- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 05-04-2022

- Failed attempt of loonie bulls to drag the asset below the March lows has fetched responsive buying.

- The greenback bulls seek a bull cross of 20- and 50-period EMAs for validation.

- An establishment of the RSI (14) above 60.00 will activate a bullish setup.

The USD/CAD pair has fetched significant bids in the North American session on Tuesday after attempting a re-test of its previous week’s low at 1.2430. A responsive buying near the potential lows indicates that the market participants have considered the asset as a value buy, which has attracted potential investors.

On an hourly scale, USD/CAD is auctioning in a descending triangle formation whose horizontal support is placed from March lows at 1.2430 while the descending trendline is plotted from March 28 high at 1.2593. It is worth noting that a firmer responsive buying near the lower boundary of a descending triangle advocates a bullish reversal and eventually leads to an intensive buying activity.

The greenback bulls seek a bull cross of 20- and 50-period Exponential Moving Averages (EMAs), which are currently trading at 1.2472 and 1.2480 respectively.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted to a 40.00-60.00 range, which eradicates weakness in the counter. However, a breach of 60.00 by the momentum oscillator will trigger a bullish setup for the asset.

A breach above the psychological resistance of 1.2500 decisively will drive the asset towards April 1 high at 1.2540. Further, a cross of the latter will send the asset to its ultimate target of March 28 high at 1.2593.

However, Lonnie bulls can shift gear if the pair drop below Tuesday’s low at 1.2403, which will drag the major towards the November 2021 low and round level support at 1.2352 and 1.2300 respectively.

USD/CAD hourly chart

-637847992659647150.png)

- The EUR/GBP pair began the week on the wrong foot, losing 1%.

- Tensions increased between Russia and Ukraine on Bucha developments and Western war crimes accusations against Russia.

- EUR/GBP Price Forecast: Aiming towards the YTD low, but upside risks remain.

EUR/GBP begins the Asian Pacific session barely flat, around 0.8339, after Tuesday’s fall below the 50-day moving average (DMA) at 0.8366, pushing the pair towards a descending channel’s bottom-trendline. At the time of writing, the EUR/GBP is trading at 0.8340, down 0.01%.

The EUR/GBP pair is down in the week, so far 1%. The fall in the cross-currency is courtesy of the Ukraine-Russia conflict, which aims to extend not for another week but instead for months. The findings of civilians bodies in Bucha, and accusations of war crimes against Russia, deteriorated peace talks discussions between the parties involved.

Overnight, the EUR/GBP pair seesawed around the 0.8370s area but fell once the European traders got to their desks and reached a daily low at 0.8328.

EUR/GBP Price Forecast: Technical outlook

The EUR/GBP is trading near the bottom of a descending channel and found support near the 0.8320s area, which once hit, the pair jumped to current levels. Nevertheless, the Relative Strength Index (RSI) at 45.75, in a bearish area, and the daily moving averages (DMAs) above the spot price, keep the EUR/GBP downtrend intact, but upside risks remain.

That said, the EUR/GBP’s first support would be March 23 swing low at 0.8295. A sustained break would expose March 4 low at 0.8233, followed by the YTD low at 0.8202.

Technical levels to watch

- The DXY has established above 99.00 and is eyeing 100.00 amid hawkish Fed officials.

- Fed Governor Lael Brainard has cleared that the Fed will start reducing the balance sheet size soon.

- An outperformance of US Services PMI has infused fresh blood into the DXY.

The US dollar index (DXY) has finally turned imbalance after consolidating in a range of 97.68-99.42 over one month. The strength of the asset amid an aggressive hawkish stance from the Federal Reserve (Fed) policymakers has supported the DXY to establish above 99.00 and has also exposed it to kiss the psychological figure of 100.00.

Fed Governor Lael Brainard’s speech

The hawkish remarks from Fed Governor Lael Brainard have injected an adrenaline rush into the DXY. The Federal Open Market Committee (FOMC) member from her speech has cleared that the Fed is going to transfer the burden of soaring inflation and therefore investors should brace for an aggressive interest rate hike in May. Adding to that, the FOMC member has stated that the Fed is “inclined to announce a stronger action if the parameters of inflation and its expectations indicate that such action is highly required.” Also, the Fed will start reducing its balance sheet size at a rapid pace to corner the sheer inflation.

US ISM Services PMI

US Institute for Supply Management (ISM) has unfolded the Services Purchase Managers Index (PMI) on Tuesday and has displayed an outperformance from the US economy against the estimates. The US ISM Services PMI landed at 58.3, higher than the preliminary estimate of 58.3 and prior print of 56.5, which has infused fresh blood into the mighty DXY.

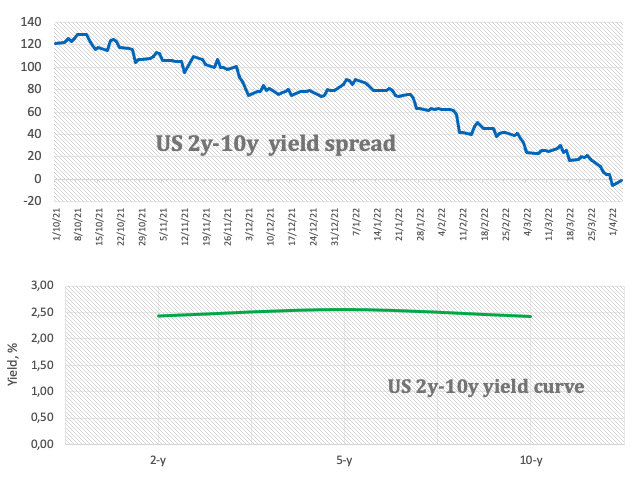

10-year US Treasury yields cross 2.5%

The hawkish stance on May’s monetary policy by Fed Governor Lael Brainard has raised the odds of a 50 basis point (bps) interest rate hike significantly. This has fueled the 10-year US Treasury yields, which have recaptured 2.55%.

Going forward, the Fed will release the FOMC minutes on Wednesday, which will unfold the mindset of Fed Chair Jerome Powell and his colleagues behind featuring a 25 (bps) interest rate hike in March.

- The uptrend remains in place as long as the EUR/JPY remains above 134.74.

- Tuesday’s price action formed a doji in a downtrend, meaning there’s indecision amongst EUR/JPY traders.

- EUR/JPY Price Forecast: Range-bound, but upside risks remain.

The EUR/JPY keeps extending its losses and giving away the 135.00 mark amidst a dismal market sentiment, courtesy of Ukraine-Russia jitters, central bank tightening, and Fed hawkish commentary, which dragged US equities down. At the time of writing, the EUR/JPY is trading at 134.83.

Since reaching a YTD high at 137.54 on March 28, the EUR/JPY has extended its losses to 300-pips. In the last six trading days, only on two, the cross-currency pair finished in the green, despite the ongoing Japanese yen weakness.

Overnight, the EUR/JPY witnessed a choppy trading session, followed by a dip under 134.50. However, the EUR/JPY reclaimed the former in the mid-European session and reached a daily high ner the 50-hour simple moving average (SMA) at 134.91, retreating afterward to current levels.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY remains upward biased, despite the ongoing correction. The daily moving averages (DMAs) reside below the exchange rate, further cementing the case for the uptrend. In fact, the 50-DMA, now at 131.00, crossed over the 200-DMA on March 28.

With that said, the EUR/JPY’s first resistance would be 135.00, which, once cleared, would pave the way for further gains. The next resistance would be April 4 daily high at 135.68, followed by 136.00 and 136.62, before the YTD high at 137.54.

On the flip side, the EUR/JPY first support would be 134.74. A decisive break would expose 134.00, followed by October 20 daily high at 133.48.

