- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-04-2022

- XAU/USD is oscillating in a range of $1,915.22-1,949.86 despite the hawkish FOMC minutes.

- Fresh sanctions imposed on Russia by the US will escalate the financial shock on Moscow.

- FOMC minutes advocate one or more 50 bps interest rate hikes this year.

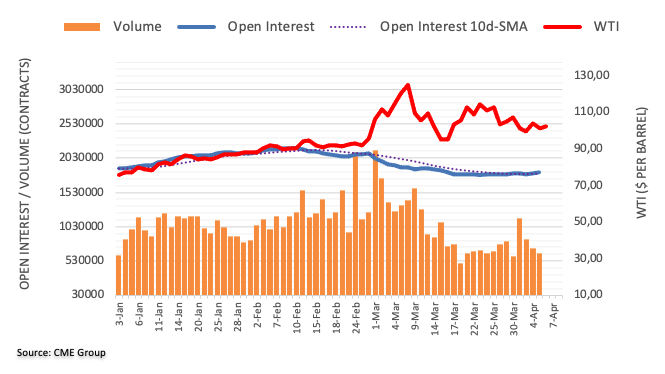

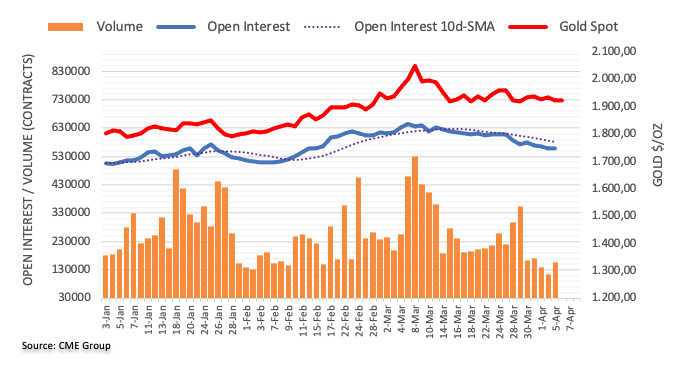

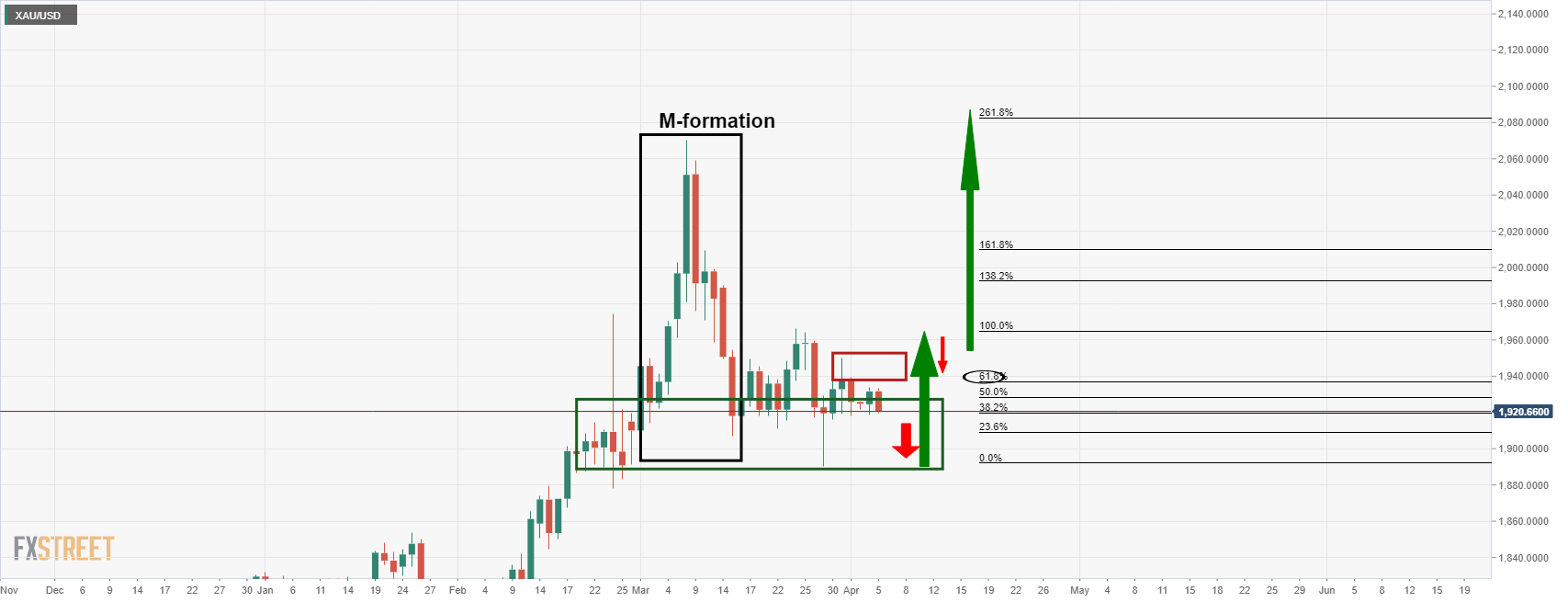

Gold (XAU/USD) has been witnessing a lackluster performance over the last six trading sessions. The precious metal is displaying back and forth moves in a range of $1,915.22-1,949.86. It is worth noting that the release of the Federal Open Market Committee (FOMC) minutes and speeches from various Federal Reserve (Fed) policymakers this week have failed to put any substantial impact on gold prices.

The minutes that have received much attention from the FOMC in March is the expectation of one more interest rate hike by 50 basis points (bps) this year. Apart from that, the rapid pace at which the Fed will augment the balance sheet reduction is one of the major highlights. Fed policymakers are majorly agreed on monthly caps of about $60B for Treasury securities, and $35B for mortgage-backed securities (MBs).

Meanwhile, Philadelphia Fed President and FOMC member Patrick Harker in his speech on Wednesday has indicated that restoration in the interest rates is likely that will bring the lending rate back to neutral at 2.5%.

The mighty US dollar index (DXY) is aiming to tap the psychological resistance of 100.00 amid fresh sanctions on Russia by the US administration, which has triggered the negative market sentiment. The US has imposed full blocking sanctions on Russia's Sberbank and Alfa Bank, which will dramatically escalate the financial shock on Moscow as these giants of the latter holds more than one-third assets of Russia

Gold Technical Analysis

On an hourly scale, XAU/USD is juggling in a range of $1,915.22-1,949.86 over the past few trading sessions. The precious metal has established below 200-period Exponential Moving Average (EMA) at $1,930.00, which adds to the downside filters. Meanwhile, the Relative Strength Index (RSI) is oscillating in a 40.00-60.00 range, which advocates a consolidation ahead.

Gold hourly chart

-637848857776738135.png)

An IMF report states that the Bank of Japan must maintain an ultra-easy policy for a prolonged period despite higher commodity prices, and a rebound in consumption.

Key notes

- BoJ 'expressed concern' over IMF's recommendation to target shorter yields under yield curve control.

- IMF's article 4 staff report: escalation of Ukraine conflict poses significant downside risks to japan's economy.

- Cuts Japan's 2022 economic growth forecast to 2.4%, down from 3.3% projected in January.

Meanwhile, the Bank of Japan (BOJ) Governor Haruhiko Kuroda said earlier this week that the yen's recent moves were "somewhat rapid", joining a chorus of policymakers who have warned that sharp falls in the currency could hurt the country's import-reliant economy.

USD/JPY is moving in on the highest levels since 2015 and last months highs of 114.64.

- The EUR/JPY pair consolidates in the 134.20-135.50 range on downbeat sentiment.

- EUR/JPY Price Forecast: Trapped within the 134.50-135.45 range amidst the lack of a catalyst.

EUR/JPY is subdued as the Asian Pacific session begins, within Wednesday’s 134.70/135.45 range, amidst a dismal sentiment, courtesy of continuing Ukraine-Russia hostilities and global central bank tightening. At the time of writing, the EUR/JPY is trading at 134.99.

On Wednesday, the EUR/JPY opened near the day’s lows and seesawed near the 50-hour simple moving average (SMA) around 134.80s. EUR/JPY bulls entered the market in the European session and lifted the pair above the 135.00 mark, but the Fed’s March minutes increased risk-aversion, dragging the cross-currency down towards current levels.

EUR/JPY Price Forecast: Technical outlook

After reaching a YTD high at 137.54, the EUR/JPY slid almost 300 pips in three consecutive days. Since then, the EUR/JPY has been range-bound in the 134.50-135.45 range, unable to break upwards/downwards of its boundaries. Nevertheless, the Relative Strength Index (RSI) at 60.98 exited overbought conditions on March 30, when the pair fell from 136.84 to 134.60 and has enough room to spare in the case that EUR bulls aim to push prices higher.

Upwards, the EUR/JPY’s first resistance would be 135.00. A decisive break would expose 135.45, followed by the 136.00 mark. On the flip side, the EUR/JPY first support would be 134.50. Breach of the latter would expose April 5 daily low at 134.29, followed by the psychological 134.00 level.

Technical levels to watch

- The DXY is marching towards 100.00 as the hawkish stance of the FOMC minutes has improved safe-haven appeal.

