- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 02-06-2014

Gold $1,244.20 -3.20 -0.026%

ICE Brent Crude Oil $108.83 -0.58 -0.53%

NYMEX Crude Oil $102.55 -0.64 -0.62%

Nikkei 14,935.92 +303.54 +2.07%

Hang Seng 23,081.65 +71.51 +0.31%

Shanghai Composite 2,039.21 -1.38 -0.07%

S&P 1,924.97 +1.40 +0.07%

NASDAQ 4,237.2 -5.42 -0.13%

Dow 16,743.63 +26.46 +0.16%

FTSE 1,380.46 +3.00 +0.22%

CAC 4,515.89 -3.68 -0.08%

DAX 9,950.12 +6.85 +0.07%

EUR/USD $1,3597 -0,26%

GBP/USD $1,6746 -0,04%

USD/CHF Chf0,8983 +0,36%

USD/JPY Y102,37 +0,60%

EUR/JPY Y139,20 +0,35%

GBP/JPY Y171,42 +0,57%

AUD/USD $0,9240 -0,74%

NZD/USD $0,8449 -0,58%

USD/CAD C$ 1,0897 +0,49%

00:00 01:00 Australia Retail Sales Y/Y April +5.7%

01:00 China Non-Manufacturing PMI May 54.8

01:30 Australia Retail sales (MoM) April +0.1% +0.3%

01:30 Australia Current Account, bln Quarter I -10.1 -7.1

01:30 Japan Labor Cash Earnings, YoY April +0.7% +0.6%

01:45 China HSBC Manufacturing PMI (Finally) May 49.7 49.7

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50%

04:30 Australia RBA Rate Statement

06:00 United Kingdom Nationwide house price index May +1.2% +0.7%

06:00 United Kingdom Nationwide house price index, y/y May +10.9% +10.9%

08:30 United Kingdom PMI Construction May 60.8 61.2

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) May +0.7% +0.7%

09:00 Eurozone Unemployment Rate April 11.8% 11.8%

14:00 U.S. Factory Orders April +1.1% +0.6%

20:30 U.S. API Crude Oil Inventories May +3.5

23:30 Australia AIG Services Index May 48.6

Most stock

indices traded higher after strong Chinese purchase managers’ index. China’s

PMI increased to 50.8 in May, beating expectations of a rise to 50.7 from 50.4

in April. That was the fastest pace in five months.

PMIs were

also in focus in the Eurozone. Eurozone’s manufacturing purchase managers’

index (PMI) decreased to 52.2 in May from 52.5 in April. Analysts had expected

that the index remained unchanged.

Germany’s

manufacturing PMI fell to 52.3 in May from 54.1 in April. Analysts had

forecasted a decline to 52.9.

France’s

manufacturing PMI sank to 49.6 in May from 51.2 in April. Analysts had expected

a decrease to 49.3.

German

preliminary consumer price index fell 0.1% in May, after a decline of 0.2% in

April. Analysts had expected a 0.1% rise.

On a yearly

basis, German preliminary consumer price index rose 0.9% in May, after a 1.3%

gain in April. Analysts had forecasted a 1.1% increase.

All these

weak figures in the Eurozone added to expectations for further easing measures by

the European Central Bank. The ECB will release its interest rates decision on Thursday.

In the

U.K., the manufacturing purchase managers’ index declined to 57.0 in May from

57.3 in April. Analysts had forecasted a fall to 57.1.

Indexes on

the close:

Name Price Change Change %

FTSE

100 6,864.1 +19.59 +0.29%

DAX 9,950.12 +6.85 +0.07%

CAC 40 4,515.89 -3.68 -0.08%

The price of oil fell moderately in today's session , was under pressure from the strengthening of the U.S. dollar.

Little support prices had submitted data for China . According to a report on Sunday , the Purchasing Managers Index in China's manufacturing sector rose in May to 50.8 against 50.4 in April. It is worth noting that analysts expect the growth rate to just 50.7 .

Contribute to lower prices rumors about the imminent resumption of the work of one of the export terminals in Libya. Corporation Libyan National Oil Corp. announced that soon will resume oil terminal of Marsa el Hariga as Libyan authorities approved staff salaries security of oil companies that have hampered oil shipments . Two tankers are waiting for loading.

Analysts predict that oil production in the countries of the Organization of Petroleum Exporting Countries (OPEC) in May increased by 75 thousand barrels per day for the first 3 months.

In addition, a negative factor for the market was the news of the sudden slowdown in business activity in the manufacturing sector in the U.S., the largest consumer of oil in the world . In May ISM Manufacturing Index fell to 53.2 from 54.9 points, analysts expect its growth to 55.7 . Nevertheless , the indicator value exceeds 50 points , indicating that even a weaker , but still growth of business activity in the sector of the American economy .

