- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 06-06-2011.

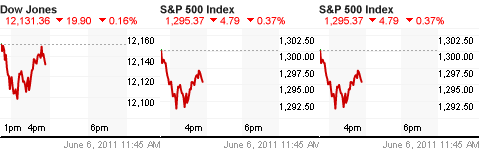

The market continues to hover near the lows, amid a relatively quiet mid-day trade. The S&P just slipped to session lows around 1289 in recent trade, leaving it slightly above technical support in the 1288/1286 zone.

- Greek accord needed before June 20.

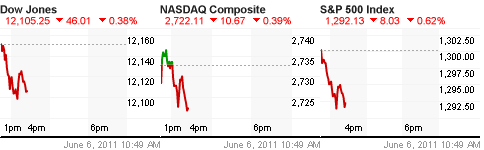

The major market averages trade just near their worst levels of the session as selling has begun to pick up in early afternoon action. Selling continues to have a great impact on the broad-based S&P 500 which is currently trading down 0.7%. The other major averages trail just behind with the Nasdaq off 0.6% and the Dow lower by 0.4%.

Shares of Apple (AAPL 341.11, -2.33) are seeing a sell-the-news reaction to the Apple Worldwide Developers Conference. At the conference CEO Steve Jobs made his first public appearance since March, and highlighted the new OS X Lion operating system for Macs, as well as the iOS 5 operating system for mobile devices, and their new iCloud Internet media service. Shares of the stock have been range bound between $330 and $360 for most of 2011.

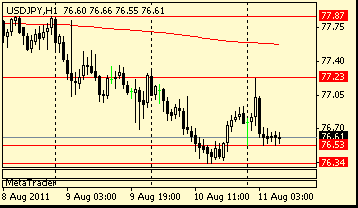

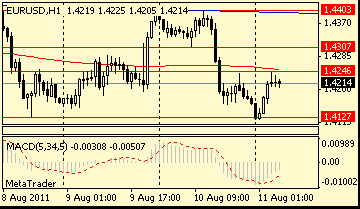

The yen rose against the dollar and the euro as signs the economic recovery is slowing boosted demand for the currency as a refuge.

The Dollar Index rose for the first time in three days after earlier touching the lowest level in a month on speculation the Federal Reserve may keep trying to support economic growth. Global stocks declined.

The MSCI World Index of stocks fell 0.4 percent, and the Standard & Poor’s 500 Index declined 0.5 percent.

“The yen movements suggest that the overall risk confidence remains relatively fragile,” said Vassili Serebriakov, a currency strategist at Wells Fargo & Co. in New York. “Soft U.S. data have been dollar-negative mainly, but today that has been offset today by global equity weakness.”

“There is a perception in the market that the global economic recovery might be stalling and investors are assessing what that means to monetary policy among major economies,” said Jeremy Stretch, London-based head of currency strategy at Canadian Imperial Bank of Commerce. “The yen is likely to benefit in this kind of environment.”

With the European Central Bank forecast to raise interest rates further, the shared currency also may have more room to gain, according to CIBC’s Stretch.

Producer prices in the euro region rose 6.7 percent in April from a year earlier, after a revised 6.8 percent increase in March, the European Union’s statistics office in Luxembourg said today. The March producer-price inflation rate was the highest since September 2008, the month Lehman Brothers Holdings Inc. filed for bankruptcy.

- Commodity prices making major impact on inflation.

The major market averages have climbed off their worst levels of the session, but still trade in negative territory. Weakness in the broader S&P 500 is pacing the decline as the index trades down 0.3% while the Dow and Nasdaq are seeing losses of close to 0.1%

Energy shares are among the worst performers today with the S&P 500 Energy Index trading down 1.1%. Today’s drop coincides with a 1.0% decline in crude oil prices that has dropped West Texas Intermediate to $99.25 per barrel. Heavyweights Exxon Mobile (XOM 80.68, -0.50) Chevron (CVX 100.09, -0.91) are outperforming the S&P Energy Index with losses of -0.7% and -0.9% respectively. Meanwhile, EOG Resources (EOG 111.52, +0.96) is the lone stock in the space trading in positive territory, currently trading higher by 0.7%.

- central bank must remain vigilant in face of rising infl risks;

- weak 4q raises concerns about strength of Iceland recovery.

The major market averages continue to struggle in the early going with all three trading in negative territory. Today's selling has pushed the S&P 500 to its worst level since March 23 as the index trades lower for the fourth consecutive session. A 0.6% drop has the S&P leading the decline with both the Dow and Nasdaq outperforming with declines of 0.4%.