- Balance sheet reduction is likely to remain at an elevated pace.

- US administration has imposed full blocking sanctions on Russia’s giant banks.

The US dollar index (DXY) is heading towards the psychological figure of 100.00 on tailwinds of negative market sentiment as the Federal Open Market Committee (FOMC) minutes have heightened the odds of an aggressive tightening monetary policy by the Federal Reserve (Fed) in May. The dictation of the FOMC minutes clears that the market participants should start bracing one or more 50 basis points (bps) interest rate hikes announcement by the Fed this year. Also, the size reduction of the balance sheet will be done at a rapid pace to contain inflation. Considering the extent of reduction in the balance sheet, Fed policymakers majorly agreed on monthly caps of about $60B for Treasury securities, and $35B for mortgage-backed securities (MBS).

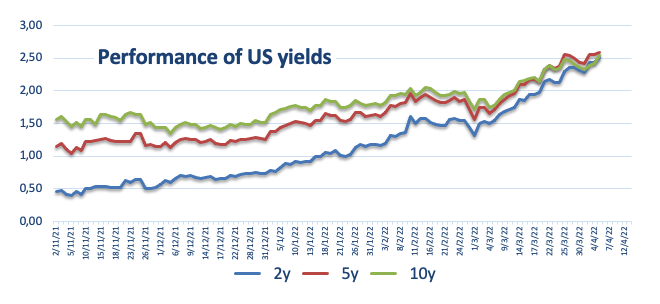

US Treasury Yields

The 10-year benchmark US Treasury yields retreated from the highs of 2.66%, which indicates that investors have already discounted the hawkish stance of the FOMC minutes. While the 2-year US Treasury yields that are more sensitive to the interest rates have faced more heat. There is no denying the fact that the rising expectations of a jumbo rate elevation by the Fed in May have underpinned the risk-off impulse.

The US escalates financial shock on Russia

The US administration on Wednesday announced that it is dramatically elevating the financial shock for Russia. The former has imposed full blocking sanctions on Russia's Sberbank and Alfa Bank, which holds more than one-third of Russia's total banking assets.

DXY Technical Analysis

On the daily scale, the DXY has exploded from its previous consolidation, which remained in a range of 97.73-99.42 in March. The 20- and 50-period Exponential Moving Averages (EMAs) at 98.70 and 97.83 respectively are scaling higher, which adds to the upside filters. Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bullish range of 60.00-80.00.

DXY daily chart

-637848827282860149.png)

- The AUD/JPY failure at 94.00 left the pair adrift to solid selling pressure.

- In March, China’s PMIs dropped below the 50-mark, indicating that its economy is slowing.

- AUD/JPY Price Forecast: A double-top and negative divergence between price action-RSI threaten to push the pair towards 87.00.

The Australian dollar gave back Tuesday’s gains amidst a risk-aversion environment in the financial markets as global equities fell while safe-haven peers rebounded. Also, the drop in China’s PMIs under the 50-expansion/contraction line signals that the second-largest economy is slowing as it goes through another Covid-19 outbreak. At the time of writing, the AUD/JPY is trading at 93.13.

Risk-aversion and weak China data threaten to slow the global economy

US equities closed in the red as the Federal Reserve hinted in its March minutes that Quantitative Tightening (QT) would start by May and reduce its balance sheet by $95 billion a month. Furthermore, the FOMC minutes signaled that most participants were looking for a 50 bps rate hike to the Federal Funds Rate, but the Russian invasion of Ukraine kept them from doing it so.

On Wednesday’s Asian session, China’s Caixin Services PMI for March came at 42.0, lower than the 53 estimated, and trailed February’s 50.2 reading. The services sector contracted on the recent Covid-19 outbreak, which spurred lockdown measures, falling at the quickest rate since February 2020.

The Australian economic docket would reveal February’s Balance of Trade, expected to rose by a A$12 B surplus. Also, Building Permits for February, estimated at 43.5%, would offer some impetus to AUD/JPY traders. Coincident Index and Leading Economic Index for February will be featured on the Japanese economic docket.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY is upward biased, but failure at 94.00 exposed the pair to selling pressure. Additionally, momentum indicators like the Relative Strength Index (RSI) at 72.05 made a successive series of lower highs, contrarily to AUD/JPY price action, with subsequent series of “quasi” same highs, forming a “double-top” chart pattern. Moreover, a negative divergence between price action and RSI would send the pair lower.

The AUD/JPY first support would be 92.26. A decisive break would expose the 91.00 mark, followed by the “double-top” neckline at 90.76.

- USD/CHF is juggling in a range of 0.9304-0.9344 after a firmer upside move on the release of the FOMC minutes.

- FOMC indicates one or more 50 bps interest rate hikes by the Fed.

- Swiss Unemployment Rate is seen at 2.2%, identical to its previous figure.

The USD/CHF pair is oscillating in a narrow range of 0.9304-0.9344 after a strong upside move from the March 31 low to near 0.9200. The pair have remained in positive territory amid rising expectations of a 50 basis point (bps) interest rate hike by the Federal Reserve (Fed).

Fed policymakers are continuously hinting that investors should brace for higher interest rates as the Fed has left with no other quantitative measure that could contain the soaring inflation. Adding to that, the tight labor market amid a lower jobless rate since February 2020 at 3.6% is compelling an interest rate hike to contain the inflation mess.

Meanwhile, the release of the Federal Open Market Committee (FOMC) minutes on Wednesday has raised uncertainty in the market. The minutes of March’s monetary policy meeting by the Fed dictate that the balance sheet reduction should be done at a more rapid pace than the pace adopted in the 2017-19 episode. Also, one or more 50 bps interest rate hike by the Fed is appropriate to ease off the elevated inflation pressure.

On the Swiss docket, investors are waiting for the release of the Unemployment Rate, which will guide them about the likely monetary policy stance to be adopted by the Swiss National Bank (SNB) going forward. As per the market estimates, the Swiss State Secretariat for Economic Affairs (SOEC) will display the Unemployment Rate at 2.2%, similar to its prior print.

Liz Truss has written in the Telegraph that the war in Ukraine is not the one Vladimir Putin planned.

''He has badly over-reached and is now suffering the consequences. But this is not the time for complacency. Russia is not retreating, but regrouping. Putin has changed his tactics, not his strategy. His forces are leaving the area around Kyiv only to push harder in the East and the South.''

''The world has seen the appalling atrocities his forces have committed in Irpin and Bucha. Civilians have been targeted – there is evidence of butchery, rape and torture. We must do all we can to ensure Putin fails. That is why the UK is stepping up under the Prime Minister’s six-point plan of action,'' she stated.

. To be precise the six-point plan of action includes:

- Mobilizing international humanitarian coalition for Ukraine

- Supporting Ukraine in its efforts for self-defence

- Maximising economic pressure on Russia

- Preventing the "creeping normalisation" of Ukraine by Russia

- Pursuing diplomatic paths for de-escalation

- Beginning a rapid campaign for strengthening security and resilience across the Euro-Atlantic area.

Within the plan, Truss said they are working to agree on a clear timetable to eliminate imports of Russian coal and gas and with G7 partners, they air to further crack down on more Russian banks.

Meanwhile, Ukraine's Zelenskyy said that the democratic world must reject Russian oil; says a hesitation to agree on an oil embargo is costing Ukrainian lives.

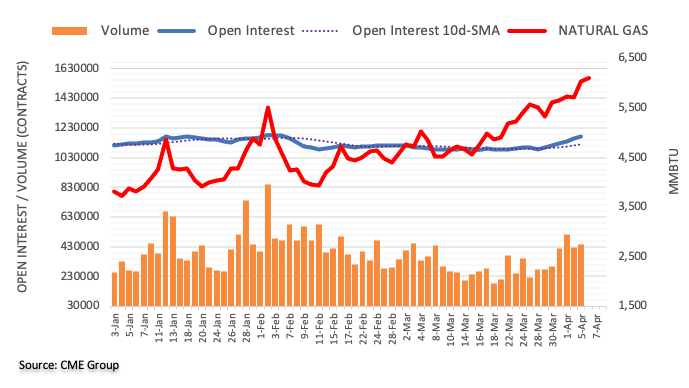

- WTI has settled below 50-EMA for the first time in 2022.

- Bulls have lost momentum as the RSI (14) has dropped below the bullish range of 60.00-80.00.

- A mean reversion towards the trendline will bring offers to the counter.

West Texas Intermediate (WTI), futures on NYMEX, have been vulnerable in the past few trading sessions. The black gold has witnessed a steep fall after recording a multi-year high at $126.51. For the first time in 2022, the asset has closed below the 50-period Exponential Moving Average (EMA), trading at $98.36.

On the daily scale, the asset is hovering around 50% Fibonacci retracement (placed from 2 December 2021 low at 62.34 to March 8 high at $126.51) at $94.55. It is worth noting that the asset has violated the trendline placed from 20 December 2021 low at $66.10. The oil prices have comfortably established below the 20-EMA, which is trading near $102.00.

The Relative Strength Index (RSI) (14) has shifted into a 40.00-60.00 range from the bullish range of 60.00-80.00, which signals a consolidation ahead.

