- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 01-08-2011.

US dollar bounces back after the Institute for Supply Management (ISM) reported the pace of growth in the U.S. manufacturing sector slowed more than expected in July while new orders hit their lowest level since 2009 (50.9 in July vs. est. 53.0 and 55.3 in June), sending the 10- year yield to the lowest level since November. As a result, investors As a result invest their wealth in "save haven" currency.

Although U.S. political leaders thrashed out a deal over the weekend, this still has to be passed by both the Senate and the House of Representatives later Monday, with the latter expected to be tight. Currency traders are also worried that the deal might not be sufficient to placate the rating agencies.

Swiss franc rebounds against the US dollar. Today the franc reached a record high again.

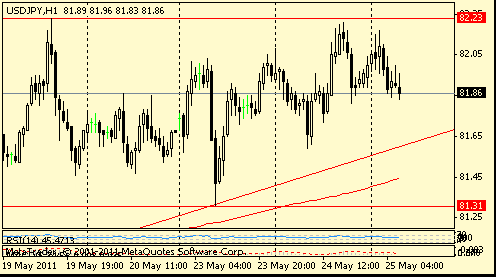

Japanese yen also weakens after today’ advance.

The euro appeared under pressure as the PMI showed that UK and EU manufacturing activity unexpectedly slowed. This intensified concerns over the situation in the European economies. In addition, today the IMF lowered its forecast for UK GDP of 2011 and 2012.

- forecasts for UK 2011 GDP lowered to 1.5% vs 1.75% seen in April.

- forecasts for UK 2012 GDP remained unchanged at 2.3%.

- forecasts for UK Q4 2011 CPI rised to 4.5% vs 4.2% seen in April.

- forecasts for UK 2011 unemployment rised to 7.7% vs 7.8% seen April.

The markets under pressure amid weaken-then-expected ISM manufacturing.

Healthcare sector suffer losses (1.4%) after the federal Centers for Medicare and Medicaid Services announced a Medicare reimbursement cut for the next fiscal year

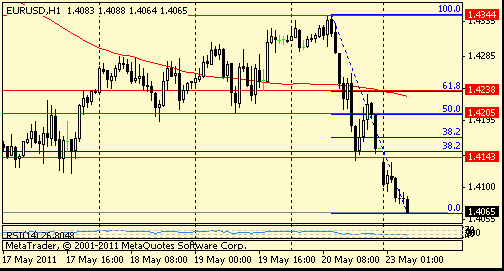

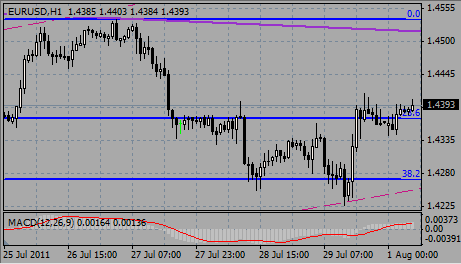

Saw low prints around $1.4255 before a modest rebound, the shove lower coming as come concealed stops below $1.4270 bids were flushed. Rebound stalled shy of $1.4300 area and euro leaking lower again as yen and swiss crosses remain heavy on risk-avoidance. Euro last $1.4270.

EUR/USD: $1.4430, $1.4200

USD/JPY: Y77.00, Y77.20, Y78.25, Y80.00, Y81.00

AUD/USD: $1.1015, $1.0925

Eased to $1.4400 area. Area of $1.4380 said to hold demand interest, expected to find interest from range type players that were sellers into the high, one trader says.

The euro rose as the U.S. debt deal struck overnight gave investors a much-needed confidence boost, but lingering uncertainties kept the gains in check, sustaining demand for safe-haven currencies like the Swiss franc and yen.

Although U.S. political leaders thrashed out a deal over the weekend, this still has to be passed by both the Senate and the House of Representatives later Monday, with the latter expected to be tight. Currency traders are also worried that the deal might not be sufficient to placate the rating agencies.

Manufacturing purchasing managers' indexes across Europe suggested the euro-zone economy got off to a weak start in the third quarter. The data showed that activity at euro-zone factories slowed to a near standstill in July, with even Germany recording slower growth than expected.

