- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-03-2022

- The NZD/USD pair records a new YTD high and is gaining in the week some 1.75%.

- US Nonfarm Payrolls report for February crushed expectations as unemployment ticks lower.

- NZD/USD Technical Outlook: Neutral-upwards as NZD bulls take a breather and prepare an assault to the 200-DMA.

The New Zealand dollar records the second-biggest gain of the year, at press time rising 1.04% during the North American session. Factors like high commodity prices amid the escalation of the Russia-Ukraine conflict, alongside the Russian army seizing the largest nuclear plant in Russia, triggered a rally in the commodity complex. At 0.6859, the NZD/USD does not reflect the market mood globally.

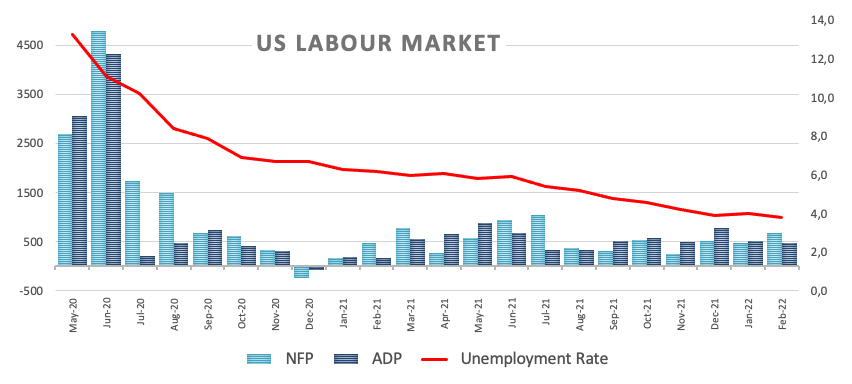

Before Wall Street’s opened, data-wise, the US economic docket featured the Nonfarm Payrolls report for February. The US economy created 678K new jobs, more than the 400K foreseen by analysts, while the January print at 481K trail’s February one. The unemployment rate declined to 3.8%, a tad lower than estimations.

Then, Fed speaking resumed before the Fed’s blackout as the March 15-16 meeting looms. Chicago Fed President Charles Evans said that he favors increases of 25 bps in each of the meetings and added that jobs numbers have been “quite good” for some time.

Russia-Ukraine Update

During the Asian session, a fire was reported at Ukraine’s Zaporizhzhia nuclear power plant, which is the largest amid an attack by Russian troops. Initially, the Ukraine Foreign Minister Kuleba confirmed the news and warned that an explosion would be ten times larger than Chernobyl. Late, the Ukraine emergency state service reported that the fire broke outside the perimeter and emphasized that the safety of the nuclear power plant was now secured. Since then, the Zaporizhzhia nuclear power plant has been seized by Russian military forces, according to the regional authority.

Week ahead economic data

Data-wise, the docket would feature medium-high data. The New Zealand economic docket, on March 10, will reveal the Business NZ PMI for February. Across the pond, the US economic docket will unveil the Trade Balance, JOLTs Job Openings, Inflation, and Michigan Consumer Sentiment.

NZD/USD Price Forecast: Technical outlook

The NZD/USD, Friday’s rally, broke the 100-day moving average (DMA) located at and if the pair achieves a daily close above it, a move towards the 200-DMA is on the cards. If that scenario plays out, the NZD/USD first resistance would be January 13 daily high at 0.6890. Breach of the latter would expose the 0.6900 mark, followed by the 200-DMA at 0.6930.

- XAG/USD rallies almost 2% during the day while eyeing of record another YTD high as Wall Street’s close looms.

- The US jobs report, although positive, was ignored by market players.

- XAG/USD Technical Outlook: Bullish, and it can extend the rally in the case of a daily close above $25.67.

Silver (XAG/USD) remains buoyant as traders head into the weekend after reaching a new YTD high at around $25.70. In the week so far, the white metal is up 5.59%, its largest gain since May 2021, though it seems to be settling as the New York close approaches. At the time of writing, XAG/USD is trading at $25.67.

In the early North American session, the US Department of Labor reported that the US economy added 678K jobs to the labor market, up from 440K estimations after a gain of 467K in January. Silver trader’s reaction was muted. Usually, it has a more significant impact on the market, but Ukraine-Russia jitters, grab investors’ attention.

Following the US Nonfarm Payrolls report release, Chicago Fed President Charles Evans said that job numbers have been suitable for some time and noted a “tremendous amount” of uncertainty regarding the Russia-Ukraine conflict. Further, Evans stated that it would “be more than essential” hike rates 25 bps at each meeting.

Global equity markets continued trading in the red, preparing to have one of its worst weeks in some time. Meanwhile, US Treasuries remain bid amid safe-haven appetite, weighing on US Treasury yields. The 10-year benchmark note is losing ten basis points, sitting at 1.743%, a tailwind for non-yielding metals, like silver and gold, which depreciate when yields rise.

In the FX space, the buck is bid, as depicted by the US Dollar Index, advancing 0.84%, up at 98.541.

XAG/USD Price Forecast: Technical outlook

XAG/USD is probing February 24 daily high at $25.62, unsuccessfully tested twice. If XAG/USD bulls achieve a daily close above, a move towards $26.00 is on the cards. However, silver bulls would face several resistance levels on their way north.

XAG/USD’s first resistance would be the $26.00 mark. Breach of the latter would expose July 16, 2021, a daily high at $26.45, followed by July 6, 2021, a daily high at $26.77.

Russia's Envoy to the UN on Friday said that there is nothing threatening the safety of Ukraine's nuclear power plant and there is no threat of radioactive material being released, reported Reuters. The plant is working normally and background radiation levels are normal, the Russian envoy added, saying that the power plant and its adjacent territory are being "guarded" by Russian troops. Friday's meeting at the UN is another attempt by Ukraine to rekindle artificial hysteria about what is happening in Ukraine, the envor added.

Russia's Envoy to nuclear discussion between major world powers and Iran said on Friday that "we will have a deal maybe in the middle of next week", reported Reuters. European negotiators probably returned to capitals because they believe they have done their job, the envoy added.

- The USD/CHF eyes to finish the week with losses, down 1.03%.

- Global equity indices record losses on a busy week impacted by economic data and geopolitical news.

- USD/CHF Technical Outlook: Neutral biased, confirmed by the DMAs with an almost horizontal slope confined to a 15-pip range.

The USD/CHF climbs for the third day in the week, but it would end the week in the red following Monday’s 1% loss, which pushed the USD/CHF below the daily moving averages (DMAs). All that amid a risk-off market mood, portrayed by global equities recording losses, blamed on Ukraine-Russia’s tussles. At the time of writing, the USD/CHF is trading at 0.9188

In the meantime, the US Dollar Index, which reached a new YTD high around 98.992, aimed higher, 0.85%, sitting at 98.62, while US Treasury yields dropped amid a safe-haven bid.

US Labor market crushed expectations, green light for a Fed rate hike

On Friday, the US Department of Labor reported that the US economy added 678K new jobs in February, higher than the 400K foreseen. Also, the Unemployment Rate ticked lower, while average hourly earnings edged slightly down.

Read more: Breaking: US Non-farm Payrolls rises by 678K in February versus median forecast for 400K gain

USD/CHF Price Forecast: Technical outlook

The USD/CHF is neutral biased, and one could argue that neutral-downward because the daily moving averages (DMAs) reside above the spot price. However, the almost flat slope and confined to within a 14-pip range keeps traders indecisive on which path to take.

Putting the DMA’s aside, upwards, the USD/CHF first resistance would be 0.9200. Once that level is cleared, the next supply zone would be the 0.9260-75 area and the 0.9300 mark. On the flip side, the 0.9150 February 21 daily low would be the first support, followed by December 31, 2021, daily low at 0.9102.

Employment data released on Friday came in above expectations, but it was mostly ignored by market participants as the Russian/Ukraine war continues to be the key driver for markets. Analysts at Wells Fargo believe that so long as the Russia-Ukraine conflict does not significantly escalate, the FOMC is poised to begin a tightening cycle on March 16 considering the solid state of the labor market alongside the most significant inflation in decades.

Key Quotes:

“Job growth continued at an impressive pace in February, with employers adding 678K new jobs. The strong pace of hiring comes as the availability of workers continues to improve. The labor force participation rate ticked higher in February, but the jobs market continues to tighten with the unemployment rate falling to a fresh cycle low of 3.8%. Average hourly earnings growth paused in February, which should ease concerns that wages—and therefore inflation—are running away.”

“This is not to say the labor market has reached nirvana. Nonfarm payrolls are still 2.1 million below February 2020 levels, and the distribution of recouped jobs is uneven across different industries, regions and demographic groups. That said, the key limiting factor to faster job growth continues to be labor supply, even with the improvement of late, rather than labor demand.”

