- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-03-2024

The headline Tokyo Consumer Price Index (CPI) for February rose 2.6% YoY from 1.8% in the previous reading, the Statistics Bureau of Japan showed on Tuesday. Meanwhile, the Tokyo CPI ex Fresh Food, Energy eased to 3.1% YoY from 3.3% in January.

Additionally, Tokyo CPI ex Fresh Food climbed to 2.5% for the said month, in line with the market expectation.

Market reaction

As of writing, the USD/JPY pair was down 0.06% on the day at 150.43.

About Tokyo Consumer Price Index (CPI)

The Tokyo Consumer Price Index is released by the Statistics Bureau and it's a measure of price movements obtained by comparison of the retail prices of a representative shopping basket of goods and services. The index captures inflation in Tokyo. CPI is the most significant way to measure changes in purchasing trends. The purchase power of JPY is dragged down by inflation. Generally a high reading is seen as positive.

- NZD/USD posts modest gains around 0.6095 in Tuesday’s early Asian session.

- Fed’s Bostic said the Fed is under no urgent pressure to cut interest rates given a strong economy.

- China will deliver a top annual political event, which might ease the fear about the fate of the Chinese economy.

The NZD/USD pair remains capped under the 0.6100 mark during the early Asian session on Tuesday. Financial markets will be cautious this week as they await economic data and policy guidance. The US February ISM Services PMI will be due later in the day. The pair currently trades near 0.6095, up 0.02% on the day.

Atlanta Fed President Raphael Bostic said that the Federal Reserve (Fed) is under no urgent pressure to cut interest rates given a strong economy and job market. Bostic further stated that it will likely be appropriate for the Fed to approve two quarter-point rate cuts by the end of this year. San Francisco Fed President Mary Daly said central bank officials are ready to lower interest rates as needed but emphasized there's no urgent need to cut given the strength of the economy.

Investors will take more cues from Fed's Chair Jerome Powell's testimony on Wednesday, which might offer some hints about a broad overview of the economy and monetary policy. The hawkish remarks might lift the US Dollar (USD) and act as a headwind for the NZD/USD pair.

China’s economy has been roiled by a property sector crisis, raising concern about the health of the second-largest economy in the world. Market players will monitor the National People's Congress to see what's on offer when it starts on Tuesday. The development surrounding the stimulus plan from Chinese authorities could boost the China-proxy New Zealand Dollar (NZD) and cap the downside of the NZD/USD pair.

Looking ahead, the US ISM Services PMI will be due on Tuesday, along with the final S&P Global Services PMI, Factory Orders, and the RCM/TIPP Economic Optimism Index. Additionally, the Fed’s M. Barr is set to speak. These events could give a clear direction to the NZD/USD pair.

- BRC Like-For-Like Retail Sales the biggest-hitting UK data this week.

- US NFP looms ahead on Friday, ADP employment preview on Wednesday.

- Fed rate cut hopes are on the rise once again, but Fed Chair Powell remains a threat.

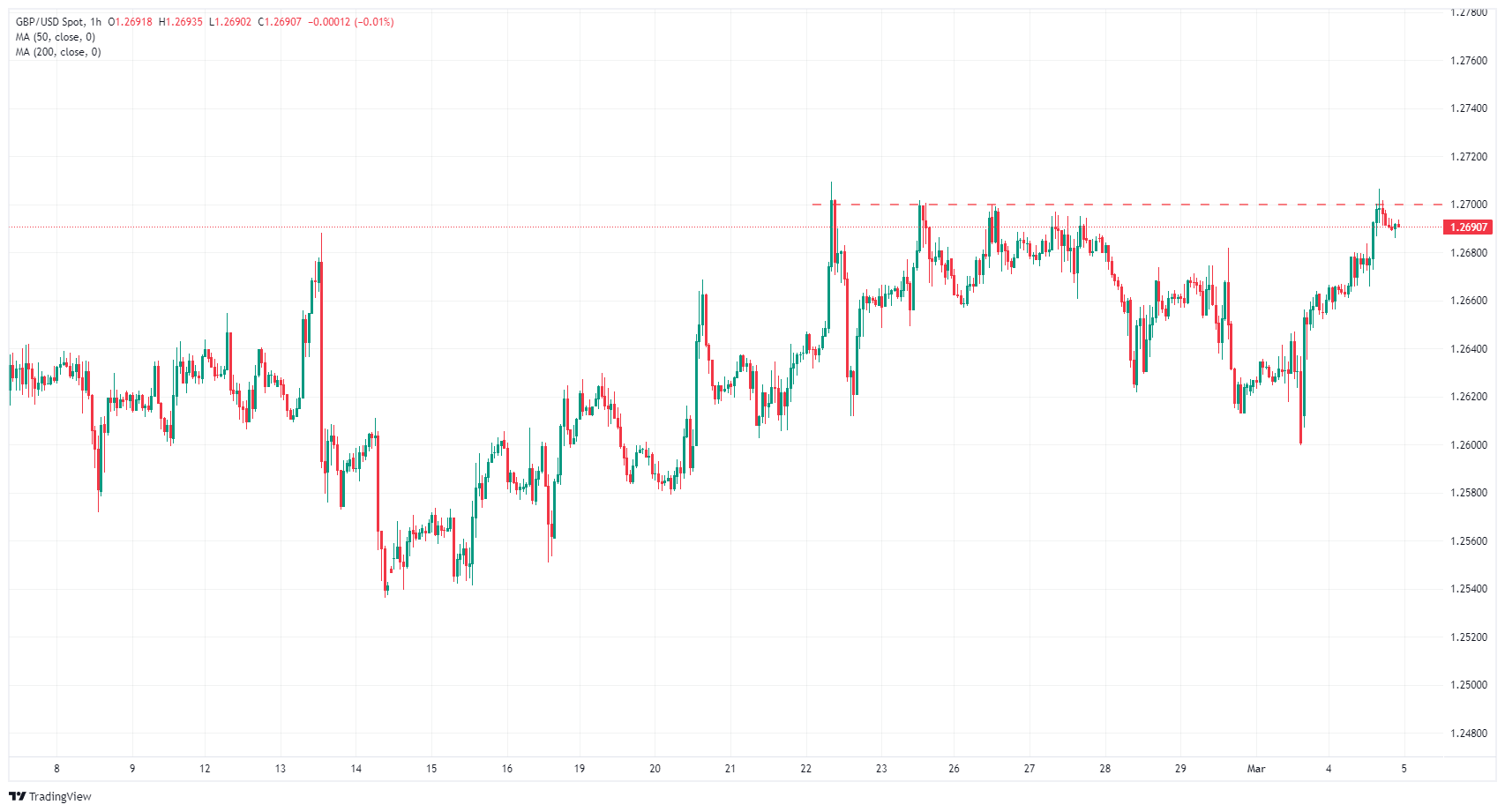

GBP/USD climbed into the 1.2700 handle on Monday before falling back, paring away some of the day’s gains but hitting the rollover higher than it started.

The UK sees only a thin showing on the economic calendar this week, and another US Nonfarm Payrolls (NFP) labor print on Friday sees investors gearing up for another kick at the can on how soon the Federal Reserve (Fed) will begin cutting interest rates.

Tuesday’s UK BRC Like-For-Like Retail Sales for the year ended February are expected to print at 1.6% YoY versus the 1.4% previous. On the US side for Tuesday, the ISM Services Purchasing Managers Index (PMI) for February is forecast to tick lower to 53.0 from the previous month’s 53.4.

US labor figures feature heavily this week, with ADP Employment Change on Wednesday followed by Friday’s NFP report. ADP Employment Change is forecast to jump to 150K for February versus the previous 107K, while this Friday’s NFP is currently forecast to fall back to 200K from the previous 353K.

Fed Chairman Jerome Powell will also be making an appearance this week, testifying before the US Congress’ House Financial Services Committee regarding the Fed’s Semi-Annual Monetary Policy Report. Plenty of soundbites and headlines are expected over the two day central bank showing, beginning on Wednesday and wrapping up Thursday.

