- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 05-05-2022

- USD/CHF is experiencing a minor pullback at around 0.9850, upside remains favored.

- The DXY printed a fresh 19-year high at 103.94 on an extremely aggressive expected hawkish tone by the Fed.

- Investors are awaiting the release of the Swiss jobless rate and US NFP.

The USD/CHF pair is displaying back and forth moves in a narrow range of 0.9840-0.9854 in the Asian session after a minor correction. Earlier, the asset scaled higher strongly as the risk-on impulse faded and the US dollar index (DXY)’s appeal improved swiftly. The major is eyeing to reclaim weekly highs at 0.9890.

The Swiss franc didn’t find any action after the in-line release of the Swiss Consumer Price Index (CPI). The yearly Swiss CPI landed at 2.5%, similar to the expectations but a little higher than the prior print of 2.4%. The lower inflation figure is not compelling for any hawkish tone by Swiss National Bank (SNB)’s Governor Thomas J. Jordan going forward. For further guidance, investors will focus on the monthly Swiss Unemployment Rate, which is seen at 2.2%.

Meanwhile, the US dollar index (DXY) shrugged off the impact of the monetary policy announcement by the Federal Reserve (Fed) and printed a fresh 19-year high at 103.94. Now, investors are awaiting the release of Friday’s US Nonfarm Payrolls (NFP). A preliminary estimate indicates additions of 391k jobs in the labor market against the prior print of 431k. An outperformance from the expectations will bolster the odds of a 75 basis point (bps) rate hike by the Federal Reserve (Fed) in June as an extremely tight labor market will weigh inflationary pressures on the rising labor cost index.

- USD/CAD fades bounce off weekly low, pares the biggest daily gains in a fortnight.

- Oil prices remain firmer despite OPEC’s offer as geopolitical risks keep favoring energy bulls.

- BOE’s inflation, growth forecasts triggered a bout of risk-aversion and reversed post-Fed optimism the previous day.

- Fed’s expectations of slower NFP growth, BOC’s hawkish comments highlight jobs report for clear directions.

USD/CAD pares the latest gains around 1.2830 as traders turn cautious ahead of the key employment data from the US and Canada on Friday. The Loonie pair’s latest weakness could also be linked to the recently firmer prices of WTI crude oil, Canada’s key export, as well as the market’s consolidation amid a wait for full markets.

The quote refreshed the weekly low earlier on Thursday before the risk-off mood propelled prices towards posting the biggest daily gains in two weeks. The Bank of England’s (BOE) forecasts suggesting doubt-digit inflation and economic recession could be cited as the key catalysts for the latest risk-aversion that recalled the USD/CAD bulls.

While cheering the sour sentiment, the Loonie pair couldn’t justify the firmer oil prices, mainly favored the by Thursday’s verdict of the OPEC+ group, comprising the Organization of the Petroleum Exporting Countries (OPEC) countries and allies including Russia. The oil cartel announced to continue with the current policy of raising monthly output by 432K barrels per day (BPD).

Also supporting the oil prices, as well as weighing on the risk catalysts is the European Union’s (EU) oil embargo on Russian imports. That said, the WTI crude oil prices stay mildly bid around $107.70 by the press time after refreshing a six-week high the previous day.

While portraying the risk-aversion, Wall Street indices slumped more than 3.0% each while the US 10-year Treasury yields rallied 3.40% on a daily closing while rising to the fresh high in late 2018 beyond 3.00%. As a result, the US Dollar Index (DXY) also regained its strength and poked April’s multi-month high around 104.00.

The USD/CAD prices are likely to remain sluggish as traders await the key economics. The scheduled jobs report become even more important after the Bank of Canada’s (BOC) hawkish stand and the Fed’s forecasts assuming an absence of major employment growth going forward.

Forecasts suggest the headline US Nonfarm Payrolls (NFP) to ease to 391K from 431K whereas the Unemployment Rate may also decline to 3.5% from 3.6%. On the other hand, Canadian Unemployment Rate is expected to soften to 5.2% from 5.3% with the likely reduction in the Net Change in Employment to 55K, versus 72.5K prior.

Technical analysis

Although 21-day EMA puts a floor under short-term USD/CAD prices around 1.2730, the quote needs to stay beyond 1.2830, comprising nearby previous resistance, to aim for further upside.

- US dollar rallies to fresh cycle highs as markets turn risk-off.

- The start of the new month and rebalancing has seen a shuffle back into the safe haven US dollar.

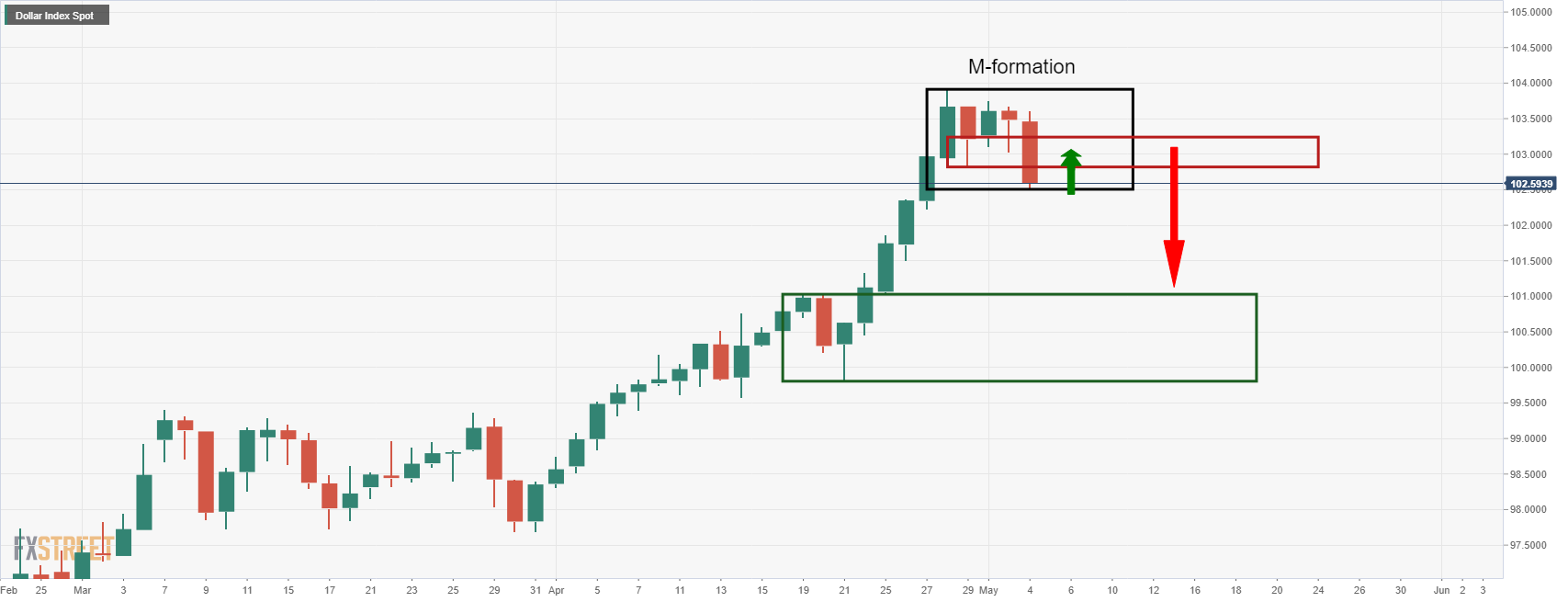

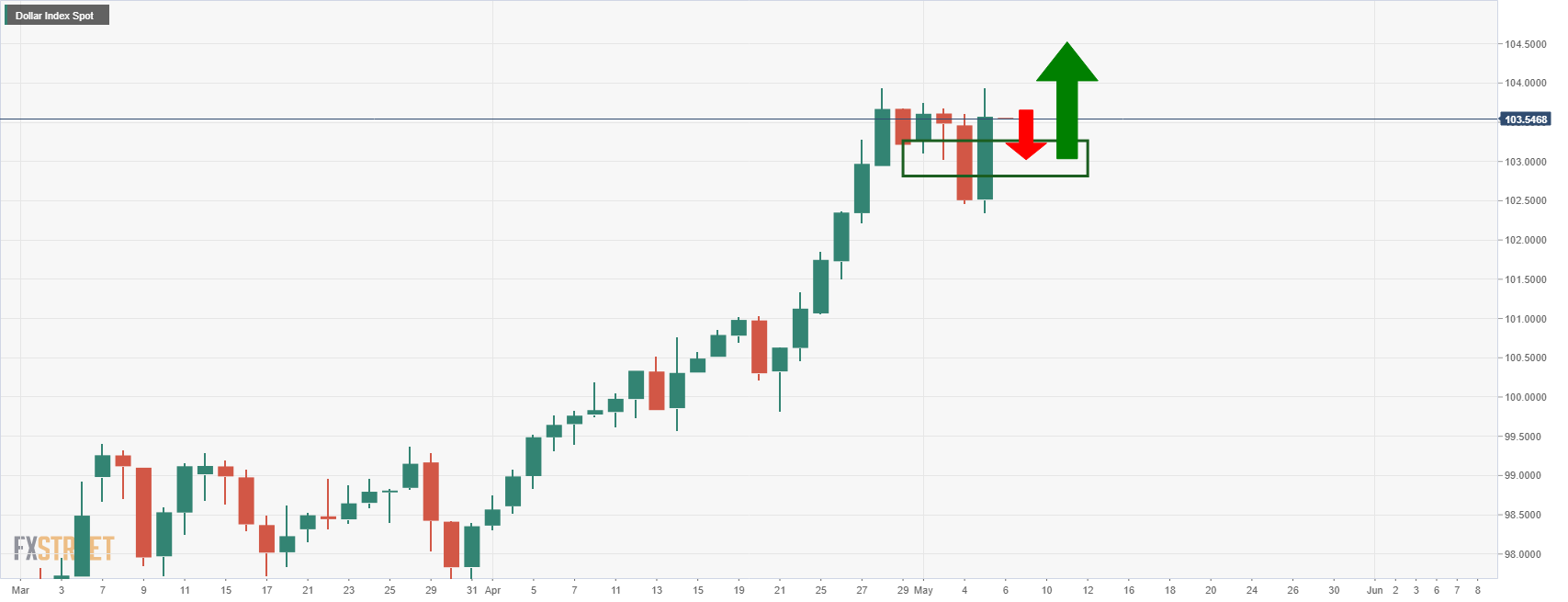

The US dollar rallied on Thursdays as bulls picked up the currency at a discount figuring the risks associated with global stagflation and ongoing geopolitical tensions will keep the US dollar in favour. At 103.549, the DXY index is 1% higher ahead of the Tokyo open, a touch lower than the overnight bull cycle high of 103.942.

