- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 02-05-2022

- AUD/NZD renews intraday low while staying inside a bearish chart formation.

- Mostly steady RSI, sustained trading above the key SMAs challenge sellers.

- RBA is expected to increase benchmark rate for the first time in over a decade.

AUD/NZD struggles to extend recent upside momentum, consolidating gains around 1.0950 during Tuesday’s Asian session.

In doing so, the cross-currency pair remains inside a three-week-old ascending triangle bearish chart pattern ahead of the Reserve Bank of Australia (RBA) monetary policy meeting.

The RBA meeting becomes more important this time as the Aussie central bank is up for a 0.15% rate hike, it's first since November 2010. The same should help the AUD/NZD prices in case matching the market consensus. However, the Australian policymakers have been behind their global friends, as far as central bank moves are concerned, which in turn may trigger a major pullback in case of disappointment.

Read: Reserve Bank of Australia Preview: Will a 15 bps rate hike be enough to lift the aussie?

That said, a convergence of the 50-SMA and the 100-SMA adds strength to the immediate downside filter around 1.0925-20, a break of which will confirm the bearish formation.

As a result, the 200-SMA and 61.8% Fibonacci retracement (Fibo.) of March-April moves, near 1.0755 will gain the market’s attention in that case.

Alternatively, an upside clearance of the 1.0985 will defy the triangle pattern and can propel the AUD/NZD prices towards the 61.8% Fibonacci Expansion of the mid-March to late April moves, near 1.1055.

AUD/NZD: Four-hour chart

Trend: Further upside expected

- A test of the lower boundary of the demand zone could result in a pullback.

- Investors should brace for a mean reversion to the 10-EMA.

- Momentum oscillator RSI (14) is signaling an oversold situation.

The NZD/USD pair is oscillating in a narrow range of 0.6429-0.6438 after a mild rebound from 0.6413 as momentum oscillators turned extremely oversold on small and medium timeframes. The asset has displayed an eight-day losing streak and is likely to remain on tenterhooks going forward. The kiwi bulls got fragile last week after slipping below yearly lows at 0.6529 vertically.

The major has drifted lower sharply to near the demand zone placed in a narrow range from 15 June 2020 low at 0.6381 to 9 March 2020 high at 0.6450. The greenback bulls are likely to display exhaustion after an intense sell-off and a pullback rally could be witnessed.

The 10- and 20-period Exponential Moving Averages (EMAs) at 0.6559 and 0.6742 respectively are trending lower, which still favors the downside.

However, the Relative Strength Index (RSI) (14) has touched a low of 22.17 on Monday, which signals that an oversold situation could be followed by a pullback.

Should the asset touches the lower boundary of the above-mentioned demand zone at 0.6381, a pullback move will drive the asset towards Monday’s high at 0.6475, followed by mean reversion to 10-EMA at 0.6559.

On the flip side, kiwi bulls could lose further if the asset tumbles below the demand zone at 0.6381 decisively. This will drag the major further towards 8 November 2019 and 16 October 2019 at 0.6322 and 0.6282 respectively.

NZD/USD daily chart

-637871321575118523.png)

- USD/CAD consolidates recent gains around the highest levels since late 2021.

- EU’s oil embargo on Russia favors WTI crude oil prices, as well as the CAD.

- Firmer yields, risk-aversion challenge downside momentum ahead of Wednesday’s FOMC.

- BOC’s Rogers, US Factory Orders will direct intraday moves.

USD/CAD bulls step back after refreshing the yearly high as oil prices, Canada’s key export, remains firmer amid escalating geopolitical tensions surrounding Russia. Also weighing on the Loonie pair are the latest US data, as well as the market’s consolidation ahead of the key Fed meeting. That being said, the quote eases to 1.2875 by the press time of the early Asian session on Tuesday.

WTI crude oil prices rose 0.80% to regain the $105.00 level, around $105.10 at the latest, as Germany backs the European Union’s (EU) total ban on Russian oil. The bloc’s powerhouse previously ruled out any such actions amid fears of economic recession. However, Moscow’s escalating military invasion of Ukraine might have played the role in pushing Berling toward the move.

Other than the oil prices, a pullback in the US Treasury yields after they rose to the fresh high in December 2018, as well as softer US data, can also be held responsible for the USD/CAD pair’s latest weakness.

The US 10-year Treasury yields cross the 3.0% benchmark for the first time in over three years before ending Monday’s North American trading session at around 2.97%. It’s worth noting that a holiday in Japan will restrict bond moves in Asia and can exert downside pressure on the US dollar due to the absence of yields’ momentum.

It should be noted that the US ISM Manufacturing PMI for April eased to 55.4 versus 57.6 market forecast and 57.1 prior readings while S&P Manufacturing PMI also softened to 59.2 from 59.7 expected and prior.

Looking forward, a speech from Bank of Canada (BOC) Senior Deputy Governor Carolyn Rogers will join the US Factory Orders for March, expected 1.1% versus -0.5% prior, to entertain short-term USD/CAD traders.

Technical analysis

Given the successful break of a downward sloping trend line from December 2021, around 1.2860 by the press time, USD/CAD prices are ready to aim for the 1.3000 threshold, with the late 2021 peak of 1.2966 likely acting as an intermediate halt.

- The DXY looks to reclaim 103.93 amid a broader strength in the Fx domain.

- Fed’s Powell is certain to elevate the interest rates by 50 bps.

- The 10-year US Treasury yields have sensed long-liquidations after hitting 3%.

The US dollar index (DXY) is oscillating in a narrow range of 103.58-103.66 in the early Tokyo session after a mild profit-booking from Monday’s high at 103.75. The DXY bulls are still rocking and are likely to attempt for recapturing its fresh 19-year high at 103.93, recorded last week.

A rate hike by 50 bps looks certain

The Federal Reserve (Fed) is set to elevate its interest rate by 50 basis points (bps) as galloping price pressures and consistency in full employment levels are compelling for sounding aggressively hawkish on Wednesday. Well, a jumbo rate hike looks certain now as the Fed has to return to neutral rates this year. Therefore, the mathematics behind rate reversion demands more than one rate hike by half a percent out of the remaining six monetary policy meetings to shore up rates to near 2.5%. Apart from the rate hike announcement, investors should focus on dictation over balance sheet reduction and further guidance on rates.

10-year US Treasury yields kiss 3%

The 10-year US Treasury yields have touched the psychological resistance of 3% for the first time in the last three years. A mean reversion of policy rates to neutral one is indicating a tad underperformance from the global equities due to the unavailability of helicopter money and easy liquidity into the economy going forward. This is pushing the US Treasury yields higher and is likely to keep yields stronger on a broader note for a longer horizon.

Key events this week: JOLTs Job Openings, ISM Services PMI, Initial Jobless Claims, Nonfarm Payrolls (NFP), Unemployment Rate.

Eminent issues on the back boiler: Russia-Ukraine Peace Talks, Reserve Bank of Australia (RBA) interest rate decision, European Central Bank (ECB) President Christine Lagarde’s speech, Fed interest rate decision, Bank of England (BOE) interest rate announcement.

- EUR/USD consolidates recent losses around a five-year low.

- Descending triangle, 50-HMA restricts short-term recovery moves amid sluggish oscillators.

- Bears keep their eyes on 61.8% Fibonacci Expansion level with multiple likely bounces around 1.0490.

EUR/USD stays defensive around 1.0510, paring recent losses around the lowest levels since 2017 during the sluggish Asian session on Tuesday.

In doing so, the major currency pair stays inside a one-week-old descending triangle formation, recently bouncing off the support line.

That being said, the 50-HMA adds strength to the upside hurdle surrounding 1.0530 that challenges the pair’s rebound.

Even if the quote rises past 1.0530, late April’s swing high near 1.0595 will act as an extra filter to the north before inviting the EUR/USD bulls.

Alternatively, multiple levels restrict the pair’s immediate downside around 1.0490, comprising the aforementioned triangle’s support line.

A break of 1.0490 will need validation from the latest bottom surrounding 1.0470, which in turn holds the gate for a slump towards the 61.8% Fibonacci Expansion (FE) of April 26-29 moves, near 1.0425.

Overall, EUR/USD remains on the back foot but the short-term recovery can’t be ruled out if it manages to break the 1.0530 hurdle, considering the sluggish MACD and RSI during the latest fall.

EUR/USD: Hourly chart

Trend: Bearish

- The EUR/JPY begins May with modest losses of 0.09%.

- A dismal market sentiment, increased appetite for safe-haven peers.

- EUR/JPY Price Forecast: From a daily chart perspective, a head-and-shoulders pattern has formed and, once validated, might drag the EUR/JPY towards 130.00.

The EUR/JPY records minimal gains as Tuesday’s Asian Pacific session begins, amidst a mixed market mood, as Asian equity futures gain, except for the Australian S&P/ASX 200. At the time of writing, the EUR/JPY is trading at 136.80 and record gains of 0.04%.

The market sentiment is mixed but tilted upbeat, as Asian futures carried on New York sentiment. In the FX space, the gainer was the greenback, while the euro remained defensive as the EUR/USD hovered around 1.0500. That bolstered the JPY vs. the EUR, recording gains of 0.09%, though diminute, are still gains. Meanwhile, concerns about China’s coronavirus outbreak which threatens to disrupt the supply side, while the Russia-Ukraine tussles continued, weighed some in the risk appetite.

