- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 01-08-2014

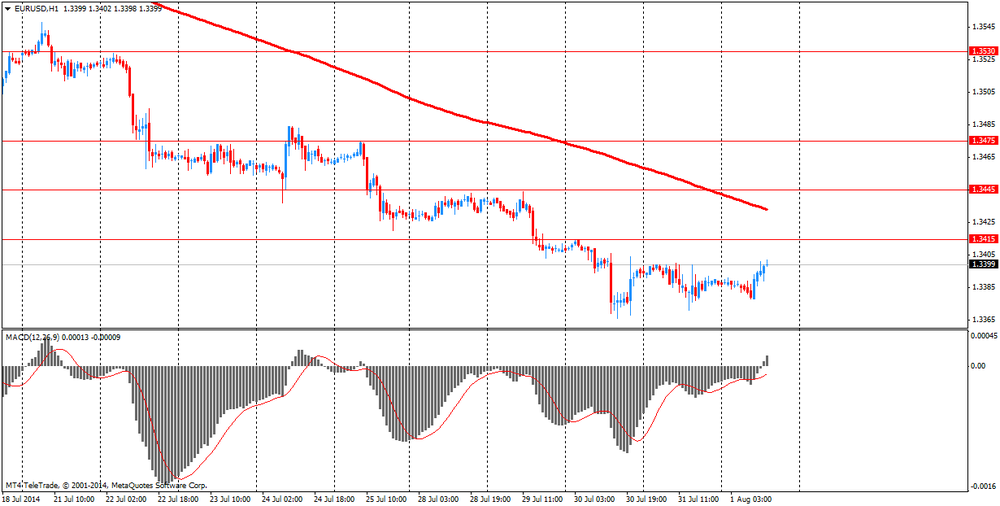

The dollar declined significantly against the euro, which was associated with the release of a report on the U.S. labor market, which has not met expectations. As it became known, unemployment unexpectedly rose in July - up 6.2% from June's 6.1%, which was the lowest value of the index since June 2008, according to the Ministry of Labor of the country. Analysts predicted changes. The number of jobs in the U.S. economy increased in July by 209 thousand after increasing by a revised 298 thousand a month earlier. Experts interviewed expected the figure to 230 thousand, previous assessment of the June rise equaled 288 thousand Edit Data for May and June added 15 thousand to employment growth. Improvement in the U.S. labor market this year, is expected to contribute to the sustainable growth of consumer spending, which, in turn, will support the creation of new jobs and ensure further economic recovery.

Dollar was little support data potrebdoveriyu. As shown by the final results of studies presented Thomson-Reuters and the Michigan Institute in July, American consumers feel more pessimistic about the economy than was recorded in the last month. According to the data, in July the final index of consumer sentiment fell to 81.8 compared with the final reading for June at 82.5 and the initial estimate for July at around 81.3. It is worth noting that, according to the average estimates of experts, the index was down compared with the June value to the level of 81.5.

