- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 01-03-2022

- WTI consolidates the biggest daily jump since May 2020.

- API stockpiles marked surprise draw of 6.5 million barrels for the week ended on February 25.

- Russia-Ukraine jitters intensify despite global pressure on Moscow, OPEC+ is likely to respect current plans, may ignore geopolitical challenges.

- EIA data, Fed Chair Powell’s Testimony will also keep oil traders busy.

WTI crude oil buyers take a breather around $104.00 during Wednesday’s initial Asian session, following a whopping rally of more than 10% the previous day.

The black gold earlier cheered hopes of no major relief to WTI traders from global producers despite the ongoing Russia-Ukraine crisis. On the same line were private inventory numbers and macros suggesting further tensions emanating from Moscow.

As per the latest weekly industry stockpile data from the American Petroleum Institute (API), US crude stocks fell by 6.1 million barrels, versus the previous addition of 5.983 million barrels.

Elsewhere, the Organization of the Petroleum Exporting Countries (OPEC) and allies led by Russia, a grouping known as OPEC+, is likely to stick to its existing policy of increasing output by 400K barrels per day (BPD) each month in April, per Reuters. The news quotes the reason as, “Russia's invasion of Ukraine having not affected OPEC+ deal functioning so far.”

Talking about geopolitics, Russian President Vladimir Putin has already conveyed his wish to continue with the military march in Kyiv until his goal is met. At the latest, the International Monetary Fund (IMF) and World Bank (WB) mentioned, “War in Ukraine creating significant spillover effects in other countries, commodity prices rising, risk driving further fueling inflation.” On the same line, US Treasury Secretary Janet Yellen also said, “The G7 continues to support the removal of key Russian financial companies from SWIFT. Additionally, prepared remarks for US President Joe Biden’s State of the Union (SOTU) speech also signaled that Biden emphasized self-reliance to tame inflation while also criticizing the Russian invasion of Ukraine.

Moving on, the OPEC+ verdict and Ukraine-Russia headlines are the main catalysts for the WTI crude oil prices moving on. Additionally, Fed Chair Jerome Powell’s bi-annual testimony and weekly official oil inventory data from the US Energy Information Administration (EIA), 2.796M expected and 4.515M prior, will be important as well.

Technical analysis

Although overbought RSI hints at a pullback towards the $100.00 threshold, WTI crude oil bulls can keep the June 2014 peak of $107.45 on the radar.

“US Treasury Secretary Janet Yellen said on Tuesday the Group of Seven nations would convene a task force to focus on freezing and seizing assets of Russian elites,” per Reuters.

More to come

- NZD/USD retreats from one-week high, stays positive for the fourth consecutive week.

- International pressure on Russia intensifies as Moscow gets tough on Kyiv, peace talks in focus.

- Wall Street, US Treasury yields portrayed risk-off mood, benefiting the DXY.

- Second-tier NZ data came in downbeat, eyes on Aussie GDP, statements from US President Biden, Fed Chair Powell.

NZD/USD remains depressed around 0.6750 during the early Wednesday morning in Asia, following a sluggish start to March.

The kiwi pair refreshed weekly top the previous day but closed in the red territory as the Russia-Ukraine crisis intensifies. However, upbeat data from China and receding calls of the Fed’s 0.50% rate hike in March seem to defend the pair buyers.

Russian President Vladimir Putin has already conveyed his wish to continue with the military march in Kyiv until his goal is met. To defend the national interest, Ukraine rushes to get European Union (EU) membership but the casualties keep rising each day.

Recently, the International Monetary Fund (IMF) and World Bank (WB) mentioned, “War in Ukraine creating significant spillover effects in other countries, commodity prices rising, risk driving further fueling inflation.” On the same line, US Treasury Secretary Janet Yellen also said, “The G7 continues to support the removal of key Russian financial companies from SWIFT.

Elsewhere, probabilities over the US Federal Reserve’s (Fed) 0.50% rate hike in March, as per CME’s FedWatch Tool, dropped to 1.7% versus above 50% before a few weeks. The same weigh on the US Treasury yields, down 12 basis points (bps) to 1.71% by the end of Tuesday’s North American session.

It’s worth noting that the Wall Street marked losses to portray the risk-off mood but the market’s rush to risk-safety favored the US Dollar Index (DXY) and gold prices. Additionally, fears to energy supply propelled WTI crude oil prices by over 10% on Tuesday to $106.33 at the latest.

Talking about the data, PMIs from China and the US were upbeat while New Zealand’s Terms of Trade Index for Q4 dropped to -1.0% versus -0.8% expected and 0.7% prior. Further, New Zealand Building Permits for January slumped to -9.2% compared to 0.5% forecasts and 0.6% previous readouts.

Looking forward, US President Joe Biden's State Of The Union (SOTU) speech, around 02:00 GMT, will precede Fed Chair Jerome Powell’s bi-annual testimony to entertain traders. However, major attention will be given to geopolitics. As per the prepared speech, US President Biden emphasized self-reliance to tame inflation while also criticizing the Russian invasion of Ukraine.

Technical analysis

NZD/USD pullback remains elusive beyond the previous resistance line from November 15, 2021, around 0.6740 by the press time. Until then, the kiwi pair can keep February’s high and the 100-DMA, respectively around 0.6810 and 0.6850, on their radar.

- AUD/USD bulls stay in charge and eye commodities for direction.

- Ukraine crisis bears down on currencies elsewhere with economies that depend on Russian fuel.

AUD/USD was the strongest performer on Tuesday despite its common correlation to the beta of the stock markets which sold off as attacks on Ukrainian cities intensified. Fixed income rallied across the curve yet, unusually, the price of the Aussie remained resilient. AUD/USD stuck to a 0.7238/89 range while by comparison, the ranges elsewhere in EUR/USD, for instance, were far greater (1.1233 to 1.1089 the low).

''The market is aggressively scaling back expectations for Fed tightening as the Dec-23 Fed Funds Futures contract rallied 25bp,'' analysts at ANZ bank explained, giving the US a run for its money, although not preventing it from soaring in a risk-off setting.

''Markets are bracing for a drawn-out conflict and appear to be focusing more on the negative growth implications than inflation risks. Expectations of a 50bp rise in fed funds this month have faded and investors are flocking to the safe haven of US Treasuries amid deteriorating liquidity.''

This has enabled the commodity currencies to hold up relative to those of, say, Europe which has a higher dependency on all things Russian. The heavy sanctions there and the result of the economic damage from Russia's invasion of Ukraine mean that traders believe the European Central Bank will delay hiking interest rates until next year.

''Europe remains highly exposed to Russia in some sectors, particularly energy,'' analysts at TD Securities explained. ''As the West rushes to sanction Russia, Europe is likely to feel the hit the hardest. This poses a typical stagflationary shock, and growth is likely to be lower, and inflation higher, than otherwise.''

Oil prices surged overnight despite the IEA announcing member countries (including the US) have agreed to release 60mbbl from reserves. This gave a lift to commodities overall. This potentially leaves the Aussie in good stead which is proving resilient as high commodity prices and strength in the domestic economy provides a buffer against geopolitical tensions.

Australia as a net energy exporter is set to gain from higher commodity prices, with liquefied natural gas and coal up sharply, while wheat, nickel, aluminium and iron ore are all firm. Meanwhile, the Reserve Bank of Australia (RBA) kept interest rates steady at 0.1% after a monthly policy meeting.

Traders have pushed out the first hike to July from June and removed one rate rise from this year to imply four increases to 1.0% by Christmas. However, analysts at Rabobank argue that, in their view, ''commodity exports offer the Australia economy good insulation and should provide support to the AUD/USD. ''

Q4 GDP rebound expected today

''We expect Australian fourth-quarter Gross Domestic Product today to show a bounce of +3.6% QoQ, with household consumption the key driver of strength'' analysts at ANZ Bank said.

''Annual GDP growth is forecast to edge up to 4.2% from 3.9% in Q3. A rise of 3.6% is not as strong as the RBA’s expectation for a 4½% gain in Q4. There’s more uncertainty than usual, in these estimates, evident in the wide range of market forecasts.''

