- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-05-2022

- Silver remains pressured despite taking rounds to the key Fibonacci retracement level.

- 12-day-old descending resistance line, bearish MACD directs the metal towards the key trend line support.

- Any recovery remains elusive until the quote rises past 200-DMA.

Silver (XAG/USD) prices stay sidelined at around $22.60, retreating of late, during Wednesday’s Asian session. In doing so, the bright metal clings to 78.6% Fibonacci retracement (Fibo.) of late 2021 to March’s peak, fading the early week’s rebound from a short-term key support line.

An important Fibo. level restricts the quote’s immediate moves around $22.55. However, bearish MACD signals and the failures to cross a downward sloping trend line from April 18 favor sellers to aim for the $22.15 support, comprising an upward sloping support line from early January.

Following that, the yearly bottom surrounding $21.95 and the December 2021 low of $21.42 could lure the XAG/USD sellers.

On the flip side, a clear upside break of the aforementioned resistance line, at $22.75 by the press time, won’t be enough for the buyers’ return as the 61.8% Fibonacci retracement level of $23.55 will challenge the rebound afterward.

Also acting as an upside hurdle is the 200-DMA, close to $23.75 at the latest, a break of which will need validation from March’s low near $24.00 before pleasing the silver buyers.

Silver: Daily chart

Trend: Further weakness expected

- The shared currency bulls have cushioned around 1.0500 but the downside is still favored.

- Formation of a Bearish Pennant chart pattern signals continuation of a downtrend.

- Slippage of the RSI (14) below 40.00 will trigger a bearish bias ahead.

The EUR/USD pair is displaying back and forth moves in the early Tokyo session ahead of the Fed’s policy, which is likely to stretch its interest rates to tame the galloping inflation. A range-bound move in mid-1.0500s is signaling a contraction in the standard deviation, which will be followed by wild moves going forward.

On an hourly scale, EUR/USD is forming a Bearish Pennant chart pattern that displays the continuation of a bearish move after a consolidation phase. Usually, a consolidation phase after a bearish momentum denotes short buildups from those investors who prefer to enter a trade when a bearish bias sets in. The asset is consolidating in a tad wider range of 1.0490-1.0578.

The 200-period Exponential Moving Average (EMA) at 1.0608 is still scaling lower, which adds to the downside filters while the asset is hovering around the 50-EMA at 1.0525, which dictates a consolidation phase.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which signals a directionless move that will be followed by wider ticks and volumes.

Should the asset drops below last week’s low at 1.0471, a bearish trigger will drag the asset towards the round level support and 2017’s low at 1.0400 and 1.0340 respectively.

On the flip side, euro bulls can regain strength if the asset oversteps Friday’s high at 1.0593 decisively. This will send the asset towards April 27 high at 1.0655, followed by the round level resistance at 1.0700.

EUR/USD hourly chart

-637872173839828989.png)

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, snapped a two-day fall with a recovery move to 2.83% by the end of Tuesday’s US session.

In doing so, the inflation gauge bounced off the lowest levels since April 13 as traders brace for the key Federal Open Market Committee (FOMC).

The key economic precursor rose to a record high during late April before easing from 3.02%. Even so, the rate remains well in support of the Fed’s anticipated hawkish move.

Read: Fed May Preview: 'Less hawkish' is the new dovish

It’s worth noting, however, that the quote’s latest uptick joins the pre-Fed cautious mood to weigh on the market’s moves, as well as help the US dollar to regain. As a result, commodities and Antipodeans witness pressure before the crucial event, namely the Fed meeting.

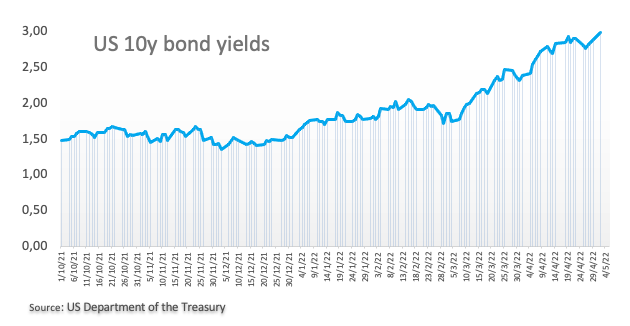

- The US 10-year Treasury yield has jumped since April 27, 30-bps.

- Expectations of a 50-bps rate hike by the Fed keep US Treasury yields upward pressured.

On Tuesday, the US 10-year Treasury yield registered losses of one basis point and finished around 2.979% amidst a choppy trading session ahead of the Federal Reserve May meeting.

The 10-year benchmark note began Tuesday’s session around 2.990% and reached a daily high at around 3.010%, but retreated from the YTD highs and settled around 2.979%.

Wednesday’s Federal Reserve monetary policy decision had kept US Treasury yields in the driver’s seat since April 27, as investors expect at least a 50-bps rate hike by the Fed, alongside the beginning of the reduction of the $8.9 trillion balance sheet.

Also read: Gold Price Forecast: XAU/USD bears reclaimed the 100-DMA and targets the 200-DMA at around $1835

US 10-year Treasury Yield Forecast: Technical outlook

From a technical analysis perspective, the 10-year benchmark note is upward biased. However, it faces solid resistance around the 3% threshold, a level not reached since December 2018. The Relative Strength Index (RSI) at 67.44 aims lower, contrary to the 10-year graph, which means that negative divergence between the yield/oscillators could drag yields lower.

With that said, on the downside, the US 10-year T-note yield first support would be the 2.80% threshold. A break below would expose March’s 2019 2.77% high, followed by April 27 lows at 2.717%. In the event of yields plunging lower, the next stop would be March’s 28 highs at around 2.557%.

To the upside, the US 10-year T-note yield first resistance would be 3.00%. A breach of the latter would expose November 7, 2018, highs at around 3.252%.

The Reserve bank of New Zealand governor, Adrian Orr, is speaking at a press conference and says that the central bank's ''aim is to keep inflation expectations from growing.'' He added that they cannot rule out a worldwide recession in the coming months.

Earlier, the Reserve Bank of New Zealand released its May 2022 Financial Stability Report. Reuters posted key notes from the reports follows:

''The New Zealand financial system remains well placed to support the economy.''

''If interest rates need to increase more than currently anticipated to contain inflationary pressure, this could lead to a softening in the labour market over time.''

''A slowdown in global growth, increasing trade protectionism, or further sanctions could amplify trade impacts in NZ.''

Meanwhile, the NZD has been drifting in markets and is doing little despite the jobs data coming in line with expectations as a rate hiking prospect for this month's meeting.

-

NZD/USD remains stuck around 0.6440 on a steady NZ Unemployment Rate at 3.2%

- GBP/USD remains sidelined, stays pressured despite the previous day’s corrective pullback.

- Clear break of ascending triangle, sustained trading below 200-HMA keeps sellers hopeful.

- Fortnight-old falling trend line offers immediate support ahead of the multi-month low marked last week.

GBP/USD aptly portrays the pre-Fed trading lull while taking rounds to 1.2500 during Wednesday’s Asian session.

The cable pair printed mild gains the previous day as a pullback from 1.2567 reversed the early Tuesday’s upbeat performance. In doing so, the quote broke an ascending triangle to the south and favored bears ahead of the key day.

Bearish MACD signals and the GBP/USD pair’s sustained trading below 200-HMA also keep the sellers hopeful.

That said, the previous resistance line from April 21, around 1.2460 by the press time, offers immediate support to the pair ahead of the latest multi-month low near 1.2410.

It’s worth noting that the GBP/USD weakness past 1.2410 will be tested by the 1.2400 threshold before directing bears towards the June 2020 bottom of 1.2251.

Alternatively, the aforementioned one-week-old triangle’s upper line, around 1.2600-2610, will restrict the quote’s short-term rebound ahead of the 200-HMA level surrounding 1.2635.

Even if the GBP/USD crosses the 200-HMA hurdle, the buyers remain cautious until witnessing a clear upside past the 1.2975-80 region comprising mid-April lows.

GBP/USD: Hourly chart

Trend: Bearish

- AUD/NZD stays firmer after NZ Q1 2022 jobs data fails to impress sellers.

- New Zealand Employment Change, Unemployment Rate match market forecasts.

- RBA’s more-than-expected rate hike, pre-Fed consolidation previously favored bulls before NZ GDT Price Index.

- Australia Retail Sales for March will offer immediate direction but FOMC will have a higher say.

AUD/NZD remains mostly sidelined around 1.1035, mildly up of late, following the release of the New Zealand jobs report on early Wednesday in Asia.

As per the latest New Zealand (NZ) employment report from the Statistics New Zealand, the first quarter (Q1) 2022 Employment Change and Unemployment Rate figures match 0.1% and 3.2% respective market forecasts. Details suggest that the Participation Rate eased to 70.9% versus 71.1% expected and prior whereas Labour Cost Index met the 3.1% YoY expectations compared to 2.8% prior readouts.

Read: New Zealand Employment Report leaves NZD sidelined ahead of Fed

Earlier in the day, NZ GDT Price Index registered fourth consecutive slump with -8.5% figure, the most since 2015, versus -0.3% expected and -3.6% previous readings. Following that, the Reserve Bank of New Zealand (RBNZ) Financial Stability Report (FSR) praised the economic transition.

Read: RBNZ: The New Zealand financial system remains well placed to support the economy.

It’s worth noting that the Reserve Bank of Australia’s (RBA) higher-than-expected rate lift, as well as robust inflation and hopes of tighter monetary policy from other major central banks added strength to the AUD/NZD prices the previous day. However, pre-Fed caution seems to have tested the bulls afterwards.

