- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-02-2023

- The US Dollar strengthens across the FX space, a tailwind for the USD/CHF.

- USD/CHF Price Analysis: Shifted to neutral biased once buyers hurdle the 20-DMA.

The USD/CHF is surging sharply during Friday’s North American session, as Wall Street is set to finish the last trading day of the week with losses. Therefore, the USD/CHF is trading at 0.9260, above its opening price by 1.42%.

USD/CHF Price Analysis: Technical outlook

On Friday, the USD/CHF rally broke two downslope resistance trendlines, which would pave the way for further losses. In addition, the 20-day Exponential Moving Average (EMA) at 0.9210 was reclaimed during the uptrend, exposing crucial resistance levels, which, once cleared it, could pave the way for further gains.

The USD/CHF first resistance will be the January 31 daily high at 0.9288. A breach of the latter and the 0.9307, the 50-day EMA is up for grabs., followed by January’s 12 high at 0.9360.

On the flip side, the USD/CHF first support would be the 20-day EMA at 0.9210. Bears reclaiming the latter would exacerbate a fall below 0.9200, followed by the February 3 daily low at 0.9112.

USD/CHF Key Technical Levels

- USD/CAD resumed its uptrend once it reclaimed the February 1 daily high at 1.3379.

- USD/CAD Price Analysis: A daily close above 1.3400 will exacerbate a rally to 1.3500. otherwise, further downside is expected.

USD/CAD climbs in the North American session after hitting a daily low of 1.3311 before Wall Street opened. Nevertheless, a strong US jobs report bolstered the US Dollar, the strongest currency in the FX space. At the time of writing, the USD/CAD exchanges hand at 1.3402.

USD/CAD Price Analysis: Technical outlook

Technically speaking, the USD/CAD is still neutral-to-upward biased, though it reclaimed some resistance levels after testing the 200-day Exponential Moving Average (EMA) a couple of days ago. On its way north, the USD/CAD pair conquered an upslope-support trendline that was broken on January 31, which means the uptrend could resume shortly.

Therefore, the USD/CAD next resistance would be the 50-day EMA at 1.3443. Break above, and the USD/CAD pair would rally to January 31 daily high at 1.3471, followed by 1.3500.

As an alternate scenario, the USD/CAD first support would be the 1.3400 mark. Once cleared, the USD/CAD might test the 20-day EMA at 1.3388, followed by a downslope trendline turned support at 1.3355-65, and then the 1.3300 psychological barrier.

USD/CAD Key Technical Levels

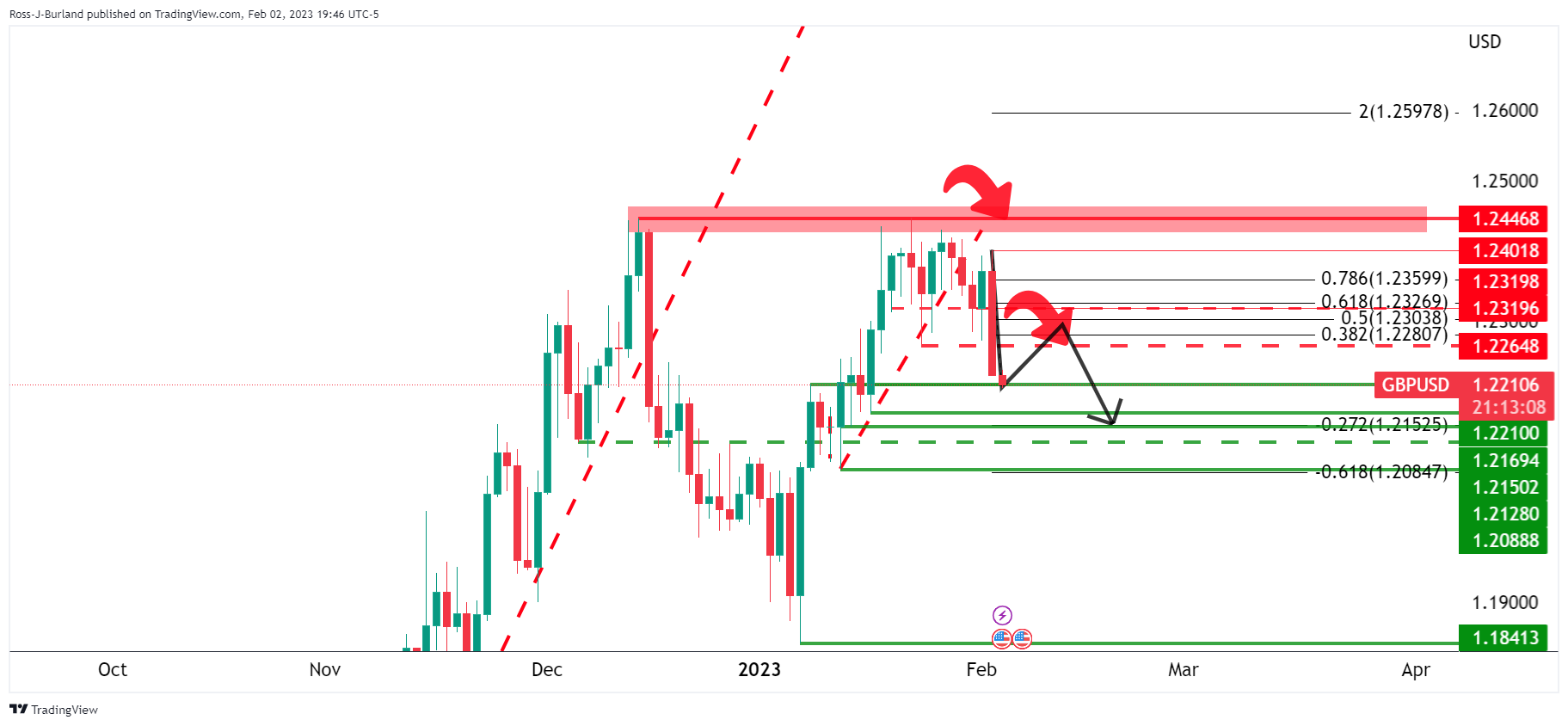

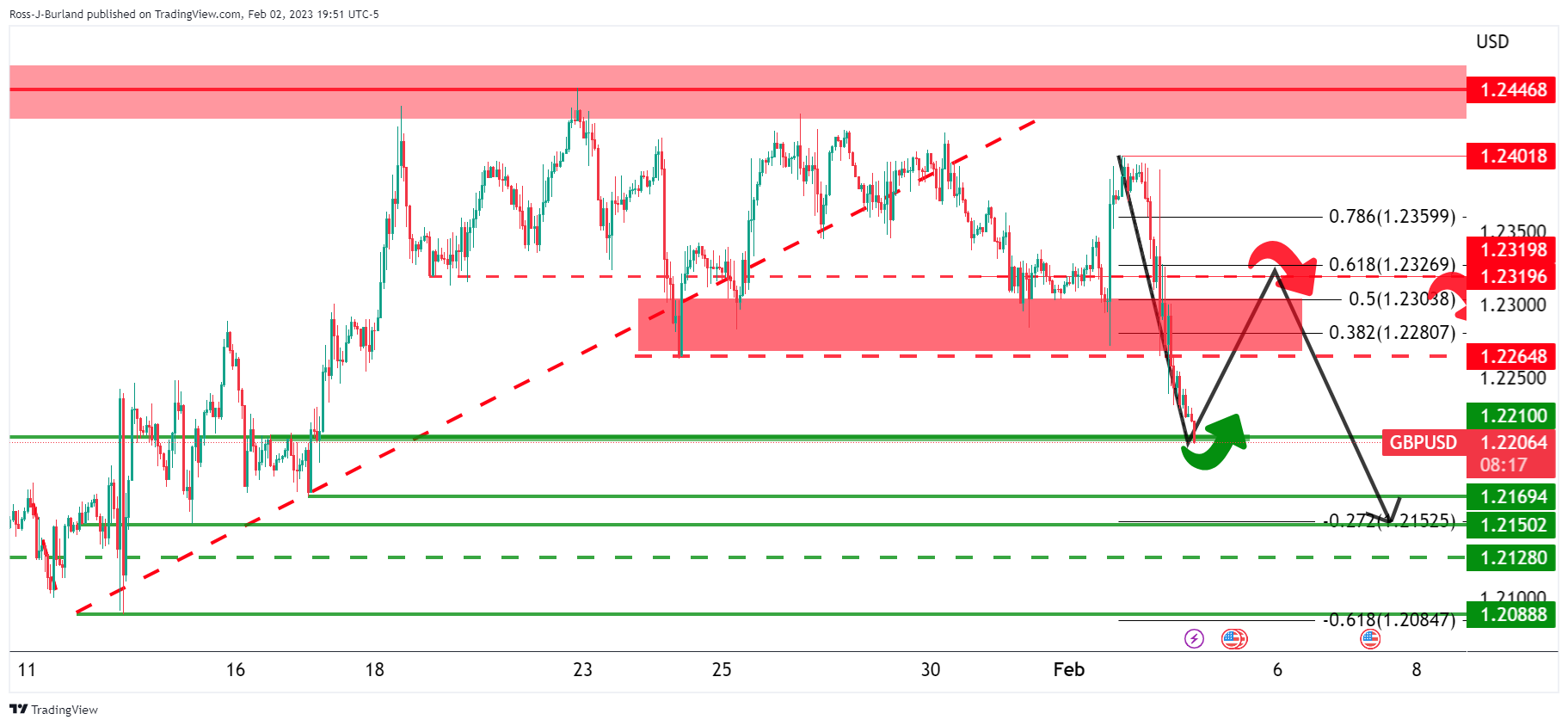

- The Pound Sterling opposes no resistance to upbeat economic data in the United States.

