- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 02-03-2023

- AUD/JPY remains sidelined after reversing from the key SMA earlier in the week, retreats of late.

- Clear downside break of bullish triangle, looming bear cross on the MACD.

- Bulls need validation from 93.10 for conviction, sellers may eye two-month-old support past 200-SMA break.

AUD/JPY bulls run out of steam around 96.00, even as the weekly performance appears mildly bid during early Friday. In doing so, the cross-currency pair signals the bear’s return, following a failure to defend the bounce off the 200-SMA, as well as amid downbeat oscillators and a clear break of the six-week-old bullish triangle.

That said, the quote drops toward the 200-bar Simple Moving Average (SMA) support near 91.60. However, the double bottoms marked during early February near 90.20-25 by the press time, could challenge the pair sellers.

Adding to the downside filter is the ascending support line from early January, close to 89.95 by the press time.

It should be observed that a successful break of the multi-day-old support line won’t hesitate to challenge the year 2023 low surrounding 87.40.

On the flip side, the lower line of the aforementioned bullish triangle, close to 92.65 at the latest, will precede the stated chart formation’s top line, around 93.10, to challenge the AUD/JPY buyers.

Should the quote remains firmer past 93.10, the mid-December 2022 swing high of 93.35 may act as the last defense of the AUD/JPY bears.

Overall, AUD/JPY remains on the bear’s radar even if the 200-SMA restricts immediate downside.

AUD/JPY: Four-hour chart

Trend: Further downside expected

- AUD/USD has rebounded after sensing a cushion around 0.6700 amid a recovery in investors’ risk appetite.

- Hopes for a bullish reversal will be fueled further in case AUD/USD delivers a break above the 50-EMA.

- A 40.00-60.00 range oscillation by the RSI (14) indicates indecisiveness among the market participants.

The AUD/USD pair has shown a recovery move after defending the round-level support of 0.6700 in the early Asian session. A loss in the downside momentum is exhausted, however, the Aussie asset would get a sense of confidence only after a confident break above the immediate resistance of 0.6740.

S&P500 futures are displaying nominal losses after a meaningful recovery, portraying a caution in the overall risk appetite theme. The struggle from the US Dollar Index (DXY) for recapturing the 105.00 resistance continues amid a recovery in the risk-on market mood. Meanwhile, the 10-year US Treasury yields are looking to continue their upside momentum above 4.06%.

A double bottom chart formation on a two-hour scale by AUD/USD around March 01 low at 0.6700 has triggered the case of a bullish reversal. The Australian Dollar tested March 01 low at 0.6700 with less selling pressure, which propelled the responsive buying from the market participants. The downward-sloping trendline plotted from February 14 high at 0.7030 has acted as a major barricade for the Australian Dollar.

Hopes for a bullish reversal will be fueled further in case the AUD/USD pair delivers a break above the 50-period Exponential Moving Average (EMA) at 0.6750.

The Relative Strength Index (RSI) (14) is still oscillating in the 40.00-60.00, indicating indecisiveness among the market participants.

A confident break above March 01 high at 0.6784 will send the asset toward the round-level resistance at 0.6800 followed by February 06 low at 0.6855.

In an alternate scenario, a slippage below March 01 low around 0.6700 will drag the Aussie toward December 07 low at 0.6669 and December 20 low at 0.6629.

AUD/USD two-hour chart

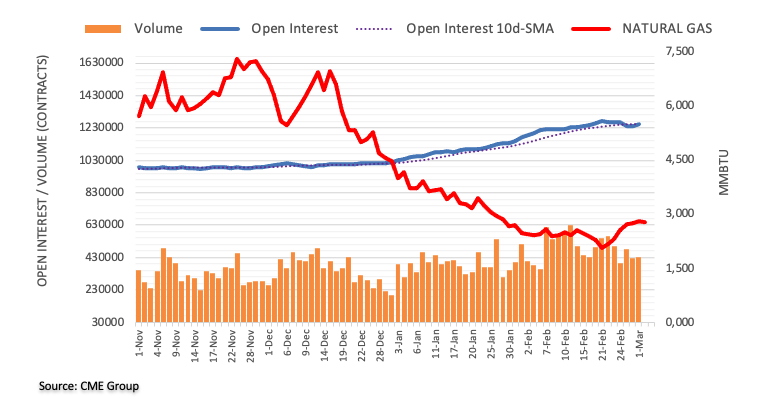

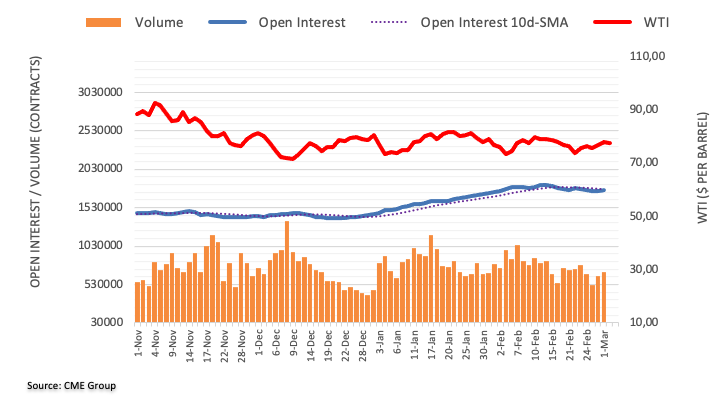

- Western Texas Intermediate advanced 0.21%, despite overall US dollar demand.

- WTI was bolstered by China’s re-opening and dovish remarks from Fed’s Bostic.

- Overall US Dollar strength due to elevated US Treasury bond yields capped WTI’s rally.

Western Texas Intermediate (WTI) clings to minuscule gains after rallying for three consecutive days, up 0.21%. The US crude oil benchmark is almost flat due to US jobs data that lifted UST bond yields above the 4% threshold that underpinned the greenback. However, upbeat data from China kept the black gold from printing losses. At the time of writing, WTI exchanges hands at $77.86 pb.

WTI’s advances on China’s demand and dovish remarks from Fed’s Bostic

China’s activity improved, as shown by Caixin Manufacturing, which rose for the first time in seven months. In the meantime, China’s imports of Russian oil are set to hit a record high in March, as its re-opening increased oil demand, hence the jump in prices.

WTI’s rally was capped in the early morning as the US Bureau of Labor Statistics (BLS) showed that unemployment claims were lower than expected, spurring speculations that the Federal Reserve (Fed) would raise rates above 5.50%

But comments from Atlanta’s Fed President Raphael Bostic, opening the door for the Fed pausing rates sometime this summer, kept WTIs from entering negative territory.

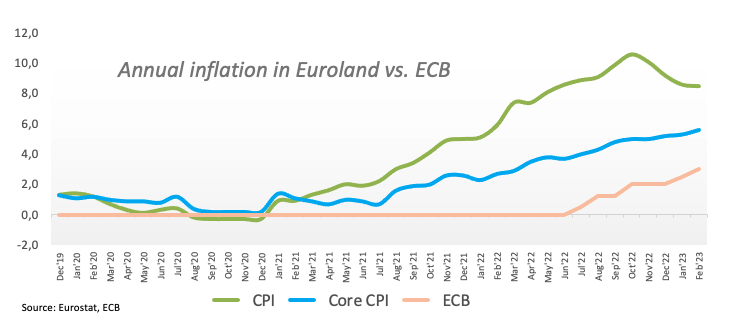

Investors’ worries dented sentiment in the European session, as inflation data for the Eurozone (EU) easied but remained almost four times higher than the 2.00% target imposed on the European Central Bank (ECB).

Fed and ECB to raise rates above initial estimates

Traders’ focus has turned to how high-interest rates in the US and Europe will get. Swaps markets are pricing that the Federal Reserve would peak at 5.5% in September, while other traders expect rates to hit 6%. On the ECB front, rates are expected to go as high as 4% or above.

WTI Technical levels

“The European Central Bank (ECB) could consider raising its key interest rate as high as 4% if underlying inflation in the euro zone remains persistently high,” said ECB Governing Council member Pierre Wunsch early Friday in Asia per Reuters.

“If the core inflation would remain at the level we see today in Europe of above 5%, and if we don't get clear signals that core inflation is going down, we will have to do more,” added the Belgian national bank Governor Wunsch in a news conference at the bank said Reuters.

ECB’s Wunsch also said, “For me, looking at rates of 4% would not be excluded but I want to insist I won't make any judgment on where the rates would have to go without seeing the developments of core inflation.”

EUR/USD grinds lower

Given the early hours of trading, the EUR/USD pair fails to react to the news and grinds near the 1.0600 mark. However, the bears seem to have run out of fuel of late.

Also read: EUR/USD pares weekly gains around 1.0600 as ECB, Fed officials back higher rates to tame inflation

- USD/CHF retreats from multi-day top as US Dollar bulls run out of steam.

- US Treasury bond yields underpin bullish bias by refreshing multi-day high, before easing from the latest peak.

- Mixed Fed talks, US data probe pair buyers as the key PMI figures loom.

USD/CHF remains sidelined around 0.9420 during early Friday, after retreating from the Year-To-Date (YTD) high before a few hours. That said, the Swiss currency pair rose to the three-month high the previous day amid broad-based US Dollar run-up but mixed comments from the Fed officials joined unimpressive US data to challenge the bulls afterward. Also challenging the quote could be the cautious mood ahead of the key US ISM Services PMI for February.

The comments from Federal Reserve Bank of Atlanta President Raphael Bostic challenged the market’s hawkish Federal Reserve (Fed) bias as the policymaker said the central bank could be in position to pause the current tightening cycle by mid to late summer. On the other hand, Boston Fed President Susan Collins said on Thursday that more rate hikes are required to bring inflation back in control. She added that the extent of interest rate hikes will be determined by incoming data.

