- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-09-2014

(raw materials / closing price /% change)

Light Crude 95.08 -0.48%

Gold 1,270.00 -0.02%

(index / closing price / change items /% change)

Nikkei 225 15,728.35 +59.75 +0.38%

Hang Seng 25,317.95 +568.93 +2.30%

Shanghai Composite 2,288.63 +22.58 +1.00%

FTSE 100 6,873.58 +44.41 +0.65%

CAC 40 4,421.87 +43.54 +0.99%

Xetra DAX 9,626.49 +119.47 +1.26%

S&P 500 2,000.72 -1.56 -0.08%

NASDAQ 4,572.57 -25.62 -0.56%

Dow Jones 17,078.28 +10.72 +0.06%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3148 +0,12%

GBP/USD $1,6458 -0,06%

USD/CHF Chf0,9176 -0,15%

USD/JPY Y104,84 -0,24%

EUR/JPY Y137,85 -0,12%

GBP/JPY Y172,55 -0,29%

AUD/USD $0,9341 +0,72%

NZD/USD $0,8324 +0,07%

USD/CAD C$1,0886 -0,38%

(time / country / index / period / previous value / forecast)

01:30 Australia Retail sales (MoM) July +0.6% +0.4%

01:30 Australia Retail Sales Y/Y July +5.5%

01:30 Australia Trade Balance July -1.68 -1.77

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270

03:00 Japan BoJ Monetary Policy Statement

06:00 Germany Factory Orders s.a. (MoM) July -3.2% +1.6%

06:00 Germany Factory Orders n.s.a. (YoY) July -4.3%

07:00 United Kingdom Halifax house price index August +1.4% +0.2%

07:00 United Kingdom Halifax house price index 3m Y/Y August +10.2%

07:30 Japan BOJ Press Conference

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15%

12:15 U.S. ADP Employment Report August 218 216

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions July 1.9 0.9

12:30 U.S. International Trade, bln July -41.5 -42.5

12:30 U.S. Initial Jobless Claims August 298 298

12:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter II +2.5% +2.5%

13:45 U.S. Services PMI (Finally) August 58.5 58.5

14:00 U.S. ISM Non-Manufacturing August 58.7 57.3

14:30 U.S. Crude Oil Inventories August -2.1

16:30 U.S. FOMC Member Mester Speaks

23:30 Australia AiG Performance of Construction Index August 52.6

23:30 U.S. FOMC Member Jerome Powell Speaks

The Reserve Bank of Australia (RBA) Governor Glenn Stevens has spoken at the Committee for Economic Development of Australia (CEDA) in Adelaide. Glenn Stevens warned of housing market bubble risk due to low interest rates. Analysts interpreted his comments as meaning the RBA won't cut rates again.

The RBA governor noted that the RBA does not want "to foster too much build-up of risk in the financial sector".

Stock indices closed higher on a ceasefire discussion. Russian President Vladimir Putin outlined a peace plan for eastern Ukraine.

Earlier, Ukrainian President Petro Poroshenko's office said that Russian President Vladimir Putin and Ukrainian President Petro Poroshenko agreed on a "permanent ceasefire". Russia denied that it had agreed to the ceasefire because Russia isn't a party in the conflict. But Russia and Ukraine discuss how to resolve the conflict.

The speculation that the European Central Bank (ECB) will add further stimulus measures also supported the markets. The ECB will released its interest rate decision on Thursday.

Eurozone's final service purchasing managers' index fell to 53.1 in August from 53.5 in July.

German final service purchasing managers' index declined to 54.9 in August from 56.4 in July.

French final service purchasing managers' index decreased to 50.3 in August from 51.1 in July.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,873.58 +44.41 +0.65%

DAX 9,626.49 +119.47 +1.26%

CAC 40 4,421.87 +43.54 +0.99%

The U.S. dollar traded mixed against the most major currencies after the U.S. factory orders. Factory orders in the U.S. climbed 10.5% in July, missing expectations for a 10.9% rise, after a 1.5% gain in June. June's figure was revised up from a 1.1% increase.

The euro traded mixed against the U.S. dollar as tensions between Russia and Ukraine eased. Ukrainian President Petro Poroshenko's office said that Russian President Vladimir Putin and Ukrainian President Petro Poroshenko agreed on a "permanent ceasefire". Russia denied that it had agreed to the ceasefire because Russia isn't a party in the conflict. But Russia and Ukraine discuss how to resolve the conflict.

