- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 01-03-2023

- EUR/JPY is marching towards 145.50 gradually as chances of more rates from the ECB look solid.

- Along with Germany, the price index in Spain and France has also surprised market participants with an upside release.

- Tokyo’s inflation is seen lower despite expansionary monetary policy from the BoJ.

The EUR/JPY pair is approaching the critical resistance of 145.50 gradually in the early Tokyo session. The cross rebounded firmly from below 144.00 after a perpendicular fall amid a surprise rise in the German Harmonized Index of Consumer Prices (HICP) (Feb) data. The annual preliminary HICP jumped to 9.3% against the consensus of 9.0% and the 9.2% figure released earlier. On a monthly basis, the German HICP has jumped by 1% vs. the expectations of 0.7%.

A surprise rise in German inflation has bolstered the expectations of further rise in interest rates by the European Central Bank (ECB). Along with Germany, the price index in Spain and France has also surprised market participants with an upside release.

It looks like the upbeat labor market is demanding higher wages from firms and then pumping extra funds into the economy. The street is already anticipating that Eurozone might avoid a deep recession, which could be backed by upbeat domestic demand.

Post-release of German inflation, ECB policymaker Joachim Nagel reiterated on Wednesday that further significant rate hikes beyond March may be needed, as reported by Reuters. He further added, "Energy price drop has no essential bearing on ECB's medium-term inflation projections." ECB policymaker expects the "German economy to contract in Q1; gradual pick up from Q2 seen but no major improvement seen."

For further action, Eurozone inflation data will be keenly watched, which is scheduled for Thursday. The preliminary Eurozone HICP (Feb) is seen declining to 8.2% from the former release of 8.6%. Apart from that, the Unemployment Rate (Jan) is expected to decline to 6.5% versus 6.6% released earlier.

The Japanese Yen is likely to dance to the tunes of the Tokyo inflation data, which will release on Friday. Tokyo’s headline Consumer Price Index (CPI) (Feb) is expected to decline to 4.1% from the prior release of 4.4%. The Japanese economy is struggling to accelerate domestic demand despite immense initiatives from Bank of Japan (BoJ) policymakers and the administration.

On Wednesday, Bank of Japan (BoJ) board member Junko Nakagawa also cited the current monetary policy as appropriate as an expansionary policy is highly essential for supporting the economy and fueling wages.

- USD/CHF picks up bids to reverse the previous day’s pullback moves.

- Swiss PMI, Real Retail Sales also came in softer after downbeat Q4 GDP.

- US ISM PMI details, hawkish Fed talks keep inflation fears on the table and propel the US Treasury bond yields.

- Second-tier data, risk catalysts are the key to clear directions.

USD/CHF licks its wounds around 0.9400, following a downbeat start of the March month, as the Swiss currency pair picks up bids during early Thursday. In doing so, the quote justifies downbeat statistics at home, versus firmer details of the US data, as well as the strong Treasury bond yields and hawkish Fed talks, which could recall the US Dollar bulls.

That said, Swiss Real Retail Sales shrank 2.2% YoY in January versus 2.2% expected growth a revised down previous reading of -3.0%. On the same line was the Swiss SVME Purchasing Managers’ Index for February as it marched 48.9 market forecasts versus 49.3 prior. It should be noted that the Swiss Gross Domestic Product (GDP) arrived at 0% in the fourth quarter (Q4) of 2022 vs. an expected growth of 0.3% and 0.2% recorded in the third quarter.

On the other hand, US ISM Manufacturing PMI details renew inflation fears as the headline gauge rose to 47.7 from 47.4 prior, versus the 48.0 expected but the Prices Paid and New Orders marked the highest figures in five and four months respectively.

Not only the data but hawkish Federal Reserve (Fed) talks also challenge the previous day’s US Dollar weakness, as well as the USD/CHF pullback. Minneapolis Federal Reserve (Fed) President Neel Kashkari said, "Wage growth is now too high to be consistent with 2% inflation." The policymaker also added and noted that it is concerning that the Federal Reserve's rate hikes so far have not brought down service inflation.

It’s worth noting, however, that the previously softer US data dump and China-inspired risk-on mood, as well as month-start consolidation, seemed to have teased the USD/CHF bears.

Amid these plays, the US 10-year Treasury bond yields rose to the highest levels since early November 2022 by poking the 4.0% mark whereas the two-year counterpart rallied to the June 2007 levels by piercing the 4.90% mark. The jump in the US Treasury bond yields suggests the market’s fears of inflation and recession, which in turn probed bulls on Wall Street and weigh on S&P 500 Futures of late, suggesting a likely rebound on the US Dollar.

Looking ahead, a light calendar pushes the USD/CHF traders to keep track of the risk catalysts for fresh impulse.

Technical analysis

A 13-day-old bullish channel, currently between 0.9345 and 0.9480, keeps USD/CHF buyers hopeful.

- GBP/USD finds interest around 1.2000 as the USD Index is demonstrating signs of volatility contraction.

- Upbeat forward demand and higher prices paid by producers indicate a rebound in US inflation.

- BoE Bailey reiterated that the UK labor market is extremely tight.

The GBP/USD pair has sensed buying interest after a marginal correction to near 1.2000 in the early Asian session. The Cable is still inside the woods amid a mixed market mood. The US Dollar Index (DXY) is looking to sustain its auction above the 104.00 support after a recovery move from below 103.70 as the United States ISM Manufacturing PMI gamut conveyed a rebound in the inflationary pressures.

S&P500 futures witnessed pressure as investors are still struggling to ignore fears of more rates from the Federal Reserve (Fed). Hawkish commentaries delivered by Fed policymakers fueled US Treasury yields. The return offered on 10-year US government bonds jumped to 4%.

Minneapolis Fed President Neel Kashkari reiterated on Wednesday that inflation in the US is still very high and that their job is to bring it down, as reported by Reuters. He further added that he is open-minded on a 25 basis points (bps) hike versus a 50 bps increase.

Considering the whole US ISM Manufacturing PMI (Feb) gamut, it would be appropriate to consider a rebound in the US Consumer Price Index (CPI) as forward demand and prices paid by producers have skyrocketed.

The ISM Manufacturing New Orders Index accelerated to 47.0 from the expectations of 43.7 and the former release of 42.5. And the Manufacturing Price Paid climbed to 51.3 vs. the consensus of 45.0 and the former release of 44.5. Higher prices paid by manufacturers will be added to the goods offered by them and will amp up the inflationary pressures.

Ambiguous commentary from Bank of England (BoE) Governor Andrew Bailey has pushed the Pound Sterling inside the woods. An absence of clear guidance on interest rates kept investors on the sidelines. BoE Bailey said that some further increase in bank rates may turn out to be appropriate but added that nothing is decided, as reported by Reuters. However, he reiterated that the United Kingdom's labor market is extremely tight.

- NZD/USD seesaws in a choppy range after confirming a bullish chart formation and refreshing two-week high.

- Convergence of 21-day EMA, 200-day EMA challenges Kiwi pair buyers.

- Looming bull cross on MACD defends upside bias.

NZD/USD bulls struggle to justify the falling wedge breakout as the key moving averages challenge upside near the mid-0.6200s during early Thursday. However, the impending bull cross on the MACD indicator keeps the Kiwi pair buyers hopeful, especially after the confirmation of the bullish chart pattern the previous day.

The upside break of a one-month-old falling wedge bullish formation failed to cross the convergence of the 200-day Exponential Moving Average (EMA) and the 21-day EMA, around 0.6270 by the press time.

Should the quote crosses the immediate hurdle, as expected due to the MACD conditions and falling wedge confirmation, the NZD/USD can quickly poke the mid-February swing high surrounding 0.6390.

In a case where the Kiwi buyers keep the reins past 0.6390, as well as cross the 0.6400 threshold, the highs marked in the last December and the previous month, respectively near 0.6515 and 0.6540, could act as buffers during the theoretical run-up targeting 0.6600.

Meanwhile, pullback moves remain less important until the quote stays beyond the aforementioned wedge’s top line, close to 0.6175 at the latest.

It’s worth noting that January’s low of 0.6190 acts as the immediate support for the NZD/USD bears to watch during the fresh fall.

That said, lows marked during November 14 and 17 around 0.6060 appear the key for the pair sellers to track as a break of which won’t hesitate to challenge the 0.6000 psychological magnet.

