- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-08-2014

(raw materials / closing price /% change)

Light Crude 98.40 +0.11%

Gold 1,289.20 +0.02%

(index / closing price / change items /% change)

Nikkei 225 15,474.5 -48.61 -0.31%

Hang Seng 24,600.08 +67.65 +0.28%

Shanghai Composite 2,223.33 +38.03 +1.74%

FTSE 100 6,677.52 -1.66 -0.02%

CAC 40 4,217.22 +14.44 +0.34%

Xetra DAX 9,154.14 -55.94 -0.61%

S&P 500 1,938.99 +13.84 +0.72%

NASDAQ 4,383.89 +31.25 +0.72%

Dow Jones 16,569.28 +75.91 +0.46%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3422 -0,02%

GBP/USD $1,6859 +0,23%

USD/CHF Chf0,9065 +0,06%

USD/JPY Y102,54 -0,04%

EUR/JPY Y137,64 -0,03%

GBP/JPY Y172,87 +0,20%

AUD/USD $0,9331 +0,23%

NZD/USD $0,8524 +0,21%

USD/CAD C$1,0904 -0,12%

(time / country / index / period / previous value / forecast)

01:30 Australia Trade Balance June -1.91 -2.00

01:45 China HSBC Services PMI July 53.1

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50%

04:30 Australia RBA Rate Statement

07:00 United Kingdom Halifax house price index July -0.6%

07:00 United Kingdom Halifax house price index 3m Y/Y July +8.8%

07:48 France Services PMI (Finally) July 48.2 50.4

07:53 Germany Services PMI (Finally) July 54.5 56.6

07:58 Eurozone Services PMI (Finally) July 52.8 54.4

08:30 United Kingdom Purchasing Manager Index Services July 57.7 58.1

09:00 Eurozone Retail Sales (MoM) June 0.0% +0.4%

09:00Eurozone Retail Sales (YoY) June +0.7% +1.2%

13:45 U.S. Services PMI (Finally) July 61.0 61.0

14:00 U.S. ISM Non-Manufacturing July 56.0 56.6

14:00 U.S. Factory Orders June -0.5% +0.6%

20:30 U.S. API Crude Oil Inventories July -4.4

22:45 New Zealand Unemployment Rate Quarter II 6.0% 5.8%

22:45 New Zealand Employment Change, q/q Quarter II +0.9% +0.7%

Most stock indices closed lower due to the impact of sanctions against Russia. Sentix investor confidence in the Eurozone declined to 2.7 in August from 10.1 in July, missing forecasts of the decrease to 9.5.

In the early trading session, markets were supported by the bailout of Banco Espirito Santo SA. Portugal' central bank released its plan on Sunday to inject 4.9 billion euros into Banco Espirito Santo SA. Banco Espirito Santo will be split into a good and a bad bank.

The number of unemployed people in Spain fell by 29,800 in July, after a drop by 122,700 in June.

Producer price index in the Eurozone climbed 0.1% in June, after a 0.1% fall in May. On a yearly basis, Eurozone's producer price index decreased 0.8% in June, after a 1.0% decline in May.

Construction purchasing managers' index in the UK fell to 62.4 in July from 62.6 in June.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,677.52 -1.66 -0.02%

DAX 9,154.14 -55.94 -0.61%

CAC 40 4,217.22 +14.44 +0.34%

The price of oil rose slightly today, but continued to be near four-month low (grade Brent), as concerns about oversupply outweigh concerns about conflicts in North Africa and the Middle East.

Recall that the projections of a surplus of oil on the African and European markets unleashed Brent 3.3 percent last week, despite the geopolitical tensions in Iraq, Libya and Ukraine. Strong U.S. economic data showing that oil demand in the world's largest economy improves, failed to support prices.

"The downward pressure on oil prices is likely to continue," - said Rick Spooner of CMC Markets. - Geopolitical risk remains, but take into account the market risk premium in prices. "

In addition, the dynamics continue to impact data on oil and petroleum products in the United States. The Department of Energy reported that gasoline inventories in the country rose last week by 365 thousand barrels - up to 218.2 million barrels, the highest level in four months. With the average volume of gasoline consumption in the past four weeks declined, despite the peak driving season in the country, at 0.5% - to the lowest level since May.

