- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-02-2023

- NZD/USD licks its wounds near one-month low, probes three-day downtrend.

- Convergence of 200-day EMA, lower line of rising wedge challenges bears.

- 50-day EMA guards immediate recovery but downbeat oscillators pushback bullish bias.

NZD/USD seesaws around the 0.6300 round figure as bears take a breather, after a three-day south-run, during early Tuesday. In doing so, the Kiwi pair portrays a corrective bounce off the 0.6270 support confluence amid downbeat oscillators.

Even so, the Kiwi pair’s sustained trading below the 50-day Exponential Moving Average (EMA) keeps the sellers hopeful unless the quote surpasses the 0.6340 immediate hurdle.

During the quote’s upside past 0.6340, the 0.6400 and 0.6500 round figures may offer an intermediate halt before challenging the bearish formation, namely the rising wedge, by attacking the top line of the pattern, currently around 0.6545.

It’s worth noting that the NZD/USD pair’s run-up beyond 0.6545 could propel prices toward June 2022 high near 0.6575 ahead of highlighting the 0.6600 threshold for the bulls.

Alternatively, a daily closing below the 0.6270 key support, encompassing the 200-day EMA and bottom line of the stated wedge, will confirm the bearish chart pattern, putting the base for a theoretical slump towards the sub-0.6000 levels.

During the anticipated fall, the mid-November 2022’s low near 0.6065 and the 0.6000 psychological magnet could act as the key intermediate halts.

Overall, NZD/USD remains on the bear’s radar despite the latest rebound.

NZD/USD: Daily chart

Trend: Further downside expected

- USD/CHF is displaying a lackluster performance after reaching to near the 0.9280-0.9290 supply zone.

- Fresh commentary from US President that the balloon incident doesn’t weaken US-China relations might improve risk appetite.

- An acceptance above the 0.9280-0.9290 supply zone is required for a fresh upside.

The USD/CHF pair is demonstrating a loss in the upside momentum after reaching to near the round-level resistance of 0.9300 in the early Tokyo session. The Swiss franc asset is struggling to extend gains ahead of the commentary from Federal Reserve (Fed) Chair Jerome Powell.

Risk-perceived assets remained jittery on US-China tensions and fresh risk of United States recession amid deepening expectations of further policy tightening by the Fed. However, fresh commentary from US President Joe Biden that the balloon incident doesn’t weaken US-China relations might improve the risk appetite of the market participants.

The US Dollar Index (DXY) is expected to remain lackluster after a three-day winning streak as investors await fresh triggers for acceptance at elevated levels.

After reaching to the supply zone in a 0.9280-0.9290 range, USD/CHF has sensed barricades amid an absence of acceptance signs at elevated levels. The Swiss franc asset is showing an inventory adjustment, which conveys that the US Dollar is gathering strength for a confident breakout.

The 20-period Exponential Moving Average (EMA) at 0.9267 is acting as a major support for the US Dollar bulls.

Meanwhile, the Relative Strength Index (RSI) (14) has yet not surrendered the oscillation in the bullish range of 60.00-80.00, which indicates that the upside momentum is still active.

Going forward, a break above the supply zone in a 0.9280-0.9290 range will expose the asset to January 12 high around 0.9360 followed by the round-level resistance at 0.9400.

On the flip side, a breakdown of Wednesday’s low at 0.9059 will drag the major toward 4 August 2021 low at 0.9018. A slippage below the latter will drag the asset further toward 10 May 2021 low at 0.8986.

USD/CHF hourly chart

-638113232999617373.png)

- Silver prices break downwards from a megaphone formation, suggesting that XAG/USD bias is downwards.

- Silver Price Analysis: Downward biased and will face strong resistance at around$22.29.

Silver price slides below a downslope trendline of a megaphone formation and also beneath the 100-day Exponential Moving Average (EMA) as Tuesday’s Asian session begins. At the time of writing, the XAG/USD exchanges hands at $22.25.

Silver Price Analysis: XAG/USD Technical Outlook

From a technical perspective, the XAG/USD is neutral-to-downward biased. Silver’s fall under a megaphone trendline could exacerbate the white metal’s fall toward the 100-day EMA at $22.29. A breach of the latter and the 200-day EMA at $21.94 would be in play, which, once cleared, and XAG/USD might test the November 28 swing low at $20.87.

Given the backdrop, oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC) suggest that selling pressure is gathering momentum.

Nevertheless, as an alternate scenario, the XAG/USD first resistance would be the 100-day EMA at $22.29. Once cleared, the non-yielding metal could climb toward the 50-day EMA at $23.05, ahead of the 20-day EMA at $23.32.

Silver Key Technical Levels

The Bank of Japan's (BoJ) aggressive market operations to defend its policy band for yields has not only sapped liquidity in the government bond market but also drastically limited the scope for speculation in bond futures, reported Reuters.

Key findings

A surprise adjustment to BOJ policy in December was supposed to improve the operation of the market but hardly did so. In that move, the central bank widened the band in which 10-year Japanese Government Bond (JGB) yields could move 50 basis points either side of zero from 25 basis points.

The move only heightened market speculation that the BOJ would further loosen or abandon its yield-control policy (Yield Curve Control – YCC), forcing it to buy even more bonds to defend its new upper limit.

Traders say betting on such policy change through futures has now become prohibitively expensive.

They cannot profitably short-sell the nearest three-month futures contract, maturing in March, because the BOJ owns most of the so-called cheapest-to-deliver bonds that the futures contract is pegged to.

The spread between futures maturing in March and June stood at 1.30 yen on Monday, after widening to much as 2.34 yen on Jan. 23, the biggest gap since Sept. 1999. In early December it was 0.6 yen.

Also read: USD/JPY Price Analysis: Bulls move in and target 133.00 ahead of the 200-DMA

- AUD/USD bounces off one-month low as traders brace for RBA.

- Market sentiment remains sour amid optimism towards US and mixed headlines surrounding US-China ties.

- RBA eyes fourth consecutive 0.25% rate hike, surprise invitation to Aussie buyers on 0.50% rate hike can’t be ruled out.

- Australia trade numbers, Fed Chair Powell’s speech also important for fresh impulse.

AUD/USD bounces off the 0.6860 support confluence, picking up bids to around 0.6885 during early Tuesday in Asia as trader brace for the Reserve Bank of Australia’s (RBA) monetary policy meeting. Not only the key support and the pre-RBA consolidation but recent positives on the US-China might have also put a floor under the risk-barometer prices. Even so, the quote remains around the lowest levels in a month while searching for clear directions of late.

The Aussie pair refreshed its multi-day low, despite witnessing mixed data, as the US Dollar cheers receding fears of recession and the recent hawkish bets on the Federal Reserve (Fed), especially after Friday’s upbeat jobs and activity numbers from the US. Also exerting downside pressure on the quote were fears of US-China tension after the US shot down a Chinese balloon and pushed back a diplomatic visit to Beijing. However, the latest comments from US President Joe Bide appear soothing on the matter as he said, “The balloon incident does not weaken US-China relations.”

On Monday, US Treasury Secretary Janet Yellen and President Biden both turned down expectations of the US recession and underpinned the US Dollar strength. The greenback also cheered sustained run-up in the US Treasury bond yields and downbeat equities as traders renew hawkish bets on the Fed after strong US data.

On the other hand, Australia’s fourth quarter (Q4) Retail Sales disappointed but monthly inflation data from TD Securities managed to put a floor under the AUD/USD price. Additionally positive for the Aussie pair were risk-positive headlines surrounding the ties between Canberra and Beijing.

Following a virtual meeting between trade ministers of Australia and China on February 6, China’s Commerce Ministry said that Australian and Chinese trade and commerce ministers conducted pragmatic and candid exchanges.

Amid these plays, Wall Street closed in the red and the US 10-year Treasury bond yields extended the last Friday’s rebound, which in turn allowed the US Dollar Index (DXY) to remain firmer for the third consecutive day.

Moving on, AUD/USD traders may take clues from ANZ Commodity Price Index for January and Australian trade numbers for December ahead of the RBA Interest Rate Decision. That said, the Aussie traders are already aware of the 0.25% rate hike and hence only the hawkish guide from RBA Rate Statement and/or a 0.50% rate hike could recall the pair buyers.

Also read: Reserve Bank of Australia Preview: No choice but to keep hiking rates

It should be noted that Fed Chairman Jerome Powell is also up for a speech and will be observed closely for clear directions.

Technical analysis

Failure to break the 0.6860 support confluence, comprising the 50-DMA and 61.8% Fibonacci retracement level of the June-October 2022 downturn, triggered AUD/USD pair’s latest bounce. However, bearish MACD signals and a sustained closing below the three-month-old previous support line, close to 0.6930 by the press time, keep the Aussie bears hopeful.

- AUD/JPY is oscillating in a rangebound territory ahead of the RBA’s interest rate policy.

- The RBA is widely expected to announce a fourth consecutive 25 bps interest rate hike.

- The majority of Japanese officials have denied headlines pertaining nomination of Masayoshi Amamiya as BoJ Governor.

The AUD/JPY is displaying back-and-forth moves around 91.30 as investors are awaiting the interest rate decision by the Reserve Bank of Australia (RBA) for fresh impetus. Signs of volatility contraction are visible in the cross ahead of RBA policy as investors will keenly focus on remarks over inflation projections.