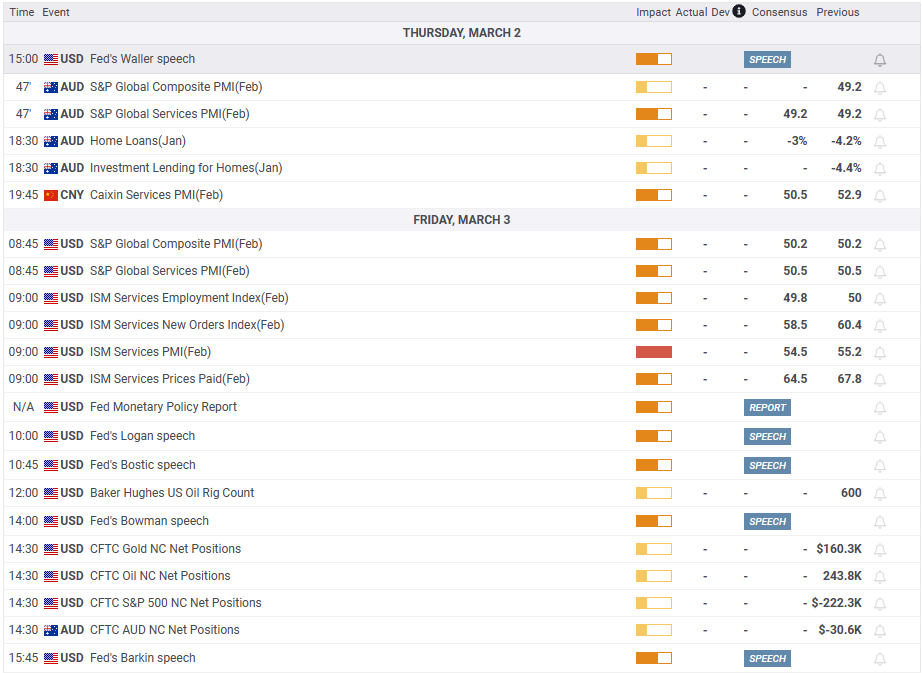

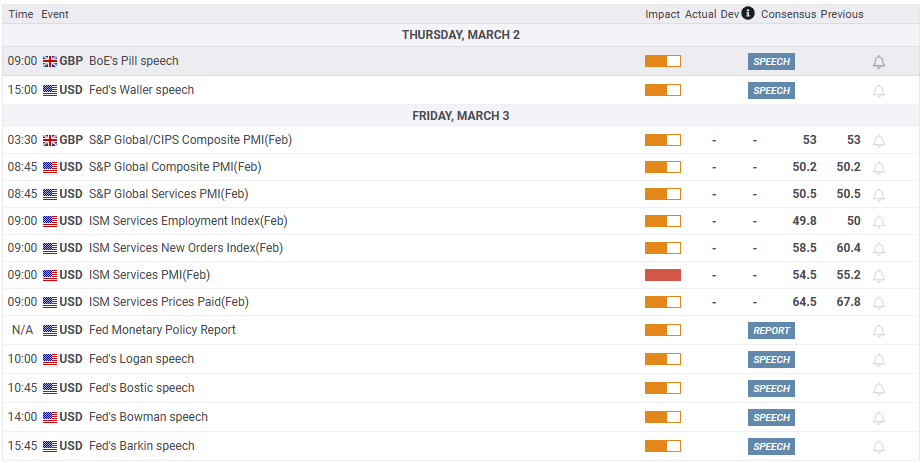

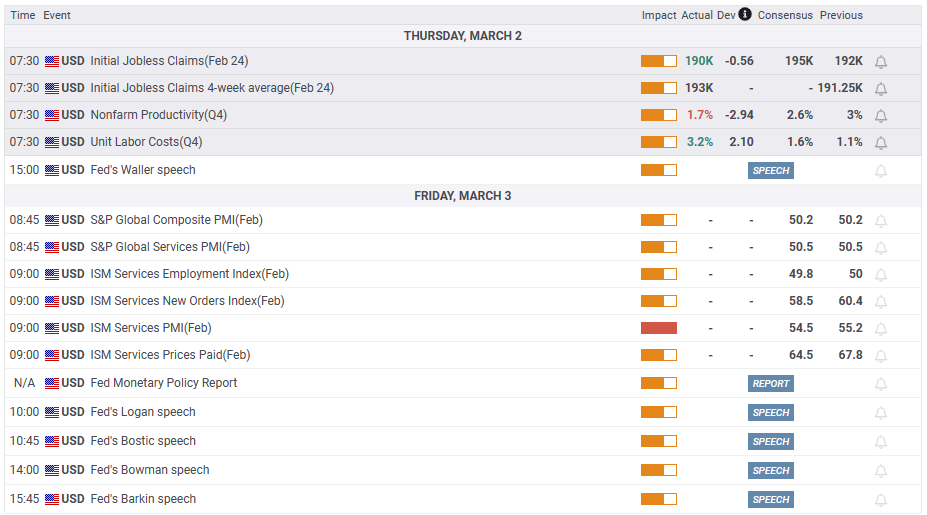

Talking about the US data, the US Jobless Claims dropped to 190K during the week ended on February 24 versus 195K market forecasts and 192K prior. Further, Nonfarm Productivity for the fourth quarter (Q4) eased to 1.7% from 3.0% prior and 2.6% market forecasts while the Unit Labor Costs jumped 3.6% versus 1.6% analysts’ estimations and 1.1% previous readings.

Elsewhere, the US-China tension at the Group of 20 Nations (G20) meeting, amid the former’s push for sanctions on countries having strong ties with Russia and aiding Moscow in war with Ukraine, previously probed the sentiment. However, the dovish Fed comments and chatters of the Sino-American trade talks seemed to have triggered a risk-on mood afterward.

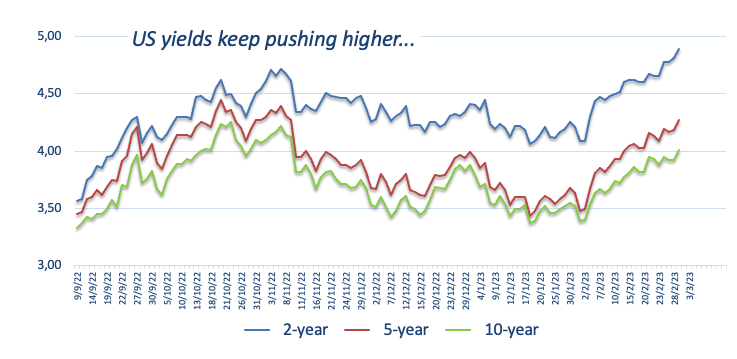

Amid these plays, Wall Street closed on the positive side, after a downbeat start, whereas the S&P 500 Futures printed mild losses by the press time. Further, US 10-year Treasury bond yields rose to a fresh high since early November 2022 while piercing the 4.0% threshold whereas the two-year counterpart rallied to the highest levels since 2007 to 4.94%. However, the bond coupons have retreated from their multi-month high of late.

Moving on, USD/CHF traders should pay attention to the US ISM Services PMI for February, expected 54.5 versus 55.2.

Also read: ISM Services PMI Preview: Strong figure set to catapult US Dollar to new highs

Technical analysis

As the higher high of the USD/CHF price fails to gain support from the higher high of the RSI (14) line, the Swiss currency pair’s further upside appears doubtful. Further, the 100-DMA hurdle surrounding 0.9435 adds to the upside filters for the pair traders to watch.

- Gold is trapped between hourly support and resistance.

- The bulls are relying on a move above $1,837 while bears seek a break below $1,831.

Gold price is holding in a bullish territory after climbing from the start of the week's low near $1,823 and reaching a high of $1,844. However, the yellow metal finished with a loss on Thursday, following three three-day winning streak, as strength in the U.S. dollar weighed. The US Dollar Index, DXY,a measure of the greenback's strength against a basket of rivals, gained 0.6% to 105.102

The greenback and bond yields rose on expectations of higher interest rates due to a series of unexpectedly robust economic reports that have hit the screens in recent weeks that may prompt a more hawkish response from the central bank. The data has been promoted Fed member Kashkari (voter) to review his prior dovish stance who said he is open to a 50bps hike at the March meeting. Still, he emphasized that the terminal rate is more important than the size of rate hikes.

Analysts at ANZ Bank said that the data is likely to keep pressure on the Fed to raising rates. ''A stronger USD and higher yields were also headwinds for investor demand of the precious metal.'' Indeed, the US rate futures have priced in a peak fed funds rate of 5.4% hitting in September. The market has all but priced out Federal Reserve rate cuts this year. The Federal Reserve sentiment is keeping the greenback in the hands of the bulls as marked price in the notion that the central bank will have to raise interest rates more than initially expected.

Gold technical analysis

As per the prior Gold price analysis, Gold price rallied as follows:

Gold prior analysis

The prior Gold price analysis said ''the double bottom near the $1,800 psychological Gold price level is offering a compelling case for a move towards the $1,830s, a touch above the January opening lows. However, a retest of the W-formation's neckline could be on the cards first.''

Gold price update

As illustrated, the Gold price burst higher after the correction and offered bulls an opportunity in late European and US markets to the target area. At this juncture, the correction has met prior resistance and is now trapped as follows:

- EUR/JPY has sensed a pause in its gradual decline below 145.00 ahead of Tokyo's Inflation.

- A surprise rise in Eurozone inflation has bolstered the case of more rates from the ECB.

- ECB Lagarde reiterated that a 50 bps rate hike for March is on the table as inflation is still too high.

The EUR/JPY pair is displaying a sideways auction in a range below 145.00 in the early Tokyo session. The cross declined on Thursday after failing to sustain above Tuesday’s high at around 145.50. The downside pressure in the Euro came after the release of the Eurozone Harmonized Index of Consumer Prices (HICP) data.