The speculation that the European Central Bank (ECB) will add further stimulus measures also supported the euro. The ECB will released its interest rate decision on Thursday.

Retail sales in the Eurozone fell 0.4% in July, missing expectations for a 0.3% decline, after a 0.3% increase in June. June's figure was revised down from a 0.4% rise.

On a yearly basis, retail sales in the Eurozone climbed 0.8% in July, missing expectations for a 0.9% rise, after a 1.9% gain in June.

Eurozone's final service purchasing managers' index fell to 53.1 in August from 53.5 in July.

German final service purchasing managers' index declined to 54.9 in August from 56.4 in July.

French final service purchasing managers' index decreased to 50.3 in August from 51.1 in July.

The British pound traded mixed against the U.S. dollar after the better-than-expected Services Purchasing Managers Index from the UK. Services Purchasing Managers Index climbed to 60.5 in August from 59.1 in July, beating expectations for a fall to 58.6.

The Canadian dollar increased against the U.S. dollar after the Bank of Canada's interest rate decision. The BoC kept its interest rate unchanged at 1.00%. This decision was widely expected by analysts.

The timing and direction of interest hike will depend on "how new information influences the outlook and assessment of risks", so the Bank of Canada.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports from New Zealand. Yesterday's better-than-expected ISM manufacturing purchasing managers' index in the U.S. and a drop in dairy product prices weighed on the kiwi. Dairy prices have fallen nearly 45% since February.

The Australian dollar rose against the U.S. dollar after the better-than-expected economic growth in Australia and after comments by the Reserve Bank of Australia (RBA) Governor Glenn Stevens. Australia's gross domestic product (GDP) rose 0.5% in the second quarter, exceeding expectations for a 0.4% gain, after a 1.1% increase in the first quarter.

On a yearly basis, Australia's GDP climbed 3.1% in the second quarter, beating expectations for a 3.0% rise, after a 3.5% growth in the first quarter.

The RBA governor has spoken at the Committee for Economic Development of Australia (CEDA) in Adelaide. Glenn Stevens warned of housing market bubble risk due to low interest rates. Analysts interpreted his comments as meaning the RBA won't cut rates again.

The Australian Industry Group's performance of services index rose to 49.4 in August from 49.3 in July.

The Japanese yen traded slightly higher against the U.S. dollar in the absence of any major economic reports from Japan.

Brent crude rebounded from a 16-month low on speculation cease-fire talks between Russia and Ukraine will ease sanctions against the biggest energy exporter.

Russian President Vladimir Putin outlined a peace plan for Ukraine after agreeing with his Ukrainian counterpart Petro Poroshenko on steps toward a cease-fire in the conflict that has raged for more than five months. West Texas Intermediate rose on expectations supply dropped last week. Oil tumbled yesterday on concern a weakening European economy will curb demand.

"The markets are very much being swayed by the events in Europe and Ukraine," said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy. The cease-fire talks "will hopefully stop the downward spiral we are seeing in the euro-zone economy and the worry about more sanctions being applied."

Brent for October settlement gained $1.68, or 1.7 percent, to $102.02 a barrel at 10:21 a.m. New York time on the London-based ICE Futures Europe exchange. The volume of all futures was 16 percent above the 100-day average. The contract closed yesterday at its lowest since May 1, 2013. The European benchmark traded at a premium of $7.75 to WTI on the ICE, compared with $7.46 yesterday.

WTI for October delivery advanced $1.39, or 1.5 percent, to $94.27 a barrel on the New York Mercantile Exchange. The contract fell yesterday to its lowest close since Jan. 14. Volume was about 4.8 percent below the 100-day average.

Gold prices updated 11-week low second consecutive session after reports that Ukraine and Russia agreed to a cease-fire in eastern Ukraine.

A day earlier, gold prices fell by 1.7% after positive manufacturing data the United States, released on Tuesday, reinforced the view that the economic recovery is gaining momentum, and raised expectations that the Fed will raise rates earlier than previously thought.

Gold hit session lows after the president of Ukraine Petro Poroshenko said that it has reached an agreement on "permanent ceasefire" in eastern Ukraine with Russian President Vladimir Putin.

