- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-04-2022

- The Canadian dollar extends its advance vs. the Japanese yen, in the market mood for the second day in a row.

- High oil prices dragged the CAD/JPY up as the Russo-Ukraine conflict persists.

- The divergence between the Bank of Japan and the Bank of Canada favors the CAD.

- CAD/JPY Price Forecast: Upward biased, but downside risks remain unless CAD bulls reclaim 99.00.

The CAD/JPY began the week on a higher note, though, as the Asian Pac session begins, the pair edges lower some 0.03%, despite a positive risk-on mood portrayed by Asian equity futures underpinned to a higher open. At the time of writing, the CAD/JPY is trading at 98.33.

Geopolitical issues around the Russian-Ukraine war began the week in the front seat and are weighing on energy prices. Developments in the weekend report that Russian troops killed civilians in Bucha and other towns were condemned by Germany and France, which in response expelled Russian diplomats. At the same time, US President Joe Biden said that Russian President Vladimir Putin could face a war crimes trial.

Aside from geopolitical issues, oil prices rose, as portrayed by Western Texas Intermediate (WTI’s), which rose by 4.33%, back above $100, a tailwind for the CAD/JPY. However, it has been reported that Iran is pumping oil production to its pre-sanction levels. Furthermore, the US State Department said they believe there is an opportunity to overcome the remaining differences in Iran's nuclear talks.

If the nuclear talks resume, that could be a headwind for the CAD/JPY because that news would drag oil prices down, benefitting JPY bulls.

Meanwhile, central bank policy divergence between the Bank of Japan (BoJ) and the Bank of Canada (BoC) favors the latter.

The Bank of Japan pledged to buy five and 10-year JGB bonds as the bank exerts its Yield Curve Control (YCC) targeted at 25 bps, as the BoJ aims to achieve its inflation target of 2%. Its posture would remain dovish unless BoJ Governor Kuroda expresses some worries about the Japanese yen value.

On March 25, BoC Deputy Governor Sharon Kozicki said: “Returning inflation to the 2% target is our primary focus and unwavering commitment. We have taken action and will continue to do so to return inflation to target, and we are prepared to act forcefully.”

Money market futures immediately priced in two subsequent 50-bps increases, and with the BoC Interest Rate Decision looming in the next week, the CAD might remain buoyant into the meeting.

Therefore, the CAD/JPY in the near term is upward biased, though it would be subject to market sentiment.

CAD/JPY Price Forecast: Technical outlook

The CAD/JPY is upward biased, though it has faced solid resistance around the 98.40s area. It is upward biased in the near term, but with the Relative Strength Index (RSI) at 73.48 in the overbought zone, it suggests a correction looms before resuming the uptrend.

That said, the CAD/JPY first resistance would be 98.46. A breach of the latter would expose essential resistance levels like March 29 daily high at 99.22, followed by March 28 YTD high at 100.19.

On the downside, the CAD/JPY first support would be 98.00. Once cleared, the next support would be 97.61, followed by 97.05.

Technical levels to watch

- USD/CHF is struggling to cross 0.9280 as investors await US Services PMI.

- The outperformance of DXY is failing to push the major higher amid a firmer Swiss franc.

- Swiss Unemployment Rate and FOMC minutes are major events that investors will keep on the radar.

The USD/CHF pair is facing barricades around 0.9280 despite the strong gains in the US dollar index (DXY). The DXY is scaling higher after the upbeat US Unemployment Rate. The US Bureau of Labor Statistics reported the Unemployment Rate at 3.6% lower than the estimates of 3.7% and the prior figure of 3.8%. The US administration is continuously recording the Jobless rate below 4%, which indicates achievement of full employment and course higher odds of a fat interest rate hike by the Federal Reserve (Fed).

The Fed is likely to approach a tight-aggressive monetary policy to corner the soaring inflation. An interest rate hike by 50 basis points (bps) is more likely on cards as the dual mandate of the Fed: inflation and Jobless rate are indicating exhaustion. Meanwhile, CME Group's FedWatch tool is showing 71% odds of a half-point rate increase.

On the Swiss franc front, the currency is performing decently against the greenback on positive market sentiment. The risk-on impulse is favoring the risk-sensitive currencies amid progress in the Russia-Ukraine peace talks. Apart from that, the Swiss franc is firmer ahead of the Swiss Unemployment Rate. The Swiss State Secretariat of Economic Affairs is likely to report the monthly jobless rate at 2.2%, similar to the previous figure.

Going forward, the minutes from the Federal Open Market Committee (FOMC) will be the major event, which is due on Wednesday. But before that, investors will focus on Tuesday’s US Services PMI, which may land at 58 against the previous print of 56.5.

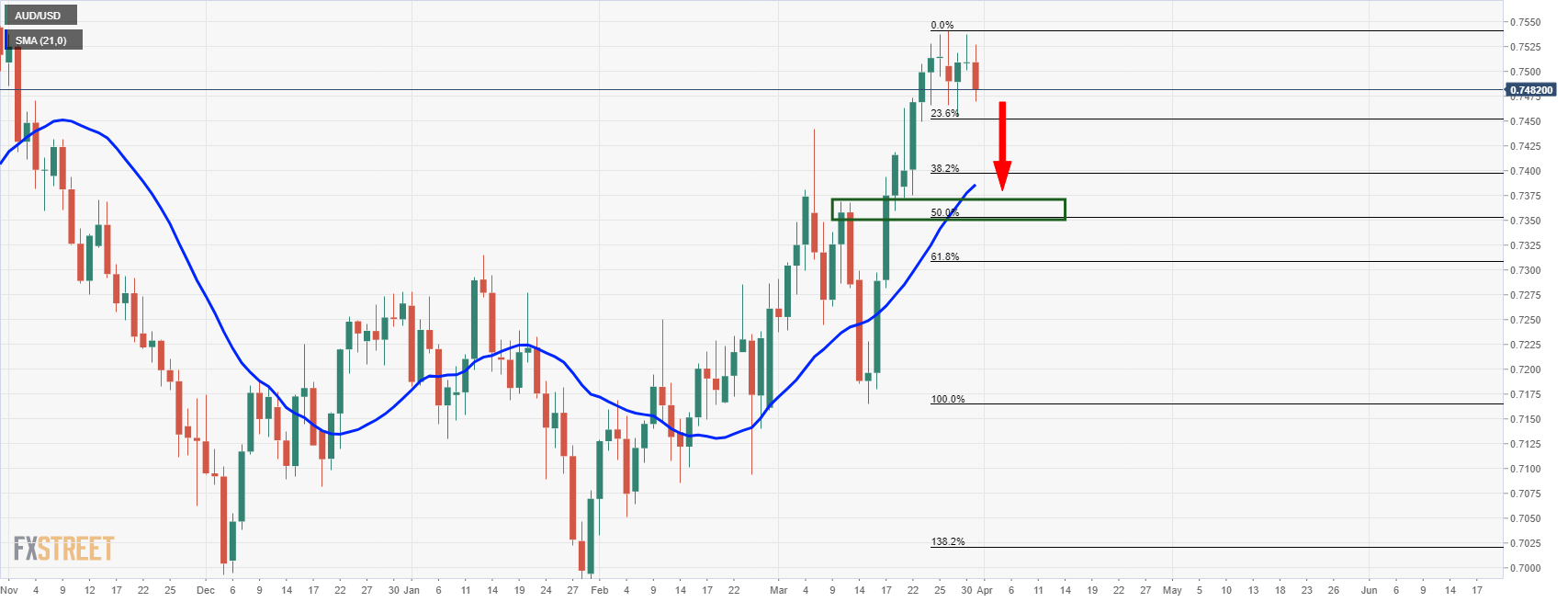

- The Australian dollar broke above the 0.7540 resistance level, unsuccessfully tested four times.

- The Reserve Bank of Australia (RBA) is expected to keep rates unchanged.

- Market players expect the central bank’s rhetoric, any hawkish tilt or hints, would push the AUD/USD higher.

- AUD/USD Price Forecast: Upward biased, and a break above 0.7600 could pave the way for further gains.

The Australian dollar advanced on Monday, ahead of Tuesday’s Reserve Bank of Australia monetary policy decision, amidst an upbeat market mood. Portraying the aforementioned, were US equities rallying, while Asian futures point to a higher open. The AUD/USD is trading at 0.7544, near YTD new highs.

The Reserve Bank of Australia (RBA) expected to hold rates unchanged

Later at around 04:30 GMT, the Reserve Bank of Australia would unveil its monetary policy decision. Uncertainty around the Russo-Ukraine conflict, global inflation, and the domestic election in Australia are factors in the backdrop.

Market participants expect the RBA to stay dovish and keep the Cash Rate unchanged at 0.10%. Given that money market futures have priced in 200 bps in 2022, it would be expected that the RBA would “lay the groundwork for at least one hike in the fourth quarter – or even a Q3 start,” analysts at Scotiabank noted.

Australian inflation is back in the target band. However, the RBA stated that it would not lift rates until inflation is ‘sustainably’ within the target band, requiring a lift in wages growth from current relatively modest levels.

Therefore, and due to the recent lift in the AUD/USD, it would be no surprise that AUD/USD traders witness a “buy the rumor, sell the fact” development in price action, opening the door for a mean-reversion move. If the RBA turns “hawkish,” the AUD would further appreciate. However, it is worth noting that traders should be aware of the market mood as the Australian dollar is a risk-sensitive currency.

AUD/USD Price Forecast: Technical outlook

The AUD/USD holds into gains as the Asian session begins, though short of the 0.7555 YTD highs. It is worth noting that the break of the 0.7500-40 range exposed the AUD/USD to further upside, and with the RBA meeting looming, any “hawkish” language or hints could send the pair to the 0.7600 mark.

If that scenario plays out, the AUD/USD first resistance would be 0.7600. Breach of the latter would clear all the path to the 0.7700 mark, followed by June 11, 2021, 0.7775 daily high. Otherwise, the AUD/USD first support would be 0.7500. A sustained break would expose the September 3, 2021, daily high turned support at 0.7478, followed by March 7 high turned support at 0.7441.