“And with inflation well-above the Federal Reserve's target, the case for the first rate hike since COVID began is clear. So long as the Russia-Ukraine conflict does not significantly escalate, the FOMC appears poised to begin a tightening cycle on March 16.”

Gold continues to find demand amid the ongoing Russia-Ukraine crisis. As FXStreet’s Eren Sengezer notes, the technical picture suggests that XAU/USD remains bullish in the near-term, pointing to additional gains towards $1,975.

US inflation data and geopolitical headlines to drive next week's action

“On Wednesday, the US Bureau of Labor Statistics will release the February Consumer Price Index (CPI) data. Unless there is a negative surprise, investors should continue to price in a hawkish Fed policy outlook. Another leg higher in the US T-bond yields on a strong CPI print could limit the yellow metal’s gains.”

“The yellow metal should continue to find demand as a traditional safe-haven next week unless investors see convincing signs of a de-escalation of the Russia-Ukraine conflict.”

“On the upside, $1,975 (static level, February 24 high) aligns as the first hurdle before the precious metal could target the all-important $2,000 level.”

“As long as $1,920 support (static level, ascending trend line) holds, sellers are likely to remain on the sidelines. Below $1,920, next support is located at $1,900 (psychological level) before $1,885 (20-day SMA).”

- The AUD/USD is set to finish the week with gains, up 1.50%.

- US Nonfarm payrolls reports crushed expectations, giving a green light for a Fed hike.

- Fed’s Evans: He said that is essential to hike in each meeting.

- AUD/USD Technical Outlook: Upward biased, as long as it remains above the 200-DMA.

The AUD/USD rallies for the third straight day, eyeing to close in the green the week, though it faced strong resistance around 0.7369, as the US Department of Labor reported that the US economy added more jobs than expected, amid a risk-off mood due to increasing tensions between Ukraine and Russia conflict. At press time, the AUD/USD is trading at 0.7348.

US Labor market improves and cements a 25 bps rate hike by the Fed

The US Bureau of Labor Statistics (BLS) unveiled the Nonfarm Payrolls report for February. The figures smashed expectations rose by 678K, higher than the 400K estimated by market analysts. Further, the Unemployment Rate fell, and average hourly earnings were little changed from the prior month.

Read more: Breaking: US Non-farm Payrolls rises by 678K in February versus median forecast for 400K gain

February’s report would be the last before the Fed March 15-16 meeting. The improvement in the labor market gives the green light to the Fed’s first rate hike since December 2018. In fact, the odds of a 25 bps increase, as reported by money market futures, are 95%, though US inflation figures on March 10 would give additional clues about the size of the rate hike.

After the US NFP report, Chicago Fed President Charles Evans crossed the wires on a CNBC interview. Evans said that job numbers have been “quite good” for some time and mentioned a “tremendous amount” of uncertainty regarding the Russia-Ukraine conflict. Furthermore, he added that it would “be more than essential” hike rates 25 bps at each meeting.

Russia-Ukraine update

During the Asian session, a fire was reported at Ukraine’s Zaporizhzhia nuclear power plant, which is the largest amid an attack by Russian troops. Initially, the Ukraine Foreign Minister Kuleba confirmed the news and warned that an explosion would be ten times larger than Chernobyl. Late, the Ukraine emergency state service reported that the fire broke outside the perimeter and emphasized that safety of the nuclear power plant was now secured.

Since then, the Zaporizhzhia nuclear power plant has been seized by Russian military forces, according to the regional authority.

AUD/USD Price Forecast: Technical outlook

The AUD/USD is bullish biased, though it witnessed a retracement to the 200-DMA, which was used to open new upward bets, with the AUD/USD jumping to the 0.7340 area. The AUD/USD first resistance would be November 16 high at 0.7368. Breach of the latter would expose the 0.7400 mark, followed by September 3 day high at 0.7478 and then 0.7500.

- USD/MXN holds bullish bias, approaching testing resistance zone 20.85/90.

- Risk aversion weighs on the Mexican peso and other emerging market currencies.

- Slide under 20.60 to alleviate bullish pressure.

The USD/MXN is on its way to the highest weekly close since December. After rising back above 20.70, the dollar gained momentum and currently is testing the 20.85 resistance area. A break higher, if sustained above 20.90, could lead to a test of the following strong barrier seen at 21.05.

The 100-week moving average is seen at 20.92. A close clearly above would be a positive sign for the US dollar, for a potential extension to 21.35.

The RSI and momentum in the daily chart are pointing north, still not at extreme overbought levels. No signs of a correction are seen at the moment. If the USD/MXN fails to break above 20.85/90, the Mexican peso could experience a brief rally. Only below 20.60, the pressure is expected to ease.

The outlook favors more gains in USD/MXN, particularly with a close above 20.80. The risk aversion environment with the stronger dollar, also favor the upside from a fundamental perspective.

USD/MXN daily chart

-637820038649893829.png)

- Spot gold has been all over the place in the last half an hour or so following the US open.

- XAU/USD rose as high as $1960 only to drop back to the mid-$1940s in a matter of minutes.

- Broadly speaking, gold remains underpinned as the Ukraine crisis sparks demand for safe havens and inflation protection.

Spot gold (XAU/USD) prices have traded in exceedingly choppy and unpredictable fashion over the course of the last half an hour or so, initially surging to fresh weekly highs just under $1960 but then pulling back sharply into the $1940s again. With the prior weekly highs at $1950 now cleared, the bulls will likely be eyeing a test of last week’s highs in the $1974 area. Technicians noted that gold, prior to recent volatility, had over the last few days formed an ascending triangle, the ceiling for which was in the $1950 area. Ascending triangles are often a precursor for a bullish breakout, which might to some extent explain the recent surge and pick-up in volatility.

More broadly though, trade has been volatile since the US open, with major equity indices there opening deeply in the red, a reflection of the broader risk-off tone to Friday trade as investors fret about the ongoing and intensifying war in Ukraine. Markets were spooked during Asia Pacific hours on Friday at the news of fight around and a fire in a major Ukrainian nuclear plant and, while the fire has reportedly been put out and the plant captured by Russian forces, markets remain jittery. All of this is underpinning gold prices and keeping prices trading with an upside bias.

Add to the mix a continued surge in global energy (oil and gas) prices, as well as sharp upside in various agricultural and base metal products exported by Russia, and the demand for inflation protection also remains strong. Other factors/market conditions are also working in favour of gold; firstly, US bond yields are sharply down on Friday amid a safe-haven bid. That lowers to the opportunity cost of holding non-yielding safe-haven assets like gold and is shieling gold from the typically negative impact of the stronger US dollar.

Meanwhile, the latest US labour market report for February, though showing stronger than expected job gains on the month and a larger than forecast drop in the Unemployment Rate, showed an easing of wage cost pressures. Rising wage growth has been one of the factors concerning the Fed in recent months, so the latest metrics have been interpreted as easing pressure on the bank to tighten policy as quickly this year, arguably a positive for gold. It is notable, however, that Fed policymaker Charles Evans recently played down reading into the latest jobs report too much, saying it didn’t change much heading into this month’s Fed meeting.

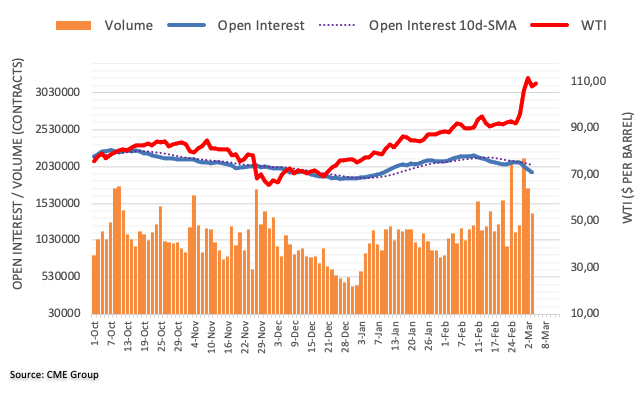

- WTI recently rallied back to session highs in the $113.00s, an impressive intra-day recovery from earlier lows in the $107.00s.

- Oil remains strongly underpinned by expectations that severe financial sanctions imposed by the West on Russia will disrupt global supply.

- Further chatter about an imminent US/Iran nuclear deal has failed to phase the oil bulls.

After dipping as low as the $107.00s per barrel in early European trade, front-month WTI futures have staged an impressive recovery and recently broke to the north of overnight highs to hit the $113.00 mark. A clean upside break to the upside would open the door, technically speaking, for a run back towards more than decade highs set earlier in the week in the $116.00s.

