- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 08-04-2011.

Listless trade continues to keep the stock market clinging closely to the neutral line. That is why the S&P 500 is on pace to conclude the week in line with where it started.

The dollar's drop has helped bolster commodities, which continue to climb. As such, the GS Commodity Index is up 1.9%.

The dollar dropped against most of its major counterparts as lawmakers failed to agree on a federal budget, increasing the likelihood of a government shutdown, and as signs of global growth damped demand for haven assets.

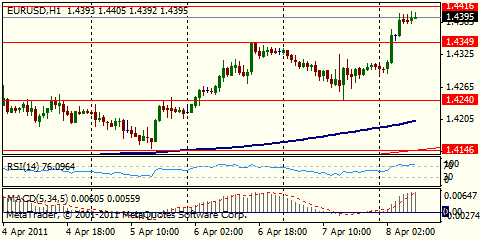

The euro reached an almost 15-month high versus the dollar after a report showing German exports rose the most in five months, boosting bets that policy makers will lift interest rates further to curb inflation.

“The main driver behind dollar weakness today is the market concern about a government shutdown,” said Paresh Upadhyaya at Bank of America Corp.

Leaders in Congress remained divided about a budget, hours away from potentially the first U.S. government shutdown in 15 years.

Europe’s currency has rallied 7.8% against the dollar this year as economic growth in Germany and accelerating consumer prices in the euro region boosted expectations that interest rates will need to rise to curb inflation, which reached a two-year high of 2.6% in March.

A report showed German exports jumped 2.7% in February from a month earlier, when they dropped 1%. That was the biggest month-on-month increase since September and above the 2% median estimate.

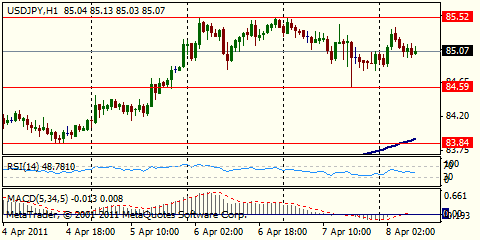

The ECB’s decision to raise its main rate yesterday comes as the central banks of other developed nations, including the U.S. and Japan, keep borrowing costs near zero to support their economies as they recover from the financial crisis.

The Fed isn’t expected to raise its target funds rate until the first quarter of 2012 and the Bank of Japan will probably keep borrowing costs on hold for the next 12 months, the median estimates in two Bloomberg surveys show.

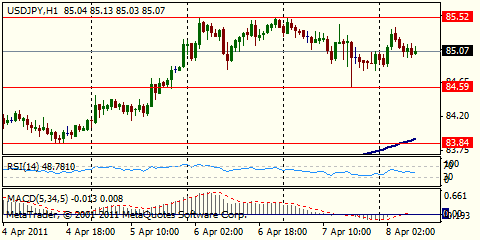

The yen headed for a fourth weekly drop versus the euro, the longest losing streak in 20 months, on speculation the BOJ will continue with accommodative monetary policy to help its economy recover from a record earthquake on March 11.

The BOJ yesterday unveiled a 1 trillion yen, one-year loan program to companies affected by the quake and tsunami as board members downgraded their economic assessment for the first time since October.

BJ's Wholesale (BJ 50.21, +0.83) reported yesterday that same-store sales for March increased by more than 5%, which is greater than what had been widely expected. Although it finished off of its session high, the stock was able to put together a solid gain yesterday. Today it has added to that advance with help from an analyst upgrade at Goldman Sachs.

In contrast, Costco (COST 76.92, -0.90) is under considerable pressure after analysts at Goldman Sachs downgraded the stock. Costco actually reported yesterday a stronger-than-expected 13% increase in same-store sales for March. That news helped the stock score a record high in the prior session.

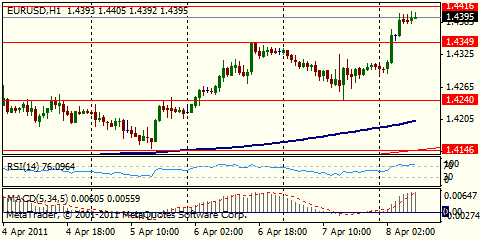

EUR/USD weakens and currently holds around $1.4422 area after the European close. Earlier rate printed session high on $1.4445. Budget wrangling ongoing in the US, some think that an agreement may give the dollar some respite. Offers and stops clustered around $1.4450.

WTI Crude off the day's highs around $111.88 with a fall over the last hour to $111.01 before settling around $111.30/35. The move seen as some profit taking ahead of the weekend. Resistance remaining at $112.94 with support at $110.09 and $109.66.

Support for stocks has moderated in the first few minutes of trade, causing the major equity averages to give back some of their opening gains. The early pullback has impacted almost every major sector, except health care and energy. They are up 0.5% and 0.7%, respectively.

Treasuries are still under pressure. As a result of renewed selling interest, the yield on the benchmark 10-year Note set a new one-month high near 3.60% this morning.

U.S. stocks were headed for a slightly higher open Friday, as oil and gold prices spiked and investors awaited news about the pending government shutdown.

Oil prices rose as high as $111.90 a barrel Friday, a day after Japan was hit with another earthquake.

Precious metals also rallied, with gold hitting an intraday record of $1,472.60 an ounce.

