- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-03-2022

- GBP/USD remains on the way to second weekly loss despite the latest inaction.

- Chatters over UK PM Johnson’s retreat from triggering Article 16 before Stormont’s elections may help in Brexit talks.

- Traders remain cautiously optimistic despite Russia-Ukraine agreement over safe passage to civilians from Kyiv.

- US NFP, risk catalysts may keep exerting downside pressure on the quote but the odds of surprises can’t be ruled out.

GBP/USD bears took a breather around 1.3345-50 amid Brexit optimism during early Friday morning in Asia. Even so, the cable pair remains on the back foot for the second consecutive week as the US dollar cheers cautious mood in the market, mainly due to the Ukraine-Russia standoff and chatters over the Fed’s 0.50% rate hike in March.

The Financial Times (FT) came out with the news quoting some of the UK Government insiders while saying, “War in Ukraine has reshaped ministerial thinking on the protocol ahead of May’s Stormont elections.” The news makes sense and can help break the deadlock over the Northern Ireland (NI) talks in the latest Brexit negotiations.

On a different page, Kyiv and Moscow agreed for a safe passage for Ukraine’s civilians during the second round of talks and showed readiness for the third phase of negotiations. The positive development should have ideally favored risk appetite but doubts over Russian military intentions keep traders skeptical.

Elsewhere, Fed Chair Jerome Powell reiterated his support for a 0.25% rate hike, actually showing readiness for a 0.50% rate-lift in the March meeting amid rising inflation fears. The same joined mixed US data and the market’s anxiety to keep the US Dollar Index (DXY) on a front foot for the fourth consecutive week. It’s worth noting that the greenback gauge renewed 21-month high the previous day.

That said, US ISM Services PMI eased for the third consecutive month in its latest release but the second-tier job data and Factory Orders came in positive. At home, UK Services PMI for February eased below 60.8 initial forecasts to 60.5.

Against this backdrop, US Treasury yields and Wall Street closed in red, despite the initial positive performance, but the S&P 500 Futures print mild gains by the press time.

Looking forward, GBP/USD traders may keep their eyes on the risk catalysts for fresh impulse. Also important will be the monthly readings of the US jobs report, mainly the Nonfarm Payrolls (NFP) figure.

Read: US Nonfarm Payrolls February Preview: Fed policy runs through Kyiv

Technical analysis

GBP/USD remains inside a 170-pip trading range between 1.3270 and 1.3440 since last week but sustained trading below the previous support line from late December 2021 keeps the pair sellers hopeful.

- The Australian dollar shows some resilience and extends its weekly gains some 1.30% despite a risk-off market mood.

- The Ukraine-Russia conflict took a breather as negotiators of both nations reunited for the second round of talks.

- AUD/JPY Technical Outlook: Upward biased testing the 85.00 mark; once cleared bull’s next target is 86.00.

The AUD/JPY is climbing though retraced from YTD highs near the 85.00 mark as market sentiment dampened, as investors assess the economic impact of the Russia-Ukraine conflict, while Wall Street indices recorded losses. Also, February’s US Nonfarm payrolls report looms, as economists expect at least 420K jobs added to the economy. At the time of writing, the AUD/JPY is trading at 84.60.

Recapping some geopolitical headlines of Thursday’s trading session, Ukrania and Russia negotiators said they would resume talks for the third time in the next week and agreed on humanitarian corridors to evacuate civilians. Ukraine President Zelensky noted that he has “to talk with Putin to end the war.” Contrarily, Russian President Vladimir Putin stated that the ongoing advance in Ukraine is “going to plan.” In a phone call with French President Macron, he told him that Russia will achieve its goals in Ukraine.

That said, in Thursday’s trading session, the AUD/JPY began the Asian session on the wrong foot, though rallied by its end, and reached a YTD high at 84.93. afterward, the cross-currency retraced towards 84.50 as Friday’s Asian Pacific session looms.

AUD/JPY Price Forecast: Technical outlook

The daily chart shows the AUD/JPY is bullish biased. The daily moving averages (DMAs) located below the spot price is the first signal that confirms the aforementioned. Also, AUD bulls holding the exchange rate above the 84.30 January 5 high, keep them in control. Nevertheless, it is worth noting that Thursday’s price action left a candlestick with an upper-wick the same size on the real body, meaning indecision.

The AUD/JPY first resistance would be 85.00. Breach of the latter would expose May 10, 2021, daily high at 85.80, followed by October 21, 2021, 86.25, daily high.

“US Commerce Secretary Gina Raimondo said on Thursday the Biden administration was examining whether providing exclusions from tariffs inherited from the previous administration was a way to ease inflation,” Reuters quotes the diplomat’s comments on CNBC interview during late Thursday.

Key quotes

The president has asked me, has asked members of his cabinet, (to) look at every possible tool in our toolbox to deal with inflation and go industry by industry to figure out how we can ease the pressure.

And so, yes, we are looking carefully to see if it would make sense to provide any exclusions from tariffs to bring down prices.

FX implications

The news fails to get any major attention but may join the latest positive development on the Ukraine-Russia talks to help improve sentiment.

Read: Forex Today: A pitch of optimism helps high-yieldings to bounce, Dollar still King

“War in Ukraine has reshaped ministerial thinking on the protocol ahead of May’s Stormont elections,” said the Financial Times (FT) late Thursday.

Key quotes

One government insider said the international situation had reshaped thinking on the protocol. ‘Before the Ukraine war, it was more likely that we could have triggered Article 16 before purdah kicks in. But now it’s looking pretty uncertain.’

Rishi Sunak, the chancellor, has consistently warned ministers about the economic consequences of triggering Article 16, including the possibility of a trade war with the EU and the likely continuation of US tariffs on British metals exports, according to government insiders.

But some Conservative MPs believed Johnson was nevertheless intent on triggering Article 16 as part of a deal with Tory rightwingers to prop up his leadership during the ‘partygate’ scandal, in which he is being investigated for breaking coronavirus restrictions.

Senior Conservatives are also concerned that Northern Ireland’s unionist parties could suffer in May’s elections due to the unpopularity of the protocol among their voters.

If the dispute is not resolved prior the election purdah, it may toughen feelings against the agreement, particularly on the part of the Democratic Unionist party and its leader Sir Jeffrey Donaldson.

FX implications

GBP/USD paid a little heed to the prices-positive news but the bears take a breather around 1.3350 by the press time.

- GBP/JPY pulled back from weekly highs above 155.00 as risk appetite deteriorated in the latter stages of US trade.

- GBP/JPY is back to trading near 154.00, near the middle of recent ranges, as markets remain concerned by Ukraine events.

Thursday was a choppy, mixed day for global financial markets, with large swings observed in commodity markets and US equities trading in both the red and green during US trade. Ultimately, risk appetite took a turn for the worse towards the end of US trading hours, as traders opted to take some risk off of the table ahead of Friday’s US labour market report. The Russo-Ukraine does not look likely to de-escalate anytime soon meaning commodity market respite seems unlikely, and the general message from Fed Chair Jerome Powell at his Congressional testimony this week was hawkish-leaning, so there isn't exactly much for investors to cheer right now.

The net result for GBP/JPY was that the pair pulled back from weekly highs it hit to the north of the 155.00 level earlier in the day, after running into resistance in the form of lows from back in mid-February. The pair has since fallen back to test the 154.00 mark and is on course to drop about 0.5% on the day, though still trades nearly 1.0% above sub-153.00 lows set earlier in the week. Until there is more clarity on the impact that the Ukraine war will have on the global economy and on how central banks will respond, risk appetite is likely to remain choppy and it might be difficult for the pair to break out of recent 152.60-155.20ish ranges.

- AUD/USD is meeting resistance and the focus is back to the downside towards 0.73 the figure.

- Ukraine crisis and commodities are in focus, driving the price.

AUD/USD is firm in the late US session as bulls step in to slow down the bearish correction on the hourly chart. However, there are prospects for further resistance as illustrated in the technical analysis below. Meanwhile, the Australian dollar sped to the highest level since November 2021 vs the US dollar as monster gains in commodity prices looked set to shower Australian exporters in cash.