A historic jump in the Australian Consumer Price Index (CPI) to 7.8% for the fourth quarter of CY2022 dictates that households are bound for extremely higher payouts to necessities and durables. Also, the Australian inflationary pressures have not peaked yet, which gives a green signal to the continuation of policy tightening by the central bank.

To tame soaring inflation, RBA Governor Philip Lowe has already pushed the Official Cash Rate (OCR) to 3.10% and further escalation in interest rates cannot be ruled out.

Analysts at ING expect “RBA to hike rates by 25 bps to 3.35%. Considering the much higher-than-expected inflation readings over the past two months, we have increased our peak RBA cash rate forecast to 4.1% from 3.6%, assuming that there are two further months of 25 bps hikes ahead. AN occurrence of the same would be the fourth consecutive 25 bps rate hike by the central bank.

Meanwhile, a virtual meeting between trade partners of Australia and China on Monday is broadly setting a positive tone for the Australian Dollar. China is willing to restart the economic, trade exchange mechanism with Australia and hopes that the latter will provide Chinese firms with a fair, open, non-discriminatory business environment.

On the Japanese Yen front, The Yen displayed sheer volatility after a report from Nikkei claimed that the Japanese government has approached Bank of Japan (BoJ) Deputy Governor Masayoshi Amamiya to succeed Haruhiko Kuroda as the head of the central bank.

Japan’s Deputy Chief Cabinet Secretary Yoshihiko Isozaki clarified on Monday that there is “no truth to report BoJ Deputy Gov Amamiya sounded out for the next BoJ governor.

Also, Japan's Finance Minister Shunichi Suzuki cited “I have not heard anything about the nomination of Amamiya as BoJ Governor,” as reported by Reuters.

“British central bank was prepared to do more to get inflation back to target,” said Bank of England (BoE) Chief Economist Huw Pill on Monday per Reuters. The news also states that the BoE suggested last week that interest rates were approaching their peak.

Key comments

I do have a high degree of confidence (about getting inflation to target) because we know what we're going to do.

We've done a lot to achieve it, we're prepared to do more as necessary to ensure that we achieve it sustainably.

And I don't think anyone is changing their mind or getting cold feet or anything like that.

BoE had to ‘guard against doing too much’ given the typical 18-month lag for rate hikes to impact the economy and the risk that it could push inflation too low.

We are reaching the point where those types of concerns are at the forefront of our minds.

But if you ask me where we are at the moment, I think we are still more concerned about the potential persistence of inflation.

Concern about inflationary pressure in the labor market ‘probably tilts us to saying we haven't quite got to the point where we're confident to engage in a discussion of a turning point in rates.’

Chances of inflation becoming more embedded in the UK is greater than continental Europe.

Also read: BoE’s Mann: Next step in bank rate is that it is more likely to be another hike

German Economy Minister Robert Habeck expressed optimism on Monday about resolving a European Union trade dispute with Washington, saying he saw room for compromise on certain elements of the US Inflation Reduction Act and its green subsidies, reported Reuters.

Reuters also quotes Germany’s Habeck as saying, “There is still a fair chance to reach agreements that will allow European industry to participate, and not be excluded from, the Inflation Reduction Act."

“The US legislative process was completed, but work was now underway on regulations implementing the law,” also mentioned Germany’s Habeck while adding, “That process was far advanced, or more or less completed, for the automotive and battery sectors, but was still ongoing for the areas of hydrogen, critical minerals and raw materials.”

The news also quotes President Joe Biden's top economic adviser Brian Deese as saying, “Europe and other U.S. allies could actually benefit from the U.S. investments planned since they would accelerate reductions in the cost of next-generation technologies that are critical for the world.”

"Europe and other allied countries have nothing to fear from the Inflation Reduction Act and quite a bit to gain," US President Biden’s Adviser Deese said.

Germany’s Habeck is slated to meet with US Treasury Secretary Janet Yellen on Tuesday along with French Finance Minister Bruno Le Maire per Reuters.

Additional reads

US President Biden: The balloon incident does not weaken US-China relations

EUR/USD dives beneath 1.0750 to 4-week lows around 1.0720s

German Factory Orders jumps 3.2% MoM in December vs. 2.0% expected

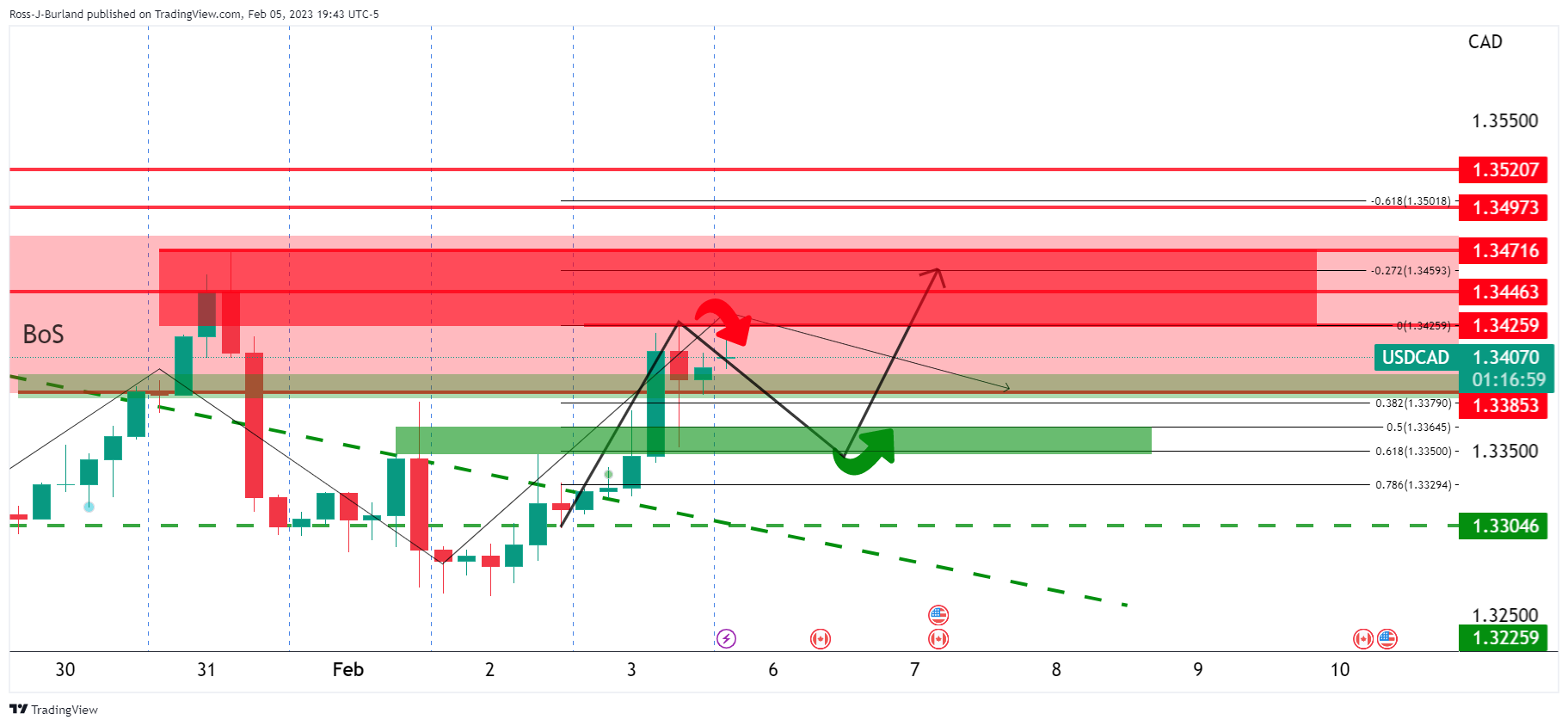

- USD/CAD is expected to perform lackluster ahead of Fed Powell’s speech.

- Significant gains will be added to the Loonie asset after a confident breakout of the Rising Channel.

- An oscillating in the bullish range by the RSI (14) favors upside bias.

The USD/CAD pair has turned sideways after a marginal correction from 1.3476 in the early Tokyo session. The Loonie asset is expected to resume its upside journey amid strength in the US Dollar Index (DXY) ahead of the speech from Federal Reserve (Fed) chair Jerome Powell for interest rate guidance. Also, Bank of Canada (BoC) Governor Tiff Macklem will provide commentary about further policy action.

S&P500 witnessed a steep fall on Monday on expectations that the Fed might consider more rate hikes amid fresh concerns after upbeat US Nonfarm Payrolls (NFP) data, portraying a sheer fall in investors’ risk appetite. The US Dollar Index (DXY) is expected to continue its three-day winning streak amid soaring hawkish Fed bets. Also, declining demand for US government bonds will keep yields solid.

Apart from that, investors will keep an eye on the movement of oil price as it has shown a sheer recovery move after dropping below $72.70, It is worth noting that Canada is a leading exporter of oil to the United States and higher oil price will support the Canadian Dollar.

USD/CAD is building strength to deliver a breakout of the Falling Channel chart pattern on a four-hour scale. The Loonie asset is expected to build an inventory accumulation as the US Dollar needs stellar buying interest for a confident breakout. A breakout of the chart pattern will be tested with a marginal correction around 1.3440.

The 10-period Exponential Moving Average (EMA) at 1.3435 will continue to act as major support for the US Dollar bulls.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.000, demonstrating an active upside momentum.

After a breakout of the Falling Channel chart pattern, testing of the breakout around 1.3440 could be an optimal buying opportunity, which will drive the asset towards January 19 high at 1.3521 followed by January 6 low at 1.3538.

