- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 01-07-2014

Stock indices increased due to better-than-expected manufacturing data from China and the U.K. and Eurozone's inflation data. The Chinese manufacturing purchase managers' index increased to 51.0 in June from 50.8 in May, in line with expectations.

Eurozone's unemployment rate remained unchanged at 11.6% in May. Analysts had expected an increase to 11.7%.

German unemployment rate remained unchanged at 6.7% in June, in line with expectations.

The German economy lost 9,000 jobs in June. Analysts had expected the economy to add 9,000 jobs.

German final manufacturing purchase managers' index declined to 52.0 in June from 52.3 in May, missing expectations for a rise to 52.4.

French final manufacturing purchase managers' index decreased to 48.2 in June from 49.6 in May, beating expectations for a drop to 47.8.

The U.K. manufacturing purchase managers' index rose to 57.5 in June from 57.0 in May, beating forecasts of a decline to 56.7.

Bilfinger SE shares dropped 19% after lowering its full-year profit forecast.

BNP Paribas SA shares climbed 3.6% after reporting the company will keep its dividend unchanged.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,802.92 +58.98 +0.87%

DAX 9,902.41 +69.34 +0.71%

CAC 40 4,461.12 +38.28 +0.87%

The U.S. dollar traded mixed against the most major currencies after the weaker-than-expected U.S. economic data. U.S. final manufacturing purchasing managers' index declined to 57.3 in June from 57.5 in April. Analysts had expected the index to remain unchanged.

ISM manufacturing PMI in the U.S. decreased to 55.3 in June from 55.4 in May, missing expectations for a rise to 55.6.

Construction spending in the U.S. climbed 0.1% in May, missing expectations for a 0.5% gain, after 0.8% rise in April. April's figure was revised up from a 0.2% increase.

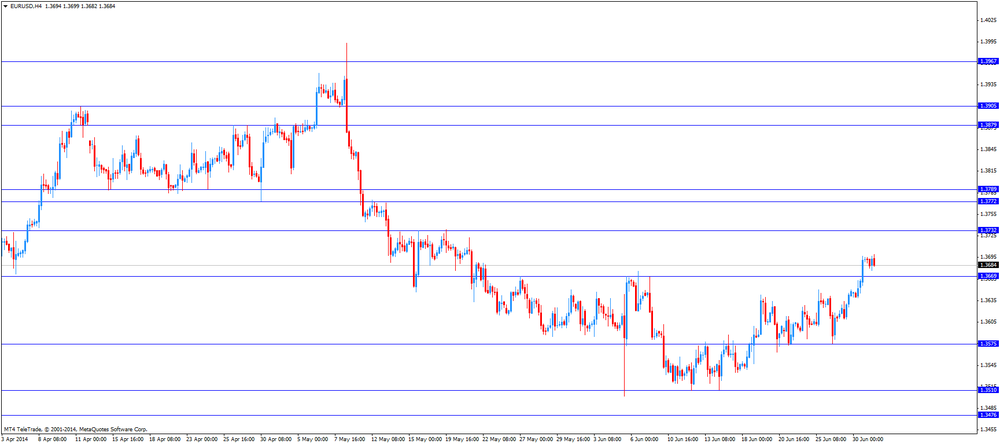

The euro traded slightly lower against the U.S. dollar after the weaker-than-expected U.S. economic data. Eurozone's unemployment rate remained unchanged at 11.6% in May. Analysts had expected an increase to 11.7%.

German unemployment rate remained unchanged at 6.7% in June, in line with expectations.

The German economy lost 9,000 jobs in June. Analysts had expected the economy to add 9,000 jobs.

German final manufacturing purchase managers' index declined to 52.0 in June from 52.3 in May, missing expectations for a rise to 52.4.

French final manufacturing purchase managers' index decreased to 48.2 in June from 49.6 in May, beating expectations for a drop to 47.8.