However, market participants do not exclude the resumption of growth in oil prices. "Now that the EU and the United States took steps to close some Russian companies access to capital markets, it can cause a reduction in exports from Russia. This, as well as the situation in the Gaza Strip can support price Brent », - told Reuters Nomura analyst Gordon Kwan.

Moreover, experts say that the world has changed so OilMarket that Russia ceases to be a major player that dictates the price of oil.

Investors are also waiting for new statistical data from the United States, which must confirm the strengthening of the country's economy, which is the world's largest oil consumer. One of the most anticipated weeks of statistical reports is to publish an index of business activity in the service of the Institute for Supply Management (ISM). According to forecasts, the figure rose in July to 56.6 points from 56.0 points in June. Recall value above 50 indicates an increase in activity.

The cost of the September futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 98.03 per barrel on the New York Mercantile Exchange (NYMEX).

September futures price for North Sea Brent crude oil mixture rose 23 cents to $ 105.09 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded mixed to lower against the most major currencies in the absence of any economic reports in the U.S. Friday's release of disappointing U.S. labour market data still weighed on the greenback. The U.S. economy added 209,000 jobs in July, missing expectations for a growth of 230,000 jobs. The unemployment rate in the U.S. increased to 6.2% in July from 6.1% in June.

The euro traded slightly lower against the U.S. dollar after economic data from the Eurozone. The number of unemployed people in Spain fell by 29,800 in July, after a drop by 122,700 in June.

Sentix investor confidence in the Eurozone declined to 2.7 in August from 10.1 in July, missing forecasts of the decrease to 9.5.

Producer price index in the Eurozone climbed 0.1% in June, after a 0.1% fall in May. On a yearly basis, Eurozone's producer price index decreased 0.8% in June, after a 1.0% decline in May.

The British pound traded higher against the U.S. dollar after the construction purchasing managers' index in the UK. Construction purchasing managers' index in the UK fell to 62.4 in July from 62.6 in June.

The Swiss franc traded little changed after the better-than-expected manufacturing purchasing managers' index. The Swiss manufacturing purchasing managers' index increased to 54.3 in July from 54.0 in June, beating expectations for a decline to 52.8.

The New Zealand dollar rose against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar increased against the U.S. dollar due to the better-than-expected retails sales in Australia. Retail sales in Australia climbed 0.6% in June, after a 0.3% fall in May. May's figure was revised up from a 0.5% decrease.

ANZ job advertisements in Australia increased 0.3% in July, after a 4.4% rise in May. May's figure was revised up from a 4.3% gain.

Australia's TD-MI monthly inflation gauge rose 0.2% in July, after 0.0% in June.

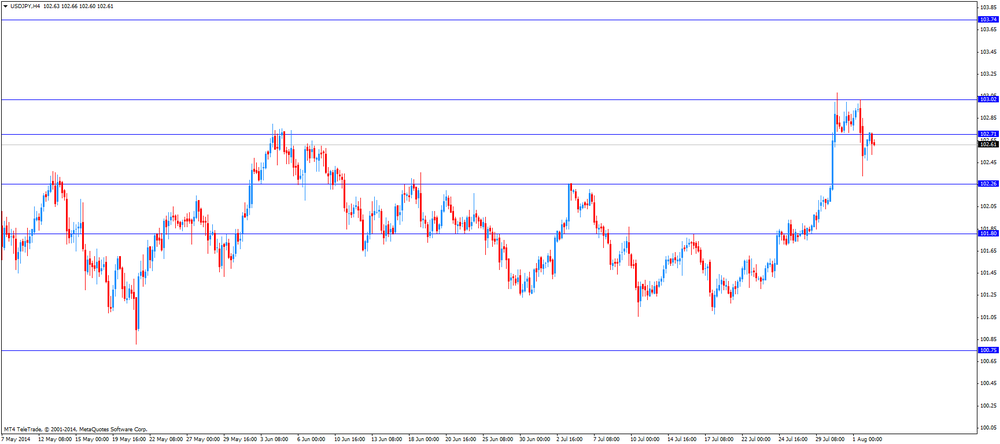

The Japanese yen traded higher against the U.S. dollar. Japan's monetary base was up to 42.7% in July from 42.6% in June.