Technical levels to watch

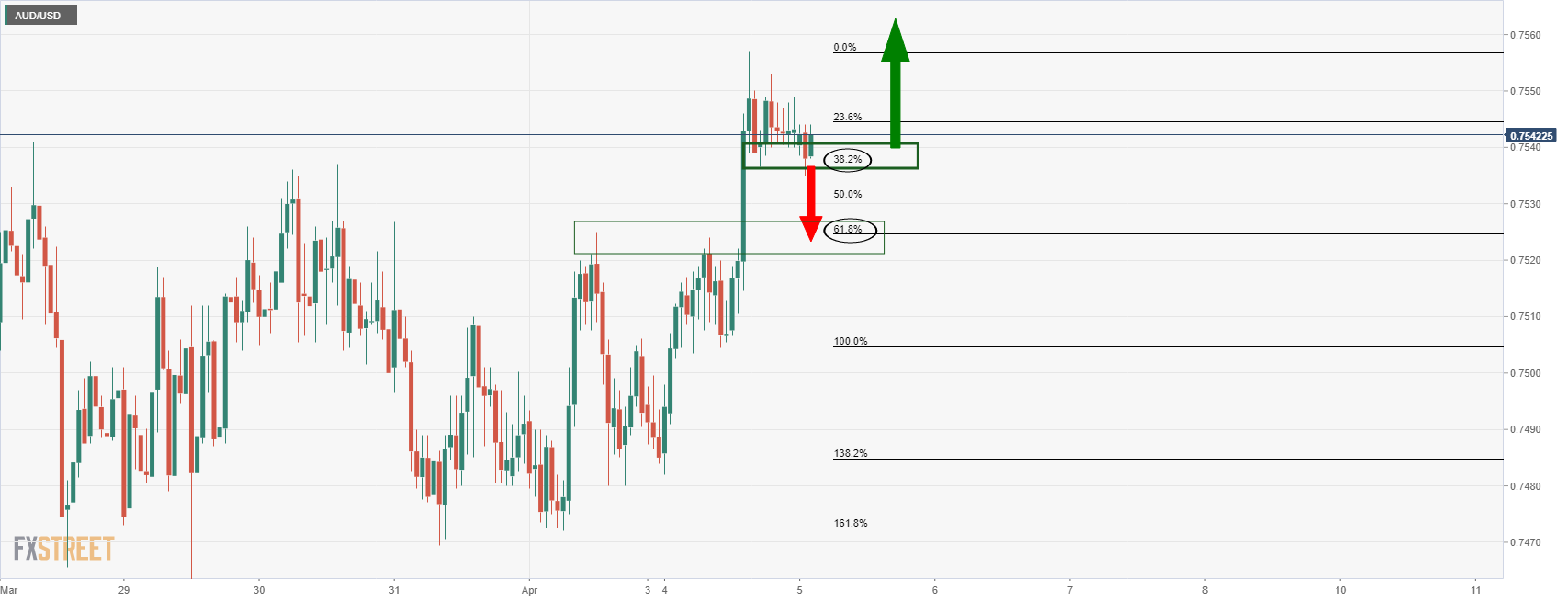

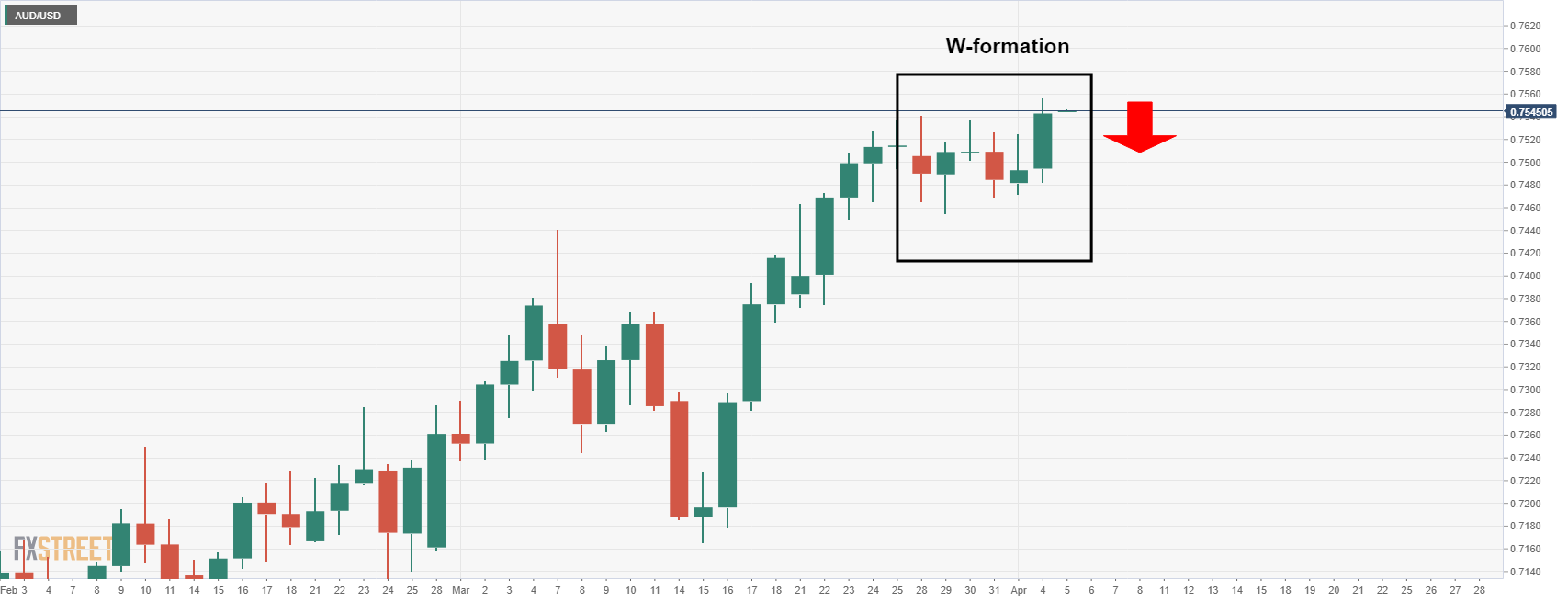

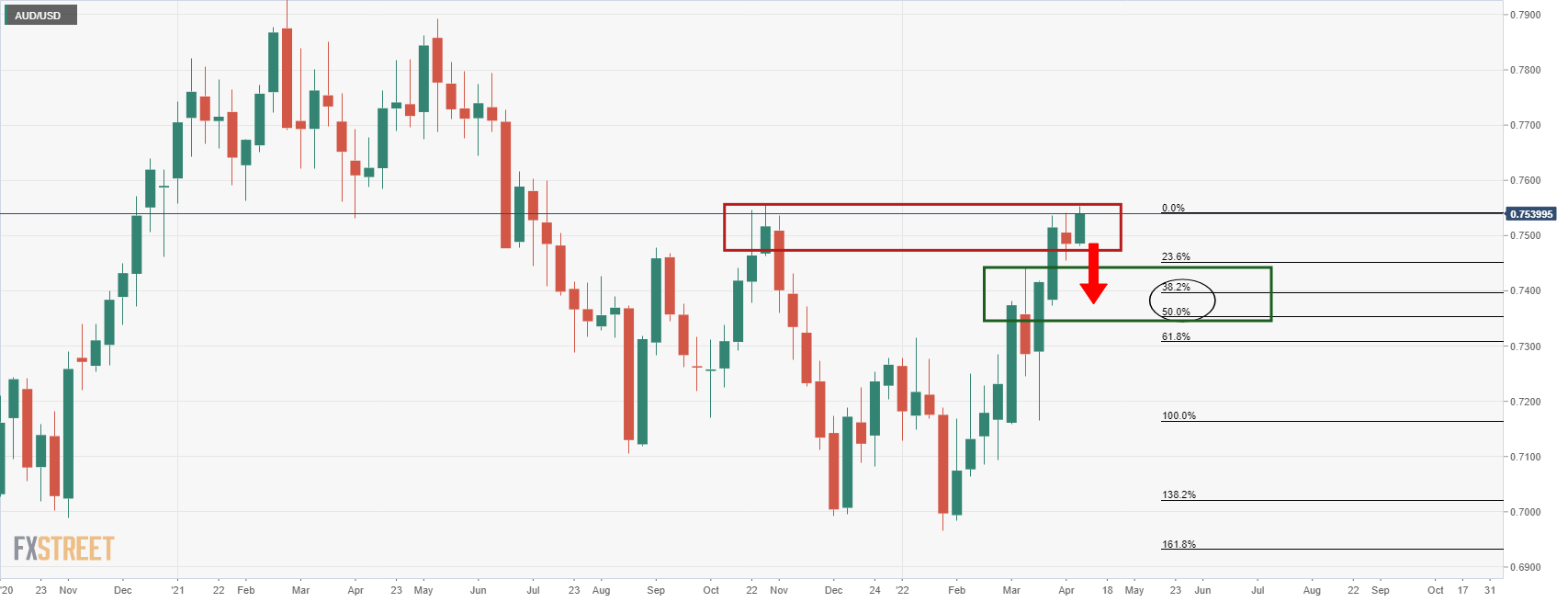

- AUD/USD bulls are back below 0.76 but remain on firm territory.

- Hawkish RBA lifted AUD to break weekly resistance.

AUD/USD is starting out the day on Wednesday in bullish territory around 0.7580 but well below the post-Reserve Bank of Australia rally highs of 0.7661. The market’s perception that the RBA could be hiking rates in the not too distant future has underpinned the Aussie and raised prospects of higher grounds towards the 0.7800 area.

''In the wake of the policy statement, wires are reporting that economists are starting to focus on the June RBA meeting as a possible date for lift-off in rates. The pace of policy tightening will depend on economic data,'' analysts at Rabobank explained.

The RBA has kept rates steady at 0.10% but it has tweaked its forward guidance. Analysts at Brown Brothers Harriman explained, ''the bank dropped its reference to remaining “patient” on policy and instead moved to being data-dependent.''

''This shift would seem to validate market expectations for liftoff coming sooner rather than later. As such, RBA tightening expectations continue to rise.''

Nevertheless, the US dollar and yields were taking the spotlight on Tuesday following comments from Federal Reserve Governor Lael Brainard. She spooked investors about potential aggressive actions by the Fed and in anticipation of hawkish minutes tomorrow. Brainard said the central bank could start reducing its balance sheet as soon as May and would be doing so at “a rapid pace.” She also indicated that interest rate hikes could come at a more aggressive pace than the typical increments of 0.25 percentage points.

US Treasury yields climbed to multi-year highs with yields taking off after her hawkish comments and U-turn. The DXY, an index that measures the greenback vs a basket of currencies, ran up to test 99.50 to print a fresh high for 2022 at 99.493.

Meanwhile, the Fed officials began the process of policy normalization by lifting rates 25bp to 0.25%-0.50% at the March meeting and on Wednesday the minutes of that meeting will be released.

''The FOMC pull no hawkish punches in its policy guidance, with Chair Powell also hinting further information about QT plans will be provided in the minutes (possibly including caps details). We continue to expect an official QT announcement at the May FOMC meeting,'' analysts at TD Securities said.

- Confluence of Gravestone Doji near the psychological resistance of 0.7000 indicates the strength of bears.

- Kiwi bulls have surrendered their establishment above 61.8% Fibo retracement.

- The momentum oscillator RSI (14) seems losing its momentum after dropping below 60.00.

The NZD/USD pair has displayed multiple failed attempts while practicing an establishment above 0.7000. The pair have witnessed an extreme responsive selling from the market participants on Tuesday, which has dragged the kiwi bulls below 0.6950. In the early Asian session, the asset is performing subdued and is expected to extend losses after slipping below Wednesday’s low at 0.6933.

On a daily scale, NZD/USD has formed a ‘Gravestone Doji’ candlestick pattern, which signals a failed attempt by the bulls on driving the asset to fresh highs. The pair has failed to breach its old recurring barricade of 0.7000, which has also been encountered consecutively in the last two weeks. Apart from that, the kiwi bulls have lost their establishment above 61.8% Fibonacci retracement (placed from 21 October 2021 high at 0.7219 to 28 January low at 0.6529) at 0.6956. However, the trendline placed from the 28 January low at 0.6529 will continue to act as major support going forward.

The 20- and 50-period Exponential Moving Averages (EMAs) at 0.6906 and 0.6845 respectively are scaling higher, which signals more upside ahead.

However, the Relative Strength Index (RSI) (14) seems losing momentum as the oscillator has dropped below 60.00.