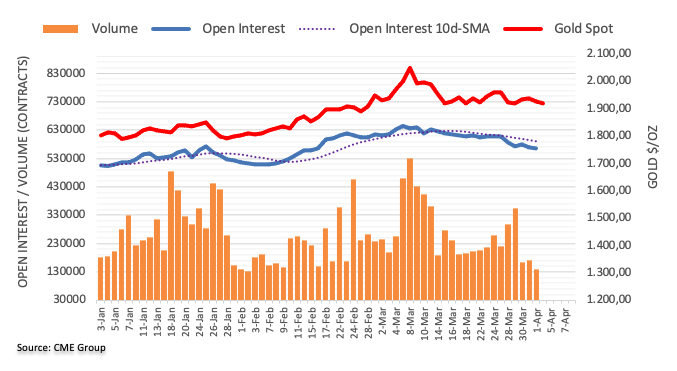

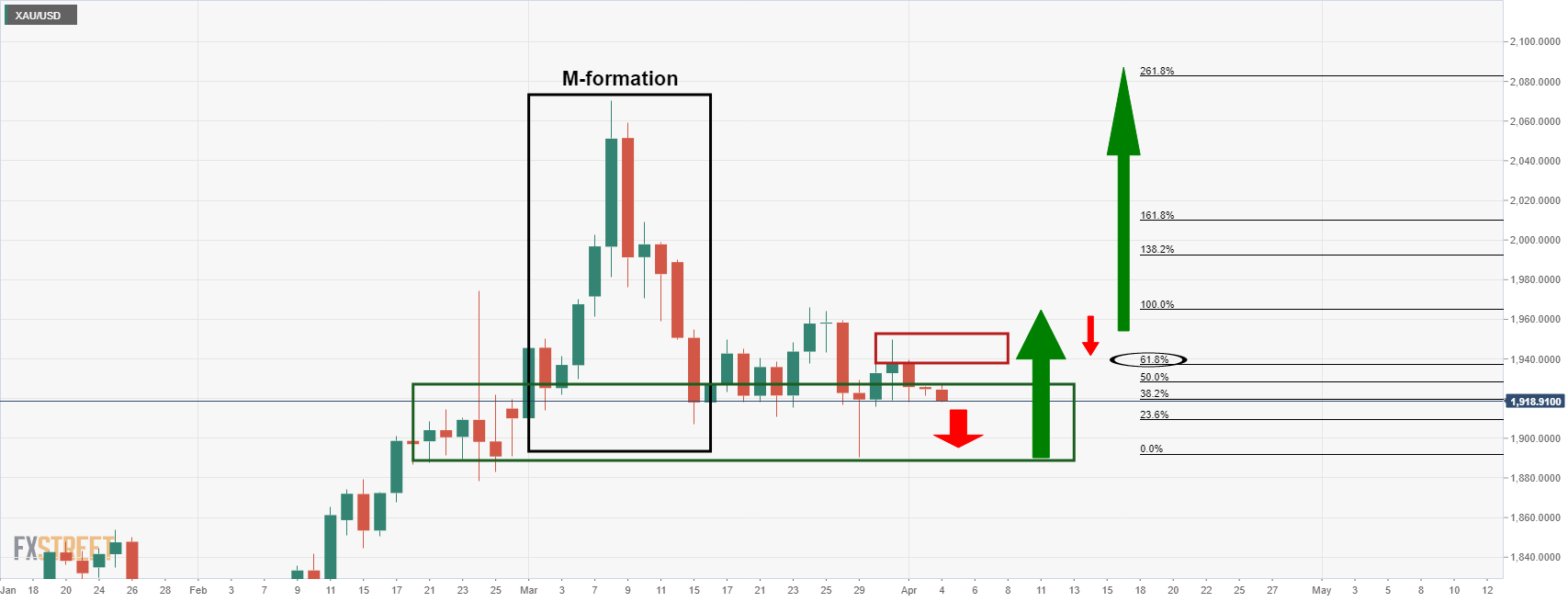

- XAU/USD is juggling in a range of $1,915.78-1,949.86 amid upbeat market mood.

- Russia-Ukraine peace talks look de-escalated as Ukraine accused Russia for death of civilians.

- The DXY is scaling higher on lower US Jobless rate.

Gold (XAU/USD) is oscillating in a range of $1,915.78-1,949.86 from the last three trading sessions amid positive market sentiment. The digestion of worst-case scenarios amid Russia’s invasion of Ukraine by the market participants has kept the tone of the market favorable. The precious metal is trading lackluster and is looking for a trigger to find direction.

A progress in the Russia-Ukraine peace talks was clearly witnessed by investors after the discussions over the major stipulations to be printed in a special document of ceasefire. Also, the month long military activity of Russian rebels in Ukraine was indicating that Russia might be out of military equipments, liquidity and resources soon, which will force it to approach a ceasefire. However, the allegation from Ukraine President Volodymyr Zelenskyy on Russia over the death of civilians by the Russian forces in Bucha, Ukraine has stretched the ceasefire expectations.

Meanwhile, the US dollar index (DXY) has reclaimed 99.00 on expectation of strong US Services PMI on Tuesday. A preliminary estimate for the US Services PMI is 58 against the prior print of 56.5. Also, the odds of a jumbo interest rate hike have increased sharply after the upbeat Unemployment Rate. The US Jobless rate at 3.6% and its consistency below 4% is bracing a 50 basis point (bps) interest rate hike by the Federal Reserve (Fed). Strong labor market amid achievement of full employment levels is hoping an aggressively tight monetary policy in May. Also, the US Treasury yields are balanced in a limited range. The 10-year benchmark US Treasury yields is trading close to 2.4% and is expecting to witness higher levels going forward.

This week, the minutes from the Federal Open Market Committee (FOMC) will remain the major event for the FX domain. The FOMC minutes will dictate the strategy behind advocating the 25 bps hike interest rate decision by the Fed.

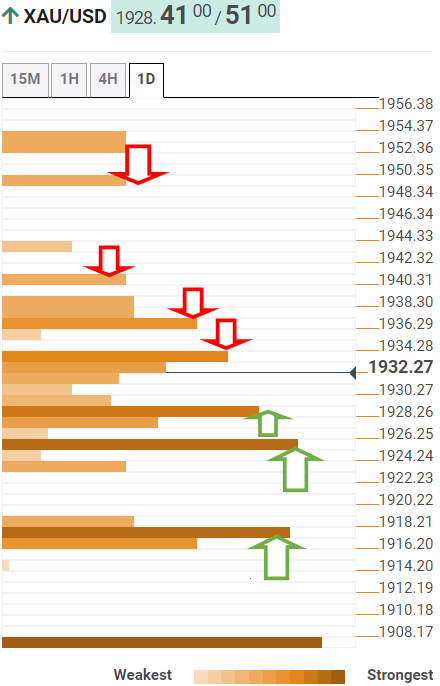

Gold Technical Analysis

On an hourly scale, XAU/USD is oscillating in a diamond pattern that signals a bullish reversal after a steep fall. The formation indicates inventory adjustment in which the inventory is shifted from retail participants to institutional investors. The 20- and 50-period Exponential Moving Averages (EMAs) near $1,930 are overlapping to each other, which signal a consolidation ahead. Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which indicates a lackluster performance.

Gold hourly chart

-637847090739651262.png)

- NZD/USD bulls firmer on bid Wall Street despite Ukraine crisis risks.

- Eyes turn to the RBA interest rate decision, kiwi rides coattails of AUD.

NZD/USD is starting out in Asia around 0.6950 after climbing from the 0.6920s in New York trade when it scored a high of 0.6969 despite a firmer US dollar in general. US stocks managed to close higher on Monday, propelled by technology shares, and in turn supported high beta currencies such as the antipodeans.

Nevertheless, the US dollar was robust at the start of the week, with the DXY higher on Monday by some 0.5% and for three straight sessions in a row. US yields were firmer due to the narrative surrounding the Federal reserve and as civilian killings in north Ukraine keep the safe-haven appeal alive in financial markets. In turn, the US dollar climbed in tandem with the yield on the US 10-year note rising 3.3bps to 2.415% on the narrative surrounding the Federal Reserve.

In this regard, this week will see the minutes of the last meeting when Fed officials began the process of policy normalization by lifting rates 25bp to 0.25%-0.50% at the March meeting. ''The FOMC pull no hawkish punches in its policy guidance, with Chair Powell also hinting further information about QT plans will be provided in the minutes (possibly including caps details),'' analysts at TD Securities said. ''We continue to expect an official QT announcement at the May FOMC meeting.''

Eyes on RBA

''The Kiwi is higher this morning, having been better bid since the reopen yesterday, before then riding on the coattails of the AUD rally and the generalised rebound in global risk sentiment,'' analysts at ANZ Bank explained.

''With regard to the former, today’s RBA meeting is absolutely crucial because it has been the rise in rate hike expectations in the Aussie rates market that have helped propel the AUD higher, and that has, in turn, given the NZD a boost. No change in policy is expected, but any perceived shift away from their erstwhile very dovish tone will be latched onto, especially with Q1 CPI due before the next meeting (in May). Other than that, as noted, Kiwi is just going along with the global vibe.''

- Formation of the symmetrical triangle is indicating a contraction in volatility and volumes going forward.

- A bull cross of 20- and 50-period EMAs is intact.

- The greenback bulls need to explode the symmetrical triangle for an upside move.

The USD/JPY pair seems losing the interest of the market participants and is trading lackluster since the first trading session of April. After a steep fall from its six-year high at 125.10 on March 28, the major is inside the woods.

On an hourly scale, USD/JPY is oscillating in a symmetrical triangle that signals indecisiveness in the sentiment of the market participants. Usually, a symmetrical triangle denotes volatility contraction and volume squeeze. The pair is juggling in a narrow range of 122.26-123.04 from the last three trading sessions.

The 200-period Exponential Moving Average (EMA), which is trading near the round level figure of 122.00 has acted as major support earlier. Adding to that, the 20- and 50-period EMAs are continued with their bull cross despite the range-bound move in the asset.

The Relative Strength Index (RSI) (14) has shifted into a 40.00-60.00 range from the bullish range of 60.00-80.00, which signals back and forth moves going forward.

A breakout of the symmetrical triangle above 123.00 will be followed by a swift move, which will send the asset towards the March 29 high at 124.30. A breach of the latter will drive the greenback bulls to a six-year high at 125.10.

On the contrary, yen bulls may strengthen on breaking of the symmetrical triangle at 121.33, which will drag the major towards the round level support at 120.00, followed by the March 18 low at 119.08.

USD/JPY hourly chart

-637847059808406688.png)

- GBP/USD holds the fort despite US doll strength to start the week.

- Markets still pricing a lot more than what the Bank of England has guided.

GBP/USD is flat on the day and has traded between a low of 1.3086 and a high of 1.3136, sustaining US dollar strength better than its rival, the euro, for now. The US dollar is robust at the start of the week, with the DXY higher on the day so far by nearly 0.5% and for three straight sessions.