Moving on, Australia’s Retail Sales for March, expected 0.6% versus 1.8% prior, will offer immediate direction to the pair but major attention will be given to the market’s mood ahead of the Federal Open Market Committee (FOMC).

Technical analysis

A daily closing beyond the August 2020 top surrounding 1.1045 becomes necessary for the AUD/NZD bulls to rule out a pullback towards a seven-week-old support line near 1.0850.

- NZD/USD has faced barricades around 0.6440 on the flat jobless rate and Employment Change.

- This has bolstered the odds of a rate hike by the RBNZ.

- Fed’s policy is in the spotlight and a jumbo rate hike looks certain.

The NZD/USD pair has not displayed any firmer move as Statistics New Zealand has reported the Unemployment Rate at 3.2%. The jobless rate is in line with the market consensus and prior print of 3.2%. The NZ jobless rate at 3.2% signals the continuation of a tight labor market in the kiwi area, which signals a wage-price hike going forward. Also, the Employment Change has been printed at 0.1% similar to the market consensus and prior print of 0.1%.

This has improved the expectations of one more rate hike by the Reserve Bank of New Zealand (RBNZ) on May 25. The market participants should be aware of the fact that the RBNZ raised its interest rates by a hefty 50 basis points (bps) resulting in a 1.5% Official Cash Rate (OCR) in the second week of April.

Meanwhile, the US dollar index (DXY) is facing barricades at 103.50. The asset is displaying exhaustion ahead of the interest rate decision by the Federal Reserve (Fed). The DXY has witnessed a dream rally last month after surging around 4% on expectations of an aggressive hawkish tone from the Fed. Apart from the rate hikes, investors are also expecting the announcements of balance sheet reduction and hawkish guidance for the remaining year.

Although the Fed’s policy will remain in the spotlight, investors will also focus on the release of ISM Services PMI, which is seen at 58.5 against the prior print of 58.3.

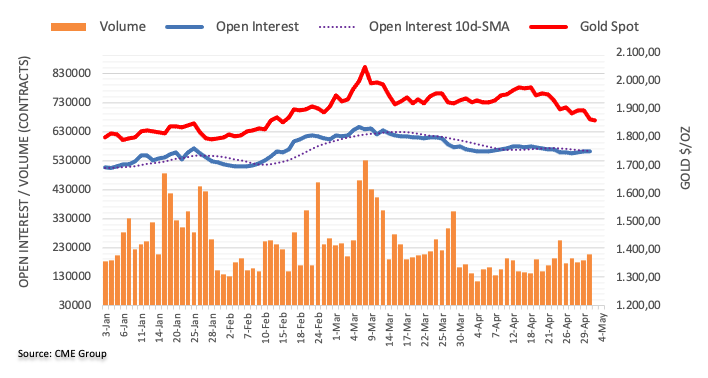

- On Tuesday, gold rose some 0.26%, though it remains below the 100-DMA.

- The yellow-metal gains were capped by falling crude oil prices and choppy trading ahead of the FOMC meeting.

- Gold Price Forecast (XAU/USD): Given that gold bears achieved a daily close below the 100-DMA, a move towards the 200-DMA is on the cards.

Gold spot (XAU/USD) slid below the 100-day moving average (DMA) at $1881.38 and recorded a daily close nearby on Monday, ahead of Wednesday’s Federal Reserve monetary policy decision, widely expected to hike rates by 50-bps, amid a scenario of high global inflation, courtesy of the Ukraine-Russia war, alongside an ongoing Covid-19 crisis in China, which threatens to disrupt the supply chain. At $1868.09, the yellow metal records minimal gains of 0.01%.

Sentiment in the financial markets is positive, as shown by gains in US equities amidst a choppy trading session ahead of the FOMC’s meeting. Asian futures are set to open higher while crude oil prices fell, a lid on precious metals gains.

The US Dollar Index fell for the second time in the last four days but clings to the 103 mark, at 103.455, registering a loss of 0.14%. Additionally, US Treasury yields dropped, led by the 10-year benchmark note, which sat at 2.979%, and fell two basis points, undermining the greenback.

On Tuesday, the Fed’s May meeting began. Furthermore, the US economic docket featured US Factory Orders for March, which grew by 2.2% m/m, beating the 1.1% foreseen. In the meantime, US JOLTs Job Openings for March rose to 11.549M, worst than the 11M estimations, illustrating a tight US labor market.

Despite mixed US data, the Federal Reserve is expected to lift rates by 50-bps on Wednesday and could begin reducing its balance sheet by $95 billion. Still, money market futures have also priced in additional 50-bps increases in June, July, and September meetings, which means that the Federal Funds Rate would be lying at the 2.25-2.50% range around that time.

Gold Price Forecast (XAU/USD): Technical outlook

The XAU/USD’s daily chart depicts the yellow metal as neutral biased. Furthermore, XAU/USD bears achieved a daily close below the 100-day moving average (DMA), lying at $1881.38, paving the way for XAU/USD’s further losses.

On the downside, gold’s first support would be the 200-DMA at $1835.08. A break below would expose an upslope trendline around $1810-15, followed by a renewed test of $1800.

Upwards, XAU/USD’s first resistance would be the 100-DMA at $1881.38. A breach of the latter would expose $1890, followed by $1900, and then April’s 29 daily high at $1919.77.

The first quarter labour market data for new Zealand has arrived and has little effect n the price of NZD with the Unemployment Rate coming in as expected at 3.2%. The focus is on the Federal Reserve.

Employment Report

Unemployment rate 3.2 pct (Reuters poll 3.2 pct).

Q1 s/adj jobs growth +0.1 pct QoQ (Reuters poll +0.1 pct).

Q1 participation rate 70.9 pct (Reuters poll 71.1 pct).

Q1 lci private sector wages (ex-o'time) +0.7 pct on pvs qtr (Reuters poll +0.7 pct).

Q1 lci private sector wages (ex-o'time) +3.1 pct on year ago (Reuters poll +3.1 pct).

Some may have been a touch disappointed that the Unemployment Rate did not come in lower vs Q4, 3.2%. However, markets will continue to expect tightness in the labour market and a need for the central bank to tighten rates at this month's meeting. A 50bp OCR hike is on the cards as it is evident that the Reserve Bank of Nzezealand is eager to get on top of inflation expectations.

NZD/USD update

The price is testing a weekly demand area and a correction higher could be on the cards, although this will depend on the Fed in the near term and then the RBNZ.

The price, from an hourly perspective, remains within a sideways channel.

Meanwhile, the focus is on the Federal Reserve and ''if the Fed frames near term aggressive hikes as likely to limit the terminal rate, that could slow the USD’s ascent near term,'' analysts at ANZ Bank argued.

About the Unemployment Rate

The Unemployment Rate released by the Statistics New Zealand is the number of unemployed workers divided by the total civilian labor force. If the rate is up, it indicates a lack of expansion within the New Zealand labor market. As a result, a rise leads to weaken the New Zealand economy. A decrease of the figure is seen as positive (or bullish) for the NZD, while an increase is seen as negative (or bearish).released by the Statistics New Zealand is the number of unemployed workers divided by the total civilian labor force. If the rate is up, it indicates a lack of expansion within the New Zealand labor market. As a result, a rise leads to weaken the New Zealand economy. A decrease of the figure is seen as positive (or bullish) for the NZD, while an increase is seen as negative (or bearish).

- USD/CAD grinds lower after the biggest daily fall in two weeks.

- US dollar pares recent gains ahead of the key FOMC.

- BOC’s Rogers teased higher rates but strong US data, hawkish expectations from Fed challenge further downside.

- US ISM Services PMI, Canadian trade numbers will add to the economic docket for a watch.

Having dropped the most in a fortnight, USD/CAD holds lower grounds near 1.2830 during the initial Asian session on Wednesday as bears take a breather ahead of the key data/events.

The Loonie pair’s pullback on Tuesday could be linked to the US dollar’s consolidation ahead of the Federal Reserve (Fed) monetary policy decision. Also favoring the USD/CAD prices were the comments from the Bank of Canada (BOC) policymaker Carolyn Rogers, not to forget firmer equities.

It’s worth noting, however, that the oil prices fail to cheer softer USD and ended posting daily losses, which in turn restricted the USD/CAD pair’s immediate downside due to Canada’s reliance on oil exports. Also challenging the quote were strong US JOLTS Job Openings and Factory Orders for March.

Moving on, USD/CAD prices are likely to remain pressured amid the pre-Fed anxiety. Though, the south-run will have a bumpy road unless the Fed chose to disappoint markets, either via rate actions or comments suggesting a softer approach to deal with robust inflation.

Other than the Federal Open Market Committee (FOMC), monthly prints of the US ISM Services PMI for April and Canadian International Merchandise Trade data for March will be crucial to watch for short-term directions.

Technical analysis

USD/CAD bears attack a fortnight-old rising trend line, around 1.2835 by the press time, after failing to cross March month’s high of 1.2900 on a daily closing basis. Given the RSI’s pullback from the nearly overbought zone and bullish MACD signals, the Loonie pair is less likely to extend the south-run.

- The DXY is struggling to sustain above 103.50 amid uncertainty over the Fed’s policy announcement.

- In addition to a rate hike, investors are expecting quantitative tightening and hawkish guidance.

- Inflation may inch further as commodities have not shown any sign of exhaustion yet.

The US dollar index (DXY) is failing to find any direction as investors have squeezed their positions significantly amid uncertainty over the release of the monetary policy by the Federal Reserve (Fed). The DXY has remained on the seventh heaven for a few trading weeks on bolstered odds of a jumbo rate hike by the Fed.