In an alternative scenario, a confident downside break below Monday’s low around 1.3400 will drag the asset toward January 3 low at 1.3321. A slippage below the latter will drag the asset toward February 2 low at 1.3262.

USD/CAD four-hour chart

-638113195527051401.png)

- EUR/USD holds lower grounds at one-month bottom, steadies after three-day downtrend.

- Downbeat MACD signals, RSI (14) join trend line breakdown to favor sellers.

- Three-month-old ascending trend line adds to the downside filters.

- Buyers need validation from 1.0930 to retake control.

EUR/USD licks its wounds at the lowest levels in a month, depressed around 1.0725 during early Tuesday in Asia. That said, the major currency pair dropped during the last consecutive three days.

Not only the three-day downtrend but the quote’s sustained downside break of an ascending trend line from early November join the bearish MACD signals and the downbeat RSI (14), not oversold, to keep sellers hopeful.

As a result, the EUR/USD pair’s further downside towards the 50-DMA, around 1.0690, appears imminent.

However, a three-month-long upward-sloping trend line, close to 1.0655 could challenge the EUR/USD bears afterward.

In a case where the EUR/USD pairs remain bearish past 1.0655, the previous monthly low near 1.0480 and the 200-DMA level surrounding 1.0320 will gain the market’s attention.

Alternatively, recovery remains elusive unless the quote stays below the support-turned-resistance line, around 1.0850.

Even so, multiple tops marked around 1.0930 appears more important as the validation point for the EUR/USD buyers.

Following that, a run-up towards the 1.1000 psychological magnet and then refreshing the monthly high, currently around 1.1030, can’t be ruled out.

Overall, EUR/USD is likely to remain bearish with the 50-DMA and ascending trend line from November 11 acting as immediate support to watch.

EUR/USD: Daily chart

Trend: Further downside expected

“The risk of a recession in the United States was still very low,” said US President Joe Biden on Monday upon his return to the White House after spending the weekend at the Camp David presidential retreat.

US President Biden also turned down the negative impact of the latest Chinese balloon shooting by the US on the Sino-American ties.

It should be noted that US President Biden will deliver the State of the Union (SOTU) address on Tuesday and is likely to call for maximum tax on billionaires and promote US-made goods and materials.

Market implications

The news should have ideally helped the market sentiment but the early hours of the Asian session fail to portray the impact. That said, the risk barometer AUD/USD pair remains pressured ahead of the Reserve Bank of Australia (RBA) monetary policy meeting.

Also read: AUD/USD slumps below the 50-day EMA to the 0.6880 area

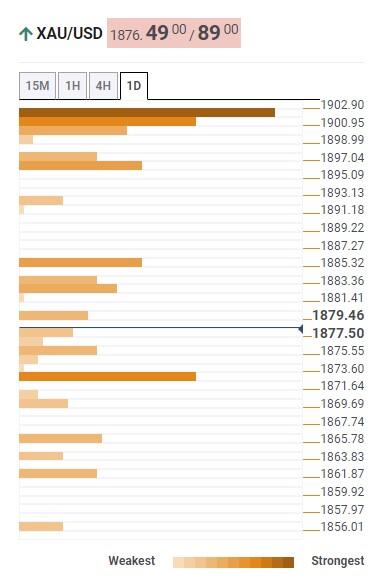

- Gold price has faced barricades around the 23.6% Fibo retracement at $1,880.00 as yields soar.

- The commentary from Fed Powell about interest rate guidance will be keenly watched.

- The USD Index has refreshed its four-week high at 103.28 amid a risk-off mood.

Gold price (XAU/USD) is displaying a sideways auction after building a cushion around $1,860.00 in the early Asian session. The precious metal is expected to display more weakness after surrendering immediate support as US Treasury yields are gaining dramatically ahead of the speech by Federal Reserve (Fed) chair Jerome Powell. The return generated by 10-year US Treasury bonds has scaled to nearly 3.65% with sheer pace.

Markets remained jittery on Monday led by US-China tensions and tight United States labor market data, which has infused fresh blood into Fed’s policy tightening spell. The risk aversion theme kept S&P500 in a negative trajectory consecutive for the second trading session. The US Dollar Index (DXY) extended its upside journey after surpassing the 102.80 resistance and refreshed its four-week high at 103.28.

For further guidance, the commentary from Fed’s Powell about the roadmap of taming stubborn inflation and fresh concerns about inflation projections due to a rebound in labor market conditions will be keenly watched. Meanwhile, U.S. Treasury Secretary Janet Yellen said on Monday the United States may avoid a recession as inflation is coming down while the labor market remains strong, as reported by Reuters.

Gold technical analysis

Gold price has sensed rejection after attempting to scale above the 203.6% Fibonacci retracement (placed from November 3 low at $1,616.69 to February 2 high of around $1,960.00) at around $1,880.00 on a four-hour scale. A rejection around 23.6% Fibo retracement indicates that the asset has been exposed to the next cushion at 38.2% Fibo retracement placed around $1,829.45.

A bear cross, represented by the 20-and 50-period Exponential Moving Averages (EMAs) at $1,921.60, adds to the downside filters.

Adding to that, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more weakness ahead.

Gold four-hour chart

- Since last Thursday, the GBP/USD has lost more than 3% as the US Dollar strengthened.

- GBP/USD Price Analysis: Daily close below the 100-DMA would exacerbate a test of 1.2000.

The Pound Sterling (GBP) capped its fall against the US Dollar (USD) on Monday at around the 100-day Exponential Moving Average (EMA) at 1.2028, though the GBP/USD remains below the latter. That said, a GBP/USD daily close would keep bears hopeful of testing the 1.2000 figure. At the time of writing, the GBP/USD hovers around 1.2024 after hitting a daily high of 1.2077.

GBP/USD Price Analysis: Technical outlook

Since last Thursday, after the Bank of England (BoE) raised rates by 50 bps, lifting the Bank Rate to 4%, the GBP/USD collapsed by 1.20%. Then it was followed by last Friday’s US jobs data, which exerted downward pressure, sending the GBP/USD into a tailspin, plummeting more than 150 pips in the session toward the 1.2050 area.

All that said, the technical outlook is tilted to the downside. Oscillators like the Relative Strength Index (RSI) and the Rate of Change (RoC0 turned bearish. The latter shows that sellers are gathering strong momentum, posing a threat to crack the psychological 1.2000.

If the GBP/USD breaks below 1.20, that would open the door for further downside. Once cleared, GBP/USD’s next support would be 1.1900, followed by a two-month-old upslope trendline that passes at around 1.1880-1.1900 and then the YTD Low at 1.1841.

GBP/USD Key Technical Levels

- AUD/USD trims its earlier losses as the Reserve Bank of Australia policy decision looms.

- The Reserve Bank of Australia is expected to raise rates by 25 bps to 3.35%.

- AUD/USD Price Analysis: Shifted downward biased as bears eye 0.6800.

The AUD/USD extended its fall since last Friday's solid US jobs report, augmented speculations that the US Federal Reserve (Fed) might increase rates above market players' expectations for a peak of 5%. Of late, the Australian Dollar (AUD) has trimmed some of those losses vs. the US Dollar (USD), as a monetary policy decision of the Reserve Bank of Australia (RBA) looms. At the time of writing, the AUD/USD is trading at 0.6883.

US data from the last week boosted the US Dollar

Wall Street continued to portray a risk-off impulse. The AUD/USD rebounded at daily lows of 0.6855 and is testing the 50-day Exponential Moving Average (EMA) at 0.6893.

The US Bureau of Labor Statistics (BLS) revealed that Nonfarm Payrolls for December surged by 517K jobs, blowing forecasts for a gain of almost 200K, while the Unemployment Rate dived to a 53-year low to 3.4% from a 3.5% previous month. Consequently, money market futures had priced the Federal Funds Rate (FFR) to be lifted to 5.25%-5.50%, per World Interest Rate Probabilities (WIRP).

The Australian economic docket will feature the Reserve Bank of Australia (RBA) monetary policy decision on Tuesday, February 7, at 03:30 GMT. Most analysts estimate the RBA would raise rates by 25 basis points (bps) to 3.35% and would update its forecasts at the meeting. Those would be available once the Statement of Monetary Policy (SoMP) is revealed on Friday.

Also read: RBA Preview: Forecasts from 10 major banks, looking for any clues that the Bank is considering pausing

Meanwhile, the US economic docket will feature Fed speaking led by Chairman Jerome Powell and Fed Governor Michael Barr. Data-wise, the US Trade Balance would be featured.

AUD/USD technical analysis

With the AUD/USD failing to crack the 200-day Exponential Moving Average (EMA) and the 100-day EMA, each at 0.7144 and 0.7016, the pair shifted from neutral to downward biased. As the major extended its losses below the 50-day EMA, it would accelerate the downtrend toward the 0.6800 figure, but firstly, AUD/USD sellers need to clear the 20-day EMA at 0.6820.

As an alternate scenario, if the AUD/USD reclaims 0.6900, a test of the 100-day EMA at 0.7016 is likely, though to reach the 200-day EMA, it would need a surprise by the Reserve Bank of Australia (RBA).

What you need to take care of on Tuesday, February 7:

The US Dollar extended its Friday rally to fresh February highs against most major rivals, fueled by a dismal market mood.

