- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 02-03-2022

- EUR/USD retreats towards the multi-day high, stays inside monthly falling wedge.

- Descending trend line from mid-February, 61.8% FE of September 2021-February 2022 moves to restrict downside past 1.1060.

- Weekly resistance line, 50-SMA guards short-term rebound, confirmation of falling wedge will be crucial for the bulls.

- Oversold RSI, downbeat MACD signals favor intermediate bounces despite suggesting an overall bearish trend.

EUR/USD remains on the back foot around 1.1110 during Thursday’s Asian session, reversing the corrective pullback the lowest since May 2020 marked the previous day.

In doing so, the major currency pair remains inside a short-term bullish chart pattern called falling wedge, recently around the support line close to 1.1060.

The RSI’s bounces off the oversold territory joined receding bearish of the MACD signals to favor the latest rebound. However, failures to cross the weekly resistance line and cautious sentiment in the market seemed to have recalled the EUR/USD bears.

That said, the pair’s further weakness towards the stated wedge’s support line near 1.1060 becomes imminent.

However, a 13-day-old descending trend line and the 61.8% Fibonacci Expansion (FE) of the pair’s moves between September 2021 and February 2022, respectively around 1.1010 and the 1.1000 threshold, will challenge the EUR/USD pair’s additional weakness.

Meanwhile, recovery moves beyond the weekly resistance line, close to 1.1190 by the press time, will be challenged by the 50-SMA and the wedge’s upper line, near 1.1235 and 1.1270.

It should be noted, though, that a clear break of the 1.1270 will confirm the bullish chart pattern, which in turn will enable the EUR/USD buyers to regain control with eyes on February’s top on 1.1495 as the next hurdle before the additional run-up.

EUR/USD: Four-hour chart

Trend: Further weakness expected

"We've certainly seen recent developments lead to notable volatility and declines in market liquidity," Lorie K. Logan, an executive vice president with the New York Fed, said recently during a virtual event organized by New York University.

"But so far, outside of Russian markets ... our sense is that broader markets have been functioning in an orderly way."

She explained that the Federal Reserve's balance sheet and its overnight lending facilities are providing liquidity and helping financial markets function smoothly despite volatility seen after Russia invaded Ukraine.

There has been no reaction to her comments. The US dollar edged higher Wednesday as investors continue to worry about the impact of an escalating conflict in Ukraine.

- Silver pares the biggest daily gains in a month at weekly top.

- RSI conditions, six-week-old ascending resistance line challenge further upside.

- Bears remain cautious until witnessing a clear break of 200-SMA, 61.8% FE could lure buyers past $25.60.

Silver (XAG/USD) bulls take a breather around $25.30 during Thursday’s Asian session, following a notable run-up to refresh the week’s top.

Although the metal’s sustained trading above the key SMAs and bullish MACD signals favor XAG/USD buyers, an upward sloping trend line from January 20, around $25.60, has been successful in turning down the bulls of late.

Also, favoring the odds of a profit-booking wave is the RSI line that inches closer to overbought territory.

In a case where the silver prices rise past $25.60, the 61.8% Fibonacci Expansion (FE) of February month moves, around $26.00, will be crucial to watch as it holds the key to further rally targeting July 2021 peak of $26.77.

Alternatively, the recent swing low near $24.90 and January’s high of $24.70 could entertain intraday sellers of XAG/USD.

Following that, the 50-SMA and an upward sloping trend line from February 03, respectively around $24.45 and $24.25, will tease silver bears.

It should be noted, however, that a clear downside break of the $24.25 will need validation from the 200-SMA level of $23.60, to portray a short-term bearish trend.

Silver: Four-hour chart

Trend: Pullback expected

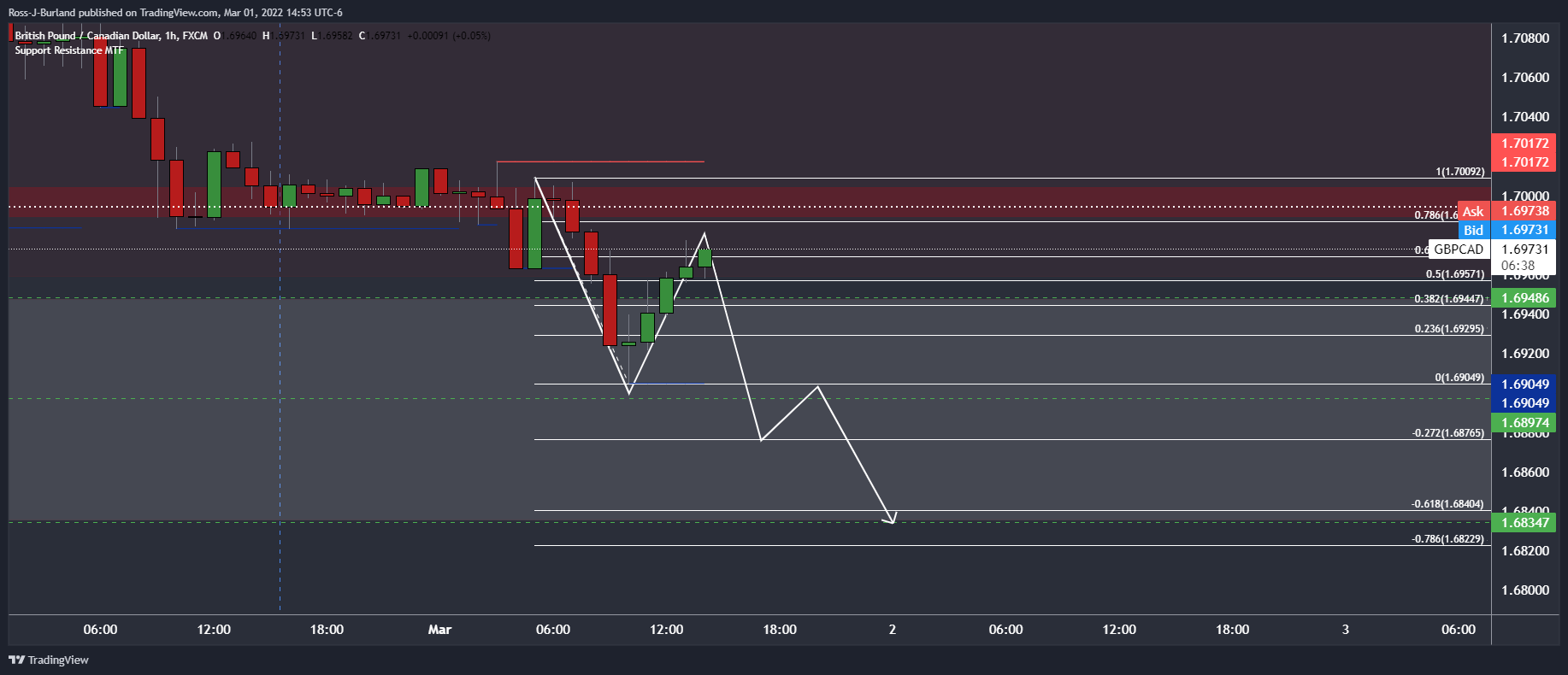

- GBP/CAD bears are beating down the gates towards a test of territories below 1.69 the figure.

- The hourly chart is in consolidation and the bears will need to commit to 1.6950/00 or face a prolonged daily correction.

As per the prior analysis from Tuesday's Asian session, GBP/CAD Price Analysis: Bears are moving in to target 1.69 the figure, the pair has reached the target area, but according to the longer-term time frames, this move may have only just started.

GBP/CAD prior analysis

''On the hourly chart, the price is reaching up into the 61.8% golden ratio territory. Should this hold as resistance, then the focus will be on the downside for a test and break of the lows for the sessions ahead. A break below 1.69 the figure opens risk to the 1.6830s daily target as illustrated above.''

''The price has stalled at the forecasted area near the 61.8% ratio and is now starting to form a bearish bias on the hourly time frame.''

GBP/CAD live market

As illustrated, the price reached the target area and has since started to correct. The correction has been volatile but so long as bears hold the fort around the neckline of the M-formation, pressures would be expected to mount leading to a downside continuation.

With that being said, the price is making a strong advance towards the 78.6% Fibonacci retracement level having broken the 50% mean reversion level at 1.6920. 1.6920 could act as a firm support. This could potentially lead to some further consolidation above it for the sessions ahead before a potential downside continuation.

GBP/CAD daily chart

GBP/CAD is known for its lengthy trends of between 550 and 650 pips before there is any meaningful correction. The current daily trend is around 490 so far. Could there be more to go still? The hourly thesis illustrated above are based on the potential for more given the strength and momentum of this bullish impulse that has smashed through 1.7025 was regarded as a potentially strong level of support. 1.6940/50s were next as prior daily wick lows. These too have been left for dust. Ib bears commit to the trend, this could go quite a way further with 1.6840/30 eyed. In such a move, this would put the impulse on par with recent trends in terms of pips.

On the other hand, if the bulls manage to overcome 1.6950 and then 1.7000, in this hourly correction, there could be a significant correction on the daily charts to follow:

- NZD/USD seesaws inside 20-pips trading range around one-week high after renewing multi-day top.

- US Treasury yields, Wall Street benchmarks rallied, gold eased on hopes of Russia-Ukraine ceasefire discussion, Powell’s Testimony.

- Fed Chair Powell backed 0.25% rate-hike, Moscow-Kyiv talks may be held during early Thursday.

- China Caixin Services PMI, ANZ Commodity Price Index will be important in Asia, US session calendar is heavy.