GBP/USD technical outlook

GBP/USD found a hard technical barrier at the 1.2700 handle on Monday, but the pair managed to eke out a thin gain on the day, gaining around a quarter of a percent by the closing bell.

The pair continues to find technical support from the 200-day Simple Moving Average (SMA) at 1.2578, but near-term technical resistance at 1.2700 is capping off bullish momentum and preventing a topside recovery into last December’s peak bids near 1.2800.

GBP/USD hourly chart

GBP/USD daily chart

Australia's Judo Bank Services Purchasing Managers Index rose to a ten-month high of 53.1 in February, climbing back above the 50.0 contractionary level and climbing over the previous print of 49.1.

The Judo Bank Australian Composite PMI also climbed to 52.1 versus the last 49.0, a nine-month high.

Services activity rose for the first time in five months, and at its fastest rate since last April, according to S&P Global.

According to Matthew De Pasquale, Economist at Judo Bank:

The February Services PMI indicates that the sector has reached a soft landing in 2023 and is now experiencing a resurgence in activity in early 2024. Though the resilience in business activity is good for economic growth and employment, it raises doubts about the likelihood that inflation will back to target under the RBA's forecast timeline.

About the S&P Global Judo Bank Australia Services PMI

The Services Purchasing Managers Index (PMI), released on a monthly basis by Judo Bank and S&P Global, is a leading indicator gauging business activity in Australia’s services sector. The data is derived from surveys of senior executives at private-sector companies from the services sector. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), employment and inflation. A reading above 50 indicates that the services economy is generally expanding, a bullish sign for the Australian Dollar (AUD). Meanwhile, a reading below 50 signals that activity among service providers is generally declining, which is seen as bearish for AUD.

- The XAU/USD is currently trading at $2,115, its highest since early December.

- The underlying strength in gold stems from softer US inflation numbers and soft economic data reported last week.

- Investors are discounting higher odds for the Fed’s easing cycle to start in June.

- Labor market figures from the US will continue modeling the expectations.

The XAU/USD is currently trading multi-month highest around $2,115 as investors continue digesting last week’s weak inflation and economic activity figures from the US. As for now Market anticipations for a rate cut only start to heighten moving closer to May and significantly by June. The non-yielding yellow metal is benefitting ahead of the critical labor market data from the US expected this week, even though the general tone of data remains firm which would justify the delay of the easing cycle from the Federal Reserve (Fed).

The yellow metal started gaining momentum last Thursday, after the report of soft Core Personal Consumption Expenditures (PCE) figures from January and followed on Friday after the release of weak Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) for February which raised concerns on an economic slowdown. However, the Fed officials, remain firm, and attach themselves to the rhetoric of three rate cuts in 2024, starting most likely in June. If markets reaffirm their bets on the easing starting in June, the US Treasury yield may get a boost, which could limit the upside to the metal.

XAU/USD technical analysis

On the daily chart for the XAU/USD, the bulls are clearly in command with the Relative Strength Index (RSI) being stationed in the overbought territory. The Moving Average Convergence Divergence (MACD) with rising green bars supports this bullish outlook, indicating increased positive momentum. However, as the price starts to hint at overbought signals, a correction may be forthcoming to consolidate recent gains. In the wider context, the XAU/USD pair remains above the 20,100 and 200-day Simple Moving Averages (SMAs), signifying that bullish sentiment still prevails in the long term.

XAU/USD daily chart

- Overextended Crude Oil markets retreat despite OPEC extension.

- Markets are taking profits and pulling back bids.

- Fed rate expectations and no-OPEC production caps gains.

West Texas Intermediate (WTI) US Crude Oil softened on Monday, testing below $79.00 per barrel and markets pull back from the recent bullish pop out of near-term congestion that has seen barrel bids grind slowly higher.

The Organization of the Petroleum Exporting Countries (OPEC) formally announced that they would be extending Q1 production cuts through the second quarter, and possibly longer if needed. Markets have largely priced in the production cap extension from OPEC, and the announcement failed to generate bullish momentum in Crude Oil.

Key non-OPEC Crude Oil producers, specifically the US, have continued to outperform market expectations. The US is producing record amounts of Crude Oil, and US Crude oIl stocks have been swamping refinery supply lines recently, keeping topside Crude Oil momentum limited.

Markets continue to get pushed further down the calendar on Federal Reserve (Fed) rate cut expectations, keeping risk appetite pinned on the lower side, helping to force down barrel bids. Markets are also becoming inured to geopolitical headlines from both the Gaza conflict between Israel and Hamas, and supply line concerns stemming from Houthi rebel attacks in the Red Sea are becoming normalized.

WTI technical outlook

Monday’s bearish pulldown in WTI US Crude Oil saw barrel shed the $79.00 handle, and price pressures are pointed to the downside despite recent price action grinding higher from last week’s swing low into $76.00.

Daily candles are drifting back into touch range of the 200-day Simple Moving Average (SMA) at $77.75, WTI bidders have a growing hill to climb over as bids tumble back below January’s peak at $79.20.

WTI hourly chart

WTI daily chart

- NZD/JPY kicks off Monday's session, operating at 91.71 with mild gains.

- On the daily chart, RSI places the NZD/JPY within the negative zone, signifying short-term rising selling traction.

- If the buyers fail to reclaim the 20-day Average, the outlook may start to turn in favor of the sellers.

In Monday's trading session, NZD/JPY is navigating around the 91.71 level, trading with mild gains. The overall market tone for the pair suggests a bearish bias as sellers remain in control, after closing a 1.70% losing week and tallying a five-day losing streak. Yet, signs of a gradual build-up of bullish momentum can be observed in the shorter timeframes.

On the daily chart, the Relative Strength Index (RSI) shows the NZD/JPY pair in the negative territory, indicating bearish momentum in the short-term, as sellers control the market after hitting overbought conditions last week. The rising red bars of the Moving Average Convergence Divergence (MACD) histogram, signal that negative momentum is increasing.

NZD/JPY daily chart

Meanwhile, on the hourly chart, the RSI is fluctuating within the positive territory, suggesting that bullish momentum may be building. However, the MACD histogram on this chart also presents rising red bars, suggesting a steady negative pull.

NZD/JPY hourly chart

In conclusion, while investors demonstrate a short-term bearish inclination on the daily chart, patterns on the hourly chart suggest that bulls are presenting a battle. That being said, the pair is holding up the 100 and 200-day Simple Moving Averages (SMAs) which typically suggest an overall bullish trend. Still, as long as the buyers fail to conquer the 20-day Average, the short-term bias will remain negative.

The small bias towards the risk-associated galaxy weighed on the Greenback at the beginning of a new trading week, although the consolidative mood is predicted to kick in soon ahead of Powell’s testimonies, the ECB meetings and key US NFP.

Here is what you need to know on Tuesday, March 5:

The continuation of the recovery in the risk complex kept the pressure under the US Dollar, sparking the second daily pullback in a row in the USD Index (DXY). On March 5, the final S&P Global Services PMI is due, seconded by the ISM Services PMI, Factory Orders, and the RCM/TIPP Economic Optimism Index. In addition, the Fed’s M. Barr is due to speak.

EUR/USD added to gains seen at the end of last week and rose to multi-session peaks around 1.0860. In the euro docket, the final HCOB Services PMIs in Germany and the broader euro bloc are only due on March 5.

The renewed selling pressure in the Greenback allowed GBP/USD to rise to four-day highs in levels just shy of 1.2700 the figure. In the UK, the BRC Retail Sales Monitor is expected on March 5, along with the final S&P Global Services PMI.

USD/JPY maintained the upside momentum unchanged and flirted with the 150.60 zone amidst the weaker Dollar and rising US yields. Tokyo inflation figures and the final Jibun Bank Services PMI are scheduled for March 5.