During the overnight session, the EUR/JPY opened around 136.88 and meandered around the 50-hour simple moving average (SMA), almost horizontal, around 137.07. However, once European traders got off their desks, the US session’s sour sentiment weighed on the EUR/JPY, dragging the pair towards new daily lows around 136.60. Nonetheless, a late improvement in market mood in the New York session lifted the cross-currency pair towards 136.80.

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY daily chart depicts the pair as upward biased, though it in the last couple of days was unable to break resistance at 138.00, courtesy of EUR weakness. Also, a head-and-shoulders pattern is forming, which would add downward pressure on the pair, though a break below the neckline is needed to validate the pattern.

If that scenario plays out, the EUR/JPY first support would be 136.00. Break below would drag the pair towards the head-and-shoulders necklines, around 134.70-135.00. Once broken, the next stop would be last year’s high, around 134.12, followed by some DMAs before reaching the 130.00 head-and-shoulders targets.

- USD/JPY treads water after a positive start to the key week.

- US 10-year Treasury yields rally to the highest since December 2018.

- Hawkish hopes from Fed propel yields and USD, economic fears add strength to the greenback’s safe-haven demand.

- Off in Japan to restrict the latest moves, US Factory Orders will decorate calendar.

USD/JPY bulls take a breather around 130.00 during the initial hour of Tuesday’s Asian session, having partially reversed a pullback from a 20-year high during the week-start advances. The yen major’s latest gains could be linked to the multi-month high US Treasury yields before Wednesday’s Federal Open Market Committee (FOMC), as well as a steady rise in the US dollar’s demand due to the rush for risk-safety.

The benchmark US 10-year Treasury yields crossed the 3.0% mark for the first time since late 2018, before ending the North American session near 2.97%. The bond rout takes clues from the market’s firmer belief of a faster monetary policy normalization by the Fed to combat the rising inflation, despite the latest easing in US data on Monday.

That said, the US Federal Reserve (Fed) is ready to announce a 0.50% increase in the Fed rate and may also share views of balance-sheet normalization amid ballooning debt and inflation. As per the latest readings of the CME’s FedWatch Tool, there is a 99.3% probability of a 0.50% rate hike, matching the market consensus. Hence, an outcome is mostly priced in and may not impress the greenback until surprising markets with different moves.

Talking about data, the US ISM Manufacturing PMI for April eased to 55.4 versus 57.6 market forecast and 57.1 prior readings while S&P Manufacturing PMI also softened to 59.2 from 59.7 expected and prior.

It’s worth noting that the escalating fears of the EU’s oil embargo on Russian energy and stricter covid-led activity restrictions in Beijing also join the aforementioned catalysts to add to the US Dollar’s strength, which in turn propel USD/JPY prices of late.

Moving on, a Constitution Day Holiday in Japan will restrict the bond moves in Asia and hence the USD/JPY prices may also witness inaction. However, the sour sentiment and pre-Fed hopes can keep favor the buyers. During the US session, Factory Orders for March, expected 1.1% versus -0.5% prior, will be important to watch, in addition to the qualitative factors, for near-term directions.

Technical analysis

USD/JPY remains inside a five-week-old ascending trend channel formation, between 128.15 and 131.70 by the press time, which in turn keeps the pair buyers hopeful amid the firmer RSI (14).

- AUD/USD is oscillating in a nine-pip range as investors are eyeing RBA’s policy.

- Higher inflation in aussie area will push the RBA for a rate hike.

- The 10-year US Treasury yields have kissed the 3% mark for the first time in the last three years.

The AUD/USD pair is hovering around 0.7050 as investors are awaiting the interest rate decision from the Reserve Bank of Australia (RBA), which will be announced in a few hours. As per the market consensus, the RBA will step up its interest rate by 15 basis points (bps) to 0.25%.

A scrutiny of the guidance from RBA Governor Philip Lowe indicates a neutral stance on the monetary policy this time. RBA’s Lowe dictated that the agency will remain data-dependent for any rate hike decision and currently our policymakers do not see any significant price pressures, which could weigh on interest rates. However, the recent print of Australian inflation at 5.1%, much higher than the market forecasts of 4.6%, and the prior print of 3.5% has triggered the odds of a rate hike by the RBA this time.

Meanwhile, the US dollar index (DXY) has witnessed a minor sell-off after failing to sustain above 103.70. On a broader note, the DXY is dedicated to reclaiming its 19-year high print at 103.93. Certainty of a jumbo rate hike by the Federal Reserve (Fed) is underpinning the greenback against other risk-sensitive currencies. The 10-year US Treasury yields have witnessed some profit-booking after kissing the psychological resistance of 3% for the very first time in three years. The Fed is set to tone aggressively hawkish on Wednesday to leash roaring inflation.

- The AUD/JPY printed modest gains of 0.07% on Monday.

- A risk-on market mood favors the Australian dollar; a sudden shift might boost the JPY prospects.

- AUD/JPY Price Forecast: Remains upwards, though downside risks remains, on sentiment shifts.

The AUD/JPY remained confined to a narrow trading range within 91.50-92.14, ahead of the Reserve Bank of Australia’s monetary policy decision on Tuesday, which is expected to hike rates by 15 bps. At the time of writing, the AUD/JPY is trading at 91.74.

Risk appetite improved toward Wall Street’s close

The market sentiment fluctuated through the day, though it improved around Wall Street’s close. US equities recovered ground, while Asian stock futures point to a higher open. Around 04:30 GMT, the Reserve Bank of Australia (RBA) would deliver its interest rate decision as an Australian federal election looms.

Inflation in Australia reached a 20-year high, while Trimmed CPI rose by 3.7% y/y, just shy of the 4% threshold. Most analysts widely expect a 15 bps rate hike, though the board might delay the hike to June as it asses the next round of wages data for Q1. Furthermore, some analysts expect a 40 bps increase, with the likes of Natixis, ING, and even Citi.

Therefore, if the RBA raises rates, an AUD/JPY push upwards might be on the cards. Nonetheless, it’s worth noting that the AUD/JPY is the risk barometer of the FX, so any sentiment shifts could favor safe-haven peers, like the JPY and the CHF.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY remains upward biased. A false breakout below March’s 31 swing low at 90.76 on April 26, AUD bulls quickly reclaimed that level and lifted the AUD/JPY towards 93.50s. The MACD aims lower, towards zero, though the histogram shows that the distance between the MACD and the signal lines is contracting, opening the door for a bullish signal.

With that said, the AUD/JPY first resistance would be 92.00. Break above would expose May’s two daily highs at 92.15, followed by 93.00. On the flip side, the AUD/JPY first support would be the 91.00 mark. A breach of the latter would expose the April 27 daily low at 90.43, followed by 90.00.

- GBP/USD bears in control and attack weekly demand area.

- The bulls have moved in at weekly support, although the greenback has firmed at the start of the week.

GBP/USD remains in the hands of the bears as per the following analysis. The price has been in a strong downtrend but there is some deceleration in the price action as per the daily chart.

GBP/USD weekly chart

The price is moving in on the weekly demand area and there is more downside to go until it reaches the July 2020 lows near 1.2250.

From a daily perspective, however, the price is starting to consolidate:

GBP/USD daily chart

The bulls stepped in at the end of last week as the US dollar corrected in month-end rebalancing. The Federal Reserve is due to meet this week which is underpinning the greenback yet again in this week's opening sessions. However, there is scope here for some accumulation on the shorter time frames that could equate to a significant correction on the daily chart. The Fibonacci scale is drawn and a move into the 38.2% Fibo or even towards a 50% mean reversion could be on the cards. 1.2700 is a compelling figure in this regard.

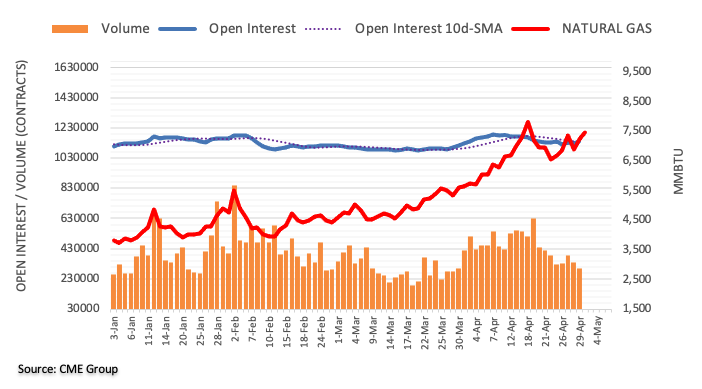

- WTI has overstepped $105.00 after tumbling to near $100.00 as supply concerns loom.

- Lower US oil strategic reserves will upthrust the oil prices further.

- EU may exempt Hungary and Slovakia from the embargo due to their higher dependency on Russian oil.

West Texas Intermediate (WTI), futures on NYMEX, has climbed above $105.00 ahead of the OPEC meeting. The oil cartel is expected to keep the oil prices above $100.00, which may force them to squeeze the oil production in an already tight market. The tailwinds of supply concerns amid OPEC’s determination to keep oil prices above $100.00 and expectations of lower oil stockpiles are outperforming the headwinds of a plummet in oil demand of to the Covid-19 resurgence in Beijing, China.

