- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-05-2022

- Gold Prices are marching towards $1,900.00 as the DXY loses appeal despite the hawkish Fed.

- The Fed has warned of more jumbo rate hikes in the next couple of meetings.

- The upside break of Descending Triangle chart pattern signals more gains ahead.

Gold Price (XAU/USD) is advancing firmly towards the psychological resistance of $1,900 after a strong upside move from around $1,866.00 as the announcement of the interest rate decision by the Federal Reserve (Fed) underpinned the precious metal against the greenback. The market participants have witnessed an activation of the ‘Buy on Rumor and Sell on News’ indicator, which has dragged the US dollar index (DXY) below the round level support of $103.00 strongly.

Key points from Fed’s policy

Fed chair Jerome Powell displayed an aggressive hawkish stance on the policy rates by stepping up the rates with 50 basis points (bps) rate hike and warned investors of more half-a-percent rate hikes in the next couple of monetary policy meetings. The Fed dictated that multi-decade inflation needs all-round restrictions to get contained. The process of balance sheet reduction will get started, which will strengthen the other quantitative tools to curb the inflation mess. Apart from that, the Fed stated that the US economy is solid enough to absorb the heat of a restrictive policy stance.

Gold technical analysis

On an hourly scale, XAU/USD has given a breakout of the Descending Triangle chart pattern on the upside. This leads to an expansion in volume and tick size after the volatility contraction. A bull cross has been displayed by the 20- and 50-period Exponential Moving Averages (EMAs), which adds to the upside filters. The relative Strength Index (RSI) has shifted into a bullish range of 60.00-80.00 from 40.00-60.00, which signals a fresh bullish impulsive wave going forward.

Gold hourly chart

-637873055187496498.png)

- EUR/USD pares the biggest daily gains in two months around one-week high.

- Overbought RSI triggered consolidation but 200-HMA, multiple levels challenge further downside.

- Key Fibonacci Retracement levels stay on the bull’s radar until the quote breaks nearby support.

EUR/USD bulls seem running out of steam after rising the most since early March, taking rounds to 1.0610-15 during Thursday’s Asian session.

The major currency pair’s latest weakness could be linked to the overbought conditions of the RSI (14).

Even so, the quote holds onto the previous day’s breakout of the 200-HMA, as well as multiple levels marked by a fortnight-long horizontal area, surrounding 1.0590-95. Hence, EUR/USD remains on the buyer’s radar unless breaking the 1.0590 level.

Should the pair drops below 1.0590, a one-week-old rising support line, around 1.0515, may offer an intermediate halt during the fall targeting the latest multi-month low of 1.0471.

Meanwhile, April 27 high near 1.0655 appears immediate resistance for the EUR/USD buyers to watch during the fresh upside.

Following that, the 50% and 61.8% Fibonacci retracement of April 21-28 downside, respectively near 1.0700 and 1.0760, will be in focus.

Overall, EUR/USD is up for the much-awaited corrective pullback after the Fed’s latest action.

EUR/USD: Hourly chart

Trend: Further recovery expected

- GBP/JPY retreats from intraday high, probes three-day uptrend.

- UK PM Johnson pushes EU over NI Protocol compromise.

- Post-Fed rally of Wall Street benchmarks pleased buyers earlier.

- BOE is up for a 25 bps rate hike but Bailey’s comments will be more important for clear directions.

GBP/JPY feels the heat of pre-BOE anxiety during Thursday’s Asian session as the cross-currency pair eases to 163.20, consolidating the three-day gains. In addition to the cautious mood ahead of the Bank of England (BOE) monetary policy decision, risk-negative headlines concerning Russia and covid also test the pair buyers of late.

The quote refreshed a three-day high during the aftermath of the US Federal Reserve’s (Fed) monetary policy as equities rallied on Fed Chair Powell’s rejection of a rate hike worth 75 basis points (bps) in upcoming meetings. It should be noted that the matched market forecasts by announcing 50 basis points (bps) of a lift to the benchmark rate, as well as conveyed quantitative tightening to begin from June, initially with a $47.5 billion cap per month.

Although the Wall Street benchmarks printed 3.0% average gains, S&P 500 Futures drops 0.15% by the press time as markets shift attention from the hopes of fresh liquidity infusion due to the disappointment from the Fed.

Talking about the risk-negative headlines, UK PM Boris Johnson renewed Brexit woes by giving the European Union (EU), “one last chance” to compromise over Northern Ireland (NI) protocol, per The Times. The move could have been a political gimmick as NI elections begin on Thursday. Elsewhere, the EU’s sixth round of sanctions on Russia and China’s covid woes, also challenge the market sentiment, as well as the GBP/JPY prices.

Moving on, the BOE is up for a 0.25% rate hike, as already conveyed in the previous meeting. However, the escalating inflation pressure pushes market players to seek something more than what’s promised, which in turn may disappoint GBP/JPY buyers if the “Old Lady” tracks the Fed.

Read: Bank of England Preview: Bailey set to bring sterling down with dovish hike

Other than the BOE, NI elections and geopolitical/covid news will also be important for the GBP/JPY traders to watch for clear directions.

Technical analysis

GBP/JPY bulls failed to cross the 21-DMA hurdle, around 163.75 at the latest, despite the recent run-up, which in turn keeps sellers hopeful to test the weekly ascending support line, close to 162.20 at the latest.

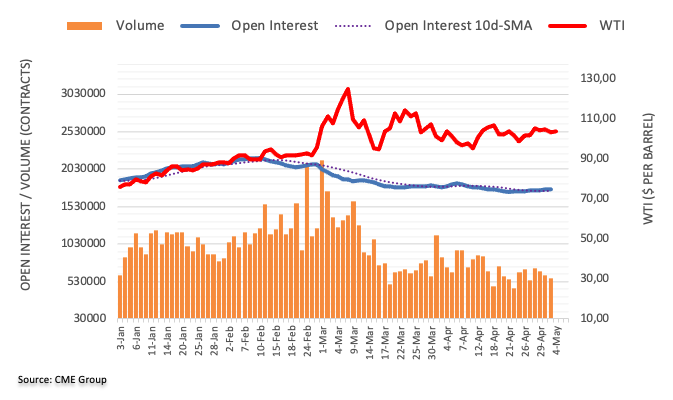

- WTI has advanced sharply higher as the odds of a Europe’s embargo on Russian oil bolstered.

- The EU may phase out the dependency on Russian oil within six months.

- The US EIA has reported an unexpected rise in oil inventories by 1.2 million barrels.

West Texas Intermediate (WTI), futures on NYMEX, have surged above $107.00 as the fears of an embargo on Russian oil by the largest trading bloc, European Union (EU), renewed. The EU, on Wednesday, spelled out its plans to prohibit Russian oil imports. This has raised concerns over the supply catalyst in an already tight oil market as a prohibition of Russian oil due to its invasion of Ukraine from 3.5 million barrels per day (bpd) customer will worsen the demand-supply mechanism.

Although the EU is indicating an embargo on Russian oil within six months, a lot of questions have been raised with respect to the alternatives to fulfilling the bumper demand of oil by Europe. Inventories are so tight in the oil market considering the falling stockpiles in US Strategic Reserves and OPEC’s sticky indication to the closed deal of discussed oil supply, along with their intention to sustain oil prices above the psychological mark of $100.00.

On the demand front, oil prices have ignored the build-up of unexpected oil stockpiles last week. The US Energy Information Administration (EIA) reported the oil inventories at 1.2 million barrels despite the release of oil from its strategic reserves. Going forward, investors will keep an eye on the OPEC meeting, which is due on Thursday. The OPEC cartel is not expected to shore up the global supply and will maintain its price stability above $100.00.

- USD/CAD grinds lower following the biggest daily fall in a fortnight.

- Impending bear cross, trend line breakdown and receding strength of MACD’s bullish bias favor sellers.

- 21-DMA, 100-DMA lure short-term sellers while bulls need a clear break of 1.2900 for conviction.

USD/CAD bears lick the post-Fed wounds around mid-1.2700s, having declined the most in two weeks, during Thursday’s Asian session.

Although the Loonie pair remains trapped inside a 15-pip trading area around 1.2750 after the latest slump, sellers keep the reins as multiple catalysts hint at the quote’s further downside.

Among them, a clear break of the previous support line from April 21 and a bear cross of the 21-DMA over the 100-DMA act as crucial factors. Also supporting USD/CAD bears are the recently easing MACD bullish signals and steady RSI.

That said, the pair’s further downside towards 21-DMA, around 1.2690 by the press time, becomes imminent. However, the 100-DMA level of 1.2681 may test the USD/CAD declines afterward. Also likely to challenge the quote’s south-run is early April’s peak of 1.2673.