From technical point of view it may be noted that the August Brent quotes reached the 200-day moving average , which is located in 108.90 . Overcoming down such technically important level could trigger a wave of sales . The nearest support level in this case will mark 108.15 .

The cost of the July futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 102.42 a barrel on the New York Mercantile Exchange (NYMEX).

July futures price for North Sea Brent crude oil mixture fell 56 cents to $ 109.01 a barrel on the London exchange ICE Futures Europe.

The U.S.

dollar traded higher against the most major currencies despite of the disappointing

ISM manufacturing purchase managers’ index in the U.S. The Institute of Supply

Management released its manufacturing purchasing managers' index for the U.S.

The index dropped to 53.2 in May, from 54.9 in April. Analysts had expected a gain

to 55.5.

The construction

spending in the U.S. remained unchanged at 0.2%, missing expectations for a

0.8% rise.

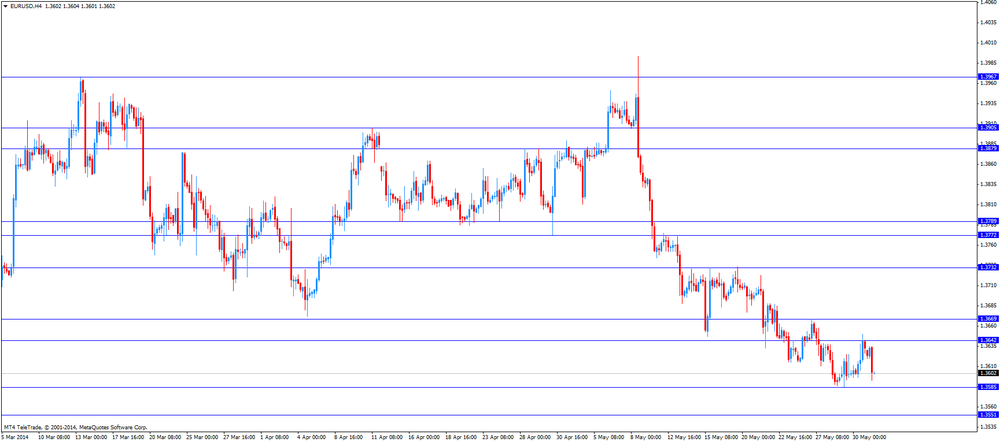

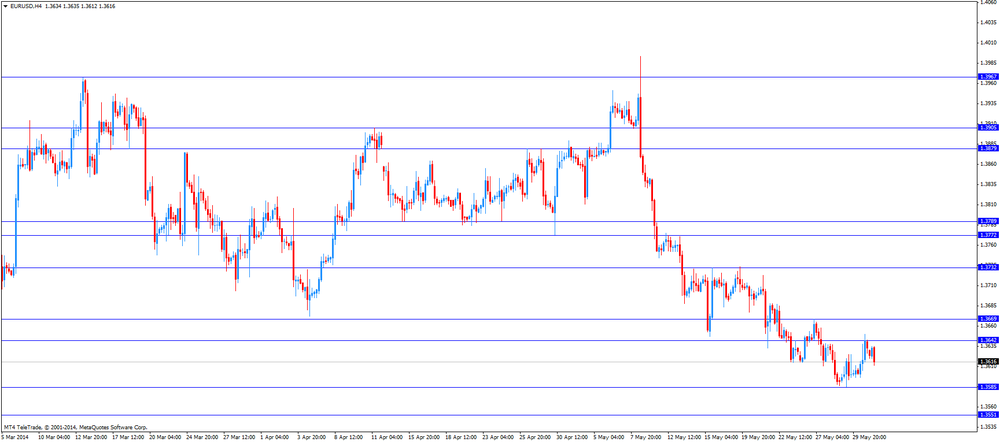

The euro traded

lower against the U.S. dollar. Investors remained cautious ahead of the

European Central Bank's decision on Thursday. There are speculations over

further stimulus measures from the ECB.

German

preliminary consumer price index fell 0.1% in May, after a decline of 0.2% in

April. Analysts had expected a 0.1% rise.

On a yearly

basis, German preliminary consumer price index rose 0.9% in May, after a 1.3%

gain in April. Analysts had forecasted a 1.1% increase.

PMIs were

also in focus in the Eurozone. Eurozone’s manufacturing purchase managers’

index (PMI) decreased to 52.2 in May from 52.5 in April. Analysts had expected

that the index remained unchanged.