Should the WTI prices encounter a mean reversion to the trendline placed from 20 December 2021, the psychological figure of $100.00, bears will drag the asset towards the 50% Fibo retracement at $94.55, followed by 61.8% Fibo retracement at $86.91.

On the flip side, bulls may regain strength if the asset oversteps Tuesday’s high at $104.60, which will send the asset towards the round level resistance at $110.00. Surpassing the latter will drive the oil prices towards the March 24 high at $115.87.

WTI daily chart

-637848784828312947.png)

- EUR/USD bears are attacking the daily support area.

- Bulls are stepping in and correction could be on the cards.

EUR/USD is hardening on the support area following today's minutes from the Federal Open Market Committee meeting. The US dollar surged higher to fresh 2022 highs but the euro remains within familiar ranges, albeit eyeing a run to test the 2022 lows. However, the pair could be in for a significant correction according to the following daily chart's analysis:

EUR/USD daily chart

The price would be expected to revisit the prior structure near a 38.2% Fibonacci retracement in the coming days. Currently, based on the recent lows, that level comes in near 1.10 the figure.

- GBP/JPY was set to gain for a fourth successive session on Wednesday despite risk-off, but failed to hold above 162.00.

- Rising global yields continues to undermine the yen, but dovish BoE vibes may cap GBP/JPY’s further upside potential.

GBP/JPY was set to climb for a fourth successive session on Wednesday, as the uptrend in global yields continued, preventing the yen from benefitting from safe-haven inflows as US equity markets tumbled amid concerns about the hawkish Fed. The pair at one point rallied as high as the 162.20s but has since slipped back to the 161.80s, with on-the-day gains now eroded to about 0.2%.

That leaves GBP/JPY trading 0.7% higher on the week, with the pair having found decent buying interest when it broke below the 160.00 mark briefly at the end of last week. While the general trend towards higher yields globally is likely to keep the pair supported, FX strategists are unconvinced as to how much higher GBP/JPY can push given the increasingly dovish sounding BoE.

Indeed, the bank’s Deputy Governor Jon Cunliffe was on the wires earlier in the week and played down expectations for persistently high inflation whilst also upping his warnings about UK economic weakness. GBP/JPY ground higher despite these dovish comments, probably because they weren't a surprise given Cunliffe had been the lone dissenter against a rate hike at the BoE’s last meeting.

A speech from the BoE’s chief economist Huw Pill on Thursday (at 1315BST), who has in the past been one of the bank’s more hawkish-leaning members, will be a closely watched event. The BoE softened its tone on the need for further monetary tightening at its last meeting and Pill is likely to reflect this more cautious viewpoint. That could dampen the prospects for GBP/JPY to muster a lasting push above 162.00, a task that will be made even more difficult if equities continue their current tumble.

- The shared currency held its ground vs. sterling, around the 0.8300 mark, amid a dismal market mood.

- Global central bank tightening, keeps stocks down, weighing on sentiment.

- EUR/GBP Price Forecast: Forming a doji suggesting consolidation lies ahead.

The EUR/GBP is barely flat in the North American session, amid a gloomy market sentiment, spurred by a negative sentiment courtesy of continuing fighting between Russia-Ukraine, and continuing sanctions imposed on Russia. At the time of writing, the EUR/GBP is trading at 0.8338.

Risk appetite decreased on Wednesday as US equities remain trading in the red. The Federal Reserve revealed its minutes and said that it is ready to begin the Quantitative Tightening at the end of May. The amount to be reduced each month would be $95 billion, split into $80 billion of US Treasuries and $15 billion consisting of mortgage-backed-securities (MBS).

Aside from this, the EUR/GBP is subdued in a 30-pip range on Wednesday. In the European session dipped towards the S1 daily pivot around 0.8320 but jumped off the lows and reclaimed the daily pivot, lying at 0.8347. Nevertheless, of late, the EUR/GBP retreated towards the 0.8330s, where it meanders at press time.

EUR/GBP Price Analysis: Technical forecast

The EUR/GBP remains downward biased, but March 4 dip towards 0.8200 pierced the 200-month simple moving average (SMA), a significant support area, as shown by the candlestick formed -a hammer on a downtrend-, meaning that the downward move was finished. As a matter of fact, the cross-currency pair bounced off those levels and rallied towards 0.8450, but Russo-Ukraine woes weighed on the common currency.

Upwards, the EUR/GBP's first resistance would be the 50-day moving average (DMA) at 0.8366. A decisive break would expose the 100-DMA at 0.8396, followed by the 200-DMA at 0.8461. On the flipt side, the EUR/GBP first support would be 0.8327. A breach of the latter would expose March 24 swing low at 0.8264, followed by the YTD lows at 0.8202.

Technical levels to watch

What you need to take care of on Thursday, April 7:

The American dollar retained its strength on Wednesday, as the focus remained on geopolitical tensions and aggressive central banks.

US President Joe Biden announced an executive order which will ban new investments in Russia. European leaders, on the other hand, were unable to reach an agreement on banning Russian coal, although they said it was due to a technical issue and that they will discuss it again on Thursday. Meanwhile, European Commission President Ursula von der Leyen said that new sanctions against the Kremlin would not be the last.

The US Federal Reserve unveiled the Minutes of its latest meeting, which reminded market players of the aggressive stance of the central bank. Policymakers are determined to move the monetary policy to neutral “expeditiously.” Additionally, the statement reads: “participants also noted that depending on economic and financial developments, a move to a tighter policy stance could be warranted.”

The EUR/USD pair trades below 1.0900, while GBP/USD hovers around 1.3070. Commodity-linked currencies are under strong selling pressure, with AUD/USD changing hands at 0.7510 and USD/CAD trading at 1.2530.

Crude oil prices were sharply down, undermined by the soft tone of Wall Street, now at around $97.00 a barrel. Global indexes closed in the red, with US ones further weighed by FOMC Meeting Minutes.

Gold price held within familiar levels, now trading at around $1,924 a troy ounce.

Solana price could double after entering buy zone

Like this article? Help us with some feedback by answering this survey:

- USD/CAD rallies but runs into a wall of resistance despite hawkish FOMC.

- WTI has dropped heavily mid-week, down some 4% WTI spot.

The commodity currencies were the hardest hit immediately after the release of the Federal Open Market Committee minutes. USD/CAD rallied after a knee-jerk blip to the downside and reached a high of 1.25558. Simultaneously, in another blow to CAD, WTI futures settled a the lowest level in around a month.

DXY, an index that measures the greenback vs a basket of six rival currencies, has run to the highest level for 2022 at 99.769 following the minutes that showed that the Federal Reserve officials expressed anxiety about inflation.

The members of the FOMC have finalized plans to shrink bond holdings in an aggressive effort to curb rising prices. The Fed is preparing to shrink the $9tn balance sheet at a pace of roughly $95bn a month.

The US dollar quickly reversed course to the said highs, but despite that the FOMC won't hesitate to deliver one or more half-point rate hikes, the dollar is back under pressure again, resting in the 99.60s at the time of writing.

The commodity currencies are overall bearing the brunt of the US dollar move, with high beta to the equities that are also suffering.

All options reviewed by policymakers featured a more rapid pace of balance sheet runoff than in the 2017–19 episode," the minutes said.

Many officials say one or more 50bps rate hikes may be warranted and many members sought a 50bps March hike if there was not a Ukraine war.

- Breaking: FOMC minutes say participants judged it appropriate to move policy towards neutral expeditiously

"Many participants noted that one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified," the minutes said.

As for oil, inventories of commercial crude unexpectedly rose last week following a decrease last week, government data showed Wednesday, driving down oil prices in recent trading.

''Oil stockpiles grew 2.4 million barrels to 412.4 million barrels in the week ended April 1, the Energy Information Administration said. Supplies were about 14% lower than the five-year average for this time of year. Analysts had expected a decrease of 2.1 million barrels, according to Investing.com. A week earlier, the inventories fell by 3.4 million barrels,'' Reuters reported.

West Texas Intermediate crude futures slid 3.1% to about $98.83 a barrel, while Brent fell 2.7% to $103.79 in recent trading. Spot WTI is down some 4% at the time of writing.

Meanwhile, the Bank of Canada's tightening expectations are running hot after it started the cycle with a 25 bp hike to 0.5% earlier this month. ''WIRP suggests nearly 85% odds for a 50 bp hike at the April 13 meeting. Looking ahead, swaps market sees the policy rate at 3.0% over the next 24 months,'' analysts at Brown Brothers Harriman explained.

- NZD/USD fell to test key support around 0.6900 in recent trade as the US dollar picked up post-Fed minutes.

- The pair was also weighed on Wednesday as global equity and commodity prices fell.

A sharp decline in global equity and commodity prices plus a pick up in the strength of the US dollar in wake of a hawkish Fed minutes release saw NZD/USD fall back to test the 0.6900 level on Wednesday. For now, support at the big figure in the form of last Friday’s lows, the 21-Day Moving Average at 0.6897 and the 200-Day Moving Average at 0.6906 is holding up and the pair has rebounded into the 0.6910s.