The strategic reserves of oil in the US are expected to slump sharply as the US is becoming a net exporter of oil in fulfilling the thirst of Europe for oil and energy. Last month, the deviation between import and export of crude oil and fuel remained in favor of exports by three million barrels daily, as per Reuters. Falling oil strategic reserves of the US won’t fulfill the demand for oil by Europe going forward, as the latter is going to embargo Russian oil completely.

Meanwhile, Hungary and Slovakia, two members of the European Union (EU) are ready to veto the decision of prohibiting the oil imports from Russia amid their way higher dependency on oil from Russia. The EU may extend their timeframe for reducing their reliance on Russian oil or will consider exemptions for them.

On the demand front, tightening curbs in Beijing after Shanghai in China due to the resurgence of the Covid-19 has raised concerns for oil demand. A slump in demand by the world’s largest oil importers will have a serious impact on the oil prices.

- The USD/CHF rallied for the eight-straight session, up by some 3.50%.

- A dismal market mood boosted the greenback, with the US Dollar Index meandering around 103.600.

- USD/CHF Price Forecast: Despite RSI at overbought territory, it remains to trend higher, but it could be subject to a mean reversion move.

The USD/CHF edges higher during the North American session as the New York session winds down for the first time in May and is trading at around 0.9779, shy of two-year-highs, gaining some 0.47%.

Wall Street is set to record losses on May’s first trading day, courtesy of a dismal sentiment. US Treasury yields are soaring, with 5s, 7s, and 20s above the 3% threshold, underpinning the greenback. The US Dollar Index, a gauge of the buck’s value against a basket of six rivals, edges higher, up some 0.37%, sitting at 103.600.

On Monday, in the overnight session, the USD/CHF opened near the daily pivot at 0.9710, though some pips above the 50-hour simple moving average (SMA), lying around the aforementioned area. Nonetheless, around the mid-European session, the USD/CHF managed to rally towards fresh two-year-highs at 0.9789, some pips shy of the 0.9800 mark, around the R2 daily pivot.

USD/CHF Price Forecast: Technical outlook

The USD/CHF daily chart shows the pair remains in a steep uptrend and has just one day of losses, compared to eight days of gains once it broke above the 0.9500 mark. Oscillators already show the pair as overbought, as the Relative Strength Index (RSI) at 83.00 illustrates. However, it remains with an upslope, a signal that the USD/CHF might keep trending higher before posting a reversal.

With that said, the USD/CHF first resistance would be April’s 2020 swing high at 0.9802. Break above would expose 0.9850, followed by 0.9901, March 23, 2020, daily high.

- NZD/USD bears stay in control as the US dollar recovers from correction.

- China is weighing on the risk sentiment surrounding the antipodeans.

NZD/USD is under pressure again at the start of the week with no let-up in the bear cycle. At 0.6433, the bird is down by some 0.33% after falling from a high of 0.6473 to a low of 0.6412.

The US dollar, meanwhile, has rebounded from the corrective lows made at the end of last month during month-end rebalancing. It sits at a 20-year high against a basket of currencies on Monday before an expected Federal Reserve rate hike this week. DXY reached a high of 103.747 today, pressuring the beaten-down antipodeans.

The focus is on the Federal Reserve this week and traders are on the lookout for the potential for the US central bank to adopt an even more hawkish tone than many expect. The Fed is expected to hike rates 50 bp to 1.0% Wednesday. While there will be no new forecasts until the June 14-15 FOMC meeting, another 50 bp hike is widely expected then also. In fact, as analysts at Brown Brothers Harriman note, WIRP suggests nearly 50% odds of a 75 bp hike then.

''Looking further out,'' the analysts said, ''the swaps market is now pricing in 300 bp of tightening over the next 12 months that would see the Fed Funds rate peak near 3.5%. Because of the media blackout, there are no Fed speakers until Chair Jerome Powell’s post-decision press conference Wednesday afternoon.''

The comments by Fed Chairman Jerome Powell at the conclusion of the meeting will be scrutinized for any new indications on whether the Fed will continue to hike rates to battle rising price pressures even if the economy weakens.

Meanwhile, global growth concerns have also boosted demand for the greenback and considering the close proximity of China and the trading relations between the antipodeans, the Chines lockdowns have weighed. Reuters reports that ''authorities in Shanghai on Monday reported 58 new cases outside areas under strict lockdown, while Beijing pressed on with testing millions of people.''

In weekend data, it has shown that China's factory activity has contracted at a steeper pace in April as the lockdowns halted industrial production and disrupted the supply chain. The data rasies fears of a sharp economic slowdown in the second quarter that will weigh on global growth.

NZD/USD technical analysis

The price has penertrated a weekly support level and is now moving deeper in the weekly demand zone as buls move aside.

What you need to take care of on Tuesday, May 3:

The American Dollar benefited from a poor market mood, ending the day higher against most major rivals. The dismal sentiment was the result of a combination of mounting tensions between Russia and Europe, downbeat macroeconomic figures, and concerns related to aggressive central banks, as the RBA, the US Federal Reserve and the BOE are set to announce monetary policies this week.

The German Economy Minister Robert Habeck noted that there is still no unity among EU member states on an oil embargo on Russia, although Finance Minister Christian Lindner added that it is still possible. At the same time, European Central Bank vice-president Luis de Guindos said that a rate hike in July is possible, although unlikely. The EUR/USD pair edged lower and traded around the 1.0500 level.

US data mixed expectations. The official ISM Manufacturing index printed at 55.4, much worse than the 57.6 expected. Nevertheless, Wall Street remained pressured for most of the session, although it ended the day mixed, as the DJIA and the Nasdaq managed to close with gains.

The GBP/USD pair settled around 1.2480, while AUD/USD trades at round 0.7050 ahead of the RBA. The central bank is expected to raise rates by 15-25 bps, pulling the trigger for the first time in over a decade.

The USD/CAD pair settled at 1.2870, despite higher oil prices. WTI ended the day at around $105.60 a barrel.

Safe-haven CHF and JPY shed ground vs the dollar, as well as Gold. The bright metal currently trades at around $1,860 a troy ounce.

Restrictions in China due to coronavirus extended in Beijing, further fueling concerns about global growth. The official Chinese NBS PMIs released over the weekend indicated a sharp economic contraction in April.

XRP price proposes lower targets amidst SEC delays and inflation pressures

Like this article? Help us with some feedback by answering this survey:

- The USD/CAD edges higher on Monday, some 0.27%.

- The US central bank tightening at a faster pace, China’s Covid-19 spread, and Ukraine’s war weighed on the market mood.

- USD/CAD Price Forecast: Upward biased, though facing solid resistance at 1.2900.

USD/CAD rallies ahead of the FOMC meeting and is testing the 1.2900 mark, for the first time, since March 8, when the greenback reached the previous YTD high around 1.2901. At 1.2884, the USD/CAD gains 0.33%, though shy of the YTD high previously reached during the day at 1.2913.

Sentiment has not improved since early during the North American session, as Wall Street is set to finish the first day of May with losses. The greenback remains in the driver’s seat as shown by the US Dollar Index, rising 0.48%, sitting at 103.712, underpinned by skyrocketing US Treasury yields.

Factors like expectations of the Federal Reserve rate hike of 50-bps alongside China’s struggling to control the coronavirus outbreak threaten to slow the global economy. Shanghai, China’s recent Covid-19 epicenter, reported 58 new cases due to “relaxing” restrictions. Meantime, Beijing keeps intensifying its efforts and, on Labour day, tested millions of people, reacting faster than Shanghai’s authorities

Regarding geopolitics, fighting between Ukraine-Russian continues, though things remain “unchanged,” as peace talks have not resumed. At the same time, Russian President Vladimir Putin emphasized that the “special military operation” would keep going until they achieved their goals.

Macroeconomic-wise, the US docket featured the ISM Manufacturing PMI for April grew slower to 55.4, missed expectations of 57.6, and trailed March’s 57.1 readings. On the Canadian front, the S&P Global Manufacturing PMI expanded at a slower pace in April, as Ukraine’s war added to pressures on capacity and costs.

USD/CAD Price Forecast: Technical outlook

The USD/CAD is upward biased, as shown by the daily chart. The daily moving averages (DMAs) below the spot price, alongside the MACD indicator, trending higher with both lines, confirms the uptrend.

With that said, the USD/CAD’s first resistance would be 1.2900. A breach of the latter would expose December 20, 2021, a daily high at 1.2963, followed by 1.3000. On the other hand, the USD/CAD first support would be April’s 29 daily high-turned-support at 1.2860, followed by April’s 28 daily low at 1.2791, and then the 1.2700 figure.

