- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-07-2014

Most stock indices traded lower in the absence of any major economic reports. The trading volume was thin as markets in the U.S. were closed for the Independence Day holiday.

Stocks declined after yesterday's gains. Yesterday's gains were driven by comments by European Central Bank President Mario Draghi and strong the U.S. jobs data. Mr. Draghi said the ECB will keep interest rate at the present levels for an extended period of time.

U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

German factory orders decreased 1.7% in May, missing expectations for a 0.8% fall, after a 3.4% gain in April. April's figure was revised up from a 3.1% increase.

On a yearly basis, German factory orders rose 5.5% in May, after a 6.3% increase in April.

Erste Group Bank AG dropped 16% after the company forecasted a full-year loss.

Raiffeisen Bank International AG shares decreased 4.1%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,866.05 +0.84 +0.01%

DAX 10,009.08 -20.35 -0.20%

CAC 40 4,468.98 -20.90 -0.47%

Prices of oil futures fell slightly today, but in the week showed maximum decline from the beginning of January. The focus of the market is still in the Middle East.

"Concerns about the declining supply, but prices are kept at a high level due to Iraq. Improving consumption forecasts combined with fears for delivery. Under such conditions, sell a few," - said vice-president of IHS Energy Insight Victor Shum. "If not for Iraq, the price would be much lower due to the possibility of increasing supplies from Libya and Iran"

It is worth noting that investors follow the negotiations on Iran's nuclear program that could lead to the lifting of sanctions, including Iran's oil exports. As for Libya, earlier this week the Prime Minister announced the end of the oil crisis, during which exports almost stopped.

At the same time, the Government of Iraq in the autonomous province of Kurdistan threatens to sue the central government does not recognize the right to an independent Kurdistan oil exports. In Syria, the Islamists seized the country's largest oil field, but Syria is not among the major oil producers and oil exported since 2011, when it came to international sanctions.

Meanwhile, we add that the American brand of WTI crude oil has suffered greater losses than Brent, responding to concerns that the hurricane "Arthur", coming to the shores of the United States, will reduce the demand for gasoline from the Americans, who during the holidays may prefer to stay at home.

Also note that today the trading volume declined as U.S. markets closed for the Independence Day holiday.

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 103.78 a barrel on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture fell 20 cents to $ 110.82 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded higher against the most major currencies. The U.S. currency was still supported by yesterday's better-than-expected U.S. labour market data. U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

Markets in the U.S. are closed for the Independence Day holiday on Friday.