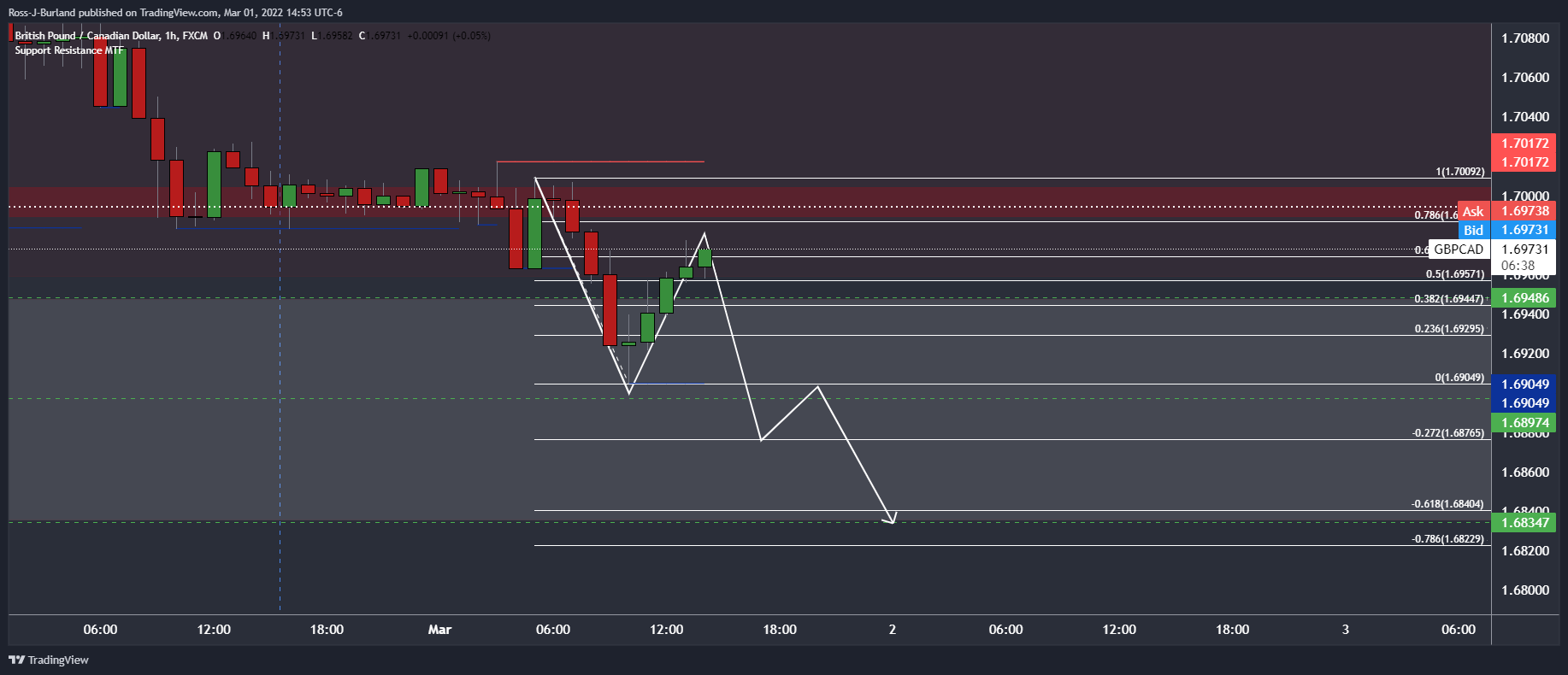

- On the hourly chart, GBP/CAD is moving in on the 61.8% golden ratio.

- A break below 1.6900 opens risk to the 1.6830s daily target.

GBP/CAD pierced the 2022 lows (1.6948) on Tuesday but has corrected back above them to post a corrective New York session high of 1.69774. From both a daily and shorter-term perspective the bias is tilted to the downside as illustrated in the following top-down analysis:

GBP/CAD weekly & daily charts

The weekly chart shows that the price has already mitigated an imbalance of the daily drop as follows:

Last week's candle shows that the price rallied to 1.71035. Therefore, the path of least resistance could now be to the downside on a break of 1.6897 with eyes to 1.6835.

GBP/CAD H1 chart

On the hourly chart, the price is reaching up into the 61.8% golden ratio territory. Should this hold as resistance, then the focus will be on the downside for a test and break of the lows for the sessions ahead. A break below 1.69 the figure opens risk to the 1.6830s daily target as illustrated above.

- The USD/JPY is extending losses in the week, so far down 0.62%.

- Russia-Ukraine war concerns dampen the market mood, lifting safe-haven peers.

- USD/JPY Technical Outlook: Upward biased, though a daily close below 114.40 could shift the pair to neutral.

The USD/JPY is under pressure for the second day in a row amid the market’s angst over Russia-Ukraine war tussles. Furthermore, the 10-year T-note closely correlated to the USD/JPY pair plunges 14 basis points (bps), sitting at 1.692%. That said, the USD/JPY is trading at 114.84 at press time.

Geopolitical tensions keep the market sentiment depressed. In the FX space, safe-haven peers rise, while risk-sensitive currencies, as of late, pared early gains, and others record losses.

USD/JPY Price Forecast: Technical outlook

Tuesday’s Asian Pacific session witnessed an upward move of 40-pips, recording March 1 daily high at 115.28, some pips above the daily pivot point. However, it appeared to be a profit-taking move, resuming its downward trend caused by Russia-Ukraine war headlines, recording a daily low at 114.69.

The USD/JPY is upward biased, as depicted by the daily moving averages (DMAs) located above the exchange rate. However, a daily close under 114.40 could shift the pair to neutral.

The USD/JPY first support would be February 24 low at 114.40. A sustained break could pave the way for further losses, with the 114.00 mark as the second support. Once cleared, the next stop would be January 24 daily low at 113.47.

Upwards, the USD/JPY first supply zone would be the 50-day moving average at 114.97. Breach of the latter would expose February 25 at 115.76, followed by the YTD high at 116.35.

Bank of England Monetary Policy Committee member Michael Saunders said on Tuesday that it isn't clear whether recent developments in Ukraine will have any effect on inflation two to three years out. However, if the large energy price rises as a result of Russia's invasion of Ukraine are maintained, this would add to the inflation peak. Saunders said that he does not want to be drawn now on the monetary policy implications of the war in Ukraine.

The Bak of England Catherine Mann said that UK inflation is headed to 7.25% in April.

She voted for a 50 basis point rise in interest rates this month because she saw little sign of an easing in the public's price expectations, which risk causing inflation to stay too high for too long.

Mann was one of four Monetary Policy Committee members to vote to raise interest rates to 0.75% from 0.25% this month, rather than the increase to 0.5% backed by the majority of the committee.

Key comments

Companies and workers will both get 5% wage increases in 2022.

5% wage rise expectation show `embedded' inflation.

More comments to come...

Cleveland Fed President and FOMC member Lorreta Mester on Tuesday said that the Ukraine situation adds upside risks to inflation and downside risks to the Fed's growth forecasts. The challenge for t

The Bank of England's Michael Saunders says vote for a 50bp hike in February ''does not necessarily imply that I believe that the level of rates one or two years ahead will be higher than the yield curve used for the February MPR.''

He says important to distinguish between the pace of tightening and the level of rates at the end of a tightening cycle.

More key comments

Says quicker tightening early on could help limit the overall tightening cycle

Says vote for a 50bp hike in February does not necessarily imply that I would vote for a 50bp hike in the event that further tightening is required.

Says case for policy to move in a larger step probably is greater when bank rate is clearly further away from the approximate level that, if maintained, would return inflation to target.

Says not in favour of aiming to restore the lost potential output by “running the economy hot".

Saunders says running the economy hot” would simply produce an even more persistent inflation overshoot.

Says maintaining a relatively loose policy stance under current conditions would be likely to produce a further undesirable rise in inflation expectations.

Says such an outcome would be costly to reverse and could limit the scope for prompt monetary easing the next time the economy needs support.

GBP/USD update

Cable is offered on the back of a risk-off theme in markets on Tuesday. The comments from Saunders, however, is serving to stall the slide with the price a touch higher as it starts to correct from the session lows of 1.3298. The price is now near 1.3310.

- WTI surged into the $104.00s on Tuesday, up sharply from Monday’s close in the $95.00s.

- The 2014 high in the $107.50 area has for now acted as a barrier to further upside.

- The historic intra-day rally has been driven by traders pricing in a greater risk of Russia oil supply disruption.

Oil prices have been surging on Tuesday as traders come to the realisation that financial sanctions on Russia are likely to have ramifications on the country’s ability to export energy products, even if Western sanctions don’t directly target Russian energy. Front-month WTI futures are currently on course for a historic one-day rally of just under $9.0 (or over 9%), with prices currently trading in the mid-$104.00s, up from Monday’s closing levels in the $95.00s.

That takes WTI’s on-the-week rally to just shy of $13.00. In recent trade, prices have pulled back quite aggressively from earlier peaks. WTI nearly challenged 2014 highs in the $107.50 area and at one point did eclipse $107, though profit-taking ahead of this key area of resistance took some wind out of the day’s rally. Once (if) this level is cleared, that will open the door to a test of the 2013 highs in the $112 area.

Traders seemed disappointed that major oil-consuming nations agreed to “only” release 60M barrels of oil reserves at Tuesday’s extraordinary International Energy Agency meeting, news which failed to offset bullishness after sources said OPEC+ would stick to its current output policy. Analysts expect the group of oil-producing nations to agree to another 400K barrel per day hike to output quotas in April when they meet later in the week.

Ukraine Defense Intelligence said on Tuesday that there are about 300 Belarussian tanks near the Belarussian/Ukrainian border, Reuters reported on Tuesday. The Russians are preparing a deliberate provocation to justify the entry of Belarussian troops into the conflict, the Ukrainian Intelligence added.

- The USD/RUB depreciated 44% in the last two days, spurred by the Russia – Ukraine conflict.

- On Tuesday, the USD/RUB prints a YTD high at 118.09.

- USD/RUB Technical Outlook: It is upward biased, though a negative divergence in the 1-hour chart looms, spurring an opportunity to dip buyers.

The USD/RUB skyrockets for the second straight day, as geopolitical tensions between Russia – Ukraine do not subside, while the USD/RUB reached a YTD high at 118.09. At the time of writing, the USD/RUB is trading at 117.75.

From a technical perspective, it is easy to spot that the USD/RUB is upward biased. The daily moving averages are below the 78.00 mark, and the USD/RUB sits above February 28 daily high at 111.67.

Therefore, it is suggested to approach USD/RUB price action from the 1-hour chart due to the strong uptrend and volatility of the markets. Caution is warranted.

USD/RUB Price Forecast: Technical outlook

USD/RUB 1-hour chart shows that the USD/RUB depreciated 32% in the day on Monday. However, the pair traded in the 96.00-112.08, for some time, before breaking upwards, reaching a new YTD high at 116.76. However, the Relative Strength Index (RSI) is at overbought levels at 74.82, aiming higher, though if the USD/RUB stabilizes around the 112.08-116.76 range, it could print a new lower high, that could portray a negative divergence between price action and RSI. That said, it could spur a move downwards.