The initial move was illustrated as a prospective scenario in the prior day's post-Fed-analysis here: US dollar and yields sinking as Powell dials down market expectations of 75bp move. More on this below.

Meanwhile, global growth fears mount following a series of worrisome economic data and ongoing geopolitical risks. The Chinese PMIs remain in contraction territory and the COVID lockdowns are disrupting supply chains. Contagion of the Ukraine crisis in the commodity markets has left a dark cloud over global growth prospects and is subsequently damaging high beta currencies and the euro.

Then, the nail in the coffin came as the Bank of England warned of stagflation and weak German data that was showing that industrial orders in March suffered their biggest monthly drop since last October sent the euro below 1.05 the figure.

The greenback was subsequently boosted by safe-haven buying as global equities come back under pressure. The S&P 500 was down 3.6% and the Euro Stoxx 50 fell 0.8%. The yield on the US 10-year Treasury note surged, rising 9.8bps to 3.03% which also helped to propel the US dollar higher ahead of today's critical Nonfarm Payrolls.

NFP could be the clincher for US dollar bulls

The Nonfarm Payrolls is a major risk and could well set the tone for the following weeks ahead of the next Fed rate decision.

''A strong payrolls report could perversely push the market to price in more tightening as the Fed reduced its optionality at its most recent meeting,'' analysts at TD Securities said.

''That leaves a resilient USD vs EUR and yen very much the path of least resistance. A softer wages print should help to temporarily take the edge off but this will be short-lived until evidence of a peak/moderation in CPI emerges.''

Meanwhile, analysts at ANZ Bank explained, ''whilst the Fed is not currently considering a 75bps rate increase, that guidance is based on expectations that the trend increase in monthly Nonfarm payrolls will slow and core inflation is stabilising. But there are no guarantees at all that that will be the case.''

''Demand for labour in the US remains very strong and core services inflation is rising steadily. The April non-farm payroll and employment reports tomorrow night, therefore, carry a lot of significance,'' the analysts added.

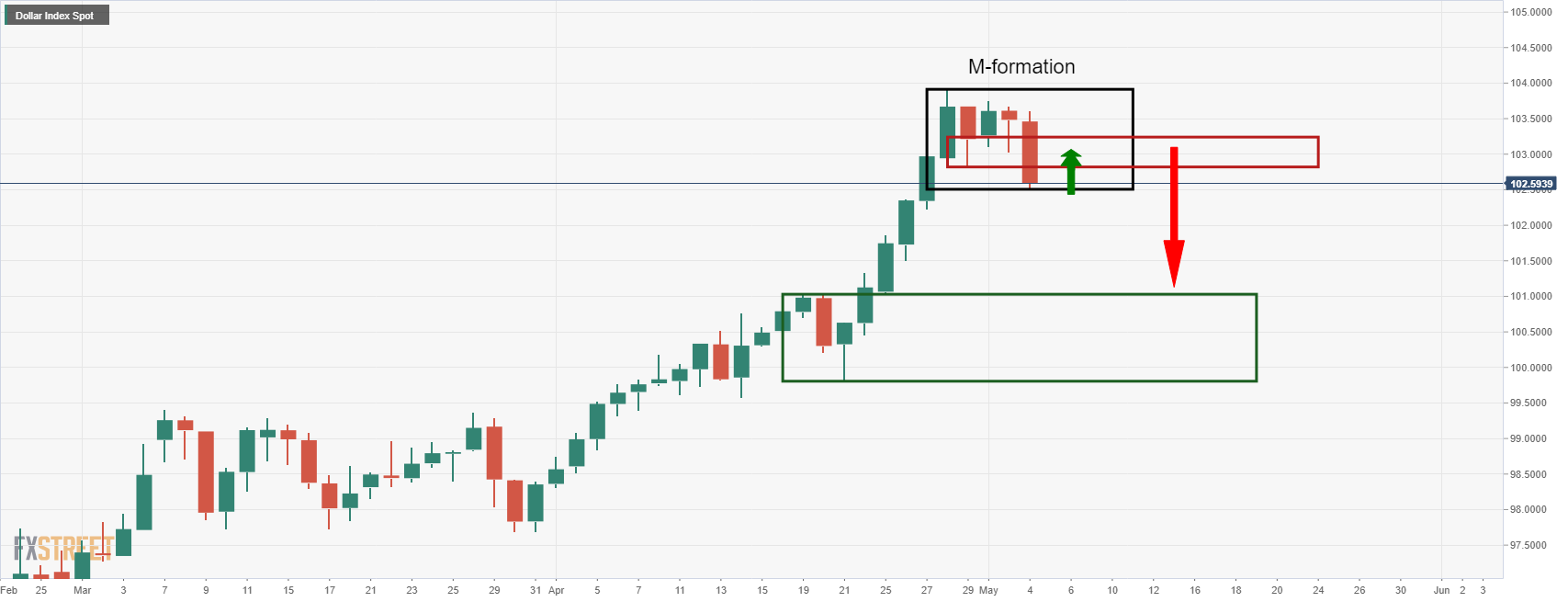

DXY technical analysis

However, the bulls are staying the course at the moment and have cleared the resistance as follows:

Should the above price action play out, the inverse head & shoulders would be a bullish factor on the daily chart.

- USD/JPY is advancing towards 130.56 as higher US NFP forecasts bolstered 75 bps rate hike chances.

- More additions to the US job market will push the labor cost index higher.

- The Japanese yen will resume its downside move after a short-lived pullback.

The USD/JPY pair is looking to recapture weekly highs at 130.56 after a minor pullback as the profit-booking kicks in. The asset witnessed a strong upside move on Thursday after the risk-perceived currencies lost their aura as a rebound in the risk-on impulse after the announcement of the interest rate decision by the Federal Reserve (Fed) faded.

Fed’s monetary policy-based rally vanished after the odds of a 75 basis point (bps) rate hike in the June meeting bolstered. Although Fed Chair Jerome Powell stated while addressing the media that a 75 bps rate is not into consideration, investors still bet on a bumper rate hike figure amid soaring inflationary pressures. The US economy is enjoying a tight labor market. The Unemployment Rate is well below the targeted figure and job opportunities are scaling higher. Soaring additions in the labor market are indicating a higher labor cost index, which may ramp up price pressures and eventually higher inflation further.

Ongoing higher inflationary pressures have raised the importance of the US Nonfarm Payrolls (NFP), which will release on Friday. The additional jobs are seen at 391k against the prior print of 431k.

Meanwhile, the Japanese yen has started declining after a pause as mounting pressure on households’ real income is impacting the economy. Higher fuel bills and other commodity prices have dampened the real income of the household and have also widened their fiscal deficit. Apart from that, an ultra-loose monetary policy by the Bank of Japan (BOJ) will keep yen on the tenterhooks.

- Silver licks its wounds above short-term key support line after the biggest daily fall in two weeks.

- Steady RSI hints at continuation of bearish grind unless crossing $23.00 resistance confluence.

Silver (XAG/USD) stays defensive at around $22.50 during the sluggish Asian session on Friday. In doing so, the bright metal consolidates the latest losses while keeping the bounce off a one-week-old support line.

The XAG/USD prices took a U-turn from 50-SMA and a downward sloping trend line from April 26, currently around $23.00.

The pullback moves gain support from the steady RSI and the lower-high formation to keep sellers hopeful.

Though, a clear downside break of the immediate support line, near $22.30, becomes necessary for the bullion before challenging the weekly bottom of $22.12.

Following that, February’s low around the $22.00 threshold and the yearly trough of $21.95 will be crucial to watch.

Alternatively, recovery moves remain elusive until crossing the $23.00 resistance, a break of which will need validation from the latest swing high near $23.30.

In a case where silver prices remain firmer beyond $23.30, the $24.00 round figure and the 200-SMA level near $24.50 could challenge the buyers.

Silver: Four-hour chart

Trend: Further weakness expected

- The cable has printed a fresh yearly low at 1.2325.

- Momentum oscillator RSI (14) has shifted into a bearish range of 20.00-40.00.

- A pullback towards the 20-EMA will be an optimal sell for investors.

The GBP/USD pair is experiencing a weak rebound after printing a fresh yearly low of 1.2325 on Thursday. The cable witnessed sheer downside after slipping below the previous week’s low of 1.2411. The asset has surrendered its crucial support of 1.2400 and has been exposed to more downside risks.

A decisive downside move below the previous week’s low at 1.2411 is likely to be re-tested for more short buildups. The pound bulls lost their strength after a bear cross of 20- and 50-period Exponential Moving Averages (EMAs) at 1.2532.

The Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which signals a fresh leg of weakness ahead.

Should the asset test the 20-EMA at 1.2420, it will be an optimal bargain opportunity for the market participants to initiate short positions, which will drag the asset towards the fresh yearly lows and 29 June 2020 low at 1.2325 and 1.2252 respectively.

On the flip side, pound bulls may dominate the asset if it oversteps Wednesday’s high at 1.2638. This will send the asset towards the round level resistance at 1.2700, followed by April 26 high at 1.2773.

GBP/USD hourly chart

-637873878748405663.png)

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, justify the market’s fresh fears of skyrocketing inflation ahead while rising for the third consecutive day by the end of Thursday’s US session.

In doing so, the inflation gauge extends the week-start bounce off the lowest levels since April 13 while flashing 2.87% at the latest. The same justifies the market’s risk-off mood and helps the US dollar to regain its charm, which in turn weighs on the riskier assets like commodities and Antipodeans.

Given the firming fears of inflation, traders will closely watch today’s US Nonfarm Payrolls (NFP) for April as the Fed’s latest rejection of 75 basis points (bps) of a rate hike may have assumed no further worsening of employment and price pressures.

“Whilst the Fed is not currently considering a 75bps rate increase, that guidance is based on expectations that the trend increase in monthly nonfarm payrolls will slow and core inflation is stabilizing. But there are no guarantees at all that that will be the case,” said the Australia and New Zealand Banking Group (ANZ).

Also read: US April Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises

- EUR/USD remains pressured after taking a U-turn from one-week high.

- Failures to stay beyond 50-SMA, receding bullish bias of MACD hint at further declines.

- Bears aim for the latest multi-month low unless crossing 100-SMA.

EUR/USD stays depressed at around 1.0540 during Friday’s initial Asian session, after the bear’s return to the table the previous day.

The major currency pair’s failures to keep the post-Fed rebound beyond the short-term key SMAs join the receding bullish bias of the MACD to favor sellers.

That said, the latest weakness aims for an upward sloping trend line from April 28, surrounding 1.0510, ahead of challenging the 1.0500 threshold.

In a case where the EUR/USD fails to rebound from the 1.0500, it can drop to the previous month’s bottom, also the lowest level since 2017, around 1.0470.

