- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-02-2023

- EUR/GBP is aiming to extend gains after a recovery move as ECB policymakers favor one more 50 bps rate hike ahead.

- Preliminary German HICP is expected to escalate to 10.0% from the former release of 9.6% on an annual basis.

- UK Sunak considered a cabinet mini re-shuffle to split Shapps’s Department for Business, Energy, and Industrial Strategy.

The EUR/GBP pair has picked demand after dropping below the round-level cushion of 0.8900 in the early Tokyo session. The cross is aiming to extend its recovery as bets for more interest rate hikes by the European Central Bank (ECB) in its upcoming monetary policy are mounting vigorously.

Annual inflation in Eurozone has softened significantly to 8.5% as the European Central Bank (ECB) is continuously hiking interest rates. Supply chain disruptions are easing now along with energy prices. Despite a win-win situation for the Eurozone inflation, ECB President Christine Lagarde is expected to remain hawkish ahead.

Isabel Schnabel, a Member of the European Central Bank (ECB)’s Executive Board, wrote in a press release entitled, 'Monetary policy in times of pandemic and war' that inflation momentum remains ‘quite elevated,‘ but cannot give all clear on inflation yet and that the ECB Intends to raise rates by 50bps in March.

For guidance on Eurozone inflation, ECB policymaker Francois Villeroy de Galhau said on Tuesday that the Eurozone was not very far from the peak of inflation, as reported by Reuters. He further added "I don't think we have to choose between fighting inflation and avoiding a recession,"

On Wednesday, investors will keenly focus on the German inflation data. The preliminary German Harmonized Index of Consumer Prices (HICP) (Jan) is expected to escalate to 10.0% from the former release of 9.6%.

Meanwhile, Pound Sterling is likely to dance to the headlines of a mini cabinet re-shuffle by United Kingdom PM Rishi Sunak after completing his stressed 100 days of work. Sunak will appoint a new Conservative Party chair, after he sacked Nadhim Zahawi over a tax scandal more than a week ago, as part of a wider overhaul, officials told Cabinet ministers Monday, as reported by Bloomberg.

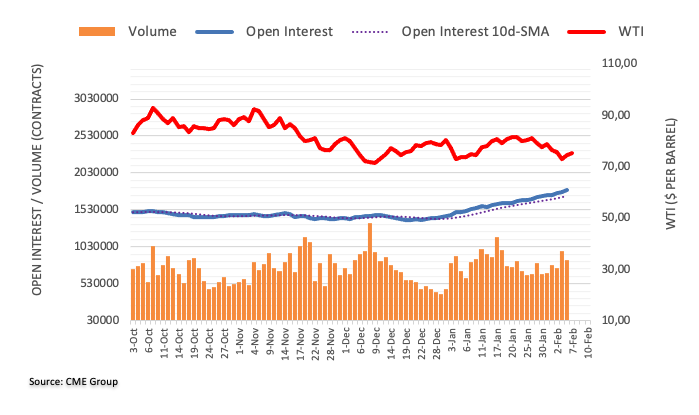

- WTI grinds higher after crossing one-week-old resistance line.

- Unimpressive oscillators, 50-DMA challenges Oil bulls ahead of the key 100-DMA hurdle.

- Pullback remains elusive below $75.60 support confluence, $73.00-72.50 region appears a tough nut to crack for bears.

WTI crude oil struggles to extend the previous day’s stellar run-up around the weekly top, making rounds to $77.70-60 during early Wednesday. In doing so, the black gold seesaws around the 50-DMA amid sluggish RSI (14) and MACD signals.

It’s worth noting, however, that Tuesday’s upside break of a one-week-long descending trend line keeps WTI bulls hopeful.

Hence, a clear upside break of the 50-DMA hurdle, currently around $77.80, appears necessary for the WTI bulls to keep the reins.

Even so, the 100-DMA and a two-month-old descending resistance line, respectively around $80.90 and $82.70, could challenge the Oil buyers before giving them control.

That said, the 61.8% Fibonacci retracement level of the commodity’s November-December 2023 downturn near $84.30, also known as the “Golden Ratio”, acts as the last defense of the Oil bears.

Meanwhile, the resistance-turned-support line joins the 23.6% Fibonacci retracement to highlight $75.60 as the key support confluence for WTI bears to watch for taking entries.

Following that, a horizontal area comprising multiple levels marked since early December 2022, near $73.00-72.50, will be crucial as a break of which can quickly drag the prices toward late 2022 low near $70.30.

Overall, Oil buyers need to wait for a clear sign but the bears are clearly off the table.

WTI: Daily chart

Trend: Sideways

Morgan Stanley upwardly revised its Federal Reserve (Fed) rate forecasts after Fed Chair Jerome Powell’s speech.

The investment bank unveiled a 0.25% rate hike expectation for the March meeting after a strong US jobs report on Friday, before conveying hopes of 25 basis points (bps) Fed rate hike in May following Powell’s speech.

The same brings Morgan Stanley’s expectation for the peak rate to 5.00% to 5.25% as per the latest forecasts.

It should be noted, however, that Fed’s Powell showed hesitance in praising the latest jump in the US Nonfarm Payrolls (NFP) during the latest appearance while asked the same of being a force to the Fed's benchmark interest rate higher than the 5% to 5.25% range currently anticipated. The same suggests a pause in the Fed rate after currently priced-in two rate hikes worth 0.25%.

Also read: Fed's Powell: Jobs report was strong, need to do further interest rate increases

- AUD/JPY remained sideways for the fourth consecutive day, unable to register new daily highs/lows.

- AUD/JPY Price Analysis: In the short term, downward biased, and it can test the 90.00 figure.

As the Asian session begins, the AUD/JPY trims some of Tuesday’s losses, though it remains trapped within the 20 and 50-day Exponential Moving Averages (EMAs), each at 91.10 and 91.27, respectively. Tuesday’s session was volatile, with the AUD/JPY reaching a weekly high of 91.93 before collapsing toward the day’s low on an intervention in the FX markets by Japanese authorities. The AUD/JPY is trading at 91.22, registering minimal gains of 0.07%.

AUD/JPY Price Analysis: Technical outlook

After Tuesday’s session, the AUD/JPY shifted neutral, with most of the Exponential Moving Averages (EMAs) staying at around 91.10-91.87. However, the AUD/JPY pair is slightly tilted to the downside since consolidating on January 26, recording successive series of lower highs/lows, meaning that in the near term, the AUD/JPY pair is downwards.

Hence, the AUD/JPY first support would be the 20-day EMA at 91.10. A breach of the latter would expose the 91.00 psychological level, which, once cleared, might send the pair diving towards the February 3 swing low at 90.34.

As an alternate scenario, the AUD/JPY supply zone would be the 50-day EMA at 91.27. Moving upwards from that level and the AUD/JPY would test the 200-day and 100-day EMAs, each at 91.52 and 91.86, respectively. Once broken, the 92.00 figure is up for grabs.

AUD/JPY Key Technical Levels

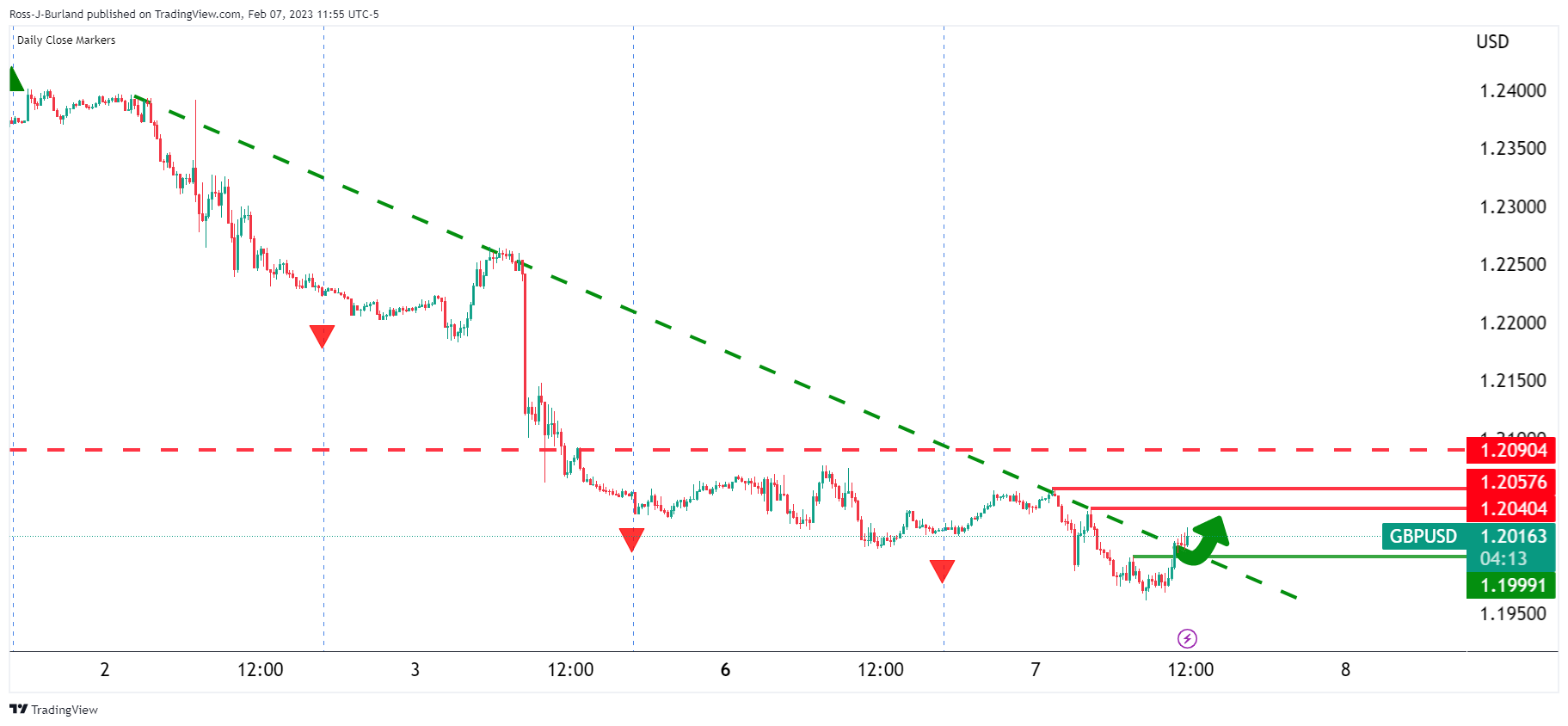

- GBP/USD picks up bids to defend the previous day’s rebound from one-month low.

- UK Prime Minister Rishi Sunak reshuffled British Cabinet on Tuesday but gained little accolades.

- Fed Chair Powell sounds mixed despite signaling higher rates.

- US President Joe Biden’s SOTU, risk catalysts are the key.

GBP/USD holds onto the previous day’s recovery moves near 1.2050 during Wednesday’s initial Asian session, despite the pause in the US Dollar’s weakness and sluggish markets. The reason could be linked to the fresh optimism surrounding the UK Prime Minister Rishi Sunak’s Cabinet reshuffle and mixed comments from the Federal Reserve (Fed) officials.

UK PM Sunak broke the British Cabinet into two departments to justify his pledge to bolster the economy and reduce energy prices, not to forget defending the Tory party's interest before the anticipated election in the next year. “Sunak created a new energy security and net zero department, led by former business minister Grant Shapps, and three other departments, with one focusing on science and innovation, a personal passion for the British leader,” said Reuters while giving details of the action.

On the other hand, Minneapolis Federal Reserve (Fed) President Neel Kashkari told CNN, "We may have to hold rates at a higher level for longer," while adding that he is not forecasting a recession. Following that, Federal Reserve Chairman Jerome Powell said, “Expect 2023 to be a year of significant declines in inflation,” while also adding that if data were to continue to come in stronger than expected, would certainly raise rates more.

Elsewhere, China’s rejection of the Pentagon request keeps the geopolitical tension high and the British workers’ strikes are also keeping the GBP/USD pressured despite the Bank of England (BOE) officials’ hawkish comments of late.

Amid these plays, Wall Street closed on the positive side but the US 10-year Treasury bond yields print a three-day uptrend to refresh a one-month high of around 3.68%.

Moving on, a light calendar may help the GBP/USD pair to defend the latest rebound. However, the US-China tension, the UK’s labor problems and the State of the Union (SOTU) speech from United States President Joe Biden will be crucial for immediate direction.