Gold prices fell slightly today, while approaching to the level of $ 1290 per ounce, which is associated with the publication of Friday's labor market data, which were worse than expected led investors to doubt the expected increase in the Fed's key interest rate.

Add that gold is under heavy selling pressure in recent weeks, as improvements in the U.S. economy generate speculation that the Fed will raise interest rates sooner than expected, which would reduce the demand for gold for use as a hedge against the flexible monetary credit policy.

"The situation in the gold market remains poor, in part because of fears that the metal will react to the expected change in U.S. monetary forecasts - said Saxo Bank analyst Ole Hansen. - But at the same time, bond yields fell again, and the equity markets were down last week. ""It can bring back some investors back into gold, but not as a defensive asset, but as an alternative to investment," - he added.

On the dynamics of trading also reflected geopolitical factors. Some investors buy gold as insurance against political and financial instability, considering that in times of turmoil, it will retain its value more reliably than other assets.

"Even despite the fact that the tension in the Gaza Strip and the Ukraine does not weaken, its value is secondary. Direction of the price of gold is determined by the state of the U.S. economy and Fed policy," - said the company's broker Newedge Thomas Capalbo.

With regard to the physical market, there is demand remains weak against the background of the summer. In addition, many consumers expect further price declines. Premiums for gold in China is approximately $ 3 per ounce, compared with more than $ 20 early this year. Premium in other parts of Asia also remain largely stable over the last few weeks.

The cost of the August gold futures on the COMEX today fell $ 2.5 - to $ 1291.10 per ounce.

The Australian Bureau of Statistics released retail sales on Monday. Retail sales in Australia gained 0.6% in June, after a 0.3% decline in May. That was the biggest one-month increase since January.

May's figure was revised up from a 0.5% decrease.

Household good retailing rose 1.7%, while food retailing climbed 0.5%. Footwear and personal accessory retailing gained 1.4%.

Sales at cafes, restaurant and takeaway food services fell 0.6%, while sales at department stores decreased 0.5%.

On a quarterly basis, retail sales in Australia decreased 0.2% in the second quarter 2014, after a gain of 1.3% in the previous quarter.

U.S. stock-index futures climbed as Portugal announced a bailout for Banco Espirito Santo SA and Berkshire Hathaway Inc. (BRK/A) beat earnings estimates.

Global markets:

Nikkei 15,474.5 -48.61 -0.31%

Hang Seng 24,600.08 +67.65 +0.28%

Shanghai Composite 2,223.33 +38.03 +1.74%

FTSE 6,708.37 +29.19 +0.44%

CAC 4,234.44 +31.66 +0.75%

DAX 9,208.13 -1.95 -0.02%

Crude oil $97.59 (-0.30%)

Gold $1292.30 (-0.192%)

(company / ticker / price / change, % / volume)