But it nonetheless still trades with losses of about 0.4% on the day, with the kiwi also facing headwinds in the form of a significant weakness in its antipodean counterpart the Aussie. At current levels, NZD/USD now trades more than 1.5% lower versus earlier weekly highs in the 0.7030s.

The kiwi’s recent depreciation versus the US dollar is in fitting with that seen across G10 markets, as deteriorating risk appetite spurs safe-haven FX flows and markets bet on an ever more aggressive approach from the Fed to monetary tightening in the coming year.

With NZD/USD for now holding up well above key support in the 0.6900 area, many kiwi bulls will remain confident. Even in the face of rocky risk appetite conditions and hawkish repricing of Fed expectations, the kiwi has shown in recent weeks that it can perform well.

Recent strong performance since Russia’s invasion of Ukraine (NZD/USD still trades over 4.0% higher versus 24 February lows) has its roots in the rise in global commodity prices. As long as commodities continue to trade at elevated levels versus prior to the start of the war (some commodity strategists have argued the war means “structurally higher” commodity prices), NZD/USD retains a strong chance of rallying back above 0.70.

- The USD/JPY remained positive in the week, up 1.11%, amidst a risk-off sentiment and underpinned by the US 10-year yield.

- USD/JPY Price Forecast: The bias is upwards, but the RSI within the overbought area might suggest caution is warranted.

The USD/JPY advances in the North American session amid a risk-off market mood, courtesy of Fed speaking, the continuation of the Russian-Ukraine war, and China’s economy about to slow, as reported by Manufacturing and Services PMIs, which fell below the expansion levels. At the time of writing, the USD/JPY is trading at 123.87.

US equities remain trading in the red, with losses between 0.89% and 2.66%. Meanwhile, the greenback remains buoyant, as shown by the US Dollar Index, a measure of the buck’s value vs. its peers, up 0.25%, sitting at 99.742, underpinned by the 10-year US Treasury yield up to six basis points, currently at 2.622%.

Overnight, the USD/JPY seesawed around the 123.50-124.00 range ahead of the release of the FOMC March meeting. Once unveiled, the USD/JPY dipped towards the daily lows at 123.46 but recovered some ground and is aiming towards the 124.00 mark.

Breaking: FOMC minutes say participants judged it appropriate to move policy towards neutral expeditiously

USD/JPY Price Forecast: Technical outlook

The USD/JPY is upward biased. The daily moving averages (DMAs) reside well below the spot price and confirm the bias. However, the Relative Strength Index (RSI) at 74.65 is well within the overbought area, suggesting that caution is warranted.

That said, the USD/JPY first resistance level would be 124.00. A breach of the latter would expose the YTD high at 125.10, followed by June 2015 swing high at 125.85, followed by April 2001 daily high at 126.85, and then February 2002 pivot high at 135.02.

On the flip side, the USD/JPY first support would be 123.00. A decisive break would open the door towards 121.27, but it would find some hurdles on its way south. Once 123.00 gives way, the next support would be 122.41, followed by 122.00 and then March’s 31 daily low at 121.27.

- AUD/USD has dropped back to near the 0.7500 level as the US dollar strengthens after the Fed minutes release.

- That means the pair has now dropped over 1.0% on the day, with lower equity and commodity prices also weighing.

The US dollar is ramping up in wake of the release of the latest Fed meeting minutes and this has pushed AUD/USD to fresh session lows back below the 0.7500 level. That means the pair is now trading lower by more than 1.0% on the day, having already been under pressure prior to the release of the Fed minutes, likely as a result of the sharp pullback being seen across global equity and commodity markets. The Aussie has a strong correlation to both risk appetite and the prices of commodities such as oil, copper and other energy and metal prices.

With the Aussie now trading back in the 0.7500 area, it has more than unwound Tuesday’s post-hawkish RBA meeting gains that saw it at one point rally as highs as the 0.7660s on Tuesday. That's a roughly 2.0% drop from weekly peaks. Now that AUD/USD is trading back within last week’s ranges (when it spent practically the entire week within a 40 pips of the 0.7500 level), longer-term Aussie bulls will be questioning whether they want to buy into the dip.

Though still substantially higher versus mid-March lows, the pullback in the last two days in US and global equity markets doesn’t look healthy. If global yields continue to rally on expectations of central bank tightening, that doesn’t bode well for a recovery back to last week’s peaks. That would bode poorly for the highly risk-sensitive Aussie, and well for the safe-haven US dollar. Much will depend on whether commodity traders buy the dip, with oil now approaching key support.

- GBP/USD is on the back foot as the US dollar rallies on hawkish FOMC.

- The FOMC minutes showed that the Federal Reserve officials expressed anxiety about inflation.

GBP was the strongest currency immediately after the release of the Federal Open Market Committee minutes, popping to 1.3107 before dropping to post minutes lows of 1.3056 when the US dollar finally broke to the upside.

DXY, an index that measures the greenback vs a basket of six rival currencies, has run to the highest level for 2022 at 99.769 following the minutes that showed that the Federal Reserve officials expressed anxiety about inflation. The members have finalized plans to shrink bond holdings in an aggressive effort to curb rising prices. The Fed is preparing to shrink the $9tn balance sheet at a pace of roughly $95bn a month.

"All options reviewed by policymakers featured a more rapid pace of balance sheet runoff than in the 2017–19 episode," the minutes said.

Many officials say one or more 50bps rate hikes may be warranted and many members sought a 50bps March hike if there was not a Ukraine war.

- Breaking: FOMC minutes say participants judged it appropriate to move policy towards neutral expeditiously

Meanwhile, some market commentators have started to speculate that the BoE may think twice about hiking interest rates beyond May. ''The BoE is expecting some labour market slack to open up going forward. If this starts to happen it can be assumed that wage inflation will be repressed and that higher prices for food and energy will slow demand for goods with elastic demand. This will lessen the need for further rate rises,'' analysts at Rabobank argued.

According to the minutes of the March FOMC meeting, participants judged that it would be appropriate to move the stance of monetary policy towards a neutral posture expeditiously, reported Reuters.

Additional Takeaways as summarised by Reuters:

On policy...

"Participants also noted that, depending on economic and financial developments, a move to a tighter policy stance could be warranted."

"All participants judged risk management would be important in deciding the appropriate stance of monetary policy, and that policy also would need to be nimble in responding to incoming data and the evolving outlook."

On balance sheet reduction...

"On balance sheet reduction, participants generally agreed monthly caps of about $60B for Treasury securities, $35B for mortgage-backed securities would likely be appropriate."

"Participants generally agreed that caps could be phased in over a period of three months or modestly longer if market conditions warrant."

"All options reviewed by policymakers featured a more rapid pace of balance sheet runoff than in the 2017–19 episode."

"Participants generally agreed that after balance sheet runoff had gotten well underway, would be appropriate to consider sales of mortgage-backed securities."

"Most participants judged it appropriate to redeem treasury coupon securities each month up to the cap amount and to redeem treasury bills when coupon principal payments were below the cap."

"Participants agreed the Fed was 'well placed' to begin balance sheet reduction as early as after the end of the Fed's May meeting."

"Several participants remarked that reducing T-bill holdings over time would be appropriate because they are highly valued as safe and liquid assets."

"Participants agreed reducing the balance sheet would play important role in firming the stance of monetary policy and expected it would be appropriate to begin this process at a coming meeting, possibly as soon as in May.

"Participants generally noted that maintaining large holdings of T-bills is not necessary under an ample-reserves operating framework."

On interest rates...

"Many participants noted that they would have preferred a 50 basis point increase in the target range for the federal funds rate at this meeting."

"Many participants noted that one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified."

On the economy and inflation...

"All participants underscored the need to remain attentive to the risks of further upward pressure on inflation and longer-run inflation expectations."

"Participants agreed uncertainty regarding the path of inflation was elevated and that risks to inflation were weighted to the upside."

"Various participants also noted downside risks to the outlook, including risks from the Russian invasion of Ukraine, a broad tightening in global financial conditions, and a prolonged rise in energy prices."

"Several participants judged the upside risk to inflation associated with Ukraine war appeared more significant than the downside risk to growth."

- The shared currency remains subdued in the North American session but holds to the 1.0900 level amidst a risk-off mood.

- Contraction in China’s Caixin Manufacturing and Services PMIs looms as a signal of global economic deceleration.

- EUR/USD Price Forecast: A break below 1.0900 would exacerbate a downward move towards 1.0806.

The EUR/USD remains in choppy trading as market players prepare for the release of the FOMC March’s meeting minutes, but earlier gave way for USD bulls, as it broke below the 1.0900 mark during the European session, but reclaimed the latter in the North American session. At the time of writing, the EUR/USD is trading at 1.0905, barely flat.

Downbeat market mood and Fedspeaking boosts the greenback

The market sentiment is downbeat, as European equities finished with losses, while across the pond, the history is the same. In the Asian session, news that China’s Caixin Services for March fell below the 50 levels, in the same tenure as Monday’s Manufacturing reading, concerns market players. The recent China Covid-19 outbreak threatens to push the brakes on the global economic recovery.

