- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-08-2011

Italian prosecutors confirmed an investigation of Moody's and S&P, saying recent moves by the agencies are a "failure" of judgement about Italy's finances. Investigators have seized documents from the offices of both firms, with 3 Moody's analysts and 1 S&P analyst being the focus of the probe.

All S&P industry groups plummeted down more than 3%. Industrial Goods and Basic Materials were hit the hardest, losing 4.6% and 5.6% respectively.

U.S. stock equities are under pressure from ongoing concerns about slowdown in the U.S. and EU economies.

US dollar declines versus “save haven” currencies frank and yen. The dollar is still under from pressure from ongoing concerns about slowdown in the U.S. and EU economies. Another pressure are speculations that the Fed may would provide more stimulus if needed.

The franc bounces back against the dollar. Today it was falling after the Swiss National Bank cut interest rates from 0.25% to zero yesterday.

The yen also corrects against the dollar. Today it plunged against all its major counterparts after Japan sold its currency in the foreign- exchange market for the first time since March to stem gains that threaten the nation’s economic recovery.

The euro sheds versus the dollar after ECB President Jean-Claude Trichet acknowledged a “particularly high” level of uncertainty said inflation expectations “must remain firmly anchored.” He said the ECB will offer banks additional cash as the region’s debt crisis spreads increasing pressure on policy makers to resume bond purchases.

Also today Italian 10-year bond spread over German 10-year Bunds widens to a new record of 391 bps. Both French and Belgium 10-year bond spread over German Bunds are at record wides.

The Canadian currency fell to the lowest level over 5 weeks amid declining crude oil prices, Canada’s biggest export.

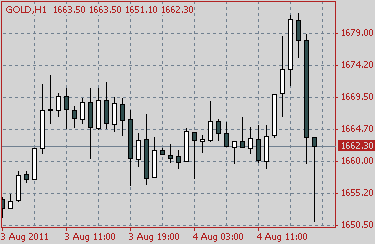

Despite the risk-aversion panic in financial markets, gold has backtracked from its earlier high at $1681.00 as trader talk speculates that recent increased volatility in the pair could prompt changes in margin requirements at some exchanges.

The gold plunged from $1685 to $1660 per once over 2 hours amid ECB Triche' comments.

Currently August gold futures are at $1,663 per once (-0.20%).

Any residual stops now triggered sub $1.4130 as euro lurches to a fresh low for the day and as US and European stocks take a whack. Euro traded sub $1.4120, pulls up shy of bids and stops reported around $1.4110.

EUR/USD: $1.4300, $1.4325, $1.4480

USD/JPY: Y78.00, Y78.50, Y79.50, Y80.00, Y80.85

EUR/JPY: Y113.50, Y113.15, Y110.00

AUD/USD: $1.0600, $1.0680, $1.0750

AUD/JPY: Y86.00

USD/CAD: C$0.9675

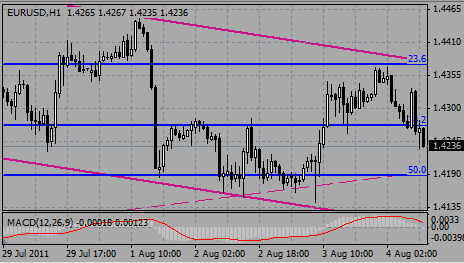

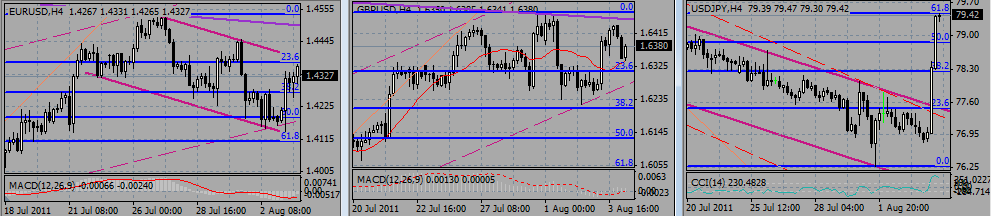

EUR/USD: the pair decreased in $1.4230 area.

