- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-07-2014

The Reserve Bank of Australia Governor Glenn Stevens said at the Australian Conference of Economists on Thursday:

- The Australian dollar remains high by historical standards;

- Investors are underestimating the probability of a significant fall in the Australian dollar at some point;

- A profitable "carry trade" is pushing the value of the Australian dollar up.

Stock indices stocks closed higher due to the ECB's interest rate remained unchanged and due to the strong U.S. labour market data. The ECB kept its interest rate unchanged at 0.15%. The European Central Bank President Mario Draghi said the ECB will keep interest rate at the present levels for an extended period of time.

U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008. Analysts had expected the unemployment rate to remain unchanged at 6.3%.

The U.K. services purchasing managers' index dropped to 57.7 in June from 58.6 in May. Analysts had expected the index to decline to 58.1.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,865.21 +48.84 +0.72%

DAX 10,029.43 +118.16 +1.19%

CAC 40 4,489.88 +45.16 +1.02%

The U.S. dollar rose against the most major currencies after the strong U.S. labour market data. U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May. May's figure was revised up from a rise of 217,000 positions.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008. Analysts had expected the unemployment rate to remain unchanged at 6.3%.

These figures are signs of the strength of the U.S. labour market. Despite of the U.S. economy's contraction in first quarter, the Federal Reserve may hike its interest rate sooner as expected.

The ISM non-manufacturing purchasing managers' index for the U.S. declined to 56.0 in June from 56.3 in May, missing expectations for a decrease to 56.2.

The U.S. trade deficit shrank to $44.4 billion in May from a $47.0 billion in April, beating forecasts of a decline to $45.1 billion. April's figure was revised down from $47.2 billion.

The number of initial jobless claims in the U.S. rose by 2,000 to a seasonally adjusted 315,000 in the week ended June 28.

The euro dropped against the U.S. dollar after the European Central Bank's interest rate decision and U.S. labour market data. The ECB kept its interest rate unchanged at 0.15%. The European Central Bank President Mario Draghi said the ECB will keep interest rate at the present levels for an extended period of time. He added "the Governing Council is unanimous in its commitment to also using unconventional instruments" if required, to address risks of a longer period of low inflation.

Mr. Draghi also said the ECB will change the frequency of its monetary policy meetings to a six-week cycle from January 2015 and the ECB will start publishing meeting minutes from January 2015.

Retail sales in the Eurozone were flat in May, missing expectations for a 0.2% gain, after a 0.2% decline in April. April's figure was revised down from a 0.4% rise.

On a yearly basis, retail sales in the Eurozone increased 0.7% in May, missing expectations for a 1.2% rise, after a 1.8% gain in April. April's figure was revised down from a 2.4% increase.

Eurozone's services purchasing managers' index decreased to 52.8 in June from 53.2 in May, in line with expectations.

German final services purchasing managers' index declined to 54.6 in June from 56.0 in May, missing expectations for a drop to 54.8.

French final services purchasing managers' index fell to 48.2 in June from 49.1 in May, in line with expectations.

Spanish services purchasing managers' index decreased to 54.8 in June from 55.7 in May, missing expectations for a rise to 55.8.

The British pound traded slightly lower against the U.S. dollar after the weaker-than-expected U.K. services purchase managers' index. The U.K. services purchasing managers' index dropped to 57.7 in June from 58.6 in May. Analysts had expected the index to decline to 58.1.

The British currency remained supported by speculations that the Bank of England will hike its interest rate sooner that expected.

The Canadian dollar traded against the U.S. dollar after the Canadian trade balance and U.S. labour market data. The Canadian trade balance deficit narrowed to C$0.152 billion in May from a deficit of C$0.961 billion in April, beating expectations for a C$0.30 billion deficit. April's figure was revised down from a deficit of C$0.64 billion.

The New Zealand dollar traded lower against the U.S dollar due to the strong U.S. labour market data. No economic reports were released in New Zealand.

The Australian dollar declined against the U.S. dollar after mixed Australian economic data, and comments by the Reserve Bank of Australia (RBA) Governor Glenn Stevens and due to the strong U.S. labour market data. The RBA Governor said that the Australian dollar remains high by historical standards and investors are underestimating the probability of a significant fall in the Australian dollar at some point.

Retail sales in Australia decreased 0.5% in May, missing expectations for a 0.3% gain, after a 0.1% decline in April. April's figure was revised down from a 0.2% rise.

