- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-07-2011

Leaks under $1.4300 and trading now within 10 pips of the morning low at $1.4285 where Asian sovereign demand was cited as underpinning. Talk earlier was of bids at $1.4280/85 area and we've since heard more at $1.4260, though some may be betting that the Asian sovereigns may not be around still.

Stocks have extended their move up from morning lows, but they remain mixed overall. For two straight sessions the broad market has lacked leadership.

Consumer staples stocks are today's best performers, as a group. The sector, which carries little overall market weight, is up 0.4%. Dow component Procter & Gamble (PG 6470, +0.44) has been a primary leader in its space.

Financials have been a steady drag on trade for the past two days. The sector's 1.1% loss is worse than any other major sector, although telecom isn't in much better shape as the group grapples with a 1.0% loss of its own.

However, given that the level of the non-manufacturing index has not fallen below its April levels, we see the report as broadly consistent with other signs of stabilization in US growth."

Stops triggered on the break below $1.5970, takes rate on to extended lows of $1.5955. Bids now seen from $1.5950 and extend toward $1.5935. Break under to target June lows $1.5910.

As they were in the prior session, the major equity averages are mixed this morning. There continues to be a lack of leadership, too.

Financials remain a source of weakness, though. The sector has already fallen to a 1% loss. Banks and diversified financial services outfits like JPMorgan Chase (JPM 40.35, -0.68) and Bank of America (BAC 10.73, -0.27) have been heavy drags in early action.

U.S. stocks were headed for a lower open Wednesday, as investors digested another interest rate hike in China, and remained on edge ahead of key jobs data due later in the week.

China's central bank lifted interest rates Wednesday for the fifth time since October in an effort to combat inflation. The People's Bank of China said Tuesday that it will raise its one-year lending rate by a quarter percentage point to 6.56%.

China's incremental tightening has sparked fears that the government could squelch growth too much, causing the economy to crash land.

Economists are expecting the report to show 120,000 jobs added to payrolls. Typically, the economy needs to add about 150,000 just to keep pace with population growth.

U.S. stocks ended little changed Tuesday, as investors took a step back after last week's stellar gains and remain wary about Europe's financial future. The Dow and S&P snapped a five-day winning streak.

Moody's Investors Service downgraded the government debt of Portugal on Tuesday, saying it's another European nation that could require a bailout.

Economy: The number of planned job cuts rose 11.6% in June to 41,432 from May's 37,135, according to outplacement consulting firm Challenger, Gray & Christmas.

The Institute for Supply Management will put out its June services index after trading begins. Economists are looking for the ISM services index to fall to 54, from 54.6 in May -- a level which would still indicate expansion in the sector.

World markets:

Oil for August delivery slipped 75 cents to $96.13 a barrel.

Gold futures for August delivery dropped $1.60 to $1,511.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.1% from 3.14% late Tuesday.

The euro weakened against all but two of its 16 major peers tracked by Bloomberg after Moody’s Investors Service cut Portugal’s credit rating to junk status, stoking speculation the nation will need a second bailout.

The 17-nation common currency slipped for a second day versus the dollar and yen as investors and government officials struggle to devise a role for creditors in a bailout of Greece without triggering a default. The Swiss franc, a traditional haven from financial turmoil, rose against the euro.

“The market doesn’t really know where the euro is going to be in a year’s time because it has no idea how the euro zone is going to navigate its way through the crisis,” said Neil Mellor, a currency strategist at Bank of New York Mellon Corp. in London. “It will be choppy because there’s greater uncertainty now than there has been for a long time.”

Moody’s lowered Portugal’s long-term government bond ratings to Ba2 from Baa1. The reductions stem partly from “the growing risk that Portugal will require a second round of official financing before it can return to the private market,” Moody’s said in a statement yesterday.

EUR/USD printed session high on $1.4464 before slept on semi official sales to $1.4300.

GBP/USD fell back to $1.6000.

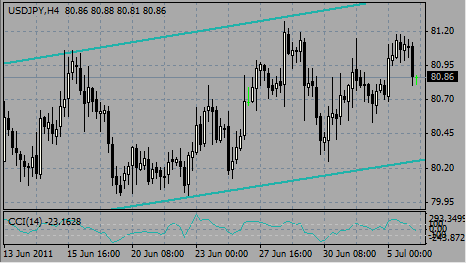

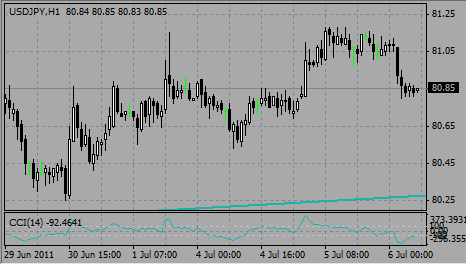

USD/JPY tries to recover, but trades quite tight at Y80.95, above recent lows on Y80.80.