AUD/USD ignored the soft tone in the Greenback and put the 0.6500 support to the test once again, reversing two daily advances in a row. The final Judo Bank Services PMI is due along with the Q4 Current Account.

In China, all the attention is expected to be on the National People’s Congress along with the release of the Caixin Services PMI.

Prices of WTI corrected lower after two straight sessions of gains, slipping back below the $80.00 mark per barrel as traders digested news that the OPEC+ will extend its oil output cuts through Q2.

Prices of Gold reached multi-week highs around $2,100 per troy ounce on the back of steady speculation about the Fed’s rate cut in June. Silver followed suit and rose to fresh two-month tops near $23.50 per ounce amidst the persistent selling pressure in the Greenback.

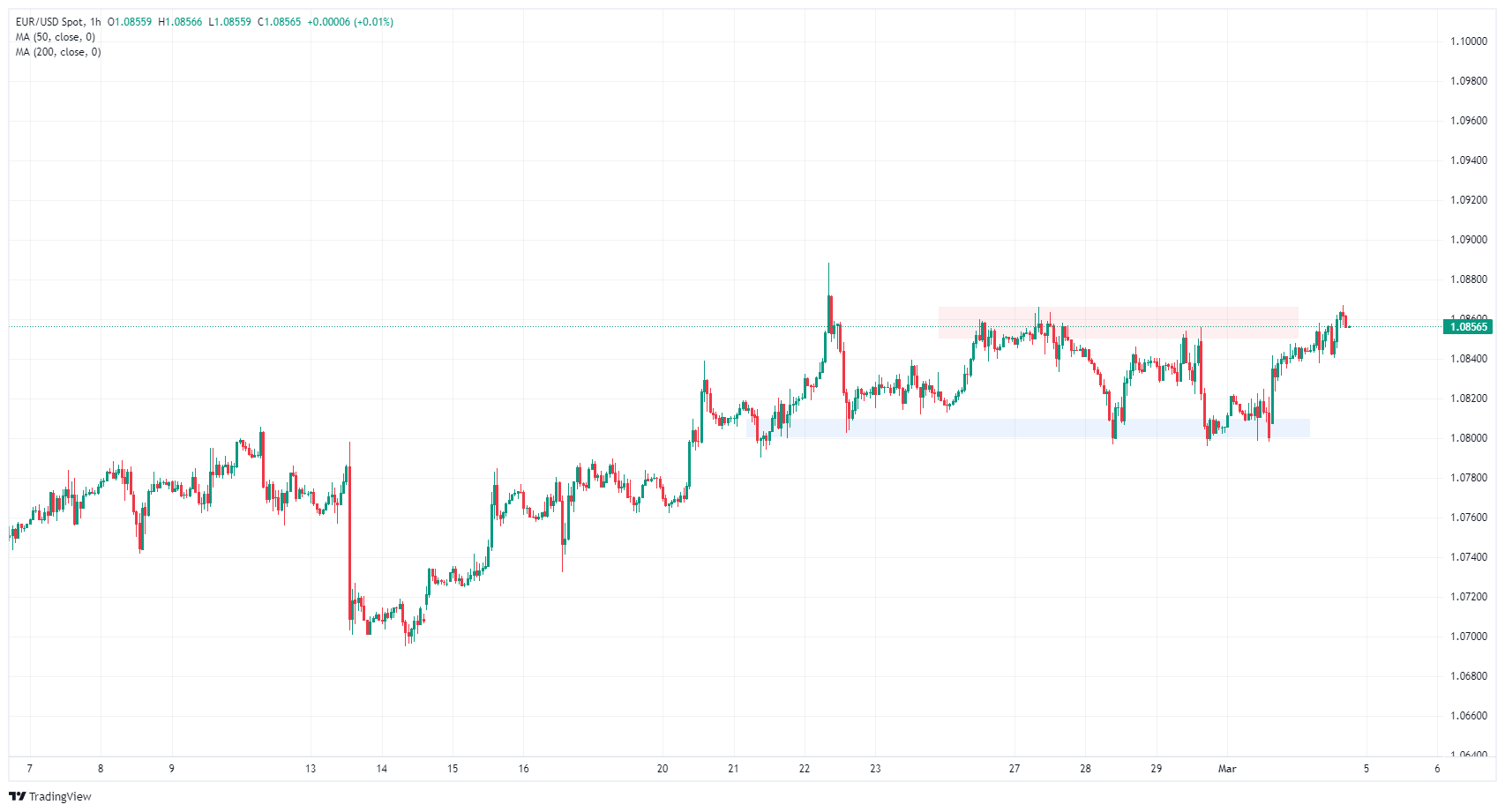

- EUR/USD finds chart paper near 1.0850.

- European investor confidence recovered on Monday.

- US NFP employment to be key data print this week.

EUR/USD drifted into the high end to kick off the trading week on Monday, finding chart space near 1.0860 and getting mired in near-term technical resistance. The pair has been rangebound for a week, and investors will look to critical US labor figures this week as markets gauge the Federal Reserve’s next move.

This week, central banks loom heavily over the Euro (EUR) and the US Dollar (USD). Fed Chairman Jerome Powell will be testifying before the US Congress’ House Financial Services Committee about the Fed’s Semi-Annual Monetary Policy Report on Wednesday and Thursday. The European Central Bank (ECB) also gives its latest rate call during Thursday’s European market session.

Daily digest market movers: EUR/USD churns in familiar territory as traders await key data

- Europe’s Sentix Investor Confidence for March rose to -10.5 from the previous -12.9, an 11-month high.

- High impact data kicks off on Wednesday with European Retail Sales for January expected to decline to 1.3% YoY versus the previous -0.8% as European economic activity continues to weaken.

- US ADP Employment Change numbers on Wednesday are expected to climb to 150K compared to the previous 107K as a precursor to Friday’s US Nonfarm Payrolls (NFP) print.

- The ECB’s rate call on Thursday is broadly expected to hold the main refi rate at 4.5%.

- Investors are looking for softening US NFP labor figures to bolster odds of a Fed rate cut.

- Tuesday’s US ISM Services PMI is forecast to tick down to 53.0 from 53.4.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the .

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.14% | -0.26% | 0.18% | 0.24% | 0.28% | 0.16% | 0.14% | |

| EUR | 0.13% | -0.13% | 0.32% | 0.38% | 0.41% | 0.31% | 0.28% | |

| GBP | 0.26% | 0.13% | 0.43% | 0.50% | 0.55% | 0.42% | 0.41% | |

| CAD | -0.18% | -0.31% | -0.43% | 0.07% | 0.09% | -0.02% | -0.03% | |

| AUD | -0.24% | -0.38% | -0.50% | -0.06% | 0.04% | -0.07% | -0.09% | |

| JPY | -0.28% | -0.41% | -0.58% | -0.12% | -0.05% | -0.11% | -0.11% | |

| NZD | -0.17% | -0.31% | -0.43% | 0.01% | 0.07% | 0.11% | -0.02% | |

| CHF | -0.15% | -0.29% | -0.41% | 0.03% | 0.09% | 0.13% | 0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: EUR/USD trapped in consolidation as investors await Fed moves

EUR/USD rose into 1.0860 on Monday, knocking into familiar technical bounds and holding onto the high side of near-term consolidation. The pair is corkscrewing through a sideways channel between 1.0860 and the 1.0800 handle.

A lack of meaningful trend on daily candlesticks leaves the EUR/USD swamped into the 200-day Simple Moving Average (SMA) near 1.0830. Despite a 1.5% climb from the last swing low into 1.0700, but the pair remains down 2.6% from December’s peak bids near 1.1140.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

- The AUD/JPY is trading at 98.04, marking a 0.12% gain during Monday's session.

- The RSI on both daily and hourly charts is in the positive zone, but momentum is limited.

- The overall trend remains bullish as the buyers recovered the 20-day SMA.