Building permits in Australia increased 9.9% in May, exceeding expectations for a 3.5% gain, after a 5.8% slip in April. April's figure was revised down from a 5.6% decrease.

AIG services index for Australia declined to 47.6 in June from 49.9 in May.

The Japanese yen traded lower against the U.S. dollar due to the strong U.S. labour market data. No economic reports were released in Japan.

Crude oil futures fell today as concerns about the termination of oil supplies from Libya began to slowly fade.

As we learned from the statements of Prime Minister Abdullah al-Tinney, the Libyan government has agreed with the rebels on the resumption of oil terminals. This gives the country the opportunity to be exported up to 500,000 barrels of oil daily.

"Even if Libya resumes production, exports amount to only 40-50 per cent of pre-crisis value, and it is a little. Investors are still watching Iraq, "- analysts said Astmax Investment. In their view, the prices will go up in July because world production capacity is not sufficient to compensate for supply disruptions from Iraq, if any.

Meanwhile, we add that the Iraqi parliament failed to form a new government at the first meeting, and Prime Minister Nuri al-Maliki expressed the hope that this will happen at the second attempt. Iraq can not afford to stay for a long time without a government since the separatists take control of new areas in the north and west of the country. But while the fighting did not affect the export of oil.

If we consider the situation from the point of view of demand, the latest data on the U.S. - one of the world's largest oil consumer - have suggested that the economy is recovering. We also recall that yesterday presented the Energy Information Administration report showed that U.S. crude inventories fell more than expected last week as refineries increased capacity before the Independence Day holiday.

Market participants also drew attention to the employment report, which turned out much better than the experts' forecasts. Non-agricultural employment increased from a seasonally adjusted 288,000 last month. It was the strongest increase since January 2012. The unemployment rate fell to 6.1% in June, the lowest level since September 2008. Economists forecast that employment will increase by 211,000 and the unemployment rate to remain unchanged at 6.3%.

Today, as it became known that the U.S. company Enterprise Product Partners sold abroad the first batch of ultra-light oil (condensate) in 40 years. According to the agency, the buyer - Japanese trader Mitsui, volume - 400,000 barrels, the actual delivery deadline - no later than the beginning of August. Recall that in June, the U.S. Commerce Department has authorized two companies to export oil ultralight actually removing acting 40 year-old ban on the supply of crude oil abroad.

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 103.75 a barrel on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture fell 13 cents to $ 110.67 a barrel on the London exchange ICE Futures Europe.

Gold prices fell markedly today, which was associated with the strengthening of the U.S. dollar against the backdrop of the employment report.

As it became known, U.S. employers added a significant number of jobs in June, a sign of improvement in the labor market. Non-agricultural employment increased from a seasonally adjusted 288,000 last month, the Labor Department said Thursday. Gain May was revised to 224,000 from 217,000, while the improvement in April was increased to 304,000 from 282,000. This was the strongest increase since January 2012. The unemployment rate, derived from a separate survey of households, fell to 6.1% in June to the lowest level since September 2008. Improvement reflects more people employed, while the size of the workforce has remained relatively stable. Economists forecast that employment will increase by 211,000 and the unemployment rate to remain unchanged at 6.3%.

It is worth recalling that the decline in the unemployment rate and recovery in the U.S. labor market are able to push the Fed to change their policy and their understated rates earlier than planned increase. This step, in turn, will reduce investor demand for gold.

The course of trade also influenced the statements of the ECB's Draghi, who said that the European Central Bank remains committed to keep benchmark interest rates at a low level for a long time. During the meeting, the bank's management has decided to leave unchanged all three base rates: lending rate at 0.15% on deposits - at minus 0.1%, and the ">If we evaluate from a technical standpoint, there is a possibility of return to $ 1,300, as after two attempts have failed to overcome resistance at $ 1332.

Meanwhile, add that physical demand for gold was weak due to the recent price rally. Prices for precious metals in China were $ 1 - $ 2 lower than the world, underscoring weak demand.

The cost of the August gold futures on the COMEX today dropped to $ 1321.3 per ounce.

