- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-04-2022

- USD/CAD is firm in the opeb, bulls eye 1.26 the figure for the days ahead.

- Fed and solid US dollar with weakening oil are helping to lift the pair.

USD/CAD is starting out the week on the front foot as the US dollar picks up a bid following Friday's Nonfarm Payrolls mixed data. The positive revisions and a dip in the Unemployment Rate have fortified the speculation of a hawkish Federal Reserve, underpinning the greenback.

At 1.2522, USD/CAD is trading 0.11% higher after popping from a low of 1.1511 to a session high of 1.2526 so far. The greenback starts the week off higher, helped by robust US job growth numbers for March and in anticipation that the Federal Reserve will increase the pace of interest rate hikes in an effort to blunt rising inflation.

431,000 new jobs were added. While the headline was below the estimates of 490,000, data for February job increases were revised higher. Additionally, the Unemployment rate fell to 3.6%, the lowest since February 2020. Hourly earnings for February were revised back to 0.1%, which along with the March figure, indicates the heat may be coming off the US labour market. Nevertheless, the DXY was higher for the second straight day after two straight down days and is trading back near 98.50. This month’s cycle high near 99.418 should eventually be tested.

Meanwhile, commodity markets ended the week lower, driven by a sharp fall across energy markets as supply shortages eased. Concerns about weak economic activity in China also weighed on sentiment. Overall, the CAD trades as a proxy for commodities and as such, it is underperforming alongside the drop in oil. Crude made further losses on Friday as the market comes to terms with the massive release of oil from the US strategic reserve, analysts at ANZ Bank explained.

''The announcement earlier in the week that the US would release as much as 180mbbls of oil over six months saw Brent crude and WTI fall more than 10%. US President Joe Biden said he expects the IEA members will add another 30-50mbbls to their efforts.'' However, the analysts explained, ''even so, this may not be enough. Amos Hochstein, US State Department’s senior energy security advisor, said that the market is short about 2mb/d, if not more.''

