- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-10-2014

(raw materials / closing price /% change)

Light Crude 90.45 +0.12

Gold 1,207.20 -0.01%

(index / closing price / change items /% change)

Nikkei 225 15,890.95 +182.30 +1.16%

Hang Seng 23,315.04 +250.48 +1.09%

S&P/ASX 200 5,292.91 -25.30 -0.48%

Shanghai Composite 2,363.87 +6.16 +0.26%

FTSE 100 6,563.65 +35.74 +0.55%

CAC 40 4,286.52 +4.78 +0.11%

Xetra DAX 9,209.51 +13.83 +0.15%

S&P 500 1,964.82 -3.08 -0.16%

NASDAQ Composite 4,454.8 -20.82 -0.47%

Dow Jones 16,991.91 -17.78 -0.10%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2652 +1,10%

GBP/USD $1,6080 +0,68%

USD/CHF Chf0,9582 -0,97%

USD/JPY Y108,72 -0,95%

EUR/JPY Y137,56 +0,16%

GBP/JPY Y174,83 -0,25%

AUD/USD $0,8758 +0,96%

NZD/USD $0,7833 +0,87%

USD/CAD C$1,1137 -0,94%

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

03:00 Japan Bank of Japan Monetary Base Target 270 270

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:00 Japan BoJ Monetary Policy Statement

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50%

03:30 Australia RBA Rate Statement

05:00 Japan Leading Economic Index August 105.4 104.2

05:00 Japan Coincident Index August 109.9

06:00 Germany Industrial Production s.a. (MoM) August +1.9% -1.4%

06:00 Germany Industrial Production (YoY) August +2.5%

07:00 United Kingdom Halifax house price index September +0.1% +0.2%

07:00 United Kingdom Halifax house price index 3m Y/Y September +9,7%

07:00 Switzerland Foreign Currency Reserves September 453.8

07:15 Switzerland Retail Sales Y/Y August -0.6% +0.8%

07:15 Switzerland Consumer Price Index (MoM) September 0.0% +0.2%

07:15 Switzerland Consumer Price Index (YoY) September +0.1% 0.0%

07:30 Japan BOJ Press Conference

08:30 United Kingdom Industrial Production (MoM) August +0.5% 0.0%

08:30 United Kingdom Industrial Production (YoY) August +1.7% +2.6%

08:30 United Kingdom Manufacturing Production (MoM) August +0.3% +0.2%

08:30 United Kingdom Manufacturing Production (YoY) August +2.2% +3.4%

08:30 United Kingdom BOE Credit Conditions Survey

12:30 Canada Building Permits (MoM) August +11.8%

14:00 United Kingdom NIESR GDP Estimate September +0.6%

14:00 U.S. JOLTs Job Openings August 4673 4710

17:20 U.S. FOMC Member Narayana Kocherlakota

19:00 U.S. Consumer Credit August 26.0 20.3

19:00 U.S. FOMC Member Dudley Speak

20:30 U.S. API Crude Oil Inventories September -0.5

23:50 Japan Current Account (adjusted), bln August 99.3 190

Stock indices closed higher despite the weak economic data from the Eurozone. Markets were driven by Friday's U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008.

German factory orders declined 5.7% in August, beating expectations for a 2.4% decrease, after a 4.9% gain in July. July's figure was revised up from a 4.6% rise. That was the largest drop since 2009.

The Sentix investor confidence index for the Eurozone dropped to -13.7 in October from -9.8 in September. Analysts had expected the index to decline to -11.3.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,563.65 +35.74 +0.55%

DAX 9,209.51 +13.83 +0.15%

CAC 40 4,286.52 +4.78 +0.11%

The U.S. dollar traded lower against the most major currencies, but remained supported by Friday's U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008.

The euro traded higher against the U.S. dollar despite the weak economic data from the Eurozone. German factory orders declined 5.7% in August, beating expectations for a 2.4% decrease, after a 4.9% gain in July. July's figure was revised up from a 4.6% rise. That was the largest drop since 2009.

The Sentix investor confidence index for the Eurozone dropped to -13.7 in October from -9.8 in September. Analysts had expected the index to decline to -11.3.

The British pound traded higher against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar increased against the U.S. dollar after the better-than-expected Ivey purchasing managers' index for Canada. The Ivey purchasing managers' index climbed to 58.6 in September from 50.9 in August, exceeding expectations for a rise to 53.4.