NZD/USD refreshed weekly high to 0.6800 during Wednesday, dribbling around the same afterward, as markets portray risk-on mood amid the early Thursday morning in Asia.

The improvement in market sentiment could be linked to the headlines surrounding Ukraine and the US Federal Reserve (Fed) Chairman Jerome Powell’s Semi-Annual Monetary Policy Report before the House Financial Services Committee. Among them, hopes of discussion over a ceasefire between Kyiv and Moscow during the likely peace talks on Thursday and Fed Chair Powell’s strong favor for 0.25% rate hike in March, not 0.50%, could be cited as the key catalysts.

It’s worth noting that a Russian negotiator was quoted to share the news of a probable round of diplomatic talks on Thursday. On the same line, Interfax also mentioned, “A potential ceasefire will be discussed in upcoming talks with the Ukrainian delegation.”

On the other hand, Fed Chair Jerome Powell’s bi-annual testimony was slightly hawkish as it conveyed inflation concerns and showed readiness to lift the Fed rate by 0.50% if needed. However, the base case was a series of rate hikes starting with 25 basis points (bps) of a push in March.

Elsewhere, China finally termed the Russian invasion of Ukraine as “war” versus the previous terminology of a “special operation”, per Bloomberg as it quoted China’s Foreign Minister Wang Yi. Further, global rating agency Fitch also downgraded Russia’s Long-Term Foreign Currency Issuer Default Rating (IDR) to 'B' from 'BBB'.

Talking about the data, US ADP Employment Change rose past 388K forecast to 475K for February, which in turn raised hopes for a firmer US Nonfarm Payrolls (NFP) when released on Friday. At home, New Zealand’s Building Permits for January and Terms of Trade Index for Q4 both dropped below expectations and previous readouts.

Amid these plays, the US 10-year Treasury yields snapped a two-day downtrend to mark a stellar run-up of 17 bps to 1.878% whereas Wall Street benchmarks also rose notably by the end of Wednesday’s North American session.

Moving on, Russia-Ukraine talks will be crucial to watch for fresh impulse and so do China’s Caixin Services PMI for February, not to forget New Zealand ANZ Commodity Price Index for the said month. Following that, a slew of data is expected to be rolled out in the US session comprising ISM Services PMI, Factory Orders, Nonfarm Productivity, etc.

Given the likely improvement in the scheduled US data, as well as China’s recently positive PMIs and hopes of a ceasefire between Kyiv and Moscow, NZD/USD may have further upside to track.

Technical analysis

A clear upside break of a descending resistance line from mid-November, now support around 0.6735, directs NZD/USD prices towards the 100-day EMA hurdle of 0.6810.

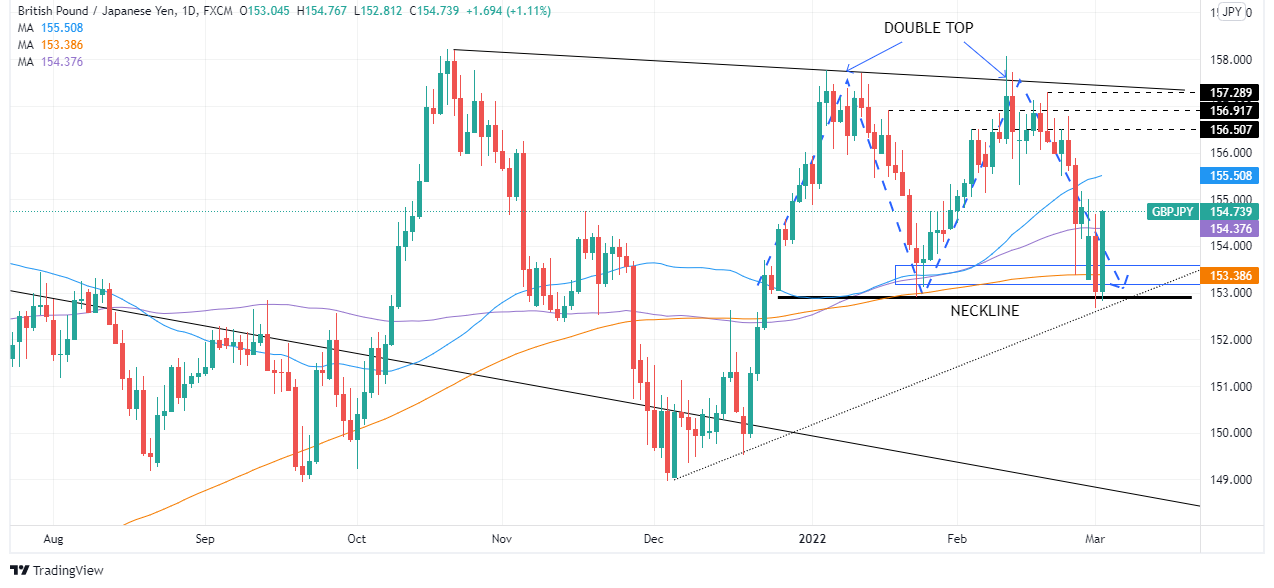

- The British pound keeps the yen under pressure, rising so far 0.88% in the week.

- GBP/JPY daily chart depicts a double-top with a target of 148.50.

- GBP/JPY Technical Outlook: Neutral-upward, bull’s failure of a daily close above 155.00 would keep bears hopeful of a leg-down.

GBP/JPY rises and leaves the 100 and 200-daily moving averages (DMAs) below in late trade in the New York session, as the price probes March’s one daily high, threatening of paring that day losses and eyeing the 155.00 mark. At press time, the GBP/JPY trades at 154.73, up more than 1% in the session.

Worth noting, the jump-off lows occurred near the confluence of the 200-DMA and the neckline of a “double-top” around 153.00. However, unless GBP/JPY bull reclaims 155.50, a 50-DMA level, GBP/JPY bears would remain hopeful of another attempt towards the former.

GBP/JPY Price Forecast: Technical outlook

The GBP/JPY meanders around the 100-DMA, though trades above it. However, to further cement a case of a move towards the 50-DMA, a daily close above 155.00 is needed. If GBP/JPY bulls reclaim the latter, it will open the door for the 50-DMA. Otherwise, the cross-currency pair would be under downward pressure, as that would signal GBP/JPY bears that buying pressure eased.

Contrarily, if GBP/JPY bears hold the price below 155.00, the first support level to challenge will be 154.00. Breach of the latter would expose the “neckline” at 152.90, once cleared, bears could target 152.00.

European Central Bank Governing Council member Mario Centeno said on Wednesday that the Russo-Ukraine war could lead to a stagflation scenario depending on the duration of the conflict and the European response, reported Reuters. The exclusion of the Russian economic area via sanctions will have a devastating impact on Russia's economy, Centeno added. Beyond sanctions, companies leaving Russia will have an "important effect" on the economy, he noted.

US Treasury Secretary Janet Yellen said on Wednesday that the US will continue to impose severe consequences on Russian President Vladimir Putin and Russia over the invasion of Ukraine. Russia will increasingly become an economic island, she continued, saying that the US is prioritising sanctions on oligarchs key to Putin's power and assembling a task force with the Justice Department to "uncover, freeze and seize" their wealth. Yellen said that 80% of Russia's banking system assets were now under restrictions and half of the Russian central bank's assets had been immobilised by Monday.

Regarding the US economy, the pace of the US recovery has exceeded the most optimistic expectations based on traditional metrics and US household finances remain healthy, posing the economy for further growth.

Bank of England Monetary Policy Committee Member Silvana Tenreyro said on Wednesday that the latest rise in oil prices will increase inflation and dampen UK economic activity, reported Reuters. The high level of companies wage expectations in the BoE's latest Agents' survey was a surprise, though we will have to see if it materialises. Evidence of a wage-price spiral in the UK is not obvious, Tenreyro added, saying that there is no explosive dynamic. There were some signs of easing supply-chain bottlenecks before the latest developments in Ukraine, Tenreyro said.

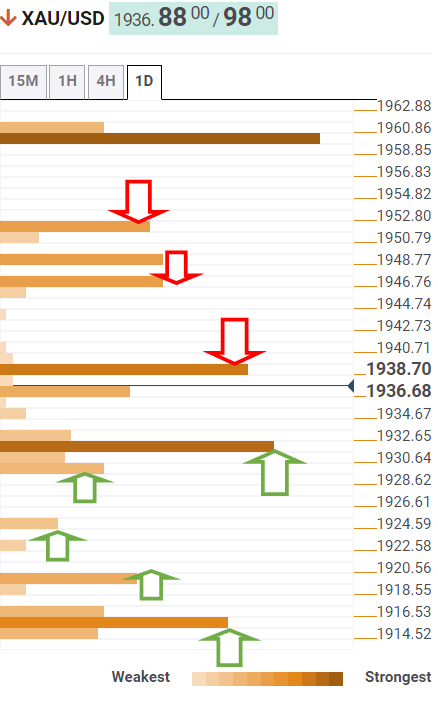

- Gold is correcting towards a critical daily support area as markets take stock of the Fed and Ukraine crisis.

- Bears have eyes towards $1,911 and then the $1,900 psychological level.

The price of gold is down by some 1.26% on Wednesday in midday New York trade after falling from a high of $1,948.01 to a low of $1,913.75 as US stocks recover in a corrective market across the board. After hitting a low of around 1.68% on Tuesday, the US 10-Year Treasury yield is back up to the 1.84% area as Federal Reserve Chair Jerome Powell signalled the central bank would start raising rates this month despite uncertainties stemming from the Ukraine crisis.