However, a spokesman for President Putin later denied the statement of the ceasefire, as Russia is not a party to the conflict, but added that the two leaders "discussed how to end the conflict."

On Thursday, the market participants are expecting the results of the ECB policy meeting on the background of the increased expectations that the central bank will announce quantitative easing to shore up economic growth and stave off deflation.

Earlier today, the index of USD, which tracks the performance of the greenback versus a basket of six other major currencies, hit a 13-month high of 83.07 before the climb up to cut 82.93.

A strong dollar usually puts pressure on gold, as it reduces the metal's appeal as an alternative asset and increases in the price of dollar-denominated commodities for holders of other currencies.

The cost of the October gold futures on the COMEX today dropped to $ 1268.00, and then increased to $ 1279.00 per ounce.

The Bank of Canada (BoC) released its interest rate decision today. The BoC kept its interest rate unchanged at 1.00%. This decision was widely expected by analysts.

Canada's central bank said the housing market is "stronger than anticipated". The BoC added that "the risks to the outlook for inflation remain roughly balanced".

The timing and direction of interest hike will depend on "how new information influences the outlook and assessment of risks", so Canada's central bank.

EUR/USD $1.3100 (E130mn), $1.3180(E240mn), $1.3200(E372mn)

EUR/GBP stg0.7855(E190mn), stg0.7875(E190mn), stg1.7900(E190mn), stg0.7915(E160mn)

USD/JPY Y104.25($331mn), Y104.65($390mn), Y105.00($1bn), Y105.50($560mn)

USD/CAD C$1.0935($330mn), C$1.0950($130mn), C$1.1100($255mn)

AUD/USD $0.9225(A$603mn), $0.9275/85(A$500mn), $0.9310(A$130mn)

NZD/USD $0.8370(NZ$120mn)

U.S. stock-index futures rose as reports of a cease-fire in Ukraine boosted global equities.

Global markets:

Nikkei 15,728.35 +59.75 +0.38%

Hang Seng 25,317.95 +568.93 +2.30%

Shanghai Composite 2,288.63 +22.58 +1.00%

FTSE 6,879.03 +49.86 +0.73%

CAC 4,419.13 +40.80 +0.93%

DAX 9,627.51 +120.49 +1.27%

Crude oil $93.90 (+1.09%)

Gold $1266.80 (+0.14%)

(company / ticker / price / change, % / volume)

| The Coca-Cola Co | KO | 41.65 | +0.02% | 0.1K |

| Merck & Co Inc | MRK | 59.83 | +0.07% | 2.3K |

| Microsoft Corp | MSFT | 45.12 | +0.07% | 10.8K |

| Procter & Gamble Co | PG | 83.10 | +0.14% | 2.6K |

| AT&T Inc | T | 34.90 | +0.17% | 6.2K |

| Exxon Mobil Corp | XOM | 98.68 | +0.19% | 4.5K |

| American Express Co | AXP | 89.90 | +0.20% | 4.0K |

| United Technologies Corp | UTX | 109.27 | +0.21% | 0.1K |

| International Business Machines Co... | IBM | 191.98 | +0.22% | 0.4K |

| Intel Corp | INTC | 34.65 | +0.23% | 11.9K |

| Verizon Communications Inc | VZ | 49.90 | +0.26% | 2.9K |

| Cisco Systems Inc | CSCO | 24.95 | +0.28% | 1.1K |

| Johnson & Johnson | JNJ | 103.66 | +0.29% | 2.9K |

| Goldman Sachs | GS | 180.40 | +0.35% | 2.2K |

| Chevron Corp | CVX | 128.00 | +0.36% | 0.1K |

| General Electric Co | GE | 25.96 | +0.43% | 14.0K |

| Caterpillar Inc | CAT | 109.40 | +0.44% | 0.1K |

| Pfizer Inc | PFE | 29.39 | +0.44% | 1.2K |

| McDonald's Corp | MCD | 93.25 | +0.48% | 2.2K |

| Nike | NKE | 79.70 | +0.53% | 1.7K |

| JPMorgan Chase and Co | JPM | 60.02 | +0.59% | 19.2K |

| Boeing Co | BA | 125.45 | -0.02% | 2.3K |

| Walt Disney Co | DIS | 90.60 | -0.22% | 3.0K |

| Home Depot Inc | HD | 90.90 | -0.27% | 6.9K |

Upgrades:

JPMorgan Chase (JPM) upgraded to Buy from Neutral at Nomura

Downgrades:

Bank of America (BAC) downgraded to Neutral from Buy at Nomura

Other:

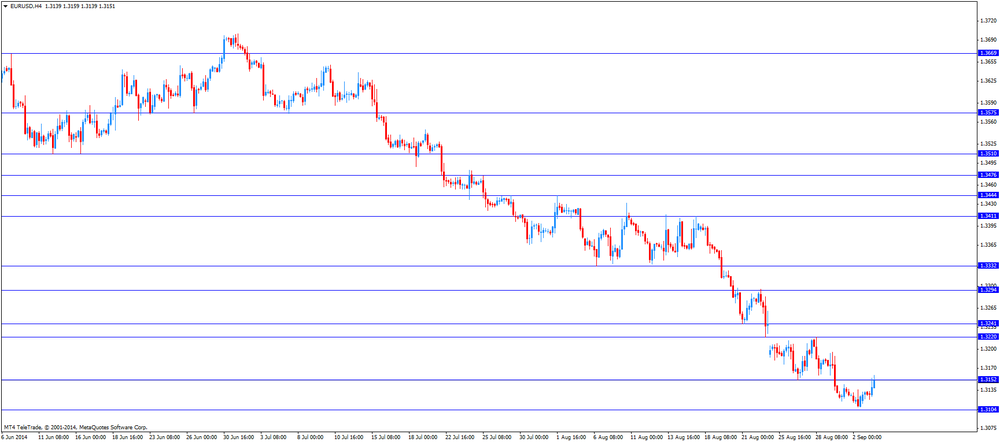

EUR/USD

Offers $1.322-40, $1.3200, $1.3175

Bids $1.3100, $1.3080, $1.3050, $1.3020, $1.3000

GBP/USD

Offers $1.6720, $1.6700, $1.6650, $1.6570

Bids $1.6440, $1.6400, 1.6380

AUD/USD

Offers $0.9415/20, $0.9400, $0.9370/80, $0.9320

Bids $0.9260, $0.9250, $0.9235

EUR/JPY

Offers Y139.00, Y138.40, Y138.25

Bids Y137.20, Y137.00, Y136.50, Y136.20

USD/JPY

Offers Y106.00, Y105.50

Bids Y104.30, Y104.00, Y103.80, Y103.50, Y103.20

EUR/GBP

Offers stg0.8035, stg0.8015, stg0.8000

Bids stg0.7890, stg0.7850, stg0.7820, stg0.7800

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 China Non-Manufacturing PMI August 54.2 54.4

01:30 Australia Gross Domestic Product (QoQ) Quarter II +1.1% +0.4% +0.5%

01:30 Australia Gross Domestic Product (YoY) Quarter II +3.5% +3.0% +3.1%

01:45 China HSBC Services PMI August 50.0 54.1

03:20 Australia RBA's Governor Glenn Stevens Speech

07:48 France Services PMI (Finally) August 51.1 51.1 50.3

07:53 Germany Services PMI (Finally) August 56.4 56.4 54.9

07:58 Eurozone Services PMI (Finally) August 53.5 53.5 53.1

08:30 United Kingdom Purchasing Manager Index Services August 59.1 58.6 60.5

09:00 Eurozone Retail Sales (MoM) July +0.3% Revised From +0.4% -0.3% -0.4%

09:00 Eurozone Retail Sales (YoY) July +2.4% +0.9% +0.8%

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. factory orders. Factory orders in the U.S. are expected to increase 10.9% in July, after a 1.1% gain in June.

The euro traded higher against the U.S. dollar as tensions between Russia and Ukraine eased. Ukrainian President Petro Poroshenko's office said that Russian President Vladimir Putin and Ukrainian President Petro Poroshenko agreed on a "permanent ceasefire". Russia denied that it had agreed to the ceasefire because Russia isn't a party in the conflict. But Russia and Ukraine discuss how to resolve the conflict.

The speculation that the European Central Bank (ECB) will add further stimulus measures also supported the euro. The ECB will released its interest rate decision on Thursday.

