- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-08-2011

Currently S&P industry groups are mixed. Basic Materials sector suffer the biggest losses (-1.1%). Top gainers are Technology, Services and Conglomerates (each +0.6%).

Despite the disappointing U.S. macroeconomic data and continuing concerns over US economy, the stock markets received a strong support from a bundle number of positive corporate reports.

Partly the markets were supported by some upbeat comments from Fed governors Donald Kohn, Vincent Reinhart and Brian Madigan, who told the Wall Street Journal that the Fed may consider another round of stimulus.

US dollar remains under pressure from worries that US economic recovery linger. Another factor to fall is ISM Non-Manufacturing data, which missed estimates. Better-than-expected statistics from ADP don't support the currency as last month ADP data were also significantly higher forecasts, but followed two days later government report showed substantial lower payrolls than expected.

The franc fell after the Swiss National Bank decided to cut its interest rate target to curb franc's sharp appreciation.

The Swiss franc renewed its downward trend against the dollar after the nation’s central bank said the currency is “massively overvalued.” The central bank said it "have to take measures against strong frank".

The loonie fell after Canada’s 30-year government bonds rose to the records dating at 1970. Earlier the currency war under pressure amid weak macroeconomic data in the US, Canada’s largest trading partner.

Yen continue gaining despite today Japan FinMin Noda said that “Yen is overvalued and will do "utmost" to stem yen strength”.

Australia’s currency rebounds against the U.S. dollar after its 5-day fall as today data showed an unexpected decline in retail sales in June. The Aussie also fell as the Bureau of Statistics in Sydney reported a lower-than-forecast trade surplus.

The New Zealand’s dollar also corrects versus the dollar. Today the currency slid to the lowest two weeks against the greenback after Fonterra Cooperative Group Ltd., the world’s largest dairy exporter, said whole-milk powder prices remained near an eight-month low.

Oil is still under pressure after morning inventories data from EIA (+1 mln barrels in the week ended June 23).

September WTI Crude oil currently are at $91.66 per barrel (-2.27%), close to earlier lows at $91.22.

- Government is taking action on deficit Italy, fundamentals and banks are solid.

- Italy debt reduction is faster than most.

- Drop in Italy bank stocks is excessive.

- Italy is well capitalized and can finance the economy.

- Markets don't reflect important EU action on Greece, markets don't correctly evaluate Italy's fundamentals.

- Berlusconi noted support from EU leaders.

Investors remain cautious as questions about the economic recovery linger.

ISM Non-Manufacturing missed estimates.

Better-than-expected statistics from ADP don't suspport the markets as last month ADP data were also significantly higher forecasts, but followed two days later government report showed substantial lower payrolls than expected.

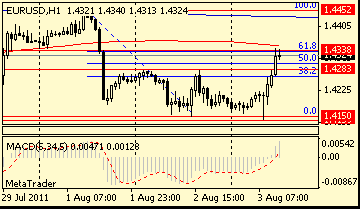

EUR/USD

Bids $1.4285/80, $1.4270/65, $1.4245/40, $1.4220, $1.4200

US non-manuf ISM index and Jun Factory Orders are scheduled to release at 14:00 GMT.

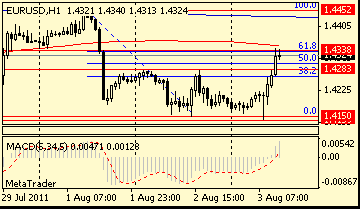

Continues to edge higher, extends recovery to $1.4334 with resistance noted at $1.4338 (50-dma and 61.8% $1.4454/1.4151; $1.4343 100-dma). Further offers seen placed toward $1.4350 with stops above.

EUR/USD extends recovery but falters ahead of yesterday's high on $1.4283, meeting the reported offers. Those offers extend up to $1.4290. Rate currently trades back around $1.4263, stops $1.4295.

The Swiss franc slid against the dollar and the euro after the nation’s central bank said the currency is “massively overvalued.”

The central bank said "we have to take measures against strong frank".

The SNB said it will "significantly'' increase the supply of liquidity to the Swiss franc money market over the coming days to help counter the currency's appreciation.

The franc earlier strengthened to records versus the 17-nation euro and the dollar.

Meanwhile, Moody’s Investors Service and Fitch Ratings affirmed their AAA credit ratings for the U.S. while warning that downgrades were possible if lawmakers fail to enact debt reduction measures and the economy weakens.

The outlook for the U.S. grade is now negative, Moody’s said in a statement yesterday after President Barack Obama signed into law a plan to lift the nation’s borrowing limit and cut spending following months of wrangling between Democratic leaders and Republican lawmakers.

EUR/USD initially fell to $1.4142 before strongly recovered to current $1.4274 after SNB's warning about frank spurred some outflow from the currency.