The New Zealand dollar traded mixed against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading, the Aussie rose against the greenback.

ANZ job advertisements increased 0.9% in September, after a 1.6% gain in August. August's figure was revised up from a 1.5% rise.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports were released in Japan.

The cost of oil futures fell slightly today, due to the still high rate of the American currency and an abundance of oil in the world market.

It is worth emphasizing that the dollar is close to a four-year maximum to a basket of six major currencies. Experts expect that the Fed could start raising interest rates by mid-2015, based on the good performance of the labor market. Presented data on Friday showed that the number of jobs in the United States in September grew by 248,000 and the unemployment rate fell to 5.9 percent, the lowest level since July 2008.

"High volume production push down oil prices with a view to preserving the low demand for the weakening in global economic recovery," - said a senior resource analyst at Samsung Futures Inc. in Seoul, Hong Sung Ki.

Experts point out that in recent months the world's supply significantly exceeds demand, sparking speculation among traders that the Organization of Petroleum Exporting Countries will reduce production to keep prices high. New arguments in favor of this step may appear this week in the form of regular monthly reports US Energy Information Administration and OPEC is likely that they will again be lowered forecasts for global oil demand. Data released last week showed that the production of OPEC countries reached in September two-year high of 31 million barrels per day.

"I believe that the price of Brent dropped enough: $ 90 - this is the minimum price at which Saudi Arabia can keep public spending at current levels. For countries such as Iran and Russia, oil prices are already below the level needed to maintain government spending ", - said economist Mitsubishi Corp in Tokyo Tony Noonan. -" Despite all the geopolitical risks, the market is still too much oil. This continues the past six months but ahead of winter - high season. "

The cost of the November futures for the American light crude oil WTI (Light Sweet Crude Oil) fell to $ 89.43 a barrel on the New York Mercantile Exchange (NYMEX).

November futures price for North Sea Brent crude oil mixture fell $ 0.48 to $ 91.53 a barrel on the London exchange ICE Futures Europe.

Gold prices increased significantly today, while reaching a high of $ 1,200 an ounce, which was associated with the correction of the dollar the United States after a significant increase on Friday. Recall, better-than-expected employment data in the United States, published on Friday, the dollar strengthened and raised expectations about what the Federal Reserve System United States may raise interest rates, which will worsen the prospects for gold.

Traders said the growing demand in China is not happening. Recall Chinese markets will be closed due to a national holiday until Wednesday. Markets in Singapore, which are key trading center for gold in South-East Asia is also closed for the holiday. It is possible that a protest in Hong Kong led to a reduction in purchases of jewelry in the rest of China.

"Everyone's attention is largely drawn to the stock market than the gold market", "- said one of the traders in Shanghai on the market of precious metals. - "I believe that demand will grow only around the end of the year."

In India, the world's second largest consumer of gold, the demand on the eve of Diwali is growing moderately. This festival this year will be celebrated on 23 October. Normally a time of purchase of gold in India are the most active. At the same time, the weakening rupee negates the decrease in the international price of gold, and prices in India have hardly changed. India imports almost all of the gold consumed, and fluctuations in foreign currency exchange rates significantly affect the price of gold in the Indian market. Premiums for gold, recorded in the price of the metal in India, in addition to international prices, in the last two weeks have doubled to about $ 15 an ounce, reflecting the growth in demand. At the same time, the premium by about a quarter below the levels seen earlier this year.

Meanwhile, we add that, according to the Commission on the Commodity Futures Trading on Friday speculators cut their bullish bets for futures and options on gold to its lowest level since early January, and recorded on the 7th weekly fall.

The cost of the December gold futures on the COMEX today rose to 1201.00 dollars per ounce.

EUR/USD: $1.2525-30(E333mn), $1.2600(E881bn), $1.2650(E734mn), $1.2685-90(E600mn), $1.2700(E3.0bn)

USD/JPY: Y109.00($2.95bn), Y110.50($603mn)

EUR-YEN: Y137.30(1.8bn)

EUR/GBP: Stg0.7800(E290mn)

USD/CHF: Chf0.9400($570mn)

AUD/USD: $0.8700(A$378mn), $0.8775(A$757mn)

NZD/USD: $0.7950(NZ$440mn)

USD/CAD: C$1.1180($230mn), C$1.1200($400mn), C$1.1250($290mn)

U.S. stock-index futures advanced as Hewlett-Packard Co. rallied amid corporate deals.