Russian forces are continuing their attempted push through Ukraine from multiple directions, while Ukrainians, led by President, Volodymyr Zelenskyare putting up "stiff resistance," according to US officials. The war in Ukraine has significant and obvious implications for commodities prices. The CRB index, for instance, has rallied to the highest levels since 2014:

Investors fear a persistent inflationary shock and stagflation concerns have played their way through to the price of the precious metal, regarded as a safe-haven. ''For the time being, direct implications of the conflict as a growth shock are more limited in the US, given that direct trade flows are marginal,'' analysts at TD securities argued.

''But indirect implications are more relevant as ongoing disruptions to supply chains are likely to have a spillover effect, while inflation is also likely to act as a tax on consumers. In turn, the market continues to price-out a 50bp Federal Reserve hike for March, but implications for the subsequent rate path are less clear.''

Fed leans towards 25bps

Today, testifying before Congress, Fed Chair Jerome Powell signalled he is leaning towards a 25bps rate rise fed funds in March, but indicated that the Fed could raise rates by 50bps if inflation proves more stubborn. However, ''if the shock simultaneously dents consumer sentiment, the Fed will have to walk a tight-rope between its unemployment and inflation targets,'' the analysts at TDS said.

On the other hand, the analysts also noted that should the ''geopolitical tensions would be unlikely to derail the Fed's plans to hike and to withdraw liquidity using quantitative tightening if inflation expectations show additional signs of de-anchoring.''

Meanwhile, data on Wednesday showed US private employers hired more workers than expected in February and data for the prior month was revised sharply higher as the labour market recovery gathers steam. This comes ahead of this Friday's Nonfarm Payrolls report.

''Employment likely continued to recover in February following an unexpectedly strong Jan report—despite the Omicron-led surge in COVID cases. We expect some of that boost to fizzle, though to still firm job growth pace,'' the analysts at TDS said. '' Seasonal adjustments were a factor last month and they will likely play a role again in Feb. We expect wage growth to slow to a still strong 0.5% MoM pace.''

Gold technical analysis

(Daily chart)

The price would be expected to continue higher along with the trendline support following the correction of this week's bullish impulse, so far. The price is meeting old resistance that would be expected to act as a support area from which bids can build. However, from an hourly perspective, there could still be some downside to come yet:

(Hourly chart)

The price has dropped corrected into hourly resistance. Should this hold, then the bears could emerge for another push to extend this daily correction into a deeper move towards $1,911 if not into test the $1,900 psychological level.

- Spot silver prices fell back to test the $25.00 level on Wednesday as US stock markets/bond yields recovered.

- A reassuring message from Fed Chair Powell that the Fed plans to cautiously press ahead with tightening helped sentiment.

Spot silver (XAG/USD) prices have pulled back sharply on Wednesday as risk appetite takes a turn for the better and global bond yields mean revert following Tuesday’s outsized decline. XAG/USD pulled back from Tuesday’s highs above $25.50 per troy ounce to probe the $25.00 level. At one point, the precious metal fell as low as the $24.80s, where it at the time traded lower by more than 2.0% but has since recovered back to the $25.15 area to now trade down just under 1.0%.

US equities were able to break out to their highest levels since mid-February as Fed Chair Jerome Powell delivered a reassuring message on the first day of his semi-annual testimony to Congress, undermining demand for safe-haven precious metals. Powell said that the Fed will move forward with prior guidance to begin a rate hiking cycle in March and reiterated that the Fed will be nimble in reacting to the evolving outlook.

He also noted that the Russo-Ukraine war added considerable uncertainty, and his measured tone appeared to reassure investors that the US economy remains in a steady pair of hands with Powell at the head of the Fed. With US stocks now pressing higher than their levels prior to the start of the Ukraine war and US bond yields having staged a decent rebound (10s are back 1.85% having gone under 1.70% on Tuesday), that will make it more difficult for silver to test last week’s highs in the $25.60s.

XAG/USD, as is also the case with other asset classes, is likely to remain choppy on geopolitical headlines in the coming days as fighting in Ukraine continues. There will likely be much focus on talks between a Russian and Ukrainian delegation which the Russians have teased could result in a ceasefire (though this is very much not the market’s base case). Otherwise, the second day of Powell’s testimony on Thursday and more US data in the form of ISM Services PMI on Thursday and the official jobs report on Friday will also be traders’ radars.

Fed Chair Jerome Powell, speaking before Congress on the first day of his semi-annual testimony, said that it would take somewhere in the region of three years to get the balance sheet to where they want it, Reuters reported. After setting a reduction course, Powell continued, the Fed may speed it up or slow it down, but it is likely to take something in the range of three years.

Additional Remarks:

"Inflation is also too high in the service sector."

"Lower immigration is definitely part of the story of labor shortage."

"We are watching global markets and dollar funding markets for stresses as a result of the war in Ukraine."

"Markets are functioning right now."

"We do expect to move the policy rate up in a series of rate increases this year."

"It is our plan to return to price stability while supporting continued expansion."

"It is very important the Fed gets on top of strong and high inflation."

"The labor market is extremely strong."

"From that standpoint, we are in a good situation for getting inflation under control."

"Workers will still get good jobs and pay increases for some time."

"The economy can withstand our rate increases."

"We need to get demand and supply back in alignment."

Chicago Fed President and FOMC member Charles Evans said on Wednesday that he expects a 25bps rate hike in March followed by more increases "in succession" than earlier thought, reported Reuters.

Additional Remarks:

"In December had expected 4 rate hikes in 2022; since then inflation has been more intense than expected."

"Later this year, we will have a better idea of if rates need to get just to neutral, or higher than that."

"If we hike in 25bps increments, for three meetings in a row, and find it's not fast enough, we can raise rates more quickly."

"We may not need to pause on rate hikes when we make a change in balance sheet policy."

"I prefer not to overshoot on rate hikes, or give the wrong signal. We will know more by June on the geopolitical environment."

The Turkish lira has come under renewed selling pressures over the past month driven by the negative impact of rising geopolitical tensions between Russia and the West, explained analysts at MUFG Bank. They see USD/TRY trading in the 13.000-15.500 range during the first quarter and at 13.100-16.500 during the second quarter.

Key Quotes:

“The Ukraine conflict will have a negative impact on lira stability through security risks in the region and higher energy prices.”

“The higher oil price if sustained is an unfavourable development for Turkey’s trade and current account balances as it will raise the imports bill.”

“The higher price of oil will further increase upside risks to the inflation outlook in Turkey. The latest CPI report worryingly revealed that headline and core inflation had already picked up to 48.7% and 39.5% respectively in January.”

“We continue to believe that domestic policy settings remain too loose which is increasing the risk that higher inflation will become embedded in the economy and further erode the value of the lira going forward. There has been no indication yet that the CBRT will shift to more orthodox policy settings in Turkey.”

“Recent lira stability has been supported by government actions including to slow dollarization in Turkey’s economy, direct intervention in the FX market, and to boosting reserves through a USD5 billion FX swap with the United Arab Emirates.”

The Bank of Canada (BoC) on Wednesday, as expected, raise the key interest rate by 25 bp. Analysts at RBC Capital Markets point out that at this early stage, they don’t think geopolitical developments preclude a follow-up hike in April, nor do they argue for the more aggressive tightening path.

Key Quotes:

“The BoC lifted its policy rate for the first time since 2018, having kept it near zero for nearly two years of the pandemic. The Russian invasion of Ukraine was noted as a major new source of uncertainty, but after a close call not to hike in January, there appeared to be a low bar to raise rates today and recent data easily cleared it.”

“The BoC will have to weigh additional inflationary pressure brought on by that conflict against two-way domestic impacts (increased revenue for commodity producers, higher prices for consumers) and concerns about the global economic outlook. Central banks would normally look through geopolitically-driven commodity price pressures, but with inflation already so far above target the BoC has said it is more concerned about upside risks to inflation than downside.”

“At this early stage, we don’t think geopolitical developments preclude a follow-up hike in April, nor do they argue for the more aggressive tightening path that markets continue to price.”

“Consistent with previous guidance, the BoC said it will “be considering when to end the reinvestment phase and allow its holdings of Government of Canada bonds to begin to shrink.” We’ve yet to see a topic for Governor Macklem’s economic progress report tomorrow but think he could use the speech to provide more details on what QT will look like—whether the BoC plans to gradually phase out reinvestment or immediately shift to a smaller share of primary market purchases. Those detail could be followed by an actual QT announcement as soon as April’s meeting depending on how financial conditions evolve in the interim.”

“We’ll of course also be looking for any comments on how the Russia-Ukraine conflict will impact Canada’s economy and the path for monetary policy.”

Fed Chair Jerome Powell, speaking before Congress on the first day of his semi-annual testimony, said that if inflation fails to about the degree expected by the Fed this year, the central bank would be prepared to raise interest rates more aggressively. That could mean 50 bps increments, Powell said.

Additional Remarks:

"I expect we will make progress in March towards a plan for reducing our balance sheet."

"The Fed will not finalize balance sheet plan at this meeting."

"The Fed will proceed, but will do so carefully in light of the Ukraine war."

"The Fed will not add to uncertainty with our moves."

"We think that inflation will peak and begin to abate this year."

Fed Chair Jerome Powell, speaking before Congress on the first day of his semi-annual testimony, said that it is time to move away from highly stimulative monetary policy settings, reported Reuters. Monetary policy cannot address supply-side challenges and constrains, Powell added.