Political tensions between Washington and Beijing weighed on the market mood, further fueling demand for the American currency. An apparent surveillance balloon from China flew through US skies last week, with the saga ending after President Joe Biden's administration took it down on Saturday. As a result, diplomatic relations between both countries were temporarily interrupted as the United States postponed Secretary of State Blinken's forthcoming trip to China.

EUR/USD fell to 1.0708, bouncing towards the current 1.0720 price zone but ending a third consecutive day in the red. Poor EU data further weighed on the Euro. Germany published December Factory Orders, which fell by 10.1% YoY, much worse than anticipated. On the other, Euro Zone Retail Sales fell by 2.7% MoM in January and by 2.8% compared to a year earlier.

GBP/USD trades around 1.2020. Earlier in the day, Bank of England Chief Economist Huw Pill said that UK policymakers are prepared to do more to get inflation back to target, as chances of inflation getting embedded in the United Kingdom are higher than in Europe.

AUD/USD trades around 0.6880 ahead of the Reserve Bank of Australia's monetary policy decision. The Canadian Dollar edged sharply lower, with USD/CAD now hovering at around 1.3440.

USD/JPY gapped higher at the weekly opening, and the gap remains unfilled. The pair currently trades at around 132.50, with eyes on a potential pullback to 131.20.

US Treasury yields advanced. The 10-year note currently yields 3.63%, up 10 bps, while the 2-year note offers 4.43%, up 13 bps. Stock markets, on the other hand, trade in the red, WITH US indexes losing some ground after their European counterparts settled in the red.

Spot gold bottomed at $1,860.20 a troy ounce, a fresh one-month low, bouncing modestly to end the day at $1,866. Crude oil prices fell intraday but managed to recover some ground. WTI posted a modest intraday advance and settled at $74.30.

Like this article? Help us with some feedback by answering this survey:

- Western Texas Intermediate recovers some ground even though the US Dollar remains buoyant.

- IEA’s Director commented that China’s reopening would drive oil prices.

- WTI Technical Analysis: Triple bottom looms around $72.50.

US crude oil benchmark known as Western Texas Intermediate (WTI) records minimal gains after diving toward an eight-week low at $72.30 per barrel on Monday, exchanging hands at around $73.96 per barrel, capped by a strong US Dollar (USD) across the board.

Wall Street’s extended its losses on Monday due to market participants repricing a less dovish Federal Reserve (Fed) as expected. Money market futures estimates 50 bps of rate hikes by the US central banks, which would lift the Fed Funds target to the 5%-5.25% range. Hence, the greenback continues to extend its recovery, as shown by the US Dollar Index, a measure of the buck’s value against a basket of six currencies, up 0.69%, at 103.703.

Since last Friday, WTI has slid 3%, following the robust US employment data.

Even though a strong US Dollar is a headwind for the “black gold,” China’s reopening prospects remain a driver for oil prices, as the International Energy Agency (IEA) Executive Director Fatih Birol reported. Birol commented that producers might reconsider their output policies as China’s Covid-19 relaxation would increase demand for crude. He added, “We expect about half of the growth in global oil demand this year will come from China.”

Oil traders should be aware that price caps on Russian products began on Sunday, as G7 nations, the EU and Australia, agreed on price limits of oil-refined Russian products.

WTI Technical Analysis

Technically, WTI is still downward biased as long as the quote stands below $82.00 PB. Additionally, last Friday’s WTI failure to crack the 20-day Exponential Moving Average (EMA) at $77.65 exacerbated oil’s fall toward the year’s lows, at $72.30, breaking below the January 4 low of $72.50.

Nevertheless, since then, oil has rebounded and is aiming toward the $73.80 area, opening the door for a leg up. Hence, WTI’s first resistance would be $74.00. A breach of the latter will expose the 20-day EMA at 77.64, followed by the $78.00 psychological level, ahead of the 50-day EMA at $78.77. Conversely, WTI’s would resume downwards once it breaks beneath $72.30.

- USD/JPY gapped up since the Asian session by about 30 pips, reaching a daily high of 132.90.

- USD/JPY Price Analysis: Neutral biased, but tilted upwards, with bulls eyeing 133.00.

The USD/JPY gapped toward new 5-week highs shy of the 50-day Exponential Moving Average (EMA) by just two pips at 132.89 and remained nearby, about to challenge the 133.00 psychological price level. The last US jobs report crushed estimates, bolstering the US Dollar (USD) on speculations for further Federal Reserve’s (Fed) aggression. Therefore, the USD/JPY rallied 3.45% since Friday and exchanged hands at 132.79 after hitting a low of 131.51.

USD/JPY Price Analysis: Technical outlook

The USD/JPY shifted neutral biased after gapping up from around 131.20 to current exchange rates. On its way up, the major reclaimed the 20-day Exponential Moving Average (EMA) at 130.53, and it’s poised to crack the 50-day EMA at 132.91, ahead of the 133.00 figure.

With the Relative Strength Index (RSI) and the Rate of Change (RoC), oscillators shifted bullish, opening the door for further upside. However, it should be said that the USD/JPY would face the trend-setter 200-day EMA at 133.88, which, once cleared, would pave the way to test the 100-day EMA above the 135.00 figure.

As an alternate scenario, the USD/JPY first support would be 132.00. A breach of the latter and the USD/JPY could test the day’s low at 131.51, followed by last Friday’s high at 131.20. Once those demand zones are broken, it would expose the 20-day EMA at 130.29.

USD/JPY Key Technical Levels

- EUR/USD stumbles to multi-week lows at around 1.0720s on a buoyant US Dollar.

- Last week’s EU’s retail sales disappointed, while factory activity in Germany improved as orders rose.

- EUR/USD Price Analysis: After dropping below the 100-DMA, risks are skewed to the downside.

The EUR/USD extended its fall to new four-week lows at around 1.0720s due to broad US Dollar (USD) strength after last Friday’s data reaffirmed the need for higher interest rates in the United States. Hence, money market futures began to price in higher interest rates, underpinning the US Treasury bond yields and the buck. At the time of typing, the EUR/USD exchanges hands at 1.0730.

Factory orders in Germany advanced, though the Euro remains downward pressured

The EUR/USD lost traction on Friday, as the US Department of Labor revealed that 517K jobs were added to the economy, crushing the 200K expectations and sending the Unemployment Rate dipping towards 3.4% from 3.5%. That triggered a sell-off of currencies, except the buck in the FX space, particularly the Euro. Even though the European Central Bank (ECB) raised rates by 50 bps, President Lagarde’s press conference was perceived as dovish, albeit the chorus of hawks expecting further aggression by the central bank.

Datawise, the European docket reported soft Retail Sales for December, which plunged to -2.7% MoM, vs. a -2.5% contraction expected. Consequently, the YoY rate was -2.8% compared to -2.7% estimates by street analysts.

Earlier in the European session, Germany revealed that factory orders improved from December’s 4.4% MoM plunge to 3.2% expansion, smashing estimates of 2%, but annually paced, barely improved to -10.1% vs. -10.2% estimated. In other data, Industrial Production in Germany and Spain will be featured on Tuesday, while Italy will do it on Friday.

On central bank speaking, the ECB’s Robert Holtzmann said, “Monetary policy must continue to show its teeth until we see a credible convergence to our inflation target.” At the same time, Kazaks added that if the incoming data meet the ECB’s current expectations, “rates will be raised by 50 basis points in March.

An absent economic calendar shifted traders’ focus to Tuesday on the US front. The docket will feature the Trade Balance alongside the Federal Reserve Chair Jerome Powell’s interview at the Economic Club of Washington.

EUR/USD Technical Analysis

After last Friday’s US NFP report, the EUR/USD broke crucial support at the 100-day Exponential Moving Average (EMA) at 1.0850. In addition, an inverted hammer, a bearish signal, emerged, opening the door for further downside. Therefore, the Euro resumed its downtrend, plunging last Friday’s low of 1.0835 and beneath 1.0800 below. That said, the EUR/USD next support would be the 1.0700 psychological level, which, once cleared, would expose the 50-day EMA At 1.0579, followed by the 20-day EMA at 1.0533, ahead of the 1.0500 mark.

The Market Participants Survey for the fourth quarter of 2022 published by the Bank of Canada (BOC) showed on Monday that the median of responses for the policy rate by end-2023 stood at 4%, forecasting a 50 bps cut.

The median forecast for the real Gross Domestic Product (GDP) points to a fall of 0.4% in 2023 and an expansion of 2% in 2024.

Market reaction

USD/CAD retreated from the weekly high it set at 1.3475 earlier in the session after this report and was last seen trading at 1.3445, where it was up 0.35% on the day.

On Friday, AUD/USD dove back below the 0.700 level. Economists at Rabobank continue to see scope for AUD/USD to strengthen to 0.72 towards the back half of this year.

AUD/USD to trade mostly in the 0.69-0.70 area on a three-month view

“An as expected 25 bps rate hike from the RBA this week, should not in itself create much of a reaction from the AUD. However, any rhetoric which pushes back against the risk of a forthcoming policy pause should lend support.”

We expect AUD/USD to trade mostly in the 0.69-0.70 area on a three-month view as the market assesses the policy outlook of both the Fed and the RBA.”

“We look for a move to AUD/USD 0.72 in the latter half of the year assuming China’s economic recovery remains on track.”

See – RBA Preview: Forecasts from 10 major banks, looking for any clues that the Bank is considering pausing

The Dollar peaked in September when real rates also peaked. Kit Juckes, Chief Global FX Strategist at Société Générale, expects to see the end of the downtrend for now.

