- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 06-04-2011.

Gainers

Symb Last Change Chg %

AOB.N 1.73 +0.21 +13.82

CEU.N 1.39 +0.15 +12.10

LZB.N 10.81 +0.97 +9.86

TCI.N 4.19 +0.33 +8.55

GMR.N 2.31 +0.18 +8.45

Losers

Symb Last Change Chg %

DL.N 3.28 -0.22 -6.29

NTE.N 6.07 -0.38 -5.89

PRM.N 4.55 -0.25 -5.21

UTA.N 3.65 -0.20 -5.19

MON.N 69.63 -3.69 -5.03

Small-cap stocks have slipped to a 0.2% loss, as measured by the Russell 2000. The Russell 2000 actually set a record intraday high in the early going.

Among the Russell 2000's sharpest movers, La-Z-Boy (LZB 10.78, +0.94) is a top performer following an analyst upgrade. American Superconductor (AMSC 14.63, -10.25) is the worst performer in the space after the company slashed its guidance and announced that a customer that has historically accounted for about three-quarters of business refused delivery of goods from AMSC.

Both the S&P 500 and the Nasdaq Composite have stabilized at the flat line after a recent dip into negative territory. Meanwhile, the Dow continues to cling to a narrow gain. Blue chips continue to be led by Cisco (CSCO 17.92, +0.70). Hewlett-Packard (HPQ 41.14, +0.85) has also provided support.

Outside of the most widely tracked averages, the Dow Jones Transportation Average is currently down 0.4%, but the Dow Jones Utility Average is up 0.6%. Meanwhile, both the S&P 100 and S&P 600 are up 0.1%.

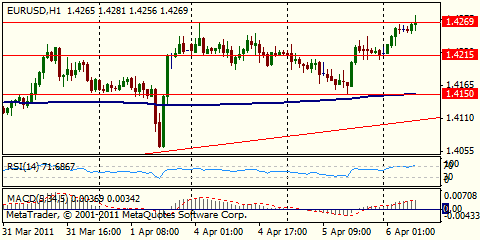

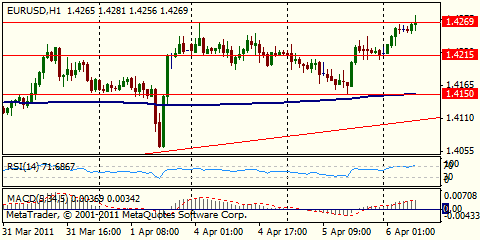

The euro rallied to its highest level against the dollar in more than 14 months on speculation the European Central Bank will increase borrowing costs further after raising its target lending rate tomorrow.

“The assumption in the market is that the ECB will not only raise rates tomorrow, but is likely to engage in further tightening, and that’s really what’s boosting the euro,” said Boris Schlossberg, director of research at online currency trader GFT Forex in New York. “Japan will remain ultra accommodative for as far as the eye can see, and the rest of the world is slowly but surely moving back toward tightening.”

ECB President Jean-Claude Trichet signaled on March 3 that policy makers may raise the benchmark rate at their next meeting to curb inflation, which reached a two-year high of 2.6 percent last month.

The ECB will raise its main rate by 25 basis points from a record low 1 percent tomorrow, according to economists.

Europe’s currency has gained 6.9 percent against the dollar this year as stronger economic growth in Germany and accelerating inflation boosted expectations that policy makers in the 17-member bloc will need to raise interest rates even as nations including Ireland and Portugal struggle to contain debt.

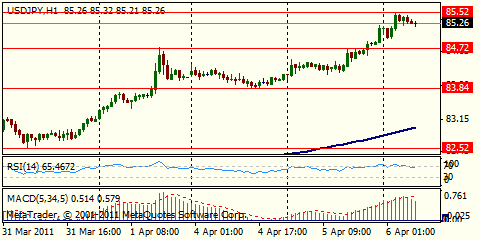

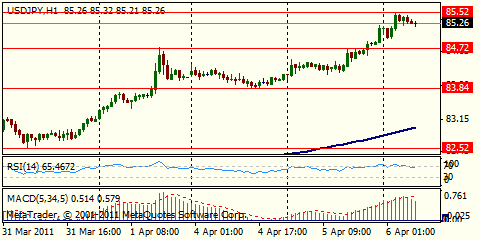

The yen tumbled against all of its major counterparts on bets the Bank of Japan will keep interest rates low as the nation recovers from the earthquake and tsunami while borrowing costs in other developed nations rise. The dollar slid against most of its peers while advancing to a six-month high versus the yen on the view that the Federal Reserve will trail other central banks in ending economic stimulus except the BOJ.

The Swiss franc gained versus most of its major counterparts, rising 0.8 percent to 91.77 centimes versus the dollar, as inflation unexpectedly accelerated in March.