- US jobs data and services activity showed that the US economy remains solid despite the US Federal Reserve tightening cycle.

- For the next week, GBP/USD traders are eyeing the UK GDP and US Fed speakers.

GBP/USD nosedives and extended its losses past the 50 and 200-day Exponential Moving Average (EMA) on Friday after a surprisingly strong jobs report from the United States (US) that increased speculations that the Federal Reserve (Fed) could raise rates back above Wednesday’s 25 basis points mark (bps). At the time of writing, the GBP/USD is trading at 1.2060 after reaching a daily high of 1.2265.

GBP/USD plunged on positive US economic data, warranting further Fed tightening

Investors’ sentiment turned sour after January’s Nonfarm Payrolls report was released. Data showed that the economy added 517K new jobs against the 200K estimated; consequently, the Unemployment Rate tumbled from 3.5% to 3.4%. Additionally, December’s data was revised upward, which means the US Federal Reserve still has ways to go to curb stubbornly high inflation towards the 2% goal.

As the headline crossed the screens, the GBP/USD dived from around its daily highs at 1.2260s and collapsed 200 pips towards the 1.2060 area. In the meantime, the US Dollar Index, a measure of the greenback’s value against a basket of six currencies, rose to a new three-week high at 102.90, up 0.94%.

Later, the Institute for Supply Management (ISM) revealed that services industry activity climbed above expansionary territory, boosted by new orders, while prices paid moderated. The ISM Non-Manufacturing PMI rose by 55.2 last month, vs. 49.2 in December and above the 50.4 foreseen by analysts.

Earlier in the European session, the UK S&P Global/CIPS Services PMI had its worst month in two years, falling to 48.7, down from December’s 49.9, its lowest level since January 2021. Therefore, the S&P Composite PMI, combining manufacturing and services data, slumped to 48.5 in January from 49.0 last month.

What to watch?

Next week’s UK economic calendar will feature the Monetary Policy Report Hearings and the Gross Domestic Product (GDP) MoM and QoQ. Across the pond, the US economic docket will feature the US Federal Reserve speakers, namely Jerome Powell and John C. Williams from the New York Fed. Additionally, Initial Jobless Claims and the University of Michigan (UoM) Consumer Sentiment would shed some light regarding the status of the US economy.

GBP/USD Key Technical Levels

The ISM Service PMI released on Friday showed the index rose back above 50, into expansion territory. Analysts at Wells Fargo, point out that after just a single month under 50, the services ISM shot back up into expansion. However, they warn the breadth of services expansion has still slowed.

Key quotes:

“The slowdown in services activity to end last year now looks more like a blip rather than the start of a lasting slowdown in the sector. That's at least according to the latest ISM services release, which revealed the index advanced 6.0 points to 55.2 after a temporary drop below 50 in December.”

“While we find it easy to talk away some of the weakness in this report, month-to-month movements in the ISM can be volatile and the breadth of expansion has eased.”

“Most components of the ISM improved, with the measure of business activity up 6.9 points to 60.4 and new orders matching that index level leaping 15.2 points after registering contraction in December. New orders now match the highest level registered over the past 12 months, an indication that activity continues to hold up in the services sector.”

“The easing of supply problems is also somewhat benefiting price pressure. At 67.8 the prices paid index remains firmly in expansion, but it has declined the past four consecutive months.”

Strategists at Rabobank point out that the change in the Bank of England’s language favours the doves, they see scope for further rate rises. They continue to expect poor United Kingdom fundamentals to be a drag on the British Pound.

Key quotes:

“The USD has found further traction on the back of the January US jobs report. That said, the single currency has still managed to climb against the beleaguered GBP, with the latter undermined by the market’s interpretation that the BoE may be even closer to peak policy rates. EUR/GBP continues to edge towards our 0.90 target. We maintain our forecast of EUR/USD1.06 on a 3 month view.”

“Weak productivity, low investment growth, high inflation, recession conditions (albeit at a less severe pace that previously signalled by the Bank), and a current account deficit are all likely to weigh on GBP this year. We continue to expect EUR/GBP to grind higher to 0.90 by the middle of the year and while we see scope for another move below GBP/USD 1.20 on a 3 month view.”

The data published on Friday by the US Bureau of Labor Statistics (BLS) showed that Nonfarm Payrolls rose by 517K in January, well above market consensus. The numbers triggered a rally of the US dollar. Analysts at Wells Fargo point out that there is still plenty of additional economic data between now and the March FOMC meeting, including another employment report and two more CPI reports, but they argue that even after accounting for the flattering seasonal effect on January payrolls, the report argues for the Fed to stay in a hawkish mood.

Key quotes:

“Seasonal adjustment factors appear to have flattered the headline as smaller-than-usual post-holiday layoffs bolstered the payrolls numbers. But the unusually few layoffs that translated into such a strong headline gain is indicative of what remains an incredibly strong jobs market, and other details of today's report underscored this strength.”

“Benchmark revisions increased the level of employment over the past couple years and showed stronger hiring momentum heading into 2023. At the same time, the unemployment rate fell to 3.4%, the lowest reading since 1969. Average hourly earnings growth remained solid and registered a 4.6% annualized rate over the past three months.”

“We suspect members of the FOMC will be cautious in reading too much into the magnitude of January's payroll gain, but the firm pace of average hourly earnings growth and a 53-year low in the unemployment rate should keep a 25 bps rate hike at the March 22 FOMC as the base case and another possible increase in May in play.”

- WTI is set to finish the week with more than 2% losses.

- Factors like solid US jobs data and the EU’s embargo on Russian oil-related products underpin WTI.

- WTI Technical Analysis: Near-term shifted upward biased, and it might test $80.00.

The US crude oil benchmark, known as Western Texas Intermediate (WTI)., jumped after the release of a solid job report in the United States (US), though prices are still headed for a weekly loss. At the time of writing, WTI exchanges hand at $77.85 per barrel, at the time of writing.

WTI’s extended its gains on Friday due to a surprising report from the US Department of Labor (DoL) which showed that in January, the economy created 517,000 jobs, surpassing the expected 200,000. As a result, the Unemployment Rate decreased from 3.5% to 3.4%, and the previous month’s figures were revised upwards.

In the meantime, the European oil embargo on Russian refined products that would begin on February 5 is being eyed by oil traders. Russian authorities commented that the EU’s ban could lead to a further imbalance in the global energy markets.

Meanwhile, according to ANZ analysts, China’s reopening has witnessed a sharp increase in traffic in its largest 15 cities following the lunar new year holiday.

All that said, WTI might continue to trim some of its weekly losses as investors are eyeing the 20-day Exponential Moving Average (EMA) at $78.47. Once broken, that could open the door for further upside.

WTI Technical Analysis

WTI’s daily chart portrays oil forming a bullish engulfing candle pattern after bouncing from three-week lows. Although the two-candle pattern is bullish, WTI still needs to hurdle essential resistance levels on the upside. WTI’s first resistance would be the 20-day EMA at $78.42, followed by the 50-day EMA at $79.19, which, once cleated, could pave the way toward the $80.00 per barrel figure.

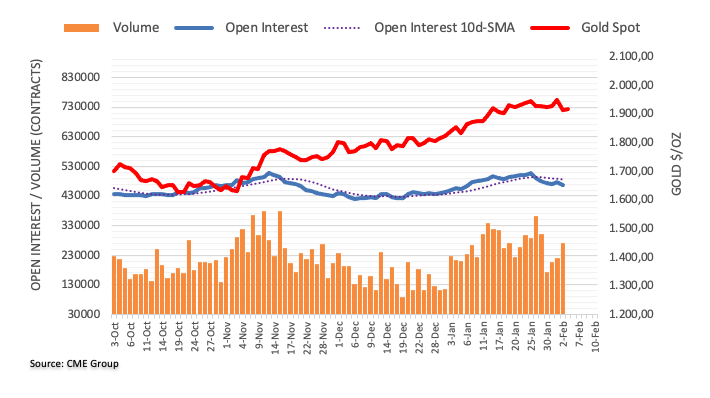

Gold price surged by $30 immediately after the Fed’s meeting on Wednesday evening and reached $1,960 the following day. Economists at Commerzbank see upside risks to their XAU/USD year-end forecast of $1,850.

US interest rate outlook to remain the more important driver

“The US interest rate outlook is likely to remain the more important driver in the medium term.”

“There is still a substantial discrepancy between the market’s expectation and the Fed’s view of the inflation trajectory and the corresponding interest rate trajectory. Since Wednesday, however, the probability has increased that the Fed is shifting more toward the market’s view. This results in an upside risk to our Gold price forecast of $1,850 at year’s end.”

- US Dollar soars across the board after NFP.

- US ISM Service brings in more favourable data.

- Silver drops by more than 3% on Friday; down 8% from Thursday’s peak.

Metals extended the sell-off after the US official employment report. Silver hits fresh monthly lows near $22.50 and is having the worst day in months.

Strong labor market, Service sector expanding again

US economic data released on Friday came in above expectations, reflecting a strong labor market and an improvement in service sector activity. The numbers boosted the US Dollar and Treasury bond yields. Wall Street is moving without a clear direction.

The data published on Friday by the US Bureau of Labor Statistics (BLS) showed that Nonfarm Payrolls rose by 517K in January, significantly above the market expectation of 185K. November and December’s figures were revised higher. The unemployment rate dropped unexpectable to 3.4%.

A different report released more recently revealed that economic activity in the service sector turned into expansion territory in January with the ISM Service PMI rising from 49.2 in December to 55.2, surpassing the market expectations of 50.4. In addition, the Price Paid Index dropped modestly from 68.1 to 67.8, above consensus of 65.5.