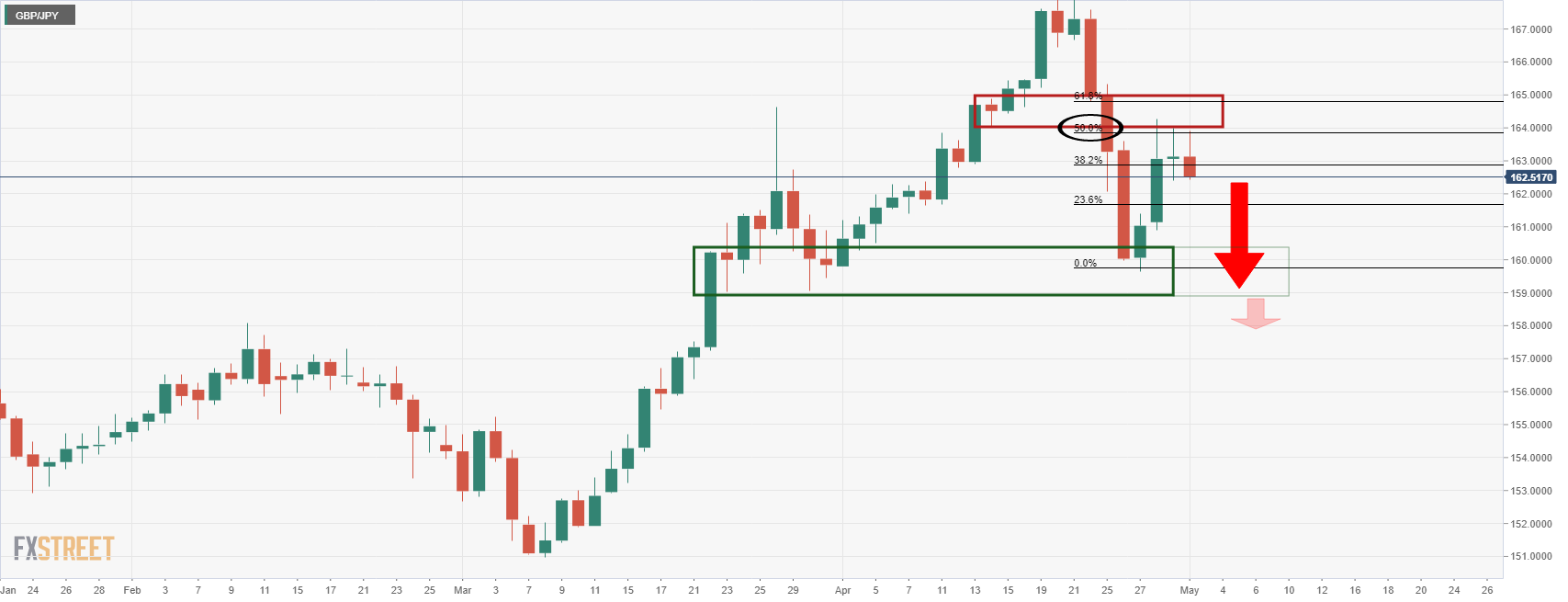

- GBP/JPY is under pressure and there are prospects of lower levels agead.

- A daily downside continuation could be on the cards.

GBP/JPY has corrected 50% of the prior bearish impulse and is meeting a prior structure on the daily chart. Subsequently, the cross is pressured and this could result in a downside continuation in the coming days should the support at 159.60 give out.

GBP/JPY daily chart

GBP/JPY chart

The cross on the hourly time frame is under pressure at a key support area after breaking below what is now the counter trendline and then support which is now expected to be resistantce if it is retested:

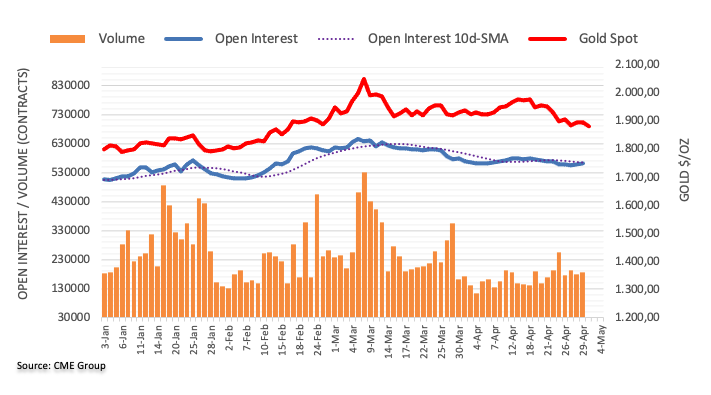

- The yellow-metal remains pressured ahead of the Federal Reserve May meeting.

- A downbeat market mood, courtesy of China’s Covid-19 struggling and weak PMIs reported, threatens to derail the world’s second-largest economy.

- Gold Price Forecast (XAU/USD): Neutral biased, though a daily close below the 100-DMA might put the 200-DMA in play.

Gold spot (XAU/USD) remains under pressure for the second consecutive trading day, and for the first time in May, as market participants prepare for the Fed’s May meeting, where investors expect a 50 bps increase to the Federal Funds Rates (FFR) as well as the begin of the QT. At the time of writing, XAU/USD is trading at $1865.91 a troy ounce.

Risk-aversion ahead of the Fed meeting boosts the greenback

The market sentiment remains dampened as the US central bank takes center stage in a busy week in the US economic docket. Alongside the Fed's May meeting, the US ISM Manufacturing PMI for April was released earlier as Wall Street opened, with the reading showing that manufacturing slowed to its lowest level in 21 months. The reading came at 55.4, missing expectations and lower than March’s 57.1.

Regarding the report, the ISM Manufacturing Business Survey Committee chair Timothy Fiore said new coronavirus outbreaks overseas were “creating a near-term headwind for the US manufacturing community,” noting that some manufacturers worried “about their Asian partners’ ability to deliver reliably in the summer months.”

In the meantime, US Treasury yields are skyrocketing during the day. The US 30-year broke the 3% threshold, while the barometer for US Treasury yields, the 10-year benchmark note, surges five and a half basis points, sitting at 2.998%. That, alongside overall greenback strength, as shown by the US Dollar Index up 0.42%, at 103.649, weighed on the non-yielding metal.

Factors alongside the busy US economic docket featuring ADP and US Nonfarm Payrolls employment reports remain in the backdrop. China keeps struggling to tackle the recent coronavirus flare-up that struck Shanghai and has already spread to Beijing. Restrictions could be re-established in Shanghai, while Beijing tested millions of people on a May Day holiday, as reported by Reuters. It’s worth noting that Caixin Manufacturing and Services PMIs, plunged below expectations.

Gold Price Forecast (XAU/USD): Technical outlook

The XAU/USD’s daily chart depicts the yellow metal as neutral biased. At the time of writing, gold is trading below the 100-day moving average (DMA) at $1879.51, a level that, if it gives way to XAU/USD bears to record a daily close below it, could open the door for a drop towards the 200-DMA around $1834.45.

On the downside, gold’s first support would be the 200-DMA at $1834.45. Break below would expose an upslope trendline around $1810-15, followed by a renewed test of $1800.

Upwards, XAU/USD’s first resistance would be the 100-DMA at $1879.51. A breach of the latter would expose $1890, followed by $1900, and then April’s 29 daily high at $1919.77.

- EUR/USD bears sty on top as markets get set for the Fed later this week.

- The US dollar is recovering fo the end of the month rebalancing correction.

The euro is under pressure in the mid-day US session and is on the verge of a break of 1.05 the figure vs the greenback. Trading at 1.0507, EUR/USD is down some 0.32% and has drifted from a high of 1.0568 to a low of 1.0501 so far at the start of this week.

The US dollar is climbing from the corrective lows as per the DXY index which measures the greenback vs. a basket of G10 currencies. The index is trading 0.4% higher at the time of writing at 103.64, below the 103.92 bull cycle highs scored towards the end of last month's trade and month-end rebalancing.

The markets are getting prepared for the outcome of the Federal Open Market Committee meeting this week where the Federal Reserve is expected to hike rates 50 bp to 1.0% Wednesday. While there will be no new forecasts until the June 14-15 FOMC meeting, another 50 bp hike is widely expected then also. In fact, as analysts at Brown Broerths Harriman note, WIRP suggests nearly 50% odds of a 75 bp hike then.

''Looking further out,'' the analysts said, ''the swaps market is now pricing in 300 bp of tightening over the next 12 months that would see the Fed Funds rate peak near 3.5%. Because of the media blackout, there are no Fed speakers until Chair Jerome Powell’s post-decision press conference Wednesday afternoon.''

The sentiment is being reflected through the yield on US Treasuries. The 10-year yield traded over the 3% milestone level today, the highest since December 2018. Similarly, the 2-year yield traded near 2.75% today, the highest since April 22 and nearing that day’s high near 2.78%.

''This uptrend is likely to continue as US inflation runs hot and the Fed continues its aggressive tightening cycle Of note, the 2-year interest rate differentials are moving back in the dollar’s favour after a brief corrective phase last week. In particular, the spreads with Japan (276 bp) and the UK (112 bp) continue to make new cycle highs, while the spread with Germany (248 bp) is lagging a bit. All three should continue to rise,'' analysts at BBH explained.

The question with respect to the value of the EUR/USD is not so much if, but when will parity be seen, or, will the US dollar keep rising?

Analysts at Westpac argue that there are factors that have scope to sustain ''further near term DXY upside.''

''Leading US activity indicators are edging lower, but the US offers a much more compelling growth story than Europe’s acute stagflationary picture and China’s Covid constrained growth story,'' the analysts said. ''The Fed is unlikely to shift tack until inflation is contained and risk appetite overall looks set to remain unsettled for some time to come.''