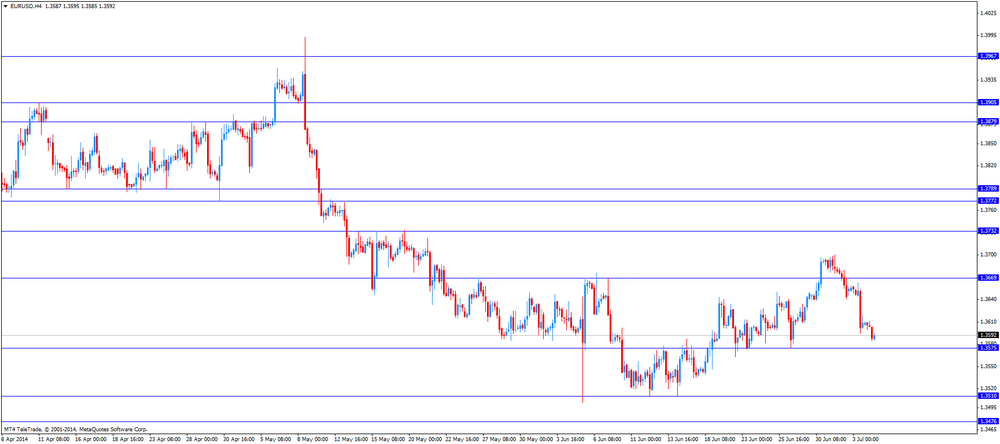

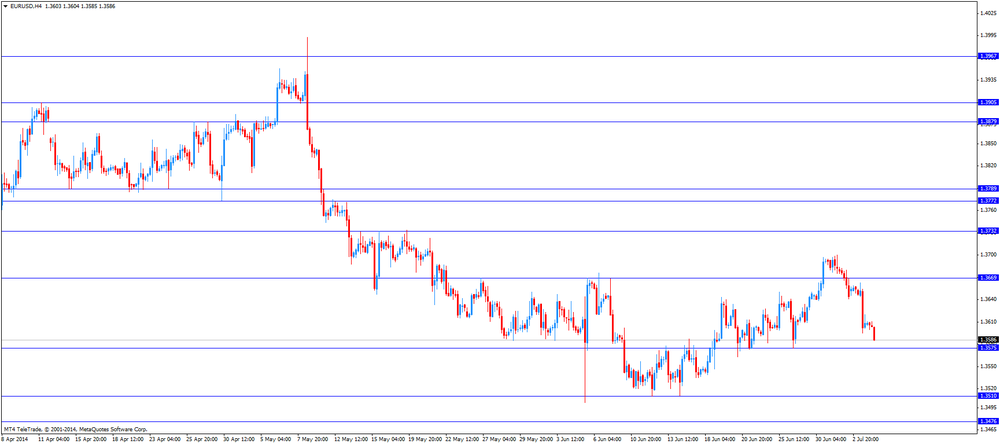

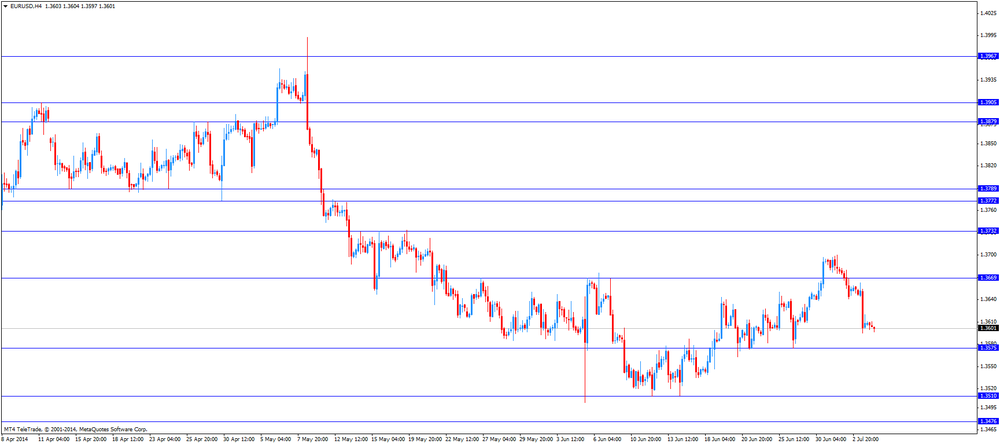

The euro traded lower against the U.S. dollar due to the weaker-than-expected German factory orders. German factory orders decreased 1.7% in May, missing expectations for a 0.8% fall, after a 3.4% gain in April. April's figure was revised up from a 3.1% increase.

On a yearly basis, German factory orders rose 5.5% in May, after a 6.3% increase in April.

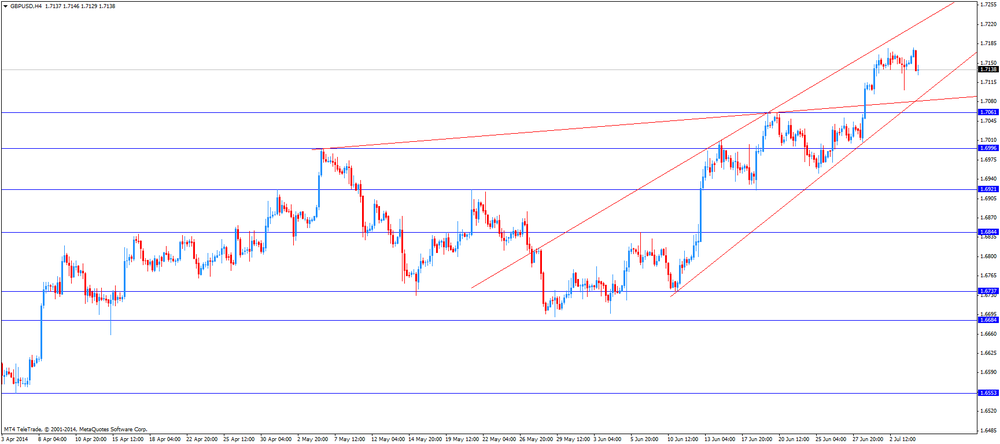

The British pound traded lower against the U.S. dollar in the absence of any major economic reports in the U.K.

