 0.35% | -0.10% | 0.02% | -0.42% | -0.40% | -0.35% | -0.11% | |

| GBP | 0.45% | 0.10% | 0.13% | -0.32% | -0.32% | -0.26% | 0.00% | |

| CAD | 0.34% | 0.00% | -0.12% | -0.44% | -0.43% | -0.38% | -0.13% | |

| AUD | 0.77% | 0.42% | 0.33% | 0.45% | 0.00% | 0.05% | 0.32% | |

| JPY | 0.77% | 0.41% | 0.30% | 0.41% | -0.02% | 0.06% | 0.28% | |

| NZD | 0.68% | 0.35% | 0.25% | 0.37% | -0.07% | -0.06% | 0.24% | |

| CHF | 0.45% | 0.11% | 0.01% | 0.13% | -0.31% | -0.30% | -0.25% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: USD/CAD drifts into the low side as Greenback waffles

The Canadian Dollar (CAD) found room above the US Dollar on Thursday, climbing around a third of a percent against the Greenback, but overall the Loonie is moderately softer across the broader FX market. The CAD lost around half a percent against the Japanese Yen (JPY), the Australian Dollar (AUD) and the New Zealand Dollar (NZD). The Canadian Dollar is flat against the Euro (EUR) as both currencies struggle to find moves.

USD/CAD found a near-term floor at 1.3500 on Wednesday, and Thursday’s US Dollar-bearish flows finished the job, knocking the pair toward 1.3460. The Dollar-Loonie pair is down around a full percent from the week’s peak bids at 1.3605.

Thursday’s decline drags the USD/CAD pair back into the 200-day Simple Moving Average (SMA) at 1.3477, and the immediate technical floor is priced in at the last meaningful swing low toward 1.3350.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Appearances from multiple Federal Reserve (Fed) policymakers crossed the newswires on Thursday. Fed Chairman Jerome Powell added to earlier comments while testifying before the US Senate Banking Committee, and Cleveland Fed President Loretta Mester struck similar chords while speaking at the Virtual European Economics and Financial Center.

Key highlights:

- Powell:

- Waiting to be more confident, we are not far from it.

- Expects bank failures from commercial real estate, but not any big banks. Small and medium-sized banks have biggest exposure.

- Believes Fed is in the right place on policy.

- Could see a case for shortening maturity of Fed holdings.

- Expects food inflation to continue flattening.

- Mester:

- Inflation may prove persistent this year.

- If the economy meets forecasts, rate cuts would be likely later this year.

- The biggest mistake would be premature Fed rate cuts.

- Fed has the luxury of holding steady while taking in more data.

- Expects Fed rate reduction to be very gradual.

- EUR/GBP falls after Eurozone growth is expected to slow in 2024 whilst UK growth revised up.

- ECB concludes its March policy meeting and in the UK the Chancellor delivers the spring budget.

- The technical outlook is bearish but with important caveats.

The Euro (EUR) is down over a tenth of a percent, trading in the 0.8540s against the Pound Sterling (GBP) on Thursday, on the back of diverging growth forecasts for the Eurozone and UK economy.

EUR/GBP slides on diverging growth stories

In Frankfurt, the European Central Bank (ECB) concluded its March policy meeting and announced its decision to keep interest rates unchanged. The ECB staff projections, however, indicated lower growth and inflation going forward, with the growth rate projected to average 0.6% for the region in 2024, and inflation 2.3%. This was below the 0.8% and 2.7% respectively of the ECB’s previous forecasts.

Across the channel in Britain, the UK’s Chancellor of the Exchequer, Jeremy Hunt, was sounding more optimistic, however. In his spring budget, presented to the House of Commons, Hunt estimated the UK economy growing by 0.8% in 2024 – stronger than the 0.7% forecast by the Office for Budget Responsibility (OBR) in November. Whilst Hunt may not be an independent source the forecast revision may still have bolstered GBP in the short-term.

The outcome appears to have been a slight depreciation of the Euro against the Pound as reflected in the EUR/GBP exchange rate.

Technical Analysis: Possible Inverse Head and Shoulders

The long-term technical outlook for the pair is sideways with a slight bearish bias in the intermediate and short-term.