Technical analysis

Tuesday’s bullish spinning top candlestick defends GBP/USD buyers unless the quote breaks the 200-DMA support surrounding 1.1950 by the press time.

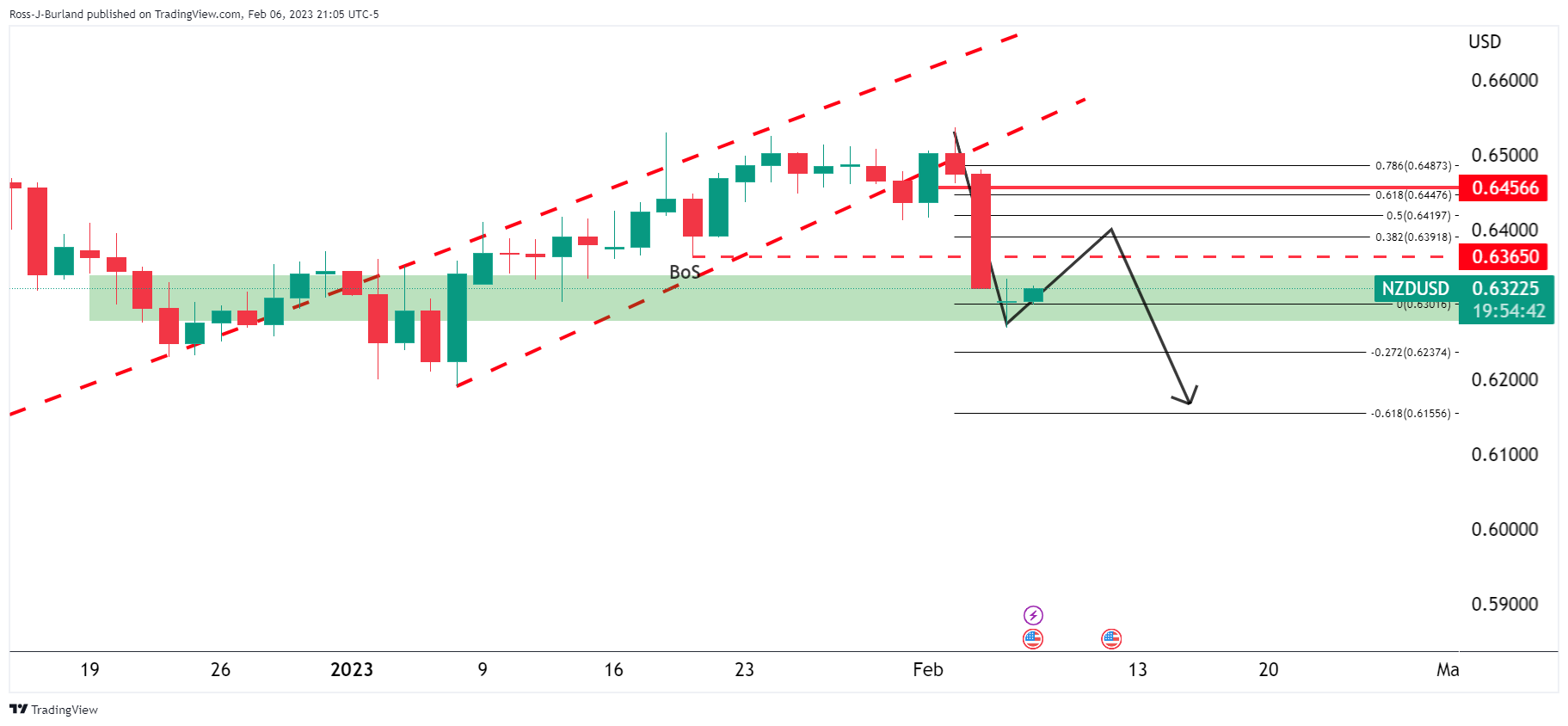

- A confirmation of more interest rate hikes by the Fed has strengthened the US Treasury yields.

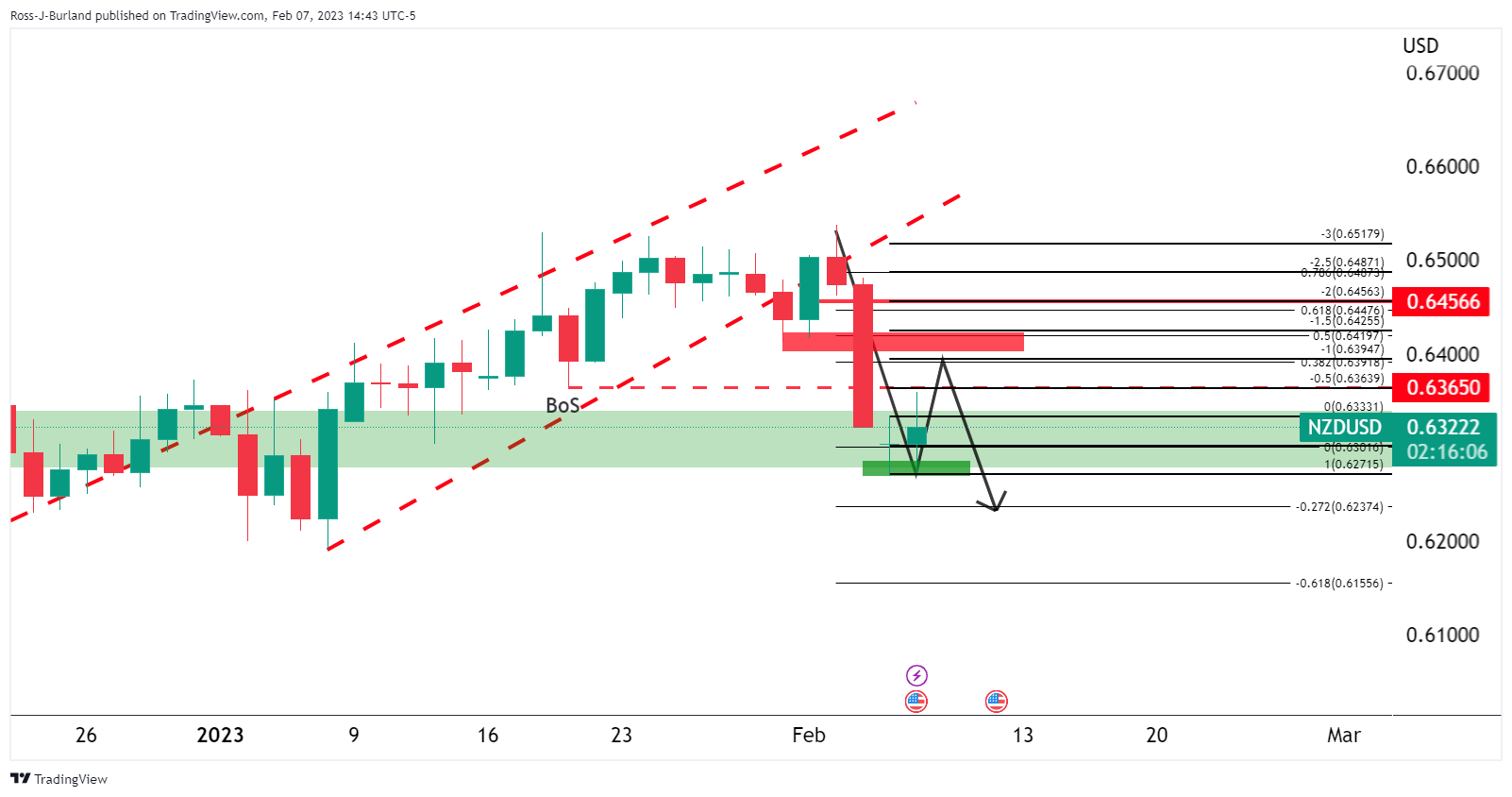

- NZD/USD has scaled above 61.8% Fibo retracement after a bullish reversal supported by the double bottom formation.

- The RSI (14) has shifted into the 40.00-60.00 zone from the bearish range, which adds to the bullish reversal filters.

The NZD/USD pair is displaying topsy-turvy moves in the early Asian session after rebounding from 0.6290 on Tuesday. The Kiwi asset is expected to extend its recovery towards the critical resistance of 0.6360 as the market mood is cheerful after investors shrugged off volatility inspired by the hawkish speech from Federal Reserve (Fed) chair Jerome Powell.

S&P500 witnessed stellar buying interest as investors were already expecting a continuation of policy tightening by the Fed to tame higher inflation. The US Dollar Index (DXY) has surrendered the 103.00 support as investors shunned the risk aversion theme. However, the confirmation of more interest rate hikes by the Fed accelerated return from 10-year US Treasury bonds to 3.68%.

NZD/USD has formed a Double Bottom chart pattern on a three-hour scale after dropping below the 61.8% Fibonacci retracement (placed from January 6 low at 0.6190 to February 2 high at 0.6538) at 0.6327. The aforementioned chart pattern plotted around 0.6272 indicates a bullish reversal amid the absence of significant selling interest while testing previous lows. A bullish reversal after testing previous lows has pushed the Kiwi asset above 61.8% Fibo retracement again.

The Kiwi asset is still below the 20-period Exponential Moving Average (EMA) at 0.6400, indicating that the upside bias is still not in the picture.

However, a range shift by the Relative Strength Index (RSI) (14) into the 40.00-60.00 zone from the bearish range of 20.00-40.00 adds to the bullish reversal filters.

For an upside move, the New Zealand Dollar is required to push the asset above the 50% Fibo retracement placed at 0.6364, which will drive the asset toward January 9 high at 0.6412 followed by January 25 low around 0.6450.

On the flip side, a breakdown below February 6 low at 0.6270 will drag the asset toward December 22 low at 0.6230. A slippage below the latter will expose the Kiwi for more downside toward January 6 low at 0.6190.

NZD/USD three-hour chart

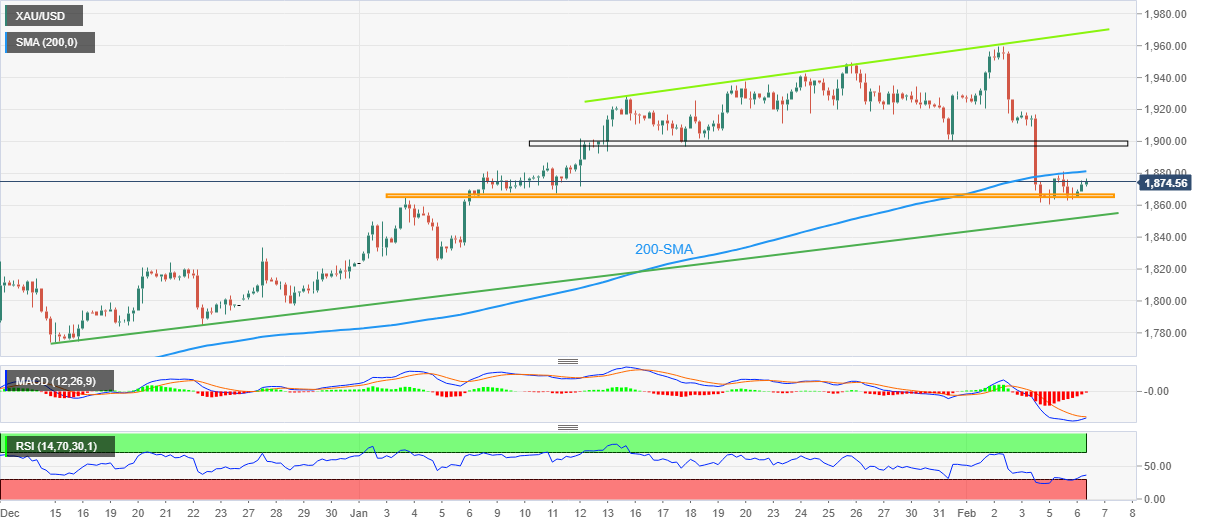

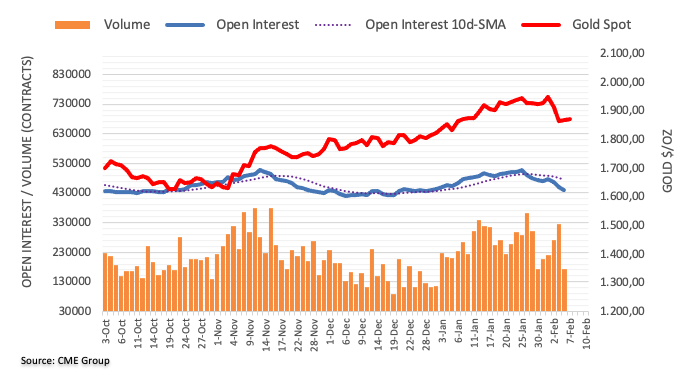

- Gold price stays pressured below short-term key Simple Moving Average.

