- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-02-2022

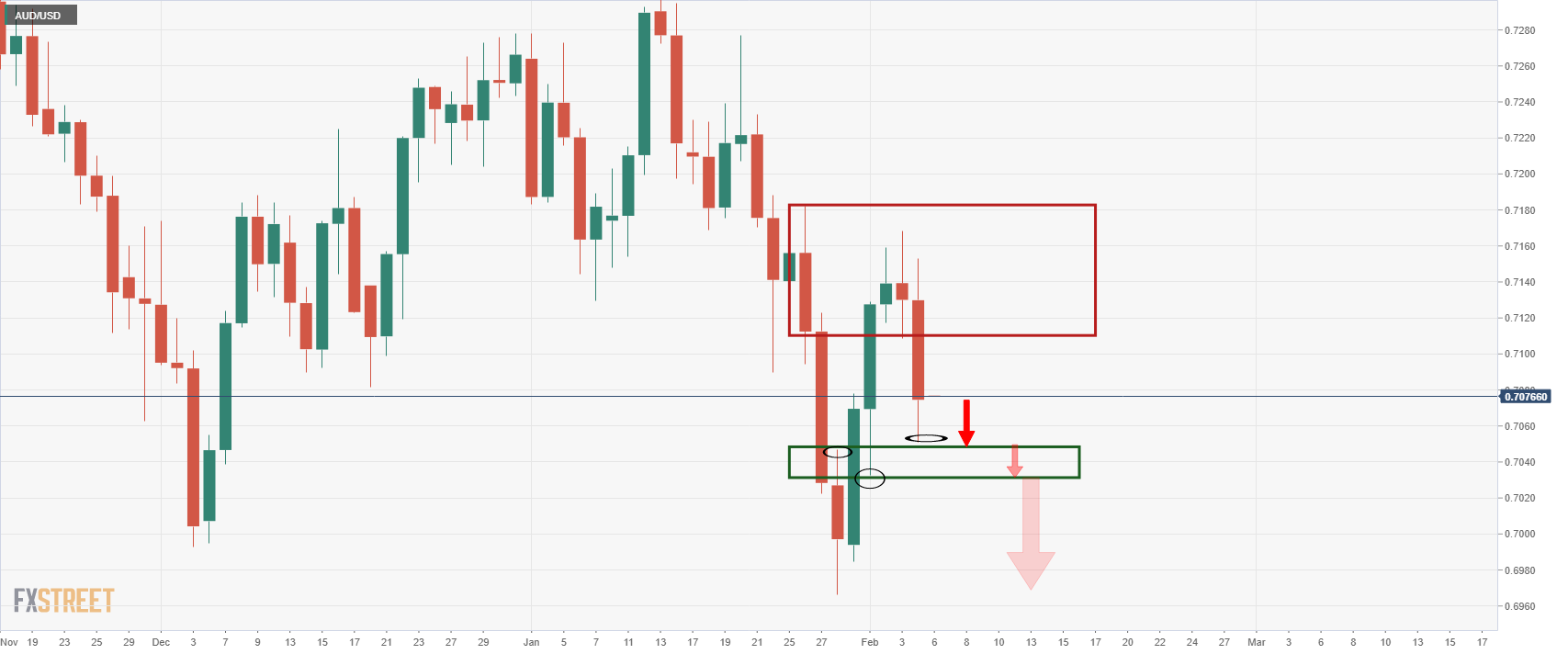

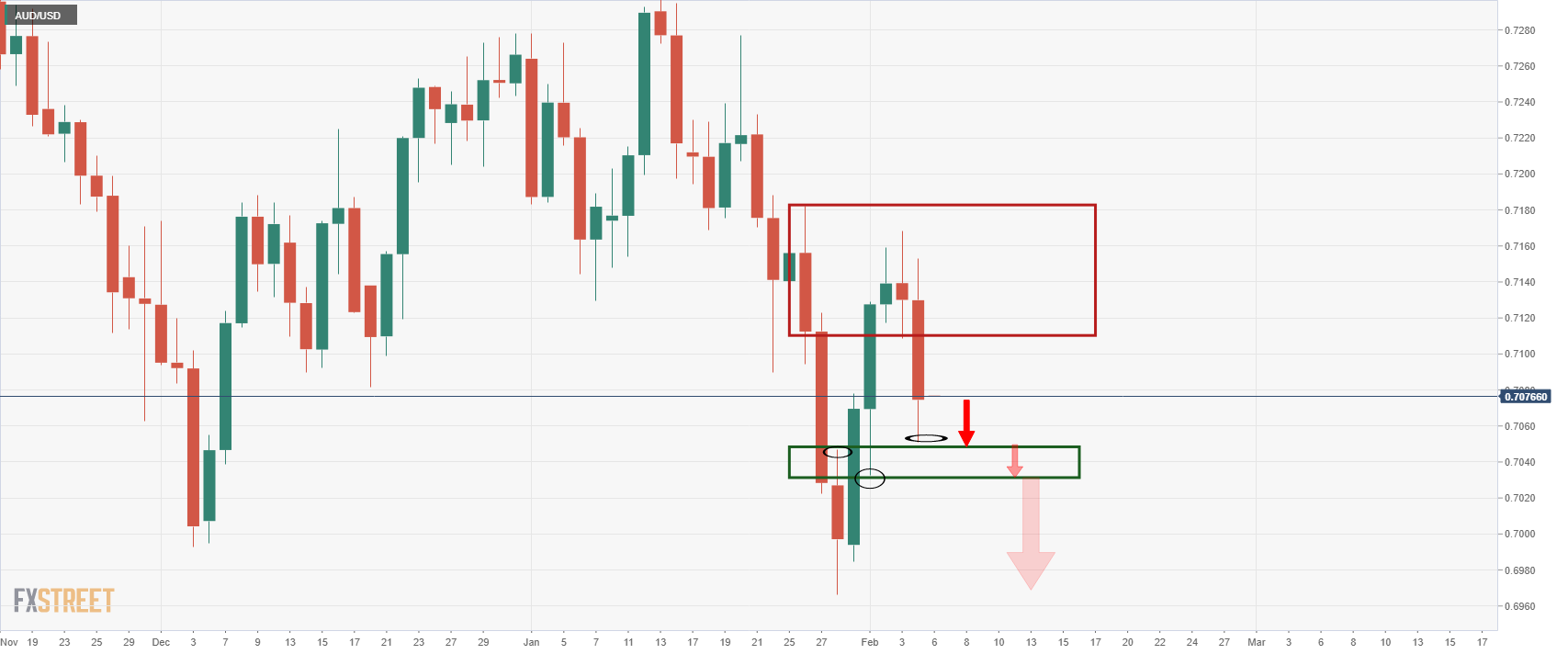

- AUD/USD holds lower ground as bears take a breather after Friday’s heavy sell-off.

- Buyers had to forgo half of weekly gains after strong US NFP.

- Sellers also watch risks concerning Russia-Ukraine war, RBA’s failures to accept hawkish scenarios.

- China’s return, Caixin Services PMI for January will be important for short-term direction.

AUD/USD retreats from an intraday high near 0.7085 during the inactive early Asian session on Monday. The Aussie pair snapped a two-week downtrend by the end of Friday, despite cutting the weekly gains in half due to the US jobs report for January.

That said, the US Bureau of Labor Statistics (BLS) offered a positive surprise to the US dollar bulls with January’s employment report. The headline Nonfarm Payrolls (NFP) rose by 467K versus the median forecast for a 150K rise and 510K revised prior while the Unemployment Rate rose to 4.0% from 3.9% in December, compared to expectations for a no-change figure. It’s worth noting, however, that the U6 Underemployment Rate extended the south-run to 7.1% from 7.3% previous readouts. Also encouraging was Average Hourly Earnings that jumped strongly to 5.7% versus 4.9%.

Additionally, hawkish comments from Fed policymakers and Russia-linked fears also exert downside pressure on the risk-barometer pair. Recently, US national security adviser said that the Russian invasion of Ukraine could be any day now.

Contrary to the Fed, policymakers at the Reserve Bank of Australia (RBA) tried to defend the easy money policy. “The RBA doesn’t expect growth in the Wage Price Index to reach 3% until mid-2023. It is a bit more optimistic on average wages growth, though, with this forecast to reach 4% by mid-2023. We think the RBA’s wages outlook is too pessimistic which lies behind our expectation that the RBA will begin raising the cash rate in the second half of 2022,” said ANZ analysts.

