- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-12-2019

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Gross Domestic Product (YoY) | Quarter III | 1.4% | 1.7% |

| 00:30 | Australia | Gross Domestic Product (QoQ) | Quarter III | 0.5% | 0.5% |

| 01:45 | China | Markit/Caixin Services PMI | November | 51.1 | 52.7 |

| 08:50 | France | Services PMI | November | 52.9 | 52.9 |

| 08:55 | Germany | Services PMI | November | 51.6 | 51.3 |

| 09:00 | Eurozone | Services PMI | November | 52.2 | 51.5 |

| 09:30 | United Kingdom | Purchasing Manager Index Services | November | 50.0 | 48.6 |

| 13:15 | U.S. | ADP Employment Report | November | 125 | 138 |

| 13:30 | Canada | Labor Productivity | Quarter III | 0.2% | 0.8% |

| 14:45 | U.S. | Services PMI | November | 50.6 | 51.6 |

| 15:00 | U.S. | FOMC Member Quarles Speaks | |||

| 15:00 | U.S. | ISM Non-Manufacturing | November | 54.7 | 54.5 |

| 15:00 | Canada | BOC Rate Statement | |||

| 15:00 | Canada | Bank of Canada Rate | 1.75% | 1.75% | |

| 15:30 | U.S. | Crude Oil Inventories | November | 1.572 |

Major U.S. stock indices fell significantly as US President Trump's statements raised concerns that a trade dispute with China might remain unresolved until the U.S. presidential election in November 2020.

US President Donald Trump told reporters at the NATO summit that negotiations with China are going very well, but it might be better to conclude a trade agreement after the presidential election next year.

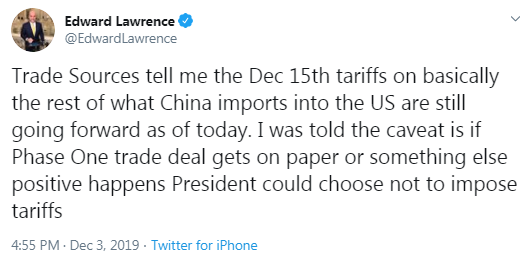

The pessimism in the market was also fueled by the Fox News news that the White House is still planning to introduce tariffs for Chinese goods scheduled for December 15, despite recent efforts to reach the “first phase” of a trade agreement.

In addition, Washington intensified economic disputes with France. The U.S. sales office has proposed import tariffs of up to 100% on French goods worth up to $ 2.4 billion, including wine, cheese, and luxury bags, after France enacted a tax on large technology companies. France threatened countermeasures from the entire European Union if the United States introduced these tariffs. On the sidelines of the NATO summit, Trump expressed the hope that the parties will be able to resolve contentious issues.

The escalation of trade tension on three fronts - Chinese, European and American (Trump announced yesterday the resumption of tariffs on imports of steel and aluminum from Brazil and Argentina) - has increased investor concern about global growth.

Almost all DOW components completed trading in the red (27 out of 30). Verizon Communications Inc. shares rose more than others (VZ; + 0.36%). Outsiders were shares of Intel Corporation (INTC; -2.83%).

Almost all S&P sectors recorded an increase. The largest decline was shown in the base materials sector (-1.1%). The utilities sector grew more than the rest (+ 0.4%).

At the time of closing:

Dow 27,503.48 -279.56 -1.01%

S&P 500 3,093.23 -20.64 -0.66%

Nasdaq 100 8,520.64 -47.34 -0.55%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Gross Domestic Product (YoY) | Quarter III | 1.4% | 1.7% |

| 00:30 | Australia | Gross Domestic Product (QoQ) | Quarter III | 0.5% | 0.5% |

| 01:45 | China | Markit/Caixin Services PMI | November | 51.1 | 52.7 |

| 08:50 | France | Services PMI | November | 52.9 | 52.9 |

| 08:55 | Germany | Services PMI | November | 51.6 | 51.3 |

| 09:00 | Eurozone | Services PMI | November | 52.2 | 51.5 |

| 09:30 | United Kingdom | Purchasing Manager Index Services | November | 50.0 | 48.6 |

| 13:15 | U.S. | ADP Employment Report | November | 125 | 138 |

| 13:30 | Canada | Labor Productivity | Quarter III | 0.2% | 0.8% |

| 14:45 | U.S. | Services PMI | November | 50.6 | 51.6 |

| 15:00 | U.S. | FOMC Member Quarles Speaks | |||

| 15:00 | U.S. | ISM Non-Manufacturing | November | 54.7 | 54.5 |

| 15:00 | Canada | BOC Rate Statement | |||

| 15:00 | Canada | Bank of Canada Rate | 1.75% | 1.75% | |

| 15:30 | U.S. | Crude Oil Inventories | November | 1.572 |

Lee Sue Ann, an Economist at UOB Group provides her views on the upcoming Fed event.