NZD/USD: Daily chart

Trend: Further upside expected

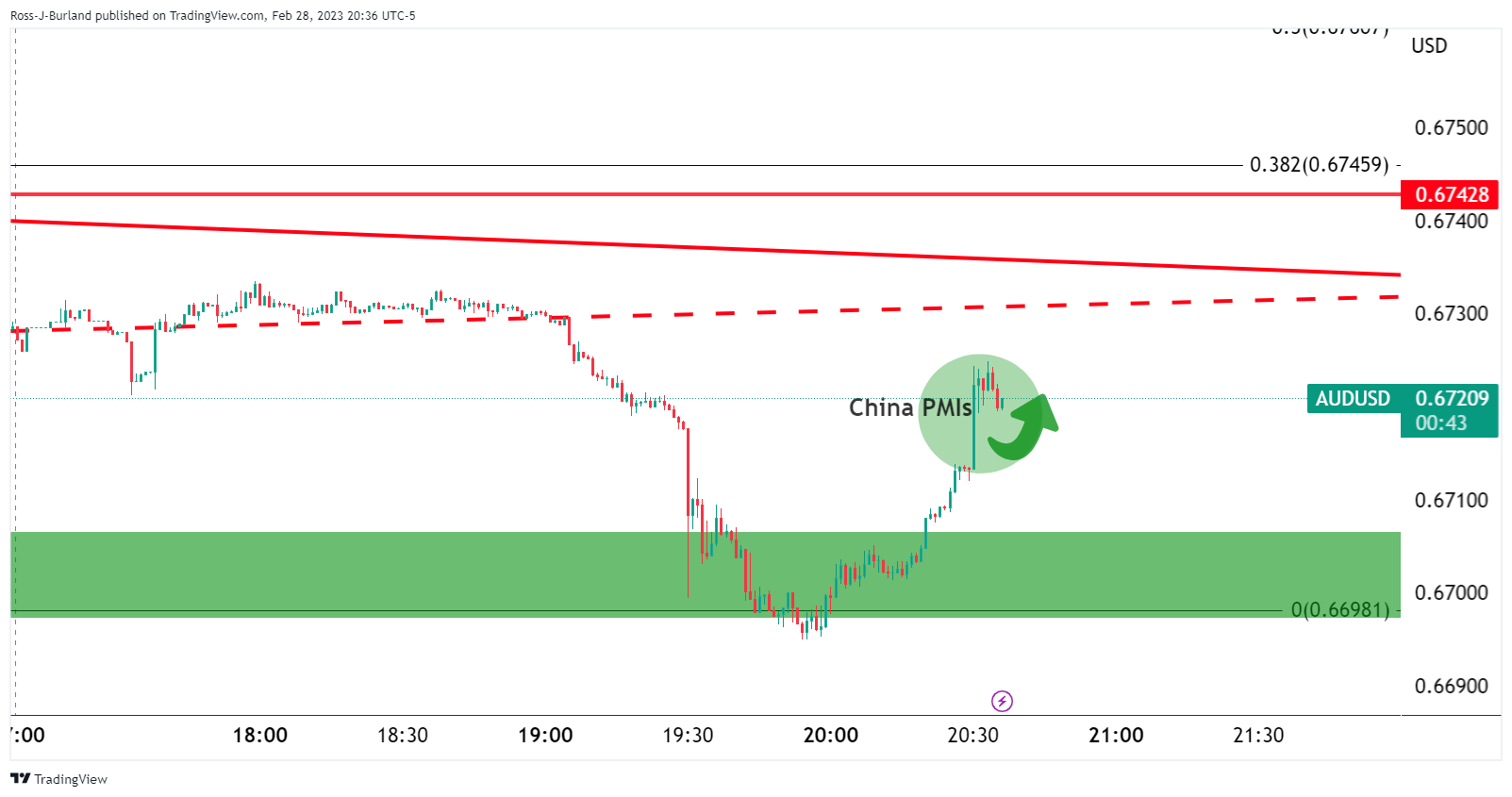

- AUD/USD struggles to defend the previous day’s rebound from a two-month low, grinds higher of late.

- Downbeat Aussie data contrasts with China-inspired optimism to challenge bulls.

- Softer US Dollar allowed Aussie buyers to begin March on a positive note.

- Strong US Treasury bond yields, mixed US data appears a challenge for the bulls.

AUD/USD remains sidelined around 0.6755 as traders await more signals to back the latest rebound from a two-month low during early Thursday morning in Asia. In doing so, the Aussie pair struggles to justify the softer US Dollar and China-linked market optimism amid strong US Treasury bond yields and mostly upbeat US data.

That said, the Aussie pair managed to reverse the Aussie GDP and inflation-induced pessimism after strong China activity data for February. The risk barometer pair also benefited from China Finance Minister Liu He’s comments as he showed readiness to bolster the nation’s fiscal spending. The policymaker also mentioned that the foundation of China's economic recovery is still not stable and challenges the AUD/USD bulls afterward.

Elsewhere, US ISM Manufacturing PMI details renew inflation fears as the headline gauge rose to 47.7 from 47.4 prior, versus the 48.0 expected but the Prices Paid and New Orders marked the highest figures in five and four months respectively.

Ahead of the data, Minneapolis Federal Reserve (Fed) President Neel Kashkari said, "Wage growth is now too high to be consistent with 2% inflation." The policymaker also added and noted that it is concerning that the Federal Reserve's rate hikes so far have not brought down service inflation.

It should be observed the US 10-year Treasury bond yields rose to the highest levels since early November 2022 by poking the 4.0% mark whereas the two-year counterpart rallied to the June 2007 levels by piercing the 4.90% mark. The jump in the US Treasury bond yields suggests the market’s fears of inflation and recession, which in turn challenge the risk-barometer AUD/USD pair. That said, Wall Street closed mixed while the S&P 500 Futures struggled for clear directions of late.

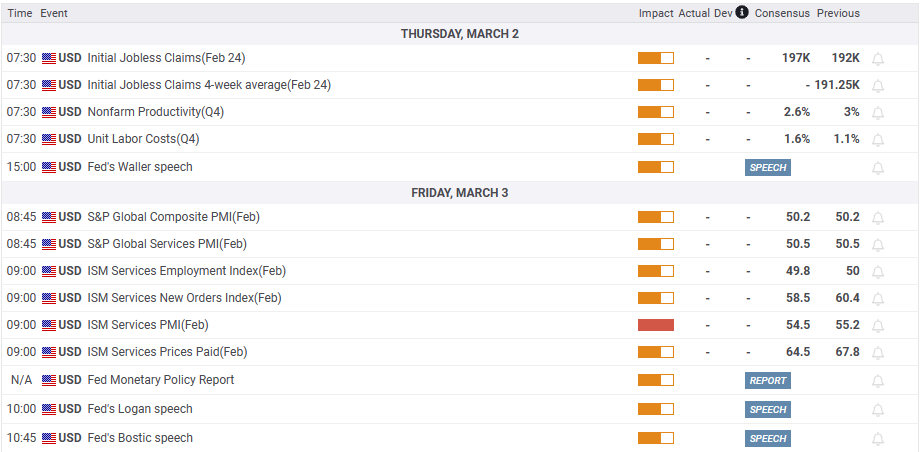

Looking forward, Australia’s Building Permits for January may offer immediate direction ahead of the US Weekly Initial Jobless Claims. However, major attention will be on Friday’s US ISM Services PMI amid fears of strong services inflation.

Technical analysis

Unless crossing a convergence of the one-month-old descending resistance line and the 200-DMA, around 0.6795, as well as staying beyond the 0.6800 round figure, the AUD/USD bulls are off the table.

- After printing an inverted hammer on Tuesday, GBP/JPY capped its fall.

- The GBP/JPY would face strong support at the confluence of the 100/200/20-day EMAs.

- GBP/JPY Price Analysis: In the near term, it’s neutral to upward biased.

The GBP/JPY finished Wednesday’s session printing a doji, meaning that neither buying/selling pressure dominated the session. Nevertheless, Tuesday’s session formed an inverted hammer, usually a bearish biased candlestick, so the GBP/JPY could extend its losses. At the time of writing, the GBP/JPY exchanges hand at 163.62

GBP/JPY Price Action

On Wednesday, the GBP/JPY traded within a 100 pip range throughout the day, though closed nearby the open. For the third time, the GBP/JPY achieved a daily close below a four-month-old downslope trendline, meaning sellers are leaning into that trendline.

The Relative Strength Index (RSI), albeit in bullish territory, is almost flat, while the Rate of Change (RoC) suggests that buying pressure is waning. Therefore, further downside is expected.

Therefore, if the GBP/JPY currency pair breaks below the daily low of 163.58 from February 28th, it would increase the likelihood of a further drop toward the weekly low of 162.59. If the currency pair falls below that level, it could reach the area where the 100 and 20-day Exponential Moving Averages (EMAs) intersect at approximately 161.89/74.

Alternatively, if the GBP/JPY currency pair rises, the first resistance level would be 164.00. If it surpasses that level, GBP buyers may push the pair towards the next level of resistance at 165.00, followed by a challenge of the year-to-date high at 166.00.

GBP/JPY Daily chart

GBP/JPY Technical levels

- EUR/USD is aiming to reclaim the 1.0700 resistance as the risk-off mood has faded.

- The Fed needs not to be in a hurry to calm down the policy-tightening spell.

- A rebound in German inflation has bolstered the case of 50 bps rate hike continuation.

The EUR/USD pair has turned sideways after failing to recapture the round-level resistance of 1.0700 in the late New York session. The major currency pair is expected to recapture the aforementioned resistance as the risk-off mood has faded after hopes of recovery in China post the release of the Caixin Manufacturing PMI overshadowed the risk of a global recession.

S&P500 settled Wednesday’s session with some losses after Federal Reserve (Fed) policymakers sounded hawkish while delivering guidance on interest rates. The US Dollar Index (DXY) has retreated to near 104.00 after failing to extend recovery above 104.20, portraying mix market mood. Meanwhile, the demand for US government bonds remained extremely weak, which led to a jump in the 10-year US Treasury yields to 4%.

Atlanta Fed President Raphael Bostic expected the central bank to push the terminal rate to the 5.00%-5.25% range as the United States Consumer Price Index (CPI) is extremely sticky. Apart from that, the Fed policymaker expects the central bank to keep the elevated terminal rate stable well into 2024.

Meanwhile, the release of the US ISM Manufacturing PMI gamut claimed that the inflationary pressures have rebounded and the Fed should not be in a hurry to calm down the policy tightening spell. The Manufacturing PMI remained contracted consecutively for the fourth time amid higher rates by the Fed. The economic data landed at 47.7, lower than the consensus of 48.0.

However, the forward demand looks extremely solid as New Orders Index jumped to 47.0 from the expectations of 43.7 and the former release of 42.5.