It should be noted, however, that the 61.8% Fibonacci Expansion (FE) of the pair’s moves between April 25 and May 05, around 1.0425, will challenge the EUR/USD bears afterward.

Meanwhile, recovery moves may initially aim for the 50-SMA and the recent swing high, respectively around 1.0560 and 1.0640.

However, EUR/USD bulls will remain cautious until witnessing a clear break of the 100-SMA, close to 1.0690 at the latest.

EUR/USD: Four-hour chart

Trend: Bearish

- GBP/JPY eyes more weakness as BOE has warned signs of recession.

- The UK corporate are failing to create more jobs and households are facing the heat of higher living costs.

- The Japanese yen is enjoying the pullback season but the downside is still intact.

The GBP/JPY pair is displaying back and forth moves in a tight range of 160.54-161.50, followed by a firmer downside move after the asset failed to overstep 164.00 on Thursday. The asset has turned into negative territory after the rate hike decision by the Bank of England (BOE) in the previous trading session.

The announcement of a rate hike came in line with the expectations of the market. The BOE elevated its interest rates by 25 basis points (bps) to 1%. This is the consecutive fourth rate hike by the BOE with a 6-3 majority for a quarter to a percent rate hike. The minority members advocated for a 50 bps rate hike. Despite an expected announcement, the sterling faced intense selling pressure after the BOE warned of signs of recession as households are facing the headwinds of higher living costs due to scaling oil prices and energy costs. Along with that, UK corporates are struggling to generate more job opportunities, which can affect the labor market and eventually the fifth largest economy in the world.

Meanwhile, the Japanese yen is enjoying a tad longer pullback season however, the downside is still intact. The ultra-loose monetary policy by the Bank of Japan (BOJ) will stay for longer. More stimulus into the economy will remain the major agenda of the BOJ, which will keep yen on the edge.

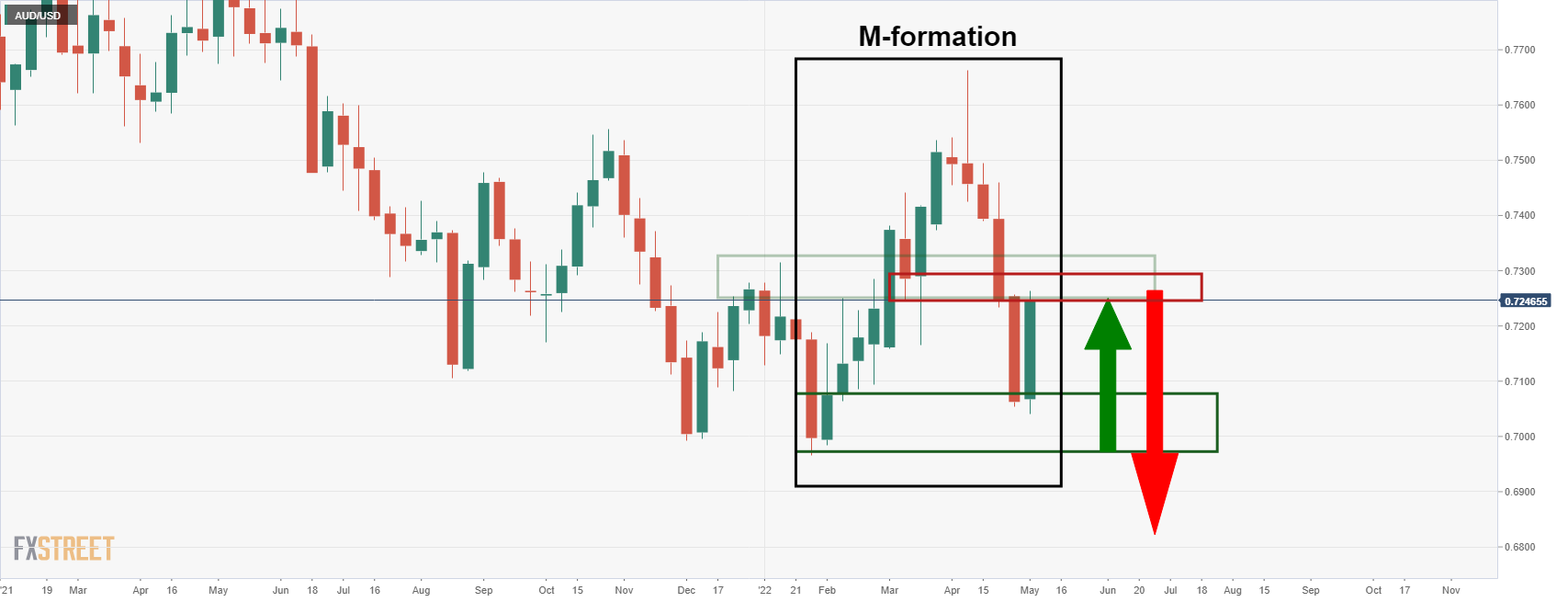

- AUD/USD remains sidelined around pre-Fed levels after the recent two-day zero-sum game.

- BOE-inspired inflation, growth fears join headlines from China, EU to reverse post-Fed gains.

- Equities slumped, yields rallied and the US dollar regained its charm during the risk-off US session.

- RBA Monetary Policy Statement, US jobs report will be important for immediate directions.

AUD/USD treads water around 0.7110, after losing nearly 150 pips the previous day, as traders await the key catalysts while taking a breather following the heavily volatile sessions. That said, the Aussie pair’s latest inaction could also be linked to the cautious mode ahead of full markets as Japan finally returns to trading, following China’s trading restart on Thursday, after a long break.

The Aussie pair witnessed a notable downside, reversing all the gains made during the post FOMC trading session, as global markets turned risk-off amid skyrocketing fears of growth and inflation.

The early Thursday’s optimism in the market couldn’t withstand the Bank of England’s (BOE) forecasts suggesting doubt-digit inflation and economic recession that rocked the boat in the US as well.

Not only the BOE but worsening covid conditions in China and the European Union’s (EU) readiness for more sanctions on Russia also weighed on the market sentiment and drowned the risk barometer AUD/USD pair. Additionally, the US Securities and Exchange Commission (SEC) added over 80 Chinese firms to the list of companies facing probable delisting from the US exchanges, which portrayed fresh Sino-American tussles and weighed on the risk appetite as well.

Following this, Wall Street indices slumped more than 3.0% each while the US 10-year Treasury yields rallied 3.40% on a daily closing while rising to the fresh high in late 2018 beyond 3.00%. As a result, the US Dollar Index (DXY) also regained its strength and poked April’s multi-month high around 104.00.

Looking forward, the Reserve Bank of Australia’s (RBA) justification of the larger-than-expected rate hike, via the Monetary Policy Statement (MPS), will be crucial for the AUD/USD traders, especially after the latest inflation and growth fears, which in turn could favor sellers if perceived negative. Also important will be the monthly employment report from the US as the Fed’s 50 bps rate hike hoped no major challenges from the jobs and inflation front.

Read: Nonfarm Payrolls Preview: Could employment become a new headache for the Fed?

Technical analysis

AUD/USD pair’s pullback from 100-DMA, around 0.7265 by the press time, eyes to retest the weekly bottom near 0.7030. Also acting as an upside filter is the confluence of a downward sloping trend line from early April and the 200-DMA, near 0.7285.

- The EUR/JPY remains trapped in the 136.50-137.50 range.

- Sentiment remains negative amidst central bank tightening and China’s Covid-19 lockdowns, which threaten to derail the post-pandemic economic recovery.

- EUR/JPY Price Forecast: The head-and-shoulders clouds the prospects of a higher EUR.

The EUR/JPY remains in choppy trading amidst a dismal market sentiment, courtesy of central bank tightening, alongside China’s weak service and composite PMIs, and also the acknowledgment of its coronavirus crisis by the Fed and the Bank of England. As the Asian Pacific session begins, the EUR/JPY prints minimal gains of 0.10% and is trading at 137.24.

US equities finished Thursday’s session with hefty losses, between 3.12% and 4.99%. Interest rate hikes in the week by the Federal Reserve and the Bank of England spurred appetite for safe-haven peers. Additionally, ongoing China lockdowns caused by the Covid-19 crisis were acknowledged by both central banks, which said it might disrupt supply chains and spur high inflationary pressures.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY is upward biased, though a head-and-shoulders chart pattern keeps the pair downward pressured. Nevertheless, the price action of the last four days shows the cross consolidating around the 136.50-137.50 range. If the EUR/JPY breaks upwards and achieves a daily close above 138.00, that would open the door for further upside, which could invalidate the head-and-shoulders.

If the EUR/JPY breaks on top of the abovementioned range, the first resistance would be 138.00. Once cleared, the following resistance would be the April 25 daily high at 139.20. A breach of the latter would expose the YTD high at 140.00.

On the other hand, the EUR/JPY first support would be the 137.00 mark. If EUR/JPY bears break that level, that will expose the 136.00 figure, followed by the head-and-shoulders neckline around 135.00-20.

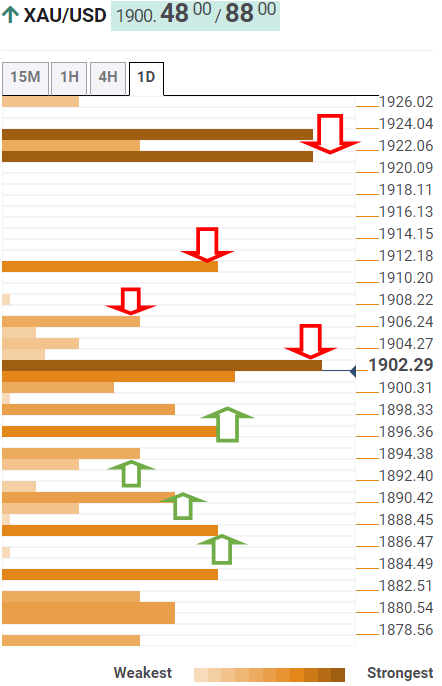

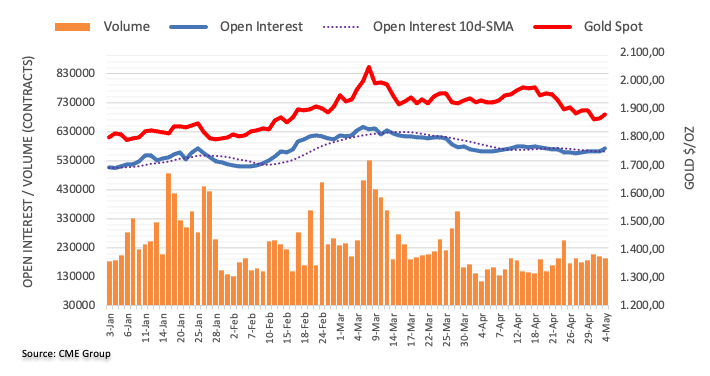

- Gold price is declining lower to near $1,860.00 as uncertainty over the US NFP release looms.