If that event plays out, USD/RUB first support would be 108.49. Breach of the latter would expose a downslope trendline, which passes around 105.00, followed by the confluence of the 50-hour simple moving average (SMA) and March 1 daily low at 96.78.

- EUR/USD embarks on a trip to test the lows of 2022.

- Ukraine's crisis and uncertainty remains in the driving seat.

EUR/USD is in free fall on Tuesday and is encroaching on the 2022 lows near 1.11. The lows of the day have so far have been 1.1107 and the 2022 low printed on Feb.24 was 1 pip below that. The high was 1.1233, so there has been some big movement. ''Traders are increasingly hedging against declines in the euro as they brace for the damage that war in Ukraine could wreak on the European economy,'' a Bloomberg article read today.

It is risk-off across the board with European stocks tumbling and there was a stampede for US and German government bonds due to the huge uncertainty caused by Russia's invasion of Ukraine. Losses for the pan-European STOXX 600 index sent it down nearly 2% by midsession and Wall Street is also in a sea of red. A majority of major S&P 500 stocks are trading in the red with financials the weakest group.

US 10-year Treasuries, which are a key driver of global borrowing costs are falling sharply to five-week lows. The 10-year German Bund yield was heading for its biggest one day fall since 2011.

February PMI data showed momentum in eurozone manufacturing growth had already waned slightly last month, although it was still relatively strong and firms said supply chain constraints had eased. With that being said, ''Europe remains highly exposed to Russia in some sectors, particularly energy,'' analysts at TD Securities explained. ''As the West rushes to sanction Russia, Europe is likely to feel the hit the hardest. This poses a typical stagflationary shock, and growth is likely to be lower, and inflation higher, than otherwise.''

The dollar remains firm as the crisis in Ukraine continues with the DXY index up for the second straight day and trading now well above 97. The high has been 97.425 so far. After there, levels to watch are the June 2020 high near 97.802 and the May 25, 2020, high near 99.975. This could leave the euro exposed all the way into the 1.0850s.

EUR/USD technical analysis

This is a snapshot of the weekly chart. As illustrated, there is little to no support all the way to 1.1020 and then plenty of imbalance to mitigate into the 1.08 figure thereafter.

- GBP/USD has slipped under 1.3550, weighed by geopolitics-related safe-haven demand for the US dollar.

- The main risk-off driver on Tuesday remains concerns about the Russo-Ukraine war and how it might impact the global economy.

GBP/USD dropped by about half a percent on Tuesday to back below 1.3350, having rejected a test of recent sessions’ highs in the low 1.3400s earlier in the day. Cable’s fallback from the 1.3430s, which marks the highs of the last three sessions, is not overly surprising amid the much more downbeat market tone on Tuesday (equities lower and yields tumbling) which is underpinning the safe-haven dollar. Sterling is more risk-sensitive than the buck and GBP/USD is thus expected to perform poorly in times of risk-off.

The main driver of risk-off on Tuesday is of course concerns about the Russo-Ukraine war and how it might impact the global economy. Amid anticipation that fighting will intensify as Russia continues to move troops into Ukraine and amid uncertainty about how the harsh financial sanctions implemented by the West against Russia might impact the global economy, investors have been derisking. Notably, expectations for tightening from European central banks has taken a substantial hit on Tuesday.

That has resulted in a substantial fall in UK bond yields (10s down over 20bps, 2s down nearly 20bps). While US yields are also substantially as well (10s down 11bps and 2s down 9bps), rate differentials have in this instance swung in favour of the buck, likely adding to the tailwinds it is experiencing on Tuesday. With traders paring their BoE tightening view, market participants will be closely watching upcoming speeches from BoE Monetary Policy Committee (MPC) members Michael Saunders (at 1830GMT) and Catherine Mann (at 1900GMT).

Beyond some more BoE speak on Wednesday from other MPC members, the most notable calendar events this week are in the US, with Fed Chair Jerome Powell testifying before Congress on Wednesday and Thursday and NFP figures on Friday. As was the case with Tuesday’s strong ISM Manufacturing report that offered some modest support to the US dollar, data this week should point to continued US economic strength.

But these events are set to play second fiddle to broader geopolitical developments. For now, it seems likely that the ceiling just above 1.3400 for GBP/USD will hold firm and, as long as safe-haven dollar demand remains firm, the risks to the pair are tilted to the downside. Some short-term GBP/USD bears may well be eyeing a test of last week’s sub-1.3300 lows.

Money markets are paring their bets for central bank tightening in 2022. The BoE is now seen lifting rates by a further 107bps versus 128bps on Monday. The ECB is now seen lifting rates just 20bps versus 25bps earlier in the day.

European bond markets reflect such sentiment. 2-year German yields are down north of 20bps on Tuesday to back under -0.70% while 2-year UK yields are down around 18bps to under 0.90%. 10-year German yields are also down about 20bps to well back below 0.00% while the UK 10-year yield is down about 22bps to back under 1.20%.

Russia's invasion of Ukraine and the subsequent harsh sanctions enacted on it by the West have sparked fears of economic weakness as a result of fears of Russian energy and other commodity supply disruptions. This is leading market players to drastically dial back on expectations for central bank tightening in the medium term.

EUR/USD failed to make much headway past 1.12 and is trading back under the figure. As it is still too early to anticipate a resolution to the Russian invasion, economists at Scotiabank expect the pair to move downward to the 1.10 level.

Resistance after 1.12 is located at 1.1240/50

“The pair has managed to hold above 1.11 against bearish price trends since early/mid-Feb and has generally only briefly dropped below the mid-figure area that stands as support followed by 1.1100/20.”

“Resistance after 1.12 is 1.1240/50 and 1.1275 and the 1.13 area.”

“For now, the EUR is unlikely to push higher and may continue to weaken toward 1.10 as the conflict drags on, and possibly escalates in the next few days.”

The loonie has posted two solid days’ worth of gains and looks to be heading for a third as USD/CAD holds losses below the 1.27 zone. Economisst at Scotiabank expect the pair to dip to the 1.2645/35 zone.

Resistance located at 1.2705/10

“We continue to target a drop to the low 1.26 zone (1.2635/45) at least in the short run; trend momentum is picking up on the intraday DMI oscillators, which should limit the USD’s ability to rally today, while longer run DMI signals remain aligned bullishly for the USD, which suggests scope for USD losses –right now – is limited.”

“We spot USD/CAD resistance at 1.2705/10 intraday.”

Senior Economist at UOB Group Alvin Liew reviews the latest US GDP figures.

Key Takeaways

“The 4Q 2021 GDP growth was revised higher to 7.0% q/q SAAR (in line with Bloomberg estimate, and slightly better than the advance estimate of 6.9%), a marked improvement from 2.3% in 3Q. For 2021 as a whole, the US economic growth came in at 5.7% (unchanged from advance estimates and is the highest since 1984) following its worst contraction since 1946, at -3.4% in 2021.”

“Growth in 4Q was again attributed to private consumption as well as business & residential investments but it was inventories that played an outsized role in 4Q, responsible for nearly 5ppts of the 7% growth. Two components, government spending and net exports of goods and services, dragged on US headline GDP in 4Q, but it should be noted the recovery in US exports helped cushioned the net exports decline to less than 0.1ppt while the expiry of several federal programs likely worsened the government spending component.”

“Our GDP growth outlook is for slower pace of increase in 1Q due to the temporary impact from the Omicron wave of COVID-19 infections, but growth will resume subsequently, and still be above potential at 3.5% for the full year of 2022. That said, we note the downside risks to growth due to inflation will now be magnified by the soaring commodity prices amidst the Russia-Ukraine conflict.”

According to IHS Markit's Final US Manufacturing PMI for February, the headline index fell a little to 57.3 from the flash estimate of 57.5.

Market Reaction

The DXY did not react but remains underpinned on the day by a safe-haven bid, with price action in the global equity space wobbly and commodity prices surging amid fears of supply disruptions as the Russia/Ukraine crisis worsens. The index remains comfortably support above 97.00 ahead of the more widely followed ISM Manufacturing PMI release at 1500GMT.

- WTI has surged above $101 to hit its highest in over seven-years, with analysts eyeing the 2014 highs near $107.50.

- The rally is being driven by concerns of supply disruptions as Western sanctions against Russia start to bite.

- For now, this has outweighed chatter about coordinated oil reserve releases.

Oil prices have surged this Tuesday as concerns grow about supply disruptions as Western sanctions against Russia, who are currently in the process of invading Ukraine, start to bite, outweighing chatter about coordinated oil reserve releases. Front-month WTI futures have surged to their highest levels since July 2014 above $101 per barrel, with the bulls eyeing a test of the next key area of resistance in the $107.50 area, which marks the 2014 highs.

That translates into on-the-day gains of more than $5.0 and takes WTI’s two-day rally to over $9.0. A senior analyst at Rystad Energy wrote that “the fragile situation in Ukraine and financial and energy sanctions against Russia will keep the energy crisis stoked and oil well above $100 per barrel in the near-term and even higher if the conflict escalates further”.

The US and EU have not imposed direct sanctions on Russian energy companies or on energy exports, but various reports in financial press point to growing difficulties in conducting trade of these goods. Banks have been pulling financing and shipping costs have surged, while major Western-based energy companies are looking to exit their stakes in Russian operations.

Russia exports between 4-5M barrels of crude oil per day, plus a further 2-3M barrels of refined products each day, making the country one of the world’s most important energy exports. Major US banks including Goldman Sachs, Morgan Stanley, and JP Morgan have all upped their oil forecasts to reflect concerns about supply disruptions, with some analysts warning of oil hitting $150.