Alternatively, the corrective pullback may initially aim for the 1.2800 threshold before the mid-March top surrounding 1.2875.

It’s worth noting, however, that a confluence of the previous support line and a two-month-old horizontal line, around 1.2900, appears a tough nut to crack for the USD/CAD bulls afterward.

USD/CAD: Daily chart

Trend: Further weakness expected

- The AUD/JPY trimmed last week’s losses and is gaining 2.37% in the week.

- The market mood improved once US central bank chief Jerome Powell pushed against aggressive rate hikes as US equities cheered the move, closing in the green.

- AUD/JPY Price Forecast: Paired last week’s losses and ready to launch a retest of the YTD high near 96.00

The Australian dollar finally rallied vs. the Japanese yen, spurred by an upbeat market mood, courtesy of the US central bank, as the Fed hiked rates 50-bps. At the same time, its Chief Jerome Powell emphasized that 75-bps are not “on the table” in subsequent meetings. At 93.80, the AUD/JPY illustrates the strength of the uptrend after rallying from 92.20s to 93.80s.

Asian equity futures to open strong amidst an upbeat sentiment

Sentiment-wise, investors’ mood is cheerful. US equities rallied, supported by Jerome Powell, and finished with gains between 2.81% and 3.41%. Meantime, Asian stock futures look set to open higher despite China’s coronavirus crisis. The Ukraine-Russia conflict appears to last longer than estimated but has taken the backseat as traders remain turned to the global central bank’s monetary policy decisions.

However, news across the wires reported the reiteration of Russia that Kyiv desire to withdraw from the negotiation process, according to Al Jazeera. Meanwhile, Euro area countries proposed a ban on Russian oil, which would be effective in six months with no gradual phase-out, as reported by Reuters.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY’s Wednesday’s price action finally broke above a 10-day old downslope resistance trendline, a signal for AUD/JPY bulls to pull the trigger and push prices higher. However, recent statements by the Japanese Minister of Finance kept investors at bay from opening fresh longs in the pair; but Fed Chair Powell gave the greenlight, pushing back against 75-bps increases. Consequently, the AUD/JPY rallied and pared last week’s gains around 93.83, Wednesday’s daily high.

With that said, the AUD/JPY remains set for a renewed test of 2022 YTD highs. The AUD/JPY first resistance would be 94.00. A breach of the latter would expose the March 28 swing high at 94.32, followed by the 95.00 figure. Once cleared, the next ceiling level would be the YTD high at 95.74.

- USD/CHF finds a minor pullback at around 0.9720 after plummeting from 0.9840.

- The Fed hikes its rates by 50 bps to tame the soaring inflation.

- Going forward, Swiss CPI and Unemployment Rate will remain in focus.

The USD/CHF pair has displayed an intense sell-off after failing to sustain above the resistance of 0.9840 as the rate hike announcement by the Federal Reserve (Fed) underpinned the positive market sentiment. The asset has plunged to near 0.9720 but is witnessing a minor pullback as profit-booking kicks in.

Potential selling pressure came after the Federal Reserve (Fed) dictated a rate hike by 50 basis points (bps) and its strategic planning to curb the inflation mess. The Fed has announced that the balance sheet reduction program will be initiated to tame the galloping inflation along with more jumbo rate hikes in the next policy meetings.

Inflation is skyrocketing and a restrictive policy is highly required for a prolonged period but what favors is the solid US economy that can absorb the shocks of price pressures. Also, the announcement that has delighted the market participants is the gradual approach to tightening the policy. The Fed has eliminated the hopes of a 75 bps rate hike by stating that the option is not into consideration.

On the Swiss front, the focus is on the release of the Consumer Price Index (CPI), which is due in the European session. The yearly Swiss CPI is seen at 2.5% against the prior print of 2.4%. Inflation in the Swiss area is advancing modestly but does not favor any hopes of a hawkish stance from the Swiss National Bank (SNB). Apart from that, Swiss agencies will also report the Unemployment Rate, which is expected to land at 2.2%, similar to its previous print.

Late Wednesday, Reuters came out with the news saying, “UK Prime Minister Boris Johnson is set to give talks with the European Union over Northern Ireland "one last chance" before introducing legislation that will allow him to override the controversial protocol governing post-Brexit trade, The Times reported.”

Additional quotes

Johnson has sent Northern Ireland minister Conor Burns to Washington in an attempt to explain the government's new strategy that would give ministers the power to unilaterally suspend part of the agreement that was signed by Johnson in 2019, the report said.

Britain and the EU have been trying for months to overcome a deadlock over the Northern Ireland protocol, which sets the trading rules for the British region that London agreed before it left the EU but now says are unworkable.

GBP/USD pares post-Fed rally ahead of BOE

The news allows GBP/USD bulls to take a breather as prices retreat towards 1.2600, following a 178-pip rally to 1.2638, mainly led by the Fed’s rejection of a 0.75% rate hike.

It’s worth noting that the cautious sentiment ahead of the Bank of England (BOE) monetary policy meeting also would have tested the cable buyers.

Read: GBP/USD oversteps 1.2630 as Fed’s policy announcement cheers market mood, BOE eyed

- AUD/USD bulls take a breather around two-week top after the heavily daily jump since November 2011.

- Fed matched market forecasts of 0.50% rate hike, announced balance sheet normalization in June.

- Powell’s rejection of a 75 bps increase in Fed rate triggered much-awaited relief rally.

- Australia's trade numbers for March, China’s return and risk catalysts will be crucial for immediate directions.

AUD/USD dribbles around 0.7250 following the biggest daily jump since late 2011 as buyers struggle to digest the Fed-led gains ahead of the Australian trade numbers. Also likely to have tested the Aussie bulls during the early Asian session on Thursday are the cautious moves as China begins the week’s trading after multiple holidays.

Having initially cheered the US dollar pullback and upbeat Australia Retail Sales, not to forget keeping the post-RBA optimism, AUD/USD rallied 180 pips after Fed Chairman Jerome Powell rejected the idea of a 0.75% rate hike in the upcoming meeting.

The Fed, however, kept its word by announcing 50 basis points (bps) of a lift to the benchmark rate, as well as conveyed quantitative tightening to begin from June, initially with a $47.5 billion cap per month.

It’s worth noting that the softer prints of the US ISM Services and ADP Employment Change for April also offered a background for the AUD/USD upside.

Alternatively, anxiety ahead of the key Aussie data and EU’s sixth round of sanctions on Russia, as well as China’s covid woes, also join the forces to test the AUD/USD bulls as Beijing’s return to markets makes traders cautious.

That said, Australia’s headline Trade Balance may rise to 8500M in March versus 7457M prior. Aussie Building Permits for March and China’s Caixin Services PMI for April are also in the economic docket and will be important to watch for immediate directions, in addition to the risk catalysts.

Technical analysis

AUD/USD prices remain below the 100 and 200 DMAs, respectively around 0.7265 and 0.7285, despite the latest rally, which in turn teases a pullback towards the previously important hurdle, namely the March’s low of 0.7165.

- GBP/USD has surged above 1.2630 as the Fed discarded the odds of a 75 bps rate hike.

- The US economy is strong enough to tackle restrictive monetary policy.

- The BOE will unveil its monetary policy on Wednesday, a 25 bps rate hike looks likely.

The GBP/USD pair is scaling sharply higher as the announcement of the interest rate decision by the Federal Reserve (Fed) has infused fresh blood into the cable. Pound bulls have attracted some significant bids around 1.2483 and have pushed the cable above 1.2630.

Earlier, the asset remained in the bear’s grip amid uncertainty over the rate hike announcement by the Fed. Now, the agency has stepped up its interest rates by 50 basis points (bps) and has provided a roadmap, which is dictating the further action precisely. For the next couple of meetings, Fed has favored consideration of a half-a-percent rate hike and has discarded the odds of a 75 bps rate hike. Also, the balance sheet reduction has been activated to tame the inflation mess. The fed will continue with its restrictive policy till it sees some signs of progress in achieving price stability. Adding to that, the Fed cleared that the US economy can handle the restrictive policy and the agency does not see signs of recession.

Going forward, uncertainty is going to stay a little longer in the cable as the Bank of England (BOE) will come up with its monetary policy announcement on Thursday. BOE Governor Andrew Bailey is expected to elevate its interest rate by 25 bps. Inflation in the UK’s zone has also climbed to the rooftop and the BOE needs to leash it on a serious note.

- The EUR/JPY record gains for the second consecutive day and remains defensive as a head-and-shoulders pattern looms.