The New Zealand dollar traded lower against the U.S dollar due to yesterday's strong U.S. labour market data. No economic reports were released in New Zealand.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports in Australia. Yesterday's strong U.S. labour market data and comments by the Reserve Bank of Australia (RBA) Governor Glenn Stevens still weighed on the Australian currency. The RBA Governor said that the Australian dollar remains high by historical standards and investors are underestimating the probability of a significant fall in the Australian dollar at some point.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports in Japan. Yesterday's strong U.S. labour market data still weighed on the yen.

Gold prices rose slightly, while closer to the maximum value since March. Continued to dictate the dynamics of trading yesterday's optimistic data on U.S. employment. We also add that today's trading volume is lower than usual as U.S. markets closed for the Independence Day holiday.

Recall that yesterday's report from the U.S. Department of Labor has shown that non-farm employment increased to a seasonally adjusted 288,000 last month. Gain May was revised to 224,000 from 217,000, while the improvement in April was increased to 304,000 from 282,000. This was the strongest increase since January 2012. The unemployment rate, derived from a separate survey of households, fell to 6.1% in June to the lowest level since September 2008. Improvement reflects more people employed, while the size of the workforce has remained relatively stable. Economists had forecast an increase in employment by 211,000 and the unemployment rate according to them was to remain unchanged - at 6.3%.

"Liquidity fell again in connection with a holiday in the United States. But when trading volume will increase on Monday, gold becomes cheaper because long positions are closed, "- said precious metals trader in Tokyo.

From a technical standpoint, the price could fall to $ 1,300 an ounce, because it had previously fallen below the support level of $ 1,316.

Over the week, gold has risen in price again, extending this series to 5 weeks due to geopolitical problems in the Middle East and Ukraine.

The cost of the August gold futures on the COMEX today rose to $ 1321.2 per ounce.

EUR/USD $1.3600, $1.3620

USD/JPY Y101.70-75, Y101.90-95

EUR/JPY Y139.25

EUR/GBP 0.7970, stg0.8050

AUD/USD $0.9350, $0.9400

NZD/USD $0.8655

EUR/USD

Offers $1.3700-20, $1.3680/85, $1.3660, $1.3635

Bids $1.3576-74, $1.3565, $1.3550/40

GBP/USD

Offers $1.7300, $1.7250, $1.7230, $1.7200

Bids $1.7095/90, $1.7065, $1.7035/30, $1.7010

AUD/USD

Offers $0.9505, $0.9480, $0.9465/70, $0.9420, $0.9400

Bids $0.9330, $0.9320, $0.9300

EUR/JPY

Offers Y140.50, Y140.00, Y139.50, Y139.30, Y139.00

Bids Y138.50, Y138.20, Y138.00

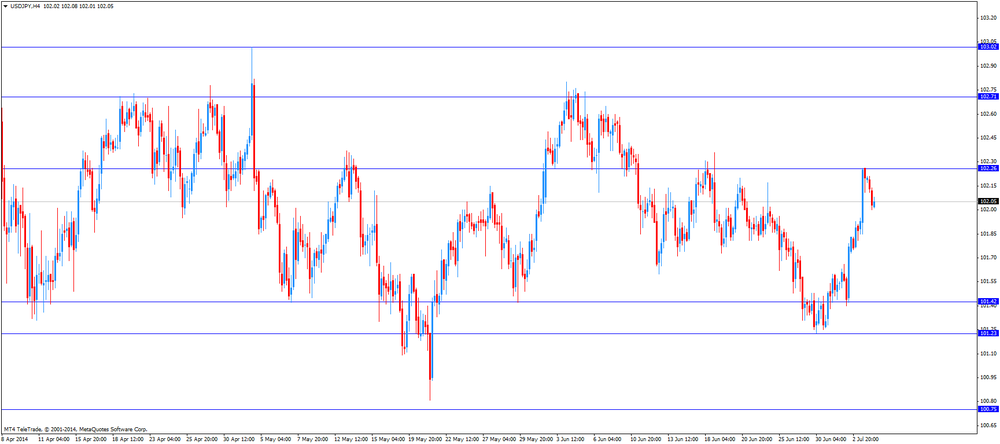

USD/JPY

Offers Y102.80, Y102.65, Y102.50, Y102.30

Bids Y101.70, Y101.40/30, Y101.20, Y101.10/00, Y100.80

EUR/GBP

Offers stg0.8030, stg0.8000, stg0.7970

Bids stg0.7915, stg0.7905-890, stg0.7800

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:40 Australia RBA Assist Gov Edey Speaks

06:00 Germany Factory Orders s.a. (MoM) May +3.4% Revised From +3.1% -0.8% -1.7%

06:00 Germany Factory Orders n.s.a. (YoY) May +6.3% +5.5%

The U.S. dollar traded higher against the most major currencies. The U.S. currency was supported by yesterday's better-than-expected U.S. labour market data. U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

Markets in the U.S. are closed for the Independence Day holiday on Friday.

