- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-02-2022

- WTI remains on the back foot after easing from eight-year high on Monday.

- French-Russia talks sound optimistic but UK PM Johnson’s comments seem to keep the risk of a war alive.

- US Goods Trade Balance, weekly private inventory data will decorate calendar.

- Headlines surrounding US-China trade deal may also entertain oil traders.

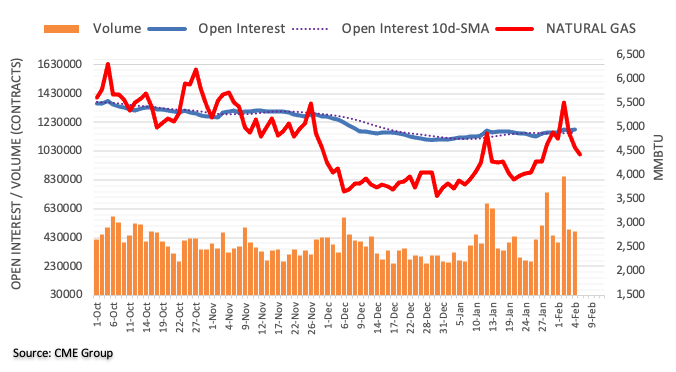

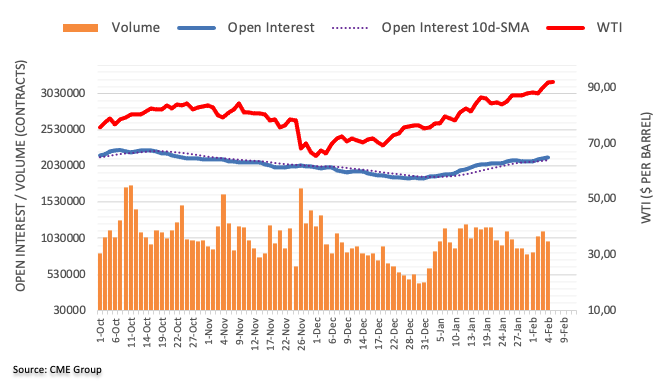

WTI crude oil prices extend the previous day’s pullback from a multi-day high, declining towards $90.00 during Tuesday’s Asian session.

In doing so, the black gold seems to justify the recent pause in the US Treasury yields, after easing from a two-year top on Monday. Also challenging the oil traders are the Sino-American trade tussles and recently downbeat China data. It should be noted, however, that the risk of a Russia-Ukraine war and fears of the OPEC+ members’ inability to meet production hike targets keep the energy buyers hopeful.

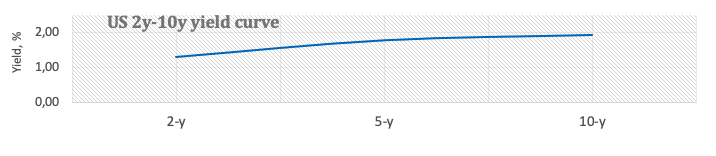

The US 10-year Treasury yields steady around 1.92%, close to the highest levels since late 2020, while the US stock future print mild gains around 4,485 at the latest.

That said, the French-Russian talks over Ukraine managed to refrain from any major negatives while the tone of Russian President Vladimir Putin seemed a bit confirmative. However, UK PM Boris Johnson showed readiness to take harsh measures and kept the geopolitical risks of a war on the table.

Elsewhere, the US conveyed dissatisfaction with China’s performance on the Phase 1 trade deal the previous day whereas Beijing’s downbeat Caixin Services PMI for January added to the bearish impulse. Furthermore, hawkish central bank scenario and indecision OPEC+ performance also tested oil bulls of late.

Moving on, the WTI crude oil traders will pay attention to the US Goods and Services Trade Balance for December, expected $-83B versus $-80.2B, for fresh impulse. Also important will be the industry stockpile report of the API Weekly Crude Oil Stock, prior -1.6445M, for the week ended on February 04.

Technical analysis

Monday’s bearish spinning top candlestick hints at further consolidation of oil gains towards a two-week-old ascending trend line near $87.20. However, WTI crude oil buyers remain hopeful until witnessing a daily closing below October 2021 top surrounding $85.00.

- The non-yielding metal advanced despite the US 10-year Treasury yield clung above the 1.90% threshold.

- US inflation expectations grind lower as shown by FRED data, eased to 2.4%.

- XAG/USD is neutral biased, but XAG bulls get ready for a test to the 100-DMA.

Silver (XAG/USD) begins the week on higher note rallies more than 2% on Monday. As the Asian Pacific session begins, XAG/ÛSD is trading at $23.01. Financial market sentiment is mixed. The Dow Jones Industrial finished with gains, while the S&P 500 and the Nasdaq closed with losses.

Despite the rise of US T-bond yields, Silver rallied. The 10-year benchmark note dropped one basis point though clung to 1.919%, while US Real Yields, as of February 4, finished at -1.00% but failed to weigh on the non-yielding metal.

In the meantime, as reported by St. Louis Federal Reserve (FRED) data, US Inflation expectations eased to 2.4%.

An absent US economic docket keeps XAG/USD traders assessing the January Nonfarm Payrolls report unveiled last Friday. The figures crushed expectations by large, 467K vs. 150K estimated. However, Fed worries regarding inflation made investors look towards Average Hourly Earnings, which shoot to 5.7%, 0.7% higher than December’s reading. That said, it further cements the US central bank hawkish expectations, as money market futures have prices in five rate hikes.

That said, silver traders’ focus would be on Thursday’s US inflation numbers for January. Estimations by analysts expect the Consumer Price Index (CPI) at 7.3%, while the Core CPI, which excludes food and energy, at 5.9%, both readings on an annual basis.

XAG/USD Price Forecast: Technical outlook

On Monday, XAG/USD broke above the 50-day moving average (DMA), but it faced strong resistance at the $23.00 figure. Nevertheless, the rally broke four resistance levels on its way up, as XAG bulls get ready for a challenge of the 100-DMA at $23.19.

Silver is neutral biased. However, a breach of the 100-DMA could send the non-yielding metal upwards. The first resistance would be January 3 high at $23.40, followed by a tenth-month-old downslope trendline, around the $24.00-$24.20 range.

- GBP/USD probes two-day downtrend inside a bullish chart formation.

- Sustained bounce off 50-SMA, steady MACD line keep buyers hopeful.

- Key Fibonacci retracement levels add to the downside filters.

GBP/USD defends the previous day’s bounce off 50-SMA, treading water around 1.3530-35 during Tuesday’s Asian session.

The cable pair dropped to a one-week low on Monday before taking a U-turn from 1.3490, which in turn portrays the two-week-old rising channel formation. Adding to the bullish is the recently steady MACD line in the positive territory.

That said, the pair’s further upside will initially aim for the 1.3600 threshold before challenging 23.6% Fibonacci retracement (Fibo.) of the December-January upside, near 1.3615.

Should GBP/USD buyers cross the 1.3615 hurdle, the upper line of the aforementioned channel near 1.3670 will challenge the additional run-up.

Alternatively, 50-SMA and the support line of the stated bullish channel together offer strong short-term support near 1.3490, a break of which will highlight 50% and 61.8% Fibo. levels for GBP/USD bears, respectively around 1.3460 and 1.3390.

Even if the pair sellers conquer 1.3390 support, the previous month’s low around 1.3355-60 will question the further declines.

GBP/USD: Four-hour chart

Trend: Further recovery expected

Geopolitical tensions between Russia and Ukraine remain fierce even as markets recently witnessed some positives, by a shift in the tone of Russian President Vladimir Putin. Adding to the market fears were comments from UK Prime Minister (PM) Boris Johnson.

During the telephonic talks with French counterpart Emmanuel Macron, Russia’s Putin said, “I hope that the situation in Ukraine can be handled amicably in the future.”

The Russia Boss also mentioned that Russia will do all it can to find middle grounds that suit everyone.

It should be noted, however, that Putin doesn’t step back from warning as he said, “If Ukraine joins NATO, Europe would be pulled into a military clash with Russia, there will be no winners.”

On the other hand, French President Macron mentioned that they can create concrete security guarantees for EU members and Russia's neighbors. “Putin has agreed to review concrete de-escalation initiatives,” added the French leader.

Elsewhere, UK PM Johnson sounds harsh in his latest comments over the issues, shared by The Times. “British sanctions and other measures will be prepared in the event of a new Russian attack on Ukraine.”

Additional comments from UK PM Johnson mentioned, “We are thinking about sending RAF typhoon fighters and royal navy warships to protect Southeastern Europe.”

Further, “The UK is preparing to reinforce the NATO battle group led by Britain in Estonia.”

“Welcome Germany's statement that, in the event of an incursion, NORD Stream 2 would be reconsidered,” adds UK’s Johnson per The Times.

FX implications

Given the risk of a war between Russia and Ukraine, oil prices remain firmer above $90.00, despite the weak-start pullback.

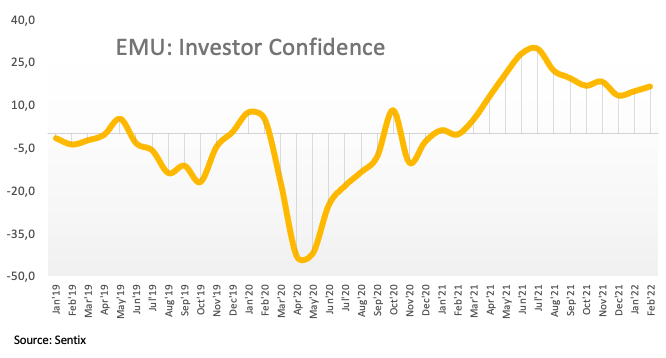

Contrary to the positive surprise provided by the last week’s US jobs report, the US inflation expectations portray a downbeat scenario ahead of the key US Consumer Price Index (CPI) data for January.

That said, the inflation gauge, as measured by the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, fades the gradual recovery from September lows tested on January 20, per the FRED website.

Recently, the inflation expectations ease to 2.4% by the end of Monday’s North American session, extending the pullback from the highest level in a fortnight tested by the end of January.

The mixed signals sent by the inflation expectations seem to have been well-received by the US Treasury yields on Monday as the bond coupons pared Friday’s heavy gains around the two-year high, recently near 1.91%.

Given the mixed signals concerning the US CPI, which in turn will help direct the Fed’s next move in March, markets can remain sluggish heading into the key US inflation data.

Read: Forex Today: Market players waiting for the next catalyst

- EUR/USD edges higher past-100-DMA, tests pullback from three-month-old horizontal resistance.

- Hidden bullish divergence, sustained trading above 100-DMA keeps buyers hopeful.

- October-November lows add to the upside filters, 50-DMA also tests sellers.

EUR/USD pauses the week-start pullback by stabilizing above 1.1400, taking rounds to 1.1440-50 during the early Asian session on Tuesday.