A bucket of cold water to calm Dollar bears down

“A pause seems likely. This week’s economic calendar is short on major market-moving data, and market participants may find themselves discussing the meaning of the US data rather than doing anything.”

“We’d warn that the rates and FX market reactions are tame so far, and that leaves room for the Dollar bounce to go further.”

“USD/JPY to 135, EUR/USD to 1.05 and GBP/USD back below 1.20 seem more likely this month than another slide for the Dollar.

“But none of that alters the two key market drivers. Firstly, as the risk of a deep global downturn fades, the Dollar remains vulnerable; and secondly, the lack of a new dominant theme means we can see choppy trading conditions until one emerges.”

Economists at the bank of Montreal point out prerequisites needed to lift EUR/USD and GBP/USD above 1.10 and 1.25, respectively.

Reduced risk of economic hard landing in Europe provides better support to EUR and GBP

“It’s one month into 2023 and the reduced risk of an economic hard landing in Europe is providing better support to the EUR and the GBP. However, for sustained appreciation vs the USD, we think these currencies need a very sold risk appetite picture, and continued improvement in inflation.”

“Progress in the Ukraine war, limited disappointment in energy prices, and smooth global trade (‘Goldilocks’) may also be prerequisites for substantial progress above 1.10 in EUR/USD and 1.25 in GBP/USD.”

- Last week’s strong US labor market report warranted further US Federal Reserve action.

- Money market futures have shown 50 bps of rate hikes priced in for the May meeting.

- Gold Price Analysis: Neutral with risk skewed to the downside.

Gold price fall is being stopped as bulls entered the market at last Friday’s low of around $1860 and reclaimed $1870. A staggering US Nonfarm Payrolls report and markets repricing further interest rate hikes augmented demand for the greenback, a headwind for the non-yielding metal. At the time of writing, the XAU/USD exchanges hands at $1868.77, up by half of a one percentage point.

Gold’s pressured by expectations for a hawkish Fed, strong US Dollar

Wall Street continued to stumble after the US Department of Labor revealed that the United States (US) economy added more than 500K jobs to the economy, while the unemployment rate dropped to a 53-and-a-half-year low level of 3.4%. That reignited the spark that the US Federal Reserve (Fed) might need to raise rates, above the market’s expectations, with traders foreseeing a rate cut in the second half of 2023.

World Interest Rate Probabilities (WIRP) suggest that 50 bps are priced in for the next couple of meetings, while chances stand at 90% for the June meeting. That would take the Federal Funds target to the 5%-5.25% range, aligned with FOMC’s December dot plots.

In the meantime, the US Dollar Index, a gauge of the buck’s value vs. its peers, advances 0.50%, up at 103.519, putting a lid on Gold’s recovery, alongside the US 10-year Treasury bond yield, up nine basis points (bps) at 3.616%.

Gold trader’s focus shifted to Federal Reserve Chair Jerome Powell’s interview at the Economic Club of Washington, alongside the Trade Balance and President Joe Biden’s delivery of the State of the Union before the US Congress, on Tuesday.

Gold Price Analysis: XAU/USD Technical Outlook

Technically speaking, XAU/USD found its foot at around $1860, shy of testing the 50-day Exponential Moving Average (EMA) at $1854.87. Although the yellow metal hit a daily high of $1881.31, risks are skewed to the downside. Supporting the aforementioned is the Relative Strength Index (RSP) collapsing to bearish territory, while the Rate of Change (RoC) portrays sellers gathering momentum.

Therefore, the XAU/USD first support would be February’s 6 low at $1860.44. Break below will expose the 50-day EMA at $1854.85, followed by the 100-day EMA at 1812.85, ahead of the $1800 psychological level.

S&P 500 extended its year-to-date rally last week despite the fact that the index 500 fell 1% on Friday. Economists at Merrill note that a lot of technicians are pointing to further upside overall.

A lot of technicians believe that the next resistance is 4325

“The last time you had a deeply inverted yield curve this deep and stocks rallied this aggressively off their lows from the October lows of say 3490 on the S&P 500 give or take was 1979 and then between 2006 and mid-2007 when the S&P rallied 25% off its lows.”

“If you go 25% off the lows of 3490, in today’s terms that moves the index to 4350. That’s not the target. These are just technical structural factors that if similar patterns hold as the last time we had a deeply inverted curve and stocks rallied this aggressively off their lows on average about 25%, it could take S&P 500 to 4250.”

“Now, if you look at technical analysis, a lot of technicians believe that the next resistance is 4325. That is not our expertise here in CIO, but with the momentum taking us above 4100, a lot of technicians are pointing to further upside overall.”

The Reserve Bank of Australia (RBA) will announce its next monetary policy decision on Tuesday, February 7 at 03:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of ten major banks regarding the upcoming central bank's decision.

RBA is expected to hike rates by 25 basis points to 3.35%. Updated macro forecasts will come at this week’s meeting. The bank then releases its Statement on Monetary Policy Friday. This report will contain updated forecasts.

ANZ

“Another upgrade to inflation forecasts in the RBA’s February Statement on Monetary Policy will provide further support for an increase in the cash rate. We expect the RBA to lift its end-2023 trimmed mean inflation forecast from 3.8% to 4.2%. Importantly, we think the February forecasts will include a return to 3% YoY inflation, which is the top of the target band, in Q2 2025. While a 25 bps hike is the most likely option, we expect the Board to consider a 50 bps hike. Early signs of a slowdown in consumer spending and a softening in business conditions should be enough though for the RBA that demand is responding to higher rates, allowing it to stick to 25 bps.”

ING

“RBA is expected to hike rates by 25 bps. Considering the much higher-than-expected inflation readings over the past two months, we have increased our peak RBA cash rate forecast to 4.1% from 3.6%, assuming that there are two further months of 25 bps hikes ahead. We see a slight softening of the labour and housing markets, but this is not likely to be decisive for future rate decisions. There will be a subsequent statement on monetary policy on 10 February and this will likely provide more clarity on direction.”

Standard Chartered

“We expect the RBA to hike the cash rate by another 25 bps to 3.35% from 3.10% previously. This would be the fourth consecutive 25 bps rate hike since October. In aggregate, the central bank would have hiked by 325 bps since it started its rate-hiking cycle back in May. On balance, we see the RBA hiking again in February, followed by another 15 bps in March. We see still-elevated inflation as a risk to further hikes.”

HSBC

“We expect the RBA to deliver a 25 bps hike. Hawkish comments hinting at further hikes could open some upside for the AUD over the near term.”

TDS

“Accelerating services inflation locks in a 25 bps hike. We forecast a follow-up 25 bps hike in Mar taking terminal to 3.6% but the statement may open the door to pausing after next week. Official forecasts will be released 10th Feb, but the statement will provide a flavour of what to expect. Wage f/c's to be revised higher but the inflation trajectory to be left broadly unchanged.”

NAB

“We expect the Board will deliver another 25 bps increase. Important for the outlook will be updated forecasts, previewed in the post-meeting statement and detailed in Friday’s SoMP on 10 February. We expect the forecasts to continue to draw a path to a soft landing, but the characterisation of the risks will be key to determine whether the RBA continues to be confident that it can return inflation to target without pushing rates deep into restrictive territory. We see the cash rate increasing by 25 bps in February and March to a peak of 3.6%.”

Crédit Agricole

“We expect the RBA to raise its cash rate by 25 bps to 3.35%, which would not have much impact on the AUD as the market is about 75% priced for such a hike. Softening household consumption and employment growth leave the market a little hesitant to fully price in a 25 bps rate hike. This data also leaves investors on the lookout for any signs from the RBA of a pause in its tightening cycle. With the market still pricing in an RBA terminal rate of between 3.60%.”

Danske Bank

“We look for a 25 bps hike.”

SocGen

“We expect the RBA to increase the cash rate target from 3.10% to 3.35%, marking its fourth consecutive ‘baby-step’ hike of 25 bps since October last year. The RBA policymakers are clearly more focused on the slowdown of economic growth, although macroeconomic indicators (especially inflation and employment) do not support a termination of the rate-hike cycle at this juncture. We maintain our base scenario that the RBA will end the tightening cycle at a terminal policy rate of 3.85% in April.”

Citibank

“RBA will likely raise its policy rate for the 9th consecutive time by 25 bps, taking the cash rate to 3.35%. With inflation well above the target band at 7.8%, the real policy rate remains negative and likely to remain there until around mid-2024. The RBA is also likely to signal further interest rate increases are likely and the risks to this week’s meeting also remain tilted hawkish with a non-trivial likelihood of a 50 bps increase. We now expect the RBA’s terminal cash rate view to rise from 3.35% in Q1 to 3.85% in Q2 while also lifting their inflation forecast for Australia with year-ended headline inflation for 2023 now forecast to be 1.4pp higher to 5.4% and underlying inflation also 1.3pp higher at 5.0%. We expect the RBA to lift the inflation forecasts to June 2024, ie, inflation to remain higher for longer in the February SMP due on Friday. This brings into focus the March and April RBA meetings that leave at least two more 25 bps hikes on the table to take the cash rate to 3.85%.”

- Canada Ivey PMI improved at a much stronger pace than expected in January.

- USD/CAD continues to trade in positive territory near 1.3450.

The Ivey Purchasing Managers Index (PMI), an economic index which measures the month-to-month variation in economic activity in Canada, climbed to 60.1 (seasonally adjusted) in January from 33.4 in December. This reading came in better than the market expectation of 55.2.

