- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 02-07-2014

The Federal Reserve Chair Janet Yellen was speaking at an inaugural central banking lecture at the IMF in Washington:

- There is no need to change monetary policy to address financial stability concerns;

- She sees "pockets of increased risk-taking across the financial system";

- "Efforts to promote financial stability through adjustments in interest rates would increase the volatility of inflation and employment";

- The monetary policy should focus on jobs and inflation;

- "Monetary policy faces significant limitations as a tool to promote financial stability";

- The crisis would not have been prevented or significantly mitigated by substantially tighter monetary policy in the mid-2000s.

The transcript of the whole speech by Janet Yellen can be found here.

Most stock indices traded slightly higher due to the better-than-expected ADP jobs report for the U.S. The U.S. economy added 281,000 jobs in June, after an increase of 179,000 jobs in May. That was the highest increase since November 2012. It is a sign that the U.S. labour market is strengthening.

Eurozone's gross domestic product increased 0.2% in the first quarter, in line with expectations, after a 0.2% gain the previous month. On a yearly basis, Eurozone's gross domestic product climbed 0.9% in the first quarter, in line with expectations, after a 0.9% rise the previous month.

The producer price index in the Eurozone declined 0.1% in May, missing expectations for a 0.1% gain, after a 0.1% decrease in April. On a yearly basis, Eurozone's producer price index fell 1.0% in May, in line with expectations, after a 1.2% decline in April.

The U.K. construction purchasing managers' index surged to 62.6 in June from 60.0 in May. Analysts had expected the index to fall to 59.7.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,816.37 +13.45 +0.20%

DAX 9,911.27 +8.86 +0.09%

CAC 40 4,444.72 -16.40 -0.37%

Oil prices fell slightly, while heading to the lowest level in almost three weeks, which was associated with positive news on Libya.

Recall that the rebels in Libya yesterday unexpectedly announced today plans to open two oil terminal of Es Sider and Ras Lanuf in the east of the country, who have not worked since last summer. The rebels have called the move a "goodwill gesture" to the government. Rather, they are hoping that the government will also meet them in regard to demands for greater autonomy in the eastern regions of the country. If two terminals will resume operations, the supply of oil from Libya will grow by about 500 thousand barrels per day. According to the National Oil Corporation of Libya, oil production in the country at the moment are about 320 thousand barrels per day.

The course of trade also affected data on oil reserves in the United States. The weekly report of U.S. Department of Energy was said commercial U.S. crude inventories last week fell by 3,155 thousand barrels - up to 384,935 million barrels. Gasoline inventories fell by 1,235 thousand barrels and reached 213,742 million barrels. Commercial distillate stocks rose by 975 thousand barrels, reaching 121,541 million barrels. Experts expected a decrease of oil reserves by 2400 thousand barrels, gasoline inventories increase by 550 thousand barrels and distillate stocks increase by 950 thousand barrels.

Recall that yesterday presented the American Petroleum Institute (API) report showed: commercial crude oil inventories in the United States during the reporting week changed insignificantly, down by 875 thousand barrels per day. While gasoline stocks in the United States decreased by 410 thousand barrels per day. However distillate stocks rose 4.4 million barrels. Congestion refinery in the U.S., meanwhile, rose to 89.9% against 88.6% the previous week

Market participants are also waiting for the monthly federal employment report, which is expected to show that the economy added 211,000 in June, new jobs. The data will be released one day earlier than usual, in connection with the celebration of U.S. Independence Day on Friday, July 4.

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 105.33 a barrel on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture fell 40 cents to $ 111.68 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded higher against the most major currencies after the ADP report. The U.S. economy added 281,000 jobs in June, after an increase of 179,000 jobs in May. That was the highest increase since November 2012. It is a sign that the U.S. labour market is strengthening.

Analysts had expected the U.S. economy to add 206,000 jobs.

Factory orders in the U.S. declined 0.5% in May, missing expectations for a 0.1% fall, after a 0.7% gain in April.