- An extremely tight labor market could add inflationary pressures.

- The formation of an Inverted Flag chart pattern could weigh pressure on gold prices.

Gold Price (XAU/USD) is oscillating in a narrow range of $1,872.95-1,881.46 as investors are awaiting the release of the US Nonfarm Payrolls (NFP), which are due on Friday. The asset witnessed a steep fall after testing the barricade of $1,910.00 and is aiming to slip further to near $1,860.00 amid uncertainty over the US employment data.

The announcement of the monetary policy by the Federal Reserve (Fed) resulted in a firmer rebound in the gold prices but most of them have been surrendered as the uncertainty of the interest rate decision has been carry-forwarded by the US NFP. The additions in the US labor market are expected t land at 391k against the prior print of 431k.

Despite the solid hangover of multi-decade inflation, the US economy is experiencing a tight labor market, which clears that the growth has not vanished and the economy is far from recession fears. However, a tight labor market could also fuel inflationary pressures as more job openings will result in higher wages, which eventually will add up price pressures and an extremely tight labor market would raise the odds of a 75 basis point (bps) by the Fed.

Gold technical analysis

The precious metal is forming an Inverted Flag chart pattern on a smaller timeframe. The formation of the above-mentioned chart pattern indicates a consolidation after a sheer downside, which will be followed by a further downside move. The 50-period Exponential Moving Average (EMA) at $1,883.86 is declining, which adds to the downside filters while the 20-EMA at $1,879.15 is acting as a major resistance for the gold prices. Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range but is likely to attract volatility after slipping below 40.00 decisively.

Gold 15-minute chart

-637873844908153750.png)

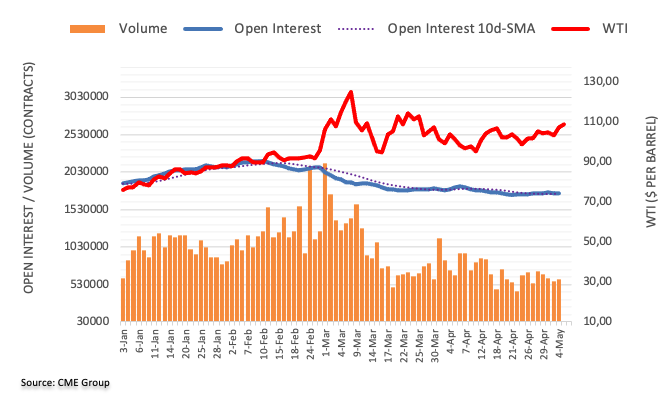

- West Texas Intermediate (WTI) crude oil is higher.

- Markets weigh OPEC and EU proposal to ban Russian oil.

At 108.60, West Texas Intermediate (WTI) crude oil is higher on the day by some 1% as the market continued to react to the European Union's proposal to ban imports of Russian oil. Additionally, OPEC+ has ratified their planned 432k bpd quota increase.

The EU's move to ban imports of Russian crude oil and refined products has helped to underpin the upside in the oil prices while several countries worry about the impact of cutting off Russian oil imports stood in the way of agreement.

The European Commission President Ursula von der Leyen announced the oil embargo on Wednesday and also other punishments that have included sanctions on Russia's top bank and a ban on Russian broadcasters from European airwaves. However, the proposal has not yet been approved by member countries. With all being said, still, some speculated that the ban was not the reason for the price increase since Russia has been able to find other buyers for its crude exports.

"The proposal provides for a transitional period of up to eight months, and had already been reported in gazettes for several days. It is therefore hard to see why yesterday's price response should have been so dramatic,'' Commerzbank analyst Carsten Fritsch said.

- The AUD/JPY paired Wednesday’s gains and retreated from weekly highs amidst a 1.14% loss.

- The central bank’s tightening and China’s lockdowns could slow down the global economy.

- AUD/JPY Price Forecast: Upward biased, though a wall of solid resistance lies around 94.00.

The AUD/JPY slumps from weekly highs after the US central bank decided to lift rates on Wednesday, triggering a risk-on market mood, which boosted risk-sensitive currencies like the AUD, the NZD, and the CAD. Nevertheless, on Thursday, a violent shift in sentiment witnessed flows towards safe-haven peers, ultimately favoring the Japanese yen. At the time of writing, the AUD/JPY is trading at 92.58.

US equities finished Thursday’s session with huge losses, between 3.12% and 4.99%. Rate increases by the Federal Reserve on Wednesday, and the Bank of England on Thursday, dented appetite for riskier assets. At the same time, both central banks acknowledged China’s lockdowns, adding that it might disrupt supply chains and spur high inflationary pressures.

On Thursday, the AUD/JPY opened around Wednesday highs around 93.70, and in the Asian session, it probed the 94.00 mark. Nevertheless, as sentiment shifted, the AUD/JPY broke the market structure lows around 93.33 in the hourly chart and accelerated towards Wednesday’s daily lows around 92.26.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY daily chart shows the pair is in an uptrend. The daily moving averages (DMAs) below the spot price aim high. However, it is worth noting that the 50-DMA confluences with the April 27 swing low, each around 90.25 and 90.43 respectively, meaning that a negative shift in sentiment could send the AUD/JPY tumbling towards the 50-DMA. Nevertheless, unless that scenario plays out, the AUD/JPY is upward biased.

That said, the AUD/JPY first resistance would be 93.00. A breach of the latter would expose the May 4 daily high at 93.82, followed by the March 28 daily high at 94.32 and then the YTD high at 95.74.

Analysts at ANZ Bank have revised their farmgate milk price forecast for the 2021-22 season down 40c to $9.30/kg milksolid (MS). This is the bottom end of Fonterra’s current forecast range of $9.30-$9.90/kg MS.

''Our forecast for the 2022-23 season has dropped 80c to $8.50/kg MS as commodity prices are anticipated to keep falling in the coming months.''

''The NZD is assumed to appreciate steadily across our forecast period to reach USD0.69 by the end of the 2022 calendar year.''

- NZD/USD bears pile in again as the US dollar attracts a safe-haven bid.

- DXY rallies to fresh bull cycle highs, sinking the bird ahead of NFP.

At 0.6421, NZD/USD is down some 1.88% after falling from a high of 0.6568 to a low of 0.6393 as investors move back into the US dollar as a discount. The greenback rallied to a fresh bull cycle high as per the DXY index that measures the US dollar vs. six major rivals.

''The Kiwi is significantly lower this morning, having slid around 1½ cents from yesterday’s peak as post-Fed optimism faded, the USD regained its erstwhile solid footing, equity indices sank and bond yields surged,'' analysts at ANZ Bank explained.

''There wasn’t really anything Kiwi-specific in the mix; rather it was just a global tornado of risk capitulation. Readers will be aware that we had been expecting a post-Fed risk rally, and there were always question marks about how long-lived it would be, but few likely would have picked this quick a turnaround.''

The catalyst today came from a bearish rate hike from the Bank of England, warning of price pressures and wage deflation, and ultimately putting the fear of stagflation into the markets. Additionally, the economic data from outside of the US continues to disappoint with Chinese PMI's sinking deeper within already contracting territory.

Weak German data that was showing that industrial orders in March suffered their biggest monthly drop since last October hammered down the coffin for the euro on Thursday. Consequently, the greenback was boosted by safe-haven buying as global equities come back under pressure.

''Price action of this sort will likely leave a sour taste in many people’s mouths, and in the wake of it, one has to consider the possibility that the typical early-cycle USD fade gets hijacked by volatility (and not just the Ukraine crisis and BoJ policy),'' analysts at ANZ Bank warned

Eyes turn to NFP

It is now all about the Nonfarm Payrolls.

''Whilst the Fed is not currently considering a 75bps rate increase, that guidance is based on expectations that the trend increase in monthly Nonfarm payrolls will slow and core inflation is stabilising. But there are no guarantees at all that that will be the case,'' analysts at ANZ Bank explained.

''Demand for labour in the US remains very strong and core services inflation is rising steadily. The April non-farm payroll and employment reports tomorrow night, therefore, carry a lot of significance.''

- The USD/CHF recovered all the ground shed post-Fed and is gaining 1.32%.

- A dismal market mood, spurred by the central bank’s tightening, and China’s covid crisis, threatens to disrupt the global economic recovery.

- USD/CHF Price Forecast: If USD/CHF bulls reclaim 0.9900, a move towards parity is on the cards.

The Swiss franc is losing ground against the buck, and the USD/CHF continues to reach a new YTD high after each of the last seven trading sessions amidst a dismal market mood. At 0.9852, the USD/CHF is rallying in the day, though retreated from early daily and current YTD highs around 0.9890.

Wall Street is in a middle of a stock blood bath, as reflected by the market sentiment. Central bank “aggressive” tightening, elevated US Treasury yields and a possible economic slowdown in China, spurred by the zero-tolerance Covid-19 policy, keep investors on their toes.

In the case of the USD/CHF, the pair reversed Wednesday’s profits after dipping to weekly lows reached on May 2 at around 0.9713 but staged a comeback and at the time of writing, is probing May 4 daily high at 0.9852.

USD/CHF Price Forecast: Technical outlook

The USD/CHF is upward biased from a daily chart perspective, as shown by the daily moving averages (DMAs) sitting below the exchange rate. However, the Relative Strength Index (RSI), well within the overbought territory at 79.01, might suggest that the pair is about to peak, nevertheless, it is aiming higher.

With that said, the USD/CHF’s first resistance would be March’s 23 daily high at 0.9901. Once cleared, the next step would be the parity at 1.000.

- EUR/USD bears are moving in for the kill to break 1.05 the figure.

- Eyes are on the monthly support that guards the risk of a break below parity.

- The NFP data will be key in this regard as the US dollar bulls look for a reason to stay the course.

At 1.0520, EUR/USD is down some 0.9% in late trade on Wall Street. The price dropped from a high of 1.0641 to a low of 1.0492 on the day with the US dollar soaring at the start of the North American shift. The euro was sold off in the wake of damaging data from the eurozone and ongoing concerns over the Ukraine crisis.

Investors are looking ahead at the prospect of a summer of discontent as global growth fears mount following a series of worrisome economic data and ongoing geopolitical risks. Chinese PMIs remain in contraction territory and the COVID lockdowns disrupting supply chains combined with the contagion of the Ukraine crisis in commodity markets has left a dark cloud over global growth prospects.

Then, the Bank of England warning of stagflation and weak German data that was showing that industrial orders in March suffered their biggest monthly drop since last October hammered down the coffin for the euro on Thursday. The greenback was subsequently boosted by safe-haven buying as global equities come back under pressure.