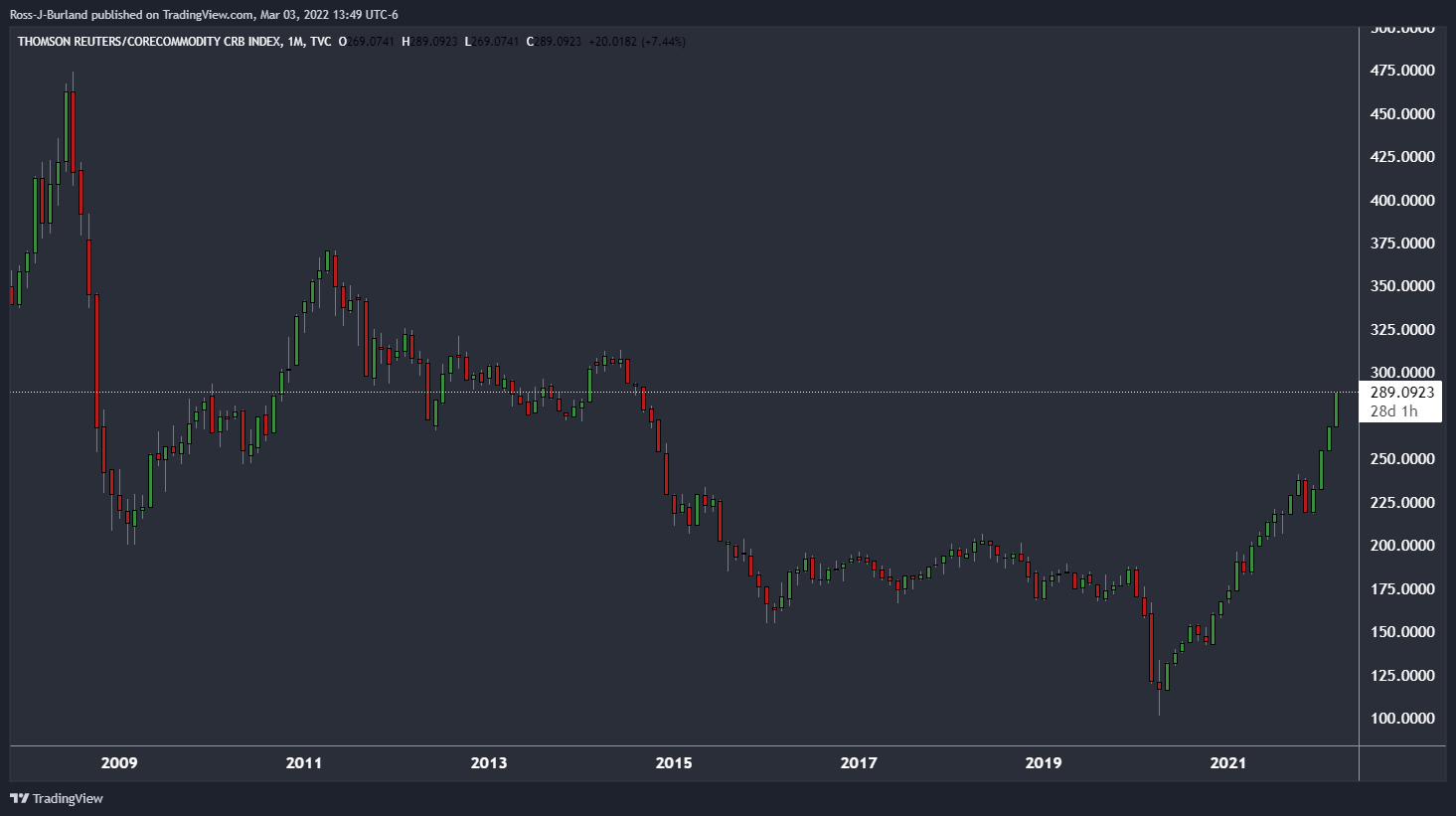

Commodities have taken off, as illustrated in the CRB Index below:

Ever-tightening sanctions on Russia have markets fearing major shortages in oil and energy, metals and wheat.

''Coal contracts rose between 25% and 50% on Wednesday as buyers sought to replace Russian supplies. The Australian government said it was helping countries connect with local coal producers to fill the gap,'' Reuters reported.

This brings us to Australia's surplus that was reported earlier in the week which ballooned to A$12.9 billion ($9.39 billion) on higher coal and iron ore earnings. This was the largest surplus on record and well above market forecasts of A$9 billion,'' Reuters explained and there is more in the pipeline according to Taylor Nugent, an economist at NAB. "Records will be broken in coming months if prices are sustained." Bigger earnings mean bigger flows out of the greenback into the Aussie as US dollar earnings are converted.

Meanwhile, as of yet, Russian troops have not made it to the Ukraine capital Kyiv as the invasion of Ukraine entered its eighth day Thursday. However, the mayor of Kherson said the strategic port city in Ukraine's south had been "captured" by Russian forces. The apparent capture of Kherson, situated on the Dnieper River, marks the first major city to fall into Russian hands as Ukrainians continue to defend key hubs across their country.

The focus has remained on a number of strategic cities, including the capital, Kyiv, Ukraine's second-biggest city, Kharkiv, and another key port city, Mariupol. In more positive news, Russia and Ukraine are agreeing to a ceasefire in heavily embattled areas where humanitarian corridors will be developed to allow the evacuation of its citizens from the bombed cities.

AUD/USD technical analysis

The price is stalling on the bid and following another failed attempt to rally, meeting the 61.8% Fibonacci level, the focus is back to the downside towards 0.73 the figure.

- US equities were mixed on Thursday and defined more by rotation from growth into value than risk-on or risk-off.

- The S&P 500 recovered most of an intra-day drop of nearly 1.0%, but remains capped under 4400.

US equity market trade has been more defined by rotation from high multiple tech and growth names into more defensive stocks and value names on Thursday as opposed to any broad risk-on/risk-off trend. With not much having changed on the Ukraine/Russia war front (i.e. no signs of de-escalation) and remarks from Fed Chair Jerome Powell in line with his remarks a day earlier, a near-flat trading S&P 500 shouldn’t be too surprising. The index dipped as low as the 4340s where it was at the time about 1.0% lower on the day in earlier trade, but has since recovered to the 4375 area, where it trades with modest losses of about 0.3%. The 4400 level continues to provide strong resistance.

The Nasdaq 100 was last down about 1.2% and trading back just above 14,000 having been as high as the 14,300s earlier in the day, with the index seemingly coming under selling pressure as it tested its 21-Day Moving Average. The Dow, meanwhile, was last flat and trading just under the 33,900 mark, close to the middle of its intra-day 33,650-34,180ish range. The CBOE S&P 500 Volatility Index dropped just under a point to slightly under 30.00 again, still well above its long-term average which is close to 20.00.

Investors face a wall of worries on multiple fronts. Commodity prices were all over the place on Thursday, with WTI swinging as high as the $116.00s (multi-year highs) before dropping back under $110 amid continued feverish speculation as to the impact of Russia sanctions. The take of Fed policymakers, including Powell, who spoke on Thursday at the second of his two-day semi-annual testimony before Congress, is that events are likely to worsen the inflation problem. And that could mean a faster pace of rate hikes (i.e. 50bps intervals) later this year if inflation fails to subside as expected.

That could be one reason why interest rate-sensitive growth/tech names are underperforming on Thursday, although with US bond markets broadly flat on the day, that might be reading too much into things. Thursday also saw the release of the widely followed ISM Services PMI survey for February which underwhelmed and was at its weakest in a year. But with equity investors much more focused on geopolitics and the Fed’s reaction right now, perhaps it wasn’t too surprising not to see a reaction. As long as the upcoming jobs report doesn’t surprise in a big way to the up or downside, that may well be the case on Friday also.

- The New Zealand dollar advances 2.05% in the week.

- Financial sentiment improved as Ukraine/Russia negotiators agreed to create a corridor for evacuation while scheduling another round of discussions.

- NZD7USD Technical Outlook: A daily close above 0.6810 would shift the pair’s bias to neutral-downward.

NZD/USD barely advances, and its two-day rally seems to falter as Thursday’s price action forms a “doji” after reaching a weekly top around February 23 high at 0.6809. In the middle of a mixed market mood, the NZD/USD is trading at 0.6802.

Market mood improved on positive news on Ukraine-Russia meeting

Wall Street jumped on the back of tilted positive news of the Russia-Ukraine second round of talks. A Ukrainian negotiator said that both parties agreed to have a third round of negotiations, while Russia-Ukraine agreed on creating corridors for evacuating civilians. Furthermore, he noted that the agreement involved a “possible” temporary ceasefire during that event. On the Russian front, the negotiator commented that they discussed future political regulation of the conflict between the parties and agreed to support humanitarian corridors.

Meanwhile, the Federal Reserve will move forward with plans to raise interest rates this month to tame inflation, even as the outbreak of war in Ukraine has made the outlook “highly uncertain,” Fed Chair Jerome Powell said on Wednesday. Powell noted that due to geopolitical concerns, he would open the door to the possibility that the rate hike will be only 25 basis points versus 50 basis points.

In the meantime, the US Dollar Index (DXY), a gauge of the greenback values against six major currencies, reached a high at 97.95, up so far 0.48%, while US Treasury yields are almost flat, led by the 10-year US T-note yield at 1.856%.

Elsewhere, data-wise, on Wednesday, the NZ economic docket was absent. Across the pond, the US economic docket reported that Initial Jobless Claims for the previous week fell more than forecasted as market players prepare for Friday’s Nonfarm payrolls report, which estimates that the US added 415K jobs in February.