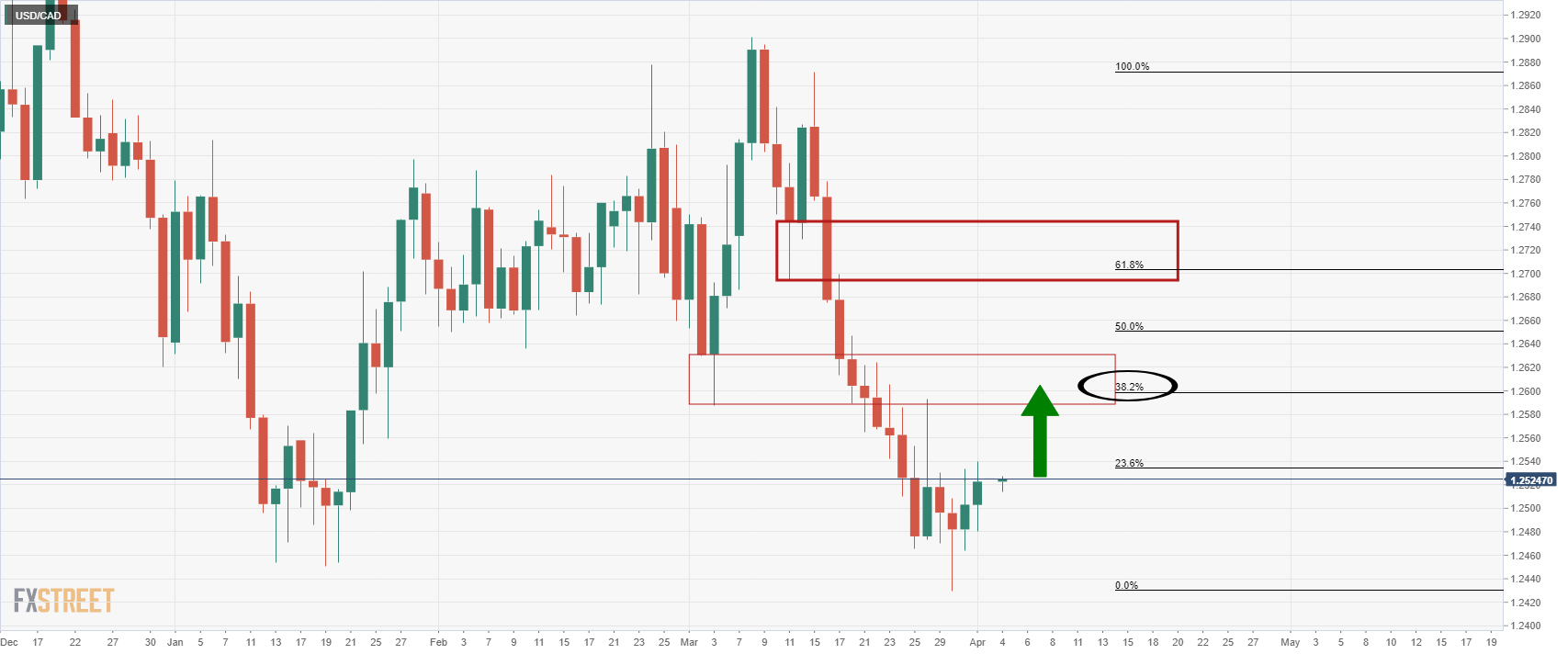

USD/CAD technical analysis

The M-formation is a reversion pattern and the price would be expected to revert to the 38.2% Fibonacci retracement level near 1.26 the figure in the coming days.

- USD/JPY has attracted bids near 122.00 on firmer DXY.

- Improved US Jobless Rate has raised the odds of a 50 bps interest rate hike from the Fed.

- The Russia-Ukraine negotiations seek an official confirmation of a ceasefire.

The USD/JPY pair has bounced back sharply after a corrective pullback from the last week’s high at 125.10 as investors turned to the mighty greenback on record lows US Unemployment Rate. The pair have established above 122.00 and is displaying a positive open test-drive session on Monday in which a minor weakness at the open gets shrugged off after the asset oversteps the opening price of the trading session.

The US Unemployment Rate reported on Friday has shifted the focus on a jumbo-size interest rate hike by the Federal Reserve (Fed) in May. The Unemployment Rate has landed at 3.6% lowest since February. The major agenda of the Fed is to achieve full employment and the US economy is maintaining it technically amid securing a Jobless Rate below 4% since December. This has raised the odds of an interest rate hike by 50 basis points (bps) in May’s monetary policy significantly. The US dollar index (DXY) has jumped near 98.50.

Meanwhile, the peace talks between Russia and Ukraine is getting progressed as negotiations between Russian leader Vladimir Putin and Ukraine’s President Volodymyr Zelensky after the development of a specific written document are likely to bring a ceasefire soon.

Negotiator David Arakhamia told Ukrainian media that an encounter between Ukraine's President Volodymyr Zelensky and Russian President Vladimir Putin would "with a high probability" inch towards a ceasefire. The nations are approaching a ceasefire verbally however, no official confirmation has come in writing.

- NZD/USD pressured in the open on a firmer US dollar.

- Fed expectations underpin the greenback following Friday's NFP.

NZD/USD is holding near support at 0.6910 in the open, trading down some 0.10% after sliding from 0.6921 at the start of the session. The greenback is firm following Friday's mixed Nonfarm Payrolls that points to a hawkish Federal Reserve outlook.

On Friday, there was a miss on headline payrolls, but upward back revisions and a lower Unemployment Rate lifted the greenback. 431,000 jobs were added last month, below the estimates of 490,000, although data for February job increases were revised higher. However, the Unemployment rate fell to 3.6%, the lowest since February 2020. This has supported the US dollar.

The DXY index, which measures the greenback vs. a basket of currencies, was higher for the second straight day after two straight down days and is trading back near 98.50. This month’s cycle high near 99.418 should eventually be tested. The US dollar is bid in the open on Monday, now trading in the 98.60s.