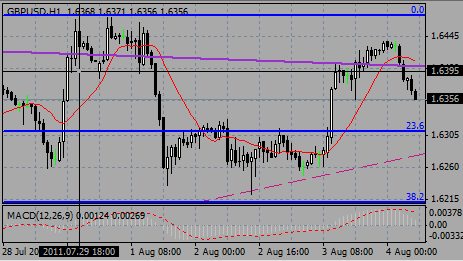

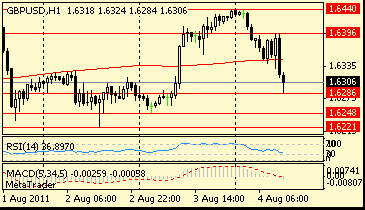

GBP/USD: the pair decreased in $1.6330 area.

USD/JPY: the pair holds in Y80.00 area.

US Jobless claims report also due to come at 12:30 GMT.

EUR/GBP broke under stg0.8700 to a new lows around stg0.8680 before corrected to current stg0.8695. Support remains at stg0.8675/65 (200-dma).

GBP/USD weakens following the euro, while EUR/GBP pressures stops through stg0.8695/90. Cable broke under support in the area between $1.6380/70, with 50% retrace of the recovery from $1.6333 to $1.6395 coming in around $1.6364. Below here and rate can ease toward $1.6350 ($1.6348 76.4%) ahead of $1.6335/30. Resistance remains at $1.6400.

Data released:

05:00 Japan BoJ meeting announcement 0.00-0.10% 0.00-0.10%

The yen weakened against all its major counterparts after Japan sold its currency in the foreign- exchange market for the first time since March to stem gains that threaten the nation’s economic recovery.

The yen slumped more than 3% against the dollar, the biggest intraday drop since March, after the Bank of Japan followed its Swiss counterpart in easing monetary policy.

Japanese Finance Minister Yoshihiko Noda said today’s intervention was one-side.

“Intervention will be more effective if it comes with monetary easing,” said Kazuo Kitazawa at Credit Suisse Group AG. “I can’t say intervention is successful until the yen depreciates beyond 80 against the dollar.”

The Bank of Japan expanded its asset-purchase fund to 15 trillion yen ($189 billion) from 10 trillion yen, according to a statement. Policy makers also kept the benchmark interest rate near zero. They ended their meeting a day earlier than scheduled on request of the government.

The franc fell for a second day after the Swiss National Bank cut interest rates to zero yesterday.

The Swiss National Bank yesterday lowered its target from 0.25%.

The franc has gained 9.2% over the past month. The yen has risen 0.9% and the dollar has fallen 0.9%, the indexes show.

Meanwhile, gains in the dollar were tempered before U.S. reports today and tomorrow that economists said will show initial jobless claims rose and the unemployment rate stayed above 9%.

EUR/USD rose to $1.4344 after it earlier tested lows on $1.4140. Later rate recovered decline and weakened to $1.4245/50.

USD/JPY eased from Y77.40 to Y76.80 before BOJ intervention lifted it to Y80.00. Currenty rate retreats.

Germany's Factory Orders are scheduled at 10:00 GMT.

The BoE and ECB rate decisions will be the main focus for today with announcement comes at 11:00 GMT and 11:45 GMT respectively.

Later the main attention will be on ECB's head Trichet's traditional press-conference at 12:30 GMT.

US Jobless claims report also due to come at 12:30 GMT.

- BOJ's outlook on economic recovery still intact;

- we don't make our policy based on some specific forex levels;

- uncertainty over the economy still big.

- BOJ's outlook on economic recovery still intact;

- we don't make our policy based on some specific forex levels;

- uncertainty over the economy still big.

- expects BOJ efforts to be effective;

- continuing to watch FX markets;

- will take steps if necessary.

