- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 27-05-2020.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:00 | New Zealand | ANZ Business Confidence | May | -66.6 | |

| 01:30 | Australia | Private Capital Expenditure | Quarter I | -2.8% | -2.6% |

| 09:00 | Eurozone | Consumer Confidence | May | -22.0 | -18.8 |

| 09:00 | Eurozone | Industrial confidence | May | -30.4 | -27 |

| 09:00 | Eurozone | Business climate indicator | May | -1.81 | |

| 09:00 | Eurozone | Economic sentiment index | May | 67 | 70.3 |

| 12:00 | Germany | CPI, m/m | May | 0.4% | -0.1% |

| 12:00 | Germany | CPI, y/y | May | 0.9% | 0.6% |

| 12:30 | U.S. | Continuing Jobless Claims | May | 25073 | 25750 |

| 12:30 | Canada | Current Account, bln | Quarter I | -8.76 | -10 |

| 12:30 | U.S. | Initial Jobless Claims | May | 2438 | 2100 |

| 12:30 | U.S. | Durable Goods Orders ex Transportation | April | -0.2% | -14% |

| 12:30 | U.S. | Durable Goods Orders | April | -14.4% | -19% |

| 12:30 | U.S. | Durable goods orders ex defense | April | -15.8% | |

| 12:30 | U.S. | PCE price index, q/q | Quarter I | 1.4% | 1.3% |

| 12:30 | U.S. | PCE price index ex food, energy, q/q | Quarter I | 1.3% | 1.8% |

| 12:30 | U.S. | GDP, q/q | Quarter I | 2.1% | -4.8% |

| 14:00 | U.S. | Pending Home Sales (MoM) | April | -20.8% | |

| 15:00 | U.S. | Crude Oil Inventories | May | -4.983 | -2.5 |

| 15:00 | U.S. | FOMC Member Williams Speaks | |||

| 23:01 | United Kingdom | Gfk Consumer Confidence | May | -33 | |

| 23:30 | Japan | Tokyo CPI ex Fresh Food, y/y | May | -0.1% | -0.2% |

| 23:30 | Japan | Unemployment Rate | April | 2.5% | 2.7% |

| 23:30 | Japan | Tokyo Consumer Price Index, y/y | May | 0.2% | |

| 23:50 | Japan | Retail sales, y/y | April | -4.6% | -11.5% |

| 23:50 | Japan | Industrial Production (MoM) | April | -3.7% | -5.1% |

| 23:50 | Japan | Industrial Production (YoY) | April | -5.2% |

FXStreet reports that according to economists at UBS, the world will emerge from COVID with considerably higher levels of debt while will be left structurally less global by the crisis, spurring on the de-globalization trend.

“We expect government debt as a percentage of GDP to be about 15-25 percentage points higher at the end of 2021 than it was at the end of 2019.”

“Interest rates have little room to go lower, which limits the potential for high-quality bonds to provide significant positive returns in the event of an equity market downturn.”

“Central banks may be prepared to tolerate a rate of inflation somewhat above the 2% target rate for a year or two. Inflation between 2% and 5%, if not for too long, would likely not add to inflation uncertainty risk, and could help modestly reduce debt burdens.”

“Governments are likely to view more goods as being strategically important, and so encourage more domestic production. Meanwhile, companies have become more aware of the operational risks posed by long global supply chains. Bringing production closer to the end market is likely to become a more common response.”

FXStreet reports that economists at UBS forecast a U-shaped recovery and expect Chinese equities to outperform developed markets.

“In our central scenario, we see the second quarter marking the lowest point in economic activity, and we expect a subdued U-shaped economic recovery from the third quarter onwards, as a second wave could lead to recurring restrictions. Renewed outbreaks mean that intermittent suppression measures, including partial lockdowns, are likely, and we project economic activity to only normalize sustainably in December.”

“US-China tensions may heat up as the US election nears, but we believe the economic recovery remains far more important for investment sentiment.”

