- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 05-02-2023

- WTI is looking for an intermediate cushion after a vertical fall to near $73.00, more downside looks favored.

- Hawkish interest rate guidance by western central banks has weakened oil demand projections.

- The OPEC has decided to stick to current oil restrictions despite declining oil price.

West Texas Intermediate (WTI), futures on NYMEX, is gauging an intermediate cushion after dropping to near the critical support of $73.00. The oil price witnessed a massive sell-off on Friday after a surprisingly impressive United States Nonfarm Payroll (NFP) report. And, further downside is favored as investors have underpinned the risk aversion theme as Federal Reserve (Fed) pause bets have faded for now.

According to the US NFP report, the United States economy added fresh 517K in January, extremely higher than the consensus of 185K and December’s release of 260K. While the Unemployment Rate was trimmed to a multi-decade low of 3.4% lower than the expectations and the prior release of 3.6% and 3.5% respectively.

Households in the United States are expected to be equipped with higher funds, which will trigger the overall demand in the economy. It is worth noting that Average Hourly Earnings have surprisingly dropped significantly to 4.4%. However, the impact of a decline in the labor cost index might be offset by a rise in the number of individuals employed. As negotiation power will again shift in the favor of job-seekers due to solid labor demand.

Apart from that US ISM Services PMI landed better than expectations. The economic data improved to 55.2 from the consensus of 50.4. Also, the New Orders Index indicates forward demand scaled to 60.4 vs. the projections of 57.6, which indicates that the overall demand is recovering. However, the fear of further interest rate hikes by the Fed carries higher weightage in comparison with the expression of demand recovery.

Meanwhile, an absence of further restrictions on oil output by the OPEC also strengthened oil bears. A continuous flow of oil amid weaker oil demand due to fresh interest rate hikes by the Fed, the European Central Bank (ECB), and the Bank of England (BoE) along with hawkish interest rate guidance are favoring further downside in the oil price ahead.

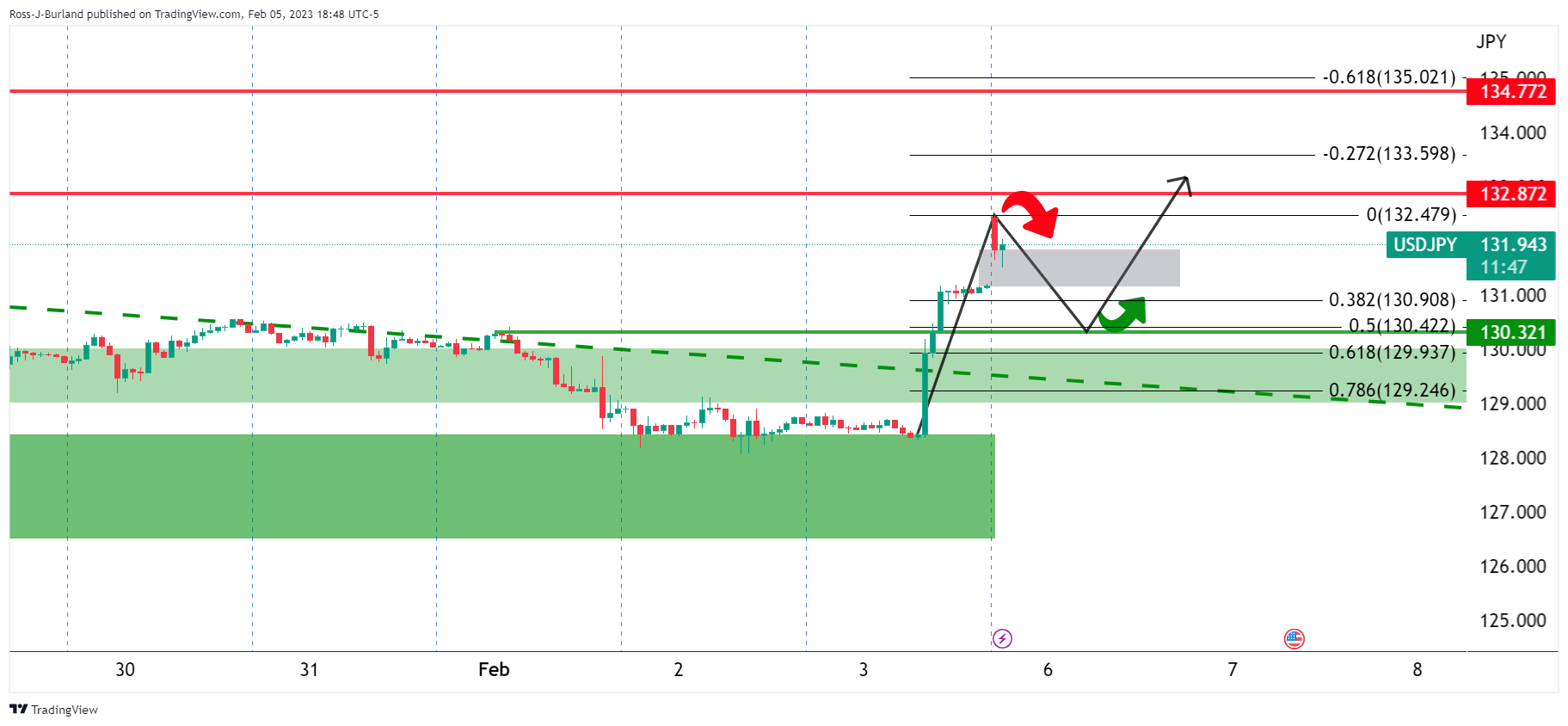

- USD/JPY is on the way to closing the bullish opening gap.