US data start at 14:00 GMT with ISM Non-mfg PMI for June.

The rate extends losses to $1.0655 and through key support $1.0670. Euro-dollar stops triggered through $1.4330 continue to weigh down the pair. Support seen at $1.0650, ahead of $1.0610/00.

- Moody's move on Portugal fuels speculation;

- Portugal should stick with current fiscal plan

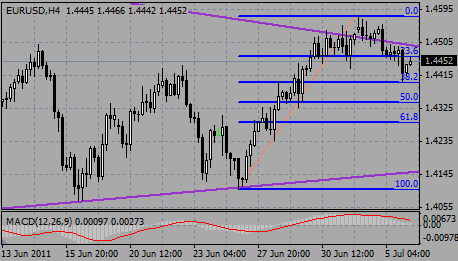

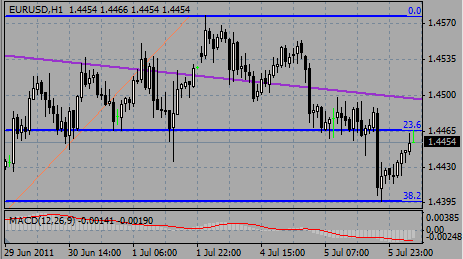

The rate test the zone of demand between $1.4350/35. A break of $1.4335/30 (50% of the resent rebound from $1.4100) expected to add to downside momentum and open a move toward $1.4325/20 ahead of $1.4280 (61.8%).

AUD/USD remains under pressure, holding around $1.0688 after it failed to break above $1.0700. Support at $1.0670/60. Break below opens the way to $1.0610/00. If rise resumes stops may cap at $1.0740, then - around $1.0790/95.

- further strong euro wouldn't hurt German export sector;

- German exports won't be hit markedly by weaker global economy;

- Germany deficit of 1.7%/GDP in 2011, 0.9% in 2012;

- Germany CPI of 2.4% in 2011, 1.8% in 2012;

- if no haircut on Greek public debt, Greece will collapse.

EUR/USD: $1.4500, $1.4475, $1.4450, $1.4300, $1.4250

USD/JPY: Y81.00, Y80.25, Y79.90

GBP/USD: $1.6200

EUR/GBP: stg0.8980

AUD/USD: $1.0750, $1.0680, $1.0675

Data released:

05:00 Japan Leading indicators composite index (May) preliminary 99.8 99.8 96.2

05:00 Japan Coincident indicators composite index (May) preliminary 106.0 - 103.6

The dollar weakened Wednesday on speculation the U.S. jobless rate will remain elevated, delaying any tightening in monetary policy by the Federal Reserve.

The greenback fell as economists said figures this week will show U.S. employers hired 100,000 workers last month, after adding 54,000 in May. The jobless rate held at 9.1%, the analysts predicted. Payroll increases of around 200,000 a month are needed for a sustained decline in the unemployment rate.

“We’re likely to see the dollar weak until we get the Fed indicating it needs to tighten,” said Joseph Capurso, a currency strategist at Commonwealth Bank of Australia. “The fundamentals of interest-rate differentials remain crucial to currency directions.”

Demand for the euro was limited before Greek bondholders meet with officials in Paris today to discuss their role in a second rescue for the debt-stricken nation.

“So many stakeholders are involved in Europe’s debt crisis, such as an international entity, a central bank, private financial firms, rating companies and policy makers,” said Daisaku Ueno, president of Gaitame.com Research Institute Ltd.. “We don’t know who will say what, or when. The euro can’t be on an uptrend.”

Moody’s Investors Service yesterday cut Portugal’s long- term government bond ratings to Ba2, two levels below investment grade.

The ECB will probably increase its main refinancing rate to 1.50% tomorrow from 1.25%.

EUR/USD printed session high on $1.4464 before slept on semi official sales to $1.4358. Now rate tries to recover.

GBP/USD tested strong support at $1.6100 before it was back to $1.6021.

USD/JPY tries to recover, but trades quite tight at Y80.95, above recent lows on Y80.80.

In Europe today's focus will be on final EU GDP (Q1) reading with no changes expected (09:00 GMT). Later (at 10:00 GMT) Germany is due to report on manufacturing orders for May.

US data start at 14:00 GMT with ISM Non-mfg PMI for June.

EUR/GBP continues to correct from early Europe highs of stg0.9010 and currently tests overnight lows at stg0.8977. Demand interest seen

in the area between stg0.8980/70, a break to open a deeper move toward stg0.8955/50.