- Federal Reserve officials sound hawkish during their latest appearances.

- United States Treasury bond yields weigh on XAU/USD despite US Dollar retreat.

- US President Joe Biden’s speech will be eyed to gauge immediate directions of Gold price.

Gold price (XAU/USD) stays defensive around $1,870, after the last two days’ failed attempt to rebound from $1,860, as market sentiment stays sluggish amid mixed signals from the Federal Reserve and the geopolitical front. Adding confusion to the metal traders’ minds could be the lack of major data/events. Even so, the bullion remains on the bear’s radar as the United States Treasury bond yields remain firmer.

Federal Reserve officials keep Gold bears hopeful

The Federal Reserve (Fed) officials managed to praise the recent upbeat data from the United States even as their tone appears mixed, which in turn exerts downside pressure on the Gold price. The same joins sluggish market sentiment and the previous week’s dovish Fed hike to probe the XAU/USD bears.

On Tuesday, Minneapolis Federal Reserve (Fed) President Neel Kashkari told CNN, "We may have to hold rates at a higher level for longer," while adding that he is not forecasting a recession.

Following that, Federal Reserve Chairman Jerome Powell said, “Expect 2023 to be a year of significant declines in inflation,” while also adding that if data were to continue to come in stronger than expected, would certainly raise rates more.

United States-China tension also weighs on XAU/USD

Apart from the Fed talks, the latest tension between the United States and China also please the Gold bears. Although US President Joe Biden tried placating the fears of another round of Sino-American tussles by saying, “The balloon incident does not weaken US-China relations,” China’s rejection of the Pentagon request keep the geopolitical tension high and tease XAU/USD sellers. “China has declined a US request for a phone call between U.S. Defense Secretary Lloyd Austin and Chinese Defense Minister Wei Fenghe,” a Pentagon spokesman said on Tuesday reported Reuters.

Treasury yields cheer easing fears of US recession and tease Gold sellers

It’s worth noting that the United States Treasury bond yields remain firmer, even if the US Dollar retreats of late. The reason could be linked to the comments from US Treasury Secretary Janet Yellen and President Joe Biden which pushed back the US recession concerns, as well as slightly hawkish Federal Reserve comments. Also underpinning the US bond yields, as well as weighing on the Gold price, are mixed talks from the rest of the world's central bank officials.

That said, the US 10-year Treasury bond yields print a three-day uptrend to refresh a one-month high of around 3.68% while the US Dollar Index (DXY) eases from its monthly peak to 103.35 as of late.

Central banks favor Gold buyers

It’s worth noting that the global central banks seek solace in Gold buying, despite the aforementioned negative catalysts. As a result, the latest revised World Gold Council (WGC) update states, “Following a correction to the historical data from 1950-1969, Gold Demand Trends has been amended to report that 2022 was a record year for annual central bank buying. Previously, 2022 had been reported as the second-highest year on record.”

US President Joe Biden’s speech eyed

Although the aforementioned mixed signals and firmer yields weigh on Gold prices, the traders lack clear directions and hence today’s State of the Union (SOTU) speech from United States President Joe Biden will be crucial for immediate direction. Ahead of the 02:00 AM GMT release, Reuters said, “US President Joe Biden will face Republicans who question his legitimacy and a public concerned about the country's direction in Tuesday's State of the Union speech that is expected to serve as a blueprint for a 2024 re-election bid.”

US President Biden’s SOTU will be closely observed for the Sino-American tussles and could weigh on the Gold price in the case that appears tough.

Gold price technical analysis

Gold’s failure to cross the 200-bar Simple Moving Average (SMA), despite bouncing off $1,860, portrays the underlying momentum weakness for the commodity.

That said, the gradual rebound in the Relative Strength Index (RSI), placed at 14, joins mildly bullish signals from the Moving Average Convergence and Divergence (MACD) indicator to challenge the XAU/USD bears.

As a result, the metal sellers seem to wait for a clear break of $1,860 to confirm further downside of the Gold price.

Even so, an upward-sloping support line from mid-December 2022, close to $1,850 at the latest, may act as an extra filter toward the south before directing the XAU/USD bears toward the $1,800 threshold. Though, seven-week-old horizontal support near $1,825 may act as an intermediate halt.

Meanwhile, the Gold price rebound needs validation from the 200-SMA, around $1,883 by the press time, as well as the $1,900 to recall the buyers.

Following that, the $1,930 and the $1,945 levels may probe the XAU/USD bulls before directing them to the recent high near $1,960 and a three-week-old ascending resistance line, around $1,970 as we write.

Overall, the Gold price remains on the bear’s radar even as the road toward the south appears bumpy.

Gold price: Four-hour chart

Trend: Further weakness expected

- The EUR/JPY cut last Friday’s gains, dropping towards the 200-day EMA, as sellers target 140.00 and below.

- EUR/JPY Price Analysis: The pullback towards the 200-DMA might pave the way for a deeper correction before resuming the uptrend.

EUR/JPY continued to trade lower for two consecutive days, retracing most of last Friday’s gains, and reclaimed the 50 and 20-day Exponential Moving Averages (EMAs), on its way south. The Euro’s (EUR) collapse was capped by the trend-setter 200-day EMA at 140.30, though it would likely remain under pressure. At the time of writing, the EUR/JPY is trading at 140.52, with losses of 1.20%, as Tuesday’s session ends.

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY shifted to neutral from neutral-upwards, according to the daily chart, following Tuesday’s fall beneath essential demand zones. In addition, the EUR/JPY pair could turn neutral downwards as the spot price hovers nearby the 200-day EMA, which, once cleared, could pave the way for further losses.

The Relative Strength Index (RSI) and the Rate of Change (RoC) supported the above-mentioned scenario, meaning that in the short term, the EUR/JPY might pull back before resuming its uptrend.

Therefore, the EUR/JPY first support would be the 200-day EMA at 140.30. A breach of the latter will send the pair sliding towards the 140.00 figure, which, once cleared, the EUR/JPY might fall toward the January 20 daily low of 139.03.

As an alternate scenario and the current trend, the EUR/JPY first resistance would be the 20-day EMA at 141.03. A break of that supply zone and the EUR/JPY might rally toward the psychological 142.00 area followed by the February 7 high fo 142.33.

EUR/JPY Key Technical Levels

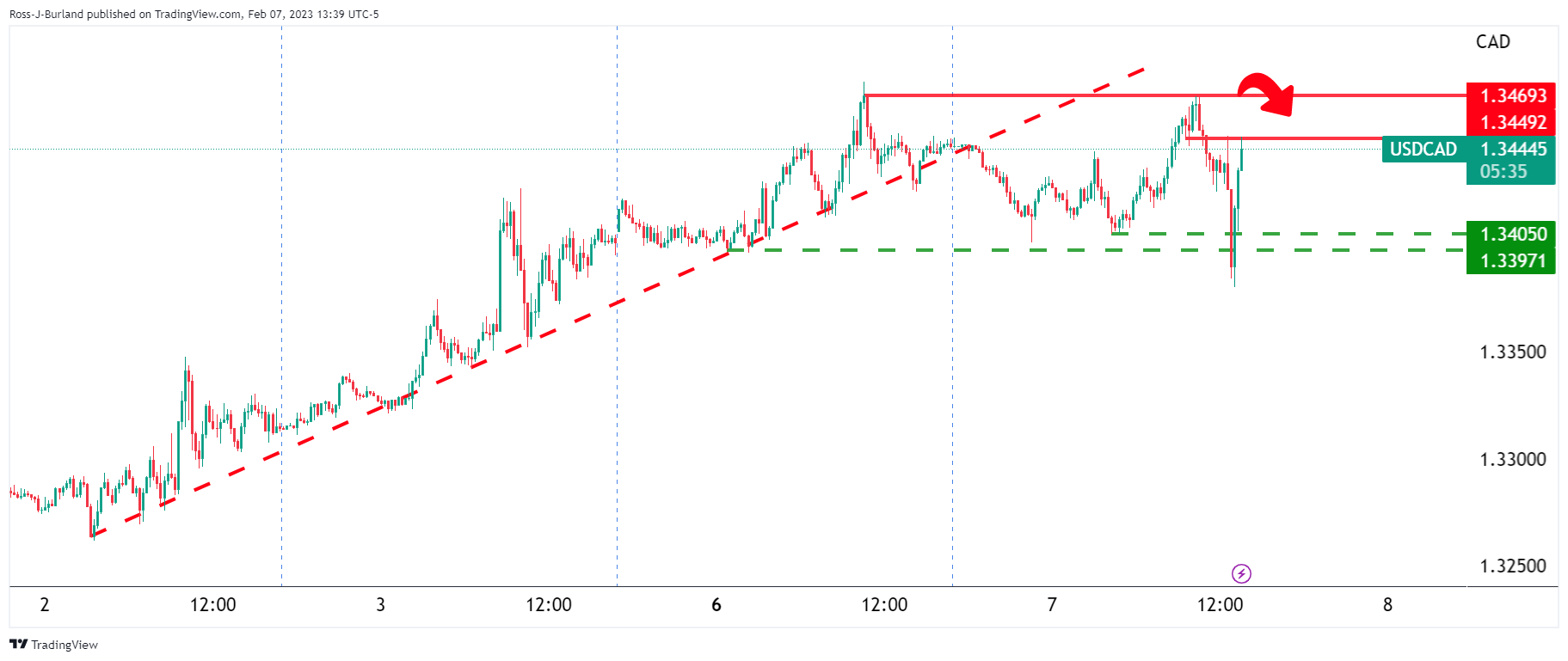

- USD/CAD has slipped below the 20-period EMA amid risk-on mood and the higher oil price.

- Fed Powell’s hawkish commentary failed to infuse blood into the safe-haven assets.

- A Fakeout of the Falling Channel pattern has trimmed demand for the US Dollar.

The USD/CAD pair has dropped vertically below the crucial support of 1.3400 in the early Tokyo session. The Loonie asset is facing immense pressure amid a decline in the US Dollar Index (DXY) and a sheer recovery in the oil price. The USD Index showed immense volatility despite Federal Reserve (Fed) chair Jerome Powell favors for a continuation of interest rate hikes after a stronger-than-expected January United States Nonfarm Payrolls (NFP) report.

Risk-perceived assets like S&P500 settled Tuesday’s session on a bullish note supported by tech-savvy stocks, portraying that the risk appetite theme is in traction. The alpha generated by 10-year US Treasury bonds has surged to near 3.68%.

USD/CAD sensed the presence of sheer selling pressure after an attempt of delivering a breakout of the Falling Channel chart pattern on a two-hour scale. The formation of a Fakeout pushed the asset below the 20-period Exponential Moving Average (EMA) around 1.3414, which indicates that the short-term trend is bearish.

The Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range from the bullish range of 60.00-80.00, which indicates that the bullish view has been negated for now.

The bullish view for the US Dollar was negated after a failure in delivering a Falling Channel breakout, which has exposed the loonie for a downside till January 3 low at 1.3321 and February 2 low at 1.3262 as the asset has slipped below the round-level support of 1.3400.

In an alternative scenario, a break Above February 7 high at 1.3469 will drive the asset toward January 19 high at 1.3521 followed by January 6 low at 1.3538.

USD/CAD two-hour chart

-638114057321041780.png)

“China has declined a US request for a phone call between U.S. Defense Secretary Lloyd Austin and Chinese Defense Minister Wei Fenghe,” a Pentagon spokesman said on Tuesday reported Reuters.

Brigadier General Patrick Ryder also stated, per Reuters, “The Pentagon submitted the request for a secure call on Saturday, immediately after shooting down a suspected Chinese surveillance balloon off the coast of South Carolina.”

"Unfortunately, the PRC (People’s Republic of China) has declined our request. Our commitment to open lines of communication will continue," Ryder added.