NZD/USD Price Forecast: Technical outlook

Thursday’s price action denotes that the pair is subdued, almost flat in the day. Of late, the NZD/USD pair reclaimed the 0.6800 mark, though the uptrend appears to peak as price action consolidates. If NZD/USD bulls achieve a daily close above February 23 0.6809 high, the pair will shift to neutral-downward, exposing the 100-DMA as the first resistance level at 0.6843. Once cleared, the next supply zone would be January 13 daily high at 0.6890, followed by 0.6900.

Contrarily, failure at 0.6809 would resume the downtrend, with the January 6 low at 0.6733 as first support. Breach of the latter would expose 0.6700, followed by the February 24 daily low of 0.6630.

- The USD/CAD pairs some Wednesday’s losses, though struggles to reclaim the 50-DMA, which could spur a leg-down.

- Negative market sentiment, keep safe-haven peers buoyant.

- USD/CAD Technical Outlook: Neutral biased but could turn neutral-downwards if USD/CAD bulls struggle at 1.2680, 50-DMA.

Trapped between the 50 and 100-day moving averages (DMAs) after a steeper loss on Wednesday while the Bank of Canada (BoC) hiked 25 basis points to its Bank Rate to 0.50%, the USD/CAD edges higher. At the time of writing, the USD/CAD is trading at 1.2661, 40-pips short of the 1.2700 mark.

Geopolitical headlines hit the financial markets again. While Russia-Ukraine held the second round of talks in Belarus, the Ukrainian military reported that Belarus troops received the order to cross the Ukrainian border. Said that the market mood still dampened as witnessed in global equities. The CAD weakened against safe-haven peers amid rising US crude oil prices cling to the $110 mark.

The Bank of Canada Governor Macklem crosses the wires at press time, and you can follow the coverage here.

USD/CAD Price Forecast: Technical outlook

The USD/CAD bias is neutral, but it could be “neutral-downwards.” Why? Because on March 2 recorded a daily close below February 10 low at 1.2632, breaking the previous market structure; nevertheless, on Thursday, the USD/CAD recovered but is struggling to break above the 50-DMA at 1.2680.

USD/CAD’s failure at the 50-DMA would allow further losses. The pair’s first support would be the confluence of the 100-DMA and February 10 daily low in the 1.2632-40 area. Breach of the latter would expose March 3 daily low at 1.2587, followed by the 200-DMA at 1.2567, and ultimately would reach January 19 low at 1.2450.

If the scenario of the USD/CAD reclaiming the 50-DMA, the first resistance would be 1.2700. Once cleared, the next ceiling level would be March 2 high at 1,2741, followed by January 22 high at 1.2797 and a three-month-old downslope trendline around 1.280030.

The Ukrainian military said on Thursday that it believes that Belarusian troops have received the order to cross the Ukrainian border, Reuters reported.

Bank of Canada Governor Tiff Macklem said on Thursday that the decision to hike interest rates means ending reinvestments and moving towards Quantitative Tightening (QT) as "a natural next step", Reuters reported. The timing and pace of QT will be fully transparent, Macklem added, saying that when we initiate quantitative tightening, we do not intend to actively sell bonds.

Additional Remarks:

"When we initiate quantitative tightening, we do not intend to actively sell bonds."

"Broadening in price pressures is a big concern and makes it more difficult for Canadians to avoid inflation."

"Longer-term inflation expectations have remained well anchored and we will use our tools 'with determination' to keep them that way."

"History shows that if inflation expectations become unmoored, it becomes much more costly to get inflation back to target."

"We need higher rates to dampen spending growth so demand does not run significantly ahead of supply."

"Canadian economy can handle higher rates; we know this will be a significant adjustment."

"We expect global demand and supply of goods to gradually come into better balance through 2022."

"Roughly 40% of our bond holdings mature within the next 2 years; this suggests balance sheet would shrink relatively quickly."

"As Canadian gov't bond holdings mature and roll off, the level of settlements balances on our balance sheet will decline roughly in tandem."

"Our primary tool is the policy interest rate; adjustments to pace and timing of removal of monetary stimulus will focus on policy rate."

"We fully intend to tighten policy in a deliberate and careful away, being mindful of the impacts and monitoring effects closely."

Federal Reserve Chairman Jerome Powell, on the second day of his semi-annual testimony before the US Congress, said that, right now, very low-interest rates are not appropriate and inflation is too high, reported Reuters.

Additional Remarks:

"We are going to use our tools to bring it (inflation) down."

Repeats he will support a 25bps rate rise in March.

"We are prepared to raise interest rates by more than that in a meeting or meetings if inflation doesn't come down."

"Interest rate is the active tool of monetary policy."

"Over the course of this year, we will raise interest rates and allow the balance sheet to shrink."

"We will decide the path for the balance sheet and let it go in the background."

According to a US official, Russian President Vladimir Putin has now committed 90% of its pre-staged combat power into Ukraine, reported Reuters. Russian troops are just outside of Kharkiv now, the official continued, and Mariupol is still under Ukrainian control but Russian forces appeal to be trying to isolate the city.

The official said that the US cannot confirm or deny the use of Russian thermobaric weapons in Ukraine, but knows that 480 Russian missiles have been launched so far. The majority of missile launches have come from inside Ukraine, the official said, who also emphasised that the US does not have boots on the ground in Ukraine. Overhead imagery has been impacted recently by poor weather, the official added.

- The AUD/USD extends its gains in the week, up some 2.71%.

- The market sentiment is mixed, portrayed by some global equity indexes are fluctuating.

- In the FX complex, the market mood is constantly swinging between risk-off/on.

- AUD/USD Technical Outlook: Daily close above the 200-DMA would expose higher prices.

AUD/USD climbs for the third day in the week, threatening to break above a 10-month-old downslope trendline, and so-far leaves the 200-DMA at 0.7324 below the spot price, early as Wall Street’s open. At 0.7333, the AUD/USD shows some resilience of risk-sensitive currencies, despite that European and US equities reflect a mixed market mood.

European equity indices record losses, while US equity indices opened on the right foot. In the FX space, rusk-sensitive peers advance, contrarily to safe-haven ones. The greenback extends gains, with the US Dollar Index up 0.27%, sitting at 97.620, while US Treasury yields rise.

In geopolitical themes, Russia-Ukraine talks resumed as reported by the Tass news agency earlier in the day. Meanwhile, the Russian Deputy Foreign Minister said that talks with Ukraine in Belarus could yield results, while Lavrlo said that Putin and French President Macron held discussions in a phone call. A French official reported that Russia’s Putin told Macron that if Ukraine neutralization and disarmament can’t be reached diplomatically, he would extend Russia’s “special military operations.”

Australian and US economic data

During the Asian session, the Australian economic docket featured data for January, led by Australian building Approvals, which contracted more than estimations. At the same time, the Trade Balance printed a surplus of 12.9 B vs. 9.1 B estimated. Furthermore, Exports expanded 8%, more than 1% in December, and Imports contracted 2%.

Across the pond, the US economic docket featured US Initial Jobless Claims for the week ending on February 26, which came at 215K, lower than the 225K estimated, while US Markit Services PMI for February came at 56.5, fell short a tenth than estimations. Late in the session, the US ISM Services Index for the same period declined to 56.5, worse than estimations, while Durable Goods Orders and Factory Orders fulfilled expectations.

AUD/USD Price Forecast: Technical outlook

The AUD/USD is neutral-upward biased. Indeed a daily close above the 200-DMA would expose 0.7400, and the AUD/USD would shift to upward bias, further cemented by positive China’s economic outlook for 2022.

However, on its way towards 0.7400 and higher, AUD/USD bulls would need a break above November 16 high at 0.7368. Breach of the latter would expose the aforementioned 0.7400 mark, followed by September 3 day high at 0.7478 and then 0.7500.

AUD/USD’s failure at the 200-DMA could trigger a leg down, towards 0.7300, followed by the 100-DMA at 0.7234.

- Second day of gains in Wall Street weighs on USD/MXN.

- Mexican peso’s upside seems limited on the current environment.

- Mixed data from the US on Thursday, NFP due on Friday.

The USD/MXN is rising modestly on Thursday, hovering around 20.66 on the back of a mixed US dollar. The greenback is being supported by a cautious tone across financial market as the crisis in Ukraine continues.

Wall Street indices are rising for the second day in a row, keeping Mexican peso’s losses limited. Another wave of risk aversion could send USD/MXN toward 21.00. Crude oil prices are having an extremely volatile session. The WTI barrel hit the highest level in more than a decade above 116.00, and then pulled back to as low as 107.69.

Economic data from the US came in mixed. Initial Jobless Claims dropped to the lowest level in eight weeks, while the ISM services PMI fell unexpectedly to 56.5 from 59.9. The employment component of the ISM services dropped to 48.5 from 52.3 and the Price Paid rose to 83.1. On Friday, the US official employment report is due.

Short-term outlook

The USD/MXN holds a bullish tone, although it failed to post a daily close above the 20.70 area on Wednesday. If the dollar manages to rise back and consolidate above 20.70, it would clear the way for a test of the following critical resistance at 20.85/90, the last defence to 21.00.

