- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 15-06-2011.

As a result of today's drop the S&P 500 is down almost 8% from its three-year high.

However, the financial sector, down 2.3% today, has fallen 15% from the 30-month high that it set in February.

As for energy, which is now today's worst performing sector as it grapples with a 2.4% loss, is down 11% from the near three-year high that it set in April.

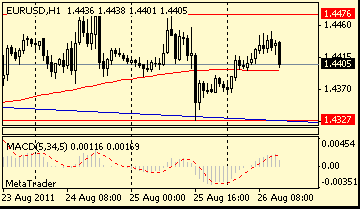

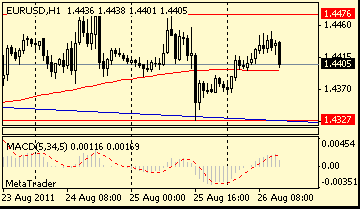

EUR/USD recover and currently holds around $1.4177. Rate earlier tested bids around $1.4150. Stops below remain intact. Lower support comes at $1.4125, where demand is. Break under makes possible the challenge of techs support at $1.3970 (May 23 low).

Blue chips continue to trade at their lows for the day. Declining issues outnumber advancers by more than 5-to-1 on the NYSE.

Meanwhile, the dollar continues to improve its position and currentl holds 1.6% higher against a basket of major foreign currencies.

The single currency suffered after rating agency Moody’s warned it could downgrade three French banks. Moody’s said it would review the ratings of BNP Paribas, France’s largest bank, and peers Société Générale and Crédit Agricole, focusing on their holdings of Greek public and private debt.

The move came amid continued wrangling between eurozone finance minister and central bankers over who should bear the cost of a fresh rescue package for Greece.

German Chancellor Angela Merkel and French President Nicolas Sarkozy will meet on June 17 in Berlin, with pressure mounting for the leaders to resolve their differences over a rescue for Greece.

The euro remained weaker after strong US CPI report for May and a measure of manufacturing in the New York region unexpectedly shrank in June.

The consumer-price index increased 0.2 percent, compared with the 0.1 percent median forecast of economists. The core measure, which excludes more volatile food and energy costs, climbed 0.3 percent, the biggest increase since July 2008.

The Federal Reserve Bank of New York’s general economic index dropped to minus 7.8, the lowest level since November, from 11.9 in May. The median forecast was 12.

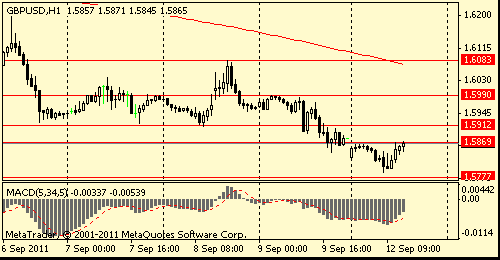

Sterling fell versus the dollar after a report showed Britain’s jobless claims rose in May at its fastest pace in almost two years in May.

So, U.K.’s jobless claims rose by 19,600 in May after a revised 16,900 increase in the prior month. The median forecast was for an increase of 6,500.

Resistance 3: Y82.20 (high of May)

Resistance 3: Chf0.8610 (50.0 % FIBO Chf0.8890-Chf0.8330)

Resistance 3: $ 1.4430 (resistance line from Jun 9)

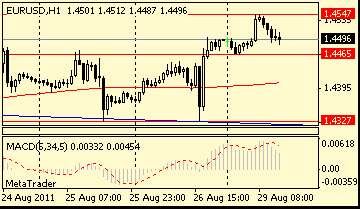

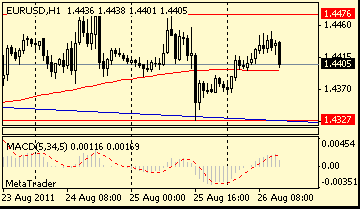

EUR/USD weakens again, holding under $1.4300 - around $1.4281. Rate remains vulnarable to Greece reports. Bids mentioned ahead of $1.4250 area. Stops are positioned below that level.

A precipitous drop at the start of trade took the broad market to within close reach of yesterday's opening level before support surfaced. Weakness remains widespread in that all 10 major sectors are in the red. That comes in stark contrast to early trade in the prior session.