Elsewhere, the hawkish Fed speaking in the week dragged global equities down while bond yields rose. On Wednesday, Fed’s Governor Lael Brainard spooked the markets, commenting that the balance sheet reduction might begin in the May meeting, something unexpected by traders as they were looking to QT to start in the July meeting. Meanwhile, Kansas City Fed Esther George said that a 50 bps move would be an option we must consider and emphasized that conditions favor going faster than before.

Money market futures portrays market players’ response to Brainard’s remarks -one of the doves of the FOMC. The CME FedWatch Tool shows that investors have priced a 75.5% chance of a 50 bps rate hike in the May meeting, which will lift the Federal Funds Rate (FFR) to 1%.

Meanwhile, the US Dollar Index, a gauge of the greenback’s measure against a basket of its rivals, retreats from YTD highs, down 0.05%, sitting at 99.443. Contrarily, the US Treasury yields are rising.

The 10-year benchmark note sits at 2.586%, up one basis point but short of the YTD high at 2.66%, as market players expect the release of March’s monetary policy minutes.

On the Geopolitical front, the fighting continues in Eastern Europe. Moscow said that work is ongoing when the next round of discussions with Ukraine occurs.

EUR/USD Price Forecast: Technical outlook

The EUR/USD downtrend remains intact and is accelerating towards a retest of the YTD low at 1.0806, as shown by the 300-pip fall in the last five trading days. Furthermore, the Relative Strength Index (RSI) at 38.94 below the 50-midline is in bearish territory, with enough room to spare before RSI reaches oversold conditions if the event of the EUR/USD aiming lower.

That said, the EUR/USD first support level would be 1.0900. A clear break would expose the YTD low at 1.0806, followed by April 2020 cycle lows at 1.0727 and then the Covid-19 pandemic outbreak lows in March 2020 at 1.0636.

- The gold price is holding within familiar ranges into the FOMC minutes.

- The Ukraine crisis is supporting safe-haven flows into the precious metals.

- XAU/USD to remain bearish amid rising US yields

The gold price is under pressure on Wednesday but contained within a familiar range as it continues to trade sideways on the daily chart. At the time of writing, at $1,922.10, XAU/USD is down 0.06% and has travelled between a high of $1,933.58 and a low of $1,915.08.

The US dollar was flat to slightly higher on Wednesday, as measured by the DXY index and vs a basket of currencies. In early-morning trading, the dollar index eased to 99.313, but has since climbed back to 99.54 to trade slightly in the green in the count down to the Federal Open Market Committee minutes. On Tuesday, the index touched its highest since May 2020 at 99.759.

The sharp gains were made the previous session following hawkish comments from one of the Federal Reserve's top officials. On Tuesday Fed's Lael Brainard, usually a more dovish policymaker, said she expected a combination of rate increases and a rapid balance sheet runoff to bring US monetary policy to a "more neutral position" later this year. Her comments sent both US yields and the dollar on a tear, slightly weighing on the price of gold that remains supported above the psychological $1,900 round number in sideways consolidation.

At the Fed's last meeting, it raised rates for the first time since 2018 and pivoted from an easy monetary policy to battle the effects of the coronavirus pandemic to a more aggressive stance on fighting inflation. Meanwhile, the minutes of the FOMC's March meeting is expected to provide fresh details on its plans to reduce its bond holdings.

For that, US Treasury yields rose and stock indexes fell sharply today ahead of the release of the minutes. 30 minutes before the release of the minutes, the yield on 10-year Treasury notes was up 1.84% at 2.60%. The Dow Jones Industrial Average fell 0.6%, the S&P 500 lost 1.17% and the Nasdaq Composite dropped 2.38%.

Russian & Ukraine peace talks, slow progress

Meanwhile, the Kremlin said on Wednesday that peace talks between Moscow and Kyiv were not progressing as rapidly or energetically as it would like.

Reuters reported that ''Russia has accused the West trying to derail peace talks with Ukraine by fuelling "hysteria" over allegations of war crimes by Moscow's forces following their retreat from the Kyiv region.''

''Kyiv and the West say there is evidence, including images and witness testimony gathered by Reuters and other media organisations, that Russia committed war crimes in the Ukrainian town of Bucha. Moscow denies the charge and has called the allegations a 'monstrous forgery.'''

"The only thing I can say is that work (on the talks) is continuing," Kremlin spokesman Dmitry Peskov told reporters on a conference call when asked about the prospect of another round of negotiations between Moscow and Kyiv.

"There is still a long road ahead. The work process is ongoing but it is dragging along the way more than we would like."

Russian sanctions, supportive of USD

The news at the start of this week of further sanctions from the US and the EU on Russia which will not be cost-free, particularly for the Eurozone economy, is another factor to consider which can help to support gold prices. While these have serious implications for EUR, which will likely see the US dollar supported, risk-off flows into gold could offset the gains in the greenback.

However, default risk has risen for Russia. Today, Russia said foreign banks declined to process $649.2 mln of coupon payments after the Treasury Department banned Russia from making any debt payments through US banks. The ramifications of such a shortfall of liquidity in the money markets would be expected to drive up further real demand for the US dollar.

Gold technical analysis

The price has been making a base for itself on the daily time frame at a prior structure as marked up on the chart above. The weekly 61.8% ratio has held as support and the price has been accumulating above there and in the low $1,900s ever since. A catalyst will be needed to see the price breakout of its sideways range with a bias to the upside while holding above the weekly 61.8% ratio.

- The USD/CHF keeps trimming last week’s losses, up 0.81% in the week.

- The break of a bullish flag on an H4 chart opened the door for further gains.

- USD/CHF Price Forecast: The pair is upward biased, as depicted by the daily chart.

The USD/CHF climbs for four consecutive days amid a gloomy market mood North American session, blamed on hawkish Fed expectations, high US Treasury yields, and the release of the Fed’s March meeting minutes. At the time of writing, the USD/CHF is trading at 0.9324.

European and US equities reflect the aforementioned dismal sentiment. At the same time, the US Dollar Index, a gauge of the greenback’s value against a basket of peers, rises 0.01% and sits at 99.491. The 10-year US Treasury yield is rising four basis points, up at 2.596%, normalizing the yield curve that had inverted over the last few days.

Overnight the USD/CHF braced to February 10 daily high at 0.9296, and once cleared, the USD/CHF rallied and reached a fresh weekly high at 0.9349 but retreated to current levels as market players waited for the release of the FOMC March meeting minutes.

USD/CHF Price Forecast: Technical outlook

The USD/CHF uptrend remains intact. The daily moving averages (DMAs) reside well below the spot price, though almost horizontally, but sitting beneath the 0.9263 50-DMA.

The 4-hour chart shows that a bullish flag , drawn since March 14 highs around 0.9460, was broken, meaning that the USD/CHF could aim higher, but as the release of the Fed’s minutes loom, the pair remains subdued.

That said, the USD/CHF first resistance would be 0.9349. Breach of the latter would expose March 27 and 29 highs area around the 0.9370-80 region, which would expose the 0.9400 mark once broken.

Technical levels to watch

- Silver has rebounded from one-week lows at $24.12 to near $24.50 as markets await the Fed meeting minutes release.

- Rising US yields and USD strength have weighed recently, though geopolitics remains a source of support.

- Dips towards $24.00 may thus be subject to being bought into.

Spot silver (XAG/USD), whilst continuing to trend gradually to the downside as US yields and the US dollar continues to advance ahead of the release of the minutes of the last Fed meeting, has rebounded in recent trade. Spot prices hit fresh one-week lows at $24.12 per troy ounce earlier in the session but have since rebounded back towards $24.50 where they now trade with gains of about 0.6% on the day. That means XAG/USD has recovered back above its 50-Day Moving Average in the $24.30s, a level that has been offering support over the past three sessions.

But against the backdrop of further hawkishness from Fed policymakers in recent days ahead of what is likely to be very hawkish-sounding Fed minutes release at 1900BST, the risks remain tilted towards higher US yields and a stronger US dollar. Given silver’s negative correlation to both of these, that suggests a continued steady grind lower towards $24.00 is more likely than not. Silver bears will thus be eyeing a test of recent lows just under $24.00, which also happen to coincide with the 200DMA.

Was it not for the high level of geopolitical risk premia priced into precious metals markets, plus ongoing demand for inflation protection and investors mull the inflationary impact of the Russo-Ukraine war, XAG/USD would likely be significantly lower. Whilst Fed hawkishness, rising yields and the risk of a stronger US dollar are all negative for silver, it would be brave to call for silver to drop all the way back to annual lows in the $22.00 area.

The US and UK both toughened financial sanctions on Russia on Wednesday, while the EU is in the process of passing sanctions on imports of Russian commodities, including coal and oil. Meanwhile, there have not been any fresh indications recently that a Russo-Ukraine peace deal might be near, and Russia shows no signs of wanting to end its invasion of Ukraine. As a result, dips towards $24.00 may be bought into in the short term.

- China’s March Caixin Manufacturing and Services PMIs fell below 50 for the first time since 2020, signaling its economy is slowing.

- A hawkish Fed speaking weighs on market sentiment, alongside Russo-Ukraine tussles.

- USD/RUB Price Forecast: The uptrend remains intact, but a daily close under 80.3254 might open the door towards the 200-DMA around 77.20s.