EUR/USD technical analysis

The weekly chart shows that the price is a strong bear trend which is meeting a critical level, 10490, that guards the June 2017 lows near 1.0450. Should the price reach these lows, then there would be prospects of a correction towards the 2020 lows and a 38.2% Fibo correction on the way to 1.0700.

- The USD/JPY began May on the right foot, up some 0.21%.

- The market mood is risk-of, courtesy of the FOMC meeting and China’s Covid-19 spread.

- USD/JPY Price Forecast: Range-bound, contained to the upside, after last week’s language intervention by the Japanese Finance Minister.

The USD/JPY remained comfortable above the 130.00 figure on Monday, as US Treasury yields heightened the day ahead of the Federal Reserve monetary policy meeting, led by the 10-year benchmark note closing into the 3% threshold. At the time of writing, the USD/JPY is trading at 130.11, up some 0.20%.

Market sentiment weighed by the FOMC meeting and China’s Covid-19 spread

A risk-off environment struck Monday’s trading session. The sentiment is dismal ahead of the Federal Reserve meeting, as China struggles to control the Covid-19 spread, with Shanghai reporting 58 new cases as restrictions threaten to be imposed once again, while Beijing keeps pushing for more testing. On the Ukraine-Russian front, things remain unmoved, with talks going nowhere, while hostilities escalate, as newswires reported that Russia is “laying the groundwork” for a takeover of Moldova, according to the Times.

Meanwhile, earlier in the North American session, the ISM Manufacturing PMI for April grew at a slower pace to 55.4 and missed expectations of 57.6, and trailed March’s 57.1 readings. Regarding the report, the ISM Manufacturing Business Survey Committee chair Timothy Fiore said new coronavirus outbreaks overseas were “creating a near-term headwind for the US manufacturing community,” noting that some manufacturers worried “about their Asian partners’ ability to deliver reliably in the summer months.”

The positive of the reading is that the index of Prices Paid fell from 87.1 to 84.6, a signal that could probably mean that inflation could be peaking.

Also, read: US: ISM Manufacturing PMI falls to 55.4 in April versus 57.6 expected

Meanwhile, US bond yields remain elevated ahead of the Federal Reserve May’s monetary policy meeting. The US 10-year Treasury note sits at 2.99%, hovering around the 3% threshold, underpinning the greenback, with the US Dollar Index gaining some 0.28%, up at 103.502.

On the Japanese front, the Consumer Confidence nudged up in April to 33, from a 31.7 forecast and higher than the 32.8 in March. “Consumer sentiment turned positive as COVID-19 cases fell further and as the lifting of curbs paved the way for a reopening of the economy,” according to sources cited by Reuters.

USD/JPY Price Forecast: Technical outlook

The USD/JPY daily chart shows that the pair remains confined to the 130.00 area as market players await the Federal Reserve. Both MACD lines MACD and signal are trendless, which means the major is range-bound, awaiting a fresh catalyst.

Meanwhile, the USD/JPY 1-hour chart depicts the USD/JPY seesawing around the daily pivot point around 130.05, while MACD on this time frame depicts the pair as range-bound.

Upwards, the USD/JPY first resistance would be 130.50. Break above would expose the R1 daily pivot around 130.80, followed by the 131.00 mark. On the other hand, the USD/JPY first support would be the daily pivot around 130.05. A breach of the latter would expose the 100-hour simple moving average (SMA) at 129.39, followed by the S1 daily pivot near 129.10-14.

Analysts at Wells Fargo brought forward expectations for monetary tightening from the Reserve Bank of Australia; however, they still expect the Aussie to soften versus the US dollar over the medium term. They forecast AUD/USD at 0.6700 by the third quarter of 2023.

Key Quotes:

“In an environment of positive economic momentum and above-target underlying inflation, the Reserve Bank of Australia (RBA) has turned more hawkish. In its April statement and minutes, the RBA said that faster inflation and a pickup in wage growth have moved up the likely timing of an initial rate hike. More specifically and arguably more notable, policymakers opted to drop the "patient" language from its official statement, further cementing the hawkish shift in tone.”

“We have brought forward our expectations for RBA policy rate increases, and now expect an initial 15 bps rate hike in June, followed by 25 bps hikes at each meeting in July, August, November, and December, which would bring the policy rate to 1.25% at the end of 2022. In 2023, we expect the tightening cycle to continue with 25 bps hikes in Q1, Q2, Q3, and Q4, taking the RBA policy rate to 2.25% by the end of next year.”

“Even though we have brought forward our expectations for monetary tightening, we still believe RBA rate hikes should lag behind those of the Federal Reserve. We also believe RBA rate hikes are likely to fall short of the tightening currently priced by market participants. As a result, we expect the Australian dollar to soften against the U.S. dollar over the medium term with some potential stabilization later on.”

“We forecast the AUD/USD exchange rate to reach 0.6700 by Q3-2023. However, we believe the risks are tilted to the upside. Should inflation prove to be more persistent, the currency could experience a more gradual pace of depreciation than our base case forecast suggests.”

On Thursday, the Bank of England will announce its decision on monetary policy. A 25 basis point interest rate hike to 1.00% is expected. In line with consensus and market pricing, analysts at Danske Bank expected the central banks to hike by 25bp but they warn focus is definitely much more on forward guidance than the rate hike itself.

Key Quotes:

“We expect the Bank of England to stick to its more dovish signals, although higher-than-projected inflation and rising inflation expectations increase the probability of the BoE turning more hawkish once again. The Bank of England sounds concerned about the growth outlook and the BoE projected a rise in the unemployment rate eventually in the February 2022 Monetary Policy Report. If we are right, however, about the BoE sticking to its dovish signals, it is likely to weigh on GBP given the hawkish market pricing.”

“Markets are pricing in a total of 150bp for the rest of the year (so basically a 25bp rate hike at each of the remaining meetings with risks skewed towards a 50bp rate hike at one of the upcoming meetings). Our Bank of England call is two additional rate hikes (August and November) but see risks skewed towards more rate hikes.”

“We are still of the view that EUR/GBP will trade around 0.84 this year. On the one hand, GBP usually benefits when USD performs but on the other hand GBP is no longer supported as much by relative rates and things may turn around if ECB turns more hawkish and/or BoE remains more cautious than what markets are pricing in. GBP/USD has declined a lot recently and we think the cross can move further down over the coming year.”

US Manufacturing sector data released on Monday came in below market consensus. The ISM dropped to 55.4 in April from 57.1 and below the 57.6 expected. The slowdown in the ISM manufacturing index indicated the sector expanded at the slowest pace of activity in over a year-and-a-half in April, explained analysts at Wells Fargo.

Key Quotes:

“The ISM manufacturing index unexpectedly slowed 1.7 points to 55.4 in April. While this reading still indicates expansion in the sector (value above 50 threshold designates expansion from contraction), it suggests activity expanded at the slowest pace in over a year-and-a-half. The underlying details of the report point to a slight pullback in the demand for goods, but purchasing manager comments continue to blame out-of-whack supply chains.”

“The employment component indicated a slower pace of hiring in April, with the largest decline of any component (-5.4 points) to 50.9, a reading that's just above the 50 threshold between expansion and contraction. Today's report doesn't materially change our expectations for Friday's nonfarm payroll report for April, where we forecast employers added 400K net new jobs during the month.”

- US dollar remains firm amid higher US bond yields.

- US data below expectations, eyes on Fed and BoE.

- GBP/USD turns negative after being rejected from 1.2600.

The GBP/USD broke under 1.2530 and dropped to 1.2505, reaching a fresh daily low. The pair remains near the lows, with a bearish tone amid a stronger US dollar across the board.

Cable is trimming half of Friday’s gains and a break under 1.2500 would increase the bearish pressure. The pound was rejected on Friday and again on Monday from above 1.2600, showing the main bearish trend still has momentum.

The US dollar rose across the board after the beginning of the American session despite weaker than expected economic data. The S&P Global and the ISM Manufacturing PMIs dropped came in below market consensus. The key report of the week will be on Friday with the Non-farm Payroll.

Higher US yields and risk aversion continues to boost the dollar. The US 10-year yield rose to 2.99% and the 30-year jumped to 3.05%. The DXY is up 0.40%, trading above 103.60. In Wall Street, the Dow Jones is falling 0.22% and the S&P drops 0.20% after falling sharply on Friday.

The key event ahead is the FOMC meeting. The Fed is expected to announce a 50 basis points rate hike on Wednesday. The statement and Chair Powell comments will likely trigger volatility.

The Bank of England will also have its monetary policy meeting. The consensus is for a 25bp rate hike. Analysts at Danske Bank expect the BoE to stick to its more dovish signals, although higher-than-projected inflation and rising inflation expectations increase the probability of a hawkish twist. “The Bank of England sounds concerned about the growth outlook and the BoE projected a rise in the unemployment rate eventually in the February 2022 Monetary Policy Report. If we are right, however, about the BoE sticking to its dovish signals, it is likely to weigh on GBP given the hawkish market pricing,” they explained.

Technical levels

- The Australian dollar begins May downbeat, losing 0.29%.

- Sentiment fluctuated risk-off/risk-on, following a worse than expected US ISM Manufacturing PMI.