On the flip side, the 20.45/55 band is currently offering support to USD/MXN. A break lower would negate the short-term negative bias.

Technical indicators show the RIS moving north, supporting the upside, while Momentum is flattening still in positive ground.

USD/MXN daily chart

-637819179471704811.png)

The UK said on Thursday that 45 Organization for Security and Co-operation in Europe (or OSCE) participating nations are invoking the OSCE's Moscow Mechanism. This will set up a mission of experts to look into potential rights abuses committed by Russian forces in Ukraine. Ukraine supports the invoking of the Moscow Mechanism, the UK mission to the OSCE said.

The OSCE mission will establish the facts around issues including cases of possible war crimes and crimes against humanity, including deliberate and indiscriminate attacks against civilians, the US said. The OSCE mission of experts will collect and analyse information with a view to presenting it to accountability mechanisms, as well as international courts and tribunals, the UK said.

- USD/RUB trades in the middle of the range around 104.00.

- Russia and Ukraine should resume talks later in the day.

- Putin-Macron call leaves scarce hope for a peaceful solution to the conflict.

The Russian currency remains highly volatile and takes USD/RUB to the middle of the daily range in the 104.00 region on Thursday.

USD/RUB looks to Belarus

USD/RUB resumes the upside following Wednesday’s pullback, although the bullish attempt seems to have met decent resistance in the low-111.00s so far on Thursday.

The ruble stays under scrutiny as the Russian invasion of Ukraine remains under way, although it has been severely hurt following West sanctions on Moscow and the Bank of Russia (CBR) along with the inability of major Russian lenders to keep using the SWIFT system.

It is worth recalling that FX interventions by the CBR in combination with an emergency raise of the policy rate to 20.00% prevented the depreciation of the ruble from spiraling in past sessions, although the threaten of further and harder sanctions by Western powers and the impact on the Russian economy do not bode well for the currency for the time being.

Later in the session, all the attention is expected to be in Belarus for another round of talks between Russian and Ukrainian officials.

USD/RUB levels to watch

So far, the pair is up 1.69% at 104.22 and faces the next hurdle at 122.25 (all-time high Mar.2). On the downside, a breach of 90.00 (monthly high Feb.24) would aim for 78.08 (55-day SMA) and finally 74.48 (200-day SMA).

EUR/NOK is trading around 9.85. In the short-term, if markets calm down while energy prices remain high, EUR/NOK could fall to 9.50. Longer out, economists at Nordea see the pair around 10.00.

EUR/NOK to trade around 10.00 this year

“If equity markets calm down while energy prices remain high, the EUR/NOK could fall further towards 9.50 by the summer.”

“Norges Bank will start to sell NOK by the summer to offset the huge increase in taxes from oil&gas companies, that should give more balanced NOK flows and a weaker NOK, all else equal. We therefore see EUR/NOK trading around 10.00 longer out.”

“When it comes to USD/NOK, we see the cross coming above 9.00 toward year-end. The pair has potential on the upside as we continue to believe that higher US rates will drive the USD stronger.”

The GBP’s loss of the 1.34 handle is weighing on the cable toward a test of the mid-figure area. Economists at Scotiabank note that the pair could suffer a substantial drop to the 1.32 support zone.

GBP/USD price action points to more downside ahead

“With the pound showing limited signs of a break past the mid 1.34s, price action points to more downside ahead while it builds a wide ~1.3275-1.3435 trading band over the past five sessions.”

“Support after the mid-1.33s is the big figure and once the 1.3270/75 zone breaks, the GBP is looking at a quick decline to the 1.32 support area.”

“Intermediate resistance is ~1.3420 after the figure, followed by the mid 1.34s.”

AUD/USD is testing the YTD high and the 200-day moving average (DMA) at 0.7315/30. A break above here would end Credit Suisse’s medium-term negative view and turn the risks higher.

Break below 0.7245/36 to open the door for further falls

“We remain with our view that 0.7315/30 is likely to hold the recovery and hence we look for a turn back lower from here, with support seen at 0.7274 and then at this week’s lows at 0.7245/36, a close below which is required to prevent further upside. A break below here would then open the door to for a fall back to the 55-DMA at 0.7184, which would bring AUDUSD back in the middle of the recent range.”

“Only a sustained break above 0.7315/30 would refute the medium-term downtrend and lead us to change our currently neutral position, with resistance seen at 0.7367, then 0.7422/31.”

USD/CAD is breaking below 1.2635. Next support is located at 1.2568/46, which is the 200-day moving average (DMA) and 2021 uptrend, analysts at Credit Suisse report.

1.2554/46 set to hold

“We now see losses to potentially extend further within the broader range, with next important support seen at the 200-DMA at 1.2568 and then the uptrend from 2021 at 1.2554/46.”

“Being a major medium-term support, we expect 1.2554/46 to hold the current decline for an eventual bounce back above 1.2652/62 and next above the February low at 1.2634 – bringing USD/CAD back in the middle of the medium-term upward trending range.

“A break below 1.2554/46 would increase the risk of a more protracted weakness, with only a sustained break below 1.2449/48 definitely confirming a concerted swing lower within the broader range, which would lead us to shift our bias to a more negative side. However, this is not our base case.”

- Silver is consolidating close to multi-month highs not far below $25.50 as markets remain intensely focused on the Ukraine conflict.

- Technicians have noted that spot silver prices have over the last few days formed an ascending triangle.

- Upcoming tier one US data releases (ISM Services on Thursday, NFP on Friday) will play second fiddle for geopolitics.

Spot silver (XAG/USD) prices are consolidating close to multi-month highs with the $25.50 per troy ounce mark for now acting as resistance, but ongoing nervousness about the ongoing Ukraine conflict and its economic impact underpinning the safe-haven metal for now. At current levels in the $25.30s, spot silver trades broadly flat on the day, with focus for now on talks between Ukrainian and Russian delegations in the hopes that some sort of ceasefire might be in the offing.

Given maximalist demands still being made by Russian President Vladimir Putin on Tuesday, demands which the Ukrainian government is very unlikely to accept, hopes that a broad ceasefire agreement can be reached are slim. That suggests no end in sight for the rally in the prices of commodities exported by Russia (oil, gas, various agricultural products and base metals), which will likely keep assets deemed as offering inflation protection in demand (like silver).

Technicians have noted that spot silver prices have over the last few days formed an ascending triangle, a pattern that is more often than not indicative of a bullish breakout. Technical buying on a break above the $25.50 could dovetail nicely with the fundamentals if the Ukraine conflict continues to intensify and Western nations are expected to continue tightening the sanctions noose around Russia’s neck. Silver can move aggressively and some bulls likely have their sights set on mid-2021 highs in the $28.00 area.

With focus so heavily on geopolitics, upcoming tier one US data releases (ISM Services PMI on Thursday and the official jobs report on Friday) and the second day of Fed Chair Jerome Powell’s testimony before the US Congress will take something of a back seat. Powell explained on Wednesday that current uncertainties regarding the impact of the Ukraine war would not deter the Fed from getting moving regarding removing policy stimulus. An expected strong jobs report on Friday should support this stance and probably won’t dent silver’s near-term appeal much.

- EUR/USD stays under heavy pressure well below 1.1100.

- The 1.1057 level should hold the downside near term.

EUR/USD retreats for the fourth session in a row on Thursday and threatens to revisit the 2022 low in the 1.1060/55 band (March 2).

Despite the daily RSI flirts with the oversold territory, the pair could still drop further. Against this, the breach of the 2022 low at 1.1057 (March 2) could spark a deeper retracement and retest the psychological 1.1000 mark in the not-so-distant future.

The negative outlook for EUR/USD is expected to remain unchanged while below the key 200-day SMA, today at 1.1596.

EUR/USD daily chart

- There were 215K initial claims in the week ending 26 February, a little less than expected.

- FX markets did not react to the latest labour market data.

There were 215,000 initial jobless claims in the US in the week ending on 26 February, less than the 226,000 expected and below the week prior, when there were 233,000 claims (revised up from 232,000), data published by the US Department of Labor (DOL) revealed on Thursday. Continued Claims in the week ending on 19 February rose very slightly to 1.476M from 1.474M the week prior, almost bang in line with expectations for a 1.475M reading. The insured unemployment rate was thus steady at 1.1%, unchanged from the week prior.

Market Reaction

Strong weekly jobless claims figures hasn't impacted FX markets. The US Dollar Index (DXY) continues to trade close to highs of the day in the 97.60s.

- USD/CHF remained confined in a narrow trading band heading into the North American session.

- Signs of stability in the equity markets undermined the safe-haven CHF and extended support.

- Modest USD strength also contributed to limiting the downside, though geopolitics capped gains.

The USD/CHF pair oscillated in a narrow trading band heading into the North American session and was last seen hovering around the 0.9200 mark, nearly unchanged for the day.