The S&P 500 Consumer Discretionary Index trades just below the flat line, down 0.3%, to outperform the broader S&P 500. Shares of motorcycle maker Harley-Davidson (HOG 37.51, +1.64) are the best performing among S&P 500 listings as rumors of a private equity takeover have provided a boost of 4.4%.

All three of the major market averages are now in negative territory as the S&P 500 leads the decline with a loss of 0.4%.

Financial shares are lower by close to 1.0% in early action as European weakness in the sector has spread to U.S. trade. Wells Fargo (WFC 26.15, -0.71), JP Morgan Chase (40.49, -1.08), Citigroup (C 38.72, -1.11), and Bank of America (BAC 11.00, -0.28) are all lower by at least 2.0%.

Strong IVEY data supported USD/CAD, earlier slipt to C$0.9765. Rate currently holds around C$0.9795. Area of C$0.9750 seen as offering support (100d MA). Offers expected to be near Friday's high area of C$0.9850.

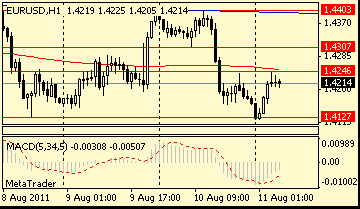

EUR/USD $1.4625, $1.4525, $1.4500

USD/JPY Y80.00, Y80.25, Y81.00, Y81.25, Y81.50, Y82.00, Y82.10

EUR/JPY Y116.80

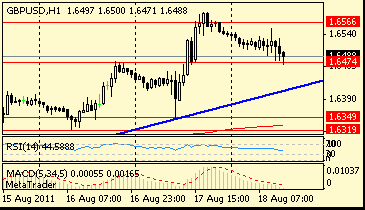

GBP/USD $1.6300

AUD/USD $1.0750, $1.0650

AUD/JPY Y85.25

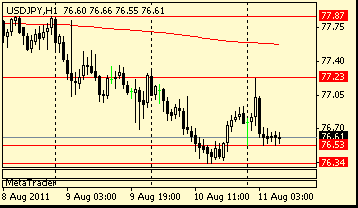

GBP/USD back below $1.6400 - at $1.6386 currently, a bit higher earlier lows on $1.6383. Offers seen at $1.6420/25. Bids now seen into $1.6380, with interest extending toward $1.6370.

U.S. stocks were poised to take a breather Monday, after falling last week following a string of disappointing job news.

U.S. stocks fell sharply on Friday, with the Dow and S&P posting a fifth consecutive week of declines as traders digested a disappointing May jobs report.

With no economic reports on tap for Monday, it could be a volatile session.

Companies: Investors will be monitoring Apple (AAPL, Fortune 500) CEO Steve Jobs' speech at the Worldwide Developers Conference in California. Jobs is expected to unveil a new Apple cloud computing music service and possibly a new version of the iPhone. Shares of Apple edged up slightly in premarket trading.

World markets: European stocks were mixed in morning trading. Britain's FTSE 100 rose 0.2%, the DAX in Germany dipped 0.1% and France's CAC 40 fell 0.8%.

In Asian markets, Japan's Nikkei finished 1.2% lower.

Commodities: Oil for July delivery slipped $1.03 to $99.19 a barrel.

Gold futures for June delivery edged up $1.20 to $1,542.90 an ounce.

USD/JPY tries to recover after dipping to the lows around Y79.96. Bids remain at Y79.80 with a break of which could trigger stops down to Y79.50. Large barrier at this latter level with stops behind. Markets trading around Y80.04.

Data released:

09:00 EU(17) PPI (April) 0.9% 0.9% 0.7%

09:00 EU(17) PPI (April)Y/Y 6.7% 6.7% 6.7%

The Japanese yen rose against the dollar and the euro as a decline in stocks and signs that economic recovery is slowing boosted demand for safe-heaven.

The yen advanced as economic data including last week’s U.S. job report pointed to growth stalling.

The yen’s gain helped to pare its decline this year. The currency is down 5.2%. It has still beaten the dollar, which dropped 6.4% during the same period.

“The general trend of dollar weakening will continue until the Fed signals it’s going to raise rates,” said Greg Anderson, a senior currency strategist at Citigroup Inc..