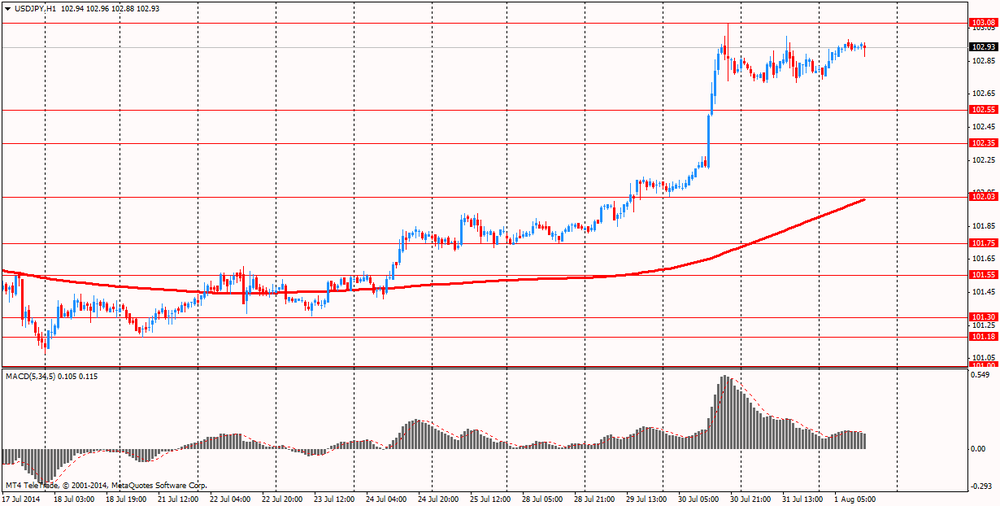

The yen has strengthened significantly against the U.S. dollar, after data on employment in the United States reported an increase in the number of jobs in the labor market at a moderate pace. However, they fell short of market expectations, while the unemployment rate rose. The July employment report in the U.S. has forced investors to transfer funds in U.S. Treasury bonds, especially with short maturities, triggering a drop in bond yields. Its reduction, in turn, exert downward pressure on the dollar against other currencies. U.S. bond yields decline makes the dollar less attractive to investors, as it reduces the gain on assets denominated in that currency. It is worth noting that improving data supported the prevailing market view that the U.S. economy is close to the Fed's mandate. In a statement this week, the Fed acknowledged the improvement of data, indicating that it may be approaching the first increase in interest rates since the financial crisis.

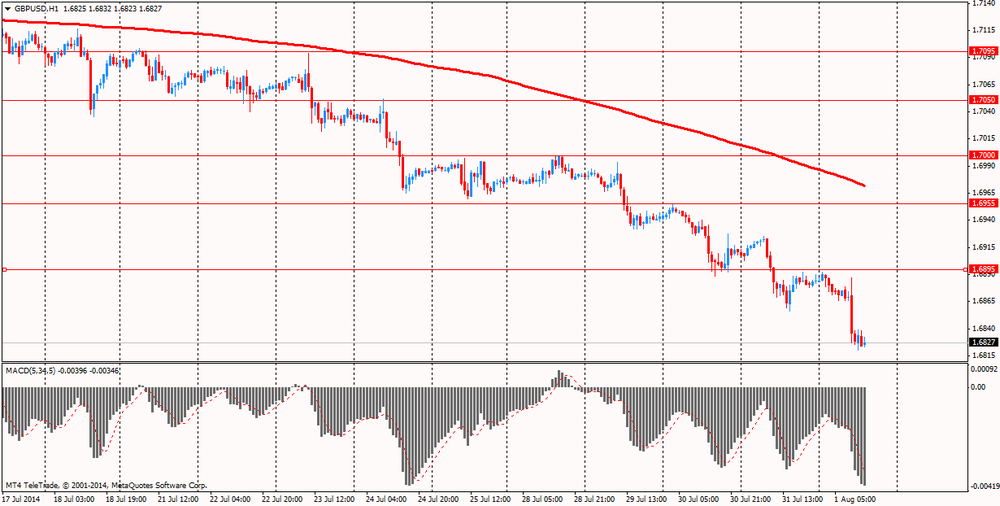

The British pound fell sharply against the U.S. dollar, as data on manufacturing activity disappointed investors. In the UK manufacturing activity grew at the slowest pace in a year in July, while a slowdown in new orders and output end of the first half of the "significant growth spurt," said Friday Markit Economics. Industrial activity index fell to 55.4 from a revised level of 57.2 in June. Economists had forecast a reading of 57.2 in July, from 57.5 previously voiced in June. The new orders index fell to 57.8 from 60.6 and the output index also fell. Although the report refers to some loss of momentum in manufacturing, the sensor is higher than the average in the 51.5 series, and showed expansion of 17 consecutive months. Other indicators show continued strength - a report from the Confederation of British Industry showed that factory orders are at their highest level since 1995. "Despite the cooling in July, growth in production and new orders remain well above their long-term trends, maintaining a constant job creation," said Rob Dobson, economist at Markit in London. "Growth rates remain historically very strong, to help promote another robust economic growth in the third quarter."

European stocks fell today, while reaching its lowest level in more than three months, which was associated with the publication of weaker-than-expected corporate reporting.

Investors are starting to be concerned about what rosy forecasts for higher profits in the second half of the year may not materialize. "There are doubts that the corporate sector is able to support the growth in order to justify the current level of capitalization" - believes economist Charles Stanley Betstoun Jeremy Carr.

Meanwhile, we add that the EU back fears of a new round of banking crisis, which is caused by the continuing deterioration of the situation of the second largest bank in Portugal Banco Espirito Santo.