The preliminary Eurozone HICP (Feb) landed at 8.5%, surpassing the consensus of 8.2% but remaining lower than the prior release of 8.6%. Earlier this week, nations like Germany, Spain, and France reported their HICP figures well above the estimates and the former releases. This indicates that the Eurozone inflation is getting stubborn after some declining moves and more rates from the European Central Bank (ECB) are highly required to cool down the stick inflation.

ECB President Christine Lagarde reiterated on Thursday “The case for a 50 bps rate hike this month is still on the table as inflation is still too high.” She further added, “We have to use all tools at our disposal to bring inflation down and we don’t know the peak for rates yet.”

Analysts at Danske Bank expect ECB’s deposit rate to peak at 4%, after a 50 basis points interest rate hike, in both March and May followed by a 25bp hike in both June and July.

On the Tokyo front, investors are awaiting the release of the Tokyo Consumer Price Index (CPI) for fresh impetus. Tokyo’s headline Consumer Price Index (CPI) (Feb) is expected to decline to 4.1% from the prior release of 4.4%. The Japanese economy is struggling to accelerate domestic demand despite immense initiatives from Bank of Japan (BoJ) policymakers and the administration and an escalation in the price pressures is coming from rising import prices.

- GBP/JPY is about to finish the week almost flat.

- A multi-month downslope resistance trendline has held the GBP/JPY from re-testing YTD highs.

- GBP/JPY Price Analysis: Failure to crack 164.00 can pave the way for further downside.

The GBP/JPY was rejected around 163.90s, dropping towards the mid 163.00-164.00 range as the Asian Pacific session is about to begin. A risk-off impulse in the FX space spurred a flight to safe-haven peers, like the Japanese Yen (JPY). At the time of typing, the GBP/JPY exchanges hands at 163.30.

GBP/JPY Price Action

After peaking in the week around 166.00, the GBP/JPY lost traction and extended its losses below 164.00, but the bias is still neutral to upwards. The 20-day Exponential Moving Average (EMA) at 162.00 is aiming north, 16 pips shy of the 100-day EMA. Once cleared, the GBP/JPY could continue to aim higher, but it is facing solid resistance at a five-month-old downslope resistance trendline at around 164.00.

The GBP/JPY needs to crack the trendline for a bullish continuation. Achievement of that, the GBP/JPY next resistance would be the psychological 165.00 figure, followed by the YTD high at 166.00.

Conversely, the GBP/JPY first support would be an upslope trendline drawn from mid-February. A breach of the latter will expose the 100-day Exponential Moving Average (EMA) at 162.16, followed by the 20-day EMA at 162.00.

GBP/JPY Daily chart

GBP/JPY Technical levels

- USD/CAD holds lower ground as sellers attack bullish chart pattern.

- Bearish MACD signals, downbeat RSI hints at rejection of pennant formation but 50-SMA can test the bears.

- Multiple hurdles to the north challenge Loonie pair buyers.

USD/CAD bears flex muscles around 1.3590 amid the early Asian session on Friday, poking the lower line of a one-week-old bullish pennant.

That said, the Loonie pair’s multiple failures to stay beyond 1.3600, as well as the recent grinding near the highest levels since early January, suggest that the bulls are running out of steam. Additionally, the bearish MACD signals and the RSI (14) conditions suggesting the continuation of the latest weakness by staying around the neutral 50 level also signal further declines of the quote.

However, the 50-bar Simple Moving Average (SMA) level surrounding 1.3570 could test the USD/CAD pair sellers ahead of the late February swing low near 1.3515 and the 1.3500 round figure.

In a case where the quote breaks the 1.3500 threshold, the odds of its slump to the 1.3440-35 support zone can’t be ruled out. It should be noted that the 200-SMA joins multiple levels marked since mid-February to highlight the stated support area.

Meanwhile, recovery moves remain unimpressive unless the quote stays inside the bullish pennant, currently between 1.3595 and 1.3635.

Following that, the highs marked during late February and early January, respectively near 1.3665 and 1.3685 will precede the December 2022 peak of 1.3705 to check the USD/CAD pair’s upside momentum.

USD/CAD: Daily chart

Trend: Further downside expected

- GBP/USD pair has dropped to near weekly low around 1.1922 despite easing risk-off mood.

- Consideration of policy slowdown or a pause in the policy tightening spell by the BoE could push Sterling on the back foot.

- The Cable is hovering near the horizontal support of the Descending Triangle plotted from 1.1920.

The GBP/USD pair has dropped to near weekly low around 1.1922 in the early Asian session. The Cable is expected to be dumped by the market participants as the street is anticipating a pause or a deceleration in the pace of interest rate hiking by the Bank of England (BoE) despite the fact that the United Kingdom inflation is still trending in the double-digit figure.

Analysts at Commerzbank are of the view that “Bailey is not really committing very firmly to further strong tightening measures. In view of an inflation rate in double-digits, I would have hoped for more commitment toward rate hikes. But obviously, the BoE is not willing to inflict (further) harm on the economy and the population to get a grip of inflation.”

Meanwhile, the market sentiment looks positive as risk-sensitive assets like S&P500 has shown a decent recovery on Thursday. The US Dollar Index (DXY) is struggling to recapture the 105.00 resistance as the risk aversion theme is fading gradually.

GBP/USD is auctioning near the horizontal support of the Descending Triangle chart pattern plotted from February 17 low around 1.1920 on a four-hour scale. The downward-sloping trendline of the aforementioned chart pattern is placed from the February high at 1.2402.

The 100-period Exponential Moving Average (EMA) at 1.2060 will act as a major barricade for the Pound Sterling.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped below 40.00 from the 40.00-60.00 range, indicating that the bearish momentum could be triggered.

A confident break below February 17 low at 1.1915 will drag the Cable firmly towards January 5 low at 1.1875 followed by the round-level support at 1.1800.

On the contrary, a move above February 24 high at 1.2040 will drive the asset towards February 23 high around 1.2080. A breach of the latter will expose the asset to February 21 high of around 1.2140.

GBP/USD four-hour chart

- EUR/USD holds lower ground after falling the most on a day in one month.

- US data, ECB/Fed talks and EU figures all hint at higher rates to battle inflation woes.

- Light calendar, macro could restrict market moves ahead of US ISM Services PMI.

- Next week’s Fed Chair Powell’s testimony, US NFP are crucial.

EUR/USD treads water around 1.0600, after posting the biggest daily loss in a month, as traders await more clues amid the battle between the hawks of the European Central Bank (ECB) and the Federal Reserve (Fed). That said, the quote dropped heavily the previous day but couldn’t rule out the weekly gains amid the US Dollar’s limited capacity to win the bids, despite strong US Treasury bond yields and hawkish Fed commentary. With this, the Euro pair remains sidelined during the initial hour of Friday’s Asian session after pausing the bears around 1.0575 a few minutes back.

On Thursday, United States Treasury bond yields rallied multi-month high amid escalating fears of inflation and higher rates from major central banks, mainly from the Fed. The same allowed the US Dollar to post the biggest daily jump since early February. However, late Thursday’s comments from Federal Reserve Bank of Atlanta President Raphael Bostic joined the cautious mood ahead of the US ISM Services PMI for February to probe the greenback bulls afterward.

The benchmark US 10-year Treasury bond yields rose to a fresh high since early November 2022 while piercing the 4.0% threshold whereas the two-year counterpart rallied to the highest levels since 2007 to 4.94%. It should be noted that the strong yields initially weighed on the US equities but the comments from Fed’s Bostic allowed Wall Street to close on a positive side.

Fed’s Bostic said on Thursday that the central bank could be in position to pause the current tightening cycle by mid to late summer. On the other hand, Boston Fed President Susan Collins said on Thursday that more rate hikes are required to bring inflation back in control. She added that the extent of interest rate hikes will be determined by incoming data.

Other than the hawkish Fed, US data suggesting a tight labor market and higher wage costs also underpinned the inflation woes and helped the US Dollar to remain firm. On Thursday, US Jobless Claims dropped to 190K during the week ended on February 24 versus 195K market forecasts and 192K prior. Further, Nonfarm Productivity for the fourth quarter (Q4) eased to 1.7% from 3.0% prior and 2.6% market forecasts while the Unit Labor Costs jumped 3.6% versus 1.6% analysts’ estimations and 1.1% previous readings.

In the case of the Eurozone, the latest accounts of the ECB February policy meeting were published on Thursday and stated, “Governing Council members agreed that further increases in key rates are required for policy to enter restrictive territory,” reported Reuters.

On the same line, European Central Bank (ECB) President Christine Lagarde, said in an interview with Spanish TV on Thursday that the case for a 50 bps rate hike this month is still on the table as inflation is still too high.

Talking about the data, the annualized Eurozone Harmonised Index of Consumer Prices (HICP) came in a tad lower to 8.5% in February versus 8.6% prior and 8.2% market forecasts. However, the Core HICP grew 5.6% during the said month when compared to 5.3% analysts’ expectations and previous reading. The monthly figures were quite impressive as the headline HICP jumped by 0.8% in February vs. -0.3% expectations and -0.2% previous while the core HICP arrived at 0.8% last month as against the 0% expected and -0.8% registered in January.