- The sentiment is positive; once Fed Chair Powell said that 75-bps increases are not in the table, US equities rallied sharply.

- EUR/JPY Price Forecast: The head-and-shoulders clouds the prospects of a higher EUR.

The EUR/JPY remains subdued amidst an upbeat market mood, courtesy of the telegraphed 50-bps hike by the US Federal Reserve, and also as Fed’s Chief Powell discarded 75-bps increases, US equities rallied. At the time of writing, the EUR/JPY is trading at 137.19 as the Asian Pacific session begins.

The market sentiment is upbeat, as US equities closed with hefty gains, between 2.81% and 3.41%. Asian stocks futures look set to open higher despite China’s coronavirus crisis. Developments around the Ukraine-Russia conflict remain in the backseat as investors focus on the central bank’s monetary policy decisions.

However, news across the wires reported the reiteration of Russia that Kyiv desire to withdraw from the negotiation process, according to Al Jazeera. Meanwhile, Euro area countries proposed a ban on Russian oil, which would be effective in six months with no gradual phase-out, as reported by Reuters.

On Wednesday, the EUR/JPY pair opened near the 137.00 mark and seesawed around a 20-pip range ahead of the US central bank monetary policy meeting. Once the headline crossed wires, the EUR/JPY seesawed around 136.60-137.40, settling afterward at around 137.20s.

EUR/JPY Price Forecast: Technical outlook

From a daily chart perspective, the EUR/JPY bias remains upwards, but a formation of a head-and-shoulders chart pattern looms. To question the latter’s validity, EUR/JPY bulls need to reclaim 137.98. Once done, the head-and-shoulders would not be valid.

With that said, the EUR/JPY first support would be the 137.00 mark. If EUR/JPY bears break that level, that will expose the 136.00 figure, followed by the head-and-shoulders neckline around 135.00-20.

- EUR/USD soars above 1.0620 as investors underpinned risk-sensitive currencies on Fed’s policy release.

- The Fed vapors the odds of 75 bps in the remaining five monetary policies.

- Euro bulls ignored the underperformance of the Retail Sales.

The EUR/USD pair has witnessed a juggernaut upside move after the Federal Reserve (Fed) feature a rate hike by 50 basis points in the New York session. The shared currency bulls have established the asset above 1.0600 and are driving it higher towards the next barricade at 1.0650.

Well, an interest rate decision of a 50 bps rate hike was highly expected by the market participants therefore, investors have already discounted the announcement however, what made the Fx domain underpin the risk-sensitive currencies is the guidance. Fed chair Jerome Powell announced that a rate hike by 75 bps is not into consideration but investors should brace for more 50 bps interest rate hikes.

The Fed will remain data-dependent now and need evidence of declining price pressures for a moderate stance. The central bank will aim for progress in price stability, which will require a tight monetary policy for a prolonged period. The better fact is, that the US economy can handle the restrictive monetary policy.

Meanwhile, euro bulls ignored the underperformance of Euro Retail Sales, released on Wednesday. The Retail Sales landed at 0.8% lower than the market consensus of 1.4% and the prior print of 5.2%.

Going forward, investors will focus on the US Nonfarm Payrolls (NFP), which will release on Friday. The US NFP is expected to land at 394k against the previous figure of 431k.

- NZD/USD rallies on US dollar weakness following the Fed.

- The Fed has dialled back 75bps rake hike expectations.

At 0.6540, NZD/USD is consolidating the post-Federal Reserve rally around the highs of Wednesday. The kiwi rallied from a low of 0.6425 to a high of 0.6556.

The US dollar and US Treasury yields were under pressure following the Federal Reserve interest rate decision, statement and the Fed chair's presser. The US 2-year Treasury yield has fallen by some 5% to a low of 2.612%.

After hiking by 50bps today and formally starting quantitative tightening as the Fed seeks to get a grip on inflation, Jerome Powell gave the green light to a series of additional 50bp hikes but said 75bps was not something that was being considered.

''Ruling out 75bp hikes will limit scope for a blowout in expectations (which were, and are still split between 50 and 75bps for the June meeting), in turn weighing on the USD broadly,'' analysts at ANZ Bank said arguing that the ''correction seems warranted given the potential for Fed expectations to keep recalibrating lower.''

For the Reserve Bank of New Zealand, yesterday's labour data will have been eyed. The RBNZ had which had pencilled in a 3.1% lift in private sector labour costs in the February MPS. As analysts at ANZ Bank explained, ''the data will confirm that the labour market will be a key driver of domestic inflation pressures over 2022. This will require ongoing interest rate hikes to bring labour demand back in line with labour supply and nip a potential wage-price spiral in the bud. That’s consistent with our expectation for a 50bp hike in May.''

NZD/USD technical analysis

NZD/USD has rallied into a resistance area and would be expected to revert. The imbalance of price to the prior highs could be mitigated in the coming days/ and or sessions all the way to a 61.8% Fibonacci retracement.

The Reserve Bank of New Zealand's governor Adrian Orr is crossing the wires and has stated that he doesn't see stagflation as a core risk.

In other comments, he said ''it's business as usual'' on monetary policy and the central banks have ''no regrets on monetary policy,'' and that he is ''proud of where we are''.

He added that ''being too out of step with others has risks.''

Meanwhile, the kiwi has rallied in the immediate aftermath of the Federal Open Market Committee meeting where the Fed announced a 50bp rate hike and quantitative tightening starting in June. NZD/USD is up some 1.75% on the day.

What you need to take care of on Thursday, May 5:

The American dollar plunged after the US Federal Reserve monetary policy decision. The central bank delivered as expected, as the central bank raised rates by 50 bps to a range of 0.75% to 1% while announcing they would begin trimming the balance sheet on June 1. They would start with a $47.5 billion cap on monthly runoff and rise to $95 billion monthly after three months.

The market did not react to the announcement but later to chief Powell’s words. Among other things, Powell noted that the Russian invasion of Ukraine adds to already overheated inflation, remarking that the central bank is highly committed to taming it. He then dismissed the chance of a 75 bps while adding that core inflation is nearing a peak, although more evidence is needed. The greenback plummeted as stocks rallied on relief.

Asian and European indexes closed in the red, but Wall Street soared. The Dow Jones Industrial Average added 932 points, while the Nasdaq Composite gained 401 points. The S&P closed the day 2.99% higher.

US government bond yields, on the other hand, eased, with the one on the 10-year note settling at 2.93% after peaking at 3.01%.

Meanwhile, European Commission President Ursula von der Leyen presented the sixth pack of Russian sanctions. She said the region would phase out the Russian supply of crude oil and refined products by the end of the year. The news weighed on high-yielding assets, keeping European indexes trading in the red amid the potential effects on economic growth. US Treasury Secretary Janet Yellen later noted that such a move could drive oil prices higher and that she needs to see the conditions of how this will be accomplished.

Commodity-linked currencies benefited the most from the broad dollar’s weakness combined with soaring equities. AUD/USD trades around 0.7260, while USD/CAD is down to 1.2730.

The EUR/USD pair trades at 1.0624, while GBP/USD advanced beyond the 1.2600 figure. Even safe-haven CHF and JPY posted gains against the greenback.

Gold currently trades at $1,883 a troy ounce while crude oil price resumed their advances, with WTI now at around $107.60 a barrel.

The Bank of England will announce its monetary policy decision on Thursday.

Like this article? Help us with some feedback by answering this survey:

- US dollar plummets as the Fed dials back expectations of 75bp hikes.

- The Fed gives the nod to a series of 50bps hikes instead.

Both the US dollar and US Treasury yields are under pressure following the Federal Reserve interest rate decision, statement and the Fed chair's presser. The US 2-year Treasury yield has fallen by some 5% to a low of 2.612%.

After hiking by 50bps today and formally starting quantitative tightening as the Fed seeks to get a grip on inflation, Jerome Powell gave the green light to a series of additional 50bp hikes but said 75bps was not something that was being considered.

The Federal Reserve is now "highly attentive" to inflation risks and amid “robust” job gains "ongoing increases" in the Fed funds rate will be "appropriate". The Fed is starting quantitative tightening and a press release with the Fe's plans for reducing the size of the balance sheet was released showing $47.5bn per month that will start on June 1st before getting to a "max" of $95bn in September:

The Committee intends to reduce the Federal Reserve's securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account (SOMA). Beginning on June 1, principal payments from securities held in the SOMA will be reinvested to the extent that they exceed monthly caps.

For Treasury securities, the cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month. The decline in holdings of Treasury securities under this monthly cap will include Treasury coupon securities and, to the extent that coupon maturities are less than the monthly cap, Treasury bills.