- “The FOMC cut its policy Fed Funds Target Rate (FFTR) by 25bps to a range of 1.50-1.75% at the October meeting. The minutes helped reinforced expectations for a Fed policy cycle pause in December after three sequential 25bps rate cuts in July, September and October. We expect the Fed to implement the next 25bps rate cut in 1Q20, and thereafter to stay on pause again for the rest of 2020”.

- U.S. President Trump wants to get the right deal

- Trump's objectives on U.S. China trade deal haven't changed

- He is happy to continue with tariffs if no deal with China is made

- Hong Kong situation is a variable in China trade deal, but Chinese retaliation on Navy vessels is not a big deal

- U.S. can live without the port of Hong Kong

- If there is a little bit of time needed for more talk then the tariffs will probably be postponed; otherwise, the tariffs will go into effect

- There is no time pressure to get China trade deal done

- He is optimistic that U.S. will eventually get something done on trade with China

- Brazil, Argentina tariffs not related to China

- Expects staff-level talks with China to continue but no high-level meetings are scheduled

- Europe has consistently not lived up to the WTO rules

- Pres. Trump has flexibility to impose tariffs on Europe

- Remains to be seen if Trump would also impose tariffs on other countries that impose a digital tax

- Does not believe there is anything imminent regarding Huawei access to the U.S. banking system

Jacqui Douglas, the chief European macro strategist at TD Securities, notes that, with 9 days to go for the UK elections, the betting odds point to steady expectations for a Conservative majority, in line with results from last week's YouGov MRP model.

- “The Conservative-Labour vote spread has narrowed slightly. It's now teetering around 10%, the rough dividing line between a safe or narrow Conservative win, where it could be more difficult to pass contentious legislation.

- There are two election risks in view:

- US President Trump visit: Trump is in London for NATO meetings. While he has pledged to stay out of the election, moments later he said Johnson is very capable and will do well and waded into the NHS trade deal debate. Any "helpful" comments from Trump may not actually be very helpful for Johnson.

- Friday's Johnson-Corbyn debate: Johnson needs to prevent Corbyn from landing any fatal blows during their head-to-head debate.”

- If polls narrow more decisively into the 5-10ppt range, that would likely see GBP pare back some of its recent gains. We do expect another YouGov MRP poll before election day to further guide expectations.”

FX Strategists at UOB Group think USD/CNH should continue to trade within the current rangebound theme in the next weeks.

- "24-hour view: Instead of ‘trading sideways within a 7.0230/7.0400 range’, USD popped to a high of 7.0456 yesterday. While the advance lacks momentum, there is scope for USD to edge towards 7.0500. At this stage, a sustained rise above this level is not expected. Support is at 7.0350 followed by 7.0260.

- Next 1-3 weeks: There is not much to add as USD traded in a quiet manner and closed unchanged at 7.0326 last Friday (29 Nov). The movement is still viewed as part of a sideway-trading. In other words, we continue to expect USD to trade between 6.9700/7.0500 for a while more."

U.S. stock-index futures tumbled on Tuesday after the U.S. President Donald Trump said that it might be better to wait until after next year's presidential election to complete a trade deal with China.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 23,379.81 | -149.69 | -0.64% |

Hang Seng | 26,391.30 | -53.42 | -0.20% |

Shanghai | 2,884.70 | +8.89 | +0.31 |

S&P/ASX | 6,712.30 | -150.00 | -2.19% |

FTSE | 7,162.61 | -123.33 | -1.69% |

CAC | 5,723.44 | -63.30 | -1.09% |

DAX | 12,975.13 | +10.45 | +0.08% |

Crude oil | $55.82 | -0.25% | |

Gold | $1,480.60 | +0.78% |

Richard Franulovich, head of FX strategy at Westpac, suggests that while global markets seem to hang on every twist and turn in global trade developments they have if anything been decoupling lately.

- “Global markets were tightly correlated between Aug-Oct 2019, trading mostly around the ebb and flow in US-China trade hostilities. But since then there has been a notable shift; at one end of the spectrum, US equity and credit markets forged ahead solidly while AUD and US fixed income yields have been “stuck” at much lower levels.

- In AUD’s case, the RBA’s ongoing easing bias and a growing recognition that unconventional easing is a serious policy option for 2020 is likely a key factor holding it back. Commentators have noted that at least some of the RBA’s ongoing easing bias is motivated by a desire to cap AUD upside.”