Press reports suggest that a coordinated crude oil reserve release by the US and its allies could amount to between 60-70M barrels and such a move is currently under discussion at an extraordinary ministerial meeting of the Internation Energy Agency. Confirmation that nations agreed on the release might trigger some profit-taking in crude oil later in the session, analysts suggested, but shouldn’t shift the underlying bullish dynamic.

With fresh sources suggesting OPEC+ is going to stick to its current output policy of increasing quotas by 400K barrels per day/month in April, despite the Russian invasion of Ukraine, hopes of near-term supply relief from OPEC+ remain non-existent.

The Bank of Canada (BoC) is set to announce its interest rate decision on Wednesday, March 2 at 15:00 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of seven major banks, regarding the upcoming announcement.

As the BoC 25 bps rate lift-off is well discounted by the market, the focus will remain on any hawkish tilt in the forward guidance.

NBF

“BoC should finally begin its rate normalization exercise. Wednesday’s rate hike will be the first of many (five in our estimation) this year as the BoC finds itself on the back foot in its fight against above-target inflation. There’s undoubtedly a very strong case to be made for going big with a 50 basis point move but we’ve not seen enough from the BoC to suggest that’s coming. On the other hand, the central bank will have become aware of increased geopolitical risk following the invasion of Ukraine by Russia, an element that could favor a more cautious approach. This explains why, as of now, our base case incorporates a vanilla 25 bp-25 bp March-April hike structure, consistent with the empirical record for BoC tightening cycles.”

TDS

“The BoC loudly telegraphed a rate hike in March; we look for a 25bp increase, as the facts on the ground haven't changed enough to justify a more drastic tightening. We expect the Bank will remain in its reinvestment phase for the balance sheet, and it will signal more rate hikes to come. With the Fed and BoC set to hike next month, we don't see a huge swing factor for USD/CAD. The BoC might offer CAD a marginal first-mover advantage versus the USD but much depends on risk appetite and geopolitical developments.”

ING

“A 25bp rate hike is our call for this meeting despite geopolitical nervousness. We continue to look for six interest rate increases in total from the BoC this year, with a further three in 2023. This would leave the policy rate at 2.5% by the end of next year, a level it was last at all the way back in October 2008.”

RBC Economics

“Russia’s invasion of Ukraine is not expected to keep the Bank of Canada from hiking interest rates. The BoC in January expected the Omicron wave would be ‘less severe than previous waves’ and current conditions look to be playing out that way. We look for the BoC to follow Wednesday’s expected rate hike with 3 more this year, the next coming as soon as April.”

Citibank

“We expect a 25bp rate hike this week, taking the policy rate to 0.50%. Our base case is then 25bp rate hikes at each of the April, June, July, and October meetings this year but hiking by less than what markets currently price for tightening beyond 2022. One potential hawkish risk for this meeting, however, would be if the BoC announces the end of balance sheet reinvestments. This is not our base case but there could be some more communications around the details of how balance sheet runoff will work (when it commences). We also expect a largely neutral statement, as the BoC has been clear in its intentions to raise rates in a series of steps in order to respond to too-high inflation.”

CIBC

“A healthy Q4 for real GDP ended on a soft note in December, and with that likely to have carried through into January, sets the stage for a Covid-related soft patch in the overall Q1 pace. But unlike when it met in January, the BoC can point to a steady taming in hospitalizations and a reopening in services in late February, giving it the green light for what we expect will be a quarter-point hike this month, and another in April. The Bank isn’t a fan of forward guidance when it’s no longer at the lower bound on rates, so the market will be left to its own devices in estimating the precise path ahead. But its language will indicate that it expects a series of rate hikes to provide a braking force on inflation later this year and into 2023 while conceding that in the near-term, the CPI will continue to run well about its target.”

Wells Fargo

“As inflation and labor market dynamics evolve in this way, we continue to believe the BoC will look to raise interest rates. We recently adjusted our forecast and now believe BoC policymakers will raise policy rates 25 bps. We will be paying attention to any commentary around recent developments and their impact on monetary policy.”

In spite of recent developments, strategists at TS Securities believe the Federal Reserve is still likely to start raising rates in March. However, the tightening in financial conditions thus far makes the odds of a 50bp rate hike less likely, so they expect the Fed to hike rates by 25bp at every meeting until November.

Fed to pause after the November hike to reassess policy for several meetings

“While there are clear downside risks posed by geopolitical uncertainty and tighter financial conditions, we do not think that this will derail the Fed from starting the hiking cycle in March. We continue to forecast the Fed to raise rates at the March FOMC meeting, but believe the odds of a 50bp move have fallen significantly.”

“We look for the Fed to start the hiking cycle in March with a 25bp rate hike and deliver six consecutive hikes in 2022. We forecast the Fed funds rate to end the year at 1.5-1.75%.”

“After a pause at year-end and early 2023, we see the Fed raising rates three more times to reach a terminal rate of 2.25-2.50%.”

“We also adjust our US rates forecasts given the tweak to our Fed call but continue to look for the 10y to reach 2.5% by year-end.”

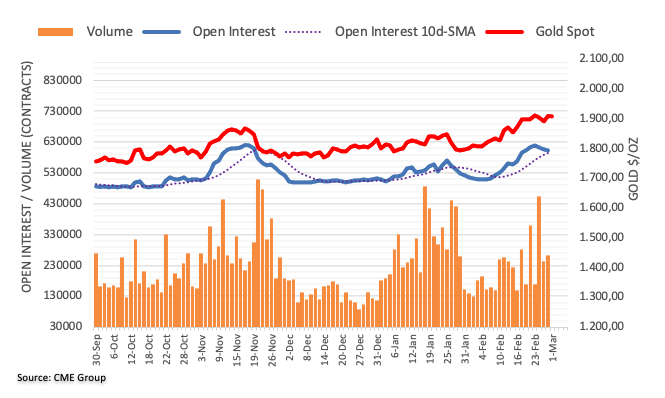

- Gold is well supported near $1920 amid strong demand for inflation protection as commodity prices surge.

- Russia/Ukraine headlines have been negative and indicative that de-escalation in the near future remains highly unlikely, supporting haven assets.

- US data and Fed speak, though worth keeping an eye on, will likely play second fiddle this week.

Gold appears to have started March where it left things off in the final weeks of February and is trading firmly on the front foot, underpinned by a decent dose of demand for inflation protection as commodity prices surge. Spot prices (XAU/USD) currently trade in the $1920 region, up about 0.5% on the day, with tailwinds also coming from global debt markets, where yields have plummetted for a second successive session as traders reduce central bank tightening bets. The US 10-year, for instance, is down a further 9bps on Tuesday to under 1.75%, having been above 2.0% as recently as last Friday. Lower bond yields increase the relative attractiveness of investing in non-yielding assets such as precious metals.

In terms of the latest on the Russia/Ukraine front; headlines have been negative and indicative that de-escalation in the near future remains highly unlikely. Ukrainian President Volodymyr Velenski said talks between the Ukrainian and Russian delegation on Monday did not achieve their intended aim and Russia continues to amass troops in the north in preparation for an assault on Kyiv. All the while, Russian forces continue to gain ground in southern regions of the country and the rhetoric between Russian and Western/NATO officials gets ever more heated.

As a result, energy prices and the prices of other commodities where Russia is a ley exporter are likely to remain underpinned in the near future, which may keep a bid in precious metals amid demand for inflation/stagflation protection. Bulls are subsequently likely to continue to eye a retest of last week’s highs in the $1970s and a potential push back to record highs above $2000. Traders should remember that geopolitics isn't the only game in town this week, with plenty of US data and Fed speak also to keep an eye on, though this is likely to play second fiddle to Russia/Ukraine developments.

Gold has catapulted to a $1,974 high before giving up gains and quickly succumbed to a $1,878 low. Technically, in the bigger picture, gold’s price profile remains bullish unless it craters under $1,770, Benjamin Wong, Strategist at DBS bank, reports.

Stay constructive, buy the dips

“For gold to dispel the prospect of a corrective decline before resuming its upward path, a move that sustains over $1,950-$1,973 is required.”

“Our prior tactical $1,810 long was taken out in the recent volatile moves, and we replenish a long at $1,863. We add on at $1,810 with an invalidation at $1,770 accompanied by a $1,920 harvest point.”

“Sub-$1,780-$1,770 would be a key level for gold to hold regardless of market volatility to ensure the bullish build-up from last August’s $1,690 level stays intact. A break thus can likely alter the larger landscape; however, this is not the fancied case.”

“A noticeable gap between CFTC speculators and industry insiders needs to narrow before gold stabilises.”

USD/IDR is expected to pick up further traction with the next target at 14,408 ahead of 14.448, suggested Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“USD/IDR traded between 14,310 and 14,385 last week, narrower than our expected range of 14,270/14,380… with Daily MACD turning higher, the bias for the rest of this week is on the upside.”

“Resistance is at 14,408 followed by a rather strong level at 14,448.”

The European Parliament has accepted Ukraine's application to join the EU and a special admission procedure has begun, Nexta TV reported on Twitter on Tuesday.

For Ukraine to formally become part of the EU, all member states will need to agree to its accession and the European Council will also need to approve it. For now, Ukraine remains a candidate to join the EU.

OPEC+ is likely to stick to its existing policy of increasing output by 400K barrels per day (BPD) each month in April, with Russia's invasion of Ukraine having not affected OPEC+ deal functioning so far, sources told Reuters.

"We are striving for Europe to choose for Ukraine," Ukrainian President Volodymyr Zelenskyy said on Tuesday, as reported by Reuters.