GBP/USD posted lows around $1.6245 before recovered to $1.6365.

USD/JPY fell to the lows near Y76.95 before it was back to Y77.33.

ADP employment report is due to come at 12:15 GMT.

US non-manuf ISM index and Jun Factory Orders are scheduled to release at 14:00 GMT.

EUR/USD: $1.4200, $1.4300

USD/JPY: Y78.30

AUD/USD: $1.0700, $1.0750, $1.0850

EUR/GBP tries to recover from earlier lows at stg0.8695 to stg0.8735. Offers have been reported in place between stg0.8745/50, a break to

expose Tuesday's high at stg0.8770.

Majors close:

Nikkei -120.42 (-1.21%) 9,844.59

Topix -7.74 (-0.91%) 843.96

DAX -157.23 (-2.26%) 6,796.75

CAC -65.26 (-1.82%) 3,522.79

FTSE-100 -56.04 (-0.97%) 5,718.39

Dow -265.87 (-2.19%) 11,866.60

Nasdaq -75.37 (-2.75%) 2,669.24

S&P500 -32.89 (-2.56%) 1,254.05

10-Years 2.61% -0.14

Oil -0.58 (-0.62%) 93.19

Gold +19 (+1.16%) 1,664

The markets fell after Monday’ weak macroeconomic data from the U.S. According to the Institute for Supply Management (ISM), US manufacturing index of business activity dropped to 50.9 in July, down from 55.3 in June.

Purchasing managers index data from Brazil and the U.K. also showed a contraction in July manufacturing activity.

Average forecast was a reduction to 53.0 points.

Japanese exporters strained under the weight of a strengthened yen, which fueled speculation that Tokyo might intervene to curb the currency’s rise. Today Japanese Finance Minister Yoshihiko Noda said the nation’s currency is overvalued and he’s watching markets closely.

As a result, shares of Japanese export-aimed companies dropped: Nikon Corp. -2.85%, Komatsu Ltd. -1.88%, Nintendo Co. -2.78%.

Loss-based banks in China have put pressure on the indices of Hong Kong and Shanghai. In Hong Kong, shares of Industrial & Commercial Bank of China Ltd. -3.67% lost after reports that Goldman Sachs sold 638 million shares in Hong Kong.

Shares of HSBC Holdings PLC rose 1.23% in Hong Kong after the quarterly report exceeded expectations and disclosure of plans to reduce 30 thousand workers in 2013.

Against the background of falling oil futures declined yesterday that because of fears of slowing U.S. economy, also suffered the loss of the energy sector: the Hong Kong stock Cnooc Ltd. decreased by 1.02%, Aluminum Corp. of China Ltd., or Chalco dropped by 2.67%. In Sydney, shares of Chalco lost 1.44%.

Meanwhile, a decline for Chinese banks weighed on stocks in Hong Kong as well as Shanghai.

Mainland China-based banks were mostly lower in Hong Kong. Shares of Industrial & Commercial Bank of China Ltd. dropped by 3.7% following media reports that Goldman Sachs International had sold 638 million Hong Kong-listed shares of the Chinese lender for a client.

Shares of HSBC Holdings PLC climbed by 1.2% in Hong Kong and provided support to the broader market a day after the company reported better-than-expected first-half results and announced a plan to cut 30,000 jobs by 2013.

Several resource-sector stocks also fell in the region after commodity prices declined in U.S. trading. Shares of energy major Cnooc Ltd. dropped 1%, and Aluminum Corp. of China Ltd., or Chalco, gave up 2.7% in Hong Kong. Chalco’s shares also lost 1.4% in Shanghai trading.

European stock exchanges plunged to a 10-month low.

European stocks shed amid concern that a slowdown in the world’s largest economy may derail global growth. Surged bond yields in Italy reawakened concern that the region’s debt crisis will worsen amid slowing global growth. Italy’s 10-year yield jumped to the most since 1997.

Market participants also concerned that the crafted agreement between Barack Obama and congressional leaders to raise the federal debt ceiling and spending reduction may lead to slowdown in economic recovery. Yesterday they approved legislation to hike the U.S. debt limit by at least $2.1 trillion and cut federal spending by $2.4 trillion.

The Switzerland’s SMI index (SMIC) tumbled 4.1% as the euro and the US dollar dropped to a record low against the franc: Swiss Re AG (SREN) -5.44%, ABB Ltd. - 4.64%, Nestle SA - 1.29%

In Italy Fiat Industrial SpA’ shares fell by 8.43% and Parmalat SpA IT: PLT decreased by 2.70%.

In London banking sector was the worst performer : shares of Rio Tinto PLC fell by 1.91%, shares of BHP Billiton PLC went down by 1.93%.

US stocks eased 2%-3% on Tuesday.