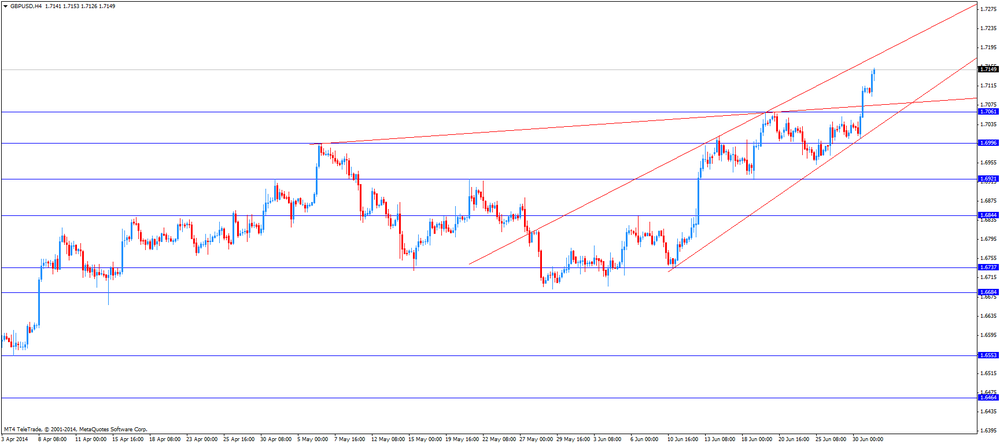

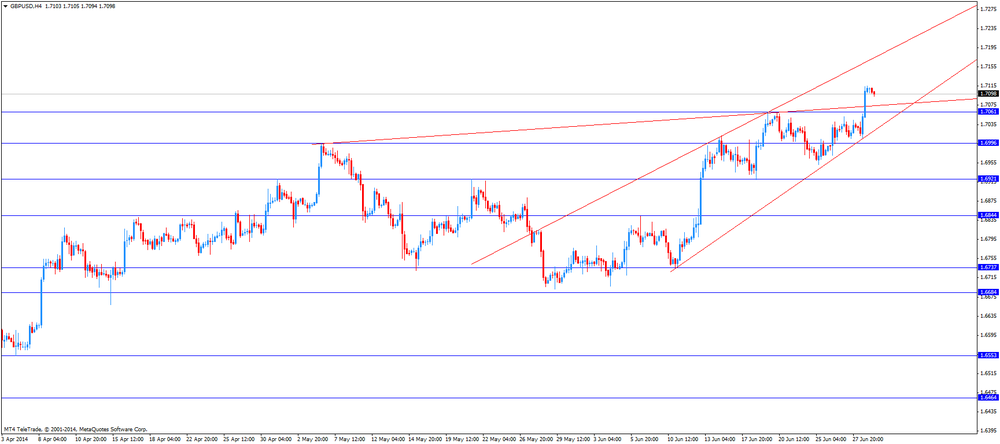

The British pound traded higher against the U.S. dollar after the weaker-than-expected U.S. economic data. The U.K. manufacturing purchase managers' index rose to 57.5 in June from 57.0 in May, beating forecasts of a decline to 56.7.

The Swiss franc traded mixed against the U.S. dollar after the weaker-than-expected U.S. economic data. The manufacturing purchase managers' index in Switzerland gained to 54.0 in June from 52.5 in May, beating expectations for a rise to 52.6.

The New Zealand dollar traded higher against the U.S dollar after the weaker-than-expected U.S. economic data and due to the strong manufacturing data from China. The Chinese manufacturing purchase managers' index increased to 51.0 in June from 50.8 in May, in line with expectations.

China's final HSBC manufacturing purchase managers' index declined to 50.7 in June from 50.8 in May. Analysts had forecasted the index to remain unchanged at 50.8.