“Further upside for equity markets as a whole would likely require additional fiscal or monetary stimulus, greater clarity about exit strategies, or a medical breakthrough.”

“We expect Chinese equities to lead the recovery, outperforming developed market ex-US stocks, as China is likely already in the advanced stages of the virus outbreak cycle.”

FXStreet reports that according to Nordea, the EUR750 billion recovery fund proposal presented by the Commission would illustrate a strong commitment to keep the Euro-area and the EU together and support EUR assets.

“The European Commission proposed today a EUR750 billion package to support the recovery from the corona crisis, of which EUR500 billion would take the form of grants and EUR250 billion in loans.”

“Today’s proposal, if implemented, should decrease the risks regarding the future of the Euro-area. It is clearly beneficial for Italian bonds, but is negative for German bonds both via a higher credit risk component and via an improved economic outlook.”

“Given the number of open questions and the difficult negotiations ahead, there will most likely be market volatility ahead, as the market reassesses the prospects of a compromise.”

“Assuming an eventual compromise is found, without watering down today’s elements too much, it should support the euro and EUR assets in general in the medium-term.”

- U.S. does not need to accept that second wave is inevitable or reopening will result in outbreaks

- Reopening should be done "gradually" without "leapfrogging" over health recommendations

- There is "good chance" that vaccine would be able to deployable by end of the year

- Political parties should "reserve judgement" when having conventions

- Certain areas of the country are seeing nice decrease in cases

- We're seeing some signs of pickup

- We're seeing signs of increased travel and spending

- Tourism will take longer

- We will be watching data on restarting very closely

- We need fiscal policy that can provide income to individuals

- The virus is driving this, that's what we will be following

- I expect inflation to remain low over the next year or so

FXStreet reports that strategists at Credit Suisse apprise that EUR/USD strength has extended to retest important resistance from its early May high and 200-day average at 1.1009/19, which is being tested and would mark a base.

“Only a close above 1.1019 would see this achieved to mark a more significant base and important turn higher, with resistance next at 1.1065, then 1.1145/66 – the late March high and 61.8% retracement of the March collapse – which we would expect to cap at first.”

“The 13-day average and price support at 1.0915/10 needs to hold to keep the immediate risk higher in the range. A break can see a fall back to 1.0870/64, but this needing to be removed for a fresh test of the uptrend, today at 1.0815.”

Statistics

Canada announced on Wednesday that the value of building permits issued by the

Canadian municipalities tumbled 17.1 percent m-o-m in April, following a

revised 13.4 percent m-o-m decline in March (originally a plunge of 13.2

percent m-o-m). The April decrease was the largest since October 2008.

According to

the report, the value of residential permits plummeted 14.2 percent m-o-m in

April, as single-family permits fell by a record 35.9 percent m-o-m, while

permits for multi-family dwellings rose by 4.8 percent m-o-m.

At the same

time, the value of non-residential building permits dropped 21.9 percent m-o-m

in April, due to declines in industrial (-34.7 percent m-o-m), commercial (-21.57

percent m-o-m) and institutional (-10.5 percent m-o-m) permits.

In y-o-y terms,

building permits tumbled 37.0 percent in April.

FXStreet reports that the Credit Suisse analyst team apprise that USD/CAD broke below 1.3856/3793 to suggest a more important move lower, with the support seen initially at 1.3734 being currently tested.

“We turn our near-term bias to the downside and see support initially at 1.3734. Removal of here would see a move back to 2019 high at 1.3665, just ahead of the 61.8% retracement of the 2020 surge at 1.3609/08, where we would expect an initial attempt to floor the market.”

“Resistance moves initially to 1.3805, then 1.3965, ahead of 1.4048, which needs to cap to keep the downside bias intact. Removal of here though would see a move back to the downtrend from late March at 1.4114/19.”