Health care has managed to do the best job of limiting its loss this morning; the sector is down just 0.3%. Boston Scientific (BSX 7.10, +0.36) is currently a primary leader in the health care space, helping to offset weakness in among heavyweight pharmaceutical plays like Pfizer (PFE 20.40, -0.18) and Merck (MRK 35.41, -0.23).

U.S. stocks were headed for an early sell-off Wednesday, with futures falling sharply after disappointing manufacturing and inflation data.

It could be a rocky day on Wall Street. In addition to the U.S. data released before the bell, news that European officials failed to reach an agreement on bailing out Greece could also keep investors skittish.

The Labor Department's consumer price index rose 0.2% in May. Economists polled by Briefing.com expected consumer inflation ticked up by 0.1% in May, down from the 0.4% rise in the previous month.

Meanwhile, the Empire State manufacturing index declined by 7.8 points, while economists were forecasting an increase of 10 points.

Companies: Shares of Carnival Corporation (CCL) slipped more than 2% in premarket trading, after the cruise-line operator lowered its fiscal 2011 earnings outlook earlier this week -- leading some analysts to cut their price targets for the company.

Scotts Miracle Gro (SMG) cut its full-year forecast as well, sending shares of the lawn-care product maker more than 5% lower before the market open Wednesday. The company said continued bad weather has led to lower consumer demand.

Meanwhile, Owens-Illinois (OI, Fortune 500) lowered second-quarter earnings per share guidance to below the previous year's level -- after originally forecasting earnings per share to be unchanged. The cut came amid rising manufacturing costs, the company said. Shares of Owens-Illinois dropped 5% in premarket trading.

Internet radio site Pandora will begin trading Wednesday on the New York Stock Exchange under the ticker symbol "P." Late Tuesday, Pandora priced its initial public offering at $16 a share.

World markets:

Oil for July delivery slipped 41 cents to $98.96 a barrel.

Gold futures for August delivery fell $7.30 to $1,517.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury rose, pushing the yield down to 3.09% from 3.10% late Tuesday.

Recovers off session lows of Y115.30 to currently trade Y115.55. Bids remain at Y115.25, a break here opens Y114.90. Resistance at Y115.65, ahead of Y116.25.

The euro fell, snapping a two-day advance against the dollar, as European Union officials struggled to break a deadlock on a second Greek rescue plan.

“There’s still a lot of uncertainty about how the Greek debt issue will be resolved, and that’s putting some pressure on the euro,” said Lutz Karpowitz, a currency strategist at Commerzbank AG in Frankfurt. “The main problem is how to involve the private bondholders in a new rescue package. We’re still pretty confident a solution will be found and once that happens, it should be positive for the euro.”

EU finance ministers yesterday agreed to convene again on June 19 after they failed to reconcile a German-led push for bondholders to share part of the cost of a new Greek aid plan. European Central Bank warnings were backed by France that the move might constitute the region’s first sovereign default.

“There are still worries over Greece, given uncertainty about how it can avoid a credit event such as a default,” said Tsutomu Soma, a bond and currency dealer at Okasan Securities Co. in Tokyo. “Financial damage could be widespread. It’s a reason to sell the euro.”

ECB policy makers have warned against German proposals for extending Greek bond maturities for seven years, which rating companies have said would be considered a default. ECB President Jean-Claude Trichet, who attended yesterday’s meeting, said on June 9 that governments were flirting with what may be an “enormous mistake.”

Australia’s dollar was the best performer versus the shared European currency after central bank Governor Glenn Stevens reiterated that policy makers will need to raise interest rates at some stage. Demand for the greenback may be capped by estimates that U.S. reports today will show inflation slowed and homebuilder confidence stayed weak. The pound advanced versus the euro as data showed U.K. consumer confidence surged.

US data starts at 1230GMT with the May Consumer Price Index and the June NY Fed Empire State Survey. Consumer prices are expected to reflect the continued price pressures from food and energy, though to a lesser extent than in at the wholesale level. Overall CPI is forecast to hold steady in May, while core CPI is expected to rise 0.1%. At the same time, the NY Fed Empire State Index is expected to rise to a reading of 14.0 in June after falling in May. The US Treasury International Capital System (TICS) data is due at 1300GMT, shortly followed at 1315GMT by industrial production, which is expected to rise 0.2% in May after a flat reading in April that resulted from a shortage of motor vehicle parts from Japan. US data then continues with the weekly EIA Crude Oil Stocks data at 1430GMT.