Consumer prices increased 1 percent from a year earlier, the Federal Statistics Office reported. The median forecast of economists was for a 0.5 percent annual pace, the same as in the previous month.

Recent selling pressure took both the S&P 500 and the Nasdaq Composite back toward the neutral line, but they have started to retrace the move.

Tech had been a key source of leadership in recent trade, but the sector has since slipped a bit. It still trades with a 0.4% gain, though. Financials are now providing primary support. As a group, financials are up 0.6%. Investment banking issues and specialty finance names have been particularly strong players.

USD/JPY Y83.00, Y83.50, Y84.00, Y84.10, Y84.25, Y84.50

EUR/USD $1.4150, $1.4200, $1.4250, $1.4265, $1.4300

EUR/AUD A$1.3900

AUD/USD $1.0200, $1.0300

USD/CHF Chf0.9200

AUD/JPY Y84.50

U.S. stock futures pointed to a higher open.

Some investors are shrugging off minutes from the Federal Reserve released Tuesday, which showed central bank officials in sharp disaggreement about rising prices.

Meanwhile, gold prices are rallying as other investors believe inflation will become an issue sooner than later. Gold futures for June delivery breached a new intraday trading record of $1,462.10 an ounce. Silver broke a 31-year high of $39.71 an ounce earlier in the morning.

Companies: Dish Network (DISH, Fortune 500) announced Wednesday that it won ownership of Blockbuster for $320 million in a bankruptcy court auction. Blockbuster put itself up for sale in February, after the movie rental chain filed for bankruptcy last fall.

Monsanto (MON, Fortune 500) shares were little changed in pre-market trading, after the agricultural product giant reported quarterly earnings of $1.87 a share, slightly higher than analysts were expecting.

After the bell, investors get results from home furnishings retailer Bed Bath & Beyond (BBBY, Fortune 500), which is expected to earn 97 cents a share.

Economy: No major economic reports are on the agenda for Wednesday, but investors will continue to keep an eye on budget negotiations in Congress and political turmoil in the Middle East and North Africa.

Congress risks a federal government shutdown if it fails to approve a spending bill by Friday.

USD/JPY slowly gets higher with possibly some AUD/JPY buying. AUD/JPY on course for a retest of the day's high of Y88.71. USD/JPY at $85.28/30.

EUR/USD holds around $1.4300 area amid light flows. Rate trades lower overnight highs at $1.4317 with barrier strikes at $1.4325/30. After the break higher, momentum has faded, one trader says, but pair remains a buy on dips.

GBP/USD easing back to $1.6283 as euro-sterling gets a lift back towards the earlier high of stg0.8785 printed after the UK Industrial production data.

Data released:

08:30 UK Industrial production (February) -1.2% 0.4% 0.5%

08:30 UK Industrial production (February) Y/Y 2.4% 4.3% 4.4%

08:30 UK Manufacturing output (February) 0.0% 0.6% 1.0%

08:30 UK Manufacturing output (Ferbuary) Y/Y 4.9% 5.8% 6.8%

09:00 EU(16) GDP (Q4) final 0.3% 0.3%

09:00 EU(16) GDP (Q4) final Y/Y 2.0% 2.0%

10:00 Germany Manufacturing orders (February) seasonally adjusted 2.4% 1.3% 3.1 (2.9)%

10:00 Germany Manufacturing orders (February) not seasonally adjusted, workday adjusted Y/Y 20.1% 16.5 (16.0)%

The euro rallied to a more than 14- month high versus the dollar before the European Central Bank meets tomorrow to decide on interest rates. The ECB will raise its main rate by 25 basis points from a record low 1% tomorrow, according to surveyed economists.

“The rise we’re seeing in the euro is very much interest- rate driven,” said Sarah Hewin, a senior economist at Standard Chartered Plc. “Markets are increasingly shifting from the view of a one-and-done rate hike at the next meeting, to one that sees more rate hikes further out.”

Europe’s currency has gained 6.9% against the dollar this year as stronger economic growth in Germany and accelerating inflation boosted expectations that policy makers in the 17-member bloc will need to raise interest rates. ECB President Jean-Claude Trichet signaled on March 3 that policy makers may raise the benchmark rate at their next meeting to curb consumer-price inflation, which reached a two-year high of 2.6% in March.

“The ECB will likely hike rates tomorrow,” said Tsutomu Soma at Okasan Securities Co.. “The bias is for the euro” to strengthen.

Gross domestic product in the euro area expanded 0.3% in the fourth quarter from the previous three months, a report today showed. The reading was in line with the median estimate of economists. German factory orders jumped a more-than-forecast 2.4% in February from a month earlier when they increased 3.1%. Economists had forecast a 0.5% gain.