In Monday's session, the AUD/JPY pair is trading at 98.04, reflecting a 0.12% gain. Despite a slight decrease in buying momentum, there's an overall moderate bullish sentiment dominating the market as indicators seem to recover after recent declines.

On the daily chart, the AUD/JPY pair's Relative Strength Index (RSI) is currently in positive territory, indicating that buyers have had the edge recently after diving below 50. Despite slight decreases in the latest readings, there's still a moderate bullish momentum. The Moving Average Convergence Divergence (MACD) histogram shows flat red bars, suggesting a loss in positive momentum but a still mildly bullish sentiment in the market.

AUD/JPY daily chart

Switching to the hourly chart, the RSI values present a similar picture, hovering in the positive territory, and the MACD histogram continues with red decreasing bars, indicating a loss in selling momentum but a flattened buying traction. The readings imply that the pair is experiencing similar dynamics on a shorter-term scale.

AUD/JPY hourly chart

By contrasting the daily and hourly charts, indicators suggest a consistent bullish momentum, albeit with decreased intensity. Despite the short-term neutral-to-negative outlook, the pair's position above the 20, 100, and 200-day Simple Moving Averages (SMAs) reinforces the perspective that buyers are in control in a broader market view.

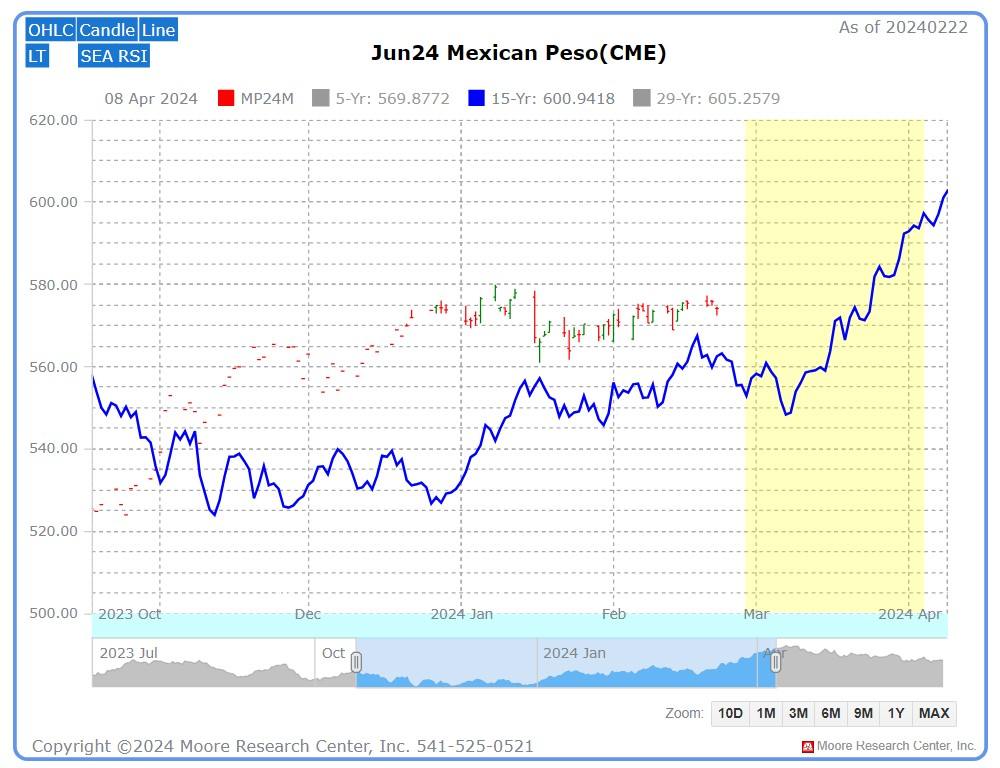

- The Mexican Peso found fresh gains against the US Dollar on Monday.

- Mexican inflation is expected to ease sharply, propping up Banxico cut expectations.

- Seasonal flows typically bolster the Mexican Peso at the tail end of the first quarter.

The Mexican Peso (MXN) gained ground against the US Dollar (USD) on Monday as counter-balanced rate cut expectations push the USD/MXN pair further down the charts. Common seasonal flows see bullish momentum leak into the Mexican Peso during the first quarter, and markets are forecasting a tumble in Mexican inflation.

Mexico is broadly expected to see further rate cuts from the Banco de México, aka Banxico. Mexico’s main reference rate has been held at record highs of 11.25% since April of 2023. US labor figures are also in the mix, with Friday’s Nonfarm Payrolls (NFP) in the barrel. Hopes of market rate cuts from the Federal Reserve (Fed) are also weighing on Monday market action.

Daily digest market movers: Uptick in Banxico rate cut bets push Peso to six-week highs

- Mexico’s inflation print due on Thursday is expected to print a continued decline in Mexican price growth, forecast to print at 0.12% for February versus the previous 0.89%.

- January’s 0.89% Mexico inflation print was a 22-month high.

- This week’s US labor figures kick off with Wednesday’s ADP Employment Change for February, forecast to jump to 150K from the previous 107K.

- Fed Chairman Jerome Powell due to testify before the Financial Services Committee about the Semi-Annual Monetary Policy Report on Wednesday and Thursday.

- Friday’s February US NFP is expected to fall back to 200K from the previous 353K, and investors will be keeping a close eye on revisions to previous prints.

- Tuesday will kick off the US weekly data docket with ISM Services Purchasing Managers Index (PMI) figures for February forecast to tick down to 53.0 from 53.4.

- The Mexican Peso typically finds bullish interest heading into the second quarter, according to the Moore Research Center (MRCI).

- MRCI: Mexican Peso has closed higher from February 28 to April 4 about 93% of the time over the past 15 years.

Technical analysis: USD/MXN drops into new lows as Peso finds bullish bids

The Mexican Peso (MXN) is climbing on Monday, driving the USD/MXN pair down below the 17.00 handle for the first time since mid-January. The pair is down nine-tenths of a percent from last week’s peak bids near 17.12.

USD/MXN is on pace to close in the red for a third consecutive trading day, and bids are tumbling into chart territory last seen in January. 2024’s technical floor sits at January’s swing low into the 16.80 handle, and the pair continues to drop away from the 200-day Simple Moving Average (SMA) at 17.25.

USD/MXN hourly chart

USD/MXN daily chart

Mexican Peso FAQs

What key factors drive the Mexican Peso?

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

How do decisions of the Banxico impact the Mexican Peso?

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

How does economic data influence the value of the Mexican Peso?

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

How does broader risk sentiment impact the Mexican Peso?

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Atlanta Federal Reserve (Fed) President Raphael Bostic hit newswires on Monday after his quarterly essay was released.

Key highlights

- Soft landing is hardy assured given uncertainty.

- Does not anticipate back-to-back rate cuts when they begin.

- Fed's Bostic still expects two 25-basis point rate cuts in 2024.

- Needs to see more progress and gain confidence on disinflation before voting to reduce policy rates.

- Inflation is on track to return to 2% target, but still too early to claim victory.

- January's hiring was a fresh sign of continued US labor strength.

- Inflation is still widespread, with more than the usual share of items increasing above 5% with trimmed mean stuck at 2.6%.

- Fed still has time to be sure inflation returns to target.

- Fed's Bostic does not see degradation of the US labor market.

- Risks to inflation and employment have balanced out.

- Pent-up exuberance in US economy remains an inflation risk.

- Businesses are not distressed and are ready to invest.

- Services inflation remains higher, may take longer for adjustments to occur.

- Dopes not have a base case for when it might be appropriate to reduce pace of balance sheet decline

- Canadian Dollar finds the middle as investor appetite churns.

- Bank of Canada rate call slated for the midweek.

- US NFP expectations to draw attention through the week.

The Canadian Dollar (CAD) is cycling familiar levels on Monday with markets awaiting another rate showing from the Bank of Canada (BoC) and this week’s key US Nonfarm Payrolls (NFP) report due on Friday. The BoC is expected to hold rates at 5% on Wednesday, and investors hopeful for a rate cut from the Federal Reserve (Fed) will be looking for softening economic figures from the US this week.