On the Eurozone front, stronger-than-anticipated German Harmonized Index of Consumer Prices (HICP) cleared that the road towards achieving price stability for the European Central Bank (ECB) is full of troubles. The German HICP climbed to 9.3% from the estimates of 9.0% and the former release of 9.2%. ECB President Christine Lagarde has already announced that the central bank is looking to hike interest rates further by 50 bps in its March monetary policy.

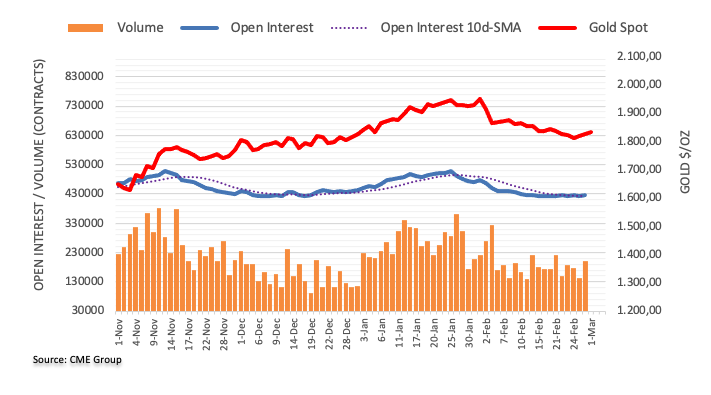

- Gold price probes three-day winning streak with a retreat from one-week high.

- Softer US Dollar, China-inspired optimism favor XAU/USD buyers amid a lack of major United States data/events.

- US ISM Manufacturing PMI details, upbeat Treasury bond yields challenges Gold buyers.

Gold price (XAU/USD) retreat to $1,836, following a three-day rebound from a two-month low, as the metal buyers struggle to gain a major positive catalyst to back the latest run-up, especially amid upbeat United States data and Treasury bond yields. It’s worth noting, however, that the softer US Dollar and China-linked market optimism puts a floor under the XAU/USD price amid a lack of major data/events.

Gold price eases on United States data, yields

Gold price pares recent gains while easing from the short-term key technical hurdle surrounding $1,845 after the United States ISM Manufacturing PMI details renew inflation fears. That said, the headlines gauge rose to 47.7 from 47.4 prior, versus the 48.0 expected. However, the details were quite interesting as Prices Paid and New Orders marked the highest figures in five and four months respectively.

On the other hand, the US 10-year Treasury bond yields rose to the highest levels since early November 2022 by poking the 4.0% mark whereas the two-year counterpart rallied to the June 2007 levels by piercing the 4.90% mark. The just in the US Treasury bond yields suggest the market’s fears of inflation and recession, which in turn underpin the hopes of the US Dollar rebound and the pullback of the XAU/USD.

Amid the upbeat data and strong yields, the Minneapolis Federal Reserve (Fed) President Neel Kashkari reiterated on Wednesday that inflation in the US is still very high and that their job is to bring it down, as reported by Reuters. "Wage growth is now too high to be consistent with 2% inflation," Kashkari added and noted that it is concerning that the Federal Reserve's rate hikes so far have not brought down services inflation.

US Dollar, China challenges XAU/USD bears

Although the Gold buyers seem to fade the momentum due to the latest swing in the US data and the hawkish Federal Reserve talks, not to forget upbeat yields, the XAU/USD sellers are off the table as the US Dollar remains weak and China flashes signs of a rebound.

That said, the US Dollar Index (DXY) began March on a back foot after posting the biggest monthly gain since September 2022, with a daily loss of nearly half a percent while poking the 104.40 level at the latest.

Elsewhere, strong prints of China’s Caixin and NBS Manufacturing PMIs for February join the Non-Manufacturing PMI for the said month to mark an upbeat economic rebound in the world’s biggest industrial player. Following the data, China Finance Minister Liu He showed readiness to bolster the nation’s fiscal spending while also mentioning that the foundation of China's economic recovery is still not stable.

Moving on, the Gold price may witness further consolidation of the recent gains amid a light economic calendar in the United States. However, scheduled readings of the Eurozone inflation data and risk catalysts surrounding China and Russia may keep entertaining the XAU/USD traders.

Gold price technical analysis

Gold price struggles to justify the previous day’s descending channel breakout as it retreats from the 61.8% Fibonacci retracement level of its up-move from December 2022 to February 2023, as well as the 100-bar Simple Moving Average (SMA).

The pullback move also gained support from the Relative Strength Index (RSI) line, placed at 14, as it hit the overbought territory.

Hence, a pullback towards the previous resistance line of a one-month-old bearish channel’s top line, close to $1,821 appears imminent.

However, bullish signals from the Moving Average Convergence and Divergence (MACD) indicator and multiple supports around $1,800 and $1,780 challenge the XAU/USD past $1,821.

Meanwhile, a convergence of the 100-SMA and the 61.8% Fibonacci retracement, also known as the “Golden Fibonacci ratio”, around $1,842-45, restrict the immediate run-up of the Gold price.

Following that, the 200-SMA hurdle of $1,880 appears the last defense of the Gold bears.

Hence, Gold price is likely to decline further but the downside room seems limited.

Gold price: Four-hour chart

Trend: Pullback expected

- USD/CAD retreats from daily and weekly highs as the Asian session is about to begin.

- Despite dipping, oscillators remain bullish, meaning that further USD/CAD upside is expected.

- USD/CAD Price Analysis: Bullish reclaiming of 1.3600 could trigger a rally towards 1.3800.

The USD/CAD tumbled from weekly highs around 1.3658, dropping nearly 0.40%, as Wall Street closed with losses, while the greenback remained offered throughout the session. US economic data was mixed, though a subcomponent of the ISM Manufacturing PMI report for February sparked inflation fears in the United States (US). At the time of writing, the USD/CAD exchanges hands at 1.3594.

USD/CAD Price action

The USD/CAD is upward biased despite dipping below 1.3600, in a fall sponsored by overall US Dollar weakness. Technically speaking, the USD/CAD pair’s failure to print a lower low than Tuesday’s 1.3560 kept the uptrend intact, even though the Relative Strength Index (RSI) shifted downwards.

For a bearish continuation, USD/CAD sellers must achieve a daily close below 1.3560. Once that is achieved, the USD/CAD next support would be the January 19 daily high turned support at 1.3520, ahead of testing the 1.3500 psychological level.

On the other hand, and in the most likely scenario, the USD/CAD first resistance would be the 1.3600 psychological level. A breach of the latter will expose the year-to-date (YTD) high at 1.3665, followed by the 1.3700 figure, and then the November 3 daily high at 1.3808.

USD/CAD Daily chat

USD/CAD Technical levels

- USD/JPY shorts are in the market but need to break 135.20.

- USD/JPY bears eye a break of 135.20 to open the risk of a move to 134.00.

USD/JPY could be setting itself up for a fade on rallies to break trendline support. The following illustrates a bearish bias given the week's template so far.

USD/JPY technical analysis

On the face of it, things would appear bullish given the trendline and holding above the 135.20s horizontal support that guards 134.05 below it.

However, when zooming down to the week's template so far, we can see a failed break out on Tuesday that was followed up by shorts on Wednesday and breaking structure around 135.70/90:

We have Day 1 shorts (D1S) and Day 2 Shorts in the market which is building the case for a significant move lower. The thesis is that bears are lurking up high and will be looking to sell at a premium, fading any rallies in the high-volume sessions such as in London and US. A break of 135.20 opens the risk of a move to 134.00 for the near future for a test of last week's lows.

- NZD/USD was the strongest peer in the FX space and rallied more than 1%.

- US manufacturing activity stabilized, but input prices rose, sparking inflation concerns.

- NZD/USD Price Analysis: Will test solid resistance around 0.6280-0.6300, with daily Mas hoovering around the area.

Despite sentiment shifting sour, the NZD/USD rallies and stays firm above the 0.6250 area, bolstered by a softer greenback, albeit UST bond yields are rising sharply. US equities are pointing toward registering losses, which could weigh on risk-sensitive currencies at the beginning of the Asian session. At the time of writing, the NZD/USD is gaining 1.16% or 71 pips.

NZD/USD continued its uptrend on a soft US Dollar

Wall Street is set for a lower close. The Institute for Supply Management (ISM) reported that the February US Manufacturing Purchasing Managers’ Index (PMI) was 47.7, lower than the estimated value of 48. Although it seems to have stabilized compared to the previous month’s reading of 47.4., the prices subcomponent increased significantly, causing concerns about inflation among investors.

That augmented speculations that the Federal Reserve would continue tightening monetary conditions as traders pushed back rate cuts, as the CME FedWatch Tool reported.

The NZD/USD trimmed some of its earlier gains on the ISM release and dipped toward 0.6222, before resuming the uptrend, despite hawkish comments by Federal Reserve officials.

Neil Kashkari of the Minnesota Fed commented that he’s open to raising rates by 25 or 50 bps at the upcoming meeting, while he foresees rates peaking around 5.4%. Of late, Atlanta’s Fed President Raphael Bostic commented that rates need to go as high as 5% - 5.25% and stood there “well into 2024.”

On the New Zealand (NZ) docket, the lack of data kept investors leaning on US Dollar dynamics and expectations that the Reserve Bank of New Zealand (RBNZ) is expected to raise rates in April, with odds for a 50 bps standing at 51%, per money market futures.

NZD/USD Technical analysis

The NZD/USD is neutral to upward biased, even though it sits below the daily Exponential Moving Averages (EMAs). However, at the time of typing, it faces solid resistance with the 50 and 200-day EMAs, at 0.6293 and 0.6282, respectively. If the NZD/USD cracks the 200-day EMA, that will exacerbate a rally above the 0.6300 mark. Otherwise, failure to do it would pave the way for further downside.