Should the asset drop below Wednesday’s low at 0.6933, it will trigger the formation of the Gravestone Doji candlestick pattern and activate the greenback bulls. Activation of the latter will drag the asset towards 50% Fibo retracement at 0.6875, followed by the 50-EMA at 0.6845.

On the flip side, kiwi bulls may regain strength if the asset overstep the psychological resistance of 0.7000, which will drive the asset higher towards the 19 November 2021 high at 0.7050, followed by the 22 October 2021 low at 0.7131.

NZD/USD daily chart

-637847918011240868.png)

- Additional Fed officials aim to begin QT by the May meeting.

- Geopolitical jitters in Ukraine weigh on market sentiment and elevated prices.

- EUR/USD Price Forecast: To keep extending losses if the 1.0900 mark gives way to USD bulls.

The EUR/USD remains under selling pressure after falling below the 1.1000 mark, as hawkish Federal Reserve commentary and escalation of the Russia-Ukraine war turned sentiment sour on Tuesday. At press time, the EUR/USD is trading at 1.0905, as EUR bears prepare for a renewed test of 1.0806 YTD low.

Market sentiment remains downbeat, as portrayed by falling US equities. The greenback remains buoyant, extending its rally to four days, rising 0.50%, sitting at 99.485, after reaching a new YTD high at 99.524.

Tuesday’s Fed parade lifts US Treasury yields

On Tuesday, Fed policymakers crossed wires. Fed Governor Lael Brainard stated that the Fed “is prepared to take stronger action” if needed and added that the balance sheet reduction might begin in the May meeting. On those remarks, US equities slid, and the US Dollar Index reclaimed the 99.000 level.

Elsewhere, Kansas City Fed President Esther George (voter 2022) said that a 50 bps move would be an option, as conditions favor going faster than before. Later, San Francisco Fed President Mary Daly commented that the labor market is extremely tight and noted that the Fed is on a path to raising rates. Daly added that growth would slow but expected it to be a short-lived event.

Meanwhile, conditions around the Ukraine-Russia conflict continue to worsen. Germany and France expelled Russian diplomats from their embassies, responding to Russian troops’ war crimes committed in Bucha once the Russian soldiers moved east.

The US and the G7 are coordinating new sanctions on Russia, expanding to financial institutions, state-owned companies in Russia, and unspecified Russian officials and their family members.

Data-wise, the Eurozone economic docket featured March’s IHS Markit Services PMIs for countries in the EU, and the Eurozone, which rose firmly. Regarding the US economic docket, March’s US ISM-Non Manufacturing PMI rose to 58.3, higher than the 58.1 estimated and better than the 56.5 from the previous reading.

EUR/USD Price Forecast: Technical outlook

The EUR/USD remains in a downtrend, as depicted by the daily chart. On Monday, the EUR/USD was unable to trade above Pitchfork’s mid-line between the top/central parallel line, around 1.1054, exposing the pair to further selling pressure. Subsequently, the EUR/USD extended its fall, and a break below 1.0900 could pave the way for further losses.

That said, the EUR/USD first support would be 1.0900. Breach of the latter would expose Pitchfork’s central-parallel line around 1.0850-70 range, followed by the YTD low at 1.0806.

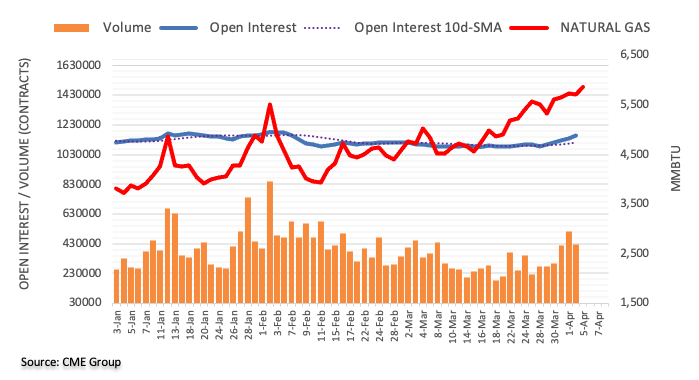

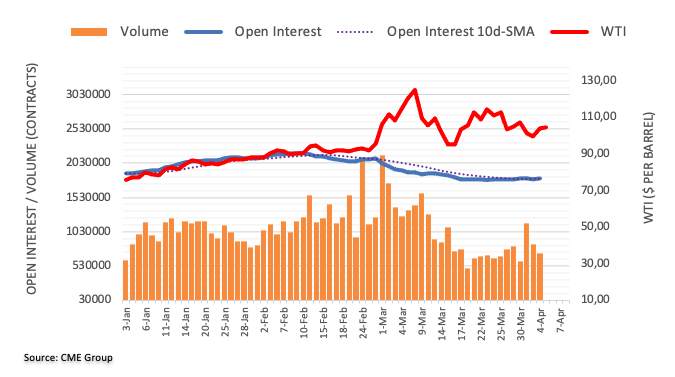

- West Texas Intermediate (WTI) crude oil is under pressure to test $100bbls.

- Supply vs demand concerns is being weighed by traders.

West Texas Intermediate (WTI) crude oil was bleeding out on Tuesday as the European Union mulls new sanctions on Russia, mounting up the supply concerns in the oil market.

However, the EU has yet to move against the oil and gas imports from the country that provide much of its energy. Spot WTI is lower by some 2.9% and had travelled between a high of $105.57 and a low of $99.92. WTI crude for May delivery closed down US$1.32 to US$101.96 per barrel.

Reuters reported that ''the EU may move to ban imports of Russian coal following reports of large-scale civilian murders by Russian troops that occupied areas near Kyiv, while it and the United States are also weighing additional measures to lessen Russia's ability to wage war against its neighbor.''

Additionally, ''China's decision to extend a quarantine on Shanghai, one of the country's most important commercial centres, also raised demand concerns as the country reports rising Covid-19 infections,'' an article by Reuters read.

Staying with Chinese demand, analysts at TD Securities' tracking of Chinese mobility had indicated a 10% slump in road traffic, but the analysts explained they ''now see a sign of stabilization in Chinese mobility according to a weighted average of congestion indicators for the 15 largest cities by vehicle registrations. Notwithstanding, changes in Chinese demand pale in comparison to the persistent underproduction from OPEC+, and certainly to the continued impact on Russian oil exports from self-sanctioning highlighted by Urals trading at a record discount.''

- Geopolitical angst and hawkish Fed speak saw GBP/USD fall back from early highs to under 1.3100 on Tuesday.

- Cable continues to fail attempts to push above its 21DMA and continues to threaten a test of recent 1.3050 lows.

GBP/USD fell back below the 1.3100 level on Tuesday as hawkish commentary from Fed Vice Chair Lael Brainard sparked a rally in US yields that helped the US dollar gain ground across the board. That means that the pair has failed to hold above its 21-Day Moving Average now for a fifth successive session. A current levels near 1.3070, the pair trades lower by about 0.3% on the day, a near-100 pip pullback from earlier session highs in the 1.3160s.

The pound got some short-lived support during early European trade after much stronger than expected final UK March PMI survey from IHS Markit. But pessimism regarding Russo-Ukraine peace talks in wake of accusations that the Russian military has committed war crimes, plus worries as the EU announced a proposal for tougher sanctions on Russia limited the upside potential for European FX in early trade. GBP/USD bears will now be eyeing a test of last week’s lows at 1.3050, with focus shifting to Wednesday’s release of the minutes of the last Fed meeting.

Traders will recall that the last Fed meeting was very hawkish and this bias towards favouring a much faster pace of monetary tightening is likely to be evident in the meeting accounts. Whilst that shouldn’t come as a surprise, it could easily keep a bid underneath the buck and US yields on the front foot. Given the BoE’s softening rhetoric on the need to tighten monetary policy settings further as of late, which contrasts sharply with the Fed, there is plenty of downside risk for GBP/USD.

Thursday’s speech from BoE Chief Economist Huw Pill will be eyed in this context. Evidence of further Fed/BoE policy divergence could send GBP/USD back to test annual lows in the 1.3000 area sometime later this week. Many analysts are calling for a break lower into the upper 1.20s in the coming months.

What you need to take care of on Wednesday, April 6:

The American dollar is the overall winner on Tuesday, firmly up against all of its major rivals. Diminishing chances of a diplomatic solution to the Russia-Ukraine conflict and central banks’ aggressiveness were behind the market’s movements.

At the beginning of the day, the Reserve Bank of Australia abandoned its patient stance, providing an unexpected boost to the local currency. Governor Philip Lowe dropped the sentence “prepared to be patient” from its usual statement and hinted at an interest rate hike in June. The last time the RBA hiked was in 2010. Lowe also said that policymakers will now focus on inflation and labour costs data. The Australian Federal election will take place in May.

During the American afternoon, US Federal Reserve Governor Lael Brainard hinted at an aggressive reduction of the balance sheet and noted that combined with rate hikes would move monetary policy closer to neutral later this year. His words sent the yield on the 10-year Treasury note to 2.567%, now holding nearby.

Meanwhile, the EU is analyzing a ban on Russian coal imports as the US increases oil imports from Canada. France's Europe Affairs Minister Beaune said that a new round of sanctions against Russia would most likely be imposed on Wednesday.

The EUR/USD pair plunged to 1.0900 while GBP/USD trades around 1.3076. The AUD/USD pair managed to retain some of its post-RBA gains but pulled down from a fresh 2022 high of 0.7660. USD/CAD nears 1.2500 as crude oil prices edged sharply lower, with WTI currently hovering around $100.00 a barrel.

Gold traded as high as $1,944.56 a troy ounce, now struggling around $1,920, amid renewed demand for the greenback.

The US FOMC will publish the Minutes of its latest meeting on Wednesday.

Bitcoin price may not hit the $51,000 target amidst smart money influence

Like this article? Help us with some feedback by answering this survey:

- AUD/JPY surged towards year-to-date highs on Tuesday post-the RBA’s hawkish announcement but fell short of breaching last week’s 94.32 peak.

- Profit-taking triggered by a mild bought of risk-off on Wall Street has seen the pair pullback to near 93.70.