''With very little local data out this week and the crucial “25 or 50” RBNZ MPS decision not due till next week, this week is likely to be another week shaped by global events, including the RBA decision tomorrow and Fed minutes on Thursday,'' analysts at ANZ Bank said.

- GBP/USD is oscillating in a range of 0.3051-0.3183 ahead of the speech from BOE’ Bailey.

- The progress on ceasefire hopes between Russia and Ukraine will underpin the risk-perceived currencies.

- Record lowest US Unemployment Rate has firmed the odds of an aggressive interest rate hike from the Fed.

The GBP/USD has continued to trade lackluster around 1.3100 amid the absence of a fresh trigger that could dictate a direction in the asset. The cable has traded in a range of 0.3051-0.3183 last week but is likely to find direction this week as investors are waiting for the speech from Bank of England (BOJ)’s Governor Andrew Bailey, which will provide insights into the likely monetary policy action in May. Apart from that, the peace talks round between Russian leader Vladimir Putin and Ukraine’s President Volodymyr Zelensky after the development of a specific written document will assert pressure on the cable.

To tame inflation, the BOE has already shifted the burden to the economy by raising the interest rates to 75 basis points. The print of the yearly UK’s Consumer Price Index (CPI) at 6.2% is signaling one more rate hike from the BOE. Meanwhile, positive cues from the Russia-Ukraine peace talks are likely to underpin the pound against the greenback as US Blinken says western sanctions may be lifted from Russia depending on the outcome of negotiations between Russia and Ukraine.

The US dollar index (DXY) is approaching 99.00 amid the lowest US Unemployment Rate since February 2020. The US Bureau of Labor Statistics has reported the Unemployment Rate at 3.6% lower than the estimate of 3.7% and the previous figure of 3.8%. It would not be incorrect to claim that the US economy has reclaimed its pre-Covid-19 levels of unemployment numbers. This has firmed the odds of a jumbo interest rate hike by the Federal Reserve (Fed) next month.

- Gold starts out on the backfoot due to a strong US dollar and the Fed.

- Risk-off flows should continue, however, supporting the safe havens.

- XAU/USD to remain bearish amid rising US yields.

At $1,924.27 the low in the open, the gold price is starting out on the back foot on Monday in the Asian open. The yellow metal ended Friday down some 0.62% at $1,925 after travelling from a high of $1,939.62 to a low of $1,918.10.

Investors are having to weigh up the risks of a protracted war in Ukraine and as the peace talks drag on to no avail as well as a US recession against a hawkish backdrop at the Federal Reserve. Analysts at TD Securities explained that gold remains in the crosshairs as the Fed pricing provides a constant dark cloud over the precious metal market.''

''While safe-haven appetite and massive ETF inflows provide a strong offset, keeping prices above CTA liquidation thresholds near $1830/oz, the drag of a hawkish Fed backdrop is increasingly weighing on the upside momentum of the yellow metal.''

On Friday, the US Nonfarm Payrolls were solid for March. 431,000 jobs were added last month, below the estimates of 490,000, although data for February job increases were revised higher. However, the Unemployment rate fell to 3.6%, the lowest since February 2020. This has supported the US dollar. As measured by the DXY index, the greenback was higher for the second straight day after two straight down days and is trading back near 98.50. This month’s cycle high near 99.418 should eventually be tested. The US dollar is bid in the open on Monday, now trading in the 98.60s.

Additionally, Reuters reported that the futures contracts tied to the Fed's policy rate fell after the jobs report, pointing to expectations that the Fed will hike by a half-a-percentage point at each of its next three meetings to deal a more decisive blow to price pressures. ''That would follow a quarter-point hike on March 16, when the Fed embarked on a new tightening cycle.''

Nonetheless, despite the strength in the greenback, analysts at TD Securities argued that ''so long as material progress on ceasefire talks and de-escalation remains elusive, haven flows are likely to keep the yellow metal supported.'

As per the speculation of a US recession, the analysts said, at the same time, ''the 2y-10y curve flirting with inversion has further fueled talk of the recession on the horizon, offering another positive dynamic for the gold market. With that said, while geopolitical tensions and yield curve recession signals re-ignite investor interest in gold, downside risks are more prevalent amid a hawkish Fed backdrop and as negotiators continue to work towards a ceasefire.''