The European Central Bank President Mario Draghi said at the press conference today:

- The ECB will keep interest rate at the present levels for an extended period of time;

- "The Governing Council is unanimous in its commitment to also using unconventional instruments" if required, to address risks of a longer period of low inflation;

- Geopolitical risks, developments in emerging market economies and global financial markets may have the potential to affect economy in the Eurozone negatively;

- The exchange rate of the euro is not a policy target;

- If banks don't lend after receiving loans from the European Central Bank, they will have to pay the money back;

- The frequency of ECB's monetary policy meetings will change to a six-week cycle from January 2015;

- The ECB will start publishing meeting minutes from January 2015;

- There are further downside risk relates to insufficient structural reforms in euro area countries;

- The economic outlook for the Eurozone remain on the downside;

- The economy in the Eurozone recovered moderately in the second quarter;

- The ECB is interested in asset-backed securities.

The U.S. Bureau of Labor Statistics released its labour market data today. U.S. companies added 288,000 jobs in June, exceeding expectations for an increase by 211,000 positions, after a gain of 224,000 jobs in May. May's figure was revised up from a rise of 217,000 positions.

The unemployment rate in the U.S. dropped to 6.1% in June from 6.3% in May. That was the lowest level since September 2008. Analysts had expected the unemployment rate to remain unchanged at 6.3%.

These figures are signs of the strength of the U.S. labour market. Despite of the U.S. economy's contraction in first quarter, the Federal Reserve may hike its interest rate sooner as expected. Analysts expect the first interest rate hike mid-2015.

The U.S. economy contracted 2.9% in the first quarter. The contraction was caused by the extremely cold winter in the U.S. But recently released figures show that the U.S. labour market and U.S. housing market gain momentum.

U.S. stock futures rose as data showed employers added more workers than projected in June and investors awaited details of the European Central Bank's stimulus plans.

Global markets:

FTSE 6,855.35 +38.98 +0.57%

CAC 4,464.12 +19.40 +0.44%

DAX 9,974.55 +63.28 +0.64%

Nikkei 15,348.29 -21.68 -0.14%

Hang Seng 23,531.44 -18.18 -0.08%

Shanghai Composite 2,063.23 +3.81 +0.19%

Crude oil $104.00 (-0.46%)

Gold $1318.40 (-0.94%)

(company / ticker / price / change, % / volume)