| Caterpillar Inc | CAT | 100.52 | 0.00% | 2.2K |

| Walt Disney Co | DIS | 86.15 | +0.90% | 4.5K |

| Boeing Co | BA | 121.3 | +0.76% | 0.3K |

| Procter & Gamble Co | PG | 80.15 | +0.63% | 1.2K |

| The Coca-Cola Co | KO | 39.53 | +0.61% | 1.4K |

| United Technologies Corp | UTX | 105.35 | +0.57% | 2.2K |

| American Express Co | AXP | 86.8 | +0.38% | 1.8K |

| Verizon Communications Inc | VZ | 50.02 | +0.38% | 3.1K |

| Goldman Sachs | GS | 170.85 | +0.35% | 1.8K |

| JPMorgan Chase and Co | JPM | 56.68 | +0.35% | 1.4K |

| Microsoft Corp | MSFT | 43.01 | +0.35% | 7.7K |

| AT&T Inc | T | 35.45 | +0.34% | 5.6K |

| Intel Corp | INTC | 33.85 | +0.31% | 15.3K |

| Johnson & Johnson | JNJ | 100.15 | +0.25% | 0.1K |

| Exxon Mobil Corp | XOM | 99.01 | +0.21% | 0.1K |

| International Business Machines Co... | IBM | 189.55 | +0.21% | 0.3K |

| Pfizer Inc | PFE | 28.92 | +0.21% | 0.3K |

| Wal-Mart Stores Inc | WMT | 73.65 | +0.15% | 0.9K |

| General Electric Co | GE | 25.38 | +0.12% | 2.9K |

| McDonald's Corp | MCD | 94.4 | +0.11% | 2.7K |

| Merck & Co Inc | MRK | 56.5 | -0.53% | 0.5K |

| Chevron Corp | CVX | 127.36 | -0.42% | 3.4K |

| Nike | NKE | 76.54 | -0.30% | 0.2K |

| Cisco Systems Inc | CSCO | 24.99 | -0.04% | 22.0K |

Upgrades:

Downgrades:

Chevron (CVX) downgraded to Equal-Weight from Overweight at Morgan Stanley; tgt raised to $140 from $135

Other:

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia MI Inflation Gauge, m/m July 0.0% +0.2%

00:30 Australia MI Inflation Gauge, y/y July +3.0% +2.6%

01:30 Australia Retail sales (MoM) June -0.3% +0.6%

01:30 Australia Retail Sales Y/Y June +4.6% -0.2%

01:30 Australia ANZ Job Advertisements (MoM) July +4.4% +0.3%

07:30 Switzerland Manufacturing PMI July 54.0 52.8 54.3

08:30 Eurozone Sentix Investor Confidence August 10.1 9.5 2.7

08:30 United Kingdom PMI Construction July 62.6 62.4

09:00 Eurozone Producer Price Index, MoM June -0.1% 0.0% +0.1%

09:00 Eurozone Producer Price Index (YoY) June -1.0% -1.1% -0.8%

The U.S. dollar traded mixed to higher against the most major currencies in the absence of any economic reports in the U.S. Friday's release of disappointing U.S. labour market data still weighed on the greenback. The U.S. economy added 209,000 jobs in July, missing expectations for a growth of 230,000 jobs. The unemployment rate in the U.S. increased to 6.2% in July from 6.1% in June.

The euro traded slightly lower against the U.S. dollar after economic data from the Eurozone. The number of unemployed people in Spain fell by 29,800 in July, after a drop by 122,700 in June.

Sentix investor confidence in the Eurozone declined to 2.7 in August from 10.1 in July, missing forecasts of the decrease to 9.5.

Producer price index in the Eurozone climbed 0.1% in June, after a 0.1% fall in May. On a yearly basis, Eurozone's producer price index decreased 0.8% in June, after a 1.0% decline in May.