Oil prices remain underpinned by expectations that severe financial sanctions imposed by the West on Russia for its invasion of Ukraine will disrupt the country’s oil exports, as evidence builds that Russian sellers are having difficulty shifting product. As Russian President Vladimir Putin ramps up the intensity of his assault on Ukraine (reportedly Russian forces are leaning more towards artillery and airstrikes), risks remain tilted towards further imposition of sanctions from the West.

Fears that Western nations might ban Russian energy exports outright are another factor supporting crude oil prices and keeping the bull-run alive, even in the face of reports that a US/Iran nuclear deal might be imminent. Commodity analysts say that an end to US sanctions on Iranian oil exports as a result of a deal could see as much as 1.3M barrels per day in exports return to global markets. Strategists have warned this is unlikely to make up for the shortfall in supply from Russia.

At current levels in the $113.00s, WTI is trading with on-the-day gains of about $5.0, taking its on-the-week gains to over $21, the best percentage weekly gain since the middle of 2020. For now, the bulls remain very much in control and this doesn’t seem likely to change until there is more certainty on global supply, an unlikely prospect as the Russo-Ukraine war intensifies.

We have likely yet to see the bottom in EUR/USD as rising commodity prices due to Putin’s war in Ukraine will lead to higher price pressure, according to economists at Nordea. Furthermore, rates will remain in favour of a lower EUR/USD.

Energy prices will hurt growth in the euro area more than in the US

“The repercussions for energy prices are most severe in Europe due to its energy dependency on imports. The US is in comparison energy self-reliant and a net petroleum exporter. It is also worth noting that European households spend a higher proportion of their income on heating/gas/electricity compared to American households. Hence, the economic ramifications will be more pronounced for the European economies than in the US.”

“A hawkish Fed compared to a more uncertain ECB argues for a lower EUR/USD rate.”

“We still expect EUR/USD to come to 1.08 in the coming months on the back of a higher interest rate differential.”

“The USD enjoys the benefits of its status as the world’s reserve currency and it being a save heaven in these troubling and uncertain times.”

- EUR/CHF is on the way to parity as the euro gets crushed.

- US NFP data was very strong, as expected, sending the US dollar to fresh highs.

EUR/CHF has reached a new low at 1.0025 on the back of the stellar US Nonfarm Payrolls report which has propelled the greenback to a fresh high and sent the euro into the abyss where it touches 1.0885 vs the US dollar, breaking 1.0900.

The US jobs data arrived as follows:

- US Change in Nonfarm Payrolls Feb: 678K (est 423K; prev 467K).

- US Unemployment Rate Feb: 3.8% (est 3.9%; prev 4.0%).

- US Average Hourly Earnings (Y/Y) Feb: 5.1% (est 5.8%; prev 5.7%).

- US Average Hourly Earnings (M/M) Feb: 0.0% (est 0.5%; prev 0.7%).

The DXY is now trading around the highs of the day at 98.916 as markets price in a Federal Reserve rate hike. However, the week is also ending on a risk-off note and this is crushing the euro.

''There is now really nothing in the way of support until the April 2020 low near 1.0725 and then the March 2020 low near 1.0635,'' analysts at Brown Brothers Harriman said.

In terms of the Federal Reserve the analysts said, ''given the heightened uncertainty surrounding the Ukraine crisis, we think 50 bp would simply be too aggressive at the moment. WIRP suggests zero odds of a 50 bp move and so the Fed does not have to feel that it has to do 50 bp just to meet market expectations,'' analysts at Brown Brothers Harriman said.

''The Fed can then wait nearly two months until the May 3-4 FOMC meeting to see how the crisis has impacted the US economy before deciding on its next move. If circumstances warrant, the Fed could always move intra-meeting but that seems unlikely right now.''

- GBP/USD witnessed heavy selling for the second successive day amid a blowout USD rally.

- The worsening situation in Ukraine, upbeat NFP report continued underpinning the USD.

- Technical selling below the 1.3270 area aggravated the bearish pressure around the pair.

The GBP/USD pair continued lowing ground through the early North American session and weakened further below mid-1.3200s in reaction to upbeat US monthly jobs report. The pair was last seen trading around the 1.3240-1.3235 region, down nearly 0.80% for the day.

The pair added to the overnight losses and continued losing ground for the second successive day on Friday amid a blowout US dollar rally, bolstered by the global flight to safety. The Russian attack on Ukraine's Zaporizhzhia nuclear power plant - the largest of its kind in Europe - raised fears of an environmental catastrophe. This, in turn, unnerved investors and boosted demand for traditional safe-haven assets.

The stronger USD momentum got an additional boost from better-than-expected US employment details. In fact, the headline NFP showed that the US economy added 678K new jobs in February, smashing market expectations for 400K. Adding to this, the previous month's reading was revised higher to 481K from 467K reported earlier. Moreover, the unemployment rate fell more than anticipated, to 3.8% from 4.0% in January.

The greenback shot to its highest level since May 2020 and was seen as a key factor that dragged the GBP/USD pair lower. Apart from this, the ongoing downward trajectory could further be attributed to some technical selling below the 1.3270 support zone. This now seems to have set the stage for a further near-term depreciating move amid the worsening situation in Ukraine.

Technical levels to watch

- EUR/USD keeps the bearish note intact below 1.1000.

- US Non-farm Payrolls rose by 678K jobs in February.

- The unemployment rate ticked lower to 3.8%.

The selling interest around the single currency remains well and sound at the end of the week and drags EUR/USD to the 1.0930 area in the wake of US NFP.

EUR/USD in fresh lows around 1.0930

EUR/USD keeps the negative stance on Friday after the US economy created 678K jobs during February, bettering expectations for a gain of 400K jobs. The January reading was revised to 481K (from 467K).

Further data showed the jobless rate eased to 3.8% and the critical Average Hourly Earnings – a proxy for inflation via wages – came flat on a monthly basis and expanded 5.1% over the last twelve months. Another key gauge, the Participation Rate, improved to 62.3%.

EUR/USD levels to watch

So far, spot is losing 1.13% at 1.0940 and faces the next up barrier at 1.1192 (10-day SMA) followed by 1.1309 (55-day SMA) and finally 1.1395 (weekly high Feb.16). On the other hand, a drop below 1.0924 (2022 low Mar.4) would target 1.0900 (round level) en route to 1.0870 (low May 25 2020).

- NZD/USD attracted fresh buying on Friday and rallied to the highest level since January 14.

- Strong rally in commodity prices continued acting as a tailwind for the resources-linked kiwi.

- Geopolitical tensions boosted the safe-haven USD, though did little to hinder the momentum.

- Traders now eye NFP for a fresh impetus, though the focus remains on the Russia-Ukraine saga.

The NZD/USD pair maintained its bid tone heading into the North American session and was last seen trading around the 0.6825 region, just a few pips below the seven-week high.

Following an early slide to the 0.6770-0.6765 region, the NZD/USD pair attracted fresh buying on Friday and prolonged its bullish trajectory witnessed over the past one month or so. The New Zealand dollar continued drawing support from the recent monster gains in commodity prices that followed Russia's invasion of Ukraine.

The worsening situation in Ukraine led to a fresh surge in prices for raw materials and contributed to the relative outperformance of resources-linked currencies, including the kiwi. In the latest development, Russian military forces seized Ukraine's Zaporizhzhia nuclear power plant - the largest of its kind in Europe.

The early bombardment by Russian troops on Friday raised fears of an environmental catastrophe and triggered a fresh wave of the global risk-aversion traders. This, in turn, pushed the safe-haven US dollar to the highest level since June 2020, albeit did little to prompt any selling around the perceived riskier kiwi.

Bulls, however, took a breather just ahead of mid-0.6800s, or a resistance marked by the 100-day SMA resistance and preferred to wait for the release of the US monthly jobs report (NFP). The key focus, however, will remain on developments surrounding the Russia-Ukraine saga, which should continue to infuse volatility around the NZD/USD pair.

Technical levels to watch

NATO Secretary General Jens Stoltenberg stated on Friday that NATO calls on Russian President Vladimir Putin to stop the war in Ukraine immediately without conditions and engage in diplomacy, reported Reuters. Stoltenberg said that the days to come in Ukraine are likely to be worse and NATO has a responsibility to ensure that the conflict does not spread beyond Ukraine. Furthermore, Stoltenberg urged that NATO is not seeking war with Russia and remains committed to keeping its options for diplomacy open. NATO allies agree, Stoltenberg continued, that we should not have NATO planes in Ukrainian airspace or NATO troops on Ukrainian soil.

US monthly jobs report overview

Friday's US economic docket highlights the release of the closely-watched US monthly jobs data. The popularly known NFP report is scheduled for release at 13:30 GMT and is expected to show that the economy added 400K new jobs in February, down from the 467K reported in the previous month. The unemployment rate is expected to edge lower to 3.9% from 4.0% in January. Given Wednesday's upbeat US ADP report on private-sector employment, market participants are anticipating a positive surprise from the official figures.