- But the broader long-term fundamentals continue to look positive for the pair.

AUD/JPY surged towards year-to-date highs above the 94.00 level on Tuesday, the Aussie bulls spurred by a hawkish shift in the RBA’s rate guidance language at its latest policy announcement, though the pair has since pulled back somewhat. AUD/JPY was last trading in the 93.70 region, still up about 1.2% on the day and taking its rebound from last Thursday’s sub-91.00 lows to more than 3.0%, but about 40 pips below earlier session highs in at 94.166.

Risk appetite took a turn for the worse during US trading hours despite strong US ISM Services PMI data amid worries about tougher Western sanctions on Russia and following surprisingly hawkish remarks from Fed Vice Chair Lael Brainard. The drop in US equities contributed to a bought of profit-taking in the risk-sensitive Aussie, and it looks like the bulls hoping for fresh multi-year highs are going to have to wait.

But against the backdrop of an increasingly hawkish RBA, on balance resilient global equity markets, generally rising global yields and what economists have described as “structurally higher” commodity prices, AUD/JPY’s rally may yet have room to run. A break above last week’s highs at 94.32 may be imminent (this week?), in which case, the Q2 2015 highs in the 97.00s would come into play.

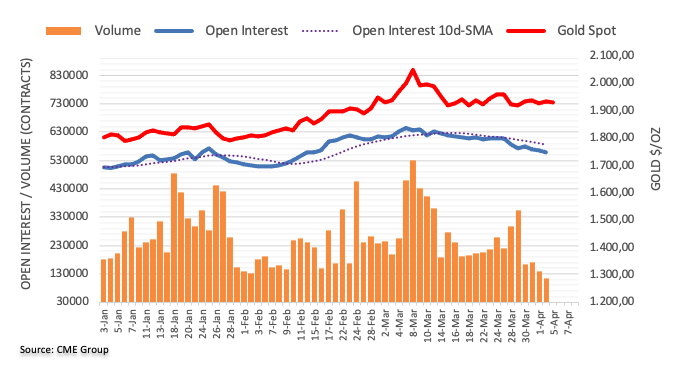

- Precious metals are being traded with the Fed in mind.

- The US dollar prevails as US yields continue to move higher, weighing on silver prices.

The price of silver was under pressure in mid-afternoon US session trade following a rise in the US dollar. At the time of writing, XAG/USD is down some 0.9% after sliding from a high of $24.9485 to a low of $24.2976 so far.

The greenback is higher after comments from Federal Reserve Governor Lael Brainard spooked investors about potential aggressive actions by the Fed and in anticipation of hawkish minutes tomorrow.

US Treasury yields rose to multi-year highs with yields taking off after Brainard's comments and the DXY, an index that measures the greenback vs a basket of currencies, ran up to test 99.50 to print a fresh high for 2022 at 99.493.

The market right now is focused on the Fed's intentions for its balance sheet and Brainard said the central bank could start reducing its balance sheet as soon as May and would be doing so at “a rapid pace.” She also indicated that interest rate hikes could come at a more aggressive pace than the typical increments of 0.25 percentage points.

Meanwhile, the Fed officials began the process of policy normalization by lifting rates 25bp to 0.25%-0.50% at the March meeting and on Wednesday the minutes of that meeting will be released.

''The FOMC pull no hawkish punches in its policy guidance, with Chair Powell also hinting further information about QT plans will be provided in the minutes (possibly including caps details). We continue to expect an official QT announcement at the May FOMC meeting,'' analysts at TD Securities said.

- The USD/CHF was choppy in the Asian/European session, but Fed speaking remarks triggered a jump in the exchange rate.

- USD/CHD Price Forecast: Neutral, but slightly tilted upwards.

The USD/CHF grinds higher and breaks above an eleven-month-old downslope resistance trendline, near the 0.9260 area, a confluence with the 50-day moving average (DMA), and sets to reclaim the 0.9300 mark courtesy of a dampened market mood in the financial markets. At the time of writing, the USD/CHF is trading at 0.9296.

Overnight, the USD/CHF was in choppy trading around 0.9250-60 area, but jumped of late in the North American session, towards the 0.9290s region on hawkish remarks by the Federal Reserve Governor Lael Brainard.

Fed’s Brainard said that the Fed “is prepared to take stronger action if inflation and inflation expectations suggest the need to do so.” She added that the balance sheet might reduce its balance sheet in May.

USD/CHD Price Forecast: Technical outlook

The USD/CHF is neutral biased but reclaimed to trade above the 50 and the 200-day moving average (DMA), each at 0.9261 and 0.9210, respectively. It is worth noting that the Relative Strength Index (RSI) is back above the 50-mid line, at 52.07 in bullish territory, which opens the door for further upside.

That said, the USD/CHF first resistance would be 0.9300. A decisive break would expose January 31 daily high at 0.9343, followed by November 23 cycle high at 0.9373, and then 0.9400.

On the flip side, the USD/CHF first support would be the 50-DMA at 0.9261. Breach of the latter would send the pair sliding towards the 200-DMA at 0.9210, followed by March 31 swing low at 0.9194.

Technical levels to watch

- US equities reversed lower on Monday as traders weighed escalating sanctions and hawkish Fed speak.

- The S&P 500 was last down 0.8%, the Nasdaq 100 lost nearly 2.0% as US yields hit fresh multi-year highs.

US equities reversed lower on Monday, weighed initially by the prospect of tougher US/EU sanctions against Russia, but then with losses exaccerbated shortly after the US market open following hawkish remarks from Fed Vice Chair Lael Brainard. Brainard said that the Fed would begin reducing its balance sheet at a “rapid” pace as soon as May, implying the Fed might actively sell bonds, rather than just letting them roll off the balance sheet.

Traders have thus been upping their bets that the Fed tightens monetary policy conditions more aggressively and this sent yields across the US curve lurching to multi-year highs, delivering a blow to equity market valuations. The S&P 500 was last trading down about 0.8%, more than reversing Monday’s gains to fall back beneath the 4550 mark. Bears will be eyeing a test of last week’s lows just above 4500.

The yield-sensitive tech/growth stock-heavy Nasdaq 100 index fell closer to 2.0% and, in doing so, has also handed back all of Monday’s gains that saw the index close pretty much bang on its 200-Day Moving Average in the 15,150 area. The Nasdaq 100’s ongoing struggle to push and hold above its 200DMA is not a good sign for the bulls. In an environment where the Fed looks on the verge of accelerating its monetary tightening timeline quite aggressively, and one where yields are as a result trading with an upside bias, this shouldn’t be too surprising.

The Dow Jones Industrial Average, which is much more heavily weighted towards cyclical and value stocks that maintain a positive (or less strongly negative) correlation to yields, was last trading down a more modest 0.5%. Still, as is the case with the Nasdaq 100, the index also continues to struggle to break/hold back above its 200DMA, which currently resides pretty much bang on 35,000. The index was last trading near 34,750.

A solid ISM Services PMI survey release for March did little to lift the mood for equity markets, which are probably more inclined to take good news (regarding the economy) as bad news given Fed hawkishness. Indeed, Brainard mentioned on Tuesday that she is keeping an eye out for signs of economic slowdown, so signs of the opposite would surely embolden the Fed to go harder regarding monetary tightening.

Looking ahead, geopolitics will of course remain a key focus for the rest of the week but traders should also note Wednesday’s Fed meeting minutes. Given the way things have gone recently, few would be surprised to see US yields and the US dollar rallying on yet another hawkish surprise. That means, for the Nasdaq 100 and Dow, breaking back above 200DMAs may remain a challenge.

- GBP/JPY's rally is capped into a sideways consolidation near 161.80.

- The focus is on US yields, Ukraine and BoE outlook.

At 161.79, GBP/JPY is nearly 0.5% at the time of writing, after travelling from a low of 160.49 to reach a high of 161.97. The yen is under pressure as US yields and the dollar climb. Yields took off after US Federal Reserve Governor Lael Brainard put the focus back on the possibility of aggressive monetary policy tightening ahead of tomorrow's minutes of the prior Fed meeting.

Brainard said she expects rapid reductions to the Fed's balance sheet alongside methodical increases to the benchmark rate. This has sprung life into the US dollar and the yen is bearing the brunt of it. GBP/USD is also under pressure which has left GBP/JPY trading sideways in the past few hours of late-morning US trade.

Domestically, the pound net short GBP positions increased for a fourth week as concerns rise as to the cost of living crisis in the UK. Soaring global energy and food prices are a concern. On the heels of the Chancellor’s mini-budget in March the focus has switched to the cost of living crisis in the UK. This is questioning how many more rate hikes the BoE can announce this cycle.

''The Bank of England and market economists have warned that UK inflation could peak at 8% in the coming months and, due to the impact of the Russia/Ukraine conflict, both energy prices and headline inflation may remain elevated for longer, analysts at Rabobank said.

Meanwhile, analysts at ING Bank argued that “adverse energy developments caused by new sanctions might take a toll on GBP this week, and cable could make a decisive move below 1.31 by the weekend,” analysts at ING Bank said.

Over the weekend, BoE’s Deputy Governor Cunliffe said that ''while he recognizes the risk of second-round effects and that further tightening of monetary policy might be necessary, I am not at present convinced that we will inevitably have to lean heavily and constantly against an embedding of an inflationary psychology as we progress through this challenging period and as the impact.”

- The USD/JPY dropped 30-pips on BoJ’s Kuroda yen comments.

- A downbeat market mood lifts the prospects of the greenback, and the yen is pressured.

- Fed speaking lifts US yields and the US dollar.

- USD/JPY Price Forecast: Upward biased, but it could be subject to a mean reversion move, with the RSI at overbought conditions.

The USD/JPY advances for the third straight day, despite yen-related remarks by the Bank of Japan (BoJ) Governor Kuroda, who stated that “forex moves are somewhat rapid,” spurring a 30-pip drop in the pair, though recovered of late on broad US dollar strength. At the time of writing, the USD/JPY is trading at 123.58.

Also, a downbeat market sentiment keeps the greenback’s firm. European bourses closed mixed, while US equities fell, while the US yields and the greenback rose on Fed speaker remarks, hinting that the US central bank would hike rates and might begin reducing its balance sheet at the May meeting.