Silver hit a fresh low after the ISM data at $22.47, the lowest since December 7. As the end of the week looms, XAG/USD attempts to trim losses and trades at $22.65, down 3.40% for the day. From Thursday’s high it has fallen 8%.

Technical added pressure to XAG/USD and suggest at the moment that more losses are likely. Price is breaking a one-and-a-half consolidation range to the downside, after being rejected again from above $24.00.

Interim support emerges around $22.50, and below is the strong barrier at around $22.00. A recovery back above $23.00 could alleviate the bearish pressure.

XAG/USD daily chart

Technical levels

EUR/USD came briefly above 1.10 this week before falling to just below 1.09 today. Economists at Nordea note that the rate differentials continue to point toward a higher EUR/USD ahead.

EUR/USD to move about sideways in the near term

“Given that the ECB has had room for more positive rate surprises than the Fed, a higher EUR/USD is understandable.”

“The better outlook on the Euro Area’s energy balance also points toward a lower risk-premium on the Euro.”

“In the short-term, we see EUR/USD moving about sideways as markets reprice expectations on both the Fed and the ECB, however, it is clear that the rate differentials continue to point toward a higher EUR/USD ahead. China's reopening also points in that direction due to a better outlook for the global economy.”

GBP gained further in January, mainly versus USD. Economists at MUFG Bank believe that the Pound could struggle in the near term before a sustained appreciation trend emerges.

Global risk a key support for GBP

“The sharp decline in natural gas prices and the continued reopening of China have helped lift global growth expectations and equity markets. The rolling correlation of GBP and global equity markets is currently close to multi-decade highs underlining the importance of broader market conditions.”

“A sense of political stability, a less severe recession and policy rates peaking should help confidence in the UK improve later this year. However, there remains a probability of a worsening in global investor risk sentiment which could see GBP weaken in the near-term before a sustained appreciation trend emerges.”

- AUD/USD falls sharply by more than 100 pips on US economic data.

- The US Nonfarm Payrolls report almost tripled the market’s expectations for job creation.

- US ISM Non-Manufacturing PMI is back at expansionary territory.

AUD/USD collapsed after US economic data revealed on Friday showed that the labor market remains tight, and it would keep the US Federal Reserve under pressure to bring down inflation to the 2% target. That, alongside the US Dollar paring WEdneadys losses on Thursday, are the reasons for today’s price action. At the time of writing, the AUD/USD exchanges hands at around 0.6970s.

US jobs data surprised investors, as further Fed action is expected

Wall Street opened the last trading session of the week with losses. The US Department of Labor (DoL) revealed January’s data that surprised investors, with Nonfarm Payrolls data smashing expectations as the economy created 517K jobs in the economy, exceeding estimates for the creation of just 200K jobs. Consequently, the Unemployment Rate fell to 3.4% from 3.5%, while December’s figures were revised upward.

Average Hourly Earnings, sought by the US Federal Reserve as a measure of wages inflation, linked to last week’s Employment Cost Index (ECI), came at 0.3% MoM, in line with forecasts but lower than December’s report.

All that said, the AUD/USD extended its losses, but not without putting a fight around the 0.7000 psychological barrier. Once it gave way, the AUD/USD dropped below the 20-day Exponential Moving Average (EMA) at 0.6992 ad so far is eyeing the confluence of the January 19 daily low and the 50-day EMA at 0.6871.

In the bond market, US Treasury bond yields, mainly the 10-year benchmark note rate, climbed 14.5 bps to 3.54% after falling towards a monthly low of 3.334% on Thursday.

Of late, the US economic calendar revealed that S&P Global PMIs came slightly above estimates. Meanwhile, the ISM Non-Manufacturing PMI Index, which reports the behavior of the services economy, is back above in expansionary territory, rose to 55.2 from 50.4 estimates and way above December’s 49.2

AUD/USD Key Technical Levels

Gold price tumbles sharply after a solid January US Nonfarm Payrolls report. A break under $1,880 would exacerbate losses, strategists at TD Securities report.

Pricing for rate cuts has notably reversed weekly gains

“A wild beat on NFP data is creating shocking whipsaws in recent trends. Pricing for rate cuts has notably reversed weekly gains, adding further support to the broad Dollar, and pummeling Gold prices in the process.”

“CTA trend followers are unlikely to add to downside flows until prices break the $1,880 range, which suggests the yellow metal will continue to take its cue from the broad Dollar for the time being.”

“While central banks bought a whopping 417t in 2022Q4, pointing to substantially underreported official purchases, prices are now challenging the uptrend support driven by the recent central bank buying-binge.”

- ISM Services PMI in January rose back into the expansion territory.

- US Dollar Index clings to impressive daily gains above 102.50.

The economic activity in the US service sector expanded at a robust pace in January with the ISM Services PMI rising to 55.2 from 49.2 in December. This reading came in better than the market expectation of 50.4.

Further details of the publication showed that the prices Paid Index edged slightly lower to 67.8 from 68.1 but came in higher than the analysts' estimate of 65.5.

The Employment Index recovered to 50 from 49.4 and the New Orders Index climbed to 60.4 from 45.2.

Market reaction

The US Dollar Index preserves its bullish momentum after this data and was last seen rising 1.05% on the day at 102.78.

- The index picks up extra pace after another solid NFP print.

- The US labour market shows no signs of weakness so far.

- The US economy added far more jobs than predicted.

The greenback adds to the optimism seen in the second half of the week and lifts the USD Index (DXY) back above the 102.00 hurdle on Friday.

USD Index in multi-session tops

The index climbed further and flirted with the area of recent peaks around 102.60 soon after another stellar prints from the US labour markets. The bull run, however, fizzled out somewhat afterwards.

In fact, the US economy almost tripled the expected job creation in January at 517K jobs vs. 185K estimated, while the jobless rate unexpectedly retreated to 3.4%. Further positive results came from the 4.4% yearly increase in Average Hourly Earnings.

Following Friday’s price action, the dollar remains en route to close the first week with gains after three consecutive pullbacks.

Later in the NA session comes the ISM Non-Manufacturing also for the month of January.

USD Index relevant levels

Now, the index is gaining 0.65% at 102.39 and faces the next up barrier at 102.63 (weekly high February 3) seconded by 102.89 (January 18) and then 103.94 (55-day SMA). On the downside, the breach of 100.82 (2023 low February 2) would open the door to 100.00 (psychological level) and finally 99.81 (weekly low April 21 2022).

- US jobs numbers surpass expectations in January, not earnings.

- US Dollar and Treasury bond yields soar after NFP.

- GBP/USD extends weekly losses as USD jumps on data.

The GBP/USD tumbled from 1.2250 to 1.2100, reaching the lowest level in three weeks after the NFP. During the last hour, it rebounded modestly rising toward 1.2150.

The data published by the US Bureau of Labor Statistics (BLS) revealed on Friday that Nonfarm Payrolls rose by 517K in January, much higher than the market expectation of 185K. November and December's figures were revised higher. The unemployment rate dropped to 3.4%.

The US Dollar rose sharply across the board after the report while US yields soared. At the same time, the Pound printed fresh monthly lows versus the Euro.

A bad end, for a bad week

On a weekly basis, the GBP/USD is having the biggest decline since September at times of the UK government crisis. The result is the combination of a major recovery of the US Dollar during the last two days of the week but also, on the back of a weaker pound following central bank meetings.

On Thursday, as expected, the Bank of England raised the key interest rate by 50 basis points. Analysts at TD Securities point out the Monetary Policy Committee toned down its guidance on the pace of future hikes. "The vote was less dovish than expected (7-2) but language was softened to suggest a meeting-by-meeting approach to hikes from here".

Next week is light in terms of major data releases. Attention will be back of Federal Reserve officials after the latest FOMC meeting and today's employment data. Fed chair Powell is among the official that will speak.

In the UK, Q4 and December GDP data is due next Friday. "Further strikes, a fall in hospital visits, and heavy snowfall likely drove a sharp decline in Dec GDP. However, even this bad a monthly reading won't quite tip the UK into recession—for now at least", said TDS analysts.

Technical levels

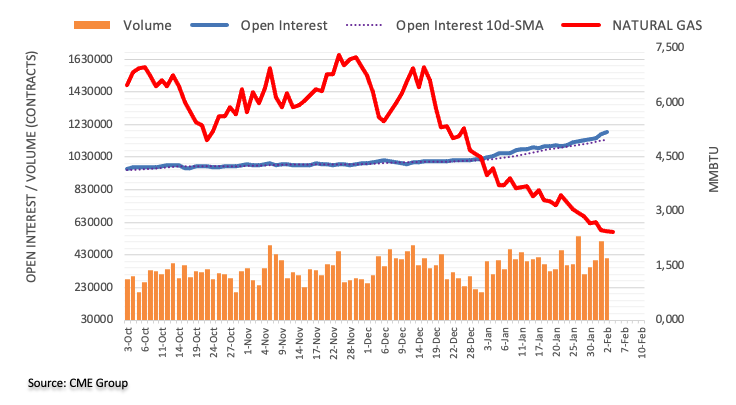

Historically mild weather through January has seen natural gas demand slump well below seasonal norms. Is there a bottom in sight for gas markets? Strategists at TD Securities analyze the outlook for the commodity.

Weak prices could keep production growth flat for now

“We expect that weak prices could keep production growth flat for now, but prices would need to fall below $2/MMBtu to induce material economic shut-ins.”

“While further weather-driven price weakness could be in the cards in the immediate term, we do not anticipate a further rout in prices with the return of Freeport LNG potentially signaling that the bottom is in.”

- Gold plunges after a solid January US NFP report.

- The US economy added more than 500K jobs, and the unemployment rate fell to 3.4%.