As Joseph Trevisani, Senior Analyst at FXStreet, explains: “These labor market statistics, especially the declining claims numbers and the record number of available jobs, backed by strong retail sales and high levels of business orders, argue for continued high levels of hiring.”

Analysts at Wells Fargo sounded more optimistic and offered a brief preview of the report: “Our forecast of 450K new jobs in February is predicated on lower COVID-19 cases, robust labor demand and improving labor supply. We project that US employment will recover to its pre-pandemic level by year-end, giving the Fed plenty of cover to tighten monetary policy at a steady pace this year as the central bank gets above-target inflation.”

How could the data affect EUR/USD?

Heading into the key release, a further escalation in the Russia-Ukraine war triggered a fresh leg up in the US dollar and dragged the EUR/USD pair below the 1.1000 mark for the first time since May 2020. A stronger than expected NFP report could provide an additional lift to the greenback and continue exerting downward pressure on the major. Conversely, any disappointment is more likely to be overshadowed by the worsening situation in Ukraine and might do little to lend any support. This, in turn, suggests that the path of least resistance for the USD is to the upside and down for the pair.

Meanwhile, Eren Sengezer, Editor at FXStreet, offered a brief technical outlook and outlined important technical levels to trade the major: “The Relative Strength Index (RSI) on the four-hour chart is now slightly below 30, showing that the pair is technically oversold. Hence, 1.1000 (psychological level) support could hold in the short term and the pair could stage a correction before the next attempt. In case buyers fail to defend that support, the next bearish target is located at 1.0960 (static level).”

“On the upside, former support of 1.1060 now aligns as initial resistance. The descending trend line coming from Monday reinforces that resistance as well. As long as this level stays intact, sellers should continue to dominate the pair's action. Above 1.1060, 1.1100 (psychological level, 20-period SMA) could be seen as the next resistance before 1.1150 (static level),” Eren added further.

Key Notes

• US Nonfarm Payrolls February Preview: Fed policy runs through Kyiv

• NFP Preview: Forecasts from 10 major banks, potential for upside surprise

• EUR/USD Forecast: Bears to retain control unless euro reclaims 1.1060

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous months reviews and the unemployment rate are as relevant as the headline figure.

- USD/JPY witnessed some selling on Friday and retreated further from an over two-week high.

- The global rush to safety benefitted the JPY and exerted pressure amid sliding US bond yields.

- A blowout USD rally helped limit any deeper losses ahead of the US monthly jobs report (NFP).

The USD/JPY pair remained on the defensive through the mid-European session and was last seen hovering near the lower end of its daily trading range, around the 115.30 area.

The pair extended the previous day's pullback from the 115.80 region, or the two-and-half-week high and edged lower for the second successive day on Friday. The global risk sentiment took a hit amid a further escalation of the Russia-Ukraine war and forced investors to take refuge in traditional safe-haven assets. This, in turn, benefitted the Japanese yen and exerted some downward pressure on the USD/JPY pair.

In the latest development, Russian troops attacked Europe's largest nuclear power plant in Ukraine and fueled fears of an environmental catastrophe. Moreover, Ukraine's regional authority confirmed that Zaporizhzhia nuclear power plant has been seized by Russian military forces. Adding to this, media reports suggest that gas flowing from Russia to Europe has come to a halt, which further weighed on investors' sentiment.

The global flight to safety led to a sharp decline in the US Treasury bond yields. This was seen as another factor that inspired bearish traders and contributed to the offered tone surrounding the USD/JPY pair. That said, a blowout US dollar rally back closer to June 2020 swing high helped limit deeper losses. Traders also prefer to wait on the sidelines ahead of the release of US monthly employment details.

The closely-watched NFP report is expected to show that the US economy added 400K new jobs in February and the unemployment rate ticked down to 3.9% from 4.0% in the previous month. A major divergence from the expected readings could infuse some volatility, though any immediate reaction is more likely to be short-lived. The market focus will remain glued to the incoming headlines surrounding the Russia-Ukraine saga.

Technical levels to watch

- EUR/USD drifts lower and challenges 1.1000.

- The dollar gathers extra steam and rose to fresh cycle tops.

- US Nonfarm Payrolls will be the salient event later in the session.

The selling pressure around the European currency remains well and sound for yet another session and drags EUR/USD to the boundaries of the psychological support at 1.1000 on Friday.

EUR/USD weaker on safe haven demand, looks to data, Ukraine

Another day, another record low for EUR/USD. This time the pair probed the area near the 1.1000 support against the backdrop of the intense demand for the greenback and the safe haven universe in general.

Indeed, worsening conditions in the Russia-Ukraine military conflict led investors to increase their positions in safer assets. This behaviour intensified following the failed attempts to agree a ceasefire at Thursday’s talks between officials of both countries.

The firm note in the German money markets, in the meantime, sustains further the interest in bonds and drags yields of the 10y Bund back to the -0.020% region, along with the pullback seen in their US peers.

Back to the docket, Retail Sales in the broader Euroland expanded 0.2% MoM in January and 1.7% over the last twelve months and Germany’s trade surplus widened to €9.4B in the first month of the year.

The NA session will be much more entertaining with the release of February’s Nonfarm Payrolls (400K exp.) and the Unemployment Rate (3.9% exp.).

What to look for around EUR

EUR/USD continues to look to the geopolitical scenario and risk appetite trends for direction. On this, the recent deterioration of the Russia-Ukraine front is expected to keep the pair under pressure amidst solid risk-off sentiment and demand for the dollar. In the longer run, occasional bouts of strength in the pair should remain underpinned by speculation of a potential interest rate hike by the ECB probably sooner than many anticipate, higher German yields, persevering elevated inflation and a decent pace of the economic activity and auspicious results from key fundamentals in the region.

Key events in the euro area this week: Germany Trade Balance, EMU Retail Sales (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is losing 0.48% at 1.1012 and faces the next up barrier at 1.1192 (10-day SMA) followed by 1.1309 (55-day SMA) and finally 1.1395 (weekly high Feb.16) and finally 1.1395 (weekly high Feb.16). On the other hand, a drop below 1.1001 (2022 low Mar.4) would target 1.1000 (round level) en route to 1.0870 (low May 25 2020).

- GBP/USD witnessed some selling for the second successive day amid sustained USD strength.

- The worsening Ukraine crisis weighed on the sentiment and benefitted the safe-haven USD.

- Investors now look forward to the US monthly jobs report (NFP) for some short-term impetus.

The GBP/USD pair dropped to a fresh daily low during the first half of the European session, with bears now awaiting sustained weakness below the 1.3300 round-figure mark.

The pair extended the overnight retracement slide from levels just above the 1.3400 mark and witnessed some selling for the second successive day on Friday. The downfall dragged the GBP/USD pair back closer to the lower end of its weekly trading range and was sponsored by resurgent US dollar demand, bolstered by the global flight to safety.

Investors rushed to take refuge in safe-haven assets in reaction to the news that Russian troops attacked Europe's largest nuclear power plant in Ukraine. This marked a further escalation of the Russia-Ukraine war and pushed the greenback to its highest level since June 2020, which, in turn, exerted some downward pressure on the GBP/USD pair.

The nervousness eased after the International Atomic Energy reported that there has been no change in radiation levels at the Zaporizhzhia nuclear power plant site. Moreover, Ukraine's emergency services said that the fire at the nuclear plant has been extinguished. That said, investors remained on the edge amid the worsening situation in Ukraine.

In the latest development, Ukraine regional authority confirmed that Zaporizhzhia nuclear power plant has been seized by Russian military forces. Moreover, media reports suggest that gas flowing from Russia to Europe has come to a halt. This fueled worries about the potential economic fallout from the Ukraine crisis and acted as a tailwind for the buck.

The fundamental backdrop supports prospects for a further near-term depreciating move for the GBP/USD pair, though the recent range-bound price action warrants caution. Hence, it will be prudent to wait for a convincing break below the weekly low, around the 1.3270 area, before confirming a fresh breakdown and placing aggressive bearish bets.

Market participants now look forward to the US monthly employment details, popularly known as NFP. The closely-watched jobs report is scheduled for release later during the early North American session. Given that the market focus remains on headlines surrounding the Russia-Ukraine saga, the data seems unlikely to provide any meaningful impetus to the GBP/USD pair.

Technical levels to watch

USD/CAD has recovered and it is trading above the 1.2700 level. Still, economists at OCBC Bank expect the pair to remain under pressure, especially on failure to hold the 1.2640/50 zone.

More downside for the EUR/CAD and GBP/CAD rather than the USD/CAD

“The Bank of Canada followed up its rate hike with some hawkish signalling. Macklem outlined plans to allow the bonds held to roll off and reduce the balance sheet, and did not rule out 50 bps hikes.”