For agency debt and agency mortgage-backed securities, the cap will initially be set at $17.5 billion per month and after three months will increase to $35 billion per month.

Nevertheless, the markets had been pricing in a more aggressive stance at the Fed. The initial knee-jerk “sell-the-fact” reaction in the greenback as the Fed delivered the expected 50bp hike was exacerbated when Powell took 75bps rate hikes off the table. This is giving risk appetite a boost and the euro is making a case for a significant multi-week correction that could take place between now and the next meeting in June.

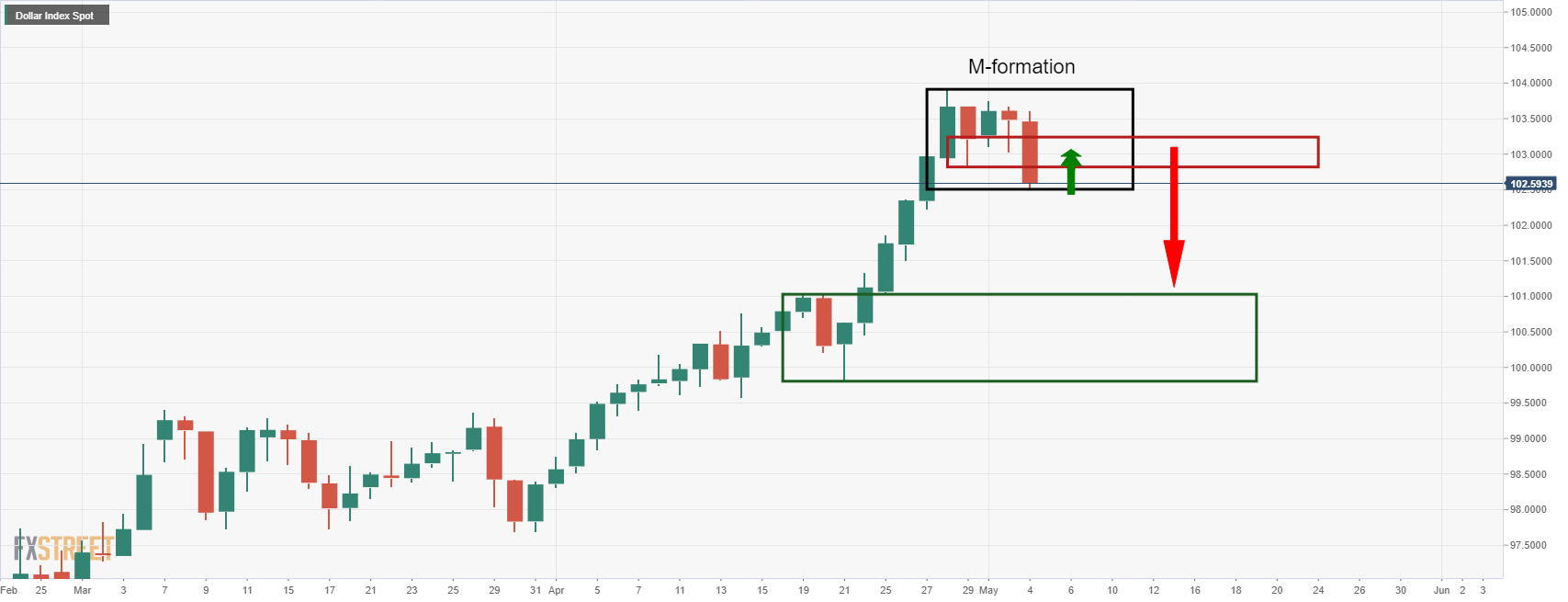

In turn, the DXY index which is calculated by factoring in the exchange rates of six foreign currencies vs. the greenback is set up for a move that could extend as far as 101.00 in the coming days/weeks:

The M-formation is a bullish reversion pattern where the price would be expected to retest the neckline, prior to a more significant move to the downside and towards the old resistance structure. However, much will depend on this week's Nonfarm Payrolls data.

If the US jobs data on Friday fuels expectations around potentially larger than 50bp rate hikes, then the DXY bulls will be back in play and the euro will be at risk of moving below 1.0500. The euro is, by far, the largest component of the DXY index, making up 57.6% of the basket.

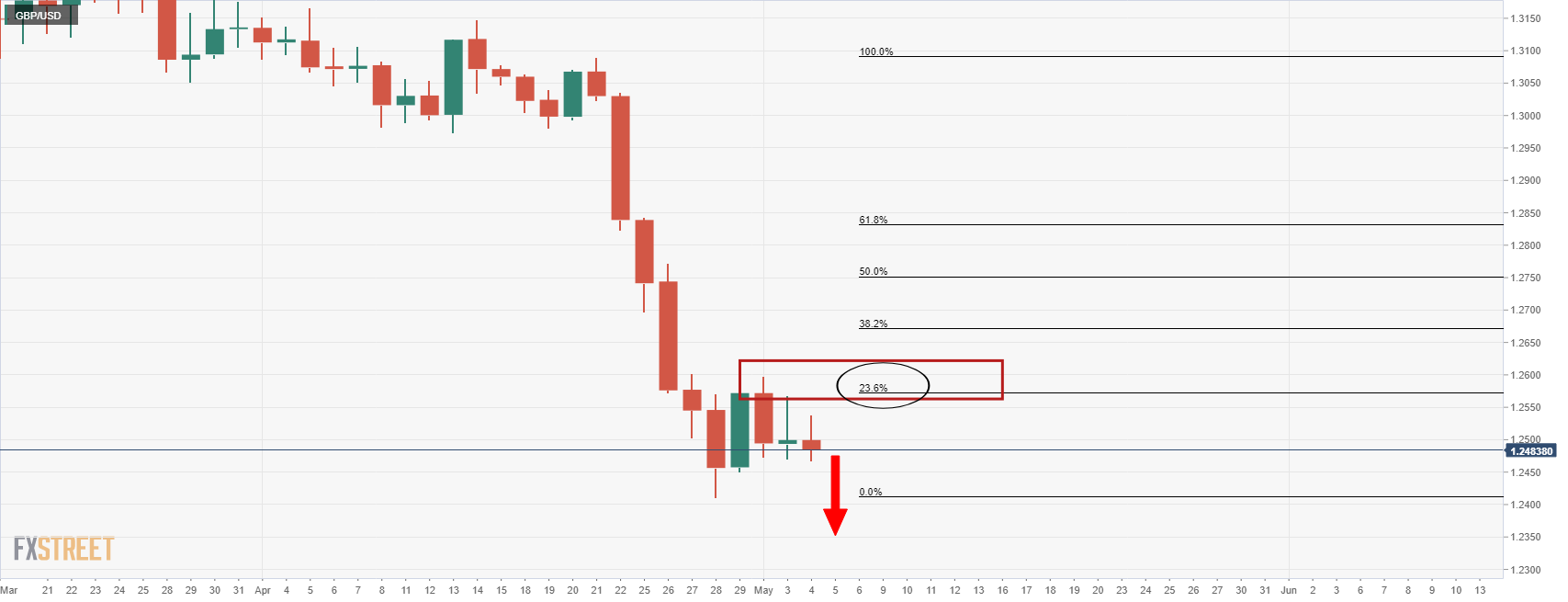

The W-formation there is also compelling in this regard:

The euro is headed towards a 38.2% Fibonacci retracement of the daily bearish impulse. This has a confluence with prior daily highs. Either way, the W-formation is a bearish pattern and a retest of the neckline would be expected to occur in due course. Whether the euro can continue higher will depend on matters related to geopolitics as well as the market's appetite for the US dollar. Unstable risk sentiment, COVID and a lower appetite for emerging markets combined with the Fed's focus on fighting inflation are all factor that would be expected to underin the greenback.

- The AUD/USD record gains of more than 130-pips and eyes the 100-DMA at 0.7260.

- The Fed raised 50-bps to the Federal Funds Rates (FFR) and would begin its QT on June 1.

- Fed’s Chair Powell emphasized that 75-bps increases are not something the Fed is considering.

The AUD/USD is rallying sharply and jumped from 0.7090s to 0.7230s after the Federal Reserve decided to raise rates by 50-bps and announced the start of the Quantitative Tightening (QT) on June 1, as the US central bank aims to trim its $8.9 trillion balance sheet. At around 0.7220s, the AUD/USD reflects investors’ sentiment as Fed Chair Jerome Powell speaks.

So far, the Fed’s policy decision seems to be perceived as hawkish, as Fed money markets futures are pricing in a 77% chance of a 50-bps hike at the June meeting and a 23% chance of a 75-bps increase.