EUR/USD: $1.4300, $1.4325, $1.4480

USD/JPY: Y78.00, Y78.50, Y79.50, Y80.00, Y80.85

EUR/JPY: Y113.50, Y113.15, Y110.00

AUD/USD: $1.0600, $1.0680, $1.0750

AUD/JPY: Y86.00

USD/CAD: C$0.9675

EUR/USD

Offers: $1.4320/25

Bids: $1.4270, $1.4250, $1.4235/30, $1.4200

GBP/USD

Offers: $1.6440/50

Bids: $1.6320/10

USD/JPY

Offers: Y80.00/10

Data released:

07:45 Italy PMI services (July) 48.6 47.0 47.4

07:50 France PMI services (July) 54.2 54.2 56.1

07:55 Germany PMI services (July) seasonally adjusted 52.9 52.9 56.7

08:00 EU(17) PMI services (July) 51.6 51.4 53.7

08:30 UK CIPS services index (July) 55.4 53.2 53.9

09:00 EU(17) Retail sales (June) adjusted 0.9% 0.4% -1.3 (-1.1)%

09:00 EU(17) Retail sales (June) adjusted Y/Y -0.4% -1.1% -2.3 (-1.9)%

12:15 USA ADP employment (July) +114K +97K +157K

14:00 USA ISM Non-mfg PMI (July) 52.7 52.8 53.3

14:00 USA ISM Non-mfg business index (July) - 53.4

14:00 USA Factory orders (June) -0.8% -1.0% 0.6 (0.8)%

US dollar remained under pressure amid worries that US economic recovery linger. Another factor to fall is ISM Non-Manufacturing data, which missed estimates.

Better-than-expected statistics from ADP didn't support the currency as last month ADP data were also significantly higher forecasts, but followed two days later government report showed substantial lower payrolls than expected.

The franc fell after the Swiss National Bank decided to cut its interest rate target to curb franc's sharp appreciation.

The Swiss franc renewed its downward trend against the dollar after the nation’s central bank said the currency is “massively overvalued.” The central bank said it "have to take measures against strong frank".

The loonie fell after Canada’s 30-year government bonds rose to the records dating at 1970. Earlier the currency war under pressure amid weak macroeconomic data in the US, Canada’s largest trading partner.

Yen continued gaining despite today Japan FinMin Noda said that “Yen is overvalued and will do "utmost" to stem yen strength”.

Australia’s currency rebounds against the U.S. dollar after its 5-day fall as today data showed an unexpected decline in retail sales in June. The Aussie also fell as the Bureau of Statistics in Sydney reported a lower-than-forecast trade surplus.

The New Zealand’s dollar also corrected versus the dollar. Today the currency slid to the lowest two weeks against the greenback after Fonterra Cooperative Group Ltd., the world’s largest dairy exporter, said whole-milk powder prices remained near an eight-month low.

EUR/USD rose to $1.4344 after it tested daily lows around $1.4140. Later rate was narrowed within the $1.4260/$1.4350 range.

GBP/USD gained from $1.6250 to $1.6410. After some consolidation rate resumed its recovery and printed highs on $1.6430.

USD/JPY weakened from Y77.40 to Y76.80.

Germany's Factory Orders are scheduled at 10:00 GMT.

The BoE and ECB rate decisions will be the main focus for today with announcement comes at 11:00 GMT and 11:45 GMT respectively.

Later the main attention will be on ECB's head Trichet's traditional press-conference at 12:30 GMT.

US Jobless claims report also due to come at 12:30 GMT.

Majors close:

Nikkei -207.45 (-2.11%) 9,637.14

Topix -17.21 (-2.04%) 826.75

DAX -156.16 (-2.30%) 640.59

CAC -67.85 (-1.93%) 3,454.94

FTSE-100 -133.88 (-2.34%) 5,584.51

Dow +29.82 (+0.25%) 11,896.40

Nasdaq +6.29 (+0.50%) 1,260.34

S&P500 +23.83 (0.89%) 2,693.07

10-Years 2.62% +0.009

Oil -1.860 (-1.98%) 91.930

Gold -21.800 (-1.33%) 1,666.300

Most Asian stock markets closed lower by 2% on Wednesday.