In doing so, the major currency pair keeps the bounce off the 100-DMA amid a hidden bullish RSI divergence on the daily chart.

A hidden bullish RSI divergence is price-positive formation when the quote makes lower-low but the RSI prints higher lows.

With this, the EUR/USD prices may again battle the immediate hurdle, namely a three-month-old horizontal resistance area near 1.1480-85. However, lows marked during October-November, around 1.1525-30, will challenge the pair buyers afterward.

Alternatively, a daily closing below the 100-DMA level of 1.1420 will direct EUR/USD bears towards the 50-DMA level surrounding 1.1325.

Following that, the previous resistance line from September, close to 1.1300, will restrict the pair’s further downside.

Overall, EUR/USD is up for consolidating losses marked during late 2021.

EUR/USD: Daily chart

Trend: Further upside expected

- AUD/USD consolidates Friday’s heavy losses at a slower pace as markets look for fresh clues.

- Upbeat Aussie data, border reopening news battle fresh US-China tussle on Phase 1 deal to test momentum traders.

- Lack of major data/events ahead of Thursday’s US CPI will keep risk catalysts on the driver’s seat.

AUD/USD prices seesaw around 0.7125-20 during early Tuesday morning in Asia, having reversed most of Friday’s losses the previous day.

The risk barometer cheered multiple upbeat catalysts from home to post notable gains at the week’s start. However, a light calendar and the market’s wait for the US Consumer Price Index (CPI) data on Thursday may test the momentum traders looking forward.

Recently, the US-Japan trade announcements to cut tariffs on Japanese steel and fight excess output battled the Sino-American tensions over the Phase 1 deal to confuse the risk barometer pair. Also challenging the AUD/USD traders are the mixed performance of equities and the US Treasury yields.

On Monday, Australia’s TD Securities Inflation rose past 0.2% to 0.4% in January while ANZ Job Advertisements improved to -0.3% versus the revised down prior figures of -5.8%. Further, the AiG Performance of Services Index also improved past 49.6 to 56.2 whereas Q4 Retail Sales output flashed record growth of 8.2% in Q4 2021 versus 8.1% prior. Hence, Aussie data offered a good start to the bulls.

Elsewhere, Australia Prime Minister Scott Morrison announced the full reopening of the international borders for fully vaxxed visa holders from February 21. Also contributed to the AUD/USD rebound were the recent positive comments from Russian President Vladimir Putin as he said, “Russia will do all it can to find middle grounds that suit everyone.”

Moving on, National Australia Bank’s (NAB) Business Conditions and Business Confidence for January will decorate the economic calendar ahead of the US Goods Trade Balance for December.

Given the absence of major data/events and mixed concerns in the market, mostly positive, not to forget the shift in attention from hawkish central bank story to trade, AUD/USD prices are likely to continue grinding higher.

Technical analysis

AUD/USD pair’s recovery moves from 0.7050-45 horizontal area needs validation from 50-DMA level surrounding 0.7165.

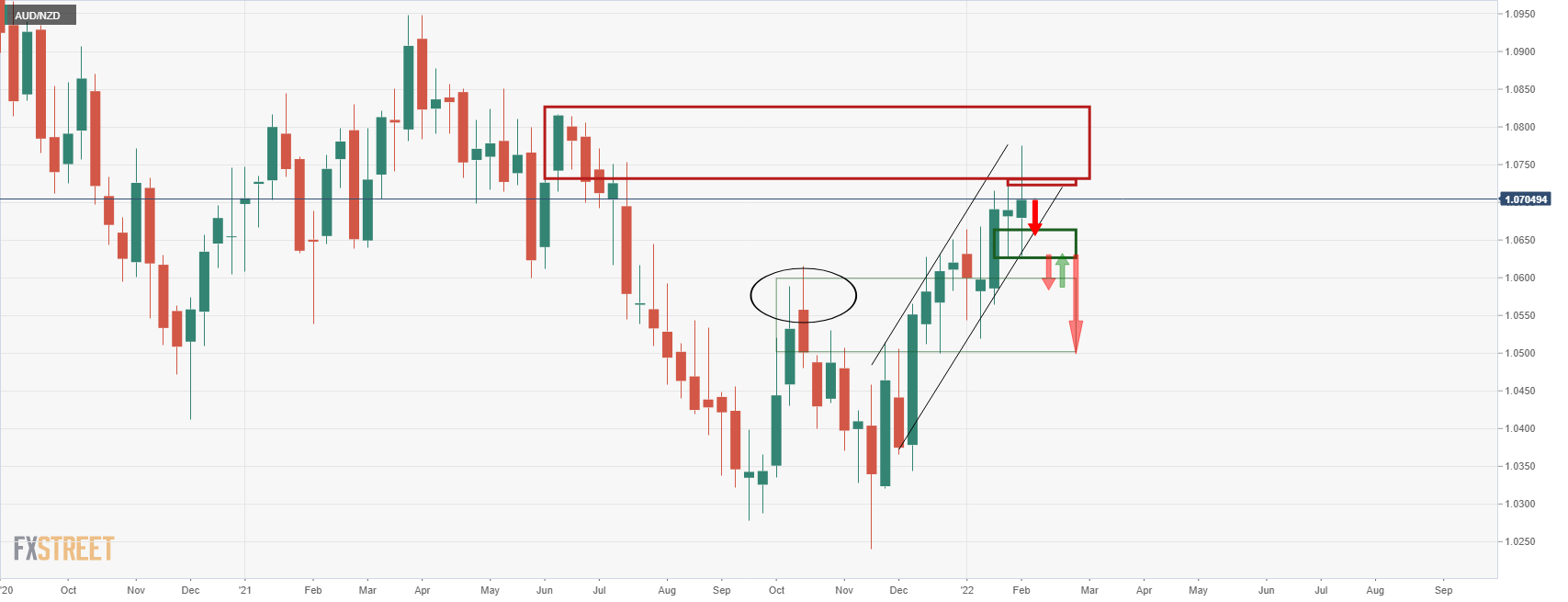

- The Australian dollar advances vs. the Japanese yen in a risk-off market mood.

- AUD/JPY is neutral biased, but a daily close above the 50-DMA would exert upward pressure on the pair.

The AUD/JPY climbs during the day as the North American session ends, despite a risk-off market mood, which usually favors the safe-haven status of the Japanese yen. At the time of writing, the AUD/JPY is trading at 82.00.

US equity indices finished mixed, led by losses of the S&P 500 and the Nasdaq Composite, down 0.37% and 0.84%, respectively. Meanwhile, the Dow Jones finished flat.

AUD/JPY Price Forecast: Technical outlook

On Monday’s overnight session, the AUD/JPY began the week on the right foot, advancing from daily lows up to daily highs. AUD/JPY price action in the last two days suggests indecision. However, a daily close above the 50-day moving average (DMA) could spur a jump towards the confluence of the 100 and the 200-DMA lying in the 82.40-50 range, respectively.

That said, a breach of the abovementioned confluence would expose AUD/JPY’s January 20 high at 82.97, which, once broken, will challenge a five-month-old downslope trendline around the 83.40-60 range.

On the flip side, AUD/JPY’s first support would be a February 4 daily low at 81.29, stalling downward moves for four straight days. A downward break of it could pave the way for further losses. The next support would be January 24 swing low at 80.69, followed by January 28 low at 80.36.

“The United States and Japan on Monday announced a deal to remove Trump-era tariffs from about 1.25 million metric tons of Japanese steel imports annually after Washington granted similar access for European Union steelmakers last year,” said Reuters during late Tuesday morning in Asia.

The news quotes US official to mention, “The new deal, which excludes aluminum at Japan's request, will take effect on April 1 and requires Japan to take ‘concrete steps’ to fight global excess steel manufacturing capacity, largely centered in China.”

A joint statement was also mentioned stating that Japan would start to implement within six months "appropriate domestic measures, such as anti-dumping, countervailing duty, and safeguard measures or other measures of at least equivalent effect,” to establish more market-oriented conditions for steel.

Key quotes

US Commerce Secretary Gina Raimondo said the deal ‘will strengthen America’s steel industry and ensure its workforce stays competitive, while also providing more access to cheaper steel and addressing a major irritant between the United States and Japan, one of our most important allies.’

Unlike the EU deal, past steel product exclusions from tariffs will not be added to Japan's quota for two years. Any exclusions must be applied for through the Commerce Department's normal process, according to the U.S. announcement.

Japan also will initially not participate in U.S.-EU talks on a global agreement to discourage trade in steel made with high carbon emissions - another initiative aimed at battling carbon-intensive Chinese steel output. But U.S. officials said that Japan would confer with the United States on methodologies for measuring carbon intensity in steel and aluminum production.

Japan's steel industry also is highly dependent on coal-fired blast furnace production, while more than 70% of U.S. steel is made with electric-arc furnaces that emit less carbon.

FX implications

Considering a lack of major data/events and the market’s wait for Thursday’s US Consumer Price Index (CPI), traders paid a little heed to the news with the USD/JPY prices waiting for Tokyo open after ending the sluggish week-start day near 115.00

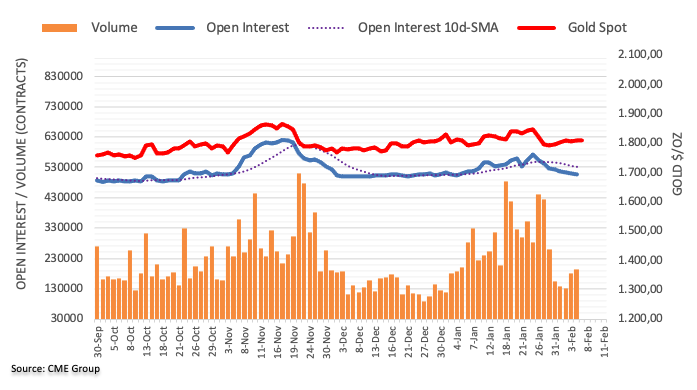

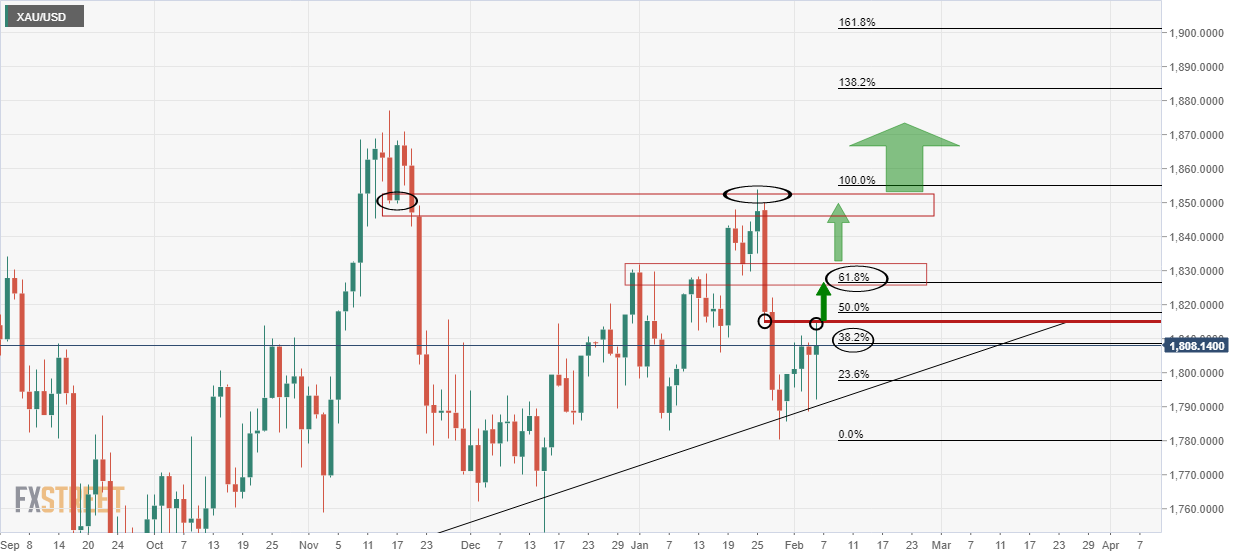

- Gold bulls are in control, but the focus is on the downside while below key daily resistance.