- Gold Technical Analysis: To the upside eyeing $1890, and downwards $1850.

Gold price tumbles sharply after the US Department of Labor revealed a staggering Nonfarm Payrolls report that added more jobs to the economy than expected and saw the unemployment rate dip lower. Therefore, the XAU/USD is dropping from daily highs at $1918 and collapsing toward the $1880 area, breaking the 20-day EMA on the way down.

US jobs data crushed expectations; further Fed action warranted

US equity futures remain negative as Wall Street is set to open in the red. The greenback was lifted by a surprisingly upbeat US Nonfarm Payrolls report for January added 517 jobs in the last statement, raising the buck from its ashes, as the US Dollar Index advanced 0.58% and reached a new two-week high at 102.63. Consequently, the XAU/USD extended its losses below the January 18 daily low of $1896.74 and the 20-day Exponential Moving Average (EMA) at $1891.70.

Delving into the data, December’s report was upward revised from 223K to 260K people added to the workforce. Meanwhile, Average Hourly Earnings rose 0.3%in-line with estimates but below December’s 0.4%. The Unemployment Rate dropped from 3.5% in December to 3.4% and pressured the US Federal Reserve (Fed), as a tight labor market could cause another spike in inflation.

In the bond market, US Treasury bond yields, mainly the 10-year benchmark note rate, climbed 12.5 bps to 3.521% after falling towards a monthly low of 3.334% on Thursday.

Ahead into the calendar, the ISM Non-Manufacturing PMI is expected to improve, while the S&P Global Services and Composite PMIs are also headed toward a slight recovery.

Gold’s Technical Analysis

After the NFP report, the XAU/USD dropped from around daily highs and is trapped within the 20-day EMA and the 50-day EMA, each at $1891.70 and $1854.99. An extension below the 50-day EMA would put in play the December 27 daily high-turned-support at $1833.29 before Gold can challenge the 100-day EMA at $1812.11. On the bullish side, XAU/USD needs to reclaim January’s 18 swing low of 1896.74, so bulls can have a chance to test $1900.

The US Dollar will likely weaken anew when uncertainties about the Fed, the US economy’s landing and China’s recovery resolve, in the view of economists at HSBC.

Gap between the Fed’s guidance and the market’s less hawkish perspective remains in place

“We think the path of the USD is likely to remain choppy in the coming months.”

“That gap between the Fed and the market still needs to be resolved, as does the debate about whether the US economy is heading towards a notable recession.”

“China’s growth prospects also remain central to the path for risk appetite and the USD. We believe these will be resolved over time, with the growth-inflation mix turning for the better. This will then open the door to a weaker USD.”

Since its low in October, AUD/USD has been recovering strongly. Economists at Société Générale expect the pair to enjoy further gains.

China’s growth spark is benefiting Australia

“The Chinese reopening remains the dominant macro theme in FX, while AUD/USD performance is strongly linked to Chinese equities.”

“China’s growth spark is also benefiting Australia. Both China and Australia’s trade surpluses have increased, and Australia started the year with the biggest monthly increase in consumer confidence for almost two years.”

“Australian growth should be one of the least impaired in G10 by the global tightening cycle, likely securing further AUD/USD gains.”

EUR gained further in January. Economists at MUFG Bank expect the EUR/USD pair to extend its race higher.

Upward pressure on yields and increased fragmentation risks

“The ECB estimated a suppression of the term premium of potentially over 150 bps from QE since the GFC. That term premium is now rising and this is resulting in a narrowing of 10yr spreads versus the US which will help support EUR.”

“Fragmentation risks are a downside risk that could see EUR suffer if there is evidence of supply lifting market volatility. Still, overall we believe the trend for EUR/USD this year will be the upside.”

- USD/JPY rallies around 150 pips in reaction to the mostly upbeat US employment details.

- The US economy added 517K new jobs in January and the jobless rate dropped to 3.4%.

- A weaker risk tone, hawkish BoJ expectations could lend support to the JPY and cap gains.

The USD/JPY pair catches some bids during the early North American session and spikes to a fresh daily top, around the 129.80 region in reaction to the mostly upbeat US employment details.

In fact, the headline NFP print showed that the US economy added 517K jobs in January, surpassing even the most optimistic estimates. Adding to this, the unemployment rate unexpectedly edged down to 3.4% during the reported month from 3.5% in December. The data further points to the underlying strength in the US labor market, which should allow the Fed to stick to its hawkish stance. This, in turn, provides a strong boost to the US Dollar and is seen as a key factor behind the USD/JPY pair's sharp rally of around 150 pips in the last hour.

That said, a combination of factors lends some support to the Japanese Yen (JPY) and fails to assist spot prices to build on the momentum beyond the 200-hour SMA. Diminishing odds for an imminent pause o the Fed's rate-hiking cycle take a toll on the global risk sentiment, which is evident from a weaker tone around the equity markets. This, along with speculations that high inflation may invite a more hawkish stance from the Bank of Japan (BoJ) later this year, underpins the safe-haven JPY and keeps a lid on any further gains for the USD/JPY pair.

Hence, it will be prudent to wait for strong follow-through buying before positioning for an extension of the intraday positive move. Nevertheless, the USD/JPY pair, for now, seems to have erased its modest weekly losses and remains at the mercy of the USD price dynamics.

Technical levels to watch

- EUR/USD reverses initial gains and revisits 1.0850.

- US Non-farm Payrolls surprised (largely) to the upside in January.

- The US unemployment rate dropped to 3.4%.

EUR/USD comes under further downside pressure and rapidly gives away the initial optimism, returning to the mid-1.0800s in the wake of another stellar print from the US jobs report on Friday.

EUR/USD: Gains appear limited near 1.1030 so far

EUR/USD picks up extra selling pressure after the release of the Nonfarm Payrolls showed the US economy added 517K jobs during January, largely surpassing initial estimates for a gain of 185K jobs. In addition, the December reading was also revised up to 260K (from 223K).

Further data saw the Unemployment Rate ticking lower to 3.4% and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.3% MoM and 4.4% from a year earlier. Additionally, the Participation Rate increased a tad to 62.4% (from 62.3%).

Later in the session, the attention will be on the release of the ISM Non-Manufacturing PMI.

EUR/USD levels to watch

So far, the pair is losing 0.37% at 1.0866. The breakdown of 1.0802 (weekly low January 31) would target 1.0766 (weekly low January 17) en route to 1.0648 (55-day SMA). On the other hand, the immediate up barrier comes at 1.1032 (2023 high February 2) followed by 1.1100 (round level) and finally 1.1184 (weekly low March 31 2022).

- USD/CAD scales higher for the second straight day and builds on the overnight recovery.

- Sliding US bond yields weighs on the USD and keeps a lid on any further gains for the pair.

- Investors now look forward to the closely-watched US monthly jobs data for some impetus.

The USD/CAD pair sticks to its strong intraday gains through the early North American session and is currently placed just above mid-1.3300s, still up over 0.30% for the day.

The overnight US Dollar rebound from a nine-month low run out of steam on the last day of the week amid a modest downtick in the US Treasury bond yields. This, in turn, is seen as a key factor acting as a tailwind for the USD/CAD pair. That said, a generally weaker tone around the equity markets limits the downside for the safe-haven buck and remains supportive of the bid tone surrounding the major.

Apart from this, expectations that robust employment could keep the US inflation higher and allow the Fed to stick to its hawkish stance for longer favours the USD bulls. In fact, an unexpected fall in the US Initial Jobless Claims on Thursday pointed to the underlying strength in the labor market. This might have raised hopes for a positive surprise from the closely-watched US monthly jobs data.

The popularly known NFP report is expected to show that the US economy added 185K jobs in January, down from 223K in the previous month. Moreover, the jobless rate is anticipated to edge higher to 3.6% from 3.5% in December. The data should drive the USD demand. This, along with oil price dynamics might influence the commodity-linked Loonie and provide some impetus to the USD/CAD pair.

Technical levels to watch

The Canadian Dollar may enjoy some modest upside, buoyed by risk appetite, rather than rates, in the opinion of economists at HSBC.

Risk appetite matters far more than rates differentials for USD/CAD

“Our analysis suggests that risk appetite matters far more than rates differentials for USD/CAD.”

“We believe a potential prolonged pause in the monetary tightening cycle means that the risk of an over-tightening has retreated, reducing the risk of a domestic recession and the threat of a more onerous downturn in the housing market. This may open the door to some risk appetite-related upside for the CAD over the coming few weeks.”

“The BoC provides the first example of an end, albeit a conditional one, to a developed market’s tightening path in the current cycle. Others are likely to join in the coming months, building a risk-on narrative that will support the CAD this year.”

As widely expected, the ECB Governing Council raised the key interest rates again by 50 basis points. Economists at Commerzbank expect the ECB to reduce the pace of interest rate hikes to 25 bps in May. The deposit rate would then be 3.25%.

Is 3.25% enough?

“As expected, the ECB raised its deposit rate by 50 bps to 2.5%. Moreover, it has already suggested a further rate hike of the same amount for the March meeting.”

“For the meeting thereafter in May, however, we expect the pace of rate hikes to be reduced to 25 bps because inflation should continue to fall.”

“At 3.25%, the end of the rate hike process would then be reached, even if we do not consider this sufficient to bring inflation back down to 2% in the medium term.”

- AUD/USD remains under some selling pressure for the second successive day on Friday.

- The risk-off impulse weighs on the Aussie, though fresh USD selling helps limit losses.

- Investors now look forward to the key US monthly jobs data (NFP) for a fresh impetus.

The AUD/USD pair is seen extending the previous day's retracement slide from the 0.7155-0.7160 area, or its highest level since June 2022 and losing ground for the second successive day on Friday. The pair remains depressed heading into the North American session and is currently placed near the lower end o its daily range, around mid-0.7000s.