| The Coca-Cola Co | KO | 42.30 | +0.02% | 0.6K |

| Cisco Systems Inc | CSCO | 25.май | +0.08% | 10.9K |

| Caterpillar Inc | CAT | 109.66 | +0.09% | 0.8K |

| Verizon Communications Inc | VZ | 49.71 | +0.10% | 13.0K |

| United Technologies Corp | UTX | 115.30 | +0.14% | 0.2K |

| Home Depot Inc | HD | 82.11 | +0.16% | 1.2K |

| AT&T Inc | T | 35.73 | +0.17% | 22.8K |

| Merck & Co Inc | MRK | 59.19 | +0.24% | 0.4K |

| Procter & Gamble Co | PG | 79.77 | +0.26% | 3.0K |

| Chevron Corp | CVX | 130.59 | +0.28% | 0.4K |

| JPMorgan Chase and Co | JPM | 57.13 | +0.28% | 1.7K |

| Walt Disney Co | DIS | 86.69 | +0.29% | 1.4K |

| Pfizer Inc | PFE | 30.48 | +0.36% | 2.1K |

| Johnson & Johnson | JNJ | 106.25 | +0.37% | 0.6K |

| General Electric Co | GE | 26.72 | +0.41% | 24.1K |

| Intel Corp | INTC | 31.11 | +0.42% | 6.7K |

| Wal-Mart Stores Inc | WMT | 75.62 | 0.00% | 0.1K |

| Exxon Mobil Corp | XOM | 101.50 | -0.07% | 1.8K |

| Microsoft Corp | MSFT | 41.80 | -0.24% | 0.2K |

| International Business Machines Co... | IBM | 187.84 | -0.29% | 0.7K |

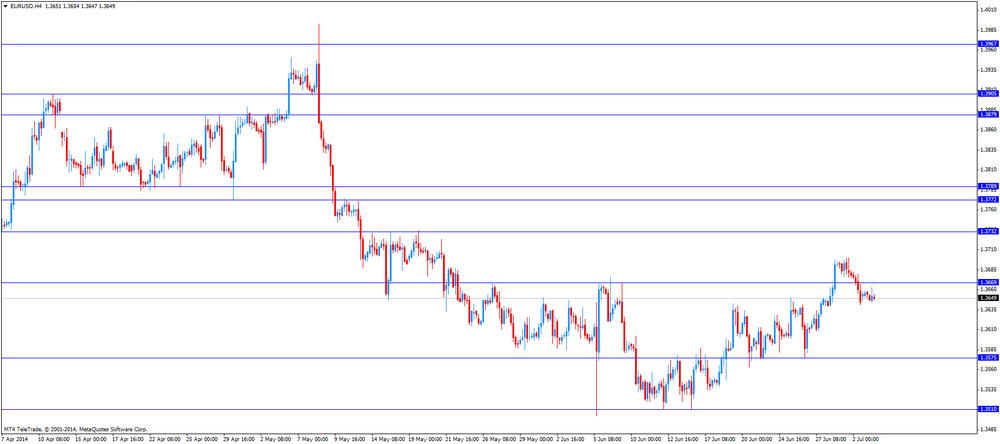

EUR/USD

Offers $1.3700-20, $1.3680/85

Bids $1.3625/20, $1.3576-74, $1.3565, $1.3550/40

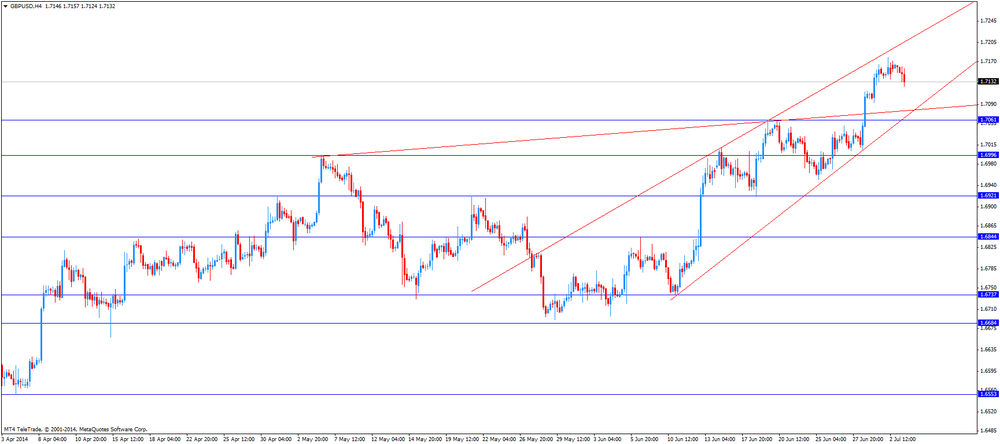

GBP/USD

Offers $1.7300, $1.7250, $1.7230, $1.7200

Bids $1.7095/90, $1.7035/30

AUD/USD

Offers $0.9505, $0.9480, $0.9465/70, $0.9420, $0.9400

Bids $0.9350, $0.9320, $0.9300

EUR/JPY

Offers Y140.50, Y140.00, Y139.50

Bids Y138.50, Y138.20, Y138.00

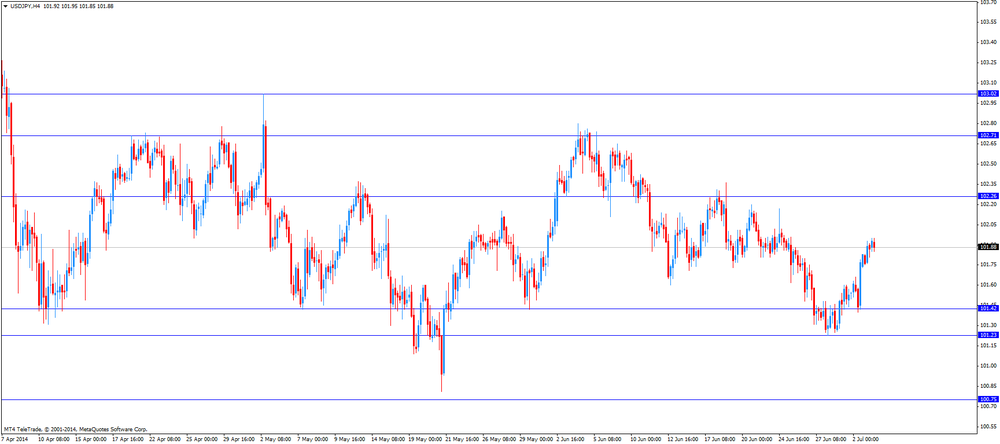

USD/JPY

Offers Y102.50, Y102.00

Bids Y101.50, Y101.40/30, Y101.20, Y101.10/00, Y100.80

EUR/GBP

Offers stg0.8000

Bids stg0.7950, stg0.7935/30, stg0.7925/20, stg0.7905-890

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia RBA's Governor Glenn Stevens Speech