The data from Canada this week will be the BoC’s rate call, with Friday’s Canadian labor figures due to get eclipsed by the US NFP employment numbers. Canada’s Unemployment Rate is expected to tick higher this week, and current market forecasts call for a pullback in the US NFP print.

Daily digest market movers: Canadian Dollar mostly flat as markets hinge on rate cuts

- Quiet start to the week as markets focus on Fed rate cut odds.

- Softer US data last week leads to an uptick in June rate cut hopes.

- BoC expected to hold steady on rates on Wednesday.

- Tuesday’s US ISM Services Purchasing Managers Index (PMI) for February is forecast to tick down to 53.0 from 53.4.

- Markets will be looking for softer US data prints as investors hope a weakening US economy will boost odds of a Fed rate cut.

- CME FedWatch Tool sees over 70% odds of a Fed rate trim in June at current cut.

- Wednesday’s BoC rate call is forecast to see no moves from BoC Governor Tiff Macklem.

- The US ADP Employment Change for February is slated for Wednesday and is forecast to show an uptick is US employment to 150K for the month, up from the previous month’s 107K.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.17% | -0.29% | 0.08% | 0.10% | 0.24% | 0.05% | 0.07% | |

| EUR | 0.17% | -0.12% | 0.24% | 0.27% | 0.41% | 0.22% | 0.24% | |

| GBP | 0.29% | 0.12% | 0.35% | 0.39% | 0.53% | 0.33% | 0.36% | |

| CAD | -0.08% | -0.23% | -0.35% | 0.04% | 0.16% | -0.03% | 0.00% | |

| AUD | -0.10% | -0.27% | -0.39% | -0.03% | 0.12% | -0.05% | -0.03% | |

| JPY | -0.24% | -0.42% | -0.57% | -0.20% | -0.15% | -0.21% | -0.17% | |

| NZD | -0.05% | -0.21% | -0.33% | 0.03% | 0.06% | 0.19% | 0.03% | |

| CHF | -0.08% | -0.24% | -0.36% | 0.00% | 0.03% | 0.16% | -0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: Canadian Dollar shifts to flat side as market eyes drift

The Canadian Dollar (CAD) is mostly flat on Monday with the Loonie shedding around four-tenths a percent against the Pound Sterling (GBP) to kick off the trading week. The CAD is close to flat against the US Dollar (USD), trading within a tenth of a percent from Monday’s opening bids.

The USD/CAD pair is set to trade into a flat range for a third consecutive trading day. Bids are pushing into the middle and prices are hung up on rangebound figures between 1.3600 and 1.3550. The 1.3600 handle is the immediate near-term technical ceiling, and prices continue to trade on the high side of the 200-day Simple Moving Average (SMA) at 1.3477.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

- DXY Index is currently trading at a loss around 103.70.

- Key drivers of DXY Index movements will be US labor market data to be released this week.

- Expectations of the start of the easing cycle in June may limit losses.

The US Dollar Index (DXY) is presently fluctuating in the vicinity of 103.70, exhibiting minor losses on Monday. The market remains focused on potential variations in line with the flow of incoming data, including the key Nonfarm Payrolls (NFP) figures from February set for release later in the week.

The US labor market continues to influence the Federal Reserve’s (Fed) easing cycle, which is predicted to commence in June. This suggests that the Fed may adopt a more dovish stance in case a slowdown in employment is seen. The dovish outlook, inherently indicative of lower interest rates and near-term cuts, could potentially lead to a weaker US Dollar.

Daily digest market movers: DXY stands weak at the start of the week, eyes on labor market data

- Predictions for the Nonfarm Payrolls report (NFP) see an addition of 200K jobs in February, which will mean a deceleration from January’s reading. Wage inflation measured by the Average Hourly Earnings and the Unemployment Rate will also be studied.

- Other key employment figures set to be released this week include JOLTs Job Openings and ADP Employment Change from February and weekly Jobless Claims.

- Market predicts no likelihood of a rate reduction at the impending March 20 meeting, with the probability escalating to 25% on May 1 and reaching 90% for the June meeting.

- US Treasury bond yields are up and trading at 4.59% for the 2-year, 4.20% for the 5-year, and 4.22% for the 10-year bonds, which may limit the downside for the session.

DXY technical analysis: DXY faces bearish pressure in near term, bulls control broader view

The technical outlook for DXY indicates a somewhat convoluted scenario. The Relative Strength Index (RSI) showcases a negative posture with a descending trajectory, urging a comprehensive bearish momentum for the index in the short term. Similarly, the visible rise in red bars in the Moving Average Convergence Divergence (MACD) corroborates the increasing selling momentum, providing further weight to the bearish perspective.

In contradiction, the Simple Moving Averages (SMAs) paint a different picture entirely on the broader scale. Despite the bears asserting their presence by pushing the DXY below the 20 and 100-day SMAs, it remains notably above the 200-day SMA. This firm positioning suggests that the bulls are anything but phased, maintaining control over the larger time horizon. Consequently, while the immediate outlook may have the scales tipped in the bear's favor, the ongoing bullish undercurrent cannot be ignored.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Economists at ING remain positive on commodity currencies.

MXN and BRL may well prove resilient despite ongoing rate-cutting cycles

In the G10 space, we continue to see good upside potential for commodity currencies, in particular, the undervalued Norwegian Krone, Aussie Dollar and New Zealand Dollar.

In emerging markets, the Chinese Yuan should continue to be driven by China-specific factors until US rates move decisively lower and allow USD/CNY to decline sustainably. The upcoming Two Sessions is a key risk event for the Yuan and China-sensitive currencies.

In Latam, the Mexican Peso and Brazilian Real may well prove resilient despite ongoing rate-cutting cycles; while in the CEE region, we expect the paths of the Polish Zloty (strong) and Hungarian Forint (weak) to keep diverging.

The key risks to our bearish Dollar view are a potential USD positive/EM negative re-election of Donald Trump, or – from a purely macro perspective – prolonged resilience in US inflation and consequent further delay in Fed easing.

- Spot Gold prices are on the rise on Monday.

- Markets are expecting Fed rate cuts after middling data.

- XAU/USD pushes back into all-time high territory.

XAU/USD rose above $2,100.00 on Monday as markets lean into Spot Gold bids. Investors are ramping up bets of a June rate cut from the Federal Reserve (Fed) after US economic data middled to softened last week.

Markets are jostling into risk-taking position ahead of this week’s key US Nonfarm Payrolls (NFP) report coming up on Friday. Traders will be looking for a softer labor figure to add to the rate cut puzzle, and broad-market hopes for a weakening US economic outlook are crystallizing into XAU/USD buying.

This week also sees the US ADP Employment Change for February as a labor data preview of Friday’s NFP, albeit one with a shaky connection in recent history. Fed Chairman Jerome Powell will also be speaking on Wednesday, testifying before the Financial Services Committee about the Semi-Annual Monetary Policy Report beginning at 15:00 GMT.

US economic data will kick the week off with Tuesday’s ISM Services Purchasing Managers Index for February, expected to soften to 53.0 from January’s 53.4.

XAU/USD technical outlook

Spot Gold is extending last Friday’s gains, tipping over the $2,100.00 handle in the early week’s trading. XAU/USD is up over a full percent bottom-to-top on Monday, and intraday bids are accelerating into the high end away from the 200-hour Simple Moving Average (SMA) at $2,038.89.

Daily candlesticks are on approach to all-time highs set in December at $2,144.48, and XAU/USD has climbed around 4% from last week’s low bids near $2,025.00.

XAU/USD hourly chart

XAU/USD daily chart

Economists at Commerzbank expect the EUR/USD exchange rate to end the year at 1.1000

Limited upside potential

We see limited upside potential for EUR/USD this year. By the end of the year, we expect prices to be around 1.1000.