DXY, an index that measures the greenback vs. six rivals, is currently trading at 103.59 and is 1.06% higher on the day after rallying from a low of 102.352 to a new cycle high of 103.942. The move comes following the Federal Reserve the prior day affirming that it would take aggressive steps to combat soaring inflation.

The greenback was initially sold off as markets sold the fact yesterday when the Fed hiked by 50bps, as expected. However, there was a cohort of investors expecting a more aggressive move and guidance from the Fed's chairman, Jerome Powell, during the press conference. Instead, the dollar dropped sharply when the Fed chairman, dialled back on prospects of 75bps hikes.

Looking ahead, a lower appetite for emerging markets combined with the Fed's focus on fighting inflation are all factors that would be expected to underpin the greenback. Friday's Nonfarm Payrolls are going to be important in this regard.

The moves in the markets come ahead of Friday's showdown event in the US jobs market. The Nonfarm Payrolls (NFP) is a major risk and could well set the tone for the following weeks ahead of the next Fed rate decision.

''A strong payrolls report could perversely push the market to price in more tightening as the Fed reduced its optionality at its most recent meeting,'' analysts at TD Securities said.

''That leaves a resilient USD vs EUR and yen very much the path of least resistance. A softer wages print should help to temporarily take the edge off but this will be short-lived until evidence of a peak/moderation in CPI emerges.''

Should the jobs data come in strong, it could exacerbate the fall in the euro that is already testing the bull's commitments around 1.05 the figure:

EUR/USD technical analysis

As per the prior day's post-Fed analysis in both the DXY and euro, the price indeed reverted to test and penetrate the neckline of the W-formation.

Prior analysis:

The price came into a handful of pips from the 38.2% Fibonacci retracement level of the prior bearish impulse. The market has sunk to challenge the neckline of the W-formation, penetrating to print below 1.05 the figure on the day:

A break of the neckline followed by a bearish close will open the door for further downside ahead, as per the monthly chart:

What you need to take care of on Friday, May 6:

The American dollar recovered all the ground shed post-Fed and even reached fresh weekly highs against some of its major rivals as financial markets entered panic mode.

The catalyst came from the Bank of England monetary policy meeting. The central bank raised interest rates by 25 bps to 1.0%, agreed by all voting members. However, the central bank downwardly revised its growth estimates for this year and the next one, warning the UK will fall into recession before the year-end, adding that inflation will likely have two digits by the same time. As a result, the GBP/USD pair fell to 1.2324, its lowest since June 2020.

Stagflation-related fears hit US trading desks, with Wall Street collapsing and government bond yields soaring to their highest in four years. The yield on the 10-year Treasury note hit an intraday high of 3.10%, stabilizing in the American afternoon just below such a high.

Ahead of the close, the Dow Jones Industrial Average is down over 1,300 points, the Nasdaq Composite sheds roughly 6%, while the S&P 500 is down 4.20%.

The EUR/USD pair returned to the 1.0500 area after touching a weekly high of 1.0641. The shared currency is among the weakest USD rivals, as the Union is struggling to replace Russian energy while the ECB stands well beyond the curve, likely to discuss a rate hike not early than July.

Meanwhile, the OPEC+ agreed to increase oil supply by 432K bpd in June to cool down overheating prices. The barrel of WTI is currently trading at $108.30 a barrel, up for the day.

On the other hand, Gold Price collapsed. The bright metal surged beyond the $1,900 threshold at the beginning of the day but ended it at around $1,870, unable to resist the greenback’s strength.

Commodity-linked currencies were sharply down, with AUD/USD now trading below 0.7100 and the USD/CAD at around 1.2850.

The greenback advanced against safe-haven currencies, with USD/CHF reaching 0.9889, its highest since March 2020. USD/JPY trades a handful of pips above 130.00.

The focus now shifts to US employment figures, as the country will publish on Friday the April Nonfarm Payrolls report.

Like this article? Help us with some feedback by answering this survey:

- The AUD/USD is making a U-turn and is losing 2.33% during the day.

- The central bank’s tightening and China’s Covid-19 lockdowns cloud the global economic outlook.

- AUD/USD Price Forecast: Failure at the 100-DMA exacerbated the 160-pip fall, as bears eye 0.7000.

The Australian dollar losses ground and gave back Wednesday’s gains amidst a risk-off market mood, courtesy of central bank tightening, alongside China’s weak service and composite PMIs, and also the acknowledgment of its coronavirus crisis by the Fed and the Bank of England. At the time of writing, the AUD/USD is trading at 0.7093.

Central bank tightening and China’s Covid-19 lockdowns dampened the market mood

The market sentiment dampened as the Bank of England’s press conference was undergoing in the middle of the European session. The BoE hiked rates by 25-bps in line with expectations and expressed its concerns about China’s ongoing Covid-19 crisis, which according to the BoE, threatens to hit supply chains again and add to inflation pressures. Adding to the abovementioned, the Fed mentioned in the FOMC statement that “… COVID-related lockdowns in China are likely to exacerbate supply chain disruptions.”

In a note to clients, analysts at Brown Brothers Harriman (BBH) wrote that the Chinese economy “is clearly staggering from Xi’s COVID Zero policy. While policymakers have pledged more stimulus, it is unlikely to be very effective until the hard lockdowns have ended.”

Reflection of the previous mentioned are US equities, which are plunging as the New York session winds down. Contrarily, US Treasury yields are soaring, with the US 10-year Treasury yield, reaching 3.10% for the first time since 2018, underpinning the greenback. The US Dollar Index, a gauge of the buck’s value against a basket of peers, records gains of 1.24% and sits at 103.782.

Meanwhile, on Wednesday, the Fed continued taking measures to tame inflation. The US central bank lifted rates by 0.50%, up to the 1% threshold, and announced the beginning of Quantitative Tightening (QT) by $47.5 billion in the first three months. Later, Fed Chair Jerome Powell said that 75-bps hikes were not discussed in the meeting, though it opened the door for at least a “couple” of 50-bps increases. Nevertheless, money market futures show 71% odds of a 75-bps rate hike by the June meeting while fully pricing a 50-bps raise.

Data-wise, the US Department of Labour reported the Initial Jobless Claims for the last week of April, showing an increase in unemployment claims of 200K, higher than the 182K estimated.

The Australian economic docket displayed mixed data, with the Balance Trade printing a surplus of A$ 9.314 billion. On the negative side, Building Permits and Private House Approvals disappointed market players, weighing on the AUD/USD.

In the week ahead, the Australian docket will feature the Statement on Monetary Policy. Across the pond, the US Nonfarm Payrolls report for April estimates the creation of 391K of jobs in the US economy. Regarding the Unemployment Rate is expected to dip to 3.5%.

AUD/USD Price Forecast: Technical outlook

AUD/USD price action in the last two trading sessions is forming a tweezers-top pattern, which, once confirmed, means that further downside pressure lies ahead. The AUD/USD faced solid resistance around the 100-day moving average (DMA) at 0.7259, a level that AUD bulls could not reclaim, leaving the AUD/USD vulnerable to heavy selling pressure IF market sentiment shifted. Therefore, the AUD/USD remains downward biased.

With that said, the AUD/USD’s first support would be February’s 4 daily low at 0.7051. Break below would expose May’s 2 swing low at 0.7029, followed by the YTD low at 0.6967.

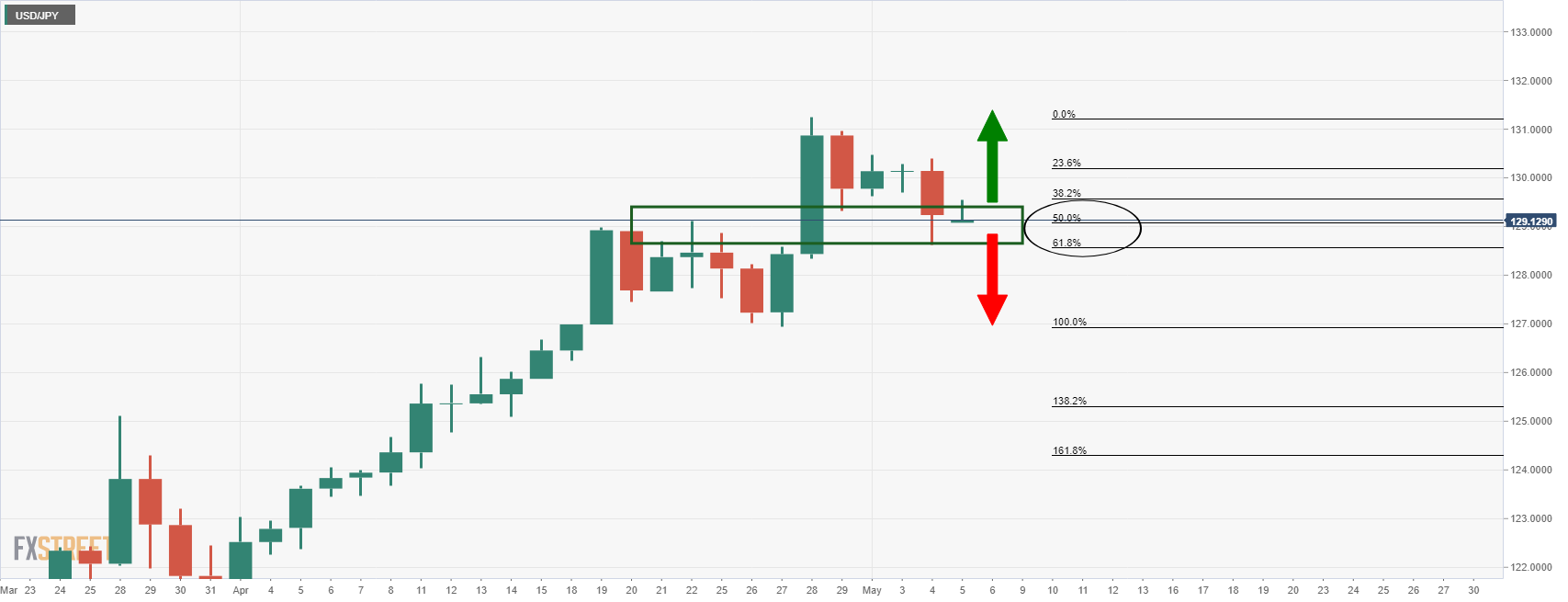

- USD/JPY bulls taking control as the US dollar soars.

- The prior series of bullish flags are encouraging for the current price action.

USD/JPY is on the verge of a bullish breakout according to the daily and hourly chart's structures and price action. The following illustrate the bullish bias across the aforementioned time frames:

USD/JPY daily charts

The price has been making a series of higher highs following a bull flag breakout within the bullish US dollar cycle as illustrated above.

In the current bull flag breakout, we can see that the price corrected to as far as 61.8% Fibonacci ratio and has rallied from prior resistance. This offers conviction to the breakout.