Additional to that, the Russian-Ukraine woes sum up investors’ dismal mood. Europe announced a new tranche of sanctions on Russia, led by German and France, who expelled Russian diplomats responding to Russian military atrocities in Bucha.

Meanwhile, the US and the G7 are coordinating new sanctions on Russia, expanding sanctions on financial institutions, state-owned companies in Russia, and unspecified Russian officials and their family members.

Fed policymakers dominate headlines

Earlier, Fed Governor Lael Brainard said that the Fed “is prepared to take stronger action if inflation and inflation expectations suggest the need to do so.” She added that the balance sheet might reduce its balance sheet in May.

On the same note, Kansas City Fed President Esther George (voter 2022) said that a 50 bps move would be an option, as conditions favor going faster than before. Later, San Francisco Fed President Mary Daly commented that the labor market is extremely tight and noted that the Fed is on a path to raising rates. Daly added that growth would slow but expected it to be a short-lived event.

USD/JPY Price Forecast: Technical outlook.

The USD/JPY keeps trending higher. However, it is worth noting that the Relative Strength Index (RSI) at 73.90 at overbought conditions reacted with less force to the upside on the rally towards current prices, meaning that the USD/JPY might be subject to a mean reversion move.

However, the uptrend remains intact unless the USD/JPY falls below 121.27. That said, the USD/JPY first resistance would be 124.00. A breach of the latte would expose solid supply zones, like 124.30, followed by the YTD high at 125.10.

San Francisco Fed President Mary explained that the labour market is extremely tight while the Fed is on a path to raising interest rates.

She added inflation is as harmful as not having a job while many of the imbalances we see are covid-related.

''I don't expect a big slowdown in the US economy due to high oil prices,'' she said, adding that the Fed projections do not show a lot of 'overshooting' on rates.

''We can start the balance sheet reduction as early as the May meeting.''

''The Fed will use balance sheet reductions in addition to rate hikes to reduce policy accommodation.''

There has been no market reaction to the comments while US Treasury yields already rose to multi-year highs as comments from US Federal Reserve Governor Lael Brainard put investor focus on the possibility of aggressive monetary policy tightening.

Yields rallied after Brainard said she expects rapid fire style of reductions to the Fed's balance sheet alongside methodical increases to the benchmark rate. The yield on 10-year Treasury notes ( was up 12.9 basis points to 2.541% while the 2-year note yield was up 9.2 basis points at 2.520%, leaving the 2-10 curve at 2 basis points after having been inverted for the most part since last week.

Wednesday brings the release of minutes from the Fed's last policy meeting.

- The Loonie gains some ground and clings to Tuesday’s gains, as the USD/CAD falls 0.07%.

- Europe’s new tranche of sanctions on Russia affects peace talks as hopes of diplomatic exit wane.

- Positive data from Canada and the US is about to set the USD/CAD to finish flat Tuesday’s session.

- USD/CAD Price Forecast: Neutral biased, but Tuesday’s price action depicts solid buying pressure around the 1.2400 mark.

The USD/CAD have been seesawing in a volatile session on Tuesday amid the North American session, in a 90-pip range, with the US dollar of late, recovering some ground against the Loonie, but keeps trading in the red. At the time of writing, the USD/CAD slides and is trading at 1.2460.

Mixed market sentiment and Fed speaking lift the greenback

Fluctuating European and US equities reflect a mixed market mood. The prospects of a diplomatic exit to the Russo-Ukraine conflict wane. Europe’s response to Russian war crimes in Bucha, from Russian troops to civilians, escalated the conflict. Germany and France expelled Russian diplomatics while the EU explores a coal and oil embargo against Russia. However, there are still some discussions in the latter as the German Finance Minister Lindner said that a ban on Russian gas imports would be more harmful to Germany than Russia.

On Tuesday, Fed Governor Lael Brainard said that the US central bank “is prepared to take stronger action if inflation and inflation expectations suggest the need to do so.” She added that policy would be tightened “methodically” with a series of interest rates and would begin to lower the balance sheet as soon as the May meeting.

Later, Kansas City Fed President Esther George (voter 2022) said that a 50 bps move would be an option to consider, as conditions favor going faster than before. She emphasized the need for the US central bank to go above neutral to bring inflation down.

The Canadian economic docket featured February’s Balance of Trade which printed a surplus of C$2.66 billion against C$2.4 billion estimated, but trailed January’s reading, revised up to C$3.12 billion. The US docket unveiled March’s US ISM-Non Manufacturing PMI, which rose to 58.3, higher than the 58.1 estimated and better than the 56.5 from the previous reading.

USD/CAD Price Forecast: Technical outlook

The USD/CAD dipped to a fresh YTD low during the session at 1.2402, but the greenback recovered some ground and lifted towards 1.2450s, so Tuesday’s price action is forming a hammer, meaning that buying pressure overtook bears around the 1.2400 area, which would be a difficult support level to surpass. Nevertheless, to pose a threat to CAD bulls, USD ones would need to reclaim 1.2540, which then would expose the 200-day moving average (DMA) at 1.2615.

The USD/CAD is neutral biased, and upwards its first resistance would be 1.2493. Once cleared, the next resistance would be 1.2500, followed by 1.2540. On the flip side, the USD/CAD first support would be 1.2400. A decisive break would expose November 10 daily low at 1.2387, followed by October 21 daily low at 1.2288.

- Gold has pulled back from earlier highs and is back in the low $1920s as the US dollar/US yields rally.

- Fed Vice Chair Brainard was hawkish on balance sheet reduction, sparking the reversal lower.

- Focus now turns to Wednesday’s Fed minutes release as gold bears eye a test of recent sub-$1900 lows.

Spot gold (XAU/USD) prices have pulled back sharply from an earlier rally towards their 21-Day Moving Average in the $1940s and recently hit session lows beneath the $1920 mark. Technical selling ahead of last Thursday’s highs in the $1950 area and the 21DMA probably played a part but the pullback looks to have mostly been a result of hawkish commentary from Fed Vice Chairwoman Lael Brainard. She said that rapid balance sheet reduction was likely to begin as soon as May and her comments triggered a spike in US yields across the curve.

US 10-year yields hit their highest levels since April 2019 and now trade more than 15 bps higher on the day in the 2.56% area. US 2-year yields also hit their highest since April 2019 and were last up more than 9 bps on the session to the north of the 2.50% level. Higher US yields increase the “opportunity cost” of holding non-yielding assets such as gold and also helped to push the US Dollar Index towards its highs for the year near 99.50. A stronger US dollar makes USD-denominated gold more expensive for the holders of international currency.

Further Fed speak is expected in the coming hours (NY Fed President John Williams is up at 1900BST), keeping upside risks to US yields and the buck alive. That might mean that spot gold prices continue to languish in the low $1920s, as prices continue to probe the lows of the last five sessions. The main calendar event of the week is the release of the minutes of the Fed’s last (and very hawkish) meeting on Wednesday.

At this point, given all the hawkish rhetoric that has come from various Fed policymakers in recent days, the bar for a hawkish surprise from the minutes is high. But the direction of Fed policy remains clear, with the big question now how high the terminal rate will be. A slip back towards $1900 for XAU/USD certainly seems to be on the cards this week. But geopolitics and ongoing angst about the inflationary impact of the Russo-Ukraine conflict might be enough to keep gold supported above its 50DMA (currently at $1901.40), as was the case last week.

- US dollar gains momentum as US yields soar.

- EUR/USD extends weekly lows after breaking the 1.0950 support area.

- A test of 1.0900 (March 14 low) seems likely.

The EUR/USD broke below 1.0950 and tumbled to 1.0920, reaching the lowest level since March 14. The pair remains under pressure amid a stronger US dollar across the board.

Treasuries tumble, dollar gains

Equity prices are mixed on Tuesdays amid no improvement toward peace in Ukraine and following US economic data. The European Union is proposing new sanctions on Russia. Regarding data, the ISM Service sector index rose in March to 58.3 from 56.5.

Fed Vice Chairwoman, Lael Brainard said on Tuesday that the Fed is prepared to take stronger action if the inflation outlook and inflation expectations indicators suggest the need for such action. New York Fed President John William will deliver remarks in a few minutes.

Treasuries are falling, with the yield on the 10-year bond up 6.80% at 2.56%, the highest level since mid-2019. Yields strengthened the greenback during the American session. The DXY is up 0.35%, trading at 99.35 and could post the highest daily close in almost two years.

Short-term outlook

The break of 1.0950 left EUR/USD vulnerable to more losses. The next strong support area might be seen around 1.0900 (March 14 low), followed by 1.0880. The euro is likely to remain under pressure while under 1.0950. A recovery above would alleviate the negative tone, with the next resistance at 1.0980.

Technical levels

- AUD/USD is paring its impressive post-hawkish RBA gains and is back to trade near 0.7600.

- The buck has been picking up recently as US stocks fall/yields rally after hawkish Fed commentary.

- The pair earlier lept as high as the 0.7660s after the RBA dropped its reference to “patience”, signaling coming hikes.

Though the pair continues to trade with hefty post-hawkish RBA rate decision gains, AUD/USD has pared back from the multi-month highs it hit above 0.7650 earlier in the day and is now trading closer to 0.7600. The pullback comes as US equity markets take a knock and US bond yields rally in wake of hawkish commentary from Fed Vice Chair Lael Brainard, who indicated rapid balance sheet reduction could begin as soon as May. The knock to sentiment coupled with a boost to the buck has weighed on AUD/USD, as it has other major currency/USD pairs.

AUD/USD still stands to close out the session bout 1.0% higher, after marking what technicians will likely see as a significant breakout to the north of Q4 2021 highs in the 0.7550 area during Asia Pacific trade. The Aussie bulls took control after the RBA dropped its reference to being “patient” when it comes to rate hikes and, as a result, the market’s base case seems to be for a first 25 bps rate hike to come in June. How that AUD/USD has broken out to fresh annual highs, the bulls will be marking their next upside targets.