The euro traded lower against the U.S. dollar due to the better-than-expected U.S. jobs report. Eurozone's gross domestic product increased 0.2% in the first quarter, in line with expectations, after a 0.2% gain the previous month. On a yearly basis, Eurozone's gross domestic product climbed 0.9% in the first quarter, in line with expectations, after a 0.9% rise the previous month.

The producer price index in the Eurozone declined 0.1% in May, missing expectations for a 0.1% gain, after a 0.1% decrease in April. On a yearly basis, Eurozone's producer price index fell 1.0% in May, in line with expectations, after a 1.2% decline in April.

The number of jobless claims in Spain decreased by 122,684 from May.

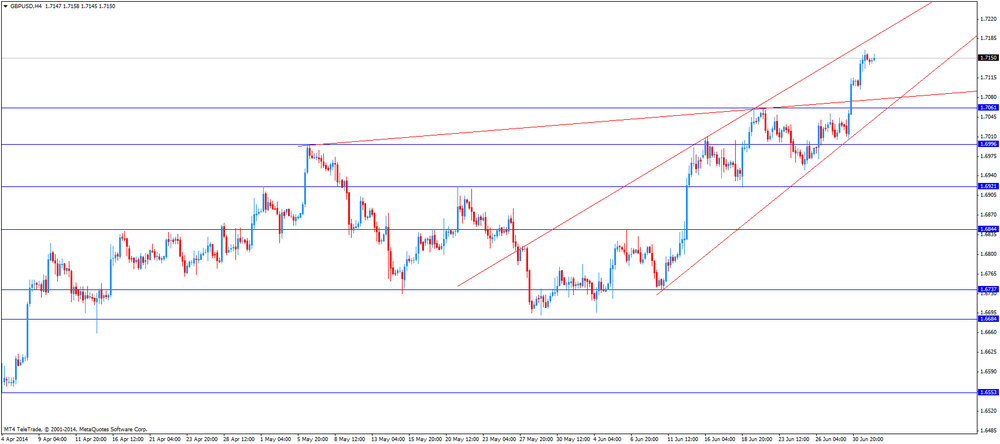

The British pound traded higher against the U.S. dollar due to the better-than-expected U.K. construction purchase managers' index. The U.K. construction purchasing managers' index surged to 62.6 in June from 60.0 in May. Analysts had expected the index to fall to 59.7.

Nationwide house price index for the U.K. increased 1.0% in June, exceeding expectations for a 0.7% rise, after a 0.7% gain in May.

On a yearly basis, Nationwide house price index for the U.K. climbed 11.8% in June, after 11.1% rise in May.

The New Zealand dollar declined against the U.S dollar after milk powder prices decreased at an auction, but later recovered a part of its losses. No economic reports were released in New Zealand.

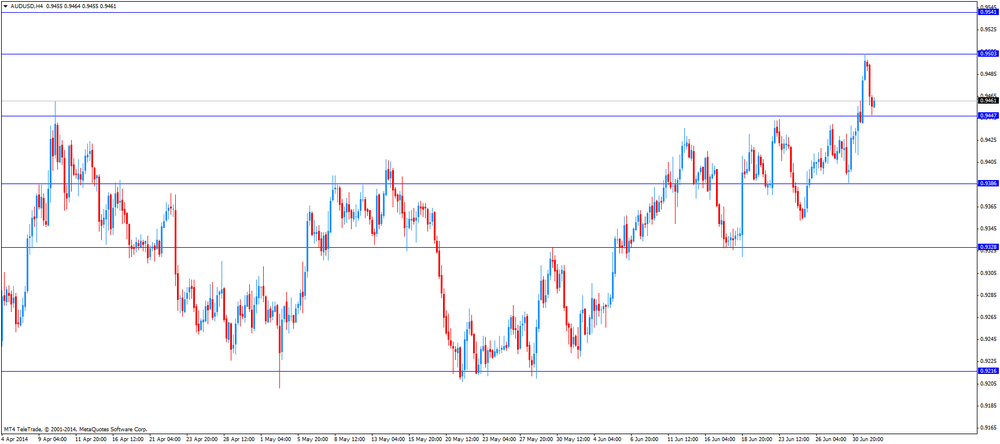

The Australian dollar declined against the U.S. dollar due to the weaker-than-expected Australian trade balance and the better-than-expected U.S. jobs report. Australia's trade deficit increased to A$1.91 billion in May, from A$0.78 billion in April. April's figure was revised down from a deficit of A$0.12 billion. Analysts had expected the trade deficit to sink to A$0.21 billion.