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 166.54 | -1.73(-1.03%) | 3220 |

ALCOA INC. | AA | 20.05 | -0.28(-1.38%) | 4423 |

ALTRIA GROUP INC. | MO | 50.4 | -0.20(-0.40%) | 10667 |

Amazon.com Inc., NASDAQ | AMZN | 1,764.26 | -17.34(-0.97%) | 34886 |

American Express Co | AXP | 116 | -1.26(-1.07%) | 6566 |

Apple Inc. | AAPL | 259.07 | -5.09(-1.93%) | 527730 |

AT&T Inc | T | 37 | -0.32(-0.86%) | 67974 |

Boeing Co | BA | 350.9 | -4.28(-1.21%) | 61260 |

Caterpillar Inc | CAT | 140 | -2.96(-2.07%) | 10511 |

Chevron Corp | CVX | 116.04 | -0.76(-0.65%) | 11094 |

Cisco Systems Inc | CSCO | 44.3 | -0.40(-0.89%) | 50111 |

Citigroup Inc., NYSE | C | 73.5 | -1.02(-1.37%) | 18428 |

Deere & Company, NYSE | DE | 164 | -1.29(-0.78%) | 5632 |

E. I. du Pont de Nemours and Co | DD | 64 | -0.86(-1.33%) | 229 |

Exxon Mobil Corp | XOM | 67.85 | -0.57(-0.83%) | 31046 |

Facebook, Inc. | FB | 197.41 | -2.29(-1.15%) | 125759 |

FedEx Corporation, NYSE | FDX | 155.28 | -2.75(-1.74%) | 3754 |

Ford Motor Co. | F | 8.94 | -0.07(-0.78%) | 81582 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.25 | -0.20(-1.75%) | 104994 |

General Electric Co | GE | 10.97 | -0.19(-1.70%) | 239236 |

General Motors Company, NYSE | GM | 35.47 | -0.41(-1.14%) | 33764 |

Goldman Sachs | GS | 215.24 | -2.40(-1.10%) | 2295 |

Google Inc. | GOOG | 1,278.00 | -11.92(-0.92%) | 4655 |

Hewlett-Packard Co. | HPQ | 19.68 | -0.15(-0.76%) | 5804 |

Home Depot Inc | HD | 216 | -1.62(-0.74%) | 23477 |

HONEYWELL INTERNATIONAL INC. | HON | 171.79 | -2.53(-1.45%) | 2167 |

Intel Corp | INTC | 56.88 | -0.78(-1.35%) | 92864 |

International Business Machines Co... | IBM | 131.98 | -0.93(-0.70%) | 5071 |

International Paper Company | IP | 45.88 | -0.36(-0.78%) | 533 |

Johnson & Johnson | JNJ | 136.99 | -0.37(-0.27%) | 1311 |

JPMorgan Chase and Co | JPM | 129.96 | -1.51(-1.15%) | 25204 |

McDonald's Corp | MCD | 194.69 | -0.49(-0.25%) | 8732 |

Merck & Co Inc | MRK | 86.84 | -0.20(-0.23%) | 1596 |

Microsoft Corp | MSFT | 147.62 | -1.93(-1.29%) | 200893 |

Nike | NKE | 92.83 | -0.73(-0.78%) | 8945 |

Pfizer Inc | PFE | 38 | -0.29(-0.76%) | 6352 |

Procter & Gamble Co | PG | 122.54 | -0.18(-0.15%) | 2703 |

Starbucks Corporation, NASDAQ | SBUX | 83.6 | -0.97(-1.15%) | 24427 |

Tesla Motors, Inc., NASDAQ | TSLA | 332.2 | -2.67(-0.80%) | 159248 |

The Coca-Cola Co | KO | 53.72 | -0.03(-0.06%) | 13317 |

Travelers Companies Inc | TRV | 134.35 | -0.91(-0.67%) | 1402 |

Twitter, Inc., NYSE | TWTR | 29.87 | -0.55(-1.81%) | 146192 |

United Technologies Corp | UTX | 143.2 | -1.79(-1.23%) | 1929 |

UnitedHealth Group Inc | UNH | 275.09 | -4.57(-1.63%) | 9047 |

Verizon Communications Inc | VZ | 59.72 | -0.24(-0.40%) | 8556 |

Visa | V | 179.05 | -2.74(-1.51%) | 17765 |

Wal-Mart Stores Inc | WMT | 118.1 | -1.18(-0.99%) | 15538 |

Walt Disney Co | DIS | 148.35 | -2.27(-1.51%) | 88544 |

Yandex N.V., NASDAQ | YNDX | 40.75 | -0.37(-0.90%) | 11926 |

Tesla (TSLA) target raised to $423 from $372 at Piper Jaffray; Overweight rating maintained

Analysts at TD Securities note that the UK construction PMI data for November was stronger than the consensus as it came at 45.3.