Germany’s

manufacturing PMI fell to 52.3 in May from 54.1 in April. Analysts had

forecasted a decline to 52.9.

France’s

manufacturing PMI sank to 49.6 in May from 51.2 in April. Analysts had expected

a decrease to 49.3.

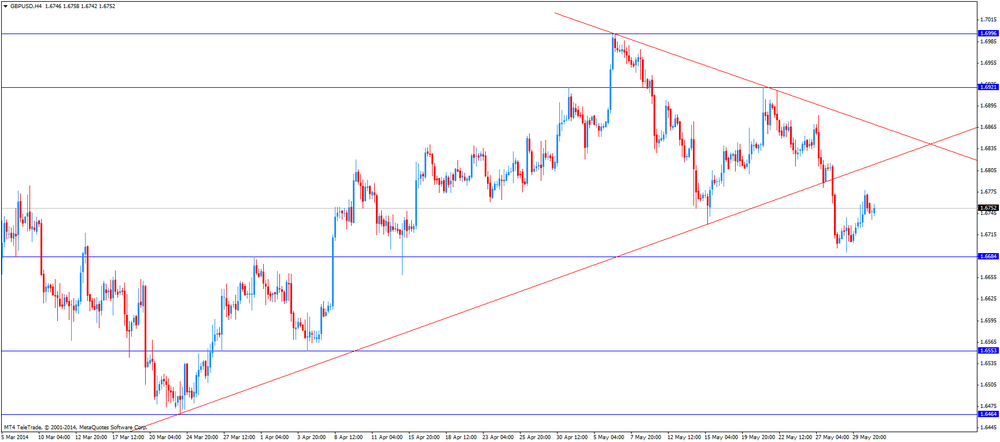

The British

pound traded mixed against the U.S. dollar. Manufacturing purchase managers’

index in the U.K. declined to 57.0 in May from 57.3 in April. Analysts had

forecasted a fall to 57.1.

Net lending

to individuals in the U.K. increased by £2.4 billion in April, after a £2.8

billion rise in March. Analysts had expected a gain by £2.7 billion.

The number

of mortgage approvals in the U.K. was 62,918 in April. That was the lowest

number since July 2013.

The Swiss

franc fell against the U.S. dollar. Switzerland’s manufacturing PMI sank to

52.5 in May from 55.8 in April. Analysts had expected a decrease to 55.7.

The

Canadian dollar fell against the U.S. dollar due to the strength of the U.S.

dollar and in the absence of any major economic reports in Canada.

The New

Zealand dollar traded lower against the U.S dollar. The decline of the kiwi was

driven by the weakness of the Australian dollar. Markets in New Zealand were

closed on Monday for a public holiday.

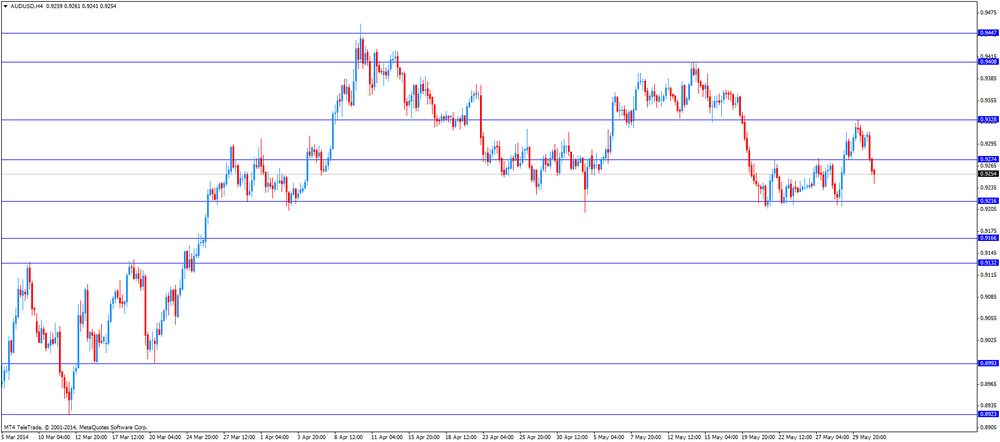

The

Australian dollar slid against the U.S. dollar after the release of the weak

building permits data in Australia. The number of building permits in Australia

dropped 5.6% in April, after a decline of 4.8% in March. March’s figure was

revised down to 4.8% from a decrease of 3.5%. Analysts had expected a 2.1%

gain. On a yearly basis, the building permits in Australia rose 1.1% in April,

after a 20.0% increase in March.

Company

operating profits in Australia increased 3.1% in the first quarter, after a

1.7% rise the previous quarter. Analysts had forecasted a 2.6% gain.

