- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 12-05-2011.

Brown Brothers Harriman strategists say global investors are increasingly paying attention to the risks stemming from Greece restructuring its debt and the possibility that this restructuring might involve lowering rates and extending maturities. One of the key issues is that what is now a sovereign crisis could become a banking crisis for Greece, "and beyond," they say. "A large haircut would wipe out Greek banks for all practical purposes and severely hurt foreign

banks," they say. BIS data suggests that foreign exposure to the sovereign debt of Greece, Ireland, and Portugal is roughly $266 billion which is "about half as much as foreign exposure to peripheral banks ($488 billion) and non-financial businesses ($100 billion) combined," the strategists say. They note that "ECB's Gonzalez-Paramo and Starkhave both recently warned that a Greek debt restructuring could trigger a Lehman-type banking crisis (or worse) in Europe."

Stocks have eased off of session highs at the same time that the dollar has made a move up from its session low. The dollar is still down with a 0.1% loss and the stock market is still up with a solid gain, though.

Consumer staples stocks continue to climb. The sector is now up 1.2% as participants show a preference for defensive-oriented issues. That preference has lifted the telecom sector to a 0.9% gain, the health care sector 0.8% higher, and the utilities sector up 0.7%. Financials are still lagging; their 0.3% loss makes them the worst performing sector of the day.

Pushed to a fresh high for the day around $1.4275 as a rebound in Dow and a recovery and surge in crude oil to fresh highs for the day renewed risk-appetites, no doubt the allure of stops associated with earlier sales into the 55d ma also played a part. Euro stalls and reverses, talk had suggested $1.4280 (50% of the latest fall) as another sell area but talk has mentioned stops above $1.4285. Break above will target $1.4310 (61.8%), ahead of $1.4350. Closest support eyed around $1.4230.

The euro erased a decline against the dollar as Lucas Papademos, a former European Central Bank vice-president who’s now an adviser to the Greek government, said that restructuring the country’s debt is not necessary.

The shared currency earlier slid versus the greenback after officials from the European Union, European Central Bank and International Monetary Fund began yesterday their fourth evaluation of Greece’s economy.

EU Economic and Monetary Affairs Commissioner Olli Rehn said the delegation will need “a few weeks” to determine Greece’s financing needs and the potential size of any new aid.

“The market is really focused on the Greek situation and any euro bounces are an opportunity to sell,” said Greg Salvaggio, senior vice president of capital markets at currency- trading firm Tempus Consulting Inc in Washington. “There is a 70 percent chance they will have to restructure Greece’s debt, and that would open Pandora’s box.”

The yen strengthened against most of its major counterparts as falling commodities and stocks prompted investors to unwind bets on higher-yielding assets.

Australia’s dollar was among the worst performers versus the greenback as China raised its banks’ reserve requirements to restrain prices, adding to the likelihood its growth will slow, and raw materials slid for a second day. The euro touched the lowest level against the dollar in more than six weeks as concern persisted that Greece will have to restructure debt.

“With commodities coming off, equities coming off, you’re going to see risk aversion, and you’ll see the dollar and yen benefit,” said John McCarthy, director of currency trading at ING Groep NV in New York. “The euro still looks quite heavy.”

The S&P 500 recently came in touch with the neutral line, but it failed to extend the move. That has invited some renewed selling interest, which has dropped the benchmark Index back to a narrow loss.

The stock market's recent climb coincided with a pullback by the dollar. The dollar had been up above its 50-day moving average to a monthly high earlier this morning, but it has had a hard time holding on to gains. A recent slip has left the Dollar Index down with a 0.1% loss.

Improvement among commodities has also come amid the dollar's downturn. The CRB Commodity Index was down about 1% a couple of hours ago, but now it is off by only 0.3%

Stocks remain in the red following a failed attempt to move higher. The ill-fated climb actually saw the Nasdaq come within close reach of the flat line.

Financials have been a heavy drag on trade today. The sector's 1.1% loss takes it to its lowest level of 2011.

Weakness within the financial sector is widespread. Franklin Resources (BEN 126.82, +0.61), Invesco (IVZ 24.68, +0.14), and Chubb (CB 65.17, +0.15) are among the few that have managed to tick higher today. Goldman Sachs (GS 144.16, -3.72) and Citigroup (C 41.92, -1.00) are the worst performers. Their weight has also made them the heaviest drags on trade.

EUR/USD $1.4240, $1.4145, $1.4100, $1.4055, $1.4000, $1.4450

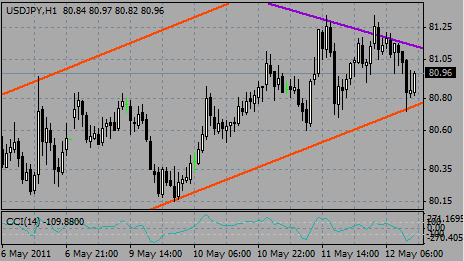

USD/JPY Y80.00, Y80.30, Y81.00, Y81.50, Y81.90, Y82.05, Y82.30

EUR/JPY Y115.70, Y116.50

GBP/USD $1.6500, $1.6600

USD/CHF Chf0.8900

AUD/USD $1.0600, $1.0655, $1.0700

GBP/USD A$1.5550

U.S. stocks were poised to open lower Thursday as commodity prices sold off for a second day and investors digested reports on the labor market and retail sales.