- “The construction PMI rose from 44.2 to 45.3 in November (mkt 44.5), posting a stronger recovery than expected although still sitting at an extremely weak reading. It seems that it wasn't as affected by election/ political uncertainty as the other PMIs for the month.”

Analysts at Standard Chartered note that China’s manufacturing and non-manufacturing PMIs improved significantly in November, to 50.2 and 54.4, respectively, from 49.3 and 52.8 in October.

- “The sub-indices suggest an improvement in industrial production (IP), export and import demand on a sequential basis. Wholesale prices of industrial goods, however, have eased further m/m.

- We do not think a single-month improvement in PMIs (especially following the significant slide in October) will change the policy direction. The People’s Bank of China (PBoC) is expected to maintain a pro-growth stance in coming months.

- We expect export growth to have picked up to 0.4% y/y in November from -0.9% y/y in October. Imports likely rose 0.6% y/y (versus a 6.4% y/y decline in October) on higher crude oil prices and the resumption of soybean imports from the US. The trade surplus is expected to narrow to USD 41.6bn in November from USD 43bn prior due to better import performance.

- Base effects and elevated pork prices may have pushed up CPI inflation to 4.2% y/y in November from 3.8% y/y in October, while PPI deflation likely accelerated to 1.7% y/y from 1.6%. The purchasing price sub-index returned to contractionary territory in November (49 versus 50.4 in October).

- We expect IP growth to have edged up to 5.6% y/y in November as work resumed after the week-long National Day holidays in October. Fixed asset investment (FAI) growth likely inched lower to 5.1% y/y YTD in November, given lingering US-China trade uncertainty. We expect retail sales growth to have rebounded to 7.8% y/y in November on higher inflation and Singles’ Day sales promotions.”

FX Strategists at UOB Group believe that a move to the key 110.00-area in USD/JPY looks unlikely, at least in the very near-term.

- "24-hour view: We highlighted yesterday ‘USD could test the strong 109.75 resistance’ but held the view ‘a sustained rise above this level appears unlikely’. While USD came close to 109.75, the sharp sell-off from 109.72 was clearly not anticipated. The rapid drop is deep in oversold territory, but it is too early to expect a recovery. From here, USD could edge lower but any weakness is viewed as lower trading range of 108.75/109.25 (a sustained decline below 108.75 is not expected).

- Next 1-3 weeks: The failure to break the major 109.75 resistance (high of 109.72 yesterday) coupled with the sharp sell-off from the high suggests that USD is not ready to trade above 110.00 just yet (we previously held the view ‘a break of 109.75 would greatly increase the odds for USD to move above 110.00’). From here, USD is deemed to have moved into a sideway-trading phase even though the weakened underlying tone suggests it would likely test the bottom of the expected 108.50/109.55 sideway-trading range first.”

Analysts at TD Securities note that the Reserve Bank of Australia (RBA) left its cash rate unchanged at 0.75% in line with theirs and market expectations, indicating that they prepared to ease further if needed.

- “The statement was a little more constructive than in the November meeting, with RBA noting that the risks to the global economy have lessened recently, while expectations of global easing have been scaled back and financial market sentiment has improved.

- RBA repeated that Australia's economy has reached a gentle turning point, but uncertainty remains on the outlook for consumption. Once again they note that a lift in wages would be welcome and help push inflation into a 2-3% range. Lower rates may be needed to achieve this in our view.

- RBA noted the turnaround in established housing markets but that housing credit remains low. RBA highlights the "long and variable" lags in monetary transmission, again suggesting that they want to assess the impact of previous cuts before moving again. There is little here to change the view that the next move is down and a Feb cut still appears likely, but for now, RBA is in wait and see mode.”

- Says negative rates can have negative side effects on the financial system

FX Strategists at UOB Group think the NZD could pick up extra pace and attempt a test of the 0.6560 region.

- "24-hour view: NZD outperformed yesterday as it rocketed by +1.20% to close at 0.6511. The rally is severely over-extended and further NZD strength is not expected for today. However, it is too early to expect a significant pullback. NZD is more likely to consolidate and trade sideways at these higher levels. Expected range for today, 0.6480/0.6520.N

- ext 1-3 weeks: We expected NZD to “trade sideways for a period” since more than 2 weeks ago (see annotations in the chart below). The sideway-trading phase ended with a huge bang as NZD rocketed and made an outsized gain of +1.20% (0.6503). On top of the impressive gains, NZD also closed at the highest level since the shock 50 bps cut by RBNZ in early August. The strong improvement in momentum suggests NZD could continue to advance towards 0.6560 in the coming weeks. Only a move below 0.6460 (‘strong support’ level) would indicate that our view is wrong."

