- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 10-06-2011.

The euro declined against the dollar for the third day, extending the first weekly drop in almost a month, as European Central Bank President Jean-Claude Trichet signaled a slowing pace of interest-rate increases this year.

The euro has lost 1.9% this week.

The ECB yesterday left its inflation forecast for next year unchanged at 1.7% while he signaled the bank intends to lift the benchmark interest rate in July.

The greenback has gained 1% this week.

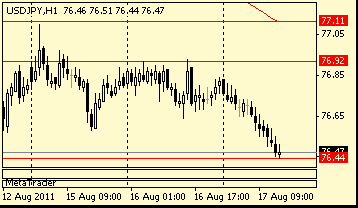

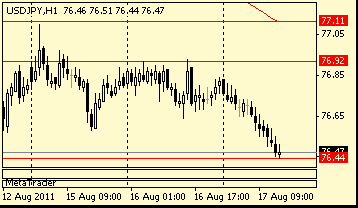

“Exporters are selling the dollar and buying the yen,” said Takashi Kudo at NTT SmartTrade Inc..

The Japanese currency also rose against higher-yielding currencies as stocks and commodities declined, boosting demand for the yen as a refuge.

The Standard & Poor’s 500 index fell 1.2%, heading for its sixth weekly loss.

Crude oil fell below $100 a barrel, sliding as much as 3.1% to $98.7 in New York.

The major market averages are off their worst levels, but are still seeing losses of 1.1% or more for the session.

The S&P 500 Financial Index is under pressure, trading down 1.6% and sporting the largest losses among the 10 S&P 500 sectors.

Insurance giant Travelers (TRV 59.25, -1.83) is seeing the biggest drop trading down 3.0%.

Among other financials banking giants JP Morgan Chase (JPM 40.27, -0.71) and Wells Fargo (WFC 25.77, -0.45) are each down 1.7%.

Stocks are off their worst levels of the session, but are still sharply lower. All three of the major market averages are seeing losses of 1.2%.

Shares of Toyota Motor (TM 80.81, -1.11) are off 1.4% after the company said it is expecting full year 2012 revenues of JPY280 billion, well below the consensus of JPY432 billion.

Fellow Japanese automaker Honda Motor Corp. (HMC 36.88, -0.32) is trading down 0.9% on the news.

Crude oil continues to tumble, partly on a lack of topside followthrough, partly on risk aversion, and partly on a report in the al-Hayat newspaper stating that Saudi Arabia will boost production in July to 10 million barrels per day (from 8.8mn in May), traders say. It's largely expected after the lack of agreement at this week's OPEC meeting, they note. The front contract holds at $99 per barrel, down from an earlier high of $102.15 and up from a low of $98.79. In May, crude posted a 31-month high of $114.83 (May 2) only to fall to $94.63 (May 6). This month, oil has traded in a $97.74 (June 7) to $103.31 (June 1) range.

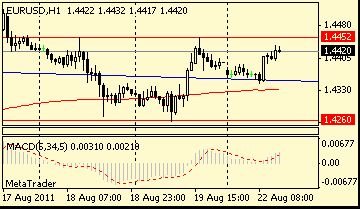

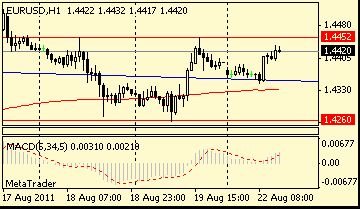

EUR/USD continues to go down and currently holds around lows on $1.4386. Resistance is near recent lows on $1.4440. Rate earlier triggered bids between $1.4440/30 area to spurr the decline.

The major market averages continue to sport moderate losses in early action. The Dow and S&P lead today's decline, each trading down 0.8%

Shares of Lululemon Athletica (LULU 90.97, +4.83) are higher by close to 5.5% at the open after the company announced strong first quarter earnings. The company made $0.46 per share, topping the consensus estimate of $0.38 per share. Revenues climbed 35.1% YoY to $186.8 million, and the company issued upside guidance of $0.42-$0.44 versus the Capital IQ consensus of $0.39. The company also raised its full year 2012 guidance, seeing earnings per share of $2.10-2.16 vs. $2.08 Capital IQ consensus estimate, up from $1.90-2.00 and full year 2012 revenues of $915-930 mln vs. $924.48 mln Capital IQ consensus estimate, up from $885-900 mln.