Stocks fell sharply Wednesday, as energy and materials stocks got slammed by a sell-off in oil and gasoline futures. That selling continued early Thursday, with oil prices down 2.6% to $95.62 a barrel.

Other commodities were also selling off in early trading, with silver futures down 5.5% to $33.58 an ounce, and gold futures dropping to 0.9% to $1488.90 an ounce.

Oil executives from Chevron (CVX, Fortune 500), Shell (RDSA), BP (BP), Exxon Mobil (XOM, Fortune 500) and ConocoPhillips (COP, Fortune 500) are headed to Washington to testify before Congress.

Economy: The number of people who filed for first-time unemployment benefits in the most recent week fell to 434,000, down from the previous week but worse than economists' expectations. Initial unemployment claims have been stuck above the key 400,000 level for four weeks.

Offsetting that bad news was retail sales, which rose 0.5% in April, according to the Commerce Department. But the bulk of the gains came from increasing gas and food prices so the optimism may fade.

Companies: Companies scheduled to report quarterly results on Thursday include department store chains Kohl's (KSS, Fortune 500) and Nordstrom (JWN, Fortune 500).

GBP/USD drags lower below earlier low/support at $1.6250. Rate extends corrective pullback to $1.6235 as stops triggered in the move. Next support noted into $1.6230, a break to expose tech support at $1.6220/15 ahead of $1.6200.

Data released:

08:30 UK Industrial production (March) 0.3% 0.7% -1.2%

08:30 UK Industrial production (March) Y/Y 0.7% 1.2% 2.4%

08:30 UK Manufacturing output (March) 0.2% 0.3% 0.0%

08:30 UK Manufacturing output (March) Y/Y 2.7% 2.8% 4.9%

09:00 EU(17) Industrial production (March) -0.2% 0.4% 0.6 (0.4)%

09:00 EU(17) Industrial production (March) Y/Y 5.3% 6.3% 7.7 (7.3)%

The dollar strengthened against the majority of its most actively traded peers as commodity prices and stocks slumped.

The Dollar Index, which tracks the greenback against the currencies of six major U.S. trading partners, climbed to the highest in three weeks as the Stoxx Europe 600 slid 1.1%, following a decline in U.S. and Asian equities.

The euro fluctuated between gains and losses versus the dollar amid speculation Greece may have to restructure debt.

The pound fell against the dollar after a report showed manufacturing rose less than estimated, giving the Bank of England leeway to hold its main interest rate at a record low for longer to spur growth.

Sterling also declined against the Japanese yen and retreated from a seven-week high against the euro. Manufacturing output rose 0.2% in March from the month before, the Office for National Statistics said today, below the 0.3% median estimate. A separate release showed industrial production rose 0.3% from February, less than the 0.8% survey forecast.

EUR/USD failed to hold around daily highs on $1.4230 and retreated to $1.4177. Attemps to go back to highs were short-lived and euro fell to $1.4120. Currently rate recovers, holding around $1.4177.

GBP/USD fell sfter the weak UK data from $1.6380 to the lows around $1.6250. Rate currently trades at $1.6277.

USD/JPY weakened from Y81.30 to Y80.70. Currently rate holds around Y81.00 - at Y80.95.

Retail sales probably climbed in April, showing growing employment is enabling Americans to withstand higher costs for groceries and gasoline, economists said before a report today. The projected 0.6% gain in purchases would follow a 0.4% March increase, according to the median forecast of economists.

The Commerce Department’s sales figures are due at 12:30 GMT. Economists’ estimates ranged from gains of 0.2% to 1.2%.

The Labor Department will also issue two reports at 12:30 GMT. One may show jobless claims fell by 44,000 to 430,000 last week.

The other may show producer prices rose 0.6% in April after increasing 0.7% the prior month.

June WTI crude oil posts a new day's low of $95.46, a bit higher of support at $94.97 and the 6 May low of $94.62. Crude currently trades around $95.62 per barrel.

USD/CAD currrently holds around C$0.9677/80 after triggering offers at C$0.9676/77. Rate printed session high on C$0.9684 with resistance is around options at C$0.9725.

Renewed worries about Greece debt and another sell-off in the commodities market drove the euro sharply lower on Wednesday and the selling continued today.

Speculation over whether Greece will receive more bailout funding kept risk appetite volatile as investors continued to price in a high probability that the country will eventually need to restructure its debt.

Comments from a German deputy finance minister that euro zone officials will debate Greece's debt crisis next week but that no decision will be taken added to uncertainty as markets fret over the potential for a Greek debt restructure.

Greece is not the only source of worry for investors, with Finland delaying a parliamentary vote on the EU's Portugal bailout plan to Friday from Wednesday because the country's second-largest party remained undecided.

The Finnish parliament's approval is important because it, unlike others in the euro zone, has the right to vote on EU requests for bailout funds.