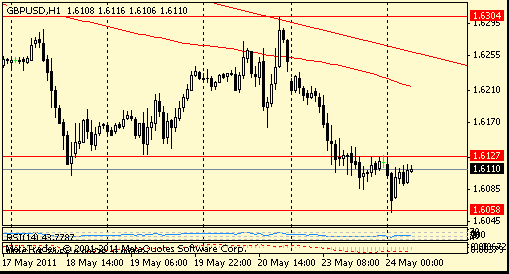

The economic situation looked worse in the U.K., however. The PMI showed that U.K. manufacturing activity unexpectedly contracted last month for the first time in two years. That saw sterling fall more than half a cent against the dollar to dip briefly below $1.64 and the euro climb to GBP0.8795 against the pound. But the weaker dollar helped sterling to rebound.

The pound has benefited in recent weeks from the market's focus on euro-zone and U.S. fiscal concerns but with a semblance of resolution to both crises, sterling may start to underperform, some strategists say.

US construction specding and ISM manuf index are in schedule at 14:00 GMT.

EUR/USD:

Bids $1.4410/00, $1.4380, $1.4350/40, $1.4320/15, $1.4280/70

Continues to slide in recent trade through small bids to a session low Y77.18. Next target is the Asian low of Y76.90 a break here to test the lifelow Y76.25.

GBP/USD tested bids around hourly lows on $1.6400 before recovered a bit to current $1.6440. Rate earlier fell after the weak UK CIPS report (49.1 in July after 51.3).

EUR/USD challenges earlier highs on $1.4420. Rate currently holds around $1.4412. A break of $1.4420 to open a move toward $1.4440/50. Support remains at $1.4380.

Data released:

01:00 China Manufacturing PMI (Jul) 50.7 50.2 50.9 3

02:30 China HSBC Manufacturing PMI (Jul) 49.3 48.9

The yen slid after U.S. President Barack Obama said leaders from the two parties reached an agreement to reduce the deficit, cutting demand for refuge currencies.

Obama said from the White House that leaders of both parties in the U.S. House and Senate had approved an agreement to raise the nation’s debt ceiling by $2.1 trillion and cut the federal deficit by as much as $2.5 trillion over a decade.

Shortly before Obama spoke, Senate Majority Leader Harry Reid and Minority Leader Mitch McConnell took to the Senate floor to endorse the accord.

Treasury Secretary Timothy F. Geithner has said the U.S. will run out of options to prevent a default by tomorrow if the debt limit isn’t increased.

Standard & Poor’s said on July 14 that the chance of a downgrade is 50 percent in the next three months and it may cut the rating as soon as this month if there isn’t a “credible” plan to reduce the nation’s deficit.

The Swiss franc weakened from a record high against the greenback as gains in stocks boosted investor appetite for higher-yielding assets.

The New Zealand dollar reached its strongest ever on improved prospects for the nation’s exports after data showed faster-than-estimated manufacturing in China.

The Purchasing Managers’ Index for China’s manufacturing was at 50.7 in July, compared with 50.9 in June, accordong to the statement released today. That was more than median forecast.

EUR/USD initially rose from $1.4345 to the highs on $1.4420. Offers capped the rally and euro retreated to $1.4382.

GBP/USD fell from $1.6470 to the lows under $1.6400 following the weak UK CIPS report. Later rate was back to the figure.

USD/JPY rallied from Y76.90 to Y78.05 before corrected to Y7740. Later rate was at Y77.80.

US construction specding and ISM manuf index are in schedule at 14:00 GMT.

EUR/USD recovers from recent lows around $1.4381 and currently meeting resistance on approach to $1.4405 (61.8% $1.4420/1.4381). Stronger resistance comes at session highs on $1.4420. A break here to open a move toward $1.4440/50.

EUR/USD: $1.4430, $1.4200

USD/JPY: Y77.00, Y77.20, Y78.25, Y80.00, Y81.00

AUD/USD: $1.1015, $1.0925

Last week the euro outperformed the dollar, rising 0.1% to $1.4369 and losing what analysts described as the “ugly contest” for the title of the world’s least favoured currency.