US yields have been on the up due to the narrative surrounding the Federal reserve and as civilian killings in north Ukraine keep the safe-haven appeal alive in financial markets. ''For the moment, risk markets are taking the expectation of successive 50bp rate rises at the May and June FOMC meetings in their stride,'' analysts at ANZ Bank said.

Meanwhile, with markets still pricing a lot more than what the Bank of England has guided to markets, the focus will be on the MPC speak this week as it is becoming more and more important. ''We look for continued pushback on market pricing, with Bailey, Cunliffe, and Pill all making appearances in the week. Cunliffe will be most interesting, as he was the lone dove in March, so we watch for any change in position,'' analysts at TD Securities said.

Meanwhile, analysts at Rabobank said, ''central bankers are well aware that there is an economic cost to hiking interest rates. They are also aware that conventional theory suggests that taking the necessary action to keep inflation expectations confined brings a far better economic outcome long-term than allowing hyper-inflation to become entrenched.''

Noting that there is an energy price crisis which has been exacerbated by the war in Ukraine, the analysts explained that ''this came on top of the supply side issues brought about by the pandemic and by Brexit. The market has re-considered the outlook for UK rates in the wake of the BoE’s dovish tightening in March. However, in our view, the market may still have too many rate hikes priced in. This leaves GBP vulnerable against both the USD and the EUR.''

- In the North American session, the white metal slides almost 0.50% on high US yields and a positive market mood.

- Germany and France expel Russian diplomats as a response to the Bucha killing.

- Silver Price Forecast (XAG/USD): The bias is neutral upwards, but caution is warranted due to the closeness of the 200-DMA.

Silver (XAG/USD) extends its fall to three-consecutive trading sessions, struggling to get to the $25.00 mark, weighed by rising US Treasury yields and an upbeat market mood, despite the escalation of the Russia-Ukraine conflict. At the time of writing, XAG/USD is trading at $24.50.

As reflected by European and US equities, an upbeat market mood weighs on the safe-haven status of the non-yielding metal. The Russia-Ukraine conflict further escalates after Ukrainian forces found that Russia’s army had killed 410 unarmed people in the city of Bucha. Europe’s response came at the expulsion of Russian diplomatics in German and France, as Europe weighed the possibility of an energy-oil embargo on Russia.

In the US, President Biden said that Vladimir Putin could face a war crimes trial and vowed Washington would impose another tranche of sanctions against Russia.

In the meantime, US Treasury yields are rising, portraying the Federal Reserve’s hawkishness of late, as some officials expressed the possibility of 50-bps hikes. The US 10-year Treasury yield gains four basis points, sits at 2.421%, a tailwind for the greenback, which, as shown by the US Dollar Index, remains buoyant, up 0.38%, at the 99.000 mark.

The US economic docket unveiled Factory Orders for February on a monthly basis, which came at -0.5% as estimated but trailed January’s 1.5% reading. The economic calendar would feature more Fed speaking on Tuesday and Wednesday’s FOMC minutes.

Silver Price Forecast (XAG/USD): Technical outlook

XAG/USD’s bias is upwards, though, in the last three trading sessions, a series of subsequent lower highs/lows sent silver towards the 50-day moving average (DMA) at $24.33, a solid line of defense for XAG bulls, lifting the white-metal to the $24.30s area.

Upwards, the XAG/USD’s first resistance would be April 1 daily high at $24.86. A breach of the latter would expose the $25.00 figure, followed by November 16, 2021, a $25.40 daily high, and then August 4, a daily high at $26.00.

On the flip side, XAG/USD’s first support would be the 50-DMA at $24.33. Once cleared, the following demand zone would be $24.00, followed by the 200-DMA at $23.94.

Technical levels to watch

- AUD/JPY rallied above 92.50 on Monday and is now over 2.0% higher versus last Thursday’s lows.

- Buoyant commodity prices and advancing equities made for a bullish mix for the pair.

- Focus now turns to the upcoming RBA meeting as markets brace for a hawkish shift.

In a strong start to the week for AUD/JPY, the pair has risen about 0.8% and was last trading to the north of the 92.50 level, roughly 2.0% higher versus last week’s lows in the 90.70 area. Commodity prices rose nearly across the board on Monday as tensions between the West and Russia amped up in wake of a growing pile of evidence of war crimes committed by Russian forces in the areas where they have now withdrawn from in northern Ukraine. Despite this, global equities remained resilient and have even seen reasonable gains during US trade, creating the perfect conditions for the Aussie to outperform.

The announces its latest monetary policy decision during the coming Asia Pacific session. If the central bank opts for a more hawkish stance regarding its guidance on interest rates hikes (i.e. signaling they could come in the coming months), that could add to AUD/JPY tailwind by highlighting the contrast between the hawkish-turning RBA versus the still ultra-dovish BoJ. AUD/JPY bulls will be eyeing a test of last week’s highs in the 94.00 area, perhaps for sometime later this week.

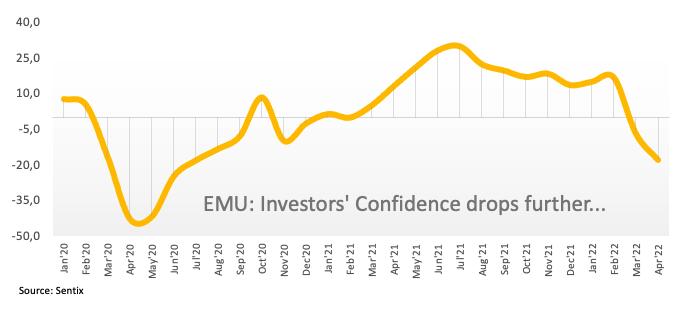

Dutch central bank head and European Central Bank governing council member Klaas Knot said on Monday that the ECB should act in the face of high inflation and that gradual but timely normalisation of policy is needed, reported Reuters. High inflation is not entirely due to the supply shock and demand has recovered far quicker than expected, Knot added.

Knot's remarks comes after data last week showed Eurozone inflation to have risen to a record 7.5% YoY in March, according to the headline Consumer Price Index and comes amid increased media reporting on rising food costs.

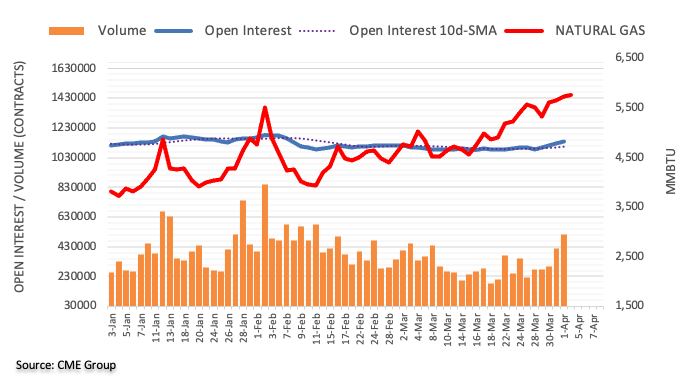

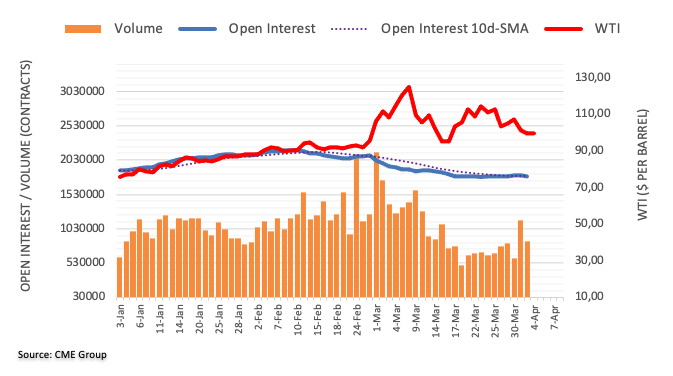

- WTI bulls move in as US and EU move towards sanctioning Russia further.

- US Strategic Petroleum Reserve (SPR) does little to cool down supply concerns.

West Texas Intermediate (WTI) crude oil rose on Monday on persisting supply concerns as Russian energy sanctions are very much on the table following the Russian forces' civilian killings in north Ukraine. For a fresh high of the day, at $103.82. WTI spot is up by some 4.5% as White House's National Security Advisor, Jake Sullivan, announced that the US is working with European allies to coordinate further sanctions on Russia.

Sullivan said that they have concluded Russia has committed war crimes, Bucha offers further evidence to support that, pointing to a protracted war. '' Ukraine-Russia conflict may not be just a few more weeks, could be months.''

Ukraine’s top prosecutor has said 410 bodies had been found in towns recaptured from retreating Russian forces around Kyiv as part of an investigation into possible war crimes. The weekend media reported mass killings of civilians in the town of Bucha which had been under Russian occupation until recently.

The reports led to an array of calls from within the European Union for the bloc to go further in punishing Moscow. Consequently, a fifth package of sanctions against Russia is being arranged with the new round of measures expected to be approved later this week.

Meanwhile and despite the release of 180-million barrels from the US Strategic Petroleum Reserve (SPR) and an agreement last week from members of the International Energy Agency (IEA) to release some of their own strategic reserves, oil is firmer due to the persistence of geopolitical concerns.

"The global oil market remains in deep deficit of likely 1.5 mb/d over the last 4 weeks, before the loss of Russian supply even started, with global inventories at their lowest levels in recent history on a demand-adjusted basis and with limited OPEC and shale elasticity in months to come. Demand destruction requires higher prices, yet this dynamic is being nullified by increased government interventions in cutting gasoline taxes," Goldman Sachs said in a report.

''Indeed, while the SPR release can quell near-term tightness concerns, it does not solve the longer-term issues in the crude market. Structural deficit conditions could still persist down the road as these reserves will need to be replenished at a time when global spare capacity and inventory levels will still be stretched,'' analysts at TD Securities explained.

''In this sense, the right tail in energy markets is set to remain structurally fat as depleted reserves would add to the existing risks of self-sanctioning, stretched spare capacity across OPEC+, constrained shale production, an uncertain Iran deal and OECD inventories at their lowest since the Arab Spring. We expect this vast array of supply risks to remain the driving force in the energy market.''

What you need to take care of on Tuesday, April 5:

Most major pairs struggled for direction on Monday, as market participants remained cautious ahead of the announcement of new sanctions on Russia. The EUR was the worst performer and the AUD was the best one.