At his press conference, Fed Chair Powell said that 75-bps increases are not something the Fed is considering, and they are not actively considering it. He added that “if we see what we expect to see,” 50-bps increases would be“on the table” at the following couple of FOMC meetings.

Remarks of the Fed’s decision

The Federal Open Market Committee (FOMC) revealed in its monetary policy statement that inflation is “expected to return to its 2% objective” and expressed that high prices reflect supply and demand imbalances are related to the Covid-19. The central bank reiterated that it would remain “attentive to inflation risks.”

Also, the US central bank acknowledged the negative print in Q1’s GDP and said that “household spending and business fixed investment remained strong.”

Concerning the balance sheet reduct, the Fed will begin on June 1 at a slower pace than estimated. The central bank would reduce its balance sheet by $47.5 billion for the first three months. The initial cap of US Treasuries would be $30 billion, while $17.5 billion of mortgage-backed securities (MBS). After three months, the Quantitative Tightening (QT) will hit $60 billion in US Treasuries and $30 billion on MBS.

AUD/USD Market’s reaction

The AUD/USD immediately surged above the R1 daily pivot at 0.7150, rallying sharply towards the R3 pivot point around 0.7250, and is pairing last week’s losses. At the time of writing, the AUD/USD is shy of the daily highs, around 0.7220s.

Jerome Powell, Chairman of the Federal Reserve System, is delivering his remarks on the monetary policy outlook at a press conference following the FOMC's decision to hike the policy rate by 50 basis points in May.

Key quotes

"As we raise interest rates, demand moderates."

"Businesses will invest a little less, consumers will spend a little less."

"There may be some pain for people in us getting inflation back down to 2% but bigger pain not dealing with it."

"No one should look at any summary of economic projections as a resting place."

"It's just us adapting to the data and using our tools to deal with it."

"Wages are to some extent being eaten up by inflation."

"We've got to get back to price stability to stop those wages being outpaced by inflation."

"Long expansions are good for labor market."

"The best thing for everyone is to get back to price stability."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term*. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

"*Note: On February 4, 2022, the Federal Reserve Board named Jerome H. Powell as Chair Pro Tempore, pending Senate confirmation to a second term as Chair of the Board of Governors."

- Gold is benefiting from safe-haven flows and a dialling back of an uber hawkish Fed.

- Fed's chairman, Powell, has taken out 75bps rate hike speculation in markets.

At $1,885, the gold price is rallying some 0.87% on the day, breaking out of sideways consolidation and taking on a critical daily resistance area after Federal Reserve chairman, Jerome Powell disappointed the more hawkish of the financial market's participants.

Fed futures were initially pricing in a higher chance of a 50 basis point hike at the June meeting before Powell spoke, but the US dollar has come under strong selling pressure during the press conference. Powell stated that 75bps hikes were not on the table and that it will be 50bps at the next two meetings if the members of the board see what they expect to see.

The comments have stripped the 2-year Treasury yield down to a low of 2.614% so far, sinking the US dollar index to 102.50 from the post-Fed interest rate decision highs of 103.61. The gold price has benefitted from a combination of the dialling down of 75bp hikes and safe-haven flows given the uncertainty expressed by the Fed over the Ukraine crisis.

Meanwhile, a press release has also been published with the plans for reducing the size of the balance sheet.

The Committee intends to reduce the Federal Reserve's securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account (SOMA). Beginning on June 1, principal payments from securities held in the SOMA will be reinvested to the extent that they exceed monthly caps.

For Treasury securities, the cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month. The decline in holdings of Treasury securities under this monthly cap will include Treasury coupon securities and, to the extent that coupon maturities are less than the monthly cap, Treasury bills.

For agency debt and agency mortgage-backed securities, the cap will initially be set at $17.5 billion per month and after three months will increase to $35 billion per month.

Gold technical analysis

Gold has rallied into the daily resistance from an area of demand from where the price last reacted in a significant fashion leading to what would be fresh cycle highs. However, the bulls need to get above $1,900 to mark a more convincing bullish case for higher on the charts. Failure to do so could otherwise lead to a downside extension towards $1,820 in due course.

Jerome Powell, Chairman of the Federal Reserve System, is delivering his remarks on the monetary policy outlook at a press conference following the FOMC's decision to hike the policy rate by 50 basis points in May.

Key quotes

"Certainly possible Fed will need to move policy to restrictive levels."

"If we need to do that, will not hesitate."

"We are absolutely prepared to do that."

"Fed does see restoring price stability as absolutely essential."

Price stability is particularly essential for labor market."

"We've been hit by historically large inflationary shocks since the pandemic."

"We have to look through that and find price stability out of this."

"It's going to be very challenging to achieve price stability."

"If we think it's appropriate, we will take rates into restrictive levels."

"The decision to do that will be on the table when we reach neutral."

"I expect we will get to neutral expeditiously."

"Effect of shrinking balance sheet is uncertain."

"People estimate that broadly on the path we are on balance sheet reduction will deliver an equivalent of 1/4 pct point rate increase over the course of a year."

"Important they know we know how painful high inflation is."

"Monetary policy is working through expectations."

"Markets think our forward guidance is credible."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term*. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

"*Note: On February 4, 2022, the Federal Reserve Board named Jerome H. Powell as Chair Pro Tempore, pending Senate confirmation to a second term as Chair of the Board of Governors."

Jerome Powell, Chairman of the Federal Reserve System, is delivering his remarks on the monetary policy outlook at a press conference following the FOMC's decision to hike the policy rate by 50 basis points in May.

Key quotes

"We understand the pain from high inflation."

"It's our job is to make sure high inflation doesn't get entrenched."

"Bringing down inflation is not going to be pleasant."

"Raising rates isn't going to be pleasant, but need to restore stable prices."

"Everyone will be better off, the sooner we get this job done."

"Good chance we can bring inflation down without significant increases in unemployment."

"Economy is doing fairly well."

"We expect productivity to be solid this year."

"Nothing in economy suggests it is close to recession."

"We have a good chance of avoiding a recession."

"We have a good chance to restore price stability without a recession."

"There should be room to reduce surplus demand without putting people out of work."

"That said, Fed does not have surgical tools."

"No one thinks this will be easy."

"There is a plausible path to avoid recession."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term*. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

"*Note: On February 4, 2022, the Federal Reserve Board named Jerome H. Powell as Chair Pro Tempore, pending Senate confirmation to a second term as Chair of the Board of Governors."

Jerome Powell, Chairman of the Federal Reserve System, is delivering his remarks on the monetary policy outlook at a press conference following the FOMC's decision to hike the policy rate by 50 basis points in May.

Key quotes

"Ukraine war, China lockdowns both likely to add to headline inflation."

"Both issues also likely to limit progress on supply chain issues being resolved."

"Both Ukraine and Russia situations could make the supply chain situation worse."

"Russia, China situations are both negative shocks."

"For now, we are focused on doing the job we need to do on demand."

"Supply-side issues put the central bank in a difficult situation."

"Need to get labor supply and demand in better balance, no particular goal on the right number of job vacancies."

"What we would like to see is progress on wages, inflation."

"Policy works through interest-sensitive spending and asset prices broadly."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term*. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

"*Note: On February 4, 2022, the Federal Reserve Board named Jerome H. Powell as Chair Pro Tempore, pending Senate confirmation to a second term as Chair of the Board of Governors."

Jerome Powell, Chairman of the Federal Reserve System, is delivering his remarks on the monetary policy outlook at a press conference following the FOMC's decision to hike the policy rate by 50 basis points in May.

Key quotes

"We are raising rates expeditiously to a broad range, plausible levels of neutral."

"We are raising rates expeditiously to a broad range of neutral."

"No bright red line on what neutral is."

"Will be making a judgment about whether we've done enough."

"We will not hesitate to go higher if we have to on rates."

"If that path involves levels higher than neutral, we will not hesitate to go there."

"If higher rates are required, we will not hesitate."

"We don't see strong evidence that inflationary psyschology has changed."

"Short-term inflation expectations are quite elevated."

"We don't see a wage-price spiral."

"We know we need to expeditiously move policy rate up to more normal levels and keep going if we have to."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term*. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

"*Note: On February 4, 2022, the Federal Reserve Board named Jerome H. Powell as Chair Pro Tempore, pending Senate confirmation to a second term as Chair of the Board of Governors."

- USD/CAD smashes below daily support on Fed Powell.

- The Fed expects to hike rates by 50bps at the next two meetings, not 75bps, US yields and the US dollar are falling.

At 1.2754, USD/CAD was pressured through a key daily support area following the Federal Reserve and during the press conference. The pair has fallen from a high of 1.2853 to score a post Fed low of 1.2785 so far.