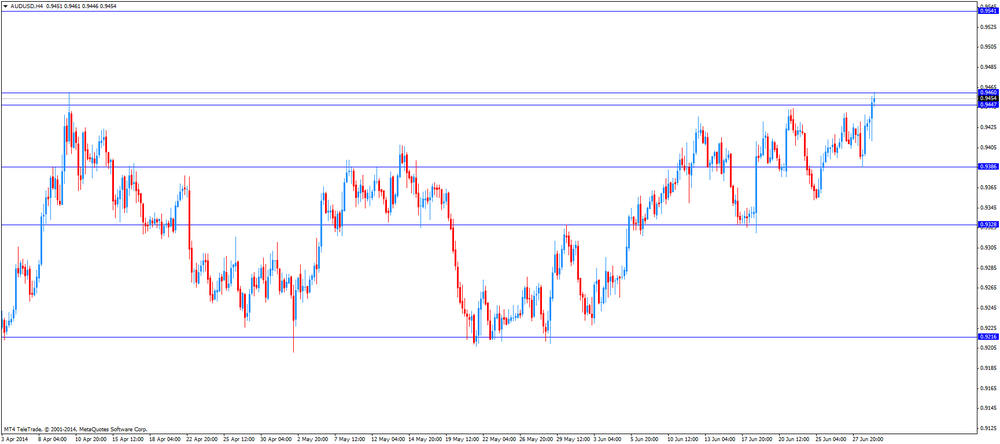

The Australian dollar rose against the U.S. dollar after the weaker-than-expected U.S. economic data. The Reserve Bank of Australia (RBA) kept its interest rate unchanged at a record low 2.5%. The RBA Governor Glenn Stevens said that the Australian dollar "offering less assistance than it might" in lifting economic growth.

RBA commodity prices decreased 9.6% in June, after a 12.8 drop in May.

AIG manufacturing index for Australia declined to 48.9 in June from 49.2 in May.

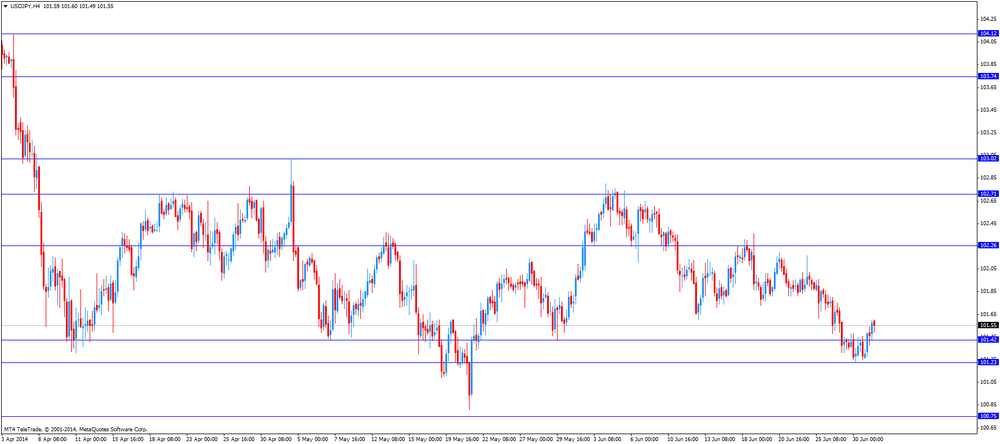

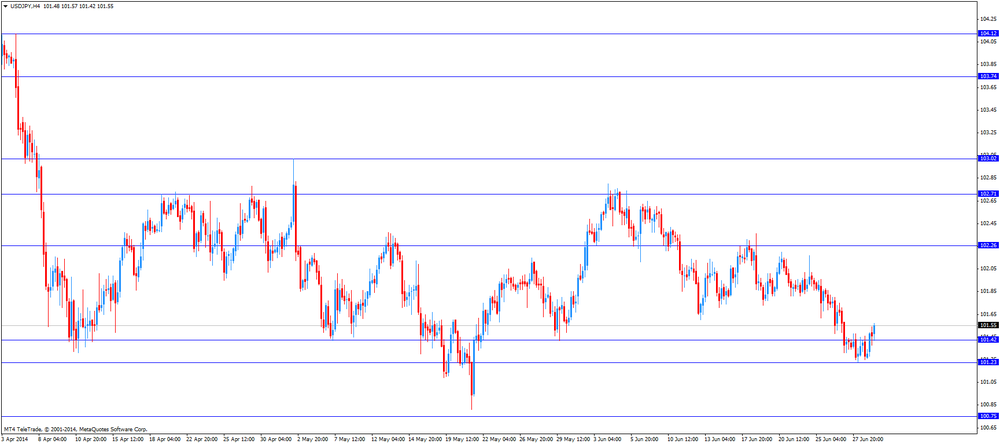

The Japanese yen traded mixed against the U.S. dollar after the weaker-than-expected U.S. economic data. Japan's Tankan manufacturing index was plus 12 in the second quarter, missing expectations for plus 16, after plus 17 the previous quarter. This was the first decline in six quarters.

Japan's Tankan non-manufacturing index was plus 19 in the second quarter, in line with expectations, after plus 24 the previous quarter.