“Stay negative on the USD/CAD, but it will need to hold below 1.2640/50 for more downside momentum.”

“Still prefer downside for the EUR/CAD and GBP/CAD for now, rather than the USD/CAD.”

- AUD/USD attracted fresh buying near the 0.7300 mark and shot to a multi-month high on Friday.

- Rallying commodity prices continued benefitting the aussie and remained supportive of the move.

- Bulls seemed unaffected by sustained USD strength and even shrugged off the risk-off impulse.

The AUD/USD pair built on its steady intraday ascent through the first half of the European session and shot to a near four-month high, around the 0.7375 region in the last hour.

The pair witnessed some selling during the early part of the trading on Friday in reaction to the news that Russian attacked Europe's largest nuclear power plant in Ukraine. The downtick, however, was quickly bought into near the 0.7300 mark and pushed the AUD/USD pair into the positive territory for the third successive day.

The recent monster gains in oil and metal prices that followed Russia's invasion of Ukraine continue benefitting commodity-linked currencies, including the Australian dollar. Apart from this, rising bets for an eventual interest rate hike by the Reserve Bank of Australia in 2022 further underpinned the domestic currency.

The worsening situation in Ukraine forced investors to take refuge in traditional safe-haven assets and lifted the US dollar to its highest level since June 2022. Bulls, however, seemed unaffected by sustained USD strength and even shrugged off the risk-off impulse, which tends to weigh on the perceived riskier aussie.

From a technical perspective, Friday's strong move up took along some short-term trading stops placed near a technically significant 200-day SMA and confirmed a near-term bullish breakout. This, in turn, provided an additional boost to the AUD/USD pair and contributed to the ongoing momentum to the highest level since November 10.

Market participants now look forward to the US economic docket, highlighting the release of the closely-watched US monthly jobs report (NFP) later during the early North American session. Any immediate market reaction is likely to be short-lived as the focus remains on developments surrounding the Russia-Ukraine saga.

Technical levels to watch

The EUR/USD continued to edge towards the 1.1000 base. A break below here would clear the way for additional losses to the 1.0850/00 zone, economists at OCBC Bank report.

Short-term implied valuations are near the 1.0850 vicinity

“The pair touched lows at 1.1010, and may well be on track for a sterner test of the support.”

“Even if the pair does not breach 1.1000 on the weekly close, expect the level to stay under pressure next week.”

“Beyond 1.1000, look towards the 1.0800/50 zone for the next level of support.”

“Our short-term implied valuations are already near the 1.0850 vicinity.”

See – EUR/USD: Break below 1.10 to clear the way towards key long-term support at 1.0884 – MUFG

The market environment continues to favour a strong dollar as we head into a weekend where the battle for Ukraine’s major cities looks set to intensify further. Domestic factors are also offering support to the greenback, economists at ING report.

USD could receive some extra help from solid NFP

“Another spike in the USD OIS-FRA spread is signalling that liquidity/USD funding conditions have continued to deteriorate. While still far from alarming levels seen in spring 2020, this may translate into more strength in the dollar.”

“Fed fund futures are close to pricing back in six hikes by the end of 2022, and a solid US payroll number today could help cement tightening expectations further – ultimately adding to USD good momentum.”

“Today, G7 leaders will meet, and we may hear about more sanctions against Russia. Investors will keep an eye on any hints of a coordinated effort to limit dependency on Russian commodities, which could put more upside pressure on energy prices.”

“In the current environment, we could see the dollar remain bid along with those pro-cyclical currencies that are not geographically exposed to the conflict in Ukraine (CAD, AUD, NZD).”

See – NFP Preview: Forecasts from 10 major banks, potential for upside surprise

Pressure has continued to build around a break below 1.1000 in EUR/USD. Below here, the key long-term support at 1.0884 will be in focus, economists at MUFG Bank.

A break of 1.1000 is certainly feasible now

“EUR/USD long-term support comes in on the trendline support from the record low in October 2000 of 0.8230 and the pandemic-related low in March 2020 of 1.0636. That support is at 1.0884 on the monthly chart in March.”

“A break of 1.1000 is certainly feasible now in the very short-term which will see the markets immediately focus on the key long-term support level.”

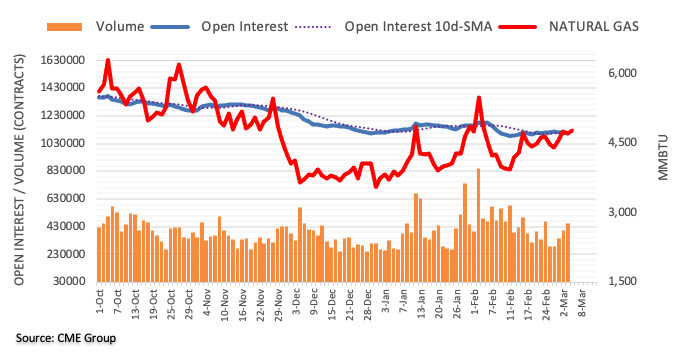

Considering advanced prints from CME Group for natural gas futures markets, open interest went down for the third session in a row on Thursday, this time by nearly 10K contracts. On the flip side, volume extended the uptrend for the fourth straight session, now by almost 51K contracts.

Natural Gas looks to retest $5.00

Thursday’s downtick in prices of natural gas was accompanied by shrinking open interest, indicative that extra losses look unlikely in the very near term and therefore leaving the door open to a probable visit to the $5.00 mark per MMBtu in the near term.

- USD/CAD struggled to capitalize on its modest intraday gains to the 1.2720 region.

- Bullish crude oil prices underpinned the loonie and acted as a headwind for the pair.

- The worsening Ukraine crisis benefitted the safe-haven USD and extended support.

The USD/CAD pair retreated a few pips from the daily high and was seen trading with modest intraday gains, just below the 1.2700 mark during the early European session.

The pair built on the overnight strong rebound of over 100 pips from sub-1.2600 levels, or the lowest since January 26 and gained some follow-through traction for the second straight day on Friday. News that Russian troops are shelling Europe's largest nuclear power plant in Ukraine triggered a fresh wave of the global risk aversion trade and boosted the safe-haven US dollar. This, in turn, extended some support to the USD/CAD pair.

That said, a fresh surge in crude oil prices underpinned the commodity-linked loonie and capped gains for the USD/CAD pair, rather attracted some selling near the 1.2720 region. Following the previous day's turnaround from the multi-year high, crude oil regained positive traction on Friday amid the worsening situation in Ukraine. The latest development fueled fears of a disruption in Russian crude exports and pushed oil prices higher.

The market nervousness, however, eased a bit after the International Atomic Energy reported that there has been no change reported in radiation levels at the Zaporizhzhia nuclear power plant site. Adding to this, Ukraine's emergency services said that fire at the nuclear plant has been extinguished and led to modest pullback in oil prices. This, along with sustained USD strength, remained supportive of the mildly positive tone around the USD/CAD pair.

Market participants now look forward to the US monthly jobs report, due for release later during the early North American session. The popularly known NFP report might influence the USD, which, along with oil price dynamics should provide some impetus to the USD/CAD pair. The focus, however, will remain glued to the incoming headlines surrounding the Russia-Ukraine saga.

Technical levels to watch

Open interest in crude oil futures markets dropped for the third session in a row on Thursday, this time by more than 43K contracts according to preliminary readings from CME Group. In the same line, volume added to the previous daily drop and went down by around 345.5K contracts.

WTI: Rally expected to resume soon

Thursday’s retracement in prices of the WTI is seen as temporary only amidst shrinking open interest and volume. Against this, the rally in the commodity is forecast to resume in the very near term and with the next target at the recent highs past the $116.00 mark per barrel, an area last visited back in September 2008.

Gold remains one of the most sensitive assets to changes in risk mood. Apart from the encouraging fundamentals favoring XAU/USD, the metal’s technical setup also points to more upside, FXStreet’s Dhwani Mehta reports.

See – Gold Price Forecast: XAU/USD to surge towards the $2,075 record high on a weekly close above $1,917/23 – Credit Suisse

Symmetrical triangle breakout points to more gains

“The Ukraine-Russia war re-escalation will likely keep investors away from higher-yielding assets, boding well for the traditional safe-haven gold. The yellow metal could attract further bids on its appeal as an inflation hedge as well.”

“The Nonfarm Payrolls report from the US, with only 400K jobs likely to have added in America last month, remains of relevance. If the US NFP figures disappoint markets, then it will weigh on the Fed’s aggressive tightening expectations, offering additional impetus to gold buyers.”

“XAU/USD has confirmed an upside breakout from a symmetrical triangle formation. With the bullish breakout, gold is positioned to retest the 13-month highs of $1,975 if it finds acceptance above the $1,950 psychological barrier.”