Trend: Neutral upwards.

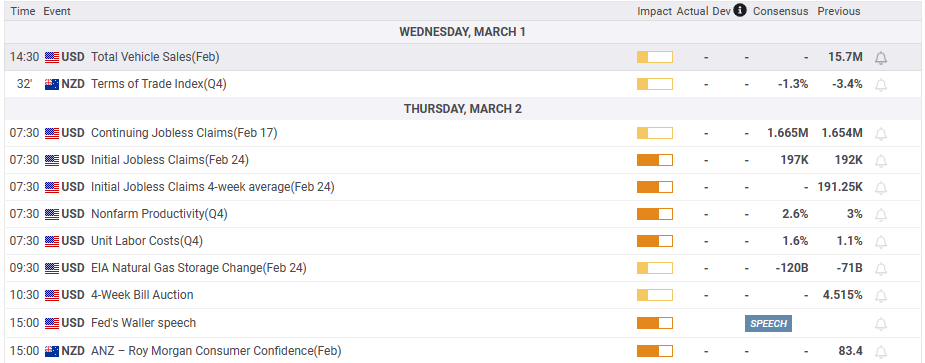

What to watch?

What you need to take care of on Thursday, March 2:

The US Dollar dropped across the board on Wednesday, even as US yields jumped. Most European stock markets posted losses, and in Wall Street, indexes were mixed. The market hit bottom after the release of the US ISM Manufacturing PMI but then recovered.

The February Index rose to 47.7, showing the sector remains in contraction territory. The surprise came from the Price Paid Index, which jumped 6.8 points to 51.3 and triggered a sell-off in Treasuries and a short-lived recovery of the US Dollar. Currencies reflected somewhat more optimism than equities. Chinese PMIs rose above 50, leading to hopes for the economic outlook.

Market participants will continue to look closely at the bond market after a day in which US and European bond yields jumped after inflation figures. The economic calendar shows for Thursday Eurozone CPI, European Central Bank minutes and US Initial Jobless Claims.

The Euro was among the top performers across the FX board, boosted by higher-than-expected German inflation numbers and hawkish ECB expectations. EUR/USD hit weekly highs near 1.0700 and then pulled back. The Pound lagged with GBP/USD testing levels under 1.2000. USD/JPY ended flat on Wednesday despite higher government bond yields.

AUD/USD rebounded from monthly lows, being able to defend the 0.6700 support. The Kiwi was the best performer on Wednesday, with NZD/USD hitting the highest level in two weeks at 0.6275. USD/CAD dropped modestly and is hovering around 1.3600.

Gold rose for the second day in a row despite higher yields, finding resistance at $1,845/oz. Bitcoin was unable to regain $24,000 and pulled back.

Like this article? Help us with some feedback by answering this survey:

- US Dollar is under pressure in risk-on markets.

- Euro rallies to a one-week high and China is bouncing back.

The US Dollar is broadly weaker to kick off March after posting a 3% gain for February while risk appetite roared back to life on the evidence of a stronger-than-expected recovery in the Chinese economy.

At the time of writing, DXY, an index that measures the greenback vs. a basket of currencies, is losing 0.36% after falling from a high of 105.09 and reaching a low of 104.09 on the day so far, backing down from its first monthly gain after a four-month losing streak.

A bunch of strong U.S. economic data in recent weeks has raised market expectations that the Federal Reserve has further to go in hiking rates. Futures pricing continues to edge higher, with a peak rate climbing on Wednesday to 5.45% in the fed funds by September. However, China's Non-manufacturing activity grew at a faster pace in February, while the Caixin/S&P Global manufacturing PMI reading for last month likewise surpassed. The offshore yuan jumped 1.3% to 6.8683 per dollar, set for its largest one-day gain since late November.

The US Dollar has also struggled to hold up vs. the Pound and Euro. For instance, the pound surged 1% at the start of the week after Britain struck a post-Brexit Northern Ireland trade deal with the European Union. However, the euro, which is the majority of the basket in the DXY, is firmer due to the latest German inflation data exceeding expectations, supporting the case for the European Central Bank to raise interest rates further. The data comes ahead of key eurozone inflation data on Thursday while the Single Currency rises to a one-week high of 1.0691.

- GBP/USD bears are in town and eye a move towards last week's lows.

- Failed breakout to the upside for the week leaves a bearish bias on the charts.

GBP/USD shorts are in the market. Still, the price moved up marginally at times due to a weaker US Dollar on Wednesday, trimming gains made earlier in the session on the back of the Bank of England Governor Andrew Bailey who said there are still no decisions on the terms of whether interest rates would need to rise again.

Nevertheless, the downside bias is playing out as the following technical analysis shows:

GBP/USD daily chart

The bulls have run into a trendline resistance on the daily chart and rallies have ended with lower peaks in the process forming a bearish bias for the foreseeable future.

The topping pattern is more evident o the lower time frames with the head and shoulders engulfing the opening balance range for the week so far. There has been a failed breakout at last week's highs which tips the balance in favour of the sorts that came in at D1S, (Day 1 Shorts) on Tuesday. We are seeing D2S on Wednesday as the price breaks the prior day's lows and a bearish close could offer a sell-high opportunity on Thursday:

Zooming in on the head and shoulders pattern, the bears are in play and resisted in the 1.2050s and eye last week's lows.

- Silver price holds to its earlier gains but remains at risk, of closing the session below $21.00 a troy ounce.

- US ISM Manufacturing PMI missed estimates, though it showed some improvement.

- Federal Reserve officials emphasized the need to raise rates to the 5.25% - 5.50% area.

Silver price advances in the North American session after finding resistance above the $21.00 area, though it clings to gains of 0.33%. Bolstered by a softer US Dollar (USD) after United States (US) data missed estimates, the white metal is extending its gains for two straight days. At the time of writing, the XAG/USD trades at around $20.90s.

US manufacturing activity improved, but higher input prices overshadowed the data

Sentiment shifted sour on US manufacturing data. The ISM revealed February’s Manufacturing PMI came at 47.7, below estimates of 48, though it appeared to stabilize, with the prior’s month reading at 47.4. However, the prices subcomponent jumped, reigniting inflation worries amongst investors, as witnessed by US money market futures, with traders expecting rates to climb as high as 5.50%, with no rate cuts in 2023.

A knee-jerk reaction tumbled the XAG/USD from $21.11 to $20.89 a troy ounce. However, Silver’s fall was capped by the US Dollar, which continued to weaken through the US session.

Earlier, Federal Reserve officials crossed newswires and continued their hawkish rhetoric. Minnesota’s Fed President Neil Kashkari (voter) said interest rates should reach 5.4% in December and stay at that level. He also mentioned that he would consider increasing rates by either 25 or 50 basis points during the upcoming Fed meeting.

Later, Atlanta’s Fed President Raphael Bostic commented that rates need to go as high as 5% - 5.25% and stood there “well into 2024.”

The Fed’s hawkish rhetoric did not help the greenback, which, by the US Dollar Index, is down 0.46% at 104.471. Contrarily, the US 10-year Treasury bond yield is advancing seven basis points, eyeing a break above the 4% threshold, a headwind for precious metals prices.

XAG/USD Technical analysis

Silver’s daily chart portrays XAG/USD as downward biased. The bearish case is further cemented by crossing the 20-day EMA below the 200-day EMA, which could exacerbate a test of the YTD low at around $20.43. XAG/USD’s recovery in the last couple of days is sponsored by a technical signal, with the Relative Strength Index (RSI) exiting from oversold conditions, which triggered a buy signal. Failure to extend its gains above $21.00 could pave the way for further downside.

The XAG/USD first support would be the February 27 daily low of $20.56, which, once cleared, it could pave the way to the YTD low at $20.43. On the other hand, if Silver stays afloat above $21.00, the XAG/USD could test the February 24 high at $21.39.

What to watch?

- AUD/USD rallies towards trendline resistance.

- Bears could be lurking in the 0.68s as W-formation is a pull.

AUD/USD bulls were thrown a lifeline in Asia following Chinese data that surprised in a big way to the upside, following a disappointment in local data from Australia that would have otherwise tipped the bias to the bears for the foreseeable future.

The following illustrates the potential from here for the price to continue higher for the foreseeable future but also notes that there could be a pull in gravity due to the daily chart's W-formation.

In prior analysis, it was noted that AUD/USD had reached toward a 50% mean reversion area and had been starting to come under pressure. However, it was also noted that this was not to say that the correction is on the way out. Instead, it could have been building up into a geometrical pattern:

A target of the 78.6% Fibonacci higher up near 0.6800 would align with the daily trendline resistance as follows:

However, the cracks started to come through in Asia: Aussie data dump crashes AUD/USD

AUD/USD had broken a trendline support, invalidating a thesis for a stronger correction (in the meantime), resisted by the 50% mean reversion of the prior bearish impulse:

It was stated that the data would be expected to continue to weigh on the Aussie as aggressive monetary tightening is likely cooling the economy and therefore casting a move dovish sentiment over the Reserve Bank of Australia.

However, along came Chinese data to the rescue, throwing the bulls a much-needed lifeline:

China NBS Manufacturing / Non-manufacturing PMIs beats are a welcome surprise for AUD bulls

We have seen a significant recovery in AUD/USD as follows:

This puts 0.6800 back on the map.