Japan's average cash earnings climbed 0.8% in May, in line with expectations, after a 0.7% gain in April.

Japanese manufacturing purchase managers' index climbed to 51.5 in June from 51.1 in May.

Prices of oil futures declined slightly today, having fallen under the influence of upbeat manufacturing data in China, and the tense situation in Iraq and in Ukraine.

As it became known, purchasing managers index was 51.0. Figure corresponds to the median estimate of analysts and increased compared to 50.8 in May. A similar index from HSBC Holdings Plc and Markit Economics rose to 50.7 compared with 49.4 in the previous month. In June, production in China grew at the fastest pace this year. This creates signs that the government's efforts to help stabilize the second largest economy in the world.

"The growth of the PMI index suggests that growth recovered in connection with the recent policy-oriented growth, including investments in infrastructure and the rapid financing of budgets", - said Liu Li-Gang, chief economist for Greater China in the Banking Group Australia New Zealand and Hong Kong. - "The recent promise premier Li Keqiang to achieve growth targets shows that the overall position of politicians will be more conducive to growth in the second half of the year." Recall that on July 16, China will publish data on GDP for the second quarter. It is expected that the economy grew by 7.4% compared with a year earlier.

"Markets need a catalyst that would set the direction of prices. Course, need to monitor the situation in Iraq and the Ukraine, but the economic data, including the United States, point to improvements in the global economy," - said OptionsXpress analyst Ben Le Brun.

Market participants are also waiting for the publication of a weekly report on crude oil inventories in the United States. Experts expect a decline in U.S. oil inventories for the previous week by 2.5 million barrels. A week earlier, the Ministry of Energy reported an increase in stocks at the terminal at Cushing, which stores the physical quantities of oil, 416 thousand barrels. Increase was the third in the last five months, and the level of reserves at the terminal close to the minimum five years.

"Regarding the positive dynamics of quotations WTI is largely due to expectations reduce inventories, - said the head of Mizuho Securities futures Bob Yeager. - Provisions on the terminal in Cushing falling at an alarming rate. "

Traders also expected employment data in the U.S., which will be published on Thursday. According to analysts, the number of jobs in June increased by 211,000, and if the forecast is confirmed, the increase in the number of jobs exceeds 200,000 the fifth month in a row, which has not happened since September 1999, January 2000.

Cost of the August futures on U.S. light crude oil WTI (Light Sweet Crude Oil) fell to $ 105.25 a barrel on the New York Mercantile Exchange (NYMEX).

August futures price for North Sea Brent crude oil mixture fell 13 cents to $ 112.20 a barrel on the London exchange ICE Futures Europe.

Gold prices rose slightly, reaching maximum values at the same time the end of March, due to the weakness of the U.S. dollar and growing tensions in Iraq. Recall that the market closed yesterday, rising to the second quarter in a row, and in June showed the best result since February.

"In this quarter, we expect higher gold prices, or even their growth due to great uncertainty," - said Phillip Futures investment analyst Howie Lee. According to him, the resistance level for gold - $ 1365 per ounce, and the level of support - $ 1189.

Gold is also supported by geopolitical problems. Iraqi army is trying to dislodge Sunni insurgents from Tikrit and Ukraine renewed offensive against pro-Russian separatists in the east of the country after the end of the truce. It should be noted that due to local wars in Iraq and Ukraine gold has risen in price by 10 percent since the beginning of the year.

Experts point out that in the coming days will be determined by the prospects of gold widely anticipated report from the U.S. labor market, the publication of which is scheduled for Thursday. It may surprise the market, both for better and for worse. In the first case, possible sale of gold on a background of concerns about the return policy tightening by the Federal Reserve System. In the second case, buying gold is likely to continue due to expectations of a longer period of soft U.S. central bank policy.

Meanwhile, adding that the investment demand for gold has also increased, which further supports the demand for gold futures. As it became known, the world's largest reserves secured gold exchange-traded fund SPDR Gold Trust on Monday rose by 5.68 tons to 790.70 tons, indicating the growth of investment demand. In general, in the II quarter of the volume of deposits decreased by 37 t On the other hand, during the same period last year, the volume of deposits in the funds has fallen by more than 400 tonnes demand in the physical market, however, decreases with increasing prices. Prices in China for $ 1 per ounce lower than the world.

The cost of the August gold futures on the COMEX today rose to $ 1330.8 per ounce.