- Dealing with effects of COVID-19 pandemic is "Europe's moment"

- Boldest measures are safest for future of EU

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 07:30 | Eurozone | ECB President Lagarde Speaks | ||||

| 08:00 | Switzerland | Credit Suisse ZEW Survey (Expectations) | May | 12.7 | 31.3 |

EUR rose against most other major currencies in the European session on Wednesday supported by reports that European Commission (EC) proposed a EUR1.1 trillion budget for 2021-27 that would come together with EUR750 billion recovery fund (incl. EUR500 billion in grants and EUR250 billion in loans) to help the member states' economies recover from the coronavirus pandemic. The budget could include revenues from ETS trading scheme, carbon levy on imports and corporate tax and may include funding from a digital tax.

The size of the EC's proposal is bigger than the proposal, which was made by France and Germany last week for a EUR500-billion recovery fund.

At the moment, the EC's president Von Der Leyen is unveiling recovery proposal in EU Parliament.

- We do not expect a rapid recovery

- Making forecasts at this moment is very difficult

- It is crucial lockdown restrictions are reduced whenever possible

- We have a slightly deflationary environment

- Must ensure that monetary conditions remain accommodative

- SNB willing to intervene in currency markets more strongly

The Mortgage

Bankers Association (MBA) reported on Wednesday the mortgage application volume

in the U.S. increased 0.3 percent in the week ended May 22, following a 2.6 percent

drop in the previous week.

According to

the report, applications to purchase a home surged 8.6 percent, while refinance

applications decreased 0.2 percent.

Meanwhile, the

average fixed 30-year mortgage rate edged up to 3.42 percent from 3.41 percent.

“The home

purchase market continued its path to recovery as various states reopen,

leading to more buyers resuming their home search,” noted Joel Kan, an MBA

economist. “Additionally, the purchase loan amount has increased steadily in

recent weeks and is now at its highest level since mid-March.”

FXStreet reports that analysts at Credit Suisse note that AUD/USD has pushed higher to test of 0.6659/6706, a pivotal resistance area comprising of the 200-day average, the March high, and 78.6% retracement, which is ideally capping.

“We look for the 0.6659/6706 area to cap and see weakness taking over again in due course. With this in mind, we see support initially at 0.6610, then 0.6538, ahead of the late May lows and 21-day exponential average at 0.6507/06, where we would expect to see fresh buying at first.”

“A closing break above 0.6706 would mark a break of a major barrier and turn the medium-term risks to the upside, with resistance thereafter at 0.6745/50, ahead of the February high at 0.6774. This though is not our base case.”

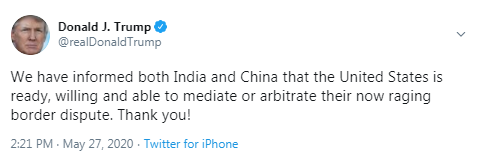

- There is a "whole menu" of potential options for Trump on China action

- Should not prejudge the next move from Trump or China

FXStreet reports that according to analysts at Deutsche Bank, the momentous scale of monetary and fiscal countermeasures to support the global economic recovery are likely to extend the duration of the gold bull market.

“The date of policy tightening is pushed out indefinitely, and policymakers will be careful to avoid triggering a second taper tantrum.”

“The growing consensus that the pandemic will be largely deflationary with weaker consumption outweighing lower productivity, suggests policymakers will not have to choose between supporting growth and controlling inflation. If policymakers indeed face no such difficult choices, then the prominence of central bank support for asset markets reduces the probability of a repeated 'March-madness' sell-off, in the event of subsequent waves of infection depressing growth.”

“With prolonged downward pressure on growth, asset purchase programs are more likely to be extended to provide a counterweight to lost income, higher propensity to save, and a weak investment climate into 2021. We believe this also extends gold upside potential.”

- Spain to be granted EUR77.3 billion in grants

- France to be granted EUR39 billion in grants

Meanwhile, Reuters reports, citing sources familiar with the matter, that Italy will also receive EUR91 billion in loans under the proposal and Spain will get EUR63 billion in loans.

Overall, the European Commission is to propose the EU budget worth EUR1.1 trillion for 2021-27 that will come together with the coronavirus recovery fund that will mobilize EUR500 billion in grants and EUR250 billion in loans to help the member states' economies recover from the coronavirus pandemic.

