- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 02-03-2011

"Оverall economic activity continued to expand at a modest to moderate pace in Jan & early Feb" after expanding moderately in Jan. All 12 dists reported growth, vs 12 in Jan and 10 in Dec. Retail sales increased in all areas except Richmond & Atlanta, and mfg was better everywhere. Tourism improved but was worse in NY and KC. Some Dists "reported a slight increase" in residential real estate though it remains at a low level. Some saw better comm'l real estate. Most regions saw an increase in nonfinancial services. Loan demand was mixed. Non-wage input costs rose, but wage pressures remained minimal. There were some hints of price pressures: many mfrs said to be passing thru higher inputs, retailers are hiking prices or planning to, and jobs mkt was better in all areas. Book was summarized at Atlanta Fed based on info up to Feb 1

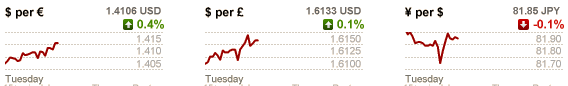

The dollar fell against most of its major counterparts, reaching the weakest level versus the euro in almost three months, as oil rose above $100 a barrel for a second day amid unrest in North Africa and the Middle East.

Crude oil for April delivery climbed as much as 2.8 percent to $102.37 a barrel in New York as turmoil in North Africa and the Mideast spread, fueling concern supplies will be disrupted.

Libyan forces loyal to Muammar Qaddafi counterattacked rebels in the east coast, where much of the country’s crude is refined or shipped abroad.

The euro gained versus most major currencies after a report showed European producer-price inflation accelerated more than forecast in January, adding to speculation the central bank will signal tightening monetary policy at its meeting tomorrow.

“The strength in the euro isn’t going to go away until post press release from the European Central Bank,” said Andrew Wilkinson, senior market analyst at Interactive Brokers Group LLC in Greenwich, Connecticut. “Until then, it’s just too easy for interest-rate speculators to push the euro higher.”

The euro erased early losses after factory-gate prices in the euro region jumped 6.1 percent from a year earlier, following a 5.3 percent rise in December, the European Union’s statistics office in Luxembourg said today. That’s the fastest since September 2008.

“There is broad dollar selling across the board; the market is clearly sensing negative effects of higher oil prices on the dollar,” said John McCarthy, director of currency trading at ING Groep NV in New York. “There is decent willingness to sell dollars, but no one is panicking -- that will turn around when oil gets high enough to scare the equity market.”

New Zealand’s dollar was the worst major performer after the prime minister said he expected an interest-rate cut. The Swiss franc rose to a record versus the greenback.

Stocks have extended their downturn so that the Dow and S&P 500 are now in the red. The Nasdaq, now barely positive, continues to find support from semiconductor stocks, which are up 1.1% as a group.

Oil prices continue to drive action among stocks. The energy component recently pushed past $102 per barrel, which makes for a fresh session high.

Oil's hike hasn't helped energy stocks, however. Instead, the sector is down 0.5% as it gets caught up in broader market selling pressure.

Stocks are at session highs following a pullback in oil prices. Oil prices recently fell below $100 per barrel, but they have since rebounded to $100.20 per barrel so that they sport a 0.6% gain. Oil prices are still off of their session high near $101.50 per barrel.

Semiconductor stocks continue to climb, which has helped give the Nasdaq a nice lead over its counterparts. Their 2.5% advance this session follows an industry upgrade from analysts at JPMorgan. Semiconductor stocks are already up 12% this year.

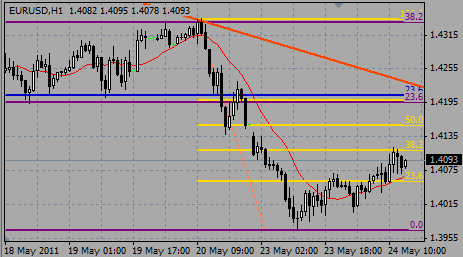

EUR/USD rallies ahead of tomorrow's ECB meeting. Supply mentioned ahead of $1.3900 with a strong barrier there. Stops above $1.3900. Currebtly rate holds around $1.3885.

GBP/USD holds up with a break of $1.6350 to open a move toward $1.6370. Neat resistance is at $1.6400 (1.618% swing target of the recent pullback from $1.6330 to $1.6216). Rate currently trades around $1.6333, off recently posted highs at $1.6344.