- More substantial CTA trend follower liquidations below $1800/oz.

- XAU/USD indecisive as investors assess central banks' rate outlook.

Gold, XAU/USD, was a form performer at the start of the week due to solid demand for safe-haven assets amid rising geopolitical tension. The concerns of imminent monetary policy tightening by the US Federal Reserve was cast aside as a consequence and gold has printed a fresh corrective high at $1,823.59.

The US dollar, despite the risk-off tones, was a touch fragile on the day due to the surprise hawkish rhetoric from the European Central Bank last week. The ECB now sees “upside risk to inflation” and Lagarde noted “things have changed”." President Lagarde's clear signal that the door has opened for rate hikes later this year is a real game-changer for the foreign exchange market," said MUFG analyst Lee Hardman.

"Over the past year the EUR has underperformed on the back of expectations that the ECB will maintain loose policy while the BoE and Fed tighten," Hardman argued. These themes were being digested in slow Monday markets which have led to the US dollar index DXY to steady at around 95.50.

Who's buying gold?

Analysts at ANZ Bank explained that ''the yellow metal has remained stubbornly resilient during China's Spring Festival celebrations against the weight of a decisively hawkish Fed. Even the outstanding beat in last week's US jobs data did not provide enough firepower for gold prices to break below their bull-market-era trendline established since 2018.''

''On the surface, one might assume that a growing appetite for safe-havens amid Russian tensions could be driving prices higher. However, tracking ETF flows suggests little such interest in the yellow metal when accounting for options-related distortions, whereas the Fed's decisively hawkish tone is keeping capital from sustainably flowing into the yellow metal, the analysts added.''

''It remains to be seen whether central bank purchases might be playing a substantial role in keeping gold prices from breaking lower, as the data continues to point to little speculative interest for the yellow metal.''

''Ultimately, the macro regime should keep prices vulnerable to a deeper consolidation, in support of our tactical short gold position.'' However, they expect more substantial CTA trend follower liquidations below $1800/oz.

Gold technical analysis

As illustrated on the daily chart, the bulls have overcome the sellers in the $1,810 area and are in pursuit of the 61.8% golden ratio.

Gold, prior analysis

Gold, live market

While there are no direct confluences at a specific price target between the neckline of the M-formation and the 61.8% ratio, the area between the two mile-stones near $1,830 will be expected to offer firm resistance.

In any case, until the M-formation's neckline is broken, the focus is on the downside, as illustrated in pre-open markets earlier this week as follows:

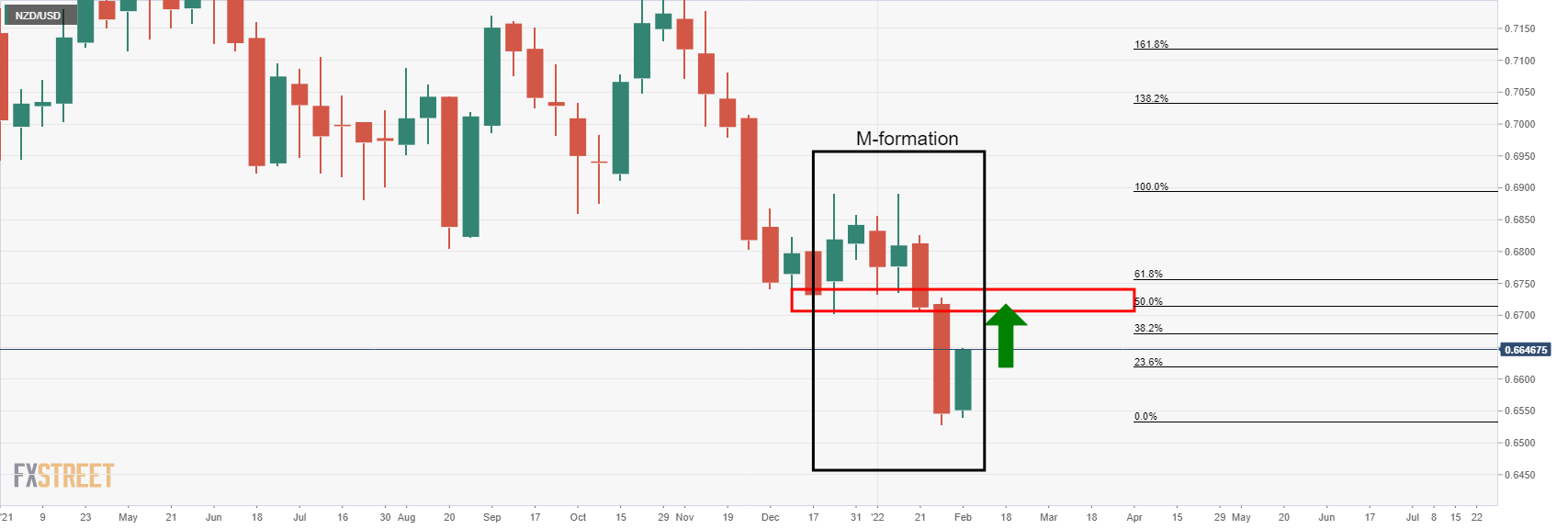

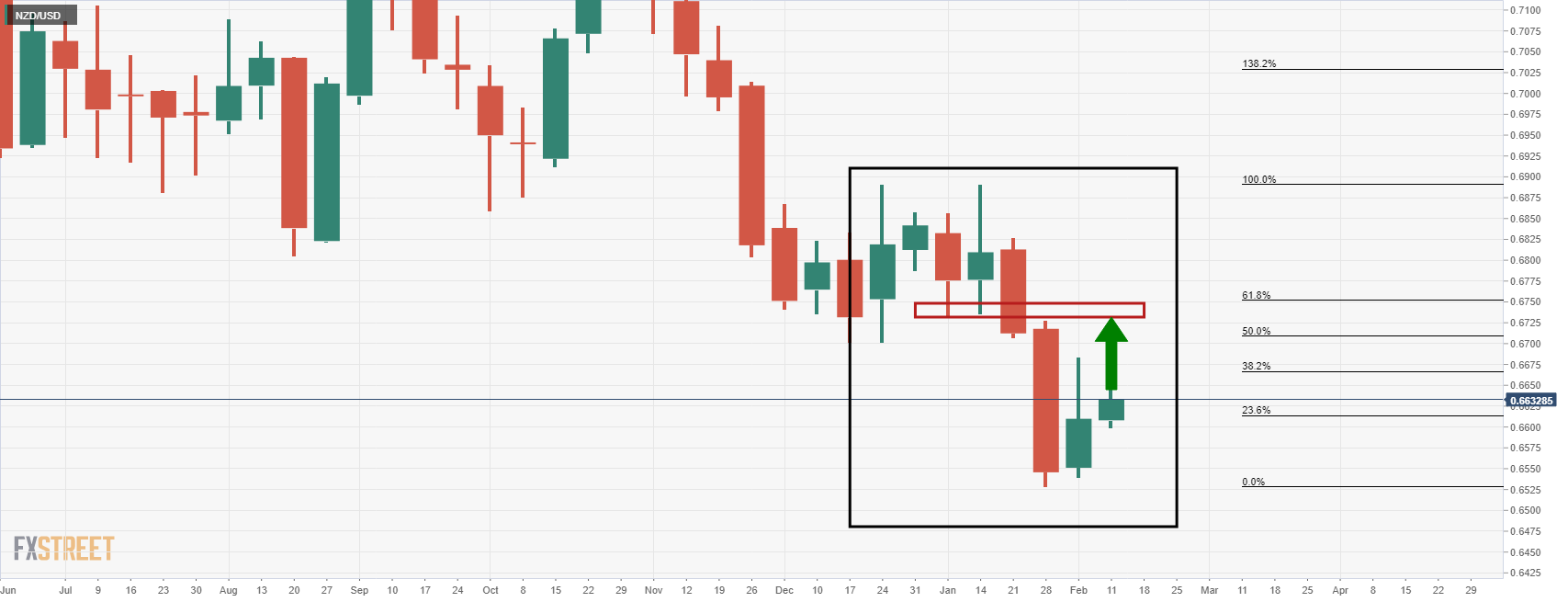

- NZD/USD bulls are hunting down a weekly key target.

- A quiet start to the week, a time to reflect on both domestic ad offshore fundamentals.

NZD/USD is firm at the start of a new week and has eyes on the weekly targets towards 0.67 the figure. At 0.6630, the pair is trading 0.28% higher on the day towards a critical target on the longer-term time frames, as illustrated below.

However, overall, it has been a quiet start to the week so far as traders digest a busy week of events last week and significant fundamentals that are setting the stage for March and the third round of 2022's central bank meetings.

''FX markets have generally been pretty tame since Friday, and that was despite much stronger-than-expected US data that rattled bonds,'' analysts at ANZ Bank explained. ''This is a quiet week for domestic data, with mostly second-tier data. But US CPI could cause volatility,'' the analysts said.

For an insight into what is to be expected in the data, analysts at TD securities explained, ''Core, as well as total prices likely, slowed on an m/m basis, with the pace still fairly strong. Strength in used vehicles was probably partly offset by weakness in hotels and airfares. Our forecast implies 7.2%/5.8% yoY for total/core prices, up from 7.0%/5.5%. The report will include updated weights and seasonal factors, neither of which should change trends significantly.''

Meanwhile, the ''bigger picture,'' analysts at ANZ argue, ''we still see the NZD as conflicted rather than trending – local data has been very strong, commodity prices are booming and interest rates are best in class, but the rest of the world is experiencing its own “re-awakening”, and fears of a hard landing and/or housing market wobbles never seem to be too far away.''