On the same line was news from Reuters saying, “The US Coast Guard on Monday imposed a temporary security zone in waters off South Carolina during the military's search for debris from a suspected Chinese spy balloon shot down by a US fighter jet, and the White House said it would keep a calm approach to relations with Beijing.”

Market implications

Following the news, AUD/USD retreats from 0.6960 while paring the Reserve Bank of Australia (RBA) inspired gains, last seen around 0.6950 during early Wednesday morning in Asia.

Also read: AUD/USD Price Analysis: Bulls at the ready for a test of 0.7020

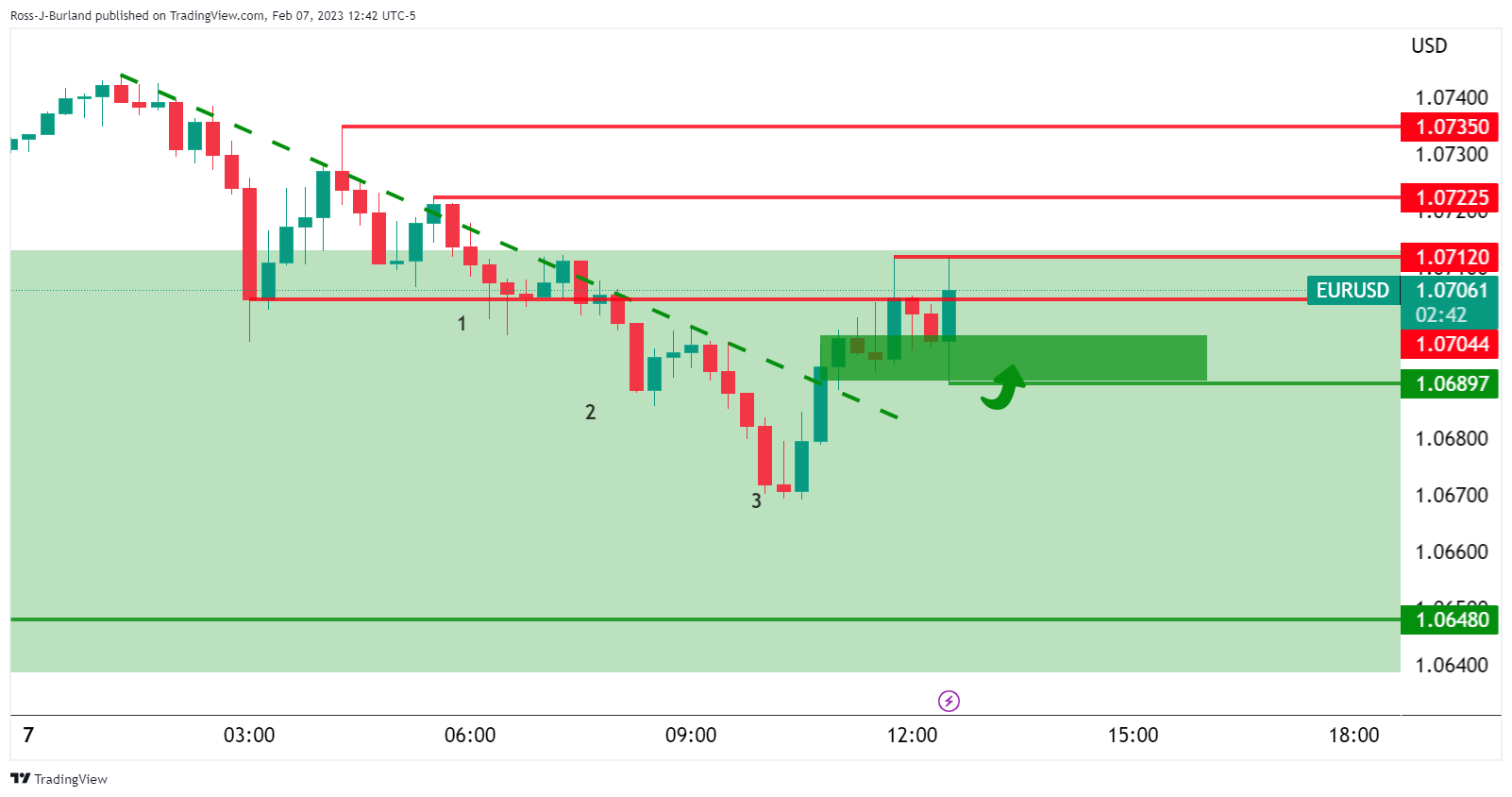

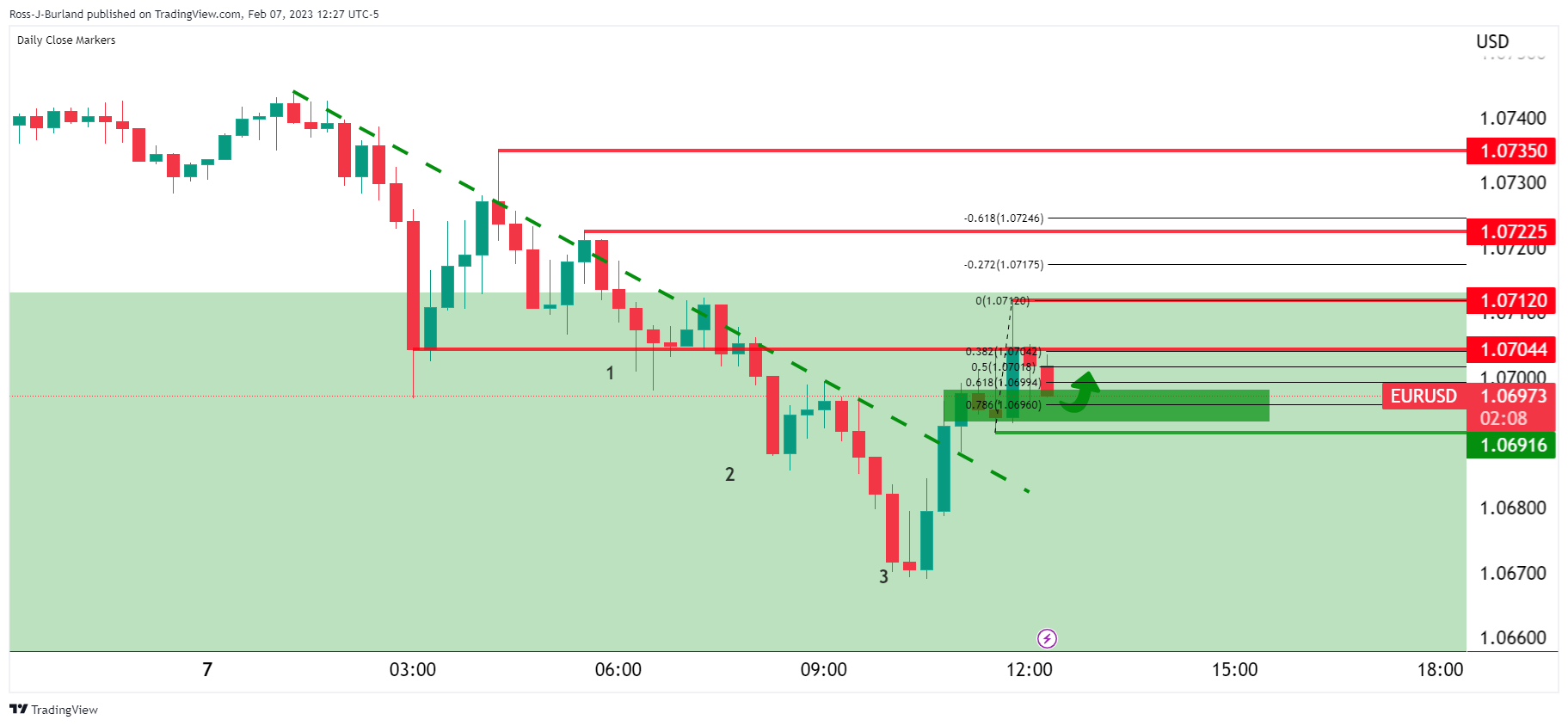

- EUR/USD has shifted its business above 1.0700 despite hawkish Fed commentary.

- Fed’s Powell has given the green signal to policy tightening continuation amid a strong job report.

- ECB Schnabel has advocated for a 50 bps interest rate hike in March.

The EUR/USD pair has shifted its auction profile above the round-level resistance of 1.0700 in the early Asian session. The major currency pair rebounded firmly after dropping to near 1.0670. The recovery move in the shared currency pair is looking to extend its recovery above the immediate resistance of 1.0725 ahead.

The Euro has gained strength despite hawkish commentary by Federal Reserve (Fed) chair Jerome Powell. The US Dollar Index (DXY) dropped to near 102.70 after failing to sustain above the 103.50 resistance. S&P500 futures recovered firmly after terminating the two-day winning streak as the confirmation of further policy tightening by the Fed chair Jerome Powell was already anticipated by the market participants. Therefore, the speech from Fed Powell triggered the ‘Sell on Rumor and Buy on News’ indicator.

A sheer recovery in the 500-US stock basket is portraying an improvement in the risk appetite of the market participants. Meanwhile, the demand for US government bonds weakened further as the Fed will keep higher interest rates steady for a longer period along with more interest rate hikes. This led to a jump in the 10-year US Treasury yields to near 3.68%.

Fed Powell cited “The jobs report was certainly stronger than anyone expected and the strong jobs report shows you why we think that inflation taming will be a process that takes a significant period of time.”

On the Eurozone front, Isabel Schnabel, a Member of the European Central Bank (ECB)’s Executive Board, wrote in a press release entitled, 'Monetary policy in times of pandemic and war' that inflation momentum remains ‘quite elevated,‘ but cannot give all clear on inflation yet and that the ECB Intends to raise rates by 50bps in March.

There is no denying the fact that Eurozone inflation has slowed down significantly in the past two months and activities are also showing contraction. In spite of that, the road of a 2% inflation recovery is far from over, which bolsters the case of further interest rate hikes by the ECB.

- AUD/USD bulls look for a move to test 0.720 commitments.

- A first bullish day following a series of red days opens the risk of a move into the M-formaiton's neckline.

AUD/USD caught a bid on the back of US Federal Reserve Chair Jerome Powell who spoke on Tuesday and doubled down on statements last week that disinflation has started. He was however arguing that stronger data could lead to a higher terminal rate than what the market is currently pricing.

Nonetheless, the markets were released that there was nothing uber dovish in his comments following a blockbuster Nonfarm Payrolls outcome from Friday's data. Subsequently, the stock market rallied and the high beta currencies, such as the Aussie, benefitted as Powell expects declines in inflation this year. Consequently, the following analysis is based on a bullish bias with both technicals and fundamentals aligning:

AUD/USD daily chart

The daily chart's daily M-formation leaves the scope for a move to head into the M-formaiton's neckline in a 50% mean reversion to test the 0.70s with the 61.8% ratio eyed higher up in the 0.7020s.

AUD/USD H4 chart

The W-formation on the 4-hour chart is a meanwhile bearish pattern that leaves the dynamic support structure vulnerable to a restest. However, the day is headed for a bullish close which puts the directional bias for the day ahead to the upside following three bear closes as signified by the red arrows.

AUD/USD H1 chart

The hourly chart shows that the price is riding the trendline support with eyes on the 0.6980s and then a test of the 0.70s for the day ahead. This thesis is founded on the basis that we are about to correct towards the daily M-formaiton's neckline as illustrated above. The price is now on the backside of the prior bearish leg and has also broken the structure of 0.6950 or thereabouts.

- USD/CHF will likely remain pressured following Powell’s “neutral” speech.

- USD/CHF Price Analysis: Downward biased, but it could print a leg-up once it clears the 50-day EMA.

USD/CHF slid from weekly highs and reached around 0.9290 after the US Federal Reserve (Fed) Chair Powell’s speech failed to push back against a perceived dovish rate hike, even though he acknowledged a strong US jobs report. At the time of writing, the USD/CHF exchanges hands at 0.9219, below its opening price.

USD/CHF Price Analysis: Technical outlook

The USD/CHF is resting at around the 20-day Exponential Moving Average (EMA) at 0.9217 as Wall Street’s session wanes. Failure to crack the latter would keep USD/CHF bulls hopeful for higher prices, but they will need to challenge the 50-day EMA at 0.9303 if they want to shift the bias to neutral upwards. In that outcome, the USD/CHF could aim higher and face the next supply zone at a downslope trendline drawn from December’s highs, which passes in the 0.9320-35 area. Once cleared, the 100-day EMA would be up for grabs at 0.9420.