AIG

manufacturing index in Australia climbed to 49.2 in May from 44.8 in April.

The

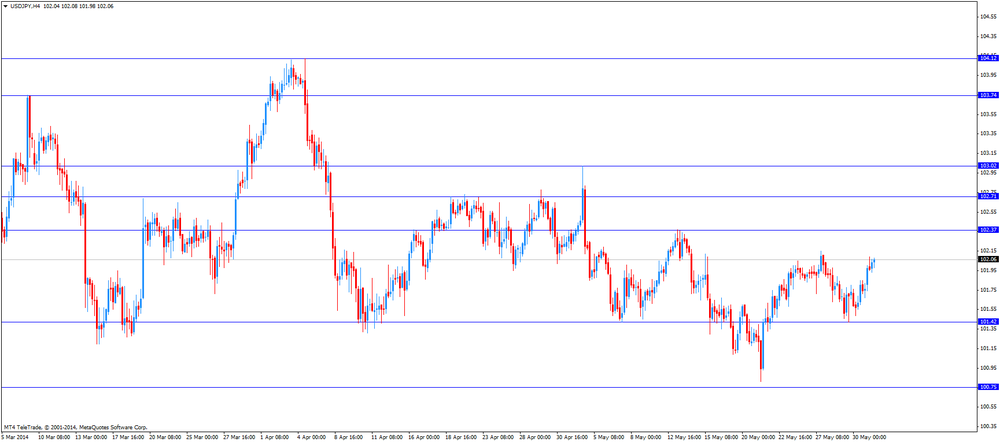

Japanese yen declined against the U.S. dollar after release of the

better-than-expected manufacturing purchasing managers' index (PMI) in China.

China’s PMI increased to 50.8 in May, beating expectations of a rise to 50.7

from 50.4 in April.

Capital

spending in Japan climbed 7.4% in the first quarter, after a 4.0% increase the

previous quarter.

Gold prices declined moderately today , while fixing its fifth session decline in a row ( the longest series in seven months ) , as rising stock markets dropped interest in precious metals . In addition, market participants expect announcement of the outcome of the ECB meeting and the publication of key U.S. data .

Gold continues to decline after last week as prices remain below the key support levels , showing bearish signals on the chart. Last week, prices fell by 3.53 %. May the price of gold fell by 3.9% , the largest monthly decline since November.

Precious metal is under heavy selling pressure lately as investors predict high rates of economic growth in the U.S. in the second quarter .

" The technical outlook for gold is unfavorable . Are likely to drop to $ 1230, and then to $ 1,200. Physical markets reacted poorly to a fall in prices last week, but if they reach $ 1,200 , may be increased activity, " - said a trader in Tokyo.

Buyers in the physical market waiting for further decline in prices. In India , which occupies the second place in the world for the consumption of gold, ">The data also showed that last week, hedge funds and money managers cut their bullish bets in gold futures and options to the lowest level in nearly four months, which is another sign of decline in investor interest in the metal.

The cost of the June gold futures on the COMEX today dropped to $ 1245.5 per ounce.

EUR/USD $1.3600, $1.3615, $1.3650, $1.3710

USD/JPY Y101.50-55, Y102.00, Y102.25, Y102.50

GBP/USD $1.6700

EUR/GBP stg0.8200, stg0.8245

USD/CHF Chf0.9035

AUD/USD $0.9350

USD/CAD C$1.0845, C$1.0850, C$1.0890, C$1.0950

U.S. stock-index futures were little changed as manufacturing in China expanded before a report on factory data in the world’s biggest economy.

Global markets:

Nikkei 14,935.92 +303.54 +2.07%

Hang Seng 23,081.65 +71.51 +0.31%

FTSE 6,864.79 +20.28 +0.30%

CAC 4,520.58 +1.01 +0.02%

DAX 9,964.58 +21.31 +0.21%

Crude oil $102.68 (-0.03%)

Gold $1245.80 (+0.01%)

(company / ticker / price / change, % / volume)