NZD/USD technical analysis

- NZD/USD Price Analysis: The 50% mean reversion is giving way in Asia

NZD/USD is on the verge of finding itself in a significant area on the charts, as per the prior analysis above.

NZD/USD live market

- EUR/JPY slipped back from earlier highs above 132.00 as ECB’s Lagarde sounded a little more cautious.

- However, the pair remained decently supported above the key 131.50 level, an area that may continue to offer support this week.

EUR/JPY stabilise above a key level of support at 131.50 on Monday, after hitting fresh three-month highs above 132.00 earlier in the session. In wake of her hawkish press conference after last week’s ECB meeting that sent the euro lurching higher versus its G10 counterparts, President Christine Lagarde struck a more measured tone on Monday. This helped bring the EUR/JPY back from earlier session highs and has calmed calls for an imminent test of the Q4 2021 highs in the mid-133.00s.

For reference, Lagarde gave some additional dovish context to last week’s hawkish shift. She continued to imply that a rate hike in 2022 was a possibility and noted the ECB might revise up its inflation forecast to see it remaining above 2.0% at the end of the year. However, she emphasised that there would be no need for major policy tightening, given that inflation is expected to stabilise near 2.0% in the medium term. Rather, she emphasised, it would just be policy normalisation.

EUR/JPY traders will not turn their focus to a speech from ECB Chief Economist Philip Lane on Thursday. Like Lagarde, Lane has consistently underestimated inflation in recent months and was until only very recently pushing the idea it would end 2022 under 2.0%. With Lagarde having now dropped that stance, Lane probably has too. A more hawkish-sounding Lane should thus not be surprising, but could nonetheless continue to offer EUR/JPY support this week, with BoJ policymakers expected to remain as dovish as ever. That might imply the pair remains supported above support at 131.50 this week, barring any catalyst for safe-haven assets that benefit the yen.

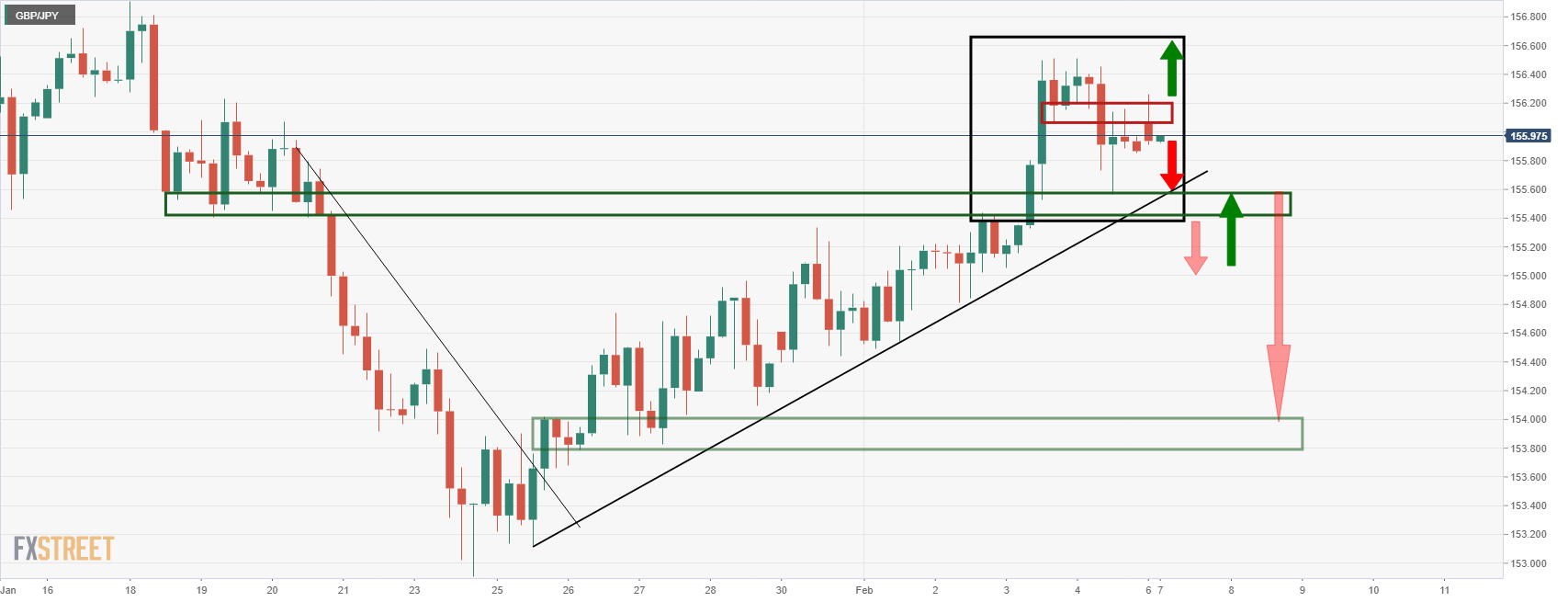

- The GBP/JPY bounces off daily lows, though it loses some 0.06% in the day.

- Market participants’ lack of conviction keeps the GBP/JPY range-bound.

- GBP/JPY is range-bound with no apparent bias, but Monday’s price action gives “hope” to GBP/JPY bulls.

The GBP/JPY consolidated around the 154.30-156.50 range in the last week, as risk-sentiment fluctuates between risk-off/on mood. At the time of writing, the GBP/JPY is trading at 155.78.

As portrayed by US equities, financial markets are mixed, fluctuating between gainers and losers. In the FX complex, a risk-on market mood spurred demand for risk-sensitive currencies, like the British pound. Nevertheless, so far, trimmed earlier losses vs. the Japanese yen.

GBP/JPY Price Forecast: Technical outlook

GBP/JPY Monday’s price action witnessed the pair falling towards 155.13, a daily low, though the GBP bounced off the lows as the North American session progressed.

In the last two days, the GBP/JPY price action has printed lower daily highs/lows, suggesting that the pair is headed downwards, despite that the daily moving averages (DMAs) indicate the GBP/JPY is upward biased.

That said, GBP/JPY traders may wait on the sidelines, expecting a breakout of the 154.30-156.50 trading range.

Nevertheless, the long wick below the candlestick “real body” gave clues that the pair might resume the upward move based on Monday’s price action. The first resistance on the way north would be 156.00. Once that level gives way, the next resistance would be February 3 daily high at 156.50, followed by the 157.00 figure.

On the downside, the break of 155.00 would expose the DMAs as targets for GBP/JPY bears.

- WTI bears eye the 50% mean reversion mark around $88.80.

- Supply-side drivers and US/Iran are the focus.

Trading at $91.22, West Texas Intermediate crude oil, (WTI), is down 0.8% on the day so far after falling from a high of 92.70 to a low of 90.76. The black gold is retreating from its highest levels in seven years as supply risk sentiment takes over amidst a blurry outlook for oil.

The Biden administration is said to have reinstated waivers to sanctions previously imposed on Iran. Signs that the Iran file is marching towards a deal are becoming increasingly apparent which will enable international nuclear cooperation projects. There are therefore prospects to revive the 2015 nuclear deal the US pulled out of under former President Donald Trump, ''further blurring the near-term outlook for supply risk'', analysts at TD Securities explained.

As for the Russia risk, the analysts at TD Securities explained, ''our real-time gauge of Russia supply risks suggests that this risk premium is receding. Instead, we argue that price action is more consistent with a disruption from the Texas Freeze, which is having an outsized impact amid low inventories and spare capacity...As weather disruptions ease, energy prices will again be increasingly vulnerable to de-escalation in supply risk.''

WTI technical analysis

-637798603605560005.png)

The price of oil is receding from the multiyear tops and a correction into a deeper area of what might be regarded as a support target could be on the cards. This falls in at the confluence area between the prior daily highs and at the 50% mean reversion mark around $88.80.

- XAU/USD has recently pushed back above $1820 and, in doing so, moved back above its 21DMA.

- The bulls will be eyeing a move towards the next key resistance area around $1830.

- XAU/USD has been taking advantage of the subdued FX markets and a slight pullback in US government bond yields.

Spot gold (XAU/USD) prices have been picking up steam in recent trade and recently rallied to the north of the 21-Day Moving Average at $1818 and above the $1820 level. At current levels around $1823, the precious metal is trading with on-the-day gains of about 0.8%. Now that resistance in the form of last week’s high at $1815 has been breached, the bulls will be eyeing a move towards the next key resistance area around $1830.

XAU/USD has been taking advantage of the subdued tone to trade in FX markets (where the DXY is flat) and a slight pullback in US government bond yields from multi-month/year highs hit last week after strong US jobs data. Analysts have pointed out that, in recent session’s weeks, the precious metals' negative correlation to the US dollar and US yields has weakened. That implies the precious metal might not be quite as vulnerable as it normally would be to an upside surprise in this week’s US Consumer Price Inflation data, which is scheduled for release on Thursday.

Market commentators have been citing elevated demand for inflation protection (in no small part due to the recent surge in oil prices) and safe-haven demand as geopolitical tensions remain elevated as driving recent upside. Indeed, XAU/USD is now more than 2.0% up from the lows it printed in the $1780s just seven sessions ago.

With the precious metal having found strong uptrend support in the $1780s and now successfully made it back above its major moving averages (21, 50, 200), the technical momentum for a return to and test of annual highs in the $1850s appears to be there. Perhaps gold might even be able to test its November highs near $1880. In the long run, however, it remains to be seen whether XAU/USD can resist the tide of a global rise in interest rates.

What you need to know on Tuesday, February 8:

The week started in slow motion, and the dollar ended the day mixed across the board. It managed to add some ground against its European rivals, although EUR/USD held above 1.1400, while GBP/USD settled at around 1.3530.

European Central Bank President Christine Lagarde poured cold water on rate hikes speculation. Speaking before the EU Parliament she said that there is no sign that inflation will measurably exceed the bank's 2% target in the medium term.

Commodity-linked currencies, on the other hand, managed to advance with AUD/USD trading at around 0.7120 and USD/CAD accelerating its slide at the end of the day to trade in the 1.2660 price zone.

Gold maintained its bullish stance throughout the day, ending the American session at $1,820 a troy ounce. Crude oil prices, however, retreated from their multi-year highs and WTI settled at $91.20 a barrel

Equities traded mixed, unable to find a clear direction. Wall Street is poised to close mixed with the major indexes trading around their opening levels.

US Treasury yields were sharply up ahead of the opening, holding on to gains, but pulling back from intraday highs.

Generally speaking, the week will be light in terms of macroeconomic releases, although the US will publish January Inflation next Thursday.

Shiba Inu Price Prediction: SHIB bulls are back, target $0.000054

Like this article? Help us with some feedback by answering this survey:

- The USD/JPY is upbeat, but a descending wedge indicates that a downward move lies ahead.

- Despite broad US Dollar strength, the USD failed to capitalize vs. the Japanese yen.

- USD/JPY may print a leg-down before resuming towards new YTD highs.