However, from a daily chart standpoint, the trendline resistance is a roadblock for higher:

Coupled with the W-formation, there could be a weight of gravity on the bulls for the foreseeable future:

- USD/CHF is trapped within the 0.9340-0.9425 region for the fourth straight day.

- USD/CHF Price Analysis: Negative divergence in the 4-hour chart opened the door for further losses.

The USD/CHF is trimming some of Tuesday’s gains, dropping slightly above the 100-day Exponential Moving Average (EMA), which sits at 0.9384, after hitting a daily high of 0.9428. At the time of writing, the USD/CHF exchanges hands at 0.9387, below its opening price by 0.36%.

USD/CHF Price action

Since the start of the week, the USD/CHF remains range-bound within the 0.9340-0.9425 area. The Relative Strength Index (RSI) portrays buyers in charge, but its slope turned south, suggesting pressure is waning.

The USD/CHF 4-hour chart paints a different picture. As price action edged up, the RSI reached lower peaks. That means a negative divergence has formed, which usually anticipates a reversal. However, the USD/CHF would face solid support levels, as the EMAs are resting below the spot price.

Therefore, the USD/CHF first support would be the 20-EMA at 0.9374. A breach of the latter will expose the weekly low of 0.9341, followed by the 50-EMA at 0.9335, ahead of testing the 0.9300 mark. Once cleared, the next stop for USD/CHF sellers would be the 100-EMA at 0.9295, closely followed by the 200-EMA at 0.9278.

USD/CHF 4-hour chart

USD/CHF Key technical levels

- USD/JPY failed to gain traction, despite rising US Treasury bond yields.

- Federal Reserve officials are still expecting rates at around 5.25%, according to December’s 2022 dot-plots.

- Manufacturing activity in the United States remains depressed, though a jump in input prices keeps traders worried about further Fed tightening.

The USD/JPY remains pressured, though capped by recent US economic data, as the US ISM Manufacturing PMI for February fell short of estimates. However, some subcomponents show that again prices are rising. The USD/JPY is exchanging hands at 136.08.

USD/JPY continues to consolidate after mixed US ISM Manufacturing PMI

US equities are trading mixed after the release of the ISM. The reading came at 47.7, below estimates of 48 for February, meaning that factories still feel the impact of the Federal Reserve’s (Fed) aggression. Delving into the report, the Prices Index rose to 51.3, past the 45.1 estimates, spurring a knee-jerk reaction in the US Dollar Index (DXY), and the USD/JPY spiked to 136.31.

Lately, investors have turned less optimistic about inflation in the United States (US). Money market futures are pricing the Federal Funds Rate (FFR) at around 5.25% -5.50% by June 2023, and no rate cuts throughout the year.

Earlier, S&P Global Manufacturing PMI for the US came shorter than the prior’s month data, at 47.3 vs. 47.8, a prelude of what was coming, later with data released by the ISM.

Federal Reserve officials insist on their hawkish rhetoric led by Neil Kashkari, President of the Federal Reserve Bank of Minneapolis. He said interest rates should reach 5.4% in December and stay at that level. He also mentioned that he would consider increasing rates by either 25 or 50 basis points during the upcoming Fed meeting and added that the dangers associated with not tightening monetary policy are greater than those of tightening it too much.

Contrarily, Atlanta’s Fed President Raphael Bostic believed that rates need to go as high as 5% - 5.25% and stood there “well into 2024.” He added that the economy has the momentum to support higher rates without a major downturn.

Despite the hawkishness provided by Kashkari, the USD/JPY failed to edge higher. Additionally, rising UST yields, like the 10-year benchmark note rate, approach the 4% threshold, but sentiment keeps USD/JPY traders on the sidelines, waiting for additional US economic data.

USD/JPY Technical analysis

The USD/JPY daily chart shows the major consolidating at around 136.00. Back-to-back doji’s in the daily time frame suggest that buyers and sellers are at equilibrium. The Relative Strength Index (RSI) is almost flat but nearby overbought conditions, while the Rate of Change (RoC) indicates sellers are gathering momentum.

For a bullish resumption, the USD/JPY must clear the YTD high of 136.91, so the pair might test 138.00. Otherwise, a fall below 135.25 would pave the way toward 135.00.

What to watch?

Gold Price has managed to stay above its 200-Day Moving Average (DMA). This level stands at $1,775 and is expected to floor the bright metal, strategists at Credit Suisse report.

Move above $1,890/1,900 needed to clear the way for a retest of $1,973/98

“Gold has broken below its 55-DMA, currently seen at $1,859, but has so far managed to remain clearly above the long-term 200-DMA, currently seen at $1,775. We continue to look for this to remain a floor and for the broader risk to turn higher again from here in due course.”

“Above $1,890/1,900 is needed to clear the way for a retest of $1,973/98. Beyond here stays seen needed to reassert an upward bias for a test of long-term resistance from the $2,070/72 record highs of 2020 and 2022.”

- US Dollar rises across the board after the ISM report.

- Inflation indicators of the ISM Manufacturing rise significantly.

- EUR/USD trims gains, holds above critical short-term support levels.

The EUR/USD retreated after the release of the ISM Manufacturing PMI that boosted, at least momentarily, the US Dollar across the board. The pair pulled back from 1.0691, the highest level in a week to 1.0640.

After finding support at the 1.0640 area, the EUR/USD is moving back toward the daily highs as Dollar’s momentum after data fades. The pair is hovering around 1.0670, slightly below the 20-day Simple Moving Average. Despite the retreat the short-term bias continues to point to the upside.

USD up on data, but not for long

Data released in the US showed activity in the Manufacturing sector contracted again in February with the ISM PMI rising from 47.4 to 47.7 (below 50 marks contraction), against market consensus of 48. The Price Paid Index rose from 44.5 to 51.3, surpassing expectations of a 45 reading.

The inflation indicators of the ISM report pushed Treasury yields to the upside. The US 10-year bond yield reached 4% for the first time since November. The US Dollar reacted to the upside but lost impulse during the last minutes, as stocks and commodity prices rebounded.

The Euro is among the top performers on Wednesday following German inflation data that came in above expectations. The figures add pressure to the European Central Bank. A 50 basis point rate hike seems warranted in March and the focus is on the meetings ahead.

Technical levels

Eurostat will release the preliminary estimate of Eurozone Harmonised Index of Consumer Prices (HICP) data for February on Thursday, March 2 at 10:00 GMT and as we get closer to the release time, here are the expectations forecast by the economists and researchers of six major banks regarding the upcoming EU inflation print.

Headline is expected at 8.2% year-on-year vs. 8.6% in January while core is expected to remain steady at 5.3%. On a monthly basis, the HICP in the old continent is expected to fall by 0.3% in the reported period as against the previous decrease of 0.2%. The core HICP is likely to show no growth at 0% in February vs. -0.8% prior.

Commerzbank

“In the euro area, inflation continues to be strongly dominated by the development of energy and food prices. In February, energy prices fell significantly, which will probably push the inflation rate down from 8.6% to 8.1%. However, from the ECB's point of view, it is probably more significant that the core inflation rate remains at a high 5.3%. This shows that underlying inflation remains high.”

TDS

“Softer energy inflation likely continued to weigh on headline inflation in the EZ. That said, on MoM basis, energy inflation likely stayed resilient, in part as subsidized prices won't have declined by as much as wholesale prices. Core will be the main focus though, and another strong print will add more pressure on the ECB to keep hiking in 50 bps clips after Mar.”

Nomura

“We expect the headline rate to be unchanged at 8.6%, but see core rising to 5.6%, which will be the highest since 1993.”

SocGen

“We expect the February HICP to decelerate from 8.6% to 8.2% YoY, dragged down by energy inflation but core inflation should be up 0.2pp to 5.5% YoY and will likely stay above 3.5% this year.”

Citibank

“Eurozone headline inflation should edge lower in the February flash HICP but only slightly, confirming the passthrough of lower gas prices takes time. However, we expect another solid MoM print on core CPI. Services inflation should edge higher while the January uptick in core goods HICP is likely to reverse only partially and probably not before March/April. Euro Area HICP, February: Citi Forecast 8.5% YoY, Prior 8.6% YoY; Core CPI, Feb: Citi Forecast 5.4% YoY, Prior 5.3% YoY.”

Wells Fargo

“All signs point to headline inflation having already peaked and now trending lower. On the other hand, it is less clear when underlying inflation will begin to recede substantially. In response to still-present inflation pressures, we do not think the ECB is finished monetary tightening quite yet. We expect the ECB to follow through on its guidance for another 50 bps rate hike in the Deposit Rate in March and expect two additional 25 bps increases in May and June, which would see a peak at 3.50% for the current cycle.”

In an essay published on Wednesday, Atlanta Fed President Raphael Bostic said that he maintains the view the policy rate needs to rise to the 5.00%-5.25% range and remain at that level well into 2024, as reported by Reuters.

"A narrative has gained momentum among some commentators that the Fed should consider reversing its course of raising the federal funds rate lest we go too far and cause undue economic hardship," Bostic further elaborated. "History teaches that if we ease up on inflation before it is thoroughly subdued, it can flare anew."

Market reaction

The US Dollar Index showed no immediate reaction to these remarks and was last seen losing 0.4% on the day at 104.52.

A stronger USD is expected in the near-term. However, economists at CIBC Capital Markets believe that medium-term USD risks are to the downside.

USD could be supported in the near-term

“The USD could be supported in the near-term by resilience in the economy and continued Fed hikes, and although we may add a hike to our existing forecast, we still expect the Fed to undershoot the market's hiking expectations, weighing on the USD into mid-year, as attention turns to other advanced economies that are raising interest rates.”