- Oil continued its historic surge on Wednesday, with WTI rallying as high as the $112.40s to eclipse 2014 highs.

- Traders are realising that harsh Western sanctions on Russia is disrupting global oil flows.

- Prices have since backed off a little to near $110, but are still up over $3.0 on the day.

Oil prices continued their historic surge higher on Wednesday, with front-month WTI futures rallying as high as the $112.40s to eclipse 2014 highs around $112.20 and eye a test of last decade’s highs just below $115.00. Prices have since backed off a little to chop either side of the $110 level, but at current levels in the mid-$109.00s still trade higher by about $3.0 on the day, taking currently weekly gains to above $17.00.

The melt-up in crude prices has been driven by a realisation since the start of the week that the harsh financial sanctions implemented by Western nations against Russia for its Ukraine invasion will likely prove highly disruptive to global oil flows. Analysts at Reuters said on Wednesday that “trade in Russian oil was in disarray as producers postponed sales, importers rejected Russian ships and buyers worldwide searched elsewhere for crude as Western sanctions”.

Financial press reported that oil buyers are avoiding oil from the CPC pipeline (providing 1.0% of world supply) that goes through Kazakhstan due to sanction concerns. Market commentators noted that Russia’s main Urals oil benchmark was offered at a record discount to peers on Wednesday, but still got no bidders. According to Energy Aspects, an energy consultant, 70% of Russian crude oil trade is currently “frozen” as a result of bank sanctions, higher freight rates and political risks.

OPEC+ agreed to go ahead with a 400K barrel per day output quota hike in April as expected, news which didn’t result in a crude oil market impact, just as traders shrugged off an announcement from member nations of the International Energy Agency a day earlier that 60M barrels would be released from oil reserves. “The next frontier of oil prices will be defined by prices in search of demand destruction,” RBC Capital Markets analysts said. “Two weeks ago, our call for $115 a barrel by summer seemed aggressive, in light of the ongoing tightening fundamental framework, infused by geopolitics, there may be further risk to the upside,” they continued.

EUR/USD fell to a new low since May 2020 at 1.1060 before clawing its way back to a failed test of resistance at 1.11. Economists at Scotiabank expect the pair to pull toward a test of 1.10.

After the 1.11 zone, resistance is at 1.1135/40

“EUR/USD is now nearing oversold on the RSI and the 1.10 psychological trigger may also provide a solid floor on continued declines, but the pair is showing limited signs of a reversal of its decline since early-Feb.”

“After the 1.11 zone, resistance is 1.1135/40 and the mid-figure area followed by 1.12.”

“Support after the 1.1060 low and the mid-1.10s is the big figure.”

EUR/JPY continues to fall aggressively for a retest of the December lows at 127.51/38. Economists at Credit Suisse expect the pair to break below here and test of channel support at 127.04.

Resistance at 129.24 to cap

“We continue to look for a move below the December lows at 127.51/38 in due course to retest the medium-term nine-month channel bottom, today seen at 127.04. A fresh hold here will be looked for, but with the broader risk seen lower and an eventual break can clear the way for a test of support seen next at the 38.2% retracement of the 2020/2021 bull trend at 126.59.”

“Resistance is seen at 128.38 initially, with 129.19/24 ideally capping to keep the immediate risk lower. Above can see a recovery back to 129.79, with the 200-day average and price resistance at 130.31 ideally now capping any further strength.”

BoC Monetary Policy Decision – Overview

The Bank of Canada (BoC) is scheduled to announce its monetary policy decision this Wednesday at 15:00 GMT and is widely expected to hike its benchmark interest rate by 25 bps to 0.50%. This would mark the first rate hike since October 2018 and the start of the tightening cycle amid the recent surge in Canada’s annual inflation rate to the highest level since 1991. Apart from this, investors will closely scrutinize the accompanying monetary policy statement for fresh clues about the central bank's policy outlook.

According to Dhwani Mehta, Senior Analyst and Editor at FXStreet: As the BOC 25 bps rate lift-off is well discounted by the market, the focus will remain on any hawkish tilt in the forward guidance. Governor Tiff Macklem and Co. could hint at aggressive tightening plans instead of a gradual approach towards normalizing monetary policy.

How Could it Affect USD/CAD?

Heading into the key event risk, the USD/CAD pair slipped back below the 1.2700 mark and was pressured by a combination of factors. A goodish recovery in the risk sentiment forced the safe-have US dollar to trim a part of its early gains to the highest level since June 2020. On the other hand, strong follow-through rally in crude oil prices to a fresh multi-year high underpinned the commodity-linked loonie and exerted some downward pressure on the major.

A more hawkish BoC would be enough to provide an additional boost to the Canadian dollar and pave the way for a further near-term depreciating move for the pair. That said, any immediate market reaction is more likely to be limited as the focus remains glued to developments surrounding the Russia-Ukraine saga. Nevertheless, the set-up seems tilted in favour of bearish traders and supports prospects for additional losses.

From current levels, any subsequent slide is likely to find decent support near mid-1.2600s. This is followed by the February monthly low, around the 1.2635 region, which coincides with the 100-day SMA. A convincing break below will make the pair vulnerable to break below the 1.2600 mark and test the 1.2570-1.2560 support before eventually dropping to the very important 200-day SMA, near mid-1.2500s.

On the flip side, the 1.2750 region now seems to have emerged as an immediate resistance ahead of the 1.2780-1.2785 static hurdle. Some follow-through buying beyond the 1.2800 mark might shift the bias in favour of bullish traders and lift the pair towards last week's swing high, around the 1.2875-1.2880 zone. A subsequent strength beyond the 1.2900 mark has the potential to push the pair to 2021 high, around the 1.2960-1.2965 area.

Key Notes

• Bank of Canada Rate Decision Preview: Hawkish hike to exacerbate the pain in USD/CAD

• BoC: Four scenarios, USD/CAD to tick down -0.20% with expected 25bp rate hike – TDS

• USD/CAD Analysis: 1.2650 holds the key for bulls amid geopolitical risks, ahead of BoC/Fed’s Powell

About the BoC Interest Rate Decision

BoC Interest Rate Decision is announced by the Bank of Canada. If the BoC is hawkish about the inflationary outlook of the economy and raises the interest rates it is positive, or bullish, for the CAD. Likewise, if the BoC has a dovish view on the Canadian economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

Fed Chair Jerome Powell, in the pre-release of his opening remarks at Wednesday's testimony before the US Congress, said that he expects it to be appropriate to raise interest rates at the coming March meeting. Powell said that the Fed is monitoring the situation in Ukraine, the impact of which on the US economy is "highly uncertain".

Powell reiterated that the Fed needs to be "nimble" in responding to incoming economic data and the evolving economic outlook and reiterated his call for balance sheet reduction to begin after rate liftoff has begun. Powell did not mention anything about the magnitude of the coming rate hike in March or any thereafter. The base case according to money market pricing is that the Fed will hike interest rates by 25bps.

Market Reaction

Powell's remarks have not come as a surprise to market participants and thus the DXY has not moved. Attention now turns to the Q&A portion of his testimony.

EUR/CHF is falling sharply after breaking below the 1.03 and 1.0254/35 barriers. Analysts at Credit Suisse look for further weakness, with next supports at 1.01/0084 and 1.00.

EUR/CHF to see an aggressive acceleration lower

“We could see a dramatic acceleration lower, in line with the sharp fall over the couple of days, which is mirrored by the fresh turn lower in momentum indicators.”

“We shift our focus toward a fall to parity, with only minor support before here at 1.01/0085. Failure to hold at parity and the next major support zone is now seen until 0.9839/30.”

“Near-term resistance now moves to the broken 1.0235/39 low from 2015, which we now expect to cap to maintain the direct downside pressure. A reversal back above here into the weekly close would point a potential reversal, however, this is not our base case. Next resistance though is at 1.03.”

- USD/CHF gained traction for the second straight day and was supported by a combination of factors.

- A positive risk tone undermined the safe-haven CHF and extended some support amid stronger USD.

- Traders now eye US ADP report/Powell’s testimony for some impetus amid the Russia-Ukraine saga.

The USD/CHF pair held on to its modest intraday gains heading into the North American session and was last seen trading just a few pips below the 0.9200 mark.

A combination of supporting factors assisted the USD/CHF pair to attract some buying near the 0.9165 region on Wednesday and move into the positive territory for the second successive day. Receding safe-haven demand undermined the Swiss franc and acted as a tailwind for the major amid modest US dollar strength.

As investors digest the recent developments surrounding the Russia-Ukraine saga, a goodish recovery in the equity markets drove investors away from traditional safe-haven assets. A slight improvement in the risk sentiment was reinforced by an uptick in the US Treasury bond yields, which extended support to the buck.

Apart from this, the worsening situation in Ukraine continued benefitting the greenback's status as the global reserve currency and also extended support to the USD/CHF pair. In fact, reports indicated that Russia has intensified the bombardment of Ukrainian cities and a large Russian convoy was approaching the capital Kyiv.

That said, diminishing odds for a 50 bps Fed rate hike move in March held forced the USD to pare a part of its intraday gains to the highest level since June 2020. The recent geopolitical developments now seem to have convinced investors that the Fed would adopt a less aggressive policy stance to combat high inflation.

Hence, it will be prudent to wait for strong follow-through buying before positioning for any further appreciating move. Market participants now look forward to the US ADP report on private-sector employment. This, along with Fed Chair Jerome Powell's semi-annual testimony, might provide some impetus to the USD/CHF pair.