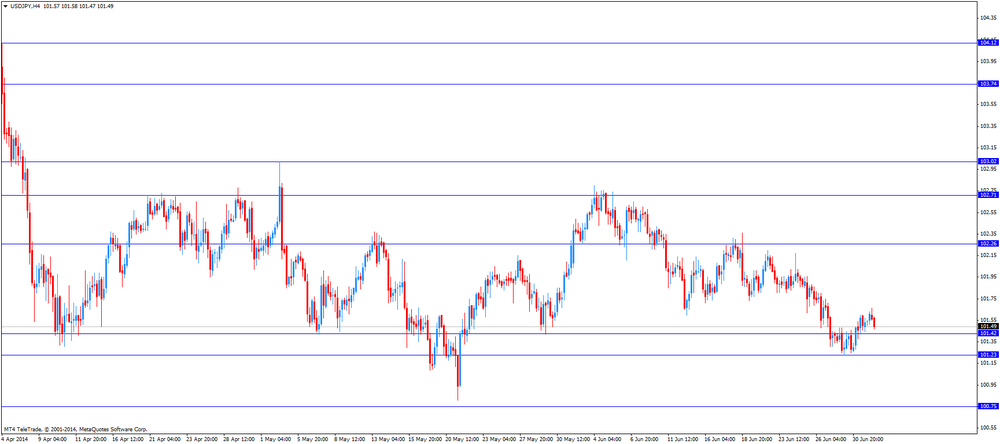

The Japanese yen declined against the U.S. dollar due to the better-than-expected U.S. jobs report.

The monetary base in Japan climbed 42.6% in June, missing expectations for a 48.3% increase, after a 45.6% rise in May.

Gold prices rose slightly, being at the same time near three-month high, which was associated with an increase in reserve funds and expectations of key data on the U.S. labor market.

"Large injections into the fund for two consecutive days support prices. This is a good sign, because the physical demand in Asia is weak because of higher prices. Their further growth seems increasingly likely, given the unrelenting tension in Iraq and Ukraine ", - said a trader in Hong Kong.

As it became known, the world's largest reserves secured gold exchange-traded fund SPDR Gold Trust on Tuesday rose by 5.69 tonnes to 796.39 tonnes. Due to the size of the fund can be considered as an indicator of market sentiment.

Market participants are also watching the situation in Ukraine, where troops continue an offensive against militias in the east. Regarding the situation in Iraq, Sunnis and Kurds left the first session of the new parliament after the Shiites could not find a replacement for Prime Minister Nouri al-Maliki, thus reducing the probability of there quickly create a unity government that would have saved the country from a split.

It is worth noting that traders expect the employment report in the U.S., which will be published on Thursday and will assess the state of the world's largest economy. The data will be released one day earlier than usual, in connection with the celebration of U.S. Independence Day on Friday, July 4. Also tomorrow, will be announced the results of the European Central Bank, which should give a clue about the future strategy of monetary stimulus

Pressure on gold today have data from ADP, which showed that private sector employment in the U.S. increased by 281,000 jobs in June. Economists had expected ADP report on growth in June, only 206,000. Increasing employment in May from ADP was unchanged at 179,000. Evaluation precedes ADP report on the situation on the labor statistics from the Employment Bureau. Economists expect that off-farm employment increased by 211,000 in June, compared with 217 000 in May. The unemployment rate in June is expected at 6.3%.

Market participants are also preparing for the performance Fed chief Janet Yellen at the International Monetary Fund, to hear further hints on the future course of monetary policy. Following her comments follow a conversation with the director of the IMF, Christine Lagarde.