The markets plummeted down amid concern that the agreement between Barack Obama and congressional leaders on federal debt ceiling and spending reduction may lead to slowdown in economic recovery. On Tuesday the Senate and President Obama approved approved the legislation plan to hike the U.S. debt limit by at least $2.1 trillion and cut federal spending by $2.4 trillion.

IMF' chief Lagarde said that “By reducing a major uncertainty in the markets and bolstering U.S. fiscal credibility, this agreement is good for both the U.S. and the global economy.” Then he added “Raising the debt ceiling means a severe economic disruption has been avoided, and the accompanying deficit reduction deal is an important step toward fiscal consolidation.”

Economy: June US personal income coincided with the forecast of 0.1% compared with previous growth of 0.2%. June US personal spending fell by 0.1%, the first decline in the last 2 years. Analysts expected the figure remain unchanged (0.0%) after its rising by 0.1% in May.

Corporate news: Shares of NYSE Euronext (NYX) plunged 5% as the stock exchange operator posted a 19% drop in second-quarter profit, due in part to costs associated with its Deutsche Boerse merger.

General Motors (GM) reported July U.S. sales added 7.6% to 214,915 vehicles vs. expected +7%. On Tuesday shares of General Motors added 3.6%

Ford Motor (F) reported July U.S. sales advanced by 9% to 180,865 vehicles vs. expected +7.6%. On Tuesday shares of Ford Motor advanced by 4.1%.

Shares of MetroPCS Communications (CPS), the largest retailer in Germany, plunged 36.6% as the company’s Q2 profit rose at 306 million euros compared with 334 million euros a year earlier. Its Media-Saturn household electronics unit suffered in the first quarter the first loss in 20 years. EPS $0.24 vs. est. $0.29.

Shares of SM Energy Company (SM) went up by 9.5% as the company reported a massive 2Q beat on strong volumes/lower costs, upped 2011 guidance and established a big 2012 volume target. EPS $0.91 vs. est. $0.55. Production for 2012 expected to increase by 35%-40%.

EUR/USD

Offers: $1.4225, $1.4235/40, $1.4280/85

Bids: $1.4200

GBP/USD

Offers: $1.6300/05, $1.6325/30, $1.6345/50

Bids: $1.6250, $1.6225/20

USD/JPY

Offers: Y78.00, Y78.10

Bids: Y76.95/00

Data released:

03:30 Australia RBA meeting announcement 4.75% 4.75% 4.75%

09:00 EU(17) PPI (June) 0.0% 0.1% -0.2%

09:00 EU(17) PPI (June) Y/Y 5.9% 5.9% 6.2%

12:30 USA Personal income (June) 0.1% 0.1% 0.2 (0.3)%

12:30 USA Personal spending (June) -0.2% 0.0% 0.1 (0.0)%

12:30 USA PCE price index ex food, energy (June) 0.1% 0.2% 0.2 (0.3)%

12:30 USA PCE price index ex food, energy (June) Y/Y 1.3% - 1.3 (1.2)%

12:55 USA Redbook (30.07)

US dollar renewed its decline amid concern that crafted agreement between Barack Obama and congressional leaders to raise the federal debt ceiling and spending reduction may lead to slowdown in economic recovery. Today Senate approved the debt limit hike bill. According to the plan, the U.S. debt limit will be raised by at least $2.1 trillion and cut federal spending by $2.4 trillion.

European stocks tumbled to the lowest level in 11 months amid concern that a slowdown in the world’s largest economy may derail global growth. Another pressure for the currency is surging bond yields in Italy reawakened concern that the region’s debt crisis will worsen amid slowing global growth. Italy’s 10-year yield jumped to the most since 1997.

The Swiss franc climbed to a new life-time high today. It was supported by “save haven” status and beating statistics on Swiss SVME PMI and retail sales.

The Australian dollar fell after the nation’s central bank kept its main interest rate unchanged.

The yen remained under pressure amid speculations Japan will intervene in currency markets. Today Japanese Finance Minister Yoshihiko Noda said the nation’s currency is overvalued and he’s watching markets closely.

EUR/USD initially fell from $1.4280 to $1.4150 before recovered to daily highs and retreated again to $1.4180.

GBP/USD fell from $1.6330 to $1.6220. Later rate was back to $1.6316.

USD/JPY tested highs on Y77.80, but failed to set above and retreated to the lows around Y76.90.

Today's focus in Europe will be on Germany's Purchasing Manager Index Services for July at 07:55 GMT.

Later the same data from EU and UK will be released.

ADP employment report is due to come at 12:15 GMT.

US non-manuf ISM index and Jun Factory Orders are scheduled to release at 14:00 GMT.

Oil continues to get down Wednesday, although prices hold off the lows. The front-month WTI contract declined 37 cents to $93.42 per barrel, having touched a low at $93.10.