Also attracted the attention of market data on unemployment in the U.S. in July. As it became known, the pace of hiring by American employers slowed in July but remained high, while employment growth was broad-based, indicating continued improvement in the labor market and the economy as a whole. Non-agricultural employment increased by 209,000 last month, and the unemployment rate rose to 6.2% from 6.1% in June. The unemployment rate fell by 1.1 percentage points from July 2013, when it was 7.3%. Economists had expected employment to increase by more 230,000 and the unemployment rate will remain at 6.1%. Employment rose by 298,000 in June, which was revised from earlier estimates of 288 000 and a gain in May was revised up to 229,000 from the earlier estimate of 224,000. Increase employment averaged 245,000 over the past three months, compared with an average of 209 000 for the 12 months ended in June. The July increase extends a series of observations, when non-farm employers added 200,000 more jobs for six consecutive months, the first time since 1997.

National benchmark indexes fell in 16 of the 17 western European markets that were open today. Markets in Switzerland were closed for a national holiday.

FTSE 100 6,679.18 -50.93 -0.76% CAC 40 4,202.78 -43.36 -1.02% DAX 9,210.08 -197.40 -2.10%

The value of shares ArcelorMittal, the world's largest steel producer, fell during trading up 6.2%. The company lowered its forecast EBITDA for 2014 to "more than $ 7 billion" with $ 8 billion

Paper French operator Iliad SA fell 6.9% after it became known that the company has made an offer to buy 56.6% stake in the fourth largest operator in the U.S., T-Mobile US, for $ 15 billion

Shares of Europe's largest construction company Vinci SA fell 6.4%. Vinci predicts a "small" decrease in revenues in 2014, whereas previously the French company expected that this figure "slightly change." Vinci profit excluding interest and tax payments in the first half of 2014 amounted to 1.54 billion euros, were worse than the average forecast of analysts at 1.63 billion euros.

Quotes insurance company Axa SA increased by 1.1% due to stronger-than-expected quarterly reports. In the first half net profit rose 22 percent - up to 3 billion euros, which was higher than expert estimates at 2.7 billion euros.

Paper Arkema SA fell 25 percent, registering the largest decline over the past 8 years. The company said it will be able to achieve its goal of sales and profit only in 2017 and not 2016 as previously predicted. We also learned that in the second quarter EBITDA was at 206 million euros, compared with forecasts of 234 million euros.

The price of oil fell moderately today, being at the same time near two-week low (grade Brent), as excess in the Atlantic basin and low demand outweighed concerns about tensions in the Middle East, North Africa and the Ukraine.

Experts point out that in spite of geopolitical risks, oil prices continue to fall. Neither situation in Iraq or a reduction in exports of Libyan oil or another military conflict between Israel and Hamas is unable to keep them from falling. It seems that speculators realized that almost all of these events will not reflect on the world oil market. According to forecasts, this year its production exceeds demand, so price drop seems logical.

The course of trade also influenced today's data on China, which showed activity indicators in the manufacturing sector in China in July rose, which was another sign of recovery in the sector. The official purchasing managers' index for the manufacturing of China in July rose to 51.7, its highest level in 27 months, against 51.0 in June, the National Bureau of Statistics reported. The July index was above economists' forecast - at 51.4. Subindex of manufacturing activity in small businesses in July rose to 50.1, surpassing the mark of 50 for the first time since April 2012. The new orders sub-index rose to 53.6, its highest level since May 2012. Meanwhile, according to HSBC Holdings PLC, the Purchasing Managers Index rose to 51.7 in July, its highest level in 18 months, against 50.7 in June. Nevertheless, the figure was lower than the preliminary assessment and the experts' forecasts - at the level of 52.0 points

Meanwhile, adding that a further fall in prices for oil futures today restrained today significant weakening of the U.S. dollar.

Market participants' attention is also drawn data and Thomson-Reuters Institute of Michigan, which showed that in July U.S. consumers feel more pessimistic about the economy than was recorded in the last month. According to the data, in July the final index of consumer sentiment fell to 81.8 compared with the final reading for June at 82.5 and the initial estimate for July at around 81.3. It is worth noting that, according to the average estimates of experts, the index was down compared with the June value to the level of 81.5.

The cost of the September futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 97.36 a barrel on the New York Mercantile Exchange (NYMEX).