A generally weaker tone around the equity markets turns out to be a key factor weighing on the risk-sensitive Aussie, though the emergence of fresh US Dollar selling limits losses for the AUD/USD pair. Investors remain sceptical about a speedy Chinese economic recovery in the wake of rising COVID-19 cases and lingering supply chain issues. This, along with disappointing quarterly earnings reports from major tech sector players, disrupts the recent positive sentiment around perceived riskier assets.

The USD, on the other hand, fails to capitalize on the overnight bounce from a nine-month low amid a downtick in the US Treasury bond yields. That said, hopes for a positive surprise from the US Nonfarm Payrolls (NFP) might continue to act as a tailwind for the safe-haven Greenback. An unexpected fall in the US Initial Jobless Claims on Thursday pointed to the underlying strength in the labor market and forced investors to scale back their bets for an imminent pause of the Fed's rate-hiking cycle.

Hence, the market focus will remain glued to the release of the closely-watched US monthly jobs data. Market participants seem concerned that robust employment could keep the US inflation higher and allow the Fed to stick to its hawkish stance for longer. This, in turn, could push the US bond yields higher, along with the USD, and set the way for some meaningful corrective decline for the AUD/USD pair. Nevertheless, spot prices, for now, seem to register the first weekly loss in seven.

Technical levels to watch

The US Dollar Index (DXY) weakened further in January after a sharp sell-off in Q4 last year. Economists at MUFG Bank see a weaker USD but do not expect a linear straight-line weakening trend.

Weaker USD as Fed hiking work nearly complete

“The lion’s share of the tightening has now been completed by the Fed and there are elevated risks of recession as the impact of that tightening begins to play out this year. That is likely to mean the US Dollar weakens this year.”

“High nominal rates, rising real rates and QT will all prove challenging for the markets and will result in volatility and bouts of USD strength as risk aversion sporadically intensifies.”

- EUR/USD resumes the upside following the post-ECB sell-off.

- The surpass of 1.1030 exposes a move to 1.1100.

EUR/USD reverses the recent pessimism and embarks on a recovery north of the 1.0900 hurdle on Friday.

A move beyond the so far 2023 high at 1.1032 (February 2) should retarget the round level at 1.1100 prior to the weekly peak at 1.1184 (March 31 2022).

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0317.

EUR/USD daily chart

- The index fades the initial uptick to the 102.00 zone on Friday.

- The negative view persists while below the resistance line near 102.30.

The upside momentum in DXY falters just ahead of the key 102.00 barrier in pre-NFP trading at the end of the week.

In the near term, further losses appear in the pipeline while below the 3-month resistance line near 102.30. If the index manages to clear this region it could accelerate gains to the provisional 55-day SMA, today at 103.93.

Below this line, the dollar is expected to keep the short-term bearish bias unchanged and with the immediate target at the 2023 low at 100.80 (February 2).

In the longer run, while below the 200-day SMA at 106.44, the outlook for the index remains negative.

DXY daily chart

- GBP/USD stages a solid recovery from the 50 DMA support, a nearly three-week low set on Friday.

- Sliding US bond yields fails to assist the USD to capitalize on its bounce and lends some support.

- A dovish assessment of the BoE decision on Thursday could cap gains ahead of the US NFP data.

The GBP/USD pair finds decent support near the 50-day SMA and stages a goodish intraday recovery from the 1.2185-1.2180 region, or a nearly three-week low touched earlier this Friday. The momentum allows spot prices to recover a part of the previous day's Bank of England (BoE)-inspired losses and climb back above the 1.2250 level during the mid-European session.

It is worth recalling that the Uk central bank, in its policy statement, removed the phrase that they would "respond forcefully, as necessary" (to inflation). Furthermore, BoE Governor Andrew Bailey said that inflation will continue to fall this year and more rapidly during the second half of 2023. This, in turn, lifted expectations for a less aggressive policy tightening going forward and undermined the British Pound.

That said, the emergence of fresh US Dollar selling assists the GBP/USD pair to attract some buyers near a technically significant 50-day SMA support. In fact, the USD Index, which tracks the greenback against a basket of currencies, fails to capitalize on the overnight bounce from a nine-month low amid a modest downtick in the US Treasury bond yields. The USD downside, however, seems cushioned ahead of the key US macro data.

Friday's US economic docket highlights the release of the closely-watched US NFP report. An unexpected drop in the US Weekly Initial Jobless Claims pointed to the underlying strength in the labor market and might have lifted expectations for a positive surprise from the official employment details. This, along with a weaker tone around the equity markets, should limit losses for the safe-haven buck and cap the GBP/USD pair.

Technical levels to watch

- EUR/JPY trades with modest losses and adds to Thursday’s strong drop.

- The cross broke below the 200-day SMA, exposing further weakness.

EUR/JPY remains under pressure and briefly revisited the key 140.00 neighbourhood at the end of the week.

The cross appears to have broken below the multi-session consolidative phase as well as the 200-day SMA, today at 140.93.

In doing so, further decline now appears in store in the very near term and with the immediate target at the 138.00 region.

EUR/JPY daily chart

USD/JPY managed to stage a rebound from multi-week lows on Thursday but failed to gather recovery momentum. Economists at Société Générale note that the pair could see another leg lower on a break under 127.20.

Support 127.20, resistance 129.90

“USD/JPY rebounded towards the upper limit of the steep channel within which recent decline evolved at 131/131.20 (now at 129.90), however, a break is still awaited.”

“Failure to reclaim last week's high of 131/131.20 could mean persistence in decline.”

“US NFP may test depth of support for stronger Yen and return to a mid-January low of 127.23.”

“Below 127.20, next potential supports are located at 126.50/125.85 representing 2015 high and 124.00.”

See – US NFP Preview: Forecasts from eight major banks, another healthy gain

Economist at UOB Group Enrico Tanuwidjaja reviews the latest inflation figures in Indonesia.

Key Takeaways

“Indonesia’s headline inflation rate eased slightly lower to 5.3% y/y in Jan from 5.5% in Dec last year but it continued to gain on month basis by 0.3%.”

“The food, beverage, and key essential household items and transportation prices continue to underpin the overall elevated level of inflation.”

“We keep our 2023 average inflation forecast to trend down slightly lower to 4% from an average of 4.2% last year. Inflation is likely to edge lower to BI’s target range of 2-4% in 2H23.”

Gold climbed above $1,950 following the Fed meeting. Economists at Commerzbank expect the yellow metal to shed some of its gains in the next few weeks.

Sceptical view of ETF investors

“Short-term investors are pricing in an upcoming end to the rate hike cycle and rate cuts in the near future. We do not rule out a correction in the next few weeks, as this is anything but certain.”

“In this sense, we share the still sceptical view of ETF investors.”

European Central Bank (ECB) Governing Council member Pierre Wunsch told Reuters on Friday that the ECB won't go from a 50 basis points rate hike in March to a zero in May. Wunsch added that a 25 bps or a 50 bps hike was possible in May.

"If core remains persistent, if we keep seeing core momentum being close to 5%, for me a terminal rate of 3.5% would be a minimum," Wunsch further explained and noted that the market reaction to ECB's hawkish tone on Thursday was surprising.

Market reaction

The EUR/USD pair showed no immediate reaction to these comments and was last seen posting small daily gains at 1.0930.

The Danish central bank sanctioned an interest rate hike of 35 bps. This is 15 bps lower compared to the hike from the ECB and should be enough to weaken the DKK, according to economists at Danske Bank.

Denmark hikes 15 bps less than ECB

“Danmarks Nationalbank (DN) hikes 35 bps to 2.10% in response to ECB’s 50 bps rate hike.

“DN hiked 15 bps less and widened the spread to -40 bps in response to a period of downward pressure on EUR/DKK.”

“We expect this to be enough to weaken DKK and the need for FX intervention.”

The Dollar has essentially erased all the post-FOMC losses. But today’s Nonfarm Payrolls release in the US brings mostly downside risks for the Dollar, in the view of economists at ING.

Downside risks from data today

“With volatility abating after the key Fed and ECB announcements and some of those defensive trades being unwound, today’s NFP release in the US brings mostly downside risks for the USD.”

“Any evidence that wage growth is losing pace and/or that hiring is slowing down materially would likely fuel rate cut expectations further, and hit the Dollar.

“US 2-year rates are currently trading 10 bps above the psychological 4.00% mark: a break below may exacerbate a Dollar slump. Should such USD weakness materialise, we think that high-beta currencies may emerge as key winners thanks to the positive impact on risk assets.”

See – US NFP Preview: Forecasts from eight major banks, another healthy gain

EUR/USD eased after the European Central Bank (ECB) meeting. You-Na Park-Heger, FX Analyst at Commerzbank, expects the pair to trade sideways for the time being.

A more hawkish ECB is difficult to imagine

“It emerged yesterday that things are getting increasingly difficult for EUR bulls. A lot seems to be priced into EUR/USD already, and a more hawkish ECB is difficult to imagine.”

“Currently, it looks as if the inflation trend justifies an end to interest rate hikes in the near future, so there is probably no further upside potential in EUR/USD for the time being.”

“A sideways move in EUR/USD, possibly in the 1.08-1.09 range – which we saw prior to the recent test of the 1.10 mark seems most likely to me for now.”

- Gold price struggles to gain any meaningful traction and oscillates in a range on Friday.

- Traders now seem to have moved to the sidelines ahead of the key US monthly jobs data.

- Bets for more rate hikes by Federal Reserve underpin US Dollar and act as a headwind.