On Monday, during the North American session, the USD/JPY slides some 0.05%. At the time of writing is trading at 115.13. The market sentiment is mixed, as portrayed by US equity indices fluctuating between gainers/losers.

In the meantime, the US Dolla Index, a gauge of the greenback’s value against a basket of its peers, is up 0.09%, sitting at 05.57. In the meantime, the US 10-year benchmark note retreats from earlier gains slump one and a half basis points, down to 1.916%, a headwind for the USD/JPY, which has a strong positive correlation with it.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is upward biased from a technical perspective. The daily moving averages (DMAs) reside beneath the spot price, suggesting the previous-mentioned. Nevertheless, the possibility of another leg-down before resuming towards YTD highs and above may be on the cards due to a descending wedge formation.

A double-top appears to be formed in the near term, but it would need a daily close below the neckline, located at 114.14, to confirm its validity. In that event, the first support would be the 100-DMA at 113.76. Breach of the latter would target the bottom trendline of a descending wedge, around 113.40.

In that outcome, a move towards 114.00 would open the door for further gains. The next resistance would be February 2 daily low, support-turned-resistance at 114.14, followed by the 50-DMA at 114.48, followed by the downslope-trendline from the descending-wedge, around 115.30.

- USD/CAD bulls are seeking a break of 1.2880's.

- Inverse H&S are taking shape for the week ahead.

As per last week's analysis, USD/CAD Price Analysis: Bulls are firming up at a critical support area, the bulls came out in force and took the price higher, but as illustrated below, the bears are putting up a fight.

USD/CAD prior analysis, daily chart

It was illustrated that the bulls will be keen on the discount and to take the price higher.

USD/CAD live market

The price rallied but was met with supply at the start of the new week, despite a dip in the price of oil:

-637798574237325558.png)

The move in the Canadian dollar could be down to the market's rethinking for the Bank of Canada in March. Despite Friday's poor Employment for January and subsequent sell-off in the loonie, the BoC is unlikely to have not seen this coming.

''We don't expect this report to derail the BoC in March as the Bank should have incorporated near-term weakness into its latest projections,'' analysts at TD Securities argued, ''We continue to look for four rate hikes in 2022, with balance sheet runoff starting in April.''

Therefore, staying with the technicals, the bulls might take solace from the formation of the Inverse Head & Shoulders on the daily chart as follows:

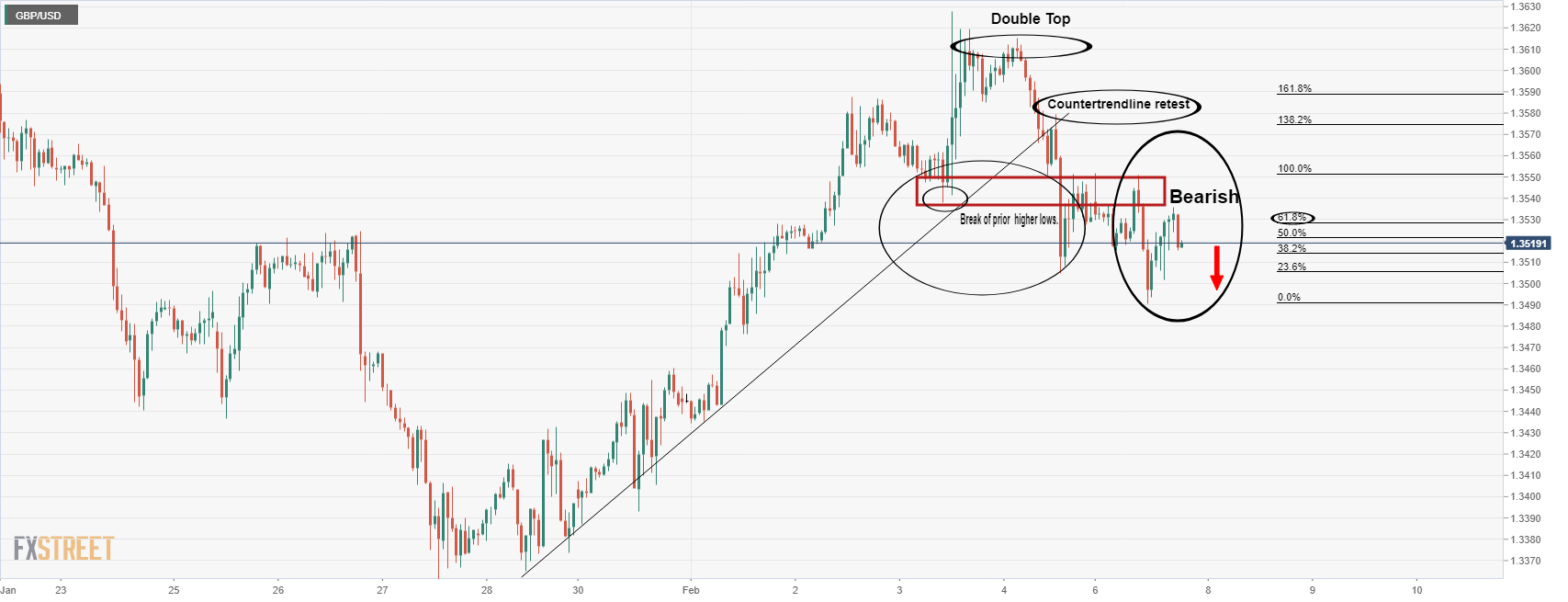

- GBP/USD bears are back in play following bullish early morning NY correction.

- From a bearish perspective, bears could be targetting the 1.3450's prior breakout levels.

- US inflation, UK GDP and central banks in focus.

GBP/USD has fallen onto the back foot in recent trade and is pressuring back below 1.3515 following a significant correction to 1.3535 that started in the early New York session from the 1.3490s. It is a US dollar and euro story at the start of the week as traders digest the importance of last week's main events in the central bank meetings and US jobs data.

As expected, the Bank of England (BoE) raised the Bank Rate by 25bp to 0.50% and announced the beginning of "passive QT" (ceasing reinvestments of maturing bonds) last week. However, the big surprise was that four out of nine policymakers voted for a 50bp rate hike. This set cable higher to test 1.3630.

However, on Friday, there was an unexpected jump in US jobs created in January according to Nonfarm Payrolls that bizarrely completely contradicted the ADP report that was also reported last week. Nevertheless, the NFP report has raised the outlook for a faster timetable for Federal Reserve rate hikes.

Payrolls grew 467,000 jobs last month and data for December was revised higher to show 510,000 jobs created instead of the previously reported 199,000. Reuters had forecast 150,000 jobs added in January while estimates ranged from a decrease of 400,000 to a gain of 385,000 jobs.

In stark contrast, the ADP private payroll jobs fell 301k in January, versus expectations for a 180k rise. That drop followed a weak initial claims report for the labour market survey week in January. This had resulted in a wave of downward revisions for Friday’s official nonfarm payrolls release, which was flipped on its head ad traders moved back into the US dollar.

The outcome has resulted in some analysts questioning the reliance of such a gauge. ''I have repeatedly stressed how ridiculous it is to look at US jobs data when they are just estimates of the small monthly delta of a very large number strained through an algorithm and seasonal adjustments,'' an analyst at Rabobank argued.

''Worse,'' the analysts exclaimed, ''there were vast backward revisions for years. The million jobs created last summer now happened this winter. Economic history was just rewritten – and we are supposed to take it seriously.''

Nevertheless, the financial markets depend on the data and the outcome reignites expectations the Fed hikes rates by 50 bps in March. GBP/USD, consequently, fell when the US dollar rallied 0.1% on the back of Friday's data.

For the week ahead, there are two key data events. One, market participants are waiting to see the release of US Consumer Price data for January on Thursday and on Friday, preliminary UK Gross Domestic Product is due for the fourth quarter and December.

''We look for UK GDP to contract 0.8% MoM in December, thus bringing GDP below its pre-COVID level once again,'' analysts at TD Securities said.

''Manufacturing likely declined 0.3% MoM, while we expect the services sector to contract 0.9% moM, in part driven by voluntary COVID measures and a substantial amount of people isolating due to the Omicron surge, but also due to a fade in consumer demand.''

GBP/USD technical analysis

As illustrated above, we have seen a break of the counter trendline and restest that failed. This was followed by a break of the old support structure as the prior higher lows which is now expected to continue acting as a resistance on multiple retests. failures would be expected to lead to a downside continuation for the week ahead. From a bearish perspective, the near term price trajectory on the H1 chart could play out as follows, targetting the 1.3450's:

- On Monday, the shared currency slides 0.24% post-ECB Lagarde remarks.

- A positive market mood keeps the EUR low-yielder on the wrong foot, while the greenback advanced a touch.

- If the EUR/USD prints a daily close under the 100-DMA, it would add further downward pressure on the pair.

On Monday, the EUR/USD trims Friday’s gains in the New York session, down some 14%. At press time is trading at 1.1424, as ECB’s President Christine Lagarde is crossing the wires in the last hour.

The market sentiment is upbeat, though, in the FX complex, the USD recovers in the day, with the US Dollar Index advancing 0.05%, sitting at 95.55, weighing on the EUR/USD.

ECB President Lagarde appears in the EU Parliament

In her appearance at the EU Parliament, ECB’s President Christine Lagarde said that “inflation is likely to remain high, in the near term.” However, she emphasized that “there is no sign that would measurably exceed the 2% target in the medium term.” Furthermore, she noted that “it will remain above the 2% target, but it would be lower than current levels.”

It seems that in the Q&A session, ECB’s Lagarde down-talked the hawkish tone perceived by market participants on last Thursday’s ECB’s monetary policy pivot. Following Lagarde’s quotes, the EUR/USD retreated from 1.1450s to current levels.

Earlier during the European session, the EU economic docket revealed that German Industrial Production for December shrank 0.3% when estimates looked for a 0.4% increase. Alongside macroeconomic releases, ECB’s officials crossed the wries.

ECB member Klaus Knot said that the bank should end the APP and noted that the first-rate hike in Q4 is possible. Meanwhile, ECB’s Kazaks pointed out that a “July hike would imply an extremely quick and unlikely tapering pace, with an increased risk of persistent inflation net-new asset purchases become less necessary.”

Across the pond, an absent economic docket has EUR/USD traders waiting for US inflation figures on Thursday.

EUR/USD Price Forecast: Technical outlook

The EUR/USD threatens to break below Pitchfork’s top-trendline, around 1.1415-20. In the event of a daily close below it, it would exacerbate a downward move towards Pitchfork’s mid-line but first would need to overcome some hurdles on the way south. The first support would be 1.1400. Breach of the latter would expose a four-month-old upslope trendline around 1.1340-50 region, followed by the 50-day moving average (DMA) at 1.1317.

- USD/CHF is consolidating near 0.9250 amid a quiet start to a week that sees the release of US CPI data.

- An upside surprise could further build the case for aggressive Fed tightening and build on last Friday’s post-jobs data rally.