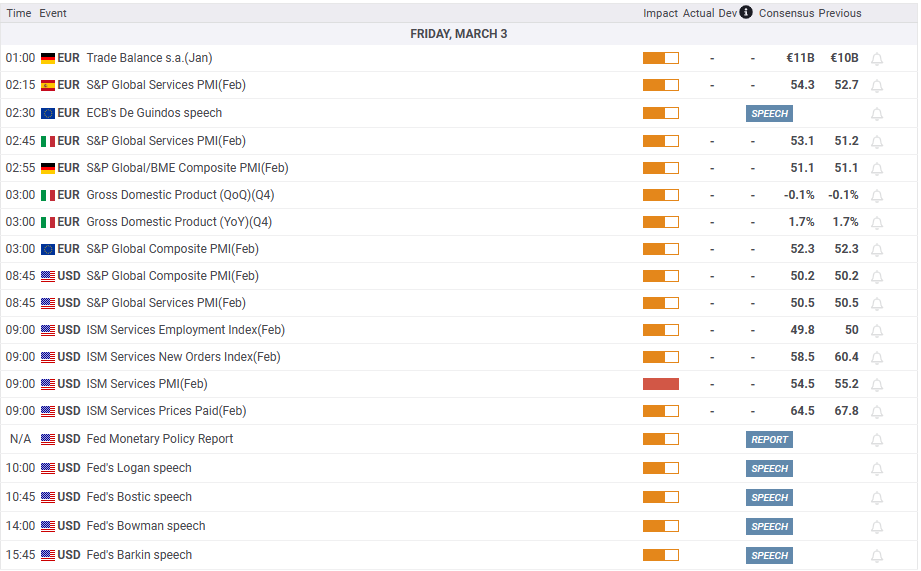

Looking ahead, EUR/USD traders should pay attention to the second-readings of the Eurozone and German activity numbers ahead of the US ISM Services PMI for February, expected 54.5 versus 55.2. It’s worth noting that the stated PMI allowed the US Dollar to rally the previous month after it gained support from the strong US Nonfarm Payrolls (NFP), up for publication in the next week.

Also read: ISM Services PMI Preview: Strong figure set to catapult US Dollar to new highs

Technical analysis

EUR/USD wobbles within a 130 pip trading range comprising a convergence of the 50-day and 21-day Exponential Moving Average (EMA), around 1.0660-65, as well as the 200-day EMA support surrounding 1.0535.

- NZD/USD has rebounded firmly from 0.6200 as investors’ risk appetite has improved.

- Investors are playing with the ‘value-buying’ concept and channelizing funds into some risk-sensitive assets.

- A surprise rise in the US New Orders Index will clear that the overall forward demand is in an expansionary mode.

The NZD/USD pair has sensed a buying interest near the round-level support of 0.6200 in the early Asian session. The Kiwi asset is looking to stretch its recovery above the immediate resistance of 0.6230 as the US Dollar Index (DXY) has witnessed a loss in the upside momentum. The upside in the Kiwi asset looks favored as the risk appetite of the market participants is improving.

Investors are ignoring the fact that the Federal Reserve (Fed) has no other option than to stretch interest rates further to bring down the persistent inflation. Therefore, the market participants are playing with the ‘value-buying’ concept and channelizing funds into some risk-sensitive assets. S&P500 futures have some a significant recovery in Thursday’s session, portraying a risk-on mood.

The USD Index has corrected marginally after failing to hit the critical resistance of 105.20. Also, it is struggling to sustain itself above the round-level support of 105.00. Meanwhile, the demand for US government bonds remained vulnerable on Thursday as investors see interest rates above 5% by the Fed sooner. This fueled the 10-year US Treasury yields to 4.06%.

After the release of the mixed United States ISM Manufacturing PMI, which showed that the production sector is constantly contracting but assured a stellar forward demand, investors are shifting their focus towards the US ISM Services PMI (Feb).

The economic data is seen lower at 54.5 from the former release of 55.2. The New Orders Index, which conveys the forward demand is expected to decline to 58.5 from the prior figure of 60.4. A surprise rise in the New Orders Index will clear that the overall forward demand is in an expansionary mode and could propel the Consumer Price Index (CPI) ahead.

Meanwhile, the New Zealand Dollar will display an action move over the release of the Caixin Services PMI (Feb) data. The economic data is likely to drop to 50.5 vs. the prior figure of 52.9. It is worth noting that New Zealand is one of the leading trading partners of China and a decline in the Services PMI might impact the New Zealand Dollar ahead.

- Silver is pressed up against a daily dynamic trendline resistance.

- Bulls rely on hourly structure to push higher.

Silver is down some 0.4% and topping out in the final part of the US session after a move up from today's lows of $20.674. The precious metal made a high of $21.015 while traders balance the risks associated with the Federal Reserve's interest rate policy and sentiment.

Meanwhile, from a technical outlook, the white metal is up against major resistance as the following illustrates:

The daily charts see the metal pressed up against a daily dynamic trendline resistance as the price corrects after breaching the horizontal structure. If the bears commit around here, there will be prospects of a downside continuation:

As per the hourly chart below, however, the price has broken up and there are prospects of a near term bullish continuation:

- AUD/USD fell from 0.6760s as US Treasury bond yields exploded.

- US jobless claims continued their downtrend, printing figures below estimates.

- What to watch? Australia’s PMIs, US Services PMIs, and Fed speakers.

AUD/USD found resistance at around 0.6760, dropping almost 0.40% on Thursday after solid economic data from the United States (US) was released. A tight labor market, and last week’s higher inflation figures in the US, suggest that the US Federal Reserve (Fed) still has ways to go to curb inflation. The AUD/USD exchanges hands at around 0.6730s.

AUD/USD to finish Thursday’s session with losses

Wall Street Is set to close with solid gains in Thursday’s session. Nevertheless, in the FX space, risk-perceived currencies, like the Australian Dollar (AUD), took their toll on higher US Treasury bond yields, with 2s, 5s, and 10s, staying above the 4.08% threshold. Consequently, the US Dollar rose, as shown by the US Dollar Index (DXY), up 0.57%, at 104.965.

The US docket revealed that Initial Jobless Claims for the week ending February 25 came at 190,000 below the 195,000 estimated by analysts. Following the release, US Treasury bond yields skyrocketed above the 4% mark, with 2s reaching as high as 4.90%, while the DXY hit a daily high of 105.180.

The AUD/USD edged lower and hit a daily low of 0.6706; sellers failed to extend its fall below the R1 daily pivot point at around 0.6707. nevertheless, the AUD/USD recovered some ground, on Atlanta’s Fed President Raphael Bostic saying that the Fed could be in a position to pause by mid-late summer.

Bostic added that he foresees the Federal Funds Rate (FFR) to peak at around 5.00% - 5.25% and reiterated that it will stay there “well into 2024.”

What to Watch?

The docket will feature the S&P Global Services PMI on the Australian front, while China’s data with the Caixin Services PMI will also influence the Aussie Dollar (AUD). On the US front, Fed speakers would cross newswires alongside the release of the ISM and S&P Global Services PMIs.

AUD/USD Technical levels

What you need to take care of on Friday, March 3:

The US Dollar erased recent losses and strengthened on the back of US economic data and higher US yields. The greenback held onto gains even amid a late rally in Wall Street. US yields hit fresh highs, with the 30-year rising above 4% and the 2-year at fresh multi-year highs above 4.90%. The DXY rose more than 0.50%, stabilizing around 105.00.

Initial Jobless Claims declined to 190K and Unit Labor Cost for Q4 were revised higher from 1.6% to 3.2%. The figures contribute to the expectation about a more restrictive monetary policy than previously thought by showing extended tightness in the labor market. On Friday, Service sector data is due.

US February ISM Services PMI Preview: Will it influence Fed rate hike bets?

US stocks finished higher after a late rally that started following comments from Federal Reserve’s Bostic mentioning that the central bank “could be in a position to pause by mid to late summer.” On Wednesday the currency market reflected more optimism than equities; that changed on Thursday with currencies reacting only marginally to the rally in Wall Street as majors remained in a small range.

The EUR/USD erased recent gains and pulled back to 1.0570 and EUR/GBP consolidated around 0.8670. Eurozone inflation figures confirmed previous data having no impact on the Euro.

USD/JPY hit levels above the critical 137.00 zone, reaching the highest level in two months, supported by higher yields but it then pulled back. Inflation data for Japan is due.

GBP/USD dropped to test weekly lows at 1.1920, a zone that has become a key short-term support; it then rebounded to 1.1950 after the US Dollar weakened on risk appetite.

The Kiwi pulled back on Thursday but still remains among the top performers of the week. NZD/USD found support at 0.6200 and remains on its way to end a four-week streak of weekly losses. On a quiet session, USD/CAD moved sideways around 1.3600 while AUD/USD lost ground modestly, approaching the 0.6700 critical support.

An unusual steady session for gold that finished flat below $1,840/oz. Bitcoin held above $23,100 and late in the American session rose above $23,500.

Like this article? Help us with some feedback by answering this survey:

The European Central Bank (ECB) will have its next board meeting on March 16. Analysts at Danske Bank expect the central bank’s deposit rate to peak at 4%, after a 50 basis points interest rate hike, in both March and May followed by a 25bp hike in both June and July.

FX reaction depends on the growth backdrop

“We adjust our expectations for the policy path from ECB and now expect a policy peak rate of 4% (deposit rate), with hikes of 50bp in March, 50bp in May, 25bp in June and 25bp in July. We naturally remain data dependent and may adjust the call at a later stage, but for now we see the risks around our baseline rate hike expectations as broadly balanced. Our revision comes on the back of more resilient economic activity and more ‘sticky’ underlying inflation developments.”

“To the extent markets begin to shift focus from an improved short-term outlook to the price of growth to be paid further out, then EUR/USD is likely to follow back sharply again. We maintain a 6M target on EUR/USD of 1.02 while we acknowledge some topside risk to our 1M projection of 1.06.”

Analysts at MUFG Bank see the Indian rupee starting a recovery during the second quarter. They forecast the USD/INR pair at 83.00 by the end of the first quarter and at 80.50 by the third quarter.

Key Quotes:

“The rupee tracked losses of Asian currencies amid a stronger US dollar fuelled by expectations of more Fed rate hikes, but its decline was milder compared to regional peers, thanks to improving macroeconomic numbers. India’s trade deficit narrowed (more than expected) to USD17.75 billion in January from a deficit of USD23.77 billion in December. Also, lower crude oil prices offered some support the INR as well.”