The focus remained on the Eastern Europe crisis. As announced, Moscow has moved troops away from Ukraine’s northern region. However, Kyiv reported the massive assassination of civilians and war crimes, which resulted in western nations announcing plans to add sanctions on the Kremlin.

French President Emmanuel Macron called to add sanctions on Moscow, while Germany and France decided to expel Russian diplomats from their countries. The US is also preparing more sanctions against Putin & Co. Ukraine’s President Volodymyr Zelenskyy said that considering what Russia has done in the country, it's difficult to negotiate with them.

The EUR/USD pair trades at around 1.0960, while AUD/USD trades near a fresh 2022 high of 0.7555. The GBP/USD pair is stable at around 1.3110, while USD/CAD hovers around 1.2485. The USD/JPY pair is unchanged at around 122.80, as USDCHF changes hands at 0.9260.

Gold advanced within range, finishing the day at around $1,930 a troy ounce. Crude oil prices edged also higher, with WTI settling at 103.80.

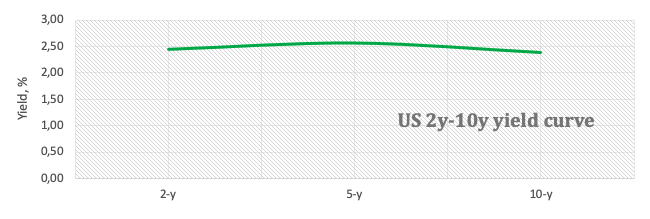

The yield on the 10-year Treasury note stands at 2.42%, while that on the 2-year note is currently at 2.43%. The inverted yield curve spurred recession-related concerns, although the market’s reaction has been limited so far. Nevertheless, mounting concerns hint at potential gains of safe-haven assets.

Crypto.com price consolidates before a major breakout

Like this article? Help us with some feedback by answering this survey:

- USD/CAD is lower, weighed by strong Building Permits data and a BOS survey that supports fast BoC tightening.

- However, the pair continues to trade within recent ranges near 1.2500, as the buck remains broadly buoyant.

- But strategists think that given advancing equities, high commodity prices and a hawkish BoC, USD/CAD can fall towards 1.2400.

Though the latest Business Outlook Survey (BOS), released by the Bank of Canada once per quarter, was broadly interpreted as supporting the case for a faster pace of rate hikes from the BoC in the quarters ahead, its impact on the loonie was limited. USD/CAD was last trading down about 0.2%, but continues to respect recent ranges and remains close to the 1.2500 level that has been acting as a magnet for the past week or so. For reference, the headline BOS indicator dipped back from Q4 2021’s record highs reading of 5.9 to 4.98 in Q1 2022, leaving it still well above pre-pandemic levels.

The general takeaway from the release was that Canadian firms continue to face elevated inflationary pressures and continue to face struggles in hiring/retaining workers, who are demanding higher pay. The BOS survey was conducted before Russia's invasion of Ukraine and a special survey that was conducted in March showed that about half of firms said they expected to impacted by the war, mostly through higher commodity prices.

Elsewhere, strong Canadian Building Permits figures were also supportive to the loonie, after the headline figure recorded a 21% MoM leap in February versus January to hit a record one-month high. But the US dollar has also performed quite well on Monday as tensions on the Russo-Ukraine front rise and this is, for now preventing USD/CAD from breaking lower towards last week’s multi-month lows in the 1.2430 area.

Russian forces stand accused of committing war crimes in Ukraine after evidence emerged of mass civilian killings in the north post-Russia’s withdrawal and European currencies have been underperforming on the chatter of tougher sanctions. But the loonie has in recent weeks been immune to geopolitical-related risk-off given its positive exposure to higher commodity prices, which are now seen as “structurally higher” in wake of the Russo-Ukraine war.

WTI remains well supported to the north of the $100 per barrel mark and global equities have been advancing, which is a cocktail for a lower USD/CAD. If the BoC can maintain its lead over the Fed in terms of monetary tightening (a 50bps move is very much expected at the bank’s next meeting), the pair stands a good chance at pushing to fresh annual lows under 1.2400 and on towards 2021 lows at 1.2300.

- The shared currency falls against safe-haven peers like the greenback and the yen on Russo-Ukraine woes.

- EUR/JPY Price Analysis: In consolidation around the 134.50-135.30 area, trendless.

The EUR/JPY pair slides as the North American session, following the footprints of the EUR/USD, which also falls, below the 1.1000 mark, as Germany and France expel Russian diplomats from their embassies as a response to the Ukrainian genocide in Bucha. At the time of writing, the EUR/JPY is trading at 134.74, near the day’s lows.

European and US equities reflect a positive market mood. However, in the FX space, the continuation of the Russo-Ukraine war weighs on the shared currency and benefits safe-haven peers, like the greenback and the Japanese yen.

Overnight, the EUR/JPY meandered around the 135.00 area and, at a certain point in the mid-European session, reached a daily high above 135.50, followed by a dip towards 134.70s since the mid-North American session, as geopolitical jitters keep the euro pressured.

EUR/JPY Price Analysis: Technical outlook

Even though the EUR/JPY is falling, it found some buyers near the 134.50s highs, as depicted by the last three days’ price action. Nevertheless, the size of the wicks on top of the candlesticks indicates that selling pressure remains in the 135.30-137.50 area, which would be a problematic resistance area to overcome for EUR bulls.

Upwards, the EUR/JPY’s first resistance would be 134.87, which, once cleared, would expose 135.00, followed by 135.30.

On the flip side, the EUR/JPY’s first demand zone would be 134.50. A decisive break would expose 134.05, followed by October 20, 2021, 133.48.05 daily high.

Technical levels to watch

- EUR/USD bears take control due to a firmer US dollar and Ukraine crisis risks.

- Investors are buying into the greenback and the long position in building ahead of the Fed.

The US dollar is robust at the start of the week, with the DXY higher on the day so far by nearly 0.5% and for three straight sessions. US yields are firmer due to the narrative surrounding the Federal reserve and as civilian killings in north Ukraine keep the safe-haven appeal alive in financial markets. In turn, the euro is on the backfoot and weighed also by the prospect of increased sanctions.

At the time of writing, EUR/USD is trading lower by 0.7% and some change after falling from a high of 1.1054 to a low of 1.0960. The euro is trapped between mixed sentiment surrounding the path of the European Central bank, Ukraine crisis risks to the economy and runaway inflation in the US which, for now at least, is supporting demand for the greenback.

ECB President Lagarde heavily caveated the central bank’s hawkish policy outlook in March, though speculation of ECB rate hikes has since stepped up on the back of rising inflation pressures in the Eurozone as well. However, traders are concerned that French President Emmanuel Macron has called for new sanctions and said there were clear indications Russian forces had committed war crimes in the town of Bucha. The German Defence Minister Christine Lambrecht also advocated for much of the same, saying that the European Union should discuss ending Russian gas imports. Russia supplies some 40% of Europe's gas needs. In this regard, markets will also be closely watching the price of oil and its implications for EZ inflation.

Ulrich Leuchtmann, Commerzbank Head of FX. argued that, "More sanctions of course also mean that the risk of energy disruptions in Europe rises, because of our own sanctions or because Russia might get completely serious with its counter-sanctions rather than just changing the payment mode for natural gas."

The ECB minutes for further insight into the impact of war on growth and inflation. ''While the information set at the time of the last ECB meeting (2 weeks after Russia's invasion of Ukraine) will be somewhat stale, the Minutes are likely to reveal details about the change to forward guidance, alongside the Governing Council's view on rapidly-rising inflation and how best to tackle it,'' analysts at TD Securities said.

Meanwhile, the US data on Friday showed US Unemployment hit a two-year low of 3.6% last month. This was leading investors to assess if the numbers would force the hand o the Fed, in anticipation of rapid-fire from the central bank in order to tackle inflation by lifting rates sharply. Subsequently, the two-year US yields hit 2.4950%, their highest level since March 2019.

However, while the US dollar is firmer as a consequence, it is still not breaking out of the 2022 highs at 99.41. The latest CFTC data suggest the market has been rebuilding its long dollar position which could be why the greenback is unable to really take off in the spot market. The market is already oversubscribed to the greenback. Speculators' net long bets on the dollar rose to an 11-week high in the latest week as Fed funds futures price in an 80% chance of a 50 basis point hike next month.

- US equities shrugged off geopolitical concerns and advanced on Monday amid outperformance in large-cap tech stocks.

- Recent Russo-Ukraine war developments raise the risk of an EU embargo on Russian energy imports and peace talk breakdown.

- But major US banks have been becoming more bullish on the equity market’s outlook.

US equity markets rose on Monday despite a resoundingly negative tone to the geopolitical newsflow and further hawkish commentary from Fed officials over the weekend. The S&P 500 was last up roughly 30 points to just over 0.6% and trading in the 4575 area, led by gains in large-cap tech stocks. That has helped the Nasdaq 100 to outperform healthily, with the tech-heavy index last up over 1.6%, versus more modest gains for the Dow of just 0.2%.

As Russian forces pull back from parts of northern Ukraine, a mountain of evidence of war crimes against the civilian population has emerged and, as a result, the pressure on Western leaders to further toughen sanctions against Russia has ramped up. Talk of an EU-wide embargo on Russian oil imports has re-emerged and, with it, downside risks to the Eurozone economy. Meanwhile, mounting evidence of Russian war crimes casts a dark shadow over peace negotiations.

But, as noted, equities are becoming increasingly resilient, not least as a chorus of big US banks adopt a more bullish outlook for the asset class. The equity market’s “risk-reward is not as poor as it is currently fashionable to believe,” noted JP Morgan on Monday. “The Fed repricing might be closer to the end, and headline inflation will mechanically peak soon… The start of Fed tightening should not be seen as a negative for stocks”.

In terms of individual movers, the biggest story was micro-blogging social media site Twitter’s historic near-30% on-the-day gain on the news that eccentric Tesla CEO Elon Musk had taken out a 9.2% stake in the company. TWTR shares jumped above $50 on Monday after closing below $40 last Friday on speculation that Musk’s stake, which was acquired in mid-March but only disclosed on Monday, was just the first step towards a total takeover of the company.

The Tesla CEO has been critical of Twitter for failing to adhere to free speech principles in recent weeks and the speculation is that Musk might want to takeover the company change how it regulates discource on the platform. Of course, Monday’s price action means musk is now sitting on healthy profit on his 9.2% stake, but the biggest boon to his net worth came in the form of a more than 5.5% surge in the value of Tesla’s share price after the company reported record deliveries in the quarter just gone.