- The bulls eye 132.80s for the sessions ahead.

USD/JPY is correcting the opening gap rally that hit a high of 132.47 and is now back to 131.70 at the time of writing. Outstanding results in the US jobs market are still being digested by investors and we could be in for some volatility ahead as the week unfolds.

The United States added 517,000 jobs in January, well more than the average analyst estimate for a 187,000-job rise. The robust increase showed the US economy continues to surge despite rising interest rates. the key here is that the data arrived at a time when markets were positioning for a Fed pivot. A more hawkish stance could now come back into play in terms of sentiment even after it raised interest rates by just 25 basis points on Wednesday. The hike was the smallest hike since it began tightening rates to slow inflation and the dovish rhetoric from the Fed's chairman, Jerome Powell, sealed the deal, at least until the jobs numbers.

''Chair Powell is pleased with the recent softer inflation prints, but says the Fed needs substantially more evidence to be confident that inflation is on a sustained downward path,'' analysts at ANZ Bank explained. ''For the Fed, the biggest uncertainty surrounding the inflation outlook is what happens with core services ex-shelter prices. Wages growth is the main driver of this component of inflation.''

''Labour market data out last week point to still-hot demand for labour, but at the same time provide further evidence of cooling wage growth. Although wage growth is easing, it needs to slow further. With the labour market remaining tight, the Fed is likely to remain hawkish with its guidance,'' the analysts added.

Meanwhile, it will be a very light week in terms of US data, especially in comparison to last week. With that being said, Federal Reserve speakers will be out in force, including Powell. Also, at the end of the week, the highlight may be Consumer Price Index revisions. Of note, January CPI data won’t be released until February 14.

From the Bureau of Labor Statistics website: “Each year with the release of the January CPI, seasonal adjustment factors are recalculated to reflect price movements from the just-completed calendar year. This routine annual recalculation may result in revisions to seasonally adjusted indexes for the previous 5 years.”

Final stages of nominations for BoJ governor

Domestically, reports suggest BOJ Deputy Governor Amamiya has been approached about the post of Governor and this suggests the government is in the final stages of its nominations for replacing the outgoing Governor Kuroda.

''Amamiya has been instrumental in helping Kuroda formulate and implement the BOJ’s massive monetary stimulus program,'' analysts at Brown Brothers Harriman argued.

''Former Deputy Governor Nakaso has emerged as the other frontrunner and is viewed as slightly more hawkish than Amamiya. That said, we believe the next Governor will have no choice but to begin removing accommodation this year. Of note, Kuroda’s term ends April 8 and Prime Minister Kishida has said that the replacement will be named in February''

USD/JPY technical analysis

USD/JPY is moving towards the gap but remains on the backside of the prior bearish trend so the bias is to the upside with the 132.80s eyed.

- US Dollar Index struggles to defend two-day rebound from the lowest levels since April 2022.

- Strong US employment data, fears surrounding China joined BOE/ECB play to underpin DXY rebound.

- Lack of major data/events, cautious mood ahead of Fed Chair Powell’s appearance probe US Dollar bulls.

US Dollar Index (DXY) stays defensive above 103.00 as bulls await more clues to extend the two-day recovery from the lowest levels since April 2022.

In doing so, the greenback’s gauge versus the six major currencies justifies the lack of major data/events to consolidate the latest upside. That said, the strong US jobs report and geopolitical fears surrounding China allowed the DXY to trigger the much-awaited rebound.

It’s worth noting that the US Bureau of Labor Statistics (BLS) surprised markets by revealing that the Nonfarm Payrolls (NFP) rose by 517K in January, versus 185K expected and 260K (upwardly revised) prior. It’s worth noting that the Unemployment Rate also dropped to 3.4% from 3.5% prior and 3.6% expected but the Average Hourly Earnings eased during the stated month.

The rebound in the US ISM Services PMI from 49.2 to 55.2, versus 50.4 expected, also underpinned the rebound in the United States Treasury bond yields and the US Dollar. That said, the benchmark US 10-year Treasury bond yields jumped the most since late September 2022 to regain 3.52% level by the volatile week’s end.

Additionally, the recent fears surrounding the US and China ahead of this week’s US diplomat visit to China also weigh on the market’s risk appetite. “A US military fighter jet shot down a suspected Chinese spy balloon off the coast of South Carolina on Saturday, a week after it first entered US airspace and triggered a dramatic -- and public -- spying saga that worsened Sino-US relations,” said Reuters.

Against this backdrop, US 10-year Treasury bond yields remain firmer around 3.55% while the S&P 500 Futures print mild losses by the press time.

Moving on, Tuesday’s speech from Federal Reserve (Fed) Chairman Jerome Powel and Friday’s US UoM Consumer Sentiment Index for February, as well as the University of Michigan's 5-year Consumer Inflation expectations, will be crucial for fresh impulse. Should Fed Chair Powell praise the recent hawkish signals from the US data, the DXY could extend the latest recovery.