Further details of the publication revealed that the Employment Index edged higher to 60.5 from 59.5 and the Prices Index declined to 63.6 from 67.5.

Market reaction

USD/CAD showed no immediate reaction to this report and was last seen trading at 1.3450, where it was up 0.4% on a daily basis.

- GBP/USD manages to reverse part of the recent sell-off.

- BoE’s C.Mann sees upside risks to the inflation outlook.

- UK Construction PMI improved a tad in January.

The British pound manages to somewhat shrug off the current dollar strength and motivates GBP/USD to rebound from earlier lows near 1.2020 on Monday.

GBP/USD looks supported near 1.2020

GBP/USD regains the smile and leaves behind the earlier drop to fresh 5-week lows in the 1.2025/20 band at the beginning of the week.

In fact, Cable manages to gather some upside traction despite the persistent buying interest in the greenback, which has already lifted the USD Index (DXY) to new 4-week peaks well north of the 103.00 barrier.

In the UK docket, BoE MPC member C.Mann said she sees upside risks to the inflation outlook, at the time when she added that the consequences of under-tightening far outweigh the alternative.

Data wise, New Car Sales expanded 14.7% in the year to January and the S&P Global/CIPS Construction PMI dropped marginally to 48.4 in the same month (from 48.8).

What to look for around GBP

Same as with the rest of the risk complex, the British pound is expected to track the dollar’s price action and the policy divergence between the Federal Reserve and the Bank of England when it comes to Cable’s near-term direction.

Furthermore, the UK economy’s bleak outlook in the next months coupled with elevated inflation leaves the prospects for further gains in the Sterling somewhat curtailed in the short term, while a BoE near its terminal rate does not look helpful for the currency either.

Key events in the UK this week: BRC Retail Sales Monitor (Tuesday) – Flash Q4 GDP Growth Rate, Balance of Trade, Construction Output, Industrial Production, Manufacturing Production (Friday).

GBP/USD levels to consider

As of writing, the pair is gaining 0.02% at 1.2052 and a breakout of 1.2174 (55-day SMA) would open the door to 1.2447 (2023 high January 23) and then 1.2666 (weekly high May 27 2022). On the other hand, the next support emerges at 1.1950 (200-day SMA) followed by 1.1841 (2023 low January 6) and finally 1.1807 (100-day SMA).

Economists at Wells Fargo believe the Mexican Peso will be able to absorb decoupling from the Fed and the currency will not come under undue pressure.

USD/MXN can move toward 18.00 by the middle of this year

“Prudent monetary policy decisions and effective forward guidance should support the Peso, while broad-based USD depreciation can help the Mexican currency strengthen against greenback during the decoupling.”

“Even with diverging paths for monetary policy between Banxico and the Fed, we believe the USD/MXN exchange rate can move toward 18.00 by the middle of this year and eventually trade with a 17 handle by the end of 2023 and into 2024.”

Economists at ANZ believe Gold will be largely guided by US economic data. A hot job market will keep Fed hawkish, pummeling the yellow metal.

Strong labour data provides more room for the Fed to remain hawkish

“Labor data has been strong despite aggressive rate hikes, providing more room for the Fed to remain hawkish and delaying any rate cut until inflation comes into its target range. We see this as a headwind for the Gold price, triggering profit booking after the recent price rally.”

“Physical Gold demand is holding up in China as the economy reopens. Central banks are continuing their buying spree amid elevated geopolitical risks.”

Senior Economist at UOB Group Julia Goh and Economist Loke Siew Ting comment on the expected increase in tourism in Malaysia and its impact on the GDP.

Key Takeaways

“The global tourism sector is expected to make a big leap this year as China reopens its borders and eases domestic restrictions sooner than expected since 8 Jan 2023. The World Tourism Organisation (UNWTO) projects that international tourist arrivals could reach 80%-95% of pre-pandemic levels in 2023 (vs. 63% in 2022) despite lingering global headwinds.”

“More than 32mn Chinese travelers visited Southeast Asia before the pandemic mainly to Thailand, Vietnam, Malaysia, Cambodia, and Laos. The effect of stronger tourism activity is expected to boost Malaysia’s GDP by at least 1.0ppt, which further supports our baseline GDP growth forecast of 4.0% for 2023. The uplift will come through further recovery in tourist arrivals, resumption of China outbound travelling, and sustained domestic tourism demand.”

“Key risks to Malaysia’s tourism outlook include a weaker global outlook, slower China recovery and return of China tourists, capacity constraints, and inflation risks. To mitigate these downside risks and sustain the tourism recovery will require consistent and stable reopening of countries and borders, minimal quarantine restrictions and requirements, affordable travel, improved travel connectivity, visa facilitation, processing of passports, build-up of capacity (i.e. airline seats, hotel rooms, and supply of labour), technology improvements and e-payment facilities, better safety and security.”

- EUR/USD picks up further downside traction near 1.0750.

- Losses could accelerate below the 3-month line near 1.0760.

EUR/USD extends the corrective decline for the third consecutive session and flirts with the 1.0750 region at the beginning of the week.

A convincing breakdown of the 3-month support line around 1.0760 could open the door to extra weakness in the short-term horizon. Against that, there is an interim support at the 55-day SMA at 1.0655 prior to the 2023 low at 1.0481 (January 6).

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0318.

EUR/USD daily chart

UOB Group’s Senior Economist Alvin Liew reviews the latest PMI figures in Singapore.

Key Takeaways

“Even as we are pleasantly surprised by Jan’s uptick, Singapore’s manufacturing Purchasing Managers’ Index (PMI) still remained in contraction territory although it edged higher slightly by 0.1 point to 49.8 in Jan (from 49.7 in Dec), the fifth consecutive month of contraction in overall activity for the manufacturing sector.”

“Similarly, the electronics sector PMI remained in contraction territory but enjoyed a slightly better uptick of 0.2 point to 49.1 in Jan from 48.9 in Dec. This was nonetheless the 6th consecutive contraction since Aug 2022. The reason for the improvement was attributed to slower contraction for most of the sub-indices within both of the Jan PMIs, but importantly, these sub-indices still remained in contraction territory (i.e sub-50).”

“Manufacturing PMI Outlook – The small uptick in Jan overall and electronics PMIs was a surprise to us but does not change our negative view for manufacturing in 2023. Despite the Jan improvement, most of the sub-indices within the PMI surveys remained in contraction territory and we have also kept our view of weaker external demand and the electronics downcycle remaining in place, which are typically a bad combination for economies which are trade reliant with a significant share of manufacturing related to electronics, such as Singapore, South Korea and Taiwan. We expect the PMIs for Singapore to stay in contraction territory in the first three months of 2023 and the weakness may extend for at least another quarter (or even two).”

EUR/USD moved below 1.08. A break under the 50-Day Moving Average (DMA) at 1.0680 could deepen the fall, economists at Société Générale report.

50-DMA at 1.0680 is crucial support

“Formation of weekly Inverted Hammer points towards the possibility of a pause.”

“The 50-DMA at 1.0680 is crucial support. Break can lead to a deeper pullback towards January low of 1.0480.”

“Reclaiming 1.1040 would be essential to affirm the next leg of up move.”

See – EUR/USD: Risks are skewed towards further pullback – OCBC

- The index pushes higher and consolidates the breakout of 103.00,

- There is an interim hurdle at the 55-day SMA at 103.88.

The march north in the index appears unabated and now extends the recovery from last week’s lows near 100.80 to the area well above the 103.00 yardstick.

DXY surpasses the 3-month line and this allows for the continuation of the upside momentum to, initially, the temporary 55-day SMA, today at 103.88. Further up, there are no relevant hurdles until the 2023 top at 105.63 (January 6).

In the longer run, while below the 200-day SMA at 106.45, the outlook for the index remains negative.

DXY daily chart

- USD/CAD attracts some dip-buying on Monday amid a strong follow-through USD buying.

- An uptick in oil prices underpins the Loonie and caps any meaningful upside for the major.

- The fundamental backdrop still favours bulls and supports prospects for additional gains.

The USD/CAD pair reverses an intraday dip to sub-1.3400 levels and climbs to a four-day high during the first half of trading action on Monday. Spot prices, however, struggle to capitalize on the move and remain below mid-1.3400s through the early North American session.

The US Dollar builds on Friday's solid bounce from a nine-month low and gains strong follow-through traction, which, in turn, acts as a tailwind for the USD/CAD pair. The upbeat US monthly employment details pointed to the underlying strength in the labor market and fueled speculations that the Fed will keep hiking interest rates to tame inflation. This continues to push the US Treasury bond yields higher and underpins the buck.

Meanwhile, expectations that the US central bank will stick to its hawkish stance for longer, along with fears of worsening US-China relations, take its toll on the global risk sentiment. This is evident from a sea of red across the equity markets, which is seen as another factor benefitting the safe-haven greenback. That said, an uptick in oil prices underpins the commodity-linked loonie and keeps a lid on any further gains for the USD/CAD pair.

Turkey's oil terminal in Ceyhan halted after a major earthquake struck nearby early on Monday. This, along with price caps on Russian products that took effect on Sunday, raises supply concerns and provides a modest lift to oil prices. That said, the uncertainty about a strong recovery in the Chinese economy and looming recession risks might hold back bulls from placing aggressive bets around the black liquid, at least for the time being.