- Bulls may target a return to/test of last week’s highs in the mid-0.9300s.

It’s been a subdued session thus far for USD/CHF, with the pair easing back from Asia Pacific session highs in the 0.9260 area to dip as low as the 0.9220s, before returning back close to the 0.9250 mark. The tone in FX markets on Monday has, for the most part, been a subdued one, with USD/CHF confirming to the lack of volatility seen across most other major G10 currencies on the session. A slight WoW rise in Swiss Sight Deposits last week, implying further SNB forex market interventions, has not impacted sentiment at all, with focus very much on incoming risk events.

Fed policymakers Michelle Bowman and Loretta Mester will be speaking on Wednesday ahead of the release of the January Consumer Price Inflation report on Thursday. Traders will be interested as to whether Bowman or Mester push back against the recent shift in market pricing to imply a roughly one in three chance of a 50bps rate hike in March after last Friday’s strong jobs report. However, more interestingly will be whether US inflation surprises to the upside once more.

If this was to be the case, the USD/CHF’s Friday rebound from under 0.9200 to the mid-0.9200s might extend towards last week’s highs in the 0.9340 area. Recall that dollar weakness in the first part of last week saw the pair pull back to as low as 0.9180. Traders at the time said the move was “positioning-related”. If that is the case, there might even be the case for a move back towards H2 2021 highs in the 0.9360s on strong data.

ECB President Christine Lagarde, during testimony before the EU Parliament, said that inflation at the end of 2022 will remain above the ECB's 2.0% target, though will be lower than current levels. In wake of Lagarde's more hawkish remarks after last week's ECB meeting where she expressed greater levels of concern about inflation, this comment does not come as a surprise, though does mark a shift from the ECB's previously held stance that inflation will fall back under 2.0% by the year's end. We're seeing inflation moving to target leading to policy normalisation, she added, before adding that this would not amount to measurable policy tightening.

Additional Remarks:

"We see little evidence of risk to our monetary transmission process."

"PEPP reinvestment is one of the tools we can use if that happens."

"Growth in Q1 has been slower than anticipated, but will then pick up."

Market Reaction

The euro has not reacted to the latest remarks from Lagarde.

- EUR/GBP is consolidating in the 0.8450 area, with the latest comments from ECB’s Lagarde not provoking any euro reaction.

- The pair did hit fresh annual highs in the 0.8470s earlier in the session.

- Some are calling for further medium-term upside following last week’s surprise hawkish ECB stance shift, despite continued BoE hawkishness.

EUR/GBP hit fresh annual highs in the 0.8470s on Friday but has since pulled back to consolidate around the 0.8450 area, where it trades broadly flat on the session. The latest remarks from ECB President Christine Lagarde before the EU parliament did not add anything new to her remarks in last week’s post-ECB meeting press conference. Recall that, last Thursday, her refusal to reiterate a prior statement that rate hikes in 2022 are unlikely and greater emphasis on upside inflation risks triggered a lurch higher in EUR/GBP from fresh multi-year lows under 0.8300.

Last week also saw the BoE surprise markets in a hawkish manner, with four out of nine Monetary Policy Committee members unexpectedly voting for a 50bps rate hike (the BoE actually hiked rates to 0.5%, as expected). These calls for a bigger move were rooted in near-term inflation fears, with the bank now expecting headline CPI to surpass 7.0% in April when UK energy regulator Ofgem raises the gas price cap. The BoE’s hawkish surprise, while enough to briefly push EUR/GBP under 0.8300 and towards a test of the late-2019/early-2020 lows in the 0.8280 area, was overridden by the surprise shift in the ECB’s stance.

The end result was that EUR/GBP enjoyed its best week since April 2021, rallying more than 1.7% to current levels in the mid-0.8400s. As traders reassess their expectations as to the outlook for BoE/ECB policy divergence, some think EUR/GBP could yet be headed higher. In Q2, the UK faces a cost of living crisis with taxes and energy costs set to rise in tandem, factors which likely help keep the BoE’s terminal interest rate capped relative to elsewhere in the G10.

Meanwhile, if over the same time period the Eurozone continues to face hotter than expected inflation, the likelihood that the ECB accelerates its QE taper and signals a Q4 rate hike are high. That could continue to support EUR/GBP in the medium-term, perhaps facilitating a test of the next key resistance are around 0.8600.

In the short-term, analysts flagged a risk of some euro profit-taking after last week’s big moves, especially if ECB policymakers attempt to push back against excessively hawkish money market pricing. Lagarde’s measures comments on Monday certainly don’t suggest further short-term bullish impetus, and a speech from dovish ECB Chief Economist Philip Lane later in the week will also be of note. Any short-term pullback in EUR/GBP may find support in the 0.8420s in the form of the January highs.

- The non-yielding metal advances half percent in the North American session.

- The rise of US T-bond yields capped upward moves in the yellow metal but failed to push prices lower.

- XAU/USD is neutral-upward biased as depicted by DMAs below the spot price.

Gold (XAU/USD) climbs in the North American session, despite US T-bond yields shooting through the roof after the US Nonfarm Payrolls report smashed expectations. At the time of writing, XAU/USD is trading at $1,816.

Financial markets mood is upbeat. As of late, US Treasury yields move higher in the session, with the 10-year benchmark note rate at 1.936%, underpins the greenback, with the DXY flat at 95.50.

On Friday of the last week, the US Nonfarm Payrolls report showed that the US economy added 467K jobs to the economy, smashing 150K estimations. At the same time, the Unemployment Rate rose to 4%, a tick higher than foreseen. However, Fed concerns about inflation made investors turn their attention to Average Hourly Earnings, which rose more than half-percent, from 5% in December to 5.7% in January, further cementing Fed’s hawkish expectations, as money market futures have priced in at least five rate increases.

That said, the non-yielding metal stayed resilient, despite the outstanding US employment report. Following the announcement, XAU/USD found bids around $1790, followed by a break of the $1800 figure, finishing above it in the last week.

Analysts at TD Securities noted that “… tracking ETF flows suggests little such interest in the yellow metal.” However, they said that “it remains to be seen whether central bank purchases might be playing a substantial role in keeping gold prices from breaking lower, as the data continues to point to little speculative interest for the yellow metal.”

That said, gold traders, attention turns to Thursday US inflation figures, which would give some clues regarding US Treasury yields direction, which significantly influences gold prices.

XAU/USD Price Forecast: Technical outlook

At press time, gold is trading above the 200-day moving average (DMA), which sits at $1,806, suggesting an upward bias. Nevertheless, as most of the daily moving averages (DMAs) reside in the $1,796-$1,806 range, almost horizontal, the yellow metal is neutral.

Upwards, XAU/USD’s first resistance would be the central line of Pitchfork’s channel around $1,825-27. Breach of the latter would expose July 15, 2021, a daily high at $1,834, followed by the mid-line between the top/central Pitchfork’s channel around $1,840-50.

On the other hand, gold’s first support would be $1,800. A downward break would open the door for a fall to the 100-DMA at $1,796, followed by the bottom-trendline of Pitchfork’s channel at $1,790, and January 28 daily low at $1,780.

On Thursday, the Bank of Mexico will annoujnce its decision on monetary policiy. Market participants expect a rate hike (most likely of 50bps), as infaltion continues to run well above Banxico’s 2-4% target. According to analysts at Wells Fargo, the central bank’s statement could sound less hawkish than previously amid weaker-than-expected economic data.

Key Quotes:

“Mexico's central bank announces its monetary policy decision next week, with the consensus forecast for another aggressive rate increase from the central bank. Mexico's central bank surprised the market at its December meeting, increasing its Overnight Rate by 50 bps to 5.50%. The central bank cited "the magnitude and diversity of inflation shocks" as well as "the risk of price formation becoming contaminated." With Mexico's CPI inflation still well above the target range, the consensus forecast is for another 50 bps rate hike to 6.00%.”

“In addition to any rate increase, the focus will be on guidance from Mexico's central bank surrounding future hikes, and whether the pace of tightening could slow going forward. It is certainly possible the central bank's accompanying statement could sound less hawkish than previously. Economic reports this week, for example, show Mexico's Q4 GDP dipping by 0.1% quarter-over-quarter and the January manufacturing and services PMIs declining, while next week Mexico's January CPI is expected to slow to 7.01% year-over-year.

European Central Bank President Christine Lagarde, speaking before the EU Parliament on Monday, said that there is no sign that inflation will measurably exceed the bank's 2.0% target in the medium term. We are not subject to excess demand or labour market overheat, she added.

Analysts at Danske Bank still view that the level of around 0.83 in the EUR/GBP cross was the bottom as relative rates now seem more supportive for euro than the British pound. They continue to forecast EUR/GBP at 0.84 in twelve months.

Key Quotes:

“We now expect the BoE to deliver four additional 25bp rate hikes this year (March, May, August and November) versus two additional hikes previously. Our new BoE call remains slightly less aggressive than markets pricing, where five rate hikes are priced in.”

“We continue to believe that risk is skewed towards more rate hikes (and also a probability of a 50bp rate hike). BoE is now likely to announce some details on “active QT” in connection with the May meeting. Initially, EUR/GBP fell slightly below 0.83 on the hawkish signal but EUR/GBP is now trading closer to 0.85 supported by the ECB.”

“We are still of the view that the level of around 0.83 was the bottom in the cross, as relative rates now seem more supportive for EUR than GBP, as BoE rate hikes are already priced in and the ECB is turning more hawkish.”

“Overall, we still see the 2022 investment environment as USD-positive, which is usually benefitting GBP relative to EUR, which we believe will dominate slightly. Hence, we continue targeting EUR/GBP at 0.84 in 12M.”

- Australian dollar rises versus US dollar and regains 0.7100.

- DXY in negative territory, far from last week lows.

The AUD/USD is trading at daily highs at 0.7116. It has been moving all day with a positive bias supported, recovering after falling sharply on Friday when the greenback rallied on the back of the NFP report.

The dollar is posting mixed results on Monday while the aussie is among the top performers across the G10 space. AUD/NZD erased Friday’s losses and is looking at last week highs above 1.0730 while EUR/AUD is retreating from five-month highs back under 1.6100.

AUD/USD outlook

The AUD/USD is up by almost 50 pips on Monday. The outlook is still biased to the downside. A recovery above 0.7165 would be a positive development for the Aussie as it would break a horizontal resistance and also rise above the 20 and 55-day simple moving average. The next strong resistance stands at 0.7220 followed by 0.7250 (100-day simple moving average).

A slide back under 0.7100 would keep the door open for a test of the recent low at 0.7050, the last protection to 0.7000. A weekly close clearly under 0.7000 should point to further losses over the medium term.

Technical levels

In the introductory remarks section of her testimony before the EU Parliament on Monday, ECB President Christine Lagarde said that we continue to see the risks to the economic outlook as broadly balanced over the medium-term.