01:00 China Non-Manufacturing PMI June 55.5 55.0

01:30 Australia Building Permits, m/m May -5.6% +3.5% +9.9%

01:30 Australia Building Permits, y/y May +1.1% +14.3%

01:30 Australia Retail sales (MoM) May +0.2% +0.3% -0.5%

01:30 Australia Retail Sales Y/Y May +5.7% +4.6%

01:45 China HSBC Services PMI June 50.7 53.1

07:48 France Services PMI (Finally) June 49.1 48.2 48.2

07:53 Germany Services PMI (Finally) June 56.0 54.8 54.6

07:58 Eurozone Services PMI (Finally) June 53.2 52.8 52.8

08:30 United Kingdom Purchasing Manager Index Services June 58.6 58.1 57.7

09:00 Eurozone Retail Sales (MoM) May +0.4% +0.3% 0.0%

09:00 Eurozone Retail Sales (YoY) May +2.4% +0.7%

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15% 0.15%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. labour market data. Analysts expect that the U.S. economy will add 211,000 jobs in June, after 217,000 jobs in May.

The unemployment rate in the U.S. should remain unchanged at 6.3% in June.

The euro traded mixed against the U.S. dollar after the European Central Bank's interest rate decision. The ECB kept its interest rate unchanged at 0.15%.

Retail sales in the Eurozone were flat in May, missing expectations for a 0.2% gain, after a 0.2% decline in April. April's figure was revised down from a 0.4% rise.

On a yearly basis, retail sales in the Eurozone increased 0.7% in May, missing expectations for a 1.2% rise, after a 1.8% gain in April. April's figure was revised down from a 2.4% increase.

Eurozone's services purchasing managers' index decreased to 52.8 in June from 53.2 in May, in line with expectations.

German final services purchasing managers' index declined to 54.6 in June from 56.0 in May, missing expectations for a drop to 54.8.

French final services purchasing managers' index fell to 48.2 in June from 49.1 in May, in line with expectations.

Spanish services purchasing managers' index decreased to 54.8 in June from 55.7 in May, missing expectations for a rise to 55.8.

The British pound declined against the U.S. dollar after the weaker-than-expected U.K. services purchase managers' index. The U.K. services purchasing managers' index dropped to 57.7 in June from 58.6 in May. Analysts had expected the index to decline to 58.1.

The Canadian dollar increased against the U.S. dollar ahead of the Canadian trade balance. The Canadian trade balance deficit should narrow to C$0.3 billion in May from a deficit of C$0.64 billion in April.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.7124

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions May -0.64 -0.3

12:30 U.S. International Trade, bln May -47.2 -45.1

12:30 U.S. Initial Jobless Claims June 312 310

12:30 U.S. Average hourly earnings June +0.2% +0.2%

12:30 U.S. Nonfarm Payrolls June 217 211

12:30 U.S. Unemployment Rate June 6.3% 6.3%

14:00 U.S. ISM Non-Manufacturing June 56.3 56.2

Stock indices traded higher ahead of the European Central Bank's interest rate decision and the U.S. payrolls. The European Central Bank will release its interest rate decision today. Market participants expect the ECB's interest rate remains unchanged at 0.15%. The European Central Bank cut its interest rate to 0.15% from 0.25% in June.

The U.S. Bureau of Labor Statistics will reveal its labour market data on Thursday. Analysts expect that the U.S. economy will add 211,000 jobs in June, after 217,000 jobs in May.

The unemployment rate in the U.S. should remain unchanged at 6.3% in June.

Retail sales in the Eurozone were flat in May, missing expectations for a 0.2% gain, after a 0.2% decline in April. April's figure was revised down from a 0.4% rise.

On a yearly basis, retail sales in the Eurozone increased 0.7% in May, missing expectations for a 1.2% rise, after a 1.8% gain in April. April's figure was revised down from a 2.4% increase.

Eurozone's services purchasing managers' index decreased to 52.8 in June from 53.2 in May, in line with expectations.

German final services purchasing managers' index declined to 54.6 in June from 56.0 in May, missing expectations for a drop to 54.8.

French final services purchasing managers' index fell to 48.2 in June from 49.1 in May, in line with expectations.

Spanish services purchasing managers' index decreased to 54.8 in June from 55.7 in May, missing expectations for a rise to 55.8.