The euro declined against the U.S. dollar due to the weaker-than-expected German factory orders. German factory orders decreased 1.7% in May, missing expectations for a 0.8% fall, after a 3.4% gain in April. April's figure was revised up from a 3.1% increase.

On a yearly basis, German factory orders rose 5.5% in May, after a 6.3% increase in April.

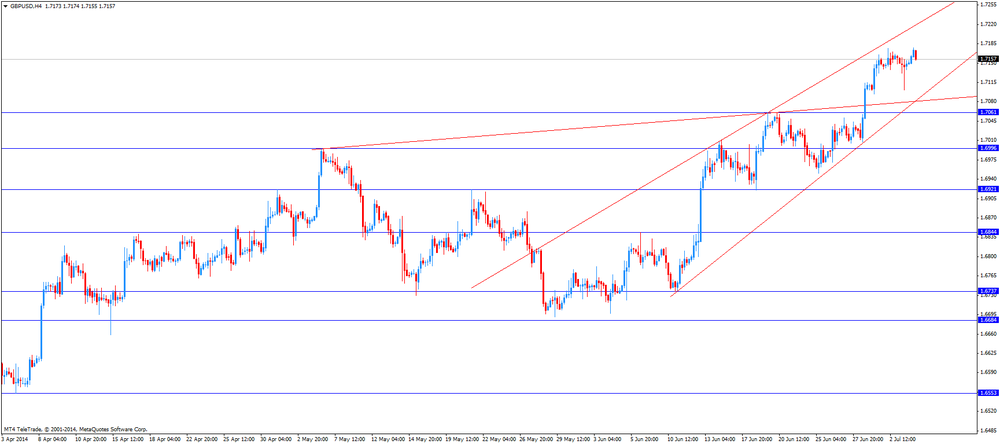

The British pound decreased against the U.S. dollar in the absence of any major economic reports in the U.K.

EUR/USD: the currency pair fell to $1.3585

GBP/USD: the currency pair declined to $1.7129

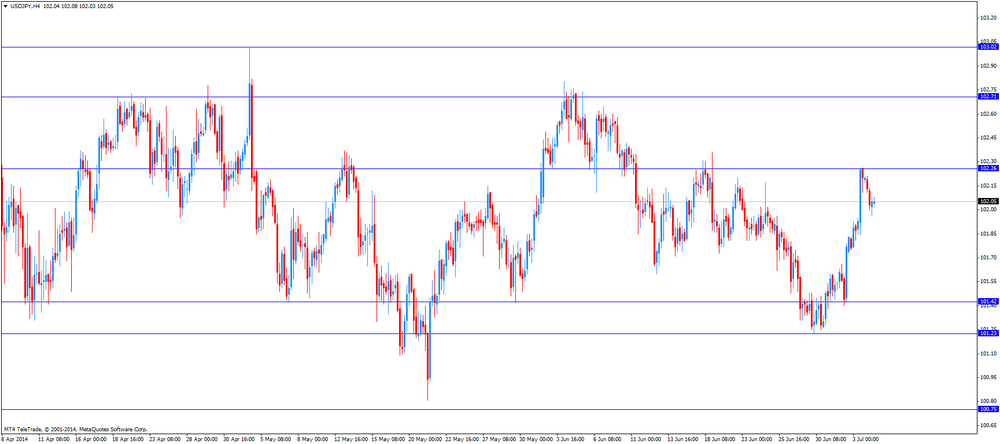

USD/JPY: the currency pair traded mixed

Most stock indices traded lower after yesterday's gains. Stocks increased due to comments by European Central Bank President Mario Draghi and strong the U.S. jobs data. Mr. Draghi said the ECB will keep interest rate at the present levels for an extended period of time.

U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

German factory orders decreased 1.7% in May, missing expectations for a 0.8% fall, after a 3.4% gain in April. April's figure was revised up from a 3.1% increase.

On a yearly basis, German factory orders rose 5.5% in May, after a 6.3% increase in April.

Erste Group Bank AG dropped 14% after the company forecasted a full-year loss.