Against this backdrop, the US Dollar Index (DXY) dropped the most since early November 2021 before snapping a five-day downturn to bounce off a three-week low the previous day. Further, the US 10-year Treasury yields rallied to the fresh high since January 2020, with the latest addition being 8.9 basis points (bps) to 1.916%. It should be noted, however, that equities were surprisingly mixed.

Looking forward, second-tier data at home may entertain traders but major attention will be given to China’s returns after a one-week-long holiday, as well as China Caixin Services PMI for January, expected 52.9 versus 53.1 prior. The dragon nation missed the recently hawkish plays, which can push policymakers at the People’s Bank of China (PBOC) towards impressive steps to defend the yen and the same may help the AUD/USD prices to rebound. Though, any failures to witness the PBOC move, as well as downbeat China data, can keep AUD/USD on the back foot.

Technical analysis

Last week’s U-turn from the 50-DMA, around 0.7165 by the press time, directs AUD/USD sellers towards 2021 bottom surrounding 0.6995 before highlighting January’s low of 0.6966.

- GBP/USD remains pressured towards the key moving average, keeping Friday’s pullback.

- Steady RSI, failures to cross 21-DMA, 61.8% Fibonacci retracement favor sellers.

- Bulls remain worried until witnessing upside break of 1.3630.

GBP/USD stays depressed around 1.3530, keeping the previous day’s pullback moves during Monday’s Asian session.

In doing so, the cable pair remains below 21-DMA and the 61.8% Fibonacci retracement (Fibo.) level of October-December 2021 downside.

Given the steady RSI and the pair’s inability to stay beyond the key resistances, the latest declines are likely to extend towards the nearby support, namely the 100-DMA level surrounding 1.3510 and the 1.3500 threshold.

It’s worth noting that a broad support area between 1.3470 and 1.3430, comprising multiple levels marked since early November 2021, will challenge the GBP/USD to bear past 1.3500.

Should the quote drop below 1.3500, a three-month-old horizontal line near 1.3360-55 may lure the pair sellers.

Alternatively, the 21-DMA and 61.8% Fibo. level guard short-term recovery of the GBP/USD pair around 1.3555 and 1.3580.

Following that, February’s top around 1.3630 will act as a last defense for the bears before directing the quote to a downward sloping trend line from October 2021, around 1.3720.

GBP/USD: Daily chart

Trend: Further weakness expected

- EUR/USD grinds higher around three-month top, awaits fresh directions after six-day uptrend.

- US NFP triggered the pullback from multi-day top but hawkish ECB policymakers keep buyers hopeful.

- Yields helped USD to pare recent losses on US jobs but equities didn’t drop much.

- Russia-Ukraine headlines, China’s return may entertain traders during a likely softer start to the week.

EUR/USD seesaws near 1.1455-60 during an inactive early Asian session on Monday, following the heaviest weekly jump since March 2021.

The major currency pair failed to portray the positive surprise from the US Bureau of Labor Statistics (BLS) the previous day as policymakers from the European Central Bank (ECB) bolster rate-hike expectations. It’s worth noting that the ECB marked a hawkish stand despite keeping the monetary policy unchanged the last week.

On Friday, US Nonfarm Payrolls (NFP) for January rose by 467K versus the median forecast for a 150K rise and 510K revised prior while the Unemployment Rate rose to 4.0% from 3.9% in December, compared to expectations for a no-change figure. It’s worth noting, however, that the U6 Underemployment Rate extended the south-run to 7.1% from 7.3% previous readouts. Also encouraging was Average Hourly Earnings that jumped strongly to 5.7% versus 4.9%.

The jobs report was encouraging and triggered the much-needed bounce of the US Dollar Index (DXY). Even so, the DXY dropped the most since early November 2021 before snapping a five-day downturn to bounce off a three-week low the previous day whereas the US 10-year Treasury yields rallied to the fresh high since January 2020, with the latest addition being 8.9 basis points (bps) to 1.916%. It should be noted, however, that equities were surprisingly mixed.

Following the US employment data, European Central Bank governing council member Olli Rehn said that it would be logical for the ECB to hike its key interest rate at the latest by next year, in an interview with Helingin Sanomat. On the same line were the weekend comments from Dutch Central Bank President and a member of the European Central Bank's governing council, Klaas Knot as he expects the ECB to raise interest rates in Q4 2022.