The Euro is likely to appreciate slightly over the next few months if it becomes clear that the ECB will cut its key interest rate more slowly than the market had previously expected. However, the EUR-positive effect is unlikely to last. If the market recognizes that Eurozone inflation is stuck at stubbornly high levels, even moderate ECB interest rate cuts will be seen as inappropriately loose monetary policy and therefore EUR-negative.

Even if Fed rate cuts are priced in, the dollar may suffer a little because of the current strength of the USD if they are actually announced. However, the negative effect will probably be limited by the fact that it should soon become clear that the Fed will cut interest rates less than the market had previously expected. In contrast to the ECB, the Fed's stance is also likely to be USD-positive in the medium and long term given the lower inflation we expect in the US.

Another USD-positive argument is that the growth gap between the US on the one hand and the Eurozone and most other G7 economies on the other is likely to widen further.

USD/CAD has been trading relatively stable around 1.3500 for several weeks. Economists at Commerzbank analyze the pair’s outlook.

Loonie unlikely to appreciate further against the USD in 2025

Given the cautious stance of the BoC, we remain comfortable with our forecast of lower USD/CAD levels in the coming quarters. However, we have adjusted the levels slightly higher to reflect the new forecast from our economists, who no longer expect a US recession.

However, we no longer expect the CAD to appreciate further against the US Dollar in 2025. The reason for this is that the Fed is likely to end its interest rate cuts earlier than the market currently expects and our economists anticipate very strong US growth. The Canadian economy is unlikely to be able to withstand this, even if growth there should also pick up again.

Source: Commerzbank Research

Economists at ABN Amro expect the EUR/USD pair to hover around the 1.1000 level.

Expectations for Fed/ECB policy to continue to drive the direction in EUR/USD

For this year, we expect expectations for Fed/ECB policy to continue to drive the direction in EUR/USD.

The market expects both the Fed and the ECB to start its easing cycle in April/May and rates to be reduced to 4% for the Fed and 2.5% for the ECB by the end of 2024.

We expect the easing cycles to start later, in June, and the Fed to arrive at 4.25% and the ECB at 2.75% at the end of the year. So, both for the Fed and the ECB we are somewhat less dovish than the market and the difference with the market is roughly the same. Therefore, we expect EUR/USD to stay around 1.1000 for the time being.

Is the Bank of Japan (BoJ) ready to act? Economists at Rabobank analyze Yen’s outlook ahead of the BoJ’s March meeting.

USD/JPY to edge lower into the BoJ’s March meeting

While we favour an April rate hike over a move in March, we expect USD/JPY to edge lower into the March 19 meeting in anticipation of an early move.

Even on a steady policy outcome this month, we expect downside pressure on the JPY to be limited as the market turns its attention towards the likelihood of a rate hike next month.

That said, given the resilience of the US economy and related US inflation risks, we see downside potential in USD/JPY to be limited to a move back to 140.00 on a 12-month view.

- USD/JPY advances toward 151.00 as BoJ might postpone policy-normalization plans.

- BoJ Ueda wants to see more wage data before announcing victory over deflation.

- The US Dollar will be guided by Fed Powell’s testimony and employment data.

The USD/JPY pair marches toward a three-month high of 150.80 in the early New York session. The asset strengthens as the Japanese Yen comes under pressure after Bank of Japan (BoJ) Governor Kazuo Ueda cited concerns over exiting the dovish monetary policy stance.

BoJ Ueda stressed the need to scrutinize more wage growth data to confirm that it could keep inflation above the 2% target. Contrary to BoJ Ueda, BOJ board member Hajime Takata said last week that the central bank must consider overhauling its ultra-loose monetary policy, including an exit from negative interest rates and bond yield control, Reuters reported.

Meanwhile, the US Dollar remains on the backfoot as expectations for Federal Reserve (Fed) rate cuts in June remains firm. The US Dollar witnesses higher liquidity outflows when hopes for interest-rate normalization by the Fed deepen.

This week, investors will focus on Fed Chair Jerome Powell’s testimony before Congress, which is scheduled for Wednesday and Thursday. Market participants hope that Fed Powell will reiterate the need to keep interest rates unchanged in the range of 5.25%-5.50% until it gains confidence that inflation will return sustainably to the 2% target.

In addition to Fed Powell’s testimony, the United States Automatic Data Processing (ADP) Employment Change data for February will influence market expectations for the interest rate outlook. The consensus shows that US private employers hired 150K job seekers against 107K in January.

The US Dollar (USD) closed lower over the week through Friday, its second, consecutive net weekly drop, and is starting the new week on the defensive again. Shaun Osborne, Chief FX Strategist at Scotiabank, analyzes Greenback’s outlook.

Some loss of bullish momentum apparent

The USD’s drift from the mid-February peak looks partly technical and partly fundamental. DXY gains stalled around (just a little above) the 61.8% retracement resistance of the late 2024 decline on the one (technical) hand while there have been some signs of slowing US activity on the (fundamental) other.

The USD has been running a bit hot relative to my estimate of spread-driven fair value for some time, making additional USD gains versus the core majors harder to justify. Recall also that seasonal trends tend to be mostly USD-supportive in Q1 but turn against the USD in Q2/Q3.

All else equal, I think the USD will struggle to improve significantly from current levels and that downside risks are starting to strengthen as the quarter winds down.

USD/CAD is little changed on the session so far. Economists at Scotiabank analyze the pair’s outlook.

Risks tilted mildly to the downside

A lower close to the USD on Friday tilts risks mildly to the downside for funds from a technical point of view.

At the very least, spot is looking at pretty solid resistance at 1.3600/1.3605 after clear rejections of the figure area last week.

The USD’s mild drop Friday also formed the third leg of a bearish ‘evening star’ pattern on the daily candle chart which should see spot put a bit more pressure on moderate support at 1.3540/1.3550 in the short run and, below there, point to a test of 1.3440/1.3450.

GBP/USD stretches its upside. Economists at Scotiabank analyze the pair’s outlook.

Clear and sustained push through 1.2710 should see gains extend a little more

Solid gains in Cable Friday suggest spot can push a little higher in the short run to retest the low 1.2700 area. But the broader backdrop for the Pound remains somewhat challenged by weak or bearish leaning trend oscillators on the intraday and daily DMI signals.

A clear and sustained push through 1.2710 should see gains extend a little more towards the recent range highs at 1.2775/1.2800.

Support is firm now at 1.2600/1.2610.

EUR/USD nudges higher. Economists at Scotiabank analyze the pair’s outlook.

Narrower EZ/USD spread lifts EUR

EUR/USD has been supported by narrowing spreads versus the USD in the past couple of weeks. A clearly dovish ECB may undermine that trend, and weigh on the EUR, but a hold and ‘no rush’ messaging may support a firmer EUR.

Some positive price signals (spot moving above the 40-DMA at 1.0836) and an alignment of shorter-term (intraday and daily) trend oscillators give the short-term EUR chart a positive spin to start the week.

The EUR’s grind higher since the mid-February low may have a chance to develop a little more momentum and test resistance at 1.0880/1.0890. A clear push through here should see gains progress to 1.1000/1.1100.

Support is firm at 1.0795/1.0800.

- The US Dollar trades for most part in the green against major peers.

- Markets brace for quite some headline risks ahead of the US Jobs Report on Friday.

- The US Dollar Index still orbits around 104.00 though could be seen choosing direction after this week.

The US Dollar (USD) is facing a very chunky week with traders needing to be on point if they want to survive the carnage ahead. Two main elements this week will be the hearing of the US Federal Reserve Chairman Jerome Powell, who is set to face Senator Elisabeth Warren and other politicians in Congress and the US Jobs Report on Friday. Meanwhile headline flow out of the Chinese National People’s Congress and US President Joe Biden’s State of the Union could trigger some intraday volatility.