However, the bulls now need to clear hourly resistance:

USD/JPY H1 chart

The price is attempting to break clear of the bear's commitments at resistance. The 38.2%, 50% and 61.8% ratios align with the prior resistances on the hourly time frame that could act as support and lead to a surge higher in order to challenge the daily highs for the sessions ahead:

- Gold prices are back in the hands of the US dollar ahead of NFP.

- A break of daily support at $1,850 opens the door to a test of $1,800 should US dollar strength prevail.

At $1,875, the gold price has been pressured and is trading not far from the lows of the day down at $1,872.54, losing some 0.34% at the time of writing. Gold fell from a high of $1,909.82 as the US dollar rebounded on Thursday, moving in on the 20-year highs reached last week, as per the DXY index.

DXY, an index that measures the greenback vs. six rivals, is currently trading at 103.84 and is 1.3% higher on the day after rallying from a low of 102.352 to a new cycle high of 103.942. The move comes following the Federal Reserve the prior day affirming that it would take aggressive steps to combat soaring inflation. Markets initially sold the fact yesterday but the dollar dropped sharply when the Fed chairman, Jerome Powell, dialled back on prospects of 75bps hikes.

However, the traders have now sold the euro which has propelled the greenback higher again. Weak German data showing that industrial orders in March suffered their biggest monthly drop since last October and the Ukraine crisis tensions are weighing on risk sentiment in the eurozone. The greenback was subsequently boosted by safe-haven buying as global equities come back under pressure.

All eyes on NFP

The moves in the markets come ahead of Friday's showdown event in the US jobs market. The Nonfarm Payrolls (NFP) is a major risk and could well set the tone for the following weeks ahead of the next Fed rate decision.

''A strong payrolls report could perversely push the market to price in more tightening as the Fed reduced its optionality at its most recent meeting,'' analysts at TD Securities said.

''That leaves a resilient USD vs EUR and yen very much the path of least resistance. A softer wages print should help to temporarily take the edge off but this will be short-lived until evidence of a peak/moderation in CPI emerges.''

Should the jobs data come in strong, it could exacerbate the fall in gold prices, especially considering that the breadth of traders' short positions remains near their lowest levels on record. Shorts that have been squeezed between $1,890 and $1,910 in this week's rally in the gold price will likely be looking to reinvest any dry powder on further signs that the US dollar bulls are moving in again.

Gold technical analysis

The price is carving out a case for a significant downside continuation with the resistance near $1,890 holding up for the most part bar a clearing in the short-lived spike to $1,910. A break of daily support at $1,850 opens the door to a test of $1,800 should US dollar strength prevail.

- Risk-aversion keeps the greenback buoyant, recovering Wednesday’s losses.

- Fed’s Chair Powell pushed back against 75-bps raises but kept 50-bps “on the table.”

- USD/CAD Price Forecast: Remains upward biased, as USD/CAD bears failed to reclaim 1.2800.

The USD/CAD trims Wednesday’s losses and is approaching March’s 15 daily highs around 1.2871 after the Federal Reserve raised interest rates by 0.50% for the first time in 22 years. At the time of writing, the USD/CAD is trading at 1.2859.

The market sentiment is dismal, as US equities are trading in the red, posting losses between 2.65% and 4.46%. The greenback is poised to test the 104.000 mark, up 1.21% during the day, while the US 10-year Treasury yield rose to 3.086%, gaining 14 basis points, underpinning the USD/CAD pair.

The Federal Reserve May meeting left traders with a 50-bps increase in the Federal Funds Rate (FFR). Also, the US central bank announced that it would reduce its $8.9 trillion balance sheet on June 1 by $47.5 billion, $30 billion of US Treasuries, and $17.5 billion of mortgage-backed securities (MBS).

Meanwhile, in his press conference, Fed Chair Jerome Powell pushed back against 75-bps increases but would not discount 50-bps hikes in a couple of more meetings. Money market futures odds of another 50-bps raise in June are 100%. However, the chances of a 75-bps hike lie at 71%, reflected by the jump on the US 10-year benchmark note.

On Thursday, the US economic docket featured Initial Jobless Claims for the week ending on April 29, which increased to 200K from 182K foreseen by analysts. The report notes that labor costs surged to 11.6%, showing the tightness of the job market.

In the week ahead, the Canadian docket will feature Canadian employment figures. Analysts at TD Securities wrote in a note that they expect another 40K jobs to be added to the economy. Furthermore, they noted that “services should account for the bulk of newly created jobs, alongside a mixed performance for the goods-producing sector. We also look for wage growth to hold at 3.7% y/y as tight labor market conditions help offset a large base-effect.”

On the US front, the US Nonfarm Payrolls report for April is estimated that 391K jobs were added to the economy, though lower than the previous 431K reached.

USD/CAD Price Forecast: Technical outlook

The USD/CAD dipped towards April’s 29 swing lows around 1.2718 post-Federal Reserve decision on Wednesday. However, a shift in market sentiment, alongside technical support in the level mentioned above, spurred a jump from weekly lows towards the March 15 swing high around 1.2871. Additionally, the Relative Strength Index (RSI) shifted gears and is aiming higher, at 60.99, with enough room if the USD/CAD prints another leg-up.

With that said, the USD/CAD first resistance would be 1.2871. Break above would expose 1.2900, followed by the YTD high at 1.2913 and then the December 20 cycle high at 1.2964.

- The Bank of England hiked rates to 1%, though slashed UK’s economic growth in 2023.

- The US and UK central bank’s expressed concerns about China’s Covid-19 crisis, which threatens to disrupt supply chains, consequently triggering high inflation.

- GBP/USD Price Forecast: To fall towards June 2020 swing lows around 1.2251.

The British pound plummets on Thursday after the Bank of England (BoE) hiked 25-bps interest rates in a 6-3 split decision. However, the bank’s projections of a probable UK recession in 2023 shifted sentiment negatively, spurring a 280-pip drop from near weekly highs from 1.2630s to below 1.2350. At around 1.2330s, the GBP/USD reflects the scenario post-BoE decision.

As previously mentioned, the BoE lifted rates to the 1% threshold. Albeit widely expected, what dented the market sentiment is that the “old lady” slashed its growth forecasts, with 2023 showing a contraction of 0.25% vs. 1.2% on its previous projections. That, alongside the central bank’s worries about China’s renewed lockdowns, added to the Fed’s concerns on the same issue.

On Wednesday, in its monetary policy statement, the Fed mentioned that “… COVID-related lockdowns in China are likely to exacerbate supply chain disruptions,” while the Bank of England said that it was “worried” about renewed Covid-19 lockdowns and added that threatens to hit supply chains again and add to inflation pressures.

Additionally, in the Asian session, China’s Caixin Services PMIs printed a dismal figure, at 36.2 vs. 42.1 expectation, portraying the effects of April’s lockdowns in Shanghai.

Meantime, the US Dollar Index, a gauge of the greenback’s value, is trimming Wednesday’s losses and reached a new YTD high at around 103.942, though at the time of writing is sitting around 103.855, gaining 1.31%. Also, the US 10-year Treasury yield reclaimed the 3% threshold and is rallying 15 basis points, currently at 3.090%, underpinning the greenback.

On Thursday, the US economic docket featured Initial Jobless Claims for the week ending on April 29, which increased to 200K from 182K foreseen by analysts. The report notes that labor costs surged to 11.6%, showing the tightness of the job market.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is under heavy selling pressure, and once it broke below July’s 2020 cycle lows around 1.2479, it opened the door for further losses. The MACD indicator shows that the MACD-line is aiming downwards, signaling that the downtrend is accelerating. With no immediate support nearby, the GBP/USD’s following line of defense would be the June 2020 swing lows around 1.2251.

- Wall Street is falling sharply, volatility soars as US yields hit multi-year highs.

- Emerging market currencies are under pressure on risk aversion.

- USD/MXN erases losses and looks at 20.50.

The USD/MXN is rising sharply on Thursday, erasing Wednesday’s losses and so far, recovering 20.30. During the last two hours, the pair rose more than 1.20% amid a rally of the US dollar across the board.

US stocks give back Fed gains and more

The greenback gained momentum amid a selloff in Treasuries. The US 10-year yield stands at 3.09% and the 30-year at 3.18%, both at the highest level since Q4 2018. Higher yields and risk aversion are boosting the dollar. The DXY is about to test the 2022 high as it trades at 103.82.

Fears about higher rates hit market sentiment. Stocks in Wall Street had on Wednesday the best day since 2020. On Thursday, they are given back all those gains and even more. The Dow Jones tumbles 3.30%, and the Nasdaq plummets 5.02%.

The negative environment weakened emerging market currencies. The worst performer is the South African rand (USD/ZAR up 3.90%) and the Brazilian real USD/BRL +2.58%).

Key levels

The USD/MXN is back at the 20.30 level after hitting earlier the lowest level in two weeks under 20.00. The reversal put upside risks back to the table. If it holds above 20.30, the dollar could rise to test the critical short-term resistance area of 20.50. Above the next resistance stands at 20.70.

If USD/MXN failed to hold above 20.30 and slips back under 20.20, the Mexican peso could regain control, looking for a new test of 20.00.

Technical levels

- US dollar rises across the board on risk aversion and higher US yields.

- S&P 500 drops 3.40%, erases Fed’s rally.

- USD/JPY tests weekly highs after sharp reversal.

The USD/JPY rose further climbing above the level it had before the FOMC meeting. It is testing the weekly high near 130.40 after rising from than 150 pips from the daily lows boosted by higher US yields.

The sell-off in Treasuries resumed after a two-day pause and the day after the FOMC meeting. The dollar started to decline after the release of the Fed statement announcing a 50bps rate hike. The comments from Powell discarding a 75bps rate hike triggered mores losses for the greenback that bottomed on Thursday during Asian hours. Back then, USD/JPY was trading near 128.70.

The dollar started to recover and recently it gained more speed to the upside. It erased all losses from the Fed meeting and is back near the recent top. The DXY is up by 1.20% at 103.70. At the same time, US yields jumped. The US 10-year stands at 3.09% and the 30-year at 3.18%, the highest level since the fourth quarter of 2018.

Risk aversion is not preventing the selloff in Treasuries and it keeps the yen limited. The Japanese currency remains neutral across the board even as the Dow Jones tumbles 2.57%, the S&P 3.00% and the Nasdaq 4.19%.

The USD/JPY is testing the 130.40/50 area. Above the next resistance is seen at 130.75, and then comes the 2022 top at 131.25. If the pair fails to break 130.40 it could pull back initially to 130.30 and then to 129.70.

Technical levels

- Gold extends its losses below solid resistance around $1,890.

- The Federal Reserve and the BoE expressed concerns about China’s covid crisis.