Expectations from the Fed in the monetary policy meeting

An announcement of interest rate elevation by 50 basis points (bps) is on the cards. The Fed is going to bring a healthy stretch in the interest rates to corner the inflation mess. Apart from that, the galloping balance sheet demands a serious reduction now, therefore investors should brace for quantitative tightening. Lastly, more rate hikes by half a percent for the remaining year could be announced by the Fed. The Fed is determined to return to the neutral rate culture by the end of this year and for the happening of the event, bulk rate hikes are highly required.

On the front of the economic indicators, the Fed could dictate that inflation is expected to bring more upside to the table as commodity and fossil fuel prices have not shown any kind of exhaustion yet. Also, the tight labor market will stay for longer and the economy is much more solid to face the heat of liquidity contraction going forward.

Key events this week: ISM Services PMI, Initial Jobless Claims, Nonfarm Payrolls (NFP), Unemployment Rate.

Eminent issues on the back boiler: Russia-Ukraine Peace Talks, Fed interest rate decision, Bank of England (BOE) interest rate announcement.

New Zealand quarterly employment report overview

Early Wednesday in Asia, at 22:45 GMT Tuesday the world over, the global market sees the first-quarter (Q1) 2022 employment data from Statistics New Zealand.

With the Reserve Bank of Australia’s (RBA) higher-than-expected rate lift, as well as robust inflation and hopes of tighter monetary policy from other major central banks, today’s jobs report becomes crucial for the NZD/USD traders, mainly due to the wage prices index data.

Market consensus suggests no change in the headline Unemployment Rate of 3.2% and the Employment Change figure of 0.1%. Further, the Participation Rate may also remain unchanged at 71.1% but the Labour Cost Index could rise to 3.1% from 2.8%.

Ahead of the data, ANZ said,

We expect the NZ labor market data to be strong, with unemployment to fall to 3.1%, but against a market that’s already pricing in hefty hikes, the hurdle for impact is high.

On the same line Westpac mentioned,

Ongoing tightness in the labor market suggests employment growth will remain subdued and the unemployment rate will fall slightly in Q1 (Westpac f/c: 3.0% and 0.2% respectively); the labour cost index should continue to indicate wages growth with a lag behind inflation (Westpac f/c: 0.7%).

How could it affect the NZD/USD?

NZD/USD edges lower towards 0.6400, fading the previous day’s bounce off the lowest levels since June 2020, as traders await the key NZ jobs report, as well as the Fed’s verdict.

As the pre-Fed anxiety gains momentum, the NZD/USD prices weaken. However, firmer inflation data at home, coupled with the RBNZ’s readiness to faster normalizing rates, strong employment data will back the consensus of a 0.50% rate hike in the next move, which in turn could offer immediate strength to the Kiwi pair. Even so, the upside momentum is likely to be less impressive considering the market’s cautious mood.

Technically, a descending trend line from August 2021, around 0.6370, lures NZD/USD bears unless the quote rises successfully beyond January’s low near 0.6530.

Key Notes

NZDUSD steady above 0.6400 ahead of NZ employment data, Fed’s decision

NZ Employment Preview: Forecasts from four major banks, another record low

About New Zealand unemployment rate and employment change

The quarterly report on New Zealand's unemployment rate and employment change is being released by Statistics New Zealand.

The unemployment rate is the number of unemployed workers divided by the total civilian labor force. If the rate is up, it indicates a lack of expansion within the New Zealand labor market. As a result, a rise leads to weaken the New Zealand economy. A decrease of the figure is seen as positive (or bullish) for the NZD, while an increase is seen as negative (or bearish).

On the other hand, employment change is a measure of the change in the number of employed people in New Zealand. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. A high reading is seen as positive (or bullish) for the NZ dollar, while a low reading is seen as negative (or bearish).

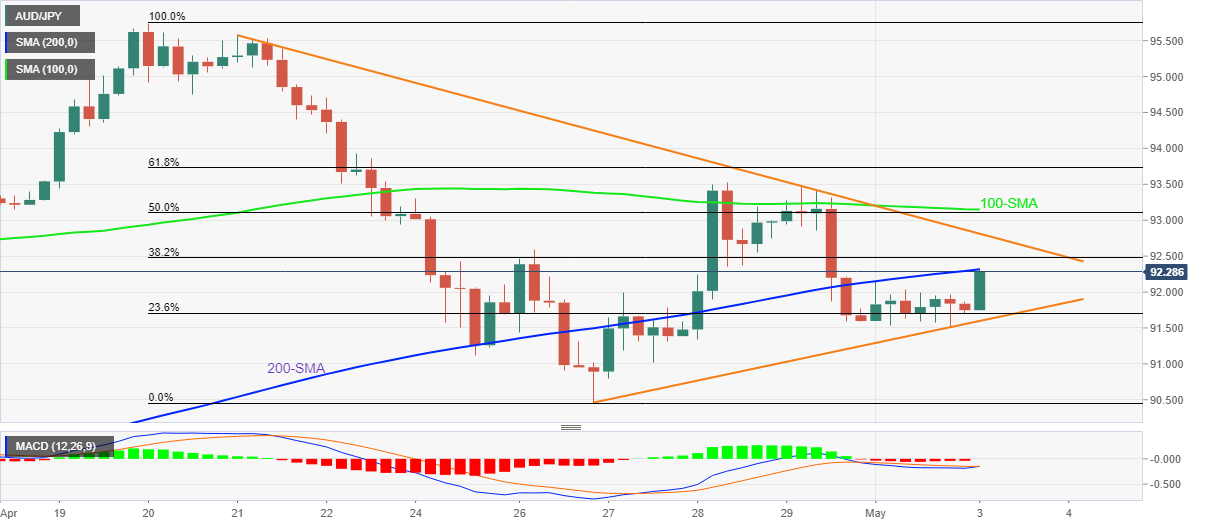

- The AUD/JPY edges high for the second-consecutive day, though it remains trapped in the 91.90-92.60 range.

- A positive market mood could not trigger a strong rally for the Australian dollar, despite the RBA hiking rates by 25-bps.

- AUD/JPY Price Forecast: The outlook remains constructive, though a break above 94.00 would open the door for further gains; otherwise, a test of April’s lows at around 90.43 is on the cards.

The AUD/JPY prints modest gains on Tuesday after the Reserve Bank of Australia pulled the trigger and hiked “surprisingly” interest rates by 25-bps for the first time since November 2010. At 92.34, the AUD/JPY failed to rally sharply, as the next central bank expected to tighten monetary conditions, the Federal Reserve, would unveil its decision on Wednesday.

Investors’ mood remains positive, as shown by US equities advancing ahead of the Fed’s May meeting. The Australian dollar is the strongest currency in the FX complex, while the safe-haven peers, the CHF, JPY, and the greenback, are the laggards.

Factors like China’s coronavirus crisis threaten to derail the global economic recovery. Furthermore, developments around the Ukraine-Russia conflict, like the oil embargo and Russia’s demand for natural gas being paid in roubles, keep energy prices upward pressured, though they seem to weigh less in the market mood.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY is still upward biased, despite the dip from YTD highs around 95.74, to April 27 daily lows at 90.43. The daily moving averages (DMAs) below the exchange rate confirm the aforementioned. The MACD-line, as shown by its histogram, begins to aim towards the signal-line, meaning that “some” buyers could be adding long positions in the AUD/JPY.

With that said, the AUD/JPY’s first resistance would be the downslope trendline drawn from the YTD tops that pass around the 92.80-93.20 area. A breach of the latter would expose the 94.00 mark, followed by the March 28 daily high at 94.32, and then the 95.00 figure.

On the other hand, if the AUD/JPY breaks below the April 28 daily low at 91.33, that would open the door for a test of April 27 at 90.43, but first, AUD/JPY bears would need to overcome some hurdles on the way down. The following support after 91.33 would be 91.00, followed by April’s 27 low.

Key Technical Levels

- AUD/USD sits in sideways consolidation in anticipation of the Fed.

- The RBA spike was shorted lived as traders move to the sidelines.

AUD/USD stuck to a sideways drift on Tuesday following an initial spike on the back of a hawkish Reserve Bank of Australia. AUD/USD traded between 0.7150 highs and a low of 0.7080 in New York.

The RBA surprises everyone with a 25bp move. Analysts at ANZ Bank explained, ''in what might be termed a ‘goldilocks’ move, the RBA decided that 15bp was too small, 40bp too much whereas a 25bp lift in the cash rate was a return to 'business as usual.'''

''In his post-meeting press conference, the Governor indicated that it was “not unreasonable to expect” the cash rate to eventually get to 2.5%. This is in line with our expectation for mid-2023, though we continue to think the cash rate will eventually need to move into the 3s – albeit not for some time after next year. Lowe also said that the RBA was 'not inclined to deviate” from monthly moves of 25bp “unless there is a very strong argument to do so.' A lift in underlying inflation to almost 5% by the end of this year might be viewed by some as meeting that threshold.''

Meanwhile, looking at the greenback, the US dollar came under pressure against a basket of currencies on Tuesday, as investors start to move to the sidelines ahead of the Fed. The dollar index (DXY) was last at 103.47, down 0.13% on the day, after reaching 103.93 on Thursday, the highest since December 2002. With inflation running at its fastest pace in 40 years, DXY hit a 20-year high on expectations the US central bank will be more aggressive than its peers while expecting a stronger US economy than that of the eurozone.

For the day ahead, investors are in anticipation of the Fed and expect the central bank to hike rates by 50 basis points at the end of a two-day meeting on Wednesday in order to combat soaring inflation. The markets are going to be listening closely to the comments by Chairman Jerome Powell for further clues on future rate hikes.

- USD/CHF looks to overstep 0.9800 as expectations of a hawkish tone by the Fed bolstered.