Payrolls rose 54,000 in May, Labor Department data showed on June 3. That was below the median forecast for an 165,000 increase. The unemployment rate unexpectedly climbed to 9.1% last month from 9% the previous month.

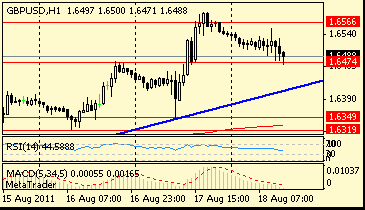

The euro earlier reached a one-month high against the dollar on bets European Union officials will reiterate their intent to craft a new aid package for Greece.

EU and International Monetary Fund officials agreed to pay the next installment to Greece. Greece said a review of the country’s economic progress concluded “positively.”

“I expect the euro group to agree to additional financing to be provided to Greece under strict conditionality,” said Jean-Claude Juncker after meeting with Greek Prime Minister George Papandreou on June 3.

Producer prices in the euro region rose 6.7% in April from a year earlier, after a revised 6.8% increase in March, the European Union’s statistics office said today. The March producer-price inflation rate was the highest since September 2008.

The ECB is expected to leave its 1.25% rate unchanged at its June 9 meeting.

EUR/USD retreated after some consolidation around one-month high on $1.4660. rate later slipped to session lows on $1.4599.

GBP/USD continues to go down from Asian highs on $1.6460. Rate printed session lows near $1.6388 and currently tries to recover.

USD/JPY tested support at Y80.00, but failed to break under to spurr some recover to current Y80.14.

The Canadian Ivey Purchasing Managers Index is also due at 1400GMT.

At 1715GMT, US Treasury Secretary Tim Geithner delivers a speech to the International Monetary Conference in Atlanta.

- Friday's U.S data don't change medium-term prospects;

- see moderate, slow U.S recovery;

- only one direction for interest rates - up;

- challenge is timing the exit right;

- near-zero rates risk creating same problems again;

- infl.threat is not next month, but next year;

- the challenges in Europe are serious.

- Friday's U.S data don't change medium-term prospects;

- see moderate, slow U.S recovery;

- only one direction for interest rates - up;

- challenge is timing the exit right;

- near-zero rates risk creating same problems again;

- infl.threat is not next month, but next year;

- the challenges in Europe are serious.

AUD/USD weakens on continued selling of AUD/NZD ahead of tommorow mornings rate decision by the RBA. Bids now seen at $1.3100/10 with offers at $1.3155/60 (resistance too).

- speculative moves could hit Portugal, Ireland;

- question is if Greece willing to implement plan;

- Greece is solvent if willing to sell its assets;

- cost of reform lower than cost of restructuring;

- in default, banks would need new public money;

- default would severely affect domestic fin.mkts;

- must strengthen monitoring of adjustment programs.

- speculative moves could hit Portugal, Ireland;

- question is if Greece willing to implement plan;

- Greece is solvent if willing to sell its assets;

- cost of reform lower than cost of restructuring;

- in default, banks would need new public money;

- default would severely affect domestic fin.mkts;

- must strengthen monitoring of adjustment programs.

GBP/USD printed lows under $1.6400 - at $1.6392 before recovered to current $1.6409. When slipping, rate triggered stops at $1.6395. Now support is at $1.6375/70 ahead of $1.6350.

Daily studies on gold continue to be mixed as gold struggles to maintain a rally above a 5-week resistance line at $1546.60. Initial resistance seen at $1556.60 (the daily Bollinger band top) and further resistance seen at $1574.5/1575.8 (May 2 high) and the record high of Apr 29.

The euro hovered near a one-month high against the dollar on Monday, boosted by progress over Greek debt financing and a potential widening of interest rate differentials ahead of central bancs' meetings this week.

The euro has jumped almost 4% in the past three weeks as Greece has inched closer to stave off the threat of a default by getting additional financial aid.

The EU and IMF have made clear a new bailout package, following a 110 billion euro deal agreed only a year ago, depends on Athens keeping to its promises for further austerity and accelerated privatisations.

According to a German news magazine Der Spiegel, a new package might cost more than 100 billion euros ($144 billion).

Also the euro is seen rising ahead of the European Central Bank's policy meeting on Thursday, when the bank is expected to prepare markets for an interest rate hike in July.

Such an outcome would widen rate differentials in the euro zone's favour.

"We believe that the ECB is set to signal on Thursday that the next rate hike will be in July and this positive interest rate dynamic will continue to help the euro," said Elsa Lignos, currency strategist at RBC Capital Markets.