Analysts at ABN AMRO note that ECB's President Christine Lagarde struck a dovish tone in remarks at a hearing of the Committee on Economic and Monetary Affairs of the European Parliament.

- “She noted that the outlook for the global economy remained ‘sluggish and uncertain’ and that this was weighing on investment and exports, with the manufacturing sector slowing the most due to these developments. At the same time, she noted that the weakness was spreading saying that the Governing Council was ‘seeing signs of spillovers to other parts of the economy, with recent survey data pointing to some moderation in the services sector’.

- The weakness in the economy had ‘been affecting price developments, which remain subdued’ and she added that ‘inflation expectations are at or close to historical lows’. Against this background, she talked up the effectiveness of the ECB’s tools saying that ‘monetary policy can respond effectively even when growth is being dampened by external factors’. She asserted the ECB remained ‘resolute in its commitment to deliver on its mandate’ and added that ‘monetary policy will continue to support the economy and respond to future risks in line with our price stability mandate’.

- We think her comments are consistent with our view that the ECB will announce a second stimulus package in the coming months (most likely in March of next year).

- Finally, the ECB President hinted that the review could take a while to complete, saying that it would require ‘ time for reflection and for wide consultation’.”

FX Strategists at UOB Group reiterate they expect the GBP/USD to trade within the familiar broad range.

- "24-hour view: GBP traded between 1.2897 and 1.2949 yesterday, narrower than our expected sideway-trading range of 1.2885/1.2955. The underlying tone has firmed somewhat and this would likely translate into a test of 1.2980. For today, a sustained rise above this level is not expected (next resistance is at 1.3000 followed closely by last month’s top at 1.3012). Support is at 1.2920 but the stronger level is closer to 1.2900.

- Next 1-3 weeks: Despite big moves in other major currency pairs, GBP traded in a relatively quiet manner yesterday and ended the day little changed. The price action offers no fresh clues and the outlook for GBP remains mixed. In other words, there is no change to our view wherein GBP ‘could trade sideways within a broad range for a while more’ (same view since last Tuesday, 26 Nov, spot at 1.2900). From here, a 1.2840/1.3012 range (narrowed from 1.2770/1.3012 previously) is likely enough to contain the movement in GBP, at least for the next few days. Looking forward, the current consolidation is likely to be resolved by GBP moving above last month’s peak at 1.3012”.

Bill Evans, an analyst at Westpac, notes that the Reserve Bank of Australia (RBA) has held the cash rate steady and the commentary was a little more optimistic but Westpac retains their call for the next cut in February.

- “The key themes around the policy outlook which have been consistently promoted in these RBA statements in recent months have been repeated today.

- Firstly, the Board “continues to monitor developments, including in the labour market”, and secondly, “the Board is prepared to ease monetary policy further if needed”.

- However, an additional theme appears in today’s Decision Statement, “long and variable lags in the transmission of monetary policy”. This is not a new observation, given that it has appeared in Board minutes in the past but being elevated to the more succinct Decision Statement gives it some enhanced prominence.

- Finally, in reference to the turnaround in established housing markets, the Decision Statement still notes that “new dwelling activity is still declining and growth in housing credit remains low”.

- This Decision Statement is a little more positive than we have seen in the past, mainly through the linking of rising house prices to a potential lift in spending and residential construction. It also continues to emphasize that the Board is prepared to be patient, is monitoring developments, that policy has long and variable lags, and is prepared to ease "if necessary”.

- If we were expecting a policy move over the next month, then this Decision Statement would raise some questions. However, our forecast that there will be a cut at the February meeting looks much safer. Over the course of the next few months, there will be a clear test of the RBA’s view that the unemployment rate will hold steady. There will also be further evidence around the strength of the consumer with the national accounts to be released tomorrow as well as two more retail sales reports.

- The response of the Australian dollar to any confidence that the RBA will be on hold in February will also be important. We assess that one of the factors behind the consistently low AUD is the expectation that the RBA will continue down its easing path.

- Overall, despite this emphasis on “monitoring” and the slightly more upbeat discussion on the Australian economy, we still feel confident that the rate cut in February will be delivered.”

White House considered banning China's Huawei from the U.S. financial system earlier this year as part of a host of policy options to thwart the blacklisted telecoms equipment giant, Reuters reports, citing three people familiar with the matter.