Government shutdown The federal government faces a shutdown in less than 24 hours unless Congress and the White House reach agreement on a budget for the remainder of fiscal 2011 by midnight

Companies: Shares of Expedia (EXPE) surged 13% in premarket trading. The travel site operator announced late Thursday that it planned to split itself into two companies. One for TripAdvisor and another for the other Expedia businesses, which include Hotels.com and Hotwire.

Economy: Investors will get February wholesale inventories figures from the Commerce Department at 14:00GMT.

Economists expect a rise of 1% versus 1.1% in January.

World markets:

The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 3.59% from 3.55% late Thursday

EUR/USD

Offers: $1.4430/35, $1.4450/55, $1.4480, $1.4500

Bids: $1.4350/40, $1.4325/20

- But size of Portugal plan depends on many factors;

- Portugal program most likely three years.

The euro gained versus the dollar, extending a second weekly advance, after a report showing German exports rose the most in five months boosted bets that policy makers will lift interest rates further to curb inflation.

A report today showed German exports jumped 2.7 percent in February from a month earlier, when they dropped 1 percent. That was the biggest month-on-month increase since September.

“You can’t ignore the yield story with the euro,” said Chris Walker, a foreign-exchange strategist at UBS AG in London. “The incentive for the ECB to raise rates is going to keep the euro supported. The main justification for rate hikes in the euro zone has been that the German economy is motoring ahead.”

The European Central Bank yesterday raised its main refinancing rate to 1.25 percent from a record-low 1 percent and left the door open for further increases.

The ECB’s decision to raise its main rate yesterday comes as the central banks of other developed nations, including the U.S. and Japan, keep borrowing costs near zero to support their economies as they recover from the financial crisis. The Federal Reserve is not expected to raise its target funds rate until the first quarter of 2012 and the Bank of Japan will probably keep borrowing costs on hold for the next 12 months, the median estimates in two Bloomberg surveys show.

EUR/USD: trades above $1.4400.

USA Wholesale inventories data are due at 14:00 GMT.

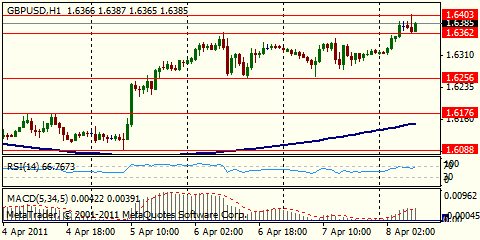

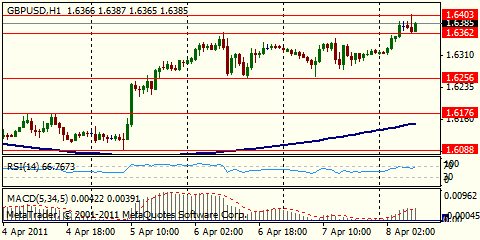

RBS has changed its Bank of England rate forecast and now look for the first move in August in the wake of UK construction output data. RBS previously looked for a hike in May. "Today's ONS construction data show that not only have the downside risks to Q1 GDP that we flagged in our previous Tracker (6 April) crystallised, but the underlying data appear dramatically weaker than previously assumed", said RBS.

Bids are now tested at $1.6360. Stops are seen in place below $1.6350. Break lower will open the way to $1.6310, ahead of the stronger support around April 6-7 base $1.6260/55. Offers seen at $1.6415, a break to expose earlier highs at $1.6430. Stops noted above $1.6445, which if triggered brings the 2010 high at $1.6459 into view. More stops noted above $1.6460.

Metals are continuing to post fresh highs on a weaker dollar, inflation concerns following the rapid rise of Crude oil prices, and safe-haven investment.

- Stresses 'solidarity is not a one-way-street'

- Countries must conduct solid econ, fiscal policies

- Eu reforms don't go far enough

- Need tougher sanctions when fiscal rules breached

EUR/USD $1.4400, $1.4325, $1.4315, $1.4300, $1.4215

USD/JPY Y85.50, Y85.00, Y84.80, Y84.00

EUR/JPY Y118.50

GBP/USD $1.6200

AUD/USD $1.0480, $1.0475, $1.0370, $1.0360

Hang Seng +0.47% 24,396.07

UK data dominates the calendar with producer prices, which are released at 0830GMT along with Construction Output data. Input prices are expected to rise markedly, by 2.1% on the month, but base effects would result in the year on year increase declining to 12.6% from February's 14.6%. Output prices in today's data are expected to rise 0.6% on the month to stand 5.1% above levels a year earlier, while core data is forecast at 0.3% m/m, 2.9% y/y.

The euro remain near its highest level in more than a year after European Central Bank President Jean- Claude Trichet said today’s interest-rate increase wasn’t necessarily the “first of a series.”

The ECB raised its key rate by 25 basis points to 1.25 percent.

The euro eased a bit versus its major peers after Portugal’s Prime Minister, Jose Socrates, said yesterday the nation was seeking financial assistance from the European Union.

Portugal plans to make a formal written request to the European Commission for financial aid, government minister Pedro Silva Pereira said in Lisbon. A rescue package for Portugal may be worth as much as 75 billion euros ($107 billion), two European officials with knowledge of the situation said.

The yen strengthened against the dollar after reports of a 7.4 magnitude earthquake off Japan’s coast and tsunami warnings.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.