- An aggressive tight policy stance will shrink liquidity and growth rate going forward.

- The Swiss CPI is seen at 2.5% against the prior print of 2.4%.

The USD/CHF pair is attempting to test the round level resistance of 0.9800 after failing to kiss the same in the last New York session. Broad-based strength in the US dollar index (DXY) is supporting the asset to resume rallying higher.

The asset has printed a fresh yearly high at 0.9800 on Tuesday ahead of the announcement of the monetary policy by the Federal Reserve (Fed). A serious transition from an ultra-loose stimulus era into a tight liquidity phase is strengthening all the greenback-dominated currencies. Tight monetary policy in the US economy will keep the greenback in the grip of bulls for a prolonged period. The Fed is highly expected to announce a rate hike by 50 basis points (bps), which will shrink liquidity and henceforth have a significant impact on the growth rate.

The DXY is oscillating in a narrow range of 103.44-103.51 in the early Tokyo session and has been displaying high volatility since Tuesday. Meanwhile, the 10-year US Treasury yields are moving higher to recapture the psychological resistance of 3%.

On the Swiss front, investors are eyeing the release of the Consumer Price Index (CPI), which is due on Thursday. A preliminary reading shows a tad improvement in the inflation figure at 2.5% against the prior print of 2.4%.

The Reserve Bank of New Zealand released its May 2022 Financial Stability Report. Reuters posted key notes from the reports follows:

The New Zealand financial system remains well placed to support the economy.

House prices remain above sustainable levels despite recent declines.

Rising global interest rates have put downward pressure on the prices of assets such as equities; housing.

Expect to see a slowdown in high-DTI lending over the coming months.

While gradual adjustment in house prices to a more sustainable level is desirable for the stability of the financial system, larger correction remains a possibility.

If interest rates need to increase more than currently anticipated to contain inflationary pressure, this could lead to a softening in the labour market over time.

Expect the increasing trend in capital ratios will continue during the next few years as the remaining elements of capital review are implemented.

Proceeding to design a framework for operationalising DTI restrictions.

Our 2022 stress test programme investigates risk for banks from higher interest rates & falling house prices.

Underlying weaknesses in some industries may be revealed as targeted fiscal support is removed.

Intend to have the framework for operationalising DTI restrictions finalised by late 2022.

A slowdown in global growth, increasing trade protectionism, or further sanctions could amplify trade impacts in NZ.

Meanwhile, the NZD has been drifting in markets on Tuesday ahead of key employment data but it erased most of yesterday’s gains made before the larger than expected hike by the Reserve Bank of Australia.

- USD/JPY bears are seeking a deeper correction.

- The 50% mean reversion level is holding up, guarding a 61.8% retracement.

USD/JPY ended the day flat on Wall Street around as markets moved into consolidation ahead of the Federal Reserve. At the time of writing, USD/JPY is trading at 130.16 and has traded between 129.69 and 130.29. The pair is correcting a bullish impulse in the daily charts that was made when the US dollar rallied to 20-year highs last week.

The following illustrates the price in the daily chart and prospects of a deeper retracement:

USD/JPY daily chart

The W-formation is a reversion pattern and so far, the price has corrected into a 50% mean reversion area which is holding up as support. A break of here would be expected to see the price challenge the old highs and presumed support near a 61.8% golden ratio of around 128.60.

What you need to take care of on Wednesday, May 4:

Financial markets were in a better mood on Tuesday, with global indexes managing to post gains, resulting in less demand for the safe-haven dollar.

However, spiraling inflation, tensions in Europe amid the Russian war on Ukraine and a rising number of coronavirus contagions, not only in China, anticipate a long road ahead towards economic stability and kept investors in cautious mode.

At the same time, central banks have started draining markets from easy money meant to provide support in the early stages of the pandemic. The Reserve Bank of Australia hiked the cash rate by 25 bps early on Tuesday. The US Federal Reserve and the Bank of England will announce their decisions in the upcoming days, and both could pull the trigger by 50 bps.

The yield on the 10-year US Treasury note peaked at 3% on Monday, while the German note yielded over 1% for the first time since 2015, both easing on Tuesday and putting some pressure on the greenback.

Global indexes edged higher, although Wall Street trimmed most of its gains ahead of the close, giving the dollar a chance to recover some ground.

The American dollar is still the strongest, as Tuesday's losses were modest, and the currency holds on to most of its yearly gains. EUR/USD hovers around 1.0510 early in the Asian session, while GBP/USD cannot sustain gains beyond the 1.2500 figure. Commodity-linked currencies posted modest gains against their American rival, with AUD/USD now trading around0.7090 and the USD/CAD pair around 1.2840.

Gold ticked higher, now trading at around $1,866 a troy ounce. Crude oil prices eased, with WTI changing hand at $102.75 a barrel.

Top 3 Price Prediction Bitcoin, Ethereum, XRP: Crypto shows signs of bouncing in May

Like this article? Help us with some feedback by answering this survey:

- EUR/USD is holding up despite the Fed expectations.

- Traders are moving to the sidelines in anticipation of the Fed's announcements.

EUR/USD is regaining some territory into the Wall Street close as the greenback continues to be faded, unable to break higher as traders start to move to the sidelines ahead of the Federal Reserve. In contrast to the expectations the Fed, however, the European Central Bank's tightening expectations remain subdued which has given the US dollar a boost over the euro of late.

At the time of writing, at 1.0522, the euro is some 0.18% higher at and has travelled from a low of 1.0492 to a high of 1.0577 so far. The markets are pausing in the trade of between the ECB and Fed. However, the divergence favours the greenback with the ECB WIRP suggesting odds of liftoff June 9 are now around 25% vs. 30% at the start of this week and 40% at the start of last week, while liftoff July 21 remains fully priced in, as analysts at Brown Brothers Harriman noted. By stark contrast, a hawkish outcome is expected for the months ahead.

ECB eyes on troubling data

Meanwhile, data has been released which do not paint the best looking picture for the eurozone. Eurozone reported March PPI and Unemployment. The PPI climbed 36.8% YoY vs. 36.3% expected and a revised 31.5% (was 31.4%) in February, while the Unemployment Rate arrived in at the expected 6.8% vs. a revised 6.9% (was 6.8%) in February. Germany also reported Unemployment at -13k vs. -15k expected and -18k in February, with the Unemployment Rate firm at 5.0%.

''The PPI readings are worrisome as the acceleration implies further upside pressure on CPI in the coming months,'' analysts at BBH explained.

As for the Fed, while consecutive rate hikes of at least 50bps are expected, the analysts at BBH also explained that the ''March minutes also showed that “the Committee was well placed to begin the process of reducing the size of the balance sheet as early as after the conclusion of its upcoming meeting in May.” If the Fed stays true to form, then a plan close to the one outlined here will be announced Wednesday and implemented on May 15.'' Traders will be looking to the comments by Chairman Jerome Powell for further clues on future rate hikes.

Looking to the US dollar, the greenback came under pressure against a basket of currencies on Tuesday, as investors start to move to the sidelines ahead of the Fed. With inflation running at its fastest pace in 40 years, DXY hit a 20-year high at the end of last week's business on expectations the US central bank will be more aggressive than its peers while expecting a stronger US economy than that of the eurozone.

However, supporting the euro on Tuesday, a gauge of global equity markets rose slightly on Tuesday. MSCI's gauge of stocks across the globe (IACWI) gained 0.23% and the pan-European STOXX 600 index (.STOXX) rose 0.09% after surviving a "flash crash" on Monday in Nordic markets caused by a sell order trade by Citigroup.

- The New Zealand dollar continues its eight-day free fall from 0.6800s to 0.64000.

- The Federal Reserve began its two-day monetary policy meeting, expected to hike rates by 0.50% and start reducing the balance sheet.

- A positive Q1 New Zealand employment data increased the odds of a 50-bps rate hike by the Reserve Bank of New Zealand.

The NZD/USD slides for the eighth consecutive day amidst a risk-on market sentiment that usually favors the kiwi. However, as the Federal Reserve meeting started today, market players remain at bay, awaiting Wednesday’s US central bank decision. At 0.643s, the NZD/USD is trading near fresh 22-month lows at the time of writing.

Positive sentiment fails to lift the kiwi

Sentiment-wise, European and US equities are rising on Tuesday, despite investors’ concerns about China’s zero-tolerance Covid-19 program, which threatens to reimpose strict restrictions in Shanghai, while Beijing continues testing millions of people in desperation to control the crisis. Regarding the aforementioned, Fitch Ratings cut China’s GDP prospects for 2022, which initially were 4.8% to 4.3%, and blamed the potential delay in the easing of current curbs. China is expected to follow its strictly Covid Zero strategy until 2023.

Aside from this, US economic data revealed on Tuesday failed to boost the prospects of the greenback, as shown by the US Dollar Index, losing 0.16%, sitting at 103.443. March’s US Factory Orders grew faster than the 1.1% estimated, to 2.2% m/m; contrarily, the JOLTs Job Openings rose to 11.549M, almost 600K higher than the 11M estimated, reflecting the tightness of the US labor market.

Meanwhile, on Wednesday, the Federal Reserve is expected to hike rates by 50-bps for the first time in decades. Also, market participants estimate that the Quantitative Tightening (QT) aiming to reduce the Fed’s balance sheet would start after the May meeting at a $95 Billion pace.

In the week ahead, important New Zealand data would cross the wires on Wednesday. New Zealand employment figures, alongside the Reserve Bank of New Zealand Stability Reports, would be reported. Analysts at TD Securities wrote in a note that they expect the labor market to tighten further in Q1 while the Unemployment Rate would fall to 3%.