Investors remained cautious as questions about the US economic recovery linger amid weak US macroeconomic data. The markets was also under speculations about EU debt crisis as Italy’s 10-year yield jumped to the most since 1997 Tuesday.

So many investors dumped equities in favor of investments perceived to be safer, such as gold. The gold hit a new life-time high at the Asian session.

Port operator Cosco Pacific Ltd. plunged 7.6%, and merchandise trading firm Li & Fung Ltd. sank 5%.

Shares of China Cosco Holdings Co. tumbled 5.2% in Hong Kong, after UOB Kay Hian cut its price target, saying the shipping company is expected to post a loss in the first half of the year.

Many of the region’s steel makers were also hard-hit, with JFE Holdings Inc. dropping 3.3% in Tokyo, BlueScope Steel Ltd. stumbling 5.4% in Sydney, and Hyundai Steel Co. giving up 3.9% in Seoul.

Such concerns helped the financial sector lose ground in Asia, with Sumitomo Mitsui Trust Holdings Inc. down 2.7% in Tokyo, Australia & New Zealand Banking Group Ltd. dropping 2.6% in Sydney, and HSBC Holdings PLC losing 1.2% in Hong Kong.

European stock equities also ended the day lower by 2%.

The markets remain under pressure by concerns over possible slowdown in global economy growth. On Wednesday both French and Belgium 10-year bond spreads over German Bunds were at record widens, boosting worries about EU debt crisis.

The exchanges received support from beating PMI services data from UK and EU in a whole.

Then Italian PM Berlusconi spoke, denying a problem and blaming the current crisis on international speculation. He said the nation's banks - having passed the stress tests – “are solid”, and noted that “Italy is well capitalized and can finance the economy”.

Morning inventories data from EIA put pressure on the markets as showed a rise in stockpiles by 1 mln barrels in the week ended June 23.

Cairn Energy PLC was among Wednesday’s worst performers in London, dropping 5.1%. The oil and gas exploration company said its LF7-1 well, drilled in a basin off the coast of Greenland, didn’t find oil.

Mining stocks were also lower, including a 4.2% pullback for BHP Billiton PLC (-4.22%) . Credit Suisse downgraded BHP to a neutral rating from outperform, saying Rio Tinto PLC (-3.86%) is its preferred play in the sector.

The banking sector of the region appeared under pressure after French bank Societe Generale (-9%) warned that its 2012 earnings target will be hard to achieve after taking writedowns on its Greek bond holdings.

Most other banks saw shares fall, including a 6.6% retreat for Credit Agricole SA in Paris and a 3.7% pullback for Commerzbank AG in Frankfurt.

US stocks rebounded to the green zone.

Concerns about slowdown in global economy remained as the US debt ceiling bill was signed Tuesday. A fall in ISM Non-Manufacturing put pressure on the markets during the afternoon.

Despite the disappointing U.S. macroeconomic data and continuing concerns over US economy, the stock markets received a strong support from a bundle number of positive corporate reports.

Partly the markets were supported by some upbeat comments from Fed governors Donald Kohn, Vincent Reinhart and Brian Madigan, who told the Wall Street Journal that the Fed may consider another round of stimulus.

Economy: According to the report drom ADP Employer Services, companies in the U.S. added 114K workers to payrolls in July, beating estimated gain of 101K. The June figure was revised down to a gain of 145K from a previously reported 157K.

June factory orders declined by 0.8% after rising 0.6% last period, but up from forecasted drop by 1.0%.

Crude oil stocks change from EIA showed a rise in stockpiles by 1 mln barrels in the week ended June 23.

Japan's benchmark stock indices ended session mixed, unable to hold gains after the BOJ moved on policy. The Nikkei ended higher by 22.04 points, or 0.23%, to stand at 9659.18. The broader-based TOPIX was down 0.48 points at 826.27.