The Reserve Bank of Australia (RBA) released its interest decision on Tuesday:

- The RBA kept its interest rate unchanged at a record low 2.5%. This decision was expected by market participants;

- The economic growth should be below trend over the year.

The RBA Governor Glenn Stevens said:

- The Australian dollar "offering less assistance than it might" in lifting economic growth;

- Commodity prices remain high, but some commodity prices that are important to Australia have declined;

- "There has been some improvement in indicators for the labour market in recent months, but it will probably be some time yet before unemployment declines consistently. Growth in wages has declined noticeably".

EUR/USD $1.3500, $1.3610, $1.3620, $1.3625, $1.3640

USD/JPY Y101.50, Y102.50

EUR/JPY Y138.00, Y139.65

AUD/USD $0.9350, $0.9400, $0.9425, $0.9500

EUR/GBP stg0.7900, stg0.7990, stg0.8010, stg0.8020, stg0.8065, stg0.8075, stg0.8135

EUR/CHF Chf1.2200

U.S. stock futures rose as a report showed China's manufacturing expanded before the release of U.S. factory data.

Global markets:

Nikkei 15,326.2 +164.10 +1.08%

Hang Seng 23,190.72 -30.80 -0.13%

Shanghai Composite 2,050.38 +2.05 +0.10%

FTSE 6,784.82 +40.88 +0.61%

CAC 4,450.95 +28.11 +0.64%

DAX 9,857.06 +23.99 +0.24%

Crude oil $105.75 (+0.34%)

Gold $1327.70 (+0.42%)

(company / ticker / price / change, % / volume)

| Procter & Gamble Co | PG | 78.68 | +0.11% | 0.3K |

| American Express Co | AXP | 95.05 | +0.19% | 8.7K |

| Wal-Mart Stores Inc | WMT | 75.21 | +0.19% | 16.9K |

| Caterpillar Inc | CAT | 108.89 | +0.20% | 4.3K |

| Verizon Communications Inc | VZ | 49.05 | +0.25% | 13.7K |

| Intel Corp | INTC | 30.98 | +0.26% | 17.7K |

| Merck & Co Inc | MRK | 58.01 | +0.28% | 0.7K |

| JPMorgan Chase and Co | JPM | 57.39 | +0.30% | 3.7K |

| Travelers Companies Inc | TRV | 94.36 | +0.31% | 4.5K |

| Cisco Systems Inc | CSCO | 24.93 | +0.32% | 0.1K |

| Walt Disney Co | DIS | 86.02 | +0.33% | 3.3K |

| Johnson & Johnson | JNJ | 104.99 | +0.35% | 0.1K |

| General Electric Co | GE | 26.38 | +0.38% | 0.6K |

| Microsoft Corp | MSFT | 41.86 | +0.38% | 1.7K |

| AT&T Inc | T | 35.50 | +0.40% | 6.2K |

| Pfizer Inc | PFE | 29.80 | +0.40% | 5.4K |

| Boeing Co | BA | 127.76 | +0.42% | 5.3K |

| 3M Co | MMM | 143.24 | 0.00% | 1.2K |

| E. I. du Pont de Nemours and Co | DD | 65.44 | 0.00% | 15.2K |

| Exxon Mobil Corp | XOM | 100.68 | 0.00% | 1.3K |

| Nike | NKE | 77.55 | 0.00% | 3.0K |

| Home Depot Inc | HD | 80.96 | 0.00% | 1.6K |

| International Business Machines Co... | IBM | 181.27 | 0.00% | 1.7K |

| United Technologies Corp | UTX | 115.45 | 0.00% | 1.2K |

| The Coca-Cola Co | KO | 42.26 | -0.24% | 0.1K |

| Goldman Sachs | GS | 166.29 | -0.69% | 3.7K |

Upgrades:

Downgrades:

Goldman Sachs (GS) downgraded to Mkt Perform from Outperform at Bernstein

Other:

Verizon (VZ) initiated with a Buy at BTIG Research, target $60

Economic calendar (GMT0):