They added that “we remain cognizant of downside risk posed by the Omicron disruption on the labor market. On wages, we expect a 0.8% q/q increase in the Labour Cost Index, which would bring the annual growth rate to 3.2% y/y, the highest since Q4’08. A strong Q1 labor market print will support our call for the RBNZ to continue with its “stitch-in-time” approach and aggressive tightening stance, hiking by 50bps in May.”

Key Technical Levels

- Gold bulls are stepping in at a weekly demand area.

- The Fed is anticipated for the week ahead and is keeping traders sidelined.

At $1,871.10, the gold price is firmer on Tuesday, rising from a low of $1,850.47 to a high of $1,878.14 so far. The price has upheld the bid in synch with a slight retreat in US Treasury yields and the US dollar ahead of this week's Federal Reserve went.

The US benchmark 10-year Treasury yields drifted away from the 3% level on Tuesday, marking a low of 2.915% so far. Meanwhile, the dollar index, DXY, was down 0.16%, making bullion less expensive to other currency holders.

All eyes on the Fed

Investors are in anticipation of the Fed and expect the central bank to hike rates by 50 basis points at the end of a two-day meeting on Wednesday in order to combat soaring inflation. Traders will be looking to the comments by Chairman Jerome Powell for further clues on future rate hikes.

If the outcome of the FOMC meeting is more hawkish than expected, gold could come under pressure again while a more dovish than expected outcome and ongoing concerns for geopolitics could see the safe haven quality of gold appealing to investors.

Analysts at TD Securities argued that ''gold prices are still vulnerable to a positioning squeeze, with both CTA trend followers and technicians set to liquidate additional length below the $1840/oz range.''

''The bar is low for additional outflows in the yellow metal, but tomorrow's knee-jerk reaction may also whipsaw traders with the Fed's move well telegraphed, notwithstanding the elevated anxiety levels,'' the analysts concluded.

As for the greenback, it came under pressure against a basket of currencies on Tuesday, as investors start to move to the sidelines ahead of the Fed. With inflation running at its fastest pace in 40 years, DXY hit a 20-year high at the end of last week's business on expectations the US central bank will be more aggressive than its peers while expecting a stronger US economy than that of the eurozone.

Additionally, a gauge of global equity markets rose slightly on Tuesday. MSCI's gauge of stocks across the globe (IACWI) gained 0.23% and the pan-European STOXX 600 index (.STOXX) rose 0.09% after surviving a "flash crash" on Monday in Nordic markets caused by a sell order trade by Citigroup. nevertheless, it is a bit more of a chop on Wall Street in late mid-day trade with both the NASDAQ and Dow Jones in the red while the S&P 500 is just about hanging on in the green.

Gold technical analysis

The gold price has been pressured this week to below a weekly structure which could turn out to be significant for the days ahead:

As illustrated, the price has moved below the weekly structure to test the demand area which is so far holding up. Should the bulls take control, there will be prospects of the resistance are holding that could result n a downside extension towards the trendline support.

- The EUR/JPY recovers some ground but remains defensive as a head-and-shoulders pattern, put a lid on higher prices.

- Market sentiment is positive, though it is worth noting that China’s Covid-19 battle could outweigh risk appetite and shift sentiment negatively.

- EUR/JPY Price Forecast: The head-and-shoulders clouds the prospects of a higher EUR.

The EUR/JPY remains trapped in the 136.50-138.00 range for the third consecutive trading session, though it snaps two days of successive losses and prints decent gains of 0.19% in the North American session. At 137.01, the EUR/JPY reflects a positive market sentiment across the board.

Global equities pushed higher on Tuesday, while bond yields rose, except for US Treasuries. In the commodities segment, precious metals rise, and crude oil falls. China remains under pressure as the Covid-19 outbreak lasts longer than foreseen, as Shanghai authorities could reinstate stricter measures again. Furthermore, Fitch Rating cut China’s growth prospects from 4.8% to 4.3% amidst the zero-tolerance program imposed by Beijing.

Meanwhile, the EUR/JPY remains capped by the EUR/USD major’s action, which remains confined to the 1.0500-70 range, ahead of a crucial Fed monetary policy meeting.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY remains threatened by a head-and-shoulders chart pattern in the daily chart. Although it could be invalidated, once the EUR/JPY pushes above 140.00, that scenario is unlikely as central banks linked to them remain accommodative. Also, the JPY’s presence in the cross leaves it subject to market sentiment, which could send the pair lower if it turns negative.

With that said, the EUR/JPY first support would be the 137.00 mark. If EUR/JPY bears break that level, that will expose the 136.00 figure, followed by the head-and-shoulders neckline around 135.00-20.

Key Technical Levels

- On Tuesday, GBP/USD records minimal gains below the 1.2500 region.

- GBP/USD remains confined to the 1.2410-1.2600 range ahead of important Fed-BoE monetary policy meetings.

- GBP/USD Price Forecast: To remain downward pressured below 1.2600.

Amidst an upbeat market mood, as illustrated by global equities rising, the GBP/USD post modest gains, despite retreating from daily highs around 1.2567 towards the 1.2490s area, ahead of key monetary policy announcements by the Federal Reserve and the Bank of England, the former on May 4, while the latter at May 5. At the time of writing, the GBP/USD is trading at 1.2504.

A weak US dollar and high UK yields, a tailwind for GBP/USD

Wall Street’s record gains in the North American session. In the FX space, broad US dollar weakness keeps the greenback pressured, as shown by the US Dollar Index, falling some 0.20%, currently at 103.406. Meanwhile, high UK bond yields lifted Cable’s prospects though it failed to break the 1.2600 ceiling of the 1.2410-1.2600 range.

During the day, the UK economic docket featured April’s Manufacturing PMI, which was upward revised and came higher than the March reading. On Thursday, the Bank of England (BoE) would meet to decide its monetary policy. Money market futures expect a 25-bps interest rate increase, but some BoE members of late expressed “some” concerns regarding a slower pace of the UK economy, which has consumers suffering amid the worst cost-of-living squeeze in decades.

Regarding the US, the docket featured US Factory Orders for March, which grew by 2.2% m/m, higher than the 1.1% estimates. At the same time, March’s US JOLTs Job Openings came at 11.549M, beating expectations of 11M, showing the tightness of the US labor market.

Despite mixed US economic data, the Fed is expected to lift rates by 50-bps on Wednesday and could begin reducing its balance sheet by $95 billion. Also, money market futures have priced in additional 50-bps increases in June, July, and September meetings, which means that the Federal Funds Rate would be lying at 2.25-2.50% range by that time.

GBP/USD Price Forecast: Technical outlook

The GBP/USD remains defensive, though price action in the last four trading sessions consolidated in the 1.2410-1.2600 area. The MACD indicator shows that downward pressure seems to wane as the histogram approaches zero. However, as long as the distance between the MACD-line and its signal-line remains aiming lower, some selling pressure remains, so the GBP/USD is skewed to the downside.

The GBP/USD first support would be 1.2500. A breach of the latter would expose April’s 29 daily low at 1.2445, followed by the YTD low at 1.2411.

The Bank of Canada Governor Senior Deputy Governor Carolyn Rogers says the labour market is a really strong indicator right now of excess demand in the Canadian economy.

Key comments

We don't target components of inflation, we target the overall level of inflation.

We need higher rates to moderate demand including demand in the housing market.

Housing price growth is unsustainably strong in Canada, it would not be a bad thing for the economy for the growth in housing prices to moderate a bit.

We do expect that housing price growth will moderate as rates go up.

We think the technology that underlines digital currencies has some potential.

It's completely realistic that Canadians are going to want a digital Canadian dollar at some point.

Meanwhile, USD/CAD has been consolidating in bullish territory but is down by some 0.28% at the time of writing, moving sideways within a 1.2825/93 range on Tuesday.

European Central Bank member, Isabel Schnabel, told a German newspaper Handelsblatt on Tuesday that the ECB may need to raise interest rates as soon as July to stop high inflation from getting entrenched.

Reuters quoting the news:

"Now it's not enough to talk, we have to act," Schnabel was quoted as saying. "From today's perspective, I think a rate hike in July is possible."

''Before then the ECB must end its bond purchase scheme, probably at the end of June, Schnabel added, warning inflation is becoming increasingly broad.''

EUR/USD is higher on the day by some 0.23% yet has not reacted to the comments, sticking to the 1.0530s.

- The Aussie dollar gains some 0.72% on Tuesday, following the RBA’s 0.25% rate hike.

- The RBA’s also noted that it would begin its Quantitative Tightening.

- AUD/USD Price Forecast: Failure at 0.7165 paved the way for further losses.

The Australian dollar registers solid gains after the Reserve Bank of Australia (RBA) delivered a “surprisingly” rate hike of 25 bps earlier during the day to lift rates to the 0.35% threshold. However, after recording a daily high at 0.7147, the AUD/USD retreats as the Federal Reserve May meeting looms and, at the time of writing, trades at 0.7091.

RBA hiked rates by 25 bps to 0.35%

During the Asian session, the RBA surprised market participants with its monetary policy decision. In its statement published with the decision, the RBA said, “The economy has proven to be resilient and inflation has picked up more quickly, and to a higher level than expected.” It’s worth noting that the bank pulled the trigger ahead of knowing the Wage Price Index, which was the reason holding back the central bank, before committing to tightening monetary policy. Regarding the aforementioned, the RBA stated, “There is also evidence that wages growth is picking up.” Additionally, the RBA began its Quantitative Tightening (QT) as it decided not to reinvest any maturing proceeds of its balance sheet.

On the macroeconomic front, the US docket featured US Factory Orders for March, which grew by 2.2% m/m, higher than the 1.1% estimates. At the same time, March’s US JOLTs Job Openings came at 11.549M, beating expectations of 11M, showing the tightness of the US labor market.