The plan, which was ultimately shelved, called for placing Huawei Technologies Co Ltd, the world's second-largest smartphone producer, on the Treasury Department's Specially Designated Nationals (SDN) list.

One of the people familiar with the matter, who favours the move, told Reuters that it could be revived in the coming months depending on how things go with Huawei.

The plan was considered by the White House National Security Council, and seen by officials as a nuclear option atop a ladder of policy tools to sanction the company, two of the people said. Such a designation can make it virtually impossible for a company to complete transactions in U.S. dollars.

Administration officials drafted a memo and held interagency meetings on the issue, according to one of the people, showing the extent to which administration officials mulled deploying the United States' most aggressive sanctioning tool against the Chinese company.

Its use was tabled in favour of other measures, such as placing Huawei on a trade blacklist, which forces some suppliers to obtain a special license to sell to it.

FX Strategists at UOB Group suggested that EUR/USD could visit tops above 1.1090 although a move to the 1.1125 level looks unlikely for the time being.

- "24-hour view: While we highlighted yesterday that ‘an interim short-term bottom is in place’, we expected EUR to ‘trade sideways’. The sudden surge in EUR came as a surprise as it soared to an overnight high of 1.1089. While the rapid rise is running ahead of itself, there is room for EUR to move above last month’s peak at 1.1096 first before a pull-back can be expected. For today, the next resistance at 1.1125 is likely out of reach. Support is at 1.1060 but only a breach of 1.1040 would indicate the current strong upward pressure has eased.

- Next 1-3 weeks: We detected the waning downward momentum yesterday (02 Dec, spot at 1.1015) and cautioned that ‘the prospect for EUR to move to 1.0965 has diminished’. However, the subsequent rally in EUR that surged above the 1.1055 ‘strong resistance’ level came as a surprise. The price action suggests that last Friday’s (29 Nov) low of 1.0979 is an intermediate bottom and EUR could stay above this level for next 1 to 2 weeks. Despite the rapid rise, it is too early to expect a sustained advance even though a test of the strong 1.1125 resistance would not be surprising. At this stage, the probability of a sustained rise above this level is not high. All in, EUR is expected to trade with a firm footing and only a break of 1.1020 (‘strong support’ level) would indicate that the current upward pressure has eased."

U.S. President Donald Trump said a trade agreement with China might have to wait until after the U.S. presidential election in November 2020, denting hopes of a quick resolution to the dispute which has weighed on the world economy.

"I have no deadline, no. In some ways I think I think it's better to wait until after the election with China," Trump told.

"But they want to make a deal now, and we'll see whether or not the deal's going to be right, it's got to be right."

Investors have been hoping that the United States and China can avert an escalation of their trade tensions which have slowed global economic growth. Washington and Beijing have yet to ink a so-called "phase one" agreement announced in October, which had raised hopes of a de-escalation in their prolonged trade war.

Trump said a deal with China would only happen if he wanted it to, and he thought he was doing very well in the talks.

Karen Jones, analyst at Commerzbank, points out that EUR/GBP recovered yesterday and given that there is again divergence seen of the daily RSI, they suspect that we will see a bounce higher still this week.

“Initial resistance is last week’s high at .8606 and above here lies a minor downtrend channel resistance line at .8620 ahead of the four month downtrend line at .8752. Overhead resistance is reinforced by .8786 the mid-September low. Support is offered by last week’s low at .8498. Below here lies the May low at .8465. We note the TD support at .8440 and we look for the market to hold here.”

Germany's next representative to the European Central Bank's Executive Board would have voted against restarting bond purchases but considers the tool valid, she told a confirmation hearing in the EU Parliament on Tuesday.

"I’m not sure it was absolutely necessary to restart the asset purchases at that time," Isabel Schnabel said. "If I had voted, maybe I would have said maybe we wait with the asset purchases. But in the end of course probably the decision would have been the same."

The ECB voted in September to restart indefinite bond purchases, even as a third of the 25-member Governing Council opposed the move.

She added that recent economic data have been more benign than feared, supporting expectations that the euro zone will avoid a recession.

According to estimates from Eurostat, in October 2019, compared with September 2019, industrial producer prices rose by 0.1% in both euro area (EA19) and EU28. In September 2019, prices increased by 0.1% in the euro area and remained stable in the EU28. In October 2019, compared with October 2018, industrial producer prices fell by 1.9% in the euro area and by 1.6% in the EU28.

Industrial producer prices in the euro area in October 2019, compared with September 2019, rose by 0.7% in the energy sector, by 0.3% for non-durable consumer goods and by 0.1% for both capital goods and durable consumer goods, while they fell by 0.3% for intermediate goods. Prices in total industry excluding energy fell by 0.1%. In the EU28, industrial producer prices rose by 0.2% for both energy sector and non-durable consumer goods, by 0.1% for durable consumer goods and remained stable for capital goods, while they fell by 0.3% for intermediate goods. Prices in total industry excluding energy fell by 0.1%.