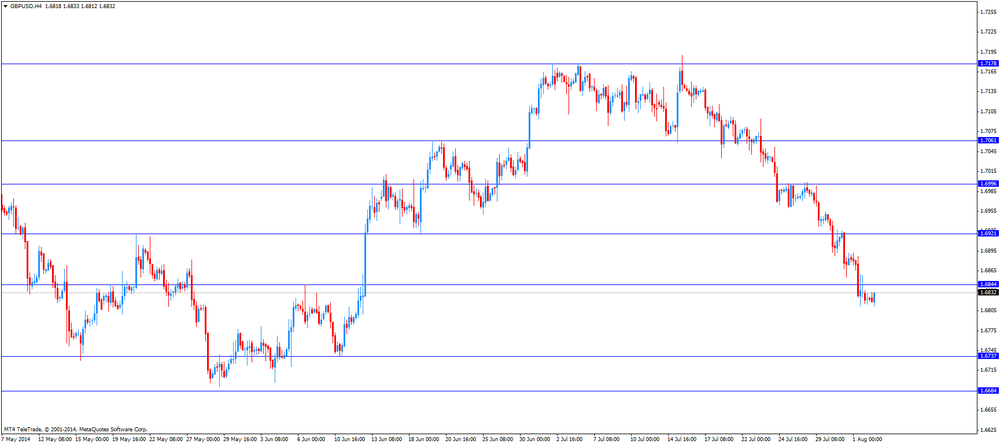

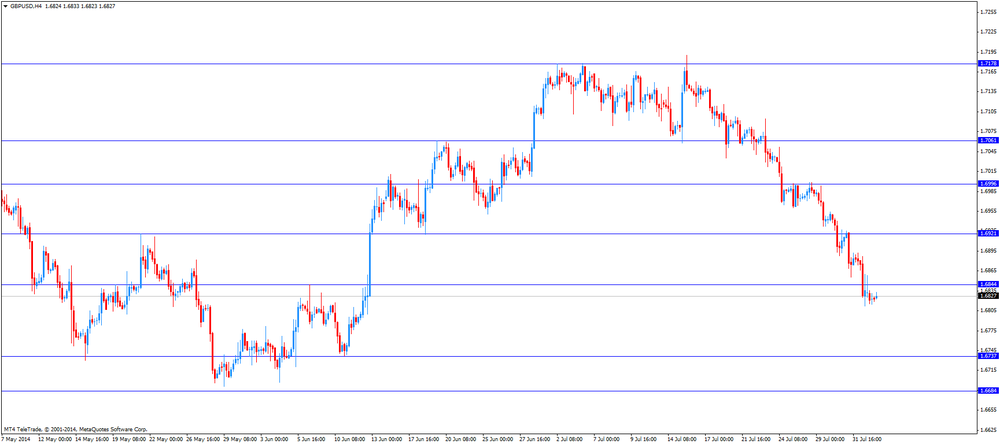

The British pound traded mixed against the U.S. dollar after the construction purchasing managers' index in the UK. Construction purchasing managers' index in the UK fell to 62.4 in July from 62.6 in June.

The Swiss franc traded little changed after the better-than-expected manufacturing purchasing managers' index. The Swiss manufacturing purchasing managers' index increased to 54.3 in July from 54.0 in June, beating expectations for a decline to 52.8.