The mixed data would not derail the Federal Reserve from delivering the so-telegraphed 50 bps rate hike on Wednesday. Of late, as the Fed decision looms, the AUD/USD has retreated from daily highs.

Sentiment-wise, China keeps struggling trying to contain the Covid-19 spread. However, its zero-tolerance of the coronavirus is hurting its economy, as Fitch Ratings cut its forecast for China’s 2022 GDP to 4.3% from 4.8%. Furthermore, the Ukraine-Russia tussles seem to desensitize market players, and unless market-moving events develop, it will remain in the backseat.

Meanwhile, the US Dollar Index, a measurement of the greenback’s value against its speers, slumps 0.08%, sitting at 103.526, also weighed by falling US Treasury yields. The 10-year US Treasury yield sits at 2.946%, retreated five bps from the YTD high at 3%, reached on Monday.

AUD/USD Price Forecast: Technical outlook

The AUD/USD failure to break March’s 15 daily low-turned-resistance at 0.7165 opened the door for further losses, meaning that the Aussie dollar is trading back below 0.7100. With that said, the AUD/USD first support would be February’s 4 cycle low at 0.7051. Once cleared, the following line of defense would be 0.7000, followed by the YTD low January’s 28 swing low at 0.6967.

The recent sharp depreciation of the Chinese Renminbi (RMB) was in line with the expectations of the BBVA Research Team at the beginning of the year amid the unsynchronized monetary policy cycle between China and the US. They predict RMB to USD exchange rate at 6.6 at end-2022 with upside risks.

Key Quotes:

“Depreciation is unavoidable amid the contrast monetary policy measures between China and the US when we talk about RMB exchange rate trend till end-2022. We predict the RMB to USD exchange rate at end- 2022 to be 6.6 with some upside risk, while a macro analytical framework is more important to understand the underlying logic and make the forecasting. In addition, policy intentions of Chinese central banks on exchange rate need to be carefully considered and evaluated.”

“In the medium-to-long term, the PBoC is willing the RMB exchange rate to display some two-way fluctuation around its equilibrium level, and they will certainly intervene the FX market if the RMB exchange rate displays some one-way trending, either one-way appreciation or depreciation. That means, China’s monetary authorities are likely to stick to their pledge of keeping the CNY stable on a trade-weighted basis.”

- US dollar corrects lower across the board, short-term trend still bullish.

- USD/MXN in a consolidation range between 20.30 and 20.50.

- Above 20.50, the next resistance emerges at 20.70.

The USD/MXN is falling on Tuesday, moving in a consolidation range. The pair bottomed at 20.28, the lowest intraday level in a week and quickly rebounded back above 20.30. It is hovering around 20.36, looking again at the 20.40 level.

The main trend keeps pointing to the upside, although technical indicators on the daily chart, like the RSI, are turning to the downside. Price is around the 100 and 200-day Simple Moving Average, which stand around 20.45. A horizontal resistance is seen at 20.50, so a consolidation clearly above 20.50 should open the doors to more gains, initially targeting the 20.70 area.

Risks still appear to be tilted to the upside, but USD/MXN needs to break above 20.50 over the next sessions. A firm slide below 20.30 would strengthen the Mexican peso. The next support stands at 20.20 and then comes the 20-day Simple Moving Average at 20.13. Below this latter, the short-term bias will change to bearish.

USD/MXN daily chart

-637871903319105413.png)

Technical levels

- XAU/USD rises after finding support at the $1850 area.

- FOMC meeting kicks off, US yields retreat.

- US dollar drops modestly across the board, DXY drops by 0.25%.

Gold printed a fresh daily high during the American session at $1878.20 on Tuesday boosted by a recovery in Treasuries and a weaker US dollar. The metal is holding onto gains, recovering from monthly lows.

Earlier, XAU/USD bottomed at $1850, the lowest level since mid-February and then turned to the upside. The recovery gained support above $1860 and boosted gold further.

On the day before the FOMC decision, US yields are pulling back from multi-year highs. The US 10-year stands at 2.92% after hitting on Monday 3% for the first time since 2018. The Fed is expected to announce an increase in interest rates by a half percentage point that would be the first one by such magnitude in more than 20 years. Market participants also expect the central bank to start shrinking its balance sheet by USD95 billion per month from June.

What the Fed signals about the futures, will likely trigger volatility across financial markets. “Our base case remains that the Fed will follow up next week’s 50bp hike with 50bp increases in June and July before switching to 25bp as quantitative tightening gets up to speed. We see the Fed funds rate peaking at 3% in early 2023”, said analysts at ING.

Next resistance at $1880

If XAU/USD keeps rising, it will face resistance at the $1880 level and then at $1890. Even if it hits $1900 the outlook will remain negative. A recovery back above $1915 would weaken the bearish bias.

On the flip side, a slide back under $1860 would expose the $1850 critical area that is the recent low and also a medium-term level. Below at $1833 awaits the 200-day Simple Moving Average.

Technical levels

- The Loonie recovers some ground vs. the greenback and gains some 0.28%.

- US dollar bulls take profits ahead of the Federal Reserve meeting.

- Fitch Ratings cut China’s growth from 4.8% to 4.3%, weighing on market sentiment.

- USD/CAD Price Forecast: Remains upwards, though a slump towards 1.2777 is on the cards.

The USD/CAD slid as the greenback weakens ahead of the Federal Reserve’s monetary policy decision, to be known on Wednesday, as USD bulls book profits and get to the sidelines to assess the direction, pace of QT, and how many 50-bps hikes would the Fed deliver in the year. At the time of writing, the USD/CAD is trading at 1.2854, recording decent losses of 0.17%.

The US dollar weakens ahead of the Fed

Meantime, the US Dollar Index, a gauge of the greenback’s value, slumps 0.25%, sitting at 103.346, also weighed by falling US Treasury yields. The 10-year benchmark note sits at 2.920%, retreated eight bps from the YTD high at 3%, reached on Monday.

The fluctuation of European and US equities reflects a mixed sentiment. Additionally, China’s zero-tolerance Covid-19 threatens to slow the global economic recovery after authorities could probably reinstate strict measures in Shanghai. Meanwhile, according to Bloomberg, Fitch Ratings cut its forecast for China’s 2022 gross domestic product growth from 4.8% to 4.3% due to Covid-19 lockdowns that have hobbled the economy.

On the macroeconomic front, the Canadian docket would feature the Bank of Canada Governor, Rogers. On the US front, US Factory Orders for March rose by 2.2% m/m, higher than the 1.1% estimates. At the same time, March’s US JOLTs Job Openings came at 11.549M, beating expectations of 11M, showing the tightness of the US labor market.

That said, USD/CAD traders would need to be aware that once the Fed hikes 0.50%, both countries will have interest rates at 1%, which could favor the USD in the long term. Why? Because, as Brown Brothers Herriman (BBH) analysts noted, World Interest Rates Probabilities (WIRP) “suggests three more 50 bp hikes in June, July, and September that would take the Fed Funds rate up to 2.25-2.50%. After that, two 25 bp hikes are priced in for November and December that would take the Fed Funds rate up to 2.75-3.0%.” They added that “there is a greater than 50% chance of a final 25 bp hike in February that would take Fed Funds up to 3.0-3.25%.”

USD/CAD Price Forecast: Technical outlook

The USD/CAD is upward biased, though Tuesday’s price action illustrates how the greenback’s bulls take profits ahead of the Fed’s meeting. After the USD/CAD reached a YTD high at 1.2913, it is threatening to dip towards the 1.2800 mark, further confirmed by the slope of the Relative Strength Index (RSI) aiming downwards, shy of reaching overbought territory at 63.85.

With that said, the USD/CAD first support would be 1.2800. A break below would expose April’s 27 daily low at 1.2777, followed by April’s 29 swing low at 1.2718.

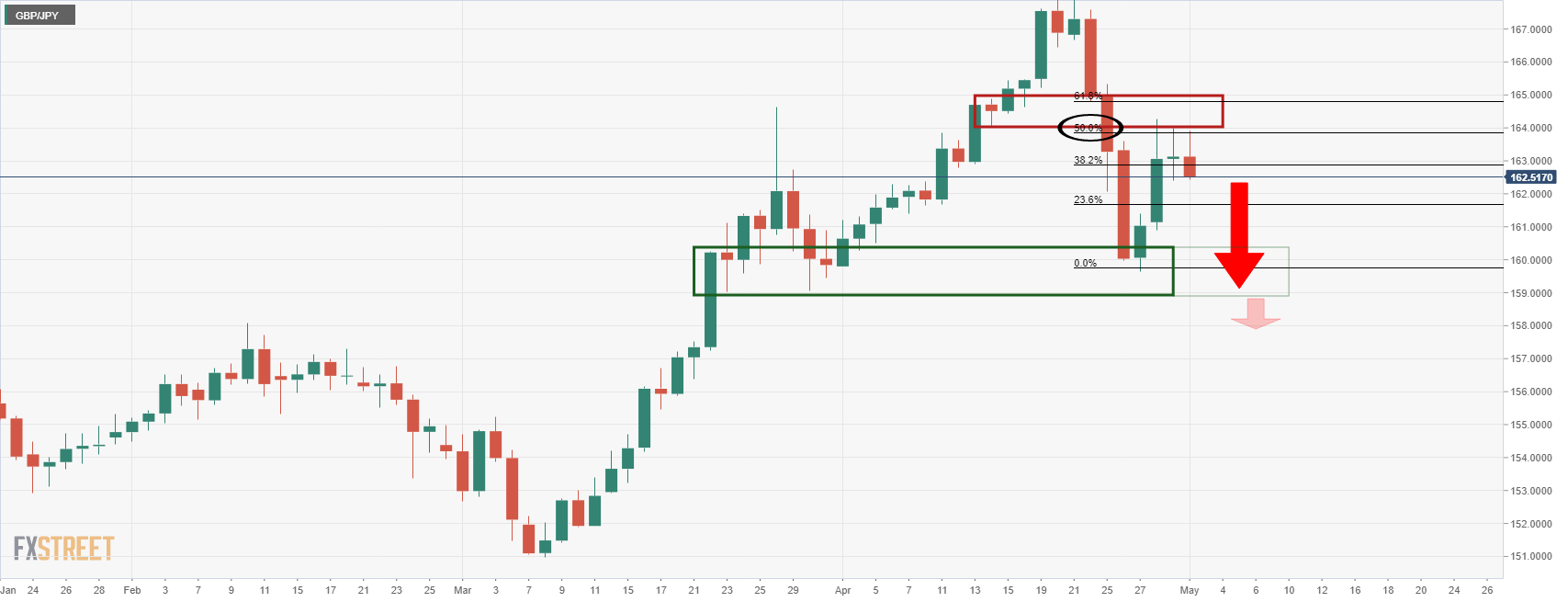

- GBP/JPY continues to trade in a stable fashion and pivot either side of the 163.00 level.