Technical levels to watch

OPEC+ has agreed to stick to its existing output plan which entails 400K barrel per day hikes to oil output quotas each month in April, Reuters reported citing sources. The meeting of OPEC+ member nation oil ministers has now ended, Reuters reported. OPEC+ did not discuss increasing output quotas at a faster pace, Energy Intel reported.

Market Reaction

The very much expected outcome of Wednesday's meeting has not seemingly had much immediate impact on crude oil markets, which remain choppy, volatile and trading with a firmly upside trading bias. Front-month WTI futures are currently swinging near the $110 level, up roughly another $3.50 on the session, taking weekly gains to about.

US ADP jobs report overview

Wednesday's US economic docket highlights the release of the ADP report on private-sector employment, scheduled at 13:15 GMT. Consensus estimates suggest that the US private-sector employers added 388K jobs in February as against the loss of 301K jobs in the previous month. The report might influence expectations from the official Nonfarm Payrolls (NFP) report and help predict how things could move on Friday.

How could it affect EUR/USD?

Ahead of the key release, a goodish recovery in the risk sentiment forced the safe-have US dollar to trim a part of its early gains to the highest level since June 2020. Apart from this, stronger than expected Eurozone CPI print extended some support to the shared currency and assisted the EUR/USD pair to gain some positive traction on Wednesday. That said, the optimistic move in the markets runs the risk of fizzling out rather quickly amid worries about the worsening situation in Ukraine. This should continue to act as a tailwind for the buck and keep a lid on any meaningful upside for the major, suggesting that the immediate reaction to the US ADP report is more likely to be short-lived.

Meanwhile, Eren Sengezer, Editor at FXStreet, outlined important technical levels to trade the pair: “EUR/USD seems to have met interim support at 1.1080 and the pair could face renewed bearish pressure if buyers fail to defend this level. On the downside, 1.1000 (psychological level) could be seen as the next support.”

“In the meantime, the Relative Strength Index (RSI) indicator on the four-hour chart is still below 30, suggesting that the pair could push lower before turning technically oversold. Resistances are located at 1.1150 (static level), 1.1180 (20-period SMA) and 1.1220 (static level),” Eren added further.

Key Notes

• US ADP February Preview: Private job creation returns

• EUR/USD Forecast: Euro bears eye 1.1000 as Russian aggression continues

• EUR/USD to drop towards 1.10 unless heartening news of a ceasefire in Ukraine – ING

About the US ADP jobs report

The Employment Change released by the Automatic Data Processing, Inc, Inc is a measure of the change in the number of employed people in the US. Generally speaking, a rise in this indicator has positive implications for consumer spending, stimulating economic growth. So a high reading is traditionally seen as positive, or bullish for the USD, while a low reading is seen as negative, or bearish.

- GBP/USD attracted some dip-buying on Wednesday and reversed the early dip to the fresh YTD low.

- A positive risk tone prompted some profit-taking around the safe-haven USD and extended support.

- Geopolitical risk acted as a tailwind for the buck and kept a lid on any meaningful gains for the major.

The GBP/USD pair reversed the early European session slide to the fresh YTD low and was last seen trading in neutral territory, just above the 1.3300 round-figure mark.

As investors assess the impact of aggressive sanctions against Russia over its invasion of Ukraine, a goodish recovery in the equity markets undermined traditional safe-haven assets on Wednesday. This, in turn, forced the US dollar to pare its intraday gains to the highest level since June 2020 and assisted the GBP/USD pair to attract some buying near the 1.3270 region.

Apart from this, diminishing odds for a 50 bps Fed rate hike move in March acted as a headwind for the greenback. The recent geopolitical developments now seem to have convinced investors that the Fed would refrain from opting for a more aggressive policy stance to combat stubbornly high inflation. That said, rebounding US Treasury bond yields extended some support to the buck.

This, along with the worsening situation in Ukraine, continued boosting the greenback's status as the global reserve currency and kept a lid on any meaningful upside for the GBP/USD pair. In the latest geopolitical developments, reports indicated that Russia has intensified the bombardment of Ukrainian cities and a large Russian convoy was approaching the capital Kyiv.

Moreover, the Ukrainian foreign minister said that it was not clear when the second round of talks with Russia would take place. Adding to this, a spokesperson for the German economy minister noted that they have prepared three more sanction packages against Russia. Hence, the market focus will remain glued to fresh headlines surrounding the Russia-Ukraine saga.

In the meantime, traders on Wednesday might take cues from the US ADP report on private-sector employment. Later during the US session, Fed Chair Jerome Powell will testify before the House Financial Services Committee and provide some impetus to the GBP/USD pair. Any immediate market reaction, however, is more likely to be overshadowed by geopolitical headlines.

Technical levels to watch

Ukrainian foreign minister said on Tuesday that it was not clear when the second round of talks with Russia would take place, as reported by Reuters.

Meanwhile, a spokesperson for the German economy minister noted that they have prepared three more sanction packages against Russia and added that it was not out of the question that more could come.

Market reaction

Markets stay relatively quiet following these remarks. As of writing, the Euro STOXX 600 Index was virtually unchanged on the day and the US Dollar Index was clinging to modest daily gains at 97.60.

The annualized Eurozone Harmonised Index of Consumer Prices (HICP) jumps by 5.8% in February, coming in much higher than the previous reading of 5.1%, the latest data published by Eurostat showed on Wednesday. The consensus forecast was for a hotter reading of 5.4%.

The core figures arrived at 2.7% YoY in February when compared to 2.5% expectations and 2.3% booked in January.

The Euro area figures come a day after Germany’s annual inflation for February rose above expectations of 5.4%, arriving at 5.5% following a 5.1% increase reported in January.

Soaring inflation in the Euro area has intensified a policy dilemma for the European Central Bank (ECB), which must convey a sense of calm amid war-related market turmoil but also respond to mounting price pressures, per Reuters.

The bloc’s HICP figures hold significance, as it helps investor assess the chances that the European Central Bank (ECB) might signal a faster than the expected path for policy tightening.

Key details (via Eurostat)

“A 32% jump in energy costs drove inflation last month but unprocessed food prices were also up sharply, rising 6.1% and making inflation especially painful for lower-income families.”

“Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in February (31.7%, compared with 28.8% in January), followed by food, alcohol & tobacco (4.1%, compared with 3.5% in January), non-energy industrial goods (3.0%, compared with 2.1% in January) and services (2.5%, compared with 2.3% in January).”

EUR/USD reaction

EUR/USD is off the new 2022 low of 1.1059 but remains heavy near 1.1080, as the time of writing. The spot is losing 0.44% on the day, as the safe-haven US dollar holds firmer amid escalating Russia-Ukraine conflict.

GBP/USD has been trying to stabilize around 1.3300 following Tuesday's drop. A decline below 1.3270 is set to ramp up bearish pressure, FXStreet’s Eren Sengezer reports.

Next bearish target is located at 1.3200

“On the downside, near-term support seems to have formed at 1.3270. In case that level turns into resistance, GBP/USD could continue to push lower toward 1.3200 (psychological level, static level).”

“On the upside, initial resistance aligns at 1.3350 (static level) ahead of 1.3375 (20-period SMA on the four-hour chart) and 1.3430 (static level).”

UOB Group’s FX Strategists expect USD/CNH to accelerate losses on a breach of the 6.3000 level in the next weeks.

Key Quotes

24-hour view: “Our expectations for USD to ‘dip below 6.3050’ did not materialize as it dipped to 6.3070 before rebounding (high has been 6.3210). Momentum indicators are mostly neutral and USD is likely to trade sideways between 6.3150 and 6.3250.”

Next 1-3 weeks: “There is not much to add to our update from yesterday (01 Mar, spot at 6.3100). As highlighted, the underlying tone has softened but USD has to close below 6.3000 before a sustained decline is likely. The chance for USD to close below 6.3000 is not high for now but it would remain intact as long as USD does not move above 6.3450 within these few days.”

- Gold price remains choppy below $1,950, lacking a clear directional bias.

- The Russia-Ukraine updates affect the risk sentiment, gold price action.

- Will gold recapture $1,950 on Russia-Ukraine peace talks 2.0, Powell?

Gold price appears choppy but within a familiar range above the $1,900 mark, as the prevalent risk sentiment remains the main market driver amid incoming updates surrounding the Russia-Ukraine war. Uncertainty over the timing of another round of peace talks, soaring oil prices and global growth worries continue to sap investors’ confidence, diverting the safe-haven flows into the US dollar. Gold traders brace for the US Employment data and Fed Chair Jerome Powell’s testimony for fresh trading opportunities.

Read: Powell Preview: Rethink because of the war? Not so fast, Fed set to remain on track, dollar to rise

Gold Price: Key levels to watch

The Technical Confluences Detector shows that gold price has found solid support at $1,931, which is the intersection of the Fibonacci 23.6% one-month and the previous low four-hour.

If the latter gives way on selling resurgence, then the Fibonacci 38.2% one-day at $1,928 could come to the immediate rescue of gold bulls.

The additional declines will call for a test of the SMA10 four-hour at $1,924, below which the Fibonacci 61.8% one-day at $1,919 will help limit the downside.

The level to beat for gold bears is seen at $1,916, where the Fibonacci 38.2% one-week coincides with the pivot point one-day S1.

On the upside, strong resistance is aligned at $1,936, which is Fibonacci 23.6% one-day.

Gold bulls need a sustained break above $1,939 (confluence of the Fibonacci 61.8% one-week, and SMA5 four-hour) to resume the upside towards the $1,950 level.