The yen slumped against the dollar on speculation Japan will hold its current monetary policy to support the economy. Japan’s central bank will keep its target rate at zero to 0.1% at the end of its meeting tomorrow.

EUR/USD slowly rose from $1.4270 in EU to highs on $1.4315. But rate failed to hold above and back under $1.4300.

GBP/USD fell from $1.6364 to the session lows around $1.6262 following the poor UK IP data. Later rate recovered to $1.6315.

USD/JPY recovered from Y84.80 to Y83.20.

There is no major data left for today.

Gold prices continue to hold higher amid MENA concerns, EU debt and the Japanese nuclear crisis. Today gold posted a new all time spot high of $1460.95. Chinese inflation concerns adding to the drive. The price of Gold having risen by over 28% in the last year. Gold currently trades around $1458.

JPM's analysts reviews FOMC mins and say they are consistent with recent statements. "In short, there are hawks who want tightening and doves who prefer continued easy policy. These minutes don't really change our view."

AUD/USD holds higher around $1.0380, a bit lower Asian high on $1.0398. Monday's post float high of $1.0422 beckons ahead of an option barrier at $1.0450. Aussie trades $1.0385.

EUR/JPY retreats after testing earlier highs on Y121.97. A break here likely to fuel a further stampede through Y122.30 (May 10 high) towards Y123.38 (May05 high). Cross trades Y121.70.

The yen fell as the Bank of Japan began a meeting on Wednesday that may signal its readiness to further loosen monetary policy to support the economy.

The yen has been on a downward trend since a rare joint intervention by leading central banks to weaken the currency.

"The yen is weakening due to expectations for interest rates to rise abroad," said Tsutomu Soma, senior manager at Okasan Securities. "In countries other than Japan, there are moves towards raising interest rates or exiting from extreme monetary easing... But in Japan, a massive amount of funds have been pumped into the money market as an emergency measure."

Japan's Nikkei share average closed down 0.3 percent. A weaker yen ought to be positive for Japan's heavyweight exporters, but investors remain concerned about production capacity knocked out by the devastating March 11 earthquake.

"The dollar going above 85 yen is a significant breakthrough," said Hiroaki Osakabe, a fund manager at Chibagin Asset Management. "But carmakers and other manufacturers have to be able to produce at full capacity first to really feel positive impact. That's why they're not surging on the news."

The Bank of Japan is expected to keep policy on hold at its two-day meeting that started on Wednesday. In contrast, there are strong expectations the European Central Bank will bump its key policy rate up 25 basis points from a record low 1 percent on Thursday to curb inflationary pressures, with markets already pricing in more tightening later in the year.

Minutes of last month's Federal Reserve policy-setting meeting, released on Tuesday, showed the U.S. central bank appeared intent to complete a $600 billion bond-buying plan and to keep rates at exceptionally low levels for an extended period.

GBP/JPY earlier fell from highs on Y139.67 to the lows around Y138.07 following the very disappointing UK Industrial output data. Later rate recovered to Y138.67.

GBP/USD tries to recover after it fell to the lows around $1.6266 following the poor UK data. Cable has now recovered to the Asian opening levels trading $1.6285.

EUR/USD $1.4150, $1.4200, $1.4250, $1.4265, $1.4300

EUR/AUD A$1.3900

AUD/USD $1.0200, $1.0300

USD/CHF Chf0.9200

AUD/JPY Y84.50

Hang Seng +0.56% 24,285.05

Shanghai Composite +1.14% 3001.36

The dollar rose against the yen after Federal Reserve Chairman Ben S. Bernanke said yesterday inflation must be watched “extremely closely,” spurring bets interest rates may be raised sooner than forecast.

Australia’s dollar dropped from almost a record after the Reserve Bank of Australia Governor Glenn Stevens held the overnight cash target rate at 4.75 percent for a fourth straight meeting as floods disrupted coal mining in the nation’s northeast and a rising currency tempered inflation.

FOMC said: "To mitigate (infl) risks... agreed that FOMC would continue its planning for the eventual exit from the current, exceptionally accommodative stance of monetary policy. In light of uncertainty about the economic outlook, it was seen as prudent to consider possible exit strategies for a range of potential economic outcomes. A few participants indicated that economic conditions might warrant a move toward less-accommodative monetary policy this year; a few others noted that exceptional policy accommodation could be appropriate beyond 2011." Also, "A few members noted that evidence of a stronger recovery, or of higher inflation or rising infl expectations, could make it appropriate to reduce the pace or overall size of the purchase program. Several others indicated that they did not anticipate making adjustments to the program before its intended completion."

Recall that staff forecasts were rev down for growth, up for inflation.

UK data: at 0830GMT with UK industrial production and manufacturing output data. IP is expected to come slow slightly to +0.4% m/m, 4.3% y/y with manufacturing at 0.6% m/m, 5.8% y/y.

© 2000-2024. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.