For a resumption of the downtrend, the USD/CHF needs a break below the 20-day EMA and February 7 low of 0.9191. A breach of the latter will poise the USD/CHF pair towards the February 3 daily low of 0.9112, ahead of the 0.9100 figure.

Momentum indicators are beginning to show bearish signals, with the Relative Strength Index (RSI) crossing below the 50-mid line. The Rate of Change (RoC) portrays buying pressure is fading, strengthening the bearish outlook in the near term.

USD/CHF Key Technical Levels

- The Japanese Yen gained traction, as shown by the USD/JPY sliding 1% toward 131.10s.

- USD/JPY Price Analysis: On a pullback in the near-term, as bull’s eye, the 20-DMA

The USDJPY erased Monday’s gains and collapsed to the 131.00 area after hitting a week-high of 132.90. Intervention by Japanese authorities weakened the US Dollar (USD), giving way to a 140 pip drop. At the time of writing, the USD/JPY exchanges hand at 131.21, below its opening price by 1.08%.

USD/JPY Price Analysis: Technical outlook

From a daily chart perspective, the USD/JPY remains upward biased, even though it failed to crack Monday’s daily high and tumbled beneath the 20-day Exponential Moving Average (EMA) at 130.58. However, bulls stepped in around the latter, and the USD/JPY reclaimed the 131.00 figure, which could exacerbate a re-test of 132.00. Then, the USD/JPY next resistance would be the 50-day EMA at 132.84, ahead of the 200-day EMA at 133.85.

As an alternate scenario, the USD/JPY first support would be the 131.00 figure. Once broken, the 20-day EMA at 130.58 would be the following line of defense for USD/JPY bulls, followed by a move lower to the 130.00 psychological level.

Indicators portrayed a sideways scenario, with the Relative Strength Index (RSI), although remaining upward biased, about to turn bearish. Contrarily, the Rate of Change (RoC) suggests that buyers remain in control, albeit being outpaced by sellers on Monday.

USD/JPY Key Technical Levels

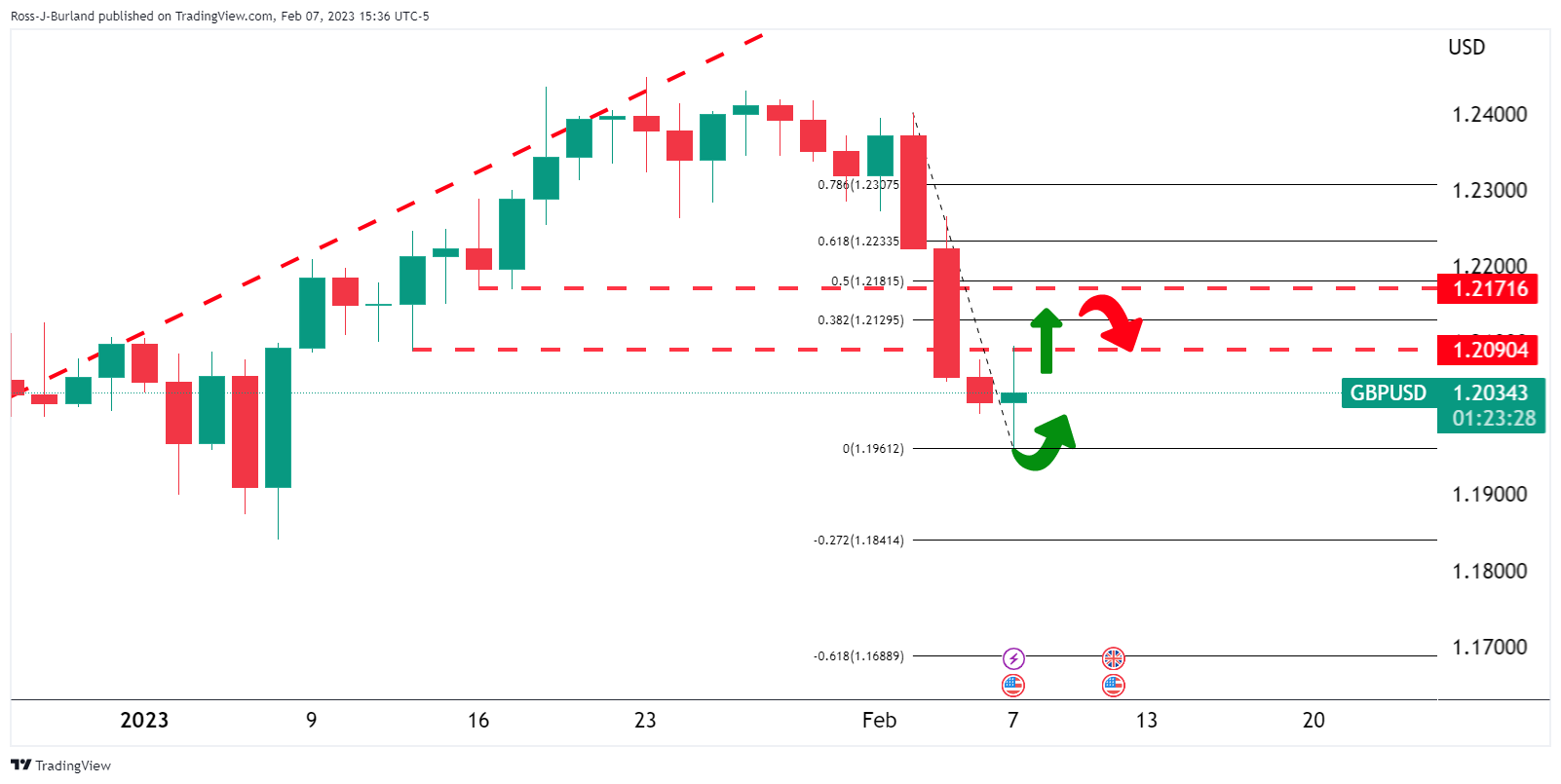

- GBP/USD is setting the foundations for a bullish setup with the 1.2180s eyed in a 50% mean reversion target.

- A 38.2% Fibonacci retracement is located at 1.2195.

- Nevertheless, bears will be lurking considering the break of structure at 1.2090.

GBP/USD bulls moved in on Tuesday and are setting the foundations for a bullish correction of the recent slide from the 1.23s at the start of February. The following illustrates the bullish bias for the day ahead.

GBP/USD M15 chart

The price has rallied from a low of 1.1960 to a high of 1.2095, taking out Monday's high, MH, and breaking structures, BoS, along the way, The price has also moved to the backside of the prior bearish dynamic resistance, (bearish trendline), that would now be expected to act as a counter-trendline.

The breakout of these structures leaves the directional bias in favour of a meanwhile bullish correction on the daily chart for the day ahead, pending a bullish close on Tuesday:

Zoomed in ...

This leaves the foundations of a long trade for whichever session traders are in, looking for a bullish setup with the 1.2180s eyed in a 50% mean reversion target. On the way there, a 38.2% Fibonacci retracement is located at 1.2195. Nevertheless, bears will be lurking considering the break of structure at 1.2090.

What you need to take care of on Wednesday, February 8:

The US Dollar ended the day mixed across the FX board. The American currency extended its February rally throughout the first half of the day, but shed ground unevenly in the last trading session, as US Federal Reserve Chairman Jerome Powell participated in a moderated discussion at the Economic Club of Washington DC.

Federal Reserve Chair Jerome Powell started repeating his hawkish message, stating they would probably need to do further interest-rate increases adding that the process is going to be “bumpy.” The market welcomed the concept delivered by Powell that stronger than anticipated data will see the Fed raising rates accordingly. The US Dollar fell as Wall Street soared as an immediate reaction. Nevertheless, he then added that strong labor market report, or higher inflation reports will result in the Fed raising rates by more than what is currently priced in.

The USD recovered as stocks collapsed to fresh daily lows, but then again changed course and finished the day with substantial gains.

The Euro was the weakest USD rival, with the pair ending the day at around 1.0710. European Central Bank (ECB) policymaker Joachim Nagel said that ECB rate cuts are not on the agenda in the foreseeable future and noted that the central bank’s rates are not yet restrictive. He added that “more significant” hikes are needed. Additionally, Isabel Schnabel Member of the Executive Board of the ECB, said that she intends to raise rates by 50 bps in March.

GBP/USD battled to retain the 1.2000 mark, after falling to a fresh multi-week low of 1.1960.

The AUD/USD pair settled at around 0.6940, helped by the Reserve Bank of Australia. The RBA delivered a hawkish message while raising rates by 25 bps. Substantial gains in Wall Street provided additional support.

USD/CAD trades around 1.3410. Bank of Canada Governor Tiff Macklem said on Tuesday that no further rate hikes will be needed if, as expected, the economy stalls and inflation comes down.

USD/JPY finally closed the weekly opening gap, currently trading at 131.20.

Spot gold was unable to attract investors and consolidate in the $1,860/70 price zone.

Crude oil prices benefited from Wall Street’s rally, with WTI ending the day at $77.30 a barrel.

Top 3 Price Prediction: Bitcoin, Ethereum, Ripple: When all signs point north

Like this article? Help us with some feedback by answering this survey:

- NZD/USD could be headed for a deep bullish correction if they get above 0.6365.

- If the bulls hold the fort, we will be closing in the green for a second day putting the directional bias in favour of longs.

NZD/USD is up on the day with the US dollar still under pressure despite a hawkish tone from the Federal Reserve pertaining to the recent Nonfarm Payrolls data. Federal Reserve's chairman Jerome Powell said in comments day made at The Economic Club of Washington, D.C. Signature Event that he expects 2023 to be a year of significant declines in inflation.

The US Dollar fell during a slew of comments that gave something to both the bulls and the bears. However, the greenback bounced back when investors digested some of the more hawkish tones. Powell explained that the ‘base case is that it will take time and more rate increases to finish the process.

Nevertheless, the greenback remains on the back foot technically and the high beta currencies such as the Kiwi have enjoyed a bounce in US stocks on Tuesaday following a series of down days since the NFP report. The US economy added 517K jobs in January, the most since July and much more than market expectations of 185K. Following the release of the data on Friday, ISM services also pointed to a strong services sector, adding to concerns about persistent inflation and bolstering the case for more rate increases.

Meanwhile, the latest domestic data showed that New Zealand's Unemployment Rate edged up to 3.4% in the 4th quarter of 2022 from 3.3% in the 3rd quarter, bolstering bets that the central bank will shift to a less aggressive stance. NZ's annual inflation also came in below the Reserve Bank of New Zealand's 7.5% projection and investors now expect the RBNZ to downshift to a 50 basis point rate hike in February after delivering a record 75 basis point increase in November.

As for the direction for the Bird, analysts at ANZ Bank wrote in a note on Wednesday that they upgraded their NZD forecasts – ''we now see it reaching 0.65 in Q3, 0.67 in Q4, and 0.68 by the fourth quarter next year''.

NZD/USD technical analysis

NZD/USD could be headed for a bullish correction given that it closed green on Monday, with prospects of a move into in-the-money shorts from Friday's selloff. We have a double bottom under last week's lows and bulls are moving in on those lows at around 0.6320.

If the bulls hold the fort, we will be closing in the green for a second day putting the directional bias in favour of longs for the sessions ahead. A 100% measured move of the current consolidation range has a confluence with the 38.2% Fibonacci near 0.6390. a break of 0.6400 opens the risk of a move to 0.6425 in a 50% mean reversion to near the prior lows 31 Jan lows. However, 0.6365 needs to give first as a prior Jan 19 support structure.

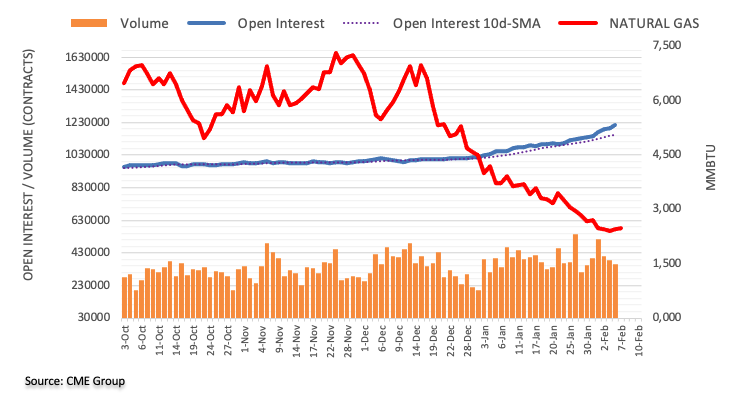

- Western Texas Intermediate got bolstered as the US Dollar weakens on soft US Fed Powell remarks

- China’s reopening and Turkey’s earthquake are one of the multiple factors underpinning oil prices.