Technical analysis

Clear upside break of a three-month-old descending resistance line, now support around 101.95, directs DXY bulls towards a downward-sloping trend line resistance from late November 2022, close to 104.00 at the latest.

- Silver price pares the biggest daily loss in a year with mild gains.

- Convergence of 100-EMA, 50% Fibonacci retracement level probes bears.

- Downbeat RSI, failure to break key support tease short-term XAG/USD buyers.

- Bulls need to cross 61.8% Fibonacci retracement to retake control.

Silver price (XAG/USD) remains on the recovery mode as it prints mild gains around $22.40 during early Monday morning in Asia. In doing so, the bright metal pares the biggest daily loss in a year at the lowest levels in two months.

The 100-day Exponential Moving Average (EMA) joins the 50% Fibonacci retracement level of the metal’s March-September 2022 downturn to highlight the $22.30-25 support confluence that recently triggered the XAG/USD rebound.

Adding strength to the recovery moves is the downbeat RSI (14) that challenges Silver bears.

However, bearish MACD signals join the quote’s sustained downside break of the 61.8% Fibonacci retracement level surrounding $23.40, also known as the golden level, which keeps the Silver bears hopeful.

Even if the XAG/USD manages to cross the $23.40 hurdle, a one-month-old horizontal resistance area around $24.55-65 will be crucial for the bulls to cross to retake control.

Alternatively, a downside break of the $22.30-25 support confluence has another chance of pushing back the Silver bears in the form of the 200-EMA, close to $21.95 by the press time.

In a case where XAG/USD remains bearish past $21.95, the previous resistance line from the last March, near $20.80, will be in focus.

Silver price: Daily chart

Trend: Recovery expected

- USD/CHF is struggling to extend the upside above 0.9280, upside seems favored amid the upbeat market mood.

- The US Dollar Index (DXY) has shifted its auction above 102.50 as Fed might not pause its policy tightening spell.

- A pullback move to near 10-period EMA will present a bargain buy for the market participants.

The USD/CHF pair is facing fragile barricades after a perpendicular rally to near 0.9280 in the early Asian session. The Swiss franc asset is expected to display a volatility contraction before resuming its upside journey as the US Dollar seeks more strength for further upside.

S&P500 settled Friday with significant losses as the stronger-than-projected United States Nonfarm Payrolls (NFP) report faded expectations of a pause in the policy tightening spell by the Federal Reserve (Fed). The US Dollar Index (DXY) has shifted its auction above 102.50 and is expected to continue its upside momentum ahead.

USD/CHF has sensed long liquidation after a vertical rally to near the horizontal resistance placed from January 24 high around 0.9280. The Swiss franc asset needs more strength for printing more gains. Therefore, the major might demonstrate some volatility contraction before resuming its upside journey.

The Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, showing no signs of divergence but an overbought situation cannot be ruled out.

A minor pullback move to near the 10-period Exponential Moving Average (EMA) at 0.9233 will trigger a bargain buy opportunity, which will drive the asset towards January 31 high at 0.9288. A break above the latter will expose the asset to January 12 high around 0.9360.

On the flip side, a breakdown of Wednesday’s low at 0.9059 will drag the major toward 4 August 2021 low at 0.9018. A slippage below the latter will drag the asset further toward 10 May 2021 low at 0.8986.

USD/CHF hourly chart

-638112357044516997.png)

- NZD/USD seesaws around intraday low, mildly offered during three-day downtrend.

- Markets in New Zealand are off due to Waitangi Day celebration.

- Strong US data, fresh geopolitical fears surrounding China weigh on Kiwi prices.

- Light calendar in NZ emphasizes Fed Chair Powell’s reaction to recent hawkish market signals for fresh impulse.

NZD/USD remains depressed as it flirts with short-term key support around 0.6300 during early Monday in Asia, following a downside gap to begin the week’s trading. In doing so, the Kiwi pair justifies the market’s risk-off mood and firmer US data amid a holiday in New Zealand (NZ) markets.

Market sentiment worsens amid strong US data renewing hawkish bias for the Federal Reserve (Fed), as well as due to the geopolitical tension surrounding China.

That said, the US Bureau of Labor Statistics (BLS) surprised markets by revealing that the Nonfarm Payrolls (NFP) rose by 517K in January, versus 185K expected and 260K (upwardly revised) prior. It’s worth noting that the Unemployment Rate also dropped to 3.4% from 3.5% prior and 3.6% expected but the Average Hourly Earnings eased during the stated month.

Other than the headline US job numbers, the rebound in the US ISM Services PMI from 49.2 to 55.2, versus 50.4 expected, also underpinned the rebound in the United States Treasury bond yields and the US Dollar. That said, the benchmark US 10-year Treasury bond yields jumped the most since late September 2022 to regain 3.52% level by the volatile week’s end.

On the other hand, the recent fears surrounding the US and China ahead of this week’s US diplomat visit to China also weigh on the market’s risk appetite. “A US military fighter jet shot down a suspected Chinese spy balloon off the coast of South Carolina on Saturday, a week after it first entered US airspace and triggered a dramatic -- and public -- spying saga that worsened Sino-US relations,” said Reuters.

While portraying the mood, S&P 500 Futures drops 0.40% while the US 10-year Treasury bond yields remain sluggish near 3.52% by the press time.

