- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 19-07-2011.

Gains remain strong as stocks sit slightly beneath their session highs. Buying interest has also broadened, such that health care stocks and utilities stocks are up 0.6% after they had been mired near the neutral line for most of the session. Even telecom has pushed up to a 0.4% gain after it had been in the red for a couple of hours.

Meanwhile, the dollar has trimmed its loss. In turn, it now trails a collection of competing currencies by a relativey tame 0.2%. The dollar's upturn has coincided with a downturn by crude oil prices as the energy component enters the close of pit trade. Just before settlement, oil prices were quoted at $97.50 per barrel after they had been above $98 per barrel earlier this session.

Leaking back lower again as gold gives up a chunk of gains but as stocks continue to hold the bult of theirs. Euro bids remain at $1.4140 with stops below $1.4135. Break lower will target $1.4100-$1.4090.

Although participants have displayed a preference for risk this session, Treasuries have managed to tick higher. The move has taken the yield on the benchmark 10-year Note back toward 2.90%.

On Tuesday the U.S. dollar shed against most of its rivals amid revived appetite for risky assets as stocks rose on better-than-expected company earnings. Partly the dollar dropped on hopes European officials will make progress toward a second bailout package for Greece as crucial factor to curb the region’s debt crisis.

The euro rallied against the dollar and rose from almost a record low versus the Swiss franc.

Lately market players concerned about possible spread of the EU debt crisis doubted that European leaders will solve the problem. But many official persons, in particular German Chancellor Angela Merkel and Greece Finance Minister Evangelos Venizelos, said about their confidence that the EU leaders will reach agreement on new financial assistance program for Greece. It should be noted that the EU summit is scheduled for Thursday, July 21.

Australia’s dollar also climbed amid renewed investor appetite for higher-yielding assets Another factor to rise was today’ dovish minutes from the Reserve Bank’s last meeting, reduced expectations that policy makers will increase interest rates to curb inflation.

The Canadian dollar advanced to an 11-week high after the Bank of Canada left its rate at 1 percent the central bank’s policy statement.

Japan yen also gains.

Although it continues to sport a strong gain, the S&P 500 has drifted lower in recent trade. It now trades near the 1315 zone. Near-term support is said to stand at the 1313 line.

Part of the market's move lower stems from renewed weakness among financial stocks. The sector had staged an early rebound that took it to a solid gain, but that move has failed to hold, so financials are now back near the neutral line with a 0.1% gain.

Bank of America (BAC 9.41, -0.31) continues to be a considerable burden on the overall financial space. Despite an upside earnings surprise for the latest quarter, shares of the diversified bank and financial services giant have dropped more than 3% to a new two-year low.

Oil prices have spiked to $98.30 per barrel, which gives them a heady 2.5% gain. Natural gas prices are actually down 0.3% to $4.51 per MMbtu.

As for precious metals, gold prices are down fractionally to $1600.60 per ounce after they set a fresh record high near $1608 per ounce during the prior session. Silver also made a strong push higher yesterday, but the precious metal has pulled back today so that it trades with a 0.3% loss at $40.20 per ounce.

In the backdrop, the dollar has declined to a 0.6% loss against a collection of competing currencies.

Tech stocks rallied 1.8% at open. The group's strength has helped the tech Nasdaq to go ahead of its counterparts.

Among tech issues, IBM (IBM 181.20, +5.92) is a top performer. The stock's jump to a new all-time high comes in response to a stronger-than-expected earnings report and upside guidance.

Within the Nasdaq, though, Intel (INTC 22.78, +0.50) is a leader ahead of its quarterly report, which is scheduled to take place after the close of trade on Wednesday.

GBP/USD tries to get higher, holding around $1.6120, while EUR/GBP tracks EUR/USD. Offers atill at earlier highs on $1.6160, extending to $1.6170. Support at $1.6110/00.

EUR/JPY Y110.00, Y111.35, Y113.00

EUR/GBP stg0.8735

AUD/USD $1.0585, $1.0600, $1.0770

AUD/JPY Y84.80

CAD/JPY tripped stops through Y83.15 as the rate rises above the 200 day MA at Y83.16 to a session high Y83.21 after more hawkish rate outlook from BoC. The rate is currently Y83.16.