"We are fighting to be equal members of Europe," Zelenskyy added. "Ukraine is giving away its best people for the desire to be treated as equals."

Market reaction

Markets remain risk-averse during the European trading hours on Tuesday following these remarks. As of writing, S&P futures were down 0.8% on the day, the benchmark 10-year US Treasury bond yield was losing more than 5% at 1.73 and the US Dollar Index was rising 0.2% at 96.95.

Quek Ser Leang at UOB Group’s Global Economics & Markets Research, noted that further upside in USD/THB is expected to face a strong hurdle at 33.13.

Key Quotes

“We highlighted last Monday (21 Feb, spot at 32.13) that ‘further USD/THB weakness is not ruled out but conditions remain deeply oversold and a sustained decline below 31.95 appears unlikely’. We added, ‘a breach of 32.32 would indicate that the current USD/THB weakness has stabilized’. While we noted the oversold conditions, we did not expect the sharp and swift bounce as USD/THB soared to 32.89 last Thursday (24 Feb).”

“Daily RSI is unwinding rapidly from oversold conditions and this coupled with daily MACD moving into positive territory suggests the rebound has more room to go. A breach of the 55-day exponential moving average at 32.92 would not be surprising but the declining trend-line at 33.13 is a strong resistance level and may not be easy to crack. On the downside, a break of 32.30 (minor support is at 32.44) would indicate that the current upward pressure has eased.”

British Prime Minister Boris Johnson said on Tuesday that they will do more to exclude Russian banks from the SWIFT system and freeze their assets, as reported by Reuters.

Additional takeaways

"The odds have always been heavily against the Ukrainian armed forces."

"It's already clear Putin will ultimately fail in Ukraine."

"We must prepare for an even larger outflow of refugees, perhaps in the millions."

"Europe must finally wean ourselves off Russian oil and gas."

"We are ready for a prolonged crisis."

"There is only one way out and that is for Putin to turn back the tanks."

"It is hard to see how Putin can be seen as a valid interlocutor."

"I cannot pretend this is something the UK can fix by military means."

"Reasonable for Ukraine to ask for EU membership."

Market reaction

The British pound struggles to find demand on Tuesday and the GBP/USD pair was last seen posting small daily losses near 1.3400.

Russian Prime Minister Mikhail Mishustin said on Tuesday that Russia has temporarily suspended options for foreign investors to pull from Russian assets, as reported by Reuters.

Additional takeaways

"Financial measures ordered by President Vladimir Putin will support the rouble rate."

"Import substitution should become the key area of development for us."

"We still see foreign businesses as potential partners."

"Russia should intensify economic shift away from dependence on natural resources."

Market reaction

The market mood continues to sour during the European trading hours and the Euro STOXX 600 Index was last seen losing 1.7% on a daily basis.

A Kremlin spokesperson said on Tuesday that it was too early to assess the results of the latest talks with Ukraine and noted that President Vladimir Putin was briefed on the matter, as reported by Reuters.

Additional takeaways

"We need to analyse and think about perspective after talks with Ukraine."

"Ukraine's EU application is not a strategic security question because EU is not a military bloc."

"Not in a position to give an assessment of the military situation, this is a question for the defence ministry."

"Russian forces are not hitting civilian infrastructure and housing, this is ruled out."

"Kremlin blames reports of attacks on civilian targets on 'nationalist groups using people as human shields."

"No plan at the moment for Putin to speak to Zelenskyy."

"Sanctions imposed against Putin personally have no effect at all."

"There can be no question of sanctions forcing us to change our position."

"Russia categorically rejects accusations of war crimes."

"Allegations Russia used cluster bombs or vacuum bombs are fake."

"Russia considers Zelenskyy legitimate president of Ukraine."

"Zelenskyy could give the command to lay down arms and then there would be no casualties."

Market reaction

EUR/USD remains on the back foot as market mood continues to sour in the European session. As of writing, the pair was down 0.42% on the day at 1.1172.

- AUD/USD is looking to extend the pullback after rejection just shy of 0.7300.

- Risk sentiment takes a big hit after Russia says will continue operations in Ukraine until it achieves its goal.

- Dovish RBA adds to the weight on the aussie while Chinese PMIs improve.

AUD/USD is feeling the pull of gravity once again after facing rejection just below the 0.7300 level, as the US dollar springs back to lift amid a renewed wave of risk-aversion across the financial market.

Comments from the Russian official re-ignited the risk-off trades, with the S&P 500 futures accelerating declines towards 4,378, down 0.75% on the day.

Russian Defence Minister Sergei Shoigu said that Russia “will continue operation in Ukraine until it achieves its goals, per Interfax. Adding to it, Russia's Foreign Minister Sergey Lavrov said that Ukraine still has soviet nuclear technology,” adding that Moscow “cannot fail to respond to this danger.”

The high beta AUD retreated further in tandem with the risk sentiment, as investors scurried for safety in the US dollar. The US dollar index jumped to retest 97.00, up 0.15% on the day.

Earlier in the day, the Reserve Bank of Australia (RBA) left the key interest rates unchanged at 0.10% but said that the board is prepared to be patient, given the Russia-Ukraine war uncertainty.

Markets have also shrugged off the upbeat Chinese Manufacturing PMIs, as the sentiment around the Russia-Ukraine war dominates and will continue doing so ahead of the US ISM Manufacturing PMI.

AUD/USD: Technical levels to consider

Economist at UOB Group Lee Sue Ann suggests the Bank Negara Malaysia (BNM) could keep its policy rate unchanged at the Thursday’s meeting.

Key Takeaways

“We think the build-up of domestic inflation pressures together with sustaining growth momentum and more aggressive Fed monetary policy tightening would justify an interest rate hike by BNM as early as in 2Q22.”

“We expect the OPR to be raised twice this year (+25bps in 2Q22 and +25bps in 3Q22), bringing it to 2.25% by end-2022.”

- EUR/USD fades the earlier uptick to 1.1230.

- Cautiousness remains high and fuels the risk aversion.

- Flash Germany CPI, US ISM Manufacturing next of relevance.

The selling bias around the single currency remains well and sound and now motivates EUR/USD to recede from earlier tops near 1.1230 to the sub-1.1200 region on turnaround Tuesday.

EUR/USD weighed down by geopolitics

EUR/USD resumes the downside and now adds to Monday’s losses around the 1.1200 neighbourhood after the Russian offensive is expected to continue until its target is achieved, said Russia’s Defence Minister. His comments encouraged the re-emergence of the risk aversion among traders and put the risk complex under extra pressure in the first half of the week.

Indeed, inflows to the safe haven universe remains pretty much unchanged on the back of the fragile geopolitical environment and after initial Russia-Ukraine talks in Belarus on Monday only yielded the promise of further dialogue in the near future.

In the meantime, spot is expected to remain under scrutiny for as long as the military conflict in Ukraine lasts, always tracking the risk aversion sentiment as well as safe haven (dollar) dynamics.

Closer to home, Germany advanced CPI will be the salient event later in the European afternoon, while the ISM Manufacturing takes centre stage across the pond later in the NA session. Earlier in the session, final Manufacturing PMI in Germany came at 58.4 and 58.2 when it comes to the broader Euroland.

What to look for around EUR

EUR/USD continues to look to the geopolitical scenario and risk appetite trends for near-term direction. On this, the recent deterioration of the Russia-Ukraine front is expected to keep the pair under pressure amidst solid risk-off sentiment and demand for the greenback. In the meantime, bouts of strength in the pair should remain underpinned by speculation of a potential interest rate hike by the ECB probably sooner than many anticipate, higher German yields, persevering elevated inflation and a decent pace of the economic activity and auspicious results from key fundamentals in the region. The threat to this view, as usual, comes from the Fed and a potential tighter-than-expected start of the normalization of its monetary conditions.

Key events in the euro area this week: Germany, EMU Final Manufacturing PMI, Germany Flash CPI (Tuesday) – Germany Retail Sales, Unemployment Change, Unemployment Rate, EMU Flash CPI (Wednesday) – Germany/EMU Services PMI, EMU Unemployment Rate, ECB Accounts (Thursday) – Germany Trade Balance, EMU Retail Sales (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is losing 0.34% at 1.1180 and faces the next up barrier at 1.1322 (55-day SMA) followed by 1.1390 (weekly high Feb.21) and finally 1.1395 (weekly high Feb.16). On the other hand, a drop below 1.1118 (low Feb.28) would target 1.1106 (2022 low Feb.24) en route to 1.1100 (round level).

USD/BRL is gradually drifting towards the lower limit of its large consolidation at 4.95/4.89. Should this support gets violated, the pair would extend the down move towards 4.81 and projections of 4.73, analysts at Société Générale report.

USD/BRL to rebound towards 5.28 if 4.89 holds

“4.95/4.89 is a crucial support zone. Defending this can result in a rebound towards 5.28 and perhaps even towards 5.38, the low of November.”

“Only if support at 4.89 get violated, would there be a risk of extension in the down move towards 4.81 and projections of 4.73.”

USD/CNH risks a deeper pullback once 6.3000 is cleared according to FX Strategists at UOB Group.

Key Quotes

24-hour view: “Our expectations for USD to ‘test the resistance at 6.3350’ did not materialize as it traded within a range of 6.3072/6.3275 before closing largely unchanged at 6.3133 (+0.04%). The underlying tone has softened somewhat and USD could dip below 6.3050 but a clear break of 6.3000 is unlikely. On the upside, a breach of 6.3200 would indicate the current mild downward pressure has eased.”