The pair struggled to capitalize on its gains recorded over the past two trading sessions and witnessed subdued/range-bound price action on Thursday, though a combination of factors acted as a tailwind. Stable performance in the equity markets undermined the safe-haven Swiss franc and extended some support to the USD/CHF pair amid modest US dollar strength.

Ukraine's Presidential Adviser said that the delegation is headed for the second round of talks with Russia, which is set to start in a couple of hours. This, in turn, helped ease concerns about the recent escalation in geopolitical tensions, instead revived hopes of a ceasefire between Russia and Ukraine and led to modest recovery in the risk sentiment.

In the latest development, Russian President Vladimir Putin told his French counterpart Emmanual Macron on Thursday that the goals of Russia's operation in Ukraine will be achieved in any case. This comes on the back of reports that Russia has intensified the bombardment of Ukrainian cities, which should keep a lid on any optimistic move in the markets.

On the other hand, the USD drew support from the overnight hawkish comments by Fed Chair Jerome Powell, saying that the US central bank could take tougher action if inflation levels do not come down. Moreover, Chicago Fed President Charles Evans said that monetary policy is currently wrong-footed and needs to be upwardly adjusted toward neutrality.

The fundamental backdrop seems tilted in favour of bullish traders, though investors seemed reluctant and remain wary of the worsening situation in Ukraine. Hence, the incoming headlines surrounding the Russia-Ukraine saga would continue to play a key role in influencing the USD/CHF pair. Apart from this, traders will take cues from Fed Chair Jerome Powell's second day of testimony.

Technical levels to watch

- EUR/JPY resumed the downside following Wednesday’s advance.

- A drop to the 2022 low near 127.30 remains likely.

EUR/JPY partially fades the strong gains recorded on Wednesday and comes under selling pressure after failing to move further north of the 128.50 area.

Further losses in EUR/JPY remain in the pipeline, with a potential visit to the so far 2022 low at 127.29 (March 2) in the short-term horizon. Further south the cross is expected to target the February 2021 low at 126.10 (February 4) ahead of 125.59 (January 27 2021 low). The loss of the latter should open the door to a visit of the 2021 low at 125.08 (January 18).

In the longer term, the outlook for the cross is seen as negative while below the 200-day SMA, today at 130.25.

EUR/JPY daily

Russian President Vladimir Putin told his French counterpart Emmanuel Macron on Thursday that the goals of Russia's operation in Ukraine will be achieved in any case, as reported by Reuters.

Earlier in the day, "Russians might have pointed multiple rocket-launching systems in the Russian border village of Popovka towards their own territory. Knowing the barbaric nature of Russian actions we fear a false flag operation," Ukraine's foreign minister said.

Market reaction

EUR/USD pair showed no immediate reaction to these comments and was last seen losing 0.4% on the day at 1.1075.

According to the accounts of the February European Central Bank monetary policy meeting, members of the Governing Council concurred that the latest figures suggested that inflation was likely to remain elevated for longer than expected, per Reuters.

Additional takeaways

"Despite the latest higher than expected inflation outcomes, the extent of possible revisions in the march projections, in particular for the medium-term outlook, remained an open issue."

"Incoming information was unlikely to lead to a substantially different or more benign inflation assessment but might instead imply another upward revision to the inflation outlook for the coming quarters."

"There was broad agreement that the situation had changed and that the inflation narrative needed to be adjusted."

"View was widely shared that convergence to the ECB's medium-term inflation target was no longer a distant prospect."

"Fulfilment of the forward guidance criteria more likely within a shorter time span."

"It remained an open question whether the outcome of the march projections would show inflation reaching the ECB's target durably within the projection horizon."

"Some argued that net asset purchases and negative policy rates were no longer seen as consistent with the incoming data."

"It was regarded as unlikely that inflation would drop below the target in the medium term."

"While downside risks to price stability had clearly receded, it was regarded as premature to draw conclusions."

"Governing Council should be careful not to introduce additional policy inertia (i.e. a slower pace of adjustment) when assessing the fulfilment of the forward guidance criteria."

"A scaling-back of monetary accommodation should commence."

"The main risk was no longer of tightening monetary policy too early but too late.."

Market reaction

The shared currency stays on the back foot after this publication and the EUR/USD pair was last seen trading at 1.1086, where it was down 0.3% on the day.

Around 1200 GMT on Thursday, Ukraine's Presidential Adviser said that the second round of talks with Russia was set to start "in a couple of hours," as reported by Reuters.

"The Ukrainian delegation is headed to talks with Russia by helicopter," the adviser added.

Market reaction

These comments don't seem to be having a noticeable impact on risk sentiment. As of writing, the Euro Stoxx 600 Index was losing 0.7% on the day and US stock index futures were down between 0.2% and 0.4%.

The next round of the Russia-Ukraine ‘peace talks’ could begin at 1200 GMT on Thursday, Belta agency reports, citing a Russian negotiator.

Meanwhile, the Kremlin said,” Ukrainians clearly not in a hurry to get to next round of talks, hope they will get there today.”

Earlier on, the Russian Deputy Foreign Minister noted that “Russia sees prospects for negotiations with Ukraine in Belarus.”

On Wednesday, Interfax reported a Russian negotiator saying that a potential ceasefire will be discussed in upcoming talks with the Ukrainian delegation.

-

Russia’s Lavrov: Nuclear war is only in Western politicians' heads, not in Russians' heads

Market reaction

Markets remain in a wait-and-see mode ahead of the peace talks, with the S&P 500 futures posting small losses while the US dollar remains the most favored across the G10 fx space.

GBP/USD has reversed its direction following Wednesday's rebound. As FXStreet’s Eren Sengezer notes, the near-term technical outlook points to a slightly bearish bias.

Buyers are struggling to retain control of the action

“The static resistance that seems to have formed at 1.3430 stays intact and buyers are unlikely to show interest in the pair unless it manages to flip that level into support.”

“On the downside, interim support is located at 1.3350 ahead of 1.3300 (psychological level) and 1.3270 (static level). A daily close below the latter could be taken as a strong bearish sign and open the door for an extended slide toward 1.3200 (psychological level).”

“On the flip side, 1.3450 (50-period SMA on the four-hour chart) and 1.3500 (psychological level, 100-period SMA, 200-period SMA) align as next hurdles above 1.3430.”

EUR/USD has lost its traction following a weak recovery attempt. As FXStreet’s Eren Sengezer notes, the pair is set to face additional selling pressure once 1.1060 fails.

Near-term support seems to have formed at 1.1060

“Markets remain cautious regarding the possibility of a diplomatic solution to the crisis with Russian forces moving closer to Kyiv and the pair is finding it difficult to preserve its recovery momentum. In case investors are convinced that Russia is looking to end the military aggression, the euro is likely to capitalize on a relief rally.”

“In case sellers manage to drag the price below 1.1060, additional losses toward 1.1000 (psychological level) could be witnessed. The Relative Strength Index (RSI) indicator on the four-hour chart stays below 50 and confirms the bearish bias.”

“On the upside, the initial resistance is located at 1.1150 (20-period SMA, static level) before 1.1200 (psychological level) and 1.1220 (50-period SMA).”

See – EUR/USD: Risks to a big break below 1.10 are building – ING

Russia is halting purchases of foreign currency and gold for this year in lieu of a suspension of parts of its fiscal rule amid the use of extra oil and gas revenues, the nation’s Finance Ministry said in a statement on Thursday.

This move comes to protect the rouble from oil price swings, as the beleaguered domestic currency meanders near record lows against the US dollar.

- USD/RUB pierces off 100.00 to extend pullback from record top as Russia-Ukraine peace talks loom

- GBP/USD edged lower on Thursday and eroded a part of the overnight strong recovery gains.

- Geopolitical risks continued underpinning the safe-haven USD and exerted downward pressure.

- The market focus will remain glued to fresh developments surrounding the Russia-Ukraine saga.

The GBP/USD pair remained on the defensive through the early part of the European session and was last seen trading near the daily low, around the 1.3380 region.

The pair struggled to capitalize on the previous day's solid rebound of over 130 pips from the 1.3270 area, or the fresh YTD low and edged lower on Thursday amid modest US dollar strength. Concerns about the economic impact of Russia's invasion of Ukraine continued underpinning the greenback's safe-haven status and acted as a headwind for the GBP/USD pair.

In fact, reports indicate that Russia has intensified the bombardment of Ukrainian cities and Russian forces have captured the Black Sea port of Kherson. That said, hopes of ceasefire talks between Russia and Ukraine capped gains for the USD. Apart from this, diminishing odds for a 50 bps Fed rate hike in March should help limit losses for the GBP/USD pair.

The recent geopolitical developments now seem to have convinced investors that the Fed would refrain from opting for a more aggressive policy response to combat stubbornly high inflation. This was evident from the overnight muted market reaction to Fed Chair Jerome Powell's comments, saying that the central bank could take tougher action if inflation levels do not come down.