- Gold consolidates above the $1900 mark amidst a lack of catalyst and seesawing market sentiment.

- Germany and France expel Russian diplomats from their countries to respond to the Bucha genocide.

- Gold Price Forecast (XAU/USD): Range bound in the $1900-$1950 area.

Gold (XAU/USD) is almost flat but edges high during the North American session amid a risk-on market mood, as portrayed by US equities trading with gains. A rebound in oil prices boosted the prospects of the precious metals sector, in particular the yellow metal, so in consequence, XAU/USD is trading at $1931.05, up some 0.35% at press time.

US equities began the New York session lower but lifted in the mid of the trading session. The Russia-Ukraine war drags on, and the atrocities committed by Moscow of Bucha would exacerbate several tranches of new sanctions imposed by European countries. Germany’s response to that, expelled a substantial number of Russian diplomats, according to AFP, citing a minister. In the same tone as Germany, France has decided to remove “a lot” of Russian diplomatic personnel, a signal of escalation in the Eurozone.

Aside from this, US Treasury yields are recovering from Friday’s losses. The US 10-year benchmark note is up two and a half basis points sitting at 2.399%, though stills below the 2-year, which sits at 2.440%, extending the yield curve inversion for the second straight day.

Following the rise of US yields is the greenback, as portrayed by the US Dollar Index, a gauge of the buck’s value against a basket of peers, is up 0.42%, sitting at 99.05%.

Before Wall Street opened, the US economic docket featured Factory Orders for February on a monthly basis, which came at -0.5% as estimated but trailed January’s 1.5% reading. That said, the docket would turn to Fed speaking on Tuesday, followed by Wednesday’s FOMC minutes.

Gold Price Forecast (XAU/USD): Technical outlook

XAU/USD’s price action depicts the bias as neutral. The current environment keeps non-yielding metal traders waiting for a catalyst, as fluctuating market sentiment, alongside higher US T-bond yields, keeps prices more volatile than pre-war levels. Gold has been seesawing through the last fourteen days, and the escalation of sanctions on Russia from Western countries would keep XAU/USD trading in familiar ranges.

Upwards, XAU/USD’s first resistance would be $1950. Once cleared, the next resistance would be February 24, a daily high at $1974.48, followed by the $2000 mark, and then the YTD high at $2070.63.

On the flip side, XAU/USD’s first support would be $1915.57. A breach of the latter would expose the 50-day moving average (DMA) at $1899.90, followed by November 16, 2021, $1877.14 daily high.

Technical levels to watch

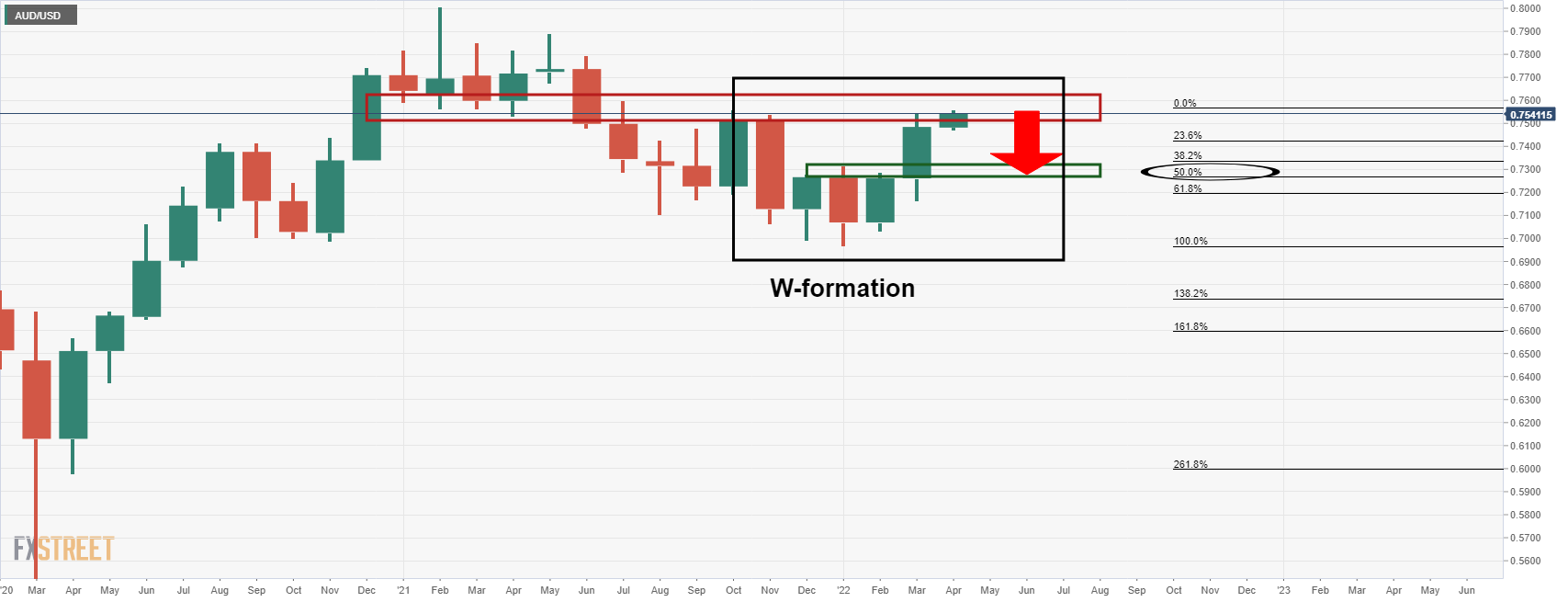

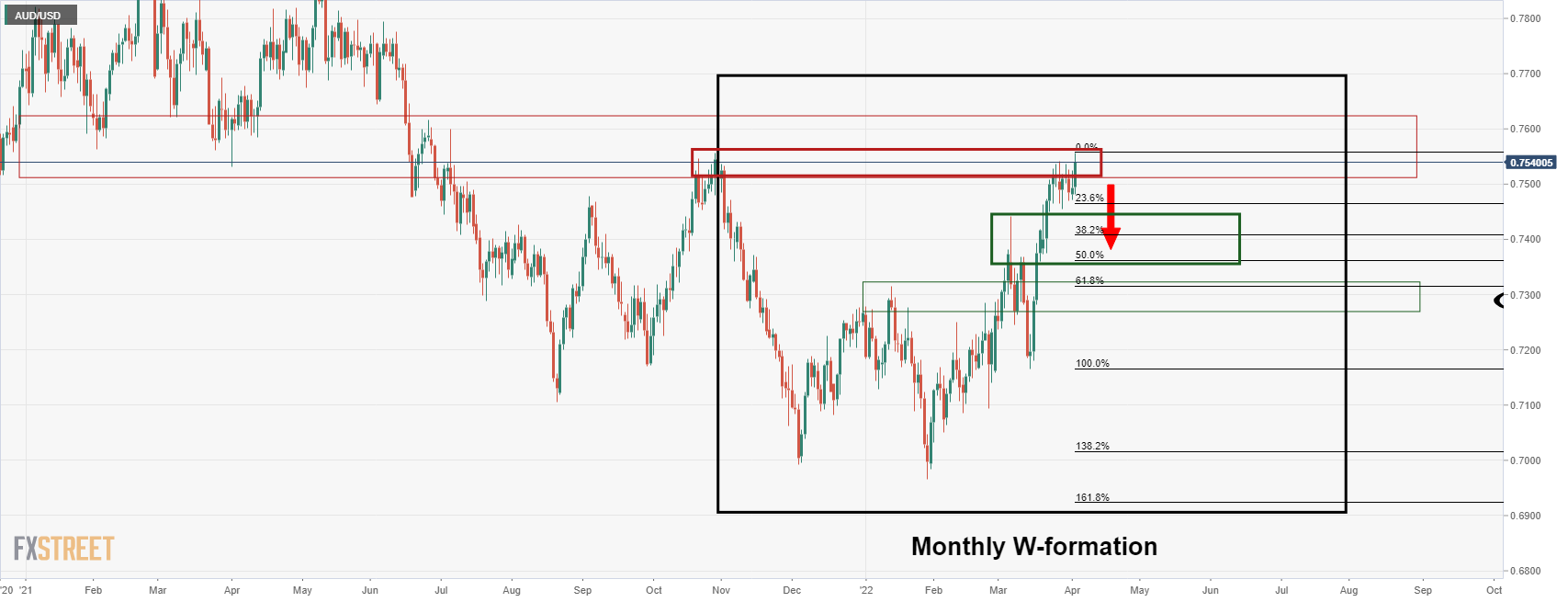

- AUD/USD bulls need to close above 0.7560 or 0.7400 the figure will be exposed.

- Bears will look to the 38.2% Fibonacci retracement level as a target on repeated upside breakout failures.

AUD/USD has moved higher in New York trade as US equities rally. From a technical standpoint, the price is breaking into fresh cycle highs but until the October 2021 highs are well and truly cleared, the resistance could keep the bulls contained and the monthly W-formation should be noted.

AUD/USD monthly chart

The W-formation is a reversion pattern and the price would be expected to revert to restest the neckline of the formation. In this case, the neckline is aligned with the 50% mean reversion level near 0.7260.

AUD/USD daily chart

Meanwhile, the daily chart shows that the price is running into a wall of daily resistance, so should the bulls be unable to break and close above 0.7560, then the focus will remain on the downside with 0.7400 the figure exposed as it comes near to the 38.2% Fibonacci retracement level.

- The USD/CHF edges higher but remains trapped between the 0.9240-80 range.

- A positive market mood boosts the prospects of the greenback.

- USD/CHF Price Forecast: Range-bound between the 0.9200-0.9300 range.

The USD/CHF grinds higher but fails to break above Friday’s high at 0.9279 as the pair probes an eleven-month-old downslope trendline. At press time, the USD/CHF is trading at 0.9266 during the North American session.

Of late, an improved market sentiment, as portrayed by European and US equities, lifted the USD/CHF pair. The USD/CHF was about to break below the 50-hour simple moving average (SMA), but a positive tone in the markets, alongside renewed demand for the greenback, lifted the pair so far. Nevertheless, it is not outside the woods unless the USD/CHF reclaims the 0.9280 area.

USD/CHF Price Forecast: Technical outlook

The USD/CHF bias is neutral-upwards. Its daily chart depicts a subsequent series of higher highs/lows since the beginning of 2022. March 31 dip towards the 200-day moving average (DMA) at 0.9209 was rejected, forming a “spinning top” candlestick, meaning failure to commit between buyers/sellers.