- WTI Technical Analysis: Range-bound, but it could test $78.00 PB in the short term.

The US crude oil benchmark, also known as Western Texas Intermediate (WTI), advances sharply as the US Dollar (USD) weakens, as the US Federal Reserve (Fed) Chair Jerome Powell speaks at the Economic Club of Washington. At the time of writing, WTI is trading at $76.50 PB.

Wall Street turned green as Fed Chair Jerome Powell failed to pushback against the last week’s astonishing employment report in the United States (US), which spurred a market’s reaction, sending the US Dollar soaring and US Treasury bond yields jumping more than 20 bps, namely the 10-year benchmark note rate.

However, the US Dollar Index (DXY) is falling 0.35%, down at 103.264, sparking an upward reaction in WTI, hovering around the 20-day Exponential Moving Average (EMA) at $77.61.

Additional factors influencing oil prices are optimism about China’s reopening, and worries about supply shortages as a major export terminal in Turkey was shut down following an earthquake in the country.

China’s reopening following the relaxation of the Covid-19 zero-tolerance policy augmented speculations that oil demand would increase during 2023. Even the International Energy Agency (IEA) estimates that half of 2023 global oil demand will come from China.

Meanwhile, operations at Ceyhan, Turkey’s main oil export terminal, were shut after an earthquake hit the region. The terminal will remain closed until February 8.

WTI technical analysis

WTI is trading sideways after the US Federal Reserve Chair Jerome Powell finished its speech. It should be said that WTI broke to new daily highs of $77.11 on dovish remarks by Powell, weakening the US Dollar. Nevertheless, oil failed to gain traction and clear the 20-day EMA at $77.58, which could’ve exposed last Friday’s high at $77.96. Break above and the $78.00 figure is up for grabs.

On the flip side, WTI's first support would be $74.40, which, once cleared could pave the way for further downside.

Reuters reported that Bank of Canada Governor Tiff Macklem said on Tuesday that no further rate hikes will be needed if, as expected, the economy stalls and inflation comes down.

Key comments

"If new data are broadly in line with our forecast and inflation comes down as predicted, then we won't need to raise rates further," Macklem said in a speech to financial analysts in Quebec City.

"Inflation is turning the corner. Monetary policy is working," Macklem said, adding that economic growth would be "close to zero" through the third quarter of this year.

USD/CAD update

We are headed for an inside day as the US Dollar picks up a bid in the aftermath of the Federal Reserve's chairman Jerome Powell's comments:

- The US Dollar longs were cleared out on Fed chairman Powell.

- However, the drop in the greenback could be seen as a discount to the most bullish of the US Dollar bulls.

The US Dollar, as measured by the DXY index, fell from a high of 103.49 to a low of 103.001 after comments from Federal Reserve's Jerome Powell circulated the wires. Powell is peaking at The Economic Club of Washington, D.C. Signature Event and repeated much of the same as he did at the press conference that followed last week's interest rate decision.

Key comments

The jobs report was certainly stronger than anyone expected.

The strong jobs report shows you why we think this will be a process that takes a significant period of time.

Expect 2023 to be a year of significant declines in inflation.

We probably need to do further interest-rate increases.

If data were to continue to come in stronger than expect, would certainly raise rates more.

2% inflation is a global standard and not something the Fed is looking to change.

Fiscal authorities are concerned about the debt limit.

The debt limit debate can only end with congress raising it, which has to happen.

Congress needs to raise debt ceiling in timely fashion

If debt ceiling isnt raised no one should think fed can shield economy from effects.

I am not actively contemplating the sale of securities.

It will be a couple of years before the fed's balance-sheet decline comes to an end.

The US is ‘just at the beginning’ of the disinflation process.

Worries most about when disinflation will take hold in larger services sector, also concerned about outside events.

The US economy added 517K jobs in January, the most since July and much more than market expectations of 185K. Following the release of the Nonfarm Payrolls data on Friday, ISM services data pointed to a strong services sector, adding to concerns about persistent inflation and bolstering the case for more rate increases.

EUR/USD and US Dollar reactions

However, we have seen a shake out of the in-the-money US Dollar longs during this event with a rally in the Euro, for instance:

However, there was a bounce in the greenback in more recent moments during his comments which has sunk the Euro as risk appetite dwindled:

This is a 61.8% ratio retracement in the DXY index and a firm one at that with support at 103.00 holding steadfast. The longs were cleared out, but this could be seen as a discount to the most bullish of the US Dollar bulls.

This is a developing story.

Federal Reserve Chairman Jerome Powell is speaking at The Economic Club of Washington, D.C. Signature Event coming up in the next moments.

Key notes

The jobs report was certainly stronger than anyone expected.

The strong jobs report shows you why we think this will be a process that takes a significant period of time.

We probably need to do further interest-rate increases.

If data were to continue to come in stronger than expect, would certainly raise rates more.

2% inflation is a global standard and not something the fed is looking to change.

Fiscal authorities are concerned about the debt limit.

The debt limit debate can only end with congress raising it, which has to happen.

Congress needs to raise debt ceiling in timely fashion

If debt ceiling isnt raised no one should think fed can shield economy from effects.

I am not actively contemplating the sale of securities.

It will be a couple of years before the fed's balance-sheet decline comes to an end.

More to come...

EUR/USD update

The US Dollar is sinking and EUR/USD has rallied hard as follows:

Isabel Schnabel, a Member of the ECB’s Executive Board, wrote in press release entitled, 'Monetary policy in times of pandemic and war' that inflation momentum remains ‘quite elevated,‘ but cannot give all clear on inflation yet and that the ECB Intends to raise rates by 50bps in March.

Key notes

Underlying inflation rate still extraordinarily high.

Inflation slowing not yet linked to ECB policy.

Keeping ‘particularly close eye’ on core inflation.

Sees unions continuing to keep demanding higher wage.

EUR/USD update

The price of EUR/USD is under pressure and volatile ahead of Federal Reserve Chairman Jerome Powell speaking. However, a bullish outcome could come from dovish rhetoric.

- Gold remained steadily firm, around $1870 ahead of Powell’s speech.

- US Federal Reserve officials expect rates to peak above 5%, with some estimating 5.4%.

- Gold Price Forecast: To remain neutral biased but slightly skewed to the downside.

Gold price clings to gains on Tuesday, though it remains below Monday’s high of 1881.31, ahead of Fed’s Chair Jerome Powell’s comments in an event at the Economic Club of Washington at 17:40 GMT. Hence, the XAU/USD is exchanging hands at 1874.20 after hitting a daily low of 1865.81 at the time of writing.

XAU/USD seesaws as investors expect a hawkish speech by Powell

Wall Street has turned positive, except for the Dow Jones Industrial. A late risk-on impulse at around the London Fix weighed on the US Dollar (USD), with Briton traders squaring their positions ahead of Powell’s speech. It’s the first time the Fed Chair takes the stand after an eye-opening US jobs report, with the economy adding more than 500,000 jobs and the unemployment rate diving to 53-year lows at 3.4%.

Comments from Federal Reserve officials spurred a reaction from market participants. Raphael Bostic, from the Atlanta Fed, commented that the Fed would need to raise rates further than previously foreseen. Echoing some of its comments was the Minnesota Fed President Neil Kashkari, a voter in 2023, that he anticipates the Federal Fund rate at around 5.4% due to the stronger-than-expected labor market report, which showed that the US central bank needs to keep raising rates.

The reflection of those comments is US bond yields. The 10-year benchmark note rate is 3.652%, up by two bps. After the US Nonfarm Payrolls report, the 10-year bond yield rallied 26 bps, as traders expect the Federal Funds rate to peak at around 5.25%. In addition, the US 10-year TIPS bond yield, a proxy for real yields, is advancing one bps, sitting at 1.369%, capping Gold’s rally on Tuesday.

What to Watch?

The US economic docket will feature further Fed speaking, Initial Jobless Claims for the week ending on February 4, and the University of Michigan Consumer Sentiment.

Gold Price Analysis: Technical outlook

XAU/USD remains neutral biased, trapped within the boundaries of the 20 and 50-day Exponential Moving Average (EMA) at the $1897-$1855 range. To resume its upward bias, Gold needs to break Monday’s high of $1882, which would exacerbate a test of the 20-day EMA, ahead of the $1900 mark. Otherwise, the XAU/USD will be under selling pressure, with the February 6 low at $1860.44, as the first demand area, followed by the 50-day EMA, ahead of December’s 27 daily high-turned-support at $1833.29

- EUR/USD bulls need a dovish tilt in the Fed chair Powell's speech that could weigh on the US Dollar.

- A break of session highs would leave the 1.0720s vulnerable in the near term.

- The daily ATR is 100 pips, so there is room for a range extension for the day.

EUR/USD is hitting a wall of resistance in the New York session as the countdown to the Federal Reserve's Jerome Powell gets underway. He speaks at The Economic Club of Washington, D.C. Signature Event coming up in the next moments.

Leading into the event, the US Dollar came under pressure that gave some life to the Euro bulls. We have seen a rally from the session lows that created a three-push pattern on the 15-min chart and a subsequent burst to the upside an hour after the cash-open on Wall Street.

The following illustrates the break of structure and prospects of a continuation higher depending on the outcome of the Powell event.

EUR/USD M15 chart

The bulls have moved in:

zoomed in ...

However, ahead of the event, there is a reluctance to hold onto positions. Should there be a dovish tilt in the speech, this could weigh on the US Dollar and see the price extend beyond the session highs and eye 1.0720s in the near term. The daily ATR is 100 pips, so there is room for a range extension for the day given the market has only completed around 75% of the ATR so far.

- GBP/USD rallies in the New York session ahead of Fed Powell.

- GBP/USD is the back side of the trendline resistance which is now expected to act as a counter-trendline with a focus on the upside.

- There are prospects of a move towards the 1.2050s with the 1.1990s eyed as support.

GBP/USD is breaking 1.20 the figure and the bulls eye 1.2050 for the sessions ahead. Cable has done 80% of the daily ATR of 122 so far and has travelled between a low of 1.1960 and 1.2057 on Tuesday.

The US Dollar lost some ground in the London fix which boosted the Pound to fresh session highs in New york, delving into 50% of the London session sell-off in a move that precedes a key speech from Federal Reserve's chairman, Jerome Powell. There will be other Fed speakers as well as the start of the refunding auctions with the 3-year auction today.

Fed Chairman Powell will be interviewed at a live transmitted event at the Economic Club of Washington, D.C., beginning at 18.00 CET. ''This could give Powell an opportunity to mitigate the markets' very dovish reaction to his press conference last week if he wants to, especially in light of the strong jobs report and ISM data we have seen since then,'' analysts at Danske Bank explained.

Meanwhile, the UK's Monetary Policy Committee recently raised its policy rate by 50bp to 4.00%, which was in line with consensus but above our forecast for a 25bp hike. The vote was split 7-2, with the two members voting against preferring no change at all in Bank Rate. However, the Bank of England is now moving into data-dependent mode and given that inflation is expected to be significantly lower by year-end and prospects of a rising unemployment rate, there are downside risks for the Pound should the BoE flip the script.

Nevertheless, we have heard from a hawkish BoE MPC member Catherine Mann this week who said ''the consequences of under-tightening far outweigh, in my opinion, the alternative. We need to stay the course, and in my view the next step in bank rate is still more likely to be another hike than a cut or hold.” In fact, BoE speakers are plentiful this week and we heard from Chief Economist Huw Pill as well who said, ''if you ask me where we are at the moment, I think we are still more concerned about the potential persistence of inflation.''

''Concerned about inflationary pressure in the labour market ‘probably tilts us to saying we haven't quite got to the point where we're confident to engage in a discussion of a turning point in rates.''

GBP/USD technical analysis

As per the start of the week's analysis, where it was registered that GBP/USD had closed in the red for three day's in a row, a move up into the in-the-money shorts was anticipated:

However, as the illustration above suggested, the bears could be lurking in a move-up to test the break of structure area (BoS) near 1.2090.