Additional Remarks:

"The current pandemic wave and associated restrictions are likely to continue to have a negative impact on growth at the start of this year."

"Our commitment to delivering on our inflation mandate remains absolutely unwavering."

"The economic impact of the current pandemic wave appears to be less damaging to activity than previous ones."

"Bottlenecks will still persist for some time, but there are signs that they may be starting to ease."

"Inflation is likely to remain high in the near term."

"We need more than ever to maintain flexibility and optionality in the conduct of monetary policy."

"The likelihood is that the current price pressures will subside before becoming entrenched, enabling us to deliver on our 2% target over the medium term."

"In the past surges in energy prices weakened the spending power of households, and reduced inflation over the medium term."

Market Reaction

No market reaction to Lagarde's remarks yet, which are very much in fitting with the ECB's usual script, but traders will be keeping an eye out for any juicier nuggets of information that might come during the Q&A.

- The S&P 500 has on Monday enjoyed a modest rebound back above 4500 in quite trade.

- US data and earnings will be in focus this week after big tech earnings spurred large market swings last week.

- If US data triggers a further repricing of hawkish Fed bets, that risks further downside, particularly for growth/tech names.

US equity markets have erased pre-market losses to trade modestly higher early on Monday’s trading session. That means the S&P 500, up about 0.25%, has been able to climb back to the north of the 4500 level, though has so far traded within thin ranges as investors mull incoming US data and Fed speak plus more earnings this week. The Nasdaq 100 index is about 0.8% higher and the 14.75K area, while the Dow is flat but remains decently supported above the 35K mark.

In terms of notable stories, shares of Pelaton, which fell more than 75% over the course of the year as the global economy reopened, hurting demand for at-home exercise equipment, lept more than 20% on Monday. Reportedly, Amazon and Nike are both interested in buying the company out. Otherwise, their arent much by way of other major US equity market stories to update on. The main earnings in focus this week include Nike and Pfizer, while traders will continue to digest last week’s big tech earnings.

Recall that dour Facebook earnings on Thursday halted and partially reversed what had up until then been a very strong and broad equity market recovery on the week, with the co.’s shares now down nearly 30% versus pre-earnings levels. As far as the broader equity market was concerned, strong earnings from Amazon, which is up more than 16% versus pre-earnings levels, saved the day, or week. The S&P 500 still managed to end the week about 1.5% higher.

This week will be a key test as to whether the first week in February was a dead cat bounce or the start of a more meaningful recovery back towards record highs following January’s more than 5.0% pull-back. The same concerns about Fed tightening which motivated the January decline remain elevated and at the forefront of investor minds in wake of strong US labour market figures last week and ahead of US Consumer Price Inflation data this week.

If the upcoming inflation figures further pump already elevated expectations for a 50bps hike from the Fed in March, that means downside risk for growth/big tech names. Last Friday’s lows at the 4450 balance area are a clear level of support to keep an eye on to the downside, with any break below potentially opening the selling floodgates for a move back towards support in the 4300 area.

- The NZD/USD clings to the 0.6600 figure as volatility shrinks post-US NFP report.

- The rise in US Treasury yields stalls upward moves in the NZD/USD, as the 10-year yield sits above 1.90%.

- NZD/USD is downward biased and might test YTD lows if it fails to reclaim 0.6700.

The New Zealand dollar advances as the North American session begins holds above 0.6600 though it faces resistance at a 12 month-old bottom trendline of a descending channel. At the time of writing is trading at 0.6630. The market sentiment is tilted upbeat, though it is mixed in the FX complex.

Rising US Treasury yields across the curve weigh some in risk-sensitive currencies, led by the 10-year US T-bond benchmark note sitting at 1.931%, after a stellar US NFP report. However, the greenback failed to capitalize on that, as global central banks are looking towards tightening monetary conditions.

The Reserve Bank of New Zealand (RBNZ) would meet on February 26, where market analysts expect an increase of 25 bps to the overnight cash rate (OCR) to reach 1%. That would make it the first G8 central bank to reach that threshold, followed by the Bank of England (BoE), sitting at 0.50%.

Absence of New Zealand macroeconomic news, NZD/USD traders, would lean on the dynamics of the buck. Meanwhile, the US economic docket would not report tier one or two information until February 10, where the US Consumer Price Index (CPI) for January will be unveiled, foreseen to rise three tenths to 7.3%, followed by the Core CPI is estimated at 5.9%.

NZD/USD Price Forecast: Technical outlook

The NZD/USD remains downward biased. On Friday, a downslope bottom-trendline of a descending channel, rejected upward, moves around 0.6680, sending the pair tumbling towards the figure. Nevertheless, USD bulls could not push the pair to the 0.6500 handle, signaling that the pair might be headed in consolidation ahead of the RBNZ meeting late in the month.

Downwards, NZD/USD’s first support would be 0.6600. Breach of the latter would expose February 4 daily low at 0.6588, followed by January 28 cycle low at 0.6528 and then 0.6500.

On the opposite, the 0.6580-85 region, where the twelve-month-old downslope trendline pass, would be the first resistance, followed by January 6 daily low previous support-turned-resistance at 0.6732.

- USD/TRY keeps the broad range bound theme unchanged.

- Turkey’s 10y bond yields drop to multi-day lows near 21%.

- End Year CPI Forecast, Unemployment Rate next of note in the docket.

The Turkish lira depreciates at the beginning of the week and lifts USD/TRY to the 13.60 region.

USD/TRY remains largely within a consolidation mode

USD/TRY resumes the upside and leaves behind Friday’s small dip amidst the tepid recovery in the greenback and alternating risk appetite trends, as traders continue to adjust to the latest US Nonfarm Payrolls figures.

The domestic currency adds to recent losses, particularly after inflation figures in Turkey showed consumer prices rising more than 48% in the year to January, the highest level since April 2002.

On the latter, finmin N.Nebati sees (hopes?) inflation peaking in April and to start a decline to a single-digit print by June 2023. Nebati’s view (wish) of the CPI not hitting 50% will surely be put to the test in the upcoming months, however.

What to look for around TRY

The pair keeps the multi-session consolidative theme well in place, always within the 13.00-14.00 range. While skepticism keeps running high over the effectiveness of the ongoing scheme to promote the de-dollarization of the economy – thus supporting the inflows into the lira - the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are a sure recipe to keep the domestic currency under pressure for the time being.

Key events in Turkey this week: Unemployment Rate (Thursday) - End Year CPI Forecast, Current Account, Industrial Production, Retail Sales (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 0.50% at 13.5752 and a drop below 13.3054 (55-day SMA) would expose 13.2327 (monthly low Feb.1) and finally 12.7523 (2022 low Jan.3). On the other hand, the next up barrier lines up at 13.9319 (2022 high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

GBP/USD is coming back from a minor drop under 1.35. However, only a break above the 1.3550 region would alleviate downside pressure on the cable, economists at Scotiabank report.

Important support located at the 1.3450 area

“Cable will have to climb back above ~1.3550 to show signs of a possible reversal of recent losses – and a continuation of its gains since late-Jan.”

“Support after the figure zone is ~1.3475 and then the mid-1.34s where the 50-day MA of 1.3440 also stands.”

EUR’s bullish streak appears to have stalled after six consecutive days of gains. Economists at Scotiabank note that a break below 1.14 would clear the path for a quick dip towards the 1.1350 region.

Initial resistance located at the 1.1450 area

“The 1.1410/15 zone will act as a minor floor ahead of firmer support at the figure area. A break under 1.14 leaves the EUR/USD liable to a quick drop to the mid-1.13s and a test of its 50- day MA of 1.1320.”

“Resistance after ~1.1450 is 1.1470 and 1.1485 followed by the figure.”

The Canadian dollar has picked up a little support on Monday. Nonetheless, economists at Scotiabank view this move as a mere correction and believe that the 1.2780 zone is likely to remain a very sensitive technical point for funds in the next few days.

USD/CAD losses are possibly corrective in nature

“Losses are possibly corrective in nature only and the broader pattern of trade that has developed through late January warns of a potential inverse Head & Shoulders pattern which risks pushing USD/CAD significantly higher on a break above the neckline trigger at 1.2780 currently.”

“USD/CAD losses below intraday support at 1.2715 will help mitigate upward pressure on the pair to some extent.”

- WTI has erased most of an earlier session dip under $91.00 but has been choppy in $91.00-$92.00 ranges

- Some attributed earlier session profit-taking to positive signs in US/Iran nuclear talks.

- Traders are also mulling developments regarding geopolitical, near-term supply concerns and ongoing strong demand.

WTI was hit by profit-taking in early European trade, dipping at one point underneath the $91.00s. However, trade has since been choppier in both directions, with WTI prices more recently swinging between the $91.00-$92.00 area. At current levels around $91.50, front-month WTI futures trade with losses of about 50 cents on the day and remain only a few bucks below recent seven-year highs above $93.00, as the market mood for the most part remains bullish.

Market commentators had cited positive signs on the US/Iran nuclear negotiations front as one trigger for profit-taking earlier in the day; the US restored sanction waivers to Iran that will allow international nuclear cooperation projects. Although the waivers hardly do anything to help the Iranian economy, market commentators said it was a sign of goodwill from the US that showed the country is intent on finding a deal.

Iranian crude oil exports, hobbled by strict US sanctions, currently stand at about 700K barrels per day (BPD) versus pre-US sanction levels of well over 2M BPD. If the US and Iran can agree on a deal to return to the 2015 nuclear pact, this jump in oil exports could help ease upward pressure on crude oil markets in the near term. However, analysts at Fujitomi Securities cautioned that “investors expect more twists and turns in the U.S.-Iranian talks and no agreement to be reached anytime soon.”

WTI’s impressive intra-day recovery speaks to the ongoing bullishness of the mood prevailing in crude oil markets. As the US continues to warn that a Russian military incursion into Ukraine could be imminent, the amount of geopolitical risk premia priced into global oil markets remains high. Oil markets will focus on a meeting in Moscow between French President Emmanuel Macron and Russian President Vladimir Putin later in the day, with no progress towards dialing down tensions expected.

In the meantime, recent cold weather in the US has hampered near-term output, with Reuters reporting that two major refineries with a combined more than 800K BPD in output were knocked offline. That contributes to the narrative of near-term tightness in global oil markets, just as the Saudis were reported (by Bloomberg) to have raised official oil selling prices for Asian, North American and European customers. Many analysts will remain comfortable in the calls for WTI to hit $100.

- Silver gained strong positive traction and shot to the $23.00 mark, or a multi-day high on Monday.

- Technical indicators on the daily chart warrant some caution before placing aggressive bullish bets.

- A convincing break through the $23.40-$23.45 area is needed to support prospects for further gains.

Silver built on Friday's rebound from the post-NFP low to the $22.00 neighbourhood, or a near one-month low, and gained strong positive traction on the first day of a new week. The intraday positive move pushed spot prices back closer to the $23.00 round-figure mark during the early North American session.