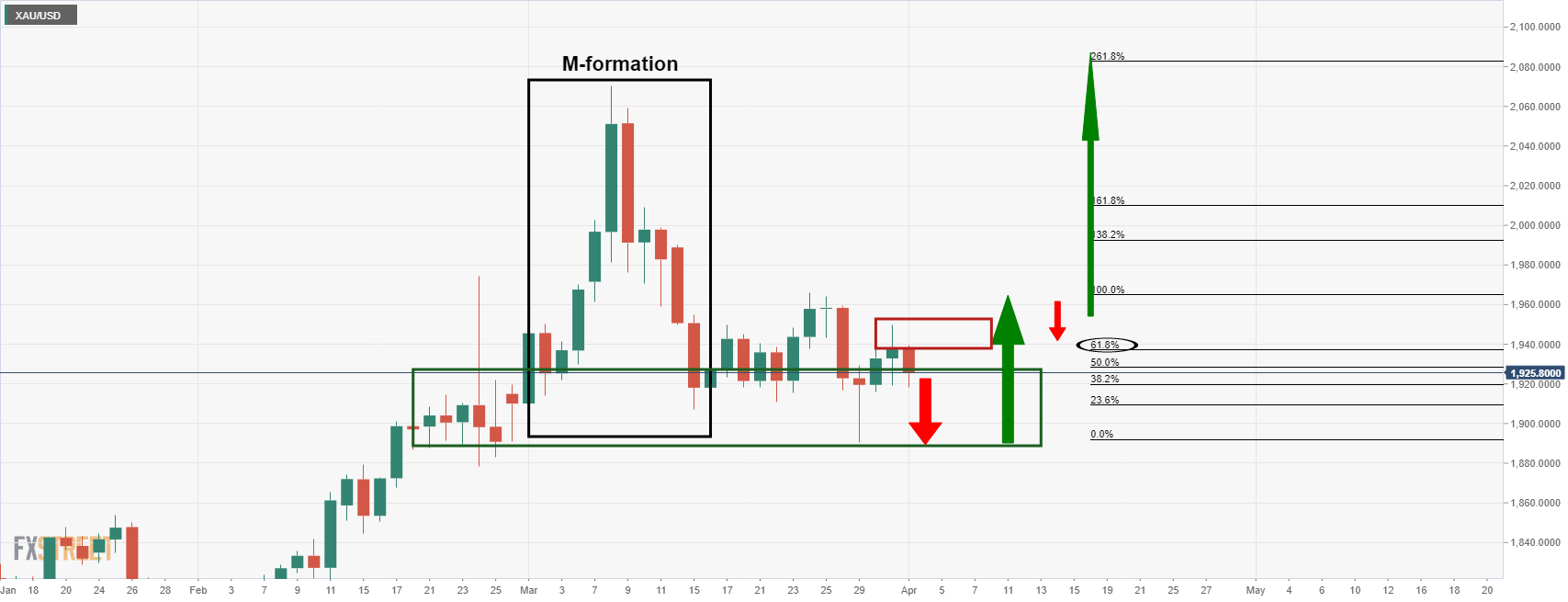

Gold, technical analysis

As per the pre-open analysis, Chart of the Week, Gold: XAU/USD is pressured for the open ...

... the M-formation is a bullish reversion pattern and the price would be expected to be attracted to the neckline between $1,980 and $2,000. However, the sideways consolidation has played out to the point that there appears to be a bias to the downside for the near term where gold is being resisted by a 61.8% Fibo currently.

- EUR/USD is auctioning near the upper boundary of the previous consolidation in a 1.0945-1.1042 range.

- Soaring inflation in Eurozone is likely to compel ECB to hike the interest rates.

- The DXY is firmer on record lows US Unemployment Rate.

The EUR/USD pair seems to find significant bids near its previous consolidation range, which placed in a range of 1.0945-1.1042. The pair has sensed a corrective pullback after a decent upside, which may call a rebound going forward.