Market participants now look forward to the release of the final UK Services PMI for some impetus ahead of the usual Weekly Initial Jobless Claims data from the US. Traders might further take cues from Fed Chair Jerome Powell's second day of testimony before the Senate Banking Committee. The focus, however, will remain glued to headlines surrounding the Russia-Ukraine saga.

Technical levels to watch

Analysts at Citigroup noted that the “outlook for crude oil remains very binary,” adding that the Ukraine situation makes a negative bet too risky for now.

Key quotes

“De-escalation (in Ukraine crisis) could mean subsiding of prices.”

“Further flashpoints could maintain a geopolitical risk premium in oil markets for a longer period.”

“While our market outlook remains out-of-consensus and we continue to project significant downside for crude oil prices in a six-to-nine-month context, the timing of this was negatively impacted from the escalating Russia-Ukraine conflict, widening supply risk premiums, and upward price momentum for the crude oil futures strip.”

“With the potential for spot oil prices to clear $125 per barrel in the short-term, we step aside.”

“Over the next month, there will probably be a better opportunity to either tactically or thematically short the energy market again.”

- NZD/USD attracted dip-buying near the 0.6760 area on Thursday, though lacked follow-through.

- A generally positive risk tone was seen as a key factor that benefitted the perceived riskier kiwi.

- Geopolitical risks continued underpinning the greenback and kept a lid on any meaningful upside.

The NZD/USD pair reversed an intraday dip and climbed to a fresh daily high during the early European session, with bulls now awaiting sustained strength beyond the 0.6800 mark.

The pair attracted some dip-buying near the 0.6760 region on Thursday and might now be looking to build on its recent upward trajectory witnessed over the past one month or so. The intraday uptick was sponsored by a generally positive risk tone, which tends to benefit the perceived riskier kiwi.

Despite rising geopolitical tensions, hopes of ceasefire talks between Russia and Ukraine remained supportive of a positive tone around the equity markets. That said, the worsening situation in Ukraine continued underpinning the safe-haven US dollar and capped the upside for the NZD/USD pair.

In the latest developments, Russia has intensified the bombardment of Ukrainian cities and Russian forces have captured the Black Sea port of Kherson. This, in turn, warrants some caution before placing aggressive bullish bets around the NZD/USD pair and positioning for further gains.

Market participants now look forward to the release of the usual Weekly Initial Jobless Claims data, due later during the early North American session. This, along with Fed Chair Jerome Powell's second day of testimony before the Senate Banking Committee, might influence the USD.

Apart from this, traders will take cues from fresh developments surrounding the Russia-Ukraine saga, which will continue to play a key role in driving the broader market risk sentiment. The combination of factors could produce some short-term trading opportunities around the NZD/USD pair.

Technical levels to watch

Cost of living concerns hamper rate rises and GBP rebounds. In the view of economists at Westpac, the cable is at risk of falling towards December 2021 lows around 1.3175/65.

GBP held hostage as current inflation shock exacerbates UK’s cost-of-living crunch

“The BoE has already cited the cost of living impact as a reason for its gradual tightening path. Debate within the MPC is likely to increase as fighting inflation with higher rates is likely to increase the cost-of-living burden on households and businesses.”

“GBP/USD is threatening to break support within its lowered perceived 1.33-1.35 range and risk a retest of Dec 2021 lows between 1.3165-1.3175.”

“Russia sees prospects for negotiations with Ukraine in Belarus,” the country’s Deputy Foreign Minister said on Thursday.

“Russia maintains channels of communication with the US and other western countries,” he added.

Meanwhile, Reuters reports, citing the UK intelligence sources, “the Russian advance on Kyiv has made little discernible progress over three days.”

Additional takeaways

“Despite heavy shelling, Kharkiv, Chernihiv, Mariupol remain in Ukrainian hands.”

“Some Russian forces have entered Kherson but the military situation remains unclear.”

Read: Russian troops enter in strategic Black Sea port city of Kherson, Ukraine

EUR/USD seems to have steadied around 1.1100 in the early European session on Thursday. According to economists at Westpac, the pair risks breaching the 1.10 level.

EUR/USD is unlikely to sustain rebounds

“Continued Ukrainian conflict will weigh on EUR and regional rates, countering higher and persistent inflation.”

“EUR/USD is unlikely to sustain rebounds. Resistance is likely in front of 1.1300 with mounting pressure to test 1.1000 or even force a flush towards 1.0775-00.”

Crude Oil prices rallied and hovered near $110. Another move higher could easily happen if either sanctions or some sort of Russia-Ukraine war-related event reduces shipments, strategists at TD Securities report.

Oil price at $110 or higher may not be sustainable long-term

“Any additional sanctions or unanticipated supply interruption could easily see prices surge still higher in the near-term, as this would augment the already significant concern of a large deficit, and there are few alternatives. Under these conditions, it would not be surprising to see key benchmark crudes jump to around $145.”

“The redirection of crude flows, larger OPEC production quotas, more US shale output and demand destruction could force prices back to below the $100 longer-term. Certainly, an eventual easing of geopolitical tensions in Europe would do the job to rebalance the market too.”

- USD/CAD turned lower for the second straight day and dropped to a fresh multi-week low.

- Bullish crude oil prices, hawkish BoC underpinned the loonie and dragged the pair lower.

- Geopolitical risks benefitted the safe-haven USD and could help limit any further losses.

The USD/CAD pair dropped to a six-week low during the early European session, with bears now eyeing a break below the 1.2600 round-figure mark.

The pair struggled to capitalize on its modest intraday uptick, instead met with a fresh supply near the 1.2655 region and turned lower for the second successive day on Thursday. This also marked the fourth day of a negative move in the previous five and was sponsored by strong follow-through rally in crude oil prices, which tend to benefit the commodity-linked loonie.

The imposition of harsh sanctions against Russia over its invasion of Ukraine sparked supply worries and pushed crude oil prices to a fresh multi-year high. Apart from this, the hawkish Bank of Canada decision on Wednesday also extended support to the CAD. It is worth recalling that the BoC hiked rates for the first time since October 2018 and said they would need to go higher.

On the other hand, Fed Chair Jerome Powell, during his semi-annual testimony before Congress, said that the US central bank would begin carefully hiking interest rates in March. Powell simultaneously promised that the Fed could take tougher action if inflation levels do not come down, though did little to impress the US dollar bulls amid a generally positive risk tone.

Despite rising geopolitical tensions, hopes of ceasefire talks between Russia and Ukraine remained supportive of a positive tone around the equity markets. That said, the worsening situation in Ukraine could act as a tailwind for the safe-haven greenback. This, in turn, could help limit the downside for the USD/CAD pair and warrants some caution for bearish traders.

In fact, reports suggest that Russia has intensified the bombardment of Ukrainian cities and Russian forces have captured the Black Sea port of Kherson. Hence, the market focus will remain on developments surrounding the Russia-Ukraine saga. The incoming headlines will drive the risk sentiment, which, along with oil price dynamics, should provide impetus to the USD/CAD pair.

From a technical perspective, sustained break and acceptance below the 100-day SMA might have already set the stage for an extension of the ongoing depreciating move for the USD/CAD pair. This, in turn, suggests that any meaningful recovery attempt could be seen as an opportunity to initiate fresh bearish positions and runs the risk of fizzling out rather quickly.

Market participants now look forward to the release of the usual Weekly Initial Jobless Claims data from the US. This, along with Fed Chair Jerome Powell's second day of testimony before the Senate Banking Committee, might influence the USD. Traders will further take cues from oil price dynamics for some short-term opportunities around the USD/CAD pair.

Technical levels to watch

During February the Indian rupee weakened against the US dollar from 74.618 to 75.333. In the view of economists at MUFG Bank, Downside risks are building for the rupee in the year ahead.

Backdrop of global risk aversion and higher oil prices are negative for INR

“The global backdrop of risk aversion due to Russia’s invasion of Ukraine, the surge in Brent crude oil prices to levels above $100/bbl, and upcoming policy tightening by the Fed are major factors that will undermine the rupee.”

“We expect USD/INR to head higher with our end-2022 forecast at 77.50, which is above the record high of 76.92 recorded in April 2020.”

Here is what you need to know on Thursday, March 3:

The dollar continued to gather strength against its rivals and the US Dollar Index (DXY) reached its highest level since June 2020 in the American trading hours on Wednesday. Reports of Russian negotiators looking to discuss a ceasefire with Ukraine, however, triggered a relief rally and forced the greenback to lose interest. Delegations are expected to meet on Thursday and the market mood remains cautiously optimistic. Later in the day, January PPI from the euro area, the European Central Bank's Monetary Policy Meeting Accounts, the weekly Initial Jobless Claims and ISM Services PMI from the US will be featured in the economic docket. FOMC Chairman Jerome Powell will testify before the Senate Banking Committee.

On the first day of his semi-annual testimony, Powell confirmed that a 25 basis points rate hike in March would be appropriate. Powell voiced his concerns over the inflation outlook and noted that there wouldn't be any direct effects on the US economy from Russian sanctions. "We think we need to engage in a series of rate increases and let our balance sheet shrink," the chairman added.