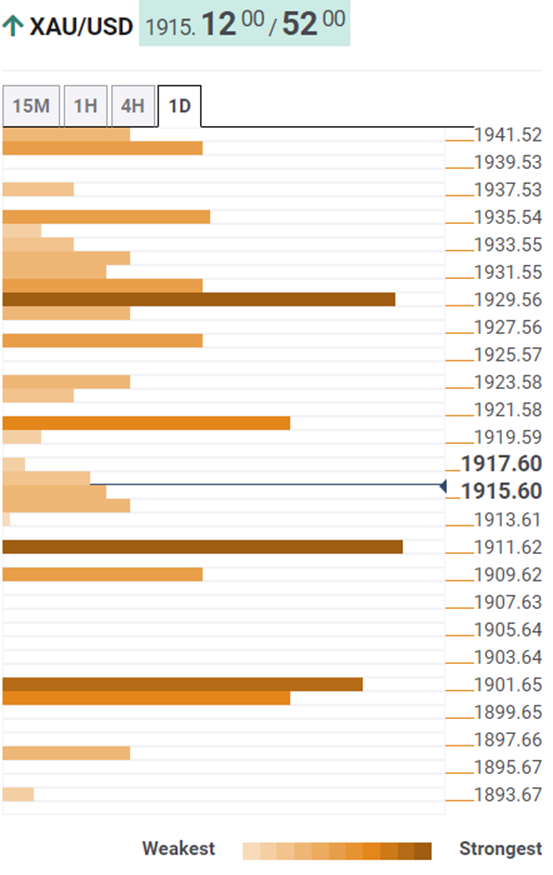

Gold price finds some support near the $1,910 region and for now, seems to have stalled the previous day's sharp retracement slide from the highest since April 2022. The XAU/USD, however, seems to struggle to gain any traction and oscillates in a range around the $1,915 area through the first half of the European session.

Modest US Dollar strength caps upside for Gold price

The US Dollar (USD) manages to preserve the overnight recovery gains from a nine-month low, which, in turn, is seen as a key factor acting as a headwind for the US Dollar-denominated Gold price. The USD draws support from hopes for a positive surprise from the Nonfarm Payrolls (NFP), due later during the early North American session from the United States. The expectations were fueled by the upbeat Weekly Initial Jobless Claims released on Thursday, which pointed to the underlying strength in the labor market.

Sliding US bond yields lend support to Gold price

The upbeat data, meanwhile, forces investors to scale back their bets for an imminent pause in the Federal Reserve’s (Fed) rate hike cycle. This is seen as another factor lending support to the buck and capping the upside for the non-yielding Gold price. That said, a modest downtick in the US Treasury bond yields holds back the USD bulls from placing aggressive bets. Apart from this, a generally weaker tone around the equity markets contributes to limiting the downside for the safe-haven XAU/USD, for the time being.

Focus remains on monthly jobs data from United States

Traders also seem reluctant and prefer to wait on the sidelines ahead of the release of the closely-watched US monthly employment details. The report is expected to show that the economy added 185K jobs in January, down from 223K in the previous month. Moreover, the jobless rate is anticipated to edge higher to 3.6% from 3.5% in December. The key US macro data will influence the USD demand and provide a fresh impetus to Gold price. Nevertheless, the XAU/USD remains on track for its first weekly fall in seven.

Gold price technical outlook

From a technical perspective, any subsequent slide is likely to find decent support near the $1,900 round-figure mark. A convincing break below might prompt technical selling and expose the $1,880-$1,877 support zone. Gold price could eventually slide to test the next relevant support near the $1,856-$1,855 region.

On the flip side, the $1,920 level now seems to act as an immediate hurdle, above which the XAU/USD could climb back to the $1,949-$1,950 region. Some follow-through buying should allow Gold price to surpass an intermediate hurdle near the $1.970-$1,980 area and aim to reclaim the $2,000 psychological mark for the first time since March 2022.

Key levels to watch

The Pound was slightly weaker after an initially positive reaction to the BoE statement. Economists at ING believe that the EUR/GBP pair is set to break above 0.9000 in the coming months.

EUR/GBP may manage to stay below 0.9000 for now

“It appears that the BoE is not diverging much from market expectations, which means that it may be up to data in the UK to drive any large swings in the Pound rather than surprises from the BoE.”

“With markets doubting the ECB's hawkishness, EUR/GBP may manage to stay below 0.9000 for now, although a break higher seems highly likely over the coming months.”

- EUR/USD alternates gains with losses above the 1.0900 mark.

- Germany, EMU Final Services PMI surprised to the upside in January.

- Markets’ attention will be on the US labour market and ISM Non-Manufacturing.

The single currency continues to digest Thursday’s post-ECB acute pullback and motivates the EUR/USD to trade within a tight range in the low-1.0900s on Friday.

EUR/USD focuses on data

Price action around EUR/USD remains muted so far in the European morning amidst increasing prudence among market participants in light of the upcoming US Nonfarm Payrolls for the month of January (185K exp).

In the meantime, investors continue to adjust to the latest ECB event amidst fresh comments from rate setters. On this, Board member Simkus suggested that the March meeting could not see the last 50 bps rate hike, at the time when he left the door open to another hike in May, although he did not give details on its potential size.

In the domestic calendar, final Services PMIs in Germany and the euro area came at 50.7 and 50.8, respectively, for the month of January. In addition, the ECB published its Survey of Professional Forecasters and now see inflation tracked by the HICP higher in 2023 and 2024 while Real GDP growth expectations appear largely unchanged.

Later in the NA session, the US Nonfarm Payrolls will take centre stage seconded by the Unemployment Rate and the ISM Non-Manufacturing.

What to look for around EUR

The pronounced upside pushed EUR/USD north of the key 1.1000 hurdle on Thursday, although the pair retreated markedly in the wake of the ECB event and retested the 1.0880 region.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the central bank delivered a 50 bps at its meeting on Thursday.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: Germany, EMU Final Services PMI, ECB SPF (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.06% at 1.0916 and faces the next up barrier at 1.1032 (2023 high February 2) followed by 1.1100 (round level) and finally 1.1184 (weekly low March 31 2022). On the other hand, the breakdown of 1.0802 (weekly low January 31) would target 1.0766 (weekly low January 17) en route to 1.0648 (55-day SMA).

- NZD/USD remains under some selling pressure for the second successive day on Friday.

- The USD adds to the previous day’s recovery gains and exerts some downward pressure.

- A softer risk tone further weighs on the risk-sensitive ahead of the crucial US NFP report.

The NZD/USD pair edges lower for the second successive day on Friday and moves away from its highest level since June 2022 touched the previous day. The pair remains on the defensive through the first half of the European session and is currently placed just above mid-0.6400s.

The US Dollar builds on the overnight recovery move from a nine-month low and gains some follow-through traction on the last day of the week, which, in turn, is seen weighing on the NZD/USD pair. The modest USD uptick could be attributed to some repositioning trade amid hopes for strong US monthly jobs data, due for release later during the early North American session.

An unexpected drop in the US Weekly Initial Jobless Claims pointed to the underlying strength in the labor market and raised the possibility of a positive surprise from the US NFP report. Furthermore, the upbeat data forced investors to re-evaluate their expectations about the Fed's future rate-hike path, which, in turn, prompts some short-covering around the greenback.

The anxiety ahead of the key US macro data is evident from a generally softer tone around the equity markets. This offers additional support to the safe-haven buck and weighs on the risk-sensitive Kiwi. That said, declining US Treasury bond yields hold back the USD bulls from placing aggressive bets and help limit the downside for the NZD/USD pair, at least for now.

From a technical perspective, repeated failures to find acceptance above the 0.6500 psychological mark could be seen as signs of bullish exhaustion. That said, it will still be prudent to wait for strong follow-through selling before confirming that the NZD/USD pair has topped out in the near term and positioning for any meaningful corrective pullback.

Technical levels to watch

Gold price is holding steady above the $1,900 mark. All eyes now turn toward the United States Nonfarm Payrolls (NFP) data release for fresh trading impetus in XAU/USD, FXStreet’s Dhwani Mehta reports.

United States Nonfarm Payrolls data in focus

“A weaker-than-expected US NFP print is likely to bolster the dovish ‘Fed pivot’ expectations, triggering a risk rally at the expense of the US Dollar. In such a scenario, Gold price could receive the much-needed boost to resume its northward trajectory.”

“The US Treasury bond yields face a double whammy, as risk-off flows dominate while traders weigh the dovish Federal Reserve policy outlook. Gold price, therefore, could find some support if the Treasury bond yields sell-off extends.”

See – US NFP Preview: Forecasts from eight major banks, another healthy gain

The European Central Bank (ECB) conducted a survey of Professional Forecasters (SPF) for the first quarter of 2023, with the key findings noted below.

“Eurozone's HICP inflation seen at 5.9% in 2023, 2.7% in 2024, 2.1% in 2025 and longer-term.”

"According to respondents, these changes mainly reflect a combination of recent data outturns, ongoing stronger and broader than expected indirect effects of energy price developments as well as higher forecast wage growth.”

“Expect inflation to fall to 2.1% in 2025, which was not part of the survey in October, and stabilize there in the long term.”

“Real GDP growth expectations largely unchanged.”

“Unemployment rate expectations revised down.”

Market reaction

The above survey findings seem to have some positive impact on the Euro, as EUR/USD is extending its renewed upside above 1.0900. At the time of writing, the pair is trading at 1.0912, modestly flat on the day.

USD/CNH could extend the downtrend further and revisit the 6.6750 level in the next few weeks, comment UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang.

Key Quotes

24-hour view: “Yesterday, we held the view that USD ‘could drop below the Jan’s low of 6.6980’. Our view was incorrect as USD rebounded to a high of 6.7442. The rapid rebound appears to be running ahead of itself and USD is unlikely to advance much further. Today, USD is more likely to trade sideways between 6.7200 and 6.7500.”