Next 1-3 weeks: “Our latest narrative was from last Friday (25 Feb, spot at 6.3185) where USD is likely to trade between 6.3050 and 6.3450. The underlying tone has softened but USD has to close below 6.3000 before a sustained decline is likely. The chance for USD to close below 6.3000 is not high for now but it would remain intact as long as USD does not move above 6.3450 within these few days.”

EUR/USD has remained within the limits of 1.1120 and 1.1485 since January. A break under the lower band would open up additional losses towards 1.0840, economists at Société Générale report.

Reclaiming 1.1330/1.1345 essential to avert further dip

“A bounce is not ruled out however a descending trend line at 1.1330/1.1345 could cap. Crossing this would be essential for a retest of 1.1485.”

“In the event 1.1120 gets violated, there would be a risk of next leg of downtrend towards projections of 1.1080/1.1040 and the multiyear ascending trend line at 1.0840.”

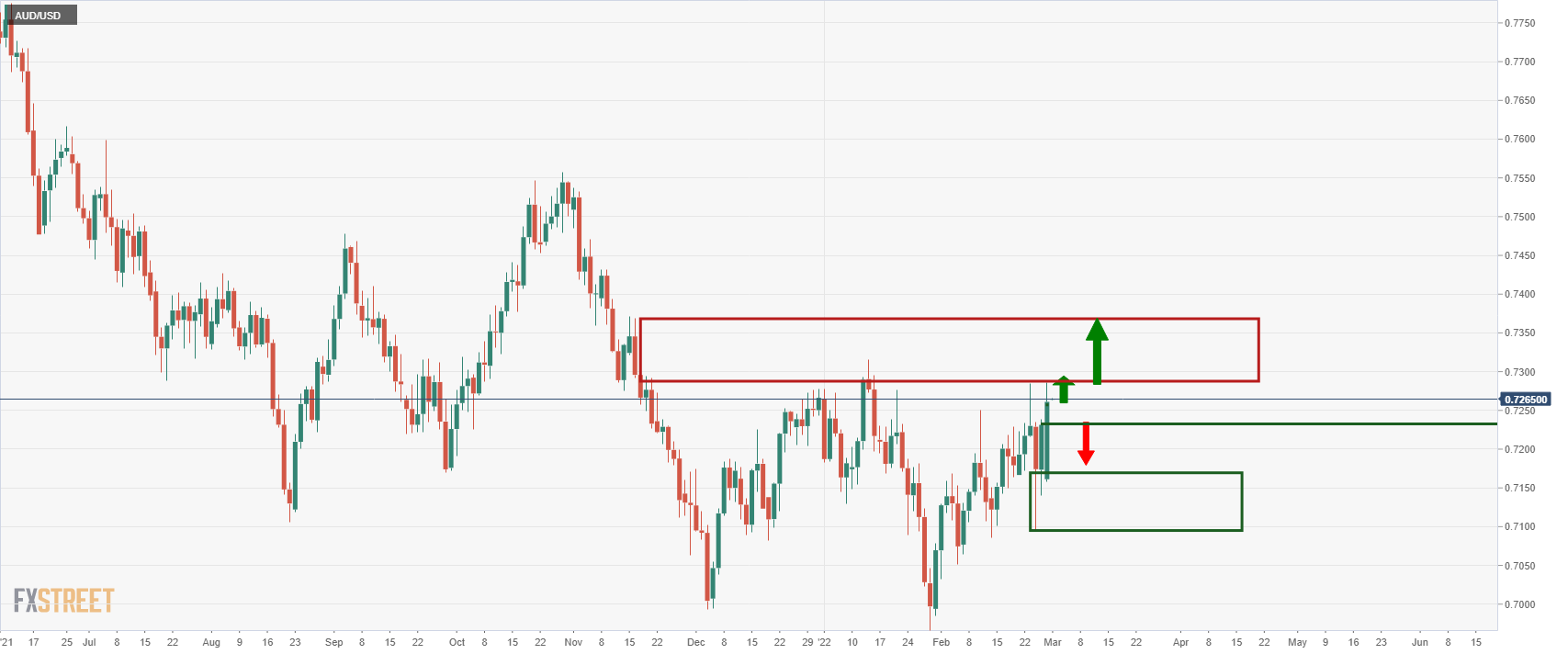

AUD/USD is up modestly on the day at 0.7270. If the aussie manages to surpass the 0.7340/0.7360 resistance zone, the pair could advance towards last October peak of 0.7560, economists at Société Générale report.

0.7340/0.7360 could cap upside

“Short-term hurdle is located at 0.7340/0.7360, a descending trend line drawn since February last year. If the pair establishes itself beyond this resistance, the phase of rebound could extend towards 0.7485 with possibility to retest last October's peak of 0.7560.”

“Graphical level of 0.6990 will remain important support near-term.”

Russia's Foreign Minister Sergey Lavrov said on Tuesday, Ukraine still has soviet nuclear technology,” adding that Moscow “cannot fail to respond to this danger.”

Meanwhile, the country’s Defence Minister Sergei Shoigu said that Russia “will continue operation in Ukraine until it achieves its goals, per Interfax.

Market reaction

Risk sentiment takes a hit on these above comments, with S&P 500 futures dropping 0.58% on the day.

AUD/USD has stalled its upside while the US dollar index is seeing some fresh signs of life.

GBP/USD seems to have settled comfortably above 1.3400 early Tuesday. As FXStreet’s Eren Sengezer notes, cable looks to extend recovery to 1.3500.

Additional recovery gains toward 1.3500 in case buyers claim 1.3440

“In case market participants are convinced of Russia's willingness to look for a diplomatic solution to the conflict, the pound could continue to gather strength against the relatively safer dollar. On the flip side, the greenback is likely to attract investors if there is a negative shift in risk sentiment.”

“An ascending triangle seems to have formed on the four-hour chart. The triangle resistance is located at 1.3440 and it could be assessed as a bullish sign if this level turns into support.”

“On the upside, 1.3500 (psychological level) could be seen as the next target ahead of 1.3540 (100-period SMA, 200-period SMA).”

“Supports are located at 1.3400 (psychological level, 20-period SMA, ascending trend line), 1.3340 (static support) and 1.3300 (psychological level).”

The UK manufacturing sector activity expanded more than expected in February, the final report from IHS Markit confirmed on Tuesday.

The seasonally adjusted IHS Markit/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) was revised sharply higher from 57.3 to 58.0 in February, beating expectations of 57.3.

Key points

Output and new orders expand at quicker rates.

New export orders decrease.

Input price inflation remains elevated.

Rob Dobson, Director at IHS Markit, commented on the survey

“February saw rates of expansion in the UK manufacturing production and new orders both accelerate. Growth was boosted by stronger domestic demand and by firms catching up on delayed work as material shortages and supply chain disruptions started to dissipate. Consumer goods output in particular also benefitted from increased sales due to a further easing of COVID restrictions.”

“However, the trend in new export orders is less positive, slipping back into contraction after January’s short-lived uptick. While companies maintain a positive outlook for the year ahead, rising headwinds, especially the intensifying geopolitical backdrop, are ratcheting up near-term risks to demand and confidence.”

GBP/USD reaction

At the press time, GBP/USD is holding the upside above 1.3400, currently trading at 1.3425. The spot is modestly flat on the day.

European Union (EU) “can't ban Russian gas completely,” European Commissioner for Competition, Margrethe Vestager, said in an interview with Der Spiegel on Tuesday.

The developing humanitarian crisis is deeply concerning. Amid the current environment, economists at UBS think the US dollar should stand out and see the greenback as an optional choice to help protect portfolios.

Position for US dollar strength

“The US dollar is considered a safe-haven currency that tends to rally during periods of heightened geopolitical uncertainty or risk-off sentiment in financial markets.”

“We think that market expectations of six or seven US interest rate hikes this year are likely to support the US dollar in the months ahead.”

“We see the greenback as an attractive tactical currency position at present.”

- DXY comes under pressure below the 97.00 yardstick.

- The appetite for riskier assets improves a tad on Tuesday.

- ISM Manufacturing, Final Manufacturing PMI next of note later.

The greenback, when tracked by the US Dollar Index (DXY), struggles for direction in the 96.70 zone following some mild improvement in the risk complex.

US Dollar Index keeps looking to geopolitics

The index remains vigilant on the events coming from the Russia-Ukraine military conflict, although the recent talks between officials from both parties appear to have opened the door to a negotiated solution in the near term.

In the meantime, US yields have reversed the recent downside and now attempt a tepid recovery across the curve, always underpinned by the shift in investors’ appetite for riskier assets.

Other than geopolitics, market participants will be closely following the results from the US manufacturing sector, where the ISM gauge will take centre stage seconded in relevance by the final print from Markit.

What to look for around USD

In the broader scenario, the war-led risk aversion continues to bolster the dollar and keeps the index well bid on the back of the deterioration of the geopolitical arena. The constructive view in the buck remains underpinned by the current elevated inflation narrative and the probability of a more aggressive start of the Fed’s normalization of its monetary conditions. In the longer run, recent hawkish messages from the BoE and the ECB carry the potential to undermine the expected move higher in the dollar in the next months.

Key events in the US this week: Final Markit Manufacturing PMI, ISM Manufacturing PMI (Tuesday) – MBA Mortgage Applications, ADP report, Powell’s testimony, Fed’s Beige Book (Wednesday) – Initial Claims, ISM Non-Manufacturing, Factory Orders, Powell’s testimony (Thursday) – Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict under the Biden administration.

US Dollar Index relevant levels

Now, the index is losing 0.01% at 96.73 and a break above 97.73 (2022 high Feb.24) would open the door to 97.80 (high Jun.30 2020) and finally 98.00 (round level). On the flip side, the next down barrier emerges at 96.03 (55-day SMA) followed by 95.67 (weekly low Feb.16) and then 95.17 (weekly low Feb.10).