The U.K. services purchasing managers' index dropped to 57.7 in June from 58.6 in May. Analysts had expected the index to decline to 58.1.

Current figures:

Name Price Change Change %

FTSE 100 6,851.17 +34.80 +0.51%

DAX 9,980.77 +69.50 +0.70%

CAC 40 4,470.98 +26.26 +0.59%

Most Asian stock indices declined ahead of the European Central Bank's interest rate decision and the U.S. payrolls. The European Central Bank will release its interest rate decision today. Market participants expect the ECB's interest rate remains unchanged at 0.15%. The European Central Bank cut its interest rate to 0.15% from 0.25% in June.

The U.S. Bureau of Labor Statistics will reveal its labour market data on Thursday. Analysts expect that the U.S. economy will add 211,000 jobs in June, after 217,000 jobs in May.

The unemployment rate in the U.S. should remain unchanged at 6.3% in June.

The Chinese non-manufacturing purchase managers' index decreased to 55.0 in June from 55.5 in May.

The Chinese HSBC services manufacturing purchase managers' index climbed to 53.1 in June from 50.7 in May.

Indexes on the close:

Nikkei 225 15,348.29 -21.68 -0.14%

Hang Seng 23,531.44 -18.18 -0.08%

Shanghai Composite 2,063.23 +3.81 +0.19%

EUR/USD 1.3500, 1.3550, 1.3570/75, 1.3600/05, 1.3630/40, 1.3650, 1.3665, 1.3685, 1.3700, 1.3750, 1.3770, 1.3795/800

AUD/USD 0.9200, 0.9225/30, 0.9250/55, 0.9280, 0.9300, 0.9350, 0.9385, 0.9400, 0.9420, 0.9430, 0.9500

USD/JPY 101.00, 101.25, 101.45/50, 101.75, 101.90, 102.00/10, 102.35/40, 102.50, 102.55/60, 102.75, 103.00, 103.25, 103.50/60

GBP/USD 1.7040, 1.7050, 1.7200

USD/CAD 1.0600, 1.0620, 1.0650/55, 1.0660, 1.0680, 1.0690/700, 1.0720/25

EUR/GBP 0.8040

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia RBA's Governor Glenn Stevens Speech

01:00 China Non-Manufacturing PMI June 55.5 55.0

01:30 Australia Building Permits, m/m May -5.6% +3.5% +9.9%

01:30 Australia Building Permits, y/y May +1.1% +14.3%

01:30 Australia Retail sales (MoM) May +0.2% +0.3% -0.5%

01:30 Australia Retail Sales Y/Y May +5.7% +4.6%

01:45 China HSBC Services PMI June 50.7 53.1

07:48 France Services PMI (Finally) June 49.1 48.2 48.2

07:53 Germany Services PMI (Finally) June 56.0 54.8 54.6

07:58 Eurozone Services PMI (Finally) June 53.2 52.8 52.8

08:30 United Kingdom Purchasing Manager Index Services June 58.6 58.1 57.7

09:00 Eurozone Retail Sales (MoM) May +0.4% +0.3% 0.0%

09:00 Eurozone Retail Sales (YoY) May +2.4% +0.7%

The U.S. dollar traded higher against the most major currencies. The U.S. currency was supported by yesterday's the better-than-expected U.S. jobs report. The U.S. economy added 281,000 jobs in June, after an increase of 179,000 jobs in May.

The New Zealand dollar traded slightly lower against the U.S dollar in the absence of any major economic reports in New Zealand.

The Australian dollar declined against the U.S. dollar after mixed Australian economic data and comments by the Reserve Bank of Australia (RBA) Governor Glenn Stevens. The RBA Governor said that the Australian dollar remains high by historical standards and investors are underestimating the probability of a significant fall in the Australian dollar at some point.

Retail sales in Australia decreased 0.5% in May, missing expectations for a 0.3% gain, after a 0.1% decline in April. April's figure was revised down from a 0.2% rise.

Building permits in Australia increased 9.9% in May, exceeding expectations for a 3.5% gain, after a 5.8% slip in April. April's figure was revised down from a 5.6% decrease.

AIG services index for Australia declined to 47.6 in June from 49.9 in May.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports in Japan.