Those are likely to include the June 2021 highs in the 0.7775 area, the May 2021 ner 0.7900 and the February 2021 highs at 0.8000. Technicians note that AUD/USD also note that AUD/USD is very likely to soon be the beneficiary of a “golden cross”, where the 50-Day Moving Average moves above the 200DMA. This could help infuse further bullishness.

Given the pair’s massive more than 6.0% rebound from mid-March sub-0.7200 lows, a further 3-5% to challenge these highs in the coming months doesn’t seem too far-fetched. Against a backdrop of structurally elevated commodity prices thanks to the Russo-Ukraine war, stock markets that remain resilient and an RBA that is finally taking action to at least keep up with the majority of the rest of its already tightening fellow G10 central banks, further upside seems plausible from a fundamental standpoint.

- The GBP/USD gains for the second consecutive day, up some 0.04%.

- Eurozone sanctions on Russia weighed on market mood, and equities fell.

- In the FX space, the safe-haven status of the greenback lifts the DXY above 99.00.

- GBP/USD Price Forecast: The downward bias remains intact below 1.3275.

The British pound remains confined to the 1.3100-60 range for the fourth consecutive day, amid a risk-off market mood and a soft US Dollar, courtesy of Russo-Ukraine linked issues, Fed tightening looming, and Fed and Bank of England speaking. At the time of writing, the GBP/USD is trading at 1.3115.

The market sentiment is mixed, as illustrated by European and US equities. The escalation of European sanctions on Russia weighed on sentiment. Germany and France expelled Russian diplomats on Monday. Also, there is mounting pressure for an oil embargo against Russia, but German Finance Minister Lindner said that a ban on Russian gas imports would be more harmful to Germany than Russia.

Over the weekend, BoE’s Deputy Governor Cunliffe crossed the wires. He expressed that while he “recognizes the risk of second-round effects and that further tightening of monetary policy might be necessary, I am not at present convinced that we will inevitably have to lean heavily and constantly against an embedding of an inflationary psychology as we progress through this challenging period and as the impact.”

On the Fed speaking side, Fed Governor Lael Brainard said that the US central bank “is prepared to take stronger action if inflation and inflation expectations suggest the need to do so.” She added that policy would be tightened “methodically” with a series of interest rates and would begin to lower the balance sheet as soon as the May meeting.

The US Dollar Index, a gauge of the greenback's value against a basket of its rivals, advances 0.30%, sits at 99.280, underpinned by the rise of the US 10-year T-note yield sitting at 2.541%, which climbs twelve basis points.

The UK economic docket featured the UK S&P Global/CIPS UK Services PMI Final, which came at 62.6, higher than the 61 estimated. On the US front, the US ISM-Non Manufacturing PMI rose to 58.3, higher than the 58.1 estimated and better than the 56.5 from the previous reading.

GBP/USD Price Forecast: Technical outlook

Cable has been range-bound for the last four trading sessions, unable to break under/above the 1.3100-60 area. Nevertheless, the daily moving averages (DMAs) above the spot price cement a bearish bias unless GBP/USD bulls reclaim November 26 1.3275 daily low-turned-resistance.

With that said, the GBP/USD first support level is November 13, 2020, daily low at 1.3105. A decisive break would expose the March 29 swing low at 1.3050, followed by the confluence of the bottom-trendline of the descending channel and the YTD low at 1.2999.

- Oil prices have been choppy on Tuesday, with WTI swinging between $105.50 highs and $101.00 lows.

- Geopolitics has been in focus with the EU outlining new restrictions on Russian imports, including on coal.

Oil prices have been choppy on Tuesday, with front-month WTI future erasing earlier session gains that saw prices rise as high as $105.50 to drop as low as $101.00. Prices have now stabilised in the $103.00s. The EU announced new sanctions on Russia, including a ban on all coal imports, in response to alleged widespread war crimes committed by Russian forces against Ukrainian civilians. The EU did not announce new sanctions on Russia’s oil industry, rather indicating that they would come soon, thus removing one potential bullish catalyst for oil prices.

But as the pressure mounts on Western nations to inflict more damage on Russia’s economy, geopolitical risks are set to remain strongly supportive of the oil complex. Add to that the fact that newsflow regarding peace talks has been less optimistic this week than in previous weeks, with recent war crime allegations clearly darkening the mood. The prospect of an imminent peace deal looks slim.

As a result, despite the US’ recent historic oil reserve release announcement, a $100 or high WTI price continues to make good sense. After all, progress in US/Iran talks appears to have once again stalled and OPEC+ leading nations Saudi Arabia and the UAE seem anything but eager to open to taps. If the recent pullback from earlier highs near the 21-Day Moving Average in the $106.00s continues, it wouldn’t be surprising to see dip-buyers emerge around the $100 level.

Data released on Tuesday showed an increase above expectations in the ISM Service Sector index in March to 58.3. Inflation and supply chain issues have been among the top challenges for the service sector for months, and Russia's war on Ukraine has worsened both, explained analysts at Wells Fargo. They noted that despite headwinds, “orders and activity both ramped up a bit and businesses are finally netting some new hires.”

Key Quotes:

“The ISM services index rose in March to 58.3, a welcome improvement, but short of expectations for a more stout increase. After two difficult years, this was supposed to be the beginning of better times for the service industry. The receding of the Omicron surge, a broadening of office workers returning to the office at least a few days a week, and some incipient improvement with supply chains might have put activity back into the swing of something reminiscent of normal. But Russia's invasion of Ukraine rained on the parade by making supply problems and inflation worse.”

“At least business remains strong. Overall business activity picked up, and new orders rose as did order backlogs. In the face of high inflation and supply shortages, the orders keep rolling in.”

“Recent labor market developments also point to an improvement in labor supply. The 5.5 point gain in the employment component was large enough to push the index back into expansionary territory after signaling a contraction in February hiring.”

Deputy chief of staff and adviser to Ukrainian president Ihor Zhovkva said on Tuesday that there will be no compromise from Ukraine on ceding territory to Russia, reported Bloomberg. Zhovkva continued that any meeting between Russian President Vladimir Putin and Ukrainian President Volodymyr Zelenskyy will be "difficult", before noting that talks must continue for peace.

His remarks come after Russian troops pulled back from regions to the north of Ukraine and seemingly left evidence of widespread war crimes against Ukrainian civilians in their wake. Ukrainian President Zelenskyy is currently speaking at the UN security council and accused Russia of committing "the most terrible war crimes" since World War two.

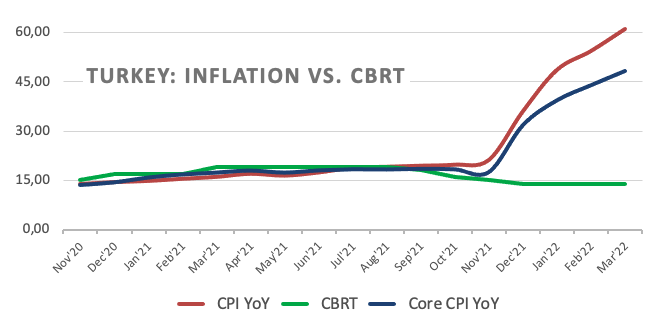

- USD/TRY adds to Monday’s gains near 14.70.

- The lira remains under pressure and looks to geopolitics.

- Turkey 10y bond yields rebound to the 26.00% region.

The Turkish lira depreciates further and lifts USD/TRY to new multi-day highs around 14.70 on Tuesday.

USD/TRY higher post-Turkey CPI, Ukraine

The lira extends the bearish note so far this week after inflation in Turkey ran at its fastest pace in the last 20 years, in March, as consumer prices rose 61.14% from a year earlier. The Core CPI rose 48.39 and Producer Prices increased nearly 115% vs. the same month of 2021.

Following the release of the March inflation figures, the real interest rates in Turkey now became the lowest in the world at just past 47%. It is worth mentioning that the CBRT’s easing cycle in 2021 coupled with negative effects of the coronavirus pandemic and lately by the war in Ukraine have all been factors impacting negatively on the Turkish currency.

What to look for around TRY

The lira keeps the range bound theme unchanged vs. the greenback, always in the area below the 15.00 neighbourhood for the time being. So far, price action in the Turkish currency is expected to gyrate around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine. Extra risks facing TRY also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Turkey this week: End Year CPI Forecast (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Earlier Presidential/Parliamentary elections?.

USD/TRY key levels

So far, the pair is gaining 0.26% at 14.7155 and faces the next hurdle at 14.9889 (2022 high March 11) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a drop below 14.5136 (weekly low March 29) would expose 14.0419 (55-day SMA) and finally 13.7063 (low February 28).

Fed Vice Chairwoman Lael Brainard said on Tuesday that the Fed is prepared to take stronger action if the inflation outlook and inflation expectations indicators suggest the need for such action, reported Reuters. The combined impact of rate hikes and balance sheet reduction will bring monetary policy to a more neutral position later this year, she continued, noting that once monetary policy is more neutral, the extent of additional tightening will depend on the evolving outlook for inflation and employment.

The Fed will tighten monetary policy "methodically" through a series of rate hikes, Brainard said, and will start reducing the size of the balance sheet at a rapid pace as soon as the May meeting. She said she expects the balance sheet to shrink at a considerably more rapid pace than during the previous recovery.

On inflation, Brainard noted that it is much too high and subject to upside risks. Meanwhile, she noted that Russia's invasion of Ukraine and recent Covid-19 lockdowns in China are likely to extend supply chain bottlenecks and also pose downside risks to growth.

Brainard said that she is watching the yield curve and other data for suggestions of increased downside risks to activity, before noting that longer-term inflation expectations remain within normal ranges. She added that she is monitoring the extend of the rotation from goods demand into services and whether the service sector can absorb this without inflationary pressures being sparked.

Finally, Brainard acknowledged that the burden of inflation on lower-income households, those with more household members or older household heads is not necessarily captured in the official consumer price indices.

Market Reaction

Brainard's remarks appear to have stoked a hawkish reaction in US markets, with traders citing her warning that rapid balance sheet reduction could begin in as soon as May. US 10-year bond yields have jumped a few bps in the last few minutes to back above 2.50% and are eyeing a test of multi-year highs set back on 28 March at 2.557%. 2-year yields also jumped a few bps to just under 2.50%. Of course, that means the 2s/10s spread is no longer inverted and goes to show that Fed policy can fight yield curve inversion by sounding more hawkish on the QT front.