The cost of the August gold futures on the COMEX today rose to $ 1330.9 per ounce.

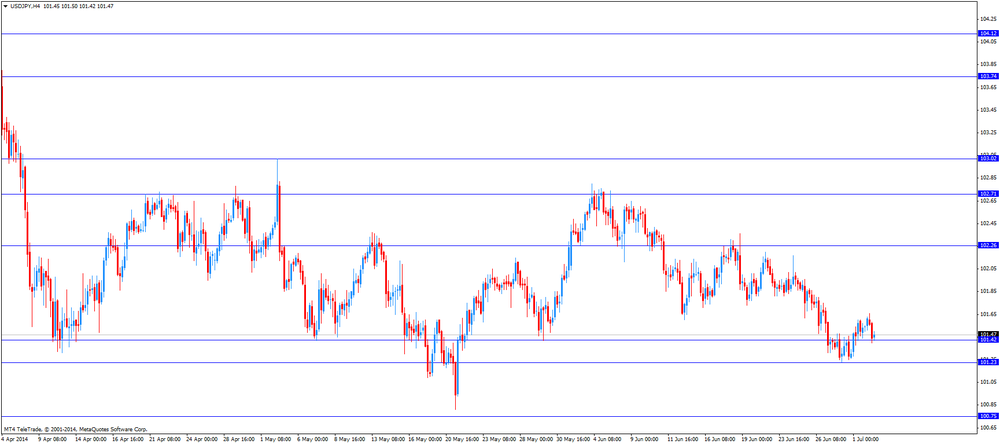

USD/JPY 101.25, 102.50

USD/CAD 1.0630, 1.0675, 1.0770

EUR/USD 1.3600, 1.3610, 1.3640, 1.3650, 1.3675, 1.3700

AUD/USD 0.9350, 0.9450

EUR/GBP 0.7950, 0.7985

EUR/CHF 1.2200

The ADP Research Institute released its employment report today. The U.S. economy added 281,000 jobs in June, after an increase of 179,000 jobs in May. That was the highest increase since November 2012. It is a sign that the U.S. labour market is strengthening.

Analysts had expected the U.S. economy to add 206,000 jobs.

Manufacturers, builders and other goods-producing industries added 51,000 jobs. Construction payrolls rose by 36,000 positions. The factory sector added 12,000 jobs.

Service-sector payrolls climbed by 230,000 jobs.

The U.S. Bureau of Labor Statistics will reveal its labour market data on Thursday. Analysts expect that the U.S. economy will add 211,000 jobs in June, after 217,000 jobs in May.

The unemployment rate in the U.S. should remain unchanged at 6.3% in June.

(company / ticker / price / change, % / volume)