Goldman Sachs | GS | 159.81 | 0.00% | 0.6K |

Exxon Mobil Corp | XOM | 100.53 | 0.00% | 1.7K |

JPMorgan Chase and Co | JPM | 55.57 | 0.00% | 0.2K |

Merck & Co Inc | MRK | 58.2 | +0.59% | 0.5K |

Cisco Systems Inc | CSCO | 24.73 | +0.45% | 0.7K |

Microsoft Corp | MSFT | 41.05 | +0.27% | 7.4K |

International Business Machines Co... | IBM | 184.84 | +0.26% | 4.7K |

Walt Disney Co | DIS | 84.22 | +0.25% | 0.7K |

Pfizer Inc | PFE | 29.68 | +0.17% | 1.0K |

American Express Co | AXP | 91.64 | +0.15% | 0.1K |

Boeing Co | BA | 135.45 | +0.15% | 0.7K |

Nike | NKE | 77 | +0.12% | 2.0K |

Intel Corp | INTC | 27.35 | +0.11% | 1.6K |

Caterpillar Inc | CAT | 102.32 | +0.09% | 5.7K |

Visa | V | 215 | +0.08% | 3.0K |

Johnson & Johnson | JNJ | 101.49 | +0.03% | 0.6K |

The Coca-Cola Co | KO | 40.86 | -0.12% | 4.4K |

General Electric Co | GE | 26.77 | -0.07% | 3.4K |

AT&T Inc | T | 35.45 | -0.06% | 15.3K |

Home Depot Inc | HD | 80.19 | -0.05% | 0.5K |

Verizon Communications Inc | VZ | 49.95 | -0.02% | 29.5K |

Upgrades:

Alcoa (AA) upgraded from Underperform to Neutral BofA/Merrill

Downgrades:

Other:

Apple (AAPL) reiterated at Outperform at RBC Capital Mkts, target raised from $645 to $675

Economic

calendar (GMT0):

00:30

Australia MI

Inflation Gauge, m/m May +0.4% +0.3%

00:30 Australia MI Inflation Gauge, y/y May +2.8% +2.9%

01:30 Australia Building Permits, m/m April -4.8%

+2.1% -5.6%

01:30 Australia Building Permits, y/y April +20.0% +1.1%

01:30 Australia Company Operating Profits Quarter I +1.7%

+2.6% +3.1%

06:30 Australia Commodity Prices, Y/Y May -12.6% -12.8%

07:30 Switzerland Manufacturing PMI May 55.8

55.7 52.5

07:48 France Manufacturing PMI

(Finally) May

51.2 49.3 49.6

07:53 Germany Manufacturing PMI (Finally) May 54.1

52.9 52.3

07:58 Eurozone Manufacturing PMI (Finally) May 52.5

52.5 52.2

08:30 United Kingdom Purchasing Manager Index Manufacturing May

57.3 57.1 57.0

08:30 United Kingdom Net Lending to Individuals, bln April 2.9 2.7 2.4

08:30 United Kingdom Mortgage Approvals April 67 64 62.9

12:00 Germany CPI, m/m (Preliminary) May -0.2% +0.1% -0.1%

12:00 Germany CPI, y/y (Preliminary) May +1.3% +1.1% +0.9%

The U.S.

dollar traded higher against the most major currencies ahead of the release of ISM

manufacturing purchase managers’ index in the U.S. The index should climb to

55.7 in May from 54.9 in April.

The euro declined

against the U.S. dollar. Investors remained cautious ahead of the European

Central Bank's decision on Thursday. There are speculations over further

stimulus measures from the ECB.

German preliminary

consumer price index fell 0.1% in May, after a decline of 0.2% in April.

Analysts had expected a 0.1% rise.

On a yearly

basis, German preliminary consumer price index rose 0.9% in May, after a 1.3%

gain in April. Analysts had forecasted a 1.1% increase.

PMIs were

also in focus in the Eurozone. Eurozone’s manufacturing purchase managers’

index (PMI) decreased to 52.2 in May from 52.5 in April. Analysts had expected

that the index remained unchanged.

Germany’s

manufacturing PMI fell to 52.3 in May from 54.1 in April. Analysts had

forecasted a decline to 52.9.

France’s

manufacturing PMI sank to 49.6 in May from 51.2 in April. Analysts had expected

a decrease to 49.3.

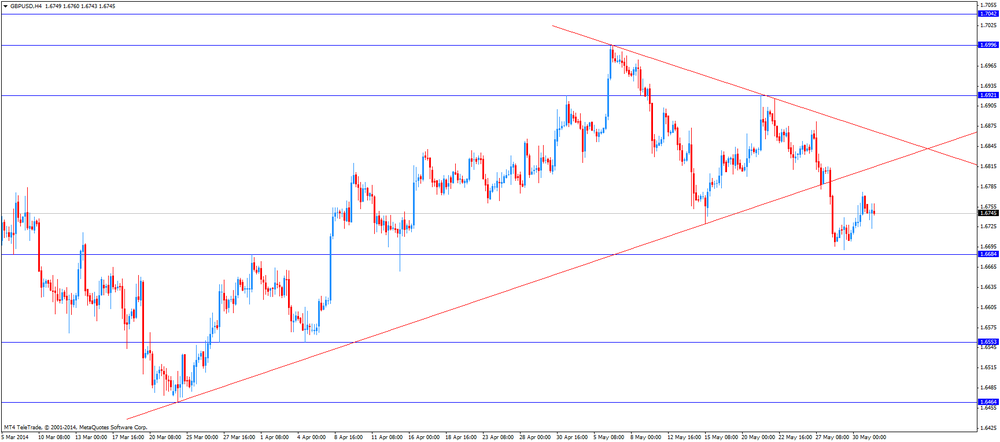

The British

pound traded mixed against the U.S. dollar. Manufacturing purchase managers’