EUR/USD:

Offers: $1.4320, $1.4340, $1.4350/55, $1.4370/80, $1.4400, $1.4415/20

Bids: $1.4285/80, $1.4255/45

European shares dipped early on Wednesday after euro zone ministers failed to agree on how to share the costs of a new bailout for Greece and with French banks placed under review for a downgrade by Moody's.

BNP Paribas (BNPP.PA), Societe Generale (SOGN.PA) and Credit Agricole (CAGR.PA) fell between 1.6 and 1.9 percent after Moody's Investors Service put them on review for a possible downgrade, citing the banks' exposure to Greece's debt crisis.

Cable posted new low at $1.6270 (76.4% $1.6215/1.6442), passing through demand in the area between $1.6285/75 with apparent ease. A break and clear below $1.6270 to expose the June 10-13 lows around $1.6215. $1.6250 to provide interim support. Resistance remains at $1.6380, ahead of $1.6430.

EUR/USD: $1.4280, $1.4400, $1.4420, $1.4500, $1.4510

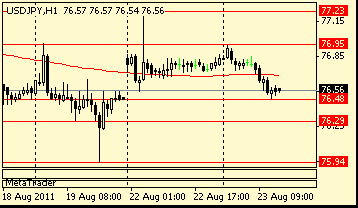

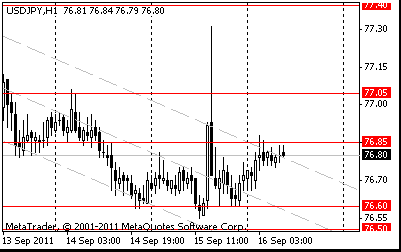

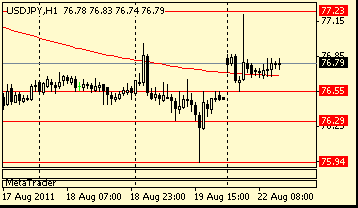

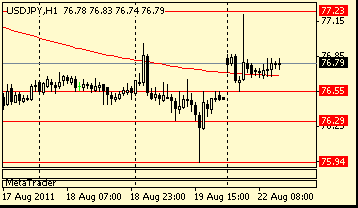

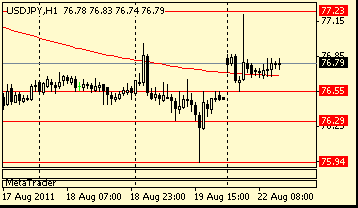

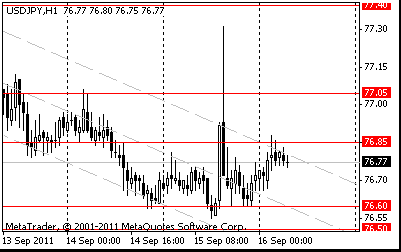

USD/JPY: Y79.00, Y79.80, Y80.00, Y80.40, Y80.50, Y80.60, Y80.65, Y81.00

EUR/GBP: stg0.8840

USD/CHF: Chf0.8470, Chf0.8365

AUD/USD: $1.0700, $1.0710, $1.0550

AUD/NZD: NZ$1.3010

AUD/JPY: Y84.15

EUR/JPY recovers from session lows of Y115.58 and currently holds around Y115.70. Support still remains at Y115.60 with a clear break under to open a decline to Y114.90/94 (the base of Ichimoku cloud and 10th June low). Resistance comes at Y116.15/20 (Y116.19 - 21 day moving average), behind this Y116.45/50.

EUR/USD breaks under the support zone at $1.4350/40 to hold currently at a new session lows on $1.4324. Next support seen into $1.4335 (76.4% Fibo of $1.4285/1.4498 move) ahead of $1.4325/20.

GBP/USD weakens after the release of UK labour market data, where claimant count rose more than expected. Rate dropped from around $1.6365 to current $1.6315, heading for bids on $1.6300.

July WTI crude retreats from Asian highs of $99.61 to print a low in Europe of $98.50. Support now seen at $98.08 and $97.65 with resistance at $101.09 and $102.80. Currently the black gold trades around $98.88 per barrel.