| JPMorgan Chase and Co | JPM | 57,23 | -0,59% | 37.3K |

| Home Depot Inc | HD | 81,70 | -0,15% | 0.1K |

| Pfizer Inc | PFE | 30.07 | -0,07% | 67.3K |

| Exxon Mobil Corp | XOM | 101,30 | -0,06% | 0.4K |

| Verizon Communications Inc | VZ | 49,35 | -0,04% | 2.7K |

| Intel Corp | INTC | 30,97 | -0,03% | 5.2K |

| Merck & Co Inc | MRK | 58,50 | -0,02% | 5.3K |

| E. I. du Pont de Nemours and Co | DD | 65,41 | 0,00% | 1.1K |

| Microsoft Corp | MSFT | 41,87 | 0,00% | 0.3K |

| Johnson & Johnson | JNJ | 105,90 | 0,03% | 1.5K |

| Wal-Mart Stores Inc | WMT | 75,30 | 0,03% | 5.9K |

| International Business Machines Co... | IBM | 186,43 | 0,04% | 1.3K |

| The Coca-Cola Co | KO | 42,32 | 0,07% | 0.3K |

| Boeing Co | BA | 128,25 | 0,08% | 0.8K |

| General Electric Co | GE | 26,42 | 0,08% | 4.4K |

| AT&T Inc | T | 35,52 | 0,11% | 0.6K |

| Caterpillar Inc | CAT | 109,30 | 0,12% | 0.1K |

| Procter & Gamble Co | PG | 79,43 | 0,19% | 9.0K |

| Walt Disney Co | DIS | 86,66 | 0,22% | 6.1K |

| Goldman Sachs | GS | 167,20 | 0,23% | 0.1K |

| Nike | NKE | 78,25 | 0,32% | 8.1K |

| Visa | V | 215,00 | 0,35% | 0.5K |

| Chevron Corp | CVX | 131,20 | 0,51% | 0.1K |

| Cisco Systems Inc | CSCO | 25.03 | 0,56% | 49.0K |

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised to $115 from $100 at Evercore

Nike (NKE) named Top Overweight idea at Morgan Stanley, target $88

Economic calendar (GMT0):

01:30 Australia Trade Balance May -0.12 -0.21 -1.91

06:00 United Kingdom Nationwide house price index June +0.7% +0.7% +1.0%

06:00 United Kingdom Nationwide house price index, y/y June +11.1% +11.8%

08:30 United Kingdom PMI Construction June 60.0 59.7 62.6

09:00 Eurozone GDP (QoQ) (Finally) Quarter I +0.2% +0.2% +0.2%

09:00 Eurozone GDP (YoY) (Finally) Quarter I +0.9% +0.9% +0.9%

09:00 Eurozone Producer Price Index, MoM May -0.1% +0.1% -0.1%

09:00 Eurozone Producer Price Index (YoY) May -1.2% -1.0% -1.0%

11:15 Australia RBA Assist Gov Debelle Speaks

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. jobs data and factory orders. The U.S. economy should add 206,000 jobs according to the ADP employment report.

Factory orders in the U.S. should decline 0.1% in May, after a 0.7% gain in April.

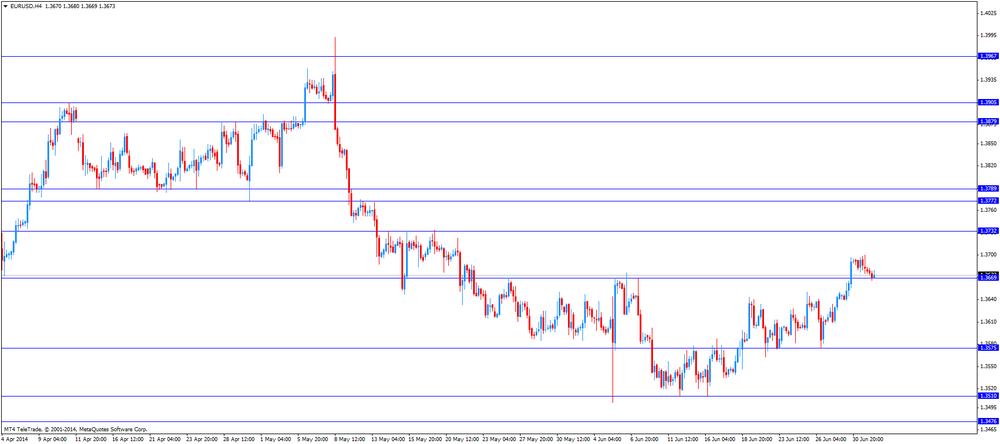

The euro declined against the U.S. dollar after the weaker-than-expected economic data from Eurozone. Eurozone's gross domestic product increased 0.2% in the first quarter, in line with expectations, after a 0.2% gain the previous month. On a yearly basis, Eurozone's gross domestic product climbed 0.9% in the first quarter, in line with expectations, after a 0.9% rise the previous month.

The producer price index in the Eurozone declined 0.1% in May, missing expectations for a 0.1% gain, after a 0.1% decrease in April. On a yearly basis, Eurozone's producer price index fell 1.0% in May, in line with expectations, after a 1.2% decline in April.

The British pound climbed against the U.S. dollar due to the better-than-expected U.K. construction purchase managers' index. The U.K. construction purchasing managers' index surged to 62.6 in June from 60.0 in May. Analysts had expected the index to fall to 59.7.