index in the U.K. declined to 57.0 in May from 57.3 in April. Analysts had

forecasted a fall to 57.1.

Net lending

to individuals in the U.K. increased by £2.4 billion in April, after a £2.8

billion rise in March. Analysts had expected a gain by £2.7 billion.

The number

of mortgage approvals in the U.K. was 62,918 in April. That was the lowest

number since July 2013.

The Swiss

franc fell against the U.S. dollar. Switzerland’s manufacturing PMI sank to 52.5

in May from 55.8 in April. Analysts had expected a decrease to 55.7.

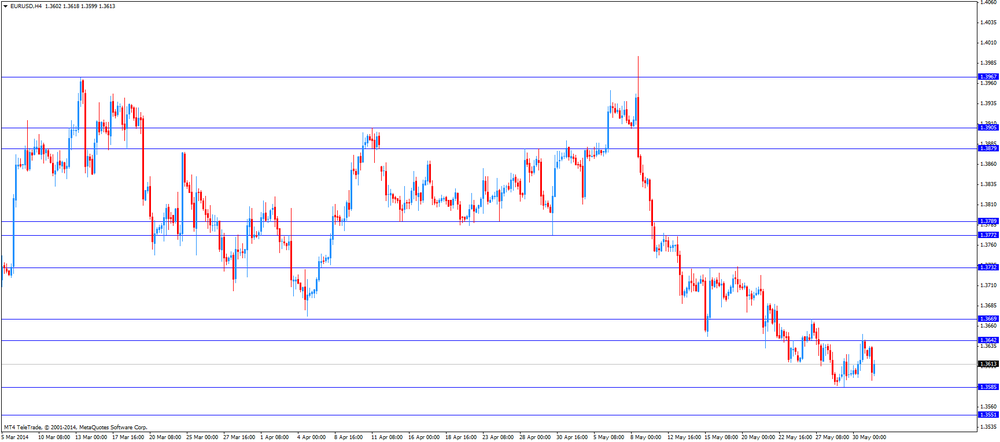

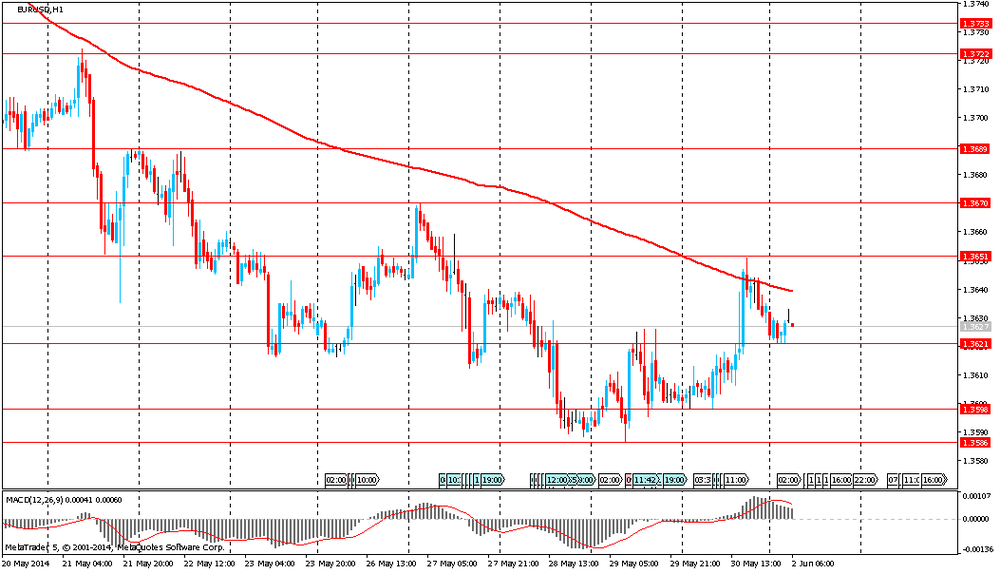

EUR/USD:

the currency pair declined to $1.3593

GBP/USD:

the currency pair traded mixed

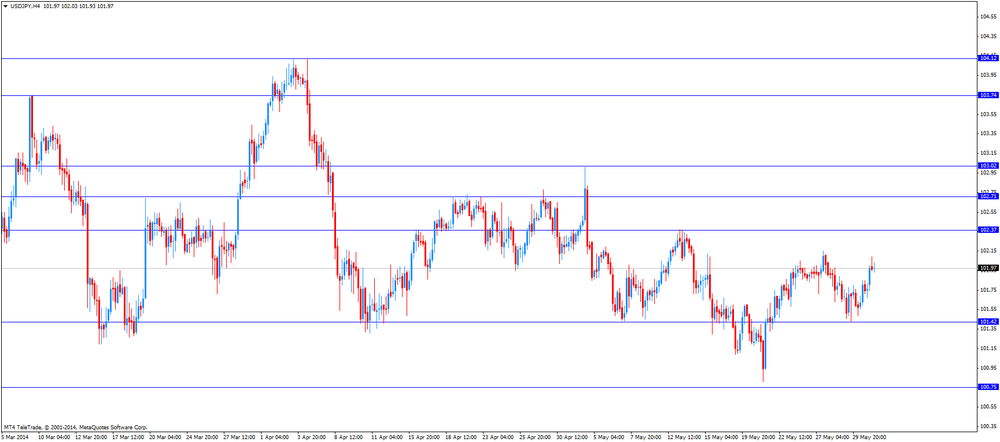

USD/JPY:

the currency pair increased to Y102.08

The most

important news that are expected (GMT0):

14:00 U.S. ISM Manufacturing May 54.9

55.7

23:50 Japan Monetary Base, y/y May

+48.5% +51.2%

EUR/USD

Offers $1.3695/700, $1.3688, $1.3670/80, $1.3655

Bids $1.3585/80, $1.3550, $1.3525/20, $1.3500

GBP/USD

Offers $1.6860, $1.6835/40, $1.6770/80

Bids $1.6725, $1.6690

AUD/USD

Offers $0.9350, $0.9330, $0.9300

Bids $0.9220, $0.9210/00

EUR/JPY

Offers Y140.00, Y139.75/80, Y139.45/50

Bids Y138.50, Y138.00, Y137.80, Y137.50, Y137.00

USD/JPY

Offers Y102.80, Y102.25/30

Bids Y101.60, Y101.05/00

EUR/GBP

Offers stg0.8215-25, stg0.8195/205, stg0.8160/65

Bids stg0.8080

Stock

indices increased after strong Chinese purchase managers’ index. China’s PMI increased

to 50.8 in May, beating expectations of a rise to 50.7 from 50.4 in April. That

was the fastest pace in five months.

Eurozone’s

manufacturing purchase managers’ index (PMI) decreased to 52.2 in May from 52.5

in April. Analysts had expected that the index remained unchanged.

Germany’s manufacturing

PMI fell to 52.3 in May from 54.1 in April. Analysts had forecasted a decline

to 52.9.

France’s manufacturing

PMI sank to 49.6 in May from 51.2 in April. Analysts had expected a decrease to

49.3.

In the U.K., the manufacturing purchase managers’ index declined to 57.0 in May from 57.3 in

April. Analysts had forecasted a fall to 57.1.

Current

figures:

Name Price Change Change %

FTSE

100 6,861.61 +17.10 +0.25%

DAX 9,967.97 +24.70 +0.25%

CAC 40 4,522.86 +3.29 +0.07%

The currency

pair EUR/USD declines due to speculation the European Central Bank will add

further stimulus measures and disappointing manufacturing purchase managers’

index (PMI). The ECB will release its interest rates decision on Thursday.

Eurozone’s manufacturing

purchase managers’ index (PMI) decreased to 52.2 in May from 52.5 in April.

Analysts had expected that the index remained unchanged.

Germany’s manufacturing PMI fell to 52.3 in May from 54.1 in April. Analysts had forecasted a decline to 52.9.

France’s manufacturing PMI sank to 49.6 in May from 51.2 in April. Analysts had expected a decrease to 49.3.

Asian stock

indices rose due to the better-than-expected manufacturing purchasing managers’

index (PMI) in China. The National Bureau of Statistics and China Federation of

Logistics & Purchasing released yesterday the manufacturing purchasing managers’

index. China’s PMI increased to 50.8 in May, beating expectations of a rise to

50.7 from 50.4 in April. That was the fastest pace in five months.

Markets in

China and Hong Kong were closed on Monday for a public holiday.