The Reserve Bank of Australia (RBA) became the first G10 central bank to meet since conflict in Ukraine started. In the view of economists at MUFG Bank, the policy statement will keep alive expectations that the RBA is moving closer to raising rates that have been supporting the Australian dollar recently.

RBA places more focus on inflation impact from Ukraine conflict

“The RBA noted that recent geopolitical tensions were a major new source of uncertainty. The main policy focus though was on the risk they pose for faster inflation rather than any material impact on growth. They now expect a higher CPI spike due to higher petrol prices resulting from global developments.”

“While inflation has picked up, the RBA still believes it is too early to conclude it will be sustained within their target range. It is prepared to be patient before raising rates. There was no clear indication that the RBA has moved closer to raising rates.”

“The Australian rate market is more confident though that inflationary conditions will encourage the RBA to begin raising rates by the summer.”

“The aussie should continue to outperform in the near-term unless there is deeper correction in risk assets.”

The Reserve Bank of Australia (RBA) left its policy rate unchanged at 0.1% as expected and the bank reiterated that the policy rate will not be increased until actual inflation is sustainably within the 2%-3% target range. Subsequently, economists at ING expect the AUD/USD pair to be capped at the 0.7300 level.

RBA freezes the policy discussion until May

“The RBA defied any expectations that it is moving towards a more hawkish stance. The focus has remained on wage growth which ‘remains modest’, adding that ‘it is likely to be some time yet before growth in labour costs is at a rate consistent with inflation being sustainably at target’. This virtually freezes the policy discussion until mid-May, which may put a cap on AUD gains compared to peers that can count on ongoing central bank tightening cycles.”

“Australia’s growth figures for 4Q tomorrow are expected to show a 3.5% quarter-on-quarter bounce, but should have a limited impact on AUD given the RBA’s focus on wage dynamics.”

“AUD/USD may climb to the 0.7300 mark today on the back of relatively upbeat risk environment, but even though it is less exposed to the Ukrainian conflict than European currencies, its high beta to global sentiment continues to pose downside risks in the short-term.”

The most important event right now is clearly Russia’s attack on Ukraine. In the opinion of economists at Danske Bank, the impact will not derail the global expansion but with the Federal Reserve hiking rates at every meeting in 2022, the EUR/USD pair is forecast at 1.08 on a 12-month view.

Ukraine crisis a new risk to global growth

“The Russian attack on Ukraine creates new downside risk to growth and further upside risks to inflation. However, our baseline scenario is that it will not derail the global expansion and we still look for the Fed to hike rates at every meeting this year and ECB to hike in December.”

“We continue to look for bond yields to move higher over the coming quarters on the back of high inflation and Fed tightening not only via higher rates but also ‘active quantitative tightening’ by selling bonds starting in May. Geopolitics currently mitigate the upward pressure on global yields.”

“EUR/USD has moved lower still to 1.12 and we expect the tightening cycle and economic slowdown to drive a further decline on a 12-month horizon to 1.08.”

In opinion of FX Strategists at UOB Group, USD/JPY is still seen navigating the 114.80-115.90 range in the next weeks.

Key Quotes

24-hour view: “We highlighted yesterday that ‘the outlook is mixed’ and we expected USD to ‘trade between 115.00 and 115.90’. USD subsequently dropped to 114.85 before rebounding (high has been 115.77). The outlook remains mixed and USD is likely to trade between 114.85 and 115.65 for today.”

Next 1-3 weeks: “We continue to hold the same view as from last Friday (25 Feb, spot at 115.45). As highlighted, the outlook appears to be neutral and USD is expected to trade within a range of 114.80/115.90 for now.”

GBP/USD stays relatively quiet above 1.3400. However, downside risks persist as the focus will be on whether sanctions/retaliation will start impacting the commodity flows from Russia, economists at ING report.

Sterling still vulnerable

“The pound is set to remain highly sensitive to any news regarding a possible curb in gas flows from Russia and more spikes in gas prices, although a somewhat reduced volatility is allowing some tentative stabilisation around the 1.3400 mark in GBP/USD since yesterday. Still, we continue to see a clear prevalence of downside risks for the pair.”

“As eurozone CPI numbers could provide some support to the euro today and tomorrow, EUR/GBP could inch higher towards the 0.8400 level it briefly touched last week.”

After the loonie initially fell noticeably against the USD last week, a recovery set in, which continued on Monday despite a roller coaster ride. In view of the excessively high inflation rates, the Bank of Canada (BoC) is set to embark on a path of hiking rates, providing support to the loonie, economists at Commerzbank report.

CAD to benefit from significantly higher commodity prices

“One support for the CAD recovery is likely to be the expectation that Canada, as a commodity country, will benefit from significantly higher commodity prices. In this context, Putin's war in Ukraine and the high uncertainty fuel the expectation that the supply shortage, will continue or even worsen – with the consequence of further rising (commodity) prices.”

“Expectations of interest rate hikes are likely to provide further support for the loonie. Inflation rates, which have already shot well above the Bank of Canada's (BoC) target range, could accelerate further instead of drifting back toward the 2% target value as expected by the BoC from the second half of the year.”

Today’s CPI figures out of Germany are set to have some market impact despite investor focus being firmly on Ukraine. Economists at ING expect the EUR/USD pair to stay above 1.12 amid high inflation data from Germany.

German inflation in focus

“We expect to see a rise in February’s German headline inflation to 5.1%, in line with expectations, which may offer some support to the euro as markets may at least cement their pricing for a September ECB hike after having re-priced the timing for policy tightening in the past weeks.”

“We expect evidence of accelerating inflation to help EUR/USD hold on to the 1.1200 level for now, although sanctions/retaliation and rising commodity prices still suggest a downward-tilted balance of risk for the pair.”

Fundamentally driven forecasting of Russian assets or exchange rate no longer makes sense, for now at least, according to economists at Commerzbank.

Intractable ruble

“In a narrow sense, the ruble exchange rate might reflect valuation appropriate for clearing the energy and commodity trade which Russia will continue to do. Even this will be full of caveats as western countries are rapidly announcing programmes to substitute away from Russian energy.”

“In the end, the exchange rate would be valued to reflect an economy which is retreating to a shell of its former condition. Optimists will look for some resolution on the geopolitical side after which the harshest sanctions might be reversed. Equally, pessimists will worry about the various possible military and other accidents – if any of those scenarios come to pass, that would keep Russia, like Iran, out of the mainstream world economy for the years to come.”

The FX market expected little from the Reserve Bank of Australia (RBA) Policy Statement. And that appears to have been the correct stance here. Regarding the AUD/USD pair, the commodity story remains super supportive for the aussie, but the 200-day moving average (DMA) at 0.7330 is set to cap gains.

RBA to be patient as inflation to spike higher on Ukraine

“The RBA did warn that ‘the war in Ukraine is a major new source of uncertainty’ and that ‘the prices of many commodities have increased further due to the war in Ukraine’. However, it also sounded more upbeat on the outlook for the ‘unemployment rate to fall to below 4% later in the year and to remain below 4% next year’ and that ‘the decline in infection rates and high numbers of job vacancies point to a strong bounce-back [in hours worked] over the months ahead’.”

“We tend to see the aussie as being well supported by super strong commodity prices, though likely capped by the 200-DMA up at 0.7330.”

“We still see weakness developing in the AUD into the March Fed lift-off which is now less than 3 weeks away. Bigger picture, we would look to use that weakness as an opportunity to buy for strength later in the year.”

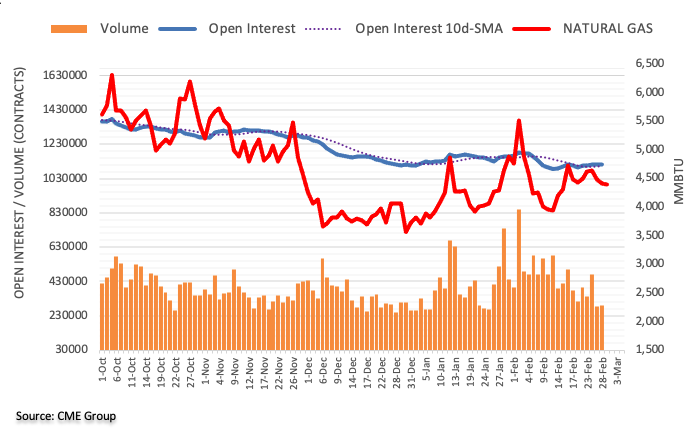

Open interest in natural gas futures markets increased for the third session in a row on Monday according to advanced prints from CME Group. Volume followed suit and rose by around 5.5K contracts.

Natural Gas could revisit the 200-day SMA

Prices of natural gas extended the downside at the beginning of the week amidst increasing open interest and volume, refocusing the attention to the 200-day SMA around $4.30 per MMBtu as the next target of note in case the downtrend accelerates.

NZD/USD could see its upside bias gathering traction in the next weeks, commented FX Strategists at UOB Group.

Key Quotes

24-hour view: “We highlighted yesterday that ‘while the risk for today is on the downside, any weakness is not expected to challenge last week’s near 0.6630’. Our view for a lower NZD was wrong as it soared and closed on a firm note at 0.6776 (+0.47%). The rapid rise has room to extend but in view of the overbought conditions, the major resistance at 0.6810 is unlikely to come under challenge (there is another resistance at 0.6780). Support is at 0.6745 followed by 0.6725.”