At home, the last week’s New Zealand jobs report eased pressure on the Reserve Bank of New Zealand (RBNZ) to act fast, which in turn joins a light calendar at home during this week to allow the NZD/USD buyers to take a breather.

However, Tuesday’s speech from Federal Reserve (Fed) Chairman Jerome Powel and Friday’s US UoM Consumer Sentiment Index for February, as well as the University of Michigan's 5-year Consumer Inflation expectations, will be crucial for fresh impulse.

Technical analysis

An upward-sloping trend line from mid-November 2022, around 0.6300 by the press time, appears the immediate challenge for the NZD/UDS bears to tackle.

“Oil producers may have to reconsider their output policies following a demand recovery in China, the world's second-largest oil consumer,” International Energy Agency (IEA) Executive Director Fatih Birol said on the sidelines of the India Energy Week conference on Sunday per Reuters.

Key comments

We expect about half of the growth in global oil demand this year will come from China.

If demand goes up very strongly, if the Chinese economy rebounds, then there will be a need, in my view, for the OPEC+ countries to look at their (output) policies.

Price caps on Russian oil have achieved the objectives of both stabilizing oil markets and reducing Moscow's revenues from oil and gas exports.

Fuel markets might face difficulties in the short term as global trade routes ‘reshuffle’ to accommodate Europe drawing on more imports from China, India, the Middle East and the United States.

That could force other markets such as Latin America to scout for alternative imports.

Fuel market balance could improve from the second half as more refining capacity is added globally.

WTI bears take a breather

The news allowed WTI crude oil bears to take a breather at the one-month low surrounding $73.50, following a three-day downtrend.

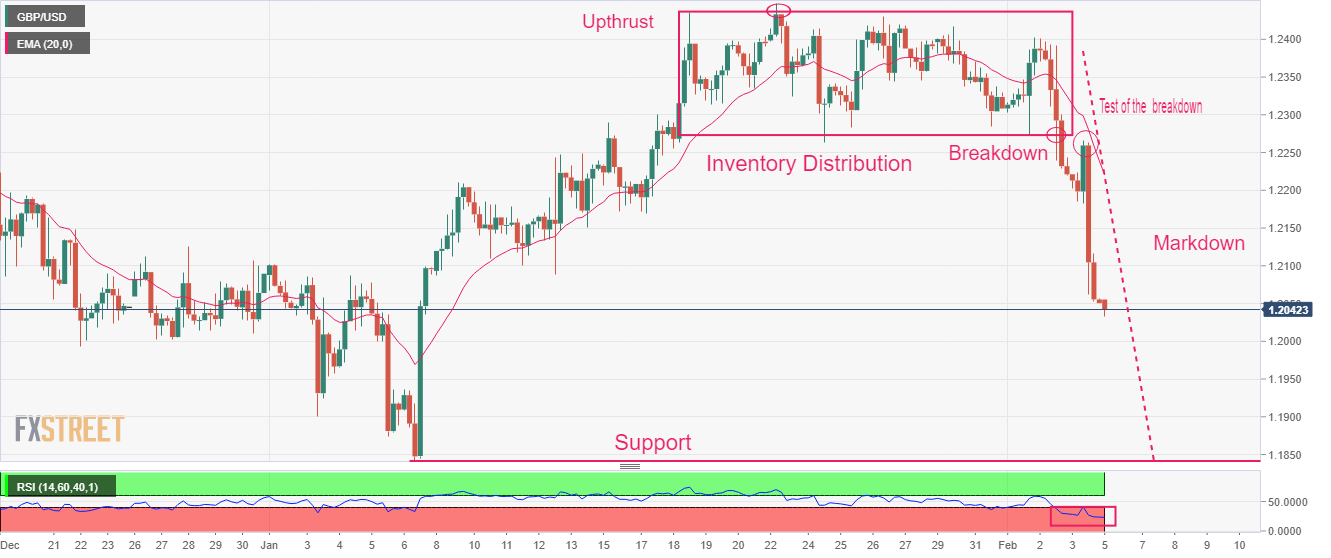

- GBP/USD witnessed significant selling pressure after testing the inventory distribution breakdown around 1.2268.

- The Cable is in a Wyckoff’s markdown phase and may find support near 1.1850.

- A 20.00-40.00 range oscillation by the RSI (14) indicates more weakness ahead.

The GBP/USD pair has dropped below the critical support of 1.2050 in the early Tokyo session on expectations that the Federal Reserve (Fed) will continue hiking interest rates due to upbeat United States official employment data. The market mood has turned risk-averse as further interest rate hiking by Fed chair Jerome Powell will deepen recession fears.

S&P 500 futures tumbled after a three-day winning streak, portraying a sheer decline in the risk appetite of the market participants. The 10-US Treasury yields have recovered above 3.51% as the inflation projections are set to rebound further.

GBP/USD witnessed a massive sell-off after delivering a downside break of the Inventory Distribution formed on a two-hour scale. The formation of Upthrust around January 23 high at 1.228 indicates the presence of significant selling interest. The Cable has shifted into a markdown phase after testing the downside break of Wyckoff’s inventory distribution.

The 20-period Exponential Moving Average (EMA) at 1.2224 will act as a major barricade for the Pound Sterling bulls.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the bearish range of 20.00-40.00, which indicates that the downside momentum is active.

A further decline in the Cable below the intraday low at 1.2033 will drag the asset toward January 3 low at 1.1900 followed by horizontal support placed from January 6 low around 1.1841.