Nationwide house price index for the U.K. increased 1.0% in June, exceeding expectations for a 0.7% rise, after a 0.7% gain in May.

On a yearly basis, Nationwide house price index for the U.K. climbed 11.8% in June, after 11.1% rise in May.

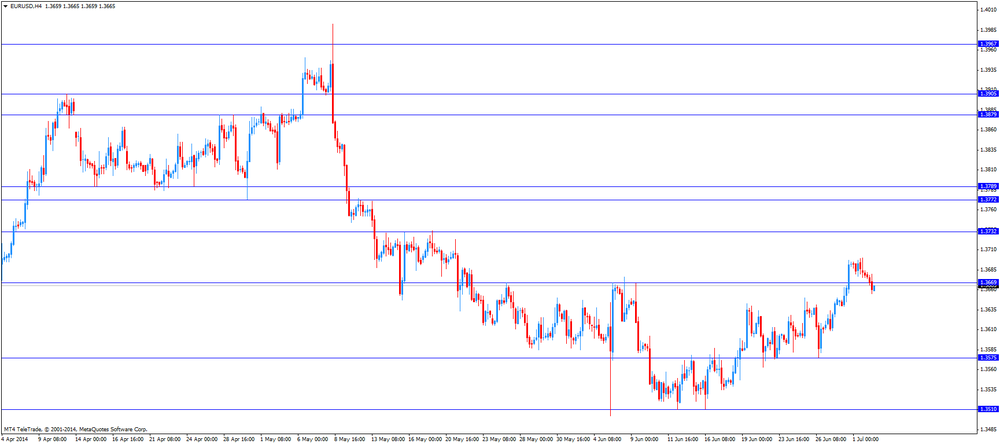

EUR/USD: the currency pair declined to $1.3655

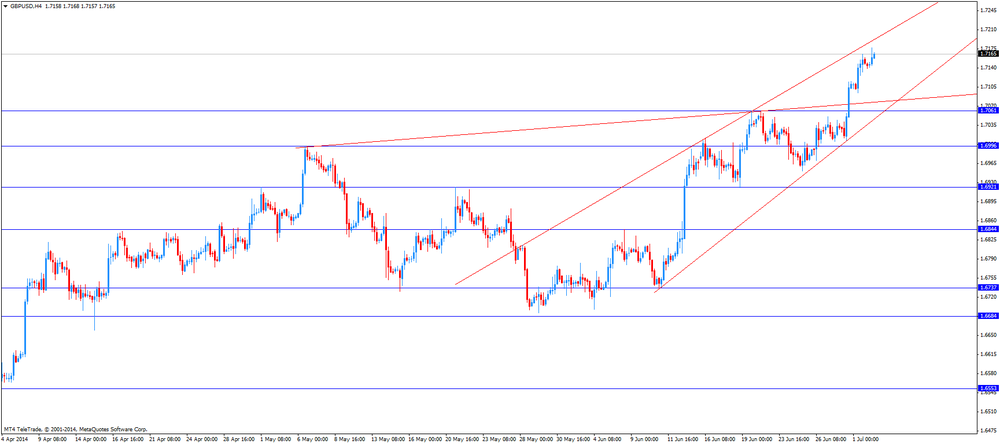

GBP/USD: the currency pair climbed to $1.7177

USD/JPY: the currency pair decreased to Y101.40

The most important news that are expected (GMT0):

12:15 U.S. ADP Employment Report June 179 206

14:00 U.S. Factory Orders May +0.7% -0.1%

15:00 U.S. Fed Chairman Janet Yellen Speaks

EUR/USD

Offers $1.3700-20

Bids $1.3656-50, $1.3576-74, $1.3565

GBP/USD

Offers $1.7250, $1.7230, $1.7200

Bids $1.7095/90

AUD/USD

Offers $0.9650, $0.9600, $0.9550, $0.9505

Bids $0.9450, $0.9420, $0.9400, $0.9380, $0.9350

EUR/JPY

Offers Y140.00, Y139.50, Y139.20, Y138.85/90

Bids Y138.50, Y138.20, Y138.00, Y137.50

USD/JPY

Offers Y102.50, Y102.00, Y101.80, Y101.65/70

Bids Y101.40/30, Y101.20, Y101.10/00, Y100.50

EUR/GBP

Offers stg0.8000

Bids stg0.7950, stg0.7930-20, stg0.7900

Most stock indices traded higher ahead of the ECB's interest rate decision on Thursday. The European Central Bank cut its interest rate to 0.15% from 0.25% in June.