- The pair is in wait-and-see mode ahead of this week’s pivotal BoE meeting on Thursday.

- For now, the 21DMA at around 163.50 is offering strong resistance.

GBP/JPY continues to trade in a stable fashion and pivot either side of the 163.00 level, as has been the case since the start of the week, as traders keep their powder dry ahead of key risk events later this week. At current levels in the 162.60 area, GBP/JPY is trading flat on the day and a tad in the red on the week, with the 21-Day Moving Average just above 163.50 continuing to act as a ceiling, as has been the case since last Thursday.

The BoE will be announcing policy on Thursday, with a 25 bps rate hike expected by analysts. Given continued insistence from the BoJ that it remains premature to discuss moving away from their ultra-dovish policy stance just yet, Thursday’s rate hike from the BoE will mark a further divergence in the monetary policy stance of the two banks.

Whilst some might argue this supports GBP/JPY upside, the BoE’s guidance on the outlook for future rate hikes and tone on the economy will likely be more important than the expected rate hike itself. The BoE has been sounding more dovish on the economy in recent weeks as the UK struggles through its worst cost-of-living crunch in decades and, with recent data showing the punishing impact that this is having on consumption and consumer sentiment, the BoE may well soften its tone on the need for further rate hikes.

GBP/JPY traders will also be watching how trends in broader risk appetite evolve over the course of the week with Fed tightening and US jobs data also in focus. Sentiment in the global equity space, to which GBP/JPY is typically quite sensitive, remains ropey and any further downturn could push the pair back towards last week’s sub-160.00 lows and towards its 50DMA at 159.37.

The US Federal Reserve will announce its monetary policy decisions on Wednesday, May 4 at 18:00 GMT and as we get closer to the release time, here are the expectations as forecast by analysts and researchers of 18 major banks.

The FOMC is widely expected to hike its policy rate by 50 basis points (bps) following the May policy meeting. The Fed is also expected to start shrinking its balance sheet by USD95 billion per month from June.

Danske Bank

“We expect the Federal Reserve to hike the target range by 50bp. We expect the Fed to signal that more 50bp rate hikes are likely in coming months in order to get quicker back to neutral. We expect the Fed to announce the balance sheet runoff to start in mid-May. We expect the cap to be set at USD95bn as outlined in the minutes. Our current Fed call is that the Fed will hike by 50bp in May, June and July and 25bp in September, November and December (a total of 225bp). We still see risks skewed towards faster rate hikes, as monetary policy remains too accommodative.”

ANZ

“We expect the Fed to raise rates by 50bp and simultaneously announce quantitative tightening, which will result in an asset reduction of around USD95bn per month. Based on current levels of excess demand evident across many sectors of the economy, we expect a period of restrictive interest rates will be necessary. We have raised our fed funds path by 50bp, including back-to-back 50bp hikes in June and July, and now expect the top end of the fed funds target range to hit 2.75% by year-end, in line with our estimate of neutral. We also expect a terminal rate of 3.75% to be reached by June 2023, which is 50bp higher than our previous forecast.”

Commerzbank

“Because of high inflation, the Fed is now resorting to more drastic measures. The key interest rate will probably be raised by half a percentage point, and further steps are likely to follow.”

Westpac

“Heading into the May meeting, members of the FOMC are singularly focused on the historic pace of inflation and associated risks. A 50bp hike in the fed funds rate at this meeting is therefore anticipated along with a clear signal that the rapid tightening of rates will continue in June and be paired with a quick ramping up of quantitative tightening through mid-year. While unlikely at the May meeting, from June/July the FOMC’s view on risks will again broaden to include activity. Assuming inflation pressures are by then showing signs of easing, the July meeting is likely to see a return to 25bp increases in the fed funds rate, taking the policy rate to a peak of 2.375% at year-end.”

ABN Amro

“We to expect 50bp rate hikes in May and June, with the Fed to continue hiking in 25bp steps thereafter. This would take the target range for the fed funds rate to 2.5-2.75% by early 2023. Thereafter, we expect the Fed to pause, with inflation likely to be materially lower by that point, and pipeline pressures such as wage growth also likely to have eased.”

ING

“The Fed is widely expected to raise its policy rate by 50 basis points 8%+ inflation and a tight labour market trump the surprise 1Q GDP contraction attributed to temporary trade and inventory challenges. That said, the weakness in GDP makes it less likely that we will hear the Fed explicitly making the case for a more aggressive 75bp hike at the June or July FOMC meetings. We are open to the possibility, but that would probably require a decent set of consumer spending numbers over the coming months and some very solid jobs gains that contribute to further wage pressures. Our base case remains that the Fed will follow up next week’s 50bp hike with 50bp increases in June and July before switching to 25bp as quantitative tightening gets up to speed. We see the Fed funds rate peaking at 3% in early 2023.”

Deutsche Bank

“We believe the Fed will kick tightening up a notch, lifting the fed funds target range by +50bps. The market agrees, and then some, with +51.8bps of tightening priced for the meeting, suggesting some market participants believe there’s still some risk of an even larger hike. We believe the Chair will signal this is but the first of a series of potential +50bp hikes, as the Fed tries to get policy to neutral as quickly as possible in light of historic inflation. With the question of how fast the Fed needs to raise rates generally understood (answer: very), focus will shift to how far they need to hike rates to tighten financial conditions adequately. That task will be augmented by balance sheet rundown, as the Fed has also signaled they will announce the beginning of QT, with the first assets likely rolling off the Fed’s portfolio in June. Our estimates are that QT will proceed through next year, adding around three additional +25bp hikes of tightening, only to stop once the economy careens into recession at the end of 2023.”

CE

“We expect the Fed to hike interest rates by 50bp and to launch its quantitative tightening, with the cap on maturing principal allowed to roll off each month quickly rising to USD95bn.”

Rabobank

“The Fed is not going to be deterred by the unexpected decline of GDP in Q1, because consumption and investment remained solid. Instead, the focus is on fighting inflation, which is well above target. We expect a 50 bps rate hike and the launch of balance sheet reduction. Further ahead, we expect the Fed to slow down its hiking cycle to 25 bps per meeting as soon as consumption and investment slow down. However, as the wage-price spiral has already started, the Fed will have to continue hiking well into restrictive territory. This will most likely lead to a recession in the second half of next year. This also means that the Fed will have to cut rates again before the end of 2023.”

TDS

“A likely 50bp hike in the Funds rate at the May FOMC meeting has been widely telegraphed by a number of Fed officials, including Chair Powell. We believe the focus for markets will lie elsewhere, particularly on any guidance regarding the Fed's policy path in the near term. Balance-sheet runoff plans will also be in the spotlight. We now expect the Fed to deliver 3 consecutive 50bp hikes (in May, June, and July) and subsequently hike rates by 25bp per meeting until they reach a terminal funds rate of 3.25% by March 2023.”

SocGen

“We look for a 50bp hike in the fed funds target range to 0.75-1.00% and a faster move to neutral, which Fed officials see at 2.40%. The Fed is likely to consider 25bp or 50bp increases at future meetings, depending on the data, with the goal of reaching the neutral level even earlier than guidance from March. We expect the Fed to announce the run-off of its balance-sheet holdings of Treasury and mortgage-backed securities.”

RBC Economics

“The Fed is expected to accelerate the withdrawal of monetary policy stimulus. A 50 basis point increase in the fed funds target range is expected following this week’s FOMC meeting, building on the 25 bp hike in March. We expect that to be followed by an additional 150 bp in rate hikes this year – with the risk that those hikes come sooner rather than later.”

NBF

“The Fed is poised to continue to withdraw the extraordinary monetary policy stimulus provided over the past two years. Following March’s 25 basis point rate increase, the Fed looks set to accelerate its pace of tightening; a 50-bp hike is now fully anticipated by the market. With this outcome all but guaranteed, we’ll be more focused on the tone of the statement and what it implies for the size of rate hikes going forward. We’ll be interested to see if Chairman Jerome Powell affirms the market’s hawkish outlook in his post-decision press conference. As a reminder, the Fed’s March dot plot signaled an end-of-year fed funds target of 1.75%-2.00% – well below current expectations. We should also get some details on quantitative tightening, a process which could begin as soon as mid-May.”