Retail sales in the Eurozone fell 0.4% in July, missing expectations for a 0.3% decline, after a 0.3% increase in June. June's figure was revised down from a 0.4% rise.

On a yearly basis, retail sales in the Eurozone climbed 0.8% in July, missing expectations for a 0.9% rise, after a 1.9% gain in June.

Eurozone's final service purchasing managers' index fell to 53.1 in August from 53.5 in July.

German final service purchasing managers' index declined to 54.9 in August from 56.4 in July.

French final service purchasing managers' index decreased to 50.3 in August from 51.1 in July.

The British pound traded mixed against the U.S. dollar after the better-than-expected Services Purchasing Managers Index from the UK. Services Purchasing Managers Index climbed to 60.5 in August from 59.1 in July, beating expectations for a fall to 58.6.

The Canadian dollar increased against the U.S. dollar ahead of the Bank of Canada's interest rate decision. Analysts expect the Bank of Canada will keep its interest rate unchanged at 1.00%.

EUR/USD: the currency pair rose to $1.3159

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada BOC Rate Statement

14:00 U.S. Factory Orders July +1.1% +10.9%

18:00 U.S. Fed's Beige Book

Stock indices traded higher on reports that Russia and Ukraine agreed on a ceasefire. Ukrainian President Petro Poroshenko's office said that Russian President Vladimir Putin and Ukrainian President Petro Poroshenko agreed on a "permanent ceasefire". Russia denied that it had agreed to the ceasefire because Russia isn't a party in the conflict. But Russia and Ukraine discuss how to resolve the conflict.

The speculation that the European Central Bank (ECB) will add further stimulus measures also supported the markets. The ECB will released its interest rate decision on Thursday.

Eurozone's final service purchasing managers' index fell to 53.1 in August from 53.5 in July.

German final service purchasing managers' index declined to 54.9 in August from 56.4 in July.

French final service purchasing managers' index decreased to 50.3 in August from 51.1 in July.

Current figures:

Name Price Change Change %

FTSE 100 6,879.9 +50.73 +0.74%

DAX 9,623.77 +116.75 +1.23%

CAC 40 4,428.42 +50.09 +1.14%

Eurostat released retail sales today. Retail sales in the Eurozone fell 0.4% in July, missing expectations for a 0.3% decline, after a 0.3% increase in June. June's figure was revised down from a 0.4% rise.

Food, drinks and tobacco sales declined 0.6%, the non-food sector fell 0.25, while automotive fuel increased by 0.5%.

The largest decreases were registered in Austria (-1.5%) and Germany (-1.4%). The highest rises were registered in Portugal (+2.6%) and Latvia (+2.2%).

On a yearly basis, retail sales in the Eurozone climbed 0.8% in July, missing expectations for a 0.9% rise, after a 1.9% gain in June.

The non-food sector rose 1.5%, automotive fuel fell by 2.9% and food, drinks and tobacco sales declined by 0.2%. The highest gains were registered in Luxembourg (+14.1%), Estonia (+9.2%) and Romania (+6.3%). The largest decreases were registered in Malta (-2.5%), Poland (-1.1%), Belgium (-1.0%) and Austria (-1.0%).

Asian stock indices closed higher as China's services purchasing managers' index rises. China's non-manufacturing purchasing managers' index (PMI) increased to 54.4 in August from 54.2 in July. The HSBC services PMI for China rose to 54.1 in August from 50.0 in July. That was the highest reading since March 2013.

Japanese stocks rose as Japan's Prime Minister Shinzo Abe appointed Yasuhisa Shiozaki as health minister. Yasuhisa Shiozaki should reform the Government Pension Investment Fund (GPIF).

Tensions between Russia and Ukraine eased as Russian President Vladimir Putin and Ukrainian President Petro Poroshenko agreed on a cease-fire.

China Mobile Ltd. shares rose 3.8% in Hong Kong after the company reported that it started taking preorders for iPhone 6.

Renesas Electronics Corp. shares jumped 17%.

Sony Corp. shares increased 2.7% due to the weaker yen.