At the same time, there are some signs on the daily chart indicating that the pair has the potential to reverse the bearish trend and recover. It is too early to say for sure, however, and confirmation from price action first would be required to alter the bearish outlook.

Euro vs Pound Sterling: Daily chart

The first hint is that the Moving Average Convergence/ Divergence (MACD) is converging bullishly with price action, suggesting the possibility of a recovery on the horizon.

Price made a lower low in February compared to December 2023, but the MACD failed to reflect this and made a higher low on the second trough in February instead. This nonconfirmation and convergence between the indicator and the exchange rate is a bullish sign.

Another bullish sign is that EUR/GBP may have formed a bottoming pattern called an Inverse Head and Shoulders (H&S) in January and February. This could be a sign the market may be reversing on the intermediate time frame.

If an inverse H&S is forming then it will break higher if price confirms the pattern by pushing above what is known as “the neckline”. The neckline is drawn as a resistance line at the highs. On EUR/GBP this is at 0.8750.

A break above the neckline could be followed by a rise of either the same length as the height of the pattern extrapolated higher, or a Fibonacci 61.8%.

Given the confluence of resistance from the 100 and 200-day Simple Moving Averages (SMA) at around 0.8615, as well as resistance from the trendline nearby, this zone provides a potential conservative estimate for the pattern, although it may well go higher if accompanied by a major shift in fundamentals.

- Initial Jobless Claims released by the US Department of Labor were slightly higher than expected.

- Unit Labor Costs from Q4 also came in weak.

- Markets await February’s Nonfarm Payrolls figures on Friday.

The US Dollar Index (DXY) dipped to the 103.1 level on Thursday, so far tallying a near 0.60% weekly decline. This downward movement can be attributed to the rise in Initial Jobless Claims for the week ending March 2 and the lower-than-expected Unit Labour Costs from Q4. On Friday, data on the Unemployment Rate, Average Hourly Earnings and NonFarm Payrolls from February arrive, and they will likely set the pace of the DXY in the short term.

In case the US reports additional labor market data on Friday, hopes of rate cuts arriving soon may add further pressure to the Greenback.

Daily digest market movers: DXY sees drop in soft labor market figures

- ADP jobs report hints at fewer than anticipated jobs, but JOLTS suggests a tight labor market.

- For the week that ended on March 2, Initial Jobless Claims were mildly above the consensus at 217,000.

- Q4 Unit Labour Costs from the US were lower than anticipated, rising by 0.4% vs. the estimate of 0.6%.

- US Treasury bond yields continue to decline with 2-year yield falling to 4.54%.

- Markets still see the start of the easing of the Federal Reserve (Fed) in June. However, Friday’s data will shape those expectations.

DXY technical analysis: DXY bears advance as buyers are nowhere to be found

The DXY's technical aspects paint a rather bearish picture. The negative slope and territory of the Relative Strength Index (RSI) indicate weakening buying momentum. Concurrently, the Moving Average Convergence Divergence (MACD) is displaying red bars, a sign that sellers are taking control of the DXY's direction.

In terms of price movement, the currency index stands below its 20,100 and 200-day Simple Moving Averages (SMAs). This position shows a broad-scale bearish outlook, as it typically signals an overall selling trend.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

The US Bureau of Labor Statistics (BLS) will release the February jobs report on Friday, March 8 at 13:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 10 major banks regarding the upcoming employment data.

Expectations are for a 200K rise in Nonfarm Payrolls following the stronger-than-expected 353K increase recorded in January. Meanwhile, Average Hourly Earnings are expected to slow to 4.3% vs. 4.5% in January and the Unemployment Rate is set to remain steady at 3.7%.

Commerzbank

We still see strong demand for labor despite the high interest rates. At the same time, the renewed increase in immigration means that sufficient applicants are entering the market, which is why the jobs on offer can be filled. Monthly employment growth is no longer weakening. Accordingly, we expect job growth of 200K for February with an unchanged low unemployment rate of 3.7%.

Deutsche Bank

We estimate gains in payrolls to moderate to 225K. We also see MoM gains in hourly earnings slowing to 0.2% and the unemployment rate staying at 3.7%.