On the economic front, all eyes of course will be on the usual suspects ahead of the US Jobs Report with the ADP Nonfarm Employment number and the JOLTS Job Openings report on Wednesday. As always, no connection between ADP and Nonfarm Payrolls on Friday, though enough to create volatility besides the more than five US Fed speakers besides Jerome Powell that are due to release comments on the markets.

Daily digest market movers: Keep a close eye on the monitors this week

- Head of the Philadelphia Fed Patrick Harker is due to take the stage later this Monday around 16:00 CET.

- The US Treasury will head to markets to allocate a 3-month and a 6-month bill near 16:30 GMT.

- Japan’s Nikkei Index has breached 40,000 for the first time ever.

- Nikki Haley won the Columbia District (Washington DC) Primary, snapping the winning streak of former US President Donald Trump.

- A few elements to already note in your calendar for this week which could bear some important headline risk:

- China holds its National Party Congress from March 5 to March 11. Be on the lookout for any headlines on easing and stimulus support for Chinese markets.

- Super Tuesday is ahead as well with Primaries for both the Republicans and Democrats in 17 states.

- US President Joe Biden is due to release its State of the Union on Thursday.

- Equities are looking for direction with no real outliers to report. Only element worth mentioning in the far end of the risk spectrum is that Bitcoin is soaring near 3.5% this Monday.

- According to the CME Group’s FedWatch Tool, expectations for a Fed pause in the March 20 meeting are at 97%, while chances of a rate cut stand at 3%.

- The benchmark 10-year US Treasury Note trades around 4.20%, roughly sideways seeing last week’s range.

US Dollar Index Technical Analysis: Grab your pitchforks

The US Dollar Index (DXY) enters another week of being caught between what can only be described as the pitchfork of Simple Moving Averages (SMA). On the topside the 100-day SMA (104.63) is making sure the DXY does not escape any higher, while the 55-day SMA (103.51) makes sure the Greenback does not slip back to the lower levels of 2024. This week is bearing more headline risk and events which could finally move the needle and stage a breakout either way for the DXY.

To the upside, the 100-day Simple Moving Average (SMA) near 103.94 is being well respected this Monday. Should the US Dollar be able to cross above it, to 104.60, 105.12 is the next key level to keep an eye on. One step beyond there comes 105.88, the high from November 2023. Ultimately, 107.20 – the high of 2023 – could come back into scope.

Looking down, the 200-day Simple Moving Average at 103.74 has been broken a few times recently, though it has not seen a daily close below it last week, showcasing its importance. The 200-day SMA should not let go that easily though, so a small retreat back to that level could be more than granted. Ultimately, should it lose its force, prices could fall to 103.22, the 55-day SMA, before testing 103.00.

US Dollar FAQs

What is the US Dollar?

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

How do the decisions of the Federal Reserve impact the US Dollar?

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

What is Quantitative Easing and how does it influence the US Dollar?

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

What is Quantitative Tightening and how does it influence the US Dollar?

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

The price of Brent Oil has recovered from its six-month low in mid-December and has hovered around $80 since the beginning of the year. Economists at Commerzbank analyze Brent’s outlook.

Oil price between demand concerns and supply risks

Negative factors such as the weak economies in China and Europe and supportive factors such as supply risks due to tensions in the Middle East are balancing each other out.

We expect the price of Brent Oil to remain stable at around $80 for the time being.

As the year progresses, the oil market should tighten as demand picks up and the Brent Oil price should rise to $90 by the end of 2024.

The Czech Koruna (CZK) was a notable underperformer among CEE over the past year. Economists at Commerzbank analyze the EUR/CZK outlook.

Not expecting much rebound

The Czech Koruna will probably stabilise in coming months as inflation moderates by more than rates will be cut.

But later in 2025, we forecast the CZK to depreciate, once again, on the back of a weaker Euro (EUR), and also on the back of stubborn wage and core inflation which could re-accelerate in the medium term.

Source: Commerzbank Research

- WTI Oil jumps above $79 in European trading on Monday.

- Oil traders are positioning for more upside, with futures net long at highest since October.

- The US Dollar Index is retreating back below 104 with markets looking ahead of US Jobs Reports on Friday.

Oil prices are in the green this Monday morning, backed by headlines that came out over the weekend confirming that OPEC will persist its production curbs for at least Q2, in line with expectations. Traders are seeing further bullish signs with the Commodity Futures Trading Commission (CFTC) noting speculative net long positions rising to the highest since October 2023. The OPEC cuts were voluntary, with recent data pointing to a dramatic rise in February versus January. More countries will be reporting in the coming days.

Meanwhile, the US Dollar Index (DXY) is easing on Monday with the Euro being on the forefront ahead of the European Central Bank Meeting this week. For the US Dollar, all eyes will be on US Federal Reserve Chairman Jerome Powell who will undergo his semi-annual statement before Capitol Hill (and the grilling by Senator Elizabeth Warren). That comes ahead of the US Jobs Report, which is facing high expectations after the upbeat surprise in February.

Crude Oil (WTI) trades at $79.66 per barrel, and Brent Oil trades at $83.60 per barrel at the time of writing.

Oil news and market movers: OPEC communicates as expected

- OPEC+ agrees to extend its current supply curbs in order to meet the oversupply from the US that is hitting the markets.

- Canada’s newest and biggest Oil pipeline is set to come online in the coming weeks, according to MEG Energy Corp.

- According to a Bloomberg Survey, despite the production cuts, other OPEC members are pumping above average: Libya saw its production in February rise by 120 million barrels, which is 11.2% of monthly increase as it resumed production from its Sahara Oil field. Nigeria rose by 2% in February.

- Iraq and the United Arab Emirates (UAE) are currently pumping up near 400 million barrels per day above target.

Oil Technical Analysis: OPEC cuts have one big issue

Oil prices are cheerful after comments over the weekend from a few OPEC delegates and people close to the decision that was taking place. Although the cuts are welcomed in order to keep current price levels maintained, a small issue is arising with the countries that are not upholding any supply curbs, and are even jacking up their production even more. Add the already elevated supply out of the US, and it could be that OPEC will either have to ask internally to all countries to stick to their agreed quota’s or to have deeper supply cuts after Q2.

Oil bulls are clearly seeing more upside potential with, as mentioned in the article above, net speculative bullish bets soaring to the highest level since October of 2023. These speculators could well be sitting on their hands until Oil prices finally reach $85 again. with $86.90 quickly following suit before targeting $89.64 and $90.00 as top levels.

On the downside, the 200-day Simple Moving average (SMA) near $77.76 is the first point of contact to provide some support. Quite close behind are the 100-day and the 55-day SMAs near $76.19 and $74.96, respectively. Add the pivotal level near $75.27, and it looks like the downside is very limited and well-equipped to resist the selling pressure..

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

What is WTI Oil?

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

What factors drive the price of WTI Oil?

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

How does inventory data impact the price of WTI Oil

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

How does OPEC influence the price of WTI Oil?

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Gold (XAU/USD) consolidates its gains after reaching a fresh 2024-high above $2,080. Strategists at TD Securities analyze the yellow metal’s outlook.

More data weakness needed for takeoff

It is hoped that the combination of lower yields, which are likely to attract discretionary investors into futures and ETFs, along with strong physical markets in China and robust central bank buying, will move Gold to new highs.

We believe that the yellow metal is set to move into $2,300+ territory, once there is more certainty surrounding the timing and magnitude of the pending Fed pivot.

But there will still need to be more evidence that the economy is slowing sufficiently to facilitate a steady drop in inflation before this rally becomes sustainable and moves to our target.

- EUR/USD focuses on shifting its auction range above 1.0850 as the US Dollar drops.

- Weak US Manufacturing PMI has prompted expectations of Fed rate cuts in June.

- Eurozone’s high monthly inflation growth has eased early ECB rate-cut expectations.

The EUR/USD pair aims to shift the trading range above the crucial resistance of 1.0850. The major currency pair strengthens as the US Dollar remains on the back foot and hopes of early European Central Bank (ECB) rate cuts drop further.