“Heading into March, we continue to expect a play of the theme of Fed policy in near term and so the headwinds remain for INR. On the fundamental basis, India’s GDP growth in the October-December quarter is expected to slow from 6.3%yoy in the prior quarter amid weakening demand, adding further selling pressure to the currency. We expect USD/INR to rise to 83.00 by end-Q1. INR will receive some boost in the period between Q2 and Q4 due to a weakening US dollar and India’s relative better economic performance.”

Federal Reserve Bank of Atlanta President Raphael Bostic said on Thursday that the central bank could be in position to pause the current tightening cycle by mid to late summer. He favors a 25 basis points rate hike in March but warned they are “watching” incoming data, that shows high inflation and a strong labor market. He will adjust the rate outlook if data comes in stronger.

According to him, risks are now roughly balanced. He added that a debate is underway at the Fed about how much influence is having the current tightening in the economy. Despite “some attenuation” of inflation, the Fed must remain resolute in controlling inflation. There is still a “long way to go”.

Bostic mentioned that businesses say they are expecting a slowdown in the pace of wage increases but they still plan to hire more workers.

Regarding chances to monetary policy, Bostic argued that slow and steady modifications should reduce the risk of “hard” outcomes. He said it is appropriate to be cautious so the Fed does enough to control inflation, doing no more than what they need to.

Market reaction

Stocks in the US moved higher following Bostic’s comments and the US Dollar pulled back modestly. The Dow Jones is up by 0.85% and the Nasdaq gains 0.32%. The DXY is off highs, hovering around 105.00, consolidating a daily gain of around 0.55%.

- EUR/USD tumbles below 1.0600 as US T-bond yields stay above 4%.

- US employment data reiterated the tightness of the labor market, warranting further Fed action.

- EUR/USD Price Analysis: Neutral biased, though approaches the 100 and 200-DMAs.

The EUR/USD loses traction in the mid-North American session and trades below its opening price by 0.83%, below the 1.0600 mark. Reasons like unemployment claims in the United States (US) easing triggered investors’ reaction, that perhaps their inflation view is wrong, sending US bond yield skyrocketing. Hence, the US Dollar (USD) strengthened to the Euro (EUR) detriment. At the time of writing, the EUR/USD trades at 1.0575.

The US Department of Labor (DoL), revealed that the number of people who filed for unemployment benefits for the first time in the week ending on February 25 was 190K, which was lower than the 195K predicted by experts. The market reacted negatively, sending US Treasury bond yields above the 4% threshold and underpinning the US Dollar.

The EUR/USD tumbled below 1.0600 on the initial reaction following US Initial Jobless Claims data, while the US Dollar rallied. At the time of typing, the US Dollar Index (DXY), a measure of the buck’s value vs. a basket of six currencies, advances 0.73%, at 105.141.

On the Euroarea inflationary figures were unveiled. The Harmonised Index of Consumer Prices (HICP), rose 8.5% YoY, above the previous month’s 8.6%. However, the reading missed the market expectations of 8.2%. Excluding volatile items, the so-called core inflation, on its annual reading, printed at 5.6%, higher than the previous and expected 5.3%.

Even though figures were higher than expected, investors had already priced in a 50 bps rate hike by the European Central Bank (ECB) as announced by its President Christine Lagarde in its last meeting presser. However, recent data have ECB policymakers split on what signal the bank should send to the markets.

Meanwhile, the Federal Reserve (Fed) and the ECB are expected to raise rates. The former would likely hike 25 bps, as shown by money market futures, but further data to be revealed ahead of March’s meeting could put into discussion a 50 bps rate hike. On the European side, the ECB is leaning toward 50 bps, though recent data could open the door for higher rates.

EUR/USD Technical analysis

After rallying toward the weekly high of 1.0691, the EUR/USD plunges, erasing almost its Wednesday gains. The EUR/USD clashed with the 20 and 50-day Exponential Moving Averages (EMAs) at 1.0664 and 1.0657, respectively, and has reached a daily low of 1.0576. Albeit the EUR/USD pair turned south, its bias remains neutral, but a daily close below 1.0600 could pave the way for further downside.

Therefore, the EUR/USD first support would be the March 2 daily low of 1.0576. Break below, and the 100-day EMA at 1.0550 would be tested by sellers ahead of falling to the 200-day EMA at 1.0533. Conversely, the EUR/USD first resistance would be the psychological 1.0600 figure. Once conquered, the Euro could appreciate toward the confluence of the 50/20-day EMA at 1.0657/1.0665, followed by a test of 1.0700.

What to watch?

- USD/CHF advances due to higher US Treasury bond yields and a strong US Dollar.

- Bulls are eyeing a test of the 200-day EMA around 0.9452.

- USD/CHF Price Analysis: Neutral upwards and will be cemented by a daily close above 0.9400.

The USD/CHF staged ar recovery and reached a new year-to-date high at 0.9439 in the mid-North American session. A solid US jobs report triggered a US bond sell-off; consequently, UST bond yields are skyrocketing and are boosting the US Dollar (USD). The USD/CHF is trading at 0.9428, eyeing a break of a range above the February 27 daily high at 0.9429.

USD/CHF Price action

Technically speaking, the USD/CHF is neutral biased, though the break of the psychological 0.9400 could open the door for further gains. Above the current exchange rate sits the 200-day Exponential Moving Average (EMA) at 0.9452, seen as a reference to the bullish/bearishness of an asset. If the USD/CHF breaks the latter, the bias will shift to neutral-upwards. Unless the USD/CHF cracks the next resistance area at 0.9547, the November 30 high, the neutral-upwards tendency would be weak. Once the USD/CHAF pair snaps 0.9547, the major could rally toward the November 21 high at 0.9598.

Readings in oscillators support the bias change, with the Relative Strength Index (RSI) aiming higher and the Rate of Change (RoC). Therefore, the USD/CHF bias is neutral-upward.

On the other hand, failure to hold to gains above 0.9400 would exacerbate the USD/CHF fall to the 100-day EMA at 0.9386 before testing the January 24 high turned support at 0.9360.

USD/CHF Daily chart

USD/CHF Technical levels

- GBP/USD falls courtesy of US Dollar strength, as UST bond yields pushed above 4%.

- US Initial Jobless Claims continued to trend lower, below expectations.

- GBP/USD Price Analysis: Downward biased, though facing solid support around the 1.1900-1.1915 area.

The GBP/USD retraces back below the 1.2000 figure after US economic data warranted further tightening by the US Federal Reserve (Fed), as reflected by the US Treasury bond yields reaction. At the time of typing, the GBP/USD exchanges hand at 1.1950, below its opening price by 0.66%.

GBP/USD tumbled below 1.2000 as UST bond yields skyrocketed, lifting the US Dollar

On Thursday, the US Department of Labor (DoL) announced that Initial Jobless Claims for the week ending on February 25 were lower than the 195K predicted by analysts, coming in at 190K. The 4-week moving average, which helps to even out fluctuations from week to week, was at 193K and showed a slight increase from the previous week’s average of 191K. The GBP/USD extended its losses on the headline and printed a fresh daily low of 1.1924 before reversing its course.

In the meantime, US Treasury bond yields begin to reflect higher rates, with investors lifting US Treasury bond yields, with 2s, 3s, 5s, and 10s, above the 4% threshold. Consequently, the US Dollar is rising 0.57%, as shown by the US Dollar Index, at 104.971.

The Fed parade continued with Minnesota’s Fed President Neil Kashkari commenting that rates need to be raised to around 5.4%. On the contrary, Atlanta’s Fed President Raphael Bostic added that he projects the Federal Fund Rates (FFR) to peak at the 5.0% - 5.25% range. And reiterated that it will stay there “well into 2024.”

The lack of UK economic data keeps the GBP/USD pair leaning on the dynamics of the US Dollar and the Bank of England (BoE) Chief economist Huw Pill. Pill commented that economic activity in the UK may be stronger than projected and that inflation risks are skewed to the upside.

GBP/USD Technical analysis

Even though the GBP/USD edged lower, it’s facing a critical support area, with a four-month-old support trendline and the February low at 1.1914. A decisive break of the latter would expose the 1.1900 figure, which, once broken, the GBP/USD could fall to the YTD low at 1.1841. As an alternate scenario, the GBP/USD reclaiming the 1.2000 figure would expose the 20-day Exponential Moving Average (EMA) at 1.2064.

What to watch?

Federal Reserve Bank of Boston President Susan Collins said on Thursday that more rate hikes are required to bring inflation back in control. She added that the extent of interest rate hikes will be determined by incoming data.

Collins’ comments were no surprise as she repeated what has been saying in February. Later on Thursday, Fed Governor Christopher Waller will speak on the economic outlook and Minneapolis Fed President Neel Kashkari will participate in an event on “Race, Justice and the Economy".

2023 will be the beginning of the end for USD strength. Thus, strategists at Société Générale believe that Gold exposure is set to provide great returns.

Fixed income to do better than equities

“Gold can offer protection against systemic risk.”

“Continue rebalancing away from the USD. Gold will be a powerful protection against a falling USD.”

“2023 will be the year of several pivots, and overall, we expect higher returns than in 2022.”

“We see fixed income (both sovereign and credit) doing better than equities.”

After a positive January, the Australian Dollar turned lower in February and wiped out all the gains for the year. Economists at MUFG Bank expect the AUD/USD pair to recover in the second half of the year.

Further downside for AUD/USD over the short-term

“With the Fed rhetoric so hawkish we suspect over the short-term, we can see further downside for AUD/USD.”

“China data will be important in March covering Jan/Feb and we may well see evidence of pent-up demand post re-opening that may help limit AUD downside.”

“China commodity-related demand and the scope for the Fed to pause at some point in Q2 should add to a renewed upturn in demand for AUD in H2 this year.”