The USD/RUB slumps in the North American session amid a downbeat market mood courtesy of a worse than expected China’s Caixin Services PMI, which added to the Manufacturing PMI released last Friday, showed that both readings fell. Also, a hawkish Federal Reserve and extension of hostilities between Ukraine-Russia added a pinch of salt to the dismal sentiment. However, despite the aforementioned, the USD/RUB is trading at 80.0060.

Meanwhile, the US Dollar Index, a gauge of the greenback’s measure against a basket of its rivals, retreats from YTD highs, down 0.05%, sitting at 99.443. Contrarily, the US Treasury yields are rising.

The 10-year benchmark note sits at 2.62%, up seven basis points, as market players expect the release of March’s monetary policy minutes.

On Wednesday, Federal Reserve policymakers reiterated the need to normalize the economy. Fed’s Governor Lael Brainard spooked the markets, saying that the balance sheet reduction might begin in the May meeting, something unexpected by traders as they were looking to the July meeting. In the same tenor, Kansas City Fed Esther George said that a 50 bps move would be an option we must consider and emphasized that conditions favor going faster than before.

On the Geopolitical front, the fighting continues in Eastern Europe. Moscow said that work is ongoing when the next round of discussions with Ukraine occurs.

However, the USD/RUB held onto losses, breaking below the 82.7000 support area, unsuccessfully tested six times but gave way during Wednesday’s Asian Pacific session.

USD/RUB Price Forecast: Technical outlook

The USD/RUB upward bias remains intact, despite the strength of the fall. However, a daily close under the 80.3254 level would further extend losses, and the USD/RUB could aim toward the 200-day moving average (DMA) at 77.2027.

Upwards, the USD/RUB first resistance would be 82.7882. Breach of the latter would expose essential resistance levels. The next supply zone would be 85.00, followed by the 50-DMA at 88.7789. On the flip side, the USD/RUB first support would be 80.00. A decisive break would expose 78.0683, followed by the 200-DMA at 77.2027.

- Major US equity indices were lower on Wednesday as higher yields put large-cap tech stocks under selling pressure.

- Recent hawkish Fed communications are behind the move higher in yields, with focus now on Fed minutes at 1900BST.

- The S&P 500 fell more than 1.0% to the 4460s from Tuesday’s close at 4525.

Major US equity indices slumped on Wednesday in the hours prior to the release of the minutes of the Fed’s March meeting, with large-cap tech stocks leading the rout amid a continued surge in US bond yields. Hawkish remarks on Tuesday from Fed Vice Chairwoman Lael Brainard was the catalyst for a spike in yields across the US curve. Brainard is typically one of the central bank’s more dovish members but hinted to a more aggressive approach towards QT than markets had been expecting.

All other Fed speakers who have hit the wires over the last few days have all also sounded hawkish and in agreement on the need to 1) get rates quickly back to neutral, 2) begin swift balance sheet reduction. This is very much the expected tone of the upcoming minutes release, scheduled for 1900BST and this could keep maintain upward pressure on US yields. That suggests the major US indices remain at risk of incurring further losses.

The S&P 500 was last trading down 1.3% in the 4460s, having tumbled from Tuesday’s closing levels in the 4520s and, in doing so, fallen back below its 200-Day Moving Average. The main drag on the index is its mega-cap tech stocks including Microsoft (-2.9%), Apple (-2.2%), Nvidia (-5.3%), Facebook (-3.2%), Amazon (-3.2%), Tesla (-4.2%) and Alphabet (-2.0%). Underperformance in these names, as well as in the tech sector more broadly, saw the Nasdaq 100 index drop closer to 2.5%, taking its reversal back from weekly highs to close to 5.0%.

The Dow, meanwhile, was last down a more moderate 0.8%, given its greater weighting towards equity sectors that perform better in an environment of risk-off/higher yields. In terms of the S&P 500 GICS sectors, despite slightly lower oil prices on the day, energy is up over 1.5%, while defense utilities and consumer staples sectors gained 1.0% and 0.5% respectively. Despite the rising yields and growing evidence of a housing market slowdown, real estate was last up 0.4%. The big underperformers were consumer discretionary (-3.0%), information technology (-2.8%) and communication services (-2.0%).

In coordination with the US, the UK just announced new sanctions against Russia, imposing an outright ban on all new outward investment into the country, reported Reuters. The UK also imposed an asset freeze against Sberbank and Credit Bank of Moscow, steps which were taken in coordination with the US. The UK also added nine more listings to its Russian sanctions list, including three oligarchs.

For reference, the US earlier announced that it is "dramatically escalating" the financial shock on Russia by cutting off the country's largest banks

Philadelphia Fed President and FOMC member Patrick Harker on Wednesday said that he is committed to methodically raising interest rates back to neutral, which he sees at around 2.5%, reported Reuters. Reducing the balance sheet will also remove financial accommodation, he added, noting that we want to slow the economy in a way that is not so aggressive that we risk tilting it back into a recession.

Regarding inflation, Barkin said he is focused on its breadth across numbers of goods as an indicator as to whether conditions are improving. He is also focusing on demand and whether it will show signs of weakening as the Fed raises rates, he added, noting that retailers are saying there doesn't seem to be much "trade down" among consumer to cheaper goods, despite price increases.

The United States is open to all tools if China invades Taiwan, US Treasury Secretary Janet Yellen said on Wednesday, reported Bloomberg. The US is monitoring attempts to use crypto to evade sanctions, she added, referring to sanctions on Russia.

A senior Biden administration official just announced that the US is "dramatically escalating" the financial shock on Russia by cutting off the country's largest banks. The US is to impose full blocking sanctions on Russia's Sberbank and Alfa Bank, the official added, while US President Joe Biden is also set to sign a new executive order banning all new investment in Russia.

The US is "dramatically escalating" the financial shock on Russia, a senior Biden administration official said on Wednesday, by cutting off the country's largest banks, reported Reuters. The US is to impose full blocking sanctions on Russia's Sberbank and Alfa Bank, the official added, while US President Joe Biden is also set to sign a new executive order banning all new investment in Russia.

The official explained that Sberbank is critical to Russia's financial system and holds one-third of Russia's total banking assets and added that Biden's new executive order will ensure that the recent private-sector exodus from Russia continues. More than 600 multinational corporations have already left the country, the official said.

Russia will have to find new sources of dollars from outside the US and a new payment brought other than US banks to avoid falling into default, the official continued, adding that more actions will come from the EU that degrade Russia's status as a leading energy supplier.

The US remains hopeful that there is alignment with India regarding actions against Russia, and has been clear to China about the consequences of any effort to circumvent sanctions on the country, the official said. China is not openly indicating any intention to circumvent sanctions, but it is something the US is watching closely, the official warned.

Finally, the official noted that if Russian President Vladimir Putin was to change course in Ukraine, then sanctions could be slowed and possibly reversed.

Philadelphia Fed President and FOMC member Patrick Harker said on Wednesday that he doesn't see high inflation going away any time soon and that high gasoline prices will be here for some time, reported Reuters. Harker said he doesn't expect food prices to come down any time soon.

Harker said that some cooling in the housing market can now be seen as the Fed raises interest rates, and noted that more people will soon be observed joining the labour force.

Harker added that the Fed "has some time" to get to a neutral position, given the continued impact of the pandemic on jobs and inflation and added that, while the Fed "could move faster", it is already having an impact, as seen in higher bond yields.

- Gold is in wait-and-see mode pre-the release of Fed minutes near $1930, leaving it well within recent ranges.

- Equities are sharply down, but yields are sharply up, sending mixed signals for precious metals markets.

- A hawkish Fed surprise could see XAU/USD retest $1900, but amid ongoing geopolitical nerves, dips may be bought into.

Spot gold (XAU/USD) markets are in wait-and-see mode ahead of the release of Fed minutes at 1900BST later on Wednesday, with prices for now stuck within recent $1915-$1940ish ranges. At current levels around $1930, XAU/USD trades about 0.3% higher on the session, after rebounding from one-week lows printed earlier in the session in the mid-$1910s, with market participants lacking the conviction to push a bearish breakout ahead of upcoming risk events.

A sharp drop in US and European equities is for now offering gold enough safe-haven support to shield it from the negative impact of higher US yields, while the US dollar is flat amid broadly subdued FX markets pre-Fed minutes. Fed speakers in recent days (mostly the comments from Fed Vice Chair Lael Brainard on Tuesday) have pumped the US dollar and US yields higher, adding downside risks to gold, which has a negative correlation to both.

But the increasingly hawkish tone to rhetoric from Fed policymakers as of late sets the bar high for a hawkish surprise out of the upcoming minutes. Whilst a kneejerk move lower to test the 50-Day Moving Average just above the $1900 level, and recent lows in the $1890s just below it, does seem plausible, the tense geopolitical backdrop continues to stimulate safe-haven demand.

Western nations continue to toughen sanctions against Russia as punishment for its invasion of Ukraine, and with evidence of Russia war crimes against Ukrainian civilians piling up, pressure is piling up for more to be done. The EU has taken its first steps to sanction Russian energy imports, on which it is heavily reliant, announcing a ban on coal and signaling it is looking at sanctioning oil.