September futures price for North Sea Brent crude oil mixture fell 97 cents to $ 104.82 a barrel on the London exchange ICE Futures Europe.

Gold prices rose sharply today, departing from the six-week low, and almost completely offsetting the decline yesterday, which was associated with the release of weak data on the U.S. labor market, which led to slightly revise projections for changes in rates by the Federal Reserve.

The U.S. Labor Department said that the pace of hiring by American employers slowed in July but remained high, while employment growth was broad-based, indicating continued improvement in the labor market and the economy as a whole. Non-agricultural employment grew by a seasonally adjusted 209,000 last month. The unemployment rate, obtained by a separate survey of households, rose to a seasonally adjusted 6.2% in July from 6.1% in June. The unemployment rate fell by 1.1 percentage points from July 2013, when it was 7.3%. Economists had expected employment to increase by more 230,000 and the unemployment rate will remain at 6.1%. Employment rose by 298,000 in June, which was revised from earlier estimates of 288 000 and a gain in May was revised up to 229,000 from the earlier estimate of 224,000. Increase employment averaged 245,000 over the past three months, compared with an average of 209 000 for the 12 months ended in June.

Meanwhile, we add that the course of trade affects the weak demand for physical gold in Asia, despite the fall in prices on Thursday. Recall that China is a major contributor to the increase in demand for gold in the world. As reported by Reuters, the demand for gold jewelry in China in the second quarter of 2014 shows a decline for the first time in eight years. Experts expect that gold consumption in the country for the year could fall by 20% due to the weakening of the yuan and reduce the excitement of the gold market, which broke out in April last year, after a sharp fall in prices for precious metals.

"Currently, the Chinese do not rush to buy gold, because they believe that its value has decreased enough" - said Sarah Zhao, an analyst at Thomson Reuters GFMS. He also added that if the gold to continue to fall in price and fall below $ 1,200 per ounce, the buyers return to the market again.

It should be noted that since the beginning of the year, gold prices rose by 6.6 percent, but much of this success has been noted in the first quarter. By the end of June the price of the precious metal fell by 3.4 percent, while fixing the largest monthly decline since the beginning of 2014.

The cost of the August gold futures on the COMEX today rose $ 4.14 - to $ 1295.30 per ounce.

EUR/USD $1.3274(E140mn), $1.3350(E187mn), $1.3375(E198mn), $1.3400(E926mn), $1.3450(E140mn), $1.3460(E395mn), $1.3475(E149mn), $1.3500(E599mn), $1.3510(E235mn), $1.3525(E140mn)

USD/JPY Y101.00($936mn), Y101.80(Y200mn), Y102.25($450mn), Y102.50($215mn), Y102.70($400mn), Y102.75($200mn), Y104.00($521mn), Y104.95($747mn

GBP/USD $1.6955(stg211mn)

AUD/USD $0.9300(A$100mn), $0.9330(A$100mn), $0.9340(A$202mn)

USD/CAD C$1.0700($350mn), C$1.0745($285mn), C$1.0750($140mn), C$1.0775($130mn), C$1.0785($125mn), C$1.0795($102mn), C$1.0800($600mn), C$1.0870($106mn), C$1.0910($147mn), C$1.0920($158mn)

U.S. stock futures declined as data showed employers added more than 200,000 to payrolls for a sixth straight month in July.

Global markets:

Nikkei 15,523.11 -97.66 -0.63%

Hang Seng 24,532.43 -224.42 -0.91%

Shanghai Composite 2,185.3 -16.26 -0.74%

FTSE 6,669.38 -60.73 -0.90%

CAC 4,217.73 -28.41 -0.67%

DAX 9,243.29 -164.19 -1.75%

Crude oil $97.76 (-0.43%)

Gold $1285.40 (+0.32%)