"Survey indicators that have become available since the publication of the forecast have surprised to the upside, suggesting that the current momentum in economic activity may be slightly stronger than anticipated," Bank of England Chief Economist Huw Pill said on Thursday, per Reuters.

Pill further noted that some high-frequency indicators of wages have fallen quite sharply recently but acknowledged that the latest data for private sector regular pay growth surprised slightly to the upside.

Market reaction

These comments failed to help Pound Sterling find demand. As of writing, GBP/USD was down 0.9% on the day at 1.1925.

- Upbeat labor market data boosted the US Dollar.

- The Federal Reserve pressured to deliver after solid US data warrants further tightening.

- USD/CAD headed upwards due to interest rate differentials between the Fed and the BoC.

The USD/CAD stages a comeback after losing 0.41% on Wednesday and rises above 1.3600 courtesy of broad US Dollar (USD) strength, sponsored by higher UST bond yields. Data from the United States (US) reinforced the economy is solid, particularly the labor market. Therefore, the USD/CAD advances 0.24% and trades at around 1.3600s after hitting a low of 1.3582.

USD/CAD pierces 1.3600 as US jobless claims edge down

On Thursday, the US Department of Labor (DoL) revealed that Initial Jobless Claims for the week ending February 25 came at 190K below the 195K foreseen by analysts. The 4-week moving average, which smooths volatile movement from week to week, stood at 193K and climbed from last week’s 191K. The USD/CAD rose and printed a daily high of 1.3641 before settling at current levels.

Since then, the US !0-year Treasury bond yield skyrocketed above the 4% threshold, at the time of writing, stands at 4.056%, gains six basis points, and underpins the greenback. The US Dollar Index (DXY), a gauge of the buck’s value vs. a basket of six currencies, gains 0.55% at 104.944.

On Wednesday, Federal Reserve officials continued their hawkish rhetoric after last week’s data disappointed investors hopeful of witnessing lower inflation readings. Minnesota Fed President Neil Kashkari commented that he is inclined “to push up my policy path” and foresees the Federal Fund Rate (FFR) to peak at around 5.4%. Echoing some of his comments was Atlanta’s Fed President Raphael Bostic though he was moderate, projects the FFR to peak at 5.0% - 5.25% but emphasized that it will stay there “well into 2024.”

On the Canadian front, traders should be aware that the Bank of Canada (BoC) lifted rates 25 bps to 4.50% on January 25 and commented that it would pause hiking rates. Therefore, that would keep the Loone (CAD) pressured as interest rate differentials between the Fed and the BoC would increase flows to the US Dollar. Given the backdrop, the USD/CAD path of least resistance is upwards.

The USD/CAD rally was capped by high oil prices, as WTI extended its rally to three days, with investors assessing China’s oil demand once it completes its reopening.

USD/CAD Technical analysis

Technically speaking, the USD/CAD is still upward biased, but it has consolidated during the week. If the USD/CAD pair stays around 13600.1.3660, that could lead to desperate bulls, which need to reclaim the YTD high of 1.3685, on its way to 1.3700 and beyond. On the other hand, a break below 1.3600 could exacerbate a correction toward the 20-day Exponential Moving Average (EMA) at 1.3507.

What to watch?

- US yields keep rising after a fresh round of US economic data.

- Japanese Yen continues to be among the weakest currencies.

- USD/JPY with a bullish bias, testing 100 and 200-day SMAs.

The USD/JPY jumped to 137.08 following the release of US economic data on Thursday, reaching the highest level since December 20. The pair failed to hold above 137.00 and is hovering around 136.60.

The same new story

Data released on Thursday showed Initial Jobless Claims for the week ended February 24 dropped to 190K, better than the 195K of market consensus. Non-farm productivity during the fourth quarter was revised lower from 3% to 1.7% while Unit Labor Costs were revised from 1.1% to 3.2%. Federal Reserve Governor Christopher Waller and Minneapolis Fed President Neel Kashkari will speak later on Thursday.

US economic figures add to the new scenario of a tight labor market and persistent inflation. The context adds pressure to the Fed and increases expectations of higher interest rates for longer. As a response, US yields moved further north. The 10-year US yield hit 4.08%, the highest since November, and the 2-year hit 4.93%, the highest since 2007.

The Japanese Yen is the worst performer over the last five days across the G10 space, followed closely by the Australian Dollar. Higher bond yields across the globe as inflation shows signs of persistence are weighing on the Yen. On Thursday is having a mixed performance amid a deterioration in market sentiment.

A critical area ahead for USD/JPY bulls

The USD/JPY faces a strong resistance area around 137.00, the confluence of a round number, and the 100 and 200-days Simple Moving Averages. A daily close above would open the doors to more gains toward the next relevant area at 138.00/10 (November highs).

The momentum favors the US Dollar, particularly after the quick rebound on Wednesday from 135.25. However, a failure to make a run above 137.00 over the next sessions would increase the odds of a bearish correction.

USD/JPY daily chart

Technical levels

- EUR/USD comes under heavy pressure and breaches 1.0600.

- Extra losses seem in place while below the 55-day SMA at 1.0713.

EUR/USD quickly fades the Wednesday’s uptick and returns to the sub-1.0600 region on Thursday.

While below the temporary up barrier at the 55-day SMA, today at 1.0713, the pair remains vulnerable to further losses. Against that, another visit to the February low at 1.0532 (February 27) should not be ruled out.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0327.

EUR/USD daily chart

Signs of political instability and a correction in implied rates point towards a correction in recent GBP gains. Nonetheless, analysts at CIBC Capital Markets look for an appreciation in the medium-term.

Sterling under pressure in the near-term

“Beyond the improved macro dynamics, including signs of a moderation in inflationary influences, easing pressure on UK terminal rate expectations, underlying political uncertainty remains a residual GBP risk parameter.”

“Political uncertainties notwithstanding after a period of looking to sell GBP/USD rallies improving macro fundamentals, including a reduction in inflationary concerns, moderating fears of BoE overtightening, favours increasing consideration of GBP/USD looking to retest early 2023 highs, north of 1.24, into Q2.”

UOB Group’s Economist Ho Woei Chen assesses the latest release of the Chinese PMIs.

Key Takeaways

“China’s manufacturing and non-manufacturing PMIs jumped in Feb to suggest that the economic recovery momentum was more robust than expected. The corresponding rebound in the Caixin China manufacturing PMI to 51.6 (Bloomberg est: 50.7; Jan: 49.2) lends further credence to the positive outlook for the manufacturing sector.”

“The leading indicators temporarily dispel market’s worries that the rebound since China’s dismantling of its zero-Covid policy will not be able to sustain due to the downturn in global demand and persistent weak confidence in the domestic real estate market. There are also early indications that gains from the reopening of China’s economy are filtering down to employment and firms’ pricing powers.”

“We retain our cautiously optimistic outlook for China’s GDP growth at 5.2% this year and continue to watch for China’s consumption recovery, the domestic real estate market as well as the extent of slowdown in global demand. A stable Covid situation, stronger fiscal and monetary policy support at the upcoming National People’s Congress (NPC) will also boost the outlook for China this year.”

- DXY picks up strong pace and surpasses the 105.00 hurdle.

- Next on the upside comes the 2023 high near 105.30.

DXY resumes the weekly upside and reclaims the 105.00 mark and above, rapidly leaving behind Wednesday’s marked pullback.

Immediately to the upside for the dollar appears the February peak at 105.35 (February 27). The surpass of this level should pave the way for the continuation of the multi-week uptrend to challenge the 2023 top at 105.63 (January 6).

In the longer run, while below the 200-day SMA at 106.52, the outlook for the index remains negative.

DXY daily chart

The dominant driver of the FX market has recently switched to interest rates from risk appetite. Against this backdrop, USD strength looks toppish over the near term, in the view of economists at HSBC.

Near-term asymmetric downside

“While we think that the USD is likely to be range-bound, we see the balance of risks as skewed to the downside over the next few weeks.”

“As the market focus now seems to be on interest rates, rather than risk appetite, any further upside US data surprises would see a stronger USD. The employment report will be on 10 March and CPI on 14 March (the latter during the Fed’s blackout period); however, given the recent USD rally and hawkish rate expectations, there is likely an asymmetric downside to any dovish surprise.”

The Brazilian Real has been steady against the Dollar. However, the USD/BRL is set to move higher as politicians may increase their pressure on the Brazilian central bank, economists at ING report.

When politics and central banking collide

“Politicians are keen for the central bank to start cutting interest rates. However, in its most recent update, the central bank has warned about long-run inflation expectations increasingly moving away from target – clearly at odds with calls for rate cuts.”

“With core rates so high, we doubt investors will have too much patience for this kind of friction and we would favour further under-performance of the Real.”

“Were the politicians to increase their pressure on the Brazilian central bank – then USD/BRL could trade up to 5.40.”

In February, the Euro weakened further versus the US Dollar moving from 1.0866 to 1.0612. Economists at MUFG Bank expect the world’s most popular currency pair to move back higher later in the year.

ECB is set to be on hold for longer than the Fed

“As we had expected, the US Dollar has rebounded and EUR/USD is set to fall modestly further from here as inflation risks turn higher again. However, despite the substantial jump in US yields, spreads with Europe have moved only modestly and in general, EUR/USD is trading at an appropriate level based on historic spreads.”

“The end of negative rates in the Eurozone and the scope for Eurozone equity outperformance relative to the US point to the potential for EUR/USD to grind higher later this year. The ECB is set to be on hold for longer than the Fed.”

“EUR/USD – Q1 2023 1.0500 Q2 2023 1.0800 Q3 2023 1.1000 Q4 2023 1.1200”

Economist at UOB Group Lee Sue Ann comments on the latest GDP and inflation results in Australia.