Global markets:

Nikkei 15,890.95 +182.30 +1.16%

FTSE 6,574.45 +46.54 +0.71%

CAC 4,308.04 +26.30 +0.61%

DAX 9,301.8 +106.12 +1.15%

Crude oil $90.00 (+0.29%)

Gold $1196.30 (+0.28%)

(company / ticker / price / change, % / volume)

| The Coca-Cola Co | KO | 43.05 | +0.12% | 8.3K |

| Microsoft Corp | MSFT | 46.19 | +0.22% | 5.9K |

| Home Depot Inc | HD | 93.80 | +0.28% | 0.1K |

| AT&T Inc | T | 35.47 | +0.31% | 10.8K |

| Boeing Co | BA | 126.75 | +0.31% | 0.1K |

| General Electric Co | GE | 25.48 | +0.31% | 5.0K |

| Nike | NKE | 90.57 | +0.31% | 0.4K |

| Pfizer Inc | PFE | 29.32 | +0.34% | 5.5K |

| Intel Corp | INTC | 34.15 | +0.35% | 1.7K |

| Procter & Gamble Co | PG | 84.13 | +0.41% | 0.4K |

| Verizon Communications Inc | VZ | 49.92 | +0.42% | 2.7K |

| Exxon Mobil Corp | XOM | 94.33 | +0.44% | 1.1K |

| International Business Machines Co... | IBM | 189.50 | +0.44% | 0.2K |

| Caterpillar Inc | CAT | 97.83 | +0.45% | 0.1K |

| Walt Disney Co | DIS | 88.86 | +0.46% | 1.9K |

| Goldman Sachs | GS | 189.00 | +0.49% | 4.4K |

| Merck & Co Inc | MRK | 60.22 | +0.53% | 3.2K |

| Johnson & Johnson | JNJ | 105.74 | +0.58% | 0.3K |

| JPMorgan Chase and Co | JPM | 60.69 | +0.65% | 2.2K |

| Cisco Systems Inc | CSCO | 25.51 | +0.79% | 14.0K |

| McDonald's Corp | MCD | 94.32 | -0.57% | 6.5K |

| 3M Co | MMM | 139.00 | -0.83% | 0.4K |

Upgrades:

Downgrades:

McDonald's (MCD) downgraded to Equal-Weight from Overweight at Morgan Stanley

Other:

FedEx (FDX) target raised from $169 to $175 at Argus

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

00:30 Australia ANZ Job Advertisements (MoM) September +1.5% +0.9%

06:00 Germany Factory Orders s.a. (MoM) August +4.6% -2.4% -5.7%

06:00 Germany Factory Orders n.s.a. (YoY) August +4.9% -1.3%

08:30 Eurozone Sentix Investor Confidence October -9.8 -11.3 -13.7

The U.S. dollar traded lower against the most major currencies, but remained supported by Friday's U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August. August's figure was revised up from 142,000 jobs.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008. Analysts had expected the unemployment rate to remain unchanged at 6.1%.

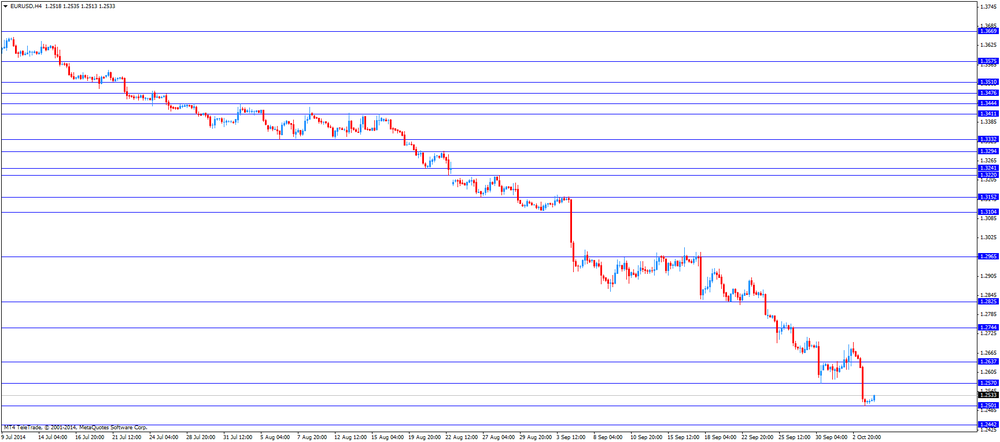

The euro traded higher against the U.S. dollar despite the weak economic data from the Eurozone. German factory orders declined 5.7% in August, beating expectations for a 2.4% decrease, after a 4.9% gain in July. July's figure was revised up from a 4.6% rise. That was the largest drop since 2009.