Upwards, the USD/CHF first resistance would be 0.9280. Once cleared, a test of February’s ten high at 0.929600 is on the cards, immediately followed by 0.9300. A decisive break would open the door toward January 31 daily high at 0.9343.

On the downside, the USD/CHF first support would be the 50-DMA at 0.9258, followed by April 1 daily low at 0.9215, and then the 200-DMA at 0.9209.

- NZD/USD is trading sharply higher on Monday, with the pair having jumped 0.6% to the 0.6960s.

- The pair has shrugged off Russo-Ukraine pessimism and recent hawkish Fed speak after bouncing at its 200DMA.

- It is now eyeing a test of recent highs at 0.7000, aided by buoyant equity markets.

NZD/USD is trading sharply higher on Monday, with the pair having jumped 0.6% to the 0.6160s after finding solid demand earlier in the session at the 200DMA just above 0.6900. Hawkish Fed commentary from the weekend which alluded to faster rate hikes (in 50 bps intervals) and imminent QT, as well a deterioration in the tone of Russo-Ukraine developments after evidence of widespread atrocities committed by the Russian military in Ukraine’s north emerges has failed to dent risk appetite in the FX space.

Indeed, though the growing pile of evidence of war crimes committed by Russian troops against Ukrainian civilians throws a dark cloud over Russo-Ukraine peace talks, global equity market are trading firmly on the front foot. This is giving the likes of the risk-sensitive kiwi and its other risk-sensitive G10 peers a lift, but the New Zealand dollar is also gaining (alongside AUD) as a result of its exposure to commodity prices, which are again broadly on the front foot.

In recent weeks, commodity-sensitive G10 currencies like the kiwi have been in demand, despite broader risk appetite, given expectations that country’s like New Zealand and Australia, who are located geographically far from Ukraine, will benefit from structurally higher commodity prices as a result of the war there. Looking at NZD/USD from a technical standpoint, the pair looks to very much still be in the pattern of posting higher highs and higher lows that has been in play since late January.

The fact that the pair found such strong support at its 200DMA on Monday will be taken as a bullish technical signal and makes a test of recent annual highs in the 0.7000 area this week likely. A break above 0.7000 could potentially open the door to a move towards Q4 2021 highs in the 0.7200 area. So long as the risk/commodity backdrop remains favourable and the RBNZ remains ahead of the Fed in terms of the tightening of monetary policy, a push to these levels is definitely on the cards.

A key event during the current week will be on Wednesday when the Federal Reserve releases the minutes of the latest FOMC meeting. At that meeting, the central bank rose interest rates as expected. Analysts at Wells Fargo point out the importance of the additional information that will contain the minutes regarding the balance sheet runoff.

Key Quotes:

“The Federal Open Market Committee (FOMC) elected to raise rates by 25 bps at its March 15-16 meeting. At the conclusion of the meeting, the committee released its quarterly Summary of Economic Projections (SEP), in which all current members submit individual forecasts for key economic indicators and the path of policy. For example, the median forecast for 2022 PCE inflation jumped to 4.3% (on a Q4-over-Q4 basis) from 2.6% in December. Moreover, the median forecaster called for 175 bps of rate hikes in 2022, up from 75 bps in December. All told, the SEP indicated that the FOMC has broadly adopted a hawkish stance on policy.

“The statement from this past meeting said “the Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting.” Moreover, Chair Powell signaled that the meeting minutes, due for release on Wednesday, will contain additional information on the balance sheet runoff. While we previously expected the FOMC to decide on balance sheet reduction in June, the statement indicates that an announcement could very much be in play at the next meeting on May 3-4, depending on developments in coming weeks.”

- Mexican peso keeps rising versus the US dollar, hit highest since July 2021.

- USD/MXN shows oversold readings but no significant sign of consolidation.

- Price remains under the 200-week SMA at 20.15.

The USD/MXN opened the week falling back under 19.80, after posting the third weekly decline in a row. The bearish bias remains intact, with the pair looking to test 19.70 in the short-term and near the critical support area of 19.55.

The US dollar needs to recover levels above 19.85 to alleviate the immediate bearish pressure, favoring some consolidation. While under 20.15, moves to the upside could look unstable; a weekly close above could suggest a temporal bottom has been established.

The fact that USD/MXN has fallen in seventeen out of the last nineteen trading days puts in perspective how far the Mexican peso’s rally has gone. Technical indicators like RSI under 30 show oversold levels. Despite the descriptions, no significant signs of a reversal or stabilizations are noted yet as the cross keeps breaking support levels.

A consolidation under 19.70 should keep the doors open to further losses. The next medium-term solid support is seen at 19.55, the 2021 low before an interim level at 19.65.

USD/MXN daily chart

- GBP/JPY has advanced on Monday in tandem with other risk-sensitive currency pairs as US equities push higher.

- Dovish BoE commentary and recent negative Russo-Ukraine war developments have failed to dent risk appetite, with GBP/JPY now at 161.00.

Dovish commentary from BoE Deputy Governor Jon Cunliffe, who said that a drop in demand through household consumption and business investment as a result of the Russo-Ukraine war will be larger than expected failed to dent GBP/JPY on Monday. The pair was last trading 0.2% higher around the 161.00 level and earlier came within a whisker of matching its highs from last Wednesday in the 161.30s. Cunliffe was the lone dissenter against a 25 bps rate hike at the BoE’s last meeting, and so market participants don’t seem surprised that he is taking a more dovish view on the economy.

Global equities are performing well on Monday, with US equities erasing pre-open indecision and now firmly on the front foot, despite concerns about recent geopolitical developments in the Russo-Ukraine war and this is lifting the risk-sensitive GBP/JPY cross. Russia’s troop pullback in the north has revealed a mountain of evidence of potential war crimes and, as a result, international pressure is mounting on the EU to implement a ban on Russian energy imports. But risk assets are for now immune and if this remains the case, then GBP/JPY could remain supported and perhaps even advance on towards the 162.00 mark.

- Japanese yen steady as US yields move sideways on Monday.

- USD/JPY consolidation, unable to recover 123.00.

- Dollar mixed across the board; DXY up for the third day in a row.

The USD/JPY is rising modestly on Monday, supported by higher US yields and a mixed US dollar. The pair peaked at 122.94 and then pulled back toward the 122.70 area.

In the short-term. USD/JPY is moving sideways with a bullish bias, facing resistance below 123.00. On the flip side, immediate support emerges at 122.50 followed by the daily low at 122.25.

US yields bounced after the beginning of the American session hitting fresh daily highs. The 10-year yield stands at 2.42% and the 2-year at 2.45%. The DXY is up for the third consecutive day, gaining 0.30% at 98.85. Equity prices are mixed in Wall Street while crude oil rises more than 3%.

Regarding US economic data, Factory Orders declined 0.5% in February, in line with expectations. The key event of the week will be the FOMC minutes on Wednesday. The divergence in monetary policy expectations between the Bank of Japan and the Federal Reserve, with risk sentiment, remain the key drivers of price action in USD/JPY.

Analysts at BBH point out that for now, the Bank of Japan won the battle to maintain Yield Curve Control. “The 10-year yield is trading near 0.21%, below the 0.25% limit under YCC. However, the struggle to contain JGB yields is by no means over, not when bond yields in the rest of the world continue to march higher. While last week’s spike in USD/JPY was an overreaction to the BOJ’s YCC operations, the direction for this pair remains clear with central bank divergence particularly strong here. A break above 123.65 is needed to set up a test of the March 28 high near 125.10.”

Technical levels

- The Russian rouble recovered to pre-war levels after a steeper depreciation of 70%.

- A mixed market mood keeps the USD/RUB within Friday’s levels.

- USD/RUB Price Forecast: Technically is upward biased but would be subject to market sentiment and developments around the Russo-Ukraine war.

The USD/RUB barely advances in the North American session, though it remains near pre-war levels, before a steeper surge that sent the pair to a multi-year-high around 154.24. At the time of writing, the USD/RUB is trading at 83.7570, contained within Friday’s high/low at 86.3461/81.7161, respectively.

Market sentiment fluctuates, though putting a lid on the USD/RUB

The market sentiment is mixed, as European bourses record losses while US ones fluctuate. The Russo-Ukraine conflict dominates the headlines as the war is set to extend for a sixth week and weighs on energy and food prices. That would spur global inflation, which, added to supply chains issues and elevated commodity prices, begin to paint a stagflation scenario.

Meanwhile, on Monday, the Russian Chief Negotiator said Russia’s stance on Crimea and Donbas remains unchanged and negated that a draft peace agreement exists. He added that talks would resume on Monday. The Russian Foreign Minister Lavrov stated that Russia does not rule out charging in Roubles for other commodities if “hostility continues from the West.”

Of late, NATO’s Secretary General Stoltenberg said that what is going on in Ukraine is not an actual withdrawal of Russian troops via Reuters.

The German Chancellor Scholtz stated that the West would agree on further Russian sanctions in the coming days.

In the meantime, the US Dollar Index, a gauge of the greenback’s value vs. a basket of peers, rises 0.26%, sits at 98.830, following Friday’s US Nonfarm Payrolls report, even though missed expectations, was solid. Also, the US ISM Manufacturing Index came lower than expected, but Manufacturing Prices rose to 87.1, higher than the 80 estimated, further cementing the case for a 50-bps Fed rate hike.

Therefore, the USD/RUB pair would still be subject to developments in Eastern Europe. Any hints of the progress of talks, Russian troops withdrawal, or cease-fire agreements could be a headwind for the USD/RUB; otherwise, the uptrend could resume short to medium-term.

USD/RUB Price Forecast: Technical outlook

The USD/RUB is contained within the 81.7161-86.3461 range, and if it stays inside those boundaries, it could mean the pair might consolidate. Nevertheless, it is worth noting that the USD/RUB exchange rate is stills above the 200-day moving average (DMA), which sits at 78.1428, maintaining the uptrend bias intact.

That said, the USD/RUB first resistance would be 86.3461. Breach of the latter would expose March 30 daily high at 87.7500, followed by the 92.3961 50-DMA.

The Bank of Canada just released its latest Business Outlook Survey (BOS) and the headline indicator dipped back to 4.98 in Q1 2022 from the record high of 5.9 it hit in Q4 2021. The BOS survey was conducted before Russia's invasion of Ukraine and a special survey that was conducted in March showed that about half of firms said they expected to impacted by the war, mostly through higher commodity prices.