- US ISM Manufacturing PMI slows and expands at a slower pace

- AUD/USD Price Forecast: Remains downward pressured and could threaten to break below 0.7000.

The Australian dollar begins May on the back foot, despite a possible rate hike by the Reserve Bank of Australia (RBA) in the week, which is following the Federal Reserve’s footsteps. However, the latter is about to accelerate the pace of tightening monetary policy on Wednesday, where market players expect a 50-bps rate increase which would lift the FFR to 1%. At the time of writing, the AUD/USD is trading at 0.7036.

US ISM Manufacturing PMI slows and expands at a slower pace

The market sentiment fluctuated to risk-off/risk-on when the Institute for Supply Manufacturing (ISM) revealed April’s Manufacturing PMI, which came at 55.4, lower than the 57.6 foreseen in the street. The drop in the month is the lowest in the last 21-months and continues the recent downturn that started in December of 2021. Timothy Fiore, chair of ISM’ said that “the US manufacturing sector remains in a demand-driven, supply chain-constrained environment.” She added that “in April, progress slowed in solving labor shortage problems at all tiers of the supply chain.”

The positive of the reading is that the index of Prices Paid fell from 87.1 to 84.6, a signal that could probably mean that inflation could be peaking.

Also, read: US: ISM Manufacturing PMI falls to 55.4 in April versus 57.6 expected

In the meantime, in the Asian/European session, equities traded with losses. China’s coronavirus outbreak had a setback in Shanghais, reporting 58 new Covid-19 cases, while Beijing intensified testing. Geopolitical-wise, the Ukraine-Russia conflict continues, and it appears would that peace talks will not resume in the near term as Russian Foreign Minister Lavrov said that Ukrainians had sabotaged negotiations, while the Ukrainian negotiator Podolyak denied this and said that Lavrov hast has not attended a single negotiation round.

Meanwhile, US Treasury yields skyrocket ahead of the Federal Reserve May’s monetary policy meeting. The 10-year benchmark note sits at 2.975%, hovering around the 3% threshold, underpinning the greenback, with the US Dollar Index gaining some 0.33%, up at 103.562.

In the week ahead, on Tuesday, the Reserve Bank of Australia (RBA) will reveal its interest rate decision, widely expected to increase by 15 bps, while Retail Sales and the RBA Chart Pack will be unveiled on Wednesday. On Wednesday, the Federal Reserve monetary policy decision will be revealed on the US front, followed by Chair Jerome Powell’s press conference, and by Friday, the Nonfarm Payrolls report.

AUD/USD Price Forecast: Technical outlook

The AUD/USD is stills downward biased, and on Monday, broke below February’s 4 swing low at 0.7051. Also, the daily moving averages (DMAs) above the spot price have the 50-DMA at 0.7346, aims lower, and close into the 200-DMA at 0.7284, triggering a death cross, motivating sellers to break below the 0.7000 figure.

That said, the AUD/USD first support would be 0.7000. Break below would expose the January 28 YTD low at 0.6967, followed by the June 15, 2020 pivot low at 0.6777.

- In a choppy start to the month, the S&P 500 hit fresh annual lows just above 4,100.

- The index has since bounced back to the 4,150 area, though investors are cautious ahead of key risk events.

- The Fed is expected to lift interest rates by 50 bps this week and official jobs data is due Friday.

In a choppy start to the month, the S&P 500 index hit a fresh annual low just above the 4,100 level shortly after the US open, only to then reverse about 50 points higher again. At current levels near 4,150 the index trades with gains of about 0.6% on the day, with investors focused on a barrage of key upcoming risk events, including Wednesday’s Fed meeting and Friday’s release of the April US labour market report.

While investors will welcome Monday’s bounce from annual lows, most won’t be betting that the recovery extends back to mid-April levels around the 4,400s. The Fed is expected to hike interest rates by 50 bps this week, as well as signaling more rate hikes of at least 50 bps in the meetings ahead in its bid to get interest rates back to around 2.50% by the year’s end to tame inflation. The bank is also expected to announce its quantitative tightening plans.

Ahead of this, longer-term US bond yields are back on the front foot, with the 10-year looking to break back above 3.0% for the first time since late 2018. If this trend continues this week, that will create a particularly difficult backdrop for high price/earnings ratio stocks, which includes most large-cap tech and growth stocks, to continue to recover.

And it's not just higher interest rates and Fed tightening that investors have to worry about. Growth concerns have been in focus at the start of the week, with official Chinese April PMI surveys out over the weekend and missing expectations by some margin, and the latest underwhelming US ISM Manufacturing PMI figures not helping. The headline index fell to its weakest since 2020, just as the supplier delivery sub-index hit a five-month high to reflect worsening lead times the Russo-Ukraine war and China lockdowns worsen global supply chain issues.

The latest index also suggested that firms continued to struggle to hire/hold onto workers in April, suggesting that while indicators of labour market slack released in Friday’s official labour market report may remain robust, the headline NFP number might be weak.

Turning to the other major US indices; the tech-heavy Nasdaq 100 index was last trading about 0.6% higher, though also hit fresh annual lows earlier on Monday and remains unable to break back above the 13,000 level. Meanwhile, the Dow was last trading higher by about 0.3%, though still remains above 33,000 and about 2.5% above earlier annual lows.

- The April US ISM Manufacturing PMI was weaker than expected at 55.4, with drops across the major sub-indices.

- FX markets did not react to the latest data.

The headline ISM Manufacturing Purchasing Manager's Index (PMI) fell to 55.4 in April from 57.1 in March, below expectations for a small rise to 57.6, according to the latest release by the Institute for Supply Management (ISM). That marked the lowest reading since September 2020.

Subindices:

- The Prices Paid Index fell a little to 84.6 from 87.1 in March.

- The New Orders Index fell a little to 53.5 from 53.8, the lowest reading since May 2020.

- The Employment Index dropped to 50.9 from 56.3, larger than the expected drop tp 56.0.

Market Reaction

Currency markets didn't react much to the latest slightly softer than expected US ISM Manufacturing PMI survey data. The DXY continues to trade in the mid-103.00s, a little higher on the day and eyeing last week's multi-month highs near 104.00.

According to the final version of IHS Markit's April Manufacturing Purchasing Managers Index (PMI) survey, the headline index fell a little to 59.2 versus the flash estimate of 59.7. That suggests that the pace of expansion in US manufacturing remained broadly robust in April. The headlines manufacturing index was 58.8 in March.

The final Output Index for April was revised a little higher to 57.6 versus the flash reading of 57.4, while the final Output Prices Index for April was revised a little lower to 76.3 from the flash reading of 78.4, though still sharply higher than March's reading of 69.7.

Market Reaction

FX markets did not react to the latest did, with attention instead on the release of ISM's Manufacturing PMI survey at 1500BST.

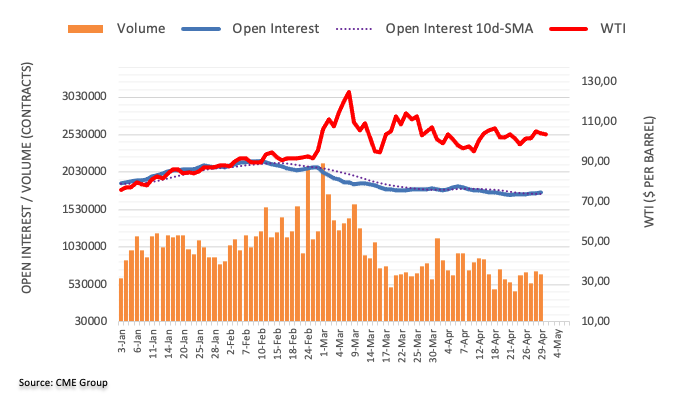

- Silver witnessed heavy follow-through selling on Monday and dived to a near three-month low.

- Last week’s break below the 200-DMA and ascending trend-line was seen as a key trigger for bears.

- Extremely oversold RSI makes it prudent to wait for some consolidation before the next leg down.

Silver extended a three-week-old bearish trend and witnessed some follow-through selling for the eighth successive day on Monday. This also marked the ninth day of a negative move in the previous ten and dragged spot prices to the $22.00 neighbourhood, or a near three-month low during the early North American session.

Looking at the broader picture, last week's sustained breakthrough the very important 200-day SMA and an ascending trend-line extending from December 2021 was seen as a fresh trigger for bearish traders. A subsequent slide below the $22.65 static support aggravated the bearish pressure and contributed to the downfall.

That said, RSI (14) on the daily chart is already flashing extremely oversold conditions and warrants caution for aggressive traders. This makes it prudent to wait for some near-term consolidation or modest bounce back towards the $22.65 area before positioning for an extension of the ongoing downward trajectory.

Hence, any further decline is more likely to pause near the $22.00 round-figure mark. That said, a convincing break below should pave the way for additional losses and expose the next relevant support near the $21.45-$21.40 region, or the December 2021 swing low.

On the flip side, attempted recovery back above the $22.65 region could be seen as a fresh selling opportunity near the $23.00 round figure. This, in turn, should cap the upside for the XAG/USD near the aforementioned ascending trend-line support breakpoint, now turned resistance near the $23.20 area.

Silver daily chart

-637870960387061115.png)

Key levels to watch

- Spot gold has extended on earlier losses and is now trading in the upper $1850s, down more than 2.0%.