The hike was hawkish and Fed futures are pricing in a higher chance of a 50 basis point hike at the June meeting. 77% priced for 50bps and 23% for a 75 basis point hike. Interest rates futures also suggest a 94% probability of an effective fed funds rate of at least 2.75% at year-end.

The Fed anticipates that ongoing increases in the target range will be appropriate as the central banks if highly attentive to inflation risks.

A press release has also been published with the plans for reducing the size of the balance sheet.

The Committee intends to reduce the Federal Reserve's securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account (SOMA). Beginning on June 1, principal payments from securities held in the SOMA will be reinvested to the extent that they exceed monthly caps.

For Treasury securities, the cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month. The decline in holdings of Treasury securities under this monthly cap will include Treasury coupon securities and, to the extent that coupon maturities are less than the monthly cap, Treasury bills.

For agency debt and agency mortgage-backed securities, the cap will initially be set at $17.5 billion per month and after three months will increase to $35 billion per month.

Fed Powell's presser has sunk the US dollar further as the chairman says 75bps is not something that the Fed is looking at and that it will be 50bps at the next two meetings if they see what they expect to see. USD/CAD is falling:

USD/CAD technical analysis

As per the prior session's analysis, USD/CAD Price Analysis: Bears have moved in to test bullish commitments at critical daily support, the current price action gives a prima facie bias to the bearish scenarios:

The price is mitigating the imbalance of the prior bullish impulse and could be on the way to 1.2720.

- The USD/JPY is almost flat post-Fed 50 bps rate hike, the first in 20-years.

- The Quantitative Tightening (QT) will begin on June 1.

- On the headline, USD/JPY fluctuated around the 129.70-130.37 range.

The USD/JPY remains steady as the US Federal Reserve decided to raise rates by 50-bps while announcing the reduction of its $8.9 trillion balance sheet. At the time of writing, the USD/JPY is trading around 129.40s as traders listen to Fed Chief Jerome Powell’s press conference.

Summary of the FOMC monetary policy statement

The US central bank stated that inflation is “expected to return to its 2% objective and the labor market to remain strong with appropriate monetary policy firming.” However, the FOMC stated that high prices reflect supply and demand imbalances are related to the Covid-19 pandemic. The Fed reiterated that it would remain “attentive to inflation risks.”

The committee acknowledged the negative print in Q1’s GDP and said that “household spending and business fixed investment remained strong.”

Concerning geopolitics, particularly the Ukraine-Russia war, the US central bank stated that “implications for US economy highly uncertain but in the near term invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity.” Furthermore, they added that the war is “causing tremendous human and economic hardship.”

Regarding the balance sheet reduction, the Fed said it would begin on June 1. The central bank will initially cap US Treasuries by $30 billion per month. Regarding agency debt and mortgage-backed securities (MBS), the Fed will reduce it by $17.5 billion per month. In both cases, the cap will be lifted after three months, as US Treasuries reduction will hit $60 billion, while the MBS cap will increase to $30 billion.

USD/JPY Reaction to the headline

The USD/JPY initially reacted downwards, as the decision was seen as a “buy the rumor, sell the fact” event and printed a daily low of around 129.73. Nonetheless, once market participants digested the Fed monetary policy statement, the USD/JPY jumped towards daily highs above 130.30s until settling around current levels, as Fed Chair Jerome Powell took the stand.

Federal Reserve Chairman Jerome Powell Press conference: here

Jerome Powell, Chairman of the Federal Reserve System, is delivering his remarks on the monetary policy outlook at a press conference following the FOMC's decision to hike the policy rate by 50 basis points in May.

Key quotes

"75 bps hike we are not actively considering."

"Broad sense that additional 50 bps increases should be on the table for next couple of meetings."

"Test is economic and financial conditions as they evolve."

"Expectations are that we'll start to see inflation flattening."

"Some evidence core PCE peaking."

"But we don't want just some evidence on inflation, we want progress."

"Difficult to give forward guidance, leaving room to look at data."

"Want to see evidence inflation is lower."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term*. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

"*Note: On February 4, 2022, the Federal Reserve Board named Jerome H. Powell as Chair Pro Tempore, pending Senate confirmation to a second term as Chair of the Board of Governors."

Jerome Powell, Chairman of the Federal Reserve System, is delivering his remarks on the monetary policy outlook at a press conference following the FOMC's decision to hike the policy rate by 50 basis points in May.

Key quotes

"Wages matter a fair amount."

"Wages are running high."

"Wages are a good illustration of how tight labor market is."

"We think supply and demand will come back into balance, wage inflation will moderate."

"We have a good chance for softish landing."

"Doesn't seem we are anywhere close to a downturn."

"We do expect it will be very challenging though."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term*. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

"*Note: On February 4, 2022, the Federal Reserve Board named Jerome H. Powell as Chair Pro Tempore, pending Senate confirmation to a second term as Chair of the Board of Governors."

Jerome Powell, Chairman of the Federal Reserve System, is delivering his remarks on the monetary policy outlook at a press conference following the FOMC's decision to hike the policy rate by 50 basis points in May.

Key quotes

"Inflation has surprised to upside and further surprises could be in store."

"We will strive not to add more uncertainty to a highly uncertain environment."

"Economy can handle tighter monetary policy."

"America is well-positioned to handle tighter policy."

"I expect will get some additional labor participation, tending to hold unemployment rate up a little."

"We think job creation will slow."

"Certainly possible unemployment could go down further."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term*. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

"*Note: On February 4, 2022, the Federal Reserve Board named Jerome H. Powell as Chair Pro Tempore, pending Senate confirmation to a second term as Chair of the Board of Governors."

Jerome Powell, Chairman of the Federal Reserve System, is delivering his remarks on the monetary policy outlook at a press conference following the FOMC's decision to hike the policy rate by 50 basis points in May.

Key quotes

"Disruptions to supply larger, longer-lasting than anticipated."

"Ukraine war likely to restrain economies abroad, create spillover to the US."

"We are acutely aware high inflation causes hardship."

"We are highly attentive to risks inflation causing to both sides of the mandate."

"Our policy has been adapting, will continue to do so."

"We think ongoing increases in interest rates will be appropriate."

"Reducing balance sheet will also play important role."

"We are on a path to move policy rate expeditiously to more normal levels."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term*. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

"*Note: On February 4, 2022, the Federal Reserve Board named Jerome H. Powell as Chair Pro Tempore, pending Senate confirmation to a second term as Chair of the Board of Governors."

Jerome Powell, Chairman of the Federal Reserve System, is delivering his remarks on the monetary policy outlook at a press conference following the FOMC's decision to hike the policy rate by 50 basis points in May.

Key quotes

"Inflation is much too high."

"We understand the hardship and moving expeditiously to bring inflation down."

"Essential we bring inflation down to keep strong labor market."

"Labor market is extremely tight."

"Improvements in labor market conditions have been widespread."

"Labor demand is very strong."

"Labor supply remains subdued."

"Wages are rising at fastest pace in many years."

"Inflation is well above goal."

"Demand in economy is strong, supply chain issues are persisting."

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term*. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

"*Note: On February 4, 2022, the Federal Reserve Board named Jerome H. Powell as Chair Pro Tempore, pending Senate confirmation to a second term as Chair of the Board of Governors."

- The EUR/USD is gaining some 0.28% on Wednesday’s session.

- The Federal Reserve hiked 50-bps for the first time in 2022.

- The EUR/USD seesawed around the 1.0530s-1.0570s to the headline.

The EUR/USD rallied as the Federal Reserve decided to hike rates by 50-bps and also announced the beginning of its Quantitative Tightening (QT) program. At the time of writing, the EUR/USD is trading at 1.0554, some 0.34% higher in the day, as traders prepare for Fed’s Jerome Powell press conference.

Key remarks of the FOMC monetary policy statement

The Federal Open Market Committee said that inflation remains elevated, reflecting supply and demand imbalances, pandemic-related. The committee emphasized that inflation is “expected to return to its 2% objective and the labor market to remain strong with appropriate monetary policy firming.” The US central bank reiterated that they would remain “attentive to inflation risks.”

The Fed acknowledged the negative print in Q1’s GDP and said that “household spending and business fixed investment remained strong.”

Regarding the Ukraine-Russia war issues, the Fed expressed that it “is causing tremendous human and economic hardship.” Furthermore, they added that “Implications for US economy highly uncertain but in the near term invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity.”

They also announced the reduction of the balance sheet on June 1. They will initially cap US Treasuries by $30 billion per month. Regarding agency debt and mortgage-backed securities (MBS), the Fed will reduce it by $17.5 billion per month. In both cases, the cap will be lifted after three months, as US Treasuries reduction will hit $60 billion, while the MBS cap will increase to $30 billion.