Key Takeaways

“The Australian economy grew 0.5% q/q in 4Q22, below expectations of 0.8% q/q, and below the revised 0.7% q/q print in 3Q22. From a year earlier, the economy expanded by 2.7% y/y, within expectations, but much lower from 3Q22’s reading of 5.9% y/y. The latest GDP prints is in line with our view of growth turning softer as high inflation and interest rates weigh on households alongside a slowdown in global growth. We see Australia’s GDP growth slowing this year to 1.7% from 3.7% in 2022.”

“Meanwhile, monthly CPI rose 7.4% y/y in Jan, down from 8.4% y/y in Dec. The latest reading, however, is the second highest annual increase since the start of the monthly CPI indicator series in Sep 2018, signifying ongoing high inflation. That said, inflation seems to have peaked in 4Q22, in line with our view. Our full-year 2023 inflation forecast of 4.8% remains unchanged.”

“All in all, the Reserve Bank of Australia (RBA) has raised the cash rate by 325bps since May 2022, and in Feb, stated that its priority is to return inflation to target, and that further increases in interest rates will be needed over the months ahead. We are keeping our view of two more 25bps hikes in Mar and Apr, which will take the OCR to 3.85%.”

- GBP/USD meets with aggressive supply on Thursday and dives back closer to the weekly low.

- The setup favours bears and supports prospects for an eventual break below the 200 DMA.

- A sustained move beyond the 50-day SMA is needed to negate the near-term bearish outlook.

The GBP/USD pair comes under intense selling pressure on Thursday and extends its intraday downward trajectory heading into the North American session. The pair is currently placed below the mid-1.1900s, down over 0.60% for the day, and remains well within the striking distance of the weekly low touched on Monday.

Looking at the broader picture, the GBP/USD pair is trading just above a technically significant 200-day Simple Moving Average (SMA) support, currently pegged around the 1.1920-1.1915 region. The said area coincides with the lower end of a short-term trading range witnessed over the past two weeks or so, which constitutes the formation of a rectangle on the daily chart.

Given that oscillators on the daily have just started gaining negative traction, a convincing break below a technically significant SMA will be seen as a fresh trigger for bearish traders. The GBP/USD could then slide towards retesting the YTD low, around the 1.1840 area set in January, which if broken will complete a bearish double-top pattern formed near the 1.2445-1.2450 region.

On the flip side, attempted recovery moves might now confront stiff resistance near the 1.2000 psychological mark ahead of the daily swing high, around the 1.2035 region and the 1.2065-1.2070 supply zone. Any subsequent move-up could attract fresh sellers near the 1.2100 mark and remain capped near the 50-day SMA strong barrier, currently around the 1.2135-1.2140 area.

Some follow-through buying has the potential to lift the GBP/USD pair towards the 1.2200 round-figure mark en route to the February 14 swing high, around the 1.2265-1.2270 region. A sustained strength beyond the latter will suggest that the slide from the 1.2445-1.2450 supply zone has run its course and shift the near-term bias back in favour of bullish traders.

GBP/USD daily chart

Key levels to watch

- EUR/JPY comes under pressure after hitting new yearly peaks.

- The continuation of the uptrend should revisit the December 2022 top.

EUR/JPY deflates from earlier YTD highs in the 145.50 region on Thursday.

The continuation of the current upside momentum faces the immediate hurdle at the 2023 high at 145.56 (March 2). Once this level is cleared, the par could then challenge the December 2022 top at 146.72 (December 15) ahead of the 2022 high at 148.40 (October 21 2022).

In the meantime, while above the 200-day SMA, today at 141.59, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

The Mexican Peso has seen a total return of 9.7% vs. the US Dollar this year. Economists at Société Générale believe that the USD/MXN pair could break below the 18.00 level.

50-DMA at 18.85/19.00 is expected to cap

“USD/MXN rallied yesterday to 18.07 and a test of 18.00 could follow for the first time since April 2018.”

“Daily MACD is within deep negative territory denoting an overstretched move. An initial rebound is not ruled out however 50-DMA at 18.85/19.00 is expected to cap. Holding below this hurdle, there is a risk of continuation in the decline.”

“Next potential support zone is at 17.90/17.60, the 50% retracement of the whole 2008-2020 uptrend.”

- Unit Labor Costs in the US increased at a stronger pace than expected in Q4.

- US Dollar Index posts strong daily gains above 105.00 after the data.

"Unit labor costs in the nonfarm business sector increased 3.2% in the fourth quarter of 2022, reflecting a 4.9% increase in hourly compensation and a 1.7% increase in productivity," the US Bureau of Labor Statistics (BLS) reported on Thursday. This reading came much higher than the market expectation for an increase of 1.6%.

"Unit labor costs increased 6.3% over the last four quarters," the BLS further noted in its publication and said that nonfarm business sector labor productivity increased 1.7% in the fourth quarter of 2022.

Market reaction

The US Dollar gathered strength after this data and the US Dollar Index was last seen rising 0.66% on the day at 105.07.

- Initial Jobless Claims in the US decreased by 2,000 in the week ending February 25.

- US Dollar Index clings to strong daily gains near 105.00.

There were 190,000 initial jobless claims in the week ending February 25, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 192,000 and came in slightly better than the market expectation of 195,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 1.1% and the 4-week moving average was 193,000, an increase of 1,750 from the previous week's unrevised average.

"The advance number for seasonally adjusted insured unemployment during the week ending February 18 was 1,655,000, a decrease of 5,000 from the previous week's revised level," the DOL noted.

Market reaction

The US Dollar continues to outperform its major rivals after this report and the US Dollar Index was last seen rising 0.65% on the day at 105.05.

Economists at HSBC analyze the USD/JPY outlook. The pair is expected to move downward in the medium-term.

USD/JPY driven by US developments for now

“We remain bullish on the JPY over the medium-term, but suspect some patience will be needed for the currency to enjoy some independent strength courtesy of the Bank of Japan (BoJ).”

“For now, USD/JPY will likely remain driven by US developments where we see the balance of risks skewed to USD weakness.”

See: USD/JPY set to test the 120 level into year-end – CIBC

- NZD/USD meets with a fresh supply and snaps a three-day winning streak to a nearly two-week high.

- Hawkish Fed expectations continue to push the US bond yields higher and revive the USD demand.

- Looming recession risks further benefit the safe-haven buck and weigh on the risk-sensitive Kiwi.

The NZD/USD pair comes under some renewed selling pressure on Thursday and stalls this week's goodish rebound from the 0.6130 area, or its lowest level since November 23. The pair maintains its offered tone around the 0.6220-0.6215 region heading into the North American session and for now, seems to have snapped a three-day winning streak to a nearly two-week top set on Wednesday.

The US Dollar makes a solid comeback and reverses a major part of the previous day's sharp retracement slide from a multi-week high, which, in turn, is seen as a key factor weighing on the NZD/USD pair. The prospects for further policy tightening by the Federal Reserve remain supportive of the ongoing move up in the US Treasury bond yields. This, along with looming recession risks, provides an additional boost to the safe-haven Greenback.

The US CPI, PPI and the PCE Price Index data released recently indicated that inflation isn't coming down quite as fast as hoped. Adding to this, the incoming upbeat US macro data pointed to an economy that remains resilient despite rising borrowing costs. This reaffirmed market expectations that the Fed will stick to its hawkish stance for longer. Moreover,

Minneapolis Fed President Neel Kashkari suggests that a 50 bps lift-off at the March was still a possibility.

This, in turn, pushes the yield on the benchmark 10-year US government bond back above the 4.0% threshold, or its highest level since November, and continues to underpin the buck. Investors, meanwhile, remain worried about economic headwinds stemming from rapidly rising borrowing costs. This overshadows the optimism led by the Chinese PMI prints on Wednesday and favours the USD bulls, supporting prospects for additional losses for the NZD/USD pair.

Next on tap is the release of the Weekly Initial Jobless Claims data from the US, which, along with the US bond yields, will influence the USD price dynamics. Apart from this, traders will further take cues from the broader risk sentiment to grab short-term opportunities around the NZD/USD pair. The focus will then shift to the Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr's scheduled speech during the Asian session on Friday.

Technical levels to watch

After four months of depreciation, the US Dollar rebounded in February. However, weaker USD view still holds, in the opinion of economists at MUFG Bank.

Further USD strength seems likely over the short-term

“Inflation still looks set to fall notably over the coming months and the US labour market is likely to slow.”

“Further US Dollar strength seems likely over the short-term but we have just corrected weaker from over-valued levels and hence we doubt this move will be sustained.”

“Spreads have only marginally moved in favour of the Dollar and remain consistent with USD depreciation.”

The accounts of the European Central Bank's (ECB) February policy meeting revealed on Thursday that Governing Council members agreed that further increases in key rates are required for policy to enter restrictive territory, per Reuters.

Additional takeaways

"Policy rates were, at present, barely consistent with the range of estimates for the neutral rate."

"The view was expressed that there continued to be value in frontloading rate hikes at the present stage."

"Reservations were expressed on the proposed communication of an intention for the March meeting."

"It was noted that the short-term momentum in core inflation had also started to decline somewhat."

"Markets were now paying more attention to core inflation than to headline inflation to gauge underlying inflationary pressures."

"Members agreed that there were no signs of a wage-price spiral."

"Wage pressures were broadening."

"A better than expected growth outlook would contribute to continued inflationary pressures."

Market reaction

EUR/USD showed no immediate reaction to these comments and was last seen losing 0.4% on the day at 1.0622.

Head of Research at UOB Group Suan Teck Kin, CFA, reviews the growth prospects for India.

Key Takeaways

“India’s real GDP growth slowed further to 4.4% y/y in the Oct-Dec quarter (3QFY22-23), against 6.3% y/y in the prior quarter (2QFY22-23) and 13.5% pace in the Apr-Jun quarter (1QFY22-23). The outcome fell short of our call of 4.5% and consensus view of 4.7%.”