On the contrary, a break above January 24 low at 1.2263 will support a bullish reversal and will drive the Cable towards February 2 high around 1.2400. A breach of the latter will send the major toward January 23 high at 1.2448.

GBP/USD two-hour chart

“I have not heard anything about nomination of Amamiya as BoJ Governor,” said Japan's Finance Minister Shunichi Suzuki per Reuters.

Also read: Japan sounds out BoJ deputy Amamiya for central bank governor

The policymaker further added that he won’t comment on each candidate for BoJ Governor.

“Aware of media report overnight that Government arranging to nominate Amamiya,” stated Japan FinMin Suzuki.

Japan’s Suzuki also stated that he has been “out of the loop” on BoJ nomination.

USD/JPY grinds higher

Following the news, the USD/JPY pair defends Friday’s recovery moves around 131.85, up nearly half a percent intraday.

It’s worth noting that Bank of Japan (BoJ) Governor Haruhiko Kuroda is up for leaving his place in April 2023 and hence the rush for the next BoJ leader is active. Also highlighting the importance of the discussions are the latest pressure on the BoJ policymaker to shift from the ultra-easy monetary policy.

- USD/CAD begins the key week on a firmer footing, mildly bid during three-day uptrend.

- Upbeat US data, geopolitical tension propelled US Dollar, weighed on Oil price of late.

- BoC Governor Macklem’s speech, Canada jobs report for January will be crucial for immediate directions.

USD/CAD prints mild gains around 1.3415 as bulls keep the reins at the start of the key week for Loonie traders. In doing so, the quote prints three-day uptrend while justifying firmer US Dollar and the downbeat prices of Oil, Canada’s main export item.

Be it the unimpressive interest rate hikes by the European Central Bank (ECB) and the Bank of England (BoE) or the strong US data, the US Dollar had it all to recover from the multi-month low. That said, the US Dollar Index (DXY) managed to post the biggest weekly gains since September 2022, not to forget snapping three-week downtrend, in the last.

On Thursday, the ECB and the BoE both matched market forecasts by announcing 0.50% hike in their respective benchmark rates. The policymakers also tried to sound hawkish but couldn’t hide the receding inflation fears, which in turn suggested lesser need for strong rate increases. The same joined downbeat tech earnings reports and helped the DXY to rebound from the lowest levels since April 2022.

Following that, the US Bureau of Labor Statistics (BLS) surprised markets by revealing that the Nonfarm Payrolls (NFP) rose by 517K in January, versus 185K expected and 260K (upwardly revised) prior. It’s worth noting that the Unemployment Rate also dropped to 3.4% from 3.5% prior and 3.6% expected but the Average Hourly Earnings eased during the stated month.

Other than the headline US job numbers, the rebound in the US ISM Services PMI from 49.2 to 55.2, versus 50.4 expected, also underpinned the rebound in the United States Treasury bond yields and the US Dollar. That said, the benchmark US 10-year Treasury bond yields jumped the most since late September 2022 to regain 3.52% level by the volatile week’s end.

Additionally helping the US Dollar are the recent fears emanating from surrounding the US and China. “A US military fighter jet shot down a suspected Chinese spy balloon off the coast of South Carolina on Saturday, a week after it first entered US airspace and triggered a dramatic -- and public -- spying saga that worsened Sino-US relations,” said Reuters.

Elsewhere, WTI crude oil dropped in the last three consecutive days to $73.45 as firmer US Dollar and fresh fears surrounding the gap for the Fed doves before they retake control, due to the strong data, weigh on the commodity prices.

Moving on, Tuesday becomes the key day for the USD/CAD pair as Bank of Canada (BoC) Governor Tiff Macklem and Federal Reserve (Fed) Chairman Jerome Powell both will appear for speeches. Following that, Friday’s Canada jobs report for January and the US UoM Consumer Sentiment Index for February, as well as the University of Michigan's 5-year Consumer Inflation expectations, will be crucial for fresh impulse.

Technical analysis

Although an upward-sloping support line from June 2022, around 1.3310 by the press time, defends USD/CAD buyers, the Loonie pair’s upside remains elusive until the quote stays below the 50-DMA level of near 1.3500.

- Gold price justifies downside break of key support line as sellers attack one-month low.

- Strong United States data underpinned recovery in US Treasury bond yields, US Dollar and weighed on XAU/USD.

- US-China tussles add strength to geopolitical tension and favor Gold sellers.

Gold price (XAU/USD) holds lower ground near $1,865, after declining to the fresh one-month low the previous day. The metal’s latest weakness could be linked to the strong United States data renewing inflation fears, as well as downbeat rate hike performances of the European Central Bank and the Bank of England (BoE). Also exerting downside pressure on the XAU/USD is the fresh geopolitical tension surrounding the US-China ties. Above all, the recovery in the US Treasury bond yield renewed the US Dollar and recalled the Gold bears after a month-long absence.

United States data propel yields and Gold bears

Although the United States Federal Reserve (Fed) announced a dovish rate hike, the strong US economics surrounding jobs and activities renewed inflation fears and favored the odds of further rate increases from the Fed.