From the perspective of a gold trader, disruptions to the global supply of key energy resources look set to worsen in the near term rather than improve, increasing risks of stagflation and underpinning demand for assets deemed as providing inflation protection. As a result, traders may continue to view dips back towards $1900 as attractive for the time being.

- AUD/USD witnessed some selling on Wednesday and moved further away from the YTD peak.

- The overnight pullback could be seen as a false breakout through an ascending trend channel.

- Dips towards the 0.7535-0.7530 area could be seen as a buying opportunity and remain limited.

The AUD/USD pair edged lower on Wednesday and retreated further from the highest level since June 2021, around the 0.7660 region touched the previous day. The pair remained on the defensive through the early North American session and was last seen flirting with the daily low, just above mid-0.7500s.

The risk-off impulse - as depicted by a sharp all across the global equity markets - acted as a headwind for the perceived riskier aussie. On the other hand, the blowout rally in the US Treasury bond yields underpinned the US dollar. This, in turn, exerted some downward pressure on the AUD/USD pair.

That said, the prospect for more Western sanctions on Ukraine continued lending support to commodity prices, which should help limit any deeper losses for the resources-linked Australian dollar. Apart from this, a hawkish RBA commentary on Tuesday warrants some caution for aggressive bearish traders.

From a technical perspective, the overnight sharp pullback could be seen as a false breakout through an upward sloping trend channel extending from the YTD low. That said, it will still be prudent to wait for some follow-through selling before confirming that the AUD/USD pair has formed a near-term top.

Moreover, technical indicators on the daily chart maintained their bullish bias and are still far from being in the overbought territory. Hence, any subsequent decline could attract some buying near the 0.7535-0.7530 area. This, in turn, should help limit the downside near the 0.7500 psychological mark.

On the flip side, the top end of the aforementioned channel, currently around the 0.7590 region, now seems to act as an immediate hurdle. Sustained strength beyond should allow bulls to aim back to reclaim the 0.7600 mark and push the AUD/USD pair back towards the YTD peak, around the 0.7660 area.

AUD/USD daily chart

-637848503358980414.png)

Key levels to watch

As strategists at TD Securities note, it is striking how traders short in gold have plunged considering that markets are pricing a hawkish Federal Reserve. However, this environment poses some risks for the yellow metal.

Where did all the shorts go?

“Our dry-powder analysis highlights that the breadth of traders short in gold has shrunk towards its lowest levels on record. This is a striking change from just a few months ago, when sentiment in the precious metals complex was pervasively negative, with short positioning bloated at lower prices.”

“Gold bugs appear to be ignoring a hawkish Fed and embracing a safe-haven asset for protection against the fog of war.”

“Strong physical demand is also likely both directly and indirectly associated with the war and its inflationary impact.”

“This set-up also leaves gold vulnerable to a de-escalation in the war or a change in the market's focus as the fear trade subsides, especially given that there are no shorts in sight.”

Philadelphia Fed President and FOMC member Patrick Harker reiterated on Wednesday that inflation is far too high in the US and said that he is worried that inflation expectation could become unmoored, reported the Wall Street Journal. The Fed will soon start cutting the size of its balance sheet, he noted, a nod in favour of recent comments from the likes of Fed Vice Chair Lael Brainard and NY Fed President John Williams that balance sheet reduction could begin in May.

GBP/USD is choppy in range above 1.30 but remains prone to weakness. Further weakening of below 1.30 is likely as rate hike bets for the Bank of England (BoE) are set to be trimmed.

There is room to go in the GBP’s leg lower

“Widening gilts-UST yield differentials have begun to weigh more clearly on the pound in recent trading, but we think there’s room to go in the GBP’s leg lower with the 5-yr spread currently sitting at its most negative level since October 2019.”

“We think it may only be a matter of time before markets begin to chip away at extended BoE pricing and the gap between year-end hike expectations widens further to drag sterling to re-test 1.30 and possibly head toward the 1.26/27 zone.”

Members of the International Energy Agency (IEA) will release 120M barrels of crude oil in a bid to cool markets, reported Bloomberg on Wednesday. The US will provide 60M of these barrels and this will be included as part of the already announced 180M barrel release that US authorities announced last week. 60M barrels will come from other nations.

The total amount of crude oil now set to be released by IEA members in the coming months now stands at 240M barrels, which is nearly equal to about two and a half days worth of global demand.

While the EUR/USD bounced back above the 1.09 level a few hours ago, economists at Scotiabank see the pair at risk of falling below 1.08 towards the 1.06 mark.

Recent price action points to another decline under 1.09

“Recent price action points to another decline under 1.09 that then leaves the overnight low of 1.0875 (a five-week low) as support followed by the mid-1.08s and then a fairly unobstructed drop to key support of 1.08.”

“Resistance after the overnight high of ~1.0925 is followed by the mid-figure zone that marked the currency’s range bottom last week.”

“We see the EUR heading for a re-test of 1.08 shortly with continued negative sentiment perhaps pulling it toward the 1.06 mark.”

- USD/JPY prolonged its positive move for the fourth straight day and climbed to a one-week high.

- The formation of a short-term ascending trend channel supports prospects for additional gains.

- Slightly overbought RSI (14) held back bulls from placing fresh bets ahead of the FOMC minutes.

The USD/JPY gained positive traction for the fourth successive day on Wednesday and shot over a one-week high, though struggled to capitalize on the move beyond the 124.00 mark.

Expectations for a more aggressive policy tightening by the Fed, along with inflation fears, pushed the US Treasury bond yields to a fresh multi-year peak. This resulted in a further widening of the US-Japanese government bond yield differential and acted as a tailwind for the USD/JPY pair.

That said, the risk-off impulse drove some haven flow towards the Japanese yen and kept a lid on any further gains for the USD/JPY pair amid modest US dollar pullback from a nearly two-year high. The technical set-up, however, supports prospects for a further near-term appreciating move.

The recent move up witnessed over the past four days or so has been along an upward sloping channel and points to a well-established short-term bullish trend. That said, investors preferred to wait on the sidelines amid slightly overbought RSI (14) on the daily chart and ahead of the FOMC minutes.

Nevertheless, the bias still seems tilted in favour of bulls and a possible move back towards the 125.00 psychological mark, or the multi-year high touched in March. That said, it will be prudent to wait for a convincing break through the channel resistance before positioning for further gains.

On the flip side, any meaningful pullback is likely to attract fresh buying and remain limited near the 123.00 round figure. The said handle coincides with the lower end of the ascending channel, which if broken would negate the constructive outlook and prompt aggressive long-unwinding trade.

USD/JPY 1-hour chart

-637848484143783675.png)

Key levels to watch

GBP/USD is rolling over and coming under short-term pressure. Economists at Credit Suisse look for an imminent break below 1.30 and a move to next support at 1.2855/29.

Resistance at 1.3287/99 to cap for an eventual fall to 1.2855/29

“We look for a break below the 1.3051/43 support to open up a fall back to the recent low at 1.3000. Beneath here should reassert the downtrend, especially if daily MACD also starts to roll over. Support is then seen next at the lower end of the nine-month channel at 1.2930/11 and eventually the 50% retracement of the uptrend from 2020 and November 2020 low at 1.2855/29. We would look for a fresh floor here.”

“Resistance is seen at 1.3177/84 initially, a close above which can see a move back to 1.3223/26 and potentially a retest of 1.3287/99. A close above here would suggest that the recovery can extend further, with resistance seen next at the 55-day average at 1.3342, where we would look for a solid cap if reached.”

- EUR/USD bounces off multi-week lows near 1.0870 .

- A visit to the YTD low in the 1.0800 zone looks likely.

EUR/USD regains the 1.0900 barrier and beyond after bottoming out in the 1.0870 region on Wednesday.

Considering the ongoing price action, further decline remains in store for the pair in the short-term horizon. Against that, a drop below the so far weekly low at 1.0875 (April 6) should put a visit to the 2022 low back on the radar in the relatively short-term horizon.

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1469

EUR/USD daily chart

- WTI continues to trade choppy and within recent ranges above $100 as traders weigh geopolitics and oil reserve releases.

- WTI’s 50DMA near $100 and 21DMA above $105 are for now containing the price action.

Global oil markets continued to trade in choppy fashion on Wednesday, with front-month WTI futures swinging between lows just above $100 per barrel to highs at $104, meaning the price action has remained contained within this week’s levels. At current levels in the $103.00 area, WTI is higher by just under $2.0 on the day. Technicals are playing an important role at present, with the 50-Day Moving Average just below $100 offer strong support at the same time as the 21DMA just above $105 offers decent resistance.

For now, it seems as though market participants are not yet willing to let WTI fall below $100, despite the announcement by US authorities of a historic crude oil reserve release last week and concerns about lockdown extensions in China. That’s probably because the geopolitical backdrop remains supportive, with Western nations readying fresh sanctions against Russia, whose military stands accused of committing widespread war crimes in Ukraine.

The European Commission on Tuesday proposed a ban on imports of Russian coal and other raw materials and said it was working on additional sanctions, including on Russian oil imports. Looking ahead, official weekly US crude oil inventory data is released at 1530GMT and comes after private weekly API inventory data on Tuesday showed a surprise build.