01:00 China Manufacturing PMI June 50.8 51.0 51.0

01:30 Japan Labor Cash Earnings, YoY May +0.7% +0.8% +0.8%

01:35 Japan Manufacturing PMI June 51.1 51.5

01:45 China HSBC Manufacturing PMI (Finally) June 50.8 50.8 50.7

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

06:30 Australia RBA Commodity prices, y/y June -12.8% -9.6%

07:30 Switzerland Manufacturing PMI June 52.5 52.6 54.0

07:48 France Manufacturing PMI (Finally) June 49.6 47.8 48.2

07:53 Germany Manufacturing PMI (Finally) June 52.3 52.4 52.0

07:55 Germany Unemployment Change June 24 -9 9

07:55 Germany Unemployment Rate s.a. June 6.7% 6.7% 6.7%

07:58 Eurozone Manufacturing PMI (Finally) June 52.2 51.9 51.8

08:30 United Kingdom Purchasing Manager Index Manufacturing June 57.0 56.7 57.5

09:00 Eurozone Unemployment Rate May 11.6% 11.7% 11.6%

12:00 Canada Bank holiday

12:00 U.S. Treasury Sec Lew Speaks

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. U.S. final manufacturing purchasing managers' index should remain unchanged at 57.5 in June.

ISM manufacturing PMI in the U.S. should climb to 55.6 in June from 55.4 in May.

The euro traded mixed against the U.S. dollar after mixed economic data from Eurozone. Eurozone's unemployment rate remained unchanged at 11.6% in May. Analysts had expected an increase to 11.7%.

German unemployment rate remained unchanged at 6.7% in June, in line with expectations.

The German economy lost 9,000 jobs in June. Analysts had expected the economy to add 9,000 jobs.

German final manufacturing purchase managers' index declined to 52.0 in June from 52.3 in May, missing expectations for a rise to 52.4.

French final manufacturing purchase managers' index decreased to 48.2 in June from 49.6 in May, beating expectations for a drop to 47.8.

The British pound increased against the U.S. dollar after the better-than-expected U.K. manufacturing purchase managers' index. The U.K. manufacturing purchase managers' index rose to 57.5 in June from 57.0 in May, beating forecasts of a decline to 56.7.

The Swiss franc traded mixed against the U.S. dollar after the better-than-expected manufacturing purchase managers' index from Switzerland. The manufacturing purchase managers' index in Switzerland gained to 54.0 in June from 52.5 in May, beating expectations for a rise to 52.6.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair was up to $1.7153

USD/JPY: the currency pair increased to Y101.60

The most important news that are expected (GMT0):

13:45 U.S. Manufacturing PMI (Finally) June 57.5 57.5

14:00 U.S. Construction Spending, m/m May +0.2% +0.5%

14:00 U.S. ISM Manufacturing June 55.4 55.6

23:50 Japan Monetary Base, y/y June +45.6% +48.3%

EUR/USD

Offers $1.3750, $1.3695/700

Bids $1.3576-74

GBP/USD

Offers $1.7200, $1.7170/75, $1.7150

Bids $1.7100/090, $1.7070/60, $1.7035/30, $1.7000

AUD/USD

Offers $0.9550, $0.9500

Bids $0.9400, $0.9380, $0.9350, $0.9320

EUR/JPY

Offers Y140.00, Y139.50, Y139.20

Bids Y138.50, Y138.20, Y138.00, Y137.50

USD/JPY

Offers Y102.50, Y102.00, Y101.80

Bids Y101.20, Y101.10/00, Y100.80, Y100.50

EUR/GBP

Offers

Bids stg0.7985-80, stg0.7950, stg0.7930-20, stg0.7900

Stock indices traded higher after mixed economic data from Eurozone. Eurozone's unemployment rate remained unchanged at 11.6% in May. Analysts had expected an increase to 11.7%.

German unemployment rate remained unchanged at 6.7% in June, in line with expectations.

The German economy lost 9,000 jobs in June. Analysts had expected the economy to add 9,000 jobs.

German final manufacturing purchase managers' index declined to 52.0 in June from 52.3 in May, missing expectations for a rise to 52.4.

French final manufacturing purchase managers' index decreased to 48.2 in June from 49.6 in May, beating expectations for a drop to 47.8.

Bilfinger SE shares dropped 14% after lowering its full-year profit forecast.

Current figures:

Name Price Change Change %

FTSE 100 6,780.06 +36.12 +0.54%

DAX 9,860.94 +27.87 +0.28%

CAC 40 4,451.76 +28.92 +0.65%

Asian stock indices traded higher due to the strong manufacturing data from China. The Chinese manufacturing purchase managers' index increased to 51.0 in June from 50.8 in May, in line with expectations. This is a sign of a recovery in the world's second largest economy.