Sterling fell today in correction after Wednesday it reached the highest since March 24 against the euro after the Bank of England raised its medium-term inflation forecasts, with markets now expecting a UK rate hike by year-end.

EUR/GBP breaks below stg0.8700 - the move that provides cable with some support. GBP/USD trades around $1.6283, off post UK IP react lows of $1.6256. The cross trades around stg0.8690, off its post data high of stg0.8728. Cable support now seen at $1.6268 (76.4% $1.6256/1.6306), a break to open a retest of earlier lows at $1.6256, and demand interest placed toward $1.6250.

USD/JPY refreshed session lows around Y80.82 and sharply retreated to current Y80.80. Large bids ahead seen in the Y80.50/55 area.

EUR/USD failed to back above $1.4200 and resumed decline, currently holding near session lows on $1.4172. Break under stops zone $1.4168 seen taking rate down to $1.4164. Heavier stops noted below $1.4160, which could allow rate to push through expected support in the $1.4155/45 area.

EUR/JPY Y115.70, Y116.50

GBP/USD $1.6500, $1.6600

USD/CHF Chf0.8900

AUD/USD $1.0600, $1.0655, $1.0700

GBP/USD A$1.5550

Hang Seng -1.14% 23,026

Nikkei -1.50% 9716.65

UK data sees Industrial Production for March at 0830GMT. Forecasts are for better UK manufacturing data, with Manufacturing output up 0.4% m/m, 2.8% y/y and industrial output up 0.8% m/m, 1.1% y/y. In light of the weak February monthly data, the Q1 GDP numbers entail a rebound in both manufacturing and industrial production in March. However, this data represents old news for policymakers. The April CIPS numbers suggest the pace of growth in the manufacturing sector eased in the second quarter.

US data starts at 1230GMT with the weekly jobless claims and also retail sales and PPI for April. Initial jobless claims are expected to fall 44,000 to 430,000 in the May 7 week after surging in the previous week on special factors that should be reversed in the current

week. Retail sales are expected to rise 0.6% in April. Industry auto sales rose slightly in the month from the previous month, while gasoline prices rose further according to AAA. Sales excluding motor vehicles are expected to be up 0.6% as well. The data will include the annual revisions already released. At 1400GMT by business inventories, which are expected to rise 0.9% in March. Factory inventories were already reported up 1.1%. The data will include the annual revisions to the retail sales data.

The Canadian dollar weakened a day after Finance Minister Jim Flaherty said the government wants to avoid extreme currency fluctuations.

Crude oil for June delivery fell 4.8% to $98.90 a barrel.

Supplies of crude in the U.S., Canada’s biggest trading partner, jumped 3.78 million barrels to 370.3 million in the week ended May 6, the Energy Department said today in a weekly report. Inventories were forecast to climb by 1.5 million barrels. The increase puts supplies at the highest level since May 8, 2009.

Canadian employers added a net 58,300 jobs in April after a decrease of 1,500 in the previous month, Statistics Canada reported last week. The median forecast of economists was for an increase of 20,000. The jobless rate unexpectedly dropped to 7.6%.

The nation reported a fourth straight trade surplus in March, the longest string since November 2008 and a sign that exporters are recovering from the global recession.

The surplus widened to C$627 million ($658 million), larger than the C$400 million median forecast.

The pound gained versus the dollar and the euro after the Bank of England said it sees inflation “markedly higher” in the near term, boosting speculation that borrowing costs will rise from record low levels.

The Bank of England left its main interest rate at a record-low 0.5 percent on May 5, three days after King indicated he favors keeping borrowing costs on hold, even as inflation accelerates at twice the bank’s 2% limit.

This morning also sees a series of regular reports with the IMF Regional Economic Outlook for Europe at 0730GMT and both the latest ECB Monthly Bulletin and IEA monthly oil market report at 0800GMT. EMU industrial output for March then follows, at 0900GMT.

UK data sees Industrial Production for March at 0830GMT. Forecasts are for better UK manufacturing data, with Manufacturing output up 0.4% m/m, 2.8% y/y and industrial output up 0.8% m/m, 1.1% y/y. In light of the weak February monthly data, the Q1 GDP numbers entail a rebound in both manufacturing and industrial production in March. However, this data represents old news for policymakers. The April CIPS numbers suggest the pace of growth in the manufacturing sector eased in the second quarter.

US data starts at 1230GMT with the weekly jobless claims and also retail sales and PPI for April. Initial jobless claims are expected to fall 44,000 to 430,000 in the May 7 week after surging in the previous week on special factors that should be reversed in the current

week. Retail sales are expected to rise 0.6% in April. Industry auto sales rose slightly in the month from the previous month, while gasoline prices rose further according to AAA. Sales excluding motor vehicles are expected to be up 0.6% as well. The data will include the annual revisions already released. At 1400GMT by business inventories, which are expected to rise 0.9% in March. Factory inventories were already reported up 1.1%. The data will include the annual revisions to the retail sales data.

- IMF confirms UK GDP forecast of +1.7% in 2011, +2.3% in 2012. IMF confirms UK inflation fcst +4.2% in 2011, +2.0% in 2012.

- commodity prices to lift inflation further over 2011.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.