But that failed to dent crude oil prices at the time. Otherwise, traders await further updates regarding Western sanctions against Russia, on the state of Russo-Ukraine peace talks, and regarding other matters such as how much oil member nations of the International Energy Agency (IEA) will release from alongside the US. Sources told Reuters on Wednesday that IEA nations haven’t yet decided how much oil to release to cool markets. For now, WTI sticking within $100-$105 ranges probably makes sense.

Economist at UOB Group Ho Woei Chen, CFA, comments on the recently published inflation figures in South Korea.

Key Takeaways

“South Korea’s headline and core inflation accelerated in Mar with the former above 4% for the first time since Dec 2011. The trajectory of the domestic inflation suggests that the headline inflation rate will stay at around 4% until 3Q22 and full-year inflation will thus far exceed our forecast of 3.3% for 2022 (2021: 2.5%).”

“As BOK Governor-nominee Rhee Chang-yong may not be confirmed by the upcoming rate meeting on 14 Apr, there is likelihood that the BOK will resume its rate hike in May instead. We maintain our call for another 50 bps rate hike this year, 25 bps hike each in 2Q and 3Q to bring the base rate to 1.75% by 3Q. The higher inflation risk may warrant a further 25 bps increase in 4Q (not in our base case yet).”

“Energy imports including coal, crude oil, petroleum and LNG have increased sharply since 2021 to account for around 25% of South Korea’s total import costs. With its net energy imports up sharply due to costlier oil, this has placed South Korea’s external balances under pressure.”

“The positive domestic outlook remains largely intact for now, underpinned by easing COVID-19 measures as well as the government’s temporary job creation that lifted employment in public services, health care and social services. South Korea is planning an extra budget after President elect Yoon Suk-yeol takes office in May. This would support further growth recovery in the country and we are maintaining our GDP growth forecast for South Korea at 3.0% this year (2021: 4.0%).”

- USD/CAD struggled to preserve its intraday gains and was weighed down by a combination of factors.

- Rebounding oil prices underpinned the loonie and acted as a headwind amid modest USD weakness.

- Bulls need to wait for a convincing breakthrough a descending trend-line extending from late March.

The USD/CAD pair built on the previous day's solid rebound from the 1.2400 neighbourhood, or the YTD low and gained some positive traction during the first half of the trading on Wednesday. The momentum lifted spot prices back above the 1.2500 psychological mark, though bulls struggled to capitalize on the move or find acceptance above the 200-hour SMA.

An uptick in crude oil prices underpinned the commodity-linked loonie. This, along with modest US dollar pullback from a nearly two-year high, kept a lid on any further gains for the USD/CAD pair. That said, the continuous surge in the US Treasury bond yields favours the USD bulls and should help limit any meaningful downside for the major, at least for the time being.

From a technical perspective, the intraday uptick faltered near a descending trend-line extending from the high touched on March 28, which should now act as a key pivotal point for traders. Meanwhile, technical indicators on the daily chart are still holding deep in the bearish territory and warrant caution before confirming that the USD/CAD pair has bottomed out.

The technical setup makes it prudent to wait for a convincing break through the aforementioned trend-line resistance to support prospects for any meaningful upside. The USD/CAD pair might then accelerate the recovery move towards an intermediate hurdle near the 1.2540 region. Some follow-through buying should allow bulls to make a fresh attempt to conquer the 1.2600 mark.

On the flip side, sustained weakness back below the 1.2470-1.2460 region will suggest that the overnight short-covering move has run its course and prompt fresh selling. This, in turn, would set the stage for a slide back towards challenging the 1.2400 round figure, or the lowest level since November 2021, which if broken would be seen as a fresh trigger for bearish traders.

USD/CAD 1-hour chart

-637848457483903907.png)

Key levels to watch

- DXY comes under pressure following new cycle tops.

- Extra advance could see he 100.00. mark revisited near term.

DXY comes under some corrective downside pressure after hitting new cycle peaks around 99.75 earlier on Wednesday.

The rally in DXY remains well and sound despite the ongoing knee-jerk and the dollar remains well positioned to attempt an assault to the psychological 100.00 mark ahead of the May 2020 peak at 100.55.

The current bullish stance in the index remains supported by the 6-month line near 96.30, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 94.98.

DXY daily chart

EUR/USD has confirmed a short-term bearish “wedge” continuation pattern following the break below 1.0944. Analysts at Credit Suisse look for a quick move lower.

Bear “wedge” continuation pattern suggests a quick move lower is likely

“EUR/USD has completed a relatively clear bearish ‘wedge’ continuation pattern following the break below 1.0944. These patterns typically lead to quick moves lower once confirmed and with this in mind, we look for a quick fall to crucial medium-term support at 1.0825/0806, which is the confirmed uptrend from the January 2017 low.”

“A break below 1.0825/0806 would open up a move to the 2018 low at 1.0635, with the potential ‘measured wedge objective’ just above here at 1.0675/74.”

“Resistances at 1.0944 and 1.0989/1008 ideally cap to maintain the bearish ‘wedge’.”

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting comment on the latest release of inflation figures in Philippines.

Key Takeaways

“Headline inflation accelerated at a faster pace of 4.0% y/y in Mar (from +3.0% in Feb), surpassing our estimate (3.6%) and Bloomberg consensus (3.7%). It was primarily driven by surging fuel and food prices amid upward adjustments in electricity rates and a weaker Peso against USD.”

“We have raised our 2022 full-year inflation target to 4.5% (from 3.5% previously; BSP est: 4.3%; 2021: 3.9%), after taking into consideration a higher-than-expected inflation outturn and broad-based price increases in Mar. Our revision also rests on the continued upward pressure on commodity prices and supply chain snags brought by the prolonged Russia-Ukraine conflict as well as the recovery momentum in domestic demand following easing of COVID-19 containment measures and border reopening since Feb. The ongoing petitions for a hike in minimum wage and public transport fare will add further upside risks to the nation’s inflation outlook.”

- GBP/USD has stabilised around 1.3075 and trades flat ahead of the release of Fed meeting minutes.

- The pair fell under 1.3100 on Tuesday following hawkish Fed commentary, highlighting the growing divergence in tone with the BoE.

- Some analysts are calling for a break below 1.3000 as this divergence between the banks further grows.

GBP/USD has stabilised around 1.3075, where it trades flat on Wednesday amid a subdued tone to broader FX market trade, with market participants opting to take a wait-and-see approach ahead of the release of Fed meeting minutes. Global equities have picked up where they left off with things on Tuesday and continue to press lower in wake of recent hawkish Fed speak from Vice Chairwoman Lael Brainard, and this is likely to weigh on risk-sensitive cable.

Market commentators have noted that the most recent hawkish remarks from Brainard, who is usually one of the Fed’s more dovish policymakers, highlighted the increasing divergence in tone between the Fed and BoE. Earlier in the week, BoE dove Jon Cunliffe (who was the lone voter against a rate hike at the bank’s last meeting) downplayed inflation risks and warned about economic weakness.

The upcoming Fed meeting minutes may well put this divergence in tone back in the spotlight, with some GBP/USD bears calling for a break below last week’s 1.3050 lows and a push towards annual lows at 1.3000. The pair actually already dipped underneath last week’s low earlier this session to hit 1.3045, but the move was short-lived with traders unwilling to overcommit pre-minutes.

Recent technical price action will embolden the bears; GBP/USD has in recent weeks been unable to sustain a move above its 21-Day Moving Average (now at 1.3125), sending a signal that the pair isn’t ready to break higher. Some FX strategists have called UK money market expectations for a further 140B bps in tightening from the BoE this year as overly aggressive and if this does start to get pulled back, the resultant downside in UK yields (at a time when US yields are rising), could be enough to send GBP/USD into the upper 1.20s.

- EUR/JPY adds to Tuesday’s advance above 135.00.

- Immediately to the upside comes the YTD high at 137.54.

EUR/JPY extends the rebound from weekly lows in the 134.30 zone and retakes the 135.00 mark and above.

The underlying upside momentum in the cross remains unchanged for the time being. However, EUR/JPY could attempt to consolidate before resuming the uptrend. That said, the next hurdle remains at the 2022 high at 137.54 (March 28) prior to a probable visit to the August 2015 peak at 138.99 (August 15) and ahead of the round level at 140.00.

In the meantime, while above the 200-day SMA at 130.14, the outlook for the cross is expected to remain constructive.

EUR/JPY daily charts

- Silver edged lower for the fifth straight day and dropped to a one-and-half-week low.

- The setup supports prospects for a fall to retest sub-$24.00 levels, or the March bottom.

- Sustained strength beyond the $25.00 mark is needed to negate the bearish outlook.

Silver extended the previous day's rejection slide from the vicinity of the $25.00 psychological mark and witnessed some follow-through selling on Wednesday. This marked the fifth successive day of a negative move and dragged spot prices to a one-and-half-week low, around the $24.15 region during the mid-European session.

From a technical perspective, the emergence of fresh selling at higher levels and the subsequent decline favours bearish traders. With technical indicators on the daily chart holding in the bearish territory and still far from being in the oversold zone, the XAG/USD seems vulnerable to retesting sub-$24.00 levels, or the March swing low.