Eurozone's gross domestic product increased 0.2% in the first quarter, in line with expectations, after a 0.2% gain the previous month. On a yearly basis, Eurozone's gross domestic product climbed 0.9% in the first quarter, in line with expectations, after a 0.9% rise the previous month.

The producer price index in the Eurozone declined 0.1% in May, missing expectations for a 0.1% gain, after a 0.1% decrease in April. On a yearly basis, Eurozone's producer price index fell 1.0% in May, in line with expectations, after a 1.2% decline in April.

The U.K. construction purchasing managers' index surged to 62.6 in June from 60.0 in May. Analysts had expected the index to fall to 59.7.

Current figures:

Name Price Change Change %

FTSE 100 6,823.11 +20.19 +0.30%

DAX 9,918.05 +15.64 +0.16%

CAC 40 4,459.48 -1.64 -0.04%

Asian stock indices increased following gains on Wall Street. The Dow and S&P 500 closed at all-time highs on Tuesday. That are signs that the U.S. economy is improving.

Stock markets were supported by yesterday's strong ISM manufacturing purchase managers' index from the U.S. and Chinese manufacturing purchase managers' index. ISM manufacturing PMI in the U.S. decreased to 55.3 in June from 55.4 in May, missing expectations for a rise to 55.6.

The Chinese manufacturing purchase managers' index increased to 51.0 in June from 50.8 in May, in line with expectations. This is a sign of a recovery in the world's second largest economy.

The monetary base in Japan climbed42.6% in June, missing expectations for a 48.3% increase, after a 45.6% rise in May.

Indexes on the close:

Nikkei 225 15,369.97 +43.77 +0.29%

Hang Seng 23,549.62 +358.90 +1.55%

Shanghai Composite 2,059.42 +9.04 +0.44%

USD/JPY 101.25, 102.50

USD/CAD 1.0630, 1.0675, 1.0770

EUR/USD 1.3600, 1.3610, 1.3640, 1.3650, 1.3675, 1.3700

AUD/USD 0.9350, 0.9450

EUR/GBP 0.7950, 0.7985

EUR/CHF 1.2200

Economic calendar (GMT0):

01:30 Australia Trade Balance May -0.12 -0.21 -1.91

06:00 United Kingdom Nationwide house price index June +0.7% +0.7% +1.0%

06:00 United Kingdom Nationwide house price index, y/y June +11.1% +11.8%

08:30 United Kingdom PMI Construction June 60.0 59.7 62.6

The U.S. dollar traded higher against the most major currencies. The U.S. currency remained under pressure after yesterday's release of weaker-than-expected economic data. U.S. final manufacturing purchasing managers' index declined to 57.3 in June from 57.5 in April. Analysts had expected the index to remain unchanged.

ISM manufacturing PMI in the U.S. decreased to 55.3 in June from 55.4 in May, missing expectations for a rise to 55.6.

The New Zealand dollar declined against the U.S dollar after milk powder prices decreased at an auction. No economic reports were released in New Zealand.

The Australian dollar dropped against the U.S. dollar due to the weaker-than-expected Australian trade balance. Australia's trade deficit increased to A$1.91 billion in May, from A$0.78 billion in April. April's figure was revised down from a deficit of A$0.12 billion. Analysts had expected the trade deficit to sink to A$0.21 billion.

The Japanese yen traded mixed against the U.S. dollar due to the declining demand for safe-haven currency.

The monetary base in Japan climbed 42.6% in June, missing expectations for a 48.3% increase, after a 45.6% rise in May.