Indexes on

the close:

Nikkei

225 14,935.92 +303.54 +2.07%

Hang

Seng closed

Shanghai

Composite closed

Dai-ichi

Life Insurance Co. shares fell 5.0% after the company reported it want to buy Protective

Life Corp. for more than 500 billion yen ($4.9 billion).

Economic

calendar (GMT0):

00:30 Australia MI Inflation Gauge, m/m May +0.4% +0.3%

00:30 Australia MI Inflation Gauge, y/y May +2.8% +2.9%

01:30 Australia Building Permits, m/m April -4.8% +2.1% -5.6%

01:30 Australia Building Permits, y/y April +20.0% +1.1%

01:30 Australia Company Operating Profits Quarter I +1.7% +2.6% +3.1%

06:30 Australia Commodity Prices, Y/Y May -12.6% -12.8%

07:30 Switzerland Manufacturing PMI May 55.8 55.7 52.5

07:48 France Manufacturing PMI (Finally) May 51.2 49.3 49.6

07:53 Germany Manufacturing PMI (Finally) May 54.1 52.9 52.3

07:58 Eurozone Manufacturing PMI (Finally) May 52.5 52.5 52.2

08:30 United Kingdom Purchasing Manager Index Manufacturing May 57.3 57.1 57.0

08:30 United Kingdom Net Lending to Individuals, bln April 2.9 2.7 2.4

08:30 United Kingdom Mortgage Approvals April 67 64 62.9

The U.S.

dollar traded higher against the most major currencies despite Friday's mixed

U.S. economic growth data. The personal spending in the U.S. declined 0.1% in

April, after a 0.9% in March. Analysts had expected a rise of 0.2%.

The

personal income in the U.S. increased 0.3% in April, meeting expectations,

after a 0.5% gain in March.

Reuters/Michigan

consumer sentiment index declined to 81.9 in May, from 82.8 in April. Analysts

had forecasted the index to climb to 82.9.

The New

Zealand dollar traded lower against the U.S dollar. The decline of the kiwi was

driven by the weakness of the Australian dollar. Markets in New Zealand were

closed on Monday for a public holiday.

The

Australian dollar slid against the U.S. dollar after the release of the weak building

permits data in Australia. The number of building permits in Australia dropped

5.6% in April, after a decline of 4.8% in March. March’s figure was revised

down to 4.8% from a decrease of 3.5%. Analysts had expected a 2.1% gain. On a

yearly basis, the building permits in Australia rose 1.1% in April, after a

20.0% increase in March.

Company operating

profits in Australia increased 3.1% in the first quarter, after a 1.7% rise the

previous quarter. Analysts had forecasted a 2.6% gain.

AIG manufacturing

index in Australia climbed to 49.2 in May from 44.8 in April.

The

Japanese yen declined against the U.S. dollar after release of the

better-than-expected manufacturing purchasing managers' index (PMI) in China. China’s

PMI increased to 50.8 in May, beating expectations of a rise to 50.7 from 50.4

in April.

Capital spending

in Japan climbed 7.4% in the first quarter, after a 4.0% increase the previous

quarter.

EUR/USD:

the currency pair traded mixed

GBP/USD:

the currency pair declined to $1.6735

USD/JPY:

the currency pair climbed to Y102.10

AUD/USD: the currency pair dropped to $0.9258

The most

important news that are expected (GMT0):

12:00 Germany CPI, m/m (Preliminary) May -0.2% +0.1%

12:00 Germany CPI, y/y (Preliminary) May +1.3% +1.1%

14:00 U.S. ISM Manufacturing May 54.9 55.7

23:50 Japan Monetary Base, y/y May +48.5% +51.2%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3770 (3696)

$1.3735 (3550)

$1.3683 (692)

Price at time of writing this review: $ 1.3627

Support levels (open interest**, contracts):

$1.3579 (3606)

$1.3551 (4853)

$1.3518 (3879)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 56541 contracts, with the maximum number of contracts with strike price $1,3850 (6047);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 74225 contracts, with the maximum number of contractswith strike price $1,3500 (7191);

- The ratio of PUT/CALL was 1.31 versus 1.32 from the previous trading day according to data from May, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.7000 (2772)

$1.6901 (2102)

$1.6803 (1205)

Price at time of writing this review: $1.6742

Support levels (open interest**, contracts):

$1.6697 (2647)

$1.6599 (2480)

$1.6500 (979)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 24529 contracts, with the maximum number of contracts with strike price $1,7000 (2772);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 27156 contracts, with the maximum number of contracts with strike price $1,6700 (2647);

- The ratio of PUT/CALL was 1.11 versus 1.12 from the previous trading day according to data from May, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.