Next 1-3 weeks: “Last Friday (25 Feb, spot at 0.6695), we highlighted that a top is in place and we expected NZD to trade between 0.6630 and 0.6760. Yesterday (28 Feb), NZD gapped down upon opening but subsequently covered the gap as it surged to high of 0.6777 during NY session. Upward momentum is beginning to build and NZD is likely to head higher. That said, 0.6810 is a solid resistance level and may not be easy to break. On the downside, a breach of 0.6690 (‘strong support’ level) would indicate that NZD is not ready to head higher just yet.”

Here is what you need to know on Tuesday, March 1:

The positive shift witnessed in risk sentiment in the second half of the day on Monday remained short-lived with Russia ramping up its military presence in Ukraine. Investors remain cautious early Tuesday and the greenback holds its ground against its major rivals. Later in the day, inflation data from Germany and the ISM's February Manufacturing PMI from the US will be looked upon for fresh impetus. European Central Bank (ECB) president Christine Lagarde is also scheduled to deliver a speech at 1300 GMT. Additionally, the US Federal Reserve is expected to publish the opening remarks of FOMC Chairman Jerome Powell's testimony on Wednesday.

Following a long meeting on Monday, delegations from Russia and Ukraine have agreed to meet again for the second round of "peace talks," reviving hopes for a diplomatic solution to the crisis. Nevertheless, NBC News reported that US intelligence agencies have determined that Russian President Putin could "double down on violence" as he was frustrated with his military struggles in Ukraine. Other headlines on the war showed that a huge military convoy was moving toward Kyiv and Russia was planning to choke off supply routes to the capital city.

US stocks futures indexes trade flat in the early European session on Tuesday and the benchmark 10-year US Treasury bond yield is up more than 1% at 1.86%. The US Dollar Index is posting small daily gains but stays below 97.00.

Earlier in the day, the data from China revealed that the business activity in the manufacturing sector expanded in February after contracting in January with the Caixin Manufacturing PMI improving to 50.4 from 49.1. In the meantime, the Reserve Bank of Australia (RBA) left its policy rate unchanged at 0.1% as expected and the bank reiterated that the policy rate will not be increased until actual inflation is sustainably within the 2%-3% target range. AUD/USD is up modestly on the day at 0.7270.

EUR/USD staged a decisive rebound in the American trading hours on Monday and ended up closing the day in the positive territory at 1.1220. The pair is trading in a relatively tight range near 1.1200 early Tuesday.

GBP/USD stays relatively quiet above 1.3400 heading into the European session on Tuesday. The Bank of England will publish the Net Lending to Individuals data for January later in the day, which is likely to be ignored by market participants.

USD/JPY turned south late Monday and closed the first day of the week in the red. The pair is moving sideways around 115.00.

Gold came under heavy bearish pressure in the second half of the day on Monday as risk flows took control of markets. XAU/USD is consolidating Monday's losses, staying afloat above $1,900.

Bitcoin surged higher and gained more than 14% on Monday before steadying above $43,000 early Tuesday. Ethereum rose 11% on Monday and came within a touching distance of the critical $3,000 mark.

Gold defends critical support line as Russia-Ukraine war flags growth risks. What next? FXStreet’s Dhwani Mehta highlights the key levels to watch out.

Gold bulls have managed to defend the rising trendline

“Markets have started to grow more concerned about the damaging impact of the Russia-Ukraine war on the global economy, which is still reeling from the post-pandemic effects. Investors’ wariness could help keep a floor under gold price.”

“XAU/USD has been forming higher lows, invariably defending the month-long rising trendline support at $1,895. If the bearish pressures intensify and sellers yield a daily closing below the latter, then a fresh downswing will come into force, opening floors towards Thursday’s low of $1,878.”

“Gold bulls could stage a rebound from the $1,895 critical support, putting the $1,920 supply zone back on the sellers’ radars. Further up, buyers could flex their muscles towards the $1,950 psychological level.”

- AUD/USD extends the previous day’s rebound from 21-DMA, renews intraday top of late.

- 15-week-long resistance line guards immediate upside, 100-DMA tests pullback moves.

- Oscillators do favor the bulls but January’s peak, 200-DMA will be tough nuts to crack for them.

AUD/USD takes the bids to refresh intraday peak surrounding 0.7270, up 0.15% intraday heading into Tuesday’s European session.

In doing so, the Aussie pair stretches the previous day’s recovery moves from the 21-DMA to battle a downward sloping resistance line from November 15, 2021, around 0.7275-80.

That said, the upbeat MACD and RSI conditions join a clear run-up beyond the 100-DMA to favor AUD/USD buyers to aim for the 0.7300 threshold.

However, tops marked in January 2022 and the 200-DMA, respectively around 0.7315 and 0.7330, will challenge the pair’s further advances.

Meanwhile, pullback moves remain elusive until staying beyond the 100-DMA level surrounding 0.7235.

During the quote’s weakness past-0.7235, the 0.7200 round figure and 21-DMA level of 0.7173 should gain the market’s attention as a break of which will recall the AUD/USD bears.

AUD/USD: Daily chart

Trend: Further upside expected

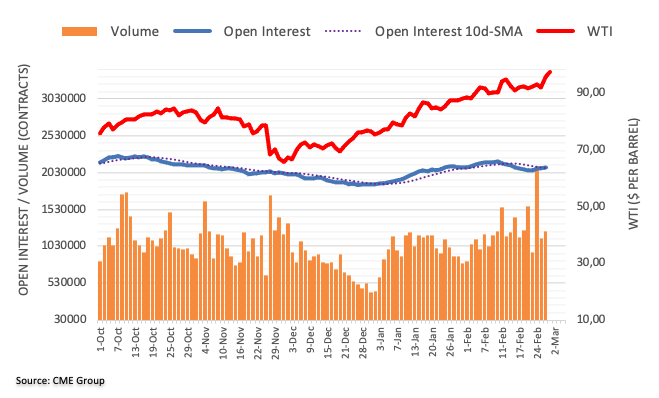

Considering preliminary readings from CME Group for crude oil futures markets, traders added nearly 2K contracts to their open interest positions on Monday, reaching the fourth consecutive daily build. In the same line, volume went up by around 103.3K contracts, partially reversing the previous daily drop.

WTI sets sails to $100.00 and above

Monday’s moderate advance in prices of the barrel of WTI was accompanied by rising open interest and volume, which opens the door to the continuation of the uptrend in the very near term. That said, the next target of note initially comes at the triple-digit barrier seconded by the YTD high at $100.50 (February 24).

Further downside in GBP/USD is likely, although there is a tough support around 1.3250, noted FX Strategists at UOB Group.

Key Quotes

24-hour view: “Our view from yesterday where ‘the risk has shifted to the downside’ was incorrect as GBP rebounded and recovered most of its initial steep drop and closed largely unchanged at 1.3421 (+0.07%). The rebound has scope to extend but a clear break of 1.3460 appears unlikely. The major resistance at 1.3505 is not expected to come into the picture. On the downside, a breach of 1.3360 (minor support is at 1.3390) would indicate that the current mild upward pressure has eased.”

Next 1-3 weeks: “After GBP plunged to a low of 1.3273, we highlighted last Friday (25 Feb, spot 1.3380) that further GBP weakness is not ruled out. However, we noted that there is a major support at 1.3250. For now, we continue to see chance for GBP to head lower and only a breach of 1.3505 (no change in ‘strong resistance’ level) would indicate that the current weakness has stabilized.”

- USD/JPY snaps two-day downtrend with mid gains, retreating of late.

- Russia-Ukraine peace talks turned inconclusive on Monday, Moscow stretches invasion of Kyiv.

- Yields underpin USD rebound ahead of US ISM PMI, Biden’s SOTU.

Despite starting March on a positive footing, USD/JPY pares intraday gains around 115.10 ahead of Tuesday’s European session.

The yen pair portrays the market’s anxiety amid mixed concerns over the geopolitical tussles between Russia and Ukraine. Also challenging the risk barometer pair is the cautious mood ahead of US ISM Manufacturing PMI for February and US President Joe Biden’s State Of The Union (SOTU) speech, where he is expected to speak on inflation per the latest White House update.

Recent headlines concerning the Russia-Ukraine crisis hints at another tranche of Western economic sanctions on Moscow while Russian diplomats harshly criticize the punitive measures levied due to their, “special operation.” Further, Russian militaries attack civilian buildings and trigger an exodus of people from Ukraine.

It’s worth noting that the peace talks between Ukraine and Russia failed to provide any conclusion the previous day but haven’t been turned down, which in turn keeps markets hopeful of an intermediate solution to the grim issue.

Other than the downbeat sentiment, firmer US Treasury yields and inflation expectations also favor the US Dollar Index (DXY) of late. That said, the DXY rises 0.15% to 96.85 while the 10-year Treasury yields rose two basis points (bps) to 1.86% by the press time. On Monday, US inflation expectations rallied to a 14-week top, per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data.

It’s worth observing that the Euro Stoxx 50 Futures rises 0.70% intraday while the S&P 500 Futures print mild losses at the latest, which in turn flash another signal of the market’s indecision and the same clutches recent USD/JPY moves.

That said, USD/JPY traders will keep their eyes on the risk catalysts for fresh impulse as the Russia-Ukraine crisis is a hot topic. Should the geopolitical tensions worsen, the yen pair may witness further downside due to the yen’s traditional safe-haven appeal.

Technical analysis

Sustained U-turn from five-week-old previous support, near 116.00 at the latest, directs USD/JPY prices towards the 100-DMA support of 114.40.

- USD/RUB has surpassed the psychological level of 100.00 swiftly on meltdown in the Russian economy.

- The firmer negative undertone in Russia will keep the mighty greenback stronger.