- Gold Price Forecast (XAU/USD): Retreated below $1,890, opening the door for further losses.

Gold spot (XAU/USD) is recording losses in the North American session, retreating from daily highs around $1,909.66, amidst a risk-off market sentiment, as two-central banks expressed worries about China, while the Bank of England (BoE) foresees a GDP contraction on 2023 for the UK. At $1,878.51 a troy ounce, XAU/USD is down 0.14% but below March’s 2022 lows at $1,890.

On Wednesday, the Federal Reserve hiked rates by 50 bps, lifting the Federal Funds Rates by 1%. The market’s initial reaction was a “buy the rumor, sell the fact” event, partly because massive greenback long positions took profits. In the same monetary policy decision, the US central bank announced that it would reduce its $8.9 trillion balance sheet on June 1 by $47.5 billion, $30 billion of US Treasuries, and $17.5 billion of mortgage-backed securities (MBS).

In his press conference, Fed’s Chief Jerome Powell pushed back against 75 bps hikes but would not rule 50 bps increases in a couple of meetings.

Across the pond, the Bank of England (BoE) hiked rates by 25 bps, though the vote was split 6-3. In its opening statement, the BoE Governor Andrew Bailey said that inflationary pressures intensified since the Ukraine-Russia war and added that inflation is well above the target. He said that risks for UK’s growth are skewed to the downside, and it is expected to slow sharply.

The Fed and the BoE worried about China’s Covid crisis

The US and the UK central banks portrayed some warnings about the ongoing Covid-19 crisis in China. The Fed mentioned that “In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions,” while the Bank of England said that it was “worried” about renewed Covid-19 lockdowns and added that these threaten to hit supply chains again and add to inflation pressures.

Aside from this, the US economic docket featured Initial Jobless Claims for the week ending on April 29, which increased to 200K from 182K foreseen by analysts. The report notes that labor costs surged to 11.6%, showing the tightness of the job market.

Gold Price Forecast (XAU/USD): Technical outlook

Gold remains neutral-downward biased, retracing the previous jump to weekly highs around $1,909.66 one day after the Fed’s decision. As of writing, XAU/USD price is below the 50 and the 100-day moving averages (DMAs), a sign of the yellow-metal weakness. Also, on its way north lies a solid resistance area around March’s lows, previous support-turned-resistance at $1,890, which in the event of XAU/USD prices shooting higher, would be difficult to overcome on its way north.

Upwards, XAU/USD traders would face solid resistance at the 100-DMA at $1,882.31, followed by March’s lows at $1,890 and the $1,900 mark. On the other hand, XAU/USD’s first support would be May 3 daily low at $1,850.34, closely followed by the 200-DMA at $1,835.41, and then January’s 28 YTD low $1,780.18.

- US stocks tumble, VIX jumps and dollar soars.

- US yields rise to the highest level in years.

- EUR/USD looks to 1.0500 and the cycle low.

The EUR/USD is falling sharply and is about to test the 1.0500 area, weakened by a rally of the US dollar. The pair bottomed at 1.0503, more than 125 pips below the daily high it reached on Asian hours.

What comes fast goes away fast

A stronger US dollar across the board accelerated the decline of the EUR/USD. The greenback benefit as US stocks tumble. The Dow Jones is falling 2.85% and the Nasdaq 4.60%, erasing Wednesday’s gains.

At the same time, US yields are rising sharply to multi-year highs the day after the Federal Reserve rose the key interest rate by 50 basis points. The US 10-year yield stands at 3.07%, up more than 4% and the 30-year at 3.17%, the highest level since December 2018.

Economic data from the US showed Initial Jobless Claims rose unexpectedly to 200K, the highest level in eleven weeks while Continuing Claims printed a fresh historic low. On Friday, the April US official employment report is due.

A test of 1.0465 seems likely

The technical outlook deteriorated significantly for the euro with the recent reversal. A break under 1.0500 would initially expose the weekly low at 1.0487 and then the 2022 low at 1.0486.

A recovery above 1.0560 should alleviate the current bearish pressure of EUR/USD. Above the next resistance stands at 1.0600.

Technical levels

- US equities have largely reversed Wednesday’s post-Fed rally, with big tech names leading the decline as yields surge.

- The S&P 500 recently fell back below the 4,200 level, taking its losses to more than 2.5% or 100 points.

Wednesday’s post-Fed jubilation has proven short-lived, with all three of the major US equity indices having already given back the lion’s share of Wednesday’s gains not even two hours into the US trading session. Yes, Fed Chair Jerome Powell did rule out 75 bps rate hikes at upcoming meetings, easing some of the most acute fears about rapid near-term Fed tightening and, yes, this has knocked short-end US yields back from highs.

But the long end of the US yield curve is telling a hawkish story. The 10-year rallied more than 10 bps on Thursday to break above the 3.0% level for the first time since December 2018, while the 30-year yield was last up an even heftier 14 bps. Clearly, bond markets have interpreted Wednesday’s message from Powell as meaning signaling the risks are tilted towards a higher Fed terminal rate and equity markets are taking note.

The tech-heavy, highly long-term bond yield sensitive Nasdaq 100 index was last trading lower by close to 4.0% on the day near the 13,000 level, a sharp reversal back from Wednesday’s close above 13,500. The S&P 500, meanwhile, recently dipped back under 4,200 amid a 2.5% on the day decline and was last trading down over 100 points from Wednesday’s close bang on the 4,300 level. The Dow was last trading down a little under 2.0% in the 33,400 area, having reversed lower from a test of its 21 and 50-Day Moving Averages in the 34,070 area on Wednesday.

As markets continue to digest the implications of Wednesday’s Fed meeting, focus will begin shifting to the release of the official April US labour market report on Friday at 1330BST. With inflation risks in focus and a key driver of market sentiment right now (as higher inflation means a more hawkish Fed), traders will be closely scrutinising the report for signs of wage growth acceleration. If the data is interpreted as having any hawkish read across to the Fed, it could be an ugly end to the week for US equities.

- WTI rallied above $110 to hit its highest levels in over a month on Thursday, though has since dropped back.

- Traders are citing the EU’s Russia oil embargo plan and OPEC+’s decision to stick to their usual ouput hike policy as supportive.

Oil prices rallied for a second straight session on Thursday, with front-month WTI futures briefly hitting their highest levels in more than one month above the $110 ber barrel mark before more recently pulling back closer to $109.00. At current levels, WTI is still more than $1.50 higher on the day. Market commentators cited concerns about a further drop in Russian output in the months ahead as the EU nears agreement on a plan that would phase out all Russian oil imports within six months.

A French official on Thursday said they were confident a deal would be reached by the end of the week, with the EU proposal facing pushback from the likes of Hungary, Slovakia and Bulgaria. Market commentators also cited OPEC+’s decision on Thursday to continue their current policy of raising output quotas by 432K barrels per day each month as supportive for the crude oil complex. OPEC+ has been under pressure by major oil-consuming nations to increase output at a faster pace.

Even before Russia’s invasion of Ukraine and the subsequent harsh Western sanctions response, the outlook for near-term OPEC+ supply increases was poor, with a number of the group’s smaller producers struggling to keep pace with output quota hikes. A recent Reuters survey revealed the group’s adherence to its supply cut pact stood at over 160% last month and this is expected to rise as Russian production further suffers in the months ahead.

“The oil market has not fully priced in the potential of an EU oil embargo, so higher crude prices are to be expected in the summer months if it's voted into law,” an analyst at Rysted Energy said on Thursday. “The planned EU oil embargo represents a massive logistical challenge for oil markets,” another analyst said.

For now, then, WTI prices above/around $110 seem to make sense and bears will be eyeing a potential test of late March highs in the $116.00s. But traders would do well to also remain cognizant of downside risks presented by the evolving lockdown situation in China, with the country still pursuing a zero Covid strategy. Beijing continues to struggle to contain a Covid-19 outbreak and has been extending restrictions as infection rates (though still low) continue to rise. Local press suggests that the situation in Shanghai has been improving, however.

Finland Central Bank head and ECB Governing Council Member Olli Rehn said in an interview with Daily Helsingin Sanomat on Thursday that it would be reasonable to expect a 25 bps rate hike in July, and for interest rates to reach zero in the Autumn. After that we could continue further normalising monetary policy gradually and proactively," Rehn said.

Rehn's remarks come after ECB Chief Economist Philip Lane said earlier on Thursday that the exact timing of rate hikes is not the most important issue, reported Reuters. The ECB will move rates, not just once, but over time in a sequence, he noted.

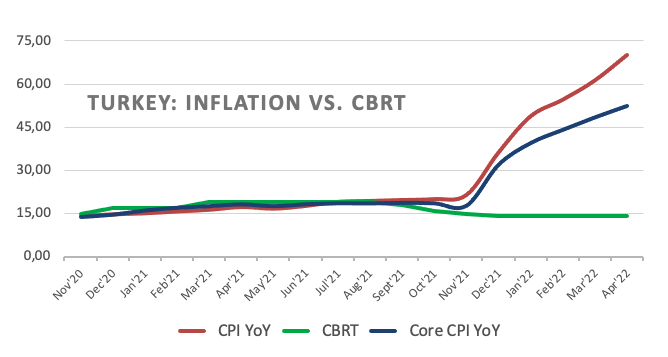

- USD/TRY picks up renewed upside interest near 14.90.

- Turkey annual CPI rose to almost 70% in April, or 20-year high.

- Turkey Manufacturing PMI eased to 49.20 also in April.

The lira trades on the defensive and gives away part of the recent advance, helping USD/TRY to regain some composure and approach the 14.90 region on Thursday.

USD/TRY up on higher inflation

USD/TRY leaves behind two consecutive sessions with losses and resumes the upside on the back of the renewed depreciation of the Turkish currency, particularly after inflation in Turkey rose at the fastest pace in the last 20 years in April.

Indeed, and tracked by the CPI, consumer prices in Turkey rose at a monthly 7.25% in April and 69.97% from a year earlier, while Producer Prices rose 7.67% MoM and 121.82% YoY. Finally, the Manufacturing PMI receded a tad to 49.20 during last month (from 49.40), remaining in the contraction territory.

The higher-than-expected inflation figures in the country were mainly in response to the transportation sector (including energy prices) as well as food prices.

Still around inflation, President Erdogan said last week that inflation should start to lose traction in May, while finmin Nebati suggested on Monday that the ongoing elevated inflation was short-lived… (wait… what?).

Maybe the CBRT is waiting for inflation to hit triple digits before taking some much-needed action…

What to look for around TRY

The lira keeps the range bound theme unchanged vs. the greenback, always in the area below the 15.00 neighbourhood for the time being. So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine. Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: Inflation Rate, Producer Prices, Manufacturing PMI (Thursday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Upcoming Presidential/Parliamentary elections.