“On the downside, the immediate cushion is seen at the triangle resistance turned support at $1,935, below which a sharp sell-off could be triggered towards the powerful cap of $1,928. A firm break below the latter could lead to the pattern failure, fuelling a fresh downswing towards the ascending 50-SMA at $1,916.”

See – NFP Preview: Forecasts from 10 major banks, potential for upside surprise

The US Bureau of Labor Statistics (BLS) will release the February jobs report on Friday, March 4 at 13:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 10 major banks regarding the upcoming employment data.

Nonfarm Payrolls are forecast to add 400K workers in February following 467K in January. The Unemployment Rate should fall 0.1% to 3.9% and the Underemployment Rate is predicted to rise to 7.2% from 7.1%.

Westpac

“Having averaged gains of 551K per month over the 12 months to January, a more modest (but still strong) gain circa 350K is expected in February. If participation is able to lift in the month, the risks favour a stronger gain for employment. While the economy is supply-constrained, the unemployment rate will remain the best indicator of labour market strength. Progress to near the historic low of 3.5% is expected during 2022 even with higher participation. If instead participation holds down as risks related to COVID-19 recede, a push towards a 3.0% unemployment rate is possible.”

Commerzbank

“Because the pandemic had depressed employment in the past two years, especially in the winter months, the statisticians now take a larger mark-up when adjusting for seasonal factors in these months. We, therefore, expect a similar increase in jobs for February (500K, consensus 400K).”

RBC Economics

“US February payrolls are expected to once again point to rising tension in the labor market. Employment likely increased again (380K). And no meaningful changes to the labour force are expected to drive the unemployment rate lower (3.9%) and push wages higher.”

SocGen

“We expect a reading of 555K, which is consistent with payroll gains over the past half-year. We think businesses must have been looking past the temporary surge and slowing service activity and thus proceeded to add to their staff at a time when labour supply was very low. The unemployment rate had been expected to move to a new low since the start of COVID-19, at a rate of 3.8%. However, in January, the unemployment rate ticked higher to 4.0% from 3.9%. We had expected a flat to slight increase in the labor participation rate; however, it rose even more than expected for January, up to 62.2 from 61.9 in December. We expect a more modest gain in the labor force for February and a rise in the participation rate to 62.3%. The more modest increase in the labor supply should result in a sharper unemployment rate decline.”

NBF

“Payrolls could have expanded 250K in the month. The household survey is expected to show a similar gain, a development which would translate into a one-tick decrease of the unemployment rate to 3.9%, assuming the participation rate stayed unchanged at 62.2%.”

Deutsche Bank

“We are expecting 300K (consensus 400K) with an unemployment rate ticking back down from 4 to 3.8% (consensus 3.9%).”

Citibank

“Following a substantial upside surprise to job growth in January, We expect a similarly strong 510K increase in February. Average hourly earnings growth is expected to rise 0.5% MoM and 5.8% higher than a year ago with wage pressures seen generally strong in the coming months as firms still plan further wage increases. Markets will likely be most focused on this aspect of the February employment report, and upside risks will be particularly important for highlighting building inflationary pressures. And after rising modestly to 4.0% in January, we expect the US unemployment rate to decline to 3.8% in February, the lowest rate since the pandemic began and just 0.3pp above the 3.5% rate that prevailed in February 2020.”

CIBC

“Indicators of activity in service sectors have improved lately and initial jobless claims have eased off since mid-January, suggesting that employers could have added 405K jobs in February. That gain in jobs could send the unemployment rate down by a tick, to 3.9%, while wage growth was likely strong at 0.5% given the ongoing labor shortage. We are too close to the consensus forecast to expect much market impact.”

TDS

“We expect employment to have continued to recover in February following the unexpectedly strong January report – despite the Omicron-led surge in COVID-19 cases. That said, we look for some of last month's boost to fizzle, though to a still firm job growth pace (TD: 300K, consensus: 400K). Seasonal adjustments were a factor in January and they will likely play a role again in February. In addition, despite firm job growth, we look for the unemployment rate to have remained steady at 4.0%, as labor force participation likely improved (consensus: 3.9%). We also expect wage growth to slow to a still strong 0.5% MoM from 0.7% in January, which would lift the YoY rate to an even stronger 5.8%.”

Wells Fargo

“Our forecast of 450K new jobs in February is predicated on lower COVID-19 cases, robust labor demand and improving labor supply. We project that US employment will recover to its pre-pandemic level by year-end, giving the Fed plenty of cover to tighten monetary policy at a steady pace this year as the central bank gets above-target inflation.”

Here is what you need to know on Friday, March 4:

Safe-haven flows, once again, took control of markets during the Asian trading hours on Friday after reports showed a fire broke out in a building at a Ukrainian nuclear complex. According to the latest headlines, the fire has been extinguished and there was no indication of elevated radiation levels. Nevertheless, markets remain risk-averse early Friday and the US Dollar Index is trading at its highest level since Mary 2020 near 98.00. Later in the day, January Retail Sales data will be featured in the European docket ahead of the February Nonfarm Payrolls report from the US.

US Nonfarm Payrolls February Preview: Fed policy runs through Kyiv.

"Europeans, please wake up. Tell your politicians – Russian troops are shooting at a nuclear power plant in Ukraine," Ukrainian President Volodymyr Zelenskyy said early Friday. With investors seeking refuge, the benchmark 10-year US Treasury bond yield is down 2.5% at 1.799% and US stock index futures are losing between 0.3% and 0.5%.

On the second day of his testimony, FOMC Chairman Jerome Powell repeated that they could consider the option of a 50 basis points rate hike if they fail to control inflation following the first series of rate increases.

Powell again promises Fed March rate hike, balance sheet reduction.

Pressured by the broad-based dollar strength amid Powell's hawkish tone and the souring market mood, EUR/USD slumped to its weakest level in 22 months near 1.1000. The pair staged a technical correction following the selloff witnessed during the Asian session but continues to trade in negative territory below 1.1030.

GBP/USD stays under modest bearish pressure after posting losses on Thursday but holds above 1.3300 for the time being.

Gold remains one of the most sensitive assets to changes in risk mood. In the Asian trading hours, XAU/USD surged above $1,950 but erased all of its gains to turn flat on the day near $1,935 in the European morning.

US February Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises.

USD/JPY is having a difficult time making a decisive move in either direction on Friday as the JPY finds demand as a safe haven and holds its ground against the dollar. The pair is moving sideways near 115.50.

Bitcoin continues to erase the gains it registered earlier in the week and falls toward $41,000 early Friday. After closing the previous two days in negative territory and losing 5% during that period, Ethereum stays on the back foot and was last seen losing 4% on the day at $2,700.

Cable could still attempt a move to the 1.3250 level in the near term, suggested FX Strategists at UOB Group.

Key Quotes

24-hour view: “Our expectations for ‘the rebound in GBP to extend’ were incorrect as it dropped to 1.3318 during NY session. While downward momentum has not improved by much, the risk is for GBP to head lower. In view of the lackluster momentum, the major support at 1.3250 is unlikely to come under threat (there is another strong support at 1.3275). Resistance is at 1.3360 followed by 1.3390.”

Next 1-3 weeks: “Yesterday (03 Mar, spot at 1.3330), we highlighted that downward momentum has waned somewhat and a breach of the strong resistance at 1.3460 would indicate that 1.3250 is out of reach. GBP subsequently rose to 1.3418 before dropping back down to 1.3318. Downward momentum still appears to be lackluster but there is still chance for GBP to decline to 1.3250. Only a breach of the ‘strong resistance’ at 1.3420 (level was at 1.3460 yesterday) would indicate that the downside risk has dissipated.”

Japan Foreign Minister Hayashi: Unity of international community including China needed for order

More to come

- Bulls look to reclaim 0.7557 despite risk-off impulse in the market.

- Overstepping of Trendline and 38.2% add to the upside filters.

- Bears can take the charge if the pair slips below 0.7275.

The AUD/USD pair has witnessed a juggernaut rally in the last few trading sessions despite a broad-based risk-off impulse in the market. The major is moving north right from the first tick of February. Now, the pair is eying to reclaim its October 28 high at 0.7557.

On a daily scale, AUD/USD has surpassed 0.7320, the 38.2% Fibonacci retracement, which is placed from the May 10 high of 0.7892 to the January 28 low at 0.6966. This indicates a bullish reversal after a strong bearish trend. The pair has also overstepped the trendline placed from May 10 high at 0.7892, which adds to the upside reversal filters.

It is worth noting that the pair made an indecisive tick on Thursday at the surface of the trendline. Usually, an indecisive tick formation near a trendline breakout indicates the importance of the respective levels. On Friday, the major has breached the indecisive tick on the upside after opening in Thursday’s value area. This indicates active participation of buyers and the pair will pick momentum swiftly.