Last week, a slight plunged in the Euro Unemployment Rate had brought a decent sell-off in the shared currency. The Eurostat reported Unemployment Rate at 6.8%, which remained in the mid of market consensus at 6.7% and the prior figure of 6.9%. Meanwhile, investors raised bets over an interest rate hike by the European Central Bank (ECB) on soaring inflation numbers.

The German annual inflation has climbed to 7.3%, the highest print in more than four decades. While the Consumer Price Index (CPI) in France has landed at 5.1% and the inflation number in Italy has reached 6.7%. Adding to that, the Eurozone Harmonized Index of Consumer Prices (HICP) rose TO 7.5%, much higher than the market estimate of 6.6% and the previous print of 5.9%. Therefore, higher standalone and consolidated Consumer Price Index (CPI) figures are likely to compel the ECB’s policymakers to underpin an interest rate hike.

Meanwhile, the US dollar index (DXY) is holding gains around 98.56 despite softer US Nonfarm Payrolls (NFP). The US economy has added 431k jobs higher than the estimate of 490k and the previous print of 750k. Although the record lows Unemployment Rate at 3.6% has cushioned the greenback.

Going forward, investors will focus on the Eurogroup meeting, which is due on Monday. This will keep the shared currency on the sidelines. While the greenback docket will release Federal Open Market Committee (FOMC) minutes on Wednesday.

- Bears eye the 50% mean reversion area to mitigate the price imbalance towards 0.7350.

- US dollar firm on US NFP and Fed expectations, RBA is also eyed this week.

AUD/USD will start out the second quarter's first full week on the back foot following last week's bearish close pertaining to a stronger US dollar and Federal Reserve interest rate hike expectations. At 0.7499, AUD/USD closed Friday a touch in the green, +0.21%, within the day's range of 0.7472 and 0.7524. However, for the week, the pair lost 1.11%.

The US dollar is firm considering the expectations so the Federal Reserve. Fed officials began the process of policy normalization by lifting rates 25bp to 0.25%-0.50% at the March meeting. On the weekend, Reuters has reported what New York Fed President John Williams said on Saturday in this regard.

''Williams, in response to questions at a symposium about whether the Fed needed to hasten its return to a neutral policy rate that neither encourages or discourages spending, noted that in 2019 with rates set near the neutral level 'the economic expansion started to slow,' and the Fed resorted to rate cuts.''

''The Federal Reserve needs to move monetary policy towards a more neutral stance, but the pace at which it tightens credit will depend on how the economy reacts,'' Williams added.

This week will offer the minutes of the last meeting. ''The FOMC pull no hawkish punches in its policy guidance, with Chair Powell also hinting further information about QT plans will be provided in the minutes (possibly including caps details),'' analysts at TD Securities said. ''We continue to expect an official QT announcement at the May FOMC meeting.''

US dollar firm

The US dollar is up as US rates recover, rising Friday, helped by robust US job growth numbers for March that firmed market expectations that the Federal Reserve will increase the pace of interest rate hikes in an effort to blunt rising inflation. 431,000 jobs were added last month, below the estimates of 490,000, although data for February job increases were revised higher. However, the Unemployment rate fell to 3.6%, the lowest since February 2020. The DXY was higher for the second straight day after two straight down days and is trading back near 98.50. This month’s cycle high near 99.418 should eventually be tested.

Looking ahead for the week, the Reserve Bank of Australia is meeting. ''We expect the RBA to reiterate that it remains 'patient', looking past the Budget handouts,'' the analysts at TD Securities said. ''The RBA seems comfortable with the risk of moving too late than too early and noted that it won't respond until there is "evidence of pervasive price pressures". Thus, we like Rec Jun'22 RBA OIS. We retain our call for the first 15bps hike in Aug but now expect another hike in Sep.''

AUD/USD technical analysis

The price is under pressure from weekly resistance and would be expected to correct towards the 50% mean reversion area to mitigate the price imbalance towards 0.7350.