EUR/USD remains under pressure on Greece concerns. Rate fell to a new session lows around $1.4350 before corrected back to current $1.4370. Bids have been mentioned around $1.4350 with stops placed below. A break here to expose $1.4335 (76.4% Fibo of $1.4285/1.4498 move) ahead of stronger support between $1.4325/20. Break under targets $1.4300 and then - $1.4285/80.

EUR/USD: $1.4400, $1.4420, $1.4500, $1.4510

USD/JPY: Y79.00, Y79.80, Y80.00, Y80.40, Y80.50, Y80.60, Y80.65, Y81.00

GBP/USD: $1.6355

EUR/GBP: stg0.8840

USD/CHF: Chf0.8470, Chf0.8360

AUD/USD: $1.0700, $1.0710, $1.0550

AUD/NZD: NZ$1.3010

AUD/JPY: Y84.15

Data:

UK labour market data is due at 0830GMT and is expected to show a 5k change in the claimant count with the rate at 4.6%. Average weekly earnings are expected to come in at 2.1%. The ILO measures are expected to show a -38k jobless change and a 7.7% rate. In London tonight, the Bank of England Governor Mervyn King delivers what is traditionally seen as his keynote annual address at the Mansion House.

14.0 in June after falling in May. The US Treasury International Capital System (TICS) data is due at 1300GMT, shortly followed at 1315GMT by industrial production, which is expected to rise 0.2% in May after a flat reading in April that resulted from a shortage of motor vehicle parts from Japan. Stocks data at 1430GMT.US data then continues with the weekly EIA Crude Oil

Retail purchases in the U.S. fell 0.2 percent in May, following a 0.3 percent increase in April, Commerce Department figures showed today in Washington. The median forecast of economists called for a 0.5 percent decrease.

Wholesale costs in the U.S. rose more than forecast in May, led by higher prices for fuel, plastics and the fastest rise in 30 years for apparel and textile costs.

The Thomson Reuters/Jefferies CRB Index of commodities rose 0.2 percent and the Standard & Poor’s 500 Index gained 1.2 percent.

Earlier China reported increased retail sales and industrial output, spurring appetite for risk.

China’s retail sales rose 16.9 percent last month, while industrial production increased more than economists forecast, the statistics bureau reported. The 5.5 percent increase in China’s consumer-price index was the fastest in almost three years. Lenders were ordered to set aside more cash as reserves.

Data offset concern the fastest-growing major economy is cooling. New loans in China tumbled in May and money supply grew at the slowest pace since 2008, the central bank reported yesterday.

The Swiss franc dropped versus all of its major counterparts as the government lowered its forecast for 2012 economic growth and said further currency appreciation poses risks to its outlook.

UK labour market data is due at 0830GMT and is expected to show a 5k change in the claimant count with the rate at 4.6%. Average weekly earnings are expected to come in at 2.1%. The ILO measures are expected to show a -38k jobless change and a 7.7% rate. In London tonight, the Bank of England Governor Mervyn King delivers what is traditionally seen as his keynote annual address at the Mansion House.

US data starts at 1100GMT with the weekly MBA Mortgage Application Index. US data continues at 1230GMT with the May Consumer Price Index and the June NY Fed Empire State Survey. Consumer prices are expected to reflect the continued price pressures from food and energy, though to a lesser extent than in at the wholesale level. Overall CPI is forecast to hold steady in May, while core CPI is expected to rise 0.1%. At the same time, the NY Fed Empire State Index is expected to rise to a reading of

14.0 in June after falling in May. The US Treasury International Capital System (TICS) data is due at 1300GMT, shortly followed at 1315GMT by industrial production, which is expected to rise 0.2% in May after a flat reading in April that resulted from a shortage of motor vehicle parts from Japan. Stocks data at 1430GMT.US data then continues with the weekly EIA Crude Oil

Resistance 3: Y81.80 (May 31 high)

Resistance 3: Chf0.8610 (50.0 % FIBO Chf0.8890-Chf0.8330)

Resistance 3: $ 1.6550 (May 31 high)

Resistance 3: $ 1.4550 (Jun 10 high, 61.8 % FIBO $1.4990-$ 1.4320)

08:30 UK Claimant count (May) 5000 12400

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.