Citibank

“A 50bp hike is all but a done deal, taking the Fed Funds rate to 0.75-1.00%. What will be more relevant to follow is guidance for future rate hikes, especially after the strong ECI print on Friday. The market is pricing a high probability of 50bp hikes in the next four meetings. Also important to follow will be the decision regarding balance sheet reduction with a likely announcement to start on May 10, with the caps starting at USD30bln/mth and ramping up to USD95bln/mth. A series of FOMC members including Williams, Bostic, Bullard and Waller are expected to speak on Friday as well. They may give a sense of how flexible balance sheet plans may be given that reduction will have been announced at the May 4 meeting.”

CIBC

“While there are no sure things in economics or sports, a 50 basis point rate hike from the Fed seems to be a lock at this point, with the accompanying statement brushing aside the first quarter GDP decline.”

Wells Fargo

“Despite the 1.4% annualized rate of contraction in Q1 real GDP, we look for the Federal Open Market Committee to raise its target range for the federal funds rate by 50 bps. A 50 bps rate hike is completely priced into markets. We also look for the Committee to announce the commencement of balance sheet reduction, which would also act as a form of monetary tightening.”

Nordea

“We expect the Fed to deliver a 50bp hike at the May meeting without making any technical adjustments to the Reverse Repo Rate (RRP) or Interest on Reserve Balances (IORB). We expect Chair Powell to bring home the message that the Committee is ready to deliver additional 50bp hikes over coming meetings in order to combat inflation. This will likely be enough to contain market pricing and keep the dollar bid. We also expect the Fed to officially announce Quantitative Tightening (QT), which will consist of a 3-month phase-in period and run-off caps of USD 60bn on US Treasuries (USTs) and USD35bn mortgage-backed securities (MBSs), effectively lowering the Fed’s balance sheet by 670bn this year.”

Barclays

“We expect the Fed to lift the target range for the federal funds rate by 50bp to 0.75%-1.00%. Given the broad parameters for balance sheet normalization laid out in the March meeting minutes, we expect the monthly run-off caps to ramp up from USD35bn in June (USD20bn for treasuries, USD15bn for agency MBS), to USD65bn in July (USD40bn/USD25bn) and then to the maximum pace of USD95bn/month from August. In the press conference, we expect much of the discussion to revolve around the speed at which the committee is prepared to lift its policy rate to neutral, with markets now pricing in 50bp hikes in every meeting through September. We continue to expect 50bp hikes in May and June, with the committee slowing the pace to 25bp per meeting from July onward as it sees signs of slowing inflation.”

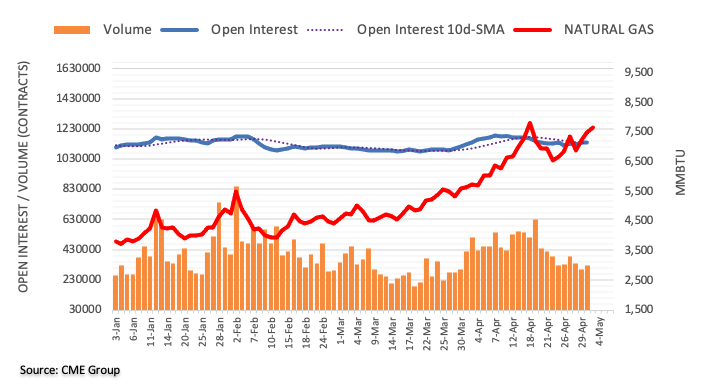

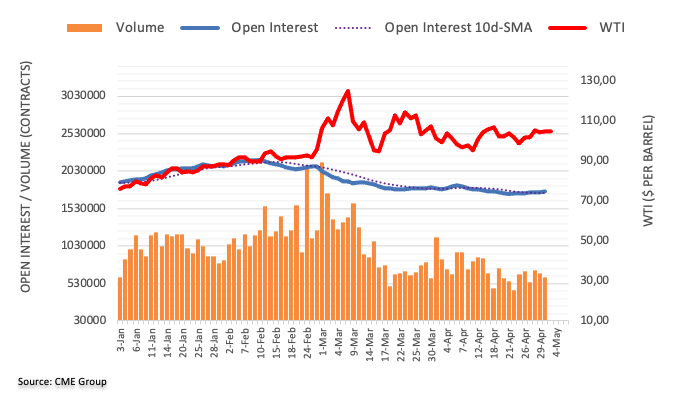

- WTI is consolidating in the mid-$104.00s, near the middle of its recent short-term $100-$108ish range.

- Traders continue to juggle the bearish theme of China lockdown worries with the bullish theme of an EU/Russia oil embargo.

Since the start of Tuesday’s European session, front-month WTI futures have been swinging between lows in the $103.00 per barrel area and highs in the $105.00 area, as traders weigh the prospect of an impending EU embargo on Russian oil imports against China lockdown concerns. At current levels in the mid-$104.00s, WTI is trading ever so slightly in the red on the day and is around the midpoint of its $100-$108ish ranges of the past five or so sessions.

The news coming out of China suggests that authorities are continuing to struggle to get a Covid-19 outbreak in Beijing under control, with a further 51 infections reported on Tuesday. Restaurants in the Chinese capital are now closed for indoor dining, apartment blocks where cases are being picked up are being put under quarantine, residents of the city are being encouraged not to leave and the reopening of schools has been postponed for at least a week after the Labour Day holidays, local press reported.

If Beijing follows down the same path as Shanghai, i.e. goes into a strict city-wide lockdown, this will further dent already diminished crude oil demand in China, a big downside risk that WTI traders must monitor. However, traders must juggle this against an announcement of an EU-wide embargo on Russian oil imports that is likely to be confirmed later this week. According to Internation Energy Agency forecasts, Russian output has likely already fallen by 3M barrels per day this month versus prior to the country’s invasion of Ukraine as a direct result of Western sanctions.

“A potential EU-wide oil embargo could significantly undermine the already diminishing availability of Russian barrels,” said one analyst at oil broker PVM. For now, Russia output fears are preventing WTI from falling back below $100 due to China demand woes. Aside from the aforementioned themes, WTI traders will also be watching upcoming US Private Weekly API crude oil inventory data out at 2130BST on Tuesday ahead of official US inventory numbers on Wednesday. Attention will then turn to the broader macro backdrop, with oil traders likely to monitor how risk appetite responds to this week’s Fed meeting and US jobs report.

There were 11.549M job openings in the US at the end of March, the latest JOLTs Job-Opening data release on Tuesday by the US Labour Department revealed, a new record high. That was higher than the 11.344M job openings at the end of February (an estimate which had been revised up from 11.266M previously) and well above the expected decline to 11M.

Market Reaction

FX markets do not seem to have reacted to the latest JOLTs report, even though it reaffirms the idea that demand for labour in the US economy is currently very high, with the number of job openings far exceeding the total number of unemployed persons. Indeed, this labour market tightness is a key reason, alongside sky-high inflation, why the Fed is expected to get on with aggressive monetary policy tightening in 2022, with a 50 bps rate hike and quantitative tightening announcement in the pipelines on Wednesday.

- EUR/USD has rebounded back to the 1.0550 area and is eyeing a test of short-term range highs near 1.0600.

- But trade in FX markets remains cautious ahead of this week’s Fed meeting and official US jobs report release.

- Against the backdrop of aggressive Fed tightening relative to the slower moving ECB, EUR/USD risks remain tilted to the downside.

Profit-taking in the US dollar ahead of the start of Tuesday’s US trading session has given EUR/USD a moderate lift, with the pair rebounding from earlier lows in the 1.0500 area back to the north of the 1.0550 mark. At current levels in the 1.0560s, the pair is trading with gains of about 0.6% and is eyeing a test of last Friday’s highs just under 1.0600, a level that marks the top of the pair’s recent short-term range.

But a barrage of upcoming risk events later in the week, most notably the Fed policy announcement on Wednesday and release of the official US labour market report on Friday, likely mean that a break back into the 1.0600s is unlikely to happen just yet. Traders/market participants tend to err towards keeping their powder dry ahead of big events in order not to get caught on the wrong side of a big move.

Technicians have marked out the 2020 lows in the 1.0630 area as a key area of resistance to keep an eye on. Against the backdrop of aggressive Fed tightening (they will lift interest rates by 50 bps this week and signal more similar-sized moves ahead) and a still very tight US labour market (as this week’s JOLTS and official jobs data will likely show), betting on a weakening US dollar seems unwise at this point.

Amid expectations that the ECB tightening will not tighten monetary policy not nearly as much as the Fed in 2022, EUR/USD risks remain tilted to the downside, strategists continue to argue. Some highlighted comments by ECB Vice President Luis de Guindos over the weekend, who spoke about interest rates not being on a “predetermined” path, which some saw as dovish.

In terms of upcoming risk events, ECB President Christine Lagarde was scheduled to speak earlier in the day and, though she hasn’t said anything on policy yet, may do later in the day. Meanwhile, the March JOLTs Job-Opening report will be released at 1500BST later on Tuesday and could trigger some short-term volatility in FX markets.

- DXY meets intense selling pressure and approaches 103.00.

- US yields reverse the initial upside and refocus on the downside.

- Factory Orders, JOLTs Job Openings come next in the docket.

The greenback fades Monday’s uptick and recedes to the 103.00 zone when gauged by the US Dollar Index (DXY) on Tuesday.

US Dollar Index weaker on yields, looks to FOMC

The index comes under downside pressure and gives away gains recorded at the beginning of the week, although the 103.00 region seems to have held the downside well enough so far on Tuesday.

The knee-jerk in the buck comes on the back of the equally corrective move in US yields along the curve, where the 10y note appears to have met quite a tough nut to crack around the key 3.0% level.

In the US data space, Factory Orders and JOLTs Job Openings/Quits, both releases for the month of March, are due next in the NA session.