On Friday, the US Bureau of Labor Statistics (BLS) surprised markets by revealing that the Nonfarm Payrolls (NFP) rose by 517K in January, versus 185K expected and 260K (upwardly revised) prior. It’s worth noting that the Unemployment Rate also dropped to 3.4% from 3.5% prior and 3.6% expected but the Average Hourly Earnings eased during the stated month.

Other than the headline US job numbers, the rebound in the US ISM Services PMI from 49.2 to 55.2, versus 50.4 expected, also underpinned the rebound in the United States Treasury bond yields and the US Dollar.

That said, the benchmark US 10-year Treasury bond yields jumped the most since late September 2022 to regain 3.52% level by the volatile week’s end. The same propelled the US Dollar to recover from the lowest levels since April 2022 and weigh on the Gold price.

Downbeat European Central Bank, Bank of England also tease XAU/USD sellers

Last week, the European Central Bank (ECB) announced a 0.50% interest rate hike by matching the market expectations.

Following the interest rate announcements, ECB President Christine Lagarde said, “We haven't reached the peak in rate, we have ground to cover.” The policymaker also signaled that the risks to inflation and growth are more balanced.

On the other hand, the Bank of England (BoE) announced a 0.50% interest rate hike by matching the market expectations. Following the interest rate announcements, BoE Governor Andrew Bailey said, “BoE's forecast suggests inflation will come down, fall quite sharply.”

Asked if rates might have peaked, says "we have changed the language we used." BoE’s Bailey also added, "Change in language reflects a turning in the corner but very early days."

On a different pate, BoE Chief Economist Huw Pill told Times Radio on Friday that it's important for the BoE to not do "too much" on monetary policy, per Reuters.

US-China tension is extra burden for Gold

Other than the United States data and monetary policy moves at the European Central Bank (ECB), as well as at the Bank of England (BoE), the latest geopolitical tension surrounding the US and China also exerts downside pressure on the Gold price.

“A US military fighter jet shot down a suspected Chinese spy balloon off the coast of South Carolina on Saturday, a week after it first entered US airspace and triggered a dramatic -- and public -- spying saga that worsened Sino-US relations,” said Reuters.

Federal Reserve Chair Jerome Powell’s speech, Sentiment data are the key

Looking forward, Gold traders should pay attention to Federal Reserve Chairman Jerome Powell’s speech and preliminary readings of the UoM Consumer Sentiment Index for February, as well as the University of Michigan's 5-year Consumer Inflation expectations, for fresh impulse. If Fed’s Powell manages to regain his hawkish bias, based on the recently firmer US data, the XAU/USD has a further downside to track.

Gold price technical analysis

Gold price broke key support lines stretched from November during the last week and pushed back the bullish bias, at least for now.

The downside expectations also take clues from the below 50 Relative Strength Index (RSI) line, placed at 40, as well as bearish signals from the Moving Average Convergence and Divergence (MACD) indicator.

That said, the XAU/USD declines to the 50-Day Moving Average (DMA), currently around $1,845, appear imminent. However, multiple tops marked during the last December near $1,825-23 could act as the last defense of the Gold buyers.

Alternatively, an upward-sloping trend line from November 23, previous support surrounding $1,878, guards immediate recovery of the Gold price. Following that, a three-month-old support-turned-resistance line could challenge the XAU/USD bulls near $1,925.

Overall, Gold price is likely to witness further downside but the trend reversal is far from sight.

Gold price: Daily chart

Trend: Further downside expected

- EUR/USD has faced barricades around 1.0800 the risk-off impulse inspired by upbeat US NFP is still solid.

- The 10-year US Treasury yields have scaled up 3.51% again amid a rebound in US inflation projections.

- Higher US NFP might offset the impact of a decline in the employment cost index.

The EUR/USD pair has sensed selling interest after a pullback move to near the round-level resistance of 1.0800 in the early Asian session. The major currency pair has resumed its downside journey as the stronger-than-anticipated United States Nonfarm Payrolls (NFP) reports have dismantled the expectations of a pause in the interest rate escalation by the Federal Reserve (Fed) after reaching 4.50-4.75%. The street considered that a meaningful declining trend in the inflationary pressures is sufficient to pause interest rate hiking for a period of time to assess the impact of policy tightening till done.

S&P500 witnessed a massive sell-off a gigantic jump in the additions to the US labor force might force a rebound in inflation projections, portraying a risk-aversion theme. Three-day winning spree in the 500-stock basket terminated on expectations that further increases in interest rates would deepen recession fears ahead. The US Dollar Index (DXY) displayed a juggernaut rally to near 102.60 and is expected to continue its upside journey as mammoth employment generation has cleared that battle against inflation is far from over.

A significant jump in the US employment numbers weakened the demand for US government bonds, which led to a jump in the 10-year US Treasury yields above 3.51%.

The United States economy has added fresh 517K, extremely higher than the consensus of 185K and the former release of 260K. The Unemployment Rate was trimmed to a multi-decade low of 3.4% lower than the expectations and the prior release of 3.6% and 3.5% respectively. Apart, from that Average Hourly Earnings have dropped to 4.4% from 4.9% released earlier. A decline in earnings data might keep inflation projections in check as lower liquidity with households will not allow them to increase spending.

On the Eurozone front, investors are keeping an eye on Retail Sales data, which is scheduled for Monday. The contraction in the economic data is expected to trim to 2.7% from the prior contraction of 2.8%. A spree of contraction in consumer spending might trim projections for the Consumer Price Index (CPI), which will delight the European Central Bank (ECB) ahead.