Stocks haven't liked it. The S&P 500 was trading 0.2% higher in the 4590s prior to Brainard's remarks but is now down over 0.5% on the day and trading in the 4550s.

The headline ISM Services PMI figure rose to 58.3 in March from 56.5 the month before, a tad lower than the expected rise to 58.4, according to the latest release from the Institute of Supply Management.

Subindices:

- Business Activity rose slightly to 55.5 from 55.1 in February.

- Prices Paid rose to 83.8 from 83.1.

- New Orders rose to 60.1 from 56.1.

- Employment rose to 54.0 from 48.5.

Market Reaction

The fairly robust ISM Services PMI survey did not have much of an impact on market sentiment, which was already improving in wake of the US market open at 1430BST.

- USD/JPY attracted some dip-buying on Tuesday, though the uptick lacked follow-through.

- The widening US-Japanese bond yield differential continued acting as a tailwind for the pair.

- The Ukraine crisis extended support to the safe-haven JPY and capped any meaningful gains.

The USD/JPY pair extended its sideways consolidative price move and remained confined in a range around the 122.80 region through the early North American session.

Following an intraday dip to the 122.35 area, the USD/JPY pair attracted some buying on Tuesday, though struggled to capitalize on the move or make it through the 123.00 round-figure mark. The widening of the US-Japanese government bond yield turned out to be a key factor that acted as a tailwind for spot prices. That said, the uncertainty over Ukraine drove some haven flows towards the Japanese yen and kept a lid on any meaningful gains for the major.

The Bank of Japan Governor Haruhiko Kuroda reiterated that the central bank will offer to buy an unlimited amount of 10-year JGBs if the rise in long-term interest rates is rapid. Conversely, expectations that the Fed will tighten its monetary policy at a faster pace remained supportive of elevated US Treasury bond yields. This, to a larger extent, helped offset a softer tone surrounding the US dollar and continued lending support to the USD/JPY pair.

The upside, however, remained capped amid fading hopes of diplomacy in Ukraine. Investors remain worried about the prospect of more Western sanctions on Russia over its alleged war crimes in Ukraine. This was evident from the prevalent cautious mood around the equity markets, which benefitted traditional safe-haven assets, including the JPY. Investors also seemed reluctant to place aggressive bets ahead of the FOMC minutes, due for release on Wednesday.

It is worth recalling that the markets expect the Fed to hike interest rates by 100 bps over the next two meetings to combat stubbornly high inflation. Hence, the minutes will be looked upon for fresh clues about the Fed's policy outlook, which will influence the near-term USD price dynamics and provide a fresh directional impetus to the USD/JPY pair. In the meantime, developments surrounding the Russia-Ukraine saga would allow traders to grab some short-term opportunities.

Technical levels to watch

- Gold has been advancing in recent trade and is now in the $1940s, up from earlier lows in the $1920s.

- Geopolitics is in focus after the EU announced new sanctions on Russia and Putin threatened restrictions on agricultural exports.

- Upcoming US data and Fed speak will also be important for gold traders to monitor.

Ahead of the release of key US ISM Services PMI data for March at 1500BST and public remarks from influential Fed policymakers Lael Brainard and John Williams later in the session, spot gold (XAU/USD) prices are trading higher. Over the course of the last hour, gold has reversed higher from the mid-$1920s to current levels above $1940, where spot prices now trade higher by about 0.5% on the day. The reversal higher from earlier lows could have something to do with the latest sanction announcement from the EU against Russia, which included new import restrictions, including on coal.

The EU also talked up the prospect of more sanctions on Russian oil imports, and Russian President Vladimir Putin announced in response that he might look at restricting agricultural exports to so-called “unfriendly” countries (like those in the EU). Lingering geopolitical tensions and the upside risks posed to global commodity prices as a result of de-globalisation between the West and Russia continue to remain a big reason why investors want to hold gold as both a safe-haven and inflation hedge.

XAU/USD bulls will now eye a test of last Thursday’s highs near $1950, which happen to also coincide quite well with the 21-Day Moving Average at $1948. A break above here would open the door, technically speaking, to a move higher towards late March highs in the $1960s. But the bulls shouldn’t get too overeager. US bond yields continue to trade with an upside bias across the curve and remain close to multi-year highs and the US dollar remains broadly buoyant, both a reflection of the Fed’s continued shift towards more hawkish rhetoric.

Most members have now indicated that they either support or are at least open to 50 bps rate hikes in the coming meeting, amid agreement that the Fed needs to get rates back to neutral as fast as possible to be in a better position to address high inflation and the hot labour market. Upcoming remarks from Fed Vice Chair Lael Brainard and NY Fed President John Williams will likely reinforce this hawkish stance.

A stronger dollar makes gold more expensive for the holders of non-USD currency, while higher yields increase the opportunity cost of holding non-yielding assets like precious metals. Gold bugs should thus keep an eye on the economic/central bank calendar, as it might scupper hopes for a push beyond $1950.

USD/JPY surged toward the 125.86 high of 2015. The pair is currently trading around the mid-122s but economists at TD Securities expect USD/JPY to retest 125 or more this quarter.

Yen is not your friend

“Unless the BoJ abandons YCC and embraces a hawkish footing, there is little that Japanese authorities can do to offset a rush to neutral by the Fed. We think there is a non-trivial risk that terminal rates are too low, especially in the US. If these two features remain in play, rate differentials will strategically support USD/JPY. This is a big reason we think 'yentervention' is a losing proposition and is unlikely to be deployed.”

“We think the pair will remain elevated and biased to re-test 125 or more this quarter. Aiding this pressure is Japan's high commodity import bill, which situates the currency as the worst to deal with the terms of trade shock in the G10. The BoJ has embraced currency weakness (a long-desired goal).”

The GBP is recording a slight gain on the day, bouncing off the low-1.31s. Bank of England (BoE) rates pricing are still too optimistic, which should drag cable down to the 1.30 level, according to economists at Scotiabank.

Broader trends since last summer suggest weakness ahead

“We think markets could do with a decent amount of repricing of BoE hikes, as they still foresee the bank rate reaching 2% this year, which should weigh on the GBP towards a test of 1.30 soon.”

“Broader trends since last summer would suggest weakness ahead in the GBP but near-term price action remains restrained, providing little sense of direction.”

“Support is 1.3090/00 followed by ~1.3080 and 1.3050/60.”

“Resistance is ~1.3150 followed by 1.3180.”

Biden administration officials are looking at ways to boost oil imports from Canada, the Wall Street Journal reported on Tuesday. The White House still opposes the Keystone pipeline and other options include shipping more oil by rail, or expanding pipeline capacity along existing routes.

Market Reaction

The loonie saw immediate strength on the news, which would of course be bullish for CAD via improved terms of trade with the US. USD/CAD fell to its lowest level since 10 November and currently trades just above 1.2400. A break below this key psychological figure looks on the cards, which would open the door to a test of sub-1.2300 Q4 2021 lows.

AUD/USD moved decisively above the important medium-term resistance at 0.7541/57 level, which should lead to further AUD strength. Therefore, economists at Credit Suisse expect aussie to advance nicely toward 0.7777/85 next, then 0.7892.

Close above 0.7599/7616 needed to confirm the medium-term higher

“Though a sustained close above the late June high at 0.7599/7616 is needed to confirm the medium-term turn higher, our bias is for this to be achieved. Thereafter, resistance would be seen at .7644/51 initially, then further above at the June high at 0.7777/85 and eventually at May 2020 high at 0.7883/92, which now serves as our first medium-term goal. “

“Medium-term momentum remains outright bullish, whilst medium-term moving averages are turning higher.”

“Near-term supports shift to 0.7534/33, next to 0.7504/02 and eventually to last week’s low at 0.7455/41. Below here would shift the short-term risk back lower again, though only below the late-March low at 0.7372/58 would warn of more sustained weakness. However, this is not our base case.”

EUR/USD remains under pressure as spot struggles to hold on to the upper 1.09s. Economists at Scotiabank expect the world's most popular currency pair to suffer further losses toward the 1.08 area.

Resistance seen at 1.0990/00 followed by the mid-1.10s

“The currency found a bottom around 1.0960 ahead of firmer support at 1.0950 – that is followed by ~1.1925 and the figure zone.”

“The EUR’s push under 1.10 leaves it at risk of losses extending to a test of the 1.08 figure zone.”

“Resistance is 1.0990/00 followed by the mid-1.10s.”

EUR/CHF has strongly turned back lower again, leading to a decisive break of the March lows at 1.0194/84 during Monday’s session. The pair should continue lower from here, in the opinion of analysts at Credit Suisse.

Break under the March lows at 1.0194/84 turns the short-term risk back lower

“EUR/CHF has broken below its recent lows at 1.0194/86, which should open up a further downside within the range. We, therefore, look for the recent weakness to extend from here, with supports seen at 1.0131 initially, ahead of the price low at 1.0112.”

“Below 1.0112 would reinforce the decline further and potentially see the weakness extend to parity, where we would for a floor for a continuation of the recent ranging. It’s worth stressing that an eventual break below here though would open up our core medium-term objective at 0.9839/30.

“Immediate resistance is seen at 1.0210/21, next at 1.0234/44, and further above at the 55-day moving average at 1.0338. Above here would warn of a potential retest of the March high at 1.0400/0404, which we look to cap any recovery to maintain the range.”

US ISM Services PMI Overview

The Institute of Supply Management (ISM) will release the Non-Manufacturing Purchasing Managers' Index (PMI) - also known as the ISM Services PMI – at 14:00 GMT this Tuesday. The gauge is expected to rise to 58 in March from 56.5 in the previous month. Given that the Fed looks more at inflation than growth, investors will keep a close eye on the Prices Paid sub-component, which is expected to edge higher to 83.3 from 83.1 in February.

How Could it Affect EUR/USD?