GBP/USD challenged $1.6000 before retreated to current $1.6010. A break here to expose demand placed from $1.5990 and extending to $1.5970, with retail interest noted within between $1.5985/70. Stops noted on a break below.

EUR/USD falls to around $1.4400/05 after it earlier rose in Europe to $1.4465. But offers from semi official names capped the rally. Bids mentioned at $1.4395/90. Further demand noted at $1.4375/70 ahead of stronger area between $1.4350/35.

Majors close:

Nikkei 225 +7.37 +0.07% 9,972.46

FTSE 100 +6.49 +0.11% 6,024.03

CAC 40 -24.28 -0.61% 3,978.83

DAX -3.52 -0.05% 7,439.44

Dow -12.98 -0.10% 12,570

Nasdaq +9.74 +0.35% 2,826

S&P 500 -1.79 -0.13% 1,338

10 Year Yield 3.14% -0.06 --

Oil $96.91 +0.02 +0.02%

Gold $1,515.70 +3.00 +0.20%

Japanese stocks advanced for a sixth day (the longest winning streak for the Nikkei 225 since the country’s March earthquake and tsunami), as Tokyo Electric Power Co. advanced.

Tokyo Electric climbed 5.1% after the utility said a self-contained cooling system is now running properly at its crippled nuclear plant.

Bank of Yokohama Ltd. rose 1.5% after Nomura Holdings Inc. raised the lender’s rating, saying it was oversold after the March 11 disaster.

Askul Corp., meanwhile, tumbled 8.3% after posting a loss because of damage to inventory and warehousing.

The Nikkei 225 rose in the past five trading days amid optimism Greece will avoid default. Stocks have risen as companies including Toyota Motor Corp. said supply chains are recovering more quickly than anticipated from Japan’s disaster.

European stocks were little changed, after the benchmark Stoxx Europe 600 Index posted six days of gains.

Celesio AG (CLS1), Europe’s biggest drug wholesaler, surged 2.8% after analysts raised their recommendation on the stock.

CSM (CSM) NV slumped more than 7%, its largest drop in 2 1/2 years, after saying first-half earnings will decline because of higher raw-material costs.

The Stoxx 600 surged 4.4% during the previous six trading days after Greek lawmakers passed a five-year austerity package, qualifying the country for further aid. The measure still slipped 1.1% in the second quarter on concern that Greece will fail to repay all its debt.

Standard & Poor’s and Fitch Ratings may enable European Central Bank President Jean-Claude Trichet to support a private investor rollover of Greek debt by saying a default rating would be partial and temporary.

Trichet put Greece’s fate in the hands of ratings companies when bank officials began saying in May that the ECB, which has lent 98 billion euros ($142 billion) to Greek banks, would refuse to accept the nation’s bonds as collateral if any “burden sharing” by private investors produced a default rating.

U.S. stocks ended little changed Tuesday, as investors took a step back after last week's stellar gains and remain wary about Europe's financial future.

Hewlett Packard (HPQ, Fortune 500) and financial leaders JPMorgan Chase (JPM, Fortune 500) and Bank of America (BAC, Fortune 500) were among the biggest laggards. Chevron (CVX, Fortune 500), Walt Disney (DIS, Fortune 500) and IBM (IBM, Fortune 500) posted the biggest gains.

Netflix's (NFLX) stock was the best performing stock on both the S&P and Nasdaq indexes. Shares jumped 8% to all-time highs after the company said it is expanding its streaming services to 43 counties in Latin America and the Caribbean later this year.

Economy: The Commerce Department said factory orders rose 0.8% in May, after falling 0.9% in April. Economists were expecting orders to edge up 1%.

Companies: Shares of China's top search engine Baidu (BIDU) rose 1.8% after it reportedly signed a deal with Microsoft (MSFT, Fortune 500) to provide English-language search results in China.

Baidu's main rival, Google (GOOG, Fortune 500), has failed to gain traction in the Chinese market.

Japan's benchmark stock indices ended Wednesday's session higher, rising for the 7th straight day in a row. Index closed well above the

10,000 level for the first time in 2 month, up 110.02 points, or 1.10%, to 10,082.48. The broader-based TOPIX was up 7.65 points at 872.53.

Analysts suggest a 2.5 million barrel draw in U.S. Crude Oil Stocks for the week ending July 1 2011:

- Crude oil stocks down 2.5 million barrels;

- Gasoline stocks up 500,000 barrels;

- Distillates stocks up 1.1 million barrels.

The API is scheduled for release at 20:30 GMT today with The US Department of Energy's weekly oil statistics is due to come at 14:30 GMT on Thursday.