AUD/USD has recaptured the 200-period Exponential Moving Average at 0.7300 and moving beyond the latter, with bulls in total control.

The Relative Strength Index (RSI) (14) has shifted above 60.00 after oscillating in a range of 40.00-60.00, which points to a fresh rally going forward.

Bulls have been established in the major and further upside will be observed once the pair will violate Friday’s high at 0.7363. A breach of 0.7363 will send the pair towards 50% and 61.8% Fibonacci retracement at 0.7430 and 0.7541 respectively.

On the contrary, bulls can lose confidence if the pair slips below Thursday’s low at 0.7275. This will drag the pair towards the 100-EMA at 0.7227 and 23.6% Fibonacci retracement at 0.7186.

AUD/USD daily chart

- USD/JPY bulls retreat from three-week-old horizontal resistance.

- RSI pullback favors sellers but 100, 50 and 21-SMAs probe further declines.

- Six-week-old support line adds to the downside filters, double tops around 116.35 appear tough nut to crack for bulls.

USD/JPY struggles to keep the bounce off intraday low around 115.45 ahead of Friday’s European trading session. Even so, the yen pair remains firmer on the weekly basis, marking the second week-on-week gains by the press time.

Sustained trading beyond multiple SMAs and an upward sloping trend line from January 24 joins firmer RSI to keep USD/JPY buyers hopeful.

Considering the quote’s latest rebound from the 100 and 21-SMA, near 115.30 at the latest, USD/JPY prices may approach a broad resistance area established since February 10, close to 115.80-90.

It should be noted, however, that the double tops around 116.35, comprising highs marked during early January and February, will be crucial resistance to watch afterward.

Alternatively, a 50-SMA level around 115.20 adds to the aforementioned SMA supports, a break of which will direct USD/JPY bears towards the multi-day-old rising trend line near 114.90.

In a case where the bears keep reins past 114.90, late February’s low near 114.40 should return to the chart.

USD/JPY: Four-hour chart

Trend: Further weakness expected

- EUR/USD drops to the fresh low since late May 2020 amid intense risk-aversion.

- Russian attacks on Ukrainian nuclear plant breaks trust in Kyiv-Moscow peace talks.

- Fed’s Powell sounds hawkish, ECB Meeting Accounts highlights the importance of faster policy normalization.

- German trade numbers, Eurozone Retail Sales may entertain traders but US NFP, risk catalysts are the key to clear directions.

EUR/USD licks its wounds around 1.1030, after refreshing the 22-month low to 1.1010 during early Friday morning in Europe.

In doing so, the major currency pair declines for the fourth consecutive day, also braces for the four-week downtrend, as the risk-aversion wave favors the US dollar bulls.

Russia’s shelling of the Ukrainian nuclear power plant in Zaporizhzhia, one of the largest in Europe, provides the latest blow to the market sentiment. Even if the radiation fears were turned down and the fire-safety team took control of the matters, Moscow’s recent actions pour cold water on the Russia-Ukraine peace talks that agreed on the safe passage of Kyiv’s civilians the previous day. On the same line were headlines from the UK Times suggesting that Ukraine’s President Volodymyr Zelensky survives three assassination attempts in days.

Moving on, Fed Chair Jerome Powell reiterated his support for a 0.25% rate hike, also showed readiness for a 0.50% rate-lift if needed in the March meeting, during the second round testimony the previous day. While portraying the market implications from Powell’s comments, CME’s FedWatch Tool marks around 89% odds favoring the same rate-lift in the next month’s Fed meeting.

Powell’s upbeat comments couldn’t find support from the US data but highlight today’s US US jobs report for February. That said, US ISM Services PMI eased for the third consecutive month in its latest release but the second-tier job data and Factory Orders came in positive on Thursday.

At home, European Central Bank monetary policy meeting accounts mentioned,” "The main risk was no longer of tightening monetary policy too early but too late."

Against this backdrop, S&P 500 Futures drop around 1.0% on a day whereas the US 10-year Treasury yields mark near six pips of a downside to 1.78% by the press time. Further, the US Dollar Index (DXY) eases after refreshing the 2022 peak while WTI crude oil also consolidates daily gains near $110.00 after initially rising to $112.81.

Moving on, geopolitical headlines will keep the driver’s seat while German trade numbers and Eurozone Retail Sales for January may provide additional hints ahead of the US Nonfarm Payrolls, expected 400K versus 467K prior.

Technical analysis

A three-week-old downward sloping trend line restricts short-term EUR/USD moves between 1.1165 and 1.0980.

- USD/INR remains firmer, eyes 11-week top marked on Wednesday.

- Five-week-old resistance line precedes, ascending trend line from late April 2021 to challenge further upside.

- Fortnight-long support limit nearby declines, 200-DMA becomes the key support.

USD/INR holds onto the previous day’s gains as bulls poke multi-day highs marked above 76.00 during early Friday morning in Europe.

The Indian rupee (INR) pair remains inside an upward sloping triangle formation established since late January, recently between 76.25 and 75.55.

Given the bullish MACD signals and the quote’s successful trading above 200-DMA, the USD/INR prices are likely to cross the 76.25 hurdle, which in turn directs the bulls towards a multi-day-old resistance line near 76.50.

However, overbought RSI conditions may test bulls past 76.50, if not then a 2021 high near 76.60 will be in focus.

Alternatively, pullback moves need to break 75.55 support before directing USD/INR bears towards the 75.00 threshold.

Even so, the 200-DMA level of 74.47 and January’s low of 73.72 will test the USD/INR sellers afterward.

USD/INR: Daily chart

Trend: Further upside expected

- USD/CHF pares intraday losses as sellers attack short-term key support.

- Bearish MACD signals, sustained trading below 100-DMA hint at the further downside.

USD/CHF fades bounce off intraday low as bears approach multi-day-old support line during Friday’s Asian session. That said, the Swiss currency (CHF) pair drops to 0.9183 by the press time.

The quote’s latest weakness could be linked to the market’s risk-aversion wave backed by the Ukraine-Russia headlines. However, the odds of Fed’s faster and more rate hikes seem to put a floor under the prices.

It’s worth noting that bearish MACD signals and failures to rebound beyond the 100-DMA also keep sellers hopeful.

Hence, the latest USD/CHF weakness eyes the ascending support line from January 13, near 0.9170. Though, a daily closing below the same becomes necessary to convince the bears.

In that case, an upward sloping support line from August 2021, near 0.9115, will lure the USD/CHF bears before highlighting the 0.9100 threshold.

Meanwhile, recovery moves remain elusive until crossing the 100-DMA level of 0.9206.

Even so, a descending resistance line from January 31, near 0.9270 by the press time, will be a tough nut to crack for USD/CHF bears.

USD/CHF: Daily chart

Trend: Further weakness expected

- GBP/USD has returned to 1.3350 after a sharp plunge on Ukraine's nuclear worries.

- The elevated uncertainty has eased off slightly, however, the risk-off impulse is still active.

- Investors await more development over shelling at Ukraine nuclear power stations for further guidance.

The GBP/USD attracted significant offers from the market participants and slipped near 1.3316 amid the Russian attack on Europe’s largest nuclear power station in Ukraine. The headline brought a broad-based selling in the risk-perceived assets as investors considered it further escalation in the Russia-Ukraine war. However, a follow-up buying has been observed and cable is looking to retest 1.3350.

Earlier, the Ukrainian government officials warned the detection of elevated levels of radiation near the plant’s side. Fierce fighting occurred between local forces and Russian rebels, which resulted in casualties, said Mayor of Energodar Dmytro Orlov. Moreover, the shelling of the Zaporizhzhia nuclear power plant was cited as a threat to world security by Orlov.

Later, the International Atomic Energy reported that “Ukraine regulator tells IAEA there has been no change reported in radiation levels at the Zaporizhzhia nuclear power plant site. This has helped the cable to reverse the losses and reclaim some of the lost ground.

Meanwhile, GBP/USD has been balanced in a range of 1.3273-1.3437 since February 24 after a steep fall amid the absence of any potential trigger that could underpin the sterling against the mighty greenback.

The US dollar index (DXY) is looking to reclaim 98.00 amid rising uncertainty over the geopolitical risks. Also, the upbeat US Initial Jobless Claims may strengthen the DXY further.

As of now, the elevated uncertainty has slightly eased off but the risk-off impulse will continue to be the broad-based picture. Going forward, more development on shelling at Ukraine nuclear power stations will keep the investors busy. Apart from that, investors will also focus on US Nonfarm Payrolls, which are due on Friday.

Reports are doing the round that US President Joe Biden and his Ukrainian counterpart Volodymyr Zelenskyy the nuclear power plant attack by Russia.

Additional takeaways

“US President Biden was updated on the fire by the Ukrainian President.”