- See risk of second round inflation effects in EMU;

- Emerging markets likely to push commodity prices up more;

- Though inflation driven by commodities, still concerned;

- Will change monetary policy stance whenever necessary;

- Keeping interest rates too low for too long is risky;

- Global monetary policy stance remains very accommodative;

- Volatility is extensive, uncertainty unusually high;

- ECB's main financing rate will become more relevant in future;

- See decreasing dependence of banks on ECB refinancing;

- National governments must address imbalances urgently.

U.S. stocks were set to open slightly lower Friday, as investors remain nervous about the slowing economic recovery.

Despite the rebound Thursday, market sentiment is still pessimistic. The Dow and S&P 500 are on pace to post their sixth-consecutive weekly loss.

The selling has been driven by concerns about the economy, following a series of weak reports on the job market, housing and manufacturing activity.

Companies: Toyota (TM) released its forecast for the fiscal year 2012 Friday morning. The auto giant said the fallout from the March earthquake and tsunami will continue to hurt sales, and cause supply disruptions across the industry.

In it's report, Toyota said it could lose $1.6 billion in profits in the current fiscal year. The automaker said it also expects consolidated net income to drop 31% to $3.4 billion in the next fiscal year ending March 31.

Toyota also forecast operating income to drop about 35% for the next business year, based on current exchange rates between the yen and the US dollar.

Lululemon Athletica's (LULU) stock jumped nearly 3% after the maker of athletic clothing reported a profit that topped estimates and raised its outook.

Shares of Fusion-io (FIO) extended their rally, rising 4% in premarket trading. Fusion-io made its public debut Thursday after raising $233.7 million through an initial public offering.

Online music streaming company Pandora said it would sell a total of 14.7 million shares through its previously announced IPO at a price range of $10-$12 a share.

Comcast (CMCSA, Fortune 500) and Micron Technology (MU, Fortune 500) stocks were also on the move early Friday.

Economy: The government reported import prices for May rose 0.4%, excluding oil. That comes after a 0.6% increase in the prior month.

Excluding agriculture, exports increased by 0.5%. That followed a 1.0% increase in April.

World markets:

Oil for July delivery fell 96 cents to $100.97 a barrel.

Gold futures for August delivery slipped $1.40 to $1,540.70 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3% from 2.96% late Thursday.

EUR/USD

Offers: $1.4495/500, $1.4520, $1.4540/50, $1.4600

Bids: $1.4430, $1.4425/20, $1.4405/00, $1.4380

- Personally favor private sector involvement in Greece;

- Private sector involvement must be purely voluntary;

- Large private sector involvement w/out coercion unlikely;

- PSI not needed economically, may be good politically;

- Must end fruitless discussions, focus on program;

- We don't participate in any greek bailout negotiations;

- Won't accept greek debt after greek credit event;

- Current ideas implicitly consider an ecb involvement;

- 2012 hicp are staff fcast, gc sees upside infl risks;

- Staff fcst based on assumption of rising s-term rates;

- Exit from fixed rate full allot still under discussion;

- Must address addicted banks problem, will take some months;

- Liquidity support does not prevent price stab monpol;

- ECB balance sheet risk is manageable

The euro declined versus the dollar, headed for the first weekly drop in four, amid prospects the European Central Bank will slow the pace of interest-rate increases this year.

The common currency fell on concern a resolution to Europe’s sovereign-debt crisis will be delayed after ECB President Jean- Claude Trichet rejected any direct participation in a second bailout for Greece. Euribor futures rose, pushing the implied yield on the March 2012 contract down four basis points to 1.93 percent, as traders reduced bets policy makers will boost rates. People expect the ECB to be on hold after raising rates in July.

The euro pared its decline against the dollar as the Bundesbank raised its forecast for German growth to 3.1 percent this year. Gross domestic product will expand 3.1 percent this year and 1.8 percent in 2012, the Frankfurt-based central bank said in its bi-annual economic outlook today. That compares with a February prediction of 2.5 percent growth for this year and a December forecast of 1.5 percent for 2012.

New Zealand’s dollar approached a record high versus the greenback after data showed China’s imports increased in May. The yen climbed against all its main counterparts on speculation Japanese exporters took advantage of yesterday’s biggest drop this month to buy the currency.