Additional Takeaways:

- 81% of firms reported capacity pressures related to labor or supply chain challenges, a new record high.

- Firms expect significant growth in wages, input prices and output prices due to persistent capacity pressures and strong demand, while there were widespread plans to increase investment spending and add staff.

- Firms continued to expect strong sales growth but at a more moderate pace than over the past year.

- Businesses tied to hard-to-distance services anticipate significant increases in their sales as restrictions related to the Covid‑19 pandemic ease.

- The balance of opinion on indicators of future sales growth fell to 39 in Q1 from 57 in Q4 2021.

- 70% of firms said they expect inflation to be above 3% over the next two years, up from 67% in Q4 2021, though most predicted that it will return close to the BoC's target within 3 years.

- In its special survey on the impact of the Ukraine war, firms said they expect input costs to be hit by higher energy and commodity prices, further supply chain disruptions and many said they plan to pass cost increases on to customers.

- Moreover, several businesses, predominantly those tied to energy and other commodities, expect higher sales.

- In a separate BoC survey of Consumer Expectations, expectations for 1-year ahead inflation increased slightly in Q1 2022 to 5.07% from 4.89% in Q4 2021, with most respondents expecting strong spending growth to continue.

- Despite greater concerns about inflation today, longer-term expectations have remained stable and are below pre-pandemic levels, the Consumer Expectations survey revealed.

The Reserve Bank of Australia will announce its decision on monetary policy on Tuesday, April 4 at 04:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of seven major banks regarding the upcoming central bank's decision.

Uncertainty around the Ukraine crisis, minor signs of wage inflation and the May Federal election are some of the key factors that could lead the RBA to maintain its cautious stance.

Scotiabank

“The bank should nevertheless lay the groundwork for at least one hike in the fourth quarter – or even a Q3 start. We project that the RBA will hike this year, but with a large number of hikes already priced in, the RBA would need to at least meet expectations to support the AUD and, ultimately, markets have got ahead of themselves and the unwinding of RBA hike bets should weigh on the AUD through the remainder of the year. Unless the RBA quickly changes its tone from dovish to very hawkish – something that we don’t anticipate – the AUD faces limited tailwinds. A normalization of commodity prices from very elevated levels would be an additional drag over the coming months.”

Westpac

“The cash rate will be held at the record low of 0.1%. The focus will be on any shift in language in the decision statement. Westpac expects the tightening cycle to begin this August. Inflation is now back in the target band and the unemployment rate, at 4.0%, will soon move below 4% for the first time since 1974. However, the RBA has stated that it will not lift rates until inflation is ‘sustainably’ within the target band – which requires a lift in wages growth from current relatively modest levels. We anticipate that by August, with the benefit of additional information on inflation, wages and unemployment, the case will be made for the tightening cycle to commence.”

Standard Chartered

“We currently expect the RBA to start normalising rates in August. At the last meeting in March, the RBA reiterated that it will be patient in hiking rates and said it may take some time before labour cost growth is consistent with inflation being sustainably at target. That said, the RBA’s reference to supply-side inflation appears to have shifted towards its being more persistent than thought versus how strong demand inflation is after supply-side problems are solved. Since the meeting, February labour data pointed to sustained tightness in the labour market. RBA governor speeches also noted that a rate hike this year may be plausible. That said, the governor noted that the RBA is monitoring inflation psychology and domestic labour costs, and noted that wage growth may remain moderate. We expect further subtle shifts in inflation and rate hike views amid current strong growth and rising inflation dynamics.”

Danske Bank

“Despite the global inflationary pressures, we do not yet expect to see changes to their monetary policy.”

TDS

“We expect the RBA to reiterate that it remains 'patient', looking past the Budget handouts. The RBA seems comfortable with the risk of moving too late than too early and noted that it won't respond until there is "evidence of pervasive price pressures". Thus, we like Rec Jun'22 RBA OIS. We retain our call for the first 15bps hike in Aug but now expect another hike in Sep.”

SocGen

“We expect the RBA to hold the cash rate target at 0.10%. The RBA’s rate guidance likely won’t change. The policy statement will probably say that the RBA will not increase the cash rate until actual inflation is sustainably within the 2-3% target range and that it is too early to conclude that this condition has been met. The RBA will likely maintain its upbeat outlook on economic growth and the labour market. It should continue to acknowledge the war in Ukraine as a major source of uncertainty. The key question for the RBA is when the first rate hike will take place. Our base-case scenario points to August, after the release of 2Q22 CPI. We cannot rule out the first hike in May, especially if 1Q22 CPI provides an upside surprise. But we think that the RBA’s usual step-by-step approach reduces the likelihood of ‘hasty’ action.”

Citibank

“Although any major policy changes are unlikely in this week’s April Policy Board Meeting, it could still hold clues as to when the RBA is considering its first hike (our base case remains August, markets are pricing June). The recent more hawkish tilt implies that the Bank now considers it ‘plausible’ to move rates higher later this year though Governor Lowe is still pushing back against aggressive market pricing which currently suggests that the cash rate could be 1.8% by the end of this year.”

In all probability, Bank of England Deputy Governor Jon Cunliffe said on Monday, the Ukraine invasion will intensify the prolong the surge in inflation and tighten the squeeze on household incomes, reported Reuters. A drop in demand through household consumption and business investment will, to an extent that is not yet clear, be greater than be thought in February, he added.

Additional Remarks:

"It's possible that some labour market weakness will prove to be structural rather than cyclical."

"The lower participation has been compounded by lower migration either as a result of the pandemic or Brexit."

"There is no material evidence of sectoral mismatches in the labour market, which has remained highly flexible."

"What we have seen in the labour market coming out of Covid has very much been a story of weak labour supply and strong labour demand."

"The impact of higher energy prices will not be felt evenly, these factors could amplify the hit to aggregate demand."

- Oil prices rebounded on Monday as calls for an EU-wide Russian energy import ban gained traction.

- WTI is back to trading in the $103.00s, which will dissappoint the White House after their massive reserve release announcement.

Global oil prices rebounded sharply on Monday as international calls for the EU to place a blanket ban on Russian energy imports mounted in light of mounting evidence of war crimes committed by Russian forces in Ukraine. Front-month WTI futures were last up $4.0 per barrel to trade in the $103.00s, where they now trade more than $5.50 above the near-two-week lows printed last Friday underneath $98.00. Traders also cited the news of a pause to US/Iran nuclear negotiations as supportive to oil prices, as hopes of a near-term agreement that could pave the way for as much as 1.3M barrel per day in Iranian exports to return to global markets diminished.

Monday’s rebound will come as a disappointment to the White House, who likely expected their announcement last week of a historic release of oil reserves (1M barrels per day for the next six months) to have a bigger market impact. Since the announcement, which came last Thursday, WTI prices are down only about $4.0. Technicals have likely also impacted Monday trade, with the 50-Day Moving Average offering strong support just below $100 per barrel. To the upside, short-term bullish speculators will likely target a retest of the 21DMA, which currently sits just above $107.

In past days, that has acted as a solid area of resistance, but should the push for an EU-wide ban on Russian energy imports continue to gain momentum, an upside break is very much on the cards. Massive US reserve release aside, another key bearish factor for crude oil market participants to keep an eye on right now is the lockdown situation in China, as tough restrictions in Shanghai drag on as authorities race to test all 26M of the city’s inhabitants.

- USD/CAD witnessed fresh selling on Monday and snapped two days of the winning streak.

- Strong intraday rally in oil prices underpinned the loonie and exerted downward pressure.

- Fed rate hike expectations, the Ukraine crisis benefitted the USD and should limit losses.

The USD/CAD pair remained depressed through the early North American session and was last seen flirting with the daily low, around the 1.2480-1.2485 region.

The pair struggled to capitalize on last week's late recovery from the YTD low and met with a fresh supply on Monday, snapping two successive days of the winning streak. A sharp intraday rally in crude oil prices, now up over 4% for the day, underpinned the commodity-linked loonie. This, in turn, was seen as a key factor that attracted fresh selling around the USD/CAD pair, though the downside seems limited amid a goodish pickup in the US dollar demand.

The market sentiment remains fragile amid fading hopes for a de-escalation in the Ukraine war and talk of additional sanctions on Russia. This, along with growing acceptance that the Fed would tighten its monetary policy at a faster pace to combat high inflation, acted as a tailwind for the greenback. In fact, the markets have been pricing in a 100 bps Fed rate hike move over the next two meetings, which remained supportive of elevated US Treasury bond yields.

Moreover, the US announced a plan last week to sell up to 1 million bpd of oil from the Strategic Petroleum Reserve (SPR) for six months starting in May 2022. Moreover, the International Energy Agency also agreed to release more oil on Friday. This, along with a two-month truce between a Saudi Arabia-led coalition and the Houthi group aligned with Iran, eased oil supply concerns. Adding to this, the COVID-19 outbreak in China could cap the upside for oil prices.

The combination of the aforementioned factors favours bullish traders and supports prospects for the emergence of some dip-buying around the USD/CAD pair. That said, traders might refrain from placing aggressive bets ahead of the FOMC monetary policy meeting minutes, scheduled for release on Wednesday. Hence, any attempted recovery move is more likely to attract fresh selling at higher levels and runs the risk of fizzling out rather quickly.

Technical levels to watch

Gold remains firm in the aftermath of another strong jobs report. Talk of war crimes and the potential for more sanctions are set to keep haven flows particularly strong, strategists at TD Securities report.

Hawkish Fed backdrop is increasingly weighing on the upside momentum of gold

“Aside from geopolitical flare-ups, the focus for the precious metals market this week will shift toward the FOMC minutes and clues surrounding balance-sheet runoff, which we expect will be announced at the May FOMC. In this sense, while safe-haven appetite and massive ETF inflows provide a strong offset, the drag of a hawkish Fed backdrop is increasingly weighing on the upside momentum of the yellow metal.”

“So long as material progress on ceasefire talks and de-escalation remains elusive, haven flows are likely to keep the yellow metal supported.”

“While geopolitical tensions and yield curve recession signals re-ignite investor interest in gold, downside risks are more prevalent amid a hawkish Fed backdrop and as negotiators continue to work towards a ceasefire.”

The EUR/USD pair is under strong selling pressure, falling below the 1.10 threshold. Below here, the way is clear for a significant slide to the 1.09 level, economists at Cotiabak report.

Key support at 1.0805 remains vulnerable

“Last Thursday’s rejection of the upper 1.11s (bearish outside range session) suggests a renewed bear phase for spot may be developing.”