“Private spending and investment were the two key growth drivers, accounting for more than 90% share of the 4.4% expansion and have increasingly been weighed down by the central bank’s aggressive rate hikes in the past year. On the supply side, manufacturing output shrank for the second quarter, but were offset by a robust services sector.”

“Outlook – With activities expected to moderate even further ahead, we project growth rate of 6.9% in FY22-23 (from 9.1% in FY21-22) and keep the FY23-24 GDP forecast at 6.5%. The next key event to watch will be RBI’s monetary policy decision on 6 Apr.”

A rise in US Treasury yields and a strengthening USD weighed on Gold. However, the macro backdrop remains supportive for the yellow metal, strategists at ANZ Bank report.

Expectations around the Fed’s stance to guide Gold in the short-term

“Gold prices came under pressure amid mounting expectations of US rates staying higher, which gave fresh support to the USD. Rising US yields weighed on the non-yielding yellow metal, as it increases the opportunity cost.”

“While market expectations around the Fed’s stance are likely to guide Gold in the short-term, we see the macro backdrop remaining supportive for Gold with the Fed pausing its hiking cycle and the USD resuming its downtrend.”

- Silver comes under some renewed selling pressure and snaps a two-day winning streak.

- The technical setup favours bearish traders and supports prospects for additional losses.

- Slightly oversold oscillators on the daily chart warrant caution before placing fresh bets.

Silver struggles to capitalize on this week's modest recovery gains recorded over the past two days and meets with a fresh supply on Thursday. The white metal remains depressed through the mid-European session and is currently placed near the lower end of its daily trading range, around the $20.80 region.

From a technical perspective, the XAG/USD, so far, has managed to hold its neck above the 61.8% Fibonacci retracement level of the recent rally from the October 2022 low. The said support is pegged near the $20.60 area, which is followed by the YTD low, around the $20.40 region touched earlier this week. A convincing break below the latter will be seen as a fresh trigger for bears and set the stage for an extension of the recent slide from the $24.65 zone, or a multi-month top set in February.

That said, oscillators on the daily chart are hovering near the oversold territory, making it prudent to wait for some near-term consolidation or a modest rebound before placing fresh bearish bets. Nevertheless, the lack of any meaningful buying suggests that the path of least resistance for the XAG/USD is to the downside. Hence, some follow-through weakness to the $20.00 psychological mark, en route to the next relevant support near the $19.75-$19.70 region, looks like a distinct possibility.

On the flip side, attempted recovery back above the $21.00 round figure now seems to confront some hurdle near the overnight swing high, around the $21.15-$21.20 area, ahead of the $21.35 region (50% Fibo. level). Any subsequent strength could be seen as a selling opportunity and runs the risk of fizzling out near the $22.00 confluence support breakpoint. The said handle comprises 100-day Simple Moving Average (SMA) and 38.2% Fibo. level, which if cleared could negate the bearish bias.

The XAG/USD could then witness a short-covering rally towards the $22.55-$22.60 supply zone, above which nulls might aim to reclaim the $23.00 round-figure mark, which coincides with the 23.6% Fibo. level.

Silver daily chart

Key levels to watch

The US Dollar could appreciate further in the near-term. However, economists at Barclays Research expect the greenback to ease later in the year, lifting the EUR/USD pair to 1.12 by end-2023.

Scope for further USD strength in the near-term

“The disinflation narrative is under question and the market has increased the probability of a 50 bps hike in March. The market (and the Fed) remains data dependent, and will focus on the key employment report next week.”

“Although our views are for the Dollar to normalize to fair value by end-2023 (e.g. towards 1.12 vs EUR); in the near term, the risks are for further Dollar strength.”

Policy normalization and higher JGB yields leave bias for USD/JPY to test towards 120 into year-end, economists at CIBC Capital Markets report.

BoJ policy normalization to boost JPY valuations ahead

“While Kuroda was intimately associated with Abenomics we would not expect Ueda to be so tainted. Consequently, we would anticipate policy normalization should macro conditions warrant it.”

“Q2 2023: 125 | Q3 2023: 1.23 (USD/JPY)”

“Policy normalization and higher JGB yields, easing spreads versus UST, leave bias towards USD/JPY testing towards 120 into year-end.”

Preliminary calculations by Eurostat showed a significant increase in the core inflation rate. The inflation figures for February will therefore confirm the ECB's intention to raise interest rates further, economists at Commerzbank report.

Core inflation jumps to 5.6%

“Hopes for a strong decline in the inflation rate in February were not fulfilled. It eased only slightly from 8.6% to 8.5%. While energy prices fell, food prices rose and core inflation increased from 5.3% to 5.6%.”

“Given the renewed strengthening of underlying inflation, it seems almost certain that the ECB will raise its key rates by another 50 basis points at the mid-March meeting.”

Extra losses in USD/CNH are expected to meet a solid support at 6.8400 in the near term, suggest Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group.

Key Quotes

24-hour view: “We did not anticipate the outsized sell-off in USD yesterday (we were expecting USD to consolidate). After such a sharp drop, further sustained decline is unlikely. However, there is scope for the USD weakness to extend to 6.8550 before stabilization is likely. Resistance is at 6.8950, a break of 6.9100 would indicate that the weakness in USD has stabilized.”

Next 1-3 weeks: “We have held a positive USD view since the start of last month. In our update from yesterday (01 Mar, spot at 6.9560), we indicated that ‘to maintain the upward momentum, USD has to break above 7.0000 within the next few days or the chances of further gains will diminish rapidly’. That said, we were surprised by the outsized sell-off as USD plunged below our ‘strong support’ level of 6.9220 (low of 6.8642) before closing lower by a whopping 1.08% (6.8800). The breach of our ‘strong support’ level indicates that the month-long USD strength has ended. The outsized decline appears to be overdone and while there is room for further USD weakness, we expect 6.8400 to offer solid support. On the upside, a breach of 6.9350 would indicate that USD is unlikely to weaken further.”

Kit Juckes, Chief Global FX Strategist at Société Générale, analyzes FX market. Re-pricing peak Fed Funds keeps on supporting the Dollar, but by September, the greenback should ease.

EUR/USD is finding a base

“By the time rates peak – markets think in September, the Dollar should be lower. For now, they are busy revising that peak higher.”

“We think EUR/USD is finding a base here, partly because the US rates market has priced a lot in now, and partly because the European rates market has more to price in.”

“The USD/JPY 200-DMA is at 137.70 and if that were to break, it would trigger a spike down for the yen, at least temporarily.”

“As for Sterling, Andrew Bailey’s comments yesterday took the wind out of its sails. EUR/GBP is in a slow and erratic uptrend, but I could do with a Sterling pop higher before I head to the mountains at the weekend.”

Sterling eased following yesterday’s Central Bank Governor Andrew Bailey speech. He did not make any truly restrictive comments. Therefore, GBP is set to remain under pressure, Antje Praefcke, FX Analyst at Commerzbank reports.

Bailey is putting the brakes on Sterling

“Bailey is not really committing very firmly to further strong tightening measures. In view of an inflation rate in double-digits I would have hoped for more commitment towards rate hikes. But obviously the BoE is not willing to inflict (further) harm on the economy and the population to get a grip of inflation.”

“BoE continues to progress cautiously and is waiting for further data publications – probably in the hope that inflation really will fall quickly over the coming months as it expects so that it will not have to take much more action.”

“Based on Bailey’s comments it seems that any positive set of economic data will be used by the BoE to tighten rates less or to pause the cycle. And this impression cannot be positive for Sterling. The BoE meeting on 23rd March is likely to be of particular interest against this background.”

- EUR/GBP gains some positive traction for the second straight day, though lacks bullish conviction.

- A modest downtick in the Eurozone consumer inflation caps the upside for the Euro and the cross.

- The heavily offered tone surrounding the Sterling Pound supports prospects for additional gains.

The EUR/GBP cross builds on this week's bounce from the vicinity of the 100-day SMA support near the 0.8755-0.8750 region, or a one-month low, and edges higher for the second successive day on Thursday. The cross, however, retreats a few pips from a nearly two-week high touched during the first half of the European session and is currently placed around the 0.8875-0.8870 zone.

The common currency continues with its relative outperformance against its British counterpart amid rising bets for additional jumbo rate hikes by the European Central Bank (ECB), which, in turn, acts as a tailwind for the EUR/GBP cross. The expectations were lifted by hawkish commentary by European Central Bank (ECB) officials and stronger consumer inflation data released this week from France, Spain and Germany - the Eurozone's three biggest economies.

In fact, In fact, Bundesbank President Joachim Nagel said on Wednesday that the interest rate step announced by ECB for March will not be the last and further significant hikes might even be necessary afterwards too. Adding to this, French central bank Governor Francois Villeroy de Galhau said that the ECB remains committed to bringing inflation back to 2% by the end of 2024 and it is preferable to reach the terminal rate by summer, by September at the latest.

The EUR/GBP cross, however, struggles to capitalize on the intraday uptick and remains below the 0.8900 mark after the Eurostat reported that the annualized Eurozone HICP eased to 8.5% YoY rate in February from the 8.6% previous. This, along with a goodish pickup in the US Dollar demand, holds back the Euro bulls from placing aggressive bets. Meanwhile, the downside seems cushioned amid the heavily offered tone surrounding the British Pound.

The market anxiety over the new UK-UK Brexit deal on the Northern Ireland Protocol is seen weighing on the Sterling Pound. Moreover, the price action suggests that additional rate hike by the Bank of England (BoE) is already fully priced in the markets. This, along with some speculations the UK central bank would pause the current tightening cycle, favours the EUR/GBP bulls and supports prospects for a further near-term appreciating move.

Technical levels to watch

Economists at ANZ Bank expect the European Central Bank (ECB) to remain determined to get inflation down through both action and guidance.

EA rebound underpins cyclical inflation