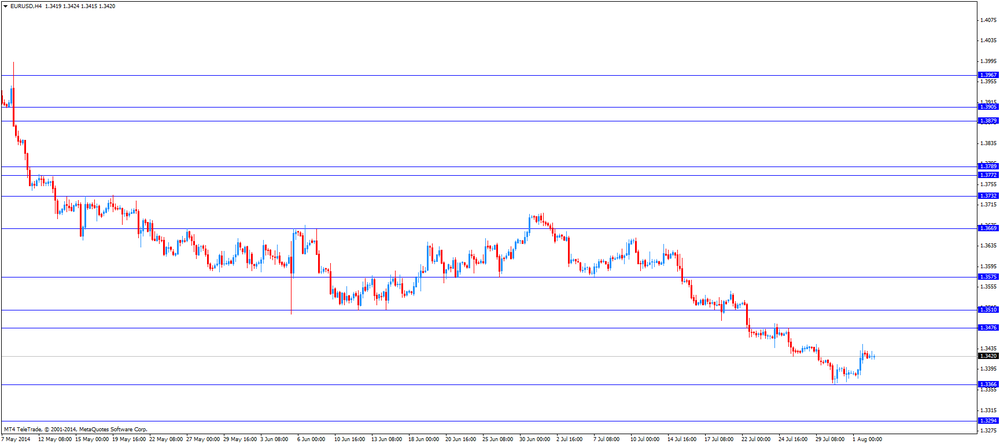

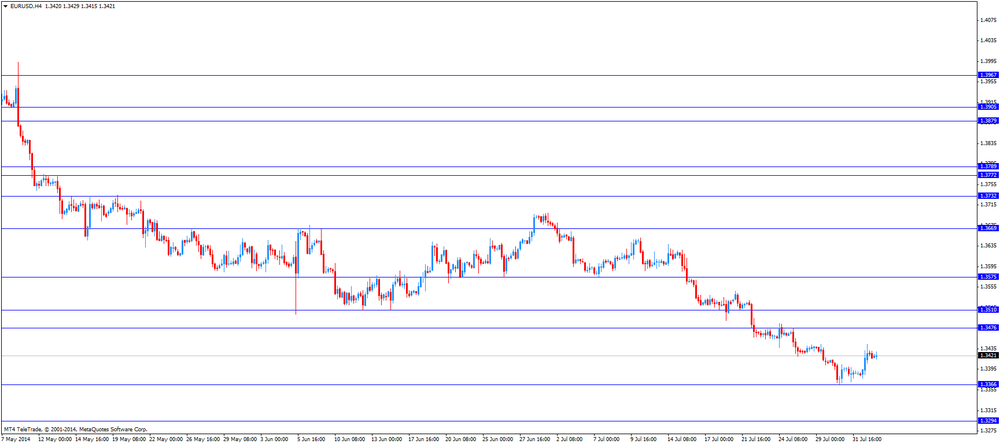

EUR/USD: the currency pair declined to $1.3415

GBP/USD: the currency pair traded mixed

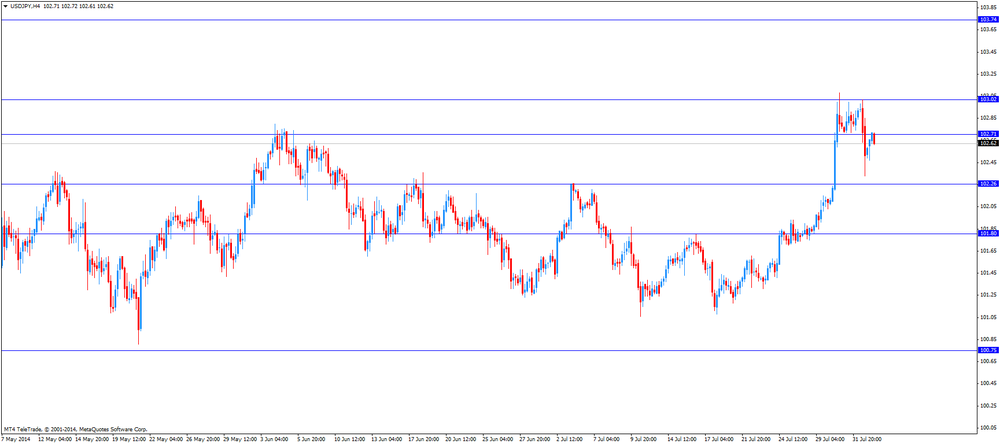

USD/JPY: the currency pair decreased to Y102.52

The most important news that are expected (GMT0):

12:30 Canada Bank holiday

23:30 Australia AIG Services Index July 47.6

EUR/USD

Offers $1.3500-10, $1.3475/85, $1.3445-50

Bids $1.3400, $1.3360/50

GBP/USD

Offers $1.6926, $1.6900

Bids $1.6800, $1.6785/80, $1.6750, $1.6700-693

AUD/USD

Offers $0.9400, $0.9375/80, $0.9350, $0.9330/35

Bids $0.9300, $0.9250, $0.9200

EUR/JPY

Offers Y139.00, Y138.80, Y138.50, Y138.00

Bids Y137.50, Y137.20, Y137.05/00, Y136.80, Y136.50

USD/JPY

Offers Y104.00, Y103.50, Y103.15, Y102.80

Bids Y102.30, Y102.25/20, Y102.00, Y101.80

EUR/GBP

Offers stg0.8100, stg0.8000, stg0.7985

Bids stg0.7900

Stock indices traded higher due to the bailout of Banco Espirito Santo SA. Portugal' central bank released its plan on Sunday to inject 4.9 billion euros into Banco Espirito Santo SA. Banco Espirito Santo will be split into a good and a bad bank.

The number of unemployed people in Spain fell by 29,800 in July, after a drop by 122,700 in June.

Sentix investor confidence in the Eurozone declined to 2.7 in August from 10.1 in July, missing forecasts of the decrease to 9.5.

Producer price index in the Eurozone climbed 0.1% in June, after a 0.1% fall in May. On a yearly basis, Eurozone's producer price index decreased 0.8% in June, after a 1.0% decline in May.

Construction purchasing managers' index in the UK fell to 62.4 in July from 62.6 in June.