According to the report from IHS Markit/CIPS, UK construction companies recorded another drop in business activity during November. The pace of decline moderated to its slowest since July. However, new work continued to fall sharply amid reports that domestic political uncertainty had led to indecision among clients.

The headline seasonally adjusted UK Construction Total Activity Index rose to 45.3 in November, from 44.2 in October, to signal the slowest drop in overall construction output for four months. Economists had expected an increase to 45.3. Reduced business activity was attributed to a lack of new work to replace completed contracts. In some cases, survey respondents suggested that unusually wet weather in November had also weighed on output. All three broad areas of construction work recorded a fall in output during November, with civil engineering the worst performing category, followed by commercial building. Meanwhile, a much slower decline in housing activity helped to moderate the overall drop in UK construction output signalled by the survey in November.

Looking ahead, construction companies remain relatively cautious about their prospects for growth over the course of 2020. The degree of business optimism was little-changed since October and still much weaker than its long-run average.

Karen Jones, analyst at Commerzbank, suggests that AUD/USD is showing signs of recovery well ahead of 0.6735.

“For any notable sustained recovery to be seen the market will need to overcome the 2019 downtrend line at .6889. This resistance is reinforced by the 200 day ma at .6919 (this is starting to look exposed). Initial support offered by the .6724 October 16 low ahead of the .6671 October low. We suspect that this will again hold for further ranging. Above the 200 day ma targets .7076, the mid- July high. The 2013- 2019 downtrend lies at .7186. Failure at .6671 on a closing basis targets the .6548 February 1999 high. We note TD support on the weekly chart at .6535 also.”

Treasury 10-year yields may slide to a record low 1.2% by the end of next year as the U.S. enters a recession, according to Societe Generale SA.

Benchmark 10-year Treasuries will probably rally as the Federal Reserve cuts interest rates by a full percentage point in the first half of 2020 to spur inflation, strategists including Subadra Rajappa wrote in a note.

“The market is pricing in a Fed hold, but 10 years into this expansion, we see the Fed leaning toward a more accommodative stance,” the analysts wrote. “We expect a steady decline in Treasury yields in 2020.”

Treasuries have led a global bond sell-off since September as the U.S. and China edged toward a partial trade deal, and expectations for the Fed to add to its three rate cuts this year fade. SocGen joins others, including Japan’s Asset Management One Co., in arguing that the recent optimism is misplaced.

“Beyond the trade war noise, structurally, we see the risk of lower yields outweighing the risk of higher yields,” according to SocGen’s strategists. “‘We recommend investors remain on high alert and retain long duration positions in bonds outright and as a hedge against risk-asset exposure.”

British Prime Minister Boris Johnson’s Conservatives have increased their lead over the opposition Labour Party slightly over the last week to 12 points, a survey by Kantar showed on Tuesday, ahead of a Dec. 12 election.

The poll put support for the Conservatives at 44%, up one point from a week earlier, while Labour was unchanged on 32%. The pro-European Union Liberal Democrats were up one point on 15%, while the Brexit Party was down one point on 2%.

Kantar surveyed 1,096 people online between Nov. 28 and Dec. 2.

Low interest rates and increased competition in the mortgage market are eroding the net interest margins of most UK lenders.

Moody's expects a modest deterioration in profitability, as persistently low interest rates and tough competition in the mortgage market erode banks' margins.

In addition, banks will continue to reinvest cost savings achieved in enhancement of IT platforms and digitalisation of processes and channels.

Some large lenders, however, will likely report higher net profit in 2020, helped by a sharp fall in conduct costs after an August 2019 deadline for compensation claims for mis-sold payment protection insurance (PPI).

The United States and China are likely to ink a “phase one” trade deal because the presidents of both countries have incentives to do so, a Yale University professor said.

“There’s a better than 50-50 chance we will get a ‘phase one, skinny’ deal, largely because both presidents, Trump and Xi, need this for domestic political reasons,” Stephen Roach, a senior lecturer at Yale University’s Jackson Institute for Global Affairs, told CNBC.

Clinching the trade agreement with Beijing could help U.S. President Donald Trump “deflect attention away” from the political problems he’s facing on the home front, Roach said. Trump, for his part, is facing an impeachment inquiry in Washington.

“Make no mistake about it, the phase one deal, as we’ve been led to understand it, is a phony deal that will accomplish nothing in the way of meaningful positive impact on American families and American consumers,” he said.