Meanwhile, we are starting to see the bulls move in as anticipated:

We are on the back side of the trendline resistance which is now expected to act as a counter-trendline with a focus on the upside. There are prospects of a move towards the 1.2050s with the 1.1990s eyed as support.

- AUD/USD resumes its uptrend after touching five-week lows around 0.6850.

- The RBA raised rates by 25 bps and projects additional increases to the cash rate.

- AUD/USD Price Analysis: Upward biased, it might test 0.7000 in the near term.

The Australian Dollar (AUD) recovered some ground vs. the US Dollar (USD) after the Reserve Bank of Australia (RBA) raised rates by 25 bps in the Asian session, which triggered a jump to fresh two-day highs of 0.6951. Nevertheless, solid US economic data increased the Fed’s likelihood of further rate hikes. Hence, the AUD/USD retreated some but is still up 0.52, trading at 0.6920.

AUD/USD is still underpinned by the Reserve Bank of Australia’s policy decision

The AUD/USD is holding to its gains. The RBA’s decision to lift rates to the 3.35% threshold keeps the Aussie Dollar (AUD) positive in the day, clinging to gains above the psychological 0.6900 level. The RBA reiterated that further increases would be needed due to core inflation being higher than expected as the central bank tries to curb elevated inflation to its 2-3% target.

ANZ analysts expect the RBA to continue to raise the cash rate to 3.85%. “Today’s RBA statement spells out that further rate hikes are coming. We continue to expect that the cash rate target will rise another 25bp in March and then to 3.85% by May 2023. We still see the risks to that peak as tilted to the high side given the momentum in inflationary pressure.”

Aside from this, investors’ eyes would dissect each word of the US Federal Reserve (Fed) Chair Jerome Powell, who would cross wires at around 17:00 GMT. Solid US economic data revealed since the first week of February would likely keep the Fed pressured to deliver price stability. January’s staggering employment report has opened the door for further tightening.

In the early morning, Minnesota’s Fed President Neil Kashkari said that he foresees the Federal Fund rate at around 5.4% due to the stronger-than-expected labor market report, which showed that the US central bank needs to keep raising rates.

AUD/USD technical analysis

Technically speaking, the AUD/USD fell to a 5-week low but found support around the 0.6850 area and reclaimed the 50-day Exponential Moving Average (EMA), which rests at 0.6876. Nevertheless, for the AUD/USD to resume its uptrend, it needs a daily close above 0.6948, which would expose the pair to further buying pressure. That said, the AUD/USD next resistance would be the 20-day EMA at 0.6975, followed by the psychological 0.7000 figure, ahead of the February 3 high at 0.7080.

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to grow at an annualized rate of 2.1% in the first quarter, up from 0.7% in the previous estimate.

"After releases from the US Census Bureau, the Institute for Supply Management, the US Bureau of Labor Statistics, and the US Bureau of Economic Analysis, the nowcasts of first-quarter gross personal consumption expenditures growth, and first-quarter gross private domestic investment growth increased from 1.9% and -9.3%, respectively, to 3.0% and -6.2%, respectively," Atlanta Fed explained in its publication.

Market reaction

This report doesn't seem to be having a noticeable impact on the US Dollar's performance against its rivals. As of writing, the US Dollar Index was posting small daily gains at 103.67.

USD/JPY broke above the 132 level. Still, economists at HSBC expect the pair to inch lower this year.

The BoJ is likely to tweak its monetary policy in 1H23

“We expect another widening of the Yield Curve Control (YCC) range in 1H23. The timing is uncertain, though. The BoJ Governor Kuroda’s last meeting will be on 10 March, and the first and second meetings chaired by the new governor will be held on 28 April and 16 June, respectively.”

“Aside from the BoJ, we think there are other plausible domestic developments that could drive USD/JPY lower in 2023: resident investors FX-hedging their foreign investments, and an improvement in Japan’s balance of payments amid JPY undervaluation (based on its real effective exchange rate) and tourism resumption.”

Besides Gold, the prices of other precious metals also came under pressure in the wake of the robust US labour market data. Economists at Commerzbank update their forecasts for Palladium, Silver and Platinum.

Forecasts for Silver and Platinum unchanged

“We are downwardly revising our Palladium forecast and now envisage a price of $1,700 by mid-year and of $1,900 by year’s end (previously: $2,000 and $2,100 respectively).

“We are leaving our price forecasts for Silver and Platinum unchanged.”

“Silver is likely to be priced at $23 by mid-year and $25 by year’s end.”

“We expect Platinum to be trading at $1,050 by mid-year and $1,150 at the end of 2023.”

Higher absolute yields in the Eurozone and Japan may drag more capital home, strengthening Euro and Yen and deepening the fall of the Dollar, Kit Juckes, Chief Global FX Strategist at Société Générale, reports.

Will capital repatriation to Europe and Japan extend the Dollar's fall?

“What will drive currency trends in the coming weeks and months? Capital flows may provide some of the answer, and weaken the Dollar further even if rate differentials move less from here on.”

“For European investors, the attraction of higher US yields goes down as Bund yields rise in absolute terms, even if the spread remains wide. And that can keep the Euro (and Yen) climbing even while yield differentials stabilize.”

“In the Eurozone and Japan, central bank buying crowded domestic savers out of domestic bond markets and forced them abroad, weakening EUR and JPY. If the ECB and BoJ can successfully exit from the bond market (and it’s worth noting that in 2018-2018, the ECB tried and failed to do so), maybe their currencies will return to pre-QE ranges eventually, too.”

- USD/CAD holds to gains as traders brace for Federal Reserve Chair Jerome Powell’s speech.

- The US trade deficit widened, though market participants ignored it.

- Bank of Canada’s Governor Tiff Macklem will cross wires later.

The USD/CAD prolongs its gains to four straight days, though it remains below the weekly high of 1.3475, meandering around 1.3460, after hitting a daily low of 1.3401, shy of the 20-day Exponential Moving Average (EMA) at 1.3399. At the time of typing, the USD/CAD exchanges hands a 1.3457, registering minuscule gains of 0.08%.

USD/CAD remains underpinned by a buoyant USD

Wall Street opened in the red, except for the Nasdaq 100. Traders are preparing for the US Federal Reserve (Fed) Chair Jerome Powell’s speech at the Washington Economic Club around 17:00 GMT. Investors are looking for Powell’s pushback following a strong jobs report released last Friday that witnessed the US economy adding 517K jobs in January vs. expectations of almost 200K. Consequently, the Unemployment Rate dived to 3.4% from 3.5%. All-in-all such a tight labor market would warrant further tightening by the Fed.

Data-wise, the US Commerce Department revealed the trade deficit widened 10.5% to $-67.4B compared to November’s $-61.0B, but below the market’s expectations of $-68.5B.

Elsewhere, Minnesota Fed President Neil Kashkari crossed wires and commented that he foresees the Federal Fund rate at around 5.4% due to the stronger-than-expected labor market report, which showed that the US central bank needs to keep raising rates. He added that “No one should overreact to one report,” but added that the strength of the services sector is still very robust, and “that’s where I think a lot of us are focusing our attention.”

In the meantime, the US Dollar Index, which tracks the buck’s performance against six currencies, continues to record gains, up 0.28% at 103.910, a tailwind for the USD/CAD pair. Nevertheless, Crude Oil prices remain underpinned following an earthquake in Turkey and Syria, which disrupted one of Turkey’s ports that exported around 1% of global supplies in January. Therefore, WTI exchanges hands at $75.47, up 1.44%, capping the USD/CAD rally.

Aside from this, Statistics Canada revealed its trade balance narrowed, compared to December’s data, as lower Crude Oil prices weighed on energy export and imports of consumer goods fell, according to Reuters. Also, USD/CAD traders could get some cues from Bank of Canada (BoC) Governor Tiff Macklem, which would cross newswires around 17:30 GMT. Given that the BoC announced a pause after lifting rates to 4.50%, it could weigh on the Loonie (CAD). Therefore, any dovish hints could pave the way for further upside in the USD/CAD, though capped by rising Oil prices.

USD/CAD Key Technical Levels

Further comments by President Lula da Silva, which could have been seen as interference in monetary policy, are likely to have put additional downside pressure on BRL, according to economists at Commerzbank.

Recent developments in Brazil are causing some concern

“Lula yesterday confirmed his view that current key rate levels of 13.75% are too high. In his view, this is not justified, and he called on companies to complain about excessive financing costs.”

“If doubts were to arise about the autonomy of the central bank while the government also pursues an expansionary fiscal policy that would not be good news for BRL. That is why recent developments in Brazil are causing some concern.”

“We can only hope that Lula will backpaddle again. If he was to keep flogging the same horse, then BRL might come under further depreciation pressure.”

European Central Bank (ECB) policymaker Joachim Nagel said on Tuesday that ECB rate cuts are not on the agenda in the foreseeable future and noted that ECB rates are not yet restrictive.

"A timely chat is needed on how far to lift QR caps after June," Nagel added and reiterated that they need "further, significant" rate hikes.

Market reaction

The Euro struggles to capitalize on the these hawkish comments. As of writing, the EUR/USD pair was trading at 1.0692, losing 0.35% on a daily basis.

- USD/JPY comes under pressure following Monday’s top near 133.00.

- US yields trade on a mixed tone ahead of Powell.

- Fed’s Powell will speak later in the NA session.

USD/JPY comes under some moderate downside pressure and probes the area below the 132.00 yardstick on turnaround Tuesday.

USD/JPY now focuses on Powell

The upside momentum in USD/JPY run out of steam in the boundaries of the 133.00 neighbourhood at the beginning of the week, as the NFP-induced bounce appear to have lost some impulse.

Tuesday’s resurgence of the selling pressure in spot comes amidst the pick-up in the risk-off sentiment, which eventually lends support to the demand for the Japanese safe haven.

Additionally, the mixed performance in US yields see the short end of the curve giving away part of the recent strong advance vs. extra gains in the belly and the long end. In the Japanese debt market, the JGB yields drop marginally below the 0.50% level.

Data wise in Japan, Household Spending dropped 1.3% in the year to December, while advanced prints for the same month saw the Coincident Index and the Leading Economic Index at 98.9 and 97.2, respectively.

Later in the NA session, Chief Powell will participate in a discussion at the Economic Club of Washington.

USD/JPY levels to consider

As of writing the pair is retreating 0.50% at 131.95 and the break below 128.08 (monthly low February 2) would aim for 127.21 (2023 low January 16) and finally to 126.36 (monthly low May 24 2022). On the upside, the immediate hurdle comes at 132.90 (monthly high February 6) seconded by 134.77 (2023 high January 6) and then 136.78 (200-day SMA).

USD/MXN has virtually unwound the entirety of the 2020/22 pandemic and energy supply shock to trade back close to the 18.50 lows. Economists at ING maintain a bullish bias on the Mexican Peso.

Peso looks good

“The very credible fiscal (Mexico 5-year CDS at 120bp vs. 233bp for Brazil) and monetary (real rates are +2%) situation are strong drivers for MXN demand.”

“Banxico continues to match the Fed in its tightening cycle, meaning that the policy rate will be taken close to 11% by the end of the quarter. Not bad with inflation running at 8.5%. And as the market takes a greater interest in carry, 3m MXN implied yields at 11.40% provided very strong risk-adjusted carry.”

“The Banamex sale or high US inflation pose the biggest threats.”

New BoJ leadership will shape market expectations on what policy stance BoJ could adopt going forward. Economists at OCBC analyze how each contender could impact the USD/JPY pair.

Upside momentum likely to have slowed

“Daily momentum is bullish but rise in RSI moderated. Upside momentum is likely to have slowed.”

“Resistance at 133.20 (23.6% fibo retracement of October high to January low) should provide decent resistance before 134.50 levels.”

“Support at 131 (before the gap up) and 130 (21 DMA), 127.50 levels (double-bottom low).”

“Focus this week on the list of BoJ nominees that is likely to be presented to parliament on 10 February though there are reports suggesting a delay to next week. Amamiya’s appointment would be most supportive of USD/JPY upside while Yamaguchi’s appointment could weigh on USD/JPY. Ito and Nakao could see gradual policy normalisation and could also weigh on USD/JPY, but to a lesser extent.”

- GBP/USD turns lower for the fourth successive day and drops to a fresh one-month low.

