- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 19-04-2011.

Tonight's list of earnings announcements features the latest from Dow components IBM (IBM 165.36, -0.58) and Intel (INTC 19.84, +0.22). Fellow tech issue Yahoo! is also scheduled to unveil its latest quarterly results.

Tomorrow morning brings the latest from Altria (MO 26.17, -0.38), Freeport McMoRan (FCX 51.72, +1.11), and Wells Fargo (WFC 30.06, +0.54). Dow components United Technologies (UTX 82.34, +0.64) and AT&T (T 30.26, -0.05) are also due to report in the morning.

Spot gold stands at $1496.25/oz, after printing a new life-time high at $1499.31. A test of $1500 has been envisioned for a while, with profit-taking expected to cap an initially rally. A push above $1500 would target the $1525.

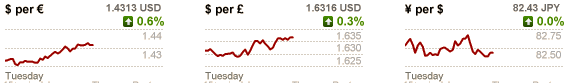

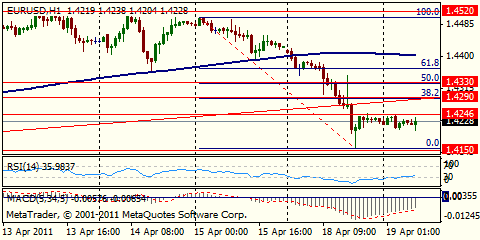

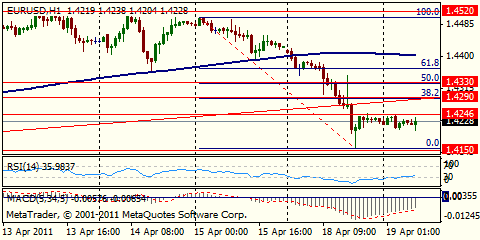

EUR/USD holds around $1.4340, but traders keep an eye on $1.4350. As noted, offers clustered around that level, a few stops above, but more supply at $1.4380/85.

The Dow and S&P 500 have worked their way up to their best levels in almost three hours. The gradual lift comes without any real source of leadership, though, so the gains could be susceptible to the challenge of sellers.

The euro advanced against the dollar and yen on speculation the European Central Bank will raise interest rates further even as nations such as Greece struggle to contain sovereign-debt turmoil.

“The prospect of an ECB rate hike is in the forefront of people’s minds,” said John McCarthy, director of currency trading at ING Groep NV. “For the time being, the euro is receiving a boost from the prospect of higher rates.”

The ECB governing council member Nout Wellink said in Toronto the central bank’s April 7 interest-rate increase sent to investors an “extremely important” signal aimed at preventing expectations of higher inflation.

Germany’s purchasing managers’ index for manufacturing unexpectedly climbed to 61.7 this month from 60.9 in March, according to Markit Economics. The median forecast of economists was for a decrease to 60.

Europe’s shared currency has dropped 1.6% over the past week. Citigroup Inc. said it has established a bet the euro will decline against the dollar.

The Canadian dollar rallied against the greenback as a government report showed the annual inflation rate accelerated to a two-year high, exceeding all economists’ forecasts.

The consumer price index advanced 3.3% in March from a year earlier, compared with 2.2% pace of increase in the previous month, Statistics Canada reported. The median forecast of economists was for a 2.8% annual rate.

The Bank of Canada will hold the target rate for overnight loans between commercial banks at 1% during the second quarter and boost it to 1.5% during the third quarter, according to a survey.

Shares of Harley-Davidson (HOG 37.60, -2.11) have tumbled more than 5% to a new one-month low. The stock is among today's worst performers.

The dramatic downturn by HOG comes after the motorcycle manufacturer announced earnings of $0.51 per share for the latest quarter, but that came short of the Wall Street consensus of $0.53 per share.

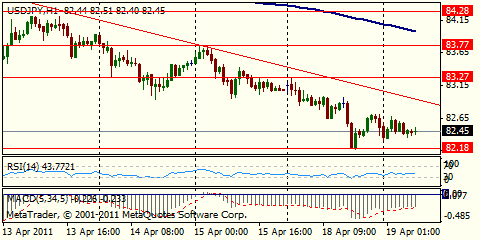

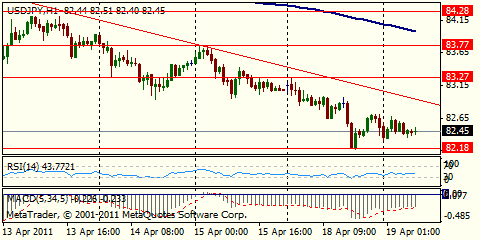

USD/JPY holds around Y82.40 and remains above the earlier low near Y82.30. Bids in place at Y82.20/15. Stops mixed in below Y82.20.

EUR/USD holds at $1.4322 area with flows said very light. Euro still expected to find supply atop $1.4230 area, extending to $1.4350. Bids back at $1.4260/65.