EUR/USD: the currency pair declined to $1.3645

GBP/USD: the currency pair fell to $1.7150

USD/JPY: the currency pair climbed to Y101.95

AUD/USD: the currency pair decreased to $0.9371

The most important news that are expected (GMT0):

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15%

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions May -0.64 -0.3

12:30 U.S. International Trade, bln May -47.2 -45.1

12:30 U.S. Initial Jobless Claims June 312 310

12:30 U.S. Average hourly earnings June +0.2% +0.2%

12:30 U.S. Nonfarm Payrolls June 217 211

12:30 U.S. Unemployment Rate June 6.3% 6.3%

14:00 U.S. ISM Non-Manufacturing June 56.3 56.2

EUR / USD

Resistance levels (open interest**, contracts)

$1.3752 (2927)

$1.3709 (5984)

$1.3681 (2285)

Price at time of writing this review: $ 1.3651

Support levels (open interest**, contracts):

$1.3627 (1835)

$1.3591 (3933)

$1.3541 (4583)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 32909 contracts, with the maximum number of contracts with strike price $1,3700 (5984);

- Overall open interest on the PUT options with the expiration date July, 3 is 42478 contracts, with the maximum number of contracts with strike price $1,3500 (5608);

- The ratio of PUT/CALL was 1.29 versus 1.29 from the previous trading day according to data from July, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.7400 (1019)

$1.7300 (423)

$1.7201 (3451)

Price at time of writing this review: $1.7156

Support levels (open interest**, contracts):

$1.7099 (730)

$1.7000 (2186)

$1.6900 (2269)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 32171 contracts, with the maximum number of contracts with strike price $1,7150 (8273);

- Overall open interest on the PUT options with the expiration date July, 3 is 30161 contracts, with the maximum number of contracts with strike price $1,6700 (2413);

- The ratio of PUT/CALL was 0.94 versus 0.96 from the previous trading day according to data from Jule, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(raw materials / closing price /% change)

Gold $1,327.66 +1.20 +0.09%

Oil $104.38 -0.96 -0.91%

(index / closing price / change items /% change)

S&P/ASX 200 5,455.4 +79.50 +1.48%

TOPIX 1,280.78 +4.70 +0.37%

SHANGHAI COMP 2,059.42 +9.04 +0.44%

HANG SENG 23,549.62 +358.90 +1.55%

FTSE 100 6,816.37 +13.45 +0.20%

CAC 40 4,444.72 -16.40 -0.37%

DAX 9,911.27 +8.86 +0.09%

Dow +20.17 16,976.24 +0.12%

Nasdaq -0.92 4,457.73 -0.02%

S&P +1.29 1,974.61 +0.07%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3656 -0,16%

GBP/USD $1,7163 +0,09%

USD/CHF Chf0,8887 +0,16%

USD/JPY Y101,76 +0,22%

EUR/JPY Y138,97 +0,05%

GBP/JPY Y174,65 +0,30%

AUD/USD $0,9441 -0,54%

NZD/USD $0,8771 +0,02%

USD/CAD C$1,0666 +0,33%

(time / country / index / period / previous value / forecast)

01:00 Australia RBA's Governor Glenn Stevens Speech

01:00 China Non-Manufacturing PMI June 55.5 55.0

01:30 Australia Building Permits, m/m May -5.6% +3.5% +9.9%

01:30 Australia Building Permits, y/y May +1.1% +14.3%

01:30 Аustralia Retail sales (MoM) May +0.2% +0.3% -0.5%

01:30 Australia Retail Sales Y/Y May +5.7%

01:45 China HSBC Services PMI June 50.7 53.1

07:48 France Services PMI (Finally) June 49.1 48.2

07:53 Germany Services PMI (Finally) June 56.0 54.8

07:58 Eurozone Services PMI (Finally) June 53.2 52.8

08:30 United Kingdom Purchasing Manager Index Services June 58.6 58.1

09:00 Eurozone Retail Sales (MoM) May +0.4% +0.3%

09:00 Eurozone Retail Sales (YoY) May +2.4%

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15%

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions May -0.64 -0.3

12:30 U.S. Average workweek June 34.5

12:30 U.S. International Trade, bln May -47.2 -45.1

12:30 U.S. Initial Jobless Claims June 312 310

12:30 U.S. Average hourly earnings June +0.2% +0.2%

12:30 U.S. Nonfarm Payrolls June 217 211

12:30 U.S. Unemployment Rate June 6.3% 6.3%

13:45 U.S. Services PMI (Finally) June 61.2

14:00 U.S. ISM Non-Manufacturing June 56.3 56.2

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.