EUR/USD Reaction to the headline

The EUR/USD dipped towards 1.0530, then rallied sharply towards 1.0573, followed by a retracement towards current levels around 1.0553 as market players get ready for the press conference of the Federal Reserve Chairman Jerome Powell.

Federal Reserve Chairman Jerome Powell Press conference: here

- GBP/USD rallies on the Fed with a relatively muted response in financial markets.

- The Fed hiked rates by 50 basis points and published plans to reduce the size of the balancesheet.

At 1.2522, GBP/USD is 0.22% higher and has rallied around 42 pips in the first 15 minutes on the knee jerk after the Federal Reserve hiked rates by 50 basis points. The Fed's target range stands at 0.75% - 1.00%.

The hike was hawkish and Fed futures are pricing in a higher chance of a 50 basis point hike at the June meeting. 77% priced for 50bps and 23% for a 75 basis point hike. Interest rates futures also suggest a 94% probability of an effective fed funds rate of at least 2.75% at year-end.

The Fed anticipates that ongoing increases in the target range will be appropriate as the central banks if highly attentive to inflation risks.

A press release has also been published with the plans for reducing the size of the balance sheet.

The Committee intends to reduce the Federal Reserve's securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account (SOMA). Beginning on June 1, principal payments from securities held in the SOMA will be reinvested to the extent that they exceed monthly caps.

For Treasury securities, the cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month. The decline in holdings of Treasury securities under this monthly cap will include Treasury coupon securities and, to the extent that coupon maturities are less than the monthly cap, Treasury bills.

For agency debt and agency mortgage-backed securities, the cap will initially be set at $17.5 billion per month and after three months will increase to $35 billion per month.

Nevertheless, the US dollar has been pressured on the release which has buoyed sterling.

GBP/USD technical analysis

Into the announcements, GBP/USD had been consolidated:

The outcome has done little to shift the structure. On a longer-term basis, GBP/USD has been poised for a downside extension following a brief bullish correction on the daily chart as follows:

If the bulls fail to break beyond the resistance, mounting bearish pressure will likely lead to a downside continuation in due course.

The US Federal Reserve announced on Wednesday that the FOMC had agreed to raise the target range for the federal funds rate by 50 basis points to 0.75% to 1%, in line with expectations.

Follow our live coverage of the Fed's policy announcements and the market reaction.

The Fed further noted that it will begin trimming the balance sheet on June 1, starting with a $47.5 billion cap on monthly runoff and rising to $95 billion monthly after three months.

Key takeaways as summarized by Reuters

"Fed anticipates ongoing increases in target range will be appropriate."

"Inflation expected to return to its 2% objective and the labor market to remain strong with appropriate monetary policy firming."

"Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, broader price pressures."

"Invasion of Ukraine by Russia is causing tremendous human and economic hardship."

"Implications for US economy highly uncertain but in the near term invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity."

"In addition, covid-related lockdowns in china are likely to exacerbate supply chain disruptions."

"We are highly attentive to inflation risks."

"Although economic activity edged down in Q1, household spending and business fixed investment remained strong."

"Job gains robust in recent months."

"Fed policy vote was unanimous."

Market reaction

The US Dollar Index turned south with the initial reaction to the Fed's policy announcements and was last seen losing 0.3% on the day at 103.12.

- AUD/USD traders await the Federal Reserve announcements.

- The RBA and Fed are a key focus while Ukrain and China risks continue to underpin the greenback.

At 0.7145, AUD/USD is 0.7% higher on the day after rallying from a low of 0.7088 to a high of 0.7154. The Australian dollar has continued to outperform this week following the Reserve Bank of Australia on Tuesday when it lifted the cash rate by a surprisingly large 25 basis points to 0.35%.

This was a surprise to the markets that were expected less of a raise and it was the first hike in over a decade. Additionally, the RBA gave the nod to more to come with the intention to pull down the curtain on its massive pandemic stimulus. However, for the day ahead, it is all about the Federal Reserve.

At the top of the hour, the markets will hear from the Fed following the Federal Open Market Committee's two-day meeting. Traders will be waiting for the decision and accompanying statement. The central bank is expected to raise the Fed Funds rate by 50bp at their May meeting to 0.875% and provide a confirmation of the quantitative tightening process. Meanwhile, Fed funds futures traders are pricing for the Fed’s benchmark rate to increase to 2.96% by year-end, from 0.33% now.

Chair Powell’s press conference will follow but there will not be any no new forecasts. Comments by Fed Chairman Powell will be key and will be scrutinized for additional signs on how the U.S. central bank will balance the need to stem inflation that has been rising at the fastest pace in 40 years. ''If he shows any hints of dovishness, markets will take yields and the dollar lower," Win Thin, global head of currency strategy at Brown Brothers Harriman, said in a report. "That said, we see no reason for Powell to hedge his bets right now and so we expect full speed ahead from the Fed," he added.

Leading into the meeting, the US dollar has fallen against a basket of currencies as traders move to the sidelines given how much of the hawkish expectations are already priced into the greenback. The dollar index (DXY) was last at 103.38, down 0.07% on the day. It reached 103.93 on Thursday, the highest since Dec. 2002 but printed a low of 103.186 today, sliding from 103.597.

Overall, the US dollar remains the go-to currency at a time when safe-haven flows are seeking shelter from the risks associated with the Ukraine crisis as well as the COVID-19 restrictions in China that have raised concerns about global growth and new supply chain disruptions.

- The Gold Price is almost flat during the day as the FOMC decision looms.

- The sentiment is mixed, blamed on the Fed policy decision and China’s coronavirus crisis.

- Gold Price Forecast (XAU/USD): Neutral-downward biased, but upside risks remains due to Fed’s monetary policy decision.

Gold spot (XAU/USD) remains subdued ahead of the Federal Reserve May monetary policy decision, in which the US central bank is foreseen to lift the Federal Funds Rate (FFR) by 0.50% to 1%. Besides, it will also announce the pace of the Quantitative Tightening (QT), expected at $95 billion, $65 billion of US Treasuries, and $30 billion of mortgage-backed securities (MBS). At the time of writing, XAU/USD is trading at $1867.82 a troy ounce.

Sentiment has improved as the Fed’s monetary policy decision gets closer, the greenback weakens

The closer the Fed’s decision gets, the market mood turns mixed. US equities fluctuate between gainers and losers. At 18:00 GMT, the Federal Reserve would release its monetary policy decision, which would trigger sharp volatility in the markets. However, at around 18:30 GMT, the Fed Chair Jerome Powell would hold its first in-person press conference in two years, in which market players would look for any hawkish/dovish commentary that could provide some forward guidance ahead.

Aside from this, Wednesday’s sentiment was also struck by China’s ongoing coronavirus crisis. Although it appears that in Shanghai, the epidemic situation seems to improve, Beijing closed 40 metro stations as cases began to ramp up, threatening to slow down the second-largest economy in the world.

Geopolitics-wise, the Ukraine-Russia conflict remains unchanged amid the late lack of peace talks. The hostilities persist as Russia tries to seize the Donbas region in Eastern Ukraine. At the same time, the EU Commission President von der Leyen said there would be a complete import ban on all Russian oil, pipeline, crude and refined.

The US Dollar Index, a gauge of the greenback’s value against a basket of its peers, is pairing some earlier losses, down 0.09%, and sits at 103.360. Contrarily, the US 10-year benchmark note sits at 2.987%, up to one and a half basis points during the day.

During the day, the US economic docket featured April’s ADP Employment Change, a prelude to Friday’s Nonfarm Payrolls report. The figures showed that the US economy added just 247K jobs, lower than the 395K estimated, while the Balance of Trade for March showed a wider deficit, from $-89 billion to $-109 billion. Regarding the Non-Manufacturing PMIs, the so-called services for April decreased, while the S&P Global Composite Final report decelerated to 56 from 57.7.

Gold Price Forecast (XAU/USD): Technical outlook

Gold remains neutral-downward biased ahead of the Fed’s decision. As of writing, XAU/USD price is below the 50 and the 100-day moving averages (DMAs), a sign of the yellow-metal weakness. Also, on its way north lies a solid resistance area around March’s lows, previous support-turned-resistance at $1890, which in the event of XAU/USD prices shooting higher, would be difficult to overcome on its way north.

To the upside, gold traders need to be aware of critical levels, like the 100-DMA at $1881.38, followed by March’s lows at $1890 and the $1900 mark. On the other hand, XAU/USD’s first support would be May 3 daily low at $1850.34, closely followed by the 200-DMA at $1835.08, and then January’s 28 YTD low $1780.18.