The single currency was under pressure as by concerns on EU debt crisis as an international rating agency Standard & Poor’s lowered Greece’s credit rating to CC from CCC with negative outlook, agency Moody's placed Spain's AA2 credit rating under review for a possible downgrade and Italy had to pay elevated yields at a government bond auction.

The Swiss franc rose to record levels amid concerns the agreement on raising the US national debt may not be reached by August 2.

But on Friday the frank’s advance was curbed after Swiss central bank saw its first-half loss nearly quadruple from a year earlier on the declining value of its international reserves.

The Swiss franc hit a series of record highs against the dollar, climbing 3.5% to SFr0.7894 over the week.

The yen, another save-heaven currency, gained by 1.8% to Y77.14, its strongest level since Tokyo intervened to counteract strength in its currency in March. This fact have negative impact on export-aimed economy of Japan.

The Australian and New Zealand dollars also rose to record highs. The Australian dollar hit a 29-year high of $1.1080 against the dollar, while the New Zealand dollar reached a 30-year peak of $0.8670.

The kiwi rose toward a record high after the central bank said it will likely remove the half-percentage-point “insurance” cut in the target lending rate made after a February earthquake. But its rise was curbed as Reserve Bank Governor Alan Bollard signaled that strength of New Zealand’ dollar may reduce the extent of rate increases.

The Canadian dollar also moved against the dollar to highest level over the last three years at C$0.9403. The loonie received support on speculation the nation’s central bank will raise interest rates at least once this year.

Asian stock markets ended the week lower amid concerns the agreement on raising the US national debt may not be reached by August 2.

By the end of the week the Japan’ Nikkei 225 fell by 2.95% at 9,901.35, below 10,000.

The Hong Kong’ Hang Seng remained virtually unchanged as lost only 0.02% at 22,440.20.

The Australia’ S&P/ASX 200 closed lower 3.87% at 4,424.60.

The China’ Shanghai Composite Index dropped by 2.49% at 3,187.53.

The markets appeared under pressure by ongoing debate of Republicans and Democrats and weak US statistics.

“Asian equity markets have very much followed what we saw in the U.S.” on Wednesday, said TD Securities strategist Roland Randall. “Markets hate uncertainty.”

Investors were also grappling with a deluge of second-quarter earnings reports, many of which gave an insight into how companies were dealing with the recovering supply chain following the Japanese earthquake and tsunami disasters.

Hyundai Motor , the world’s fifth-largest carmaker by sales together with affiliate Kia Motors , reported a 37% jump in second-quarter earnings as the South Korean company benefited from disrupted production at its Japanese rivals in the wake of the March disaster.

Shares climbed strongly in the first half of the week, but later fell sharply on news of recovering US sales at Toyota, Asia’s biggest carmaker.

Toyota said that although its market share was already recovering, it would be September before it really started to pick up momentum.

Hyundai is expected to face tougher competition in the second half as other Japanese companies including Honda and Nissan recover more quickly than expected. Shares in Hyundai fell 0.6% over the week to Won235,000, while Kia climbed 0.1% to Won77,400.

Nissan Motor was caught in the selling, even after it reported better than expected first-quarter results. Its stock fell 4.5% on the week to Y822. Toyota lost 5.3% to Y3,155 and Honda shed 4.8 % to Y3,080.

As for other companies, shares of Sony (-7.3% до Y1,947) and Toshiba (-4.5% до Y400) declined amid weaken-than-expected quarterly reports.

European stock indexes also closed the week in red, shedding between 2% and 4%.

By the end of the week the pan-European FTSEurofirst 300 index lost 2.42% at 1,108.9.

The Britain's FTSE 100 closed down 2.02% at 5,815.19.

The Frence’ CAC 40 decreased by 4.42% at 3,672.77.

The Germany’ Xetra DAX fell 2.29% at 7,158.77.

The markets were under pressure as by concerns on EU debt crisis as an international rating agency Standard & Poor’s lowered Greece’s credit rating to CC from CCC with negative outlook, agency Moody's placed Spain's AA2 credit rating under review for a possible downgrade and Italy had to pay elevated yields at a government bond auction.