- Hawkish Fed expectations, a softer risk tone underpins the USD and exerts some pressure.

- Traders look forward to Fed Chair Jerome Powell’s speech for some meaningful impetus.

The GBP/USD pair attracts fresh sellers following an intraday uptick to the 1.2055 area and turns lower for the fourth successive day on Tuesday. Spot prices drop to a fresh one-month low heading into the North American session, with bears now eyeing to challenge a technically significant 200-day SMA near mid-1.1900s.

The US Dollar reverses an intraday dip and holds steady near a one-month peak touched on Monday, which, in turn, is seen exerting downward pressure on the GBP/USD pair. The upbeat US monthly jobs data (NFP) released last week fueled speculations that the Federal Reserve (Fed) will stick to its hawkish stance. This, in turn, remains supportive of a modest intraday uptick in the US Treasury bond yields and acts as a tailwind for the greenback.

In contrast, the Bank of England last week signalled that it was close to pausing the current rate-hiking cycle. In fact, the UK central bank removed the phrase that they would "respond forcefully, as necessary". Furthermore, BoE Governor Andrew Bailey said that inflation will fall more rapidly during the second half of 2023. This, in turn, is seen weighing on the British Pound and contributing to the offered tone surrounding the GBP/USD pair.

Apart from this, the prevalent cautious market mood - amid looming recession risks - further benefits the greenback's relative safe-haven status against its British counterpart. Tuesday's intraday slide could also be attributed to some technical selling below the 1.2000 psychological mark. This, in turn, supports prospects for an extension of the depreciating move, though traders might wait for Fed Chair Jerome Powell's speech for a fresh impetus.

Investors will closely scrutinize Powell's comments on inflation and monetary policy for clues about the Fed's future rate-hike path. This, in turn, will play a key role in influencing the near-term USD price dynamics and produce some meaningful trading opportunities around the GBP/USD pair in the absence of any relevant market-moving economic releases.

Technical levels to watch

- Canada's international trade deficit narrowed slightly in December.

- USD/CAD trades virtually unchanged on the day at around mid-1.3400s.

Canada's merchandise trade deficit with the world narrowed from C$219 million in November to C$160 million in December, Statistics Canada reported on Tuesday. This reading came in better than the market expectation for a deficit of C$1 billion.

"In December, Canada's merchandise exports decreased 1.2%, mostly on lower exports of energy products," the publication read. "Meanwhile, imports were down 1.3%, mainly driven by lower imports of consumer goods."

Market reaction

USD/CAD showed no immediate reaction to these figures and was last seen trading flat on the day at 1.3448.

- US Goods and Services Trade Balance came in at -$67.4 billion in December.

- US Dollar Index continues to push higher after the data.

The United States international trade deficit in goods and services rose by $6.4 billion to $67.4 billion in December, the data published jointly by the US Census Bureau and the US Bureau of Economic Analysis revealed on Tuesday.

This reading came in better than the market expectation for a deficit of $68.5 billion.

"December exports were $250.2 billion, $2.2 billion less than November exports," the publication further read. "December imports were $317.6 billion, $4.2 billion more than November imports."

Market reaction

The US Dollar Index preserves its bullish momentum after this data and was last seen trading at its highest level in nearly a month at 103.85, rising 0.22% on a daily basis.

- EUR/USD adds to the ongoing bearish move and drops below 1.0700.

- Extra decline appears in the pipeline below the 1.0770 region.

EUR/USD remains well on the defensive and drops to new lows in the sub-1.0700 zone on Tuesday.

The pair has recently broken below the 3-month support line near 1.0770, and this now allows for the downtrend to gather extra impulse in the near term. Against that, the next interim support comes at the 55-day SMA at 1.0662, while the breach of this region could open the door to a deeper retracement to the 2023 low at 1.0481 (January 6).

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0319.

EUR/USD daily chart

Minneapolis Federal Reserve (Fed) President Neel Kashkari told CNN Tuesday that the labor market is still too hot and that it makes it harder to bring inflation down, as reported by Reuters.

"We may have to hold rates at a higher level for longer," Kashkari added and said that he is not forecasting a recession.

Earlier in the day, Kashkari told CNBC that they are totally committed to getting inflation back to the 2% target.

Market reaction

The US Dollar holds resilient against its major rivals after these comments with the US Dollar Index clinging to modest daily gains at 103.75.

The rally in EUR/USD came to a shuddering halt after the dovish market interpretation of the ECB rate decision. Still, economists at Société Générale note that the long-term points to the upside.

Further profit-taking cannot be ruled out

“Tactically, further profit-taking cannot be ruled out.”

“The ECB may try to correct the market’s dovish interpretation of the rate decision and statement last week. This could attract Euro buying but conviction is likely to remain at a low ebb until the CPI release in the US next week.”

“The longer-term trend for EUR/USD remains tilted to the upside thanks to the improved terms of trade, the boost in economic growth in China, narrowing of Fed/ECB policy spread and attractive valuation.”

“Main downside risks are associated with the new military offensive by Russia in Ukraine and escalation with the Western allies/disruption to energy supplies.”

- Gold price struggles to capitalize on its modest intraday uptick and hangs near a one-month low.

- Expectations that the Federal Reserve will stick to its hawkish stance seem to cap the XAU/USD.

- Subdued US Dollar price action lends some support ahead of Fed Chair Jerome Powell’s speech.

Gold price edges higher for the second straight day on Tuesday, albeit seems to struggle to capitalize on the modest intraday gains. The XAU/USD trades around the $1,872-$1,873 region heading into the North American session and remains close to a one-month low touched on Monday.

Subdued US Dollar demand lends support to Gold price

The US Dollar (USD) stalls its recent strong recovery move from a nine-month low and turns out to be a key factor lending some support to the Gold price. The downside for the USD, however, seems cushioned amid expectations that the Federal Reserve (Fed) will stick to its hawkish stance for longer. This, in turn, keeps a lid on any meaningful upside for the US Dollar-denominated commodity.

Hawkish Fed expectations cap the upside for Gold price

The latest monthly employment details from the United States (US) released last Friday pointed to the underlying strength in the labor market and could allow the Fed to continue raising interest rates. This, in turn, pushes the US Treasury bond yields higher and acts as a tailwind for the Greenback, capping gains for the non-yielding Gold price, at least for the time being.

Focus remains on Fed Chair Powell’s speech

Traders also seem reluctant to place aggressive bets ahead of Fed Chair Jerome Powell's appearance later during the US session. Powell's comments on inflation and monetary policy might influence market expectations about the Fed's rate-hike path. This, in turn, will play a key role in influencing the near-term USD price dynamics and provide a fresh directional impetus to Gold price.

In the meantime, the XAU/USD seems more likely to extend its sideways consolidative price move in the absence of any relevant market-moving economic releases from the US. Hence, it will be prudent to wait for strong follow-through buying before confirming that the recent sharp pullback from the highest level since April 2022 has run its course and positioning for additional gains.

Gold price technical outlook

From a technical perspective, the lack of any meaningful buying suggests that the recent downfall in Gold price might still be far from being over. Moreover, oscillators on the daily chart have just started drifting into negative territory and are still far from being in the oversold zone. This, in turn, supports prospects for a further near-term depreciating move. That said, it will be prudent to wait for some follow-through selling below the multi-week low, around the $1,860 region, before placing fresh bearish bets.

Gold price could then accelerate the fall towards the $1,825 horizontal support en route to the $1,800 round-figure mark. This is followed by the very important 200-day Simple Moving Average (SMA), currently around the $1,776-$1,775 area. The latter should act as a pivotal point, which if broken decisively will be seen as a fresh trigger for bearish traders set the stage for a deeper corrective decline.

On the flip side, any meaningful upside is likely to confront some resistance near the $1,890-$1.892 zone ahead of the $1,900 mark. A sustained strength beyond has the potential to lift the Gold price to the $1,920 horizontal barrier, above which a bout of a short-covering move could push the XAU/USD towards the $1,950 region. This is closely followed by the multi-month peak, around the $1,960 area touched last week.

Key levels to watch

The Yen has rebounded modestly supported by the release of stronger than expected wage data from Japan. Economists at MUFG Bank stick to their forecast of USD/JPY 120 this year.

Favourable outcome for spring wage negotiations needed to trigger a stronger JPY rally

“The stronger monthly wage data will need to be backed up as well by a favourable outcome for the spring wage negotiations to trigger a stronger rally for the Yen.”

“The Yen is currently lacking a fresh catalyst to trigger further gains although we still expect USD/JPY to move into the low 120.00’s this year.”

- The index adds to the ongoing rebound and approaches 104.00.

- Gains could now accelerate to the 105.60 region in the near term.

The dollar’s march north remains unabated on Tuesday and encourages DXY to challenge the 55-day SMA near 103.80.

In the near term, further gains appear in the pipeline while above the 3-month support line near 101.90. That said, the next target of note now emerges at the 2023 peak at 105.63 recorded on January 6.

In the longer run, while below the 200-day SMA at 106.45, the outlook for the index remains negative.

DXY daily chart

The Dollar is regaining ground as markets position themselves for a hawkish tone from FOMC Chairman Jerome Powell. In the view of economists at ING, the Dollar recovery may run a little longer.

The Dollar comeback hinges on Powell, again

“It looks like markets have already positioned themselves for some pushback against easing rate expectations, but the surprise strength of the US jobs report gives Powell ample room to sound more hawkish than expected. Ultimately, the ongoing upward correction may run a little longer before losing steam.”

“The overall environment is doing little to lure markets back into risk assets and away from the safe-haven Dollar. US-China tensions are a source of concerns and likely weighing on global sentiment, and the eurozone cannot count on a supportive data flow to keep the growth re-rating process going.”

“It looks like only another under-delivery (i.e. dovish surprise) by Powell can hurt the Dollar today.”

Two-year Treasury yield has dropped below the Fed funds rate. This development is usually supportive for equities though S&P 500 has already made a record annualized gain of 54.5% in just 50 days (since December 15, 2022), economists at the National Bank of Canada report.

A recession could still be avoided

“Whether or not there is a recession in the coming quarters, our research shows that the period between an inversion of the 2-year Treasury yield with the overnight rate and the first Fed rate cut tends to be relatively good for equity markets.”

“The reason why the stock market tends to perform well in the run-up to the Fed's first rate cut is that investors generally embrace a soft landing scenario. Things get more complicated for equity markets once the Fed has pivoted and the collateral damage of previous cumulative tightening is fully reflected in the economy.”

“Although a recession could still be avoided, we remain cautious about increasing our equity exposure after the recent record surge. We still recommend underweighting equities in relative terms and holding excess cash positions.”

Senior Economist at UOB Group Alvin Liew assesses the latest results from retail sales in Singapore.

Key Takeaways

“Singapore’s retail sales rebounded to end 2022 on a positive note, expanding 1.3% m/m, 7.4% y/y in Dec while Nov’s numbers saw some improvement to -3.6% m/m, 6.5% y/y. For the full year, retail sales rose by 10.5% in 2022, above our forecast of 10.5% but below 2021’s 11.1%.”

“The estimated total retail sales value was S$4.69bn in Dec (from S$4.0 bn in Nov). While the Dec months typically see a spike in retail sales value (likely due to festive spending and gift buying), the latest print is the highest monthly record since the data is made available in 1997. We suspect the high Dec sales was due to a combination of stronger demand (with some element of revenge spending), higher prices (inflation) and buying ahead of Jan 2023 GST hike.”

“Outlook – We have conservatively upgraded our 2023 retail sales growth forecast to 5.0% (from 2.3% previously) with the upside potential to our forecast mainly due to China’s lifting of zero-Covid policy.”

Minneapolis Federal Reserve (Fed) President Neel Kashkari told CNBC on Tuesday that he was surprised by the January jobs report, per Reuters.

Key takeaways

"We are not seeing much imprint of our actions on labor market."

"I am not lowering my rate path, still around 5.4%."

"I'm not changing my forecast for rates for now."

"I wish we saw more evidence underlying inflation was trending down more."

"Services side of economy is still very robust."

"We have to bring labor market into balance, haven't done enough yet."

"Nobody should overreact to one report, but there is underlying strength in services sector."

"Hard to imagine strong jobs growth can occur with wage growth moderating."

"We need to be disciplined."

"12 month PCE inflation is our ultimate goal."

"Core services ex housing has seen virtually no progress.",