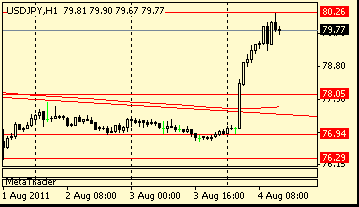

Resistance 3: Y81.50

Resistance 2: Y80.30

Resistance 1: Y80.00

Current price: Y79.97

Support 1: Y78.80

Support 2:Y77.50

Support 3:Y76.80

Comments: Rate continues its rally while the itervention lifted it from Y77.00/05 to current highs around Y80.00. Above resistance is around Y80.30 and then - at Y81.50 (Jul 08 high). Support is near Y78.80 (50% of Y81.50 - Y76.30 decline). Further losses may widen to Y77.50 (earlier broken resistance line from Jul 25).

Resistance 3: Chf0.8000

Resistance 2: Chf0.7960

Resistance 1: Chf0.7820

Current price: Chf0.7782

Support 1: Chf0.7680

Support 2: Chf0.7610/00

Support 3: Chf0.7540/50

Comments: Rate holds around session highs with resistance is near Chf0.7820 (23.6% Fibo of Chf0.8515 - Chf0.7610), then - on Chf0.7960 (38.2%). If rate retreats support comes at Asian low on Chf0.7680. Next band of support is near record lows on Chf0.7610/00.

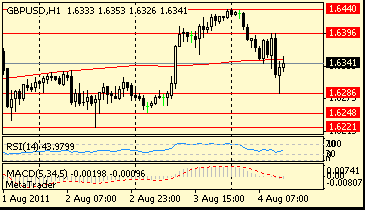

Resistance 3: $1.6540

Resistance 2: $1.6475

Resistance 1: $1.6440

Current price: $1.6360

Support 1: $1.6360

Support 2: $1.6280

Support 3: $1.6220

Comments: rate weakens after earlier rise to $1.6440 (resistance now). Suppoer comes at $1.6360 (NY hours lows) with a break lower losses may widen to $1.6280 (channel line from Jul 12). Break above $1.6440 targets Aug 01 high on $1.6475.

Nikkei -207.45 (-2.11%) 9,637.14

Topix -17.21 (-2.04%) 826.75

DAX -156.16 (-2.30%) 640.59

CAC -67.85 (-1.93%) 3,454.94

FTSE-100 -133.88 (-2.34%) 5,584.51

Dow +29.82 (+0.25%) 11,896.40

Nasdaq +6.29 (+0.50%) 1,260.34

S&P500 +23.83 (0.89%) 2,693.07

10-Years 2.62% +0.009

Oil -1.860 (-1.98%) 91.930

Gold -21.800 (-1.33%) 1,666.300

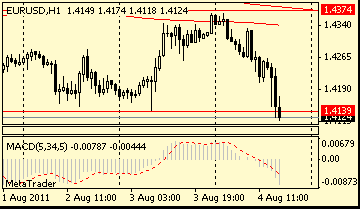

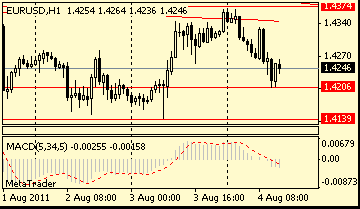

Resistance 3: $1.4540

Resistance 2: $1.4450

Resistance 1: $1.4370/80

Current price: $1.4283

Support 1: $1.4260

Support 2: $1.4140

Support 3: $1.4110

Comments: Rate was close to resistance zone between $1.4370/80 overnight (channel line from Jul 27, also 23.6% Fibo of $1.3840 - $1.4540), but failed to break above and retreated. Support remains at $1.4260 (local Aug 03 lows), then - at $1.4140 (Aug 03 lows). Break above $1.4370/80 targets $1.4450 (Aug 01 high).

10:00 Germany Manufacturing orders (June) seasonally adjusted -0.4% 1.8%

10:00 Germany Manufacturing orders (June) not seasonally adjusted, workday adjusted Y/Y 6.7% 12.2%

11:00 UK BoE meeting announcement 0.50% 0.50%

11:45 EU(17) ECB meeting announcement 1.50% 1.50%

12:30 EU(17) ECB press conference

12:30 USA Jobless claims (week to 30.07) 410K 398K

20:30 USA M2 money supply (25.07), bln - +34.1

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.