U.S. stocks were set to rebound Tuesday following the strong reports on the housing market and digest the latest corporate earnings.

Stocks began the week sharply lower, selling off nearly 1% on Monday, as worries about Europe's debt crisis and uncertainty over the U.S. debt ceiling continued to hang over the market. Meanwhile, gold prices surged.

The failure of eight banks to pass Europe's latest round of bank stress tests have done little to restore investor confidence overseas.

Economy: Before the opening bell, the Commerce Department reporting stronger-than-expected numbers of June housing starts and building permits, giving the markets an extra boost.

The government reported an annual rate of 629,000 housing starts and 624,000 housing permits for June.

Economists had forecast that housing starts would rise to an annual rate of 570,000 units in June, while permits were expected to remain unchanged at 609,000 units.

Companies: Quarterly reports from the banking sector will take center stage Tuesday morning.

Before the opening bell, Bank of America (BAC, Fortune 500) reported a net loss of $8.8 billion, or 90 cents per diluted share, in line with analyst expectations.

Goldman Sachs (GS, Fortune 500) posted second-quarter earnings of $1.1 billion profit, or $1.85 a share - missing analysts' forecasts.

Citing strong demand, Coca-Cola (KO, Fortune 500) reported earnings per share of $1.20 on revenue of $12.7 billion, beating analyst expectations.

Apple (AAPL, Fortune 500) is scheduled to report its earnings after the closing bell.

EUR/USD trades below $1.4170 following the release of weaker than expected earnings results from Goldman. Demand/support seen at $1.4160 (38.2% $1.4070/1.4217).

Data released:

09:00 Germany ZEW economic expectations index (July) -15.1 -7.0 -9.0

The euro strengthened against the dollar and Swiss franc on speculation European officials are nearing agreement on reinforcing measures aimed to prevent debt crisis from extention.

The 17-nation currency also rose versus the yen as Italian bonds narrowed their yield spread, over German debt.

Greek Finance Minister Evangelos Venizelos said a resolution of the crisis is “attainable” and European Central Bank Governing Council member Ewald Nowotny signaled the ECB may be willing to compromise on the use of Greek bonds as collateral after a default.

Negotiations over a second bailout package for Greece should be “positive for the viability of the public debt” and safeguard the nation’s banking system, Venizelos said.

Even in the event of a default, the ECB may be willing to accept Greek debt as collateral, Nowotny suggested.

The Canada’s currency fell as global stocks dropped and raw materials including crude oil and copper fell. Crude oil for August delivery decreased 1.1% to $96.15 a barrel in New York. Oil is Canada’s biggest export. Copper futures fell 0.2%.

Foreign investors bought C$15.4 billion ($16 billion) of Canadian stocks, bonds and money market securities in May, their biggest net purchase in a year, led by federal government bonds, Statistics Canada said.

EUR/USD broke above $1.4200 and printed session high on $1.4220. Rate failed to go higher and retreated to below the figure - to current $1.4165.

GBP/USD initially rose to $1.6160 before it retreated to $1.6100/10.

USD/JPY continues to weaken from Y79.10 to Y78.90.

US data starts at 1145GMT with the weekly ICSC-Goldman Store Sales data, which is followed at 1230GMT by Housing Starts and Building Permits data. The pace of housing starts is expected to rise to a 575,000 annual rate in June, which would be a second straight gain.

European stocks gained Tuesday, rebounding from a seven-month low, as companies from Novartis AG (NOVN) to International Business Machines Corp. reported earnings that beat estimates.

Novartis climbed 3.8%.

SAP AG (SAP) led a rally in technology companies after IBM boosted its forecasts.

Meanwhile, Electrolux AB (ELUXB) plunged to the lowest in almost two years as profit trailed projections.

GBP/USD retreats after it earlier rose to session highs on $1.6157. Rate currently holds around $1.6122. The pound earlier triggered stops at $1.6135. Resistance - at $1.6180.