The Sentix investor confidence index for the Eurozone dropped to -13.7 in October from -9.8 in September. Analysts had expected the index to decline to -11.3.

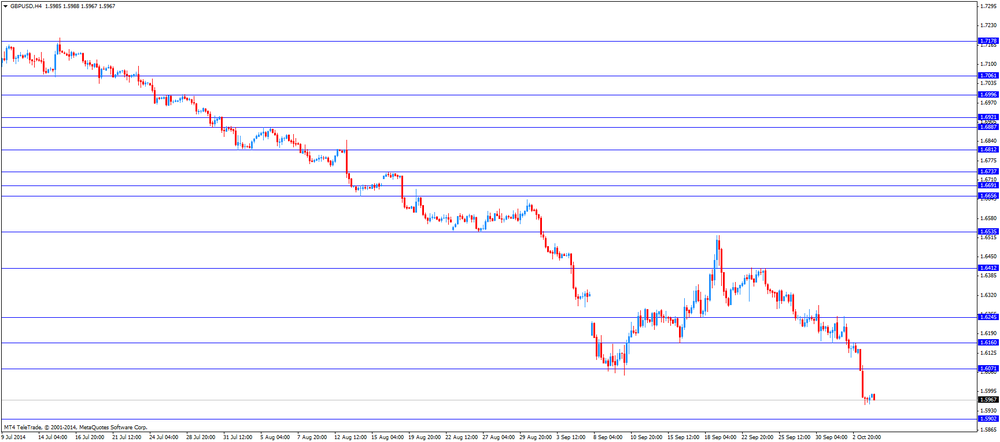

The British pound traded higher against the U.S. dollar in the absence of any major economic data from the U.K.