(company / ticker / price / change, % / volume)

| Merck & Co Inc | MRK | 56.74 | 0.00% | 2.8K |

| Procter & Gamble Co | PG | 79.2 | +2.43% | 57.0K |

| Chevron Corp | CVX | 130.06 | +0.63% | 0.3K |

| Caterpillar Inc | CAT | 100.93 | +0.18% | 7.1K |

| Exxon Mobil Corp | XOM | 99.05 | +0.11% | 4.3K |

| Pfizer Inc | PFE | 28.72 | +0.07% | 7.8K |

| Boeing Co | BA | 120.5 | +0.02% | 10.1K |

| Home Depot Inc | HD | 80.24 | -0.75% | 0.2K |

| International Business Machines Co... | IBM | 190.51 | -0.61% | 0.3K |

| Intel Corp | INTC | 33.7 | -0.56% | 81.7K |

| Cisco Systems Inc | CSCO | 25.1 | -0.52% | 44.8K |

| E. I. du Pont de Nemours and Co | DD | 64 | -0.48% | 2.7K |

| Johnson & Johnson | JNJ | 99.61 | -0.48% | 9.7K |

| Nike | NKE | 76.77 | -0.47% | 1.4K |

| The Coca-Cola Co | KO | 39.12 | -0.43% | 11.7K |

| Wal-Mart Stores Inc | WMT | 73.31 | -0.37% | 0.7K |

| General Electric Co | GE | 25.07 | -0.32% | 96.0K |

| 3M Co | MMM | 140.5 | -0.28% | 1.7K |

| Microsoft Corp | MSFT | 43.04 | -0.28% | 84.6K |

| McDonald's Corp | MCD | 94.35 | -0.22% | 1.7K |

| Walt Disney Co | DIS | 85.69 | -0.22% | 2.0K |

| United Technologies Corp | UTX | 104.95 | -0.19% | 0.3K |

| Visa | V | 210.63 | -0.18% | 4.4K |

| Verizon Communications Inc | VZ | 50.33 | -0.18% | 19.3K |

| Goldman Sachs | GS | 172.65 | -0.13% | 0.3K |

| JPMorgan Chase and Co | JPM | 57.6 | -0.12% | 5.5K |

| AT&T Inc | T | 35.55 | -0.11% | 35.0K |

| American Express Co | AXP | 87.99 | -0.01% | 0.7K |

07:48 France Manufacturing PMI (Finally) July 47.6 47.6 47.8

07:53 Germany Manufacturing PMI (Finally) July 52.9 52.9 52.4

07:58 Eurozone Manufacturing PMI (Finally) July 51.9 51.9 51.8

08:30 United Kingdom Purchasing Manager Index Manufacturing July 57.5 57.2 55.4

During the European session, the Forex market the euro rose against the dollar on the final data on business activity in the manufacturing sector.

Eurozone manufacturing activity growth remained stable at seven-month low of June, final data showed Markit Economics, published on Friday.

On a seasonally adjusted final index of purchasing managers in manufacturing was 51.8 in July, unchanged from June. Pre-reading for July was at 51.9.

The continuing growth of activity in Germany was partly offset by a deep recession of the French manufacturers.

At the same time, the German industrial sector has shown steady growth in July. Manufacturing PMI Markit / BME rose to 52.4 in July from 52 eight-month low in June. But the value for July was lower than the preliminary assessment 52.9.

On the other hand, the French manufacturing sector weakened in July, but a little less than originally anticipated.

French PMI index fell to 47.8 from a revised 48.2 in June. It was its lowest value in 2014 till now. Value for July was revised from 47.6.

The British pound fell against the U.S. dollar, as data on manufacturing activity disappointed investors.

In the UK manufacturing activity grew at the slowest pace in a year in July, while a slowdown in new orders and output end of the first half of the "significant growth spurt," said Friday Markit Economics. Industrial activity index fell to 55.4 from a revised level of 57.2 in June. Economists had forecast a reading of 57.2 in July, from 57.5 previously voiced in June. The new orders index fell to 57.8 from 60.6 and the output index also fell.

Although the report refers to some loss of momentum in manufacturing, the sensor is higher than the average in the 51.5 series, and showed expansion of 17 consecutive months. Other indicators show continued strength - a report from the Confederation of British Industry showed that factory orders are at their highest level since 1995.

"Despite the cooling in July, growth in production and new orders remain well above their long-term trends, maintaining a constant job creation," said Rob Dobson, economist at Markit in London. "Growth rates remain historically very strong, to help promote another robust economic growth in the third quarter."

EUR / USD: during the European session, the pair rose to $ 1.3402

GBP / USD: during the European session, the pair fell to $ 1.6820

USD / JPY: during the European session, the pair rose to Y102.98

U.S. at 12:30 GMT publish unemployment, changes in the number of people employed in non-agricultural sector, the change in the number of employees in the private sector of the economy, changes in the number of people employed in the manufacturing sector of the economy, the change in average hourly wages, the share of the economically active population, the total revision of employment for 2 months in July, the main index for personal consumption expenditures, changes in spending, deflator for personal consumption expenditures for June, in 13:55 GMT - indicator of consumer confidence from the University of Michigan in July in 14:00 GMT - ISM manufacturing index for July .