The Nikkei reported that Japan's government has approached Bank of Japan Deputy Gov. Masayoshi Amamiya as a possible successor to central bank chief Haruhiko Kuroda while Tokyo prepares for the first change of leadership at the BOJ in a decade.

''Government and ruling coalition officials said the subject had been discussed with Amamiya. The 67-year-old career central banker is the architect of most BOJ policies under Kuroda.''

USD/JPY update

USD/JPY has popped and is targeting 13250 in the open with eyes on 132.80 and the 134.70s thereafter following Friday's strong US Nonfarm Payrolls report. The United States added 517,000 jobs in January, well more than the average analyst estimate for a 187,000-job rise. The robust increase showed the US economy continues to surge despite rising interest rates. the key here is that the data arrived at a time when markets were positioning for a Fed pivot.

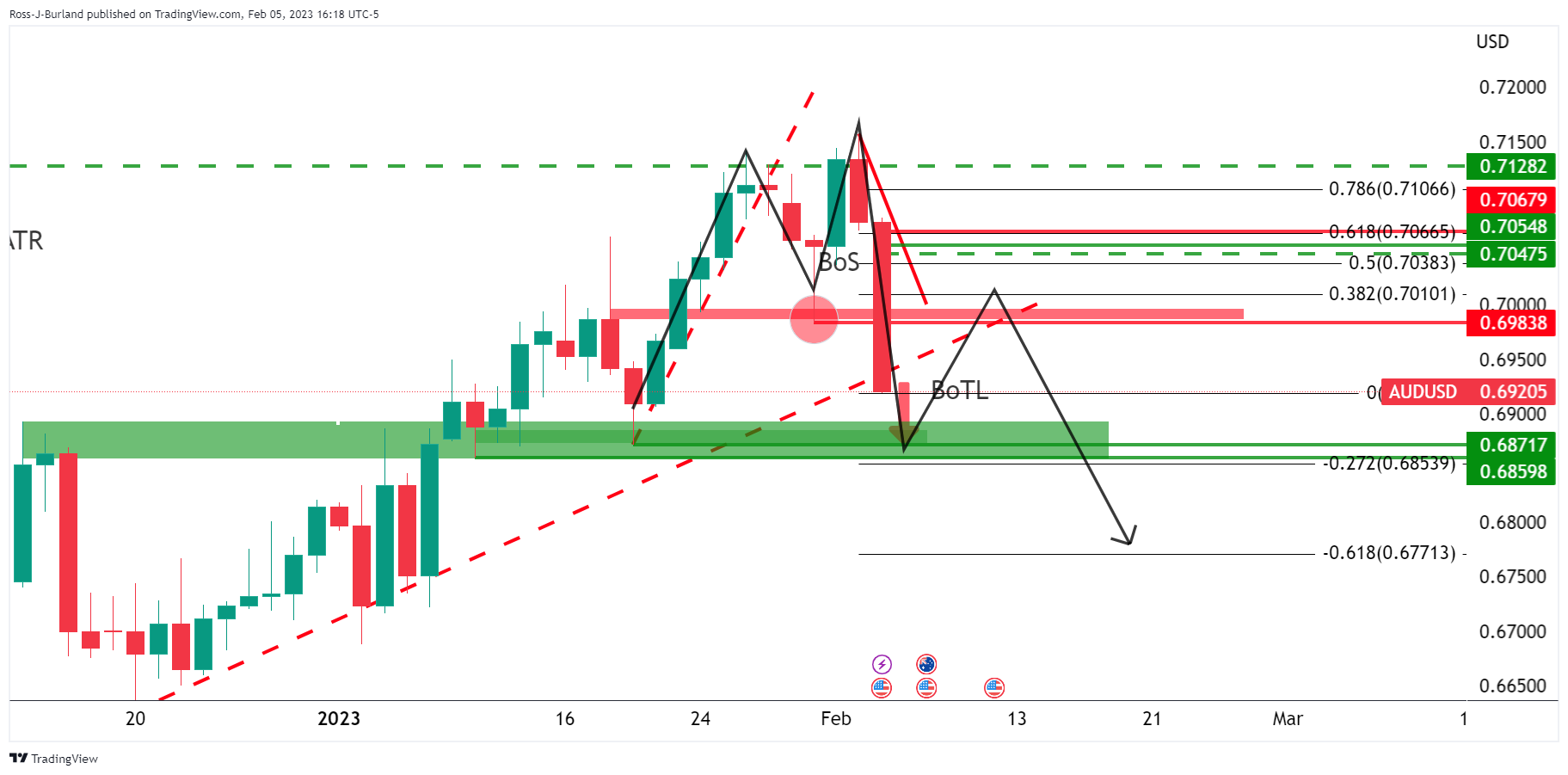

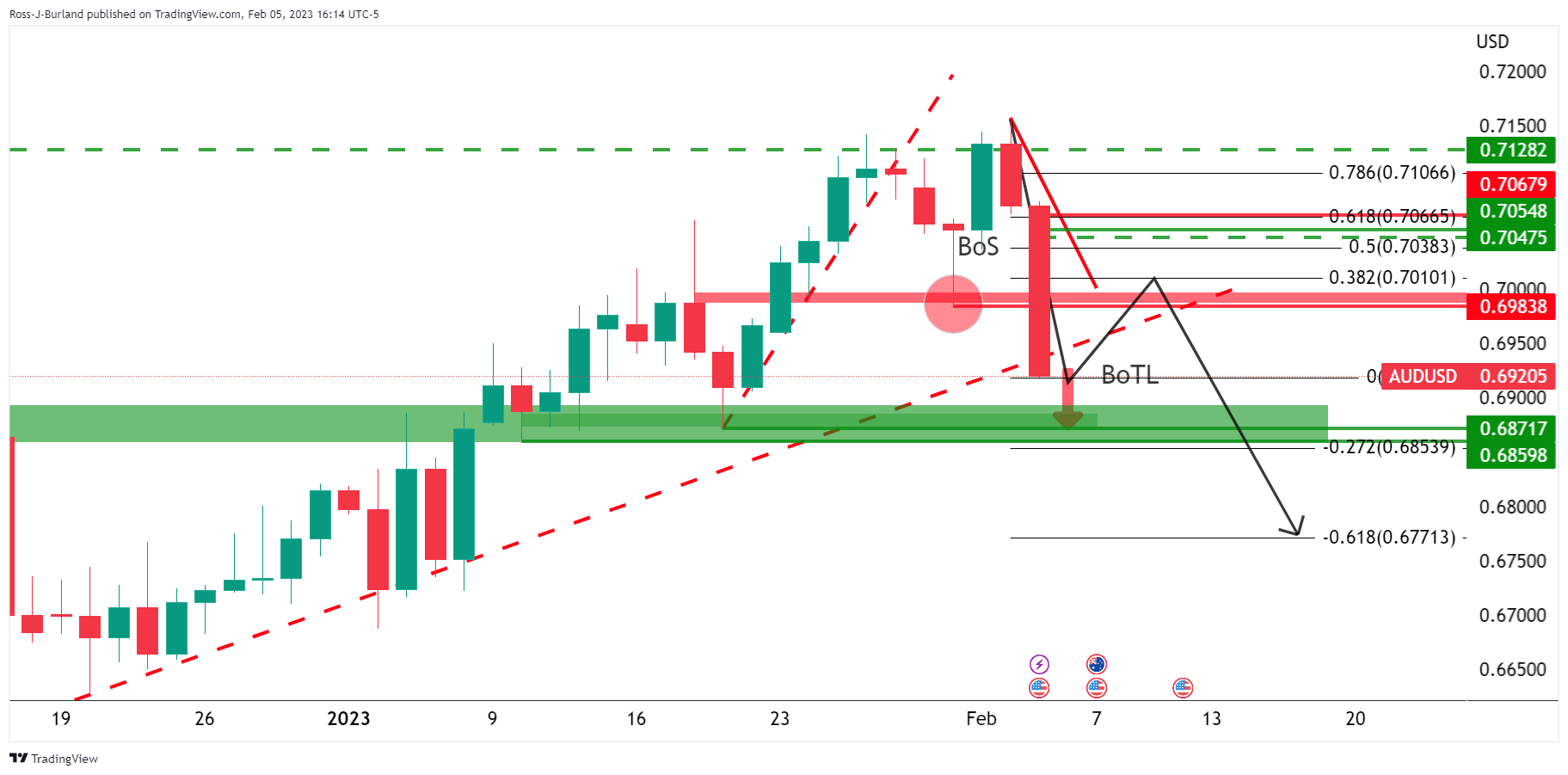

- AUD/USD bears eye support structure for the open.

- Bulls look to 100 pips higher for a corrective opportunity.

AUD/USD sold off in a huge way at the end of last week and has broken critical breakout structures along the way as the following will illustrates. The price dropped to close below a 78.6% target area:

The culprit was outstanding results in the US jobs sector that took the market off guard that was backed up by some pretty impressive Services data as well.