The overall market action seems disordered as the S&P 500 futures are slightly down while risk-sensitive currencies perform well. The US Dollar Index (DXY) drops to 103.80 as expectations for a rate cut by the Federal Reserve (Fed) have escalated.

The CME FedWatch tool shows a 58% chance that interest rates will be down by 25 basis points (bps) in the June policy meeting. The expectations for a rate-cut were at 53% before the February’s ISM Manufacturing PMI data, released on Friday.

The ISM reported the Manufacturing PMI at 47.8, lower than expectations of 49.5 and the former reading of 49.1. The agency reported that the fresh factory orders index has also come down significantly, indicating that recovery in the Manufacturing PMI has stalled.

Going forward, the market participants will focus on the Fed Chair Jerome Powell’s testimony before Congress in which he is expected to reiterate the need of having convincing evidence, which will confirm that inflation is on track to the 2% target.

On the Eurozone front, stickier-than-expected preliminary inflation data for February has pushed back expectations of early rate cuts by the ECB. The fears of persistent inflation deepened as the monthly headline and core inflation data grew strongly by 0.6% and 0.7%, respectively.

US data still holds keys to direction and volatility in FX; Friday's Nonfarm Payrolls data may confirm January’s spike was an outlier, economists at ING say.

Waiting for a volatility shake-up

US data continues to hold the keys to FX volatility. At the end of this week, the February jobs report will tell us to what extent the stellar January numbers were an outlier. ISM and NFIB numbers before that will help us and the market formulate expectations for Friday’s release, but for now our US economist expects payrolls to come in at around 200K, in line with consensus. That would still be higher than the 185k consensus call for the January release. Investors have been forced to an upward revision on the US labour market. However, a return to the 200K area would put the series on a more sustainable trend and more consistent with expectations of summer cuts by the Fed.

On Wednesday and Thursday, Fed Chair Jerome Powell will testify before Congress. A dovish change in narrative does not look very likely given the latest inflation data, and a cautious wait-and-see approach should be reiterated – but may fail to impact markets too much given the proximity with jobs data.

The action in the US calendar starts on Tuesday. Today, things look quiet across the board in developed markets, and we could see more low-volatility price action from last week. Still, the balance of risks for the Dollar before US payrolls looks slightly tilted to the upside and DXY could find some good support above 104.00.

- US stock index futures trade marginally lower to start the week.

- S&P 500 and Nasdaq Composite closed the previous at new all-time highs.

- Fed Chairman Powell will testify before Congress later in the week.

S&P 500 futures fall 0.12%, Dow Jones futures drop 0.21%, and Nasdaq futures are unchanged.

S&P 500 (SPX), Dow Jones (DJIA), and Nasdaq (IXIC) indexes closed on Friday with a 0.80% gain, a 0.23% increase, and a 1.14% rise, respectively.

What to know before stock market opens

The Dow Jones Industrial Average (DJIA) closed the previous week virtually unchanged at 39,087.39, the S&P 500 (SPX) rose nearly 1% to close at a new all-time high of 5,137.07 and the Nasdaq Composite (IXIC) added over 1% to end at a record of 16,274.94.

The Technology Sector climbed 1.78% on Friday, outperforming the rest of the major sectors, closely followed by the Energy Sector, which rose 1.17%. The Utilities Sector fell on Friday, ending the last day of the week down 0.72% at the closing bell.

NetApp Inc. (NTAP) jumped 18.167% to close at $105.31 as the biggest gainer on Friday. On the other hand, Zscaler Inc. (ZS) backslid nearly 9.4% as the biggest loser for the day, dropping to $219.23.

Assessing the latest developments in equity markets, “the S&P 500 gained +0.95% last week (and +0.80% on Friday), meaning the index has now recorded positive weekly gains for 16 out of the last 18 weeks, the first time since 1971,” noted Jim Reid, global head of economics and thematic research at Deutsche Bank, and continued:

“Talking of milestones, the Russell 2000 reached its highest level since April 2022, jumping +2.96% on the week (and +1.05% on Friday), so the rally was fairly broad. But it was tech stocks that led Friday’s sizeable rally, with the Magnificent 7 up +1.27% (+1.74% over the week). A strong earnings beat by Dell Technologies (+31.62% Friday) lifted semiconductor stocks (+4.29%) and saw Nvidia (+4.00%) move above $2trn market cap for the first time.”

Nasdaq FAQs

What is the Nasdaq?

The Nasdaq is a stock exchange based in the US that started out life as an electronic stock quotation machine. At first, the Nasdaq only provided quotations for over-the-counter (OTC) stocks but later it became an exchange too. By 1991, the Nasdaq had grown to account for 46% of the entire US securities’ market. In 1998, it became the first stock exchange in the US to provide online trading. The Nasdaq also produces several indices, the most comprehensive of which is the Nasdaq Composite representing all 2,500-plus stocks on the Nasdaq, and the Nasdaq 100.

What is the Nasdaq 100?

The Nasdaq 100 is a large-cap index made up of 100 non-financial companies from the Nasdaq stock exchange. Although it only includes a fraction of the thousands of stocks in the Nasdaq, it accounts for over 90% of the movement. The influence of each company on the index is market-cap weighted. The Nasdaq 100 includes companies with a significant focus on technology although it also encompasses companies from other industries and from outside the US. The average annual return of the Nasdaq 100 has been 17.23% since 1986.

How can I trade the Nasdaq 100?

There are a number of ways to trade the Nasdaq 100. Most retail brokers and spread betting platforms offer bets using Contracts for Difference (CFD). For longer-term investors, Exchange-Traded Funds (ETFs) trade like shares that mimic the movement of the index without the investor needing to buy all 100 constituent companies. An example ETF is the Invesco QQQ Trust (QQQ). Nasdaq 100 futures contracts allow traders to speculate on the future direction of the index. Options provide the right, but not the obligation, to buy or sell the Nasdaq 100 at a specific price (strike price) in the future.

What Factors Drive the Nasdaq 100

Many different factors drive the Nasdaq 100 but mainly it is the aggregate performance of the component companies revealed in their quarterly and annual company earnings reports. US and global macroeconomic data also contributes as it impacts on investor sentiment, which if positive drives gains. The level of interest rates, set by the Federal Reserve (Fed), also influences the Nasdaq 100 as it affects the cost of credit, on which many corporations are heavily reliant. As such the level of inflation can be a major driver too as well as other metrics which impact on the decisions of the Fed.

Eyes on Powell testimony and US jobs report

In its Semi-annual Monetary Policy Report published on Friday, the Federal Reserve (Fed) reiterated that it’s not appropriate to reduce the policy rate until they have greater confidence inflation will move sustainably toward 2%.

Fed Chairman Jerome Powell will present the monetary policy report and respond to questions in a two-day testimony before the Congress, starting Wednesday.

On Friday, the US Bureau of Labor Statistics will release February jobs report, which will include Nonfarm Payrolls, the Unemployment Rate and wage inflation figures.

Week’s focus on Powell testimony, US jobs, ECB decision [Video]

Fed FAQs

What does the Federal Reserve do, how does it impact the US Dollar?

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

How often does the Fed hold monetary policy meetings?

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

What is Quantitative Easing (QE) and how does it impact USD?

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

What is Quantitative Tightening (QT) and how does it impact the US Dollar?

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

- Gold price trades near a two-month high as Fed rate-cut bets for June deepen.

- Weak US Manufacturing PMI data weighs heavily on the US Dollar.

- Fed Powell may provide fresh insights on the timing for rate cuts this week.

Gold price (XAU/USD) hovers near a two-month high around $2,085 in Monday’s European session. The precious metal clings to gains amid increasing expectations of an interest-rate cut by the Federal Reserve (Fed) in its June monetary policy meeting.

However, the uncertainty over rate cut expectations could rebound this week as Fed Chair Jerome Powell is set to comment on inflation, interest rates, and the economy in his testimony before Congress.