FXStreet reports that global equities have recovered swiftly from the COVID-19 pandemic with the S&P 500 climbing above 3000 points for the time since late February. The rally has left major equity indexes fully valued on some measures, according to UBS.

“The S&P 500 currently trades at 24.2x our estimate of 2020 earnings and 18.9x 2021 earnings, compared to the 20-year average trailing price-to-earnings ratio (P/E) of 17.9x, and the 20-year average forward P/E of 16x.”

“For markets to catch a broad ‘second wind’ investors will need greater confidence that a second wave of virus infections will not lead to renewed lockdowns. In particular, in this scenario we would see ample room for further gains in economically sensitive parts of the market which are lowly valued and have underperformed through the crisis so far.”

FXStreet reports that analysts at Credit Suisse see a 1.05-1.07 range in EUR/CHF as the most likely outcome for the time being pending further details on the EU Recovery Fund.

“Our confidence in achieving our envisaged target of 1.0250 in EUR/CHF is much diminished. We now see a 1.05-1.07 range as the most likely outcome for the time being pending further details on the EU Recovery Fund.”

“Should the EU fail to agree to some kind of debt mutualisation or water down the initial French-German proposal significantly, the market will most likely view such a development as euro negative which would bring downside risks in EUR/CHF back into play.”

“Should an EU agreement surprise on the positive side we would expect such a development to manifest itself in higher interest rates in the Eurozone, as a reflection of higher growth and inflation prospects. Such a scenario could then lead to an upside breakout in EUR/CHF as a consequence.”

CNBC reports that the vice president of the European Central Bank (ECB) has backed the unprecedented stimulus packages launched in the region, saying there were no alternatives for lawmakers.

Governments from euro area countries have passed major stimulus efforts in a bid to soften the impact of the coronavirus crisis and keep people in work. Fiscal deficits are expected to widen, debt piles will climb and the financial repercussions could be felt for generations.

However, Luis de Guindos, the vice president of the euro zone’s central bank, said the issue of lofty debt levels needs to be put into perceptive.

“At the end of the pandemic for sure that we will have higher public debt ratio. But the alternative of doing nothing is much worse,” he told CNBC’s Annette Weisbach when asked specifically about Italy.

“It would be much worse in terms of the crisis. And it would be much worse in terms of the recovery phase,” he added.

The ECB vice chief said that concerns over public finances in the medium term will have to be addressed. But for now, he called for “powerful and strong” fiscal responses at both the national and pan-European level.

FXStreet reports that the US dollar appreciated substantially through the crisis as investors sought the liquidity and safe-haven appeal of the US dollar. Nonetheless, analysts at UBS expect the greenback to depreciate and the best to express this view is the cable.

“In our upside scenario, in which safe-haven assets and liquidity are less in demand, we expect the US dollar to depreciate.”

“Our preferred G10 currency to buy relative to the US dollar is the British pound. The currency remains deeply undervalued considering our estimate of purchasing power parity at 1.53. We target GBP/USD at 1.38 by year-end for our upside scenario, and 1.33 in our central scenario.”

Bloomberg reports that Jamie Dimon sees “pretty good odds” of a fast economic rebound starting in the third quarter thanks to the U.S. government’s stimulus programs and the strength of the consumer going into the pandemic.

“You could see a fairly rapid recovery,” the JPMorgan Chase & Co. chief executive officer said Tuesday at a virtual conference hosted by Deutsche Bank AG. “The government has been pretty responsive, large companies have the wherewithal, hopefully we’re keeping the small ones alive.”

Dimon, who runs the largest U.S. bank, pointed to economists’ forecasts that show unemployment spiking to around 18% this quarter, then falling to 14% in the third quarter and declining to about 10% or 11% by the end of the year.

In response to the crisis, the Federal Reserve has effectively cut interest rates to zero, pumped trillions of dollars into the economy and announced plans for nine emergency lending programs, including support for small businesses. The jobless rate more than tripled in April to 14.7% as employers cut an unprecedented 20.5 million jobs.