This, in turn, favours the USD/CAD bulls and supports prospects for a further near-term appreciating move. Hence, some follow-through strength beyond last week's swing high, around the 1.3470 area, looks like a distinct possibility. The momentum could get extended further towards the 1.3500 psychological mark en route to a technically significant 100-day SMA support breakpoint, now turned resistance, currently around the 1.3525-1.3530 region.

Technical levels to watch

The Dollar is around 10% off the highs seen in late September. Consensus expects the Dollar to weaken further this year, and economists at ING agree.

Sustained EUR/USD gains beyond 1.15 may be harder to achieve in H2

“At the heart of the bearish Dollar view is the call that the Fed will shift to a reflationary stance in the second half of 2023, US short-dated yields will fall and those yield differentials will move against the Dollar.”

“Lower natural gas prices have seen the eurozone terms of trade improve markedly and justify fundamentally higher levels of the Euro. Assuming that the China reopening story continues to evolve positively, we think this confluence of factors can drive EUR/USD steadily higher throughout 2023. Most of the gains, however, may come in the second quarter, when US inflation is seen falling quite sharply.”

“Sustained EUR/USD gains beyond 1.15 may be harder to achieve in the second half – especially if US debt ceiling negotiations are pushed to the limit.”

- Silver registers a modest recovery from a nearly one-month low and snaps a two-day losing streak.

- Oversold RSI (14) on hourly charts helps the XAG/USD to find support near the 23.6% Fibo. level.

- The technical setup, however, favours bearish traders and supports prospects for additional losses.

Silver stages a modest intraday recovery from a nearly one-month low, around the $22.20-$22.15 region touched earlier this Monday and reverses a part of Friday's heavy losses. The white metal, for now, seems to have snapped a two-day losing streak, though the near-term technical setup seems tilted firmly in favour of bearish traders.

The steep decline witnessed over the past two trading sessions confirmed a near-term breakdown through the $23.00-$22.90 strong horizontal support. The said area marked the lower end of a nearly two-month-old trading range and coincided with the 23.6% Fibonacci retracement level of the recent rally from October 2022. Furthermore, acceptance below the 50-day SMA adds credence to the negative outlook for the XAG/USD.

That said, the oversold RSI (14) on hourly charts assists the XAG/USD to find support near the 38.2% Fibo. level and stall its sharp pullback from the highest level since April 2022 touched last week. Hence, it will be prudent to wait for some follow-through selling below the $22.20-$22.15 area before positioning for a fall below the $22.00 mark, towards the next relevant support near the 100-day SMA, around the $21.60-$21.55 zone.

On the flip side, the aforementioned confluence support breakpoint near the $23.00-$22.90 region now seems to act as an immediate strong barrier. Any subsequent move up might now be seen as a selling opportunity and runs the risk of fizzling out near the 50-day SMA, currently around the $23.30-$23.35 region. That said, a sustained strength beyond will negate the bearish bias and prompt some short-covering around the XAG/USD.

Silver daily chart

Key levels to watch

AUD/USD up move appears to have petered out. In the view of economists at Société Générale, the 200-Day Moving Average (DMA) at 0.6800/0.6750 is likely to provide support.

A large downside is not envisaged

“An initial pullback has brought the pair back towards the upper limit of November/December range. A large downside is not envisaged; the 200-DMA at 0.6800/0.6750 is a crucial support zone. Only if this gets violated, would there be a risk of a deeper pullback.”

“Defence of the MA is likely to result in a bounce towards recent peak of 0.7130/0.7170. Overcoming this would mean an extended uptrend.”

In an interview with ABC, US Treasury Secretary Janet Yellen said on Monday that the US economy is still strong and resilient. "You don't have a recession when you have the lowest unemployment rate in 53 years," Yellen added.

Key takeaways

"Inflation remains too high but it is coming down."

"Confident the US will find a path where inflation declines significantly and economy remains strong."

"Not to pay America's bills on time would produce an economic and financial catastrophe."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen rising 0.2% on the day at 103.18.

US Dollar clings to last week's recovery gains on the back of the impressive January jobs report on Friday. Economists at Commerzbank expect the greenback to remain on a solid foot.

Gleanings from the US labour market report

“Instead of the 200K jobs created expected by analysts it turned out to be approx. 500K, instead of a rise in the unemployment rate to 3.6% we saw a fall to 3.4%. Combined with the recent rise in the number of job vacancies this provides an image of a US labor market that is heavily overheating.”

“So far – let us not delude ourselves – a considerable part of the USD valuation was based on the fact that in the US capital was particularly profitable thanks to a labor force that did not even dream of maternity laws, sick or holiday pay. If this were to change due to a long-term shortage of labor, part of the attractiveness of USD would be lost. However, these are medium- to long-term considerations.”

“For now, the USD bulls are happy about the prospect that the Fed will hardly have to consider the real-economic consequences of a more restrictive monetary policy in view of such a strong labor market. And that means: there is a prospect of higher USD carry than previously assumed.”

- AUD/USD turns lower for the third straight day and is pressured by a combination of factors.

- Strong follow-through USD buying and the risk-off mood act weigh on the risk-sensitive Aussie.

- The downside seems limited in the absence of US macro data and ahead of the RBA on Tuesday.

The AUD/USD pair struggles to preserve its modest intraday gains on Monday and attracts fresh sellers in the vicinity of mid-0.6900s. The pair turns back lower for the third successive day and retreats to the 0.6900 mark during the mid-European session, closer to over a two-week low touched earlier today.

The post-NFP strong US Dollar recovery from a nine-month low remains uninterrupted on the first day of a new week, which, in turn, is seen exerting some downward pressure on the AUD/USD pair. The upbeat US monthly employment details pointed to the underlying strength in the labor market and should allow the Fed to keep hiking interest rates. This, in turn, continues to push the US Treasury bond yields higher and underpins the greenback.

Apart from this, the prevalent risk-off environment is seen driving haven flows towards the buck and further weighs on the risk sentiment. Expectations that the US central bank will stick to its hawkish stance for longer, along with fears of worsening US-China relations, take its toll on the global risk sentiment. This is evident from a sea of red across the equity markets and forces investors to take refuge in safe-haven assets.

The downside for the AUD/USD pair remains limited, at least for the time being, as traders await the latest monetary policy update by the Reserve Bank of Australia (RBA). The central bank is scheduled to announce its decision during the Asian session on Tuesday and is expected to hike interest rates by 25 bps for the fourth time in a row. The bets were reaffirmed by the stronger domestic CPI, which rose to the highest level since 1990 in Q4.

Hence, it will be prudent to wait for strong follow-through selling before traders start positioning for an extension of the recent pullback from the highest level June 2022 touched last week. In the absence of any relevant market-moving economic releases from the US, the greenback remains at the mercy of the US bond yields. This, along with the broader risk sentiment, might produce short-term opportunities around the AUD/USD pair.

Technical levels to watch

- EUR/JPY advances further and flirts with YTD highs below 143.00.

- Extra upside remains in store above the 200-day SMA (140.96).

EUR/JPY adds to Friday’s strong advance and approaches the key 143.00 region at the beginning of the week.

EUR/JPY extends the recent sharp rebound and leaves behind the key 200-day SMA, today at 140.96, at the same time breaking above the multi-session consolidative theme and opening the door to potential extra gains in the very near term.

That said, the next up barrier of note now comes at the December 2022 peak at 146.72 (December 15).

EUR/JPY daily chart

GBP/USD has formed a potential double top after failing to cross 1.2450. Economists at Société Générale expect to see a down move towards 1.1840, with a break below here opening up more losses.

Double top, watch neckline at 1.1840

“GBP/USD has failed to reclaim December peak of 1.2450 on second attempt forming a double top. Daily MACD has started posting negative divergence denoting receding upward momentum.”

“A short-term pullback is not ruled out; neckline of the formation at 1.1840 is crucial support. Break can lead to an extended down move towards 1.1640 and target of the pattern at 1.1250.”

“Short-term price action could remain range-bound. A move beyond 1.2450 would be essential to affirm next leg of uptrend.”

Economist at UOB Group Lee Sue Ann assesses the latest ECB event on February 2.

Key Takeaways

“The European Central Bank (ECB), at its first meeting of the year, lifted interest rates by 50bps. It also gave more details on how it intends to shrink its EUR5tn bond portfolio, reaffirming a monthly cap of EUR15bn between Mar and Jun on maturing debt that is allowed to expire.”

“The latest decision follows a slew of encouraging economic data, showing a further retreat in inflation and receding chances of a recession in the 20member region. These factors give the ECB room to remain hawkish. But just how far and how fast the ECB will go from there, is still unclear.”

“In line with our current forecasts, the ECB is expected to hike by another 50bps at the next meeting on 16 Mar. This will bring the refinancing rate to 3.50% and the deposit rate to 3.00% by 1Q23. The Mar meeting will also feature a new set of economic forecasts that should heavily influence the ECB’s decision going forward, and we will update our ECB forecasts accordingly then.”

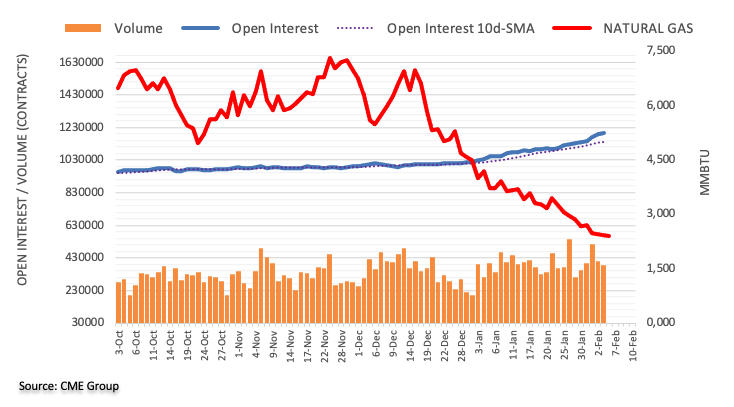

In light of advanced prints from CME Group for natural gas futures, open interest extended the uptrend in place since January 24 and rose by around 10.5K contracts on Friday. Volume, on the other hand, shrank for the second session in a row, now by around 23.7K contracts.