EUR/USD

Offers $1.3440-50, $1.3440, $1.3415-25, $1.3400

Bids $1.3360/50, $1.3320

GBP/USD

Offers $1.6926

Bids $1.6800, $1.6785/80, $1.6750

AUD/USD

Offers $0.9375/80, $0.9350, $0.9315/20, $0.9300

Bids $0.9250, $0.9200, $0.9150

EUR/JPY

Offers Y138.80, Y138.50, Y138.00

Bids Y137.50, Y137.20, Y137.05/00, Y136.80, Y136.50

USD/JPY

Offers Y104.00, Y103.50, Y103.15, Y103.00

Bids Y102.50, Y102.25/20, Y102.00, Y101.80

EUR/GBP

Offers stg0.8015-20, stg0.8000, stg0.7980/85

Bids stg0.7900

European stocks fell to their lowest level in more than three months as companies including ArcelorMittal and Vinci SA reported worse-than-forecast earnings. U.S. stock futures and Asian shares also declined.

A Markit Economics purchasing managers' index of euro-zone manufacturing was unchanged in July at 51.8. The median forecast of economists called for 51.9. A reading of 50 is the dividing line between expansion and contraction. A PMI index for the U.K. fell to the lowest level in a year, while a measure of manufacturing in Italy missed estimates, posting growth at the slowest pace in eight months.

A Labor Department report at 8:30 a.m. in Washington may show U.S. non-farm payrolls increased 230,000 in July, following a 288,000 gain in June, according to the median estimate of economists surveyed by Bloomberg. The unemployment rate in the world's biggest economy probably held at 6.1 percent, the lowest level since 2008, they forecast.

A separate report may show the Thomson Reuters/University of Michigan final index of consumer confidence in July fell to 81.8, from 82.5 in June. A third release may show the Institute for Supply Management's manufacturing index increased in July.

ArcelorMittal retreated 6.2 percent to 10.66 euros. The world's largest steelmaker predicted 2014 earnings before interest, taxes, depreciation and amortization in excess of $7 billion. It had previously forecast Ebitda of around $8 billion. The company said iron ore prices fell short of its expectations. ArcelorMittal also said second-quarter Ebitda climbed to $1.76 billion from $1.7 billion a year earlier. That missed the $1.84 billion average of analyst estimates compiled by Bloomberg.

Vinci retreated 6.6 percent to 48.22 euros. Europe's biggest builder forecast a drop in 2014 revenue, compared with an earlier projection of little change. Vinci also reported first-half earnings before interest and taxes of 1.54 billion euros ($2.1 billion), missing the median analyst prediction of 1.63 billion euros.

Iliad tumbled 7.6 percent to 190.40 euros after it offered $33 per share in cash for 56.6 percent of T-Mobile. The French mobile-phone carrier said it values the remaining shares of T-Mobile at $40.50 each. T-Mobile confirmed it received a proposal from Iliad. Its parent Deutsche Telekom AG considers the offer inferior to a separate bid by Sprint Corp., a person familiar with the matter said. Deutsche Telekom advanced 2.1 percent to 12.36 euros.

Axa SA gained 1.3 percent to 17.41 euros after France's largest insurer said first-half net income surged 22 percent to 3 billion euros, boosted by improved earnings from selling life insurance and savings products. That beat the 2.7 billion-euro average analyst projection.

FTSE 100 6,639.97 -90.14 -1.34%

CAC 40 4,187.68 -58.46 -1.38%

DAX 9,213.25 -194.23 -2.06%

EUR/USD $1.3274(E140mn), $1.3350(E187mn), $1.3375(E198mn), $1.3400(E926mn), $1.3450(E140mn), $1.3460(E395mn), $1.3475(E149mn), $1.3500(E599mn), $1.3510(E235mn), $1.3525(E140mn)

USD/JPY Y101.00($936mn), Y101.80(Y200mn), Y102.25($450mn), Y102.50($215mn), Y102.70($400mn), Y102.75($200mn), Y104.00($521mn), Y104.95($747mn

GBP/USD $1.6955(stg211mn)

AUD/USD $0.9300(A$100mn), $0.9330(A$100mn), $0.9340(A$202mn)

USD/CAD C$1.0700($350mn), C$1.0745($285mn), C$1.0750($140mn), C$1.0775($130mn), C$1.0785($125mn), C$1.0795($102mn), C$1.0800($600mn), C$1.0870($106mn), C$1.0910($147mn), C$1.0920($158mn)

Asian stocks slumped, extending the biggest global rout in six months that saw the Dow Jones Industrial Average wipe out this year's gains in one session amid weaker earnings and credit-market concerns.