“Q2 2023: 100.4 | Q3 2023: 99.5 (DXY)”

- GBP/USD turned negative after the release of the US ISM Manufacturing PMI.

- Fed’s Kashkari said he’s open to raising 25 or 50 bps.

- BoE Bailey commented that the BoE is not done hiking rates.

GBP/USD is sliding, even though the market sentiment is upbeat on positive data from China. In addition, a Bank of England (BoE) official was more hawkish than expected, sponsoring a leg-up in the GBP/USD. At the time of writing, the GBP/USD exchanges hands at 1.2005, below its opening price by 0.15%.

GBP/USD shifted negative, despite hawkish BoE’s Bailey comments

Sentiment turned mixed in the session. Data from China revealed that manufacturing activity in the second-largest economy entered the expansionary territory, a tailwind for riskier assets. That boosted global equities, except for the United States (US), with the Dow Jones trading in the green while the S&P 500 and the Nasdaq fluctuated.

The GBP/USD has retreated some of its earlier gains due to Fed officials speaking, namely the Minnesota Fed President Neil Kashkari (voter). Kashkari said that in December, he thought that rates needed to go to 5.4% and hold, and added that he’s open at the next Fed meeting to increase rates 50 or 25 bps. He said that the risks of untightening are much more significant than overtightening.

The US ISM Manufacturing PMI came at 47.7, below 48.0 estimates, which sponsored a leg toward the daily low at 1.1964.

Also read: Breaking: ISM Manufacturing PMI edges higher to 47.7 in February vs. 48 expected

Although Kashakri’s comments weighed in the GBP/USD, an earlier BoE Governor Andrew Bailey’s speech capped the GBP/USD fall. Bailey commented that the BoE is not done with hiking rates and emphasized that BoE will inevitably need to do more. He added that further increases in the Bank Rate might be appropriate. Added that if the BoE falls short on rates, it will only have to do more later on.

On Brexit news, the Senior Democratic Unionist Party official, Charles Whip Wilson, said that the party is studying the deal’s details and would not make a knee-jerk decision on whether to accept it. Wilson said that was “an indication that the government knew this deal was not great and was trying to persuade unionists to accept it on the basis that we have great respect for the monarchy.”

Of late, the S&P Global Manufacturing PMIs for the US came at 47.3 vs. a previous reading of 47.9, and at around 15:00 GMT, the release of the ISM Manufacturing PMI would shed some light on the status of the US economy.

GBP/USD Key technical levels

EUR/USD is set to hold support at 1.0483/63 to maintain a broader range, according to analysts at Credit Suisse.

Break below 1.0463 to warn of a more significant downturn

“Near-term risk stays seen lower for a deeper corrective setback to next support at the 38.2% retracement of the 2022/2023 rally and early January YTD low at 1.0483/63. We look for this to prove better support if tested though and to act as the bottom end of a broad ~1.05-1.10 range for now.”

“Below 1.0463 would warn of a potentially more significant downturn, although we would still need to see the 200-DMA at 1.0331 removed to suggest this is indeed the case.”

“Above 1.0806 remains needed to clear the way for strength back to test the 50% retracement of the 2021/2022 fall at 1.0944. An eventual weekly close above here should see a move back to the 1.1035 current YTD high and eventually what we look to be tougher resistance at 1.1185/1.1275.”

- EUR/USD rose sharply and pokes with the key 1.0700 hurdle.

- The surpass of 1.0804 opens the door to extra advances.

EUR/USD strongly reverses Tuesday’s decline and trades at shouting distance from the 1.0700 barrier on Wednesday.

There is a temporary up barrier at the 55-day SMA at 1.0715 prior to the weekly high at 1.0804 (February 14). A convincing move above the latter could open the door to extra gains in the short-term horizon with the immediate target at the 2023 peak at 1.1032 (February 2).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0328.

EUR/USD daily chart

Minneapolis Federal Reserve (Fed) President Neel Kashkari reiterated on Wednesday that inflation in the US is still very high and that their job is to bring it down, as reported by Reuters.

"Wage growth is now too high to be consistent with 2% inflation," Kashkari added and noted that it is concerning that the Federal Reserve's rate hikes so far have not brought down services inflation.

Market reaction

The US Dollar Index stays on the back foot following these comments and was last seen losing 0.55% on a daily basis at 104.35.

Economists at HSBC expect the Canadian Dollar to struggle for the time being.

Hard to make an idiosyncratic case for near-term CAD strength

“The near-term local focus is likely to be on the Bank of Canada’s (BoC) meeting on 8 March. The BoC has already signalled a conditional pause and the market has taken this on board, with just 2 bps priced in for March and 8 bps by April (Bloomberg, 27 February 2023).”

“Beyond the BoC, the focus for USD/CAD will move to the employment reports from both the US and Canada on 10 March, and then to the US CPI release on 14 March. But in the end, it is hard to make an idiosyncratic case for near-term CAD strength.”

“Like its central bank, the CAD looks likely to hit the pause button.”

Economists at CIBC Capital Markets update their USD/MXN forecasts.

USD/MXN Q1 forecast revised lower to 19.50

“We have revised our USD/MXN Q1 forecast lower to 19.50, from the previous 20.00, but kept our year-end forecast at 19.80.”

“Local and external dynamics remain supportive of the Peso in the immediate term; nevertheless, Mexico’s large dependence on US growth is likely to prompt quick and sharp rebounds in USD/MXN should US labour/growth indicators deteriorate in the coming months.”

“Q2 2023: 20.00 | Q3 2023: 20.50 (USD/MXN)”

- EUR/GBP gains strong positive traction on Wednesday and rallies to over a one-week high.

- The stronger inflation figures from the Eurozone’s three biggest economies boost the Euro.

- A modest pickup in demand for the British Pound does little to hinder the strong move up.

The EUR/GBP cross catches aggressive bids on Wednesday and builds on the previous day's bounce from the vicinity of the 100-day SMA support near the 0.8755-0.8750 region, or a one-month low. The strong move up remains uninterrupted through the mid-European session and lifts spot prices to over a one-week top, around the 0.8875-0.8880 region in the last hour.

The shared currency's relative outperformance comes amid rising bets for additional jumbo interest rate hikes by the European Central Bank (ECB) in the coming months. The expectations were lifted by signs of rebounding inflation in France, Spain and Germany - the Eurozone's three biggest economies. This, in turn, lifts the yield on Germany’s rate-sensitive two-year bond to its highest level since the 2008 financial crisis.

Apart from this, a sharp US Dollar pullback from a multi-week high further boosts the Euro and provides a goodish lift to the EUR/GBP cross. A weaker Greenback, meanwhile, also benefits the British Pound, which remains supported by the latest optimism over the UK-EU agreement on the new Northern Ireland protocol. Adding to this, speculations for additional rate hikes by the Bank of England (BoE) could cap gains for the cross.

From a technical perspective, the EUR/GBP bulls have been showing resilience near the 100-day SMA and the subsequent move-up supports prospects for additional gains. Hence, some follow-through strength, back towards reclaiming the 0.8900 mark, now looks likely a distinct possibility. The momentum could get extended towards the 0.8950-0.8955 intermediate hurdle en route to the YTD peak, around the 0.8980 zone touched in February.

Technical levels to watch

- DXY comes under heavy downside pressure and approaches 104.00.

- Further weakness should leave the 105.30 region as a near-term top.

DXY gives away around a cent following the earlier bullish attempt to the area just above 105.00 the figure on Wednesday.

The dollar needs to clear the February peak at 105.35 (February 27) to allow for the recovery to dispute the 2023 top at 105.63 (January 6). Failing to do so, the dollar could spark a deeper pullback and thus leave the 105.30 region as an interim top for the time being.

In the longer run, while below the 200-day SMA at 106.50, the outlook for the index remains negative.

DXY daily chart

- USD/CAD comes under intense selling pressure on Wednesday amid broad-based USD weakness.

- The upbeat Chinese PMIs boost investors’ confidence and weigh heavily on the safe-haven buck.

- An intraday downtick in Oil prices could undermine the Loonie and help limit losses for the major.

The USD/CAD pair continues losing ground heading into the North American session and reverses a major part of the previous day's positive to the 1.3660 area. The pair currently trades near the 1.3585 area, or the daily low, and is pressured by the heavily offered tone surrounding the US Dollar.

In fact, the USD Index, which tracks the Greenback against a basket of currencies, retreats sharply from a multi-week high amid a slight recovery in the global risk sentiment. The upbeat Chinese PMI prints released earlier this Wednesday confirmed that recovery in the world's second-largest economy gained momentum in February. This, in turn, boosts investors' confidence and weighs on the safe-haven buck.

The downside for the USD, however, is likely to remain limited amid firming expectations that the Fed will continue to raise interest rates for longer to tame inflation. Moreover, the incoming positive US macro data pointed to an economy that remains resilient, which should allow the US central bank to stick to its hawkish stance. This, in turn, favours the USD bulls and could lend support to the USD/CAD pair.