Data released:

03:30 Australia RBA meeting announcement 4.75% 4.75% 4.75%

07:45 Italy PMI services (June) 47.4 49.4 50.1

07:50 France PMI services (June) 56.1 56.7 62.5

07:55 Germany PMI services (June) seasonally adjusted 56.7 58.3 56.1

08:00 EU(17) PMI services (June) 53.7 54.2 56.0

08:30 UK CIPS services index (June) 53.9 53.5 53.8

09:00 EU(17) Retail sales (May) adjusted -1.1% -1.0% 0.9%

09:00 EU(17) Retail sales (May) adjusted Y/Y -1.9% -0.6% 1.1%

12:55 USA Redbook (02.07)

14:00 USA Factory orders (May) 0.8% 1.0% -0.9 (-1.2)%

The US currency advanced Tuesday on speculation China’s efforts to tame inflation will cool growth and damp demand for riskier assets.

The euro dropped for the first time in seven days versus the greenback after Moody’s Investors Service said banks rolling over Greek bonds into new securities may incur impairment charges.

The pound strengthened against the euro and the dollar after a report showed a measure of U.K. service PMI exceeded economists’ forecasts in June

A gauge of U.K. services growth based on a survey of companies rose to 53.9 from 53.8 in May. The median forecast was for a decline to 53.5.

The pound has slumped this year as Conservative Prime Minister David Cameron’s austerity measures to shrink the budget deficit crimp growth and inflation squeezes incomes at the fastest pace since the 1970s. Efforts to eliminate the bulk of the fiscal shortfall by 2015 involve the deepest spending cuts since World War II and more than 300,000 state-employee job losses.

The Bank of England will keep its main rate unchanged at 0.5% on July 7. Investors are betting the central bank won’t raise borrowing costs until after next May.

The Australian dollar weakened against the greenback after the South Pacific nation’s central bank left borrowing costs unchanged. The Reserve Bank of Australia kept its cash rate target at 4.75% for a seventh straight meeting as signs of slower growth from Europe to China dimmed prospects for an acceleration in hiring at home.

EUR/USD fell to $1.4400 after long-lasting consolidation between $1.4460/00.

GBP/USD rose sharply from session lows around $1.5990 to $1.6030 before retreated to $1.6035.

USD/JPY rose from Y80.70 to Y81.30 before set stable around Y80.90/20.

In Europe today's focus will be on final EU GDP (Q1) reading with no changes expected (09:00 GMT). Later (at 10:00 GMT) Germany is due to report on manufacturing orders for May.

US data start at 14:00 GMT with ISM Non-mfg PMI for June.

Resistance 2: Y81.80

Resistance 1: Y81.20

Current price: Y80.85

Support 3: Y80.00

Nikkei 225 +7.37 +0.07% 9,972.46

FTSE 100 +6.49 +0.11% 6,024.03

CAC 40 -24.28 -0.61% 3,978.83

DAX -3.52 -0.05% 7,439.44

Dow -12.98 -0.10% 12,570

Nasdaq +9.74 +0.35% 2,826

S&P 500 -1.79 -0.13% 1,338

10 Year Yield 3.14% -0.06 --

Oil $96.91 +0.02 +0.02%

Gold $1,515.70 +3.00 +0.20%

Resistance 1: Chf0.8420

Current price: Chf0.8408

Support 1: Chf0.8380

Support 2: Chf0.8250

Support 3: Chf0.7970

Comments: Rate under pressure again after it tested stron support at $1.4400 (38.2% Fibo of $1.4105 - $1.4580 rise) yesterday. In Asia euro challenged resistance at $1.4470 (23.6%). Back above will extend the recovery to $1.4500 (recent highs), and then - $1.4580 (Jul'04 high). As to the downside, break below $1.4400 opens the way to support at $1.4340 (50%) and then - to $1.4230 (Jun'28 lows).

05:00 Japan Leading indicators composite index (May) preliminary 99.8 96.2

05:00 Japan Coincident indicators composite index (May) preliminary - 103.6

09:00 EU(17) GDP (Q1) final 0.8% 0.8%

09:00 EU(17) GDP (Q1) final Y/Y 2.5% 2.5%

10:00 Germany Manufacturing orders (May) seasonally adjusted -0.1% 2.8%

10:00 Germany Manufacturing orders (May) not seasonally adjusted, workday adjusted Y/Y 10.0% 10.5%

14:00 USA ISM Non-mfg PMI (June) 54.0 54.6

14:00 USA ISM Non-mfg business index (June) - 53.6

23:50 Japan Machinery orders core (May) adjusted 3.0% -3.3%

23:50 Japan Machinery orders core (May) unadjusted Y/Y 10.8% -0.2%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.