Meanwhile, Russian aggression continued early Thursday with Russian forces reportedly taking control of the city of Kherson. Furthermore, an official from the Donetsk separatist group said that pro-Russian forces may launch targeted strikes on Mariupol unless Ukrainian forces surrender, per Interfax news agency.

The DXY is moving sideways near 97.50 early Thursday, the 10-year US Treasury bond yield, which rose nearly 10% on Wednesday, is down 1.5% at 1.85% and US stock index futures trade flat. The barrel of West Texas Intermediate is up 25% since the beginning of the week and it's trading at its highest level since November 2008 above $114.

EUR/USD seems to have steadied around 1.1100 in the early European session on Thursday. The data from the euro area showed on Wednesday that annual inflation jumped to 5.8% in February from 5.1% in January.

USD/CAD is trading at its lowest level since late January near 1.2600. As expected, the Bank of Canada raised its policy rate by 25 basis points on Wednesday and noted that it will need to continue to hike the policy rate in the upcoming meetings.

GBP/USD reversed its direction after falling below 1.3300 on Wednesday and ended up closing the day in the positive territory. The pair is trading in a relatively tight range near 1.3400 early Thursday.

After rising toward $1,950 mid-week, gold fell sharply in the second half of the day on Wednesday and lost more than 1% pressured by the surging US T-bond yields. XAU/USD is moving sideways above $1,920 in the European morning.

Bitcoin rose above $45,000 on Wednesday but struggled to preserve its bullish momentum. BTC/USD is down 1% on the day at $43,500 heading into the European session. Ethereum closed in the red on Wednesday after testing $3,000 and continues to inch lower toward $2,900 on Thursday.

USD/CHF renews intraday low around 0.9195 while posting the first daily loss in three ahead of Thursday’s European session.

In doing so, the Swiss Franc (CHF) justifies the options market’s signal, namely the one-month risk reversal (RR).

That said, the gauge of calls to puts slumps the most in two weeks with its latest reading of -0.075, per the data source Reuters.

It should be noted, however, that the weekly RR print remains neutral by the press time, after dashing a two-week downtrend by the end of Friday.

The latest risk-aversion wave could be linked to the market’s anxiety over Ukraine-Russia peace talks, as well as chatters over the Fed’s rate-hike moves in March.

Read: USD/CHF looks to settle below 0.9200 as Powell’s testimony dictates a slight hawkish stance

UOB Group’s FX Strategists noted the upside bias could push NZD/USD higher, although the 0.6840 level emerges as a tough barrier in the near term.

Key Quotes

24-hour view: “We expected NZD to ‘trade sideways within a range of 0.6730/0.6785’ yesterday. However, instead of trading sideways, NZD rose to a high of 0.6798. Despite the advance, upward momentum has barely improved and NZD is unlikely to rise much further. For today, NZD is more likely to consolidate and trade within a range of 0.6745/0.6800.”

Next 1-3 weeks: “We highlighted on Tuesday (01 Mar, spot at 0.6765) that upward momentum is beginning to build and NZD is likely to head higher. We added, ‘0.6810 is a solid resistance level and may not be easy to break’. While NZD subsequently rose to a high of 0.6798 during NY session, upward momentum has barely improved. However, further NZD strength is not ruled out but the next major resistance at 0.6840 is unlikely to come under threat. On the downside, a breach of 0.6720 (‘strong support’ level was at 0.6690 yesterday) would indicate that the current mild upward pressure has eased.”

- Palladium prints four-day uptrend inside a nine-week-old ascending trend channel.

- Overbought RSI tests buyers but upside momentum remains intact beyond $2,280-70.

Palladium (XPD/USD) remains on the front foot around $2,647, up 0.25% intraday during the four-day winning streak ahead of Thursday’s European session.

The precious metal not only renews weekly top but also stays near to the highest levels marked since late July, pinned the previous week.

The upside momentum justifies bullish MACD signals inside an upward sloping trend channel from late December 2021. However, the overbought RSI line hints at a pullback.

That said, June 2021 low near $2,460 may lure the short-term sellers but the support line of the stated channel, around $2,400, will challenge the quote’s further downside,

Even if the quote drops below $2,400, a convergence of the previous resistance line from early 2021 and an 11-week-old rising support line, near $2,280-70 will be a tough nut to crack for the palladium bulls afterward.

Meanwhile, the XPD/USD’s further upside will aim for the stated channel’s resistance line, near $2,800 at the latest, before challenging the July 2021 peak of 2,882.

Palladium: Daily chart

Trend: Bullish

- Gold prices remain steady amid market’s anxiety, dropped the most in two weeks the previous day.

- Russia-Ukraine peace talks eyed amid hopes of ceasefire, Moscow’s aggression.

- Markets remain mixed as rating agencies downgrade Moscow, Powell propelled Fed’s rate-hike bets, yields.

- Gold Price Forecast: Russia-Ukraine war favors US dollar but XAU/USD’s downside appears limited

Gold (XAU/USD) traders portray the market’s indecision around $1,925 heading into Thursday’s European session.

The yellow metal took a U-turn from a weekly high to print the biggest daily loss in a fortnight the previous day as market sentiment improved amid hopes of ceasefire talks between Russia and Ukraine. However, cautious mood ahead of the stated negotiations and increasing odds of a faster pace of Fed’s rate-hike seem to restrict the metal’s latest moves.

Russian media shared news of a probable meeting today, with a ceasefire on the table. However, the latest confirmation from Ukrainian authorities that the Moscow military captured southern city Kherson seems to challenge the peace talks.

Also negative for the market sentiment is the rating downgrade of Russia by global rating agencies like Moody’s and Fitch, not to forget the economic fallout from Moscow’s invasion of Kyiv.

The geopolitical risks also hike the inflation woes and push Fed Chair Powell to suggest faster rate lifts, to the tune of 0.50% if needed. The same propelled inflation expectations and probabilities of such an action in March, as portrayed by CME’s FedWatch Tool and the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data.

Amid these plays, S&P 500 Futures print mild gains but the US 10-year Treasury yields remain sluggish even as Wall Street ran the show of optimism on Wednesday. The cautious mood, however, keeps the US Dollar Index (DXY) firmer.

Moving on, the US ISM Services PMI, Factory Orders, Nonfarm Productivity, etc. will join the second version of Fed Chair Powell’s testimony to entertain traders. However, Russia-Ukraine headlines will be crucial for the near-term direction.

Technical analysis

Despite the latest inaction, gold remains above the 10-month-old horizontal area amid the broad rush to risk safety.

The bullish MACD signals and sustained trading beyond the monthly support line also add strength to the upside bias.

However, the overbought RSI line hints at a pullback, which in turn highlights a horizontal line stretched from September 2020, surrounding $1,975.

Gold: Daily chart

Should XAU/USD bulls remain dominant past $1,975, the $2,000 psychological magnet, also the 61.8% Fibonacci Expansion (FE) of January-February moves, will be in focus ahead of the year 2020 peak of $2,075.

Gold: Four-hour chart

Meanwhile, the aforementioned support zone from June 2021, around $1,915-12, puts a floor under the gold prices during a pullback, a break of which will highlight a 12-day-old support line, close to $1,900 by the press time.

Following that, the one-month-old rising trend line and November 2021 peak, respectively around $1,890 and $1,877, will challenge the gold sellers before the last defense for short-term buyers, namely the 21-DMA level of $1,870.

- Asian markets drift higher on significant improvement in the US bond yields.

- Powell’s testimony underpinned a quarter bps interest rate hike against a 50 bps one.

- China is underperforming to its neighbors despite remaining in the subtext of Biden’s SOTU speech.

Markets in the Asian domain part ways with the Chinese indices as the former are underpinned by Fed Chair Jerome Powell's signal to a 25 basis points (bps) interest rate hike in the March monetary policy meeting.

While the latter has sensed pressure after US President Joe Biden pinned China in his first State of the Union (SOTU) speech stating that “it is never a good bet to bet against the American people. It is worth noting that the Russian invasion of Ukraine remained the dominant part of Biden’s SOTU speech.

Biden said the US and China were engaged in a race to "win the economic competition of the 21st century", and vowed that the US was embarking on an "infrastructure decade", announcing plans this year to fix more than 65,000 miles of highway and 1,500 bridges in disrepair, as per South China Morning Post.

The Asian markets have witnessed a repulsive buying on Thursday, as investors found it a value bet after nosediving in the last few trading sessions. However, the broader risk-on impulse is still active and equities could face the heat on any negative outcome post the Russia-Ukraine peace talks.

Meanwhile, the US dollar index (DXY) seems to pare its bullish opening gap gains, which is also supporting Thursday’s rally in the Asian markets.

The 10-year US Treasury yields are trading a tad lower around 0.5% on Thursday, which seems a corrective pullback after surging by around 9.5% on Wednesday.