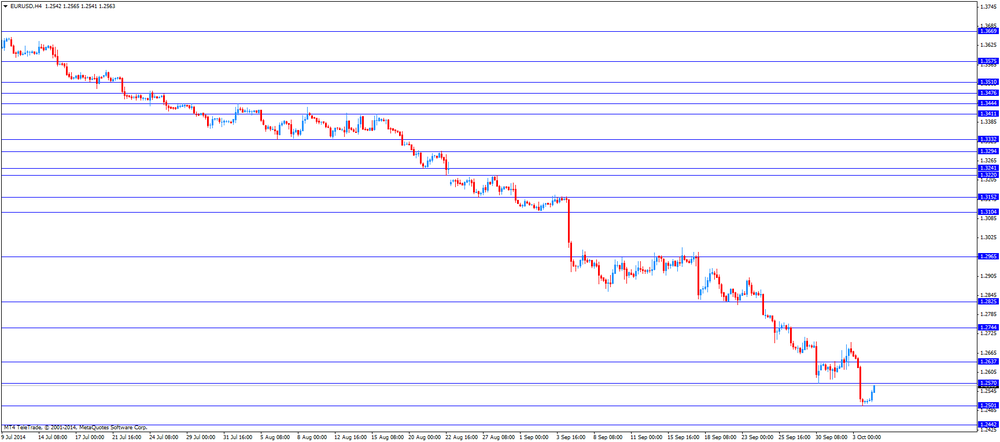

EUR/USD: the currency pair increased to $1.2565

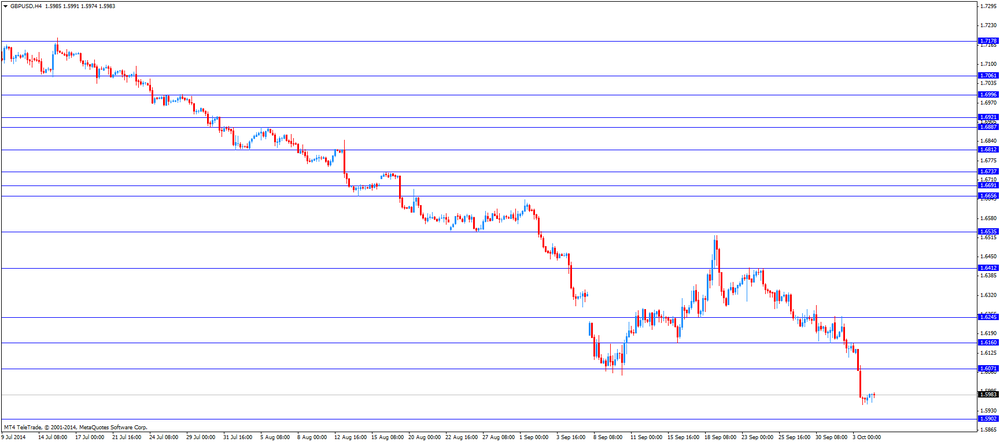

GBP/USD: the currency pair rose to $1.5991

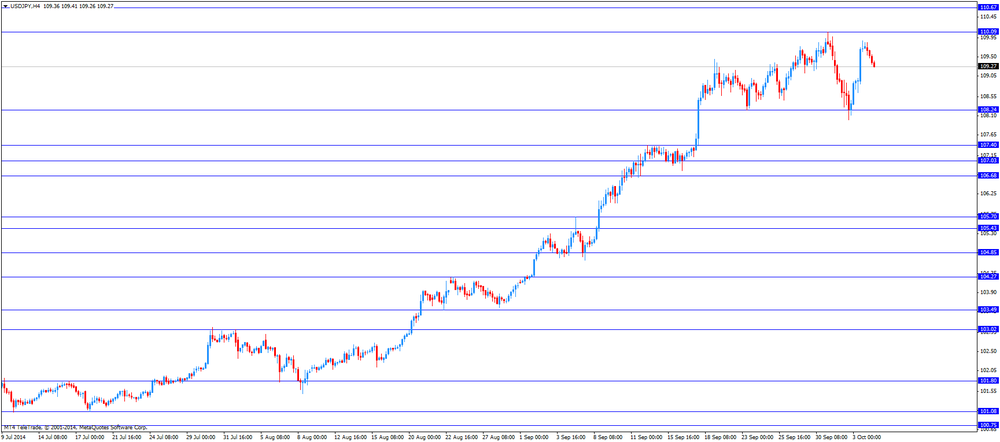

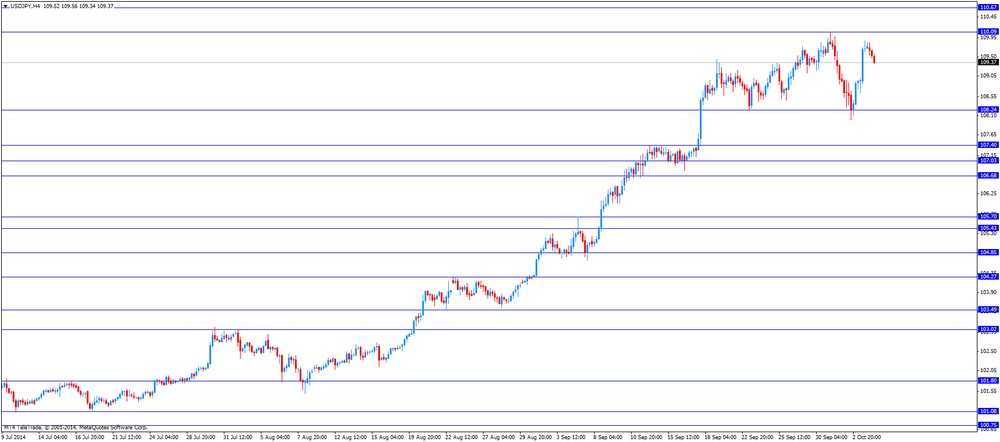

USD/JPY: the currency pair declined to Y109.26

The most important news that are expected (GMT0):

14:00 Canada Ivey Purchasing Managers Index September 50.9 53.4

21:00 New Zealand NZIER Business Confidence Quarter III 32

Stock indices traded higher, still supported by Friday's U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008.

German factory orders declined 5.7% in August, beating expectations for a 2.4% decrease, after a 4.9% gain in July. July's figure was revised up from a 4.6% rise. That was the largest drop since 2009.