S&P/ASX 200 5,556.4 -76.51 -1.36%

TOPIX 1,281.3 -8.12 -0.63%

SHANGHAI COMP 2,187.84 -13.73 -0.62%

Skymark Airlines Inc. sank 11 percent after Japan's third-largest carrier said it may go out of business should it have to pay Airbus Group NV a penalty for canceling the purchase of six A380 superjumbos.

Samsung Electronics Co. fell 3.8 percent in Seoul after UBS AG cut its rating on the stock.

Cheung Kong Holdings Ltd slid 4.4 percent in Hong Kong after the property developer controlled by billionaire Li Ka-shing posted profit that missed estimates.

EUR / USD

Resistance levels (open interest**, contracts)

$1.3501 (2517)

$1.3467 (1651)

$1.3436 (695)

Price at time of writing this review: $ 1.3385

Support levels (open interest**, contracts):

$1.3356 (2627)

$1.3326 (2796)

$1.3288 (2862)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 31896 contracts, with the maximum number of contracts with strike price $1,3600 (4432);

- Overall open interest on the PUT options with the expiration date August, 8 is 33841 contracts, with the maximum number of contracts with strike price $1,3500 (6149);

- The ratio of PUT/CALL was 1.06 versus 1.11 from the previous trading day according to data from July, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (2650)

$1.7001 (1107)

$1.6904 (650)

Price at time of writing this review: $1.6872

Support levels (open interest**, contracts):

$1.6798 (1972)

$1.6699 (1088)

$1.6600 (437)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 18321 contracts, with the maximum number of contracts with strike price $1,7100 (2650);

- Overall open interest on the PUT options with the expiration date August, 8 is 25096 contracts, with the maximum number of contracts with strike price $1,7000 (2692);

- The ratio of PUT/CALL was 1.40 versus 1.43 from the previous trading day according to data from Jule, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

01:00 China Manufacturing PMI July 51.0 51.4 51.7

01:30 Australia Producer price index, q / q Quarter II +0.9% +0.7% -0.1%

01:30 Australia Producer price index, y/y Quarter II +2.5% +2.3%

01:45 China HSBC Manufacturing PMI (Finally) July 52.0 52.0 51.7

03:30 Japan BOJ Governor Haruhiko Kuroda Speaks

The dollar headed for a third weekly gain versus the euro, the longest stretch in two months, as signs of a sustained U.S. recovery boost speculation the Federal Reserve is moving toward raising interest rates.

The Bloomberg Dollar Spot Index approached the strongest since March as economists said data today will show U.S. employers boosted jobs and the Fed's preferred gauge of inflation was near the most since 2012. U.S. employers added 230,000 workers in July and the jobless rate stayed at an almost six-year low of 6.1 percent, according to Bloomberg surveys before today's Labor Department data. The personal consumption expenditure deflator, an inflation measure preferred by the Fed, rose an annual 1.7 percent in June after climbing 1.8 percent in May, which was the biggest gain since 2012, a separate survey showed.

The dollar rose for an 11th day versus the yen, the longest stretch since 2001.

Australia's dollar headed for its biggest weekly loss since May after a Chinese Purchasing Managers' Index for manufacturing from HSBC Holdings Plc and Markit Economics showed a final reading of 51.7 in July, less than its preliminary figure of 52.

EUR / USD: during the Asian session, the pair traded in the range of $ 1.3385-90

GBP / USD: during the Asian session the pair fell to $ 1.6865

USD / JPY: during the Asian session, the pair rose to Y102.95

Focus on key US employment data at 1230GMT, with action in the dollar providing the main market drive, though UK mfg PMI at 0830GMT (median 57.2 vs 57.5 last) will provide the earlier domestic interest.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.