- As focus turns to upcoming US data and Wednesday’s Fed meeting, profit-taking is seemingly weighing on XAU/USD.

- Some are also citing downside in global energy and metal markets as reducing the demand for inflation protection.

Ahead of the release of April US ISM Manufacturing PMI data that will probably show a continued robust pace of expansion in US industry last month, spot gold (XAU/USD) prices continue to trade on the back foot. Indeed, a fall in prices that had begun during Asia Pacific trade accelerated in the run-up to the US open, with the precious metal recently breaking below key support in the $1875 and extending losses into the upper $1850s.

At current levels around $1857, XAU/USD now trades with on the day losses of over 2.0%. No specific piece of news or fundamental catalyst can be pinned down as behind the latest drop. Instead, analysts and market commentators have on Monday been talking about how nerves ahead of what is likely to be a very hawkish Fed meeting on Wednesday, as well as a barrage of tier one US data releases, is encouraging profit-taking in gold markets.

The Fed is expected to lift interest rates by 50 bps, announce quantitative tightening plans and signal more 50 bps at upcoming meetings, with the bank aiming to get interest rates back to around 2.5% by the year’s end. Higher interest rates increase the “opportunity cost” of holding non-yielding assets like gold and typically weigh on its demand.

Elsewhere, market commentators also cited sharp downside in global energy and metal prices as weighing on demand for gold via a reduced need for inflation protection. Crude oil and copper markets, to take to key examples, have cratered on Monday amid concerns about growth in China following ugly April PMI data over the weekend. XAU/USD bears will now likely target a test of resistance turned support in the $1850 area ahead of a potential test of the 200-Day Moving Average in the $1830s.

The German economy minister said on Monday that Russia could gas supplies to Germany as it did with Poland and noted that Germany was not against a ban on Russian oil imports, as reported by Reuters.

Earlier in the day, the German climate minister said that Germany has been preparing itself to be able to support a ban on Russian oil.

Market reaction

The shared currency stays on the back foot following these comments and the EUR/USD pair was last seen trading at 1.0508, where it was down 0.3% on a daily basis.

- EUR/USD fades the earlier bullish move to 1.0570.

- A visit to the YTD low at 1.0470 remains in the pipeline.

EUR/USD reverses the initial optimism and puts the 1.0500 level under pressure at the beginning of the week.

The offered stance in the pair remains well and sound despite Friday’s bounce and the door stays open to another probable visit to the YTD low around 1.0470 (April 28) in the very near term.

In the meantime, while below the 3-month line around 1.0980, extra losses in the pair are likely.

EUR/USD daily chart

- WTI has fallen back to the mid-$101.00s on Monday, down over $2.50 amid China demand concerns after weak data.

- But concerns about Russian output with the EU close to agreeing an oil import embargo may keep prices above $100.

Even though the EU looks set to agree on ending all Russian oil imports by the end of the year (aside from perhaps to Slovakia and Hungary) as soon as Tuesday, a move which is likely to exert further downwards pressure on Russian production, oil prices trade with significant losses at the start of the week. Having come within about $1.0 of its mid-April highs just above $109.00 per barrel last Friday, front-month WTI futures have reversed just over $2.50 lower on Monday to trade in the mid-$101.00s.

Traders are citing concerns about weakening economic growth in China as weighing on prices at the start of the week following the release of significantly worse than expected official April PMI survey results over the weekend. Some also cited some newsflow about the resumption of production in various oilfields located in Libya as potentially also weighing on prices. Libyan output was disrupted to the tune of 500K barrels per day in April by blockades, as the country continues to struggle with internal instability.

For the time being, so long as Chinese demand fears don’t significantly increase again in the coming days (new lockdowns could trigger this), concerns about Russian supply as the EU looks to tighten sanctions on the country following its invasion of Ukraine might be enough to keep WTI supported above the $100 mark. According to Reuters, around half of Russia’s 4.7M barrels per day in exports goes to the EU and, while some of this can be redirected to other markets at a discount (like too India), “Russia’s ability to redirect all unwanted cargoes from the West to Asia is limited,” said one analyst.

“In the case of embargoes, Russia will be forced to cut production further as it lacks storage capacity for extra crude volumes,” they continued. Russia’s sanctions-related supply woes come at a time when many OPEC+ nations were already struggling to increase output in line with the group’s recent series of output quota hikes. According to a Reuters survey, the group’s output rose by just 40K barrels per day in April, well below the 400K targeted rise, pushing the group’s compliance with its output cut pact to 164% (up from 151% a month earlier). Massive OPEC+ underproduction is another reason why WTI above, or at least near, $100 continues to make sense in the near term.

- EUR/USD loses the grips and challenges 1.0500.

- The greenback’s recovery picks up pace, yields creep higher.

- Markets’ attention remains on the US ISM Manufacturing.

Sellers regain control of the sentiment around the European currency and force EUR/USD to come down and revisit the vicinity of the 1.0500 neighbourhood on Monday.

EUR/USD looks to data, US yields

EUR/USD quickly leaves behind Friday’s bullish attempt and refocuses on the downside in a context once again dominated by the upside bias in the greenback and persistent high yields.

Indeed, US yields continue to rise in the belly and the long end of the curve, while the German 10y bund yields keep trading close to the 1.0% area.

In the euro docket, earlier results saw German Retail Sales contract 2.7% in the year to March and the final Manufacturing PMI ease to 54.6 in April. In the euro area, the Manufacturing PMI receded to 55.5, the Consumer Confidence deteriorated to -22.0 and the Economic Sentiment retreated to 105, all for the month of April.

Later in the NA session, the final Manufacturing PMI is due followed by Construction Spending and the ISM Manufacturing.

What to look for around EUR

EUR/USD leaves behind part of the recent multi-session sharp selloff and rebounds from 5-year lows around 1.0470 (April 28). The outlook for the pair still remains tilted towards the bearish side, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Occasional pockets of strength in the single currency, in the meantime, should appear reinforced by speculation the ECB could raise rates at some point around June/July, while higher German yields, elevated inflation and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: Germany Retail Sales, Final Manufacturing PMI, Consumer Confidence, Economic Sentiment (Monday) – Germany Unemployment Rate, Unemployment Change, EMU Unemployment Rate, ECB Lagarde (Tuesday) – Germany Balance Trade, Final Services PMI, EMU Final Services PMI, Retail Sales (Wednesday) – Germany Factory Orders, Construction PMI (Thursday) – Germany Industrial Production (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is down 0.34% at 1.0505 and a break below 1.0470 (2022 low April 28) would target 1.0453 (low January 11 2017) en route to 1.0340 (2017 low January 3 2017). On the flip side, the next hurdle emerges at 1.0593 (high April 29) followed by 1.0936 (weekly high April 21) and finally 1.1000 (round level).

The Canadian dollar retains a soft undertone. USD/CAD has hit 1.29, however, economists at Scotiabank expect gains to be capped above this level.

Macro fundamentals are CAD-supportive

“We think the CAD has some – fairly obvious – fundamental virtues, such as tightening BoC monetary policy and very resilient growth but those factors continue to be overshadowed by external factors (equity market vol) which may keep the USD better supported for the moment.”

“We do think that the USD gains should remain capped above 1.29, the top of the range that has held spot for the past 10 months or so, however.”

US ISM Manufacturing PMI overview

The Institute of Supply Management (ISM) will release its latest manufacturing business survey result, also known as the ISM Manufacturing PMI at 14:00 GMT this Monday. The index is anticipated to edge higher from 57.1 in the previous month to 57.6 in April. The gauge will provide a fresh update on the manufacturing sector activity and the health of the economy as a whole amid signs of slowing global growth.

How could it affect EUR/USD?

Ahead of the release, the US dollar stood tall near a multi-year high touched last week and remained well supported by the prospects for a faster policy tightening by the Fed. A stronger than expected report will reaffirm market bets and offer additional support to the buck. Conversely, any reaction to a softer print might do little to dent the underlying bullish sentiment surrounding the buck. Apart from this, concerns about the potential economic fallout from the Ukraine crisis should act as a headwind for the shared currency. This, in turn, suggests that the path of least resistance for the EUR/USD pair is to the downside.

Valeria Bednarik, Chief Analyst at FXStreet, offered a brief technical outlook for the pair: “The EUR/USD pair is down from an intraday high of 1.0567, and the daily chart shows that the risk remains skewed to the downside. The 20 SMA heads firmly lower, far above the current level, while the longer ones maintain their bearish slopes above the shorter one. Technical indicators have recovered modestly but remain within oversold levels without signs that could confirm an interim bottom.”

Valeria also outlined important technical levels to trade the EUR/USD pair: “According to the 4-hour chart, the risk is also on the downside. The pair is unable to break above a bearish 20 SMA, which currently stands a few pips above the current level. The Momentum indicator is struggling to reenter positive territory while the RSI indicator consolidates around 37, indicating absent buying interest. Bears are likely to resume acting on a break below the 1.0500 level, with the ultimate bearish target at 1.0339, the January 2017 monthly low.”

Key Notes

• EUR/USD Forecast: Bears retake control amid exacerbated risk factors

• EUR/USD Forecast: Risk-aversion to limit euro's rebound

• EUR/USD: Poised to break firmly under 1.05 in the near-term – Scotiabank

About the US ISM manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in the US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50 is seen as negative (or bearish).