China's final HSBC manufacturing purchase managers' index declined to 50.7 in June from 50.8 in May. Analysts had forecasted the index to remain unchanged at 50.8.

Japan's Tankan manufacturing index was plus 12 in the second quarter, missing expectations for plus 16, after plus 17 the previous quarter. This was the first decline in six quarters.

Japan's Tankan non-manufacturing index was plus 19 in the second quarter, in line with expectations, after plus 24 the previous quarter.

Japan's average cash earnings climbed 0.8% in May, in line with expectations, after a 0.7% gain in April.

Markets in Hong Kong were closed for holidays.

Indexes on the close:

Nikkei 225 15,326.2 +164.10 +1.08%

Hang Seng closed

Shanghai Composite 2,050.38 +2.05 +0.10%

EUR/USD $1.3500, $1.3610, $1.3620, $1.3625, $1.3640

USD/JPY Y101.50, Y102.50

EUR/JPY Y138.00, Y139.65

AUD/USD $0.9350, $0.9400, $0.9425, $0.9500

EUR/GBP stg0.7900, stg0.7990, stg0.8010, stg0.8020, stg0.8065, stg0.8075, stg0.8135

EUR/CHF Chf1.2200

Economic calendar (GMT0):

01:00 China Manufacturing PMI June 50.8 51.0 51.0

01:30 Japan Labor Cash Earnings, YoY May +0.7% +0.8% +0.8%

01:35 Japan Manufacturing PMI June 51.1 51.5

01:45 China HSBC Manufacturing PMI (Finally) June 50.8 50.8 50.7

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

06:30 Australia RBA Commodity prices, y/y June -12.8% -9.6%

07:30 Switzerland Manufacturing PMI June 52.5 52.6 54.0

07:48 France Manufacturing PMI (Finally) June 49.6 47.8 48.2

07:53 Germany Manufacturing PMI (Finally) June 52.3 52.4 52.0

07:55 Germany Unemployment Change June 24 -9 9

07:55 Germany Unemployment Rate s.a. June 6.7% 6.7% 6.7%

07:58 Eurozone Manufacturing PMI (Finally) June 52.2 51.9 51.8

08:30 United Kingdom Purchasing Manager Index Manufacturing June 57.0 56.7 57.5

09:00 Eurozone Unemployment Rate May 11.6% 11.7% 11.6%

The U.S. dollar traded mixed against the most major currencies. The U.S. currency remained under pressure after yesterday's release of weaker-than-expected Chicago purchasing managers' index. Chicago purchasing managers' index dropped to 62.6 in June from 65.5 in May, missing expectations for a decline to 63.2.

The New Zealand dollar traded slightly higher against the U.S dollar due to the strong manufacturing data from China. The Chinese manufacturing purchase managers' index increased to 51.0 in June from 50.8 in May, in line with expectations.

China's final HSBC manufacturing purchase managers' index declined to 50.7 in June from 50.8 in May. Analysts had forecasted the index to remain unchanged at 50.8.

The Australian dollar increased against the U.S. dollar after the Reserve Bank of Australia's interest rate decision and the strong manufacturing data from China. The Reserve Bank of Australia (RBA) kept its interest rate unchanged at a record low 2.5%. The RBA Governor Glenn Stevens said that the Australian dollar "offering less assistance than it might" in lifting economic growth.

RBA commodity prices decreased 9.6% in June, after a 12.8 drop in May.

AIG manufacturing index for Australia declined to 48.9 in June from 49.2 in May.

The Japanese yen traded mixed against the U.S. dollar after the weaker-than-expected data from Japan and the strong manufacturing data from China. Japan's Tankan manufacturing index was plus 12 in the second quarter, missing expectations for plus 16, after plus 17 the previous quarter. This was the first decline in six quarters.

Japan's Tankan non-manufacturing index was plus 19 in the second quarter, in line with expectations, after plus 24 the previous quarter.

Japan's average cash earnings climbed 0.8% in May, in line with expectations, after a 0.7% gain in April.

Japanese manufacturing purchase managers' index climbed to 51.5 in June from 51.1 in May.