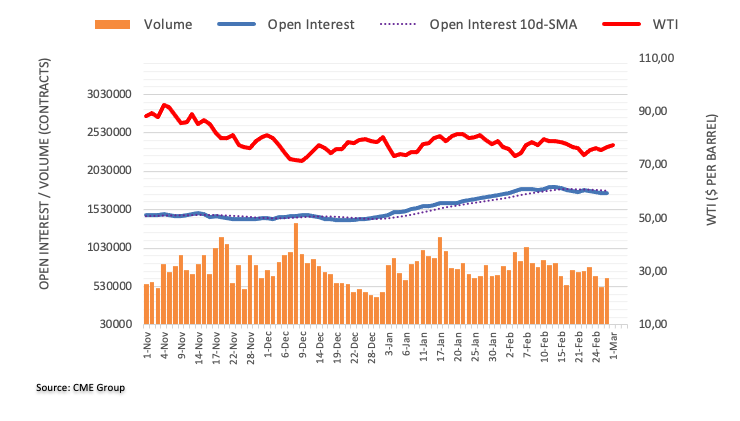

Furthermore, an intraday downtick in Crude Oil prices might undermine the commodity-linked Loonie and supports prospects for the emergence of some dip-buying around the USD/CAD pair. Investors remain worried that rising borrowing costs will dampen economic growth and dent fuel demand. This, along with signs of increasing US crude stockpiles and additional supply from OPEC - act as a headwind for the black liquid.

The aforementioned fundamental backdrop warrants some caution before placing aggressive bearish bets around the USD/CAD pair and positioning for any further depreciating move. Next on tap is the release of the US ISM Manufacturing PMI, which, along with the broader risk sentiment, will drive the USD demand and provide some impetus. Traders will also take cues from Oil price dynamics to grab short-term opportunities.

Technical levels to watch

The USD continues to recover. Nonetheless, analysts at Credit Suisse look for key resistance from the 200-Day Moving Average and 38.2% retracement of the 2022/2023 fall at 106.15/45 to cap the DXY.

The market will eventually resolve the recent range lower

“We are mildly biased towards a slightly deeper recovery to 105.63, potentially the 38.2% retracement of the 2022/2023 fall and 200-DMA at 106.15/45. We would expect this to prove the extent of the recovery though, and we would look for this to cap to define the top of a broader range.”

“Post this consolidation phase, our bigger picture view remains that the market will eventually resolve its recent range lower, triggering further weakness later on in the year to test 99.82/37, then the 61.8% retracement at 98.98.”

- Annual CPI in Germany stayed unchanged at 8.7% in February.

- EUR/USD continues to push higher toward 1.0700 after the data.

Inflation in Germany, as measured by the Consumer Price Index (CPI), stayed unchanged at 8.7% on a yearly basis in February. This reading came in higher than the market expectation of 8.5%. On a monthly basis, the CPI was up 0.8%.

Meanwhile, the annual Harmonised Index of Consumer Prices (HICP), the European Central Bank's (ECB) preferred gauge of inflation, edged higher to 9.3% from 9.2% in January, compared to analysts' estimate of 9%.

Market reaction

EUR/USD preserves its bullish momentum after this data and was last seen rising 1.05% on the day at 1.0685.

EUR/USD has had a solid advance on the day as the pair rebounds from sub-1.06 levels. Economists at Scotiabank analyze the EUR technical outlook.

Major resistance is seen at 1.08

“Short-term EUR trading patterns lean bullish after the drift from yesterday’s high in the mid-1.06s found solid support overnight around 1.0580.”

“Gains through the mid-1.06s target additional EUR gains towards 1.07 potentially.”

“We spot major resistance at the 1.08 level.”

See – EUR/USD: 1.05 will be the bottom of the first quarter range after all – ING

- Siler gains traction for the second straight day and recovers further from the YTD low.

- The setup favours bearish traders and supports prospects for further near-term losses.

- A sustained strength beyond the $22.00 confluence could negate the negative outlook.

Silver builds on the previous day's recovery move from the $20.40 area, or a nearly four-month low and scales higher for the second successive day on Wednesday. The white metal, however, trims a part of its intraday gains and trades around the $21.00 mark, still up nearly 0.50% for the day heading into the North American session.

Looking at the broader picture, the XAG/USD on Tuesday showed some resilience below the 61.8% Fibonacci retracement level of the recent rally from the October 2022 low. The said support, around the $20.60 area, should now act as a pivotal point. Given that technical indicators on the daily chart have recovered from the oversold zone and are still holding deep in the negative territory, the bias still seems tilted in favour of bearish traders.

Hence, the ongoing recovery move is more likely to confront stiff resistance near 50% Fibo. level, around the $21.35 region, ahead of the mid-$21.00s. Any subsequent strength could be seen as a selling opportunity and runs the risk of fizzling out near the $22.00 confluence support breakpoint. The said handle comprises 100-day Simple Moving Average (SMA) and 38.2% Fibo. level, which if cleared could negate the near-term bearish bias.

A sustained strength beyond could trigger a short-covering rally and lift the XAG/USD towards the $22.55-$22.60 supply zone. Bulls might eventually aim to reclaim the $23.00 round-figure mark, which coincides with the 23.6% Fibo. level.

On the flip side, 61.8% Fibo. level, around the $20.60 area, now seems to protect the immediate downside. Some follow-through selling below the overnight swing low, around the $20.40 region, should make the XAG/USD vulnerable to weaken further. The downward trajectory should pave the way for a fall below the $20.00 psychological mark, towards testing the next relevant support near the $19.75-$19.70 region.

Silver daily chart

Key levels to watch

S&P 500 has fallen to key 200-Day Moving Average support and the 38.2% retracement of its rally at 3940/27. Strategists at Credit Suisse remain biased to look for a floor here.

Break below 3886 to suggest a more important downturn

“We continue to look for the 200DMA and the 38.2% retracement of the 2022/23 upmove at 3984/27 to hold in line with our view that this a temporary setback.”

“Above 4081/91 is needed to add weight to our view for strength back to 4195/4203, then what we look to be tougher resistance at the 61.8% retracement of the 2022 fall and summer 2022 high at 4312/4325. We look for this to then prove a tough barrier to define the top of what we believe could be a broad and lengthy range.”

“Below 3886 is needed to suggest we may have seen a ‘false’ break higher and more important downturn within the broad range, with the next support then seen at 3764.”

- EUR/JPY resumes the weekly leg higher above the 14400 mark.

- Immediately to the upside comes the 2023 high near 145.50.

EUR/JPY regains composure and advances past the 144.00 yardstick following Tuesday’s daily retracement.

The continuation of the current upside momentum faces the next hurdle at the 2023 high at 145.47 (February 28). Once this level is cleared, the par could then confront the December 2022 top at 146.72 (December 15) ahead of the 2022 high at 148.40 (October 21 2022).

In the meantime, while above the 200-day SMA, today at 141.54, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

USD/JPY strength has extended to our target of the 38.2% retracement of the 2022/2023 fall and 200-Day Moving Average at 136.67/137.20. But analysts at Credit Suisse continue to look for a cap here and for the broader risk to turn lower again.

Close above 137.20 to open up further gains

“USD/JPY has extended its recovery to our target of. With the prior oversold condition now unwound, we continue to look for the 200-DMA and 38.2% retracement of the 2022/2023 fall at 136.67/137.20 to cap and for the broader risk to turn lower again.”

Below support at 134.05 is needed to add weight to our view, with support then seen next at 132.25/20, ahead of 129.80 and eventually 127.53/23 again.”

“Above 137.20 on a closing basis would suggest a more important low was established in January and strength can extend further with resistance next at 139.54/59.”

GBP/USD continues to hold support from its 200-Day Moving Average, never mind its key 1.1841 January low. Analysts at Credit Suisse look for the broader risk to eventually turn higher again from here.

GBP/USD to stay rangebound for now

“Cable continues to hold support from the 200-DMA at 1.1927 as looked for, never mind the key 1.1841 January low, and we continue to look for this to hold to keep the market trapped in a range of ~1.1850-1.2450.”

“Post this rangebound phase, we are still biased towards an eventual break above 1.2447/49 to target the May high and 61.8% retracement of the 2021/2022 fall at 1.2668/1.2758.”

“A break below 1.1841 at any stage would complete a bearish ‘double top’ to signal a much deeper sell-off, and likely a stronger USD rally more broadly, with support seen next at 1.1646.”

Today's focus is likely to be on the US Dollar again. Antje Praefcke, FX Analyst at Commerzbank, analyzes how the ISM's February Manufacturing PMI could impact the greenback.

Dollar undisputed

“The ISM index for February is likely to attract increased attention.

The market expects that the index will remain under the expansion/contraction mark of 50, but is likely to recover a little. That would constitute a rather more positive signal for USD.”

“However, as the market has already gone a long way in its expectations the upside potential in USD is likely to be limited.”

“A small excursion towards the lows seen at the start of the week might be seen again. However, as the Eurozone inflation data is due for publication tomorrow, I would be cautious about excessive Dollar gains.”

“I am more inclined to expect a strong reaction if the ISM index were to disappoint. In that case, EUR/USD is likely to rise a little further.”

Economists at Barclays Research see scope for further upside in the EUR/USD pair.

Ongoing policy normalization by the ECB supports medium-term EUR upside

“A faster exit from zero-COVID in China and a maturing tightening cycle for the Fed, given signs that US inflation is peaking, imply more upside for the EUR in 2023.”

“By our estimates, there is an additional 3-4% upside potential in EUR/USD from China’s reopening alone, which however seems to be on hold given geopolitical concerns surrounding the China-Russia rapprochement.”

“Upside risks to energy prices from geopolitics and China’s reopening have yet to materialize. Ongoing policy normalization by the ECB also supports medium-term EUR upside, notwithstanding some ambiguity in February’s message.”

- USD/JPY comes under some selling pressure on Wednesday amid broad-based USD weakness.

- The Fed-BoJ policy divergence could lend support to the pair and help limit any further losses.

- A positive risk tone could undermine the safe-haven JPY and further warrants caution for bears.