From a technical perspective, any subsequent move up beyond the mentioned handle might confront some resistance near the 100-day SMA, currently around the $23.20 area. This is followed by the $23.40-$23.45 horizontal barrier, which should act as a pivotal point and help determine the near-term trend for the XAG/USD.

Technical indicators on the daily chart – though have been recovering from lower levels – are yet to confirm a bullish bias for the XAG/USD. This makes it prudent to wait for a strong follow-through buying before confirming that the recent sharp rejection slide from the very important 200-day SMA has run its course.

A convincing breakthrough the said barriers will negate any bearish bias and trigger a fresh bout of a short-covering move. This should allow the XAG/USD to surpass the $24.00 round-figure mark and climb further towards challenging the YTD high, around the $24.70 region touched on January 20.

On the flip side, the $22.65 area now seems to protect the immediate downside ahead of the $22.40 region, which if broken would expose the $22.00 round figure. Sustained weakness below should pave the way for a further decline and drag the XAG/USD towards challenging the double-bottom support, around the $21.40 zone.

Silver daily chart

-637798387730746900.png)

Technical levels to watch

- GBP/USD is consolidating with 1.3500-1.3550 intra-day ranges ahead of a busy week of central bank speak and US/UK data.

- Ahead of risk events, the pair may continue undulations in the 1.3500-1.3600 range around a key fib level for 2022.

GBP/USD is trading broadly flat at the start of the week within a 1.3500-1.3550 intra-day range, as traders brace for a barrage of further central bank speakers as well as UK and US tier one data releases. After rallying as high as the 1.3620s last week as a result of a weakening US dollar plus a hawkish BoE surprise, the pair reversed back below 1.3550 in wake of a much stronger than expected US labour market report. January’s jobs data has pumped expectations for a 50bps first rate hike from the Fed in March, overshadowing calls from a large minority of BoE members for a 50bps move last week.

Fed tightening bets, which support the dollar last Friday, maybe pumped once again if Thursday’s US Consumer Price Inflation report also comes in hotter than expected. Fed policymakers speaking this week should be monitored just in case there is any push back against recent hawkish market moves. That could help push GBP/USD back towards last week's highs above 1.3600. Otherwise, GBP/USD traders will be monitoring a speech from BoE Governor Andrew Bailey on Thursday ahead of the release of Q4 2021 GDP growth figures and December activity data on Friday.

Technical levels of note include the 1.3550 mark, which is the 50% retracement back from the 2022 highs at 1.3750 and lows at just above 1.3350. As markets weigh Fed/BoE tightening themes, the pair may continue to undulate in the 1.3500-1.3600 area in the coming days. One theme worth keeping an eye on is Boris Johnson’s ongoing will he/won’t he stay on as UK PM saga, as the PM continues to face massive pressure in wake of a string of recent scandals. Most analysts continue not to see a Johnson departure as mattering too much for sterling given the candidates most likely to replace are unlikely to herald much by way of economic policy change.

Friday’s RBA Statement on Monetary Policy (SoMP) reinforced the “patient” stance already seen at the RBA meeting and the subsequent speech by Governor P.Lowe, noted Lee Sue Ann, Economist at UOB Group.

Key Takeaways

“The Reserve Bank of Australia (RBA), at its first monetary policy meeting of the year earlier this week (1 Feb), announced that it will stop buying government bonds from 10 Feb, but stressed that the end to its Quantitative Easing (QE) does not imply a near-term interest rate rise.”

“In its Statement of Monetary Policy released earlier today, in addition to reiterating the statement, RBA Governor Philip Lowe also stated that it is too early to conclude inflation is sustainably within target range.”

“We still look for rate hikes only in 2023, though we now flag the potential risk for that to occur earlier than our projection. A pickup in wage growth will be a crucial factor. In this regard, the RBA is likely to continue to wait until wage growth is closer to 3%. The next RBA meeting is on 1 Mar.”

Analysts at Credit Suisse continue to see further signs of EUR strength with the EUR/GBP surging higher. The pair is expected to enjoy a more sustained recovery towards the 200-day moving average (DMA) at 0.8512/15.

Initial support located at 0.8424/22

“EUR/GBP has surged higher following its successful defense of key long-term support at 0.8281/17 and a base and large bullish ‘reversal week’ have been established. We look for this to provide the platform for a more sustained recovery with resistance seen initially at 0.8471/80, then what we expect to be tougher resistance at the 200-DMA at 0.8512/15, with a cap expected here at first.”

“Support is seen at the ‘neckline’ to the base at 0.8424/22 initially, then 0.8404, with 0.8362 ideally holding to see an immediate upside bias maintained.”

- A combination of factors prompted fresh selling around USD/CAD on Monday.

- Bullish oil prices underpinned the loonie and exerted pressure amid weaker USD.

- A softer tone around the US bond yields acted as a headwind for the greenback.

The USD/CAD pair maintained its offered tone through the mid-European session and was last seen trading near the daily low, just above the 1.2700 mark.

A combination of factors failed to assist the USD/CAD pair to capitalize on Friday's strong rally and led to a modest bearish gap opening on the first day of a new week. As investors looked past disappointing Canadian jobs report, bullish crude oil prices underpinned the commodity-linked loonie. Apart from this, modest US dollar weakness acted as a headwind for the USD/CAD pair and exerted some downward pressure.

Crude oil prices consolidated the recent gains to the seven-year high and remained well supported by expectations that global supply would remain tight amid the post-pandemic recovery in fuel demand. Apart from this, the conflict between Russia and the West over Ukraine acted as a tailwind for the black gold. This, in turn, assisted the commodity to attract some dip-buying on Monday, which benefitted the Canadian dollar.

On the other hand, the USD struggled to build on the post-NFP recovery move from a two-and-half-week low and was pressured by a softer tone around the US Treasury bond yields. That said, renewed speculations for a larger Fed rate hike move at the March policy meeting – boosted by Friday's mostly upbeat US monthly jobs report – should limit any meaningful downside for the US bond yields and the greenback.

Investors now seem convinced that the Fed will adopt a more aggressive policy response to contain stubbornly high inflation. Hence, the market focus now shifts to the release of the US CPI report on Thursday. The data will play a key role in influencing the buck in the near term. Apart from this, oil price dynamics would be looked upon to determine the next leg of a directional move for the USD/CAD pair.

Technical levels to watch

- EUR/USD leaves behind the initial pessimism and retakes 1.1460.

- The YTD high at 1.1483 comes next on the upside.

The rebound in EUR/USD from last week’s YTD lows stays well and sound and now flirts with daily highs near 1.1470 on Monday.

The ongoing strength is now poised to extend further considering the recent price action. Against that, the YTD top at 1.1483 (February 4) emerges as the next target closely followed by the 200-week SMA at 1.1496. Between 1.1500 and 1.1600 there are no resistance levels of note, leaving the October 2021 top at 1.1692 as a potential longer-term target.

The recent breakout of the 5-month resistance line, today near 1.1410, leaves extra gains well on the cards in the near term at least. In the longer run, the negative outlook remains in place while below the key 200-day SMA at 1.1673.

EUR/USD daily chart

- Spot gold has been trading with a positive bias near last week’s $1815 highs on Monday.

- Analysts have been surprised by gold’s strong performance as of late despite rising bond yields on central bank tightening bets.

- The main risk this week is US CPI data on Thursday.

Spot gold (XAU/USD) prices have been trading with a positive bias on Monday, with prices currently around $1813, up about 0.3% on the day, having found support after an earlier dip back towards the 200-Day Moving Average at $1808. For now, last Friday’s pre-US jobs data high around $1815 is capping the price action, but the momentum for an upside break does seem to be there. Should XAU/USD break above $1815 resistance, its clear air to the upside all the way back to the $1830 balance area, which would be the next target for the bulls.

Some analysts are surprised at how well gold has been able to hold up in recent weeks, despite rising US and global bond yields on increasingly hawkish central bank tightening bets (particularly with regards to the Fed and ECB). Case in point; despite last Thursday the ECB opening the door to 2022 rate hikes and last Friday strong US jobs report raising the risk of a 50bps first Fed hike in March, gold ended the week up nearly 1.0%.

“Gold's been a brilliant hedge this past month against falling stocks and rising bond yields so that's adding to the underlying positive case for gold right now” said analysts at Saxo Bank. “It's a combination of inflation obviously not being transitory ... (and) another issue that we cannot really ignore is the geopolitical risks that are currently in the market with regards to Russia and Ukraine,” they continue.

Looking ahead, the main challenge for gold this week, apart from a barrage of G7 central bank speakers, will be the US Consumer Price Inflation report for January. Typically, an upside surprise would be associated with lower gold prices as a more hawkish Fed policy outlook is priced in. With investors seemingly looking for inflation and equity/bond market downside protection, that might mean gold continues to outperform, even if US inflation surprises to the upside. For reference, the YoY rate of inflation is seen hitting 7.3% in January.

- A combination of factors prompted fresh selling around USD/JPY on Monday.

- A softer risk tone underpinned the safe-haven JPY and exerted some pressure.

- Retreating US bond yields weighed on the USD and added to the selling bias.

The USD/JPY pair continued losing ground through the mid-European session and dropped to a fresh daily low, below the key 115.00 psychological mark in the last hour.

The pair struggled to capitalize on last week's goodish rebound from the 114.15 area and met with a fresh supply on Monday, snapping two successive days of the winning streak. The prevalent cautious mood – as depicted by a weaker tone around the equity markets – benefitted the safe-haven Japanese yen and exerted some pressure on the USD/JPY pair. Bearish traders further took cues from retreating US Treasury bond yields, which undermined the US dollar.

That said, speculations for a larger Fed rate hike move at the March policy meeting – boosted by Friday's mostly upbeat US monthly jobs report – should act as a tailwind for the US bond yields. It is worth recalling that the headline NFP showed that the US economy added 467K jobs in January, surpassing consensus estimates pointing to a reading of 150K. Adding to this, the previous month’s reading was also revised sharply higher from 199K to 510K.

Moreover, Average Hourly Earnings posted a strong 0.7% MoM and 5.7% YoY growth during the reported month, which further lifted the market bets that the Fed will be more aggressive in raising rates to contain stubbornly high inflation. Hence, the market focus now shifts to the release of the US CPI report on Thursday. This will influence the near-term USD price dynamics and help determine the next leg of a directional move for the USD/JPY pair.

In the meantime, the US bond yields will drive the USD demand and provide some impetus amid absent relevant market-moving economic releases from the US. Apart from this, traders will take cues from the broader market risk sentiment to grab some short-term opportunities around the USD/JPY pair.

Technical levels to watch

UOB Group’s Economist Lee Sue Ann sees the ECB starting its hiking cycle in the next year.

Key Takeaways

“Despite record rises in inflation, the European Central Bank (ECB) kept key interest rates unchanged. It will, however, discontinue net asset purchases under the Pandemic Emergency Purchase Programme (PEPP).”