Danske Bank

We expect NFP growth to cool down to 180K and average hourly earnings to land at 0.2% MoM after the surprisingly strong January report.

TDS

We look for February NFP to show some moderation in job gains (190K) after the surprise to the upside in January. Household survey volatility will likely lead to a drop in the UE rate to 3.6%, while wage growth is expected to recede to 0.1% MoM after Jan's booming print.

RBC Economics

We expect February NFP numbers to show another solid employment gain of 260K, with growth mainly coming from the leisure and hospitality, health care, and government sectors. We expect the unemployment rate to hold steady at 3.7%.

NBF

Hiring could have slowed in the month if previously released soft indicators such as S&P Global’s Composite PMI were any guide, but this may have been offset by a decrease in the number of layoffs. At least that is what a drop in initial jobless claims between the January and February reference periods suggests. With these two trends cancelling each other, job creation could have remained strong at 190K. And while the household survey may show a larger gain following the losses recorded in January, this could have been partly offset by a rebound in participation, leaving the unemployment rate unchanged at 3.7%.

SocGen

We forecast a gain of 200K and a rise in average earnings of 0.3%.

Wells Fargo

The pace of hiring still appears to be on solid ground, and we anticipate payrolls to rise by 195K during February, just slightly above the current consensus. Furthermore, we look for the unemployment rate to remain unchanged at 3.7% and for average hourly earnings to ease to 0.2% during the month alongside normalizing supply and demand for workers.

CIBC

We expect the February payroll report to be another strong release with 220K jobs gained and a bounce back in average hours worked to 34.3 from the inclement weather during reference week of last month’s survey. Over the past few months, broad-based hiring has picked up and we expect more of that trend in February. Our expectation is health care and government sectors to account for 60% of job gains and all other sectors, which behave more cyclically, to account for the remaining 40%. The unemployment rate and participation rate should remain unchanged at 3.7% and 62.5% respectively in the month. But the most important piece of the payroll report to watch out for once again will be the revisions. Given the size and volatility of revisions lately, there seem to be equal chances of either solidifying or nullifying the recent picture of the labour market.

Citi

We expect a 145K increase in NFP. December and January’s figures were likely boosted by stale seasonal adjustment factors, which positively offset non-seasonally adjusted declines in each of these months. Seasonal factors from February through June however will likely imply a downward adjustment to payroll growth. This should make for a still-declining trend of employment over coming months during the period in which hiring should typically pick up. We expect average hourly earnings to rise 0.4% MoM in February following a very strong 0.6% increase in January. This would still be a strong increase in wage growth, with average hourly earnings up 4.6% from a year ago. However, even with some rebound in aggregate hours worked in February, and thus softer average hourly earnings, markets will be particularly interested in the trend of average hours worked. Average hours worked dropped to a very low 34.1 hours/week in January, although this low level likely does reflect some weather and seasonal adjustment issues. The unemployment rate should rebound to 3.8% in February from 3.7% in January, although with risks that it remains at 3.7% if the participation rate remains subdued.

Federal Reserve Chairman Jerome Powell testifies before the Senate Banking Committee.

Key takeaways

"If the economy does as expected, we think carefully removing the restrictive stance of policy will begin over the course of this year."

"We are working hard to develop a new rule book for supervision, will involve earlier, more effective interventions."

"Surge-pricing works both ways, in slow periods prices go down."

"We need to give companies freedom to set prices."

"The Fed is independent, and the way we do that is by staying out of political issues, like immigration policy."

"When rates are normalized, underlying housing shortage will still put upward pressure on prices."

"I believe we will have a consensus on capital proposal, we are in process of digesting comments, making appropriate changes."

"We are not at the stage of making a decision on reproposing Basel 3."

"Our job is to restore price stability, that's what we are doing."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell first took office as Chair of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term. He was reappointed to the office and sworn in for a second four-year term on May 23, 2022. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

Economists at Commerzbank expect the Federal Reserve (Fed) to cut rates only five times by 25 basis points (bps) each cut.