Dimon said he thinks the Fed did the right thing in acting quickly and with what he referred to as “increasingly strong actions.”

“This wasn’t the bazooka,” he said. “The Fed took out the whole military and applied it. Just announcing these programs reduced spreads in the market. It’s going to save a lot of small businesses” and it’s “helping people avoid stress.”

Many states have begun the process of easing restrictions on businesses put in place to slow the spread of Covid-19, and “you’re already seeing the positive effects of the opening-up taking place, at least for the economy,” Dimon said.

FXStreet reports that FX Strategists at UOB Group expect USD/CNH to edge higher in the near term.

24-hour view: “USD traded between 7.1355 and 7.1491 yesterday, narrower than our expected sideway-trading range of 7.1280/7.1500. The firm price action upon opening this morning has resulted in an up-tick in momentum. While the bias is tilted to the upside, any advance is expected to face strong resistance at last week’s 7.1645 top. That said, a clear break of the solid resistance could potentially lead to a rush higher. Support is at 7.1430 followed by 7.1350.”

Next 1-3 weeks: “While USD closed little changed yesterday (7.1491, +0.02%), upward momentum is showing sign of picking up. In other words, the ‘mildly positive’ outlook that we indicated last Friday (22 May, spot at 7.1290) has improved further and from here, the risk of a break of the key resistance at 7.1652 has increased. A breach of this level would signify a break-out and could potentially lead a sharp and rapid rise as the next resistance level of note is not until 7.2000. To look at it another way, the odds for a strong advance in USD has increased and only a break of 7.1100 (no change in ‘strong support’ level for now) would indicate that a break-out is unlikely.”

CNBC reports that the International Energy Agency believes the coronavirus pandemic has paved the way for the largest decline of global energy investment in history, with spending set to plummet in every major sector this year.

In the group’s annual World Energy Investment report, published on Wednesday, the IEA said that the unparalleled decline in worldwide energy investment had been “staggering in both its scale and swiftness.”

It warned the economic impact of the public health crisis could have “serious” implications for energy security and clean energy transitions.

“The historic plunge in global energy investment is deeply troubling for many reasons,” Fatih Birol, executive director at the IEA, said in a statement.

“It means lost jobs and economic opportunities today, as well as lost energy supply that we might well need tomorrow once the economy recovers,” he continued. “The slowdown in spending on key clean energy technologies also risks undermining the much-needed transition to more resilient and sustainable energy systems.”

At the start of 2020, the IEA said global energy investment was on pace for growth of around 2%, reflecting the largest annual rise in spending in six years.

But, after the Covid-19 crisis brought large swathes of the world economy to a halt in a matter of months, the IEA said it now expects global investment to tumble by 20% compared to last year.

To be sure, that’s a fall of nearly $400 billion year-on-year.

It is very hard to forecast how badly the economy has been affected

Economic contraction now seen somewhere between 'medium' and 'severe' scenario

ECB had to resort to exceptional measures to make sure there is plenty of liquidity

ECB primary objective is to ensure price stability

FXStreet reports that in its latest client report, Morgan Stanley raised its year-end Brent oil-price forecast, in anticipation of faster rebalancing in the oil market.

“We expect demand to rebound to about 97 million barrels per day (bpd) by Q4 as economies come out of lockdown - a significant improvement although still down about 4 million bpd year-on-year.”

“Now that the rebalancing has been set in motion, we expect it to continue. Our base case forecasts call for a further tightening of the oil market over the next few quarters.”

“The recent rebalancing was mostly supply rather than demand-driven with the rise in crude prices compressing refining margins even further and inventories of oil products rising fast relative to crude oil stocks.”

eFXdata reports that TD Research maintains a structural bullish USD bias through Q3.