US data starts at 1230GMT with the May-11 Import/Export Price Index. At 1800GMT, the U.S. Treasury is expected to post a $140.0 billion budget gap in May, compared with the $135.9 billion gap in May 2010.

Dropped from around C$0.9755 to C$0.9725 on release of better than forecast Canadian jobs data. Bids seen placed between C$0.9725/20 A break to open a deeper move toward C$0.9700 ahead of C$0.9670/65.

EUR/USD $1.4500, $1.4400, $1.4375

USD/JPY Y79.50, Y79.75, Y80.00, Y80.40, Y80.65

EUR/JPY Y116.10, Y115.05, Y115.00

GBP/USD $1.6340, $1.6370

USD/CHF Chf0.8420/30

AUD/USD $1.0500

AUD/JPY Y84.50

European shares fell on Friday on persistent concerns about the pace of global economic recovery, though stocks pared losses after the German parliament voted in favour of a motion to approve new aid for Greece.

- Real eurozone economy is doing surprisingly well;

- Countries making adjustments but more needed;

- Europe fiscal exit strategy on track, unlike US, Japan.

USD/JPY Y79.50, Y79.75, Y80.00, Y80.40, Y80.65

EUR/JPY Y116.10, Y115.05, Y115.00

GBP/USD $1.6340

USD/CHF Chf0.8420

AUD/USD $1.0600, $1.0500

AUD/JPY Y84.50

Average CPI +2.5% in 2011, +1.8% in 2012

Unemployment well below 3 mln in 2012; rate 6.5%

Recovery extends to $1.6264, after post data lows of $1.6215, with euro-sterling dropping back from its initial data react high of stg0.89225 to ease under the figure. Resistance in cable now seen at $1.6280/85.

May Producer Output Prices +0.2% m/m; +5.3% y/y

May Producer Input Prices -2% m/m; +15.7% y/y

Nikkei 9,514 +0.50%

S&P/ASX 4,562 +0.27%

Shanghai Composite 2,705 +0.07%

At 0900GMT, the Bundesbank is due to the publish bi-annual German economic outlook repor.

US data starts at 1230GMT with the May-11 Import/Export Price Index. At 1800GMT, the U.S. Treasury is expected to post a $140.0 billion budget gap in May, compared with the $135.9 billion gap in May 2010.

The euro fell, erasing earlier gains, after European Central Bank President Jean-Claude Trichet’s 2012 inflation forecast prompted traders to scale back bets for the pace of interest-rate increases.

The shared European currency slid against the dollar after climbing as much as 0.5 percent, even after Trichet said at a press conference in Frankfurt that “strong vigilance” is needed to contain inflation, which means policy makers may boost rates in July. The ECB revised its 2012 inflation and gross domestic product forecasts.

The ECB said inflation next year will accelerate between 1.1 percent and 2.3 percent, compared with an earlier forecast of 1 percent to 2.4 percent. Policy makers see growth in 2012 of 0.6 percent to 2.8 percent, from a previous range of 0.8 percent to 2.8 percent.

The common currency also declined amid renewed concern that Greece may need to restructure its debt.

The Dollar Index rose today as the U.S. trade deficit unexpectedly shrank 6.7 percent to $43.7 billion in April, Commerce Department figures showed today.

New Zealand’s currency climbed to a record after the nation’s central bank said borrowing costs will need to rise in the next two years.

The Bank of England kept its benchmark rate unchanged at 0.5 percent at today’s meeting.

UK data includes industrial production and PPI at 08:30 GMT.

At 0900GMT, the Bundesbank is due to the publish bi-annual German economic outlook repor.

US data starts at 1230GMT with the May-11 Import/Export Price Index. At 1800GMT, the U.S. Treasury is expected to post a $140.0 billion budget gap in May, compared with the $135.9 billion gap in May 2010.

Resistance 3: Y81.80 (May 31 high)

Resistance 3: Chf0.8610 (50.0 % FIBO Chf0.8890-Chf0.8330)

Resistance 3: $ 1.6550 (Jun 2 high)

Resistance 3: $ 1.4690 (Jun 7-8 high)

06:00 Germany CPI (May) final 0.0% 0.0%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.