The United States added 517,000 jobs in January, well more than the average analyst estimate for a 187,000-job rise. The robust increase showed the US economy continues to surge despite rising interest rates. the key here is that the data arrived at a time when markets were positioning for a Fed pivot. A more hawkish stance could now come back into play in terms of sentiment even after it raised interest rates by just 25 basis points on Wednesday, the smallest hike since it began tightening rates to slow inflation.

Meanwhile, the Aussie had been boosted by the re-opening of the Chinese economy as well as the surprising strength of Australia’s December inflation release that landed recently and had firmly put the risk of another 25 bp rate hike from the RBA on the table for February 7. ''Accelerating services inflation locks in a 25bps hike,'' analysts at TD Securities said. ''We forecast a follow-up 25bps hike in March taking the terminal to 3.6%.''

However, markets will be looking for the statement to open the door to pausing here. And this is a sangue into the charts below because we might have seen a high for the year so far if this were to be the case:

AUD/USD daily chart

The price is breaking the trendline.

However, we have an M=formation on the charts as illustrated above.

This could therefore lead to a bullish correction to test the neckline of the M-pattern with 0.70 eyed.

However, it can't be taken away from the bears that the momentum is to the downside and we could just see a continuation of the initial balance for the week and open as early prices suggest, downs some 50 pips to 0.6880 from Friday's 0.6929 close.

If this plays out in the official open in Syden, then taking 0.6870 as a floor, the 38.2% Fibo retracement on the daily comes in at around 0.6980:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.