It should be observed that Eurozone Retail Sales shrank 3.0% in December, per the latest details, due to Omicron-linked activity restrictions.

Amid these plays, ANZ said, “The reality is it could come a lot earlier and June is live for lift-off. We are expecting a major policy shift from the ECB when it meets next month.”

Moving on, a light calendar may offer a less active start to the week but comments from the ECB and the Fed policymakers, as and when arrive, will be crucial to watch. Additionally, China returns to trading after one-week-long holidays and missed the recently hawkish plays, which in turn may push them towards taking any impressive steps to defend the yen and the same could entertain momentum traders.

Technical analysis

A clear upside break of the 100-DMA, around 1.1425 by the press time, directs EUR/USD towards October 2021 bottom surrounding 1.1525.

- NZD/USD offers no major change to begin week’s trading, dropped heavily on Friday.

- US jobs report for January propelled yields, USD rebound the previous day.

- Escalating geopolitical tensions also exert downside pressure on Antipodeans.

- China’s return after a week-long Lunar New Year will be important to watch, Caixin Services PMI to decorate calendar.

NZD/USD defends 0.6600 while portraying a corrective pullback from a one-week low after Friday’s heavy sell-off. That said, the Kiwi pair seesaws around 0.6615 by the press time of early Monday morning in Asia.

The quote rose the most on a weekly basis since late December amid broad US dollar weakness. However, Friday’s US jobs report triggered the greenback’s rebound.

On Friday, the US Bureau of Labor Statistics (BLS) offered a positive surprise to the US dollar bulls with January’s employment report. The headline Nonfarm Payrolls (NFP) rose by 467K versus the median forecast for a 150K rise and 510K revised prior while the Unemployment Rate rose to 4.0% from 3.9% in December, compared to expectations for a no-change figure. It’s worth noting, however, that the U6 Underemployment Rate extended the south-run to 7.1% from 7.3% previous readouts. Also encouraging was Average Hourly Earnings that jumped strongly to 5.7% versus 4.9%.

Additionally, hawkish comments from Fed policymakers join Russia-linked fears to challenge the NZD/USD buyers even as the US dollar weakness kept the pair on the front foot before Friday. Recently, US national security adviser said that the Russian invasion of Ukraine could be any day now.

Amid these plays, the US Dollar Index (DXY) dropped the most since early November 2021 before snapping a five-day downturn to bounce off a three-week low the previous day. Further, the US 10-year Treasury yields rallied to the fresh high since January 2020, with the latest addition being 8.9 basis points (bps) to 1.916%. It should be noted, however, that equities were surprisingly mixed.

Looking forward, China Caixin Services PMI for January, expected 52.9 versus 53.1 prior, will be important to watch for short-term direction. It should be observed that China returns to trading after one-week-long holidays and missed the recently hawkish plays, which in turn may push them towards taking any impressive steps to defend the yen and the same may help the NZD/USD prices to keep the latest bounce.

Technical analysis

Failures to cross the previous support line from August, around 0.6655 at the latest, direct NZD/USD sellers towards the yearly low near 0.6530.

Klaas Knot, the Dutch Central Bank President and a member of the European Central Bank's governing council, said on Sunday, per Reuters that he expects the ECB to raise interest rates in the fourth quarter of this year.

The ECB policymaker appeared on Dutch television program Buitenhof ECB’s Knot said that he supported winding down the Eurozone central bank's asset purchasing program as quickly as possible.

Additional quotes

Personally I expect our first rate increase to take place around the fourth quarter of this year.... Normally we would raise rates by a quarter percentage point, I have no reason to expect we would take a different step.

A second rate hike would follow the first one in short order, likely in the first quarter of 2023.

The bank must first end its asset purchasing programs, currently set to be wound down in steps to 20 billion euros per month by the fourth quarter. However, since Thursday bond markets have begun pricing in around 40 basis points of rate hikes by December.

FX reaction

Given the early hours of Asia, market players are yet to react to the news. However, the recent challenges to the risk appetite could join the chatters of hawkish monetary policies to exert downside pressure on the Antipodeans.

Another bumpy ride on Wall Street ended on Friday as Amazon's positive earnings capped a run of mixed big-tech numbers and upbeat economic data in the form of Nonfarm Payrolls surprises. The case for Federal Reserve rate hikes was cemented This led to gold prices falling under pressure from a firmer dollar and higher US Treasury yields.