EUR/USD: the currency pair declined to $1.3670

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair climbed to Y101.65

AUD/USD: the currency pair decreased to $0.9448

The most important news that are expected (GMT0):

09:00 Eurozone GDP (QoQ) (Finally) Quarter I +0.2% +0.2%

09:00 Eurozone GDP (YoY) (Finally) Quarter I +0.9% +0.9%

09:00 Eurozone Producer Price Index, MoM May -0.1% +0.1%

09:00 Eurozone Producer Price Index (YoY) May -1.2% -1.0%

11:15 Australia RBA Assist Gov Debelle Speaks

12:15 U.S. ADP Employment Report June 179 206

14:00 U.S. Factory Orders May +0.7% -0.1%

15:00 U.S. Fed Chairman Janet Yellen Speaks

EUR / USD

Resistance levels (open interest**, contracts)

$1.3758 (3038)

$1.3724 (5863)

$1.3691 (3640)

Price at time of writing this review: $ 1.3671

Support levels (open interest**, contracts):

$1.3659 (1591)

$1.3630 (1736)

$1.3592 (3998)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 32914 contracts, with the maximum number of contracts with strike price $1,3700 (5863);

- Overall open interest on the PUT options with the expiration date July, 3 is 42467 contracts, with the maximum number of contracts with strike price $1,3500 (5628);

- The ratio of PUT/CALL was 1.29 versus 1.28 from the previous trading day according to data from July, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.7400 (1019)

$1.7300 (433)

$1.7201 (2201)

Price at time of writing this review: $1.7145

Support levels (open interest**, contracts):

$1.7098 (590)

$1.7000 (2066)

$1.6900 (2269)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 29602 contracts, with the maximum number of contracts with strike price $1,7100 (6267);

- Overall open interest on the PUT options with the expiration date July, 3 is 28561 contracts, with the maximum number of contracts with strike price $1,6700 (2413);

- The ratio of PUT/CALL was 0.96 versus 1.01 from the previous trading day according to data from Jule, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(raw materials / closing price /% change)

Gold $1,327.66 +0.33 +0.02%

Oil $105.31 -0.06 -0.06%

(index / closing price / change items /% change)

S&P/ASX 200 5,375.9 -19.85 -0.37%

TOPIX 1,276.08 +13.52 +1.07%

SHANGHAI COMP 2,050.38 +2.05 +0.10%

FTSE 100 6,802.92 +58.98 +0.87%

CAC 40 4,461.12 +38.28 +0.87%

DAX 9,902.41 +69.34 +0.71%

Dow +128.73 16,955.33 +0.77%

Nasdaq +50.47 4,458.65 +1.14%

S&P +12.99 1,973.22 +0.66%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3678 -0,10%

GBP/USD $1,7148 +0,22%

USD/CHF Chf0,8873 +0,08%

USD/JPY Y101,54 +0,23%

EUR/JPY Y138,90 +0,13%

GBP/JPY Y174,12 +0,47%

AUD/USD $0,9492 +0,65%

NZD/USD $0,8769 +0,09%

USD/CAD C$1,0631 -0,34%

(time / country / index / period / previous value / forecast)

01:30 Australia Trade Balance May -0.12 -0.21

06:00 United Kingdom Nationwide house price index June +0.7% +0.7%

06:00 United Kingdom Nationwide house price index, y/y June +11.1%

08:30 United Kingdom PMI Construction June 60.0 59.7

09:00 Eurozone GDP (QoQ) Quarter I +0.2% +0.2%

09:00 Eurozone GDP (YoY) Quarter I +0.9% +0.9%

09:00 Eurozone Producer Price Index, MoM May -0.1% +0.1%

09:00 Eurozone Producer Price Index (YoY) May -1.2% -1.0%

11:15 Australia RBA Assist Gov Debelle Speaks

12:15 U.S. ADP Employment Report June 179 206

14:00 U.S. Factory Orders May +0.7% -0.1%

14:30 U.S. Crude Oil Inventories June +1.7

15:00 U.S. Fed Chairman Janet Yellen Speaks

23:30 Australia AIG Services Index June 49.9

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.