- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 25-04-2011.

The semiannual economic forecast survey from Bond Dealers of America Economic Advisory Committee finds US still has headwinds but median est is +2.9% real growth in 2011 and +3.1% in 2012, "with growth rates steadily rising quarter over quarter from 2.5% in the first quarter in 2011 to 3.3% during the second half of 2012. CPI is expected to rise to 2.8% in 2011 and slow to 1.7% in 2012. The acceleration in consumer prices this year is due to the increase in energy and food prices that is expected to moderate in 2012.

Silver prices had been up more than 5% to a new 30-year high of almost $50 per ounce earlier today, but they pulled back to close pit trade at $47.56 per ounce with a gain more on the order of 1%. Amid silver's strength, the iShares Silver Trust ETF (SLV 46.47, +0.94) has been setting record highs, just as it did today. What's more, share volume in SLV is at its highest level in history, so SLV traders are exchanging the most shares ever at the ETF's highest price ever.

The dollar won a reprieve on Monday after last week's steep slide but traders said it could head for a test of its all-time low against a basket of currencies if the U.S. Federal Reserve takes a cautious stance towards tightening later in the week.

In thin trade due to Easter holidays in Australia and much of Europe, Japanese importer bids for dollars were enough to boost the U.S. currency against the yen and help it to erase earlier losses against other currencies.

With dollar interest rates seen taking a pivotal role in the market, players are looking to a news conference by Chairman Ben Bernanke on Wednesday after the central bank's two-day policy meeting.

The dollar index rose slightly to 74.07, but many trader says it could test a three-year low of 73.735 hit last week. A break of that could open the way for a test of the record low of 70.698 hit in 2008.

The dollar has been falling due to perceptions that the United States is set to maintain an easy monetary policy even as most other major global economies look to tighter monetary policy to rein in inflation.

The Fed is widely expected to stick to completing its $600 billion asset purchase programme in June but many market players think a backdrop of softer-than-expected economic data, weak housing markets and possible government austerity measures to tackle the budget deficit all make it more likely the Fed will keep its support for the recovery in place for some time.

Many analysts believe the U.S. central bank will hold the size of its balance sheet steady by reinvesting maturing assets after June to avoid a passive tightening -- an issue that will likely be discussed at the April 26-27 meeting.

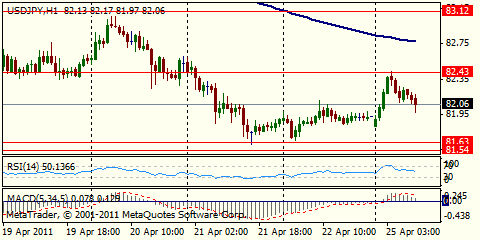

Resistance 2:Y83.10

Resistance 1:Y82.40

Current price: Y81.92

Support 3:Y79.80

Comments: rate continues to back off after overnight rally. Support is near Y81.60 (Apr 21-22 lows and Mar 29 low). Below losses may widen to Y80.70 (Mar 18-24 lows) and Y79.80 (Mar 17 high). Resistance is around Y82.40 (session high). Above there is a room for a rise up to Y83.10 (Apr 20 high).

Resistance 2: Chf0.8920

Resistance 1: Chf0.8880

Current price: Chf0.8810

Comments: Rate refreshed life-time low at Chf0.8770. break under widens losses to Chf0.8720, with stronger support comes at channel line from Dec 01'2010 at Chf0.8660. Minor resistance comes at Chf0.8880 (Friday's high). Next band of resistance comes at Chf0.8920 and Chf0.9000 (Apr 19 high).

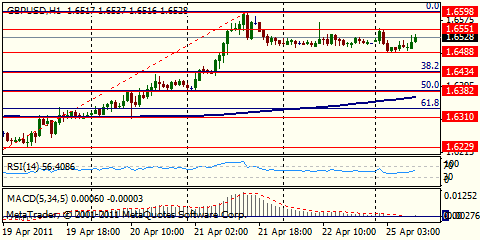

Comments: Rate remains under pressure. Currently strong support is near $1.6430 (38.2% Fibo of $1.6170 - $1.6600). Below correction may dip to $1.6380 (50%). Resistance comes at session highs on $1.6550 with stronger level is at $1.6600 (Apr 21 high). Further rise may be capped by Dec'2010 high on $1.6720.

Techs on EUR/USD

Support 3: $1.4400

Comments: Euro bears failed to break under strong support at $1.4520/25 (23.6% Fibo of $1.4160 - $1.4650 move). Currently rate tries to recover with resistance is near Thursday's high on $1.4650. Above the rise may extend to Dec 11'2009 highs on $1.4770 and then - to $1.5000. Clean break under $1.4520 widens losses to $1.4460 (38.2%) and then - to $1.4400 (50%).

June light sweet crude oil WTI futures are down $0.89 at $111.40 per barrel and ICE Brent down $0.93 at $123.06 per barrel, after trading in respective ranges of $111.08 to $113.48 and $122.80 to $124.75. On April 11, Brent posted a 32-month high of $127.02, before profit-taking.