By contrast, the dollar was stuck near a fresh one-month low hit against a basket of currencies.

The dollar index dipped as low as 73.643 after the closely-watched non-farm payrolls report last Friday showed a sharp slowdown in job creation, pushing the unemployment rate up to 9.1% from 9.0%.

GBP/USD retains a heavy tone, allows EUR/GBP to track euro recovery. Cross extends highs to stg0.8923, a bit lower Friday's highs at stg0.8924. Offers have been reported around stg0.8925 with stops below. For GBP/USD bids remain near $1.6400, with stops on a break of $1.6395.

USD/JPY Y80.00, Y80.25, Y81.00, Y81.25, Y81.50, Y82.00, Y82.10

EUR/JPY Y116.80

GBP/USD $1.6300

AUD/USD $1.0750, $1.0650

AUD/JPY Y85.25

Nikkei -1.18% 9380.35

The Canadian Ivey Purchasing Managers Index is also due at 1400GMT.

Worries about the outlook for China’s growth rate set a cautious tone on Asian equities markets this week as Beijing’s determination to cool inflation with tighter monetary policy stifled sentiment.

The Shanghai Composite registered its worst close since January at 2,705.18 on Thursday after data on Wednesday showed China’s purchasing managers’ index had dipped to 52 in May from 52.9 in April as the government expanded tightening measures to tame inflation and the property market. That followed HSBC’s manufacturing PMI figures last week, the earliest indicator of China’s industrial activity, which sparked fears with the lowest reading since July 2010.

Hong Kong’s Hang Seng fell 0.7 per cent over the week to 22,949.56. Stubborn worries about the impact of tighter monetary policy on earnings in the banking sector meant it missed out on the Friday recovery seen on the mainland, losing 1.3 per cent. China Construction Bank shed 1.9 per cent to HK$7.06 on Friday, registering a weekly loss of 1.8 per cent. China Overseas Land & Investment fell 1.7 per cent to HK$15.44, a loss of 0.2 per cent for the week.

In Japan, political turmoil added to the region’s sense of economic uncertainty. Although Naoto Kan survived a no-confidence vote to remain as prime minister, his victory came only after he had signalled willingness to resign after making progress on response to the March earthquake and tsunami and nuclear crisis.

The growth concerns, also sparked by weak US data, kept Tokyo’s exporters under pressure. Toyota Motor dropped 1.2 per cent to Y3,230 by the Friday close after its US car sales plunged 28 per cent year-on-year in May, following production shutdowns after the March disaster. The fall took the stock’s weekly loss to 3 per cent. Honda Motor, which gets more than 40 per cent of its sales from North America, shed 0.8 per cent on Friday to Y3,020.

Wider export stocks also fell. Sony, the electronics group, shed 0.6 per cent to Y2,129, hit by news of a fresh hacker attack into its movie unit website.

Meanwhile, Tokyo Electric Power closed on Friday at a record low of Y286.

European markets endured their fifth consecutive week of losses after a profit warning from Nokia and as the termination of Germany’s nuclear power industry was announced, hitting plant operators Eon and RWE.

Underpinning the week’s negative tone were concerns over the outlook for the global economy following a string of soft US economic reports – culminating in Friday’s much weaker than forecast US non-farm payrolls report for May.

Over the week, the FTSE Eurofirst 300 fell 2 per cent to 1,111.51, its biggest weekly fall since March, and its longest run of weekly losses since 2008. It finished off its lows on Friday, however, as news began to emerge of a fresh bail-out deal for Greece.

Nokia’s warning was the latest sign that Europe’s biggest technology company is struggling in the face of competition from the likes of Apple’s iPhone and rivals such as Samsung and HTC, which use Google’s Android operating system. The company said second-quarter sales and operating margins would be “substantially” below its previous forecasts as volumes and prices fell. Nokia ended the week down 22.1 per cent at €4.48, having fallen 17.5 per cent on Tuesday following the warning.

Losses for German utilities Eon and RWE followed the government’s decision to abandon its nuclear programme, setting the deadline for closing all plants by 2022.

Germany’s decision was in part a response to the meltdown at Japan’s Fukushima plant, caused by March’s earthquake and tsunami, which led to increasing safety concerns about the nuclear industry around the world.

The industry had received a brief boost last week on reports the government would scrap a tax on spent nuclear fuel rods, but the country’s environment minister said the levy would remain. RWE fell 6.9 per cent over the week to €38.19, while Eon lost 5.8 per cent to €18.84.