Jerome Powell, Chairman of the Federal Reserve System, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 18:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

About Jerome Powell (via Federalreserve.gov)

"Jerome H. Powell took office as Chairman of the Board of Governors of the Federal Reserve System on February 5, 2018, for a four-year term*. Mr. Powell also serves as Chairman of the Federal Open Market Committee, the System's principal monetary policymaking body. Mr. Powell has served as a member of the Board of Governors since taking office on May 25, 2012, to fill an unexpired term. He was reappointed to the Board and sworn in on June 16, 2014, for a term ending January 31, 2028."

"*Note: On February 4, 2022, the Federal Reserve Board named Jerome H. Powell as Chair Pro Tempore, pending Senate confirmation to a second term as Chair of the Board of Governors."

- The Swiss franc accumulates losses for the nine-consecutive trading session.

- US equities fluctuate between gainers and losers as risk appetite wobbles.

- USD/CHF Price Forecast: Upward biased, despite RSI being in overbought territory but still aiming higher.

The USD/CHF rallied and reached a two-year high at around 0.9839 as traders prepared for the monetary policy decision of the Federal Reserve. At 0.9829, the USD/CHF retraced from daily tops but is recording gains of 0.49% at the time of writing.

Sentiment has improved as the Fed’s monetary policy decision gets closer, the greenback weakens

The market mood is mixed, as US equities fluctuate between gainers and losers. Meanwhile, the Covid-19 crisis hitting China, the second-largest economy, threatens to slow down the post-pandemic economic recovery. However, it has already taken its toll as China’s Caixin PMIs last Saturday showed that the manufacturing and services indices are contracting.

In the meantime, the Ukraine-Russia fighting continues but has moved to the Donbas region, as Russia is trying to seize that territory.

The US Dollar Index, a gauge of the greenback’s value against a basket of its peers, slides some 0.11% and sits at 103.343, ahead of the Fed’s decision. Contrarily, the US 10-year benchmark note sits at 2.989%, up to one and a half basis points during the day.

USD/CHF Price Forecast: Technical outlook

The USD/CHF has sustained the steepest rally since reaching the 0.9200 region on March 31. However, despite the Relative Strength Index (RSI) being in overbought territory at 85.67, it shows no signs of a reversal coming up next, as RSI’s slope remains upward.

With that said, the USD/CHF first resistance level would be the R2 daily pivot at 0.9850. A breach of the latter would send the pair towards the R3 pivot point at 0.9890, followed by the 0.9900 figure, shy of the parity.

On the flip side, the USD/CHF first support would be the R1 pivot point at 0.9810, followed by the 0.9800 mark. Once cleared, the next support would be the 50-hour simple moving average (SMA) at 0.9787, followed by the daily pivot at 0.9770.

- On Wednesday, the NZD/USD is gaining some 0.25%, ahead of the Fed.

- A downbeat market mood keeps the NZD from printing larger gains vs. the greenback.

- NZD/USD Price Forecast: Downward biased, but upside risks remain as RSI begins to aim higher.

NZD/USD is contained within familiar levels as market players get ready for the Federal Reserve monetary policy decision. The central bank is widely expected to raise rates by 50-bps and begin its balance sheet reduction. However, at 0.6448, the NZD/USD remains weak, even though the Reserve Bank of New Zealand (RBNZ) has hiked rates and has its OCR at 1.50%.

The market mood is negative ahead of the US Fed meeting

Sentiment in the financial markets is negative. Global equities remain defensive as investors prepare for the Fed’s 50-bps rate hike, the first larger than 25-bps in 22 years, as the US central bank is trying to bring inflation down. Furthermore, the Covid-19 crisis in China threatens to slow down the second-largest economy in the world as Beijing announced the close of more than 40 metro stations. Meantime, Shanghai’s reported an improvement in the epidemic situation. However, previous restrictions imposed showed that the Chinese economy took a toll, with Caixin PMIs moving to the contracting territory.

Geopolitics-wise, the Ukraine-Russia conflict has not shown an improvement in peace talks at all. The hostilities persist as Russia tries to seize the Donbas region in Eastern Ukraine.

In the meantime, the greenback is under pressure ahead of the FOMC and losses some 0.12%, sitting at 103.329. Contrarily, the US 10-year Treasury yield tops at 2.981%, almost flat during the day.

Before Wall Street opened, some US economic data crossed the wires. The ADP Employment Change for April, a prelude to Friday’s Nonfarm Payrolls report, illustrated that the US economy added 247K jobs, lower than the 395K estimated, while the Balance of Trade for March reported a wider deficit, from $-89 billion to $-109 billion. Regarding the Non-Manufacturing PMIs, the so-called services for April decreased, while the S&P Global Composite Final report decelerated to 56 from 57.7.

NZD/USD Price Forecast: Technical outlook

From a daily chart perspective, the NZD/USD remains downward biased. The Relative Strenght Index (RSI) at 24.76 shows the NZD/USD as oversold, and it appears that the pair could be shiftings on its bias, as the RSI is beginning to aim upwards.

Here are some levels to account for at the FOMC monetary policy meeting. The NZD/USD first resistance would be the 100-hour simple moving average (SMA) at 0.6457. Break above would expose the R1 daily pivot at 0.6470, followed by the August 2020 daily high at 0.6488 and then the R2 pivot point at 0.6500. on the downside, the NZD/USD first support would be the YTD low at 0.6410. A breach of the latter would expose the S1 pivot at 0.6400, followed by the confluence of June 2020 lows and the S2 pivot at around 0.6370-80.

Canada registered another trade surplus in March, although below expectations: CAD 2.49 billion vs CAD 3.90 billion. Analysts at the National Bank of Canada highlight the trade surplus with the US reached a fresh record high.

Key Quotes:

“For the ninth time in the past ten months, Canada's trade balance remained in positive territory, with both exports and imports reaching all-time highs. Total trade (exports + imports) in the motor vehicles/parts category expanded the most in 5 months “as automakers experienced a reprieve from supply chain issues that have been limiting output for a number of months.” Despite this improvement, international exchanges in the auto sector remained 7.6% below their pre-pandemic level.”

“The energy sector, meanwhile, benefited from higher prices and uncertainty surrounding global oil supply. Imports mustered a second consecutive gain, while exports jumped 12.8%, propelling Canada’s energy trade surplus to a record level.”

“The trade surplus with the United States moved from C$10.9 billion to C$12.6 billion, another record.”

“Turning to quarterly data, trade in goods likely weighed on GDP growth in the first quarter of the year, as real exports (-2.5%) contracted at a slightly faster pace than real imports (-1.0%). The increase in import volumes in the machinery equipment category (+3.8%), meanwhile, bodes well for investment spending in Q1.”

Data released on Wednesday showed the ISM Service Sector dropped unexpectedly to 57.1 in April. Analysts at Wells Fargo point out that while supply remains a problem for service-producers, a pullback in demand and hiring were the top factors weighing on activity during the month.

Key Quotes:

“Activity in the service sector stumbled in April according to the latest ISM services report. Even as every industry other than information reported growth, the pace of expansion downshifted last month as continued supply issues, sky-high inflation and a pullback in demand weighed on activity. The overall index defied expectations for a modest improvement and slipped 1.2 points to 57.1.”

“Difficulties across the supply chain remain a large constraint on activity. This was detailed in the selected purchasing manager comments as well as the uptick in the supplier deliveries component. One clear message from both ISM reports in April is that supply chain progress took a timeout in April.”

“This environment is only exacerbated by the march higher in labor costs. While the supply of labor has improved more recently, qualified help still remains hard to find, which is keeping pressure on wages. The hiring picture from the services ISM was discouraging.”

- US dollar weakens ahead of the FOMC statement.

- Market participants ignore US economic data

- GBP/USD fails to benefit from the relatively weaker dollar.

The GBP/USD is falling modestly on Wednesday before the release of the FOMC statement. After reaching a daily high at 1.2537, it turned to the downside, falling to test the 1.2465/70 support area, where the lows of the last three days are located. The pound remained above and rebounded to 1.2500.

Market participants await the outcome of the FOMC meeting. The DXY is falling on Wednesday, trading at 103.25, down 0.20%. While US yields pulled back, to neutral territory for the day.

Data ignored, markets point to the Fed

Economic data from the US came in weaker than expected but had no impact on the greenback. The ADP Employment report showed an increase in jobs in the private sector of 247K below the 395K expected. The ISM Service PMI in April dropped unexpectedly from 658.3 to 57.1. The S&P Global Servicer MIS was revised from 54.7 to 55.6.