For the open, a higher yield environment and hawkish sentiment in global central banks would be expected to weigh on risk appetite — throw in the prospects of an imminent Russian invasion of Ukraine, then that is a mix for an even strong US dollar.

Is Russian an invasion imminent?

Following last week's Bloomberg boo-boo...

... the markets, nonetheless, might get the real thing and according to the US White House national security adviser Jake Sullivan, who was interviewed in the media on Sunday saying

''We are in the window...Any day now, Russia could take military action against Ukraine or it could be a couple of weeks from now, or Russia could choose to take the diplomatic path instead.”

“We believe that there is a very distinct possibility that Vladimir Putin will order an attack on Ukraine,” Sullivan said on ABC’s “This Week.”

DXY on the march

The dollar index, a gauge of its value against six major currencies, rose to 95.70 (DXY), after falling to a two-week low of 95.136 amid a resurgent euro.

However, the dollar was still down 1.8% on the week, on pace for its largest weekly percentage decline since November 2020.

Data showed US Nonfarm Payrolls grew 467,000 jobs last month vs an estimate whereby economists polled by Reuters had forecast 150,000 jobs added in January. Estimates ranged from a decrease of 400,000 to a gain of 385,000 jobs. Data for December was also revised higher to show 510,000 jobs created instead of the previously reported 199,000.

Adiaolylu, Average Hourly Earnings, a measure of wage inflation and a closely-watched metric, climbed 0.7% last month, and 5.7% on a year-on-year basis.

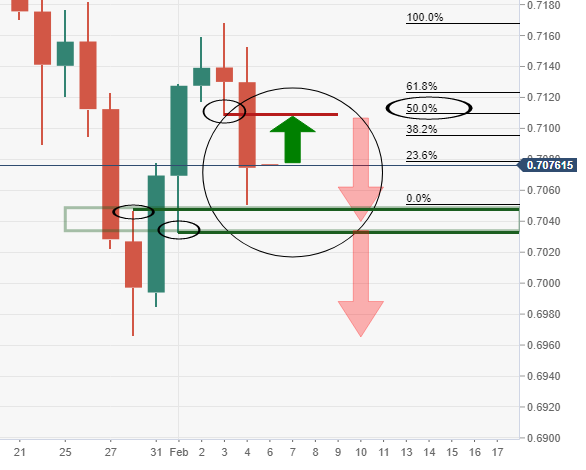

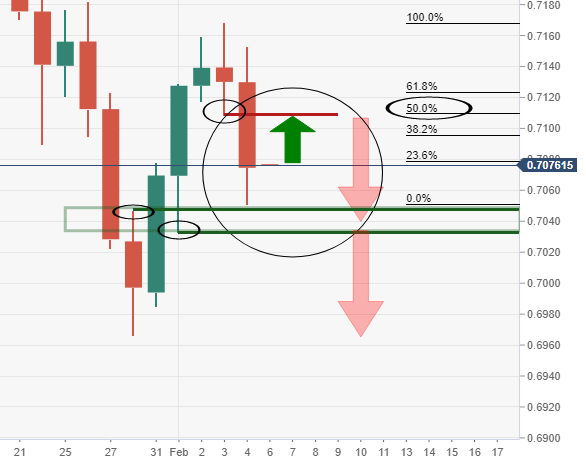

AUD/USD is a compelling story for the open based on the above risk-off potential and its high beta tendency to global equity prices and its proxy status to risk appetite:

-

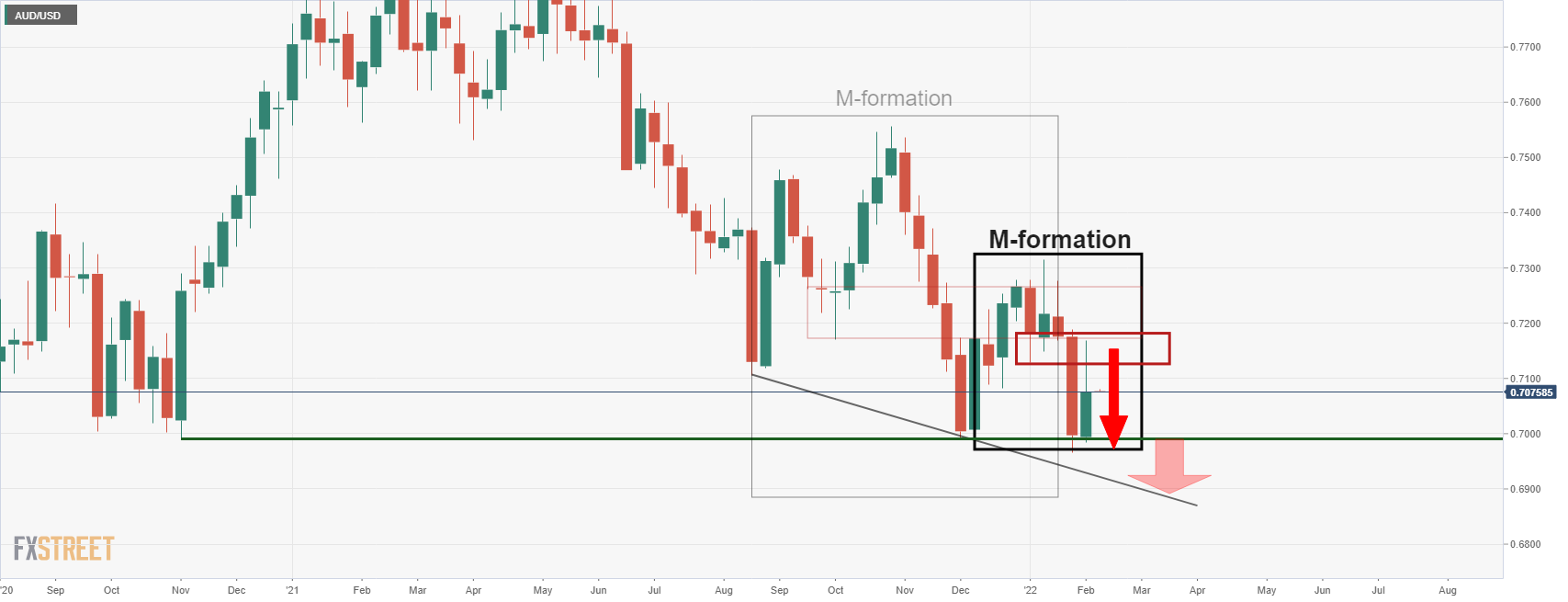

AUD/USD Price Analysis: Bears sink their teeth into US Nonfarm Payrolls

(Daily chart)

Bar potential mitigation of the markdown and the imbalance thereof, a break of 0.7050 and then 0.7030 would be key:

For the open, the H1 chart is offering a bearish scenario as follows:

- AUD/USD bears are taking back control, seeking a bearish weekly close.

- 0.6991 is a key downside level that bears will be aiming to close below.

AUD/USD was hit hard on Friday after data showed the world's largest economy created far more jobs than expected, raising the chances of a larger Federal Reserve interest rate increase at the March policy meeting. As a consequence, the AUD reversed half the week’s gains on the data that drove a surge in yields.

The US dollar moved its way up the 95 area as measured by the DXY index, crippling the Aussie that fell 0.88% vs the greenback by the close of play. The move translated into a telegraphed price drop from the previous analysis made ahead of Friday's Nonfarm Payrolls event as follows:

AUD/USD prior analysis

- AUD/USD Price Analysis: Bulls stay in charge but face a wall of daily resistance

It was stated that the bears were in anticipation of a Dijo close followed by a Bearish Engulfing. While it did not come in the previous daily close, it finally came nonetheless and confirms the bearish bias for the week ahead.

AUD/USD live market, daily chart

As illustrated, the price's last two day's of business engulfed the mid-week Doji, significantly. Bar potential mitigation of the markdown and the imbalance thereof, a break of 0.7050 and then 0.7030 would be key:

The above scenario includes a bullish open to take on bear's commitments in a 50% mean reversion of the prior two day's of bearish closes at 0.7110.

This could occur in the opening sessions as local rates market play catch up to the US Treasury yields that surged to new cyclical highs after the surprisingly strong Nonfarm Payrolls data.

AUD/USD weekly chart

Bears are monitoring the M-formation at this juncture and the weekly close below the neckline following the restest of the area leaves a bias to the downside for the week ahead. Bears will want to break the Nov swing lows near 0.6990's confirmation that the longer-term bear trend is in tact.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.