Shares in alternative energy companies were lifted as Germany renewed its commitment to lift the share of energy produced by greener sources. Among the companies that build wind turbines, Denmark’s Vestas Wind Systems gained 4.3 per cent to DKr153.30, while Germany’s Siemens added 1.1 per cent to €91.

Banks, however, were among the worst performing stocks on the FTSE Eurofirst 300 as investors were broadly averse to risk following the run of economic data that appeared to indicate slowing global growth.

Italy’s UBI Banca shed 4.8 per cent to €5.12 and domestic rival Banca Monte dei Paschi di Siena fell 7.6 per cent to €0.79. France’s Natixis lost 6.2 per cent to €3.62.

Cyclical groups reacted sharply to a US job market report that missed already modest expectations.

Technology, down 1.4 per cent, contributed the most to a 1 per cent decline in the S&P 500 index to 1,300.16, its lowest in nearly two and a half months.

Monster Worldwide, the job postings website, dropped 5.7 per cent to $13.58, its lowest since October 2010.

Semiconductor groups continued their decline, as analysts predicted a fall in demand this year. The Philadelphia “Semis” index fell 1.9 per cent, for a 3.3 per cent drop on the week.

The Nasdaq Composite was the biggest loser, falling 1.5 per cent to 2,732.78.

Jabil Circuit, manufacturer of electronics equipment, fell 4 per cent to $19.95, and MEMC Electronic Materials, a maker of solar panel chips, ended 3.6 per cent lower at $9.64.

Analysts at Deutsche Bank, citing declining demand, said they favoured chipmaking groups “that have already taken inventory adjustment”, including Intel, whose shares fell 1.6 per cent to $21.73.

Materials and industrials fell 1.3 per cent. Alcoa, the aluminium producer, sank 1.9 per cent to $15.91, and equipment maker Caterpillar dropped 1.9 per cent to $100.22.

Their losses led the Dow Jones Industrial Average to slip 0.8 per cent to 12,151.26.

Especially hard hit were groups tied to raw materials, even as the dollar slipped. Chemicals group Du Pont shed 1.7 per cent to $50.29, a four-month low. Eastman Chemical fell 2.3 per cent to $100.68.

The US economy produced just 54,000 jobs in May, well below the 165,000 jobs expected by a broad survey of economists, though many had already lowered their expectations to less than 100,000 following poor private figures earlier this week.

The S&P was still less than 5 per cent off its high for the year, falling 2.3 per cent on the week. The Dow and the Nasdaq matched that 2.3 per cent decline over the shortened week.

Shares in Goldman Sachs bounced back 0.7 per cent to $135.33. It fell more than 1 per cent on Thursday on news that the top New York City prosecutor was seeking documents related to its pre-crisis activities.

Retailers were broadly weaker this week after May sales were reported to be below expectations. Target fell 4 per cent to $47.40 and Gap fell 6.7 per cent to $17.92.

Haven currencies such as the yen and Swiss franc moved higher on Friday after an unexpectedly weak monthly US employment report.

The dollar fell 0.6 per cent against the yen and slipped to a record low of SFr0.8336 against the Swiss franc after non-farm payrolls data showed just 54,000 jobs were created in May. The market had expected a figure nearer 150,000.

The payrolls data capped off a week of miserable economic indicators that suggested US growth was stalling. A disappointing PMI manufacturing survey, house buying activity, private sector payroll figures and consumer confidence all combined to undermine risk appetite. Better news on the services sector did little to aid a dollar rally.

Over the week, the dollar fell 0.5 per cent against the yen to Y80.38 and lost 1.6 per cent to SFr0.8355 versus the Swiss franc.

The euro also had a stronger week as traders focused back on interest rate differentials. The US Federal Reserve, following the run of data, looked still some distance away from making a rate move.

The European Central Bank, however, has already lifted its main rate from 1 per cent to 1.25 per cent in May and is expected to deliver a further rise to 1.5 per cent in July.

The euro rose 2 per cent over the week to $1.4602 against the dollar, helped also by growing expectations on Friday of a fresh bail-out deal for Greece.

Sterling fell after weaker than expected services sector data rounded off a poor week of business activity surveys that indicated economic growth in the UK was likely to remain subdued in the coming months.

Sterling was down 0.7 per cent to $1.6391 against the dollar over the week, and had a poor time against most of its rivals, falling 2.8 per cent to £0.8914 against the euro.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.