Ahead of that psychological barrier, the previous day’s high of $1,946 could be tested.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

The People’s Bank of China (PBOC) is once again out with a statement on Wednesday, noting the measures likely to be undertaken for the effective functioning of the macro-prudential management system.

Key quotes

“Will step up counter-cyclical adjustment function of a macro-prudential management system.”

“Will step up monitoring, assessment and warning of systemic risks. “

“Will further expand toolbox of macro-prudential policies.”

USD/CNY reaction

USD/CNY was last seen trading at 6.3117, almost unchanged on the day.

“Russia can't win Ukraine with bombs, strikes and rockets,” Ukraine President Volodymyr Zelenskyy said in a national address on Thursday.

He went onto say that “almost 6,000 Russians have been killed in 6 days of war.”

Meanwhile, Russian media outlets report that the “Ukrainian delegation is yet to arrive for negotiations with Russia.”

“Negotiations between Russia and Ukraine will reportedly still take place - while the time has not yet been determined, it may be Wednesday evening,” RT reported.

These above headlines squash the report from Interfax that the next round of Russia-Ukraine talks may take place at the end of this week.

However, when Ukraine's Presidential Adviser was asked about date for more talks with Russia, he said, “it's under discussion,” adding that “substantial agenda is needed.”

Market reaction

The risk sentiment remains tepid and the US dollar attracts safe-haven bids amid looming Russia-Ukraine risks.

USD/RUB has shot through the roof once again, currently trading at 117.00, up over 6% on the day.

Brent Crude Oil has extended its uptrend after breaking above the multi-year descending trend line and 2018 peak of $86.75. Strategists at Société Générale expect the black gold to test the $117.00 resistance. Above here, lies the next objectives at $127.00 and $136.00.

$105 and $99.00 are short-term supports

“Brent is gradually heading towards the potential resistance located at 2014 levels $115.70/117.00 which is also a projection for the uptrend since 2020. Test of this hurdle can lead to a pause however signals of a large down move are still not visible.”

“$105 and daily Kijun line at $99.00 are short-term supports.”

“Beyond $117.00, next objectives are located at $127.00 and projections of $136.00.”

Even though the USD funding markets have calmed down a little, the dollar remains very much in demand. On Tuesday and the US Dollar Index gained 0.7%. Economists at ING expect DXY to test the next resistance at 97.70/98.

Powell testimony could drive a further wedge between the dollar and European FX

“The macro dent from Putin's war will clearly cost Europe far more heavily than the US. Indeed, pressure is building for European leaders to bite the bullet and start curtailing Russia's oil and gas imports in spite of the economic cost.”

“FOMC Chair Powell delivers semi-annual testimony to the Senate today. As long as he continues to focus on the inflationary threats expect Fed tightening expectations to remain broadly intact and the dollar supported.”

“Expect war in Europe to keep the dollar bid and DXY pressing the next layer of resistance at 97.70/98.00.”

The Bank of Canada (BoC) is set to hike rates by 25bp today. Although the move is fully priced in, the loonie could continue to perform relatively well, especially in the crosses, with external factors set to out-shadow post-BoC moves, economists at ING report.

BoC to hike by 25bp

“We expect to see a 25bp rate hike in Canada. The global re-pricing of tightening expectations has seen markets price out the possibility of a 50bp move today, although 25bp is fully embedded into CAD and should not be enough to send the loonie higher. The focus will be on forward-looking language and on the assessment of the impact from the Russia-Ukraine conflict on policy plans.”

“The spike in oil and gas prices is set to further underpin Canada’s economic momentum, while geographical distance and strong links to strong US domestic demand are likely insulating the country from any economic spillover from the Ukraine turmoil.”

“While some USD demand could keep USD/CAD around 1.2700 for now, EUR/CAD may soon test the 1.4000 support.”

See – BoC Preview: Forecasts from seven major banks, a 25bps hike with several more to come

Economists at Credit Suisse make forecast changes following Russia’s military action in Ukraine. They lower the expected EUR/USD Q1 range and the end-Q1 target.

Bearing down on EUR

“We lower our expected Q1 range from 1.1050-1.1600 previously to 1.0800-1.1400. We also lower our end-Q1 target from 1.1150 to 1.0950.”

“We wish to be clear that we see EUR/USD as a ‘sell rallies’ story, and we extend further our bearish stance that has now been in play since Q2 2021.”

Market’s perception of an “East vs West” standoff will likely lead USD/TWD to remain sensitive to Ukraine headlines. Economists at Credit Suisse expect USD/TWD to trade higher in an elevated range of 27.80-28.20.

China’s low tolerance for volatility suggests cross-straits escalation is unlikely

“We don’t think the situation in Ukraine is comparable to Taiwan. China views Taiwan as an internal, domestic issue, so its leaders do not consider the actions/disputes of two sovereign states (China’s Ministry of Foreign Affairs still affirms Ukraine’s sovereignty) as a template to settle issues regarding Taiwan.”

“China’s recent efforts to minimize FX and financial market volatility suggest its leaders have little appetite for an escalation of Taiwan Strait tensions that would add to financial market stress. Nevertheless, the market’s perception of an ‘East vs West’ standoff will likely lead USD/TWD to remain sensitive to Ukraine headlines.”

“We expect USD/TWD to trade higher in an elevated range of 27.80-28.20 over the next three months.”

- GBP/USD dropped to the lowest level since December on Wednesday amid renewed USD buying.

- The Russia-Ukraine conflict weighed on investors’ sentiment and benefitted the safe-haven buck.

- Some follow-through selling below the 1.3270 support zone will set the stage for a further decline.

The GBP/USD pair extended its steady intraday descent through the early European session and dropped to a fresh 2022 low, around the 1.3270 region in the last hour.

Following an early uptick to the 1.3340 area, the GBP/USD pair met with a fresh supply and turned lower for the second successive day on Wednesday amid renewed US dollar buying interest. Worries about the impact of aggressive sanctions against Russia and the worsening situation in Ukraine continued weighing on investors' sentiment. This was evident from a fresh leg down in the equity markets, which, in turn, was seen as a key factor that benefitted the safe-haven greenback.

In fact, reports indicated that Russia has intensified the bombardment of Ukrainian cities and a large Russian convoy was approaching the capital Kyiv. Apart from this, a goodish rebound in the US Treasury bond yields extended additional support to the buck. That said, diminishing odds for a 50 bps Fed rate hike move in March held back the USD bulls from placing aggressive bets and helped limit any deeper losses for the GBP/USD pair, at least for the time being.

The recent developments surrounding the Russia-Ukraine saga dashed hopes for a more aggressive policy response by the Fed to combat stubbornly high inflation. This was evident from the recent sharp decline in the US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond tumbled to its lowest level since January 24 on Tuesday. This, in turn, warrants caution before positioning for any further depreciating move for the GBP/USD pair.

From a technical perspective, acceptance below the 1.3300 round figure could be seen as a fresh trigger for bearish traders. The GBP/USD pair, however, found some support near the 1.3270 region, which should now act as a key pivotal point. A convincing break below will reaffirm the bearish bias and set the stage for a slide towards testing the 1.3200 mark. The downward trajectory could further get extended towards 2021 low, around the 1.3160 region.

There isn't any major market-moving economic data due for release from the UK, leaving the GBP/USD pair at the mercy of the USD price dynamics. Later during the early North American session, traders might take cues from the US ADP report and the Fed Chair Jerome Powell's semi-annual testimony before the House Financial Services Committee. The focus, however, will remain on geopolitical headlines amid the resumption of the Russia-Ukraine talks on Wednesday.

Technical levels to watch

Economists at TD Securities look for the Bank of Canada (BoC) to hike rates by 25bps in March. With the Fed and BoC set to hike, they do not see a huge swing factor for USD/CAD. Here are four possible scenarios regarding the upcoming monetary policy announcement.

Hawkish (5%)

“50bp hike + Roll-Off. BoC moves off the ELB with a 50bp hike. Inflation tracking above MPR projections, and Russia/Ukraine conflict introduces new risk to energy and supply chains. Must ensure this does not become embedded in expectations. Reinvestment of balance sheet to cease after March 11th. USD/CAD -1%.”

Mildly Hawkish (10%)

“25bp Hike + Roll-Off. BoC follows through on 25bp rate hike. Statement flags strength of inflation and modest impact from Omicron, but monitoring Russia/Ukraine conflict (and risks to inflation/activity) closely. Reinvestment of balance sheet to cease after March 11th. USD/CAD -0.50%.”

Base Case (75%)

“25bp Hike + Reinvestment. BoC follows through on 25bp rate hike. Statement flags strength of inflation and modest impact from Omicron, but monitoring Russia/Ukraine conflict (and risks to inflation/activity) closely. Continuing reinvestment phase could say more in Thursday's Progress Report. USD/CAD -0.20%.”

Dovish (10%)

“Deja Vu All Over Again (No Change). Russia/Ukraine conflict to weigh on financial conditions and growth. Appropriate to delay start of tightening given highly uncertain geopolitical backdrop and potential for escalation. USD/CAD +1.50%.”

See – BoC Preview: Forecasts from seven major banks, a 25bps hike with several more to come

Economists at Credit Suisse think it is too early to determine how the structure of the FX market for the rouble will look like or at which levels USD/RUB could settle over the medium-term.

Full extent to which Russian entities will be excluded from the international financial system is not clear yet

“The full extent to which Russian entities will be excluded from the international financial system is not clear yet. Accordingly, it is too early to determine how the structure of the exchange rate market for the rouble will look like or at which levels USD/RUB could settle over the medium-term.”