Next 1-3 weeks: “We highlighted yesterday (02 Feb, spot at 6.7120) that the rapid increase in downward momentum is likely to lead to USD dropping below last month’s low near 6.6980. There is no change in our view. However, a breach of 6.7550 (no change in ‘strong resistance’ level) would invalidate our view.”

Considering advanced prints from CME Group for natural gas futures markets, open interest increased for yet another session on Thursday, this time by nearly 13K contracts. Volume, on the other hand, went down by around 104.3K contracts after three consecutive daily builds.

Natural Gas could bounce on oversold conditions

There is no respite in the downtrend of natural gas prices. Thursday’s negative price action came in tandem with another increase in open interest, leaving the door open to the continuation of the underlying bearish trend. However, the current oversold conditions of the commodity (as per the RSI around 25) could spark a technical bounce in the short term.

Further downside pressure in USD/JPY could see the 127.20 region revisited in the short-term horizon, note UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang.

Key Quotes

24-hour view: “Our expectation for ‘further USD weakness’ did not materialize as it dipped to 128.07 before rebounding. USD appears to have moved into a consolidation phase and is likely to trade sideways today, between 128.20 and 129.20.”

Next 1-3 weeks: “We continue to hold the same view as yesterday (02 Feb, spot at 128.40). As highlighted, the risk for USD has shifted to the downside toward 127.20. The downside risk is intact as long as the ‘strong resistance’ level at 129.90 (no change in level), is not breached. “

European Central Bank (ECB) policymaker Peter Kazimir said on Friday that “I don't think the March rate hike will be the last.”

Additional comments

“We will decide subsequently how many more will be needed.”

“March rate hike won't bring us to peak of interest rates yet.”

"The battle against inflation is far from won.”

Market reaction

The Euro fails to benefit from the hawkish commentary from the ECB policymakers, trading listlessly at around 1.0900, at the time of writing.

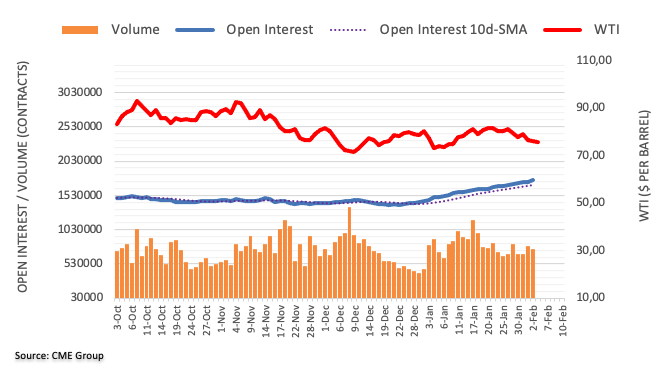

Open interest in crude oil futures markets extended the uptrend and went up by around 24.5K contracts on Thursday according to preliminary readings from CME Group. Volume, instead, reversed two daily builds in a row and dropped by around 43.3K contracts.

WTI: On its way to $72.50

Prices of the WTI prolonged the leg lower on Thursday against the backdrop of increasing open interest. Against that, the commodity could accelerate losses to, initially, the 2023 low at $72.50 per barrel (January 5).

FX option expiries for Feb 3 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0950 733m

- 1.1000 475m

- USD/CAD: USD amounts

- 1.2900 2.3b

- 1.3200 300m

- 1.3500 1.3b

EUR/USD is trading close to 1.0900 after the Fed and ECB meetings. In the view of economists at ING, markets’ doubts on ECB guidance may be a larger short-term driver, and delay another big EUR/USD rally to the second quarter.

Rate differentials may swing meaningfully in favour of the EUR

“EUR/USD rate differential is still more likely to swing in favour of the Euro this year. However, another big rate-driven EUR/USD rally may not be a story for this quarter, as the March meetings may see the Fed push back against rate cut speculation and the ECB still struggles to sell its tightening plans to the market.”

“The second quarter of this year is when the ECB-Fed divergence may emerge more distinctly, as we expect the ECB to deliver another 25 bps and strongly signal rates won’t be cut for some time, while an acceleration of the slowdown in the US economy and inflation will heavily challenge any pledge by the Fed to keep rates at 5.0% for long.”

“We target 1.15 in EUR/USD in 2Q23, and 1.12 in 4Q23.”

- GBP/USD remains under some selling pressure for the second successive day on Friday.

- A dovish assessment of the BoE decision weighs on the GBP amid a modest USD strength.

- A break below the 1.2200 mark might have set the stage for further losses ahead of NFP.

The GBP/USD pair extends the previous day's rejection slide from the 1.2400 mark and continues losing ground for the second successive day on Friday. Spot prices drop to a nearly three-week low during the first half of the European session, with bears looking to build on the negative momentum further below the 1.2200 round-figure mark.

The British Pound is undermined by a dovish assessment of the Bank of England's (BoE) policy outlook, which, along with a modest US Dollar strength, exerts pressure on the GBP/USD pair. In fact, the BoE raised the policy rate by another 50 bps and noted that further tightening would be required if there were to be evidence of more persistent price pressures. The UK central bank, however, removed the phrase that they would "respond forcefully, as necessary" in its accompanying policy statement. Furthermore, BoE Governor Andrew Bailey said that inflation will continue to fall this year and more rapidly during the second half of 2023. This, in turn, fuels speculations that the current rate-hiking cycle might be nearing the end and continues to weigh on the Sterling.

The US Dollar, on the other hand, is seen building on the overnight goodish rebound from a nine-month low amid some repositioning trade ahead of the closely-watched US NFP report. The US Weekly Initial Jobless Claims data released on Thursday pointed to the underlying strength in the labor market. This, in turn, boosted expectations for strong monthly employment details, due later during the early North American session, and forced investors to re-evaluate their expectations for future rate hikes by the Fed. Apart from this, the prevalent cautious market mood is seen as another factor benefiting the safe-haven greenback. and contributes to the offered tone surrounding the GBP/USD pair. Moreover, the technical setup supports prospects for a further near-term depreciating move.

The recent repeated failures near the 1.2445 region constitute the formation of bearish multiple tops on the daily chart. The subsequent break below the 1.2200 mark adds credence to the negative outlook and suggests that the path of least resistance for the GBP/USD pair is to the downside. Hence, any attempted recovery move might now be seen as a selling opportunity and runs the risk of fizzling out rather quickly. Spot prices seem poised to weaken further towards the 1.2130-1.2125 intermediate support en route to the 1.2100 round figure.

Technical levels to watch

European Central Bank (ECB) policymaker Gediminas Simkus said on Friday, “a rate cut this year is not very likely.”

Additional quotes

Inflation has probably peaked but core hasn't.

March rate hike May not be the last half-point move.

A rate hike in May is possible, could be 25 bps or 50 bps but hardly 75 bps.

A rate cut this year is unlikely, although it's possible in 2024, if the situation changes.

Meanwhile, ECB policymaker Bostjan Vasle said that they will need to rise rates by 50 bps in March, to stay restrictive.

Market reaction

The Euro is uninspired by the above comments, with EUR/USD eeping its range at around 1.0900, as of writing.

The Bank of England (BoE) hiked its key rate by 50 bps to 4%, but it softened its communication notably. Sterling came under strong selling pressure following the event. Economists at Commerzbank expect further GBP weakness.

BoE signals rate hikes will end soon

“It became clear that the BoE is quite close to the end of its rate hike cycle.”

“The impression suggests itself that the BoE might have hit the communication break a little too soon, as inflation is in double digits, and it will yet have to be seen whether it eases that quickly after all. The labour market seemed quite robust until now and the news of strikes signals that the risk of rising wages remains quite real.”

“Although the BoE left the door open for further rate hikes, from the FX market’s point of view a more decisive approach would have been desirable in view of the high uncertainty. Against this background, it is hardly surprising that Sterling eased and further Sterling weakness seems likely to us.”

- USD/CAD gains traction for the second straight day and is supported by a combination of factors.

- Sliding crude oil prices undermines the Loonie and acts as a tailwind amid a modest USD strength.

- Traders now look forward to the closely-watched US monthly jobs data (NFP) for a fresh impetus.

The USD/CAD pair gains positive traction for the second successive day on Friday and looks to build on the overnight recovery move from the 1.3280 region, or its lowest level since November 16. Spot prices stick to modest intraday gains, around the 1.3345-1.3350 area through the early European session and draw support from a combination of factors.

Crude oil prices prolong the recent rejection slide from the 100-day SMA hurdle and drop to a nearly four-week low on the last day of the week. The uncertainty over a strong economic recovery in China weighs on the outlook for fuel demand and exerts pressure on the black liquid. This, in turn, is seen undermining the commodity-linked Loonie, which, along with a modest US Dollar strength, lends support to the USD/CAD pair.

The US Weekly Initial Jobless Claims released on Thursday pointed to the underlying strength in the labor market and raises the possibility of strong Nonfarm Payrolls (NFP) data. Furthermore, the upbeat US macro data forces investors to re-evaluate their expectations for future rate hikes by the Fed. Apart from this, the prevalent cautious mood lends support to the safe-haven buck and remains supportive of the USD/CAD pair's uptick.

The global flight to safety, meanwhile, exerts some downward pressure on the US Treasury bond yields, which, in turn, acts as a headwind for the USD. Traders also refrain from placing aggressive bets and prefer to wait on the sidelines ahead of the release of the closely-watched US monthly jobs report, due later during the early North American session. This, along with oil price dynamics should provide a fresh impetus to the USD/CAD pair.

Technical levels to watch

Bank of England (BoE) Chief Economist Huw Pill told Times Radio on Friday that it's important for the BoE to not do "too much" on monetary policy, per Reuters.