USD/TRY key levels

So far, the pair is gaining 0.89% at 14.8575 and faces the next hurdle at 14.9889 (2022 high March 11) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a drop below 14.6836 (monthly low May 4) would expose 14.5458 (monthly low April 12) and finally 14.5136 (weekly low March 29).

Yesterday’s FOMC decision largely delivered on expectations – a 50bps hike and a little more detail on the start to the Fed’s balance sheet reduction plans. The USD wobbled following the FOMC decision and economists at Scotiabank think the outlook for the USD is more neutral now as a consequence of the Fed’s messaging.

USD rally to stall after FOMC

“With swaps already reflecting expectations that the Fed Funds target rate will nearly reach 3% in early 2023, there is little chance of short-term rates rising that much more – at least for the next few months until the Fed has a better chance of assessing whether rates need to be more restrictive. In effect, the Fed’s tightening plans now look to be fully priced by markets.”

“We don’t expect the USD to weaken sharply; it is likely to remain well supported on dips, given where domestic yields are. Higher domestic rates also make the USD an expensive short from a speculative point of view. Rather, we think the USD trend is likely to transition into a broad, choppy, sideways range trade.”

“The DXY’s price action on the week so far supports the notion of a tentative stall in the USD bull trend; a spot close on the week at or very near current levels (103.2) would put a Doji candle on the weekly chart which is a classic stalling signal and could precipitate a corrective drift in the index back to the 99/101 zone in the next few weeks.”

- AUD/USD met with a fresh supply on Thursday and eroded a major part of the overnight gains.

- The prospects for a further tightening by the Fed revived the USD demand and exerted pressure.

- Concerns about the latest COVID-19 outbreak in China further undermined the Australian dollar.

The AUD/USD pair extended its steady intraday descent through the early North American session and fell to a fresh daily low, around the 0.7165-0.7160 region in the last hour.

Having struggled to move back above the 100-day SMA, the AUD/USD pair met with a fresh supply on Thursday and snapped a two-day winning streak to a near two-week high. A combination of supporting factors assisted the US dollar to make a solid comeback and reversed the previous day's post-FOMC slump. This, in turn, was seen as a key factor that exerted downward pressure on the major.

Fed Chair Jerome Powell on Wednesday downplayed the possibility of a more aggressive policy tightening, though stated that policymakers were ready to approve 50 bps rate hikes at upcoming meetings. Moreover, the markets are pricing in a further 200 bps rate hike for the rest of 2022. This was evident from a fresh leg up in the US Treasury bond yields, which helped revive the USD demand.

This, along with concerns about rising COVID-19 cases and strict lockdowns in China, further benefitted the safe-haven buck, which seemed rather unaffected by a rise in the US Initial Jobless Claims. On the other hand, the disappointing release of China's Caixin Services PMI, along with softer Australian trade data, also contributed to driving flows away from the China-proxy aussie.

It would now be interesting to see if the AUD/USD pair is able to attract any buying at lower levels or prolongs the intraday rejection slide from a technically significant moving average. Some follow-through selling would suggest that this week's bounce from a three-month has run its course and set the stage for the resumption of the prior downtrend witnessed over the past one month or so.

Technical levels to watch

The Bank of England (BoE) has hiked by a further 25 basis points, though there are further signs that policymakers believe market rate hike expectations have gone too far. Economists at TD Securities expect reinforced weakness in the British pound.

The outlook is very soft

“The MPC delivered as broadly expected today with a 25bps hike and a promise of an update on active Gilt sales in August. Macro forecasts based on the yield curve were downgraded sharply, with the MPC expecting 10% inflation in 2022 and negative GDP growth in 2023, sending a strong signal to markets that the anticipated rate path is too high.”

“BoE outlook illustrates the fears of rising stagflation risks, raising questions about the terminal rate priced into markets. As a result, we think that GBP is losing its appeal.”

“We note that GBP also suffers from the broader European stagflationary pressures gripping the EUR. While the EUR's stagflation risks are arguably higher, it also has more room to reprice growth and rates higher. We continue to like EUR/GBP higher as a broader forecasting theme, so we will look to use dips as buying opportunities.”

“GBP's one bright spot lies in stretched market positioning and tactical valuations. It's the most oversold G10 currency, and HFFV sits at 1.2787, leaving it ripe for a short-term correction. Yet that is a move we would look to fade.”

- Silver is currently holding above $23.00 and on course for a second day of gains amid dovish central bank vibes.

- The Fed ruled out 75bps rate hikes on Wednesday and the BoE sounded the alarm about a possible UK recession.

- Focus now shifts to Friday’s official US labour market report.

Spot silver (XAG/USD) prices held above the $23.00 per troy ounce level on Thursday after markets interpreted the latest BoE policy announcement as dovish, one day after a less hawkish than feared policy announcement from the Fed. At current levels in the $23.10s, XAG/USD trades with on-the-day gains of more than 0.5%, taking its two-day rally to over 2.0% and recovery since earlier weekly lows at $22.12 to more than 4.5%.

After the Fed lifted interest rates by 50 bps as expected on Wednesday and ruled out hiking interest rates in more aggressive 75 bps intervals at upcoming meetings, a move which analysts said removed some downside risk to precious metals, the BoE warned of a recession in the UK economy in 2023, though still raised interest rates by 25 bps on Thursday. Ahead of the release of the April US labour market report on Friday, dovish central bank vibes will likely keep XAG/USD supported above $23.00.

The precious metal might even be able to rally back to test its 200-Day Moving Average in the $23.75 area. But it remains premature to bet on a more substantial rebound back to, say, April’s highs in the $26.00s. While the BoE doesn’t seem likely to tighten monetary policy settings much more amid growing concerns about UK economic growth later in the year, as well as worries about the bank’s ability to meet its long-term inflation objectives, Fed policy risks remain tilted in favour of a further hawkish shift.

Despite ruling out 75 bps rate hikes on Wednesday, Fed Chair Jerome Powell was keen to reiterate that the Fed is prioritising bringing inflation down above all else. If inflation fails to moderate as much as expected (or hoped for) by the Fed in the second half of this year, then risks are tilted towards the Fed signaling interest rates rising significantly above the so-called “neutral” rate.

That could ignite further long-term upside in USD and US yields, which could weigh heavily on silver. Rallies, thus, remain subject to being sold and many XAG/USD bears will continue to target a test of 2022 lows around the $22.00 mark.

S&P 500 has seen a further strong recovery post the FOMC to turn the spotlight on the 4308 recent high. Despite the recent strength, only a close above here would see a base complete to maintain the positive tone, analysts at Credit Suisse report.

Failure to close above 4308 on Friday would see a ‘reversal week’ avoided

“We see a key inflection point at the high of last week at 4308. For a more constructive tone, it is vital to see a quick followthrough to the upside following yesterday’s strength.”

“If a close above 4308 can be achieved on Friday this would not only see a near-term base complete but also a bullish ‘reversal week’, which we would look to then provide the platform for a deeper albeit still corrective rally. We would then see resistance next at the 38.2% retracement of the YTD fall at 4341/51, then price, gap and 63-day average resistance at 4370/94.”

“Failure to close above 4308 at the end of this week would see a ‘reversal week’ avoided. Below support at 4200 though is needed to ease the immediate upside bias and below 4153/49 to turn the broader risk lower again for a fall back to 4115.”

The Federal Reserve decided to hike its policy rate by 50 basis points (bps) as expected. As a result, gold rallied. Nonetheless, economists at TD Securities do not expect the race higher in the the yellow melta to last long.

There are not many participants remaining with appetite to buy gold

“The Fed largely met expectations, catalyzing a buy-everything rally given the pervasively poor sentiment across global markets amid well-telegraphed move. While Chair Powell took 75bp hikes out from consideration, the deck was stacked for this outcome from a positioning lens.”

“Price action is playing out according to our playbook, which also notes that there aren't many participants remaining with appetite to buy gold, with only a few participants short. The consensus trade is to the long side, with some complacent gold length still associated with the war in Ukraine.”

“The few remaining shorts hold a large position size and are likely to take profit as prices rise, fueling the ongoing rally in gold amid the buy-everything trade. However, we suspect that the rally won't last long in the yellow metal, considering that the breadth of traders short remains near its lowest levels on record.”

USD/CAD has failed to break medium-term resistance starting at 1.2900/15. However, economists at Credit Suisse maintain a positive outlook whilst above 1.2684/53.

Rejection of the March high at 1.2900/15 still seen as a correction

“USD/CAD is falling sharply back lower again, with next near-term support now seen at 1.2684/53. We retain our bullish bias whilst above this area, though a move back above 1.2846/53 is needed to relieve the immediate downward pressure and pave way for a renewed test of the March high at 1.2900/15.”

“Above March high at 1.2900/15 would see scope to challenge the 2021 high at 1.2947/67, which we view as a key medium-term barometer for the market.”

“Should 1.2684/53 be broken, this would likely act as a signal that the market is mean-reverting back within the long -term range and would lead us to neutralise our positive bias. With this in mind, support would then be seen at 1.2567, ahead of a more major support at the uptrend from Q2 2021 at 1.2458/26.”

- EUR/GBP caught aggressive bids and surged to a fresh YTD top after the BoE policy decision.

- A split MPC and gloomy economic outlook pointed to a dovish tilt, which weighed on sterling.

- Resurgent USD demand and the Ukraine crisis hold back the euro bulls from placing fresh bets.

- The technical set-up supports prospects for additional gains and a move towards the 0.8600 mark.

The post-BoE selling around sterling pushed the EUR/GBP cross to a fresh YTD high, around mid-0.8500s during the mid-European session.

The UK central bank on Thursday lifted its key interest rate for the fourth time since December, to the highest level in 13-years to curb inflation, which has leapt to a 30-year high. In the accompanying policy statement, the Bank of England noted that some degree of further tightening in monetary may still be appropriate in the coming months.

That said, a split emerged in the Monetary Policy Committee as two members said that the guidance was too strong considering the risks to growth. Moreover, the BoE warned about a sharp slowdown and is now forecasting the UK economy to contract by 0.25% in 2023. This was seen as a dovish shift, which, in turn, weighed heavily on the British pound.

In the post-meeting press conference, BoE Governor Andrew Bailey said that the MPC doesn't agree with people who think that they should raise interest rates a lot more. This, in turn, suggested that the rate hike cycle could be nearing a pause and prompted aggressive short-covering around the EUR/GBP cross, taking along some intermediate trading stops.

The momentum pushed spot prices beyond a downward-sloping trend-line resistance extending from April 2021 and might have already set the stage for further gains. That said, resurgent US dollar demand, along with concerns that the European economy will suffer the most from the Ukraine crisis, weighed on the euro and might cap gains for the EUR/GBP cross.