“In the absence of further deterioration in the sanctions regime Russia’s substantial current account surplus and possible repatriation flows are likely to support the ruble. Alternatively, in a negative scenario, sanctions on Russian exports could require another substantial devaluation of the exchange rate.”

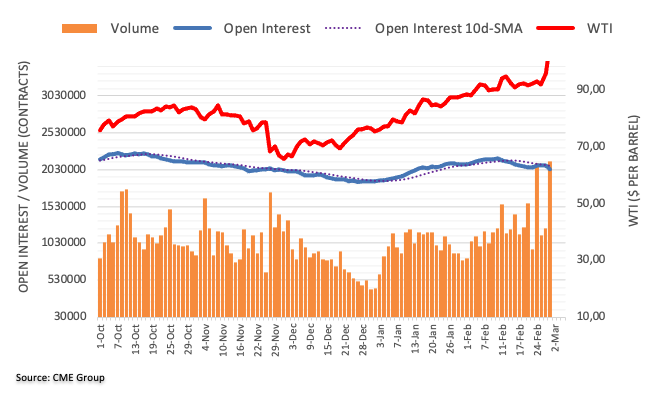

CME Group’s flash readings for crude oil futures markets noted traders scaled back their open interest positions by around 55.3K contracts on Tuesday, the largest single day drop since March 19 2021. On the other hand, volume went up by around 907.3K contracts, the second daily build in a row.

WTI: Immediate target emerges at $112.00

Prices of the barrel of WTI rose sharply on Tuesday and quickly left behind the key $100.00 mark. The strong upside was on the back of shrinking open interest, removing some strength from the likeliness of extra gains and opening the door to an impasse in the rally in the very near term at least. Further upside in crude oil prices now targets the round level at the $112.00 mark per barrel.

Here is what you need to know on Tuesday, March 2:

Safe-haven flows took control of markets in the second half of the day on Tuesday as Russia's ongoing aggression against Ukraine despite harsh sanctions imposed by western nations forced investors to seek refuge. Market participants are increasingly worried about the potential negative impact of a prolonged Russia-Ukraine war on global economic activity. Inflation data from the euro area and the ADP's private sector employment for the US will be featured in Wednesday's economic calendar. More importantly, delegations from Russia and Ukraine are set to meet for the second round of peace talks. Finally, FOMC Chairman Jerome Powell will testify before the House Committee on Financial Services at 1500 GMT.

Powell Preview: Rethink because of the war? Not so fast, Fed set to remain on track, dollar to rise

The greenback outperformed its rivals on Tuesday and the US Dollar Index gained 0.7% before settling near 97.50 early Wednesday. The 10-year US Treasury bond yield lost nearly 6% and touched its lowest level since early January below 1.7%. The barrel of West Texas Intermediate rose more than 10% and was last seen trading at its highest level since September 2013 at $109.30. The S&P 500 erased 1.5% on Tuesday and S&P 500 futures are trading flat so far on the day.

EUR/USD fell below 1.1100 for the first time since June 2020 on Tuesday. Following a technical correction during the Asian trading hours on Wednesday, the pair started to edge lower toward 1.1100 heading into the European session.

GBP/USD came under heavy bearish pressure during the American session on Tuesday and extended its slide early Wednesday. The pair is trading in the negative territory below 1.3300.

USD/CAD registered gains on Tuesday but stays on the back foot Wednesday morning. Rising crude oil prices seem to be helping the commodity-related loonie stay relatively resilient against the dollar.

The data from Australia showed earlier in the day that the economy grew by 4.2% on a yearly basis in the fourth quarter. This print beat the market expectation of 3.7% and allowed the AUD to find demand. Despite the broad-based dollar strength, AUD/USD is posting small daily gains above 0.7250.

Gold continued to attract investors and skyrocketed toward $1,950 on Tuesday. XAU/USD is staying relatively quiet below $1,940.

Bitcoin ignored the negative shift witnessed in risk sentiment and managed to push higher on Tuesday. BTC/USD is trading in a relatively tight range near $44,000 early Wednesday. Ethereum registered gains for the second straight on Tuesday but seems to have gone into a consolidation phase after testing $3,000.

Germany’s Economy Minister Robert Habeck said in a statement on Wednesday, “we are prepared should Russia stop gas exports.”

Earlier this week, Habeck pushed new proposals to counter the country's reliance on Russian gas following the invasion of Ukraine.

On Tuesday, European Commissioner for Competition, Margrethe Vestager, said: European Union (EU) “can't ban Russian gas completely.”

Market reaction

The S&P 500 futures pare back gains amid a tepid market mood while the US dollar index picks up fresh bids to regain 97.50, as of writing.

Meanwhile, WTI is up 5% on the day, heading closer to the $110 mark.

- AUD/USD grinds higher around six-week top, recently bouncing off intraday low.

- Short-term key support line, sustained trading above 200-SMA favor buyers.

- Ascending trend line from late January, early 2022 peak will challenge further upside.

- MACD portrays buyer’s hesitation but RSI support recovery moves.

AUD/USD remains on the front foot around 0.7270, up 0.18% intraday heading into Wednesday’s European session. In doing so, the Aussie pair floats above a one-week-old rising support line to print a two-day winning streak.

The upside momentum also takes clues from the firmer RSI line and the quote’s ability to stay firmer past 200-SMA.

However, an upward sloping resistance line from January 26, near 0.7310, precedes the January 2022 peak of 0.7315 to restrict the short-term upside of the AUD/USD prices.

Following that, a run-up towards the mid-November highs near 0.7370 can’t be ruled out.

Alternatively, a clear downside break of the stated support line, around 0.7260 by the press time, will direct AUD/USD towards the 61.8% Fibonacci retracement of the January 13-28 downturn, near 0.7180.

Even so, the 200-SMA level of 0.7160, as well as 0.7090-85 horizontal region, will challenge AUD/USD bears afterward.

AUD/USD: Four-hour chart

Trend: Further upside expected

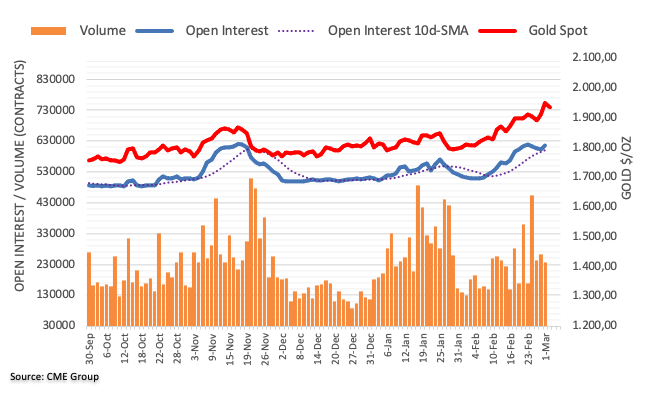

Open interest in gold futures markets increased by around 13.3K contracts after three consecutive daily pullbacks according to preliminary figures from CME Group. Volume, instead, shrank by around 25.7K contracts, keeping the choppy activity well in place for the time being.

Gold still focused on $2,000

Tuesday’s strong upside in gold prices was in tandem with rising open interest, which is indicative that extra gains appear favoured in the very near term. The moderate pullback in volume, however, might prompt some correction ahead of the continuation of the uptrend.

In opinion of FX Strategists at UOB Group, EUR/USD risks a deeper retracement if 1.1080 is breached in the next weeks.

Key Quotes

24-hour view: “Our view for EUR to trade sideways yesterday was incorrect as it plummeted to a low of 1.1088 before closing at 1.1125 (-0.83%). Further EUR weakness is not ruled out but a sustained decline below the major support at 1.1080 appears unlikely (next support is at 1.1050). On the upside, a breach of 1.1165 (minor resistance is at 1.1145) would indicate that the current weakness has stabilized.”

Next 1-3 weeks: “We have held a negative view in EUR for more than 2 weeks now. In our latest narrative from Friday (25 Feb, spot at 1.1205), we highlighted that ‘further EUR weakness is not ruled out but EUR could trade above 1.1105 for a couple of days first’. Yesterday (01 Mar), EUR dropped below 1.1105 before rebounding after touching a low of 1.1088. The price actions suggests EUR could continue to head lower. A clear break of 1.1080 could potentially open up the way for a decline to 1.1000 (there is a minor support at 1.1050). Overall, only a break of 1.1235 (‘strong resistance’ level was at 1.1290 yesterday) would indicate that the weak phase has run its course.”

- GBP/USD remains on the back foot around weekly low, fades early Asian session rebound.

- UK PM Johnson backs Russian exclusion from SWIFT, US President Biden bans flights from Moscow in US airspace.

- BOE, Fed policymakers flash mixed signals over Russia-Ukraine jitter’s impact on next moves.

- Global markets remain sluggish, yields, stock futures pare recent losses, DXY stays firmer.

GBP/USD takes offers to refresh intraday low around 1.3310, down for the second consecutive day amid early Wednesday morning in Europe. In doing so, the cable pair portrays the mixed feelings in the market, as well as cautious optimism, ahead of the key US data/events.

Having witnessed a full show of risk-aversion due to the Russia-Ukraine crisis in the last two days, market sentiment prints inactivity. The reason could be linked to the mixed comments from US President Joe Biden during his first State of the Union (SOTU) speech, as well as hopes of overcoming the Russia-Ukraine crisis as the peace talks aren’t off the table yet.