"Our forecasts have called for a weaker USD into Q4, with EUR finally marking a break to the topside. That reflects the risks around the US elections, prospects that the world could start to see green shoots for global growth on the horizon, and the fact that the USD might begin to care about US-style MMT. Any progress on this broad European proposal would cement that view while the proposal does reduce the tail risks of an EZ breakup," TD notes.

"However, we don't think these themes will resonate with the market just yet, and we believe the USD makes another leg higher, especially against European currencies like EUR and GBP this quarter. The other wildcard rests on US/China trade relations, which seem to have gotten worse. While the tone will likely continue to get worse into the election, we don't expect them to scrap the trade deal or that the US imposes sanctions," TD adds.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 01:30 | Australia | Construction Work Done | Quarter I | -0.3% | -1.5% | -1.0% |

| 05:45 | France | Consumer confidence | May | 95 | 92 | 93 |

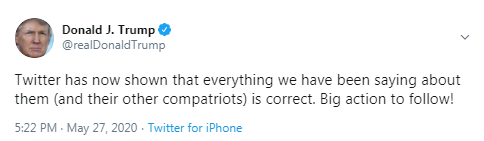

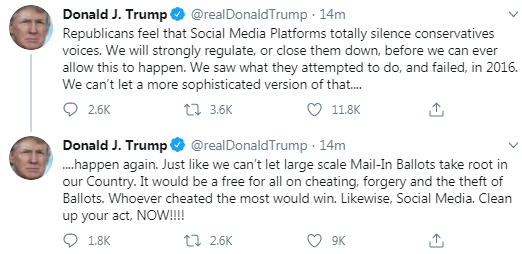

The US dollar rose against the euro, pound, and Australian dollar and was little changed against the Japanese yen. The Chinese yuan is getting cheaper due to the further deterioration of relations between the US and China. Washington may take further measures against China over Hong Kong by the end of this week, US President Donald Trump has said.

"Something you will hear before the end of this week, I think it will be powerful," he said, responding to a journalist's question about possible sanctions against China. However, he did not specify that it is about sanctions.

Last week, the Chinese authorities announced their intention to pass a bill creating a law enforcement mechanism to ensure national security in Hong Kong.

Premier Li Keqiang confirmed that Beijing intends to create "stable legal systems and enforcement mechanisms to protect national security in Hong Kong."

The yuan was also pressured by reports that the US is considering imposing sanctions on Chinese officials.

The ICE Dollar index, which shows the value of the us dollar against six major world currencies, rose by 0.30% compared to the previous trading day.

Reuters reports that German companies expect their total number of employees will continue to shrink, though the outlook for hiring has improved slightly in May after collapsing the previous month as a result of the coronavirus crisis, according to an Ifo institute survey.

The institute's employment barometer rose slightly to 88.3 points, up from 86.3 in April, helped by improving sentiment in the services and trade sectors. The manufacturing sector continued to report shrinking employment numbers.

Bright spots were in the fields of business and tax consultancy and auditing, where companies were seeking to hire new staff, as well as food and bicycle retail.

FXStreet reports that a break above 0.6230 in NZD/USD should open the door to further upside, in opinion of FX Strategists at UOB Group.

24-hour view: “We highlighted yesterday the ‘uptick in momentum could lead to NZD moving towards 0.6135’. The subsequent strong surge in NZD that sent it to a high of 0.6228 came as a surprise. The rapid rally is appears to be severely over-extended and further sustained NZD strength is unlikely for today. NZD is more likely to consolidate its gains and trade sideways at these higher levels. Expected range for today, 0.6155/0.6225.”

Next 1-3 weeks: “While we have expected a stronger NZD since early last week, we were of the view that ‘the solid resistance at 0.6175 may be tough to break’. However, NZD blast past 0.6175 yesterday (26 May) with nary a glance and rocketed to a high of 0.6228. At this stage, there is no sign of a top but 0.6230 is another solid resistance and NZD has to move clearly above this level before further sustained advance can be expected (next resistance is at 0.6300). The odds for such a move appear to be slightly better than even as long as NZD continues to hold above the ‘strong support’ (level had moved higher to 0.6110 from 0.6035).”