Current figures:

Name Price Change Change %

FTSE 100 6,709.91 +30.73 +0.46%

DAX 9,225.28 +15.20 +0.17%

CAC 40 4,232.4 +29.62 +0.70%

EUR/USD $1.3370(E194mn), $1.3400(E260mn), $1.3450(E191mn), $1.3475(E391mn), $1.3485(E232mn), $1.3500(E210mn), $1.3535(E291mn)

USD/JPY Y101.80($320mn), Y102.20($320mn), Y102.60($315mn), Y103.00($350mn), Y104.55($230mn)

AUD/USD $0.9000(A$1.2bn), $0.9175(A$893mn), $0.9225(A$169mn), $0.9385(A$100mn), $0.9400(A$792mn)

AUD/JPY Y95.50(A$270mn)

USD/CAD C$1.0850($266mn), C$1.0855($165mn), C$1.0950($600mn)

Portugal' central bank released its plan on Sunday to inject 4.9 billion euros into Banco Espirito Santo SA.

Chinese manufacturing purchasing managers' index declined 54.2 in July from 55.0 in June.

Japan's monetary base was up to 42.7% in July from 42.6% in June.

Indexes on the close:

Nikkei 225 15,474.5 -48.61 -0.31%

Hang Seng 24,600.08 +67.65 +0.28%

Shanghai Composite 2,223.33 +38.03 +1.74%

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia MI Inflation Gauge, m/m July 0.0% +0.2%

00:30 Australia MI Inflation Gauge, y/y July +3.0% +2.6%

01:30 Australia Retail sales (MoM) June -0.3% +0.6%

01:30 Australia Retail Sales Y/Y June +4.6% -0.2%

01:30 Australia ANZ Job Advertisements (MoM) July +4.4% +0.3%

07:30 Switzerland Manufacturing PMI July 54.0 52.8 54.3

08:30 Eurozone Sentix Investor Confidence August 10.1 9.5 2.7

08:30 United Kingdom PMI Construction July 62.6 62.4

The U.S. dollar traded mixed against the most major currencies. Friday's release of disappointing U.S. labour market data weighed on the U.S. currency. The U.S. economy added 209,000 jobs in July, missing expectations for a growth of 230,000 jobs. The unemployment rate in the U.S. increased to 6.2% in July from 6.1% in June.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar traded higher against the U.S. dollar due to the better-than-expected retails sales in Australia. Retail sales in Australia climbed 0.6% in June, after a 0.3% fall in May. May's figure was revised up from a 0.5% decrease.

ANZ job advertisements in Australia increased 0.3% in July, after a 4.4% rise in May. May's figure was revised up from a 4.3% gain.

Australia's TD-MI monthly inflation gauge rose 0.2% in July, after 0.0% in June.

The Japanese yen traded lower against the U.S. dollar after the release of monetary base in Japan. Japan's monetary base was up to 42.7% in July from 42.6% in June.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair was up to Y102.70

The most important news that are expected (GMT0):

09:00 Eurozone Producer Price Index, MoM June -0.1% 0.0%

09:00 Eurozone Producer Price Index (YoY) June -1.0% -1.1%

12:30 Canada Bank holiday

23:30 Australia AIG Services Index July 47.6

EUR / USD

Resistance levels (open interest**, contracts)

$1.3555 (2517)

$1.3512 (3202)

$1.3477 (2212)

Price at time of writing this review: $ 1.3420

Support levels (open interest**, contracts):

$1.3377 (2826)

$1.3340 (2733)

$1.3296 (2854)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 33820 contracts, with the maximum number of contracts with strike price $1,3600 (4265);

- Overall open interest on the PUT options with the expiration date August, 8 is 33530 contracts, with the maximum number of contracts with strike price $1,3500 (6129);

- The ratio of PUT/CALL was 0.99 versus 1.06 from the previous trading day according to data from August, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (2740)

$1.7000 (1073)

$1.6901 (976)

Price at time of writing this review: $1.6823

Support levels (open interest**, contracts):

$1.6798 (3930)

$1.6700 (1067)

$1.6600 (431)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 19614 contracts, with the maximum number of contracts with strike price $1,7100 (2740);

- Overall open interest on the PUT options with the expiration date August, 8 is 26725 contracts, with the maximum number of contracts with strike price $1,6800 (3930);

- The ratio of PUT/CALL was 1.36 versus 1.40 from the previous trading day according to data from August, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.