The Sentix investor confidence index for the Eurozone dropped to -13.7 in October from -9.8 in September. Analysts had expected the index to decline to -11.3.

Current figures:

Name Price Change Change %

FTSE 6,551.72 +23.81 +0.36%

DAX 9,267.42 +71.74 +0.78%

CAC 40 4,288.84 +7.10 +0.17%

Asian stock indices closed higher due to Friday's better-than-expected U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August. August's figure was revised up from 142,000 jobs.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008. Analysts had expected the unemployment rate to remain unchanged at 6.1%.

Hong Kong stocks were driven by gains of casinos and property developers.

Markets in Shanghai are closed until October 7 for a public holiday.

Indexes on the close:

Nikkei 225 15,890.95 +182.30 +1.16%

Hang Seng 23,315.04 +250.48 +1.09%

Shanghai Composite closed

EUR/USD: $1.2525-30(E333mn), $1.2600(E881bn), $1.2650(E734mn), $1.2685-90(E600mn), $1.2700(E3.0bn)

USD/JPY: Y109.00($2.95bn), Y110.50($603mn)

EUR-YEN: Y137.30(1.8bn)

EUR/GBP: Stg0.7800(E290mn)

USD/CHF: Chf0.9400($570mn)

AUD/USD: $0.8700(A$378mn), $0.8775(A$757mn)

NZD/USD: $0.7950(NZ$440mn)

USD/CAD: C$1.1180($230mn), C$1.1200($400mn), C$1.1250($290mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

00:30 Australia ANZ Job Advertisements (MoM) September +1.5% +0.9%

06:00 Germany Factory Orders s.a. (MoM) August +4.6% -2.4% -5.7%

06:00 Germany Factory Orders n.s.a. (YoY) August +4.9% -1.3%

08:30 Eurozone Sentix Investor Confidence October -9.8 -11.3 -13.7

The U.S. dollar traded lower against the most major currencies, but remained supported by Friday's U.S. labour market data. The economy in the U.S. added 248,000 jobs in September, exceeding expectations for 216,000 jobs, after 180,000 jobs in August. August's figure was revised up from 142,000 jobs.

The unemployment rate dropped to 5.9% in September from 6.1% in August. That was the lowest level since July 2008. Analysts had expected the unemployment rate to remain unchanged at 6.1%.

The New Zealand dollar traded slightly higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

The strength of the greenback and the suspension of some Fonterra's milk powder products by Sri Lanka's health ministry weighed on the kiwi.

The Australian dollar traded higher against the U.S. dollar. ANZ job advertisements increased 0.9% in September, after a 1.6% gain in August. August's figure was revised up from a 1.5% rise.

The Japanese yen increased against the U.S. dollar in the absence of any major economic reports were released in Japan.

EUR/USD: the currency pair rose to $1.2523

GBP/USD: the currency pair increased to $1.5988

USD/JPY: the currency pair fell to Y109.48

The most important news that are expected (GMT0):

14:00 Canada Ivey Purchasing Managers Index September 50.9 53.4

21:00 New Zealand NZIER Business Confidence Quarter III 32

EUR / USD

Resistance levels (open interest**, contracts)

$1.2708 (1467)

$1.2648 (640)

$1.2603 (264)

Price at time of writing this review: $ 1.2519

Support levels (open interest**, contracts):

$1.2457 (1724)

$1.2417 (2734)

$1.2391 (4357)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 41763 contracts, with the maximum number of contracts with strike price $1,2900 (4755);

- Overall open interest on the PUT options with the expiration date November, 7 is 43951 contracts, with the maximum number of contracts with strike price $1,2500 (4357);

- The ratio of PUT/CALL was 1.05 versus 0.92 from the previous trading day according to data from October, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.6204 (469)

$1.6107 (472)

$1.6011 (178)

Price at time of writing this review: $1.5984

Support levels (open interest**, contracts):

$1.5889 (735)

$1.5793 (1177)

$1.5695 (898)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 18269 contracts, with the maximum number of contracts with strike price $1,6750 (1885);

- Overall open interest on the PUT options with the expiration date November, 7 is 26347 contracts, with the maximum number of contracts with strike price $1,5400 (1944);

- The ratio of PUT/CALL was 1.44 versus 1.20 from the previous trading day according to data from October, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.