EUR/USD $1.3750, $1.3645, $1.3600, $1.3910

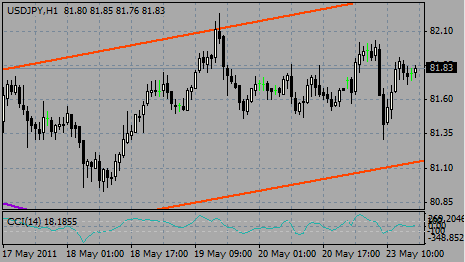

USD/JPY Y82.25, Y82.05, Y81.55

EUR/JPY Y114.00

GBP/USD $1.6400, $1.6050, $1.6040

USD/CHF Chf1.2950

AUD/USD $1.0000, $1.0050, $1.0060, $1.0100, $1.0200

AUD/NZD NZ$1.3500

U.S. stocks were set for a lower open Wednesday, following a selloff on renewed concerns about oil and the Libyan conflict.

U.S. stocks dropped Tuesday, with all three major indexes down more than 1%, as oil prices spiked to more than $100 a barrel.

World markets: World markets fell sharply Wednesday, a day after the big U.S. selloff, as forces loyal to leader Moammar Gadhafi attacked rebels in eastern Libya.

European stocks slumped at midsession. Britain's FTSE 100 slipped 0.5%, the DAX in Germany lost 0.7% and France's CAC 40 fell 0.7%.

Asian markets ended sharply lower. The Shanghai Composite slid 0.2%, while the Hang Seng in Hong Kong tumbled 1.5% and Japan's Nikkei sank 2.4%.

Economy: ADP released its latest private-sector jobs report, showing a gain of 217,000 jobs for February.

Economists had forecast the ADP report to show that private businesses hired 165,000 new workers last month, down from 187,000 in January.

A crude oil inventory report will be released at 15:30 GMT.

Companies: Warehouse retailer Costco (COST, Fortune 500) reported second-quarter earnings of $348 million, or 79 cents a share. Revenue jumped 11.3% year-over-year to $20.88 billion, slightly beating expectations. Shares edged lower in premarket trading.

Shares of Yahoo (YHOO, Fortune 500) climbed about 2% before the opening bell, amid reports that the online portal company is in talks to sell its 30% stake in its Yahoo! Japan venture.

EUR/GBP edges above stg0.8500 amid euro. Reported offers seen placed between stg0.8500/05, a break to open a move toward stg0.8520/25.

EUR/USD falls down to $1.3810 area following the ADP report but flows said very light. Euro continues to tread very familiar territory below $1.3850. Demand mentioned at $1.3800. Offers remain atop $1.3850 area of recent highs.

Data released

10:00 EU(17) PPI (January) 1.5% 0.9% 0.8%

10:00 EU(17) PPI (January) Y/Y 6.1% 5.5% 5.3%

The euro inched up on Wednesday, driven by expectations of higher official rates, although subdued risk appetite is likely to put a lid on gains and keep the dollar off a 3-1/2 month low versus a basket of currencies.

European Central Bank policymakers meet on Thursday, and with euro zone inflation well above its target, markets see the central bank sharpening its anti-inflation rhetoric.

But gains in the common currency risk a correction as geopolitical turmoil continues to fuel uncertainty and higher energy prices, causing stocks to tumble on Wednesday.

Concerns higher oil prices could hamper a global recovery are likely to erode investors' appetite for risk and drive them towards currencies like the U.S. dollar and Swiss franc, considered a safe-haven in times of stress.

"We have a deteriorating geopolitical situation which will see the U.S. dollar supported," said Ian Stannard, senior currency strategist at BNP Paribas.

Investors are nervous that the Middle-East crisis could spread, engulfing key oil producer Saudi Arabia, where financial markets have come under heavy selling pressure.

"Overall the risks for the euro are also rising, but ahead of the ECB meeting we expect it to be well supported," Stannard said. "But after the ECB meeting, we could see sovereign debt problems returning and that could see the euro under pressure."

The euro received a boost from data which showed euro zone producer prices rising in January at their highest rate in the history of the single currency, driven by energy costs. Despite this, the single currency has failed to clear the one-month high of $1.3857 it struck on Monday.

Economists say the ECB will hold fire on rates until at least October, but financial markets are betting on an earlier hike from the current record low of 1%.

EUR/USD strongly rose from $1.3740 to $1.3842 before retreated a bit. Resistance comes at Monday's high on $1.3857.

GBP/USD rose after a strong Construntion CPI data. Rate gained from $1.6210 to $1.6322 before back off under $1.6300.