Analysts at CIBC say Mar new home sales were up but remain not good-depressed at 300k. "That still leaves sales in the 270-340K range that they've been since 2009, hardly indicative of a recovery in the housing market."

Commodities under pressure Monday.

Crude oil futures sold-off to $111.00 during this sell-off and is now over 2% lower than from its session highs of around $113.40/barrel hit just over an hour ago. Current crude is down 0.7% at $111.53/barrel.

Gold fell into the red, but is now just above the unchanged line at $1504.70 +0.90. Overnight, gold chopped around the $1518.00 level.

Silver also dipped into negative territory after being over 4% higher earlier this morning in the recent sell-off.

Gold prices hold at $1413.50/oz, down from the new life-time high of $1518.10 and up from a low of $1509.75. The gold broke and closed above the psychological $1500 level last Wednesday. Resistance is expected at $1525 and $1550. On the downside, support comes at trend support (from April 12 lows).

Kimberly Clark Corp (KMB) fell below earnings expectations at $1.09 earnings per share vs $1.17 expected.

Jonson Controls, Inc. (JCI) beat expectations by $0.01 at $0.56 vs $0.55.

Credit Suisse economists expect a 2.0% q-o-q headline, vs 3.1% q-o-q in Q4. The economists however note steady job creation and strong Q1 ISM that was consistent with growth in excess of 4.0% q-o-q.

U.S. stocks were poised to head higher at Monday's open as investors continued to focus on earnings reports and awaited the latest data on the housing market.

After strong earnings propelled the Dow to a near 3-year high in the prior week, investors were looking to extend the rally Monday. The last week in April brings earnings reports from nine Dow components and 180 members of the S&P 500, including Netflix (NFLX) after Monday's close.

The market was closed Friday in observance of Good Friday.

Economy: Monday also brings the latest data on new home sales, released by the Census Bureau at 14:00 GMT.

Economists expect new home sales rose to a seasonally adjusted annual rate of 280,000 units in March from a 250,000-unit rate in February.

Companies: Netflix (NFLX) will announce first-quarter results after the closing bell. Analysts expect the online movie rental company's profit to surge almost 80%, as sales climb 43% from a year earlier.

USD/JPY bottomed around Y81.60-65 last week, before closing Friday around Y81.84. Monday's push above Y82 (at Y82.05 currently) is being viewed as mildly bullish for the pair, but traders would like to see dollar-yen take out the April 21 peak at Y82.57 before there is a shot at retesting last week's highs of Y83.10 and Y83.26 (200-day moving average at Y83.24). The pair stalled earlier at its 55-day moving average, which comes in Monday at Y82.51. The 100-day, which comes in at Y82.63, is likely to offer resistance also.

The yen fell versus all of its major counterparts on speculation the Bank of Japan will signal this week it will maintain monetary stimulus while policy is being tightened elsewhere.

The euro climbed against the yen for a second day before data this week that may show industrial orders growth in the currency bloc accelerated, bolstering the case for the European Central Bank to increase interest rates further.

Bank of Japan Governor Masaaki Shirakawa said on Monday that sentiment in Japan was worsening due to last month's devastating earthquake and tsunami, and the nuclear safety crisis they triggered in northeast Japan.

The Bank of Japan will hold its benchmark interest rate at a range of between zero and 0.1% at its April 28 meeting. The central bank may cut its forecast for real growth in fiscal 2011 to 0.8% from 1.6% as a result of a record earthquake on March 11.

EUR/USD initially failed to break above $1.4600 and retreated a bit. But later rate printed session high above the figure - at $1.4628. Strong resistance remains at Thursday's high on $1.4650. Support comes at $1.4520 (overnight low).

GBP/USD recovered and printed session high around $1.6550 before retreates to current levels around $1.65515. Rate earlier tested strong support at $1.6500/90 (23.6% Fibo of $1.6160 - $1.6600).

USD/JPY fell to Y81.88 after morning rally to Y82.40. Currently rate holds around Y82.05.

Financial markets in Australia, New Zealand, Hong Kong and London are closed for a public holiday today.

US data starts - at 1400GMT New home sales (March).

JPM comments on the Weds FOMC statement, saying it will "indicate that QE2 is coming to an end as planned" and could contain "language similar to that used when QE1 was coming to a close."

GBP/USD recovered after it fell to a strong support at $1.6500/90 (23.6% Fibo of $1.6160 - $1.6600 move) in Asia. Later rate back to session high on $1.6540, that is still lower Asian high on $1.6552.

EUR/USD tested $1.4600 and retreated a bit. EU markets mostly closed today for the Easter holiday. As a result euro bulls are not so strong Monday to push the euro above the $1.4600. Strong resistance is around Thursday's high on $1.4650. Support - at $1.4520 (morning lows).

US data starts - at 1400GMT New home sales (March).

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.