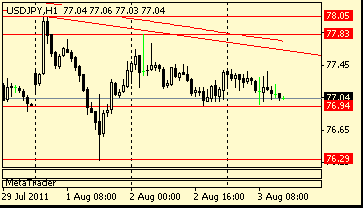

Resistance 3: Y78.40

Resistance 2: Y78.00

Resistance 1: Y77.50/65

Current price: Y77.04

Support 1: Y76.90

Support 2:Y76.30

Support 3:Y76.00

Comments: Rate gets close to initial support at yesterday's lows on Y76.90. Below dollar may weaken to Y76.30 (Aug 01 low). Resistance is around Y77.50/65 (channel lines from Jul 08 and 20 crossing). Above resistance is around Y78.00 (Aug 01 high).

Nikkei -120.42 (-1.21%) 9,844.59

Topix -7.74 (-0.91%) 843.96

DAX -157.23 (-2.26%) 6,796.75

CAC -65.26 (-1.82%) 3,522.79

FTSE-100 -56.04 (-0.97%) 5,718.39

Dow -265.87 (-2.19%) 11,866.60

Nasdaq -75.37 (-2.75%) 2,669.24

S&P500 -32.89 (-2.56%) 1,254.05

10-Years 2.61% -0.14

Oil -0.58 (-0.62%) 93.19

Gold +19 (+1.16%) 1,664

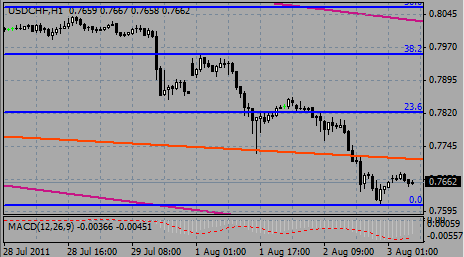

Resistance 3: Chf0.7960

Resistance 2: Chf0.7820

Resistance 1: Chf0.7710

Current price: Chf0.7714

Support 1: Chf0.7610

Support 2: Chf0.7580

Support 3: Chf0.7530

Comments: Dollar rises and currently probe resistance at Chf0.7710 with a break above targets Aug 02 high on Chf0.7820. Support remains at Chf0.7610 (record lows, printed yesterdays). Brloe rate may weaken to Chf0.7580 and then - to Chf0.7530 (channel line from Jul 08).

Resistance 3: $1.6350

Resistance 2: $1.6330

Resistance 1: $1.6300

Current price: $1.6271

Support 1: $1.6220

Support 2: $1.6130/40

Support 3: $1.6070

Comments: Pound holds above recent lows around $1.6220 (support now). Below losses may extend to $1.6130/40 (50.0% Fibo of $1.5780-$1.6480 move). Resistance is around NY highs on $1.6300, neat band of resistance comes at $1.6330 (Tuesday's high) and then - at $1.6350 (50.0% Fibo of $1.6480-$1.6220 decline).

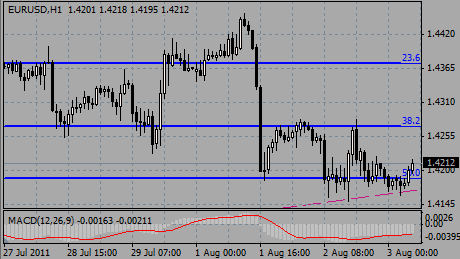

Resistance 3: $1.4340

Resistance 2: $1.4300

Resistance 1: $1.4280

Current price: $1.4166

Support 1: $1.4140/50

Support 2: $1.4110

Support 3: $1.4070

Comments: Euro resumes decline, heading close to support at $1.4140/50 (Jul 21 and Aug 02 lows). Further losses may ne widen to $1.4110 (61.8% Fibo of $1.3840 - $1.4530 move) and $1.4070 (Jul 19 low). Resistance comes at $1.4280 (yesterday's high), then - at $1.4300(50.0% Fibo of $1.4450 - $1.4150 decline) and $1.4340 (61.8%).

07:45 Italy PMI services (July) 47.0 47.4

07:50 France PMI services (July) 54.2 56.1

07:55 Germany PMI services (July) seasonally adjusted 52.9 56.7

08:00 EU(17) PMI services (July) 51.4 53.7

08:30 UK CIPS services index (July) 53.2 53.9

09:00 EU(17) Retail sales (June) adjusted 0.4% -1.1%

09:00 EU(17) Retail sales (June) adjusted Y/Y -1.1% -1.9%

12:15 USA ADP employment (July) +97K +157K

14:00 USA ISM Non-mfg PMI (July) 52.8 53.3

14:00 USA ISM Non-mfg business index (July) - 53.4

14:00 USA Factory orders (June) -1.0% 0.8%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.