Going forward, the outcome of the Russia-Ukraine peace talks will remain the major driver for markets. Any negative outcome is bound to hammer the Asian equities while a ceasefire headline will likely spur a firmer rally.

Bank of Japan (BOJ) monetary policy board member Junko Nakagawa is back on the wires, via Reuters, now speaking on the likely impact of the Ukraine crisis on the Japanese economy.

Key quotes

Direct impact on Japan’s economy from trade with Russia, Ukraine appears to be limited for now.

Hit to European economy from Ukraine crisis may indirectly weigh on Japan’s economy.

Will likely take some time to gauge broader impact of Ukraine crisis on Japan’s economy via various channels.

Rising gas, grain costs will prop up Japan’s inflation, but may work to hurt the economy if it hurts corporate profits, household income.

Japan's economy still in midst of recovery from pandemic's hit.

Market reaction

USD/JPY is trading listlessly so far this Thursday, locked in a tight range amid a mixed market mood.

The spot is adding 0.12% on the day, currently trading at 115.64.

Wages growth needs to be "about 4%" to drive inflation sustainably within the central bank’s target range, which will create the conditions for interest rates to rise, Reserve Bank of Australia (RBA) board member and academic Ian Harper said in an interview with MNI on Thursday.

Key quotes

“Wages growth of around 4% should create 1.5% labour productivity growth and drive inflation sustainably into the mid-point of the RBA's 2% to 3% target.”

"Gaining an increase in labour productivity growth to this level is problematic in the short run.”

"Demand is growing strongly, and supply is increasingly constrained so you would expect that nominal wages growth must pick up sometime soon - at least, that's what history would suggest!"

“Trimmed mean inflation is at 2.6%. The RBA has forecast it will increase to 3.25% this year before levelling off at 2.75% until June 2024. By June 2024, the RBA forecast is that wages will be growing at 3.25%.”

When asked about the inflationary impact of the Russian-Ukrainian conflict, Harper said “while this would produce a short-term spike in oil prices "this is a relative price increase and not a general price increase."

"Of course, one can spark the other if there's a rise in expected inflation over the long term. So far, those expectations are still anchored at 2.5% as is evident in longer term indexed-bond prices as well as surveys. It's early days but the energy price rises are yet to translate into persistent general price level increases.”

Market reaction

AUD/USD is back above 0.7300, mainly gaining from soaring oil prices amid the Russia-Ukraine crisis.

The pair was last seen trading at 0.7305, up 0.13% on the day.

- GBP/USD is heading higher amid a slightly less hawkish stance in Powell’s testimony.

- The DXY is defending the bids ahead of the Russia-Ukraine peace talks.

- The odds of a 50 bps interest rate hike have trimmed significantly.

The GBP/USD pair has observed a firmer rally from Wednesday’s low at 1.3272 as Federal Reserve (Fed) chair Jerome Powell’s Wednesday testimony indicated a slightly less hawkish stance for March’s monetary policy rather than an aggressive one.

Earlier, the risk-perceived assets were not performing against the greenback as the market participants were estimating that the Fed would resort to a 50 basis points (bps) interest rate hike to combat the soaring inflation.

There is no denying the fact that handling 40-year high inflation is not a cakewalk and to curb a Consumer Price Index (CPI) level of 7.5%, the Fed would require plenty of contraction policies and deployment of various quantitative tools to squeeze the liquidity.

Moreover, the ongoing Russia-Ukraine war has forced the market participants to stick with the risk-aversion theme amid galloping uncertainty in the financial markets.

The investors have cheered the advocacy of a 25 bps interest rate hike in Powell’s testimony, which is why the pound has been performing strongly against the greenback in the Asian session and is likely to continue its performance in the European session too.

Meanwhile, the US dollar index (DXY) is oscillating in a narrow range of 97.46-97.58 on Thursday as investors are waiting for the Russia-Ukraine peace talks, which may guide the investors either to continue shifting funds in the sterling or roll back to the greenback.

- USD/TRY is juggling in a range of 13.97-14.00 on inverted flag formation.

- Divergence in price and the RSI have brought a reversal in the asset.

- Bears look firmer as the major is trading below 20 and 50 EMA.

The USD/TRY pair is oscillating in a tight range just below 14.00 in the Asian session, following a confident reversal on Wednesday after hitting the highs of 14.13.

On a 15-minute scale, USD/TRY has witnessed a steep fall after forming a bearish divergence, in which the price made the higher high from 14.11 to 14.13 but the Relative Strength Index (RSI) (14) oscillator didn’t follow the same structure and made lower high in Wednesday’s trading session.

Currently, the major is forming an inverted flag pattern, which signals a directionless move after a steep fall and points to a further downside if consolidation breaks lower decisively.

Generally, a consolidation phase denotes the placement of offers by the market participants who didn’t capitalize upon the initial rally or those investors place bids, preferring to enter in an auction once the bearish stage sets in.

The 20-period and 50-period Exponential Moving Averages (EMA) are scaling lower, which indicates more weakness ahead while the 200-period EMA is flat and hoping for no bullish reversal going forward.

The RSI (14) is oscillating in a range of 40.00-60.00, which adds to the downside filters.

For further downside, bears may find significant offers once the asset violates Thursday’s low at 13.98, which will drag the major towards Wednesday’s low at 13.85. Breach of the latter would expose it to Monday’s low at 13.73.

On the contrary, bulls can take the charge if the spot pierces 50-EMA at 14.40 on the upside, which will send the pair towards the 14.15 area - the confluence of Wednesday’s high at 14.13 and February 24 average traded price of 14.19.

USD/TRY 15-minute chart

Russian military troops are in the southern Ukrainian city of Kherson and forced their way into the council building, its Mayor Igor Kolykhaye said late Wednesday.

This comes after the eastern city of Kharkiv suffers further heavy bombardment.

The Black Sea port of Kherson, the southern provincial capital of around 250,000 people, is strategically placed where the Dnipro River flows into the Black Sea and would be the first significant city to fall into Moscow's hands.

Amidst ongoing hostilities, a Ukrainian delegation has left for the second round of talks with Russian officials on a likely ceasefire after a first-round ended with little progress on Monday, Reuters reported, citing a Ukrainian Presidential Adviser Mykhailo Podolyak.

All eyes remain on the peace talks while investors remain on the edge.

The S&P 500 futures are down 0.05% on the day while the Asian stocks are tracking the positive close on Wall Street overnight after Fed Chair Jerome Powell hinted at a 25bps March rate hike.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 114.55 | 6.67 |

| Silver | 25.279 | -0.32 |

| Gold | 1927.64 | -0.8 |

| Palladium | 2664.79 | 3.94 |

Bank of Japan (BOJ) monetary policy board member Junko Nagaya said in a statement on Thursday, “Japan's economic outlook remains highly uncertain from January onward.”

Additional quotes

Japan's exports, output continue to rise as a trend.

impact of supply constraints appeared to have peaked but automakers' output cuts continuing.

Risks to Japan's economy skewed to downside for time being, evenly balanced thereafter.

Overseas growth, mainly emerging economies, may undershoot expectations if global monetary conditions tighten more than expected.

Upward pressure on Japan's inflation may remain strong for time being.

Japan's core consumer inflation may approach 2% temporarily.

Meanwhile, Japan’s Chief Cabinet Secretary Hirokazu Matsuno said that they “plan to hold a ministerial meeting on Friday to compile measures to respond to higher oil prices.”

Market reaction

USD/JPY is wavering in a narrow range between 115.44-115.70, as investors remain cautious amid impending Russia-Ukraine peace talks and ahead of Friday’s US NFP data.

The spot, however, is up 0.12% on the day, courtesy of the safe-haven demand for the US dollar.

- NZD/USD marks another pullback from seven-week-old descending resistance line.

- Bullish RSI play, weekly support line defends buyers.

- Multiple hurdles above 0.6800 to test upside past nearby trend line.

NZD/USD stays pressured near intraday low around 0.6770, paring the recent gains near the weekly top during Thursday’s Asian session.

In doing so, the kiwi pair extends the previous day’s failures to cross the resistance line from mid-January.

However, a weekly support line joins the bullish RSI signals, as higher lows on prices join higher lows of the RSI line, to keep buyers hopeful.

Hence, the latest pullback remains elusive until breaking the one-week-old support line, around 0.6750 by the press time.

Following that, a downward trajectory towards the 200-SMA and an upward sloping support line from January 28, respectively near 0.6680 and 0.6665, can’t be ruled out.

On the flip side, recovery moves will again aim for the stated resistance line from January, near the 0.6800 threshold.

Following that, highs marked in February and late January, around 0.6810 and 0.6825-30 in that order, will challenge the NZD/USD buyers before directing them to the 0.6900 round figure.

NZD/USD: Four-hour chart

Trend: Further upside expected

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Building Permits, m/m | January | 9.8% | -3.5% |

| 00:30 (GMT) | Australia | Trade Balance | January | 8.824 | 9.05 |