Indexes on the close:

Nikkei 225 15,728.35 +59.75 +0.38%

Hang Seng 25,317.95 +568.93 +2.30%

Shanghai Composite 2,288.63 +22.58 +1.00%

EUR/USD $1.3100 (E130mn), $1.3180(E240mn), $1.3200(E372mn)

EUR/GBP stg0.7855(E190mn), stg0.7875(E190mn), stg1.7900(E190mn), stg0.7915(E160mn)

USD/JPY Y104.25($331mn), Y104.65($390mn), Y105.00($1bn), Y105.50($560mn)

USD/CAD C$1.0935($330mn), C$1.0950($130mn), C$1.1100($255mn)

AUD/USD $0.9225(A$603mn), $0.9275/85(A$500mn), $0.9310(A$130mn)

NZD/USD $0.8370(NZ$120mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 China Non-Manufacturing PMI August 54.2 54.4

01:30 Australia Gross Domestic Product (QoQ) Quarter II +1.1% +0.4% +0.5%

01:30 Australia Gross Domestic Product (YoY) Quarter II +3.5% +3.0% +3.1%

01:45 China HSBC Services PMI August 50.0 54.1

03:20 Australia RBA's Governor Glenn Stevens Speech

07:48 France Services PMI (Finally) August 51.1 51.1 50.3

07:53 Germany Services PMI (Finally) August 56.4 56.4 54.9

07:58 Eurozone Services PMI (Finally) August 53.5 53.5 53.1

08:30 United Kingdom Purchasing Manager Index Services August 59.1 58.6 60.5

The U.S. dollar traded mixed against the most major currencies. The greenback was supported by yesterday's better-than-expected ISM manufacturing purchasing managers' index (PMI) in the U.S. The ISM manufacturing PMI in the U.S. rose to 59.0 in August from 57.1 in July, beating forecasts of a decline to 57.0.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports from New Zealand. Yesterday's better-than-expected ISM manufacturing purchasing managers' index in the U.S. and a drop in dairy product prices weighed on the kiwi. Dairy prices have fallen nearly 45% since February.

The Australian dollar traded higher against the U.S. dollar after the better-than-expected economic growth in Australia and after comments by the Reserve Bank of Australia (RBA) Governor Glenn Stevens. Australia's gross domestic product (GDP) rose 0.5% in the second quarter, exceeding expectations for a 0.4% gain, after a 1.1% increase in the first quarter.

On a yearly basis, Australia's GDP climbed 3.1% in the second quarter, beating expectations for a 3.0% rise, after a 3.5% growth in the first quarter.

The RBA governor has spoken at the Committee for Economic Development of Australia (CEDA) in Adelaide. Glenn Stevens warned of housing market bubble risk due to low interest rates. Analysts interpreted his comments as meaning the RBA won't cut rates again.

The Australian Industry Group's performance of services index rose to 49.4 in August from 49.3 in July.

The Japanese yen rose against the U.S. dollar in the absence of any major economic reports from Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair decreased to $1.6443

USD/JPY: the currency pair fell to Y104.91

The most important news that are expected (GMT0):

09:00 Eurozone Retail Sales (MoM) July +0.4% -0.3%

09:00 Eurozone Retail Sales (YoY) July +2.4% +0.9%

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada BOC Rate Statement

14:00 U.S. Factory Orders July +1.1% +10.9%

18:00 U.S. Fed's Beige Book

EUR / USD

Resistance levels (open interest**, contracts)

$1.3262 (3176)

$1.3224 (3079)

$1.3193 (700)

Price at time of writing this review: $ 1.3129

Support levels (open interest**, contracts):

$1.3092 (5472)

$1.3065 (6385)

$1.3031 (3530)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 67912 contracts, with the maximum number of contracts with strike price $1,3400 (6758);

- Overall open interest on the PUT options with the expiration date September, 5 is 63918 contracts, with the maximum number of contracts with strike price $1,3100 (6385);

- The ratio of PUT/CALL was 0.94 versus 0.94 from the previous trading day according to data from September, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.6701 (1037)

$1.6603 (841)

$1.6508 (112)

Price at time of writing this review: $1.6460

Support levels (open interest**, contracts):

$1.6400 (992)

$1.6300 (702)

$1.6200 (413)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 31113 contracts, with the maximum number of contracts with strike price $1,7000 (2760);

- Overall open interest on the PUT options with the expiration date September, 5 is 32008 contracts, with the maximum number of contracts with strike price $1,6800 (4025);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from September, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.