“Gains since the early March low have held in a clear consolidation pattern (bear wedge), the base of which lies at 1.10 today; a sustained push under the figure should see spot retest 1.09 fairly quickly.”

“Key support at 1.0805 remains vulnerable.”

- EUR/USD extends the downtrend to the sub-1.1000 area.

- A close below 1.1000 should spark extra weakness.

EUR/USD trades on the defensive for the third straight session and puts the 1.1000 mark to the test at the beginning of the week.

Considering the ongoing price action, further declines should not be discarded on a close below the 1.1000 level. That said, the immediate target emerges at the weekly low at 1.0944 (March 28) followed by another weekly low at 1.0900 (March 14) and prior to the 2022 low at 1.0807 (March 7).

The medium-term negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1479.

EUR/USD daily chart

USD/JPY looks to have set an exhaustive peak at the 125.29/86 highs of 2015. Analysts at Credit Suisse stay biased toward further sideways consolidation.

An exhaustive peak looks to be in place

“USD/JPY has reversed lower and entered a short-term consolidation phase since extending to just shy of the key 2015 highs at 125.29/86, with weekly RSI momentum still above 80. We have likely seen the peak in this phase of USD/JPY strength and look for further sideways consolidation.”

“Key support during this phase remains at the 38.2% retracement of the rally from late February and 13-day exponential average at 121.33/121.20, which we look to try and hold for now. A closing break would complete a clear top though to trigger a deeper corrective move lower.”

“Above 123.21 is needed to clear the way for a move back to 124.31, but with a break above here needed to clear the way for strength back to the 125.11/86 highs.”

GBP/USD is more or less flat on the session. Economists at Scotiabank expect cable to suffer a decline towards 1.30 after failing to sustain gains above the 1.33 level.

Intraday support aligns at 1.3095/00

“The GBP’s failure to hold gains through 1.33 in late March leaves a negative impression on the longer run charts and tilts risks towards renewed losses towards 1.30.”

“We spot intraday support at 1.3095/00.”

“Resistance is 1.3150/55.”

The S&P 500 Index reversed lower during the second half of last week. However, analysts at Credit Suisse stay biased tactically higher for now following the recent break above key moving averages at 4487/4455.

S&P 500 to inch higher toward 4663/68

We stay directly biased higher for now for a test of the 78.6% retracement of the 2022 fall and price resistance at 4663/68. Above here would open the door to a move to 4707/12 next, then what we look to be tougher resistance, starting at 4744/49 and stretching up to the 4819 record high. We expect a cap in this zone, in line with our broader medium-term view that the market is set to stay trapped in a broader mean-reverting phase.”

“First support is seen at 4514/01, which includes the 23.6% retracement of the recent recovery and 13-day exponential moving average, which floored the market on Friday last week. Below here the next level is seen at the 200-day average at 4488, then the 63-day average and price lows at 4461/55. Only a break below here would turn the short-term risks back lower within the range.”

- AUD/USD regained positive traction on Monday, though the uptick lacked bullish conviction.

- Hawkish Fed expectations, the Ukraine crisis underpinned the safe-haven USD and capped gains.

- Investors also seemed reluctant to place directional bets ahead of the RBA decision on Tuesday.

The AUD/USD pair maintained its bid tone through the early North American session and was last seen hovering near the daily high, just above the 0.7500 psychological mark.

The pair attracted fresh buying on Monday and inched back closer to the top end of a near two-week-old trading range, though the uptick lacked bullish conviction. The uncertainty over Ukraine continued acting as a tailwind for commodity prices, which, in turn, extended some support to the resources-linked Australian dollar.

In the latest developments, Ukraine accused Russian forces of carrying out a massacre in the town of Bucha. This prompted German Defence Minister Christine Lambrecht to say that the European Union should talk about ending Russian gas imports. Moreover, Germany and France said that a new round of sanctions targeting Russia was needed.

This comes on the back of the lack of progress in the Russia-Ukraine peace negotiations, which tempered investors' appetite for perceived riskier assets. Apart from this, expectations that the Fed would adopt a more aggressive response to combat high inflation underpinned the US dollar and capped gains for the perceived riskier aussie.

The markets have been pricing in a 100 bps Fed rate hike move over the next two meetings. Hence, the focus will remain glued to the FOMC meeting minutes, scheduled for release on Wednesday. Investors will look for fresh clues about the pace of the policy tightening by the US central bank, which, in turn, will drive the USD demand.

In the meantime, traders also seemed reluctant to place aggressive bets and preferred to wait on the sidelines ahead of the Reserve Bank of Australia (RBA) policy decision on Tuesday. This makes it prudent to wait for some follow-through buying before positioning for an extension of the recent strong bullish run from the YTD low.

Technical levels to watch

The Australian dollar is expected to be one of the stronger currencies in Q2. In the view of analysts at Credit Suisse, AUD/USD looks like it is in the process of forming a small bullish “pennant”, which would be confirmed above 0.7541/57 and would mark an important medium-term breakout.

Key support aligns at 0.7455/41

“This consolidation phase could be a small bullish ‘pennant’ continuation pattern, which would be triggered above the October and recent range high at 0.7541/57. Above here would open up a move to the late June and July highs at 0.7599/7616, with only a sustained break above here making a solid case for a fresh medium-term uptrend to arise, with next resistance then seen at 0.7715, before 0.7777/85.”

“Support is seen at 0.7479/68 initially, ahead of the last week’s low at 0.7455/41. Below here would shift our bias to tactically neutral, with next support at the recent price low at 0.7372/58, with a move below here shifting the near-term risk lower and warning of a potential fall back to mid-March low at 0.7173/63.”

USD/BRL broke below key support at the 5.00-level in a more consistent way after several attempts to do so. Although the Brazilian real may stay resilient longer than expected, in the end, economists at MUFG Bank forecast USD/BRL at 5.60 by end-2022.

More meaningful BRL depreciation in the second half

“The BRL could remain at strong levels for longer this year. However, we don’t see the bullish trend as sustainable in the medium to the long run.”

“On the domestic side, we consider that the campaign for the October presidential election might produce some noise, followed by growing concerns on how the new administration that will take office in 2023 will address the fiscal imbalance. Keep in mind that the current good figures don’t solve the structural fiscal problem.”

“In the external environment, we may expect some stabilization of commodity prices or not a huge raise, and the predominance of Fed actions in normalizing the monetary policy in the US.”

“We expect the BRL to re-weaken to the 5.60-level by year-end”

- DXY pushes higher and approaches the 99.00 mark.

- Beyond 99.00 comes the 2022 peaks around 99.40.

DXY adds to Friday’s gains and trades just pips away from the key 99.00 barrier on Monday.

DXY manages well to extend further the bounce off the decent contention area in the 97.70 zone (March 30,31), while the ongoing rebound keeps targeting the 99.00 yardstick and beyond in the near term. Above this level is seen the YTD highs around 99.40.

The current bullish stance in the index remains supported by the 6-month line near 96.20, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 94.90.

DXY daily chart

EUR/USD has been decisively capped below the 55-day moving average (DMA) at 1.1182/85. However, a break below 1.0944 is needed to reassert the downward pressure, economists at Credit Suisse report.

55-DMA at 1.1182/85 to cap on a closing basis

“We are biased toward further sideways consolidation in the short-term, with the broader downtrend still in place following the cap below the falling 55-DMA at 1.1182/85. With this in mind, a break below 1.0944 is needed to mark an important turn lower again, with next supports at 1.0900, then crucial medium-term support at 1.0825/0806, which is the confirmed uptrend from the January 2017 low. A break below here would open up a move to the 2018 low at 1.0635.”

“We are concerned about the loss of short and medium-term momentum, however, only a close above 1.1182/85 would provide the first real sign that we may have seen a more important low at our 1.0825 core objective.”

Quek Ser Leang at UOB Group’s Global Economics & Markets Research suggests that USD/IDR should keep navigating the 14,320-14,395 range for the time being.

Key Quotes

“USD/IDR traded between 14,325 and 14,368 for the whole of last week, narrower than our expected sideway-trading range of 14,300/14,390.”

“The quiet price actions offer no fresh clues and further sideway trading would not be surprising. Expected range for this week, 14,320/14,395.”

USD/JPY is moving higher again. Despite rising official concerns, analysts at BBH look for further yen weakness as it should eventually test last week’s high near 125.10.

Japan officials are getting more concerned about the weak yen

“Japan officials are getting more concerned about the weak yen. This time, it was Keiichi Ishii, Secretary General of junior coalition partner Komeito who said the Bank of Japan should pay close attention to exchange rates as a by-product of its ultra-loose policies.”

“For now, the BoJ won the battle to maintain Yield Curve Control. The 10-year yield is trading near 0.21%, below the 0.25% limit under YCC. However, the struggle to contain JGB yields is by no means over, not when bond yields in the rest of the world continue to march higher. The direction for USD/JPY pair remains clear with central bank divergence particularly strong here.”

“A break above 123.65 is needed to set up a test of the March 28 high near 125.10. After that is the June 2015 high near 125.85.”

- EUR/JPY fades part of the Friday’s advance and retests 135.00.

- Further decline is expected to meet support near 134.40.

EUR/JPY faces some downside pressure and gives away part of Friday’s gains, returning at the same time to the 135.00 region at the beginning of the week.

The underlying upside momentum in the cross remains unchanged for the time being, although further retracements are not ruled out in the near term. Against that, EUR/JPY is predicted to remain supported by the 134.40 region, where a Fibo level (of the March rally) is located.

In the meantime, while above the 200-day SMA at 130.11, the outlook for the cross is expected to remain constructive.

EUR/JPY daily chart

Ukrainian President Volodymyr Zelenskyy on Monday said that it is very hard to negotiate with Russia after seeing what they have done in Ukraine. Zelenskyy has accused Russia of war crimes and genocide against the Ukrainian people in light of the emergence of evidence of widespread atrocities committed by Russian forces against civilians. Russian forces have withdrawn from various areas to the north of Kyiv and seemingly left a trail of destruction in their wake.

Zelenskyy said that Ukraine will not rest until it has identified those responsible for the atrocities in the Kyiv region. He noted that the longer Russia drags out the negotiation process, the worse it will be for them.

- Silver is subdued at the start of the week in the $24.60s as traders weigh geopolitical developments and Fed rhetoric.

- The former is acting as a tailwind as calls grow for the EU to ban Russian energy imports.

- The latter is a headwind as rhetoric turns increasingly hawkish, keeping upside risks to USD and US yields alive.