The USD/JPY pair attracts some sellers following an intraday uptick to the 136.45 area on Wednesday and moves further away from the YTD peak touched the previous day. Spot prices slide closer to the mid-136.00s during the first half of the European session, though any meaningful corrective decline seems elusive.

A sharp US DOllar retracement slide from a multi-week high turns out to be a key factor exerting some pressure on the USD/JPY pair. The downside, however, is likely to remain limited, at least for the time being, amid the divergent Bank of Japan(BoJ)-Fed monetary policy outlook. This, in turn, warrants some caution for aggressive bearish traders and positioning for deeper losses.

In fact, the incoming BoJ Governor Kazuo Ueda and Deputy Governor nominee Shinichi Uchida recently stressed the need to maintain the ultra-loose monetary policy to support the fragile domestic economy. In contrast, the US central bank is universally expected to stick to its hawkish stance for longer and continue hiking interest rates in the wake of stubbornly high inflation.

The prospects for further policy tightening by the Fed remain supportive of elevated US Treasury bond yields and favour the USD bulls. Apart from this, signs of stability in the equity markets, bolstered by the upbeat Chinese PMIs, could undermine demand for the safe-haven Japanese Yen (JPY). This, in turn, should lend some support to the USD/JPY pair and help limit the downside.

Hence, it will be prudent to wait for strong follow-through selling before confirming that the USD/JPY pair's recent appreciating move witnessed over the past month or so has run out of steam. Traders now look forward to the release of the US ISM Manufacturing PMI. This, along with the US bond yields, will influence the USD price dynamics and provide some impetus to the major.

Technical levels to watch

European Central Bank (ECB) policymaker Joachim Nagel reiterated on Wednesday that further significant rate hikes beyond March may be needed, as reported by Reuters.

Additional takeaways

"Favoring steeper reduction of APP portfolio from July."

"Rate cut talk non-starter until sufficient evidence of underlying inflation drop towards targets."

"Energy price drop has no essential bearing on ECB's medium term inflation projections."

"German inflation to average between 6% and 7% in 2023; rate could be well above 2% in both 2024 and 2025."

"Not expecting visible recovery until H2, full year GDP drop could be smaller than 0.5% December forecast."

"German economy to contract in Q1; gradual pick up from Q2 seen but no major improvement seen."

Market reaction

EUR/USD preserves its bullish momentum after these comments and was last seen rising 0.72% on the day at 1.0652.

Bank of England (BoE) Governor Andrew Bailey said on Wednesday that some further increase in bank rate may turn out to be appropriate but added that nothing is decided, as reported by Reuters.

Key takeaways

"I would caution against suggesting either that we are done with increasing bank rate, or that we will inevitably need to do more."

"We will reach our conclusions with a determined focus on achieving the 2% inflation target on a sustained and lasting basis."

"Economy is evolving much as we expected it to."

"Inflation has been slightly weaker, and activity and wages slightly stronger, though I would emphasize ‘slightly’ in both cases."

"We have to monitor carefully how the tightening we have already done is working its way through the economy."

"If we do too little with interest rates now, we will only have to do more later on."

"We must ensure that the situation does not get worse through homemade inflation taking hold."

"UK labour market remains very tight."

Market reaction

GBP/USD's reaction to these comments were muted and the pair was last seen trading at 1.2060, where it was up 0.35% on a daily basis.

The UK and EU have, at last, agreed on a deal that makes life easier for firms trading between Great Britain and Northern Ireland. However, the UK-EU deal is no game changer for Sterling, economists at ING report.

Welcome news, but not a game changer

“The global risk environment and a potential narrowing in UK-Eurozone interest rate differentials are likely to prove more important drivers of Sterling than the new UK-EU deal.”

“Our preference is for EUR/GBP to find support in the 0.87/0.88 area and end the year closer to 0.89/0.90.”

“GBP/USD is a different story, where we continue to look for some Federal Reserve easing by the end of the year and a weaker Dollar. Our baseline view assumes that GBP/USD finds support under 1.20 in this first quarter and manages to trade in a 1.25-1.30 range by year-end.”

- AUD/USD shows resilience below the 0.6700 mark and rebounds from a nearly two-month low.

- The upbeat Chinese PMI prints benefit the Australian Dollar amid a sharp intraday USD downfall.

- Looming recession risks, hawkish Fed expectations to act as a tailwind for the USD and cap gains.

The AUD/USD pair stages a recovery from sub-0.6700 levels, or a nearly two-month low touched earlier this Wednesday and scales higher through the first half of the European session. The momentum lifts spot prices to a fresh weekly high, around the 0.6775-0.6780 region in the last hour, with bulls now eyeing to test the 200-day Simple Moving Average (SMA) support breakpoint.

The upbeat Chinese data benefits the China-proxy Australian Dollar and prompt aggressive short-covering around the AUD/USD pair amid a sharp intraday US Dollar downfall. In fact, the official Chinese PMI prints for February indicated that business activity in the country rose to pre-COVID levels and that recovery in the world's second-largest economy is gaining steam. This largely offsets the softer-than-expected Australian macro data.

The Australian Bureau of Statistics reported that the economy expanded by 0.5% in the three months to December, lower than the 0.8% expected and 0.6% in the previous quarter. On an annualized basis, fourth quarter GDP rose 2.7%, as expected, though marked a significant slowdown from the 5.9% growth recorded in the previous quarter. Another report showed that Consumer Price Index (CPI) missed market estimates and decelerated from 8.4% to 7.4% in January.

The latest optimism, meanwhile, leads to a modest recovery in the global risk sentiment and weighs heavily on the safe-haven Greenback. This, in turn, is seen as another factor pushing the AUD/USD pair higher, though hawkish Fed expectations and looming recession risks could keep a lid on any further gains. The markets seem convinced that the Federal Reserve will stick to its hawkish stance for longer in the wake of stubbornly high inflation.

This remains supportive of elevated US Treasury bond yields and supports prospects for the emergence of some USD dip-buying. Furthermore, investors remain worried about economic headwinds stemming from rapidly rising borrowing costs. Adding to this, geopolitical tensions should cap any optimism in the markets and cap the risk-sensitive Aussie. This, in turn, warrants some caution before confirming that the pair has formed a near-term bottom.

Market participants now look to the US economic docket, featuring the release of the ISM Manufacturing PMI later during the early North American session. This, along with the US bond yields and the broader risk sentiment, should influence the USD price dynamics and allow traders to grab short-term opportunities around the AUD/USD pair.

Technical levels to watch

- EUR/USD reclaims the 1.0600 barrier and beyond.

- The dollar trades well on the defensive below the 105.00 level.

- Investors’ attention remains on the advanced CPI in Germany.

Increasing buying interest lifts EUR/USD to the area of multi-day peaks near 1.0660 on Wednesday.

EUR/USD focuses on German, US data

EUR/USD resumes the upside and leaves behind Tuesday’s daily decline on the back of the renewed and marked selling pressure in the greenback, which prompts the USD Index (DXY) to retreat to the sub-105.00 region.

Extra support for the European currency also came after ECB’s Müller noted that the current tightening cycle is having and effect, although inflation remains well elevated. He also suggested that expectations of rapid rate cuts are wishful thinking. His colleague Villeroy also said that the disinflation implemented will not result in a recession, at the time when he stressed the bank’s commitment to bring inflation back to the 2% goal by end of 2024.

In the docket, Germany’s jobs report showed the Unemployment Change rose by 2K in February and the Unemployment Rate held steady at 5.5% in the same period. Still in Germany, final Manufacturing PMI came at 46.3 9 (from 47.3), while the preliminary inflation figures will be released later in the European afternoon. In the broader Euroland, the final Manufacturing PMI matched the advanced print at 48.5.

In the US, the focus of attention will be on the ISM Manufacturing seconded by Construction Spending and the final Manufacturing PMI.

What to look for around EUR

EUR/USD woke up and reclaimed the area well north of 1.0600 the figure amidst some fresh downside pressure hurting the dollar on Wednesday.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the bank has already anticipated another 50 bps rate raise at the March event.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: Germany/EMU Final Manufacturing PMI, Germany Unemployment Change, Flash Inflation Rate (Wednesday) – EMU Flash Inflation Rate, Unemployment Rate, ECB Accounts (Thursday) – Germany Balance of Trade, Final Services PMI, EMU Final Services PMI (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.68% at 1.0644 and a breakout of 1.0713 (55-day SMA) would target 1.0804 (weekly high February 14) en route to 1.1032 (2023 high February 2). On the flip side, the next support aligns at 1.0532 (monthly low February 27) seconded by 1.0481 (2023 low January 6) and finally 1.0328 (200-day SMA).

Growth in the Canadian economy ground to a halt in Q4. Following the publication of the data the Loonie eased. The losses were limited though. Still, economists at Commerzbank expect the CAD to struggle against USD and EUR.

Canadian GDP data confirms rate pause

“The Canadian GDP data for Q4 came in much lower than expected. It illustrated that the economy stagnated compared with the previous quarter. Moreover, the result for the previous quarter was revised to the downside.”

“The data is likely to confirm the BoC in its course. At the January meeting it had signalled that it wants to wait and see what the effects of the massive rate hikes last year will be on the economy and had announced a rate pause for the meeting next week.”

“The economic momentum is likely to suit the BoC and confirm it in its view that the stubbornly high core inflation levels will also return towards its target rate soon. It will be important for the Loonie now whether the Canadian data will confirm this picture.”

“CAD will continue to struggle with a recovery against USD and EUR, as core rate concerns are keeping rate expectations high there.”

EUR/USD got a lift yesterday. Economists at ING believe that the 1.05 level will be the bottom of the first quarter range.

EUR/CHF looks like it might end March near 1.00