US President Biden banned Russian flights from entering the US airspace due to Moscow’s invasion of Ukraine. On the positive side was Biden’s promotion of “self-reliance” and readiness to battle inflation with systematic steps.

Read: S&P 500 Futures, US Treasury yields retreat as US President Biden’s SOTU bans Russian flights

Russia ran deeper into Kyiv and remains hopeful to achieve its goal but UK PM Johnson said, "It's already clear Putin will ultimately fail in Ukraine." The national leader also said that they will do more to exclude Russian banks from the SWIFT system and freeze their assets.

It should be noted that the recent Russia-Ukraine tussles have already raised concerns that the global economic recovery from the pandemic will be slowed down, which in turn probes central bank hawks. However, the recent comments from the US Federal Reserve (Fed) and Bank of England (BOE) officials haven’t yet confirmed the same even if the money markets are paring back the hopes of faster policy tightening.

Elsewhere, the UK signs an £800 million post-Brexit trade deal with New Zealand but British farmers don’t like it.

That said, the GBP/USD pair traders will keep their eyes on the Russia-Ukraine headlines for fresh impulse. Also important is the US ADP Employment Change for February and Fed Chair Jerome Powell’s bi-annual testimony.

Read: US ADP February Preview: Private job creation returns

Technical analysis

A clear downside break of the two-month-old support line, now resistance around 1.3490, directs GBP/USD prices towards 78.6% Fibonacci retracement of December-January upside, near 1.3280. However, oversold RSI conditions may test the pair bears afterward.

- Gold price looks set for a fresh rally after a corrective pullback towards $1,931.10.

- Putin has ordered to target Ukrainian civilians in response to their fierce resistance.

- The fresh wave of risk-off impulse has improved the demand for the yellow metal.

Gold (XAU/USD) has witnessed a pullback after kissing Tuesday’s high at $1,950.30 towards $1,931.10. However, the precious metal has bounced back firmly amid a rebound in the risk-on impulse.

The premeditated invasion of Ukraine has caused death and destruction in Kyiv. The build-up of military troops in Ukraine has forced people to leave Ukraine to save their lives.

In order to retaliate against Putin’s army, Ukraine’s military and civilians are firmly defending their country, and sanctions from the Western leaders are delighting their resistance. Post facing the fierce resistance from Ukraine’s civilians, Putin ordered to target civilians too. Moreover, missiles were aimed at Ukraine’s second-largest city, Kharkiv.

The Russian military activities have escalated in Ukraine after the Ukraine-Belarusian border gets flooded with Belarusian tanks. Ukraine Defense intelligence said that there are 300 Belarussian tanks close by the border, as per The Jerusalem Post. This has advanced the fears of more destruction in Ukraine.

The sanctions from the Western leaders have absolutely isolated Russia from other nations in the world. The collapse of the SWIFT international banking system for the latter is alarming a financial crisis in its economy.

The escalation in geopolitical fears has improved the appeal for safe-haven assets again and eventually the demand for the precious metal. Moreover, the US dollar index (DXY) has attracted significant bids and marching towards reclaiming Thursday’s high at 97.72.

Gold Technical Analysis

On a 15-minute scale, XAU/USD has given a breakout of an ascending triangle on the upside, which was in a range of Monday’s low and Tuesday’s average traded price at $1,891.13 and 1,925.35 respectively. Usually, an ascending triangle breakout on the upside denotes an expansion in the size of ticks, depth of volumes, and eases volatility in the asset. The precious metal has since pullback towards the 50-period Exponential Moving Average, which is trading around $1,935. The Relative Strength Index (RSI) (14) has sensed support around 40.00, which indicates that the asset is not as bearish anymore.

Gold 15-minute chart

-637817906493164252.png)

“China's monetary policy will remain prudent and flexible and increase credit expansion to counter external shocks and downward domestic pressures that will help keep the yuan stable,” MNI reports, citing a statement released by the People’s Bank of China (PBOC).

Additional takeaways

“China has the ability and conditions to stabilize the economy and inflation even though the overseas uncertainties have to be intensified by the accelerated policy tightening pace of the main economies and the rising geopolitical risks.”

“The PBOC stressed currency stability is the "fundamental monetary and financial environment " for a reasonable economic growth range.”

“The PBOC also vowed to support small and medium-sized companies via optimizing lending processes.”

Market reaction

USD/CNY is trading flat at 6.3125, as of writing, holding onto the previous rebound.

- AUD/USD takes a U-turn from intraday high, stays mildly bid around six-week high.

- US President Biden confirmed earlier rumors of banning US airspace for Russian flights.

- Firmer Australia Q4 GDP, market consolidation helped buyers earlier.

- US ADP, Fed Chair Powell’s Testimony will decorate calendar, risk catalysts are the key.

AUD/USD bulls face rejections near intraday high as risk appetite fades early Asian session optimism after the US President Joe Biden’s first State of the Union (SOTU) during Wednesday.

The reason could be linked to the banning of Russian flights from entering the US airspace, due to Moscow’s invasion of Kyiv. However, his comments over “self-reliance” seem to have kept the market hopeful of economic recovery and gained him cheers from the audience.

Read: US President Biden’s SOTU: Announcing a ban on Russian flights from using US airspace

As US President Biden continues to speak, the latest statements have been positive for sentiment as they suggest a plan to battle inflation.

Read: US President Biden on inflation: Instead of relying on foreign supply chains, let’s make it in America

Earlier in the day, Australia’s fourth quarter (Q4) GDP joined mild risk-on mood to help the AUD/USD pair consolidate the previous day’s losses. That said, Australia’s fourth quarter (Q4) GDP rose past 3.0% forecasts and -1.9% prior to 3.4% QoQ. Further, the YoY number rallied to 4.2% versus 3.7% expected and 3.9% previous readouts.

The improvement in the market sentiment, as reflected by the upbeat US Treasury yields and S&P 500 Futures, seemed to have ignored the risk-negative headlines concerning the Russia-Ukraine crisis.

It’s worth noting that the International Monetary Fund (IMF) and World Bank (WB) mentioned, “War in Ukraine creating significant spillover effects in other countries, commodity prices rising, risk driving further fueling inflation.” On the same line were comments from US Treasury Secretary Janet Yellen who denounces in strongest, per Reuters, Russia's illegal, brutal invasion of Ukraine.

Against this backdrop, the US 10-year Treasury yields hold onto the early Asian session’s bullion consolidation around 1.75%, up four basis points (bps) at the latest. However, the S&P 500 Futures fades the initial mild gains by the press time, up 0.10% intraday around 4,310.

Moving on, Fed Chair Jerome Powell’s bi-annual testimony and the US ADP Employment Change for February will be important data/events to watch for fresh impulse. However, headlines concerning Ukraine and Russia will be major directives.

Read: US ADP February Preview: Private job creation returns

Technical analysis

The AUD/USD pair’s ability to provide a daily closing beyond the 100-DMA level of 0.7235 enables it to challenge January’s high of 0.7315.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 107.45 | 8.98 |

| Silver | 25.403 | 3.91 |

| Gold | 1945.1 | 1.92 |

| Palladium | 2575.93 | 3.6 |

US President Joe Biden is delivering his first State of the Union address before a joint session of the 117th Congress in the chamber of the House of Representatives at the Capitol on Wednesday.

US President Biden’s State of the Union speech – Live stream

Key takeaways

Confirms US banning Russian flights from using US airspace.

We are choking off Russia's access to technology that will sap its economic strength and weaken its military for years to come.

Putin is now isolated from the world more than he has ever been.

We are cutting off Russia’s largest banks from the international financial system.

Preventing Russia’s central bank from defending the Russian ruble, making Putin’s $630 Billion `war fund` worthless."

Getting prices under control is his highest priority.

The US in coordination with the allies will release 60 billion barrels of oil from reserves.

We stand ready to do more if necessary. United with our allies. These steps will help blunt gas prices here at home.

Related reads

-

S&P 500 Futures, US Treasury yields retreat as US President Biden’s SOTU bans Russia flights

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Gross Domestic Product (QoQ) | Quarter IV | -1.9% | 3% |

| 00:30 (GMT) | Australia | Gross Domestic Product (YoY) | Quarter IV | 3.9% | 3.7% |

| 08:00 (GMT) | United Kingdom | MPC Member Cunliffe Speaks | |||

| 08:55 (GMT) | Germany | Unemployment Change | February | -48 | -25 |

| 08:55 (GMT) | Germany | Unemployment Rate s.a. | February | 5.1% | 5.1% |

| 10:00 (GMT) | Eurozone | Harmonized CPI ex EFAT, Y/Y | February | 2.3% | 2.5% |

| 10:00 (GMT) | Eurozone | Harmonized CPI | February | 0.3% | |

| 10:00 (GMT) | Eurozone | Harmonized CPI, Y/Y | February | 5.1% | 5.4% |

| 13:15 (GMT) | U.S. | ADP Employment Report | February | -301 | 323 |

| 14:30 (GMT) | U.S. | FOMC Member James Bullard Speaks | |||

| 15:00 (GMT) | U.S. | Fed Chair Powell Testimony | |||

| 15:00 (GMT) | Canada | Bank of Canada Rate | 0.25% | 0.5% | |

| 15:30 (GMT) | U.S. | Crude Oil Inventories | February | 4.515 | 2.748 |

| 19:00 (GMT) | U.S. | Fed's Beige Book | |||

| 21:30 (GMT) | Australia | AiG Performance of Construction Index | February | 45.9 |

- DXY struggles to extend the previous day’s heavy gains as markets turn cautious ahead of the key events.