Following the downgrade of Greek debt rating, shares of National Bank of Greece lost 11.8% to € 4.73. As for the Italian banks, Intesa Sanpaolo’ shares fell by 7.4% to € 1.62, shares of UniCredit dropped by 5.3% to € 1.25, shares of Banca Monte dei Paschi di Siena shed 5.5% to € 0.52.

Shares in Veolia Environnement slid 13.3% to €15.81 over the week. The company said it planned to reveal details of a reorganization during its earnings presentation on August 4. Suez Environnement, Veolia’s smaller competitor, fell by 3.2% to €12.93.

French technology shares were also hit, following heavy losses on the US Nasdaq index over the week and some downbeat earnings. Alcatel-Lucent , the mobile technology group, had a weekly fall of 23.1% to €2.76, reporting results which fell shy of expectations.

"Blue Chips" finished the week on gloomy mood, declining on average by 4%.

At the end of the week the S&P 500 fell by 3.92% at 1,292.28, suffering the worst weekly losses since 2008.

NASDAQ Composite closed the week lower by 3.58% at 2,756.38;

Dow Jones Industrial Average shed by 4.24% at 12,143.24.

After hours the US House is scheduled to vote on Boehner debt bill again. Even if the measure passes, it is expected to die in the Senate, and President Obama has threatened to veto it.

Topping Wall Street’ estimates, stock of such giants as Chevron (CVX) (-4.54%), Sprint Nextel (S) (-18.02%), IMAX Corporation (IMAX) (-6.19%), Whiting Petroleum Corp. (WLL) (-5.88%), Oshkosh Corporation (OSK) (-0.56%) closed the week lower.

Amid strong finansial reports, shares of coffee producer Green Mountain Coffee Roasters Inc.’ (GMCR) lifted by 1.35% on the week and shares of CROCS Inc. (CROX), maker of colorful holey plastic sandals, slipped by 1.33% on the week.

Merck, the US drug company, said on Friday that it would slash as many as 13,000 jobs as it looked to cut costs and invest in emerging markets. Merck’s shares declined by 5.4% on the week.

Shares of BlackBerry maker Research in Motion (RIMM) fell by 1.81% on the week as the company announced it was laying off 2,000 employees (11% of its workforce).

Resistance 3: Y79.20

Current price: Y77.57

Support 1:Y77.40

Resistance 2: Chf0.8100

Resistance 2: Chf0.8080

Resistance 1: Chf0.7950

Support 1: Chf0.7900

Support 2: Chf0.7850

Support 3: Chf0.7730

Comments: Dollar is under pressure again, heading for initial support at Chf0.7900. Below losses may extend to record lows on Chf0.7850. Below here downside target comes at channel line from Jul 08 at Chf0.7730. Resistance comes at Chf0.7950 (Asian high). Next resistance is around Chf0.8080 and Chf0.8100 (38.2% of decline from Chf0.8520).

Nikkei -68.32 (-0.69%) 9,833

DAX -31.29 (-0.44%) 7,159

CAC -39.89 (-1.07%) 3,673

FTSE-100 -58.02 (-0.99%) 5,815

Dow +180.00 (+1.49%) 12,268.00

Nasdaq +33.75 (+1.43%) 2,393.00

S&P500 +20.10 (+1.56%) 1,308.50

Oil -1.29 (-1.33%) $96.94

10-Years 2.80% -0.15

Support 3: $1.6120

Comments: Pound weakens now with support comes at morning lows around $1.6380. Break under widens losses to Jul 29 lows around $1.6260 and then - to $1.6120 (50.0% Fibo of $1.5780-$1.6480 rise). Resistance is near Asian high on $1.6480. Above the target comes at May 31 high on $1.6550.

Support 3: $1.3840

07:45 Italy PMI (July) - 49.9

07:50 France PMI (July) 50.1 52.5

07:55 Germany PMI (July) seasonally adjusted 52.1 54.6

08:00 EU(17) PMI (July) 50.4 52.0

08:30 UK CIPS manufacturing index (July) - 51.3

09:00 EU(17) Unemployment (June) - 9.9%

Switzerland National Day

Canada Civic Holiday

14:00 USA ISM Mfg PMI (July) 53.0 55.3

14:00 USA Construction spending (June) 0.1% -0.6%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.