Key takeaways

"We have had some better news of late."

"MPC's job is to return inflation to target and hold it there over medium term."

"MPC feels it needs to see the job through."

"I am confident Thursday's rate rise was necessary and appropriate."

"I do not want to steer market interest rates on day-to-day basis."

"We have to be prepared for shocks."

"We have to recognise we have done a lot with monetary policy already."

"There is still a lot of policy in the pipeline."

"MPC has changed language quite substantially."

"MPC signalled need for continued watchfulness."

"We have reasonably high degree of confidence we will see inflation fall this year."

"Focus is on whether inflation declines further ahead."

"The notion of whether we are in recession or not may vary during the year."

"It is key to see that underlying all this is very weak performance on supply side of the economy."

Market reaction

Pound Sterling struggles to find demand following these comments and GBP/USD was last seen trading slightly below 1.2200, where it was down 0.22% on a daily basis.

EUR/USD is now firmly below the 1.10 mark. Economists at Danske Bank maintain a clear sell-on-rallies bias for the cross

EUR/USD had defied the turnaround in equities

“In recent weeks, EUR/USD has defied the shift and sudden underperformance of Eurozone equities, which we otherwise deem to have been an important driver behind the EUR/USD rally since September (Eurozone equities overperforming during this period).”

“Our tactical conviction on EUR/USD is not high, but we maintain a clear sell-on-rallies bias for the cross as we still think medium-term drivers indicate that EUR/USD is overvalued (and not undervalued).”

Here is what you need to know on Friday, February 3:

Following the highly volatile action witnessed on Wednesday and Thursday, markets seem to have turned cautious on the last trading day of the week. As investors await the January jobs report from the US, the US Dollar Index consolidates Thursday's recovery gains slightly below and US stock index futures trade in negative territory. December Producer Price Index data will be featured in the European economic docket and S&P Global will release the final revisions to January Manufacturing and Services PMIs for Germany, the Eurozone, the UK and the US. Finally, the ISM will publish the US Services PMI ahead of the weekend.

US Nonfarm Payrolls Forecast: Analyzing January NFP release.

The European Central Bank (ECB) decided to raise key rates by 50 basis points (bps) as expected and said that it intends to opt for one more 50 bps hike in March before reassessing the situation. During the press conference, ECB President Christine Lagarde refrained from committing to additional rate increases after March and noted that inflation risks are now more balanced. Lagarde's dovish tone caused EUR/USD to lose its traction and the pair erased a large portion of Wednesday's gains before stabilizing at around 1.0900 on Friday.

ECB Analysis: Lagarde lowers Euro with mixed message on moves beyond March, two more dovish comments.

Meanwhile, the Bank of England (BoE) announced that it hiked the policy rate by 50 bps to 4% with 7 members of the MPC voting in favor of the decision. The BOE's policy statement revealed that the bank lowered inflation forecasts and saw a shallow recession. Additionally, BoE Governor Andrew Bailey noted that they will re-evaluate the policy if the economy evolves in line with their central forecasts. The Pound Sterling came under strong selling pressure following the BOE event and GBP/USD dropped to its lowest level since mid-January at 1.2220. Early Friday, the pair continues to edge lower and trades below 1.2200, pressured by risk aversion.

Bank of England Quick Analysis: Three dovish things that are set to keep Sterling down for longer.

Although US Treasury bond yields continued to stretch lower on Thursday, the renewed US Dollar strength forced XAU/USD to turn south. Gold price retraced its weekly advance and was last seen trading in a tight channel slightly above $1,910.

US January Nonfarm Payrolls Preview: Analyzing Gold price's reaction to NFP surprises.

USD/JPY managed to stage a rebound from multi-week lows on Thursday but failed to gather recovery momentum. Early Friday, the pair is moving up and down slightly above 128.50. Bank of Japan (BoJ) Governor Haruhiko Kuroda told the Japanese parliament on Friday that the BoJ must maintain the ultra-easy policy to support the economy and create an environment for firms to hike wages.

Bitcoin touched its highest level since mid-August above $24,000 on Thursday but ended up posting modest daily losses. BTC/USD was last seen trading flat on the day at around $23,500. Ethereum reversed its direction after rising above $1,700 on Thursday and declined below $1,650 early Friday.

The US Bureau of Labor Statistics (BLS) will release the January jobs report on Friday, February 3 at 13:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of eight major banks regarding the upcoming employment data.

Expectations are for a 185K rise in Nonfarm Payrolls following the 223K increase in December while the Unemployment Rate is expected to inch higher to 3.6% vs. 3.5% seen in December.

Commerzbank

“In December, more than 200K new jobs were created again in the US. However, there were some details in the employment report that point to a gradual weakening of the labor market. For example, the number of temporary workers shrank for the fifth month in a row, a trend previously seen only in the run-up to recessions. In addition, despite continued substantial job creation, the number of hours worked fell. We, therefore, expect job growth to decline further to 180K in January.”

Danske Bank

“We still expect relatively strong employment growth at 200K.”

TDS

“We project payroll gains to have stayed largely unchanged vs December, posting a still solid 220K increase in January. Both the unemployment rate and average hourly earnings should have remained steady: the former at a decades-low 3.5%, and the latter printing a 0.3% MoM gain. Following Powell's flip in script, the market is asymmetric around this number. That is, a positive surprise is not likely to materially derail risk sentiment, while an indication of softness will reinforce it. That's key for the USD and other FX baskets which have more closely aligned itself to equity dynamics. That could prevent the USD from sinking to new lows in the near-term. Ultimately, however, we expect to see dip buying interest in EURUSD towards 1.08.”

SocGen

“We expect another 205K gain and would view any gain above 150K as strong. We expect the unemployment rate to edge up to 3.6%.”

CIBC

“Total hiring likely slowed to a 170K pace in January. That’s still a healthy pace of job growth, and the recent softening in the prime-age labor force participation rate leaves room for solid hiring without putting more upwards pressure on wages. Assuming an increase in participation, the unemployment rate could have increased to 3.6%, while the outsized gain in the hiring on the household survey that was seen in December isn’t likely to have been repeated in January. We’re roughly in line with the consensus expectation, suggesting limited market reaction.”

RBC Economics

“US payroll employment likely continued to rise in January, although the 150K increase in payrolls we expect would be the smallest gain since a drop in December 2020. The labour market remains tight and layoffs are still very low. But the number of job openings has been edging lower and we look for a tick up in the unemployment rate to 3.6% from 3.5% in December.”

NBF

“Payroll growth could come in at 150K. The household survey is expected to show a similar gain. This development could leave the unemployment rate unchanged at 3.5%, assuming the participation rate stayed put at 62.3%.”

Citibank

“We expect a sizable 305K increase in January, with some strength due to more technical factors but still-solid underlying job growth. We expect a somewhat stronger 0.4% increase in average hourly earnings in January compared to December, with roughly balanced risks around our above-consensus forecast. We expect the unemployment rate to remain unchanged at 3.5%, although with some elevated uncertainty around components of the household survey in January.”

- USD/JPY oscillates in a narrow range and is influenced by a combination of diverging forces.

- A modest USD uptick lends support, though weaker US bond yields cap gains ahead of NFP.

- Expectations for a hawkish shift by the BoJ underpin the JPY and further act as a headwind.

The USD/JPY pair struggles to capitalize on the previous day's modest bounce from the vicinity of the 128.00 mark, or a two-week low and oscillates in a narrow range on Friday. Spot prices seesaw between tepid gains/minor losses and hold steady above mid-128.00s through the early European session.

The US Dollar edges higher on the last day of the week and looks to build on its recovery from a nine-month low touched on Thursday, which, in turn, is seen acting as a tailwind for the USD/JPY pair. The USD uptick could be attributed to some repositioning trade ahead of the closely-watched US monthly jobs report, due for release later during the early North American session.

The US Weekly Initial Jobless Claims data released on Thursday pointed to the underlying strength in the labor market and boosted expectations for strong Nonfarm Payrolls (NFP). This, in turn, forced investors to re-evaluate their expectations for future rate hikes by the Fed and lend some support to the USD. That said, weaker US Treasury bond yields cap gains for the buck.

The Japanese Yen, on the other hand, continues to draw support from expectations that high inflation may invite a more hawkish stance from the Bank of Japan (BoJ) later this year. The bets were lifted by Japan's Nationwide core inflation, which reached its highest annualized print since December 1981. This is seen as another factor keeping a lid on the USD/JPY pair, at least for now.

Bullish traders also seem reluctant to place fresh bets in the wake of the overnight breakdown below a symmetrical triangle and ahead of the key US macro data. Nevertheless, the USD/JPY pair seems poised to register losses for the first time in three weeks.

Technical levels to watch

In the opinion of UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang, AUD/USD could now trade between 0.7000 and 0.7135 in the short term.

Key Quotes

24-hour view: “We highlighted yesterday that ‘the sharp and rapid rise appears to be overdone but AUD could rise above 0.7170 first before easing’. AUD subsequently rose to 0.7158 before dropping sharply to a low of 0.7069. Despite the decline, downward momentum has not improved much. Today, AUD is likely to trade in a range, expected to be between 0.7040 and 0.7110.”

Next 1-3 weeks: “We noted yesterday (02 Feb, spot at 0.7145) that despite the advance in AUD on Wednesday, upward momentum has not improved much. However, we were of the view that AUD is likely to trade with an upward bias toward 0.7230. AUD rose to 0.7158 before staging a surprisingly sharp pullback. While our ‘strong support’ level at 0.7050 is not breached, upward momentum has more or less fizzled out. In other words, AUD is not ready to head higher to 0.7230. Instead, it is more likely to consolidate between 0.7000 and 0.7135 for now.”