GBP/USD trades in a 1.2530-1.26 consolidation zone. Economists at Scotiabank expect the pair to slide towards 1.24 on failure to rise above the 1.26 level this week.

Cable remains on a clear weakening trend

“The GBP remains on a clear weakening trend and it would take a firm break past the 1.26 figure zone to build signs of a reversal, with limited support markers between it and the 1.27 level.”

“A failure to climb back above 1.26 over the balance of the week would point to a resumption of losses that breakthrough 1.24 – which held up the GBP last Thursday – and eventually aim for the Jun 2020 low of ~1.2250.”

The EUR is tracking its peers’ losses against the dollar. In the view of economists at Scotiabank, the shared currency remains prone to weakness on fundamentals.

Resistance after 1.0570/80 aligns at the 1.06 zone

“The EUR is set to continue to trade on the defensive amid weak growth prospects and priced out ECB expectations, as it looks to break firmly under 1.05 in the near-term.”

“The 1.05 zone remains a strong floor and triggering EUR buying pressure (as it remains in oversold territory). Below the figure area, the recent low of 1.0472 stands as key support ahead of the figure and the 2020 low of 1.0341.”

“Resistance after 1.0570/80 is the 1.06 zone followed by the mid-figure.”

- USD/CAD gained traction for the second straight day and climbed back closer to the YTD peak.

- Sliding crude oil prices undermined the loonie and extended support amid modest USD strength.

- Move beyond the 1.2900 mark favours bullish traders and supports prospects for further gains.

The USD/CAD pair built on Friday's strong intraday rally from the 1.2720-1.2715 region and climbed to its highest level since March 9 during the early North American session on Monday. The emergence of fresh selling around crude oil undermined the commodity-linked loonie. This, along with the underlying bullish sentiment surrounding the US dollar, acted as a tailwind for spot prices for the second successive day.

From a technical perspective, spot prices are now looking to extend the momentum further beyond a downward-sloping trend-line extending from December 2021 swing high. Move beyond the previous YTD top, around the 1.2900 mark, now seems to have confirmed a fresh bullish breakout and supports prospects for additional gains. The USD/CAD pair could now appreciate further and test the 2021 peak, around the 1.2665 region touched in December.

That said, RSI (14) on the daily chart have moved on the verge of breaking into overbought territory and warrants some caution ahead of this week's key event/data risks. The Fed is scheduled to announce its monetary policy decision on Wednesday. This will be followed by the closely watched monthly jobs report from the US (NFP) and Canada, which will play a key role in determining the near-term trajectory for the USD/CAD pair.

In the meantime, any meaningful pullback now seems to find some support near the 1.2860-1.2855 region ahead of the daily low, around the 1.2830 area. This is followed by the 1.2800 round-figure mark, which if broken decisively will negate the positive outlook and prompt aggressive technical selling around the USD/CAD pair. The downward trajectory could then accelerate towards the 1.2720-1.2715 area en-route the 1.2700 round-figure mark.

Some follow-through selling would pave the way for a fall towards testing the 1.2650-1.2640 region. The latter marks a horizontal resistance breakpoint and coincides with the very important 200-day SMA, which, in turn, should act as a strong base for the USD/CAD pair and a key pivotal point.

USD/CAD daily chart

-637870923479537915.png)

Key levels to watch

- GBP/USD is languishing in the mid-1.2500s with volumes thinned due to UK market closures and ahead of key BoE/Fed meetings.

- The bearish combination of a hawkish Fed plus less hawkish BoE/UK growth concerns means traders may continue selling rallies.

GBP/USD is languishing in the mid-1.2500s on Monday, with volumes thinned as a result of UK market closures and as traders braced ahead of key policy announcements from the Fed and BoE on Wednesday and Thursday. The Fed meeting is expected to be the much more hawkish of the two, with the US central bank expected to raise interest rates by 50 bps, signal more 50 bps hikes ahead and announce its quantitative tightening plans.

While the BoE might also outline quantitative tightening plans, it will likely only hike interest rates by 25 bps, and will probably further soften its tone on the need for further rate hikes ahead, given growing concerns about the state of the UK’s economic outlook. Indeed, these growing concerns about the UK economy have weighed heavily on sterling in recent sessions. This time two weeks ago, GBP/USD was trading comfortably above 1.3000, more than 3.5% higher versus current levels.

While concerns about the outlook for the UK economy amid the worst cost-of-living squeeze in decades, which has subsequently seen BoE tightening bets pared, has been a major driver of the recent drop, a broad strengthening of the US dollar has also been a key factor. Driving this strength has of course Fed hawkishness, but also concerns about geopolitics and China lockdowns, as well as general weakness in global risk assets, which spurred demand for the safe-haven buck.

This week’s central bank meetings and US data (the official April jobs report is out on Friday) may reaffirm the themes that have weighed heavily on GBP/USD in recent sessions and, as a result, traders may be looking to sell any rallies. 1.2600 looks to be a good area of resistance for now, though some technicians have also noted the 1.2670 area. After such a big move lower in recent weeks, expecting a further swift drop to 1.20 might be asking for too much in the near term. But short-term bears may well want to target a retest of last week’s lows just above 1.2400.

- DXY resumes the upside beyond the 103.00 yardstick.

- Next on the upside comes the cycle tops near 104.00.

The index leaves behind the pullback seen at the end of last week and advances above the 103.00 area on Monday.

Price action in DXY remains supportive of the resumption of the uptrend with the initial target at the 2022 highs just below the 104.00 yardstick (April 28). Above this level comes 105.63 (December 11 2002 high).

The current bullish stance in the index remains supported by the 8-month line near 96.80, while the longer-term outlook for the dollar is seen constructive while above the 200-day SMA at 95.76.

DXY daily chart

- Gold has started the week on the back foot, and is already about 1.0% lower in the $1880 area.

- XAU/USD is eyeing a test of last week’s lows at $1872 as focus turns to this week’s Fed meeting.

Spot gold (XAU/USD) prices trade firmly on the back foot at the start of the first trading day of May, with prices last trading lower by just under 1.0% in the $1880 per troy ounce area, having dropped about $17. Despite much worse than expected official April PMI numbers released out of China over the weekend that have exaccerbated fears about lockdown induced economic slowdown there, as well as increased jawboning from various EU officials on Monday regarding a possible embargo on Russian oil imports, gold has not been able to maintain a lasting bid.

The US dollar, with which XAU/USD has had a strong negative correlation as of late, has started the week on the front foot, as focus turns to an anticipated 50 bps rate hike from the Fed on Wednesday. Hawkish expectations going into the meeting, with the bank expected to signal more 50 bps rate hikes coming at its next few meetings as well as announce quantitative tightening plans, are discouraging investors from buying/holding gold, even as global inflation/geopolitical/growth concerns linger.

Higher interest rates as a result of central bank policy tightening tend to weigh on non-yielding assets such as gold given the rising “opportunity cost”. XAU/USD bulls will undoubtedly be eyeing a test of support in the form of last week’s lows in the $1872 area. A break below this key area of support would open the door to a run lower towards the 200-Day Moving Average in the mid-$1830s. Ahead of Wednesday’s Fed meeting, gold traders will also be watching the release of April US ISM Manufacturing data on Monday at 1500BST and March JOLTs Job Openings data at 1500BST on Tuesday for an update as to the economy’s ongoing strength and labour market tightness.

GBP/USD has been unable to break above 1.26. Analysts at BBH still target the June 2020 low near 1.2250 and then the May 2020 low near 1.2075.

Drop below 1.2075 to open up March 2020 low near 1.1410

“Cable traded last week at the lowest since July 2020 near 1.2410 and we continue to target the June 2020 low near 1.2250 and the May 2020 low near 1.2075.”

“If the 1.2075 level breaks, then we would target the March 2020 low near 1.1410.”

USD/JPY has resumed its march higher and is trading near 130 today. Economists at BBH continue to look for a test of the 2002 high near 135.15.

Downplaying FX intervention risks for now

“We continue to target the January 2002 high near 135.15. If that level breaks, the August 1998 high near 147.65 would come into view.

“Japan markets will be closed until Friday for the Golden Week holidays. While speculators may try to take advantage of thin markets to push USD/JPY higher, our understanding is that the Bank of Japan maintains staffing during the Golden Week to monitor markets. That said, we continue to downplay FX intervention risks for now.”

The euro remains heavy after being unable to break above 1.06. EUR/USD is trading near 1.0525 and economists at BBH expect the pair to test January 2017 low around 1.0340.

EUR/USD about to tackle last week’s cycle low near 1.0470

“EUR/USD should soon test last week’s cycle low near 1.0470.”

“We still look for a test of the January 2017 low near 1.0340. If that level breaks, we have to start talking about parity and below.”

- AUD/USD reversed an intraday slide to over a three-month low touched earlier on Monday.

- The risk-on impulse acted as a headwind for the safe-haven USD and extended some support.

- The upside seems limited ahead of the RBA decision on Tuesday and FOMC on Wednesday.

The AUD/USD pair managed to recover nearly 50 pips from over a three-month low and climbed to a fresh daily peak, around the 0.7080 region during the first half of the European session.