Fed to adjust key rates

We do not expect the first rate cut until the June meeting and therefore one meeting later than previously assumed.

Overall, we now expect five interest rate cuts of 25 bps each (previously 8). The Fed is likely to make three of these cuts this year and two next year. The key interest rate would then be 4.25%.

As broadly expected, the ECB left policy on hold today. Very little new news for the Euro (EUR) to consume here, analysts at TD Securities say.

ECB is a bit of a nothing burger for the EUR

As broadly expected, the ECB left policy on hold. The statement was largely as expected, with no tangible changes to the language.

Inflation forecasts were revised down slightly, further suggesting that cuts are coming.

President Lagarde came as close as she could to saying the ECB would not cut in April, with strong hints of June.

The ECB is a bit of a nothing burger for the EUR today with much of the focus likely to shift to US data and other global drivers.

We continue to forecast a break of 1.1000 to the upside in Q2, reflecting broad USD underperformance.

The Federal Reserve (Fed) is priced to start easing a month too soon. Therefore, economists at CIBC Capital Markets expect the US Dollar (USD) to remain strong in the near term.

USD to gradually depreciate through the end of 2024

We’re still resolute in our call for one last round of USD strength before this quarter is out. That’s largely because there’s enough evidence now that the US economy has adapted to higher rates far better than most have expected, and we still don’t think markets are paying full tribute yet to this theme.

Markets have recalibrated and are now pricing in decent odds of that first cut coming at the June meeting. That’s still a bit before when we expect the Fed will ease (July), and further recalibration there are in keeping with our call for a firmer USD in the near term.

Beyond March, we have the USD profile trending lower as the economic outlook outside of North America improves. Additionally, longer-term valuations still look very unfavourable for the USD. Market participants outside of the US should look to take advantage of the higher USD in the coming months and lock in longer-term hedges while the getting is good.

- Sterling climbs, benefiting from a weaker dollar after disappointing US employment figures.

- Initial Jobless Claims rise to 217K, underscoring cooling US labor market despite Powell's openness to future policy easing.

- UK's economic growth forecasts bolster GBP, with Chancellor Hunt presenting optimistic projections for 2024 and 2025.

The Pound Sterling moderately advanced in the North American session on Thursday, as the Greenback remains on the defensive after a soft jobs report from the United States (US). Therefore, the GBP/USD trades at 1.2756, up 0.19%.

GBP/USD edges up on weak US economic data

US economic data is not helping the US Dollar, which is failing to gain traction following Federal Reserve Chair Jerome Powell's speech on Wednesday. Powell didn’t say anything dovish other than acknowledging that the Federal Reserve would ease policy “at some point this year,” though he emphasized that it would depend on data. He would speak again on Thursday at around 15:00 GMT.

In the meantime, the labor market is cooling. The Initial Jobless Claims for the week ending March 2 came at 217K, surpassing estimates and the previous reading of 215 K. Today’s data confirms Wednesday’s US Job Openings and Labor Turnover Survey (JOLTS), which revealed that there were 8.863 M job openings, which fell short of estimates and was lower than December’s 8.889M.

Other data showed that private hiring improved by 140K, less than forecasts of 150K. On Friday, the US Department of Labor will release the Nonfarm Payrolls for February, which are expected to rise by 200K, less than January’s 353K.

Across the pond, the UK’s Chancellor of the Exchequer, Jeremy Hunt, presented the spring budget to the House of Commons. Hunt stated the UK economy is estimated to grow by 0.8% in 2024 and 1.9% in 2025, stronger than the 0.7% and 1.4% growth rates forecast by the Office for Budget Responsibility (OBR) in November.

GBP/USD Price Analysis: Technical outlook

The GBP/USD resumed its uptrend following Powell’s speech and US economic data, with buyers targeting the 1.2800 figure. It should be said that Relative Strength Index (RSI) studies are bullish and not in overbought territory, an indication that the rally has legs. Above 1.2800, the next resistance would be the psychological 1.2850, followed by the 1.2900 mark. On the other hand, if sellers drag the exchange rate below the March 6 high of 1.2761, that could open the door for a correction. The next support would be today’s low at 1.2722, followed by the 1.2700 figure.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.