EUR/USD: the currency pair declined to $1.3685

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

AUD/USD: the currency pair increased to $0.9456

The most important news that are expected (GMT0):

12:00 Canada Bank holiday

12:00 U.S. Treasury Sec Lew Speaks

13:45 U.S. Manufacturing PMI (Finally) June 57.5 57.5

14:00 U.S. Construction Spending, m/m May +0.2% +0.5%

14:00 U.S. ISM Manufacturing June 55.4 55.6

23:50 Japan Monetary Base, y/y June +45.6% +48.3%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3765 (2912)

$1.3735 (6263)

$1.3706 (3657)

Price at time of writing this review: $ 1.3683

Support levels (open interest**, contracts):

$1.3663 (1599)

$1.3632 (1613)

$1.3592 (4120)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 33220 contracts, with the maximum number of contracts with strike price $1,3700 (6263);

- Overall open interest on the PUT options with the expiration date July, 3 is 42445 contracts, with the maximum number of contracts with strike price $1,3500 (5604);

- The ratio of PUT/CALL was 1.28 versus 1.24 from the previous trading day according to data from June, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.7400 (1019)

$1.7300 (428)

$1.7201 (2123)

Price at time of writing this review: $1.7103

Support levels (open interest**, contracts):

$1.6999 (1859)

$1.6900 (2295)

$1.6800 (1721)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 27236 contracts, with the maximum number of contracts with strike price $1,7100 (4437);

- Overall open interest on the PUT options with the expiration date July, 3 is 27509 contracts, with the maximum number of contracts with strike price $1,6700 (2413);

- The ratio of PUT/CALL was 1.01 versus 1.09 from the previous trading day according to data from June, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(index / closing price / change items /% change)

S&P/ASX 200 5,395.7 -49.36 -0.91%

TOPIX 1,262.56 +9.41 +0.75%

SHANGHAI COMP 2,045.41 +9.00 +0.44%

FTSE 100 6,743.94 -13.83 -0.20%

CAC 40 4,422.84 -14.15 -0.32%

DAX 9,833.07 +17.90 +0.18%

Dow -27.45 16,824.39 -0.16%

Nasdaq +10.25 4,408.18 +0.23%

S&P -0.9 1,960.06 -0.05%

(raw materials / closing price /% change)

Gold $1,325.81 +9.64 +0.73%

Oil $105.40 -0.34 -0.32%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3694 +0,33%

GBP/USD $1,7111 +0,43%

USD/CHF Chf0,8866 -0,46%

USD/JPY Y101,31 -0,10%

EUR/JPY Y138,72 -0,05%

GBP/JPY Y173,31 +0,32%

AUD/USD $0,9430 +0,04%

NZD/USD $0,8761 -0,18%

USD/CAD C$1,0667 +0,03%

(time / country / index / period / previous value / forecast)

01:00 China Manufacturing PMI June 50.8 51.0 51.0

01:30 Japan Labor Cash Earnings, YoY May +0.7% +0.8% +0.8%

01:35 Japan Manufacturing PMI June 51.1 51.5

01:45 China HSBC Manufacturing PMI (Finally) June 50.8 50.8 50.7

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50%

04:30 Australia RBA Rate Statement

06:30 Australia RBA Commodity prices, y/y June -12.8%

07:30 Switzerland Manufacturing PMI June 52.5 52.6

07:48 France Manufacturing PMI (Finally) June 49.6 47.8

07:53 Germany Manufacturing PMI (Finally) June 52.3 52.4

07:55 Germany Unemployment Change June 24 -9

07:55 Germany Unemployment Rate s.a. June 6.7% 6.7%

07:58 Eurozone Manufacturing PMI (Finally) June 52.2 51.9

08:30 United Kingdom Purchasing Manager Index Manufacturing June 57.0 56.7

09:00 Eurozone Unemployment Rate May 11.7% 11.7%

12:00 Canada Bank holiday

12:00 U.S. Treasury Sec Lew Speaks

13:45 U.S. Manufacturing PMI (Finally) June 57.5 57.5

14:00 U.S. Construction Spending, m/m May +0.2% +0.5%

14:00 U.S. ISM Manufacturing June 55.4 55.6

20:30 U.S. API Crude Oil Inventories June +4.0

23:50 Japan Monetary Base, y/y June +45.6% +48.3%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.