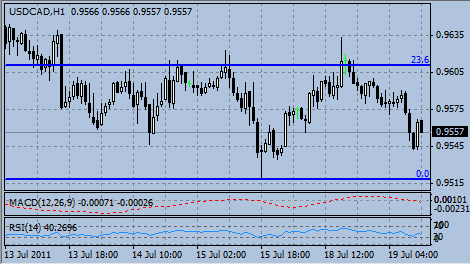

On Tuesday Canada’s dollar depreciated against its U.S. counterpart as concern European leaders may be unable to resolve the region’s debt crisis diminished demand for commodities and higher-yielding assets.

The Canada’s currency fell as global stocks dropped and raw materials including crude oil and copper fell. Crude oil for August delivery decreased 1.1% to $96.15 a barrel in New York. Oil is Canada’s biggest export. Copper futures fell 0.2%.

Foreign investors bought C$15.4 billion ($16 billion) of Canadian stocks, bonds and money market securities in May, their biggest net purchase in a year, led by federal government bonds, Statistics Canada said.

“The driver continues to be Europe, we’re seeing equities are down, oil is down and the loonie is correlated to those things quite heavily,” said Rahim Madhavji, president of Knightsbridge Foreign Exchange.

Euro-area government leaders will hold a special summit on July 21, stepping up efforts to stem the contagion from Greece. Leaders are at odds with one another and with the European Central Bank over demands by Germany and Finland that private investors bear some of the burden for a second Greek bailout.

EUR/USD printed session highs around $1.4220 before retreated to current levels below $1.4200. Resistance remains at $1.4220 (76.4% Fibo of $1.4282/1.4014 move). Above resistance comes at $1.4250 and $1.4280/85.

Gold prices continue to print fresh record highs despite daily studies losing momentum. Resistance is seen at $1617.10 (the daily

Bollinger band top), followed by a resistance at $1646.00 (channel line from Nov 2010). Initial support seen at $1596.80 (the 5-DMA). Gold currently holds around $1606.0.

EUR/JPY Y110.00, Y111.35, Y113.00

EUR/GBP stg0.8735

AUD/USD $1.0585, $1.0600, $1.0770

AUD/JPY Y84.80

Nikkei 9,890 -84.75 -0.85%

Hang Seng 21,879 +74.03 +0.34%

S&P/ASX 4,468 -3.82 -0.09%

Shanghai Composite 2,797 -19.71 -0.70%

Yesterday the dollar strengthened against a basket of rival currencies on concerns about the euro-zone debt crisis and the lack of agreement on raising the U.S. debt ceiling

The market players focus on U.S. debt ceiling talks. If the debt ceiling isn’t raised from the current $14.3 trillion by August 2, the country would face technical default.

Early Monday the rating agency Moody's suggested the US debt ceiling itself should be eliminated to bring greater stability and avoid "periodic uncertainty."

The global debt concerns overshadowed the latest corporate reports, which have been generally better than expected.

The euro fell versus major rivals.

Italy 10-year yield rose to 6.02% - highest since November 1997. Spanish bond yields also surged euro-lifetime highs.

Also analysts determined last week’s stress test of banks in Europe was fairly relaxed, stoking continued concerns about European debt.

Late Friday the European Banking Authority’s long-awaited stress tests showed that 8 banks failed and will need 2.5 billion euros ($3.5 billion) to survive a serious downturn. 16 other lenders passed, but should raise more money.

European sovereign fears, combined with wrangling over raising the debt ceiling, have boosted safe havens.

The franc reached a new record high versus the dollar on demand for safety after ECB President Jean-Claude Trichet noted again his opposition to any restructuring of Greek debt.

The gold reached a new historical high at $1.603.80. Investors see gold as the best place to park their money when there's economic or political uncertainty.

Resistance 3: Y79.90 (high of american session on Jul 12)

Resistance 3: $ 1.6190 (Jul 14 high)

Resistance 3: $ 1.4280 (Jul 14 high)

09:00 Germany ZEW economic expectations index (July) -7.0 -9.0

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.