Raiffeisen Bank International AG shares decreased 4.8%.

Current figures:

Name Price Change Change %

FTSE 100 6,866.43 +1.22 +0.02%

DAX 10,021.54 -7.89 -0.08%

CAC 40 4,482.37 -7.51 -0.17%

Most Asian stock indices traded higher due to the better-than-expected U.S. labour market data. U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

The Japanese shares were also supported by the weak yen.

Indexes on the close:

Nikkei 225 15,437.13 +88.84 +0.58%

Hang Seng 23,546.36 +14.92 +0.06%

Shanghai Composite 2,059.37 -3.85 -0.19%

EUR/USD $1.3600, $1.3620

USD/JPY Y101.70-75, Y101.90-95

EUR/JPY Y139.25

EUR/GBP 0.7970, stg0.8050

AUD/USD $0.9350, $0.9400

NZD/USD $0.8655

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:40 Australia RBA Assist Gov Edey Speaks

06:00 Germany Factory Orders s.a. (MoM) May +3.4% Revised From +3.1% -0.8% -1.7%

06:00 Germany Factory Orders n.s.a. (YoY) May +6.3% +5.5%

The U.S. dollar traded mixed against the most major currencies. The U.S. currency was supported by yesterday's better-than-expected U.S. labour market data. U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008.

Markets in the U.S. are closed for the Independence Day holiday on Friday.

The New Zealand dollar declined against the U.S dollar due to yesterday's strong U.S. labour market data. No economic reports were released in New Zealand.

The Australian dollar traded slightly higher against the U.S. dollar in the absence of any major economic reports in Australia. Yesterday's strong U.S. labour market data and comments by the Reserve Bank of Australia (RBA) Governor Glenn Stevens still weighed on the Australian currency. The RBA Governor said that the Australian dollar remains high by historical standards and investors are underestimating the probability of a significant fall in the Australian dollar at some point.

The Japanese yen traded higher against the U.S. dollar in the absence of any major economic reports in Japan. Yesterday's strong U.S. labour market data still weighed on the yen.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.7175

USD/JPY: the currency pair declined to Y102.00

EUR / USD

Resistance levels (open interest**, contracts)

$1.3705 (2149)

$1.3679 (1595)

$1.3644 (275)

Price at time of writing this review: $ 1.3606

Support levels (open interest**, contracts):

$1.3570 (311)

$1.3551 (1747)

$1.3527 (1594)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 19043 contracts, with the maximum number of contracts with strike price $1,3800 (3163);

- Overall open interest on the PUT options with the expiration date August, 8 is 26370 contracts, with the maximum number of contracts with strike price $1,3500 (6253);

- The ratio of PUT/CALL was 1.38 versus 1.29 from the previous trading day according to data from July, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.7402 (975)

$1.7304 (1371)

$1.7207 (1360)

Price at time of writing this review: $1.7171

Support levels (open interest**, contracts):

$1.7092 (700)

$1.6996 (1288)

$1.6898 (1539)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 13361 contracts, with the maximum number of contracts with strike price $1,7100 (1584);

- Overall open interest on the PUT options with the expiration date August, 8 is 16701 contracts, with the maximum number of contracts with strike price $1,6900 (1539);

- The ratio of PUT/CALL was 1.25 versus 0.94 from the previous trading day according to data from Jule, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(index / closing price / change items /% change)

S&P/ASX 200 5,491.2 +35.80 +0.66%

TOPIX 1,278.59 -2.19 -0.17%

SHANGHAI COMP 2,063.14 +3.72 +0.18%

FTSE 100 6,865.21 +48.84 +0.72%

CAC 40 4,489.88 +45.16 +1.02%

DAX 10,029.43 +118.16 +1.19%

Dow +92.02 17,068.26 +0.54%

Nasdaq +28.2 4,485.93 +0.63%

S&P +10.82 1,985.44 +0.55%

(raw materials / closing price /% change)

Gold $1,319.92 -6.94 -0.52%

Oil $103.84 -0.64 -0.61%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3609 -0,35%

GBP/USD $1,7152 -0,06%

USD/CHF Chf0,8933 +0,51%

USD/JPY Y102,21 +0,44%

EUR/JPY Y139,08 +0,08%

GBP/JPY Y175,27 +0,35%

AUD/USD $0,9344 -1,04%

NZD/USD $0,8747 -0,27%

USD/CAD C$1,0640 -0,24%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.