While NATO believes the military conflict in Ukraine will continue, there is a glimmer of hope stemming from last week's peace talks that has been updated in the following article:

-

Russia-Ukraine peace talks have advanced, a meeting between Putin And Zelensky is possible

However, Vladimir Putin's meeting with Volodymyr Zelenskyy will only take place after the development of a specific written document by the Russian Federation and Ukraine, Dmitry Peskov, the Kremlin Press Secretary has stated.

The Russian chief negotiator Vladimir Rostislavovich said Moscow-Kyiv talks will resume on Monday experts to continue work on the agreement. Medinsky said that a draft treaty between Russia and Ukraine is not yet ready "for submission to a summit meeting," although Ukraine has become more realistic about its neutral and non-nuclear status.

Further key updates

Georgia PM says will not impose economic sanctions against Russia.

Germany refused to supply Kyiv with 100 units of marder-type infantry fighting vehicles.

Zelensky said that Ukraine has not received security guarantees from any country.

The Russian defence ministry says scenes in the city of Bucha were staged to distribute photos, and videos via western media.

US Blinken says western sanctions may be lifted depending on the outcome of negotiations between Russia and Ukraine.

Peskov is convinced that the goals of the military operation in Ukraine will be achieved in full.

Russia wants to declare victory over Ukraine by May 9; US intelligence believes that Russia wants to take Donbas under full control by May 9.

Poland is ready to deploy us nuclear weapons on its soil, Polish deputy prime minister Kaczynski.

Market implications

As talks continue, this should be a positive backdrop for the open this week. Risk assets such as gold could struggle from the off.

-

Chart of the Week, Gold: XAU/USD is pressured for the open

Last week, Russia and Ukraine had been holding in-person and virtual peace talks in the past week. Both sides described the talks as difficult. However, Ukrainian and Russian negotiators have reached an agreement on enough elements of a potential peace agreement that it is ready to be discussed between Russian President Vladimir Putin and Ukrainian President Volodymyr Zelensky, a top Ukrainian negotiator said Saturday, according to Interfax Ukraine.

During talks in Turkey earlier this week, after Ukrainian officials shared the proposals for non-military negotiations regarding Crimea, the Russian negotiator Vladimir Medinsky said the Russian side had proposed a meeting between Putin and Zelensky.

Additionally, the head of the Ukrainian delegation at the talks, David Arakhamia, said during an interview on Ukrainian television that Russian negotiators on Friday had agreed to all of Ukraine’s positions, except for its stance on Crimea.

The Russian negotiators also agreed the draft documents were ready to be sent to Putin and Zelensky for direct discussions, Arakhamia said. According to Arakhamia, Turkish President Recep Tayyip Erdogan had spoken to Putin and Ukrainian officials on Friday, and “seemed to confirm” Turkish officials are ready to arrange a meeting in Turkey in the “near future.”

Market implications

Such sentiment is a positive backdrop for the open this week and could weigh on the price of gold and safe-haven assets in general.

-

Chart of the Week, Gold: XAU/USD is pressured for the open

Reuters has reported what New York Fed President John Williams said on Saturday.

''Williams, in response to questions at a symposium about whether the Fed needed to hasten its return to a neutral policy rate that neither encourages or discourages spending, noted that in 2019 with rates set near the neutral level 'the economic expansion started to slow,' and the Fed resorted to rate cuts.''

''The Federal Reserve needs to move monetary policy towards a more neutral stance, but the pace at which it tightens credit will depend on how the economy reacts,'' Williams added.

"We need to get closer to neutral but we need to watch the whole way," Williams said. "There is no question that is the direction we are moving. Exactly how quickly we do that depends on the circumstances.”

Meanwhile, the US dollar climbed on Friday, assisted by robust US job growth numbers for March. The Nonfarm Payrolls data firmed market expectations that the Federal Reserve will increase the pace of interest rate hikes in an effort to blunt rising inflation. 431,000 jobs were added last month, below the estimates of 490,000, although data for February job increases were revised higher. However, the Unemployment rate fell to 3.6%, the lowest since February 2020.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.