USD/JPY fell from Y82.10 before set stable within the Y81.80/00 range.

Analysts say further dollar gains will depend on U.S. data.

Data on Tuesday showed U.S. manufacturing grew in February at its fastest rate in nearly seven years. The data supported forecasts for a strong improvement in U.S. non-farm payrolls due on Friday, which could give the dollar a boost.

Analysts expect payrolls to rise by 185,000, after a tepid 36,000 rise in January.

The Employment Change released by the Automatic Data Processing, Inc is a measure of the change in the number of employed people. A rise in this indicator has positive implications for consumer spending which stimulates economic growth. Generally speaking, a high reading is seen as positive, or bullish for the USD. Median is 184K after previous 187K in Jan.

Gold reaches a new record high at $1435.00ю Currently initial resistance comes at daily Bollinger band top and the Jan 28 rising channel top at $1439.8/1442.1. Daily studies have a slight bullish tone albeit overbought. Initial support seen from the Jan 3 reversal high at $1423.80 then support seen as the 5-DMA at $1419.10.

The Swiss franc strengthened against the dollar as oil prices rose above $100 a barrel for a second day amid unrest in North Africa and the Middle East, fueling demand for the currency as a haven.

The euro rose versus the dollar and yen after a report showed European producer-price inflation accelerated more than economists estimated in January.

Factory-gate prices in the euro region jumped 6.1% from a year earlier, after increasing 5.3% in December, the European Union’s statistics office said today. That’s the fastest since September 2008 and more than the 5.7% gain forecast by economists before the report.

Libyan rebels braced for renewed clashes with forces loyal to leader Muammar Qaddafi and Al Arabiya television reported Iranian protesters fought with security forces. New Zealand’s dollar fell to the lowest level this year after Prime Minister John Key said he expected a cut in the nation’s benchmark rate.

The focis is on the US data now. US data starts at 1315GMT with the ADP National Employment Report.

EUR/USD printed high on $1.3837 and retreated a bit, but the focus is on the upside. Next resistance seen at the NY high at $1.3852, with stronger area noted between $1.3855/65 ($1.3862 - Feb2 high). Stops remain at $1.3865/75. Option barrier interest at $1.3860 and $1.3875. Larger barrier interest seen at $1.3900 with offers there and stops above $1.3885.

GBP/USD follows euro's rise and breaks earlier highs on $1.6300, currently holding around $1.6310. rate exposed offers at $1.6300/05 ($1.6303 76.4% $1.6330/1.6216), and the upside target now is at Tuesday's high at $1.6330. Offers may come from $1.6330/50 to $1.6325/45. Further offers suggested toward an option barrier at $1.6350. Stops remain above.

USD/JPY Y82.25, Y82.05, Y81.55

EUR/JPY Y114.00

GBP/USD $1.6400, $1.6050, $1.6040

USD/CHF Chf1.2950

AUD/USD $1.0000, $1.0050, $1.0060, $1.0100, $1.0200

AUD/NZD NZ$1.3500

U.S. stocks slid, sending the Standard & Poor’s 500 Index to its first drop in three days, as concern that rising energy costs will hurt the economic recovery overshadowed the fastest manufacturing growth since 2004.

The Institute for Supply Management’s factory index increased to 61.4, the highest since May 2004, from 60.8 in January. Readings greater than 50 signal growth. Estimates of the economists ranged from 58.7 to 63.3, with the median at 61.

Alcoa Inc. and Titanium Metals Corp. fell at least 2.9 percent as crude rose above $99 a barrel amid escalating unrest in the Middle East and northern Africa. Fifth Third Bancorp dropped 5 percent after receiving a subpoena from the Securities and Exchange Commission for information on commercial loans. Carnival Corp. slid 6.3 percent after the chief operating officer of the largest cruise-line operator sold 180,000 shares.

Stocks erased an earlier advance after crude oil extended gains amid concern unrest will spread from Libya to Iran. Oil climbed as much after 1.9 percent as authorities in Iran, the second-largest producer in the Organization of Petroleum Exporting Countries, arrested opposition leaders to derail demonstrations scheduled for today.

Federal Reserve Chairman Ben S. Bernanke, testifying to the Senate Banking Committee in Washington, said the surge in oil probably won’t cause a permanent increase in inflation and repeated that interest rates are likely to stay low. His comments suggest the Fed will stay on course to complete $600 billion of Treasury purchases through June in an effort to suppress borrowing costs and safeguard the economic recovery.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.