Natural Gas: Next on the downside comes $2.00

Friday’s session saw another negative performance of natural gas prices. The decline, once again, was amidst an uptick in open interest and keeps favouring further weakness in the very near term. Against that, the next key level of note is expected at the $2.00 mark per MMBtu.

Lee Sue Ann, Economist at UOB Group, reviews the latest BoE monetary policy meeting (February 2).

Key Takeaways

“As expected, at its first meeting of 2023, the Bank of England (BOE)’s Monetary Policy Committee (MPC) voted by a majority of 7-2 to increase the Bank Rate by 50bps to 4%. The latest decision marked the 10th increase since the BOE started hiking in Dec 2021, bringing the key rate to its highest since 2008.”

“The BOE dialed back some of its previous bleak economic forecasts. Annual CPI inflation is expected to fall to around 4% towards the end of this year, alongside a much shorter and shallower recession than previously set out. However, the MPC noted that the labor market remains tight and domestic price and wage pressures have been stickier than expected, suggesting risks of greater persistence in underlying inflation.”

“We see the BOE nearing the end of its current tightening cycle, penciling in 25bps hikes at the next 2 meetings on 23 Mar and 11 May, seeing the Bank Rate peak at 4.5%. We recognize, though, the risks to our forecasts given the BOE’s challenge of fighting inflation amid a difficult economic outlook, as reflected by the range of views on the MPC at this meeting.”

Sterling is trading on a slightly steadier footing as the UK government attempts to restore fiscal credibility. Still, economists at ING expect the EUR/GBP to reach the 0.90/91 region by end-2023.

Sterling may hold its gains through the first half of the year

“Sterling may hold its gains through the first half of the year as the Bank of England stays hawkish. But clearer signs of easing labour market and price pressures in the second half of 2023 will see conviction build of a forthcoming BoE easing cycle.”

“EUR/GBP may well be ending the year nearer 0.90/91.”

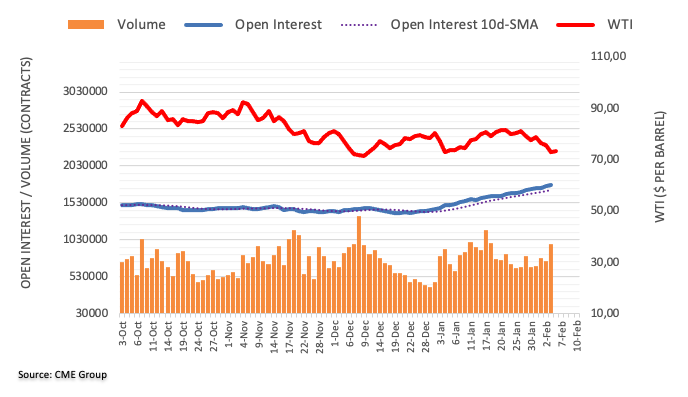

CME Group’s flash data for crude oil futures markets noted traders increased their open interest positions for yet another session on Friday, this time by around 23.5K contracts. Volume followed suit and went up by more than 227K contracts, reversing the previous daily drop.

WTI keeps targeting the YTD low at $72.50

Prices of the WTI dropped sharply and extended the weekly leg lower on Friday. The strong decline came in tandem with increasing open interest and volume and is indicative that extra pullbacks remain well in store for the time being. The immediate support of note emerges at the 2023 low at $72.50 per barrel (January 5).

Further gains in USD/CNH are likely while above the 6.7400 level, comment Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “The jump of 1.00% (NY close of 6.8063) in USD last Friday came as a surprise (we were expecting sideways trading). While USD extended its ascent in Asian trade, conditions are deeply overbought. That said, USD could continue to rise even though the major resistance at 6.8800 is unlikely to come under threat today (there is another resistance at 6.8500). Support is at 6.8000, followed by 6.7800.”

Next 1-3 weeks: “Our view last Thursday (02 Feb, spot at 6.7120) for USD to weaken was invalidated as it burst above our ‘strong resistance’ level at 6.7550 and rocketed to a high of 6.8100. Short-term conditions are deeply overbought but as long as the ‘strong support’ level, currently at 6.7400 is not breached, USD could rise further to 6.8500, as high as 6.8800.”

EUR/USD extended its pullback amid broad Dollar strength, which came on the back of strong US data. Economists at OCBC Bank expect the world's most popular currency pair to continue struggling for now.

Corrective pullback

“Daily momentum turned mild bearish while RSI fell. Risks are skewed towards further pullback.”

“Support at 1.0760, 1.0680 (50DMA, 23.6% fibo retracement of September low to February high).”

“Resistance at 1.0830 (21 DMA), 1.0940 and 1.1040 (recent high).”

See – EUR/USD: Support around 1.0730-1.0750 would be a welcome development for bulls – ING

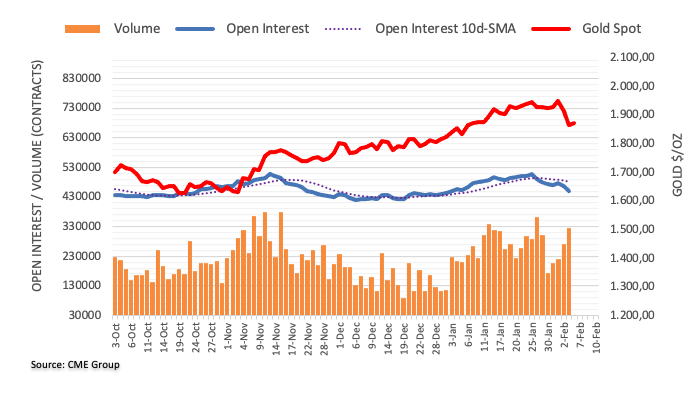

Open interest in gold futures markets dropped for the second session in a row on Friday, this time by around 18.2K contracts according to preliminary readings from CME Group. Volume, instead, rose for the fourth session in a row, this time by around 53.6K contracts.

Gold looks at another test of $1900

Gold prices accelerated the sell-off to the $1860 region last Friday. The sharp drop was amidst diminishing open interest and is supportive of a probable bounce in the short term. That said, the next targer of note now emerges at the key $1900 mark per ounce troy.

Further improvement in the sentiment could motivate USD/JPY to revisit the 133.75 level ahead of 134.75 in the short term, note Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “USD lifted off last Friday and rocketed to a high of 131.21. USD extended its ascent in Asian trade today. While further USD gains are possible, the major resistance at 133.35 might not come into view today (next resistance is at 134.75). In order to keep the overbought momentum going, USD should not move below 131.10 (minor support is at 131.60).”

Next 1-3 weeks: “Our view from last Thursday (02 Feb, spot at 128.40) for USD to weaken to 127.20 was incorrect as it jumped above our ‘strong resistance’ level at 129.90. The outsized advance and the corresponding sharp increase in upward momentum suggest USD could rise further. The levels to watch are at 133.35 and 134.75. In order to keep the strong momentum going, USD must stay above the ‘strong support’ level, currently at 129.80.”

US Dollar maintains bid tone. Economists at Société Générale expect the USD Index (DXY) to extend the rebound and see potential to reach the January peak near 105.60.

Defending 101.40 is essential for persistence in up move

“The Dollar Index approached the earlier highlighted potential support zone near 100.60/100.00 representing peak of 2015. A sharp rebound has taken shape resulting in formation of a weekly hammer. This denotes downward momentum is gradually receding.”

“The index is expected to inch higher gradually towards 50-DMA at 103.70/104.10. Overcoming this could mean a revisit of January peak near 105.60.”

“Defending 101.40, the 76.4% retracement of the rebound is essential for persistence in up move.”

The Norwegian Krone has had a horrible start to 2023. A lower interest rate differential has hurt the NOK and economists at Nordea expect EUR/NOK to trade sideways in the near-term.

NOK gets knocked down as rate differentials dwindle

“The combination of lower energy prices and dwindling interest rate differentials are the key reasons behind the NOK’s decline.”

“While the ECB will be the central bank to hike the most in the coming months, Norges Bank could have a few surprises in its sleeve. The Norwegian economy has fared better than feared, wage growth has been higher than expected, and the NOK is weaker than Norges Bank pencilled in. This argues for higher rates than previously signalled. That said, all stars need to be aligned for the NOK to perform and we believe EUR/NOK will move about sideways in the short-term.”

- Gold price catches some bids on Monday and stages a recovery from a nearly four-week low.

- The prevalent risk-off environment is seen lending some support to the safe-haven commodity.

- Hawkish Fed expectations, rising US bond yields underpin the US Dollar and cap the upside.

Gold price attracts some buyers near the $1,860 region, or a nearly four-week low touched earlier this Monday and sticks to its modest gains through the first half of the European session. The XAU/USD, for now, seems to have snapped a two-day losing streak and stalled the recent pullback from its highest level since April 2022 touched last week.

Risk-off mood benefits safe-haven Gold price