Reuters reports that French gross domestic product could fall by as much as 20% in the second quarter from the previous three months as the economy emerges from a nationwide coronavirus lockdown, the INSEE official statistics agency estimated on Wednesday.

That would mark a sharp deterioration in France's recession after the euro zone's second-biggest economy contracted 5.8% in the first quarter.

INSEE said the economy could contract 8% for the whole of 2020 in the unlikely scenario that activity returned to pre-crisis levels by July.

INSEE estimated that France's economic activity was running at 21% below normal levels after the lockdown in place from mid-March was lifted on May 11. Activity was down 33% in early May.

RTTNews reports that China's industrial profits declined at a much slower pace in April suggesting that the economic activity gradually started to recover following the coronavirus pandemic, data from the National Bureau of Statistics revealed Wednesday.

Industrial profits dropped 4.3 percent on a yearly basis, following a sharp 34.9 percent decrease in March.

During January to April period, industrial profits decreased 27.4 percent from the same period last year compared to 36.7 percent fall in the first three months of 2020.

Profits of state-owned enterprises plunged 46 percent and that of private companies fell 17.2 percent during January to April.

Data showed that automobiles, electrical machinery and electronics reported a notable recovery in April.

Production and sales increased in April, NBS official Zhu Hong said. The significant improvement in April profits was also partly due to the substantial increase in investment returns and the low base during the same period.

CNBC reports that U.S. coronavirus deaths are approaching 100,000, more than double that of any other country, according to data compiled by Johns Hopkins University. Across the country, more states reopened bars and lifted retail restrictions as California Governor Gavin Newsom announced that hair salons and barber shops could reopen in most counties under new guidelines.

Merck, meanwhile, has entered the vaccine race, announcing Tuesday it has teamed up with research nonprofit IAVI to develop a potential candidate.

Global cases: More than 5.58 million

Global deaths: At least 350,423

EUR/USD

Resistance levels (open interest**, contracts)

$1.1048 (1791)

$1.1026 (1228)

$1.1006 (778)

Price at time of writing this review: $1.0957

Support levels (open interest**, contracts):

$1.0922 (794)

$1.0885 (1424)

$1.0842 (2307)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date June, 5 is 93008 contracts (according to data from May, 26) with the maximum number of contracts with strike price $1,0700 (5288);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2514 (1451)

$1.2439 (1214)

$1.2391 (598)

Price at time of writing this review: $1.2316

Support levels (open interest**, contracts):

$1.2252 (1205)

$1.2217 (1046)

$1.2178 (1099)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 23807 contracts, with the maximum number of contracts with strike price $1,3500 (3420);

- Overall open interest on the PUT options with the expiration date June, 5 is 29652 contracts, with the maximum number of contracts with strike price $1,3500 (3095);

- The ratio of PUT/CALL was 1.25 versus 1.25 from the previous trading day according to data from May, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | Construction Work Done | Quarter I | -3% | -1.5% |

| 05:00 | Japan | Coincident Index | March | 95.5 | |

| 06:45 | France | Consumer confidence | May | 95 | 92 |

| 07:30 | Eurozone | ECB President Lagarde Speaks | |||

| 08:00 | Switzerland | Credit Suisse ZEW Survey (Expectations) | May | 12.7 | |

| 14:00 | U.S. | Richmond Fed Manufacturing Index | May | -53 | |

| 16:30 | U.S. | FOMC Member James Bullard Speaks | |||

| 18:00 | U.S. | Fed's Beige Book |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.66452 | 1.62 |

| EURJPY | 118.008 | 0.58 |

| EURUSD | 1.09746 | 0.76 |

| GBPJPY | 132.595 | 1.05 |

| GBPUSD | 1.23318 | 1.24 |

| NZDUSD | 0.61939 | 1.58 |

| USDCAD | 1.37854 | -1.38 |

| USDCHF | 0.96559 | -0.54 |

| USDJPY | 107.523 | -0.18 |

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.