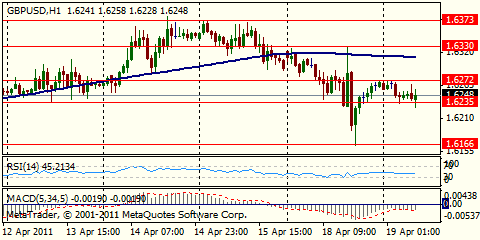

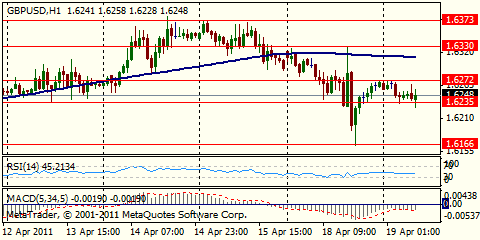

GBP/USD printed hourly highs on $1.6330 area ahead of the London fixing before stalled to $1.6318. Offers at $1.6330 were challenged. More supply likely around $1.6375/80 area.

EUR/USD $1.4300

USD/JPY Y82.50, Y82.85

GBP/USD $1.6300

EUR/GBP stg0.8840

USD/CHF Chf0.9010

AUD/USD $1.0470-75, $1.0500, $1.0550

Investors were a little more confident Tuesday, following the previous session's sell-off, with U.S. stocks headed for a higher open.

Goldman Sachs and Johnson & Johnson both reported solid quarterly results before the opening bell.

Stocks cut some losses late Monday, but still finished the session sharply lower after Standard and Poor's cut its long-term outlook on U.S. debt to negative.

Economy: The Commerce Department announced that housing starts and building permits increased in March.

Housings starts jumped 7.2% to an annual rate of 549,000 in March while building permits climbed 11.2% to a rate of 594,000. Economists had expected a rate of 520,000 housing starts in March and 540,000 building permits.

Companies: Shares of Wall Street giant Goldman Sachs (GS) rose 1.5% after the firm reported a 21% drop in net income to $2.7 billion and said it sees "encouraging indications" for global economic activity.

Johnson & Johnson (JNJ) reported better-than-expected earnings and sales. The healthcare company, which has been plagued by recalls and lawsuits, has also been quietly growing its business. Shares rose more than 2% premarket.

After the market close Monday, Texas Instruments (TXN) reported first-quarter earnings that missed analysts' estimates, saying the earthquake in Japan impacted consumer demand and production during the quarter. Shares of Texas Instruments fell 2.3% in premarket trading.

After the bell Tuesday, technology giants Intel (INTC) and IBM (IBM) will report their results. Analysts are looking for Intel to earn 46 cents a share, while IBM is expected to post earnings of $2.30 a share.

Yahoo (YHOO) will also reporting earnings after the bell Tuesday.

World markets:

Oil for May delivery slipped 75 cents to $106.37 a barrel. Oil for June delivery, which becomes the active contract Wednesday, fell 1% to $106.68 a barrel.

Gold futures for June delivery rose $3 to $1495.90 an ounce.

The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.4% from 3.41% late Monday.

The euro advanced against the dollar and the yen after a report showed German manufacturing growth unexpectedly accelerated, adding to speculation that the European Central Bank will raise interest rates further.

The unified European currency also rose against the Swiss franc and Australian dollar as Greece sold 13-week Treasury bills even after the nation’s two-year note yields rose to 20 percent amid concern that the country will eventually restructure its debt.

“The survey today confirmed a picture which has been in place that the core countries, such as Germany, are performing strongly and that will push interest rates higher,” said Lee Hardman, a currency strategist at Bank of Tokyo-Mitsubishi UFJ Ltd. “Although it’s debatable how far the ECB can go given the debt crisis, in the near-term the euro will be supported by interest-rate differentials.”

European Central Bank Governing Council Member Nout Wellink said the central bank’s April 7 interest rate increase sent to investors an “extremely important” signal aimed at preventing expectations of higher inflation.

While Wellink didn’t explicitly ratify market and economic forecasts that the ECB’s policy rate will rise a further 50 basis points this year to 1.75 percent, he made it clear the central bank will keep inflation control its main policy goal.

Drops through support at C$0.9625/20 to C$0.9595 as market reacts to release of stronger than expected CPI data. Next support seen at C$0.9585/80 with stops below. If triggered the area C$0.9560/45 may be tested. Key support lies around multimounth low C$0.9525.

Running into offers as aussie hits $1.0506, with talk of middle Eastern demand now joined by corporate names. Some resistance seen towards $1.0520 with larger towards $1.0575/80.

EUR/JPY Y121.80

GBP/USD $1.6300

EUR/GBP stg0.8840

USD/CHF Chf0.9010

AUD/USD $1.0470-75, $1.0500, $1.0550

Finland’s Justice Ministry said support for the True Finns, whose leader Timo Soini says taxpayers shouldn’t have helped rescue Greece or Ireland, jumped to 19 percent in elections yesterday. A permanent bailout fund for indebted euro-area nations requires approval from all 17 members of the bloc.

Greece may not be able to avoid restructuring its debt before summer’s end, said Otto Fricke, the parliamentary budget spokesman for Chancellor Angela Merkel’s Free Democratic Party coalition partner.

The statement was supported by European Union spokeswoman Chantal Hughes who told reporters in Brussels today that “restructuring is not an option that’s on the table.”

Later Greek official said restructuring is a matter of time. Greece ultimately will not be able to avoid restructuring its sovereign debt, an unnamed Greek government minister told the German daily Die Welt in an interview to be published Tuesday.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.