Roach explained that while the preliminary agreement addresses the bilateral trade deficit between the Washington and Beijing, it fails to recognize the United States’ existing trade deficits with other countries. “This is a deal that is purely designed as a political fix,” he added.

If the two sides cannot pin down an agreement by Dec. 15, additional U.S. levies on Chinese exports are set to go into effect. Yale’s Roach said while it’s hard to predict the next “twist and turn” on the tariff front, he thinks Trump may be “prepared at this point to stand down a bit,” as the president did in October when he suspended a tariff hike on $250 billion of Chinese imports.

According to the report from Federal Statistical Office (FSO), the consumer price index (CPI) fell by 0.1% in November 2019 compared with the previous month, reaching 101.7 points (December 2015 = 100). Inflation was –0.1% compared with the same month of the previous year.

The decrease of 0.1% compared with the previous month can be explained by several factors including falling prices for international package holidays and hotel accommodation. The prices of fruiting vegetables and heating oil also declined. In contrast, housing rentals and prices for bedroom furniture increased.

Credit Suisse discusses USD/CAD technical outlook and maintains a tactical bullish bias against a move below 1.354 in the near-term.

"USDCAD remains capped as expected at resistance from the downtrend from June and the retreat from here turns the spotlight back to the low from the end of last week and 13-day average at 1.3254. This needs to hold to suggest the immediate risk stays higher with resistance seen at 1.3319/28. Above here can see the downtrend conclusively broken with resistance then seen next at the 1.3347/48 October highs. Beyond here though is needed to suggest we are seeing a more important turn higher with resistance then seen next at the 1.3383 September high, before the 61.8% retracement of the 2018/19 downleg at 1.3417. Below 1.3254 would remove upside pressure and turn the risks back lower within the range, with support then at the 38.2% retracement of the October/November rally and 55-day average at 1.3219/13," CS adds.

Danske Bank analysts suggest that today is rather thin in the way of economic global releases and focus will be on the US decision to start targeting other countries on trade.

“US President Trump and French President Macron are expected to meet during the NATO leader meeting, which starts today. Also keep an eye on German politics, in particular whether we should expect the SPD to pull the support for the coalition government at the party congress next weekend. Riksbank's Jansson will speak at 14:30 CET today. In Denmark, the central bank will release its FX reserve data for November.”

EUR/USD

Resistance levels (open interest**, contracts)

$1.1158 (4897)

$1.1120 (3959)

$1.1098 (2831)

Price at time of writing this review: $1.1073

Support levels (open interest**, contracts):

$1.1040 (3564)

$1.0997 (3729)

$1.0949 (3421)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 6 is 109459 contracts (according to data from December, 2) with the maximum number of contracts with strike price $1,1200 (5750);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3024 (5914)

$1.2994 (1685)

$1.2974 (2995)

Price at time of writing this review: $1.2942

Support levels (open interest**, contracts):

$1.2875 (1846)

$1.2837 (139)

$1.2793 (2281)

Comments:

- Overall open interest on the CALL options with the expiration date December, 6 is 32723 contracts, with the maximum number of contracts with strike price $1,3000 (5914);

- Overall open interest on the PUT options with the expiration date December, 6 is 34979 contracts, with the maximum number of contracts with strike price $1,2800 (2281);

- The ratio of PUT/CALL was 1.07 versus 1.04 from the previous trading day according to data from December, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 61.47 | -0.45 |

| WTI | 55.87 | -0.43 |

| Silver | 16.88 | -0.53 |

| Gold | 1462.392 | 0 |

| Palladium | 1848.91 | 0.8 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 235.59 | 23529.5 | 1.01 |

| Hang Seng | 98.23 | 26444.72 | 0.37 |

| KOSPI | 3.96 | 2091.92 | 0.19 |

| ASX 200 | 16.3 | 6862.3 | 0.24 |

| FTSE 100 | -60.59 | 7285.94 | -0.82 |

| DAX | -271.7 | 12964.68 | -2.05 |

| Dow Jones | -268.37 | 27783.04 | -0.96 |

| S&P 500 | -27.11 | 3113.87 | -0.86 |

| NASDAQ Composite | -97.48 | 8567.99 | -1.12 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.68178 | 0.75 |

| EURJPY | 120.715 | 0.01 |

| EURUSD | 1.10778 | 0.52 |

| GBPJPY | 141.008 | -0.32 |

| GBPUSD | 1.29405 | 0.2 |

| NZDUSD | 0.65013 | 1.09 |

| USDCAD | 1.33072 | 0.27 |

| USDCHF | 0.99122 | -0.82 |

| USDJPY | 108.963 | -0.5 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.