“Biden and Zelensky urged Russia to halt its military activities in the area and allow firefighter access.“

There is no official statement released from either side, thus far.

Although US Energy Secretary Jennifer Granholm said, “the department has activated its nuclear incident response team and is monitoring events at the Ukraine nuclear plant.”

Related reads

- IAEA: Ukraine regulator says no change reported in radiation levels at the Zaporizhzhia nuclear power plant

- Europe's largest nuclear reactor comple

- USD/CAD fades bounce off five-week low, retreats from intraday low of late.

- Oil buyers cheer Russia-Ukraine crisis, OPEC+ inaction to stay firmer around multi-year top.

- Fed’s Powell propels 0.50% rate-hike concerns, adding importance to today's US jobs report for February.

USD/CAD struggles to keep the previous day’s rebound from late-January lows, mildly bid around 1.2700 during Friday’s mid-Asian session.

That being said, the loonie pair dropped around 40 pips initially on the news of the Russian military’s shelling on the Ukrainian nuclear power plant, one of the largest in Europe. The news renewed Chernobyl woes and propelled the market’s rush towards risk-safety, as well as fuel prices of Canada’s key export item WTI crude oil.

However, the latest headlines taming fears of nuclear radiation seemed to have placated the market’s risk-off mood.

Even so, the latest instance confirms the market’s doubt over the Russia-Ukraine peace talks that agreed on the safe passage of Kyiv’s civilians the previous day.

Amid these plays, S&P 500 Futures drop around 1.0% on a day whereas the US 10-year Treasury yields mark near six pips of a downside to 1.78% by the press time. Further, the US Dollar Index (DXY) eases after refreshing the 2022 peak while WTI crude oil also consolidates daily gains near $110.00 after initially rising to $112.81.

While firmer WTI seems to favor USD/CAD bears, recently increasing odds of faster Fed rate hikes keep the pair buyers hopeful.

Fed Chair Jerome Powell reiterated his support for a 0.25% rate hike, actually showed readiness for a 0.50% rate-lift in the March meeting amid rising inflation fears on Thursday. That said, US ISM Services PMI eased for the third consecutive month in its latest release but the second-tier job data and Factory Orders came in positive.

On the other hand, Bank of Canada (BOC) Governor Tiff Macklem showed readiness to discuss Quantitative Tightening (QT) in his latest speech while also supporting gradual rate increases.

Read: BOC’s Macklem: I am confident we will get back to our 2% inflation target

Looking forward, oil prices and headlines from Ukraine may entertain USD/CAD traders ahead of the key US Nonfarm Payrolls (NFP) for February, expected 400K versus 467K prior.

Read: US Nonfarm Payrolls February Preview: Fed policy runs through Kyiv

Technical analysis

21-DMA probes the USD/CAD pair’s latest rebound near 1.2720 but the bears aren’t likely to retake controls until witnessing a daily closing below the 200-DMA level of 1.2575.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 110.42 | -4.56 |

| Silver | 25.19 | -0.45 |

| Gold | 1936.53 | 0.37 |

| Palladium | 2768.2 | 3.84 |

- Breaking: EUR/USD breaks fresh 2022 lows, 1.1020

- Europe's largest nuclear reactor complex is being attacked by Russia.

- Oil rallies on the news, correcting some of the Iran deal noise bearish impact.

US oil is higher on the back of the Zaporizhzhia nuclear power plant in Ukraine, the largest of its kind in Europe, that was set on fire early on Friday after an attack by Russian troops, the mayor of the nearby town of Energodar said.

Ukrainian government officials crossed the Twitter feeds and warned that elevated levels of radiation are being detected near the site of the plant.

There has been fierce fighting between local forces and Russian troops, Mayor of Energodar Dmytro Orlov said in an online post, adding that there had been casualties without giving details.

“As a result of continuous enemy shelling of buildings and units of the largest nuclear power plant in Europe, the Zaporizhzhia nuclear power plant is on fire,” Orlov said on his Telegram channel, citing what he called a threat to world security.

Ukraine is Europe's second-largest nuclear power producer after France, with nuclear power meeting around 50% of the country's power requirements.

The New York Times reported ''six of Ukraine’s 15 working nuclear reactors have stopped sending power into the nation’s electrical grid — a high rate of disconnection compared with routine operations before the Russian invasion. The reduction in output might result from the war’s interference with operation of the plants, which require a wealth of industrial supplies and care. The cutbacks, Western experts say, may spiral into rolling blackouts that could further cripple the beleaguered country.''

The price of oil, naturally, rose given nuclear it is an alternative energy source. The oil market is also focused on whether the OPEC+ producers, including Saudi Arabia and Russia, would increase output from January.

''Following Russia's invasion of Ukraine, the US was clear that it wanted the flow of oil and gas to continue unabated. However, due to a combination of financial sanctions and the increasing reluctance of companies to do business with Russia, supply is being impacted. We estimate Russia's oil supply could already be down by 1mb/d. Overall, nearly 5mb/d of Russian crude could be struggling to find a buyer," ANZ Bank said in a note.

The market, overnight, reversed course after reports began circulating that there could be a deal on returning the United States to the 2015 Iran nuclear deal and removing sanctions on its oil exports, offering the prospect of some relief for the loss of Russian supplies.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Retail Sales, M/M | January | -4.4% | |

| 07:00 (GMT) | Germany | Current Account | January | 23.9 | |

| 07:00 (GMT) | Germany | Trade Balance (non s.a.), bln | January | 7 | |

| 08:00 (GMT) | Switzerland | Foreign Currency Reserves | February | 947.15 | |

| 09:30 (GMT) | United Kingdom | PMI Construction | February | 56.3 | 56.3 |

| 10:00 (GMT) | Eurozone | Retail Sales (MoM) | January | -3% | 1.3% |

| 10:00 (GMT) | Eurozone | Retail Sales (YoY) | January | 2% | 9.1% |

| 13:30 (GMT) | Canada | Labor Productivity | Quarter IV | -1.5% | |

| 13:30 (GMT) | U.S. | Average workweek | February | 34.5 | 34.6 |

| 13:30 (GMT) | U.S. | Government Payrolls | February | 23 | |

| 13:30 (GMT) | U.S. | Manufacturing Payrolls | February | 13 | 23 |

| 13:30 (GMT) | Canada | Building Permits (MoM) | January | -1.9% | 2% |

| 13:30 (GMT) | U.S. | Average hourly earnings | February | 0.7% | 0.5% |

| 13:30 (GMT) | U.S. | Private Nonfarm Payrolls | February | 444 | 378 |

| 13:30 (GMT) | U.S. | Labor Force Participation Rate | February | 62.2% | |

| 13:30 (GMT) | U.S. | Nonfarm Payrolls | February | 467 | 400 |

| 13:30 (GMT) | U.S. | Unemployment Rate | February | 4% | 3.9% |

| 15:00 (GMT) | Canada | Ivey Purchasing Managers Index | February | 50.7 | |

| 18:00 (GMT) | U.S. | Baker Hughes Oil Rig Count | March | 522 |

- GBP/CAD is consolidating in the risk-off mayhem.

- Breaking: EUR/USD breaks fresh 2022 lows, 1.1020

- Europe's largest nuclear reactor complex is being attacked by Russia.

GBP/CAD has popped higher as the Canadian dollar takes a hit with the greenback picking up a safe haven bid. Both GBP and CAD are being trapped in the tight ranges and sandwiched by the greenback. However, the following illustrates the price action development since the prior session's analysis.

GBP/CAD prior analysis

''With that being said, the price is making a strong advance towards the 78.6% Fibonacci retracement level having broken the 50% mean reversion level at 1.6920. 1.6920 could act as a firm support. This could potentially lead to some further consolidation above it for the sessions ahead before a potential downside continuation.''

GBP/CAD live chart

As illustrated, the price consolidated and then broke to the downside. It is now moving higher and this could represent a phase of accumulation for the sessions ahead.

- DXY stays firmer around 21-month top following the fresh risk-off mood.

- Russian military attacks Ukrainian nuclear power plan.

- Kyiv’s Foreign Minister Kuleba fears explosion could be 10-times Chrnobyl if the fire spreads.

- Fed’s Powell renew 0.50% rate-hike concerns, US NFP eyed.

US Dollar Index (DXY) remains on the front foot around the yearly top near 98.00 as market sentiment worsens during early Friday.

The risk-off gained major strength on the Associated Press (AP) news that Russia's military has started shelling Europe's largest nuclear power plant. Following that, Ukrainian Foreign Minister Kuleba confirmed the fire at the plant while also saying, “Fire has already erupted. if it explodes, it will be ten times the size of Chernobyl.”

Read: S&P 500 Futures, US Treasury yields fall as Russia-Ukraine fears reignite