Ahead of the key release, the US dollar was seen consolidating its gains recorded over the past three trading sessions. That said, elevated US Treasury bond yields, bolstered by speculations for a more aggressive policy tightening by the Fed, acted as a tailwind for the buck. Stronger-than-expected US macro data would reaffirm hawkish Fed expectations and push the US bond yields/USD higher. Conversely, a softer reading is more likely to be overshadowed by the prospect of more Western sanctions on Russia, which should continue to act as a headwind for the shared currency. This, in turn, suggests that the path of least resistance for the EUR/USD pair is to the downside. That said, any immediate market reaction is more likely to be short-lived as the focus remains glued to the FOMC meeting minutes, due for release on Wednesday.

Meanwhile, Eren Sengezer, Editor at FXStreet, offered a brief technical outlook for the pair: “EUR/USD registered a daily close below the key 1.1000 level, where the Fibonacci 38.2% retracement of the latest downtrend is located. During Monday's action, the 20-period SMA on the four-hour chart crossed below the 200-period and the 50-period SMAs. Additionally, the Relative Strength Index (RSI) indicator stays below 40, confirming the bearish tilt.”

Eren also outlined important technical levels to trade the major: “The pair needs to rise above 1.1000 and use that level as support in order to attract bulls and stage a recovery. 1.1020 (100-period SMA) and 1.1040 (Fibonacci 50% retracement, 50-period SMA) align as the next technical hurdles.”

“On the downside, supports are located at 1.0960 (static level), 1.0940 (Fibonacci 23.6% retracement) and 1.0900 (psychological level),” Eren added further.

Key Notes

• EUR/USD Forecast: Monday's close below 1.1000 an ominous sign for euro

• EUR/USD consolidates sub-1.1000 ahead of more US data/Fed speak as geopolitics continue to weigh

• EUR/USD to plummet towards 1.08 on a break below key support at 1.0950 – OCBC

About the US ISM Services PMI

The ISM Non-Manufacturing Index released by the Institute for Supply Management (ISM) shows business conditions in the US non-manufacturing sector. It is worth noting that services constitute the largest sector of the US economy and results above 50 should be seen as supportive for the USD.

- EUR/USD trades without clear direction around 1.0960.

- The loss of this area exposes a drop to 1.0944.

EUR/USD remains unable to gather convincing traction around 1.0960 on Tuesday.

Considering the ongoing price action, further decline remains in store for the pair in the short-term horizon. Against that, a break below the 1.0960 region carries the potential to spark a retracement to, initially, the weekly low at 1.0944 (March 28) prior to another weekly low at 1.0900 (March 14).

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1474.

EUR/USD daily chart

Strategists at TD Securities turn their attention to gold flows to gauge the sustainability of interest in the yellow metal as real rates could be less useful as a barometer for measuring gold's relative price. Strong ETF inflows into gold leave XAU/USD at risk of falling in case safe-appetite subsides.

Gold's recent disconnect against real rates is consistent with historical precedents

“Gold's correlation to real rates is subject to regime shifts, such that expectations for fed funds help to explain the regime. In fact, the monthly correlation between gold prices and real rates tends to deteriorate during hiking cycles, which suggests that gold's recent disconnect against real rates is consistent with historical precedents.”

“ETF flows have tended to be more highly correlated to changes in market expectations for Fed hiking, than to real rates, the yield curve or even price momentum. This still suggests that the strong ETF inflows have rather been associated with safe-haven appetite, which could still lead to downside risks as the negotiators continue to work towards a ceasefire and as the fear trade subsides.”

S&P 500 moved higher on Monday after holding above key moving average supports starting at 4514/4488. Analysts at Credit Suisse stay biased tactically higher, with next resistance at 4637.

Key support at 4462/55 needs to hold to maintain the direct upward pressure

“We stay directly biased higher for now for a test of the 78.6% retracement of the 2022 fall and price resistance at 4663/68. Above here would open the door to a move to 4707/12 next, then what we look to be tougher resistance, starting at 4744/49 and stretching up to the 4819 record high. We expect a cap in this zone, in line with our broader medium-term view that the market is set to stay trapped in a broader mean-reverting phase.”

“First support remains at 4514/08, which includes the 23.6% retracement of the recent recovery and 13-day exponential moving average, which floored the market on Friday. Below here the next level is seen at the 200-day average at 4488, then the 63-day average and price lows at 4462/55.”

“Only a break below 4462/55 would turn the short-term risks back lower within the range.”

European Commission President Ursula von der Leyen on Tuesday said that the atrocities committed by the Russian military in Bucha and other areas from which they have recently withdrawn cannot and will not be left unanswered, reported Reuters. It is important to sustain the utmost pressure on Russian President Vladimir Putin and the Russian government at this critical point, she continued.

The EU will thus impose an import ban on coal from Russia, worth roughly EUR 4B per year, von der Leyen announced, adding that the EU would also be imposing a full transition ban on four key Russian banks, including VTB Bank. She also announced that the EU will ban exports worth EUR 10B per year of advanced semi-conductors and would ban the imports of wood, cement, seafood and liquor, worth EUR 5.5B per year.

The EU is working on additional sanctions, including on oil imports, she noted.

The Reserve Bank of Australia (RBA) left monetary policy unchanged in its meeting this morning but hawkishly opened the door for an upcoming rate hike. AUD/USD has strengthened after the release and is trading above the 0.76 level. Subsequently, economists at Rabobank have raised their AUD/USD year-end forecast to 0.78.

Opening the door to rate hikes in the coming months

“The RBA has been making small steps towards becoming less dovish in the past couple of months and the tone of this morning’s policy statement has added to the market’s perception that the RBA could be hiking rates in the not too distant future.”

“AUD/USD has jumped higher overnight on the back of the RBA meeting and subsequently breached our 0.76 medium-term target for the currency pair. Consequently, we are pushing up our forecast to 0.78 by year-end.”

- DXY falters once again around the 99.00 region on Tuesday.

- Further gains are likely on a close above 99.00.

DXY navigates within a tight range near the 99.00 region so far on turnaround Tuesday.

DXY manages well to extend further the bounce off the decent contention area in the 97.70 zone (March 30,31), while the ongoing rebound keeps targeting the 99.00 yardstick and beyond in the near term. Above this level is seen the 2022 highs around 99.40.

The current bullish stance in the index remains supported by the 6-month line near 96.20, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 94.94.

DXY daily chart

According to the latest figures released on Tuesday by Statistics Canada, the Canadian Trade surplus fell slightly to C$2.6B in February from C$3.12B a month earlier, larger than the expected drop to C$2.9B. But that masked an increase in both imports and exports, with the former coming in at C$56.08B in February up from C$54B the month prior and the latter coming in at $58.75B from C$57.12B a month earlier.

Market Reaction

The loonie did not react to the latest trade figures, though continues to trade with a bullish bias against the US dollar with USD/CAD recently pushing below 1.2450.

- AUD/USD jumped to a fresh YTD peak in reaction to the RBA’s hawkish commentary on Tuesday.

- The Ukraine crisis underpinned commodities and further benefitted the resources-linked aussie.

- Technical buying above the 0.7600 mark also contributed to the strong intraday bullish move.

The AUD/USD pair maintained its strong bid tone through the mid-European session and now seems to have entered a bullish consolidation phase. The pair was last seen trading around the 0.7630 region, or the highest level since June 2021.

The pair added to the previous day's positive move and gained strong follow-through traction on Tuesday in reaction to a more hawkish commentary by the Reserve Bank of Australia (RBA). As was expected, the Australian central bank decided to hold the key rate at a record low but dropped its pledge to be patient on tightening policy.

In the accompanying policy statement, the RBA noted that the domestic economy remains resilient, and spending is picking up following the omicron setback. The markets were quick to react and started pricing in the first-rate hike in over a decade during the third quarter. This, in turn, provided strong lift to the Australian dollar.

Apart from this, the prospect of more Western sanctions on Russia continued acting as a tailwind for commodity prices, which was seen as another factor that benefitted the resources-linked aussie. In fact, French President Emmanuel Macron pressed for more severe sanctions on Russia following reports of atrocities in the Ukrainian town of Bucha.

The combination of supporting factors, along with subdued US dollar price action, pushed the AUD/USD pair to the fresh YTD peak, taking along some short-term trading stops near the 0.7600 mark. This, in turn, confirmed a near-term bullish breakout through an ascending channel extending from sub-0.7000 levels and supports prospects for additional gains.

That said, a slightly overbought RSI might hold back bulls from placing fresh bets amid expectations that the Fed tighten its monetary policy at a faster pace to combat high inflation. It is worth mentioning that the markets anticipate a 100 bps Fed rate hike move over the next two meetings, which was reinforced by elevated US Treasury bond yields.

Hence, the market focus will remain glued to the FOMC monetary policy meeting minutes, scheduled for release on Wednesday. Nevertheless, the near-term setup favours bullish traders, suggesting that any meaningful pullback might still be seen as a buying opportunity. Traders now look forward to the US ISM Services PMI for some short-term opportunities.

Technical levels to watch

According to the latest data from the Bureau of Economic Analysis and US Census Bureau, the US Goods and Services Trade deficit remained at $89.2B in February after posting the same number in January. That was above expectations for a slight decline to $88.5B. The Goods Trade deficit was $107.5B in February, up from $106.6B the month before, and the Services Trade surplus was $18.3B in February, up from $17.4B a month earlier.

Market Reaction

There was no market reaction to the latest US trade data, with focus turning to ISM Services PMI data out at 1500BST and Fed speak thereafter.

- EUR/USD is consolidating sub-1.1000 on Tuesday ahead of more US data and Fed speak.

- Geopolitical risk as the EU moves towards tougher restrictions on Russia energy imports plus hawkish Fed rhetoric has weighed recently.

Having slipped back below the 1.1000 level on Monday amid broad euro underperformance as expectations built for further Western sanctions against Russia, EUR/USD has stabilised above recent lows in the 1.0950 area. While geopolitics remains at the forefront of the market’s mind, there is also plenty of US data and Fed speak coming up, with US trade data out at 1330BST ahead of ISM Services PMI at 1500BST. Of particular importance will be remarks from Fed Vice Chairwoman Lael Brainard at 1605BST.